000163391712/312023Q1FALSEhttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#DeferredTaxAndOtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#DeferredTaxAndOtherLiabilitiesNoncurrentP4Yhttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#DeferredTaxAndOtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#DeferredTaxAndOtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#NonoperatingIncomeExpense0111111100016339172023-01-012023-03-3100016339172023-05-02xbrli:shares00016339172023-03-31iso4217:USD00016339172022-12-31iso4217:USDxbrli:shares00016339172022-01-012022-03-310001633917us-gaap:CommonStockMember2022-12-310001633917us-gaap:TreasuryStockCommonMember2022-12-310001633917us-gaap:AdditionalPaidInCapitalMember2022-12-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001633917us-gaap:RetainedEarningsMember2022-12-310001633917us-gaap:RetainedEarningsMember2023-01-012023-03-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001633917us-gaap:CommonStockMember2023-01-012023-03-310001633917us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001633917us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001633917us-gaap:CommonStockMember2023-03-310001633917us-gaap:TreasuryStockCommonMember2023-03-310001633917us-gaap:AdditionalPaidInCapitalMember2023-03-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001633917us-gaap:RetainedEarningsMember2023-03-310001633917us-gaap:CommonStockMember2021-12-310001633917us-gaap:TreasuryStockCommonMember2021-12-310001633917us-gaap:AdditionalPaidInCapitalMember2021-12-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001633917us-gaap:RetainedEarningsMember2021-12-3100016339172021-12-310001633917us-gaap:RetainedEarningsMember2022-01-012022-03-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001633917us-gaap:CommonStockMember2022-01-012022-03-310001633917us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001633917us-gaap:TreasuryStockCommonMember2022-01-012022-03-310001633917us-gaap:CommonStockMember2022-03-310001633917us-gaap:TreasuryStockCommonMember2022-03-310001633917us-gaap:AdditionalPaidInCapitalMember2022-03-310001633917us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001633917us-gaap:RetainedEarningsMember2022-03-3100016339172022-03-310001633917us-gaap:ShortTermInvestmentsMember2023-03-310001633917us-gaap:ShortTermInvestmentsMember2022-03-310001633917pypl:FundsReceivableAndCustomerAccountsMember2023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMember2022-03-310001633917us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-03-310001633917us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001633917srt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001633917srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-03-31pypl:segment0001633917country:US2023-01-012023-03-310001633917country:US2022-01-012022-03-310001633917pypl:CountriesOtherThanUSAndUnitedKingdomMember2023-01-012023-03-310001633917pypl:CountriesOtherThanUSAndUnitedKingdomMember2022-01-012022-03-310001633917pypl:TransactionRevenuesMember2023-01-012023-03-310001633917pypl:TransactionRevenuesMember2022-01-012022-03-310001633917pypl:RevenuesFromOtherValueAddedServicesMember2023-01-012023-03-310001633917pypl:RevenuesFromOtherValueAddedServicesMember2022-01-012022-03-310001633917pypl:InterestAndFeesEarnedOnLoansAndInterestReceivableAsWellAsHedgingGainsOrLossesAndInterestEarnedOnCertainAssetsUnderlyingCustomerBalancesMember2023-01-012023-03-310001633917pypl:InterestAndFeesEarnedOnLoansAndInterestReceivableAsWellAsHedgingGainsOrLossesAndInterestEarnedOnCertainAssetsUnderlyingCustomerBalancesMember2022-01-012022-03-31pypl:business0001633917us-gaap:CustomerRelatedIntangibleAssetsMember2023-03-310001633917us-gaap:CustomerRelatedIntangibleAssetsMember2023-01-012023-03-310001633917us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310001633917us-gaap:CustomerRelatedIntangibleAssetsMember2022-01-012022-12-310001633917us-gaap:MarketingRelatedIntangibleAssetsMember2023-03-310001633917us-gaap:MarketingRelatedIntangibleAssetsMember2023-01-012023-03-310001633917us-gaap:MarketingRelatedIntangibleAssetsMember2022-12-310001633917us-gaap:MarketingRelatedIntangibleAssetsMember2022-01-012022-12-310001633917us-gaap:DevelopedTechnologyRightsMember2023-03-310001633917us-gaap:DevelopedTechnologyRightsMember2023-01-012023-03-310001633917us-gaap:DevelopedTechnologyRightsMember2022-12-310001633917us-gaap:DevelopedTechnologyRightsMember2022-01-012022-12-310001633917us-gaap:OtherIntangibleAssetsMember2023-03-310001633917us-gaap:OtherIntangibleAssetsMember2023-01-012023-03-310001633917us-gaap:OtherIntangibleAssetsMember2022-12-310001633917us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-31xbrli:pure0001633917srt:MinimumMember2023-03-310001633917srt:MaximumMember2023-03-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMemberpypl:BitcoinMember2023-03-310001633917pypl:BitcoinMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMemberpypl:BitcoinMember2022-12-310001633917pypl:BitcoinMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMemberpypl:EthereumMember2023-03-310001633917pypl:EthereumMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001633917pypl:EthereumMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMemberpypl:EthereumMember2022-12-310001633917srt-supplement:CryptoAssetOtherMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMembersrt-supplement:CryptoAssetOtherMember2023-03-310001633917srt-supplement:CryptoAssetOtherMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMembersrt-supplement:CryptoAssetOtherMember2022-12-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMember2023-03-310001633917pypl:AccruedExpensesAndOtherCurrentLiabilitiesMember2022-12-310001633917us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001633917us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-12-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2022-12-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2023-01-012023-03-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2023-03-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2021-12-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-03-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-03-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2022-01-012022-03-310001633917us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-03-310001633917us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-03-310001633917us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001633917pypl:NetInvestmentHedgeCurrencyTranslationGainLossMember2022-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001633917us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001633917us-gaap:CashAndCashEquivalentsMember2023-03-310001633917us-gaap:CashAndCashEquivalentsMember2022-12-310001633917us-gaap:BankTimeDepositsMember2023-03-310001633917us-gaap:BankTimeDepositsMember2022-12-310001633917us-gaap:DebtSecuritiesMember2023-03-310001633917us-gaap:DebtSecuritiesMember2022-12-310001633917pypl:FundsReceivableMember2023-03-310001633917pypl:FundsReceivableMember2022-12-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberpypl:FundsReceivableAndCustomerAccountsMember2023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:MunicipalBondsMemberpypl:FundsReceivableAndCustomerAccountsMember2023-03-310001633917us-gaap:CommercialPaperMemberpypl:FundsReceivableAndCustomerAccountsMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberpypl:FundsReceivableAndCustomerAccountsMember2022-12-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917pypl:FundsReceivableAndCustomerAccountsMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:MunicipalBondsMemberpypl:FundsReceivableAndCustomerAccountsMember2022-12-310001633917us-gaap:CommercialPaperMemberpypl:FundsReceivableAndCustomerAccountsMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-03-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001633917pypl:CashTimeDepositsAndFundsReceivableMember2023-03-310001633917us-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberpypl:MarketableEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:LongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001633917pypl:CashTimeDepositsAndFundsReceivableMember2022-12-310001633917srt:MinimumMember2023-01-012023-03-310001633917srt:MaximumMember2023-01-012023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberpypl:FairValueOptionInvestmentsMember2023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberpypl:FairValueOptionInvestmentsMember2022-12-310001633917pypl:FundsReceivableAndCustomerAccountsMemberpypl:FairValueOptionInvestmentsMember2023-01-012023-03-310001633917pypl:FundsReceivableAndCustomerAccountsMemberpypl:FairValueOptionInvestmentsMember2022-01-012022-03-310001633917us-gaap:FairValueMeasurementsNonrecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-03-310001633917us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-03-310001633917us-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001633917us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310001633917us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-03-310001633917us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-03-310001633917us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001633917us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001633917us-gaap:OtherCurrentAssetsMember2022-12-310001633917us-gaap:OtherCurrentAssetsMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2022-12-310001633917us-gaap:OtherNoncurrentAssetsMember2023-03-310001633917us-gaap:OtherNoncurrentAssetsMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2022-12-310001633917us-gaap:ForeignExchangeContractMember2023-03-310001633917us-gaap:ForeignExchangeContractMember2022-12-310001633917us-gaap:OtherCurrentLiabilitiesMember2023-03-310001633917us-gaap:OtherCurrentLiabilitiesMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2022-12-310001633917us-gaap:OtherNoncurrentLiabilitiesMember2023-03-310001633917us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMember2022-12-310001633917us-gaap:SalesMember2023-01-012023-03-310001633917us-gaap:NonoperatingIncomeExpenseMember2023-01-012023-03-310001633917us-gaap:SalesMember2022-01-012022-03-310001633917us-gaap:NonoperatingIncomeExpenseMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NonoperatingIncomeExpenseMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NonoperatingIncomeExpenseMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SalesMemberus-gaap:NetInvestmentHedgingMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NonoperatingIncomeExpenseMemberus-gaap:NetInvestmentHedgingMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:SalesMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:NonoperatingIncomeExpenseMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:SalesMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:NonoperatingIncomeExpenseMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMember2023-01-012023-03-310001633917us-gaap:ForeignExchangeContractMember2022-01-012022-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-03-310001633917us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2023-01-012023-03-310001633917us-gaap:ConsumerPortfolioSegmentMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberpypl:FinancialAsset90To179DaysPastDueMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMember2023-01-012023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberpypl:OtherConsumerCreditProductsMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancialAssetNotPastDueMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberpypl:FinancialAsset90To179DaysPastDueMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberpypl:OtherConsumerCreditProductsMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2022-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2021-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2021-12-310001633917us-gaap:ConsumerPortfolioSegmentMember2021-12-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2023-01-012023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2022-01-012022-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2022-01-012022-03-310001633917us-gaap:ConsumerPortfolioSegmentMember2022-01-012022-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2023-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:LoansReceivableMember2022-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:FinanceReceivablesMember2022-03-310001633917us-gaap:ConsumerPortfolioSegmentMember2022-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberpypl:OtherConsumerCreditProductsMember2022-03-310001633917us-gaap:ConsumerPortfolioSegmentMemberus-gaap:GeographicDistributionDomesticMember2023-03-310001633917us-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:CommercialPortfolioSegmentMember2022-12-310001633917srt:MinimumMemberpypl:PayPalWorkingCapitalProductsMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917pypl:PayPalWorkingCapitalProductsMemberus-gaap:CommercialPortfolioSegmentMembersrt:MaximumMember2023-01-012023-03-310001633917pypl:PayPalBusinessLoansMembersrt:MinimumMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917pypl:PayPalBusinessLoansMemberus-gaap:CommercialPortfolioSegmentMembersrt:MaximumMember2023-01-012023-03-310001633917us-gaap:FinancialAssetNotPastDueMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2023-03-310001633917pypl:FinancialAsset90To179DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917pypl:FinancialAssetEqualToOrGreaterThan180DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917us-gaap:FinancialAssetNotPastDueMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917us-gaap:CommercialPortfolioSegmentMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2022-12-310001633917pypl:FinancialAsset90To179DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917pypl:FinancialAssetEqualToOrGreaterThan180DaysPastDueMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2022-12-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2021-12-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2021-12-310001633917us-gaap:CommercialPortfolioSegmentMember2021-12-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-01-012022-03-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2022-01-012022-03-310001633917us-gaap:CommercialPortfolioSegmentMember2022-01-012022-03-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917us-gaap:LoansReceivableMemberus-gaap:CommercialPortfolioSegmentMember2022-03-310001633917us-gaap:FinanceReceivablesMemberus-gaap:CommercialPortfolioSegmentMember2022-03-310001633917us-gaap:CommercialPortfolioSegmentMember2022-03-310001633917pypl:PayPalBusinessLoansMemberus-gaap:CommercialPortfolioSegmentMember2023-03-310001633917pypl:PayPalWorkingCapitalProductsMemberus-gaap:CommercialPortfolioSegmentMember2023-01-012023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRateNotesIssuedMay2022Member2022-05-310001633917us-gaap:SeniorNotesMemberpypl:FixedRateNotesIssuedMay2020Member2020-05-310001633917us-gaap:SeniorNotesMemberpypl:FixedRateNotesIssuedSeptember2019Member2019-09-300001633917us-gaap:SeniorNotesMemberpypl:NotesMember2022-12-310001633917us-gaap:SeniorNotesMemberpypl:NotesMember2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2400NotesIssuedSeptember2019Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2400NotesIssuedSeptember2019Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2650NotesIssuedSeptember2019Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2650NotesIssuedSeptember2019Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2850NotesIssuedSeptember2019Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2850NotesIssuedSeptember2019Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate1350NotesIssuedMay2020Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate1350NotesIssuedMay2020Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate1650NotesIssuedMay2020Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate1650NotesIssuedMay2020Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2300NotesIssuedMay2020Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate2300NotesIssuedMay2020Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate3250NotesIssuedMay2020Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate3250NotesIssuedMay2020Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate3900NotesIssuedMay2022Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate3900NotesIssuedMay2022Member2022-12-310001633917pypl:FixedRate4400NotesIssuedMay2022Memberus-gaap:SeniorNotesMember2023-03-310001633917pypl:FixedRate4400NotesIssuedMay2022Memberus-gaap:SeniorNotesMember2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate5050NotesIssuedMay2022Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate5050NotesIssuedMay2022Member2022-12-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate5250NotesIssuedMay2022Member2023-03-310001633917us-gaap:SeniorNotesMemberpypl:FixedRate5250NotesIssuedMay2022Member2022-12-310001633917us-gaap:SeniorNotesMember2023-03-310001633917us-gaap:SeniorNotesMember2022-12-310001633917us-gaap:SeniorNotesMemberpypl:NotesMember2023-01-012023-03-310001633917us-gaap:SeniorNotesMemberpypl:NotesMember2022-01-012022-03-310001633917pypl:PaidyCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2022-02-28iso4217:JPY0001633917pypl:PaidyCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2022-09-012022-09-300001633917pypl:PaidyCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2023-03-310001633917pypl:PaidyCreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001633917pypl:ProtectionProgramsMember2022-12-310001633917pypl:ProtectionProgramsMember2021-12-310001633917pypl:ProtectionProgramsMember2023-01-012023-03-310001633917pypl:ProtectionProgramsMember2022-01-012022-03-310001633917pypl:ProtectionProgramsMember2023-03-310001633917pypl:ProtectionProgramsMember2022-03-310001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:PangVDanielSchulmanEtAlMemberus-gaap:PendingLitigationMember2021-12-16pypl:action0001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:LalorVDanielSchulmanEtAlMemberus-gaap:PendingLitigationMember2022-01-190001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:KangVPayPalHoldingsIncEtAlMemberus-gaap:PendingLitigationMember2021-08-200001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:JeffersonVDanielSchulmanEtAlMemberus-gaap:PendingLitigationMember2022-08-020001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:InRePayPalHoldingsIncSecuritiesLitigationMemberus-gaap:PendingLitigationMember2023-01-110001633917us-gaap:UnfavorableRegulatoryActionMemberpypl:ShahVDanielSchulmanEtAlMemberus-gaap:PendingLitigationMember2022-11-020001633917pypl:NelsonVDanielSchulmanEtAlMemberus-gaap:UnfavorableRegulatoryActionMemberus-gaap:SubsequentEventMemberus-gaap:PendingLitigationMember2023-04-040001633917pypl:July2018AndJune2022StockRepurchaseProgramsMember2023-01-012023-03-310001633917pypl:June2022StockRepurchaseProgramMember2023-03-310001633917pypl:CustomerSupportAndOperationsMember2023-01-012023-03-310001633917pypl:CustomerSupportAndOperationsMember2022-01-012022-03-310001633917us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001633917us-gaap:SellingAndMarketingExpenseMember2022-01-012022-03-310001633917pypl:TechnologyAndDevelopmentExpenseMember2023-01-012023-03-310001633917pypl:TechnologyAndDevelopmentExpenseMember2022-01-012022-03-310001633917us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001633917us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-03-310001633917pypl:OwnedPropertyMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-01-012023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2023.

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to .

Commission file number 001-36859

PayPal Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | | | 47-2989869 |

(State or Other Jurisdiction of

Incorporation or Organization) | | | (I.R.S. Employer

Identification No.) |

| 2211 North First Street | San Jose, | California | 95131 |

| (Address of Principal Executive Offices) | | | (Zip Code) |

(408) 967-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | PYPL | NASDAQ Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of May 2, 2023, there were 1,115,713,968 shares of the registrant’s common stock, $0.0001 par value, outstanding, which is the only class of common or voting stock of the registrant issued.

PayPal Holdings, Inc.

TABLE OF CONTENTS

PART I: FINANCIAL INFORMATION

ITEM 1: FINANCIAL STATEMENTS

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| | March 31,

2023 | | December 31,

2022 |

| | (In millions, except par value) |

| (Unaudited) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,101 | | | $ | 7,776 | |

| Short-term investments | 3,559 | | | 3,092 | |

| Accounts receivable, net | 967 | | | 963 | |

Loans and interest receivable, net of allowances of $638 and $598 as of March 31, 2023 and December 31, 2022, respectively | 7,495 | | | 7,431 | |

| | | |

| Funds receivable and customer accounts | 35,276 | | | 36,357 | |

| Prepaid expenses and other current assets | 2,162 | | | 1,898 | |

| Total current assets | 56,560 | | | 57,517 | |

| Long-term investments | 4,632 | | | 5,018 | |

| Property and equipment, net | 1,633 | | | 1,730 | |

| Goodwill | 11,195 | | | 11,209 | |

| Intangible assets, net | 730 | | | 788 | |

| Other assets | 2,436 | | | 2,455 | |

| Total assets | $ | 77,186 | | | $ | 78,717 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 142 | | | $ | 126 | |

| | | |

| Funds payable and amounts due to customers | 39,026 | | | 40,107 | |

| Accrued expenses and other current liabilities | 4,164 | | | 4,055 | |

| Income taxes payable | 577 | | | 813 | |

| Total current liabilities | 43,909 | | | 45,101 | |

| Deferred tax liability and other long-term liabilities | 2,938 | | | 2,925 | |

| Long-term debt | 10,481 | | | 10,417 | |

| Total liabilities | 57,328 | | | 58,443 | |

| Commitments and contingencies (Note 13) | | | |

| Equity: | | | |

Common stock, $0.0001 par value; 4,000 shares authorized; 1,122 and 1,136 shares outstanding as of March 31, 2023 and December 31, 2022, respectively | — | | | — | |

Preferred stock, $0.0001 par value; 100 shares authorized, unissued | — | | | — | |

Treasury stock at cost, 192 and 173 shares as of March 31, 2023 and December 31, 2022, respectively | (17,522) | | | (16,079) | |

| Additional paid-in-capital | 18,529 | | | 18,327 | |

| Retained earnings | 19,749 | | | 18,954 | |

| Accumulated other comprehensive income (loss) | (898) | | | (928) | |

| | | |

| | | |

| Total equity | 19,858 | | | 20,274 | |

| Total liabilities and equity | $ | 77,186 | | | $ | 78,717 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2023 | | 2022 | | | | |

| | (In millions, except per share data) |

| (Unaudited) |

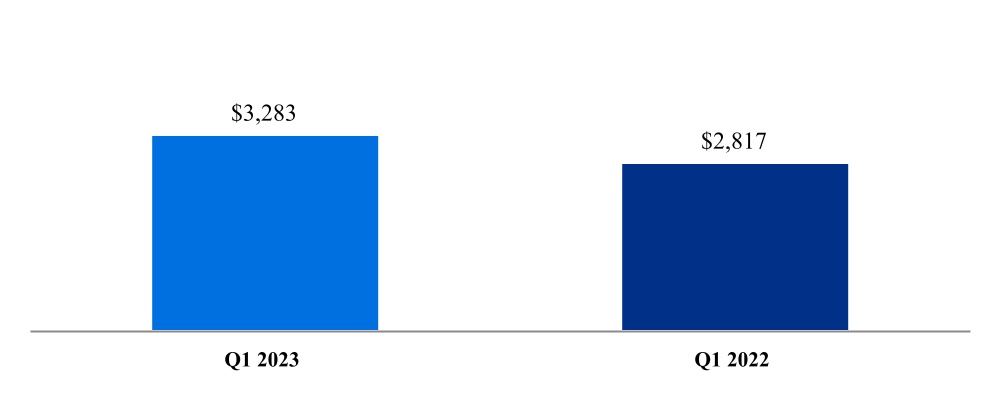

| Net revenues | $ | 7,040 | | | $ | 6,483 | | | | | |

| Operating expenses: | | | | | | | |

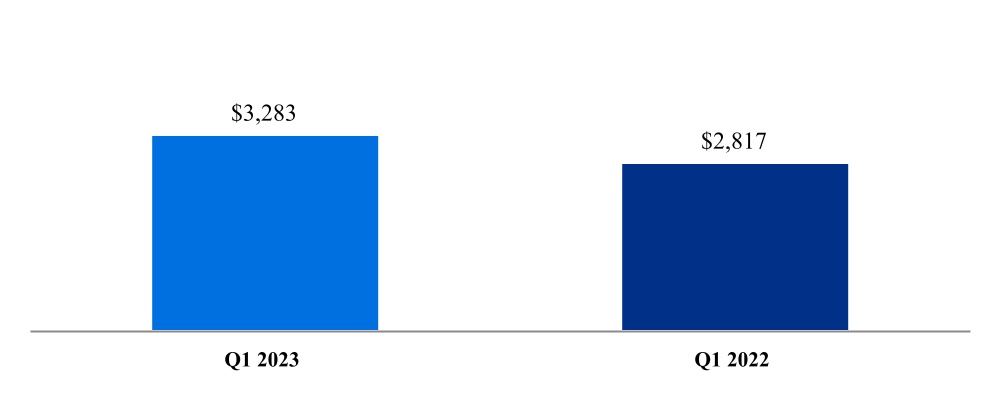

| Transaction expense | 3,283 | | | 2,817 | | | | | |

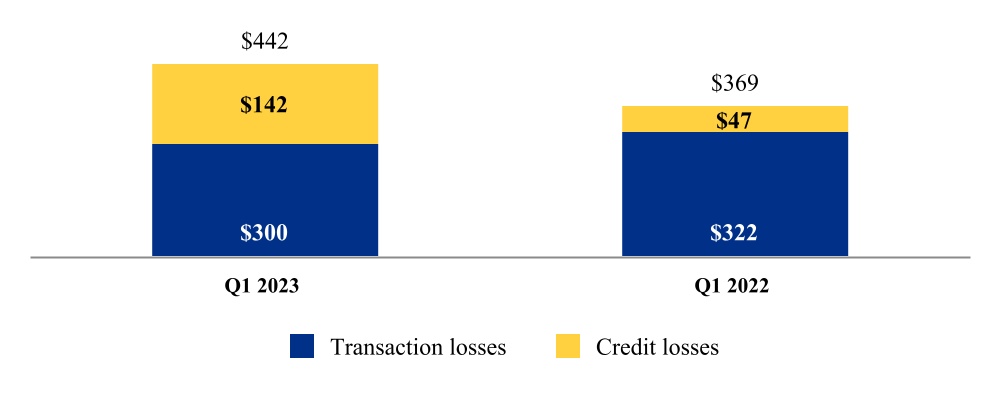

| Transaction and credit losses | 442 | | | 369 | | | | | |

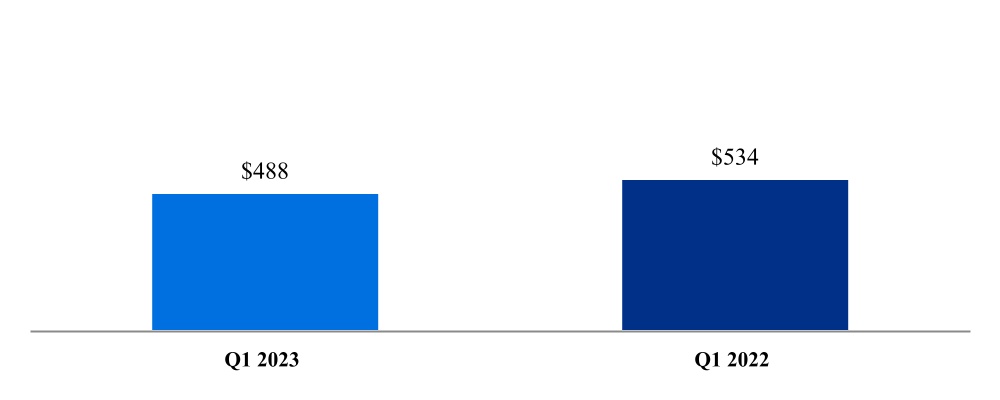

| Customer support and operations | 488 | | | 534 | | | | | |

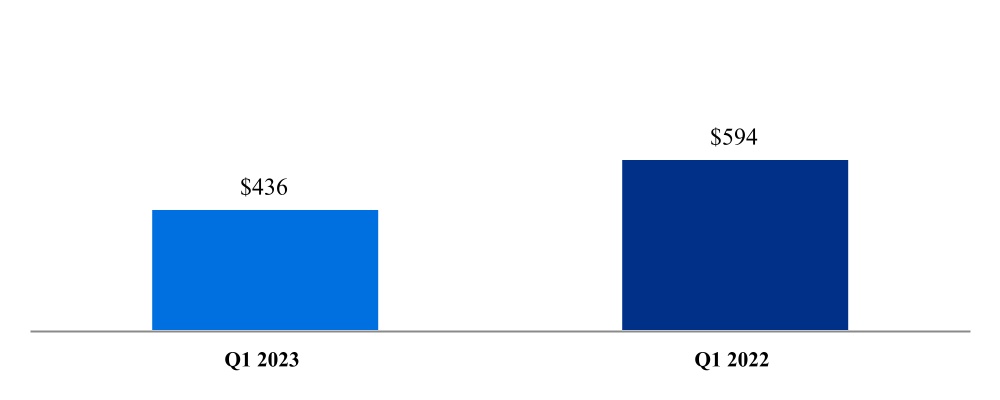

| Sales and marketing | 436 | | | 594 | | | | | |

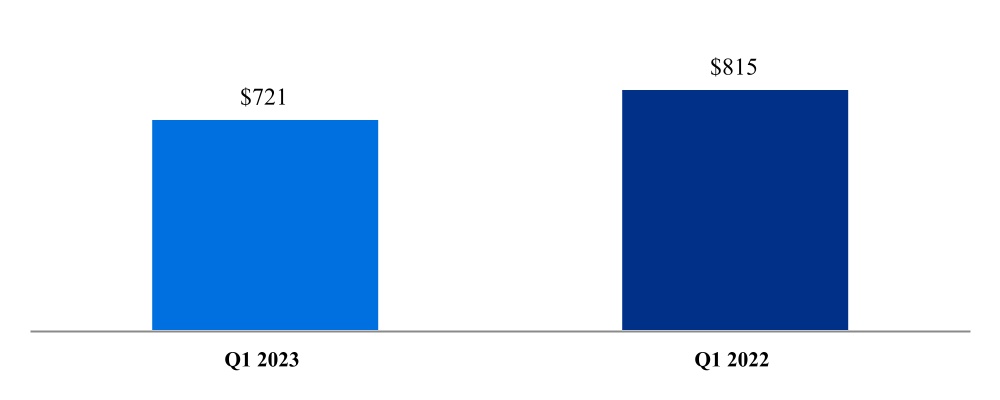

| Technology and development | 721 | | | 815 | | | | | |

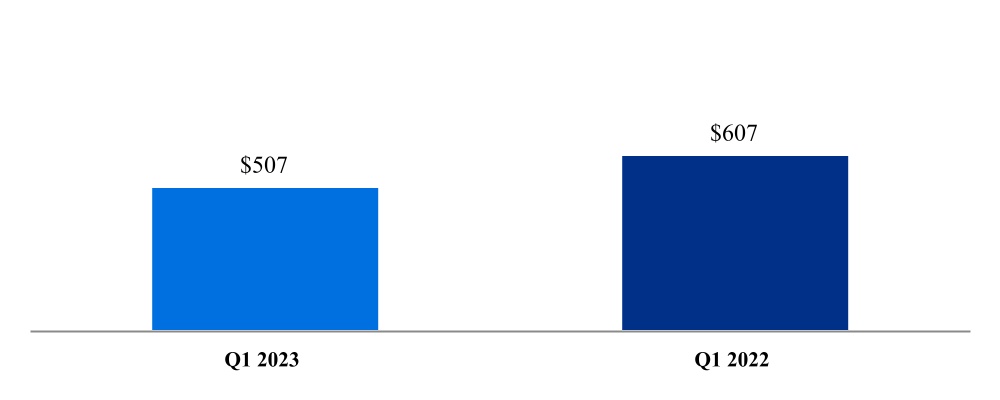

| General and administrative | 507 | | | 607 | | | | | |

| Restructuring and other charges | 164 | | | 36 | | | | | |

| Total operating expenses | 6,041 | | | 5,772 | | | | | |

| Operating income | 999 | | | 711 | | | | | |

| Other income (expense), net | 75 | | | (82) | | | | | |

| Income before income taxes | 1,074 | | | 629 | | | | | |

| Income tax expense | 279 | | | 120 | | | | | |

| Net income (loss) | $ | 795 | | | $ | 509 | | | | | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.70 | | | $ | 0.44 | | | | | |

| Diluted | $ | 0.70 | | | $ | 0.43 | | | | | |

| | | | | | | |

| Weighted average shares: | | | | | | | |

| Basic | 1,129 | | | 1,163 | | | | | |

| Diluted | 1,134 | | | 1,172 | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| | 2023 | | 2022 | | | | |

| | (In millions) |

| (Unaudited) |

| Net income (loss) | $ | 795 | | | $ | 509 | | | | | |

| Other comprehensive income (loss), net of reclassification adjustments: | | | | | | | |

| Foreign currency translation adjustments (“CTA”) | (20) | | | (95) | | | | | |

| Net investment hedges CTA gains, net | 27 | | | 21 | | | | | |

| Tax expense on net investment hedges CTA gains, net | (6) | | | (5) | | | | | |

| Unrealized losses on cash flow hedges, net | (111) | | | (3) | | | | | |

| Tax benefit on unrealized losses on cash flow hedges, net | 6 | | | — | | | | | |

| Unrealized gains (losses) on investments, net | 175 | | | (293) | | | | | |

| Tax (expense) benefit on unrealized gains (losses) on investments, net | (41) | | | 67 | | | | | |

| Other comprehensive income (loss), net of tax | 30 | | | (308) | | | | | |

| Comprehensive income (loss) | $ | 825 | | | $ | 201 | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock

Shares | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other

Comprehensive Income (Loss) | | Retained Earnings | | | | Total

Equity |

|

| | (In millions) |

| (Unaudited) |

| Balances at December 31, 2022 | 1,136 | | | $ | (16,079) | | | $ | 18,327 | | | $ | (928) | | | $ | 18,954 | | | | | $ | 20,274 | |

| | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 795 | | | | | 795 | |

| Foreign CTA | — | | | — | | | — | | | (20) | | | — | | | | | (20) | |

| Net investment hedges CTA gains, net | — | | | — | | | — | | | 27 | | | — | | | | | 27 | |

| Tax expense on net investment hedges CTA gains, net | — | | | — | | | — | | | (6) | | | — | | | | | (6) | |

| Unrealized losses on cash flow hedges, net | — | | | — | | | — | | | (111) | | | — | | | | | (111) | |

| Tax benefit on unrealized losses on cash flow hedges, net | — | | | — | | | — | | | 6 | | | — | | | | | 6 | |

| Unrealized gains on investments, net | — | | | — | | | — | | | 175 | | | — | | | | | 175 | |

| Tax expense on unrealized gains on investments, net | — | | | — | | | — | | | (41) | | | — | | | | | (41) | |

| Common stock and stock-based awards issued and assumed, net of shares withheld for employee taxes | 5 | | | — | | | (157) | | | — | | | — | | | | | (157) | |

| Common stock repurchased | (19) | | | (1,432) | | | — | | | — | | | — | | | | | (1,432) | |

| Excise tax on common stock repurchased | — | | | (11) | | | — | | | — | | | — | | | | | (11) | |

| Stock-based compensation | — | | | — | | | 359 | | | — | | | — | | | | | 359 | |

| | | | | | | | | | | | | |

| Balances at March 31, 2023 | 1,122 | | | $ | (17,522) | | | $ | 18,529 | | | $ | (898) | | | $ | 19,749 | | | | | $ | 19,858 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock Shares | | Treasury Stock | | Additional Paid-In Capital | | Accumulated Other

Comprehensive Income (Loss) | | Retained Earnings | | Total

Equity |

| | | | | |

| | (In millions) |

| (Unaudited) |

| Balances at December 31, 2021 | 1,168 | | | $ | (11,880) | | | $ | 17,208 | | | $ | (136) | | | $ | 16,535 | | | $ | 21,727 | |

| Net income | — | | | — | | | — | | | — | | | 509 | | | 509 | |

| Foreign CTA | — | | | — | | | — | | | (95) | | | — | | | (95) | |

| Net investment hedges CTA gains, net | — | | | — | | | — | | | 21 | | | — | | | 21 | |

| Tax expense on net investment hedges CTA gains, net | — | | | — | | | — | | | (5) | | | — | | | (5) | |

| Unrealized losses on cash flow hedges, net | — | | | — | | | — | | | (3) | | | — | | | (3) | |

| | | | | | | | | | | |

| Unrealized losses on investments, net | — | | | — | | | — | | | (293) | | | — | | | (293) | |

| Tax benefit on unrealized losses on investments, net | — | | | — | | | — | | | 67 | | | — | | | 67 | |

| Common stock and stock-based awards issued and assumed, net of shares withheld for employee taxes | 4 | | | — | | | (273) | | | — | | | — | | | (273) | |

| Common stock repurchased | (11) | | | (1,500) | | | — | | | — | | | — | | | (1,500) | |

| Stock-based compensation | — | | | — | | | 447 | | | — | | | — | | | 447 | |

| | | | | | | | | | | |

| Other | — | | | — | | | 1 | | | — | | | — | | | 1 | |

| Balances at March 31, 2022 | 1,161 | | | $ | (13,380) | | | $ | 17,383 | | | $ | (444) | | | $ | 17,044 | | | $ | 20,603 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 |

| | (In millions) |

| (Unaudited) |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 795 | | | $ | 509 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Transaction and credit losses | 442 | | | 369 | |

| Depreciation and amortization | 270 | | | 328 | |

| Stock-based compensation | 345 | | | 429 | |

| Deferred income taxes | (67) | | | (16) | |

| Net (gains) losses on strategic investments | (48) | | | (14) | |

| Other | (92) | | | 65 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (3) | | | (50) | |

| | | |

| Accounts payable | 3 | | | (29) | |

| Income taxes payable | (235) | | | 17 | |

| Other assets and liabilities | (240) | | | (391) | |

| Net cash provided by operating activities | 1,170 | | | 1,217 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (170) | | | (191) | |

| Proceeds from sales of property and equipment | 1 | | | 3 | |

| Purchases and originations of loans receivable | (8,267) | | | (5,525) | |

| Principal repayment of loans receivable | 8,063 | | | 5,054 | |

| Purchases of investments | (6,100) | | | (8,604) | |

| Maturities and sales of investments | 5,445 | | | 8,751 | |

| | | |

| Funds receivable | 1,076 | | | (239) | |

| Collateral posted related to derivative instruments, net | (22) | | | (1) | |

| Other investing activities | 8 | | | — | |

| Net cash provided by (used in) investing activities | 34 | | | (752) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common stock | 1 | | | 3 | |

| Purchases of treasury stock | (1,432) | | | (1,500) | |

| Tax withholdings related to net share settlements of equity awards | (149) | | | (244) | |

| Borrowings under financing arrangements | 72 | | | 286 | |

| Repayments under financing arrangements | (5) | | | (104) | |

| Funds payable and amounts due to customers | (1,020) | | | 863 | |

| Collateral received related to derivative instruments, net | (129) | | | 26 | |

| Other financing activities | — | | | 1 | |

| Net cash used in financing activities | (2,662) | | | (669) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (4) | | | 18 | |

| Net change in cash, cash equivalents, and restricted cash | (1,462) | | | (186) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 19,156 | | | 18,029 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 17,694 | | | $ | 17,843 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

PayPal Holdings, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS—(continued)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 |

| | (In millions) |

| (Unaudited) |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | $ | 2 | | | $ | 12 | |

| Cash paid for income taxes, net | $ | 495 | | | $ | 47 | |

| | | |

| The table below reconciles cash, cash equivalents, and restricted cash as reported in the condensed consolidated balance sheets to the total of the same amounts shown in the condensed consolidated statements of cash flows: | | | |

| Cash and cash equivalents | $ | 7,101 | | | $ | 4,861 | |

| Short-term investments | 13 | | | 27 | |

| Funds receivable and customer accounts | 10,580 | | | 12,955 | |

| Total cash, cash equivalents, and restricted cash shown in the condensed consolidated statements of cash flows | $ | 17,694 | | | $ | 17,843 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PayPal Holdings, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1—OVERVIEW AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

OVERVIEW AND ORGANIZATION

PayPal Holdings, Inc. (“PayPal,” the “Company,” “we,” “us,” or “our”) was incorporated in Delaware in January 2015 and is a leading technology platform that enables digital payments and simplifies commerce experiences on behalf of merchants and consumers worldwide. PayPal is committed to democratizing financial services to help improve the financial health of individuals and to increase economic opportunity for entrepreneurs and businesses of all sizes around the world. Our goal is to enable our merchants and consumers to manage and move their money anywhere in the world in the markets we serve, anytime, on any platform, and using any device when sending payments or getting paid, including person-to-person payments.

We operate globally and in a rapidly evolving regulatory environment characterized by a heightened focus by regulators globally on all aspects of the payments industry, including countering terrorist financing, anti-money laundering, privacy, cybersecurity, and consumer protection. The laws and regulations applicable to us, including those enacted prior to the advent of digital payments, continue to evolve through legislative and regulatory action and judicial interpretation. New or changing laws and regulations, including changes to their interpretation and implementation, as well as increased penalties and enforcement actions related to non-compliance, could have a material adverse impact on our business, results of operations, and financial condition. We monitor these areas closely and are focused on designing compliant solutions for our customers.

SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation and principles of consolidation

The accompanying condensed consolidated financial statements include the financial statements of PayPal and our wholly- and majority-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Investments in entities where we have the ability to exercise significant influence, but not control, over the investee are accounted for using the equity method of accounting. For such investments, our share of the investee’s results of operations is included in other income (expense), net on our condensed consolidated statements of income (loss). Investments in entities where we do not have the ability to exercise significant influence over the investee are accounted for at fair value or cost minus impairment, if any, adjusted for changes resulting from observable price changes, which are included in other income (expense), net on our condensed consolidated statements of income (loss). Our investment balance is included in long-term investments on our condensed consolidated balance sheets.

We determine at the inception of each investment, and re-evaluate if certain events occur, whether an entity in which we have made an investment is considered a variable interest entity (“VIE”). If we determine an investment is in a VIE, we then assess if we are the primary beneficiary, which would require consolidation. As of March 31, 2023 and December 31, 2022, no VIEs qualified for consolidation as the structures of these entities do not provide us with the ability to direct activities that would significantly impact their economic performance. As of March 31, 2023 and December 31, 2022, the carrying value of our investments in nonconsolidated VIEs was $135 million and $128 million, respectively, and is included as non-marketable equity securities applying the equity method of accounting in long-term investments on our condensed consolidated balance sheets. Our maximum exposure to loss related to our nonconsolidated VIEs, which represents funded commitments and any future funding commitments, was $233 million and $232 million as of March 31, 2023 and December 31, 2022, respectively.

These condensed consolidated financial statements and accompanying notes should be read in conjunction with the audited consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”) filed with the United States (“U.S.”) Securities and Exchange Commission (“SEC”) on February 10, 2023.

In the opinion of management, these condensed consolidated financial statements reflect all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair statement of the condensed consolidated financial statements for all interim periods presented. Certain amounts for prior periods have been reclassified to conform to the financial statement presentation as of and for the three months ended March 31, 2023.

PayPal Holdings, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

Reclassifications

Beginning with the fourth quarter of 2022, we reclassified certain cash flows related to our collateral security arrangements for derivative instruments from cash flows from operating activities to cash flows from investing activities and cash flows from financing activities within the condensed consolidated statements of cash flows. Prior period amounts have been reclassified to conform to the current period presentation.

The current period presentation classifies all changes in collateral posted and collateral received related to derivative instruments on our condensed consolidated statements of cash flows as cash flows from investing activities and cash flows from financing activities, respectively. We believe that the current period presentation provides a more meaningful representation of the nature of the cash flows and allows for greater transparency as the cash flows related to the derivatives impact operating cash flows upon settlement exclusive of the offsetting cash flows from collateral.

The following table presents the effects of the changes on the presentation of these cash flows to the previously reported condensed consolidated statements of cash flows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| (In millions) |

| |

| As Previously Reported (1) | | Adjustments | | Reclassified |

| | | | | |

Net cash provided by (used in): | | | | | |

Operating activities(2) | $ | 1,242 | | | $ | (25) | | | $ | 1,217 | |

Investing activities(3) | (751) | | | (1) | | | (752) | |

Financing activities(4) | (695) | | | 26 | | | (669) | |

| Effect of exchange rates on cash, cash equivalents, and restricted cash | 18 | | | — | | | 18 | |

| Net decrease in cash, cash equivalents, and restricted cash | $ | (186) | | | $ | — | | | $ | (186) | |

(1) As reported in our Form 10-Q for the quarter ended March 31, 2022 filed with the SEC on April 28, 2022.

(2) Financial statement line impacted in operating activities was “Other assets and liabilities.”

(3) Financial statement line impacted in investing activities was “Collateral posted related to derivative instruments, net.”

(4) Financial statement line impacted in financing activities was “Collateral received related to derivative instruments, net.”

Use of estimates

The preparation of condensed consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, we evaluate our estimates, including those related to provisions for transaction and credit losses, income taxes, loss contingencies, revenue recognition, the valuation of goodwill and intangible assets, and the valuation of strategic investments. We base our estimates on historical experience and various other assumptions which we believe to be reasonable under the circumstances. Actual results could materially differ from these estimates.

Recently adopted accounting guidance

In March 2022, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2022-02, Troubled Debt Restructurings (“TDRs”) and Vintage Disclosures (Topic 326): Financial Instruments – Credit Losses. This amended guidance eliminated the accounting designation of a loan modification as a TDR and the measurement guidance for TDRs. The amendments also enhanced existing disclosure requirements and introduced new requirements related to modifications of receivables due from borrowers experiencing financial difficulty. Additionally, this guidance required entities to disclose gross charge-offs by year of origination for financing receivables, such as loans and interest receivable. The amended guidance was effective for fiscal years beginning after December 15, 2022 and was required to be applied prospectively, except for the recognition and measurement of TDRs, which could be applied on a modified retrospective basis. We adopted this guidance effective January 1, 2023 on a prospective basis. Our financial statements were not materially impacted upon adoption. For additional information, see “Note 11—Loans and Interest Receivable.”

PayPal Holdings, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

There are other new accounting pronouncements issued by the FASB that we have adopted or will adopt, as applicable. We do not believe any of these accounting pronouncements have had, or will have, a material impact on our condensed consolidated financial statements or disclosures.

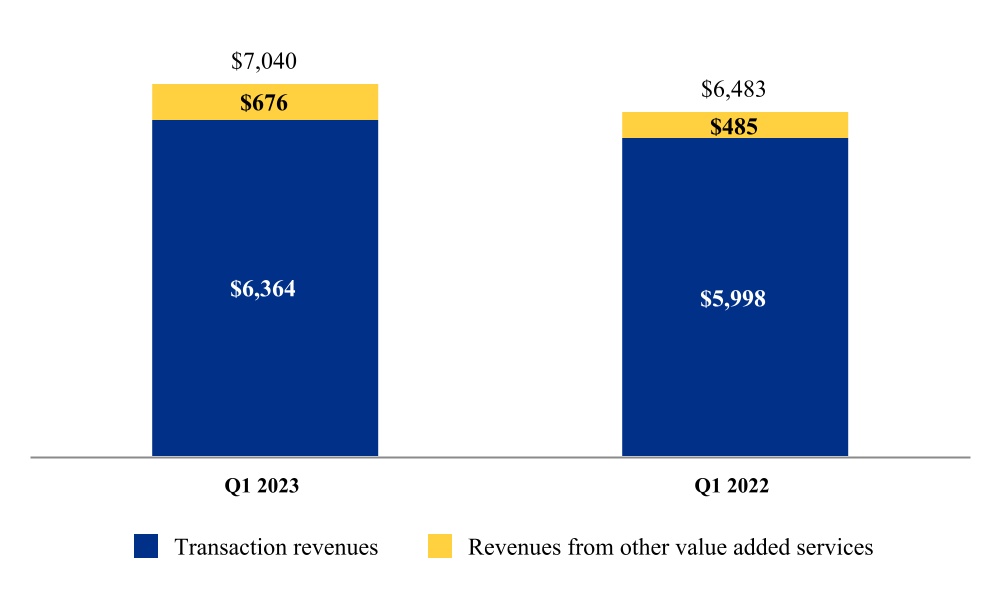

NOTE 2—REVENUE

We enable our customers to send and receive payments. We earn revenue primarily by completing payment transactions for our customers on our payments platform and from other value added services. Our revenues are classified into two categories: transaction revenues and revenues from other value added services.

DISAGGREGATION OF REVENUE

We determine operating segments based on how our chief operating decision maker (“CODM”) manages the business, makes operating decisions around the allocation of resources, and evaluates operating performance. Our CODM is our Chief Executive Officer, who regularly reviews our operating results on a consolidated basis. We operate as one segment and have one reportable segment. Based on the information provided to and reviewed by our CODM, we believe that the nature, amount, timing, and uncertainty of our revenue and cash flows and how they are affected by economic factors are most appropriately depicted through our primary geographical markets and types of revenue categories (transaction revenues and revenues from other value added services). Revenues recorded within these categories are earned from similar products and services for which the nature of associated fees and the related revenue recognition models are substantially the same.

The following table presents our revenue disaggregated by primary geographical market and category:

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2023 | | 2022 | | | | |

| (In millions) |

| Primary geographical markets | | | | | | | |

| U.S. | $ | 4,147 | | | $ | 3,671 | | | | | |

| | | | | | | |

Other countries(1) | 2,893 | | | 2,812 | | | | | |

Total net revenues(2) | $ | 7,040 | | | $ | 6,483 | | | | | |

| | | | | | | |

| Revenue category | | | | | | | |

| Transaction revenues | $ | 6,364 | | | $ | 5,998 | | | | | |

| Revenues from other value added services | 676 | | | 485 | | | | | |

Total net revenues(2) | $ | 7,040 | | | $ | 6,483 | | | | | |

(1) No single country included in the other countries category generated more than 10% of total net revenues.

(2) Total net revenues include $451 million and $187 million for the three months ended March 31, 2023 and 2022, respectively, which do not represent revenues recognized in the scope of Accounting Standards Codification Topic 606, Revenue from contracts with customers. Such revenues relate to interest and fees earned on loans and interest receivable, as well as hedging gains or losses, and interest earned on certain assets underlying customer balances.

Net revenues are attributed to the country in which the party paying our fee is located.

NOTE 3—NET INCOME (LOSS) PER SHARE

Basic net income (loss) per share is computed by dividing net income (loss) for the period by the weighted average number of common shares outstanding during the period. Diluted net income (loss) per share is computed by dividing net income (loss) for the period by the weighted average number of shares of common stock and potentially dilutive common stock outstanding for the period. The dilutive effect of outstanding equity incentive awards is reflected in diluted net income (loss) per share by application of the treasury stock method. The calculation of diluted net income (loss) per share excludes all anti-dilutive common shares. During periods when we report net loss, diluted net loss per share is the same as basic net loss per share because the effects of potentially dilutive items would decrease the net loss per share.

PayPal Holdings, Inc.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

The following table sets forth the computation of basic and diluted net income (loss) per share for the periods indicated:

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2023 | | 2022 | | | | |

| (In millions, except per share amounts) |

| Numerator: | | | | | | | |

| Net income (loss) | $ | 795 | | | $ | 509 | | | | | |

| Denominator: | | | | | | | |

| Weighted average shares of common stock - basic | 1,129 | | | 1,163 | | | | | |

| Dilutive effect of equity incentive awards | 5 | | | 9 | | | | | |

| Weighted average shares of common stock - diluted | 1,134 | | | 1,172 | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.70 | | | $ | 0.44 | | | | | |

| Diluted | $ | 0.70 | | | $ | 0.43 | | | | | |

| Common stock equivalents excluded from income (loss) per diluted share because their effect would have been anti-dilutive or potentially dilutive | 14 | | | 6 | | | | | |

NOTE 4—BUSINESS COMBINATIONS