| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| (State of other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| |

||

| (Address of principal executive offices) |

(Zip Code) |

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered | ||

| ☒ | Accelerated filer | ☐ | ||||

Non-accelerated filer |

☐ | Smaller reporting company | ||||

| Emerging growth company | ||||||

| Part I |

||||||

| Item 1. |

1 | |||||

| Item 1A. |

43 | |||||

| Item 1B. |

91 | |||||

| Item 2. |

91 | |||||

| Item 3. |

92 | |||||

| Item 4. |

92 | |||||

| Part II |

||||||

| Item 5. |

92 | |||||

| Item 6. |

94 | |||||

| Item 7. |

95 | |||||

| Item 7A. |

110 | |||||

| Item 8. |

111 | |||||

| Item 9. |

145 | |||||

| Item 9A. |

145 | |||||

| Item 9B. |

146 | |||||

| Part III |

||||||

| Item 10. |

147 | |||||

| Item 11. |

147 | |||||

| Item 12. |

147 | |||||

| Item 13. |

147 | |||||

| Item 14. |

147 | |||||

| Part IV |

||||||

| Item 15. |

148 | |||||

| Item 16. |

148 | |||||

| 152 | ||||||

| • | our ability to successfully commercialize our approved product, Oxbryta ® (voxelotor) tablets as well as inclacumab or any other product candidate we may identify and pursue, if approved; |

| • | the potential market opportunity for, and rate and degree of market acceptance of, Oxbryta, inclacumab or any other product candidate we may identify and pursue, if approved; |

| • | the benefits of the use of Oxbryta, inclacumab or any other product candidate we may identify and develop; |

| • | the limitations of current treatment options for sickle cell disease, or SCD; |

| • | our ability to successfully maintain a sales force and commercial infrastructure and to commercialize Oxbryta and any other approved products (if any) effectively and in compliance with complex compliance and other requirements; |

| • | our ability to compete with companies currently commercializing or engaged in the clinical development of treatments for the disease indications that we pursue; |

| • | our ability to manufacture Oxbryta for commercial sale and clinical development in conformity with the FDA and other applicable requirements; |

| • | our reliance on third-party contract manufacturers to manufacture and supply Oxbryta and our product candidates; |

| • | our expectations regarding government and third-party payor coverage and reimbursement; |

| • | the timing and results of our continued development of Oxbryta, including, but not limited to, ongoing or planned clinical studies to satisfy post-approval confirmatory study requirements or to seek to expand approved product labeling; |

| • | the timing and results of our preclinical studies and clinical trials of inclacumab and any other product candidate we may develop; |

| • | our ability to leverage the safety data from prior clinical studies of inclacumab, which were not in patients with SCD, in our development of inclacumab; |

| • | our ability to enroll patients in and complete our clinical trials at the pace we project; |

| • | whether the results of our preclinical studies and clinical trials will be sufficient to support any or full domestic or foreign regulatory approvals for Oxbryta, inclacumab or any other product candidate we may develop; |

| • | our ability to obtain, including under any expedited development or review programs, and maintain any or full regulatory approval of Oxbryta, inclacumab or any other product candidates we may develop; |

| • | our ability to advance any other programs through preclinical and clinical development, and the timing and scope of these development activities; |

| • | our ability to maintain, or to recognize the anticipated benefits of, orphan drug designation for Oxbryta or to obtain orphan drug designation for any product candidate we may identify and pursue in the United States, Europe or any other jurisdiction; |

| • | our ability to maintain, or to recognize the anticipated benefits of, access to accelerated development and review programs through the FDA, such as the fast track and breakthrough therapy programs, or through the EMA’s PRIME program, for Oxbryta or any product candidate we may identify and pursue; |

| • | our reliance on third parties to conduct our clinical trials; |

| • | our ability to retain and recruit key personnel; |

| • | our ability to obtain and maintain intellectual property protection for Oxbryta or any product candidate we may identify and pursue; |

| • | our estimates of our expenses, ongoing losses, future revenue, capital requirements, sufficiency of capital resources and our needs for or ability to obtain additional financing; |

| • | our financial performance; |

| • | developments and projections relating to our competitors or our industry; |

| • | our plans to explore strategic transactions to broaden our pipeline; and |

| • | our ability to implement our strategic plans for our business and technology. |

| • | Our business is substantially dependent on our ability to successfully commercialize our first approved product, Oxbryta, which will depend upon the degree of market acceptance by the medical community and marketplace. |

| • | If our sales and marketing capabilities for Oxbryta or any future product candidate for which we receive regulatory approval are not effective, we may not succeed in our commercialization efforts. |

| • | Our profitability depends on our ability to sell sufficient amounts of product at competitive prices and on the availability of adequate coverage and reimbursement through governmental or private third-party payors, the status of which is subject to significant uncertainty. |

| • | Our future growth may depend on our ability to penetrate foreign markets, which would subject us to additional regulatory burdens and other risks and uncertainties. |

| • | We will be subject to ongoing regulatory obligations and scrutiny for Oxbryta and any other product candidate for which we receive approval, which may include restrictions on product labeling, distribution or other post-marketing activities. |

| • | Our business operations and relationships with third parties are subject to various laws and regulations, and any failure to comply with such laws and regulations could adversely affect our business. |

| • | We face intense competition and rapid technological change and the possibility that our competitors may develop therapies that render our only approved product, Oxbryta, or product candidates uneconomical or obsolete, which could adversely affect our development programs, commercialization activities and financial condition. |

| • | If the market for Oxbryta or our product candidates is smaller than expected, our business and financial condition may be adversely affected. |

| • | We have a limited operating history, with only one drug approved for marketing, and expect to continue to incur losses for the foreseeable future. |

| • | We may require substantial additional funds to achieve our business goals, and any inability to obtain such funds may force us to delay, limit or terminate our commercialization of Oxbryta or our other product development efforts and operations. |

| • | We are party to a loan and security agreement that contains operating covenants and obligations that may restrict our business and financing activities. |

| • | If we are unable to obtain regulatory approval in additional jurisdictions for Oxbryta or in any jurisdictions for other product candidates, our business will be substantially harmed. |

| • | All of our programs other than Oxbryta are still in earlier development stages, so we remain very reliant on the potential success of Oxbryta in the clinic and in the marketplace. |

| • | Expedited development and regulatory approval programs for Oxbryta or other product candidates may not lead to a faster development or regulatory review or approval process, or to a timely approval, if at all. |

| • | The development of Oxbryta represents a novel therapeutic approach, and the outcomes of our clinical trials may not support any label expansion or any decision to seek, grant or maintain any regulatory approval. |

| • | Results of earlier studies may not be predictive of future clinical trial results, and initial studies may not establish or maintain an adequate safety or efficacy profile for Oxbryta or a product candidate to justify proceeding to advanced clinical trials or an application for regulatory approval. |

| • | We may encounter substantial delays in conducting or completing our clinical trials, including due to difficulties in enrolling patients or maintaining compliance with trial protocols, or the occurrence of serious adverse events or unacceptable side effects. |

| • | We may not realize the expected benefits of the orphan drug designations we have received for Oxbryta, and we may not receive orphan drug designation for any product candidate. |

| • | If the third parties upon which we rely to conduct our clinical trials, nonclinical studies, manufacturing and other activities related to the development and commercialization of Oxbryta and our product candidates fail to meet regulatory requirements or otherwise do not perform in a satisfactory manner, our business will be harmed. |

| • | If we or our licensors are unable to obtain and maintain intellectual property protection that is adequate in scope and duration for Oxbryta or our product candidates, our ability to successfully commercialize Oxbryta and other product candidates will be impaired. |

| • | We may become subject to litigation, claims and investigations, including healthcare compliance claims, product liability claims or claims alleging infringement of third parties’ proprietary rights and/or seeking to invalidate our patents, which would be costly and could impair our development and commercialization efforts. |

| • | If we are unable to protect the confidentiality of our trade secrets or other confidential information, our business would be harmed. |

| • | The COVID-19 pandemic has adversely impacted, and may continue to adversely impact, our business, including our commercialization activities, clinical trials and preclinical studies. |

| • | Our success depends on our ability to retain key employees, consultants and advisors and to attract, retain and motivate qualified personnel, including an adequate sales force, as well as managing our growth. |

| • | If we are not successful in discovering, developing, acquiring or commercializing additional product candidates, our ability to expand our business and achieve our strategic objectives could be impaired. |

| • | Any collaboration, license, distribution or other arrangements that we are a party to or may enter into in the future may not be successful. |

| • | Our operating results may fluctuate significantly, which makes our future operating results difficult to predict. |

| • | We do not currently intend to pay dividends on our common stock, and, consequently, our stockholders’ ability to achieve a return on their investment will depend on appreciation in the price of our common stock. |

| • | We are deploying a variety of patient and healthcare provider marketing materials in support of the Oxbryta launch. Given our accelerated approval in the United States, all marketing materials are required to undergo FDA review before use. Several of our materials have already been approved or are currently under review. These materials include advertisements, social media campaigns, patient starter kits, guides and brochures. |

| • | GBT Source Solutions, our comprehensive program for patients, provides support by reviewing insurance coverage options and explaining benefits, working with the specialty pharmacy partner |

| • | network to coordinate delivery of Oxbryta to wherever the patient chooses, helping with financial and co-pay assistance for eligible patients, and helping patients stay on treatment as prescribed by their treating physicians with a nurse support team. GBT Source Solutions is supported by a team of highly trained professionals and regional, field-based patient navigators that will help patients and provide resources to help HCPs understand insurance requirements and other administrative details when prescribing Oxbryta. The program features a high-touch model, including early contact to introduce the program, explain how the patient will interact with team members, and provide patient starter kits and adherence tools. Those tools include a treatment journal, a side effects management tip sheet, and bottle and app-linked reminders for daily dosing. We believe these tools will help patients better navigate the start of their treatments and help overall adherence. |

| • | Our field team, which consists of approximately 60 Sickle Cell Therapeutic Specialists and 10 Regional Business Directors, continues to engage with nearly 5,000 targeted HCPs to educate them on Oxbryta’s broad label. |

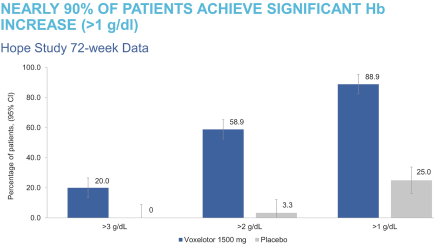

| • | We are introducing new education materials with information on the 72-week HOPE Study data presented at the ASH Annual Meeting & Exposition in December 2020, as well as the favorable safety and tolerability and durable efficacy seen with sustained use of Oxbryta. |

| • | In 2020, we executed the commercial launch of Oxbryta in the United States, leveraging our field team and GBT Source Solutions to educate HCPs, payors and other stakeholders on Oxbryta. Over the course of the year, we secured FDA approval for patient and healthcare provider marketing materials in support of the Oxbryta launch. |

| • | In March 2020, we adapted our commercial launch of Oxbryta to the challenging environment created by the COVID-19 pandemic through proactive measures to reduce the risk of spreading the COVID-19 virus among our employees, customers, business partners and local communities. |

| • | In June 2020, we announced plans to seek the potential expansion of the use of Oxbryta for the treatment of SCD in children ages 4 to 11 years. |

| • | In June 2020, we announced plans to submit an MAA to the EMA for Oxbryta to treat hemolytic anemia in SCD patients ages 12 years and older by mid-2021, and, in January 2021, we were notified that the EMA has completed the validation of the MAA we submitted and has started its standard review process. |

| • | In September 2020, we announced our entry into an exclusive agreement with Biopharma-MEA to distribute Oxbryta in the GCC region. |

| • | As of the end of September 2020 (a quarter ahead of our goal), we achieved broad payer coverage for Oxbryta in the United States, defined as 90% of lives covered by payers either through published policies or verified patient adjudication. |

| • | In December 2020, we initiated two early access programs for Oxbryta. One is in Europe and other regions outside the United States, for the treatment of hemolytic anemia in eligible SCD patients ages 12 years and older, and the other is a multi-center expanded access protocol in the United States for eligible pediatric SCD patients to provide access prior to potential market authorization for children ages 4 to 11 who have no alternative treatment options. |

| • | In March 2020, as a response to the COVID-19 pandemic and its impact on the SCD community, we created the GBT Community Fund, under which we provided $150,000 in grants to support the acute needs of SCD patients and families during the pandemic. At that time, we also made a donation of $100,000 to the Sickle Cell Disease Association of America (SCDAA) in response to its urgent call for its COVID-19 Emergency Fund, and employees and members of our Board of Directors contributed more than $100,000 to support the SCD community during the pandemic. |

| • | In June 2020, we awarded a total of $250,000 in grants to five non-profit organizations through our Access to Excellent Care for Sickle Cell Patients (ACCEL) Grant Program. The program provides grant funding to support novel projects aimed at improving access to high-quality healthcare for individuals with SCD. |

| • | In September 2020, we hosted the 9th Annual Sickle Cell Disease Therapeutics Conference, which featured discussions about the latest advances and future trends in the treatment of SCD, and the impact of COVID-19 on this vulnerable patient population. |

| • | In December 2020, as part of the GBT Gives Back initiative, GBT employees donated more than $40,500 to sickle cell organizations across the globe. |

| • | In June 2020, we presented four abstracts at the virtual edition of the 25th Annual European Hematology Association Congress. This included a retrospective analysis of data from the landmark STOP 2 study (Stroke Prevention in Sickle Cell Anemia) linking higher Hb levels to lower TCD flow velocity, a predictor of stroke risk in children with SCD, and three encore presentations of the pivotal Phase 3 HOPE Study that reinforced key attributes of Oxbryta. |

| • | In October 2020, we presented two abstracts that provide greater insight into the safety and efficacy of Oxbryta at the 15th Annual Scientific Conference on Sickle Cell and Thalassemia (ASCAT) and 1st EHA European Sickle Cell Conference. |

| • | In December 2020, we presented nine abstracts related to our SCD programs at ASH, including the 72-week analysis of the completed Phase 3 HOPE Study of Oxbryta, real-world evidence supporting the use of Oxbryta, and new research on our pipeline programs, inclacumab and GBT601. |

| • | We announced the appointment of a head of research and development who is expected to join us in May 2021 and, in August 2020, we added a chief medical officer to our senior management team. |

| • | In October 2020, we received the 2020 Rare Impact Award ® for Industry Innovation for Oxbryta from the National Organization for Rare Disorders (NORD); in addition, Oxbryta was selected as Breakthrough Drug of the Year by the 2020 National Xconomy Awards. |

| • | HbSS, or sickle cell anemia, where both genes are HbS; |

| • | HbSC, where one gene is HbS, and the other is HbC (inherited from a non-SCD impacted parent); and |

| • | HbS/ßthal, where one gene is HbS, and the other is Beta thalassemia. |

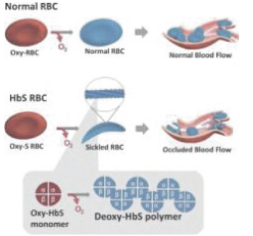

| • | inhibits abnormal hemoglobin polymer formation, the underlying mechanism of RBC sickling; |

| • | stops inappropriate RBC destruction and improves blood flow and oxygen delivery to tissues; |

| • | reduces hemolytic anemia that leads to chronic organ damage and early mortality in patients with SCD; |

| • | prevents or reduces the episodes or crises of severe pain associated with SCD; |

| • | modifies the long-term course of the disease; |

| • | is effective in all SCD genotypes and in both children and adults; |

| • | has a more favorable side effect profile than currently available therapies; and |

| • | is available as a convenient, oral therapy. |

| • | similar to crizanlizumab, reduces the frequency of VOCs, but with a more convenient dosing schedule; and |

| • | reduces the hospital re-admission rate due to VOCs in patients that are admitted to the hospital for a VOC. |

| • | A broad indication for use with no hemoglobin level restrictions and no clinically significant differences in the pharmacokinetics based on age, sex, body weight or mild to severe renal impairment; |

| • | A specific description of Oxbryta as a hemoglobin S polymerization inhibitor that may inhibit RBC sickling, improve RBC deformability, and reduce whole blood viscosity; |

| • | No restriction on use with or without hydroxyurea; and |

| • | Clinical data highlights from the HOPE Study, including the subject-level change from baseline in hemoglobin at week 24 in patients who completed 24 weeks of treatment with Oxbryta 1500 mg dose or placebo. |

| • | An analysis evaluating Symphony Health claims data from a subset of 1,275 SCD patients ages 12 and older treated with Oxbryta, which showed statistically significant reductions in annualized transfusion rates and a reduced annual rate of VOC events following the initiation of Oxbryta therapy. |

| • | A study from a single-center case series showed that both patients and clinicians observed improved health status based on the Patient Global Impression – Improvement (PGI-I) and the Clinical Global Impression – Improvement (CGI-I) scales to examine patient and clinician perception of health status in patients treated with Oxbryta. In addition, while cases of gastrointestinal side effects were reported at a rate of incidence similar to that as the HOPE Study, patients were successfully managed with adjustments to dosing regimens and persisted on treatment. |

| • | completion of extensive nonclinical studies in accordance with applicable regulations, including the FDA’s GLP regulations; |

| • | submission to the FDA of an IND, which must become effective before human clinical trials may begin; |

| • | approval by an independent institutional review board, or IRB, or ethics committee at each clinical trial site before each trial may be initiated; |

| • | performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, good clinical practices, or GCPs, and other clinical-trial related regulations to establish the safety and efficacy of the investigational drug for each proposed indication; |

| • | submission to the FDA of an NDA for a new drug; |

| • | a determination by the FDA within 60 days of its receipt of an NDA whether to accept it for filing and review; |

| • | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities where the drug is produced to assess compliance with current good manufacturing practices, or |

| cGMPs, to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; |

| • | potential FDA audit of the nonclinical study and/or clinical trial sites that generated the data in support of the NDA; and |

| • | FDA review and approval of the NDA, including consideration of the views of any FDA advisory committee, prior to any commercial marketing or sale of the drug in the United States. |

| • | Phase 1 clinical trials generally involve a small number of healthy volunteers who are initially exposed to a single dose and then multiple doses of the product candidate. The primary purpose of these clinical trials is to assess the metabolism, pharmacologic action, side effect tolerability and safety of the product candidate. |

| • | Phase 2 clinical trials typically involve studies in disease-affected patients to determine the dose of the product candidate required to produce the desired benefits. At the same time, safety and further pharmacokinetic and pharmacodynamic information is collected, possible adverse effects and safety risks are identified, and a preliminary evaluation of efficacy is conducted. |

| • | Phase 3 clinical trials generally involve large numbers of patients at multiple sites and are designed to provide the data necessary to demonstrate the effectiveness of the product candidate for its intended use, its safety in use, and to establish the overall benefit/risk relationship of the product candidate and provide an adequate basis for product approval. Phase 3 clinical trials may include comparisons with placebo and/or other comparator treatments. The duration of treatment is often extended to mimic the actual use of a product during marketing. |

| • | the federal Anti-Kickback Law, which makes it illegal for any person to knowingly and willfully solicit, receive, offer or pay any remuneration (including any kickback, bribe or certain rebates), directly or indirectly, overtly or covertly, in cash or in kind, or in return for, that is intended to induce or reward referrals, including the purchase, recommendation, order or prescription of a particular drug, for which payment may be made under a federal healthcare program, such as Medicare or Medicaid. A person or entity need not have actual knowledge of the federal Anti-Kickback Statute or specific intent to violate it in order to have committed a violation. Violations are subject to civil and criminal fines and penalties for each violation, plus imprisonment and exclusion from government healthcare programs. In addition, the government may assert that a claim that includes items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the civil False Claims Act, or FCA. There are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution. This law applies to our marketing practices, educational programs, pricing policies and relationships with healthcare providers, by prohibiting, among other things, soliciting, receiving, offering or providing remuneration intended to induce the purchase or recommendation of an item or service reimbursable under a federal healthcare program, such as the Medicare or Medicaid programs; |

| • | federal civil and criminal false claims laws, including the FCA, which prohibit individuals or entities from, among other things, knowingly presenting, or causing to be presented, to the federal government, claims for payment or approval that are false, fictitious or fraudulent; knowingly making, using or causing to be made or used, a false statement or record material to a false or fraudulent claim or obligation to pay or transmit money or property to the federal government; or knowingly concealing or knowingly and improperly avoiding or decreasing an obligation to pay money to the federal government. Manufacturers can be held liable under the FCA even when they do not submit claims directly to government payors if they are deemed to “cause” the submission of false or fraudulent claims. The government may deem manufacturers to have “caused” the submission of false or fraudulent claims by, for example, providing inaccurate billing or coding information to customers or promoting a product off-label. Companies that submit claims directly to payors may also be liable under the FCA for the direct submission of such claims. In addition, our future activities relating to the reporting of wholesaler or estimated retail prices for our products, the reporting of prices used to calculate Medicaid rebate information |

| and other information affecting federal, state, and third-party reimbursement for our products, and the sale and marketing of our products, are subject to scrutiny under this law. The FCA also permits a private individual acting as a “whistleblower” to bring actions on behalf of the federal government alleging violations of the FCA and to share in any monetary recovery. When an entity is determined to have violated the FCA, the government may impose civil fines and penalties for each false claim, plus treble damages, and exclude the entity from participation in Medicare, Medicaid and other federal healthcare programs; |

| • | the federal civil monetary penalties laws, which impose civil fines for, among other things, the offering or transfer of remuneration to a Medicare or state healthcare program beneficiary if the person knows or should know it is likely to influence the beneficiary’s selection of a particular provider, practitioner, or supplier of services reimbursable by Medicare or a state health care program, unless an exception applies; |

| • | the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, and its implementing regulations, which created additional federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program or obtain, by means of false or fraudulent pretenses, representations, or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program, regardless of the payor (e.g., public or private) and knowingly and willfully falsifying, concealing or covering up by any trick or device a material fact or making any materially false statements in connection with the delivery of, or payment for, healthcare benefits, items or services relating to healthcare matters. Similar to the federal Anti-Kickback Statute, a person or entity can be found guilty of violating HIPAA without actual knowledge of the statute or specific intent to violate it; |

| • | HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH, and their respective implementing regulations, including the Final Omnibus Rule published in January 2013, which impose requirements on certain covered healthcare providers, health plans, and healthcare clearinghouses as well as their respective business associates that perform services for them that involve the use, or disclosure of, individually identifiable health information, relating to the privacy, security and transmission of individually identifiable health information. HITECH also created new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorneys’ fees and costs associated with pursuing federal civil actions. In addition, there may be additional federal, state and non-U.S. laws which govern the privacy and security of health and other personal information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts; |

| • | federal “sunshine” requirements imposed by the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or collectively, the ACA, on drug, device, biological and medical supply manufacturers when payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to HHS under the Open Payments Program, information regarding any payment or other “transfer of value” made or distributed to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, as well as ownership and investment interests held by physicians and their immediate family members. Failure to submit required information may result in civil monetary penalties for all payments, transfers of value or ownership or investment interests that are not timely, accurately, and completely reported in an annual submission. Effective January 1, 2022, these reporting obligations will extend to include transfers of value made to certain non-physician providers such as physician assistants and nurse practitioners; |

| • | federal price reporting laws, which require manufacturers to calculate and report complex pricing metrics to government programs, where such reported prices may be used in the calculation of reimbursement and/or discounts on approved products; |

| • | the Foreign Corrupt Practices Act, or FCPA, prohibits any United States individual or business from paying, offering, or authorizing payment or offering of anything of value, directly or indirectly, to any foreign official, political party, or candidate for the purpose of influencing any act or decision of the foreign entity in order to assist the individual or business in obtaining or retaining business. The FCPA also obligates companies whose securities are listed in the United States to comply with accounting provisions requiring the company to maintain books and records that accurately and fairly reflect all transactions of the corporation, including international subsidiaries, and to devise and maintain an adequate system of internal accounting controls for international operations. Activities that violate the FCPA, even if they occur wholly outside the United States, can result in criminal and civil fines, imprisonment, disgorgement, oversight, and debarment from government contracts; and |

| • | analogous state and foreign law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers or patients; state laws that require pharmaceutical companies to comply with the industry’s voluntary compliance guidelines and the applicable compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; state and local laws that require the licensure of sales representatives; state laws that require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures and pricing information; data privacy and security laws and regulations in foreign jurisdictions that may be more stringent than those in the United States (such as the European Union, which adopted the General Data Protection Regulation, or GDPR, which became effective in May 2018); state laws governing the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect; and state laws related to insurance fraud in the case of claims involving private insurers. |

| • | appoints a rapporteur from the Committee for Medicinal Products for Human Use, or CHMP, or from the Committee for Advanced Therapies, or CAT, to provide continuous support and to build up knowledge of the medicine in advance of the filing of a marketing authorization application; |

| • | issues guidance on the applicant’s overall development plan and regulatory strategy; |

| • | organizes a kick-off meeting with the rapporteur and experts from relevant EMA committees and working groups; |

| • | provides a dedicated EMA contact person; and |

| • | provides scientific advice at key development milestones, involving additional stakeholders, such as health technology assessment bodies and patients, as needed. |

| • | The Budget Control Act of 2011, among other things, created measures for spending reductions by Congress. A Joint Select Committee on Deficit Reduction, tasked with recommending a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, was unable to reach required goals, thereby triggering the legislation’s automatic reduction to several government programs. These changes included aggregate reductions to Medicare payments to providers of up to 2% per fiscal year, which went into effect in April 2013 and, due to subsequent legislative amendments, are suspended until March 31, 2021, and are currently scheduled to remain in effect through 2030 unless additional Congressional action is taken. |

| • | The American Taxpayer Relief Act of 2012, among other things, reduced Medicare payments to several providers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. |

| • | the demonstrated efficacy and potential advantages of our drugs compared to alternative treatments; |

| • | our ability to offer our drugs for sale at competitive prices; |

| • | the availability of third-party coverage and adequate reimbursement; |

| • | the convenience and ease of administration of our drugs compared to alternative current and future treatments; |

| • | the willingness of the SCD or other target patient populations to try new therapies and of physicians to prescribe these therapies; |

| • | the availability of our drugs and our ability to meet market demand, including a reliable supply for long-term chronic treatment; |

| • | the strength of labeling, marketing and distribution support; |

| • | the clinical indications and approved labeling for which the drug is approved, including labeling restrictions for drugs approved under Subpart H, such as Oxbryta; |

| • | the prevalence and severity of any side effects and overall safety profile of the drug; and |

| • | any restrictions on the use of the drug, including together with other medications. |

| • | the burden of complying with complex and changing foreign regulatory, tax, accounting, compliance and legal requirements; |

| • | different medical practices and customs in foreign countries affecting acceptance in the marketplace; |

| • | import or export licensing requirements; |

| • | longer accounts receivable collection times; |

| • | longer lead times for shipping; |

| • | language barriers for technical training; |

| • | reduced protection of intellectual property rights in some foreign countries, and related prevalence of bioequivalent or generic alternatives to therapeutics; |

| • | foreign currency exchange rate fluctuations; |

| • | potential resource constraints, including with respect to patients’ ability to obtain reimbursement for our products in foreign markets; and |

| • | the interpretation of contractual provisions governed by foreign laws in the event of a contract dispute. |

| • | issue untitled or warning letters; |

| • | impose civil or criminal penalties; |

| • | impose injunctions; |

| • | impose fines; |

| • | impose additional specialized restrictions on the company’s activities and practices; |

| • | suspend regulatory approval; |

| • | suspend ongoing clinical trials; |

| • | seek voluntary product recalls and impose publicity requirements; |

| • | refuse to approve pending applications or supplements to approved applications submitted by us; |

| • | impose restrictions on our operations, including closing our contract manufacturers’ facilities; or |

| • | seize or detain products. |

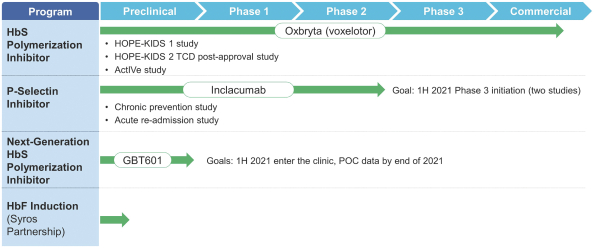

| • | commercialize Oxbryta and continue related clinical development, including conducting (i) our Phase 2a HOPE-KIDS 1 Study of Oxbryta, (ii) our Phase 3 HOPE-KIDS 2 Study, which we intend to serve as our post-confirmatory study of Oxbryta in SCD (and any other post-marketing studies that may be required by regulatory authorities, if any), and (iii) any additional clinical trials of Oxbryta we may conduct now or in the future in SCD patients or for any other indications for Oxbryta, inclacumab or any other product candidates, if any; |

| • | establish and maintain manufacturing and supply relationships with third parties that can provide adequate supplies (in amount and quality) of Oxbryta, inclacumab or any other product candidates to support commercialization and further clinical development; |

| • | seek and obtain additional regulatory and marketing approvals for Oxbryta for SCD, including for younger pediatric patient populations, or any potential approvals we may pursue; |

| • | maintain a sales and marketing organization and enter into selected collaborations to commercialize Oxbryta for SCD or any other approved indication, as well as for any other product candidates; |

| • | maintain a medical affairs organization to advance our engagement with healthcare providers and stakeholders; |

| • | advance our other programs, including inclacumab and any other product candidates, through nonclinical and clinical development and commence development activities for any additional product candidates we may identify and pursue; and |

| • | expand our organization to support our commercialization, research, development and medical activities and our operations as a public company. |

| • | our ability to successfully commercialize Oxbryta, inclacumab and any other product candidates we may identify and develop in any territories; |

| • | the manufacturing, selling, and marketing costs associated with the commercialization of Oxbryta and the potential commercialization of inclacumab and any other product candidates we may |

| identify and develop, including the cost and timing of establishing or maintaining our sales and marketing capabilities in any territory(ies); |

| • | the amount and timing of sales and other revenues from Oxbryta, inclacumab and any other product candidates we may identify and develop, including the sales price and the availability of adequate third-party reimbursement; |

| • | the time and cost necessary to conduct and complete multiple ongoing studies (including our HOPE-KIDS 1 Study, our Phase 3 HOPE-KIDS 2 Study and other studies); |

| • | the time and cost necessary to conduct and complete any additional clinical studies required to pursue additional regulatory approvals for Oxbryta for SCD, including our Phase 3 HOPE-KIDS 2 Study (which is necessary to move from our current Subpart H approval to a full approval) and any studies to support potential label expansions into younger SCD pediatric populations, or any other post-marketing studies for Oxbryta for SCD; |

| • | the progress, data and results of clinical trials of Oxbryta and product candidates; |

| • | the progress, timing, scope and costs of our nonclinical studies, our clinical trials and other related activities, including our ability to enroll subjects in a timely manner for our ongoing and future clinical trials of Oxbryta, inclacumab or any other product candidate that we may identify and develop; |

| • | the costs of obtaining clinical and commercial supplies of Oxbryta, inclacumab and any other product candidates we may identify and develop; |

| • | our ability to advance our development programs, including for Oxbryta, inclacumab and any other potential product candidate programs we may identify and pursue, the timing and scope of these development activities, and the availability of approval for any of our other product candidates; |

| • | our ability to successfully obtain any additional regulatory approvals from any regulatory authorities, and the scope of any such regulatory approvals, to market and sell Oxbryta, inclacumab and any other product candidates we may identify and develop in any territory(ies); |

| • | the cash requirements of any future acquisitions or discovery of product candidates; |

| • | the time and cost necessary to respond to technological and market developments; |

| • | the extent to which we may acquire or in-license other product candidates and technologies, and the costs and timing associated with any such acquisitions or in-licenses; |

| • | our ability to attract, hire, and retain qualified personnel; and |

| • | the costs of maintaining, expanding, and protecting our intellectual property portfolio. |

| • | sell, transfer or otherwise dispose of any of our business or property, subject to limited exceptions; |

| • | make certain changes to our organizational structure; |

| • | consolidate or merge with other entities or acquire other entities; |

| • | incur additional indebtedness or create encumbrances on our assets; |

| • | pay dividends, other than dividends paid solely in shares of our common stock, or make distributions on and, in certain cases, repurchase our stock; |

| • | repay subordinated indebtedness; or |

| • | make certain investments. |

| • | we may not be able to demonstrate to the satisfaction of regulatory authorities (including the EMA) that Oxbryta, inclacumab or any other product candidates we may develop are safe and effective for any proposed indications; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our plans or expectations regarding the pathways and endpoints for approval, including the availability of accelerated approval, or the design or implementation of our nonclinical studies or clinical trials; |

| • | the populations studied in our clinical programs may not be sufficiently broad or representative to assure safety or demonstrate efficacy in the full population for which we seek approval; |

| • | the FDA or comparable foreign regulatory authorities may require additional nonclinical studies or clinical trials beyond those we anticipate; |

| • | the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data and results from our nonclinical studies or clinical trials; |

| • | the data and results collected from nonclinical studies or clinical trials of Oxbryta, inclacumab and any other product candidates that we may identify and pursue may not be sufficient to support the submission for regulatory approval; |

| • | we may be unable to demonstrate to the FDA or comparable foreign regulatory authorities that a product candidate’s risk-benefit ratio for its proposed indication is acceptable; |

| • | the FDA or comparable foreign regulatory authorities may find deficiencies with or fail to approve the manufacturing processes, test procedures and specifications, or facilities of third-party manufacturers with which we contract and rely on for all clinical and commercial supplies of Oxbryta, inclacumab and any other product candidates (if any); and |

| • | the approval policies or regulations of the FDA or comparable foreign regulatory authorities may change in a manner that renders our development or manufacturing efforts insufficient for approval. |

| • | delays or failures in reaching a consensus with regulatory agencies on study design, including clinical endpoints sufficient to support an approval decision; |

| • | delays or failures to receive approval for conduct of clinical studies in one or more geographies, which could result in delays in enrollment and availability of data and results; |

| • | delays or failures in reaching agreement on acceptable terms with a sufficient number of prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | delays in obtaining required Institutional Review Board, or IRB, or ethics committee approval for each clinical trial site; |

| • | delays in recruiting a sufficient number of suitable patients to participate in our clinical trials; |

| • | imposition of a clinical hold by any regulatory authority, including if imposed due to safety concerns after an inspection of our clinical trial operations or study sites; |

| • | failure by our CROs, clinical sites, participating clinicians or patients, other third parties or us to adhere to clinical trial, regulatory or legal requirements; |

| • | failure to perform in accordance with the FDA’s good clinical practices, or GCPs, or applicable regulatory requirements in other countries; |

| • | delays in the testing, validation, manufacturing and delivery of sufficient quantities of Oxbryta or our product candidates or study related devices to the clinical sites and patients; |

| • | delays in having patients enroll or complete participation in a study in accordance with applicable protocols or protocol amendments or return for post-treatment follow-up; |

| • | reduction in the number of participating clinical trial sites or patients, including by dropping out of a trial; |

| • | failure to address in an adequate or timely manner any patient safety concerns that arise during the course of a trial; |

| • | unanticipated costs or increases in costs of clinical trials of Oxbryta or our product candidates; |

| • | the occurrence of serious adverse events or other safety concerns associated with Oxbryta or our product candidates; or |

| • | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols or obtaining additional IRB or other approvals to conduct or complete clinical studies of Oxbryta or our product candidates. |

| • | reliance on the third party for regulatory compliance and quality assurance; |

| • | the possible breach or termination of the manufacturing agreement by the third party or by us, including at a time that is costly or inconvenient for us; |

| • | the inability of the third party to satisfy our ordering requirements as to quality, quantity and/or price, including, without limitation, potential impact on supply chain due to the impact of public health risks, such as the COVID-19 pandemic; |

| • | the possible misappropriation of our proprietary information, including our trade secrets and know-how; and |

| • | the unwillingness of the third party to extend or renew terms with us when desired. |

| • | the research methodology used may not be successful in identifying potential product candidates; |

| • | competitors may develop alternatives that render our product candidates obsolete or less attractive; |

| • | product candidates we develop may nevertheless be covered by third parties’ patents or other exclusive rights; |

| • | the market for a product candidate may change during our program so that such a product may become unreasonable to continue to develop; |

| • | a product candidate may on further study be shown to have harmful side effects, lack of potential efficacy or other characteristics that indicate it is unlikely to meet applicable regulatory criteria or remain reasonable to continue to develop; |

| • | a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and |

| • | a product candidate may not be accepted as safe and effective by patients, the medical community or third-party payors, if applicable. |

| • | impairment of our business reputation; |

| • | withdrawal of clinical trial participants; |

| • | costs due to related litigation; |

| • | distraction of management’s attention from our primary business; |

| • | substantial monetary awards to patients or other claimants; |

| • | increased warnings on product labels or additional restrictions imposed by regulatory authorities; |

| • | the recall of Oxbryta or our product candidates; |

| • | the inability to commercialize Oxbryta or our product candidates; and |

| • | decreased demand for Oxbryta or our product candidates, if approved for commercial sale. |

| • | restrictions and obligations imposed by privacy regulations, such as provisions under the GDPR, applicable to the collection and use of personal health data in the European Union; |

| • | multiple, conflicting, and changing laws and regulations such as tax laws, export and import restrictions, employment laws, regulatory requirements, and any requirements to obtain other governmental approvals, permits, and licenses; |

| • | failure by us to obtain and maintain regulatory approvals for the sale or use of our products in various countries; |

| • | additional potentially relevant third-party patent rights; |

| • | complexities and difficulties in obtaining protection for and enforcing our intellectual property; |

| • | difficulties in staffing and managing our current and potential foreign operations; |

| • | complexities associated with managing multiple payor reimbursement regimes, government payors, or patient self-pay systems; |

| • | limits in our ability to penetrate international markets; |

| • | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises on demand and payment for our products, and exposure to foreign currency exchange rate fluctuations; |

| • | natural disasters, political and economic instability, including wars, terrorism, and political unrest, outbreak of disease, boycotts, curtailment of trade, and other business restrictions; |

| • | certain expenses including, among others, expenses for travel, translation, and insurance; and |

| • | regulatory and compliance risks that relate to maintaining accurate information and control over sales and activities that may fall within the purview of the FCPA, its books and records provisions, or its anti-bribery provisions. |

| • | comply with EMA or FDA regulations or similar regulations of comparable foreign regulatory authorities; |

| • | provide accurate information to the FDA or EMA or comparable foreign regulatory authorities; |

| • | comply with cGMP regulations and manufacturing standards that we have established and comply with applicable healthcare fraud and abuse regulations in the jurisdictions in which we operate; |

| • | report financial information or data accurately; or |

| • | disclose unauthorized activities to us. |

| • | failure to successfully develop and commercialize Oxbryta, inclacumab or any other product candidates, including results relating to our commercialization of Oxbryta in the United States; |

| • | adverse results or delays in, or the halting of, our nonclinical studies or clinical trials, especially in our ongoing or future clinical program for Oxbryta for the treatment of SCD; |

| • | reports of adverse events from our commercialization or clinical trials of Oxbryta, or from clinical trials of any other product candidates that we may develop; |

| • | any delay in the review of, or potential action with respect to, our previous or planned filing of any IND, NDA or MAA for Oxbryta, inclacumab or for any other product candidates that we may develop and any adverse development or perceived adverse development with respect to the FDA’s or any other regulatory agency’s review of such filing; |

| • | adverse regulatory decisions affecting Oxbryta, inclacumab or any other product candidates we may develop, including any delay in or denial of potential approval in accordance with our plans and expectations; |

| • | inability to obtain additional funding; |

| • | failure to prosecute, maintain or enforce our intellectual property rights; |

| • | disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies; |

| • | changes in laws or regulations applicable to Oxbryta or future products; |

| • | inability to obtain adequate product supply for Oxbryta or our product candidates or the inability to do so at acceptable prices; |

| • | introduction of new products, services or technologies by our competitors; |

| • | failure to enter into or perform under strategic collaborations; |

| • | failure to meet or exceed any financial projections that we or the investment community may provide; |

| • | the perception of the pharmaceutical industry by the public, legislatures, regulators and the investment community; |

| • | announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors; |

| • | additions or departures of key scientific or management personnel; |

| • | significant lawsuits, including patent or stockholder litigation; |

| • | changes in the market valuations of similar companies; |

| • | sales of our common stock by us or our stockholders in the future; |

| • | trading volume of our common stock; and |

| • | the other risks described in this “Risk Factors” section. |

| • | our ability to successfully commercialize Oxbryta or any of our product candidates, if approved, and the timing and costs of our commercialization activities; |

| • | the timing and cost of, and level of investment in, research and development activities relating to Oxbryta and our product candidates, which may change from time to time; |

| • | the timing and success or failure of clinical trials for Oxbryta and our product candidates or competing product candidates, or any other change in the competitive landscape of our industry, including consolidation among our competitors or partners; |

| • | our ability to obtain and maintain full regulatory approval for Oxbryta in the United States (including potential pediatric approval) and to obtain regulatory approval of Oxbryta outside of the United States (including potential European approval) as well as regulatory approval for our product candidates, and the timing and scope of any such approvals we may receive; |

| • | the cost of manufacturing Oxbryta and our product candidates, which may vary depending on the quantity of production and the terms of our agreements with manufacturers; |

| • | our ability to attract, hire, train and retain qualified personnel; |

| • | expenditures that we will or may incur to acquire or develop additional product candidates and technologies; |

| • | the level of demand for Oxbryta and our product candidates, if approved, which may vary significantly; |

| • | future accounting pronouncements or changes in our accounting policies; |

| • | the risk/benefit profile, cost and reimbursement policies with respect to Oxbryta and our products candidates, if approved, and existing and potential future drugs that compete with Oxbryta and our product candidates; |

| • | whether Oxbryta or any of our product candidates are subject to any compliance-related challenges or sanctions, or any intellectual-property related challenges; and |

| • | the changing and volatile U.S., European and global economic environments, including economic volatility as a result of the COVID-19 pandemic. |

| • | authorize “blank check” preferred stock, which could be issued by our board of directors without stockholder approval and may contain voting, liquidation, dividend and other rights superior to our common stock; |

| • | create a classified board of directors whose members serve staggered three-year terms; |

| • | specify that special meetings of our stockholders can be called only by our board of directors, the chairperson of our board of directors, our chief executive officer or our president; |

| • | prohibit stockholder action by written consent; |

| • | establish an advance notice procedure for stockholder approvals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to our board of directors; |

| • | provide that our directors may be removed only for cause; |

| • | provide that vacancies on our board of directors may be filled only by a majority of directors then in office, even though less than a quorum; |

| • | specify that no stockholder is permitted to cumulate votes at any election of directors; |

| • | expressly authorize our board of directors to modify, alter or repeal our amended and restated bylaws; and |

| • | require supermajority votes of the holders of our common stock to amend specified provisions of our amended and restated certificate of incorporation and amended and restated bylaws. |

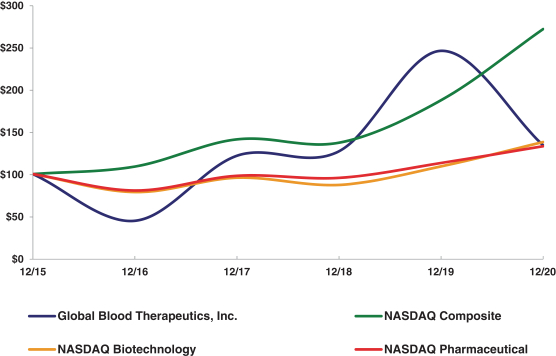

| * | $100 invested on 12/31/15 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. |

12/31/15 |

12/31/16 |

12/31/17 |

12/31/18 |

12/31/19 |

12/31/20 |

|||||||||||||||||||

| Global Blood Therapeutics, Inc. |

100.00 |

44.70 |

121.71 |

126.97 |

245.87 |

133.96 |

||||||||||||||||||

| NASDAQ Composite |

100.00 |

108.87 |

141.13 |

137.12 |

187.44 |

271.64 |

||||||||||||||||||

| NASDAQ Biotechnology |

100.00 |

78.65 |

95.67 |

87.19 |

109.08 |

137.90 |

||||||||||||||||||

| NASDAQ Pharmaceutical |

100.00 |

80.51 |

97.95 |

95.46 |

113.09 |

132.91 |

||||||||||||||||||

Years Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Summary of Operations Data: |

||||||||||||

| Product sales, net |

$ | 123,803 | $ | 2,108 | $ | — | ||||||

| Costs and operating expenses |

||||||||||||

| Cost of sales |

1,986 | 48 | — | |||||||||

| Research and development |

155,122 | 174,556 | 131,307 | |||||||||

| Selling, general and administrative |

210,851 | 117,088 | 51,435 | |||||||||

| Gain on lease modification (1) |

(984 | ) | (8,301 | ) | — | |||||||

| |

|

|

|

|

|

|||||||

| Total costs and operating expenses |

366,975 | 283,391 | 182,742 | |||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

(243,172 | ) | (281,283 | ) | (182,742 | ) | ||||||

| Interest income |

5,834 | 15,591 | 8,964 | |||||||||

| Interest expenses |

(9,809 | ) | (894 | ) | (346 | ) | ||||||

| Other expenses, net |

(406 | ) | (180 | ) | (69 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net loss |

$ | (247,553 | ) | $ | (266,766 | ) | $ | (174,193 | ) | |||

| |

|

|

|

|

|

|||||||

| Basic and diluted net loss per common share |

$ | (4.04 | ) | $ | (4.57 | ) | $ | (3.41 | ) | |||

| |

|

|

|

|

|

|||||||

| Weighted-average number of shares used in computing basic and diluted net loss per common share |

61,334,037 | 58,321,612 | 51,150,728 | |||||||||

| |

|

|

|

|

|

|||||||

| (1) | During the year ended December 31, 2020 and 2019, we recorded a gain on lease modification related to our prior premises located in South San Francisco, California. |

As of December 31, |

||||||||||||

(in thousands) |

2020 |

2019 |

2018 |

|||||||||

| Selected Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents and marketable securities |

$ | 560,892 | $ | 694,999 | $ | 591,815 | ||||||

| Working capital |

553,131 | 556,544 | 452,007 | |||||||||

| Total assets |

724,002 | 796,099 | 617,643 | |||||||||

| Long-term debt |

148,815 | 73,559 | — | |||||||||

| Accumulated deficit |

(986,469 | ) | (738,916 | ) | (472,150 | ) | ||||||

| Total stockholders’ equity |

416,157 | 578,694 | 572,799 | |||||||||

Rebates, co-payment assistance, Medicare Part D coverage gap, product returns and distributor fees |

Prompt payment discounts and chargebacks |

Total |

||||||||||

| Balances at December 31, 2018 |

$ | — | $ | — | $ | — | ||||||

| Provision related to current period sales |

529 | 113 | 642 | |||||||||

| Credit or payments made during the period |

— | — | — | |||||||||

| |

|

|

|

|

|

|||||||

| Balances at December 31, 2019 |

$ |

529 |

$ |

113 |

$ |

642 |

||||||

| Provision related to current period sales |

13,697 | 4,351 | 18,048 | |||||||||

| Credit or payments made during the period |

(7,821 | ) | (3,713 | ) | (11,534 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Balance at December 31, 2020 |

$ |

6,405 |

$ |

751 |

$ |

7,156 |

||||||

| |

|

|

|

|

|

|||||||

Change |

||||||||||||||||

Year Ended December 31, |

2020/2019 |

|||||||||||||||

(in thousands, except percentages) |

2020 |

2019 |

$ |

% |

||||||||||||

| Product sales, net |

$ | 123,803 | $ | 2,108 | $ | 121,695 | 5,773 | % | ||||||||

| Costs and operating expenses: |

||||||||||||||||

| Cost of sales |

1,986 | 48 | 1,938 | * | ||||||||||||

| Research and development |

155,122 | 174,556 | (19,434 | ) | (11 | ) | ||||||||||

| Selling, general and administrative |

210,851 | 117,088 | 93,763 | 80 | ||||||||||||

| Gain on lease modification |

(984 | ) | (8,301 | ) | 7,317 | 88 | ||||||||||

| |

|

|

|

|

|

|||||||||||

| Total costs and operating expenses |

366,975 | 283,391 | 83,584 | 29 | ||||||||||||

| |

|

|

|

|

|

|||||||||||

| Loss from operations |

(243,172 | ) | (281,283 | ) | 38,111 | (14 | ) | |||||||||

| Interest income |

5,834 | 15,591 | (9,757 | ) | (63 | ) | ||||||||||

| Interest expenses |

(9,809 | ) | (894 | ) | (8,915 | ) | (997 | ) | ||||||||

| Other expenses, net |

(406 | ) | (180 | ) | (226 | ) | 126 | |||||||||

| |

|

|

|

|

|

|||||||||||

| Net loss |

$ | (247,553 | ) | $ | (266,766 | ) | $ | (19,213 | ) | (7 | )% | |||||

| |

|

|

|

|

|

|||||||||||

| * | Change is not meaningful |

| • | employee-related expenses, which include salaries, benefits and stock-based compensation; |

| • | expenses incurred under agreements with consultants, third-party research and manufacturing organizations, and investigative clinical trial sites that conduct research and development activities on our behalf; |

| • | the costs related to production of clinical supplies, including fees paid to contract manufacturers; |

| • | laboratory and vendor expenses related to the execution of nonclinical studies and clinical trials; |

| • | payments upon achievement of certain clinical development and regulatory milestones in relation with license agreement; and |

| • | facilities and other allocated expenses, which include expenses for rent and maintenance of facilities, depreciation and amortization expense and other supplies. |

Change |

||||||||||||||||

Years Ended December 31, |

2020/2019 |

|||||||||||||||

2020 |

2019 |

$ |

% |

|||||||||||||

| Costs incurred by development program: |

||||||||||||||||

| Oxbryta for the treatment of SCD |

$ | 83,945 | $ | 117,827 | $ | (33,882 | ) | (29 | )% | |||||||

| Other preclinical programs |

45,360 | 47,015 | (1,655 | ) | (4 | ) | ||||||||||

| Inclacumab for the treatment of SCD |

25,817 | 9,472 | 16,345 | 173 | ||||||||||||

| Oxbryta for the treatment of hypoxemic pulmonary disorders |

— | 242 | (242 | ) | * | |||||||||||

| |

|

|

|

|

|

|||||||||||

| Total research and development expenses |

$ | 155,122 | $ | 174,556 | $ | (19,434 | ) | (11 | )% | |||||||

| |

|

|

|

|

|

|||||||||||

| * | Change is not meaningful |

| • | employee-related expenses, which include salaries, benefits and stock-based compensation; |

| • | fees to third-party vendors providing customer support services; |

| • | expenses incurred under agreements with consultants; and |

| • | facilities and other allocated expenses, which include expenses for rent and maintenance of facilities, depreciation and amortization expense and other supplies. |

| • | our ability to successfully commercialize Oxbryta, inclacumab and any other product candidates we may identify and develop in any territories; |

| • | the manufacturing, selling, and marketing costs associated with the commercialization of Oxbryta and the potential commercialization of inclacumab and any other product candidates we may identify and develop, including the cost and timing of establishing or maintaining our sales and marketing capabilities in any territory(ies); |

| • | the amount and timing of sales and other revenues from Oxbryta, inclacumab and any other product candidates we may identify and develop, including the sales price and the availability of adequate third-party reimbursement; |

| • | the time and cost necessary to conduct and complete multiple ongoing studies (including our HOPE-KIDS 1 Study, our Phase 3 HOPE-KIDS 2 Study, and other studies; |

| • | the time and cost necessary to conduct and complete any additional clinical studies required to pursue additional regulatory approvals for Oxbryta for SCD, including our Phase 3 HOPE-KIDS 2 Study (which is intended as our required confirmatory study to move from our current Subpart H approval to a full approval of Oxbryta) and any studies to support potential label expansions into younger SCD pediatric populations, or any other post-marketing studies for Oxbryta for SCD; |

| • | the progress, data and results of clinical trials of Oxbryta and product candidates; |

| • | the progress, timing, scope and costs of our nonclinical studies, our clinical trials and other related activities, including our ability to enroll subjects in a timely manner for our ongoing and future clinical trials of Oxbryta, inclacumab or any other product candidate that we may identify and develop; |

| • | the costs of obtaining clinical and commercial supplies of Oxbryta, inclacumab and any other product candidates we may identify and develop; |

| • | our ability to advance our development programs, including for Oxbryta, inclacumab and any other potential product candidate programs we may identify and pursue, the timing and scope of these development activities, and the availability of approval for any of our other product candidates; |

| • | our ability to successfully obtain any additional regulatory approvals from any regulatory authorities, and the scope of any such regulatory approvals, to market and sell Oxbryta, inclacumab and any other product candidates we may identify and develop in any territory(ies); |

| • | the cash requirements of any future acquisitions or discovery of product candidates; |

| • | the time and cost necessary to respond to technological and market developments; |

| • | the extent to which we may acquire or in-license other product candidates and technologies, and the costs and timing associated with any such acquisitions or in-licenses; |

| • | our ability to attract, hire, and retain qualified personnel; and |

| • | the costs of maintaining, expanding, and protecting our intellectual property portfolio. |

Year Ended December 31, |

||||||||||||

(in thousands) |

2020 |

2019 |

2018 |

|||||||||

| Cash used in operating activities |

$ | (211,862) | $ | (194,417) | $ | (135,375) | ||||||

| Cash provided by (used in) investing activities |

317,312 | (76,861) | (184,157) | |||||||||

| Cash provided by financing activities |

87,120 | 298,158 | 397,906 | |||||||||

| |

|

|

|

|

|

|||||||

| Net increase in cash, cash equivalents and restricted cash |

$ | 192,570 | $ | 26,880 | $ | 78,374 | ||||||

| |

|

|

|

|

|

|||||||

Payments Due by Period |

||||||||||||||||||||||||

Total |

2021 |

2022 |

2023 |

2024 |

Thereafter |

|||||||||||||||||||

| Term Loan |

$ | 201,938 | $ | 13,500 | $ | 13,500 | $ | 62,813 | $ | 58,313 | $ | 53,812 | ||||||||||||

| Operating lease obligations |

$ | 123,470 | $ | 11,841 | $ | 12,222 | $ | 12,584 | $ | 12,948 | $ | 73,875 | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total contractual obligations |

$ | 325,408 | $ | 25,341 | $ | 25,722 | $ | 75,397 | $ | 71,261 | $ | 127,687 | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Page |

||||

| 112 | ||||

| Audited Consolidated Financial Statements: |

||||

| 115 | ||||

| 116 | ||||

| 117 | ||||

| 118 | ||||

| 120 | ||||

| 145 | ||||

| /s/ KPMG LLP |

December 31, |

||||||||

2020 |

2019 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Short-term marketable securities |

||||||||

| Accounts receivable, net |

||||||||

| Inventories |

||||||||

| Prepaid expenses |

||||||||

| Other assets, current |

||||||||

| |

|

|

|

|||||

| Total current assets |

||||||||

| Property and equipment, net |

||||||||

| Long-term marketable securities |

— | |||||||

| Operating lease right-of-use |

||||||||

| Restricted cash |

||||||||

| Other assets, noncurrent |

||||||||

| |

|

|

|

|||||

| Total assets |

$ | $ | ||||||

| |

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | $ | ||||||

| Accrued liabilities |

||||||||

| Accrued compensation |

||||||||

| Other liabilities, curren t |

||||||||

| |

|

|

|

|||||

| Total current liabilities |

||||||||

| Long-term debt |

||||||||

| Operating lease liabilities, noncurrent |

||||||||

| Other liabilities, noncurrent |

||||||||

| |

|

|

|

|||||

| Total liabilities |

||||||||

| |

|

|

|

|||||

| Commitments and contingencies (Note 8) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $ |

||||||||

| Common stock, $ |

||||||||

| Additional paid-in capital |

||||||||

| Accumulated other comprehensive income |

||||||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Total stockholders’ equity |

||||||||

| |

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | $ | ||||||

| |

|

|

|

|||||

Year Ended December 31, |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Product sales, net |

$ | $ | $ | — | ||||||||

| Costs and operating expenses: |

||||||||||||

| Cost of sales |

— | |||||||||||

| Research and development |

||||||||||||

| Selling, general and administrative |

||||||||||||

| Gain on lease modification |

( |

) | ( |

) | — | |||||||

| |

|

|

|

|

|

|||||||

| Total costs and operating expenses |

||||||||||||

| |

|

|

|

|

|

|||||||

| Loss from operations |

( |

) | ( |

) | ( |

) | ||||||

| Other income (expense): |

||||||||||||

| Interest income |

||||||||||||

| Interest expense s |

( |

) | ( |

) | ( |

) | ||||||

| Other expenses, net |

( |

) | ( |

) | ( |

) | ||||||

| |

|

|

|

|

|

|||||||

| Total other income (expense), net |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Net loss |

( |

) | ( |

) | ( |

) | ||||||

| Other comprehensive loss: |

||||||||||||

| Net unrealized gain (loss) on marketable securities, net of tax |

( |

) | ||||||||||

| |

|

|

|

|

|

|||||||

| Comprehensive loss |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

| |

|

|

|

|

|

|||||||

| Basic and diluted net loss per common share |

$ | ( |

) | $ | ( |

) | $ | ( |

) | |||

| |

|

|

|

|

|

|||||||

| Weighted-average number of shares used in computing basic and diluted net loss per common share |

||||||||||||

| |

|

|

|

|

|

|||||||

Common Stock |

Additional Paid-In Capital |

Accumulated Other Comprehensive Income (Loss) |

Accumulated Deficit |

Total Stockholders’ Equity |

||||||||||||||||||||

Shares |

Amount |

|||||||||||||||||||||||

| Balance at December 31, 2017 |

$ |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

|||||||||||||||

| Issuance of common stock upon equity offerings, net of issuance costs |

— |

— |

||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options |

— |

— |

||||||||||||||||||||||

| Issuance of common stock upon vesting of restricted share units, net of shares withheld for employee taxes |

( |

) |

— |

— |

( |

) | ||||||||||||||||||

| Issuance of common stock pursuant to ESPP purchases |

— |

— |

— |

|||||||||||||||||||||

| Vesting of restricted stock purchases |

— |

— |

— |

|||||||||||||||||||||

| Stock-based compensation expense |

— |

— |

— |

— |

||||||||||||||||||||

| Net unrealized gain (loss) on marketable securities |

— |

— |

— |

— |

||||||||||||||||||||

| Net loss |

— |

— |

— |

— |

( |

) |

( |

) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at December 31, 2018 |

$ |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

|||||||||||||||

| Issuance of common stock upon equity offerings, net of issuance costs |

— |

— |

||||||||||||||||||||||