Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO COMBINED FINANCIAL STATEMENTS AND SCHEDULE

, 2014

Dear B/E Aerospace, Inc. Shareholder:

We are pleased to inform you that on , 2014, the board of directors of B/E Aerospace, Inc. ("B/E Aerospace") approved the spin-off of KLX Inc., or "KLX," a wholly-owned subsidiary of B/E Aerospace. Upon completion of the spin-off, B/E Aerospace shareholders will own 100% of the outstanding shares of common stock of KLX.

We believe that separating KLX from B/E Aerospace so that it can operate as an independent, publicly-owned company is in the best interests of both B/E Aerospace and KLX. The spin-off will (1) permit each company to tailor its strategic plans and growth opportunities and allow management of each company to focus on such company's specific business characteristics; (2) provide each company greater flexibility in investing capital in a manner appropriate for its business strategy and facilitate a more company-specific allocation of capital; (3) provide each company increased strategic flexibility to make acquisitions, including through the use of its own stock, and form corporate alliances; and (4) provide investors in each company with a more targeted investment opportunity.

The spin-off will be completed by way of a pro rata distribution of KLX common stock to our shareholders of record as of the close of business, Eastern time, on , 2014, the spin-off record date. Each B/E Aerospace shareholder will receive one share of KLX common stock for every shares of B/E Aerospace common stock held by such shareholder on the record date. The distribution of these shares will be made in book-entry form, which means that no physical share certificates will be issued. Following the spin-off, shareholders may request that their shares of KLX common stock be transferred to a brokerage or other account at any time. No fractional shares of KLX common stock will be issued. Fractional shares of KLX common stock to which B/E Aerospace shareholders of record would otherwise be entitled will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of the sales will be distributed ratably to those shareholders who would otherwise have received fractional shares of KLX common stock.

We expect your receipt of shares of KLX common stock in the distribution to be tax-free for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. You should consult your own tax advisor as to the particular tax consequences of the distribution to you, including potential tax consequences under state, local and non-U.S. tax laws.

The distribution does not require shareholder approval, nor do you need to take any action to receive your shares of KLX common stock. Immediately following the spin-off, you will own common stock in B/E Aerospace and KLX. B/E Aerospace's common stock will continue to trade on the NASDAQ Global Select Market under the symbol "BEAV." We expect that KLX common stock will be listed on the NASDAQ Global Select Market under the symbol "KLXI."

The enclosed information statement, which we are mailing to all B/E Aerospace shareholders, describes the spin-off in detail and contains important information about KLX, including its historical combined financial statements. We urge you to read this information statement carefully.

We want to thank you for your continued support of B/E Aerospace. We look forward to your support of KLX in the future.

| Yours sincerely, | ||

Amin Khoury Chairman of the Board B/E Aerospace, Inc. |

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

SUBJECT TO COMPLETION, DATED OCTOBER 10, 2014

INFORMATION STATEMENT

KLX Inc.

1300 Corporate Center Way

Wellington, Florida 33414-2105

Common Stock

(par value $0.01 per share)

We are sending this information statement to you in connection with the separation of KLX Inc. ("KLX"), a newly-formed company, from B/E Aerospace, Inc. (collectively with its predecessors and consolidated subsidiaries, other than, for all periods following the distribution, KLX and its consolidated subsidiaries, "B/E Aerospace"), following which KLX will be an independent, publicly-owned company. As part of the separation, B/E Aerospace will undergo an internal reorganization, after which it will contribute or otherwise transfer its Consumables Management Segment businesses to KLX and complete the separation by distributing all of the shares of KLX common stock on a pro rata basis to the holders of B/E Aerospace common stock. We refer to this pro rata distribution as the "distribution" and we refer to the separation, including the internal reorganization and distribution, as the "spin-off." We expect your receipt of shares of KLX common stock in the distribution to be tax-free for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. Every shares of B/E Aerospace common stock outstanding as of the close of business, Eastern time, on , 2014, the record date for the distribution, will entitle the holder thereof to receive one share of KLX common stock. The distribution of shares will be made in book-entry form. B/E Aerospace will not distribute any fractional shares of KLX common stock. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds from the sales pro rata to each holder who would otherwise have been entitled to receive a fractional share in the spin-off. The distribution will be effective as of 12:01 a.m., Eastern time, on , 2014. Immediately after the distribution becomes effective, we will be an independent, publicly-owned company.

No vote or further action of B/E Aerospace shareholders is required in connection with the spin-off. We are not asking you for a proxy. B/E Aerospace shareholders will not be required to pay any consideration for the shares of KLX common stock they receive in the spin-off, and they will not be required to surrender or exchange shares of their B/E Aerospace common stock or take any other action in connection with the spin-off.

B/E Aerospace currently owns all of the outstanding shares of KLX common stock. Accordingly, there is no current trading market for KLX common stock. We expect, however, that a limited trading market for KLX common stock, commonly known as a "when-issued" trading market, will develop beginning on or shortly before the record date for the distribution, and we expect "regular-way" trading of KLX common stock will begin the first trading day after the distribution date. We intend to apply for authorization to list KLX common stock on the NASDAQ Global Select Market under the ticker symbol "KLXI."

In reviewing this information statement, you should carefully consider the matters described in "Risk Factors" beginning on page 23 of this information statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement is not an offer to sell, or a solicitation of an offer

to buy, any securities.

The date of this information statement is , 2014.

This information statement was first mailed to B/E Aerospace shareholders

on or about , 2014.

This summary highlights information contained in this information statement and provides an overview of our company, our separation from B/E Aerospace and the distribution of KLX common stock by B/E Aerospace to its shareholders. For a more complete understanding of our business and the spin-off, you should read this entire information statement carefully, particularly the discussion set forth under "Risk Factors" beginning on page 23 of this information statement, and our audited and unaudited historical combined financial statements, our unaudited pro forma condensed financial statements and the respective notes to those statements appearing elsewhere in this information statement. Except as otherwise indicated or unless the context otherwise requires, "KLX," "we," "us" and "our" refer to KLX Inc. and its consolidated subsidiaries after giving effect to the internal reorganization and the distribution, and "B/E Aerospace" refers to B/E Aerospace, Inc., its predecessors and its consolidated subsidiaries, other than, for all periods following the distribution, KLX Inc. and its consolidated subsidiaries.

Our Company

We believe, based on our experience in the industry, that we are the world's leading distributor and value-added service provider of aerospace fasteners and consumables, and that we offer one of the broadest ranges of aerospace hardware and consumables and inventory management services worldwide. Through organic growth and a number of strategic acquisitions beginning in 2001, we believe we have become our industry's leading provider of aerospace fasteners, consumable products and supply chain management services. Through our global facilities network and advanced information technology systems, we offer unparalleled service to commercial airliners, business jet and defense original equipment manufacturers and their subcontractors ("OEMs"), airlines, maintenance, repair and overhaul ("MRO") operators, and fixed base operators ("FBOs"). With a large and diverse global customer base, including virtually all of the world's commercial airliners, business jet and defense OEMs, OEM subcontractors, major airlines and major MRO operators across five continents, we provide access to over one million stock keeping units ("SKUs"). We serve as a distributor for every major aerospace fastener manufacturer. In order to support our vast range of custom products and services, we have invested over $100 million in proprietary information technology ("IT") systems to create a superior technology platform. Our systems support both internal distribution processes and part attributes, along with customer services, including just-in-time ("JIT") deliveries and kitting solutions, which we believe are unmatched by any competitor. This business is operated within our Aerospace Solutions Group ("ASG") segment.

In 2013, we initiated an expansion into the energy sector. Over the past two years we have acquired seven companies in the rapidly growing business of providing technical and logistics services and related rental equipment to oil and gas exploration and production companies. As a result, we now provide a broad range of technical solutions and equipment that brings value-added resources to a new customer base, often in remote locations. Our customers include independent and major oil and gas companies that are engaged in the exploration and production ("E&P") and development of oil and gas properties in North America, including in the Northeast (Marcellus and Utica Shale), Rocky Mountains (Bakken and Piceance Basins), Southwest (Permian Basin and Eagle Ford) and Mid-Continent. This business is operated within our Energy Technical Services ("ETS") segment.

1

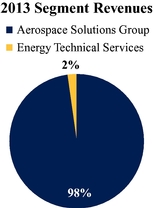

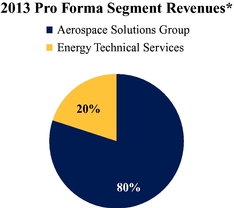

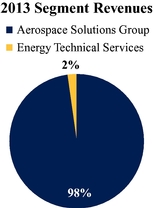

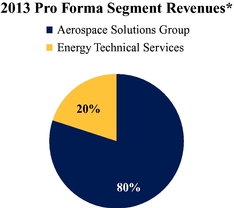

The charts below illustrate the breakdown of our segment revenues for the year ended December 31, 2013 on an actual and pro forma basis to account for acquisitions through June 30, 2014.

|

|

- *

- For the year ended December 31, 2013, we reported revenue of $1.3 billion. On a pro forma basis to give effect to acquisitions through June 30, 2014 as if they had been completed January 1, 2013, pro forma revenues for 2013 would have been $1.6 billion.

Our ASG segment has maintained strong, collaborative, long-standing relationships with its customers. As a result of our operational and information technology systems, we have historically been able to ship approximately 60% of our orders within 24 hours of receipt of the order. Our seasoned purchasing and sales teams, coupled with state-of-the-art IT and automated parts retrieval systems, help us to sustain our reputation for rapid, on-time delivery.

ASG sells fasteners and other consumable products to over 4,700 customers throughout the world. Its top five customers in 2013 collectively accounted for approximately 35% of ASG's 2013 revenues.

ETS has over 120 master services agreements ("MSAs") with customers, including substantially all of the major, regional and independent E&P companies in North America. Its top five customers collectively represented approximately 41% of ETS's 2013 revenues on a pro forma basis to account for acquisitions through June 30, 2014 (approximately 45% on an actual basis).

Our management team has extensive industry experience and company tenure. Our executive officers have an average of more than 20 years in the aerospace consumables or energy technical services industries.

Industry Overview

Aerospace Solutions Group

According to Stax, the global market for C-class aerospace parts, which includes hardware, bearings, electronic components and machined parts for both commercial and military customers, was approximately $6.5 billion in 2010. This market is generally segmented by end customer or sales channel. Based on industry sources, we estimate that during 2013 the market for the products and services provided by ASG was approximately $4.7 billion; of this amount, we estimate that approximately 34% or $1.6 billion is served by the manufacturers of these products directly to the end customers and approximately 66% or $3.1 billion is served by stocking distributors such as ASG.

We believe that there is a direct relationship between demand for fasteners and other consumable products and airliner fleet size, aircraft utilization and aircraft age, as well as the new aircraft production rates. All aircraft must be serviced at prescribed intervals, which drives aftermarket demand for aerospace fasteners and consumable products. ASG generated approximately 40% of its 2013 revenues from aftermarket sales to support the in-service fleet of commercial aircraft, business jets and

2

the global fleet of military aircraft. Historically, aerospace fastener and consumable products revenues have been derived from the following sources:

- •

- Support for commercial, business jet and military aircraft OEMs;

- •

- Mandated maintenance and replacement of specified parts;

- •

- Support for commercial aircraft, business jet and defense subcontractors, most of which tend to purchase through

distributors; and

- •

- Demand for structural modifications, cabin interior modifications and passenger-to-freighter conversions.

In addition, suppliers in the aerospace, defense and related industries increasingly rely on companies such as ASG to provide a customized single point of contact for inventory management, customized invoicing, automated forecasting and usage monitoring, centralized communications and tracking across their broad and varied supply base.

Since 2010, as the global economy began to recover from recession, increased passenger traffic volumes and the return to profitability of the global airline industry have created significant demand for commercial aircraft. The Airline Monitor forecasts a 2014 global passenger traffic increase of approximately 5.4% and projects long-term growth at an approximate compounded annual growth rate ("CAGR") of 5.7% during the 2013-2028 period. The International Air Transport Association ("IATA") expects global airline profits to improve to $18.0 billion in 2014, or 70% higher than 2013, marking the global airline industry's fifth consecutive year of profitability.

Many airlines deferred the replacement of a large number of aging aircraft over the 2008-2011 period. This, combined with recent more efficient new aircraft introductions, the growing requirements for more aircraft to support the projected long-term traffic growth, high fuel costs and the low cost of financing new aircraft drove the global airline industry to place record orders for new aircraft. Backlogs at Airbus S.A.S ("Airbus") and The Boeing Company ("Boeing") stood at record levels of approximately 5,546 and 5,237, respectively, at June 30, 2014. They have reported that they each have an approximate eight-year backlog. As a result, most industry analysts believe the outlook for new aircraft deliveries will be strong for the foreseeable future, which bodes well for ASG.

Through 2011, approximately 16% of our revenues were derived from support for military aircraft. Defense spending has historically been driven by the timing of military aircraft orders and evolving government strategies and policies. We also support military aircraft MRO providers. Defense spending began to decline in 2012 as the U.S. government implemented its sequestration program. As a result, we have seen demand from our military and defense customers decline from peak levels experienced prior to 2012 of approximately 16% of total ASG revenues to approximately 14% of 2013 revenues.

Other factors expected to affect the industries served by ASG include long-term growth in worldwide fleet of passenger aircraft, an increase in the size of the existing installed base, aging of existing fleet, and an expected improvement in the business jet market.

Energy Technical Services

The services and equipment we provide to our customers in the energy sector include wireline services, fishing (retrieval) services and equipment, pressure control and rental equipment such as frac stacks, accommodations and surface rentals and other related components. According to Spears & Associates, the market for providers of technical and logistics services and related rental equipment and other similar products and services to the oil and gas industry in North America is valued at approximately $15 billion, and growing at approximately 10% annually.

3

Demand for our technical services and products is determined by the number of oil and gas wells drilled and completed each year, and the level of production / work over activity in North America on existing wells.

- •

- With 223 billion barrels of technically recoverable shale oil reserves and 2,431 trillion cubic feet of

recoverable shale gas reserves contained within the United States, combined with the United States' long-term goal of energy independence, E&P activity in North America has been, and is expected, to

remain strong. Furthermore, any significant increase in natural gas prices is expected to expand natural gas development activity and to expand the market for our services.

- •

- Almost all E&P companies rent or lease the equipment and services required by them to drill wells and maintain

production. Drilling and completion activities require numerous products and services from time to time on an "as needed" basis.

- •

- The decline of conventional North American oil and natural gas reservoirs, together with the development of new recovery

technologies, is leading to a shift toward the drilling and development of onshore unconventional oil and natural gas resources that require more wells to be drilled and maintained. We believe the

increased drilling requirements of these unconventional resources will lead to continued drilling activity.

- •

- Technologically driven breakthroughs, including (i) continued drilling activity supported by unconventional

resources, (ii) the expanding use of horizontal drilling techniques, and (iii) longer lateral lengths and increasing number of stages per well, have all created growing demand for

technical services and products to support these advanced drilling activities, much of which are in remote areas with harsh environments.

- •

- The increasing complexity of technology used in the oil and natural gas development process requires additional technicians on location during drilling and, therefore, additional workforce accommodations. In particular, the increasing trend of pursuing horizontal and directional wells as opposed to vertical wells requires additional expertise on location and, typically, longer drilling times. In some cases, up to six to nine workforce accommodation units are used during a drilling project, an increase over traditional utilization levels.

We believe that ETS offers services and products which create value for our customers by reducing their exposure to non-productive time ("NPT") during the drilling and production phases. We provide equipment and services that assist our customers with increasing the permeability of the reservoir. We provide specialized experts and equipment to locate and remove blockages or lost equipment from the reservoir that impede drilling or production operations. We also provide accommodations and associated surface rentals such as portable light towers, generators, and pumping systems, in remote drilling sites, thereby facilitating more efficient staffing of the drilling and production activities.

Other factors expected to affect the industry served by our ETS segment include:

Higher Demand for Natural Gas in the United States. We believe that natural gas will be in high demand in the United States over the next several years because of its growing popularity as a cleaner burning fuel. Additionally, according to the International Energy Agency's 2014 World Energy Outlook, North America has been at the center of the surge in global investment in recent years and will remain the region with the largest oil and gas investment requirement until 2035.

Increasing Focus on Working Conditions and Safety. Due to the increase in rig count and the corresponding increase in demand for labor in the oil and gas industry, our customers continue to attempt to improve living and working conditions at the wellsite to help retain employees. We believe our workforce accommodations solutions and associated surface rentals for crew quarters contribute to improved living and working conditions at the wellsite. Our customers also continue to enhance their

4

safety procedures to help reduce injuries and to help ensure compliance with more stringent regulatory requirements.

Continued Outsourcing of Ancillary Services. Some of the services we provide have been historically handled by drilling contractors themselves. In many instances, these services are only ancillary to the primary activity of drilling and completing wells and represent only a minor portion of the total well drilling cost. Many drilling contractors are increasingly electing to outsource these services to suppliers who can provide high-quality and reliable services.

Our Competitive Strengths

Aerospace Solutions Group

With a deep understanding of our customers' needs and goals, we believe that we have a strong competitive position attributable to a number of factors, including the following:

Unmatched Depth and Breadth of Products and Services. We provide a comprehensive line of products and services to a broad global customer base. We offer the broadest and deepest product portfolio in the world with over one million SKUs valued at over $1 billion. We are an authorized distributor for more than 200 manufacturers, including every major aerospace fastener manufacturer, and offer products for more than 3,000 other manufacturers. Our wide array of value-added services aids in developing and maintaining strong customer relationships. Through the combination of our value-added services and unmatched depth and breadth of our inventory, we offer our aerospace customers a compelling value proposition. Our services can significantly improve on-time delivery performance, enabling our customers to reduce their inventory and total acquisition cost, while at the same time decreasing the frequency of production interruptions caused by part shortages. Due to the high levels of precision and engineering standards in the aerospace industry, our customers must ensure the highest levels of quality assurance which is provided by our rigorous quality control processes. We believe our broad product and services offering and large customer base make us less vulnerable to the loss of any one customer or program.

Premier Technology and Logistics Platform. We believe we have unrivaled management information systems for optimal execution of customer orders. We have invested over $100 million in our proprietary IT systems to create a superior technology platform. We book approximately 16,000 orders daily and manage 750,000 customer bins with greater than 99% on-time delivery. Our information technology systems and highly refined automated parts retrieval systems allow us to ship approximately 60% of orders placed within 24 hours of receipt.

Industry Leading Customer Satisfaction. We believe we provide outstanding customer service. Customer recognition awards for 2013 included, among others: Supplier of the Year at Aviation Partners Boeing (third consecutive year), Elite Supplier Award at Korean Aviation Industry, Silver Supplier Award at Erickson, Best Supplier Award at ANA, Supplier Responsiveness Award at Nordam Group and Platinum Supplier Award at SIA Engineering Company.

Long-standing Customer Partnerships. Through the unmatched depth and breadth of our products and services offering, consistent on-time delivery and focus on operational excellence and customer service, we have successfully developed long-standing partnerships with several of our top ASG customers. The average length of our partnership with our top ten customers, based on expected revenues for 2014, is approximately ten years. Additionally, during the year ended December 31, 2013, we renewed or extended over 200 existing long term agreements ("LTAs") with our customers.

Exposure to International Markets with a Balanced, Global Footprint. We are a leading global provider of aerospace fasteners and other consumables and of logistics services to the airline and aerospace industries, serving a diverse worldwide customer base of over 4,700 customers that includes

5

all major commercial, business jet and military OEMs, aftermarket MRO providers and airlines. In 2013, 57% of ASG's revenue was derived from North America, 28% from Europe and 15% in the rest of the world, which is primarily comprised of Asia, the Pacific Rim, and the Middle East. We serve our ASG customers with sales, marketing, customer service and program management specialists in 60 countries globally. We believe that our geographic diversification makes us less susceptible to a downturn in a specific geographic region and allows us to take advantage of regional growth trends.

Energy Technical Services

Strong Footprint in Key Energy Producing Geographies. Following a series of acquisitions completed in 2013 and 2014, we now provide a comprehensive range of technical services and associated rental equipment to North American E&P businesses that operate in geographies with strong drilling and production economics. We have established business presence in the Bakken formation of North Dakota, Permian Basin, Eagle Ford, Haynesville, Marcellus and Utica Shales, Piceance Basin, Mid-Continent, Oklahoma, and other key energy-producing geographies. Our operations service Arkansas, Colorado, Louisiana, New Mexico, New York, North Dakota, Ohio, Oklahoma, Montana, Pennsylvania, Texas, Utah, West Virginia and Wyoming. According to the U.S. Energy Information Administration, these states account for approximately 78% of U.S. on-shore oil production and 84% of U.S. on-shore natural gas withdrawals. We believe ETS will best serve its customers, and therefore our stockholders, by maintaining a focus on domestic oil and natural gas production areas that include both the highest concentrations of existing hydrocarbons and the largest prospective acreage for new drilling activity. We believe our well-developed geographic presence, together with our mission of being a best-in-class leading provider of our specialized services and products, provides ETS with a competitive advantage. Further, we believe our thoughtful geographic presence and carefully selected range of services and products positions our business to generate superior returns on assets deployed.

24/7 Availability of Just-in-Time Services. Our experienced industry professionals are available 24 hours a day, seven days a week to respond to customer needs, which has helped to differentiate us from many of our competitors. We specialize in just-in-time support for customers facing critical and time-sensitive operating issues in well drilling or production, leveraging our technical expertise to resolve issues encountered by our E&P customers. As an example, we are often called to wellsites in order to remove obstructions that impede drilling activities or reduce the flow of fluids and gases, often in remote locations and under harsh conditions. These obstructions could be as far as two miles or more from the wellsite. These technical services almost always require the use of various tools or equipment from our large and growing portfolio of specialized rental equipment.

Vast Range of High Quality Equipment. We supply a vast range of drilling and completion rental tools and equipment for a variety of onshore services, including well stimulation and completion, wirelines for access to the well bore, fishing intervention at the wellsite, and pressure control. We routinely refurbish and recertify our equipment to maintain the quality of our service and to provide a safe working environment for our personnel. For this purpose, we maintain dedicated on-site remanufacturing shops in several of our operations facilities.

Experienced Management Team with Proven Track Records. Our ETS management team has an average of more than 20 years of industry experience, having served as key managers in various energy service companies, including some of the largest energy service companies in the world. Through their collective expertise, we have developed a Houston, Texas-based group of industry experts responsible for maintaining a unified infrastructure to support our operations through standardized safety environmental, maintenance processes and controls and financial and accounting policies and procedures.

6

Extensive Local Market Knowledge. We operate on a geographic basis with technical sales and product line management personnel to support the geographic leaders. As a result, our regional managers are responsible for operational execution including cost control, policy compliance and training and other aspects of quality control. With the majority of our regional managers having over 15 years of industry experience, each regional manager has extensive knowledge of the customer base, job requirements and working conditions in each local market. Our product-line managers are directly responsible for asset management, customer relationships, execution of the services provided, personnel management, technology, accident prevention and equipment maintenance, all of which are key drivers of our operating profitability. This management structure allows us to monitor operating performance on a daily basis, maintain financial, accounting and asset management controls, prepare timely financial reports and manage contractual risk.

Standardized, Young Fleets of Specialized and Certified Equipment Create Competitive Advantages. Through the use of newly-acquired specialized and certified equipment, we believe we are able to create a number of competitive advantages, including:

- •

- training and operational efficiencies arising from a skilled workforce that is trained using the same equipment and

procedures, thereby increasing their familiarity with operating and troubleshooting the units and facilitating a common training platform throughout our business;

- •

- efficient maintenance due to standardized parts and components, and a reduction in equipment-driven failures due to the

young age of our equipment rental portfolio; and

- •

- higher levels of employee retention; skilled operators generally prefer to work with newer equipment which facilitates better job performance, and therefore their overall compensation.

We believe having newer, well maintained equipment provides companies such as ours with an advantage in employee development and retention in tight employment markets such as the oil field services sector.

Strong Safety Culture Creates Competitive Advantages and Barriers to Entry. Safety in our ETS segment is driven top-down. All safety-related incidents are reviewed by senior management and appropriate corrective actions are taken as necessary. We conduct standardized safety and orientation training for new employees, monthly safety meetings and annual safety trainings, which are tailored to address any unique requirements of our various product and service offerings. Safety requirements for MSAs with our customers must be reviewed and verified annually. Compliance with the safety requirements set forth by the major oil companies typically requires suppliers to maintain an effective, dedicated health, safety and environment ("HSE") function. Complying with these requirements is expensive to establish, implement and maintain. Our Vice President—HSE has more than 20 years of industry experience and acts as our in-house expert on applicable HSE requirements, developing and maintaining segment-wide policies and procedures at the recently acquired companies and monitoring compliance with our MSAs. We are aligning our policies and procedures and adopting best practices as recommended by our advisors, Leggette, Brashears & Graham, Inc., an independent HSE consulting firm, and representatives from our insurance carrier. Our HSE compliance is also monitored by a third party ("ISN"), an independent, for-profit provider of an online contractor management database. ISN collects health and safety, procurement, quality and regulatory information such as HSE policies and procedures, incident logs, safety meetings, and training information. Maintaining an adequate rating with ISN is a key requirement in order to work for many of our customers. We believe some of the companies we compete against lack the infrastructure and financial resources to provide an effective safety program, thereby providing ETS with a competitive advantage and a further barrier to entry.

7

Our Business Strategy

Aerospace Solutions Group

Our business strategy is to maintain a leadership position and to best serve our customers by:

Continued Focus on Operational Excellence and Maintenance of Market Leadership. We have built strong relationships with our existing ASG customers and suppliers through a relentless focus on operational excellence. We intend to continue providing our customers with best-in-class on-time delivery performance and quality assurance. We also intend to continue investing in our integrated, highly customized IT systems and process automation technologies. We believe that by focusing on operational excellence, we will be able to further improve our already high customer satisfaction, our industry-leading operating metrics and our global market leading position in this industry.

Winning New Business from Existing Aerospace Consumables Customers. We will continue our strategy of expanding our relationships with existing ASG customers by transitioning them to our JIT and kitting supply chain management services as well as expanding our programs to include additional customer sites and SKUs. We are a key partner supplying fasteners and consumables to support the launch of new aircraft programs. We will continue to support our customers in the launch of new aircraft programs by introducing new supply chain solutions that minimize costs, improve productivity, lower inventory investment and ensure a seamless supply of parts for production and aftermarket support. In addition, we have expanded, and expect to continue to expand, our product offerings with existing customers. We believe we create value for our customers through our industry leading on-time delivery capabilities, our continuous focus on quality, our global sourcing capabilities and our ability to get the parts where they need to be when the customer needs them. In doing so, we offer a competitive value proposition by reducing our customers' investments in working capital and ensuring that our customers' state-of-the art production systems are properly supported throughout their production processes. We believe we will be rewarded by our customers with incremental business as a result of delivering our high quality services, as promised, where they want it, when they want it and for a lower total acquisition cost.

As an example, we first began supplying consumables and other products for a portion of one division of United Technologies Corporation ("UTC") in 2004. Over time, we have substantially expanded our relationship with UTC and been awarded significantly larger portions of UTC's consumables spending. While we have served certain business units of UTC over the past ten years, we did not operate under a corporate-wide LTA. In December 2013, we expanded the scope and length of our LTA, valued at approximately $950 million, to support a number of UTC's aerospace and defense operations, including UTC Aerospace Systems, Sikorsky, and Pratt & Whitney through 2022.

Expanding our Customer Base. We believe that our services and capabilities are attractive to potential new ASG customers and we plan to expand our customer base. For example, we have succeeded in winning business after competitors were unable to meet customer service level requirements and after customers outsourced work that was previously performed internally. Historically, we have focused our activities on the major OEMs and their subcontractors, but we believe there is a significant opportunity to expand our commercial MRO presence and that we can have a greater overall presence in the commercial airline maintenance market.

Further Expansion into International Markets. We have established a presence in international locations such as the United Arab Emirates, Australia, China, Singapore, India, Germany, Mexico and Italy to support new and existing ASG customers. We will continue our international expansion efforts to more effectively serve our existing customer base and to reach new customers, as the manufacture of aircraft and aircraft structures continues to become more global and interconnected. We believe that we mitigate many of the risks associated with international expansion by entering into customer contracts before we establish a new stocking facility. We believe the depth and breadth of product offerings and

8

our logistics capabilities allow us to initially serve customers from our central warehouses, without providing on site inventories and personnel. This allows us to explore new business opportunities with minimum initial investments, allowing us to demonstrate our capabilities and the value of our services over time, prior to making significant site-specific investments. Smaller competitors without resources similar to ours are unable to do so and either must pass on these opportunities or make substantial upfront investments to try to win the business, thereby increasing the amount of risk prior to winning an LTA.

Selectively Pursuing Strategic Acquisitions. Our industry is fragmented and we believe that there are opportunities for continued consolidation. In January 2012, we acquired UFC Aerospace Corp. ("UFC"), a leading provider of complex supply chain management and inventory logistics solutions. In July 2012, we acquired Interturbine Projekt Management GmbH ("Interturbine"), a provider of material management logistical services to global airlines and MRO providers. We believe that we are well positioned to expand our product offering and geographical footprint through strategic acquisitions. Consistent with this strategy, we continue to evaluate potential acquisition opportunities for ASG. We seek to manage liability, integration and other risks associated with acquisitions through due diligence, favorable acquisition contracts and careful planning and execution of the integration of the acquired businesses.

Energy Technical Services

Our business strategy is to develop a leadership position in a niche of the technical services and related equipment rental for the North American onshore energy sector and to best serve our customers by:

Extending our Services and Product Line Offerings in Each Geographical Area. We believe we have built strong relationships with our existing ETS customers by offering a broad range of quality services and products in a safe, competent and consistent manner on a 24 hours a day, seven days a week availability basis. Through the seven acquisitions completed since August 2013, we have assembled an impressive portfolio of products, services and capabilities covering the key oil and gas geographies. Following each acquisition, we have increased capital spending to address unmet customer demand while focusing on customer service, quality of service and safety.

Pursuing Acquisition Opportunities that Meet Our Disciplined Acquisition Criteria. We expect to leverage our existing position in the energy services industry by strategically deploying capital to accelerate our revenue and earnings growth rates through acquisitions. We intend to pursue strategic opportunities in the highly fragmented and growing market for high quality providers of technical and logistic services and associated rental equipment. We believe that we are well positioned to expand our geographical footprint in North America as well as to expand our services and product offerings through both capital investment and strategic acquisitions to address our customers' needs, enhance the breadth and quality of our services and assets and to help to further improve stockholder value.

Develop Market Leadership in Niche Sectors Through Operational Excellence. Our customers are increasingly sophisticated consumers of the services we seek to provide. They require, among other things, standardized procedures and equipment, as well as health and safety practices that can be counted upon on a just-in-time basis. We compete against a large number of smaller, regional businesses who may not have either the capital investment capacity to offer the range of up-to-date equipment that we do across multiple wells and multiple geographies, nor the database and operating practices to meet the current HSE requirements. We compete based upon being a best-in-class leading provider of specialized services delivered on a consistent basis for both local customers and larger, multi-region oil & gas companies.

9

Growth Opportunities

Aerospace Solutions Group

We believe that our ASG segment will benefit from the following industry trends:

Growing Worldwide Fleet Creates Demand for Aftermarket Services and Products. The worldwide fleet of commercial airliners is expected to continue to grow over the long-term, reflecting the expected growth in passenger travel over the 2014 through 2028 period. The size of the worldwide fleet is important to us since the proper maintenance of the fleet generates ongoing demand for spare parts, including fasteners and other consumables products, to support the active fleets of commercial aircraft, business jets and military aircraft. For the years ended December 31, 2013 and 2012, approximately 40% and 35%, respectively, of ASG's revenues were derived from the aftermarket. In addition, aftermarket revenues are generally driven by aircraft usage, and as such, have historically tended to recover more quickly than revenues from OEM production.

Opportunity to Substantially Expand our Addressable Aerospace Consumables Markets. Our ASG segment leverages our key strengths, including marketing and service relationships with most of the world's airlines, commercial aircraft OEMs and their suppliers, business jet OEMs and their suppliers, MRO providers and the military. Nearly 40% of ASG's demand is generated by the aftermarket. As a result, demand for aerospace hardware, fasteners, bearings, seals, gaskets, lighting products, electrical components and other consumables is expected to increase over time as the fleet expands and ages. The aerospace and military OEMs are increasingly outsourcing to subcontract manufacturers, which benefits distributors such as ASG, as many of these subcontractors tend to purchase through distributors. In addition, aerospace manufacturers, airlines, MRO providers and suppliers are increasingly seeking companies such as ASG to provide a customized single point of contact for inventory management, automated forecasting and usage monitoring, centralized communications and tracking across their supply base.

Energy Technical Services

We believe that our ETS segment will benefit from the following industry trends:

Large, Highly Fragmented and Rapidly Growing Energy Technical Services Market. Recent shale gas and oil discoveries and new methods of extraction have uncovered vast untapped oil and gas reserves in North America, contributed to a drilling boom and created demand for products and services to support advanced drilling activities, most of which are in remote areas with harsh environments. Currently, there are 24 states with land based drilling activity and, according to Spears & Associates, the market for providers of technical and logistics services and related rental equipment and other similar products and services to the oil and gas industry in North America is valued at approximately $15 billion, and growing at approximately 10% annually. This market segment is highly fragmented with hundreds of small companies providing technical and logistics services and related rental equipment to E&P companies. With our entry into this market through several strategic acquisitions, we are providing high quality services and products to remote drilling sites using our manufacturing, certification, IT and logistics capabilities to prepare for deployment and store, locate and deliver equipment and services as needed by our customers.

Acquisition Opportunities. The highly fragmented and growing oilfield technical services, equipment rental, and logistics and services industry offers numerous acquisition opportunities to expand our existing product and service offerings in the various geographies in which we currently operate. In addition, we believe we can grow organically both through product line expansions in each of the key geographies in which we are currently operating and through geographic expansions into other emerging markets within North America.

10

Other Information

KLX started operations in 1974 as M&M Aerospace Hardware ("M&M"). B/E Aerospace acquired M&M in 2001. Our headquarters are located at 1300 Corporate Center Way, Suite 200, Wellington, Florida. Our telephone number is (561) 383-5100. Our website address is www.klx.com. Information contained on, or connected to, our website or B/E Aerospace's website does not and will not constitute part of this information statement or the registration statement on Form 10 of which this information statement is a part.

The Spin-Off

Overview

On , 2014, the board of directors of B/E Aerospace approved the spin-off of KLX from B/E Aerospace, following which KLX will be an independent, publicly-owned company.

Before our spin-off from B/E Aerospace, we will enter into a Separation and Distribution Agreement, and several other agreements with B/E Aerospace related to the spin-off. These agreements will govern the relationship between us and B/E Aerospace after completion of the spin-off and provide for the allocation between us and B/E Aerospace of various assets, liabilities and obligations (including employee benefits, information technology, insurance and tax-related assets and liabilities). See "Certain Relationships and Related Party Transactions—Agreements with B/E Aerospace Related to the Spin-Off."

We expect that, in connection with the spin-off, we will incur indebtedness in an amount estimated to be approximately $1.1 billion by an issuance of senior unsecured notes, of which we will distribute up to $650 million to B/E Aerospace. B/E Aerospace will use the funds so received, together with funds B/E Aerospace expects to raise through new borrowing, to retire all or substantially all of B/E Aerospace's existing indebtedness and pay related fees and expenses. B/E Aerospace's board of directors has determined that this will result in each company being capitalized in a manner that is most appropriate given its particular business, strategy and cash flow profile.

The distribution of KLX common stock as described in this information statement is subject to the satisfaction or waiver of certain conditions. In addition, B/E Aerospace has the right not to complete the spin-off if, at any time prior to the distribution, the board of directors of B/E Aerospace determines, in its sole discretion, that the spin-off is not in the best interests of B/E Aerospace or its shareholders, or that it is not advisable for KLX to separate from B/E Aerospace. See "The Spin-Off—Conditions to the Spin-Off."

11

Questions and Answers about the Spin-Off

The following provides only a summary of the terms of the spin-off. For a more detailed description of the matters described below, see "The Spin-Off."

- Q:

- What is the spin-off?

- A:

- The spin-off is the method by which KLX Inc. ("KLX" or the "Company") will separate from

B/E Aerospace. To complete the spin-off, B/E Aerospace will distribute to its shareholders all of the shares of KLX common stock. We refer to this as the distribution. Following the

spin-off, KLX will be a separate company from B/E Aerospace, and B/E Aerospace will not retain any ownership interest in KLX. The number of shares of B/E Aerospace common stock

you own will not change as a result of the spin-off.

- Q:

- What is KLX?

- A:

- KLX is a wholly-owned direct subsidiary of B/E Aerospace whose shares will be distributed to

B/E Aerospace shareholders if we complete the spin-off. After we complete the spin-off, KLX will be a public company and we will continue operations as a distributor and value-added service

provider of aerospace fasteners and consumables. KLX will also continue providing technical and logistics services and associated rental equipment to oil and gas exploration and production companies

in the energy sector.

- Q:

- What will I receive in the spin-off?

- A:

- As a holder of B/E Aerospace common stock, you will retain your B/E Aerospace shares and will

receive one share of KLX common stock for every shares of B/E Aerospace common stock you own as of the record date. Your proportionate interest in B/E Aerospace will not

change as a result of the spin-off. For a more detailed description, see "The Spin-Off."

- Q:

- When is the record date for the distribution?

- A:

- The record date will be the close of business of the NASDAQ Global Select Market ("NASDAQ") on

, 2014.

- Q:

- When will the distribution occur?

- A:

- The distribution date of the spin-off is , 2014. KLX expects that it will take the

distribution agent, acting on behalf of B/E Aerospace, up to one week after the distribution date to fully distribute the shares of KLX common stock to B/E Aerospace shareholders. The

ability to trade KLX shares will not be affected during that time.

- Q:

- What are the reasons for and benefits of separating KLX from

B/E Aerospace?

- A:

- B/E Aerospace believes the spin-off will provide a number of benefits,

including:

- •

- the spin-off will permit each company to tailor its strategic plans and growth opportunities and allow management of each

company to focus on such company's specific business characteristics;

- •

- the spin-off will provide each company greater flexibility in investing capital in a manner appropriate for its business

strategy and facilitate a more company-specific allocation of capital;

- •

- the spin-off will provide each company increased strategic flexibility to make acquisitions, including through the use of

its own stock, and form corporate alliances; and

- •

- the spin-off will provide investors in each company with a more targeted investment opportunity.

12

- For

a more detailed discussion of the reasons for the spin-off, see "The Spin-Off—Reasons for the Spin-Off."

- Q:

- What are the risks associated with the spin-off?

- A:

- An investment in KLX common stock is subject to both general and specific risks relating to our ASG and ETS

businesses and the industries in which they operate, our business in general, the spin-off and ownership of KLX common stock. We discuss these risks under "Risk Factors" beginning on page 23.

- Q:

- Can B/E Aerospace decide to cancel the spin-off even if all the conditions to the spin-off have been

satisfied?

- A:

- B/E Aerospace has the right not to complete the spin-off if, at any time prior to the distribution,

the board of directors of B/E Aerospace determines, in its sole discretion, that the spin-off is not in the best interests of B/E Aerospace or its shareholders, or that it is not

advisable for us to separate from B/E Aerospace.

- Q:

- What is being distributed in the spin-off?

- A:

- Approximately shares of KLX common stock will be distributed in the spin-off, based on the

number of shares of B/E Aerospace common stock expected to be outstanding as of the record date. The actual number of shares of KLX common stock to be distributed will be calculated on

, 2014, the record date. The shares of KLX common stock to be distributed by B/E Aerospace will constitute all of the issued and outstanding shares of KLX common stock immediately

prior to the distribution. For more information on the shares being distributed in the spin-off, see "Description of Capital Stock—Common Stock."

- Q:

- What do I have to do to participate in the spin-off?

- A:

- You do not need to take any action, although we urge you to read this entire document carefully. No

shareholder approval of the distribution is required or sought. You are not being asked for a proxy. No action is required on your part to receive your shares of KLX common stock. You will not be

required to pay anything for the new shares or to surrender any shares of B/E Aerospace common stock to participate in the spin-off.

- Q:

- How will fractional shares be treated in the spin-off?

- A:

- Fractional shares of KLX common stock will not be distributed. Fractional shares of KLX common stock to which

B/E Aerospace shareholders of record would otherwise be entitled will be aggregated and sold in the public market by the distribution agent at prevailing market prices. The distribution agent,

in its sole discretion, will determine when, how and through which broker-dealers, provided that such broker-dealers are not affiliates of B/E Aerospace or KLX, and at what prices to sell these

shares. The aggregate net cash proceeds of the sales will be distributed ratably to those shareholders who would otherwise have received fractional shares of KLX common stock. See "The

Spin-Off—Treatment of Fractional Shares" for a more detailed explanation.

- Q:

- How will the spin-off affect equity awards held by B/E Aerospace

employees?

- A:

- We will establish a separate KLX stock and incentive cash compensation plan, effective as of or shortly before the spin-off. Generally, we anticipate that the outstanding B/E Aerospace equity awards held by employees who will transfer employment to KLX will be assumed by KLX and converted to equity awards with respect to KLX common stock and the outstanding B/E Aerospace equity awards held by employees who will continue employment with B/E Aerospace

13

will remain equity awards with respect to B/E Aerospace common stock and will be equitably adjusted. Each time-based vesting B/E Aerospace equity award will be subject to the same terms and conditions as were in effect prior to the distribution. Performance-based vesting equity awards will also be assumed and coverted or adjusted in the same manner as described above, and will remain subject to the same terms and conditions as were in effect prior to the distribution, except that performance goals for any portion of the performance period after the distribution will be set by the KLX Compensation Committee for employees transferring to KLX and by the B/E Aerospace Compensation Committee for employees continuing employment with B/E. All outstanding equity awards held by Amin Khoury will be treated as though Mr. Khoury were solely an employee of B/E Aerospace following the distribution.

For more information on the treatment of equity awards, see "The Spin-Off—Treatment of Equity Awards."

- Q:

- What are the U.S. federal income tax consequences of the distribution to B/E Aerospace

shareholders?

- A:

- The distribution is conditioned upon, among other matters, B/E Aerospace's receipt of an opinion of

Shearman & Sterling LLP, which shall remain in full force and effect at the time of distribution, to the effect that the distribution, together with certain related transactions, should

qualify as a reorganization for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended ("Code"), and such opinion shall be in form

and substance satisfactory to B/E Aerospace, in its sole discretion.

B/E Aerospace expects to receive an opinion from Shearman & Sterling LLP to the effect that the distribution, together with certain related transactions, should so qualify. Accordingly, and so long as the distribution so qualifies for U.S. federal income tax purposes, no gain or loss should be recognized by you, and no amount should be included in your income, upon the receipt of shares of KLX common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares. For more information regarding the tax opinion and the potential U.S. federal income tax consequences to you of the distribution, see the section entitled "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution" included elsewhere in this information statement.

- Q:

- How will I determine the tax basis I will have in the KLX common stock I receive in the

distribution?

- A:

- Generally, for U.S. federal income tax purposes, your aggregate basis in the common stock you hold in

B/E Aerospace and the KLX common stock received in the distribution (including any fractional shares in KLX common stock for which cash is received) will equal the aggregate basis of

B/E Aerospace common stock held by you immediately before the distribution. This aggregate basis should be allocated between your B/E Aerospace common stock and the KLX common stock you

receive in the distribution (including any fractional shares of KLX common stock for which cash is received) in proportion to the relative fair market value of each immediately following the

distribution. See the section entitled "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution" included elsewhere in this information statement for more

information.

You should consult your tax advisor about how this allocation will work in your situation (including a situation where you have purchased B/E Aerospace common stock on different dates or at different prices) and regarding any particular consequences of the distribution to you, including the application of state, local and foreign tax laws.

14

- Q:

- Will the KLX common stock be listed on a stock exchange?

- A:

- Yes. Although there is no current public market for KLX common stock, before completion of the spin-off, KLX

intends to apply for authorization to list its common stock on NASDAQ under the symbol "KLXI." We anticipate that trading of KLX common stock will commence on a "when-issued" basis beginning on or

shortly before the record date. When-issued trading refers to a sale or purchase made conditionally because the security has been authorized but not yet issued. When-issued trades generally settle

within four trading days after the distribution date. On the first trading day following the distribution date, any when-issued trading of KLX common stock will end and "regular-way" trading will

begin. "Regular-way" trading refers to trading after a security has been issued and typically involves a transaction that settles on the third full trading day following the date of the transaction.

See "The Spin-Off—Trading Market for Our Common Stock" for more information.

- Q:

- Will my shares of B/E Aerospace common stock continue to

trade?

- A:

- Yes. B/E Aerospace common stock will continue to be listed and trade on NASDAQ under the symbol

"BEAV."

- Q:

- If I sell, on or before the distribution date, shares of B/E Aerospace common stock that I held on the

record date, am I still entitled to receive shares of KLX common stock distributable with respect to the shares of B/E Aerospace common stock I

sold?

- A:

- Beginning on or shortly before the record date and continuing through the distribution date for the spin-off,

B/E Aerospace's common stock will begin to trade in two markets on NASDAQ: a "regular-way" market and an "ex-distribution" market. If you are a holder of record of shares of

B/E Aerospace common stock as of the record date for the distribution and choose to sell those shares in the regular-way market after the record date for the distribution and before the

distribution date, you also will be selling the right to receive shares of KLX common stock in connection with the spin-off. However, if you are a holder of record of shares of B/E Aerospace

common stock as of the record date for the distribution and choose to sell those shares in the ex-distribution market after the record date for the distribution and before the distribution date, you

will not be selling the right to receive shares of KLX common stock in connection with the spin-off and you will still receive shares of KLX common stock.

- Q:

- Will the spin-off affect the trading price of my B/E Aerospace

stock?

- A:

- Yes, we expect the trading price of shares of B/E Aerospace common stock immediately following the

distribution will be lower than immediately prior to the distribution because it will no longer reflect the value of B/E Aerospace's aerospace consumables and energy technical services

business. However, we cannot provide you with any assurance as to the price at which the B/E Aerospace shares will trade following the spin-off.

- Q:

- What are the financing plans for KLX?

- A:

- We expect that, in connection with the spin-off, we will incur indebtedness in an amount estimated to be approximately $1.1 billion by an issuance of senior unsecured notes, of which we will distribute up to $650 million to B/E Aerospace. We also expect to establish a secured revolving credit facility for general corporate purposes, none of which is expected to be outstanding on the distribution date.

15

- Q:

- What will the relationship be between B/E Aerospace and KLX after the

spin-off?

- A:

- Following the spin-off, KLX will be an independent, publicly-owned company and B/E Aerospace will have

no continuing stock ownership interest in KLX. In conjunction with the spin-off, KLX will have entered into a Separation and Distribution Agreement and several other agreements with

B/E Aerospace for the purpose of allocating between KLX and B/E Aerospace various assets, liabilities and obligations (including employee benefits, insurance and tax-related assets and

liabilities). These agreements will also govern KLX's relationship with B/E Aerospace following the spin-off. These agreements will also include arrangements for transitional services. We

describe these agreements in more detail under "Certain Relationships and Related Party Transactions."

- Q:

- What will KLX's dividend policy be after the spin-off?

- A:

- KLX does not currently intend to pay dividends. KLX's dividend policy will be established by the KLX board of

directors (the "Board") based on KLX's financial condition, results of operations and capital requirements, as well as applicable law, regulatory constraints, industry practice and other business

considerations that the Board considers relevant. In addition, the terms of the agreements governing our new debt or debt that we may incur in the future may limit or prohibit the payments of

dividends. For more information, see "Dividend Policy."

- Q:

- Will I have appraisal rights in connection with the

spin-off?

- A:

- As a holder of B/E Aerospace's common stock, you will not have any appraisal rights in connection with

the spin-off.

- Q:

- Who will be the transfer agent for KLX common stock after the

spin-off?

- A:

- After the distribution, the transfer agent for KLX's common stock will be .

- Q:

- Who is the distribution agent for the spin-off?

- A:

- The distribution agent in connection with the spin-off is .

- Q:

- Where can I get more information?

- A:

- If you have any questions relating to the mechanics of the distribution, you should contact the distribution

agent at:

- Phone:

-

- Before

the spin-off, if you have any questions relating to the spin-off, you should contact B/E Aerospace at:

- B/E

Aerospace, Inc.

1400 Corporate Center Way,

Wellington, Florida 33414

Attention: Investor Relations

Phone: (561) 791-5000

www.investor.beaerospace.com

- After

the spin-off, if you have any questions relating to KLX, you should contact KLX at:

- KLX Inc.

1300 Corporate Center Way, Suite 200

Wellington, Florida 33414

Attention: Investor Relations

Phone: (561) 383-5100

www.klx.com

16

Distributing Company |

B/E Aerospace, Inc., a Delaware corporation. After the distribution, B/E Aerospace will not own any shares of KLX common stock. | |

Distributed Company |

KLX Inc., a newly-formed Delaware corporation and a wholly-owned direct subsidiary of B/E Aerospace. After the spin-off, KLX will be an independent, publicly-owned company. |

|

Distributed Securities |

All of the shares of KLX common stock owned by B/E Aerospace, which will be 100% of KLX common stock issued and outstanding immediately prior to the distribution. |

|

Record Date |

The record date for the distribution is the close of business, Eastern time, on , 2014. |

|

Distribution Date |

The distribution date is , 2014. |

|

Internal Reorganization |

As part of the spin-off, B/E Aerospace will undergo an internal reorganization that will, among other things, result in KLX owning the operations comprising and the entities that conduct B/E Aerospace's aerospace consumables and energy technical services businesses. For more information, see the description of this internal reorganization in "The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization." |

|

Indebtedness and Other Financing Arrangements |

We expect that, in connection with the spin-off, we will incur indebtedness in an amount estimated to be approximately $1.1 billion by an issuance of senior unsecured notes, of which we will distribute up to $650 million to B/E Aerospace. We also expect to establish a secured revolving credit facility for general corporate purposes, none of which is expected to be outstanding on the distribution date. |

|

Distribution Ratio |

Each holder of B/E Aerospace common stock will receive one share of KLX common stock for every shares of B/E Aerospace common stock held on the record date. |

17

The Distribution |

On the distribution date, B/E Aerospace will release the shares of KLX common stock to the distribution agent to distribute to B/E Aerospace shareholders. The shares will be distributed in book-entry form, which means that no physical share certificates will be issued. We expect that it will take the distribution agent up to one week to electronically issue shares of KLX common stock to you or to your bank or brokerage firm on your behalf by way of direct registration in book-entry form. Any delay in the electronic issuance of KLX shares by the distribution agent will not affect trading in KLX common stock. Following the spin-off, shareholders who hold their shares in book-entry form may request that their shares be transferred to a brokerage or other account at any time. You will not be required to make any payment, surrender or exchange your shares of B/E Aerospace common stock or take any other action to receive your shares of KLX common stock. |

|

Fractional Shares |

The distribution agent will not distribute any fractional shares of KLX common stock to B/E Aerospace shareholders, but will instead aggregate all fractional shares of KLX common stock to which B/E Aerospace shareholders of record would otherwise be entitled and sell them in the public market. The distribution agent will then aggregate the net cash proceeds of the sales and distribute those proceeds ratably to those shareholders who would otherwise have received fractional shares. Shareholders' receipt of cash in lieu of fractional shares from these sales generally will result in a taxable gain or loss to those shareholders for U.S. federal income tax purposes, as described in more detail under "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution." |

|

Conditions to the Spin-Off |

Completion of the spin-off is subject to the satisfaction or waiver by B/E Aerospace of the following conditions: |

|

|

• the board of directors of B/E Aerospace, in its sole and absolute discretion, shall have authorized and approved the spin-off (including the internal reorganization) and not withdrawn such authorization and approval, and shall have declared the dividend of the common stock of KLX to B/E Aerospace shareholders; |

|

|

• the Separation and Distribution Agreement and each ancillary agreement contemplated by the Separation and Distribution Agreement shall have been executed by each party thereto; |

18

|

• KLX's registration statement on Form 10, of which this information statement is a part, shall have become effective under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), no stop order suspending that effectiveness shall be in effect, and no proceedings for such purpose shall be pending before or threatened by the Securities and Exchange Commission (the "SEC"); |

|

|

• KLX common stock shall have been accepted for listing on NASDAQ or another national securities exchange approved by B/E Aerospace, subject to official notice of issuance; |

|

|

• the transfer of the aerospace consumables and energy technical services businesses to KLX (including the internal reorganization as described in "The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization"), the issuance of KLX stock to B/E Aerospace and the payment by KLX of the cash proceeds contemplated to be paid to B/E Aerospace shall have been completed; |

|

|

• B/E Aerospace shall have received an opinion of Shearman & Sterling LLP, which shall remain in full force and effect at the time of distribution, to the effect that the distribution, together with certain related transactions, should qualify as a tax-free reorganization for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code, and such opinion shall be in form and substance satisfactory to B/E Aerospace, in its sole discretion; |

|

|

• this information statement shall have been mailed to the B/E Aerospace shareholders; |

|

|

• KLX's amended and restated certificate of incorporation (as amended and restated, the "certificate of incorporation") and amended and restated bylaws (as amended and restated, the "bylaws"), each in the form filed as exhibits to the Form 10 of which this information statement is a part, shall be in effect; |

|

|

• the Board shall consist of the individuals identified in this information statement as directors of KLX; |

|

|

• arrangements shall have been made to ensure that, except for Amin Khoury, no individual who will be an executive officer of KLX or any of its subsidiaries immediately following the distribution will remain a director, officer or employee of B/E Aerospace or any of its non-KLX subsidiaries immediately following the distribution, and, except for Amin Khoury, no individual who will be employed by B/E Aerospace or any of its non-KLX subsidiaries immediately following the distribution will remain an officer or director of KLX or any of its subsidiaries immediately following the distribution; |

19

|

• any debt financing contemplated to be obtained in connection with the spin-off shall have been obtained; |

|

|

• no order, injunction or decree of any governmental authority of competent jurisdiction that would prevent the consummation of the distribution shall be in effect, no other legal restraint or prohibition preventing consummation of the distribution shall be in effect and no other event outside the control of B/E Aerospace shall have occurred or failed to occur that would prevent the consummation of the distribution; |

|

|

• any material governmental approvals and other consents necessary to consummate the spin-off shall have been obtained and be in full force and effect; and |

|

|

• no event or development shall have occurred prior to the distribution that, in the judgment of the board of directors of B/E Aerospace, would result in the distribution having a material adverse effect on B/E Aerospace or its shareholders. |

|

|

The fulfillment of these conditions will not create any obligation on B/E Aerospace's part to effect the spin-off. Except as described above, we are not aware of any material federal or state regulatory requirements that must be complied with or any material approvals that must be obtained in connection with the distribution. B/E Aerospace has the right not to complete the spin-off if, at any time prior to the distribution, B/E Aerospace's board of directors determines, in its sole discretion, that the spin-off is not in the best interests of B/E Aerospace or its shareholders, or that it is not advisable for KLX to separate from B/E Aerospace. For more information, see "The Spin-Off—Conditions to the Spin-Off." |

|

Trading Market and Symbol |

We intend to apply for authorization to list KLX common stock on NASDAQ under the ticker symbol "KLXI." We anticipate that, beginning on or shortly before the record date, trading of shares of KLX common stock will begin on a "when-issued" basis and will continue up to and including the distribution date, and we expect "regular-way" trading of KLX common stock will begin the first trading day after the distribution date. We also anticipate that, beginning on or shortly before the record date, there will be two markets in B/E Aerospace common stock: a regular-way market on which shares of B/E Aerospace common stock will trade with an entitlement to shares of KLX common stock to be distributed in the distribution, and an "ex-distribution" market on which shares of B/E Aerospace common stock will trade without an entitlement to shares of KLX common stock. For more information, see "The Spin-Off—Trading Market for Our Common Stock." |

20

Material U.S. Federal Income Tax Consequences |

B/E Aerospace expects to receive an opinion from Shearman & Sterling LLP to the effect that the distribution, together with certain related transactions, should qualify as a reorganization for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code. Accordingly, and so long as the distribution so qualifies for U.S. federal income tax purposes, no gain or loss should be recognized by a shareholder of B/E Aerospace, and no amount should be included in the income of a shareholder of B/E Aerospace, upon the receipt of KLX common stock pursuant to the distribution, except with respect to any cash received in lieu of fractional shares. For more information regarding the potential U.S. federal income tax consequences to you of the distribution, see the section entitled "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution" included elsewhere in this information statement. |

|

Relationship with B/E Aerospace after the Spin-Off |