UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

For

the quarterly period ended

OR

For the transition period from __________ to ________________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices including Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

As of November 10, 2021, the registrant had issued and outstanding shares of common stock, par value $0.0001 per share.

| 1 |

Table of Contents

| Page | |

| PART I - FINANCIAL INFORMATION | |

| Item 1. Financial Statements | 3 |

| Unaudited Condensed Consolidated Balance Sheets | 3 |

| Unaudited Condensed Consolidated Statements of Operations | 4 |

| Unaudited Condensed Consolidated Statements of Stockholders' Deficit | 5 |

| Unaudited Condensed Consolidated Statements of Cash Flows | 6 |

| Notes to Unaudited Condensed Consolidated Financial Statements | 7 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 37 |

| Item 4. Controls and Procedures | 37 |

| PART II - OTHER INFORMATION | |

| Item 1. Legal Proceedings | 38 |

| Item 1A. Risk Factors | 38 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 38 |

| Item 3. Defaults Upon Senior Securities | 39 |

| Item 4. Mine Safety Disclosures | 39 |

| Item 5. Other Information | 39 |

| Item 6. Exhibits | 40 |

| Signatures | 41 |

| 2 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (unaudited).

NEUROPATHIX,INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

Unaudited

| September 30, 2021 | December 31, 2020 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Prepaid expenses | ||||||||

| Other receivables | ||||||||

| Total Current Assets | ||||||||

| NON-CURRENT ASSETS: | ||||||||

| Property and equipment, net | ||||||||

| Security deposits | ||||||||

| Total Non-Current Assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Payroll and related liabilities | ||||||||

| Loan payable | ||||||||

| Loan payable - related party | ||||||||

| Convertible notes payable, net of $ | ||||||||

| Convertible notes payable, net of $ | ||||||||

| Capital lease obligations | ||||||||

| Patent purchase liability | ||||||||

| Due to related party, net | ||||||||

| Derivative liabilities | ||||||||

| Total Current Liabilities | ||||||||

| LONG TERM LIABILITIES: | ||||||||

| Loan payable – long term | ||||||||

| Convertible notes payable - long term | ||||||||

| Convertible notes payable - long term - related party | ||||||||

| Capital lease obligation - long term | ||||||||

| Patent purchase liability - long term | ||||||||

| Derivative liabilities - long term | ||||||||

| Total Long Term Liabilities | ||||||||

| TOTAL LIABILITIES | ||||||||

| Commitments and contingencies (Note 14) | ||||||||

| STOCKHOLDERS' DEFICIT: | ||||||||

| Preferred stock, $ par value, shares authorized | ||||||||

| Series A preferred stock, shares designated, issued and outstanding (Liquidation preference of $ | ||||||||

| Series B preferred stock, shares designated, issued and outstanding (Liquidation preference of $ | ||||||||

| Common stock, $ par value, authorized, and issued and outstanding, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| TOTAL STOCKHOLDERS' DEFICIT | ( | ) | ( | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | $ | ||||||

| The accompanying notes are an integral part of these consolidated financial statements | ||||||||

| 3 |

NEUROPATHIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| NET REVENUES: | ||||||||||||||||

| Grant revenue | $ | $ | $ | |||||||||||||

| TOTAL NET REVENUES | ||||||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Research and development | ||||||||||||||||

| General and administrative | ||||||||||||||||

| TOTAL OPERATING EXPENSES | ||||||||||||||||

| LOSS FROM OPERATIONS | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| OTHER INCOME (EXPENSE): | ||||||||||||||||

| Interest expense, net | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Change in fair value of derivative liabilities | ( | ) | ( | ) | ||||||||||||

| TOTAL OTHER INCOME (EXPENSE) | ( | ) | ( | ) | ( | ) | ||||||||||

| NET LOSS BEFORE INCOME TAX | $ | ( | ) | $ | ( | ) | ( | ) | ( | ) | ||||||

| Income tax expense | ||||||||||||||||

| NET LOSS | $ | ( | ) | $ | ( | ) | ( | ) | ( | ) | ||||||

| Loss per common share - basic and diluted | $ | ( | ) | $ | ( | ) | ( | ) | ( | ) | ||||||

| Weighted average common shares outstanding - basic and diluted | ||||||||||||||||

| The accompanying notes are an integral part of these consolidated financial statements | ||||||||||||||||

| 4 |

NEUROPATHIX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

Unaudited

| Series A Preferred Stock | Series B Preferred Stock | Common Stock | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Additional Paid-In Capital | Accumulated Deficit | Total Stockholders’ Deficit | ||||||||||||||||||||||||||||

| Balance at December 31, 2019 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Stock based compensation | — | |||||||||||||||||||||||||||||||||||

| Issuance of common stock for acquisition of intellectual property | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock for conversion of notes payable and accrued interest | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock for services | ||||||||||||||||||||||||||||||||||||

| Reduction of derivative liability | — | |||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at September 30, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Balance at June 30, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Stock based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Issuance of common stock for conversion of notes payable and accrued interest | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for services | — | — | ||||||||||||||||||||||||||||||||||

| Reduction of derivative liability | — | — | — | |||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at September 30, 2020 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Stock based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Issuance of common stock for cash | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for conversion of notes payable and accrued interest | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for services | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock in lieu of deferred compensation | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock due to settlement of accrued expenses | — | — | ||||||||||||||||||||||||||||||||||

| Issuance of common stock for payment of patent purchase liability | — | — | ||||||||||||||||||||||||||||||||||

| Reduction of derivative liability due to conversions | — | — | — | |||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at September 30, 2021 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||||

| Stock based compensation | $ | |||||||||||||||||||||||||||||||||||

| Issuance of common stock for conversion of notes payable and accrued interest | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock in lieu of deferred compensation | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at September 30, 2021 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| The accompanying notes are an integral part of these consolidated financial statements | ||||||||||||||||||||||||||||||||||||

| 5 |

NEUROPATHIX, INC,

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Unaudited

| Nine Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation | ||||||||

| Amortization of debt discount | ||||||||

| Stock based compensation | ||||||||

| Issuance of common stock for acquisition of intellectual property | ||||||||

| Issuance of common stock for services | ||||||||

| Non-cash interest expense | ||||||||

| Change in fair value of derivative liabilities | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses | ||||||||

| Other receivables | ( | ) | ||||||

| Accounts payable and accrued expenses | ||||||||

| Payroll and related liabilities | ||||||||

| Due to related party, net | ( | ) | ||||||

| NET CASH USED IN OPERATING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of equipment | ( | ) | ||||||

| NET CASH USED IN INVESTING ACTIVITIES | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from issuance of common stock | ||||||||

| Principal payments toward capital lease obligations | ( | ) | ( | ) | ||||

| Proceeds from loan payable | ||||||||

| Proceeds from loan payable - related party | ||||||||

| Proceeds from convertible notes payable | ||||||||

| Proceeds from convertible notes payable, net of OID | ||||||||

| Repayment of convertible notes payable | ( | ) | ||||||

| Proceeds from convertible notes payable | ||||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | ||||||||

| Net increase (decrease) in cash | ( | ) | ( | ) | ||||

| Cash and cash equivalents, beginning of period | ||||||||

| Cash and cash equivalents, end of period | $ | $ | ||||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for taxes | $ | $ | ||||||

| NON-CASH ACTIVITIES: | ||||||||

| Issuance of common stock for conversion of notes payable and accrued interest | $ | $ | ||||||

| Issuance of common stock for services | $ | $ | ||||||

| Issuance of common stock for payment of patent purchase liability | $ | $ | ||||||

| Issuance of common stock in lieu of deferred compensation | $ | $ | ||||||

| Property and equipment financed through capital leases | $ | $ | ||||||

| Reduction of derivative liability | $ | $ | ||||||

| Debt discount upon the issuance of convertible note payable | $ | $ | ||||||

| Debt discount upon the issuance of convertible note payable - related party | $ | $ | ||||||

| The accompanying notes are an integral part of these consolidated financial statements | ||||||||

| 6 |

| NEUROPATHIX, INC. |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| SEPTEMBER 30, 2021 |

| (UNAUDITED) |

Note 1 – ORGANIZATION AND NATURE OF OPERATIONS

Neuropathix,

Inc. (the “Company”) was incorporated under the laws of the state of Delaware on

On November 9, 2018, the Company filed an amendment to its certificate of incorporation with the Delaware Secretary of State that changed its name to Kannalife, Inc.

On November 4, 2020, the Company filed an amendment to its certificate of incorporation with the Delaware Secretary of State that changed its name to Neuropathix, Inc. The Company concurrently submitted a request to FINRA for approval of the name change as well as a ticker symbol change from “KLFE” to “NPTX.” The Company’s name change and ticker symbol change was reviewed and processed by FINRA and went effective November 6, 2020.

Unaudited Interim Financial Information

We have prepared the accompanying condensed consolidated financial statements pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for interim financial reporting. These condensed consolidated financial statements are unaudited and, in our opinion, include all adjustments, consisting of normal recurring adjustments and accruals necessary for a fair presentation of our balance sheets, operating results, and cash flows for the periods presented. Operating results for the periods presented are not necessarily indicative of the results that may be expected for 2021. Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) have been omitted in accordance with the rules and regulations of the SEC. These condensed consolidated financial statements should be read in conjunction with our audited financial statements and accompanying notes for the year ended December 31, 2020, included in the Company’s Annual Report on Form 10-K filed with the SEC on March 30, 2021.

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies used in the preparation of the condensed consolidated financial statements are as follows:

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States, or GAAP.

Significant Risks and Uncertainties

The Company’s operations are subject to a number of factors that can affect its operating results and financial condition. Such factors include, but are not limited to: the results of clinical testing and trial activities of the Company’s products, the Company’s ability to obtain regulatory approval to market its products, competition from products manufactured and sold or being developed by other companies, the price of, and demand for, Company products, the Company’s ability to negotiate favorable licensing or other manufacturing and marketing agreements for its products, and the Company’s ability to raise capital.

The Company currently has no commercially approved products and there can be no assurance that the Company’s research and development will be successfully commercialized. Developing and commercializing a product requires significant time and capital and is subject to regulatory review and approval as well as competition from other biotechnology and pharmaceutical companies. The Company operates in an environment of rapid change and is dependent upon the continued services of its employees and consultants and obtaining and protecting intellectual property.

| 7 |

In December 2019, a novel strain of coronavirus, commonly known as COVID-19, surfaced. The spread of COVID-19 around the world in 2020 and 2021 has caused significant volatility in U.S. and international markets. There is significant uncertainty around the breadth and duration of business disruptions related to COVID-19, as well as its impact on the U.S. and international economies and, as such, the Company is unable to determine if it will have a material impact to its operations. The Company’s operations as of September 30, 2021 have not been significantly affected, but may be affected in the future, by the ongoing outbreak of COVID-19 which was declared a pandemic by the World Health Organization. The ultimate disruption which may be caused by the outbreak is uncertain; however, it may result in a material adverse impact on the Company’s financial position, operations and cash flows. Possible areas that may be affected include, but are not limited to, disruption to the Company’s labor workforce, unavailability of products and supplies used in operations, and the decline in value of assets held by the Company.

Revenue Recognition

It is the Company’s policy that revenues are recognized in accordance with ASC 606 “Revenue Recognition.” Five basic steps must be followed before revenue can be recognized; (1) Identifying the contract(s) with a customer that creates enforceable rights and obligations; (2) Identifying the performance obligations in the contract, such as promising to transfer goods or services to a customer; (3) Determining the transaction price, meaning the amount of consideration in a contract to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer; (4) Allocating the transaction price to the performance obligations in the contract, which requires the company to allocate the transaction price to each performance obligation on the basis of the relative standalone selling prices of each distinct good or services promised in the contract; and (5) Recognizing revenue when (or as) the entity satisfies a performance obligation by transferring a promised good or service to a customer. The amount of revenue recognized is the amount allocated to the satisfied performance obligation. Adoption of ASC 606 has not changed the timing and nature of the Company’s revenue recognition and there has been no material effect on the Company’s financial statements.

Our revenues consist of state and federal research grants and fees received from research services for third-party product development. These revenues are recognized when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable and collectability is reasonably assured.

On

September 28, 2021, the Company received a notice of award for a $

| 8 |

Use of Estimates

The preparation of consolidated financial statements and accompanying notes in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the dates of the consolidated financial statements, and the reported amounts of revenues and expenses during the periods. Actual results could differ from those estimates. Significant matters requiring the use of estimates and assumptions include, but are not necessarily limited to, establishing the fair value of marketable securities and periodically evaluating marketable securities for potential impairment, fair value of the Company’s stock, stock-based compensation, valuation of derivative liabilities and valuation allowance relating to the Company’s deferred tax assets. Management believes that its estimates and assumptions are reasonable, based on information that is available at the time they are made.

Basic net loss per share is calculated by dividing the net loss for the period by the weighted-average number of common shares outstanding during the period. Diluted net income per share is calculated by dividing income for the period by the weighted-average number of common shares outstanding during the period, increased by potentially dilutive common shares ("dilutive securities") that were outstanding during the period. Dilutive securities include stock options and warrants granted, convertible debt, and convertible preferred stock.

The weighted average number of common stock equivalents not included in diluted income per share, because the effects are anti-dilutive, was and for the nine months ended September 30, 2021 and 2020, respectively.

Research and Development

In

accordance with FASB ASC 730, Research and Development (“ASC 730”) research and development (“R&D”)

costs are expensed when incurred. R&D costs include supplies, clinical trial and related clinical manufacturing costs, contract and

other outside service and facilities and overhead costs. Total R&D costs for the three months ended September 30, 2021 and 2020,

were $

The Company accounts for share-based compensation in accordance with the fair value recognition provision of FASB ASC 718, Compensation – Stock Compensation (“ASC 718”), prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense, which is included in the general and administrative expense in the consolidated financial statements based on the estimated grant date fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

Recently Issued Authoritative Guidance

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments – Credit Losses” to improve information on credit losses for financial assets and net investment in leases that are not accounted for at fair value through net income. ASU 2016-13 replaces the current incurred loss impairment methodology with a methodology that reflects expected credit losses. In April 2019 and May 2019, the FASB issued ASU No. 2019-04, “Codification Improvements to Topic 326, Financial Instruments-Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments” and ASU No. 2019-05, “Financial Instruments-Credit Losses (Topic 326): Targeted Transition Relief” which provided additional implementation guidance on the previously issued ASU. In November 2019, the FASB issued ASU 2019-10, “Financial Instruments - Credit Loss (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842),” which defers the effective date for public filers that are considered small reporting companies (“SRC”) as defined by the Securities and Exchange Commission to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Since the Company is an SRC, implementation is not needed until January 1, 2023. The Company will continue to evaluate the effect of adopting ASU 2016-13 will have on the Company’s consolidated financial statements.

| 9 |

Note 3 – GOING CONCERN AND MANAGEMENT’S LIQUIDITY PLANS

The

Company’s condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization

of assets and the settlement of liabilities and commitments in the normal course of business. As reflected in our accompanying condensed

consolidated financial statements, the Company has had a loss from operations of $2,801,028 and $2,977,590 for the nine months ended

September 30, 2021 and 2020, respectively. Additionally, the Company had an accumulated deficit of $

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management plans to raise additional capital through the sale of convertible debt securities offering. However, there are no assurances that such additional funding will be achieved or that management’s plans will be successful. The accompanying condensed consolidated financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Note 4 – FAIR VALUE MEASUREMENTS

The Company follows FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) to measure and disclosure the fair value of its financial instruments. ASC 820 establishes a framework for measuring fair value in U.S. GAAP and expands disclosures about fair value measurements and establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The three levels of fair value hierarchy defined by ASC 820 are described below:

Level 1 - Quoted market prices available in active markets for identical assets or liabilities as of the reporting date.

Level 2 - Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date.

Level 3 - Pricing inputs that are generally unobservable inputs and not corroborated by market data.

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

| 10 |

The carrying amounts reported in the Company’s condensed consolidated financial statements for cash, accounts payable and accrued expenses approximate their fair value because of the immediate or short-term nature of these financial instruments.

Transactions involving related parties cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated.

The following table presents liabilities that are measured and recognized at fair value as of September 30, 2021 and December 31, 2020, on a recurring basis:

| September 30, 2021 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total Carrying Value | |||||||||||||

| Derivative liabilities | $ | $ | $ | $ | ||||||||||||

| December 31, 2020 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total Carrying Value | |||||||||||||

| Derivative liabilities | $ | $ | $ | $ | ||||||||||||

NOTE 5 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at September 30, 2021 and December 31, 2020 consisted of the following:

September 30, 2021 |

December 31, 2020 | |||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Accrued interest | ||||||||

| Totals | $ | $ | ||||||

NOTE 6 – PAYROLL AND RELATED LIABILITIES

Payroll and related liabilities at September 30, 2021 and December 31, 2020 consisted of the following:

September 30, 2021 |

December 31, 2020 | |||||||

| Payroll | $ | $ | ||||||

| Payroll taxes | ||||||||

| Totals | $ | $ | ||||||

As

of September 30, 2021, the Company has accrued payroll and payroll taxes in connection with salaries paid and accrued to four officers

of the Company which includes $

| 11 |

NOTE 7 – LOAN PAYABLE

| September 30, 2021 | December 31, 2020 | |||||||||||

| Loan payable at |

* | $ | $ | |||||||||

| Loan payable at |

||||||||||||

| Loan payable at |

* | |||||||||||

| Total | 900,000 | 950,000 | ||||||||||

| Less: short term loans | ||||||||||||

| Total long-term loans | $ | $ | ||||||||||

| * - unsecured note | ||||||||||||

On July 26, 2021, the Company entered into a promissory note purchase agreement, with Cross & Company pursuant to which the purchaser agreed to purchase a promissory note in the principal amount of $100,000. The note matures on July 26, 2023. The note bears interest at 0.25% per annum. The note holds a right of offset for the holder of the note, whereby the holder shall have the right to offset any proceeds due to the Debtor for “Puts” delivered to Holder pursuant to a Equity Purchase Agreement by and between Holder and Debtor dated September 16, 2020. On July 26, 2021, Cross & Company exercised its right of offset under the promissory note agreement with the Company and the Company put 250,000 shares of its common stock to Cross & Company with net proceeds of $8,288. On August 10, 2021, Cross & Company exercised its right of offset under the promissory note agreement with the Company and the Company put 172,701 shares of its common stock to Cross & Company with net proceeds of $8,803. After the effect on the offsets, the promissory note has a remaining balance of $82,910 as of September 30, 2021.

Total

interest expense on notes payable, amounted to $

NOTE 8 – LOAN PAYABLE – RELATED PARTY

Prior

to the share exchange agreement, the Company borrowed $

The

loans represent working capital advances from shareholders, bear interest at

NOTE 9 – CAPITAL LEASE OBLIGATIONS

In

September 2019, the Company entered into a lease agreement with Thermo Fisher Scientific to acquire equipment with

In

March 2021, the Company entered into another lease agreement with Thermo Fisher Scientific to acquire equipment with

NOTE 10 – CONVERTIBLE NOTES PAYABLE

Prior

to the Share Exchange, the Company issued a convertible note to an investor, face value of $

In

December 2019, the Company entered into a Securities Purchase Agreement with an investor pursuant to which the Company agreed to sell

to the investor a $

| (a) | elects to repay the Note, it must do so at a premium of one hundred and twenty five percent (125%) of the face amount of the Note, together with all unpaid and accrued interest to the date of repayment. | |

| (b) | elects to involuntarily exercise conversion of this Note to the Holder, the Company must provide written notice to the Holder along with an executed copy of the Company’s Notice of Conversion, specifying that the Note shall be converted into shares of the Company’s Common Stock based upon at an effective conversion price of 75% of the average closing price of the Company’s common stock on the fifteen days prior to conversion. |

| 12 |

The embedded conversion feature of this Note was deemed to require bifurcation and liability classification, at fair value. Pursuant to the Securities Purchase Agreement, the Company also sold warrants to the investors to purchase up to an aggregate of shares of common stock. The fair value of the derivative liability and warrants as of the date of issuance was in excess of the Note (see Note 12) resulting in full discount of the Note as of September 30, 2021 and December 31, 2020.

On

March 12, 2020, the Company entered into securities purchase agreements with two different accredited investors (each an “Investor”,

and together the “Investors”) pursuant to which each Investor purchased an 8% unsecured convertible promissory note (each

a “8% Note”, and together the “8% Notes”) from the Company. The terms and conditions of each of the 8% Notes

are substantially the same. Each 8% Note has a principal amount of $

On

June 8, 2020, the Company entered into a securities purchase agreement, dated as of June 2, 2020 (the “Purchase Agreement”),

with an accredited investor pursuant to which the investor purchased a 12% unsecured convertible promissory note (the “12% Note”)

from the Company. The

| 13 |

On

June 23, 2020, the Company entered into a securities purchase agreement, dated as of June 19, 2020, with an accredited investor pursuant

to which the investor purchased a

Total interest expense on convertible notes payable,

inclusive of amortization of debt discount of $

Total accrued interest on convertible notes payable,

as of September 30, 2021 and December 31, 2020, was $

NOTE 11 – CONVERTIBLE NOTES PAYABLE – RELATED PARTY

In

January 2020, the Company sold $

In

February 2020, the Company sold an additional $

| 14 |

Total

interest expense on convertible notes payable – related party, inclusive of amortization of debt discount of $

Total

accrued interest on convertible notes payable – related party, as of September 30, 2021 and December 31, 2020, was $

NOTE 12 – PATENT PURCHASE LIABILITY

On December 17, 2020, the Company entered into an Intellectual Property Rights Purchase and Transfer Agreement (the “IP Purchase Agreement”) by and between Advanced Neural Dynamics (“AND”), Fox Chase, Dr. Douglas Brenneman (“Brenneman”) and the Company to acquire the IP Rights and concurrently entered into a Pharmaceutical Royalty Agreement with AND and Fox Chase.

Pursuant

to the IP Purchase Agreement, the Company acquired the IP Assets for a $

| • |

shares of restricted common stock of the Company were issued to Fox Chase at a price per share of $for an aggregate of $ |

| • | $ |

In addition, AND/Brenneman shall receive cash payments of $15,000 annually, payable in quarterly installments to offset against tax payments, netted out against actual tax costs incurred. In the event such payments are not made, there will be a 10% penalty assessed on said late tax offset payment.

The liabilities from the IP purchase agreement are recognized at the commencement date based on the present value of remaining payments over the payment term using the Company’s secured incremental borrowing rates or implicit rates, when readily determinable.

The Company’s IP purchase agreement does not provide an implicit rate that can readily be determined. Therefore, the Company uses an 8% discount rate based on our incremental borrowing rate, which is determined using the average interest rate of our long-term debt as of December 17, 2020.

NOTE 13 – DERIVATIVE LIABILITIES

The Company issued debts that consist of the issuance of convertible notes with variable conversion provisions. In addition, the Company issued warrants with variable conversion provisions. The conversion terms of the convertible notes and warrants are variable based on certain factors, such as the future price of the Company’s common stock. The number of shares of common stock to be issued is based on the future price of the Company’s common stock. The number of shares of common stock issuable upon conversion of the promissory note is indeterminate. Pursuant to ASC 815-15 Embedded Derivatives, the fair values of the variable conversion option and warrants and shares to be issued were recorded as derivative liabilities on the issuance date.

| 15 |

Based on the various convertible notes described in Note 10 and 11, the fair value of applicable derivative liabilities on notes, warrants and change in fair value of derivative liability are as follows for the nine months ended September 30, 2021:

| Derivative Liability - Convertible Notes | Derivative Liability - Warrants | Total | ||||||||||

| Balance as of December 31, 2020 | $ | $ | $ | |||||||||

| Additions during the period | ||||||||||||

| Change in fair value | ( | ) | ||||||||||

| Change due to exercise / redemptions | ( | ) | — | ( | ) | |||||||

| Balance as of September 30, 2021 | $ | $ | $ | |||||||||

The fair value of the derivative liability – convertible notes is estimated using a Monte Carlo pricing model with the following assumptions:

| Market value of common stock | $ | |||

| Expected volatility | % - | % | ||

| Expected term (in years) | – | |||

| Risk-free interest rate | % | |||

The fair value of the derivative liability – warrants is estimated using a Monte Carlo pricing model with the following assumptions:

| Market value of common stock | $ | |||

| Expected volatility | % - | % | ||

| Expected term (in years) | – | |||

| Risk-free interest rate | % | |||

| 16 |

NOTE 14 – COMMITMENTS AND CONTINGENCIES

Legal Proceedings

From time to time the Company may get involved in legal proceedings arising in the ordinary course of business. Other than as set forth in “Legal Proceedings” in Part II below, the Company believes there is no litigation pending that could have, individually or in the aggregate, a material adverse effect on its results of operations or financial condition.

Occupancy Leases

On

April 1, 2014, the Company entered into a one year lease arrangement for office space, with the option to renew the lease annually. The

lease has been renewed through April 2022. The monthly rent payment is $

On

September 15, 2015, we entered into a one year lease arrangement for additional office space, the lease has been renewed is currently

scheduled to expire on September 30, 2021. The monthly rent payment is $

On

July 1, 2018, we entered into a one year lease arrangement for additional office space, with the option to renew the lease annually.

On September 1, 2018, we subleased this office space to a third party. The subleasee will pay 50% of the rent until expiration of lease

on June 30, 2024. The monthly rent payment is $

Royalties

On December 17, 2020, the Company entered into an Intellectual Property Rights Purchase and Transfer Agreement by and between AND, Fox Chase, Brenneman and the Company to acquire the IP Rights and concurrently entered into the “Royalty Agreement with AND and Fox Chase.

Pursuant to the Royalty Agreement, the following royalties and license fees are payable to Fox Chase and AND as well:

| • | 1% royalties on net sales up to $500,000 per year per participant (for an aggregate maximum of 2% and up to $1,000,000); |

| • | 1% upfront sublicense fees per participant; and |

| • | 1% reversion rights to each participant (for 2% aggregate), which rights include future milestone payments. |

NOTE 15 – STOCKHOLDERS’ DEFICIT

Series A Preferred Stock

Series B Preferred Stock

| 17 |

Common Stock

The

Company is authorized to issue shares of common stock, par value of $ per share.

Equity Purchase Agreement with Cross & Company

On September 18, 2020, the Company entered into an Equity Purchase Agreement with Cross and Company. We have the right to “put,” or sell, up to 8,108,108 shares of our common stock to Cross. Unless terminated earlier, Cross’s purchase commitment will automatically terminate on the earlier of the date on which Cross shall have purchased shares pursuant to the Equity Purchase Agreement for an aggregate purchase price of $6,000,000 or September 18, 2023. The purchase price per share is calculated at a fifteen percent discount of the lowest trading price of the Company’s common stock during the ten days after Cross and Co. receives the shares.

On

January 4, 2021, the Company issued shares of common stock for the conversion of $

On January 12, 2021, the Company issued shares of common stock at the price of $0.18 per share in exchange for a settlement of accrued expenses.

On

January 13, 2021, the Company issued shares of common stock for the conversion of $

On January 14, 2021, the Company sold

On January 15, 2021, the Company issued shares of common stock at $ a share, to a consultant for business development services.

On January 15, 2021, the Company issued 313,972 shares of common stock at the price of $0.19 per share for the purchase of intellectual property based on a five year installment sale. This compensation is included in research and development on the consolidated statement of operations. The issuance was an error and was intended, as per agreement to be 200,000 shares at the floor price of $.30 per share. The Company and the recipient have discussed the cancellation of 113,972 shares which will occur in the second quarter of 2021.

On

January 28, 2021, the Company sold shares of common stock at the purchase price of $

per share for a total purchase price of $

On

February 1, 2021, the Company issued shares of common stock for the conversion of $

On

February 10, 2021, the Company issued shares of common stock for the conversion of $

On

February 10, 2021, the Company issued shares of common stock in exchange of cash at $0.17 per share for

a total purchase price of $

On February 10, 2021, the Company issued 3,500,000 shares of common stock in exchange of cash at $0.10 per share for a total purchase price of $.

| 18 |

On

February 22, 2021, the Company issued shares of common stock in exchange of cash at $ per share for a total purchase price

of $

On

February 26, 2021, the Company issued shares of common stock in exchange of cash at $ per share for a total purchase price

of $

On March 2, 2021, the Company issued shares of common stock at the price of $ per share in exchange for a settlement of accrued expenses.

On March 4, 2021, the Company issued shares of common stock at $ a share, to a consultant for business development services.

On

March 12, 2021, the Company issued its CEO shares of common stock at $0.13 a share in lieu of $

On

March 25, 2021, the Company issued shares of common stock in exchange of cash at $0.14 per share for a total purchase price of

$

On

July 13, 2021, the Company issued shares of common stock as part of a put agreement at $ per share for a total purchase price

of $

On

July 28, 2021, the Company issued its CEO shares of common stock at $ a share in lieu of $

On

August 10, 2021, the Company issued shares of common stock as part of a put agreement at $ per share for a total purchase

price of $

Stock Options

On

May 4, 2020, the Company granted options to purchase shares of common stock at a price of $ per share to certain directors

and employees of the Company (including our named executive officers) and are exercisable for ten years. One quarter of these options

vest on the grant day, and the remainder of the options vest equally over thirty six (36) months starting January 1, 2020. These options

were valued at $

On

May 18, 2020, the Company granted options to purchase shares of common stock at a price of $ per share to a consultant

and are exercisable for ten years. One quarter of these options vest on the grant day, and the remainder of the options vest equally

over twelve (12) months. These options were valued at $

| 19 |

On

September 14, 2020 and December 24, 2020, the Company granted options to purchase shares of common stock, respectively, at a

price of $ and $ per share, respectively, to a consultant and are exercisable for ten years. One quarter of these options

vest on the grant day, and the remainder of the options vest equally over twelve (12) months. These options were valued at $

On

September 23, 2020, the Company granted options to purchase shares of common stock at a price of $ per share to a consultant,

who is a related party, and are exercisable for ten years. One quarter of these options vest on the grant day, and the remainder

of the options vest equally over twenty four (24) months. These options were valued at $

On

December 28, 2020, the Company granted options to purchase shares of common stock at a price of $ per share to a consultant

and are exercisable for ten years. One quarter of these options vest on the grant day, and the remainder of the options vest equally

over twelve (12) months. These options were valued at $

On

March 12, 2021, the Company granted options to purchase shares of common stock at a price of $ per share to certain

directors and employees of the Company (including our named executive officers) and are exercisable for ten years. One quarter of

these options vested on the grant day, and the remainder of the options vest equally over thirty-six months starting March 12, 2021.

These options were valued at $

On

March 12, 2021, the Company granted options to purchase shares of common stock at a price of $ per share to a certain

member of the Company’s corporate advisory board, as governed under agreement. One quarter of these options vested on the grant

day, and the remainder of the options vest equally over twenty four months thereafter. These options were valued at $

On

April 2, 2021, the Company granted options to purchase shares of common stock at a price

of $ per share to a consultant and are exercisable for ten years. One quarter of these options vest on the grant day, and

the remainder of the options vest equally over twelve (12) months. These options were valued at $

On

July 13, 2021, the Company granted options to purchase shares of common stock at a price

of $ per share to a consultant and are exercisable for ten years. One quarter of these options vest on the grant day, and

the remainder of the options vest equally over twelve (12) months. These options were valued at $

The remaining expense outstanding through March 12, 2024 is $.

| 20 |

For the three months ended September 30, 2021 and 2020, the Company recorded $ and $, respectively, as stock based compensation which is included in the general and administrative expenses in the condensed consolidated statement of operations and $64,030 and $39,075, respectively, as research and development expense.

For

the nine months ended September 30, 2021 and 2020, the Company recorded $ and $, respectively, as stock based compensation

which is included in the general and administrative expenses in the condensed consolidated statement of operations and $

For the three months ended September 30, 2021 and 2020, the Company recorded $ and $, respectively, as common stock issued in lieu of deferred compensation.

For the nine months ended September 30, 2021 and 2020, the Company recorded $ and $, respectively, as common stock issued in lieu of deferred compensation.

For

the three months ended September 30, 2021 and 2020, the Company recorded $

For

the nine months ended September 30, 2021 and 2020, the Company recorded $

The fair value of the options is estimated using a Black-Scholes Options Pricing Model with the following assumptions:

| Market value of common stock on issuance date | $ |

|||

| Exercise price | $ – | |||

| Expected volatility | % – | % | ||

| Expected term (in years) | – | |||

| Risk-free interest rate | % – | % | ||

| Expected dividend yields |

On August 14, 2019, the Board authorized the Company’s 2019 Equity Incentive Plan (the “2019 Plan”) in order to facilitate the grant of cash and equity incentives to directors, employees (including our named executive officers) and consultants of our company and certain of its affiliates and to enable our company and certain of its affiliates to obtain and retain services of these individuals, which is essential to our long-term success. Our 2019 Plan allows for the grant of a variety of equity vehicles to provide flexibility in implementing equity awards, including incentive stock options, non-qualified stock options, restricted stock grants, unrestricted stock grants and restricted stock units. There were initially 7,500,000 shares of Company common stock authorized for issuance under our 2019 Plan.

On May 4, 2020, the Company amended its 2019 Plan to increase the number of shares of Company common stock authorized for issuance thereunder to 11,500,000 shares. On March 12, 2021, the Company executed a second amendment to the 2019 Plan to (i) replace all references to “Kannalife, Inc.,” the Company’s former name, to “Neuropathix, Inc.,” and (ii) increase the number of shares of Company common stock authorized for issuance thereunder 20,000,000 shares (the “Second Plan Amendment”).

The Second Plan Amendment was approved by the Company’s Board of Directors on March 12, 2021. The Second Plan Amendment remains subject to shareholder approval, which the Company shall undertake to obtain as soon as reasonably practicable, but in no event later than one year from the amendment date. In the event that the Company does not obtain the requisite shareholder approval of the Second Plan Amendment within one year, the Second Plan Amendment shall not be effective.

| 21 |

As of September 30, 2021, there were shares of Company common stock issued and outstanding under the 2019 Plan, as amended.

The following is a summary of outstanding and exercisable options:

| Numbers of Options | Weighted Avg Exercise Price | Weighted Avg Remaining Years | ||||||||||

| Outstanding as of December 31, 2020 | $ | |||||||||||

| Granted | ||||||||||||

| Exercised | — | |||||||||||

| Forfeited | — | |||||||||||

| Expired | — | |||||||||||

| Outstanding as of September 30, 2021 | $ | |||||||||||

| Outstanding as of September 30, 2021, vested | $ | |||||||||||

Warrants

In

January and February 2020, the Company entered into a Securities Purchase Agreement with investors pursuant to which the Company agreed

to sell the investors a $ and $ convertible note bearing interest at 8% per annum, respectively. The Company also sold warrants

to the investors to purchase up to an aggregate of

On

June 8, 2020, the Company entered into a Securities Purchase Agreement, dated as of June 2, 2020 (the “Purchase Agreement”)

with an accredited investor pursuant to which the investor purchased a 12% unsecured convertible promissory note (the “12% Note”)

from the Company. In connection with the Purchase Agreement and the

On

June 23, 2020, the Company entered into a Securities Purchase Agreement, dated as of June 19, 2020 with an accredited investor pursuant

to which the Investor purchased a

| 22 |

On

February 10, 2021, the Company entered into a letter agreement with Lyons Capital, pursuant to which the Company agreed to issue and

sell 3,500,000 shares of the Company’s common stock, par value $ per share, and two warrants to purchase an aggregate of

additional shares of Common Stock, the terms of such warrants are further discussed below, for an aggregate purchase price

of $

The following is a summary of outstanding and exercisable warrants:

Number of Shares |

Weighted Average Exercise Price | |||||||

| Balance at December 31, 2020 | $ | |||||||

| Issued | 4,194,161 | |||||||

| Reset | ||||||||

| Expired | ||||||||

| Balance at September 30, 2021 | $ | |||||||

At

September 30, 2021,

NOTE 16 – RELATED PARTY TRANSACTIONS

The

Company’s Chief Executive Officer (“CEO”) shares the use of the leased office space for personal living quarters. The

CEO reimburses the Company for 50% of the monthly rent, or $

As

of September 30, 2021, the Company owes the CEO $

During

the nine months ended September 30, 2021, the Company repaid $

On March 12, 2021, the Company issued its CEO shares of common stock at a share in lieu of $ of accrued compensation.

On July 28 2021, the Company issued its CEO shares of common stock at $ a share in lieu of $ of accrued compensation.

See Notes 8, 11, 14 and 15 for additional related party transactions.

NOTE 17 – SUBSEQUENT EVENTS

On

October 1, 2021, the Company put shares of common stock as part of a put agreement. An advance of $

The Company has evaluated subsequent events occurring after September 30, 2021, the date of our most recent balance sheet, through the date our financial statements were issued and determined no additional subsequent events exist.

| 23 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this quarterly report. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed below. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission on March 30, 2021.

Forward-Looking Statements

This quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). All statements other than statements of historical fact contained in this quarterly report, including statements regarding our future operating results, financial position and cash flows, our business strategy and plans and our objectives for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This quarterly report on Form 10-Q also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this quarterly report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives. These forward looking statements speak only as of the date of this quarterly report and are subject to a number of risks, uncertainties and assumptions. The events and circumstances reflected in our forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Business Developments

The Company was originally incorporated in the State of Delaware on March 25, 2013 under the name TYG Solutions Corp. Our original business plan was to develop iPhone and Android smartphone apps for companies who need an app for their internal and external operations. We subsequently expanded our operations to offering corporate website design services.

On July 25, 2018, the Company entered into a Share Exchange Agreement with Kannalife Sciences, Inc., a Delaware corporation (“Kannalife Sciences”), and certain stockholders of Kannalife Sciences (the “Kannalife Sciences Stockholders”). Pursuant to the terms of the Share Exchange Agreement, the Company acquired substantially all of the issued and outstanding shares of Kannalife Sciences by means of a share exchange with the Kannalife Sciences Stockholders in exchange for newly issued shares of the common stock of the Company (the “Share Exchange”). As a result of the Share Exchange, Kannalife Sciences became a 99.7% owned subsidiary of the Company. The business operations of the Company regarding iPhone and Android smartphone apps was reduced significantly to focus efforts on target therapeutics and drug discovery, and accordingly, by virtue of the Share Exchange, the Company acquired the business of Kannalife Sciences including all of its assets. The Share Exchange was accounted for as a reverse acquisition and change in reporting entity, whereby Kannalife Sciences was the accounting acquirer.

On November 9, 2018, the Company filed an amendment to its certificate of incorporation with the Delaware Secretary of State to change its name to Kannalife, Inc. The Company concurrently submitted a request to FINRA for approval of the name change as well as a ticker symbol change to “KLFE” and such action went effective on January 17, 2019.

On November 4, 2020, the Company filed an amendment to its certificate of incorporation with the Delaware Secretary of State to change its name to “Neuropathix, Inc.” The Company concurrently submitted a request to FINRA for approval of the name change as well as a ticker symbol change from “KLFE” to “NPTX.” The Company’s name change and ticker symbol change was reviewed and processed by FINRA, and went effective November 6, 2020.

| 24 |

Kannalife Sciences was incorporated in the State of Delaware on August 11, 2010. Kannalife Sciences is a developmental stage phyto-medical/pharmaceutical and drug discovery company that specializes in the research, development of cannabinoid and cannabinoid-based therapeutic products derived from synthetic and botanical sources, including the Cannabis “taxa” (the word “taxa” is the plural of “taxon,” which defines a group of one or more populations of an organism or organisms to form a unit).

Business Overview

As a result of the Share Exchange, our core businesses are comprised of the following:

| • | A drug development company focused on the research and development (R&D) of synthetic and phyto-medical products from: |

| o | naturally recurring sources, including but not limited to cannabis, hemp, and other similar species of plantae; |

| o | semi-synthetic sources; and |

| o | synthetic and bio-synthetic sources. |

| • | Drug discovery platform to evaluate and potentially treat neurological and oxidative stress related disorders such as OHE, CTE and CIPN with high quality assured, quality controlled cGMP pharmaceutical grade semi-synthetic and synthetic cannabinoids, CBD, and CBD-like molecules. |

| • | Topical skincare pre-clinical program designed to some of our patented, proprietary CBD-derived NCEs, for use as topical solutions, ointments, and creams for disorders such as diabetic neuropathies, diabetic ulcers, and for use as an anti-pruritic. Anti-pruritics are known as anti-itch drugs and medications that inhibit the itching often associated with a variety of disorders and diseases. |

Cannabinoids are a class of molecules derived from Cannabis plants. The two primary cannabinoids contained in Cannabis are cannabidiol, or CBD, and D9-tetrahydrocannabinol, or THC. Clinical and preclinical data suggest that CBD has positive effects on treating refractory epilepsy, FXS and arthritis and THC has positive effects on treating pain. Interest in cannabinoid therapeutics has increased significantly over the past several years as preclinical and clinical data has emerged highlighting the potential efficacy and safety benefits of cannabinoid therapeutics. The cannabinoid therapeutics market is expected to grow significantly due to the potential benefits these products may provide over existing therapies. In addition to KLS-13019 and KLS-13023 potentially offering first-line therapies to patients suffering from chemotherapy induced peripheral neuropathy and mild traumatic brain injury, respectively.

KLS-13019’s advanced formulation is designed to improve on some of the limitations associated with CBD, including but not limited to CBD’s low bioavailability and limited drug like properties. However, KLS-13019 has not been reviewed or approved for patient use by the FDA or any other healthcare authority in the world. Our pre-clinical studies suggest increased bioavailability, consistent plasma levels and the avoidance of first-pass liver metabolism. In addition, an in vitro study performed by us demonstrated that CBD is degraded to THC in an acidic environment such as the stomach.

In the past three years, our most recent research and development efforts have been centered on the use of KLS-13019 as a neuroprotectant and therapeutic agent to treat chronic and neuropathic pain. There is currently no FDA approved drug to treat CIPN. Our preclinical efforts in the research and development of treating CIPN with our lead compound KLS-13019 have been fostered by a successful study grant from NIH-NIDA that compared KLS-13019 to CBD in the prevention and reversal of neuropathic pain in animal models. As a result of the outcome of this and other preclinical studies, we believe there is strong evidence to support the use of KLS-13019 as a non-opioid solution to chronic and neuropathic pain in human clinical trials.

We intend to study KLS-13019 in patients with chemotherapy induced neuropathic pain, and we intend to study KLS-13023 in patients with mild traumatic brain injury. We believe that the claims made in the Pat. 9,611,213 and Pat. 10,004,722 sufficiently cover the use of the novel molecule KLS-13019 in the treatment of neuropathic pain, which is broadly defined and includes chemotherapy induced neuropathic pain (a/k/a: chemotherapy induced peripheral neuropathy).

| 25 |

To date, we have synthesized, pre-clinically tested and patented our proprietary CBD like NCEs, including KLS-13019, and also formulated a new CBD based molecule, KLS-13023. KLS-13023 is a target drug candidate that includes a synthetic CBD formulated in a gel capsule designed for potential use in humans, which is intended to enable more effective delivery of CBD. The formulation of this product is proprietary and currently held as a trade secret of the Company. CBD is the primary non-psychoactive component of cannabis. KLS-13023 has undergone a manufacturing feasibility study to improve some of the limitations associated with CBD, including but not limited to CBD’s low bioavailability and limited drug like properties and improvement of the delivery of CBD through the first pass in the gut and into the circulatory system. In our preclinical animal studies, KLS-13023 demonstrated effective intervention of neurodegeneration in the OHE disease state. We intend to study KLS-13023 in patients with mild traumatic brain injury. In addition, we expect that KLS-13023 will be classified by the FDA as an NCE. In our preclinical animal studies, KLS-13023 demonstrated effective intervention of neurodegeneration in the OHE disease state.

We believe these product candidates will provide new treatment options for patients, as well as additional treatment options for patients not currently receiving adequate relief from current treatment regimens.

We are still conducting pre-clinical studies and have not yet commenced our clinical program or tested KLS-13019 or KLS-13023 in humans. For KLS-13019, we plan to conduct Phase 1, and possibly Phase 2, clinical trials in either the United States or Australia, subject to applicable regulatory approval. We plan to conduct our Phase 1 clinical trials for KLS-13023 in either the United States or Australia, subject to applicable regulatory approval. We plan to submit NDAs for KLS-13019 and KLS-13023 to the FDA upon completion of all requisite clinical trials. We expect to initiate clinical trials for KLS-13019 and KLS-13023 in the first quarter of 2023.

We plan to conduct our Phase 1, and possibly Phase 2, clinical trials for KLS-13019 in the U.S. or Australia, subject to applicable regulatory approval, and do not expect at this time to file an investigational new drug application, or IND, with the U.S. Food and Drug Administration, or the FDA, prior to the commencement of those clinical trials. We must file an IND with the FDA and receive approval from the U.S. Drug Enforcement Agency, or DEA, prior to commencement of any clinical trials in the United States.

Pharmacokinetic and Pharmacodynamic Comparison Between KLS-13019 and CBD

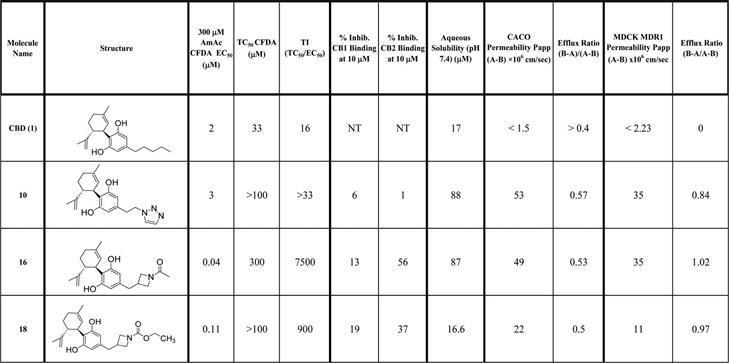

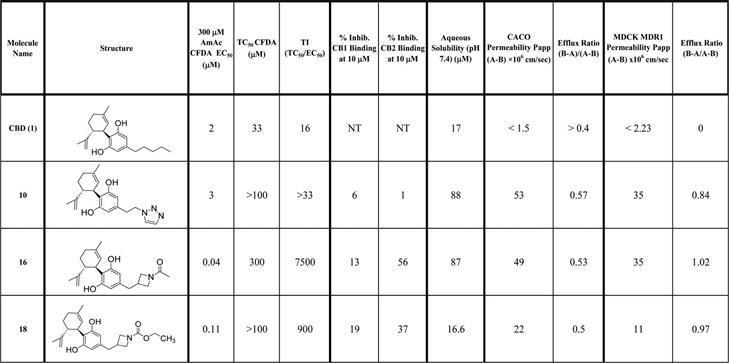

Results from PK and PD studies performed in evaluating CBD versus KLS-13019 have shown KLS-13019 to be superior in aqueous solubility (potential for drug absorption after oral administration); Log P (ratio which measures difference in solubility in two phases); bioavailability (proportion of the drug that enters the circulation); and C max at 10 mg/kg, p.o. (peak serum concentration).

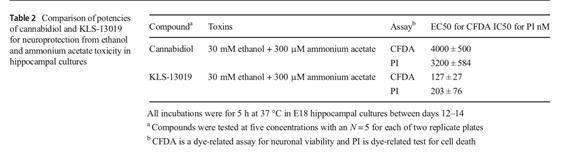

Results from our pre-clinical efforts in the potential treatment of OHE and the potential treatment of CIPN have shown a marked improvement over 99.7% pure pharmaceutical grade synthetic CBD in side by side pre-clinical comparison. In a pre-clinical comparison for neuroprotection between CBD and KLS-13019, results indicated increased potency for the new molecule (KLS-13019) as determined by six assays, while both molecules exhibited efficacy in preventing oxidative stress-related toxicities back to control values.

| 26 |

Treatment with KLS-13019 alone, however, was 5-fold less toxic than CBD. Previous studies suggested that CBD targeted the Na+ Ca2+ (sodium-calcium) exchanger in mitochondria to regulate intracellular calcium levels, an important determinant of neuronal survival. After treatment with an inhibitor, the mNCX inhibitor (“CGP-37157”), no detectable neuroprotection from ethanol toxicity was observed for either CBD or KLS-13019. Furthermore, AM630 (a CB2 antagonist) significantly attenuated CBD-mediated neuroprotection, while having no detectable effect on KLS-13019 neuroprotection. Our studies indicated KLS-13019 was more potent and less toxic than CBD. Both molecules can act through mNCX. Based on these results, amongst other things, we believe that KLS-13019 may provide an alternative to CBD as a therapeutic candidate to treat disease associated with oxidative stress.

As previously noted, comparisons between CBD and KLS-13019 have been published in peer reviewed articles in ACS Medicinal Chemistry Letters (2016, 7, 424-428) and Journal of Molecular Neuroscience (14 August 2018).

Additional follow on studies recently published on May 10, 2019 in the Journal of Molecular Neuroscience have further advanced our studies on the mechanism of action for CBD and KLS-13019 in pre-clinical testing for the treatment of CIPN. The mechanism of action for CBD-and KLS-13019-mediated protection now has been explored with dissociated dorsal root ganglion (“DRG”) cultures using small interfering RNA (siRNA) to the mitochondrial Na+ Ca2+ exchanger-1 (“mNCX-1”). Treatment with this siRNA produced a 50–55% decrease in the immunoreactive (“IR”) area for mNCX-1 in neuronal cell bodies and a 72–80% decrease in neuritic IR area as determined with high-content image analysis. After treatment with 100 nM KLS-13019 and siRNA, DRG cultures exhibited a 75 ±5% decrease in protection from paclitaxel-induced toxicity, whereas siRNA studies with 10 μM CBD produced a 74± 3% decrease in protection. Treatment with mNCX-1 siRNA alone did not produce toxicity. The protective action of cannabidiol and KLS-13019 against paclitaxel-induced toxicity during a 5-h test period was significantly attenuated after a 4-day knockdown of mNCX-1 that was not attributable to toxicity. This data indicates that decreases in neuritic mNCX-1 corresponded closely with decreased protection after siRNA treatment. Pharmacological blockade of mNCX-1 with CGP-37157 produced complete inhibition of cannabinoid-mediated protection from paclitaxel in DRG cultures, supporting the observed siRNA effects on mechanism.

| 27 |

Sodium-Calcium Exchanger (“NCX”) (often denoted Na+/Ca2+ exchanger, NCX, or exchange protein) is an antiporter membrane protein that removes calcium from cells. The exchanger exists in many different cell types and animal species. The NCX is considered to be one of the most important cellular mechanisms for removing Ca2+ (calcium ions) from cells. The exchanger is usually found in the plasma membranes and the mitochondria and endoplasmic reticulum of excitable cells.

Mitochondria is a double-membrane-bound organelle found in most eukaryotic organisms. Mitochondria generate most of the cell’s supply of adenosine triphosphate (“ATP”), used as a source of chemical energy. ATP is a complex organic chemical that provides energy to drive many processes in living cells, including muscle contractions, nerve impulse propagation and chemical synthesis.

According to Fallon, et al. in the March/April 2006 edition of Clinical Medicine, pain is uncontrolled with opioid treatments in approximately 20% of patients with advanced cancer, or 420,000 people in the United States. There are currently no FDA approved non-opioid treatments for patients who do not respond to, or experience negative side effects with, opioid medications. We believe that KLS-13019 has the potential to address a significant unmet need in this large market by treating patients with a product that employs a differentiated non-opioid mechanism of action, and offers the prospect of pain relief without increasing opioid-related adverse side effects.

Clinical Timelines

As a result of the unprecedented effects of COVID-19, we have updated our clinical timelines to give effect to the significant interruption to business and financial operations worldwide as a result of the COVID-19 crisis. We will continue to monitor the progress of the shutdowns currently in effect, and revise our clinical timelines accordingly.

Product Candidate |

Target Indication | Delivery Method | Current Development Status |

Expected Next Steps |

| KLS-13019 | Chemotherapy Induced | Oral Gel Capsule | Preclinical | 4Q23: Initiate Phase 1 |

| Peripheral Neuropathy | ||||

| Mild Traumatic Brain Injury | Oral Gel Capsule | Preclinical | 1Q24: Initiate Phase 1 | |

| KLS-13023 | Overt Hepatic Encephalopathy | Oral Gel Capsule | Preclinical | 4Q24: Initiate Phase 1 |

| Mild Traumatic Brain Injury | Oral Gel Capsule | Preclinical | 1Q24: Initiate Phase 1 |

| 28 |

With respect to certain other proprietary compounds underlying Pat. 9,611,213, we plan on pursuing topical solutions as potential relief creams and/or ointments for neuropathic pain, anti-inflammation, anti-pruritic and skin ulcers. We are considering commercialization routes that include, but are not limited to, filing and FDA Monograph and/or pursing a path to the marketplace through INCI certification and registration with the PCPC. In preclinical testing, certain molecules under Pat. 9,611,213 were screened for neuroprotection and may have the potential mechanism of action for reducing inflammation and neuropathic pain. These molecules indicate that they are more soluble than CBD, also deemed a neuroprotectant with potential anti-inflammatory properties. A molecule that is potentially more water soluble than CBD in this regard may be good candidate(s) for use in topical applications.

We believe that we will be able to raise sufficient capital to proceed forth with a Phase 1 human safety trial for the treatment of Chemotherapy Induced Peripheral Neuropathy. All preclinical work in this indication, including animal toxicity studies, are expected to be completed before the end of the second quarter 2022. We plan on entering into clinical trials sometime in the first quarter of 2023.

Additionally, we believe that we will be able to raise sufficient capital to proceed forth with a Phase 1 human safety trial for the treatment of Overt Hepatic Encephalopathy. All preclinical work in this indication, including animal toxicity studies, are expected to be completed before the end of the second quarter 2023. We plan on entering into clinical trials sometime in the first quarter 2024.

We intend to seek additional capital to proceed with our business plan regarding additional drug pipeline opportunities.

NIH-NINDS Phase 2 STTR Study Grant Award

On September 28, 2021, the Company received a notice of award for a $2.97 million Phase 2 STTR Study Grant (the “NINDS Study Grant Award”) from National Institutes of Health (“NIH”) – National Institute of Neurological Disorders and Stroke (“NINDS”). The NINDS Study Grant Award is funded through the NIH HEAL Initiative (“Helping End Addiction Long-Term”) for Development of Therapies and Technologies Directed at Enhanced Pain Management and will provide funding specifically in the Development of KLS-13019 for Neuropathic Pain. The NINDS Study Grant Award sets forth the funding allocation of $977,054 in year 1; $991,944 in year 2; and $1,001,774 in year 3. Of significant collateral importance is the current epidemic of opioid addiction and abuse by patients in the United States and around the globe. Adding to the equation is the off-label use of opioids and gabapentinoids for chronic and neuropathic pain as a result of the unmet medical need and no FDA approved non-opioid drug to treat chronic and neuropathic pain, specifically chemotherapy-induced peripheral neuropathy (“CIPN”).

| 29 |

Components of Results of Operations

Our net losses were $2,801,028 and $2,977,590 for the nine months ended September 30, 2021 and 2020, respectively. We expect to incur losses for the foreseeable future, and we expect these losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates. Because of the numerous risks and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when, or if, we will be able to achieve or maintain profitability.

Financial Operations Overview

The following discussion sets forth certain components of our statements of operations as well as factors that impact those items.

Revenues

Our revenues consist of state and federal research grants and fees received from research services for third-party product development. These revenues are recognized when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable and collectability is reasonably assured.

On September 28, 2021, the Company received a notice of award for a $2.97 million Phase 2 STTR Study Grant (the “NINDS Study Grant Award”) from National Institutes of Health (“NIH”) – National Institute of Neurological Disorders and Stroke (“NINDS”). The NINDS Study Grant Award is funded through the NIH HEAL Initiative (“Helping End Addiction Long-Term”) for Development of Therapies and Technologies Directed at Enhanced Pain Management and will provide funding specifically in the Development of KLS-13019 for Neuropathic Pain. The NINDS Study Grant Award sets forth the funding allocation of $977,054 in year 1; $991,944 in year 2; and $1,001,774 in year 3. The Company is able to draw down on the grant to reimburse approved research and development activities. As of September 30, 2021, the Company recognized $35,000 in grant revenue and receivables in connection with this grand.

Research and Development Expenses

Our research and development expenses consist of expenses incurred in development and preclinical studies relating to our product candidates, including: