UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. For the fiscal year ended April 29, 2016. |

o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from __________ to __________ |

Commission File No. 1-36820

MEDTRONIC PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

Ireland | 98-1183488 | |

(Jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

(Address of principal executive office)

+353 1 438-1700

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Ordinary shares, par value $0.0001 per share | New York Stock Exchange, Inc. |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Aggregate market value of voting and non-voting common equity of Medtronic PLC held by non-affiliates of the registrant as of October 30, 2015, based on the closing price of $73.92, as reported on the New York Stock Exchange: approximately $104.2 billion. Number of Ordinary Shares outstanding on June 20, 2016: 1,394,731,892

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s Proxy Statement for its 2016 Annual General Meeting are incorporated by reference into Part III hereto.

TABLE OF CONTENTS

Item | Description | Page | ||

Investor Information

Annual Meeting and Record Dates

Medtronic Public Limited Company, organized under the laws of Ireland (Medtronic plc, Medtronic, the Company, or we, us, or our) will hold its 2016 Annual General Meeting of Shareholders (2016 Annual Meeting) on Friday, December 9, 2016 at 8:00 a.m., local Dublin time at the Conrad Dublin Hotel Earlsfort Terrace Dublin 2, Ireland. The record date for the 2016 Annual Meeting is October 11, 2016 and all shareholders of record at the close of business on that day will be entitled to vote at the 2016 Annual Meeting.

Medtronic Website

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act) are available through our website (www.medtronic.com under the "About Medtronic - Investors" caption and “Financial Information - SEC Filings” subcaption) free of charge as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC).

Information relating to corporate governance at Medtronic, including our Principles of Corporate Governance, Code of Conduct (including our Code of Ethics for Senior Financial Officers), Code of Business Conduct and Ethics for Members of the Board of Directors, and information concerning our executive officers, directors and Board committees (including committee charters) is available through our website at www.medtronic.com under the "About Medtronic - Corporate Governance” caption. Information relating to transactions in Medtronic securities by directors and officers is available through our website at www.medtronic.com under the "About Medtronic - Investors" caption and the "Financial Information - SEC Filings" subcaption.

The information listed above may also be obtained upon request from the Medtronic Investor Relations Department, 710 Medtronic Parkway, Minneapolis (Fridley), MN 55432 USA.

We are not including the information on our website as a part of, or incorporating it by reference into, our Form 10-K.

Available Information

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The public can obtain any documents that the Company files with the SEC at http://www.sec.gov. The Company files annual reports, quarterly reports, proxy statements, and other documents with the SEC under the Exchange Act. The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 800-SEC-0330.

Stock Transfer Agent and Registrar

Wells Fargo Shareowner ServicesSM acts as transfer agent and registrar, dividend paying agent, and direct stock purchase plan agent for Medtronic and maintains all shareholder records for the Company. If you are a registered shareholder, you may access your account information online at www.shareowneronline.com. If you have questions regarding the Medtronic stock you own, stock transfers, address or name changes, direct deposit of dividends, lost dividend checks, lost stock certificates, or duplicate mailings, please contact Wells Fargo Shareowner ServicesSM by writing or calling: Wells Fargo Shareowner ServicesSM, 1110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120 USA, Telephone: 888-648-8154 or 651-450-4064, Fax: 651-450-4033, www.wellsfargo.com/shareownerservices.

Direct Stock Purchase Plan

Medtronic’s transfer agent, Wells Fargo Bank N.A, administers the direct stock purchase plan, which is called the Shareowner Service Plus PlanSM. Features of this plan include direct stock purchase and reinvestment of dividends to purchase whole or fractional shares of Medtronic stock. All registered shareholders and potential investors may participate.

To request information on the Shareowner Service Plus PlanSM, or to enroll in the plan, contact Wells Fargo Shareowner ServicesSM at 888-648-8154 or 651-450-4064. You may also enroll via the Internet by visiting www.shareowneronline.com and selecting “Direct Purchase Plan.”

PART I

Item 1. Business

OVERVIEW

Medtronic plc, headquartered in Dublin, Ireland, is among the world's largest medical technology, services and solutions companies - alleviating pain, restoring health, and extending life for millions of people around the world. Medtronic was founded in 1949 and today serves hospitals, physicians, clinicians, and patients in approximately 160 countries worldwide. We remain committed to a mission written by our founder 56 years ago that directs us “to contribute to human welfare by the application of biomedical engineering in the research, design, manufacture, and sale of products to alleviate pain, restore health, and extend life.”

With innovation and market leadership, we have pioneered advances in medical technology in all of our businesses. Our commitment to enhance our offerings by developing and acquiring new products, wrap-around programs, and solutions to meet the needs of a broader set of stakeholders is driven by the following primary strategies:

• | Therapy Innovation: Delivering a strong launch cadence of meaningful therapies and procedures. |

• | Globalization: Addressing the inequity in health care access globally, primarily in emerging markets. |

• | Economic Value: Becoming a leader in value-based health care by offering new services and solutions to improve outcomes and efficiencies, lower costs by reducing hospitalizations, improve remote clinical management, and increase patient engagement. |

Our primary customers include hospitals, clinics, third-party health care providers, distributors, and other institutions, including governmental health care programs and group purchasing organizations (GPOs).

On January 26, 2015 (Acquisition Date), Medtronic completed the acquisition of Covidien plc, a public limited company organized under the laws of Ireland (Covidien) in a cash and stock transaction valued at $50.0 billion. In connection with the transaction, Medtronic, Inc., a Minnesota corporation (Medtronic, Inc.), and Covidien were combined under and became subsidiaries of Medtronic plc. Covidien was a global leader in the development, manufacture and sale of healthcare products for use in clinical and home settings and had net sales for its fiscal year ended September 26, 2014 of $10.7 billion. On a pro forma basis, as if the Covidien merger had occurred at the beginning of fiscal year 2014, our combined net sales would have been $28.4 billion for fiscal year 2015 and $27.4 billion for fiscal year 2014; see Note 2 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K. The merger with Covidien provides the combined company with increased financial strength and flexibility and is expected to meaningfully accelerate all three strategies discussed above.

We reorganized our reporting structure and aligned our segments and the underlying divisions and businesses in fiscal year 2015 due to the acquisition of Covidien. The majority of Covidien’s operations are included in our new Minimally Invasive Therapies Group. For more information on our segments, please see Note 17 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

We currently function in four operating segments that primarily manufacture and sell device-based medical therapies. Our operating segments with each of their reported net sales for fiscal year 2016, along with their related divisions, are as follows:

Cardiac and Vascular Group (Fiscal year 2016 net sales of $10.2 billion)

• | Cardiac Rhythm & Heart Failure |

• | Coronary & Structural Heart |

• | Aortic & Peripheral Vascular |

Minimally Invasive Therapies Group (Fiscal year 2016 net sales of $9.6 billion)

• | Surgical Solutions |

• | Patient Monitoring & Recovery |

Restorative Therapies Group (Fiscal year 2016 net sales of $7.2 billion)

• | Spine |

• | Neuromodulation |

• | Surgical Technologies |

• | Neurovascular |

1

Diabetes Group (Fiscal year 2016 net sales of $1.9 billion)

• | Intensive Insulin Management |

• | Non-Intensive Diabetes Therapies |

• | Diabetes Service & Solutions |

CARDIAC AND VASCULAR GROUP

Cardiac Rhythm & Heart Failure Disease Management (CRHF)

Our CRHF division develops, manufactures, and markets products for the diagnosis, treatment, and management of heart rhythm disorders and heart failure. Our products include implantable devices, leads and delivery systems, products for the treatment of atrial fibrillation (AF), products designed to reduce surgical site infections, information systems for the management of patients with CRHF devices, and an integrated health solutions business.

The following are the principal products and services offered by our CRHF division:

Implantable Cardiac Pacemakers (Pacemakers) Our latest generations of pacemaker systems are the Advisa MRI SureScan models, the Micra Transcatheter Pacing System, and the Ensura MRI SureScan model. The Micra Transcatheter Pacing System, which is leadless and does not have a subcutaneous device pocket like conventional pacemaker, and the Advisa MRI SureScan models have received United States (U.S.) Food and Drug Administration (U.S. FDA) approval and Conformité Européene (CE) Mark approval, while the Ensura MRI SureScan models have received CE Mark approval.

Implantable Cardioverter Defibrillators (ICDs) Our latest generation ICD is the Evera MRI SureScan, the first ICD system with CE Mark, PMDA (Japan), and U.S. FDA, approval for full-body MRI scans for both 1.5T and 3T scanners. The Evera system is paired with the reliable Sprint Quattro Secure lead, the only defibrillator lead with more than 11 years of proven performance with active monitoring.

Implantable Cardiac Resynchronization Therapy Devices (CRT-Ds and CRT-Ps) Our latest generation of CRT-Ds is the Amplia/Compia/Claria family of MRI Quad CRT-D SureScan systems. The U.S. FDA and CE Mark approved Amplia and Compia MRI Quad CRT-D SureScan systems are approved for MRI scans on any part of the body. In addition, the Viva/Brava family with Attain Performa quadripolar features a new algorithm, called AdaptivCRT, which improves heart failure patients' response rate to CRT-D therapy. Viva CRT-P is our latest generation device, with respect to CRT-P.

AF Products Our portfolio of AF products includes the Arctic Front Advance Cardiac Cryoballoon System, which includes the U.S. FDA approved Aortic Front Advance ST Cryoablation Catheter, designed for pulmonary vein isolation in the treatment of patients with drug refractory paroxysmal AF. Additionally, we have a second-generation CE Mark approved Phased RF System, PVAC Gold, which uses duty cycled, phased radio frequency energy for the treatment of symptomatic paroxysmal persistent and long-standing persistent AF.

Diagnostics and Monitoring Devices Our Reveal LINQ is our newest Insertable Cardiac Monitor (ICM) System. The system is used to record the heart’s electrical activity before, during, and after transient symptoms such as syncope (i.e., fainting) and palpitations to assist in diagnosis.

TYRX Products Our TYRX products include the Absorbable Antibacterial Envelope and the TYRX Neuro Absorbable Antibacterial Envelope, which are designed to stabilize electronic implantable devices and help prevent infection associated with implantable pacemakers, defibrillators, and spinal cord neurostimulators.

Services and Solutions Our Care Management Services products and services include remote monitoring and patient-centered software to enable efficient care coordination and specialized telehealth nurse support. Our Cath Lab Managed Services business is focused on developing novel partnerships with hospitals to provide services directly related to hospital operational efficiency.

Coronary & Structural Heart Disease Management (CSH)

Our CSH division includes therapies to treat coronary artery disease (CAD), and heart valve disorders. Our products include coronary stents and related delivery systems, including a broad line of balloon angioplasty catheters, guide catheters, guide wires, diagnostic catheters, and accessories as well as products for the repair and replacement of heart valves, perfusion systems, positioning and stabilization systems for beating heart revascularization surgery, and surgical ablation products.

The following are the principal products offered by our CSH division:

Transcatheter Heart Valves (TCVs) Our latest generation TCVs include the CoreValve family of aortic valves. CoreValve, which is the only TCV system shown to be superior to open-heart surgery, has received U.S. FDA approval for extreme and high risk

2

patients. Our next-generation recapturable TCV system, CoreValve Evolut R, has received U.S. FDA approval and CE Mark approval for the 23, 26, and 29 millimeter sizes of the valve.

Percutaneous Coronary Intervention (PCI) Our latest generation PCI stent products include our Resolute Integrity drug-eluting stent systems, which have received U.S. FDA approval, as well as Resolute Onyx drug-eluting stent systems, which have received CE Mark approval.

Heart Surgery We offer a complete line of surgical valve replacement and repair products for damaged or diseased heart valves. Our replacement products include both tissue and mechanical valves. We also offer a complete line of blood-handling products that form a circulatory support system to maintain and monitor blood circulation and coagulation status, oxygen supply, and body temperature during arrested heart surgery. Additionally, we offer surgical ablation systems and positioning and stabilization technologies.

Aortic & Peripheral Vascular Disease Management (APV)

Our APV division is comprised of a comprehensive line of products and therapies to treat aortic disease (such as aneurysms, dissections, and transections) as well as peripheral vascular disease (PVD), and critical limb ischemia (CLI). Our products include endovascular stent graft systems, peripheral drug coated balloon, stent and angioplasty systems, and carotid embolic protection systems for the treatment of vascular disease outside the heart, as well as products for superficial and deep venous disease.

The following are the principal products offered by our APV division:

Endovascular Stent Grafts (Aortic) Our products are designed to treat aortic aneurysms in either the abdomen or thoracic regions of the aorta. Our product line includes a range of endovascular stent grafts and accessories including the market-leading Endurant 2S Abdominal Aortic Aneurysm (AAA) Stent Graft System and the Valiant Captivia Thoracic Aortic Aneurysm (TAA) stent graft system and the Aptus endo anchors.

Peripheral Vascular Intervention (PVI) Our primary PVI products include percutaneous angioplasty balloons including the IN.PACT family of drug-coated balloons, which have U.S. FDA and CE Mark approval, as well as peripheral stents such as the Protégé & Complete Self Expanding Vascular Stents, the Visi-Pro & Assurant Cobalt Balloon Expandable stents and directional atherectomy products such as the TurboHawk plaque excision system, and other procedure support products.

EndoVenous (EV) Our EndoVenous product lines are used to treat superficial and deep venous diseases in the lower extremities and include the Closure Fast RF ablation system, the VenaSeal medical adhesive system while also now focusing on embolisms with the Concerto detachable coil system, Micro Vascular Plug (MVP), the PV ONYX liquid embolic system and other procedure support products.

MINIMALLY INVASIVE THERAPIES GROUP

Surgical Solutions

Surgical Solutions develops, manufactures, and markets advanced surgical, general surgical, and hernia products and therapies to treat diseases and conditions that are typically, but not exclusively, addressed by surgeons. In addition, we develop, manufacture, and market several unique products in the emerging fields of minimally invasive gastrointestinal diagnostics, ablation, and interventional lung.

The following are the principal products offered by our Surgical Solutions division:

Surgical Innovations This business includes sales of stapling, vessel sealing, fixation (hernia mechanical devices), mesh, hardware and surgical instruments, as well as wound closure, and electrosurgical products. Key advanced surgical products include: the Tri-Staple technology platform for endoscopic stapling, including the Endo GIA reloads and reinforced reloads with Tri-Staple Technology and the Endo GIA ultra universal stapler; the iDrive and Signia powered stapling systems; the LigaSure vessel sealing system, which features specialty/application specific handpieces powered by proprietary hardware platforms; the Sonicision cordless ultrasonic dissection system; AbsorbaTack absorbable mesh fixation device for hernia repair; Symbotex composite mesh for surgical laparoscopic and open ventral hernia repair; and Parietex ProGrip, a selfgripping, biocompatible solution for inguinal hernias.

Early Technologies Our products include ablation products, and interventional lung and gastrointestinal solutions. This includes the PillCam SB and PillCam COLON, a minimally-invasive, swallowed optical endoscopy technology; superDimesion to evaluate lung lesions; the Cool-tip radiofrequency ablation system; the Evident microwave ablation system; and the HALO ablation catheters for treatment of Barrett’s esophagus.

3

Patient Monitoring & Recovery (PMR)

Our PMR division develops, manufactures, and markets products and therapies to enable complication-free recovery to enhance patient outcomes.

The following are the principal products offered by our PMR division:

Patient Monitoring Our products include sensors, monitors, and temperature management products. Key patient monitoring products include: Capnostream with Microstream technology capnography monitors, the Nellcor Bedside SpO2 patient monitoring system, the Bispectral Index (BIS) brain monitoring technology, the INVOS Cerebral/Somatic Oximeter, and related modules and sensors.

Airway & Ventilation This business primarily includes sales of airway, ventilator and inhalation therapy products. Key airway & ventilation products include: the Puritan Bennett 840 and 980 ventilators, the Newport e360 and HT70 ventilators, the TaperGuard Evac tube, Mallinckrodt Endotracheal Tubes, Shiley Tracheostomy Tubes, DAR Filters, and resuscitation bags.

Nursing Care This business primarily includes sales of incontinence, wound care, enteral feeding, urology, and suction products. Key nursing care products include Curity and Kerlix gauze and bandages and Kangaroo enteral feeding systems.

Patient Care & Safety (PCS) Our products include medical surgical products, such as operating room supply products, electrodes, and SharpSafety products, which includes needles, syringes, and sharps disposal products. In addition, we manufacture Original Equipment Manufacturer (OEM) products, which are various medical supplies manufactured for other medical products companies. Under our Medi-Trace brand, we offer a comprehensive line of monitoring, diagnostic, and defibrillation electrodes.

RESTORATIVE THERAPIES GROUP

Spine

Our Spine division develops, manufactures, and markets a comprehensive line of medical devices and implants used in the treatment of the spine and musculoskeletal system. Our products and therapies treat a variety of conditions affecting the spine, including degenerative disc disease, spinal deformity, spinal tumors, fractures of the spine, and stenosis. Our Spine division also provides biologic solutions for the orthopedic and dental markets and, in concert with our Surgical Technologies business, we offer unique and highly differentiated navigation, neuromonitoring, and power technologies designed for spine procedures.

The following are the principal products offered by our Spine division:

Thoracolumbar Products Our products used to treat conditions in this region of the spine include the CD HORIZON SOLERA and LEGACY Systems, and the CAPSTONE and CLYDESDALE interbody spacers. In addition, Medtronic offers a number of products that facilitate less invasive thoracolumbar surgeries, including the CD HORIZON VOYAGER, SOLERA SEXTANT and LONGITUDE Percutaneous Fixation Systems.

Cervical Products Products used to treat conditions in this region of the spine include the ZEVO and ATLANTIS VISION ELITE Anterior Cervical Plate Systems, the VERTEX SELECT Reconstruction System, and the PRESTIGE and BRYAN Cervical Artificial Discs.

Biologics Products Our Biologics platform products include INFUSE Bone Graft (InductOs in the European Union (E.U.)), which contains a recombinant human bone morphogenetic protein, rhBMP-2, for certain spinal, trauma, and oral maxillofacial applications, Demineralized Bone Matrix (DBM) products, including MagniFuse, Grafton/Grafton Plus, and PROGENIX, and the MASTERGRAFT family of synthetic bone graft products - Matrix, Putty, and Granules.

Interventional Products Our interventional products include the Xpander II Balloon Kyphoplasty system, the Kyphon-V vertebroplastly system and the Osteocool tumor ablation system.

Neuromodulation

Our Neuromodulation division includes implantable neurostimulation and targeted drug delivery systems for the management of chronic pain, common movement disorders, spasticity, and urologic and gastrointestinal disorders. Neurostimulation uses an implantable medical device, similar to a pacemaker, called a neurostimulator.

The following are the principal products offered by our Neuromodulation division:

Neurostimulation Systems for Chronic Pain We have a large portfolio of neurostimulation systems, including rechargeable and non-rechargeable devices and a large selection of leads used to treat chronic back and/or limb pain. Our portfolio of products

4

includes pain neurostimulation systems with SureScan MRI Technology, including the RestoreSensor (rechargeable) SureScan MRI, with its proprietary AdaptiveStim technology.

Implantable Drug Infusion Systems Our SynchroMed II Implantable Infusion System delivers small quantities of drug directly into the intrathecal space surrounding the spinal cord. These devices are used to treat chronic, intractable pain and severe spasticity associated with cerebral palsy, multiple sclerosis, spinal cord and traumatic brain injuries, and stroke.

Deep Brain Stimulation (DBS) Systems DBS is currently approved in many countries around the world for the treatment of the disabling symptoms of essential tremor, Parkinson's disease, refractory epilepsy (outside the U.S.), severe, treatment-resistant obsessive-compulsive disorder (approved under a Humanitarian Device Exemption (HDE) in the U.S.), and chronic, intractable primary dystonia (approved under a HDE in the U.S.). Our family of Activa Neurostimulators for DBS includes Activa SC (single-channel primary cell battery), Activa PC (dual channel primary cell battery), and Activa RC (dual channel rechargeable battery).

Gastroenterology & Urology (Gastro/Uro) Systems Our Sacral neuromodulation uses InterStim, a neurostimulator, to help control the symptoms of overactive bladder, (non-obstructive) urinary retention, and chronic fecal incontinence. Currently, Enterra Therapy is the only gastric electrical stimulation therapy approved in the U.S. (under a HDE), Europe, and Canada for use in the treatment of intractable nausea and vomiting associated with gastroparesis. The system, which contains a small neurostimulator and two leads, stimulates the smooth muscles of the lower stomach.

Surgical Technologies

Our Surgical Technologies division develops, manufactures, and markets products and therapies to treat diseases and conditions of the ear, nose, and throat (ENT) and certain neurological disorders. In addition, the division develops, manufactures, and markets image-guided surgery and intra-operative imaging systems that facilitate surgical planning during precision cranial, spinal, sinus, and orthopedic surgeries. Our Advanced Energy business includes products in the emerging field of advanced energy surgical incision technology, as well as the haemostatic sealing of soft tissue and bone.

The following are the principal products offered by our Surgical Technologies division:

Neurosurgery Our portfolio of products include both platform technologies and implant therapies. The StealthStation Navigation System and O-arm Imaging System are both platforms used in cranial, spinal, sinus, and orthopedic procedures. The Midas Rex Surgical Drills are used in cranial, spinal, and orthopedic procedures. Visualase MRI-Guided Laser Ablation is used in neurosurgery procedures, and our CSF Management Portfolio is used in treating hydrocephalus and other conditions impacting the intracranial pressure.

ENT The following products treat ENT diseases and conditions: Straightshot M5 Microdebrider Handpiece, the IPC system, NIM Nerve Monitoring Systems, Fusion ENT Navigation System, as well as products for hearing restoration and Snoring and Obstructive Sleep Apnea.

Advanced Energy Our PEAK Surgery System is a tissue dissection system that consists of the PEAK PlasmaBlade and PULSAR Generator and is cleared for use in a variety of settings, including plastic reconstructive surgery, general surgery, and certain conditions of ENT. Our Aquamantys System uses patented transcollation technology to provide haemostatic sealing of soft tissue and bone and is cleared for use in a variety of surgical procedures, including orthopedic surgery, spine, solid organ resection and thoracic procedures.

Neurovascular

Our Neurovascular division, develops, manufactures, and markets products and therapies to treat diseases of the vasculature in and around the brain. Our products include coils, neurovascular stents, and flow diversion products, as well as access and delivery products to support procedures.

The following are the principal products offered by our Neurovascular division:

The Pipeline and Pipeline Flex Embolization Devices, endovascular treatments for large or giant wide-necked brain aneurysms; the Solitaire FR revascularization device for treatment of acute ischemic stroke; and the Apollo Onyx delivery micro catheter, the first detachable tip micro-catheter available in the U.S.

DIABETES GROUP

Our Diabetes group consists of three divisions (Intensive Insulin Management, Non-Intensive Diabetes Therapies, and Diabetes Service & Solutions) that develop, manufacture, and market advanced, integrated diabetes management solutions that include insulin pump therapy, continuous glucose monitoring (CGM) systems, and therapy management software.

5

The following are the principal products offered by our Diabetes divisions:

Integrated Diabetes Management Solutions We have an integrated insulin pump and CGM system currently available on the market. In the U.S., we offer the MiniMed 530G System featuring SmartGuard technology, which automatically suspends insulin delivery when glucose levels reach a pre-determined threshold, and newest CGM sensor, Enlite, a sensor that can be worn for 6-days and is more comfortable, more accurate, and smaller than our previous generation sensor. Outside the U.S., we offer our MiniMed 640G System, an integrated system with the Enhanced Enlite CGM sensor that features SmartGuard technology, which automatically suspends insulin delivery when sensor glucose levels are predicted to approach a low limit and then resumes insulin delivery once levels recover.

Professional CGM In addition to our Personal CGM (Enlite), we offer physicians a Professional CGM product called the iPro2/iPro Professional CGM System. Patients wear the iPro2/iPro recorder to capture glucose data that is later uploaded in a physician’s office to reveal glucose patterns and potential problems, including hyperglycemic and hypoglycemic episodes. The data leads to more informed treatment decisions.

Connected Care We continue to innovate and offer new connected care solutions, including the MiniMed Connect, which is the only system providing remote access to pump and sensor data on the user's smartphone.

CareLink Therapy Management Software Our web-based therapy management software solutions, including CareLink Personal software for patients and CareLink Pro software for healthcare professionals, to help patients and their health care providers control their diabetes.

CUSTOMERS AND COMPETITORS

Cardiac and Vascular Group The primary medical specialists who use our Cardiac and Vascular products include electrophysiologists, implanting cardiologists, heart failure specialists, cardiovascular, cardiothorasic, and vascular surgeons and interventional cardiologists and radiologists. Our primary competitors are St. Jude Medical, Inc. (St. Jude), Boston Scientific Corporation (Boston Scientific), Sorin Group (Sorin), Edwards Lifesciences Corporation (Edwards), C.R. Bard Inc. (Bard), and Abbott Laboratories (Abbott).

Minimally Invasive Therapies Group The products and therapies of this group are used primarily by hospitals, physicians' offices, and ambulatory care centers, other alternate site healthcare providers and less frequently in home settings. Our primary competitors are Johnson & Johnson, Boston Scientific, Baxter International Inc., and Bard.

Restorative Therapies Group The primary medical specialists who use the products of this group include spinal surgeons, neurosurgeons, neurologists, pain management specialists, anesthesiologists, orthopedic surgeons, urologists, interventional radiologists, and ear, nose, and throat specialists. Our primary competitors include Johnson & Johnson, Boston Scientific, St. Jude, Stryker Corporation (Stryker), NuVasive, Inc., and Zimmer Holdings, Inc. (Zimmer).

Diabetes Group The primary medical specialists who use and/or prescribe our Diabetes products are endocrinologists, diabetologists, and internists. Our primary competitors are Johnson & Johnson, DexCom, Inc., Tandem Diabetes Care Inc., Insulet Corporation, and F. Hoffmann-La Roche Ltd.

OTHER FACTORS IMPACTING OUR OPERATIONS

Research and Development

The markets in which we participate can be subject to rapid technological advances. Constant improvement of products and introduction of new products is necessary to maintain market leadership. Our research and development (R&D) efforts are directed toward maintaining or achieving technological leadership in each of the markets we serve in order to help ensure that patients using our devices and therapies receive the most advanced and effective treatment possible. We remain committed to developing technological enhancements and new indications for existing products, and less invasive and new technologies for new and emerging markets to address unmet patient needs. That commitment leads to our initiation and participation in many clinical trials each fiscal year as the demand for clinical and economic evidence remains high. Furthermore, our development activities are intended to help reduce patient care costs and the length of hospital stays in the future. We have not engaged in significant customer or government-sponsored research.

During fiscal years 2016, 2015, and 2014, we spent $2.2 billion (7.7 percent of net sales), $1.6 billion (8.1 percent of net sales), and $1.5 billion (8.7 percent of net sales) on R&D, respectively. Our R&D activities include improving existing products and

6

therapies, expanding their indications and applications for use, and developing new therapies and procedures. We continue to focus on optimizing innovation, improving our R&D productivity, driving growth in emerging markets, clinical evidence generation, and assessing our R&D programs based on their ability to deliver economic value to our customers.

Acquisitions and Investments

Our strategy to provide a broad range of therapies to restore patients' health and extend lives requires a wide variety of technologies, products, and capabilities. The rapid pace of technological development in the medical industry and the specialized expertise required in different areas of medicine make it difficult for one company alone to develop an all-encompassing portfolio of technological solutions. In addition to internally generated growth through our R&D efforts, historically we have relied, and expect to continue to rely, upon acquisitions, investments, and alliances to provide access to new technologies both in areas served by our existing businesses as well as in new areas and markets.

We expect to make future investments or acquisitions where we believe that we can stimulate the development of, or acquire new technologies and products to further our strategic objectives, and strengthen our existing businesses. Mergers and acquisitions of medical technology companies are inherently risky and no assurance can be given that any of our previous or future acquisitions will be successful or will not materially adversely affect our consolidated results of operations, financial condition, and/or cash flows.

For additional information, see Note 2 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K and "Item 1A. Risk Factors - Failure to integrate acquired businesses into our operations successfully could adversely affect our business."

Acquisition of Covidien plc in Fiscal Year 2015

On January 26, 2015, pursuant to a transaction agreement, dated as of June 15, 2014 (the Transaction Agreement), Medtronic, Inc. and Covidien became subsidiaries of the Company. The total cash and stock value of the Covidien acquisition was $50.0 billion. The operating results for Covidien are included in the Minimally Invasive Therapies Group, Cardiac and Vascular Group and Restorative Therapies Group segments.

Based upon the acquisition valuation, the Company acquired $18.3 billion of customer-related intangible assets, $7.1 billion of technology-based intangible assets, $430 million of tradenames, with weighted average estimated useful lives of 18, 16, and 6 years, respectively, $420 million of in-process research and development (IPR&D), and $30.0 billion of goodwill.

Fiscal Year 2016 Acquisitions

Twelve, Inc.

On October 2, 2015, the Company's Coronary & Structural Heart division acquired Twelve, Inc. (Twelve), a privately-held medical device company focused on the development of a transcatheter mitral valve replacement device. Total consideration for the transaction was approximately $472 million, which included an upfront payment of $428 million and the estimated fair value of product development-based contingent consideration of $44 million. Based upon the acquisition valuation, the Company acquired $192 million of IPR&D and $291 million of goodwill.

RF Surgical Systems, Inc.

On August 11, 2015, the Company's Surgical Solutions division acquired RF Surgical Systems, Inc. (RF Surgical), a medical device company focused on the detection and prevention of retained surgical sponges. Total consideration for the transaction was approximately $240 million. Based upon the acquisition valuation, the Company acquired $68 million of technology-based intangible assets, $47 million of customer-related intangible assets, with estimated useful lives of 18 and 16 years, respectively, and $135 million of goodwill.

Medina Medical

On August 31, 2015, the Company's Neurovascular division acquired Medina Medical (Medina), a privately-held medical device company focused on commercializing treatments for vascular abnormalities of the brain, including cerebral aneurysms. Total consideration for the transaction was approximately $219 million, which includes an upfront payment of $155 million and the estimated fair value of revenue-based and product development-based contingent consideration of $64 million. Medtronic had previously invested in Medina and held an 11 percent ownership position. Net of this ownership position, the transaction value was approximately $195 million. Based upon the acquisition valuation, the Company acquired $122 million of IPR&D and $126 million of goodwill.

7

Patents and Licenses

We rely on a combination of patents, trademarks, tradenames, copyrights, trade secrets, and non-disclosure and non-competition agreements to establish and protect our proprietary technology. We have filed and obtained numerous patents in the U.S. and abroad, and regularly file patent applications worldwide in our continuing effort to establish and protect our proprietary technology. U.S. patents typically have a 20-year term from the application date while patent protection outside the U.S. varies from country to country. In addition, we have entered into exclusive and non-exclusive licenses relating to a wide array of third-party technologies. We have also obtained certain trademarks and tradenames for our products to distinguish our genuine products from our competitors’ products, and we maintain certain details about our processes, products, and strategies as trade secrets. In the aggregate, these intellectual property assets and licenses are of material importance to our business; however, we believe that no single patent, technology, trademark, intellectual property asset or license is material in relation to any segment of our business as a whole. Our efforts to protect our intellectual property and avoid disputes over proprietary rights have included ongoing review of third-party patents and patent applications. For additional information see “Item 1A. Risk Factors - We are substantially dependent on patent and other proprietary rights and failing to protect such rights or to be successful in litigation related to our rights or the rights of others may result in our payment of significant monetary damages and/or royalty payments, negatively impact our ability to sell current or future products, or prohibit us from enforcing our patent and other proprietary rights against others.” and Note 15 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

Markets and Distribution Methods

We sell most of our medical devices and therapies through direct sales representatives in the U.S. and a combination of direct sales representatives and independent distributors in markets outside the U.S. For certain portions of our business acquired through the Covidien acquisition, we also sell through distributors in the U.S. Our medical supplies products are used primarily in hospitals, surgi-centers and alternate care facilities, such as home care and long-term care facilities, and are marketed to materials managers, GPOs and integrated delivery networks (IDNs) primarily through third-party distributors, although we also have direct sales representatives. We often negotiate with GPOs and IDNs, which enter into supply contracts for the benefit of their member facilities. Our three largest markets are the U.S., Western Europe, and Japan. Emerging markets are an area of increasing focus and opportunity as we believe they remain under-penetrated.

Our marketing and sales strategy is focused on rapid, cost-effective delivery of high-quality products to a diverse group of customers worldwide - including physicians, hospitals, other medical institutions, and GPOs. To achieve this objective, we organize our marketing and sales teams around physician specialties. This focus enables us to develop highly knowledgeable and dedicated sales representatives who are able to foster strong relationships with physicians and other customers and enhance our ability to cross-sell complementary products. We believe that we maintain excellent working relationships with physicians and others in the medical industry that enable us to gain a detailed understanding of therapeutic and diagnostic developments, trends, and emerging opportunities and respond quickly to the changing needs of physicians and patients. We attempt to enhance our presence in the medical community through active participation in medical meetings and by conducting comprehensive training and educational activities. We believe that these activities contribute to physician expertise.

In keeping with the increased emphasis on cost-effectiveness in health care delivery, the current trend among hospitals and other customers is to consolidate into larger purchasing groups to enhance purchasing power. This enhanced purchasing power may lead to pressure on pricing and increased use of preferred vendors. Our customer base continues to evolve to reflect such economic changes across the geographic markets we serve. We are not dependent on any single customer for more than 10 percent of our total net sales.

Competition and Industry

We compete in both the therapeutic and diagnostic medical markets in approximately 160 countries throughout the world. These markets are characterized by rapid change resulting from technological advances and scientific discoveries. Our product lines face a mixture of competitors ranging from large manufacturers with multiple business lines to small manufacturers offering a limited selection of products. In addition, we face competition from providers of other medical therapies such as pharmaceutical companies.

Major shifts in industry market share have occurred in connection with product problems, physician advisories, safety alerts, and publications about our products, reflecting the importance of product quality, product efficacy, and quality systems in the medical device industry. In addition, in the current environment of managed care, economically motivated customers, consolidation among health care providers, increased competition, and declining reimbursement rates, we have been increasingly required to compete on the basis of price. In order to continue to compete effectively, we must continue to create or acquire advanced technology, incorporate this technology into proprietary products, obtain regulatory approvals in a timely manner, maintain high-quality manufacturing processes, and successfully market these products.

8

Worldwide Operations

Our global operations are accompanied by certain financial and other risks. Relationships with customers and effective terms of sale vary by country; often with longer-term receivables than are typical in the U.S. Currency exchange rate fluctuations can affect revenues, net of expenses, and cash flows from operations outside the U.S. We use operational and economic hedges, as well as currency exchange rate derivative contracts, to manage the impact of currency exchange rate changes on earnings and cash flow. See “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” and Note 8 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K. In addition, the repatriation of earnings of certain subsidiaries outside the U.S. may result in substantial U.S. tax cost.

For financial reporting purposes, net sales and property, plant, and equipment attributable to significant geographic areas are presented in Note 17 to the consolidated financial statements in “Item 8. Financial Statements and Supplementary Data” in this Annual Report on Form 10-K.

Production and Availability of Raw Materials

We manufacture most of our products at 89 manufacturing facilities located in various countries throughout the world. For additional information related to our manufacturing facilities refer to Item 2. in this Annual Report on Form 10-K. We purchase many of the components and raw materials used in manufacturing these products from numerous suppliers in various countries. For reasons of quality assurance, sole source availability, or cost effectiveness, certain components and raw materials are available only from a sole supplier. We work closely with our suppliers to help ensure continuity of supply while maintaining high quality and reliability. Due to the U.S. FDA’s requirements regarding manufacturing of our products, we may not be able to quickly establish additional or replacement sources for certain components or materials. Generally, we have been able to obtain adequate supplies of such raw materials and components. However, a sudden or unexpected reduction or interruption in supply, and an inability to develop alternative sources for such supply, could adversely affect our operations. We have reporting and disclosure requirements related to the use of certain minerals, known as "conflict minerals" (tantalum, tin, tungsten (or their ores), and gold) which are mined from the Democratic Republic of the Congo and adjoining countries. Pursuant to these requirements, we are required to report on Form SD the procedures we employ to determine the sourcing of such minerals and metals produced from those minerals. There are costs associated with complying with these disclosure requirements, including for diligence in regards to the sources of any conflict minerals used in our products, in addition to the cost of remediation and other changes to products, processes, or sources of supply as a consequence of such verification activities. In addition, the implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products. As of the date of our conflict minerals report for the 2015 calendar year, we were unable to obtain the necessary information on conflict minerals from all of our suppliers and were unable to determine that all of our products are conflict free. We may continue to face difficulties in gathering this information in the future. We may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins for all conflict minerals used in our products through the procedures we implement.

Working Capital Practices

Our goal is to carry sufficient levels of inventory to ensure adequate supply of raw materials from suppliers and meet the product delivery needs of our customers. We also provide payment terms to customers in the normal course of business and rights to return product under warranty to meet the operational demands of our customers.

Employees

On April 29, 2016, we employed more than 88,000 full-time employees. Our employees are vital to our success. We believe we have been successful in attracting and retaining qualified personnel in a highly competitive labor market due to our competitive compensation and benefits, and our rewarding work environment.

Seasonality

Worldwide sales, including U.S. sales, do not reflect a significant degree of seasonality; however, the number of medical procedures incorporating Medtronic products is generally lower during summer months, due to summer vacation schedules in the northern hemisphere, particularly in European countries. In addition, pulse oximetry sales can be impacted by flu season.

Government Regulation and Other Considerations

Our products are subject to regulation by numerous government agencies, including the U.S. FDA and similar agencies outside the U.S. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development, testing, manufacturing, labeling, marketing, and distribution of our products. Our business is also affected by patient privacy laws, cost containment initiatives and environmental health and safety laws and regulations. The primary laws and regulations that affect our business are described below.

9

The laws applicable to us are subject to change and are subject to evolving interpretations. If a governmental authority were to conclude that we are not in compliance with applicable laws and regulations, Medtronic and its officers and employees could be subject to severe criminal and civil penalties including substantial fines and damages, and exclusion from participation as a supplier of product to beneficiaries covered by Medicare or Medicaid.

Product Approval Processes

Authorization to commercially distribute a new medical device or technology in the U.S. is generally received in one of two ways. The first, known as pre-market notification or the 510(k) process, requires us to demonstrate that our new medical device or technology is substantially equivalent to a legally marketed medical device or technology. In this process, we must submit data that supports our equivalence claim. If human clinical data is required, it must be gathered in compliance with U.S. FDA investigational device exemption regulations. We must receive an order from the U.S. FDA finding substantial equivalence to another legally marketed medical device or technology before we can commercially distribute the new medical device or technology. Modifications to cleared medical devices or technologies can be made without using the 510(k) process if the changes do not significantly affect safety or effectiveness. Minimally Invasive Therapies Group products are generally subject to the pre-market notification process. A very small number of our devices are exempt from pre-market review.

The second, more rigorous process, known as pre-market approval (PMA), requires us to independently demonstrate that the new medical device is safe and effective. We do this by collecting data regarding design, materials, bench and animal testing, and human clinical data for the medical device. The U.S. FDA will authorize commercial distribution if it determines there is reasonable assurance that the medical device is safe and effective. This determination is based on the benefit outweighing the risk for the population intended to be treated with the device. This process is much more detailed, time-consuming, and expensive than the 510(k) process. A third, seldom used, process for approval exists for humanitarian use devices, intended for patient populations of less than 4,000 patients per year in the U.S. This exemption is similar to the PMA process; however, a full showing of product effectiveness from large clinical trials is not required. The threshold for approving these products is probable benefit and safety.

Many countries outside the U.S. to which we export medical devices also subject such medical devices and technologies to their own regulatory requirements. Frequently, regulatory approval may first be obtained in a country outside of the U.S. prior to application in the U.S. due to differing regulatory requirements; however, other countries, such as China for example, require approval in the country of origin first. Most countries outside of the U.S. require that product approvals be recertified on a regular basis, generally every five years. The recertification process requires that we evaluate any device or technology changes and any new regulations or standards relevant to the device or technology and, where needed, conduct appropriate testing to document continued compliance. Where recertification applications are required, they must be approved in order to continue selling our products in those countries. Because export control and economic sanctions laws and regulations are complex and constantly changing, it is possible that laws and regulations may be enacted, amended, enforced or interpreted in a manner materially impacting our ability to sell or distribute products.

In the E.U., a single regulatory approval process exists, and conformity with the legal requirements is represented by the CE Mark. To obtain a CE Mark, defined products must meet minimum standards of performance, safety, and quality (i.e., the essential requirements), and then, according to their classification, comply with one or more of a selection of conformity assessment routes. A notified body assesses the quality management systems of the manufacturer and the product conformity to the essential and other requirements within the medical device directive. Medtronic is subject to inspection by notified bodies for compliance. The competent authorities of the E.U. countries, generally in the form of their ministries or departments of health, oversee the clinical research for medical devices and are responsible for market surveillance of products once they are placed on the market. We are required to report device failures and injuries potentially related to product use to these authorities in a timely manner. Various penalties exist for non-compliance with the laws transcribing the medical device directives. We anticipate a new Medical Device Regulation to be published by the European Union in 2016, and it is likely to impose additional premarket and postmarket requirements.

To be sold in Japan, most medical devices must undergo thorough safety examinations and demonstrate medical efficacy before they are granted approval, or “shonin.” The Japanese government, through the Ministry of Health, Labour, and Welfare (MHLW), regulates medical devices under the Pharmaceutical Affairs Law (PAL). Oversight for medical devices is conducted with participation by the Pharmaceutical and Medical Devices Agency (PMDA), a quasi-government organization performing many of the review functions for MHLW. Penalties for a company’s noncompliance with PAL could be severe, including revocation or suspension of a company’s business license and criminal sanctions. MHLW and PMDA also assess the quality management systems of the manufacturer and the product conformity to the requirements of the PAL. Medtronic is subject to inspection for compliance by these agencies.

Our global regulatory environment is becoming increasingly stringent, and unpredictable, which could increase the time, cost and complexity of obtaining regulatory approvals for our products. Several countries that did not have regulatory requirements for medical devices have established such requirements in recent years and other countries have expanded, or plan to expand, on

10

existing regulations. Certain regulators are requiring local clinical data in addition to global clinical data. While harmonization of global regulations has been pursued, requirements continue to differ significantly among countries. We expect this global regulatory environment will continue to evolve, which could impact our ability to obtain future approvals for our products, or could increase the cost and time to obtain such approvals in the future. There can be no assurance that any new medical devices we develop will be approved in a timely or cost-effective manner or approved at all.

Ongoing U.S. FDA Regulations

Both before and after a product is commercially released, we have ongoing responsibilities under U.S. FDA regulations. The U.S. FDA reviews design and manufacturing practices, labeling and record keeping, and manufacturers’ required reports of adverse experiences and other information to identify potential problems with marketed medical devices. We are also subject to periodic inspection by the U.S. FDA for compliance with the U.S. FDA’s quality system regulations, which govern the methods used in, and the facilities and controls used for, the design, manufacture, packaging, and servicing of all finished medical devices intended for human use. In addition, the U.S. FDA and other U.S. regulatory bodies (including the Federal Trade Commission, the Office of the Inspector General of the Department of Health and Human Services, the U. S. Department of Justice, and various state Attorneys General) monitor the manner in which we promote and advertise our products. Although surgeons are permitted to use their medical judgment to employ medical devices for indications other than those cleared or approved by the U.S. FDA, the U.S. FDA has prohibited manufacturers from promoting products for such “off-label” uses, and has taken the position that manufacturers can only market their products for cleared or approved uses.

If the U.S. FDA were to conclude that we are not in compliance with applicable laws or regulations, or that any of our medical devices are ineffective or pose an unreasonable health risk, the U.S. FDA could require us to notify health professionals and others that the devices present unreasonable risks of substantial harm to the public health, order a recall, repair, replacement, or refund of such devices, detain or seize adulterated or misbranded medical devices, or ban such medical devices. The U.S. FDA may also impose operating restrictions, enjoin and/or restrain certain conduct resulting in violations of applicable law pertaining to medical devices, including a hold on approving new devices until issues are resolved to its satisfaction, and assess civil or criminal penalties against our officers, employees, or us. The U.S. FDA may also recommend prosecution to the U. S. Department of Justice. Conduct giving rise to civil or criminal penalties may also form the basis for private civil litigation by third-party payers or other persons allegedly harmed by our conduct.

In April 2015, we entered into a consent decree with the U.S. FDA relating to our Neuromodulation business’ SynchroMed drug infusion system and the Neuromodulation quality system. The consent decree requires the Company to complete certain corrections and enhancements to the SynchroMed pump and the Neuromodulation quality system. The consent decree limits the Company's ability to manufacture and distribute the SynchroMed drug infusion system, unless specific conditions are met. The agreement does not require the retrieval of any of the Company’s products, but the Company must retain a third-party expert to inspect the Neuromodulation quality system and to provide a certification that the system complies with the requirements of the consent decree. Once this certification is accepted by the U.S. FDA, and a U.S. FDA inspection is successfully completed, the limitations on manufacturer and distribution of SynchroMed pumps will be lifted. Thereafter, the Company must submit periodic audit reports to the U.S. FDA to ensure ongoing compliance with the consent decree.

In June 2016, TYRX, Inc. received a Warning Letter from the U.S. FDA following an inspection at the TYRX facility in Monmouth Junction, New Jersey. The Company is taking action to address the Warning Letter and has submitted a response to the U.S. FDA.

Governmental Trade Regulations

The sale and shipment of our products and services across international borders, as well as the purchase of components and products from international sources, subject us to extensive governmental trade regulations. A variety of laws and regulations, both in the U.S. and in the countries in which we transact business, apply to the sale, shipment and provision of goods, services and technology across international borders. Because we are subject to extensive regulations in the countries in which we operate, we are subject to the risk that laws and regulations could change in a way that would expose us to additional costs, penalties or liabilities. These laws and regulations govern, among other things, our import and export activities.

The U.S. FDA, in cooperation with U.S. Customs and Border Protection (CBP), administers controls over the import of medical devices into the U.S. The CBP imposes its own regulatory requirements on the import of our products, including inspection and possible sanctions for noncompliance. Medtronic is also subject to foreign trade controls administered by several U.S. government agencies, including the Bureau of Industry and Security within the Commerce Department and the Office of Foreign Assets Control within the Treasury Department. We import raw materials, components and finished products into the countries in which we transact business. We act as the importer of record in many instances, but we also sell and ship goods to third parties who are themselves responsible for complying with applicable trade laws and regulations. In our role as importer of record, we are directly responsible for complying with customs laws and regulations concerning the importation of our raw materials, components and

11

finished products. If applicable government agencies were to determine that we or such third parties were not in compliance with applicable U.S. FDA or customs laws and regulations when engaging in cross-border transactions involving our products, we may be subject to civil or criminal enforcement action, and varying degrees of liability, depending on the nature of the violation and the extent of our culpability. In addition, such determinations may cause supply chain disruptions and delays in the distribution of our products that impact our business activities.

Many countries, including the U.S., control the export and re-export of goods, technology and services for reasons including public health, national security, regional stability, antiterrorism policies and other reasons. In certain circumstances, approval from governmental authorities may be required before goods, technology or services are exported or re-exported to certain destinations, to certain end-users and for certain end-uses. In addition, international sales of our medical devices that have not received U.S. FDA approval are subject to U.S. FDA export requirements. Some governments may also impose economic sanctions against certain countries, persons or entities. In addition to our need to comply with such regulations in connection with our direct export activities, we also sell and provide goods, technology and services to agents, representatives and distributors who may export such items to customers and end-users. If applicable government agencies were to determine that we, or the third parties through which we export goods, were not in compliance with applicable export control or economic sanctions laws and regulations when engaging in transactions involving our products, we may be subject to civil or criminal enforcement action, and varying degrees of liability, dependent upon the nature of the violation and the extent of our culpability. Similarly, such determinations may cause disruption or delays in the distribution and sales of our products, or result in restrictions being placed upon our international distribution and sales of products which may materially impact our business activities.

Anti-Boycott Laws

Under U.S. laws and regulations, U.S. companies and their controlled-in-fact subsidiaries and affiliates outside the U.S are prohibited from participating or agreeing to participate in unsanctioned foreign boycotts in connection with certain business activities, including the sale, purchase, transfer, shipping or financing of goods or services within the U.S. or between the U.S. and a foreign country. Currently, the U.S. considers the Arab League boycott of Israel to constitute an unsanctioned foreign boycott. We are responsible for ensuring we comply with the requirements of U.S. anti-boycott laws for all transactions in which we are involved. If we, or certain third parties through which we sell or provide goods or services, are determined to have violated U.S. anti-boycott laws and regulations, we may be subject to civil or criminal enforcement action, and varying degrees of liability, dependent upon the nature of the violation and the extent of our culpability. Penalties for any violations of anti-boycott laws and regulations could include criminal penalties and civil sanctions such as fines, imprisonment, debarment from government contracts, loss of export privileges and the denial of certain tax benefits, including foreign tax credits, and outside U.S subsidiary deferrals.

Data Privacy and Security Laws and Regulations

The collection, maintenance, protection, use, transmission, disclosure and disposal of sensitive personal information are regulated at the U.S. federal and state, international and industry levels. U.S. federal and state laws protect the confidentiality of certain patient health information, including patient medical records, and restrict the use and disclosure of patient health information by health care providers. For example, the U.S. FDA has issued guidance advising manufacturers to review their cybersecurity practices and policies to assure that appropriate safeguards are in place to prevent unauthorized access or modification to their medical devices or compromise of the security of the hospital network that may be connected to the device. Moreover, in April 2003, the U.S. Department of Health and Human Services (HHS) published patient privacy rules under the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and, in April 2005, published security rules for protected health information. The HIPAA privacy and security rules govern the use, disclosure, and security of protected health information by “Covered Entities,” which are health care providers that submit electronic claims, health plans, and health care clearinghouses. In 2009, Congress passed the HITECH Act, which modified certain provisions of the HIPAA privacy and security rules for Covered Entities and their Business Associates (which is anyone that performs a service on behalf of a Covered Entity involving the use or disclosure of protected health information and is not a member of the Covered Entity’s workforce). These included directing HHS to publish more specific security standards, and increasing breach notification requirements, as well as tightening certain aspects of the privacy rules. HHS published the final versions of these new rules in January 2013, and Covered Entities and Business Associates were expected to be in compliance by September 2013. In addition, the HITECH Act provided that Business Associates will now be subject to the same security requirements as Covered Entities, and that with regard to both the security and privacy rule, Business Associates will be subject to direct enforcement by HHS, including civil and criminal liability, just as Covered Entities are. In the past, HIPAA has generally affected us indirectly, but these modifications increase the potential for enforcement action against us as a Business Associate. Medtronic is generally not a Covered Entity, except for our Diabetes business, Medtronic Monitoring, Inc. and our health insurance plans. Medtronic only operates as a Business Associate to Covered Entities in a limited number of instances. In those cases, the patient data that we receive and analyze may include protected health information.

A number of states have also adopted laws and regulations that may affect our privacy and security practices, such as state laws that govern the use, disclosure and protection of social security numbers or that are designed to protect credit card account data.

12

State and local authorities increasingly focus on the importance of protecting individuals from identity theft, with a significant number of states enacting laws requiring businesses to notify individuals of security breaches involving personal information. State consumer protection laws may also apply to privacy and security practices related to personally identifiable information, including information related to consumers and care providers.

We are also impacted by the privacy requirements of countries outside the United States. Privacy standards in Europe and Asia are becoming increasingly strict. Enforcement action and financial penalties related to privacy in the E.U. are growing, and new laws and restrictions are being passed. In April of 2016, the European Council and the Parliament adopted the new General Data Protection Regulation, which sets demanding requirements for the management of individually identifiable data in the E.U.

The management of cross border transfers of information among and outside of E.U. member countries is becoming more complex, which may complicate our clinical research activities, as well as product offerings that involve transmission or use of clinical data. China and Russia have passed so-called “data localization” laws, which require multi-national companies that store certain individually identifiable data on their citizens to maintain that data on servers located in their country. Restrictions on transfer or processing of that data may apply as well. The restrictions may complicate our operations in those countries, adding complexity and additional management and oversight needs, and the Chinese and Russian governments are still clarifying how they will apply and enforce these laws.

Cost Containment Initiatives

Government and private sector initiatives to limit the growth of health care costs, including price regulation, competitive pricing, bidding and tender mechanics, coverage and payment policies, comparative effectiveness of therapies, technology assessments, and managed-care arrangements, are continuing in many countries where we do business, including the U.S. These changes are causing the marketplace to put increased emphasis on the delivery of more cost-effective medical devices and therapies. Government programs, including Medicare and Medicaid, private health care insurance, and managed-care plans have attempted to control costs by limiting the amount of reimbursement they will pay for particular procedures or treatments, tying reimbursement to outcomes, shifting to population health management, and other mechanisms designed to constrain utilization and contain costs. Hospitals, which purchase implants, are also seeking to reduce costs through a variety of mechanisms, including, for example, creating centralized purchasing functions that set pricing and in some cases limiting the number of vendors that can participate in the purchasing program. Hospitals are also aligning interests with physicians through employment and other arrangements, such as gainsharing, where a hospital agrees with physicians to share any realized cost savings resulting from the physicians’ collective change in practice patterns such as standardization of devices where medically appropriate. This has created an increasing level of price sensitivity among customers for our products.

Some third-party payers must also approve coverage and set reimbursement levels for new or innovative devices or therapies before they will reimburse health care providers who use the medical devices or therapies. Even though a new medical device may have been cleared for commercial distribution, we may find limited demand for the device until coverage and sufficient reimbursement levels have been obtained from governmental and private third-party payers. In addition, some private third-party payers require that certain procedures or that the use of certain products be authorized in advance as a condition of reimbursement. International examples of cost containment initiatives and health care reforms in markets significant to Medtronic's business include Japan, where the government reviews reimbursement rate benchmarks every two years, which may significantly reduce reimbursement for procedures using our medical devices or deny coverage for those procedures. As a result of our manufacturing efficiencies, cost controls and other cost-savings initiatives, we believe we are well-positioned to respond to changes resulting from the worldwide trend toward cost-containment; however, uncertainty remains as to the nature of any future legislation, new or changed coverage and reimbursement government or private payer policies or decisions, or other reforms, making it difficult for us to predict the potential impact of cost-containment trends on future operating results.

Regulations Governing Reimbursement

The delivery of our devices is subject to regulation by HHS and comparable state and non-U.S. agencies responsible for reimbursement and regulation of health care items and services. U.S. laws and regulations are imposed primarily in connection with the Medicare and Medicaid programs, as well as the government’s interest in regulating the quality and cost of health care. Other governments also impose regulations in connection with their health care reimbursement programs and the delivery of health care items and services.

U.S. federal health care laws apply when we or customers submit claims for items or services that are reimbursed under Medicare, Medicaid, or other federally-funded health care programs. The principal U.S. federal laws include: (1) the Anti-kickback Statute, which prohibits offers to pay or receive remuneration of any kind for the purpose of purchasing, ordering, recommending making referrals to items or services reimbursable by a federal health care program; (2) the False Claims Act which prohibits the submission of false or otherwise improper claims for payment to a federally-funded health care program, including claims resulting from a violation of the Anti-kickback Statute; (3) the Stark law, which prohibits physicians from referring Medicare or Medicaid patients

13

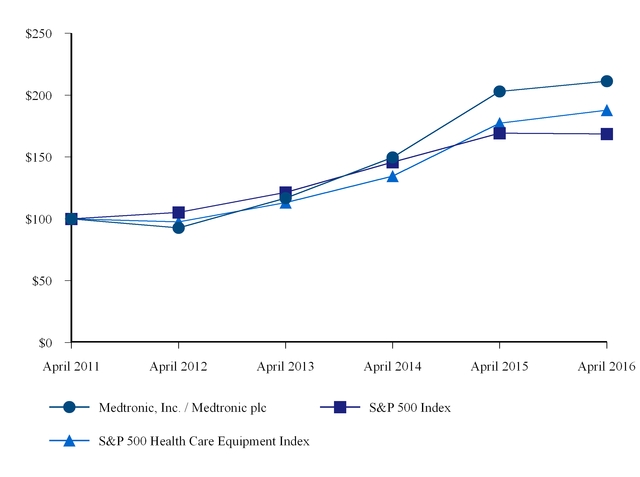

to a provider that bills these programs for the provision of certain designated health services if the physician (or a member of the physician’s immediate family) has a financial relationship with that provider; and (4) health care fraud statutes that prohibit false statements and improper claims to any third-party payer. There are often similar state false claims, anti-kickback, and anti-self-referral and insurance laws that apply to state-funded Medicaid and other health care programs and private third-party payers. Insurance companies can also bring a private cause of action for treble damages against a manufacturer for a pattern of causing false claims to be filed under the federal Racketeer Influenced and Corrupt Organizations Act, or RICO. In addition, as a manufacturer the U.S. FDA-approved devices reimbursable by federal healthcare programs, are subject to the Physician Payments Sunshine Act, which requires us to annually report certain payments and other transfers of value we make to U.S.-licensed physicians or U.S. teaching hospitals. Further, the U.S. Foreign Corrupt Practices Act (FCPA) can be used to prosecute companies in the U.S. for arrangements with physicians, or other parties outside the U.S. if the physician or party is a government official of another country and the arrangement violates the law of that country.