UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(MARK ONE)

For the quarterly period ended

For the transition period from to

Commission File No.

NEXTDECADE CORPORATION

(Exact name of registrant as specified in its charter)

| |

| |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

| | | The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | ☒ | Smaller reporting company | |

|

| Emerging growth company | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of August 5, 2022, the issuer had

NEXTDECADE CORPORATION

FORM 10-Q FOR THE QUARTER ENDED June 30, 2022

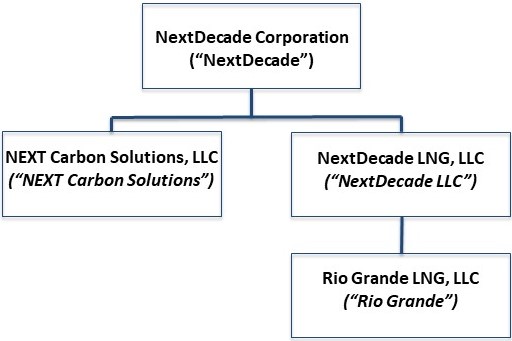

The following diagram depicts our abbreviated organizational structure as of June 30, 2022 with references to the names of certain entities discussed in this Quarterly Report on Form 10-Q.

Unless the context requires otherwise, references to “NextDecade,” the “Company,” “we,” “us” and “our” refer to NextDecade Corporation (NASDAQ: NEXT) and its consolidated subsidiaries.

PART I – FINANCIAL INFORMATION

Consolidated Balance Sheets

(in thousands, except per share data)

(unaudited)

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Property, plant and equipment, net | ||||||||

| Operating lease right-of-use assets, net | ||||||||

| Other non-current assets, net | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities, Convertible Preferred Stock and Stockholders’ Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Share-based compensation liability | ||||||||

| Accrued liabilities and other current liabilities | ||||||||

| Current common stock warrant liabilities | ||||||||

| Current operating lease liabilities | ||||||||

| Total current liabilities | ||||||||

| Non-current common stock warrant liabilities | ||||||||

| Non-current operating lease liabilities | ||||||||

| Other non-current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (Note 13) | ||||||||

| Series A Convertible Preferred Stock, $ per share liquidation preference; Issued and outstanding: shares and shares at June 30, 2022 and December 31, 2021, respectively | ||||||||

| Series B Convertible Preferred Stock, $ per share liquidation preference ; Issued and outstanding: shares and shares at June 30, 2022 and December 31, 2021, respectively | ||||||||

| Series C Convertible Preferred Stock, $ per share liquidation preference; Issued and outstanding: shares and shares at June 30, 2022 and December 31, 2021, respectively | ||||||||

| Stockholders’ equity | ||||||||

| Common stock, $ par value Authorized: million shares at June 30, 2022 and December 31, 2021; Issued and outstanding: million shares and million shares at June 30, 2022 and December 31, 2021, respectively | ||||||||

| Treasury stock: shares and shares at June 30, 2022 and December 31, 2021, respectively, at cost | ( | ) | ( | ) | ||||

| Preferred stock, $ par value Authorized: million, after designation of the Convertible Preferred Stock Issued and outstanding: at June 30, 2022 and December 31, 2021 | ||||||||

| Additional paid-in-capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities, convertible preferred stock and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative expense | ||||||||||||||||

| Development expense | ||||||||||||||||

| Lease expense | ||||||||||||||||

| Depreciation expense | ||||||||||||||||

| Total operating expenses | ||||||||||||||||

| Total operating loss | ( | ) | ) | ( | ) | ( | ) | |||||||||

| Other income (expense) | ||||||||||||||||

| Gain (loss) on common stock warrant liabilities | ) | ( | ) | ( | ) | |||||||||||

| Other, net | ||||||||||||||||

| Total other expense | ( | ) | ( | ) | ( | ) | ||||||||||

| Net loss attributable to NextDecade Corporation | ( | ) | ) | ( | ) | ( | ) | |||||||||

| Preferred stock dividends | ( | ) | ) | ( | ) | ( | ) | |||||||||

| Deemed dividends on Series A Convertible Preferred Stock | ) | ( | ) | |||||||||||||

| Net loss attributable to common stockholders | $ | ( | ) | $ | ) | $ | ( | ) | $ | ( | ) | |||||

| Net loss per common share - basic and diluted | $ | ( | ) | $ | ) | $ | ( | ) | $ | ( | ) | |||||

| Weighted average shares outstanding - basic and diluted | ||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Consolidated Statement of Stockholders’ Equity and Convertible Preferred Stock

(in thousands)

(unaudited)

| For the Three Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Series A | Series B | Series C | ||||||||||||||||||||||||||||||||||||

| Par | Additional | Total | Convertible | Convertible | Convertible | |||||||||||||||||||||||||||||||||||

| Value | Paid-in | Accumulated | Stockholders’ | Preferred | Preferred | Preferred | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Equity | Stock | Stock | Stock | |||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | $ | $ | ||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Restricted stock vesting | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Shares repurchased related to share-based compensation | ( | ) | — | ( | ) | — | — | ( | ) | — | — | — | ||||||||||||||||||||||||||||

| Issuance of common stock, net | ||||||||||||||||||||||||||||||||||||||||

| Stock dividend | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

| Exercise of common stock warrants | ||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||||||

| Net income | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| For the Six Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Series A | Series B | Series C | ||||||||||||||||||||||||||||||||||||

| Par | Additional | Total | Convertible | Convertible | Convertible | |||||||||||||||||||||||||||||||||||

| Value | Paid-in | Accumulated | Stockholders’ | Preferred | Preferred | Preferred | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Equity | Stock | Stock | Stock | |||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Restricted stock vesting | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Shares repurchased related to share-based compensation | ( | ) | — | ( | ) | — | — | ( | ) | — | — | — | ||||||||||||||||||||||||||||

| Issuance of common stock, net | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Exercise of common stock warrants | ||||||||||||||||||||||||||||||||||||||||

| Issuance of Series C Convertible Preferred Stock | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||||||

| Net loss | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| For the Three Months Ended June 30, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Series A | Series B | Series C | ||||||||||||||||||||||||||||||||||||

| Par | Additional | Total | Convertible | Convertible | Convertible | |||||||||||||||||||||||||||||||||||

| Value | Paid-in | Accumulated | Stockholders’ | Preferred | Preferred | Preferred | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Equity | Stock | Stock | Stock | |||||||||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Restricted stock vesting | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Shares repurchased related to share-based compensation | ( | ) | — | ( | ) | — | — | ( | ) | — | — | — | ||||||||||||||||||||||||||||

| Issuance of Series C Convertible Preferred Stock | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||||||

| Deemed dividends - accretion of beneficial conversion feature | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||||||

| For the Six Months Ended June 30, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Series A | Series B | Series C | ||||||||||||||||||||||||||||||||||||

| Par | Additional | Total | Convertible | Convertible | Convertible | |||||||||||||||||||||||||||||||||||

| Value | Paid-in | Accumulated | Stockholders’ | Preferred | Preferred | Preferred | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Equity | Stock | Stock | Stock | |||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | ( | ) | — | ( | ) | — | — | — | ||||||||||||||||||||||||||||

| Restricted stock vesting | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Shares repurchased related to share-based compensation | ( | ) | — | ( | ) | — | — | ( | ) | — | — | — | ||||||||||||||||||||||||||||

| Stock dividend | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Issuance of Series C Convertible Preferred Stock | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | ( | ) | — | ( | ) | |||||||||||||||||||||||||||||||

| Deemed dividends - accretion of beneficial conversion feature | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | ( | ) | $ | $ | ( | ) | $ | $ | $ | $ | ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2022 | 2021 | |||||||

| Operating activities: | ||||||||

| Net loss attributable to NextDecade Corporation | $ | ( | ) | $ | ( | ) | ||

| Adjustment to reconcile net loss to net cash used in operating activities | ||||||||

| Depreciation | ||||||||

| Share-based compensation expense (forfeiture) | ( | ) | ||||||

| Loss on common stock warrant liabilities | ||||||||

| Amortization of right-of-use assets | ||||||||

| Amortization of other non-current assets | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses | ( | ) | ( | ) | ||||

| Accounts payable | ( | ) | ||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Accrued expenses and other liabilities | ( | ) | ||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Investing activities: | ||||||||

| Acquisition of property, plant and equipment | ( | ) | ( | ) | ||||

| Acquisition of other non-current assets | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Financing activities: | ||||||||

| Proceeds from sale of Series C Convertible Preferred Stock | ||||||||

| Proceeds from sale of common stock | ||||||||

| Equity issuance costs | ( | ) | ( | ) | ||||

| Preferred stock dividends | ( | ) | ( | ) | ||||

| Shares repurchased related to share-based compensation | ( | ) | ( | ) | ||||

| Net cash provided by financing activities | ||||||||

| Net increase in cash and cash equivalents | ||||||||

| Cash and cash equivalents – beginning of period | ||||||||

| Cash and cash equivalents – end of period | $ | $ | ||||||

| Non-cash investing activities: | ||||||||

| Accounts payable for acquisition of property, plant and equipment | $ | $ | ||||||

| Accrued liabilities for acquisition of property, plant and equipment | ||||||||

| Pipeline assets obtained in exchange for other non-current liabilities | ||||||||

| Non-cash financing activities: | ||||||||

| Paid-in-kind dividends on Convertible Preferred Stock | ||||||||

| Accounts payable for equity issuance costs | ||||||||

| Accretion of deemed dividends on Series A Convertible Preferred Stock | ||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Notes to Consolidated Financial Statements

(unaudited)

Note 1 — Background and Basis of Presentation

NextDecade Corporation engages in development activities related to the liquefaction and sale of liquefied natural gas (“LNG”) and the capture and storage of CO2 emissions. We have focused our development activities on the Rio Grande LNG terminal facility at the Port of Brownsville in southern Texas (the “Terminal”), a carbon capture and storage project at the Terminal (the “Terminal CCS project”) and other carbon capture and storage projects (“CCS projects”) with third-party industrial source facilities.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, they do not include all the information and disclosures required by GAAP for complete financial statements and should be read in conjunction with the consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2021. In our opinion, all adjustments, consisting only of normal recurring items, which are considered necessary for a fair presentation of the unaudited consolidated financial statements, have been included. The results of operations for the three months ended June 30, 2022 are not necessarily indicative of the operating results for the full year.

Certain reclassifications have been made to conform prior period information to the current presentation. The reclassifications did not have a material effect on our consolidated financial position, results of operations or cash flows.

The Company has incurred operating losses since its inception and management expects operating losses and negative cash flows to continue for the foreseeable future and, as a result, the Company will require additional capital to fund its operations and execute its business plan. As of June 30, 2022, the Company had $

The Company plans to alleviate the going concern issue by obtaining sufficient funding through additional equity, equity-based or debt instruments or any other means and managing certain operating and overhead costs. The Company's ability to raise additional capital in the equity and debt markets, should the Company choose to do so, is dependent on a number of factors, including, but not limited to, the market demand for the Company's equity or debt securities, which itself is subject to a number of business risks and uncertainties, as well as the uncertainty that the Company would be able to raise such additional capital at a price or on terms that are satisfactory to the Company. In the event the Company is unable to obtain sufficient additional funding, there can be no assurance that it will be able to continue as a going concern.

These consolidated financial statements have been prepared on a going concern basis and do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary in the event the Company can no longer continue as a going concern.

Note 2 — Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Prepaid subscriptions | $ | $ | ||||||

| Prepaid insurance | ||||||||

| Prepaid marketing and sponsorships | ||||||||

| Other | ||||||||

| Total prepaid expenses and other current assets | $ | $ | ||||||

Note 3 — Sale of Equity Interests in Rio Bravo

On March 2, 2020, NextDecade LLC closed the transactions (the “Closing”) contemplated by that certain Omnibus Agreement, dated February 13, 2020, with Spectra Energy Transmission II, LLC, a wholly owned subsidiary of Enbridge Inc. (“Buyer”), pursuant to which NextDecade LLC sold

Pursuant to the RBPL Precedent Agreement, Rio Bravo agreed to provide Rio Grande Gas Supply with firm natural gas transportation services on the Pipeline in a quantity sufficient to match the full operational capacity of each proposed liquefaction train of the Terminal. Rio Bravo’s obligation to construct, install, own, operate and maintain the Pipeline is conditioned on its receipt, no later than December 31, 2023, of notice that Rio Grande Gas Supply or its affiliate has issued a full notice to proceed to the engineering, procurement and construction contractor (the “EPC Contractor”) for the construction of the Terminal. Under the RBPL Precedent Agreement, in consideration for the provision of such firm transportation services, Rio Bravo will be remunerated on a dollar-per-dekatherm, take-or-pay basis, subject to certain adjustments, over a term of at least years, all in compliance with the federal and state authorizations associated with the Pipeline.

Pursuant to the VCP Precedent Agreement, VCP agreed to provide Rio Grande Gas Supply with natural gas transportation services on the Valley Crossing Pipeline in a quantity sufficient to match the commissioning requirements of each proposed liquefaction train of the Terminal. VCP’s obligation to construct, install, own, operate and maintain the necessary interconnection to the Terminal and the Pipeline is conditioned on its receipt, no later than December 31, 2023, of notice that Rio Grande Gas Supply or its affiliate has issued a full notice to proceed to the EPC Contractor for the construction of the Terminal. VCP will be responsible, at its sole cost and expense, to construct, install, own, operate and maintain the tap, riser and valve facilities (the “VCP Transporter Facilities”), which shall connect to Rio Grande Gas Supply’s custody transfer meter and such other facilities as necessary in order for the Terminal to receive gas from the VCP Transporter Facilities (the “Rio Grande Gas Supply Facilities”). Rio Grande Gas Supply will be responsible, at its sole cost and expense, to construct, install, own, operate and maintain the Rio Grande Gas Supply Facilities. Under the VCP Precedent Agreement, in consideration for the provision of the commissioning transportation services, VCP will be remunerated on the same dollar-per-dekatherm, take-or-pay basis as set forth in the RBPL Precedent Agreement for the duration of such commissioning services, all in compliance with the federal and state authorizations associated with the Valley Crossing Pipeline.

If Rio Grande or its affiliate fails to issue a full notice to proceed to the EPC Contractor on or prior to December 31, 2023, Buyer has the right to sell the Equity Interests back to NextDecade LLC and NextDecade LLC has the right to repurchase the Equity Interests from Buyer, in each case at a price not to exceed $

Note 4 — Property, Plant and Equipment

Property, plant and equipment consisted of the following (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Fixed Assets | ||||||||

| Computers | $ | $ | ||||||

| Furniture, fixtures, and equipment | ||||||||

| Leasehold improvements | ||||||||

| Total fixed assets | ||||||||

| Less: accumulated depreciation | ( | ) | ( | ) | ||||

| Total fixed assets, net | ||||||||

| Project Assets (not placed in service) | ||||||||

| Terminal | ||||||||

| Pipeline | ||||||||

| Total Terminal and Pipeline assets | ||||||||

| Total property, plant and equipment, net | $ | $ | ||||||

Depreciation expense was $

Note 5 — Leases

Our leased assets primarily consist of office space.

Operating lease right-of-use assets are as follows (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Office leases | $ | $ | ||||||

| Total operating lease right-of-use assets, net | $ | $ | ||||||

Operating lease liabilities are as follows (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Office leases | $ | $ | ||||||

| Total current lease liabilities | ||||||||

| Non-current office leases | ||||||||

| Total lease liabilities | $ | $ | ||||||

Operating lease expense is as follows (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Office leases | $ | $ | $ | $ | ||||||||||||

| Total operating lease expense | ||||||||||||||||

| Short-term lease expense | ||||||||||||||||

| Total lease expense | $ | $ | $ | $ | ||||||||||||

Maturity of operating lease liabilities as of June 30, 2022 are as follows (in thousands, except lease term and discount rate):

| 2022 (remaining) | $ | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Total undiscounted lease payments | ||||

| Discount to present value | ( | ) | ||

| Present value of lease liabilities | $ | |||

| Weighted average remaining lease term - years | ||||

| Weighted average discount rate - percent |

Other information related to our operating leases is as follows (in thousands):

| Six Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

| Cash paid for amounts included in the measurement of operating lease liabilities: | ||||||||

| Cash flows from operating activities | $ | | $ | | ||||

| Noncash right-of-use assets recorded for operating lease liabilities: | ||||||||

| In exchange for new operating lease liabilities during the period | ||||||||

Note 6 — Other Non-Current Assets

Other non-current assets consisted of the following (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Permitting costs(1) | $ | $ | ||||||

| Enterprise resource planning system, net | ||||||||

| Rio Grande Site Lease initial direct costs | ||||||||

| Total other non-current assets, net | $ | $ | ||||||

| (1) | Permitting costs primarily represent costs incurred in connection with permit applications to the United States Army Corps of Engineers and the U.S. Fish and Wildlife Service for mitigation measures for potential impacts to wetlands and habitat that may be caused by the construction of the Terminal and the Pipeline. |

Note 7 — Accrued Liabilities and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Employee compensation expense | $ | $ | ||||||

| Terminal costs | ||||||||

| Accrued legal services | ||||||||

| Other accrued liabilities | ||||||||

| Total accrued liabilities and other current liabilities | $ | $ | ||||||

Note 8 – Preferred Stock and Common Stock Warrants

Preferred Stock

As of December 31, 2021, the Company had outstanding

In March 2022, the Company sold an aggregate of

Net proceeds from the sales of the 2022 Series C Preferred Stock were allocated on a fair value basis to the 2022 Series C Warrants and on a relative fair value basis to the 2022 Series C Preferred Stock. The allocation of net cash proceeds is as follows (in thousands):

| Allocation of Proceeds | ||||||||||||

| 2022 Series C | ||||||||||||

| 2022 Series C | Preferred | |||||||||||

| Warrants | Stock | |||||||||||

| Gross proceeds | $ | |||||||||||

| Equity issuance costs | ( | ) | ||||||||||

| Net proceeds - Initial Fair Value Allocation | $ | $ | $ | |||||||||

| Per balance sheet upon issuance | $ | $ | ||||||||||

As of June 30, 2022, shares of Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock were convertible into shares of Company common stock at an average conversion price of approximately $

The Company has the option to convert all, but not less than all, of the Convertible Preferred Stock into shares of Company common stock at the applicable conversion price on any date on which the volume weighted average trading price of shares of Company common stock for each trading day during any

The shares of Convertible Preferred Stock bear dividends at a rate of

Common Stock Warrants

The Company has issued warrants exercisable to purchase Company common stock in connection with its issuances of Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock (collectively, the “Common Stock Warrants”). The Company revalues the Common Stock Warrants at each balance sheet date and recognized a gain of $

The assumptions used in the Monte Carlo simulation model to estimate the fair value of the Common Stock Warrants are as follows:

| June 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

| Stock price | $ | $ | ||||||

| Exercise price | $ | $ | ||||||

| Risk-free rate | % | % | ||||||

| Volatility | % | % | ||||||

| Term (years) | ||||||||

Common Stock Purchase Agreement

On April 6, 2022, the Company entered into a common stock purchase agreement (the “Stock Purchase Agreement”) with HGC NEXT INV LLC (the “Purchaser”), pursuant to which the Company sold

Common Stock Warrants

During the three and six months ended June 30, 2022, Common Stock Warrants were exercised by certain holders of Series B Preferred Stock. In connection with the exercises of Common Stock Warrants, the Company issued an aggregate of

The following table (in thousands, except for loss per share) reconciles basic and diluted weighted average common shares outstanding for each of the six months ended June 30, 2022 and 2021:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic | ||||||||||||||||

| Dilutive unvested stock, convertible preferred stock, Common Stock Warrants and IPO Warrants | ||||||||||||||||

| Diluted | ||||||||||||||||

| Basic and diluted net loss per share attributable to common stockholders | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

Potentially dilutive securities not included in the diluted net loss per share computations because their effect would have been anti-dilutive were as follows (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Unvested stock and stock units (1) | ||||||||||||||||

| Convertible preferred stock | ||||||||||||||||

| Common Stock Warrants | ||||||||||||||||

| IPO Warrants(2) | ||||||||||||||||

| Total potentially dilutive common shares | ||||||||||||||||

| (1) | Does not include |

| (2) | The IPO Warrants were issued in connection with our initial public offering in 2015 and expired on July 24, 2022. |

Note 11 — Share-based Compensation

We have granted shares of Company common stock, restricted Company common stock and restricted stock units to employees, consultants and non-employee directors under our 2017 Omnibus Incentive Plan, as amended (the “2017 Plan”).

Total share-based compensation consisted of the following (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Share-based compensation expense (forfeiture): | ||||||||||||||||

| Equity awards | $ | $ | $ | $ | ( | ) | ||||||||||

| Liability awards | ||||||||||||||||

| Total share-based compensation (forfeiture) | ( | ) | ||||||||||||||

| Capitalized share-based compensation | ( | ) | ( | ) | ||||||||||||

| Total share-based compensation expense (forfeiture) | $ | $ | $ | $ | ( | ) | ||||||||||

Note 12 — Income Taxes

Due to our cumulative loss position, we have established a full valuation allowance against our deferred tax assets at June 30, 2022 and December 31, 2021. Due to our full valuation allowance, we have recorded a provision for federal or state income taxes during either of the three and six months ended June 30, 2022 or 2021.

Note 13 — Commitments and Contingencies

Obligation under LNG Sale and Purchase Agreement

In March 2019, we entered into a 20-year sale and purchase agreement (the “SPA”) with Shell NA LNG LLC (“Shell”) for the supply of approximately two million tonnes per annum of liquefied natural gas from the Terminal. Pursuant to the SPA, Shell will purchase LNG on a free-on-board (“FOB”) basis starting from the date the first liquefaction train of the Terminal that is commercially operable, with approximately three-quarters of the purchased LNG volume indexed to Brent and the remaining volume indexed to domestic United States gas indices, including Henry Hub.

In the first quarter of 2020, pursuant to the terms of the SPA, the SPA became effective upon the conditions precedent in the SPA being satisfied or waived. The SPA obligates Rio Grande to deliver the contracted volumes of LNG to Shell at the FOB delivery point, subject to the first liquefaction train at the Terminal being commercially operable.

Other Commitments

On March 6, 2019, Rio Grande entered into a lease agreement (the “Rio Grande Site Lease”) with the Brownsville Navigation District of Cameron County, Texas (“BND”) for the lease by Rio Grande of approximately

In connection with the Rio Grande Site Lease Amendment, Rio Grande is committed to pay approximately $

In the fourth quarter of 2021, Rio Grande entered into an amended agreement for wetland mitigation measures. In connection with the amended agreement, Rio Grande is committed to spend approximately $

Legal Proceedings

From time to time the Company may be subject to various claims and legal actions that arise in the ordinary course of business. As of June 30, 2022, management is not aware of any claims or legal actions that, separately or in the aggregate, are likely to have a material adverse effect on the Company’s financial position, results of operations or cash flows, although the Company cannot guarantee that a material adverse effect will not occur.

Note 14 — Recent Accounting Pronouncements

The following table provides a brief description of recent accounting standards that have been adopted by the Company during the reporting period:

| Standard |

| Description |

| Date of Adoption |

| Effect on our Consolidated Financial Statements or Other Significant Matters |

| ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity's Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in Entity's Own Equity |

| This standard simplifies the accounting for convertible instruments primarily by eliminating the existing cash conversion and beneficial conversion models within Subtopic 470-20, which will result in fewer embedded conversion options being accounted for separately from the host. This standard also amends and simplifies the calculation of earnings per share relating to convertible instruments. |

| January 1, 2022 |

| The Company adopted this standard using the modified retrospective approach, which did not have an effect on the Company's consolidated financial statements. |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “anticipate,” “contemplate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “might,” “will,” “would,” “could,” “should,” “can have,” “likely,” “continue,” “design” and other words and terms of similar expressions, are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives and financial needs.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual results could differ from those expressed in our forward-looking statements. Our future financial position and results of operations, as well as any forward-looking statements are subject to change and inherent risks and uncertainties, including those described in the section titled “Risk Factors” in our most recent Annual Report on Form 10-K. You should consider our forward-looking statements in light of a number of factors that may cause actual results to vary from our forward-looking statements including, but not limited to:

| ● |

our progress in the development of our liquefied natural gas (“LNG”) liquefaction and export project and any carbon capture and storage projects (“CCS projects”) we may develop and the timing of that progress; |

| ● |

the timing of achieving a final investment decision (“FID”) in the construction and operation of a 27 million tonne per annum (“mtpa”) LNG export facility at the Port of Brownsville in southern Texas (the “Terminal”); |

| ● |

our reliance on third-party contractors to successfully complete the Terminal, the pipeline to supply gas to the Terminal and any CCS projects we develop; |

| ● |

our ability to develop our NEXT Carbon Solutions business through implementation of our CCS projects; |

| ● |

our ability to secure additional debt and equity financing in the future to complete the Terminal and other CCS projects on commercially acceptable terms and to continue as a going concern; |

| ● |

the accuracy of estimated costs for the Terminal and CCS projects; |

| ● |

our ability to achieve operational characteristics of the Terminal and CCS projects, when completed, including amounts of liquefaction capacities and amount of CO2 captured and stored, and any differences in such operational characteristics from our expectations; |

| ● |

the development risks, operational hazards and regulatory approvals applicable to our LNG and carbon capture and storage development, construction and operation activities and those of our third-party contractors and counterparties; |

| ● |

technological innovation which may lessen our anticipated competitive advantage or demand for our offerings; |

| ● |

the global demand for and price of LNG; |

| ● |

the availability of LNG vessels worldwide; |

| ● |

changes in legislation and regulations relating to the LNG and carbon capture industries, including environmental laws and regulations that impose significant compliance costs and liabilities; |

| ● |

scope of implementation of carbon pricing regimes aimed at reducing greenhouse gas emissions; |

| ● |

global development and maturation of emissions reduction credit markets; |

| ● |

adverse changes to existing or proposed carbon tax incentive regimes; |

| ● |

global pandemics, including the 2019 novel coronavirus (“COVID-19”) pandemic, the Russia-Ukraine conflict, other sources of volatility in the energy markets and their impact on our business and operating results, including any disruptions in our operations or development of the Terminal and the health and safety of our employees, and on our customers, the global economy and the demand for LNG or carbon capture; |

| ● |

risks related to doing business in and having counterparties in foreign countries; |

| ● |

our ability to maintain the listing of our securities on the Nasdaq Capital Market or another securities exchange or quotation medium; |

| ● |

changes adversely affecting the businesses in which we are engaged; |

| ● |

management of growth; |

| ● |

general economic conditions; |

| ● |

our ability to generate cash; and |

| ● |

the result of future financing efforts and applications for customary tax incentives. |

Should one or more of the foregoing risks or uncertainties materialize in a way that negatively impacts us, or should the underlying assumptions prove incorrect, our actual results may vary materially from those anticipated in our forward-looking statements, and our business, financial condition, and results of operations could be materially and adversely affected.

The forward-looking statements contained in this Quarterly Report on Form 10-Q are made as of the date of this Quarterly Report on Form 10-Q. You should not rely upon forward-looking statements as predictions of future events. In addition, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements.

Except as required by applicable law, we do not undertake any obligation to publicly correct or update any forward-looking statements. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements as well as others made in our most recent Annual Report on Form 10-K as well as other filings we have made and will make with the Securities and Exchange Commission (the “SEC”) and our public communications. You should evaluate all forward-looking statements made by us in the context of these risks and uncertainties.

Overview

NextDecade Corporation engages in development activities related to the liquefaction and sale of LNG and the capture and storage of CO2 emissions. We have undertaken and continue to undertake various initiatives to evaluate, design and engineer the Terminal, including the Terminal CCS project, that we expect will result in demand for LNG supply at the Terminal, and other CCS projects that would be hosted at industrial source facilities.

Unless the context requires otherwise, references to “NextDecade,” “the Company,” “we,” “us,” and “our” refer to NextDecade Corporation and its consolidated subsidiaries.

Recent Developments

Rio Grande Development Activity

LNG Sale and Purchase Agreements

In April 2022, we entered into a 20-year sale and purchase agreement (“SPA”) with ENN LNG (Singapore) Pte Ltd (“ENN LNG”) for the supply of 1.5 mtpa of LNG indexed to Henry Hub on a free-on-board basis from the Terminal (“ENN LNG SPA”). The LNG supplied to ENN LNG will be from the first two trains at the Terminal.

In April 2022, we also entered into a 15-year SPA with ENGIE S.A. (“ENGIE”) for the supply of 1.75 mtpa of LNG indexed to Henry Hub on a free-on-board basis from the Terminal (“ENGIE SPA”). The LNG supplied to ENGIE will be from the first two trains at the Terminal.

In July 2022, we entered into a 20-year SPA with China Gas Hongda Energy Trading Co., LTD (“China Gas”) for the supply of 1.0 mtpa of LNG indexed to Henry Hub on a free-on-board basis from the Terminal (“China Gas SPA”). The LNG supplied to China Gas will be from the second train at the Terminal.

In July 2022, we also entered into a 20-year SPA with Guangdong Energy Group (“Guangdong Energy”) for the supply of 1.0 mtpa of LNG indexed to Henry Hub delivered on an ex-ship basis from the Terminal (“Guangdong Energy SPA”). The LNG supplied to Guangdong Energy will be from the first train at the Terminal.

In July 2022, we also entered into a 20-year SPA with ExxonMobil LNG Asia Pacific (“EMLAP”), an affiliate of ExxonMobil, for the supply of 1.0 mtpa of LNG indexed to Henry Hub delivered on a free-on-board basis from the Terminal (“EMLAP SPA”). The LNG supplied to EMLAP will be from the first two trains at the Terminal.

Each of the ENN LNG SPA, ENGIE SPA, China Gas SPA, Guangdong Energy SPA and EMLAP SPA become effective upon the satisfaction of certain conditions precedent, which include a positive final investment decision in the initial phase of the Terminal.

Rio Grande Site Lease

On March 6, 2019, Rio Grande entered into a lease agreement (the “Rio Grande Site Lease”) with the Brownsville Navigation District of Cameron County, Texas (the “BND”) for the lease by Rio Grande of approximately 984 acres of land situated in Brownsville, Cameron County, Texas for the purposes of constructing, operating, and maintaining (i) a liquefied natural gas facility and export terminal and (ii) gas treatment and gas pipeline facilities.

On April 20, 2022, Rio Grande and the BND amended the Rio Grande Site Lease to extend the effective date for commencing the Rio Grande Site Lease to May 6, 2023.

Engineering, Procurement and Construction (“EPC”) Agreements

By amendments dated April 29, 2022, Rio Grande and Bechtel Oil, Gas and Chemicals, Inc. amended each of the Trains 1 and 2 EPC Agreement and the Train 3 EPC Agreement to extend the respective contract validity to July 31, 2023.

NEXT Carbon Solutions Development Activity

Front-end Engineering and Design (“FEED”) Agreements

In May 2022, we entered into an agreement with California Resources Corporation, whereby NEXT Carbon Solutions will perform a FEED study for the post combustion capture and compression of up to 95% of the CO2 produced at the Elk Hills Power Plant. During the FEED, NEXT Carbon Solutions and California Resources Corporation expect to finalize definitive commercial documents allowing the project to proceed with a final investment decision.

In June 2022, we entered into agreements with an energy infrastructure fund to perform preliminary FEED studies at two power generation facilities. Through performance of the preliminary FEED studies, we expect to generate cash proceeds of $1.0 million in the second half of 2022.

Financing Activity

Private Placement of Company Common Stock

In April 2022, we sold 4,618,226 shares of Company common stock for gross proceeds of approximately $30 million to HGC NEXT INV LLC, as described in Note 9 - Stockholders' Equity in the Notes to Consolidated Financial Statements.

Private Placement of Series C Convertible Preferred Stock

In March 2022, we sold an aggregate of 10,500 shares of Series C Convertible Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”), at $1,000 per share for an aggregate purchase price of $10.5 million and issued an additional 210 shares of Series C Preferred Stock in aggregate as origination fees. Warrants representing the right to acquire an aggregate number of shares of our common stock equal to approximately 14.91 basis points (0.1491%) of all outstanding shares of Company common stock, measured on a fully diluted basis, on the applicable exercise date with a strike price of $0.01 per share were issued together with the issuances of the Series C Preferred Stock.

For further descriptions of the Series C Preferred Stock and related warrants, see Note 8 - Preferred Stock and Common Stock Warrants, in the Notes to Consolidated Financial Statements.

Liquidity and Capital Resources

Near Term Liquidity and Capital Resources

Our primary cash needs have historically been funding development activities in support of the Terminal and our CCS projects, which include payments of initial direct costs of our Rio Grande site lease and expenses in support of engineering and design activities, regulatory approvals and compliance, commercial and marketing activities and corporate overhead. We spent approximately $37 million on such development activities during 2021, which we funded through our cash on hand and proceeds from the issuances of equity and equity-based securities. Our capital raising activities since January 1, 2022 have included the following:

In March 2022, we sold 10,500 shares of Series C Preferred Stock at $1,000 per share together with associated warrants to purchase Company common stock for a purchase price of $10.5 million and issued an additional 210 shares of Series C Preferred Stock as origination fees.

In April 2022, we sold 4,618,226 shares of Company common stock for approximately $30 million.

During the six months ended June 30, 2022 we spent approximately $26 million on development activities and we expect this level of spend on development activities to continue to increase during the six months ending December 31, 2022 as we increase headcount and engage consultants in preparation for a positive FID of the initial phase of the Terminal. Because our businesses and assets are in development, we have not historically generated cash flow from operations, nor do we expect to do so during 2022. We intend to fund the remaining portion of 2022 development activities through the sale of additional equity, equity-based or debt securities in us or in our subsidiaries. There can be no assurance that we will succeed in selling such securities or, if successful, that the capital we raise will not be expensive or dilutive to stockholders.

Our consolidated financial statements as of and for the three and six months ended June 30, 2022 have been prepared on the basis that we will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. Based on our balance of cash and cash equivalents of $40.5 million at June 30, 2022, there is substantial doubt about our ability to continue as a going concern within one year after the date that our consolidated financial statements were issued. Our ability to continue as a going concern will depend on managing certain operating and overhead costs and our ability to raise capital through equity, equity-based or debt financings. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty, which could have a material adverse effect on our financial condition.

Long Term Liquidity and Capital Resources

The Terminal will not begin to operate and generate significant cash flows unless and until the Terminal is operational, which is expected to be at least four years away, and the construction of the Terminal will require a significant amount of capital expenditure. CCS projects will similarly take an extended period of time to develop, construct and become operational and will require significant capital deployment. We currently expect that the long-term capital requirements for the Terminal and any CCS projects will be financed predominately through project financing and proceeds from future debt, equity-based, and equity offerings by us. Construction of the Terminal and CCS projects would not begin until such financing has been obtained. As a result, our business success will depend, to a significant extent, upon our ability to obtain the funding necessary to construct the Terminal and any CCS projects, to bring them into operation on a commercially viable basis and to finance our staffing, operating and expansion costs during that process. There can be no assurance that we will succeed in securing additional debt and/or equity financing in the future to complete the Terminal or any CCS projects or, if successful, that the capital we raise will not be expensive or dilutive to stockholders. Additionally, if these types of financing are not available, we will be required to seek alternative sources of financing, which may not be available on terms acceptable to us, if at all.

Sources and Uses of Cash

The following table summarizes the sources and uses of our cash for the periods presented (in thousands):

| Six Months Ended |

||||||||

| June 30, |

||||||||

| 2022 |

2021 |

|||||||

| Operating cash flows |

$ | (17,475 | ) | $ | (7,700 | ) | ||

| Investing cash flows |

(6,210 | ) | (8,585 | ) | ||||

| Financing cash flows |

38,633 | 34,272 | ||||||

| Net increase in cash and cash equivalents |

14,948 | 17,987 | ||||||

| Cash and cash equivalents – beginning of period |

25,552 | 22,608 | ||||||

| Cash and cash equivalents – end of period |

$ | 40,500 | $ | 40,595 | ||||

Operating Cash Flows

Operating cash outflows during the six months ended June 30, 2022 and 2021 were $17.5 million and $7.7 million, respectively. The increase in operating cash outflows during the six months ended June 30, 2022 compared to the six months ended June 30, 2021 was primarily due to an increase in employee costs and professional fees paid to consultants as we prepare for a positive FID in the initial phase of the Terminal.

Investing Cash Flows

Investing cash outflows during the six months ended June 30, 2022 and 2021 were $6.2 million and $8.6 million, respectively. Investing cash outflows primarily consist of cash used in the development of the Terminal and CCS project. The decrease in investing cash outflows during the six months ended June 30, 2022 compared to the same period in 2021 was primarily due to lower spend with our engineering, procurement and construction contractor.

Financing Cash Flows

Financing cash inflows during the six months ended June 30, 2022 and 2021 were $38.6 million and $34.3 million, respectively, primarily representing proceeds from the sale of Series C Preferred Stock and the sale of common stock in 2022 and the sale of Series C Preferred Stock in 2021.

Contractual Obligations

There have been no material changes to our contractual obligations from those disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Results of Operations

The following table summarizes costs, expenses and other income for the periods indicated (in thousands):

| For the Three Months Ended |

For the Six Months Ended |

|||||||||||||||||||||||

| June 30, |

June 30, |

|||||||||||||||||||||||

| 2022 |

2021 |

Change |

2022 |

2021 |

Change |

|||||||||||||||||||

| Revenues |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||

| General and administrative expense |

11,293 | 6,533 | 4,760 | 14,616 | 7,903 | 6,713 | ||||||||||||||||||

| Development expense |

1,193 | — | 1,193 | 2,738 | — | 2,738 | ||||||||||||||||||

| Lease expense |

290 | 234 | 56 | 509 | 438 | 71 | ||||||||||||||||||

| Depreciation expense |

42 | 45 | (3 | ) | 89 | 93 | (4 | ) | ||||||||||||||||

| Total operating loss |

(12,818 | ) | (6,812 | ) | (6,006 | ) | (17,952 | ) | (8,434 | ) | (9,518 | ) | ||||||||||||

| Gain (loss) on common stock warrant liabilities |

1,886 | (4,768 | ) | 6,654 | (4,418 | ) | (6,806 | ) | 2,388 | |||||||||||||||

| Other, net |

20 | — | 20 | 21 | 2 | 19 | ||||||||||||||||||

| Net loss attributable to NextDecade Corporation |

(10,912 | ) | (11,580 | ) | 668 | (22,349 | ) | (15,238 | ) | (7,111 | ) | |||||||||||||

| Preferred stock dividends |

(5,774 | ) | (3,876 | ) | (1,898 | ) | (11,529 | ) | (7,751 | ) | (3,778 | ) | ||||||||||||

| Deemed dividends on Series A Convertible Preferred Stock |

— | (15 | ) | 15 | — | (31 | ) | 31 | ||||||||||||||||

| Net loss attributable to common stockholders |

$ | (16,686 | ) | $ | (15,471 | ) | $ | (1,215 | ) | $ | (33,878 | ) | $ | (23,020 | ) | $ | (10,858 | ) | ||||||

Our consolidated net loss was $16.7 million, or $0.13 per common share (basic and diluted), for the three months ended June 30, 2022 compared to a net loss of $15.5 million, or $0.13 per common share (basic and diluted), for the three months ended June 30, 2021. The $1.2 million increase in net loss was primarily a result of increases in general and administrative expense, development expense and preferred stock dividends, partially offset by a decrease in loss on common stock warrant liabilities.

Our consolidated net loss was $33.9 million, or $0.27 per common share (basic and diluted), for the six months ended June 30, 2022 compared to a net loss of $23.0 million, or $0.19 per common share (basic and diluted), for the six months ended June 30, 2021. The $10.9 million increase in net loss was primarily a result of increases in general and administrative expense, development expense and preferred stock dividends, partially offset by a decrease in loss on common stock warrant liabilities.

General and administrative expense during the three months ended June 30, 2022 increased approximately $4.8 million compared to the same period in 2021 primarily due to an increase in share-based compensation expense of $2.0 million and increases in salaries and wages, professional fees, travel expenses, and IT and communications. The increase in salaries and wages, professional fees, travel expense, and IT and communications is primarily due to fewer pandemic restrictions in 2022 and a 25% increase in the average number of employees during the three months ended June 30, 2022 compared to the same period of the prior year.

General and administrative expense during the six months ended June 30, 2022 increased approximately $6.7 million compared to the same period in 2021 primarily due to an increase in share-based compensation expense of $3.4 million and increases in salaries and wages, professional fees, travel expenses, and IT and communications. The increase in salaries and wages, professional fees, travel expense, and IT and communications is primarily due to fewer pandemic restrictions in 2022 and a 24% increase in the average number of employees during the six months ended June 30, 2022 compared to the same period of the prior year.

Development expense during the three and six months ended June 30, 2022 were $1.2 million and $2.7 million, respectively, due to NEXT Carbon Solutions’ preliminary FEED assessments performed on third-party industrial facilities. Similar preliminary FEED assessments were not performed during either of the three or six months ended June 30, 2021.

Gain (loss) on common stock warrant liabilities for the three and six months ended June 30, 2022 and 2021 is primarily due to changes in the share price of Company common stock.

Preferred stock dividends for the three months ended June 30, 2022 of $5.8 million consisted of dividends paid-in kind with the issuance of 2,243 additional shares of Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), 2,138 additional shares of Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock”), and 1,374 additional shares of Series C Preferred Stock, compared to preferred stock dividends of $3.9 million for the three months ended June 30, 2021 that consisted of dividends paid-in kind with the issuance of 1,978 and 1,884 additional shares of Series A Preferred Stock and Series B Preferred Stock, respectively.

Preferred stock dividends for the six months ended June 30, 2022 of $11.5 million consisted of dividends paid-in kind with the issuance of 4,468 additional shares of Series A Preferred Stock, 4,261 additional shares of Series B Preferred Stock, and 2,761 additional shares of Series C Preferred Stock, compared to preferred stock dividends of $7.8 million for the six months ended June 30, 2021 that consisted of dividends paid-in kind with the issuance of 3,956 and 3,768 additional shares of Series A Preferred Stock and Series B Preferred Stock, respectively.

Summary of Critical Accounting Estimates

The preparation of our Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make certain estimates and assumptions that affect the amounts reported in the Consolidated Financial Statements and the accompanying notes. There have been no significant changes to our critical accounting estimates from those disclosed in our Annual Report on Form 10-K for the year ended December 31, 2021.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

We maintain a set of disclosure controls and procedures that are designed to ensure that information required to be disclosed by us in the reports filed by us under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. As of the end of the period covered by this report, we evaluated, under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 of the Exchange Act. Based on that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that our disclosure controls and procedures are effective.

During the most recent fiscal quarter, there have been no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

None.

The information presented below updates, and should be read in conjunction with, the risk factors disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Except as presented below, there were no changes to the risk factors previously disclosed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

There is substantial doubt about our ability to continue as a going concern.

We have incurred operating losses since our inception and management expects operating losses and negative cash flows to continue for the foreseeable future and, as a result, we will require additional capital to fund our operations and execute our business plan. As of June 30, 2022, the Company had $40.5 million in cash and cash equivalents which are not sufficient to fund the Company's planned operations through one year after the date the consolidated financial statements are issued. Accordingly, there is substantial doubt about the Company's ability to continue as a going concern. The analysis used to determine the Company's ability to continue as a going concern does not include cash sources outside of the Company's direct control that management expects to be available within the next twelve months.

Our ability to continue as a going concern is dependent upon our ability to obtain sufficient funding through additional debt or equity financing and to manage operating and overhead costs. There can be no assurance that we will be able to raise sufficient capital on acceptable or satisfactory terms to the Company, or at all.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

Purchases of Equity Securities by the Issuer

The following table summarizes stock repurchases for the three months ended June 30, 2022:

| Period |

Total Number of Shares Purchased (1) |

Average Price Paid Per Share (2) |

Total Number of Shares Purchased as a Part of Publicly Announced Plans |

Maximum Number of Shares That May Yet Be Purchased Under the Plans |

||||||||

| April 2022 |

91,182 | $7.37 | — | — | ||||||||

| May 2022 |

— | — | — | — | ||||||||

| June 2022 |

109,823 | 5.61 | — | — |

| (1) |

Represents shares of Company common stock surrendered to us by participants in the 2017 Plan to settle the participants’ personal tax liabilities that resulted from the lapsing of restrictions on shares awarded to the participants under the 2017 Plan. |

| (2) |

The price paid per share of Company common stock was based on the closing trading price of such stock on the dates on which we repurchased shares of Company common stock from the participants under the 2017 Plan. |

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

On May 19, 2021, a putative stockholder class action complaint was filed against the Company and members of the Company’s Board of Directors (the “Board”) in the Court of Chancery in the State of Delaware captioned Mellor, v. Schatzman, et al., Case No. 2021-0444-JTL (the “Action”). The complaint asserted, among other things, that the directors breached their fiduciary duties by failing to disclose all material information necessary for a fully-informed vote in a proxy statement in which they sought stockholder approval for a potential share issuance. Following the filing of the Action and further communications between the parties, and in order to moot the plaintiff’s disclosure claims, avoid nuisance and expense associated with litigation and provide additional information to its stockholders, the Company filed a proxy statement supplement with the U.S. Securities and Exchange Commission on May 27, 2021 (the “Proxy Supplement”). Thereafter, plaintiff informed the Company that, in light of the mootness of plaintiff’s claims, plaintiff would voluntarily dismiss the Action. As of June 4, 2021, the Action had been dismissed with prejudice as to plaintiff’s individual claims and without prejudice as to all members of the purported class other than plaintiff with the Court retaining jurisdiction of the Action only for the purpose of determining an application by plaintiff for an award of attorneys’ fees and reimbursement of expenses (the “Mootness Fee Claim”) in connection with the purported benefits provided to NextDecade’s stockholders as a result of the filing of the Proxy Supplement. On June 24, 2022, plaintiff filed a Motion for Approval of Plaintiff’s Application for an Award of Attorney’s Fees and Expenses and a Service Award (the “Motion”). Following a period of arms’ length negotiations, the Company agreed in the exercise of business judgment to pay $125,000 in attorneys’ fees and expenses to plaintiff’s counsel in connection with the mooted disclosure claims asserted in the Action without admitting any fault or wrongdoing in full satisfaction of plaintiff and plaintiff’s counsel claim for fees or costs. The Court was not asked to review, and did not pass judgment on, the payment of the attorneys’ fees and expenses or their reasonableness. Plaintiff has agreed to notify the Court that the parties have reached an agreement on the Mootness Fee Claim and to withdraw the Motion.

| (1) |

Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed July 28, 2017. |

| (2) |

Incorporated by reference to Exhibit 3.2 of the Registrant’s Current Report on Form 8-K, filed July 28, 2017. |

| (3) |

Incorporated by reference to Exhibit 4.3 of the Registrant’s Registration Statement on Form S-3, filed December 20, 2018. |

| (4) |

Incorporated by reference to Exhibit 3.4 of the Registrant’s Quarterly Report on Form 10-Q, filed November 9, 2018. |

| (5) | Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed March 18, 2021. |

| (6) | Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed July 15, 2019. |

| (7) | Incorporated by reference to Exhibit 3.2 of the Registrant’s Current Report on Form 8-K, filed July 15, 2019. |

| (8) | Incorporated by reference to Exhibit 3.7 of the Registrant's Quarterly Report on Form 10-Q, filed August 6, 2019. |

| (9) | Incorporated by reference to Exhibit 3.8 of the Registrant’s Quarterly Report on Form 10-Q, filed August 6, 2019. |

| (10) | Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed March 4, 2021. |

| (11) | Incorporated by reference to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K, filed April 7, 2022. |

| (12) | Incorporated by reference to Exhibit 10.2 of the Registrant’s Current Report on Form 8-K, filed April 7, 2022. |

| (13) | Incorporated by reference to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K filed June 22, 2022. |

| * |

Filed herewith. |

| ** |

Furnished herewith. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

NEXTDECADE CORPORATION |

|

|

|

||

| Date: August 11, 2022 |

By: |

/s/ Matthew K. Schatzman |

|

|

Matthew K. Schatzman |

|

|

|

Chairman of the Board and Chief Executive Officer |

|

|

|

(Principal Executive Officer) |

|

| Date: August 11, 2022 |

By: |

/s/ Brent E. Wahl |

|

|

Brent E. Wahl |

|

|

|

Chief Financial Officer |

|

|

|

(Principal Financial Officer) |