UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ______

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based on the closing sale price of $89.49 on June 30, 2021, was approximately $

As of February 10, 2022, there were approximately

SYNEOS HEALTH, INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2021

|

TABLE OF CONTENTS |

||

|

|

Page |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

||

|

|

|

|

|

Item 1A. |

||

|

|

|

|

|

Item 1B. |

||

|

|

|

|

|

Item 2. |

||

|

|

|

|

|

Item 3. |

||

|

|

|

|

|

Item 4. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

||

|

|

|

|

|

Item 6. |

||

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

|

|

|

Item 7A. |

||

|

|

|

|

|

Item 8. |

||

|

|

|

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

|

|

|

|

|

Item 9A. |

||

|

|

|

|

|

Item 9B. |

||

|

|

|

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

||

|

|

|

|

|

Item 11. |

||

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

|

|

|

|

|

|

Item 14. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

||

|

|

|

|

|

Item 16. |

||

|

|

|

|

|

|

||

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Such forward-looking statements reflect, among other things, our business plans and strategy, market trends, beliefs regarding our competitive strengths, current expectations, future capital expenditures, and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such, including our business strategy, the future impact of the COVID-19 pandemic on our business, financial results, and financial condition, and planned capital expenditures. Without limiting the foregoing, the words “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “would,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors” in this Annual Report on Form 10-K. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information.

As used in this report, the terms “Syneos Health, Inc.,” “Company,” “we,” “us,” and “our” mean Syneos Health, Inc. and its subsidiaries unless the context indicates otherwise.

3

Summary of Principal Risk Factors

We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control. In evaluating our company, you should consider carefully the summary risks and uncertainties described below together with the other information included in this Annual Report on Form 10-K, including our consolidated financial statements and related notes included in Part II, Item 8, “Financial Statements and Supplementary Data” in this Annual Report on Form 10-K. The occurrence of any of the following risks may materially and adversely affect our business, financial condition, results of operations and future prospects.

|

|

• |

The COVID-19 pandemic and associated economic repercussions have adversely impacted our business and results of operations, and are expected to continue to do so. |

|

|

• |

If we do not generate a large number of new business awards, or if new business awards are delayed, terminated, reduced in scope, or fail to go to contract, our business, financial condition, results of operations, or cash flows may be materially adversely affected. |

|

|

• |

Our backlog might not be indicative of our future revenues, and we might not realize all of the anticipated future revenue reflected in our backlog. |

|

|

• |

If we underprice our contracts, overrun our cost estimates, or fail to receive approval for or experience delays in documentation of change orders, our business, financial condition, results of operations, or cash flows may be materially adversely affected. |

|

|

• |

Our business depends on the continued effectiveness and availability of our information systems, including the information systems we use to provide services to our customers and to store employee data, and failures of these systems, including cyber-attacks, may materially limit our operations or have an adverse effect on our reputation. |

|

|

• |

Our customer or therapeutic area concentration may have a material adverse effect on our business, financial condition, results of operations or cash flows. |

|

|

• |

Our business is subject to international economic, political and other risks that could have a material adverse effect on our business, financial condition, results of operations, cash flows or reputation. |

|

|

• |

Governmental authorities may question our intercompany transfer pricing policies or change their laws in a manner that could increase our effective tax rate or otherwise harm our business. |

|

|

• |

If we are unable to successfully increase our market share, our ability to grow our business and execute our growth strategies could be materially adversely affected. |

|

|

• |

Upgrading the information systems that support our operating processes and evolving the technology platform for our services pose risks to our business. |

|

|

• |

The operation of our early phase (Phase I and IIA) clinical facilities and the services we provide there as well as our clinical trial management, including direct interaction with clinical trial patients or volunteers, and our mobile research nursing clinical trial services, could create potential liability that may adversely affect our business, financial condition, results of operations, cash flows, and reputation. |

|

|

• |

If we are unable to attract suitable principal investigators and recruit and enroll patients for clinical trials, our clinical development business might suffer. |

|

|

• |

Our business could result in liability to us if a drug causes harm to a patient. While we are generally indemnified and insured against such risks, we may still suffer financial losses. |

4

|

|

• |

If we lose the services of key personnel or are unable to recruit experienced personnel, our business, financial condition, results of operations, cash flows, or reputation could be materially adversely affected. |

|

|

• |

Our acquisition strategy may present additional risks, including the risk that we may be unable to fully realize the competitive and operating synergies projected to be achieved through any specific acquisition. |

|

|

• |

Our relationships with existing or potential customers who are in competition with each other may adversely impact the degree to which other customers or potential customers use our services, which may adversely affect our business, financial condition, results of operations, or cash flows. |

|

|

• |

We face risks arising from the restructuring of our operations, which could adversely affect our financial condition, results of operations, cash flows, or business reputation. |

|

|

• |

We operate in many different jurisdictions and we could be adversely affected by violations of the Foreign Corrupt Practices Act, U.K. Bribery Act of 2010, and/or similar worldwide anti-corruption and anti-bribery laws. |

|

|

• |

The failure of third parties to provide us critical support services could adversely affect our business, financial condition, results of operations, cash flows, or reputation. |

|

|

• |

The biopharmaceutical services industry is highly competitive and our business could be materially impacted if we do not compete effectively. Outsourcing trends in the biopharmaceutical industry and changes in aggregate spending and research and development budgets could adversely affect our operating results and growth rate. |

|

|

• |

Actions by government regulators or customers to limit a prescription’s scope or withdraw an approved product from the market could adversely affect our business, results of operations, and financial condition. |

|

|

• |

If we fail to comply with federal, state, and foreign healthcare laws, including fraud and abuse laws, we could face substantial penalties and our business, financial condition, results of operations, cash flows, and prospects could be adversely affected. |

|

|

• |

We may be affected by healthcare reform and potential additional reforms which may adversely impact the biopharmaceutical industry and reduce the need for our services or negatively impact our profitability. |

|

|

• |

Current and proposed laws and regulations regarding the protection of personal data could result in increased risks of liability or increased cost to us or could limit our service offerings. |

|

|

• |

Our customers face intense competition from lower cost generic products and other competing products, which may lower the amount that they spend on our services and could have a material adverse effect on our business, results of operations, cash flows, and financial condition. |

|

|

• |

Our substantial debt could adversely affect our financial condition and cash flows from operations. Despite our level of indebtedness, we are able to incur more debt and undertake additional obligations. Incurring such debt or undertaking such additional obligations could further exacerbate the risks to our financial condition. |

|

|

• |

Interest rate fluctuations or foreign currency exchange rate fluctuations may have a material adverse effect on our business, financial condition, results of operations, or cash flows. |

|

|

• |

Our internal control over financial reporting is required to meet all the standards of Section 404 of Sarbanes-Oxley, and failure to achieve and maintain effective internal controls over financial reporting could have a material adverse effect on our stock price, reputation, business, financial condition, results of operations and cash flows. |

5

PART I

Item 1. Business.

Overview

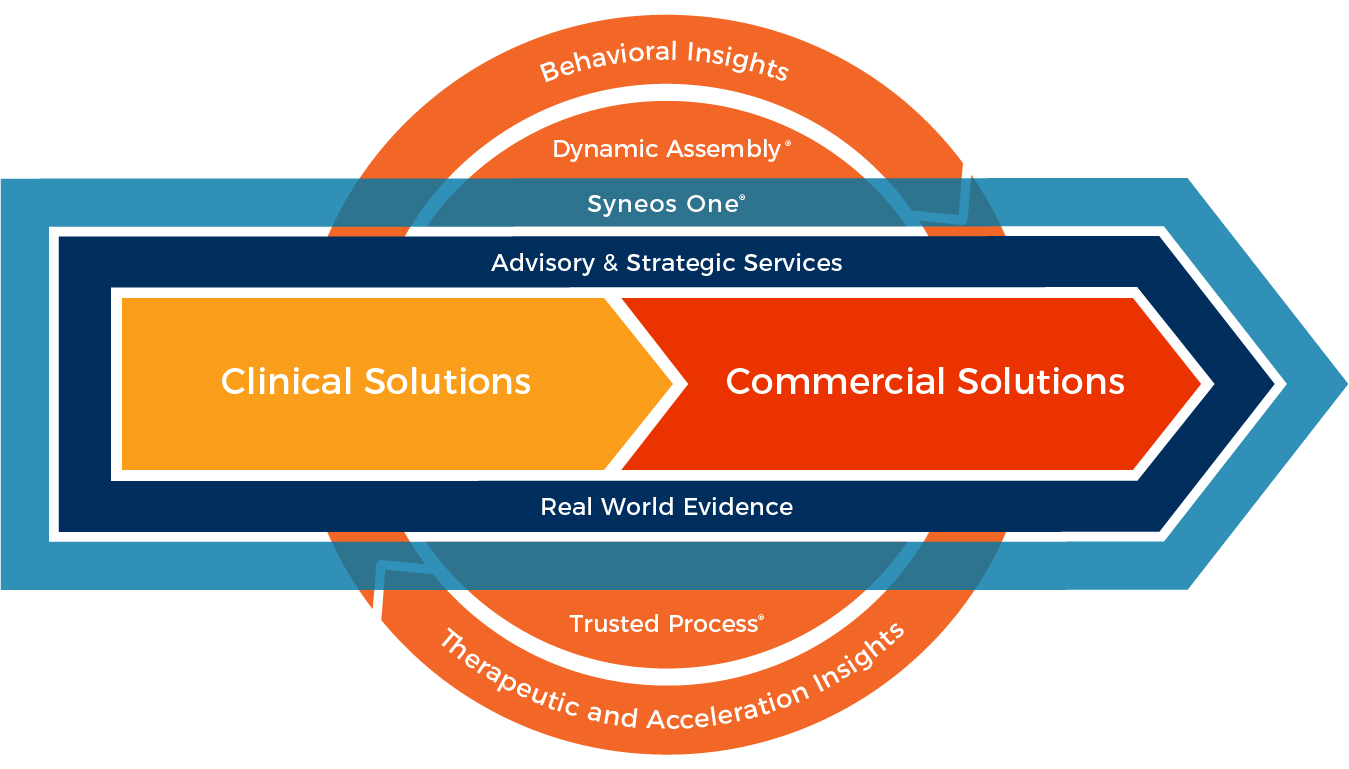

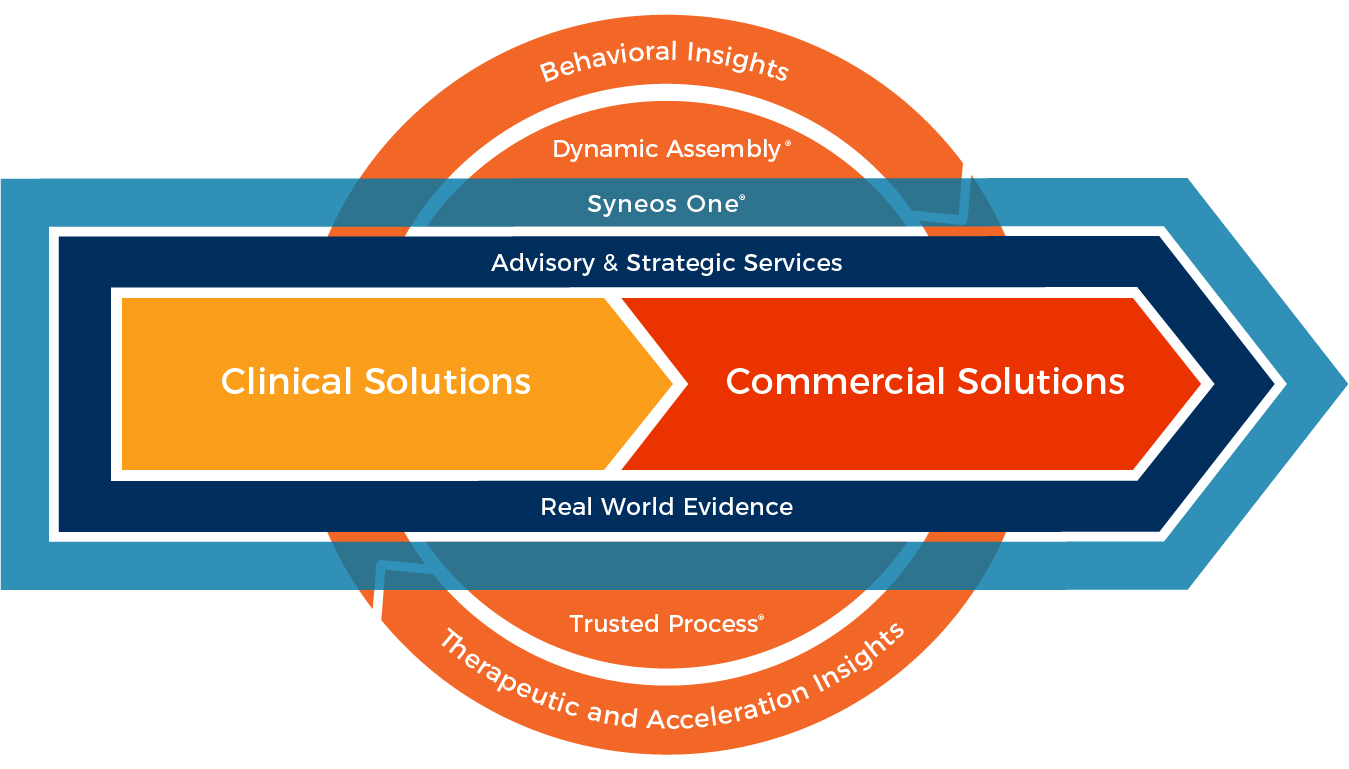

We are the only fully integrated biopharmaceutical solutions organization purpose-built to accelerate customer success. We lead with a product development mindset, strategically blending clinical development, medical affairs and commercial capabilities to address modern market realities for customers in the pharmaceutical, biotechnology, and healthcare industries. We offer both stand-alone and integrated biopharmaceutical product development solutions ranging from early phase (Phase I) clinical trials to the full commercialization of biopharmaceutical products, with the goal of increasing the likelihood of regulatory approval and commercial success while accelerating our customers’ delivery to patients in need worldwide.

We bring a deep understanding of patient and physician behaviors and market dynamics. Together we share insights, use the latest technologies, and apply advanced business practices to speed our customers’ delivery of important therapies to patients.

Our operations are divided into two reportable segments, Clinical Solutions and Commercial Solutions. Our Clinical Solutions segment offers comprehensive global services for the development of diagnostics, drugs, biologics, devices, and digital therapeutics that span Phase I to IV of clinical development. The segment is organized around clinical pharmacology and bioanalytical services, workforce deployment, full-service clinical studies, real world evidence, and consulting. This segment offers individual services including product development and regulatory consulting, project management, protocol development, investigational site recruitment, clinical monitoring, technology-enabled patient recruitment and engagement, clinical home health services, clinical trial diversity, biometrics, and regulatory affairs; all across a comprehensive range of therapeutic areas. Our Commercial Solutions segment provides commercialization services, including deployment solutions, communication solutions (public relations, advertising, and medical communications), and consulting services. We integrate our clinical and commercial capabilities into customized solutions by sharing knowledge, data, and insights. This collaboration across the development and commercialization continuum facilitates unique insights into patient populations, therapeutic environments, product timelines, and the competitive landscape.

Founded more than three decades ago as an academic organization dedicated to central nervous system (“CNS”) research, we have translated that knowledge into a global organization with deep expertise across a wide range of therapeutic specialties, as well as full data services and regulatory advisory and implementation support capabilities. Over the past decade, we have built our scale and capabilities to become a leading global provider of Phase I to Phase IV clinical development services, as well as a full range of commercialization and other complementary services. We were established as INC Research in 1998, and our corporate headquarters are located in Morrisville, North Carolina. INC Research Holdings, Inc. was incorporated in Delaware in August 2010. We changed our name to Syneos Health, Inc. after our 2017 merger (the “Merger”) with Double Eagle Parent, Inc. (“inVentiv”), the parent company of inVentiv Health, Inc.

COVID-19 Pandemic

The ongoing COVID-19 pandemic and associated economic repercussions have significantly impacted, and are expected to continue to impact, our business and our operations. With the spread of COVID-19 variants, the ongoing impacts of the COVID-19 pandemic could adversely impact our business and results of operations. See Part I, Item 1A, “Risk Factors” in this Annual Report on Form 10-K for further discussion of the potential continued impact of the pandemic on our business.

6

Our Market

The market for our solutions is primarily the biopharmaceutical industry that utilizes outsourced clinical drug and medical device development and commercialization services. We believe we are well-positioned to benefit from the following market trends:

Trends in clinical drug and medical device development. Biopharmaceutical companies continue to prioritize the outsourcing of Phase I to Phase IV clinical trials to contract research organizations (“CROs”). Several biopharmaceutical industry trends are increasing demand for outsourced research and development services from CROs:

|

|

• |

Large biopharmaceutical companies (top 50 by prior year research and development (“R&D”) expenditure) rely on CRO relationships in order to remain flexible and efficient as they seek to reduce costs and accelerate development timelines, particularly in complex therapeutic areas such as oncology. |

|

|

• |

Small and mid-sized biopharmaceutical companies typically have limited infrastructure and resources, making them more likely to outsource their clinical development. While biotechnology funding in 2021 was lighter than the peak experienced in 2020, the funding environment remains robust relative to historical levels. As a result of this increased funding, emerging biotechnology companies represent a high growth customer segment opportunity within the market. |

|

|

• |

Phase IV/post-approval/real world evidence represents an increasing area of spending across all customer segments. |

We believe that, based on industry sources and management estimates, the Phase I – IV clinical development market for CRO services will grow at a compound average annual rate of 6% to 8% through 2023, driven by a combination of research and development budget increases and further outsourcing spend. We estimate the total addressable clinical development market to be approximately $105 billion, of which $50 billion was outsourced to CROs in 2021.

Trends in commercialization outsourcing. We believe that, based on industry sources and management estimates, the market for biopharmaceutical commercial outsourcing will grow at a compound average growth rate of approximately 3% to 5% through 2023. We believe this potential growth is supported by: (i) significant biopharmaceutical sales and marketing budgets; (ii) a continuing shift toward specialty and more complex therapies requiring more complex and integrated sales and marketing execution; (iii) a robust funding environment, which provides capital to fuel development and commercialization spending, particularly for small to mid-sized companies; (iv) the strength of new drug approvals by the U.S. Food and Drug Administration (“FDA”) in recent years; (v) continued political scrutiny of pharmaceutical pricing, which is intensifying pressure for our customers to further reduce fixed costs by outsourcing; and (vi) an evolving industry landscape illustrated by a shift to more strategic relationships, particularly where economies of scale can reduce costs.

Increasingly challenging clinical development and commercialization environment. The biopharmaceutical industry is currently facing a number of challenges, including: (i) margin deterioration; (ii) reimbursement and provider access hurdles; (iii) fewer blockbuster and high profitability drugs; (iv) continued pressure from generic brand exposure; and (v) the consolidation of payers, healthcare systems, providers, and pharmacies. These challenges also make it more complicated to engage physicians and patients, making new product launches more difficult. At the same time, the industry is experiencing growing demand for specialty drugs, pressure to improve R&D productivity, the transition of the healthcare industry worldwide from a volume-based to a value-based reimbursement structure, and growing political and pricing pressures. Existing approaches to address these challenges include reducing overhead costs,

7

optimizing the deployment of marketing and field assets, and refocusing product portfolios around therapeutic areas with depth of presence and expanded market access capabilities.

Optimization of biopharmaceutical R&D efficiency. Market forces and healthcare reform, including the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, the 21st Century Cures Act, and other governmental initiatives, place significant pressure on biopharmaceutical companies to improve cost efficiencies. At the same time, the complexity, size, duration, and globalization of clinical trials has increased drug development costs. In an effort to reduce these rising costs, biopharmaceutical companies need to demonstrate a new therapy’s relative improvement in quality, safety, and effectiveness compared to the current standard of care as early as possible in the development process. Outsourcing to CROs allows biopharmaceutical companies to deploy capital more efficiently, quickly benefiting from the CROs’ existing infrastructure and therapeutic expertise without having to continuously scale in-house development resources.

Globalization of clinical trials. Clinical trials have become increasingly global as biopharmaceutical companies seek to accelerate patient recruitment, particularly within protocol-eligible, treatment-naïve patient populations without co-morbidities that could skew clinical outcomes. Biopharmaceutical companies are also increasingly seeking to expand the commercial potential of their products by applying for regulatory approvals in multiple countries, including fast-growing economies that are spending more on healthcare. As part of the biopharmaceutical approval process in newer markets, especially in certain Asian and emerging markets, regulators now often require clinical trials to include specific percentages or numbers of people from local populations, resulting in a combination of multinational and domestic clinical trials.

Management of increasingly complex clinical trials. The biopharmaceutical industry operates in an increasingly sophisticated and highly regulated environment and has responded to the demands of novel therapeutics by adapting efficient drug development processes. Complex clinical trial design expertise has emerged as a significant competitive advantage for select CROs that have a track record of successfully navigating country-specific regulatory, clinical trial protocol, and patient enrollment barriers, including sometimes subjective, evolving clinical endpoints. In addition, the therapeutic areas where we have significant experience and expertise, including neuroscience, hematology/oncology, and other complex disease areas, often require more complicated protocols than other disease indications. Many of these studies have longer durations due to these factors, resulting in demand for greater clinical trial proficiency and expertise in these therapeutic areas, particularly in light of new methods such as the use of biomarkers, gene therapy, and digital therapeutics.

Evolving commercialization outsourcing needs for large versus small to mid-sized biopharmaceutical companies. The needs of large versus small to mid-sized customers are evolving differently based upon their distinct infrastructure and corporate commercialization goals. Large biopharmaceutical companies tend to have robust internal resources and generally are seeking to augment these resources with individual outsourced services on a brand-by-brand basis. Frequently, they are also looking to establish enterprise vendor relationships with volume considerations to support broader cost savings initiatives. Conversely, small to mid-sized biopharmaceutical companies typically have limited product portfolios with fewer internal resources and less commercialization experience. As a result, these companies generally require the full spectrum of commercialization capabilities, what we call full-service commercial solutions. Historically, their only viable commercialization option was to enter into licensing agreements or a divestiture, which often meant surrendering a significant portion of an asset’s long-term economic value. However, with today’s funding environment driving sufficient capital for product launch, we believe these companies are becoming more receptive to commercialization alternatives that allow them to maintain their independence.

8

Rapid adoption of remote technology-enabled platforms. Accelerated by the COVID-19 pandemic, we have observed a significant increase in the adoption of remote and digital solutions to facilitate continued healthcare delivery to patients and support to healthcare providers (“HCPs”) for our customers’ products. Technology-enabled, insights-powered site- and patient-centric solutions that have been on the rise include risk-based and remote monitoring, home health, and virtual personal and non-personal outreach to medical facilities and clinics. In light of these trends, we have continued to invest in our Decentralized Solutions and Kinetic capabilities. Decentralized Solutions are designed to speed clinical trial data collection, ease site and patient burden, expand available patient populations, and improve patient diversity. Kinetic is designed to digitally enhance our Commercial Solutions by synchronizing customer engagement across multiple personal and digital channels to provide real-time performance data and intelligence. In addition to investing in our current technologies, we invested in new technology and data capabilities in 2021 through our acquisitions of StudyKIK Corporation (“StudyKIK”) and RxDataScience, Inc. (“RxDataScience”). StudyKIK expands our portfolio of patient-direct, technology-enabled solutions while RxDataScience helps biopharmaceutical customers solve challenging problems through advanced analytics, data management, and artificial intelligence. As adoption of remote technology-enabled platforms increases over the longer term, we believe these capabilities provide an opportunity for improved efficiencies that could help to offset the potential revenue impact from reduced travel and other reimbursable expenses, while improving access to clinical trials and the health of patients worldwide.

Our Competitive Strengths

Our key competitive strengths are:

Differentiated positioning through our full suite of clinical and commercial services. We believe our customers are facing an increasingly complex and evolving market where regulatory approval no longer guarantees a successful product launch. To address this modern market reality, we believe that clinical development and commercial disciplines must work together to accelerate the delivery of differentiated therapies to the market that meet the needs of patients, healthcare professionals, and payers. As the only company with in-house capabilities to provide a full suite of integrated clinical development and commercial solutions, we believe we are well-positioned to successfully navigate this increasingly complex and evolving market for our customers.

Global leadership and experience in biopharmaceutical outsourcing. We believe our scale, global reach, and breadth of services, coupled with our deep industry expertise and experience, are critical to our customers who are seeking to consolidate their outsourcing to a smaller set of large global providers. We offer our services through a highly skilled staff of more than 28,000 employees and contingent workers located in more than 60 countries as of December 31, 2021, and have conducted work in more than 110 countries. In addition, over the last five years, more than 94% of all new molecular entities approved by the U.S. Food and Drug Administration (“FDA”) and 95% of the products granted marketing authorization by the European Medicines Agency (“EMA”) have been developed or commercialized with our support.

Syneos One® represents a unique offering in the market. Our Syneos One® offering coordinates integrated solutions across the full clinical development and commercialization continuum. This offering provides our small to mid-sized customers with an economic alternative to divesting, out-licensing, or co-promoting assets, and provides our large biopharmaceutical customers with further opportunity to reduce their fixed-cost infrastructure, and an alternative approach to developing and promoting their non-core assets. We believe this offering represents a unique capability in the market that can reduce program risk and optimize clinical development timelines, while maximizing return on investment.

9

Proprietary Methodology – the Trusted Process®. Since 2006, we have used the Trusted Process® to standardize our delivery methodology in the conduct of clinical trials, which increases our service delivery predictability, accelerates median clinical study start-up time on new projects, and reduces operational risk. We have recently evolved the Trusted Process to reflect the “product development mindset” that biopharmaceutical customers are increasingly expecting from a service provider and to provide our customers an operational strategy best designed to maximize their research and development investments.

Our dedicated Operations Management function defines, maintains, improves, and ensures consistent application of the Trusted Process® across our global footprint. In addition, it contributes to the absolute reduction of cycle times in critical path milestones, providing greater operating efficiency, more predictable project schedules, and a reduction in overall delivery timelines. Our metrics-driven Trusted Process® methodology is divided into four phases:

|

|

• |

PlanActivation® – the design phase, where the objectives are analyzed utilizing our therapeutic and technical subject matter experience to develop a quality-driven strategy for success; |

|

|

• |

QuickStart® – the engineering phase, which serves to align the team to the strategy, create shared expectations, and develop a joint execution plan; |

|

|

• |

ProgramAccelerate® – the execution and control phase, where we proactively manage conduct. Data is used to ensure timelines, risks, issues, and quality are actively managed while maintaining positive relationships with all stakeholders; and |

|

|

• |

QualityFinish® – the closing phase, where we develop a closeout plan that accounts for the remaining deliverables and provision of actionable data and/or the final product. |

While initially developed to better manage clinical trial complexity, the Trusted Process® is also actively deployed in our early phase, real world and late phase (“RWLP”), functional service provider (“FSP” or “FSP360”), Global Client Solutions, and Syneos One® offerings. Additionally, it is being adapted and deployed as warranted within our commercial service portfolio to further drive efficiency, consistency, and quality in our integrated operations.

Functional Service Provider Model. Our FSP360 model provides flexible resourcing solutions in the areas of biostatistics and programming, data management, drug safety and pharmacovigilance, study start-up, medical writing, clinical monitoring, trial master file support, and site and investigator payments. Our model includes a comprehensive plan designed to ensure both speed and quality for operations, relationship management, communication, quality and risk mitigation, and internal processes and tools. We collaborate extensively across functional teams to ensure customer needs are appropriately identified and supported.

Adding value across the biopharmaceutical product life cycle. We believe our ability to utilize our broad experience, data assets, and information technology assets across our full suite of services uniquely positions us to provide solutions that help biopharmaceutical customers optimize execution and reduce costs throughout the product development life cycle using the following capabilities:

|

|

• |

Superior clinical trial design: We believe our expanding clinical and commercial knowledge and our access to electronic medical records and claims data allows us to expedite the completion of clinical trials without sacrificing quality, improving the probability of regulatory approval, and subsequent commercial success. |

10

|

|

• |

Enhanced site selection and patient recruitment: We utilize our data assets, behavioral insights, social media, communications capabilities, and our expanded portfolio of patient-direct, technology-enabled solutions to enhance the speed and success of site selection and patient recruitment. These capabilities provide additional value with effective patient engagement, particularly for compliance with protocol requirements, and long-term patient retention. |

|

|

• |

Proactive pre-launch reimbursement and formulary management: We bridge the gap between clinical development and commercialization by using insights derived from our diverse capabilities and ability to communicate clinical benefits to payers and Pharmacy Benefit Managers (“PBMs”) to help optimize reimbursement and patient access. |

|

|

• |

Effective commercial product launch capabilities: We help our customers navigate the global complexities of launching a product by orchestrating interconnected work streams to develop and execute an effective product launch strategy that incorporates current therapeutic insights and market realities. |

|

|

• |

Full-service commercial: We enable companies to develop, launch, and commercially support their brands by accessing our comprehensive solutions, and acting as their virtual commercialization infrastructure. In 2021, approximately 33% of our commercialization customers purchased services from more than one of our commercialization services offerings. These customers represented approximately 88% of our Commercial Solutions revenue in 2021. |

|

|

• |

Efficient project ramp-up: We scale clinical or commercial projects rapidly and effectively through our recruiting, training, and deployment capabilities, leveraging our dedicated recruiting personnel and our proprietary database of approximately 1.1 million industry professionals. |

Harmonizing diverse data via Dynamic Assembly® to create “asset customized” insights. Our strategic, capital-efficient approach to data and technology, Dynamic Assembly®, allows us to quickly address the nuances of each customer challenge from their clinical trial protocol through to their commercial product launch. Our open, source-agnostic and flexible architecture focuses on integrating quality data with the insights and best practices we have established during our decades of developing and commercializing biopharmaceutical products. We have access to significant data assets from a diverse number of sources including a variety of third-party data and technology providers, as well as our clinical and commercial operations. Our recent acquisitions of StudyKIK and RxDataScience are intended to deliver new technology-enabled, data-driven insights to customers, helping to improve access to and diversity in clinical trials. Together, our acquisitions and partnerships with best-of-breed providers for Dynamic Assembly are helping customers harmonize multiple data types and sources, both structured and unstructured, creating new “asset-customized” data aimed at achieving deeper patient behavioral learnings and insights.

Agile, insights-driven virtual/digital solutions. We believe our innovative digital solutions, underpinned by our unique combination of therapeutic and behavioral insights, position us to address the evolving market dynamics in which our customers operate. These solutions include:

|

|

• |

Decentralized Solutions is our clinical model that allows for configurable, decentralized trials using a patient-centric approach supported by Dynamic Assembly to move beyond traditional trial design. We partner with best of breed technology and data providers, including some of our own – and leverage our clinical and commercial insights, therapeutic expertise, and knowledge of the site and patient communities – to design solutions that best fit the needs of a particular customer and protocol. |

11

|

|

• |

Technology-enabled solutions. These solutions help to drive increased performance in areas like clinical trial diversity, clinical trial protocol insights, decentralized clinical trials, real world evidence generation, and omnichannel analytics. For example, Kinetic is designed to optimize HCP engagement and accelerate patient referrals into clinical trials through advanced targeting and digital capabilities. Kinetic is our modern customer engagement capability that integrates intelligence to accelerate impact and optimize commercial performance of customer brands. This omnichannel capability enables our field teams to transition to virtual and hybrid teams, while overlaying new digital capabilities. As adoption of telehealth and digital channels increases, a greater number of siloed and uncoordinated channels are touching HCPs. This leads to reduced effectiveness of commercial programs. Kinetic addresses this challenge by deploying advanced targeting, analytics, and the latest technologies – powered by a team of data scientists and behavioral experts – to create connected intelligence across channels, platforms, and content. The net result of Kinetic is optimized outcomes for our customers, leveraging the appropriate combination and timing of communications to drive improved brand performance. |

|

|

• |

Therapeutic expertise and organizational alignment. We believe our approach for aligning Clinical Solutions business units therapeutically, particularly local country team alignment of clinical research associates (“CRAs”) by therapeutic area, differentiates us from our competitors and has played a key role in our growth, ability to win new clinical trials, and the successful relationships we have developed with clinical research sites. Our therapeutic expertise is managed by our senior leadership and delivered by our senior scientific and medical staff. Looking ahead, we are strengthening our local country teams for effective employee engagement while maintaining our advantage of therapeutically aligning CRAs. We believe this “global to local” therapeutic approach improves the effectiveness and efficiency of our customers’ clinical trials by ensuring that our clinical staff working at our investigative sites have the therapeutic expertise and experience required to manage clinical trials. We also believe our specialized therapeutic expertise within our Commercial Solutions segment is unique in our industry and is becoming increasingly important to our customers as therapies become more complex and targeted. Our experienced medical and scientific professionals include more than 1,700 employees with M.D.s, Ph.D.s, or Pharm D.s. These employees apply innovative insights and science to clinical trials as well as to the commercialization of products and support customers across both our Clinical Solutions and Commercial Solutions segments. |

Industry-leading principal investigator and clinical research site relationships. We have extensive, often longstanding relationships with principal investigators and clinical research sites. We believe quality site relationships are critical for delivering clinical trial results on time and on budget for our customers. Motivated and engaged investigator sites can facilitate faster patient recruitment, increase retention, maintain safety, ensure compliance with protocols as well as with local and international regulations, and streamline reporting. We have dedicated personnel focused on enhancing clinical research site relationships. We work with these sites in collaborative partnerships to improve cycle times and standardize start-up activities to drive efficiency.

12

Diversified customer base with a growing number of preferred provider relationships. We have a customer base of over 800 customers that includes nearly all of the 50 largest global biopharmaceutical companies (based on annual investment in research and development). Additionally, our customer base is geographically diverse with well-established relationships in the United States (“U.S.”), Europe, and Asia. We have several customers with whom we have achieved “preferred provider” or strategic alliance relationships. We define these customers as relationships from which we generate significant revenue and where we have executed master service agreements in addition to regularly scheduled strategy meetings to discuss the status of our relationship, and for which we serve as a preferred supplier of services. We have also entered into strategic agreements with small to mid-sized (“SMID”) biopharmaceutical companies to develop their full portfolio of products from early clinical development through commercialization. We believe these relationships provide us enhanced opportunities for more business, although they are not a guarantee of future business. Our 2020 acquisition of Synteract further enhanced our leading position for serving customers across the SMID category, diversifying our customer base and expanding support to the high-growth emerging biopharmaceutical segment. We continue to experience strong SMID demand, as evidenced by double-digit growth in our request-for-proposal volumes in 2021 as compared to 2020.

Highly experienced management team with a successful track record of delivering growth. We have a dedicated executive management team with significant experience and knowledge focused on the biopharmaceutical industry. Each member of our leadership team has 15 years or more of experience, including experience with biopharmaceutical companies, payers, healthcare systems, and outsourced services providers. This team has successfully grown our company into a leading biopharmaceutical solutions organization through a combination of organic growth and strategic acquisitions.

Our Business Strategy

Our goal is to increase our market share and improve our market position. We believe our end-to-end product development model, where clinical insights inform commercialization and commercial insights improve clinical trial design and execution, is unique to the industry. The key elements of our business strategy include:

Further penetrate the large pharmaceutical market. We believe one of the largest opportunities to increase our market share and improve our market position is to further penetrate large pharmaceutical companies. Large pharmaceutical companies have increasingly focused on partnering with larger outsourcing vendors that offer a full suite of service capabilities. We have invested in expanding our global scale, breadth of services, and infrastructure to build up our service capabilities for this customer sector.

Continued penetration of the small and mid-sized biopharmaceutical market. We are a leader in the small and mid-sized biopharmaceutical market, which is the fastest growing segment of the market, and we believe there is further opportunity to grow this segment. Our 2020 acquisition of Synteract further enhanced our leading position for serving SMID customers, diversifying our customer base and expanding support to high-growth emerging biopharmaceutical companies. Small and mid-sized biopharmaceutical companies typically have fewer internal resources, less existing infrastructure, and less clinical development and commercialization experience. This customer segment is attracted to our full suite of clinical and commercialization services, our Syneos One® offering, our therapeutic expertise and organizational alignment down to the CRA level, and our Trusted Process® operating model.

13

Bring differentiated solutions to the market and increase cross-selling opportunities. We believe we are uniquely positioned to address our customers’ evolving needs as the only fully integrated provider of a full suite of services across the product development continuum. Our breadth of services enables us to provide customized solutions designed to successfully accelerate the time to market for our customers’ clinical or commercial projects. We believe sharing commercial insights during the early phases of clinical trials can lead to better informed decisions around clinical trial design and strategies. Similarly, we believe our therapeutic and clinical trial expertise can lead to improved decisions about regulatory and payer approvals, market access, reimbursement and formulary inclusion, field team development, and other steps that are critical to the commercial success of our customers.

We believe that we have substantial opportunities to expand the reach of services that we provide to our existing customers. Given our past success in expanding the scope of services provided to current customers, we intend to further expand our business with our existing customers by cross-selling additional clinical and commercial services.

Strengthen our geographic footprint. We have developed a global platform with a presence in all of the major biopharmaceutical markets and intend to further expand our business outside of the U.S., targeting regions where we are underpenetrated and that offer significant growth opportunities. We have expanded our capabilities, existing relationships, and local regulatory knowledge, which we believe will continue to position us well for new customer wins in a wide array of markets. We have added geographic reach through both acquisitions and organic growth in areas such as Asia-Pacific, Latin America, the Middle East and Africa, and Europe, which we believe is critical to obtaining business awards from large and mid-sized biopharmaceutical companies. We may also selectively identify and acquire complementary businesses to enhance our services, capabilities, and geographic presence.

Capitalize on industry trends favoring outsourcing. Our Clinical Solutions and Commercial Solutions segments are benefiting from specific industry trends that are expected to drive attractive growth rates. Global demand for biopharmaceutical products continues to increase, driven by expanding access to healthcare, increasing life expectancy, and the growing prevalence of chronic conditions in both developed and emerging markets. However, higher costs and increased complexity are driving our customers to seek efficiency and expertise through outsourcing services. We believe outsourcing both clinical development and commercialization services optimizes returns on invested R&D for biopharmaceutical companies. Further, as business models continue to evolve in the healthcare sector, we believe that the rate of commercial outsourcing may follow a similar long-term path as that of the clinical development market.

Drive acceleration of commercial outsourcing with our Syneos One® offering. We believe regulatory approval is only the first step towards a successful outcome, as our customers cannot earn a positive economic return for their asset until they achieve significant adoption in the commercial marketplace. We believe our Syneos One® offering is uniquely positioned to determine the appropriate mix of clinical and commercial solutions to help customers optimize the development process of their products and maximize the return on their investment. In addition, Syneos One® enables multiple selling points along the operational timeline of product development. The need for a full suite of product development services is particularly strong with our small to mid-sized customers in the near-term, given their increased access to funding to bring a product to the market coupled with their limited internal resources. Large biopharmaceutical companies may represent a long-term opportunity if market pressures to reduce fixed-cost infrastructures further intensify. Given our strong relationships in both customer segments and our breadth of services, including our focus on Medical Affairs, we believe we are well positioned to capitalize on the needs of both customer types.

14

Meet demand for comprehensive commercialization solutions. Customer preference and the complexity of product development in the modern market is creating increasing demand for a full-service experience for commercial customers. We believe a move to more integrated outsourcing will drive future growth and further diversify our revenue and backlog. This full-service model creates a collaborative relationship, allowing for solutions that incorporate data and insights to drive patient-centric approaches. This combination helps achieve the customer’s goal of maximizing product performance while diversifying our Commercial portfolio, which we believe can drive more predictable revenue.

Successfully acquire and integrate companies and evaluate and pursue other strategic initiatives to augment our organic growth. As part of our ongoing business strategy, we regularly evaluate new opportunities for growth through strategic initiatives, including potential acquisitions, investments, dispositions, or other transformative transactions.

We closed the following strategic acquisitions during 2021:

|

|

• |

StudyKIK, a leading clinical trial recruitment and retention company, expanding our portfolio of patient-direct, technology-enabled solutions. StudyKIK supports patient recruitment, patient retention, eConsent Solutions, Telemedicine Video Calling, and study companion mobile applications to expedite clinical trials, which we believe will result in benefits to customers including accelerated patient enrollment and retention, extensive patient population-based insights, improved site, sponsor, and physician experiences, and reduced patient burden. |

|

|

• |

RxDataScience, a specialist organization that helps biopharmaceutical customers solve challenging problems through advanced analytics, data management, and artificial intelligence. RxDataScience is well aligned to our lab to life model offering advanced analytic solutions across the entire product development spectrum from clinical through commercial. |

Over the past decade, we have developed a systematic approach for integrating strategic and tuck-in acquisitions. These acquisitions have enabled us to provide fully integrated clinical and commercial solutions and expand our global service offerings while also allowing us to achieve significant synergies and cost reductions. We intend to continue evaluating selective strategic growth opportunities that we believe will enhance our services offerings and geographic presence and thereby create value for our shareholders.

Continue to enhance our Trusted Process® methodology to deliver superior outcomes. We intend to continue the development and enhancement of our Trusted Process® methodology, which has delivered measurable, beneficial results for our customers and provides actionable data that can expedite drug development decisions. While originally developed through years of experience and refinement in our Clinical Solutions segment, we are proactively evaluating opportunities to also deploy the Trusted Process® within our RWLP, FSP360 and Syneos One® offerings and is being adapted and deployed as warranted across our commercial service portfolio to further drive efficiency, consistency, and quality in our integrated operations. We believe our Trusted Process® will continue to lead to high levels of customer satisfaction, particularly as we evolve to a product life cycle operating model.

15

Our Services

We provide services through two reportable segments: Clinical Solutions and Commercial Solutions. Each reportable segment provides multiple service offerings that – when combined through the sharing of critical insights and data – creates a fully-integrated biopharmaceutical outsourced services provider. Our Clinical Solutions segment offers a variety of clinical development services spanning Phase I to Phase IV, including full-service global studies, unbundled service offerings, and real world evidence studies. Our Commercial Solutions segment provides customers with the full range of commercialization solutions, which include specialized field teams, communications solutions (advertising, public relations, and medical communications), and consulting services.

Clinical Solutions

Our extensive range of clinical solutions supports the entire clinical development process from Phase I to Phase IV and allows us to offer our customers an integrated suite of investigative site support and clinical development services. We offer these services across a wide variety of therapeutic areas with deep clinical expertise for Phase I to Phase IV clinical trials. We have particular strengths in the complex therapeutic areas such as neuroscience and hematology/oncology with the latter representing the largest and fastest growing therapeutic area. We provide total biopharmaceutical program development through our full-service platform, while also providing discrete services for any part of a trial, primarily through our FSP360 group. The combination of service area experts and the depth of clinical capability allows for enhanced protocol design and actionable clinical trial data. Importantly, all of our services in Clinical Solutions operate with the discipline of the Trusted Process®. Our comprehensive suite of clinical development services and delivery platforms includes:

16

Full-service Clinical Development

Our full-service clinical development offering provides comprehensive solutions to address the clinical development needs of our customers for Phase I to Phase IV clinical trials. Our solutions can be delivered on a full-service project basis, on a functional or resource basis (see FSP360 below), or through a hybrid approach depending on the needs of our customers. We are able to customize our services to provide customers support within an individual clinical study, a single function, multiple functions within a single therapeutic area, or across a customer’s entire product portfolio. Our comprehensive suite of clinical development services includes the following, among others:

|

|

• |

Patient Recruitment and Retention. Our patient recruitment services group helps identify and manage appropriate vendors, focuses on patient recruitment and retention strategies by utilizing our patient-direct, technology-enabled solutions, and acts as a liaison to media outlets and other vendors. These services also provide significant value for patient engagement and long-term retention throughout the conduct of a trial. |

|

|

• |

Site Start-Up. Our site start-up team helps maximize the enrollment period of the study by arranging applicable regulatory authority and ethics committee approvals, site contract negotiations, regulatory authority submissions, and the corresponding oversight of those activities. |

|

|

• |

Project Management. Our project managers and directors provide customer-focused leadership in managing clinical trials and are accountable for the successful execution of all assigned projects, where success includes on-time, on-budget, and high quality results that lead to satisfied customers. Project managers and directors have the skills, education, experience, and training to support the successful conduct of clinical trials. |

|

|

• |

Clinical Monitoring. Our CRAs oversee the conduct of a clinical trial by working with and monitoring clinical research sites to ensure the quality of the clinical data being gathered by the sites. The clinical monitor ensures the clinical trial is conducted according to Good Clinical Practice (“GCP”), International Conference on Harmonisation (“ICH”) guidelines, and local regulations, to meet the customers’ and regulatory authorities’ requirements according to the study protocol. CRAs engage with clinical research sites in site initiation, training, and patient recruitment. We deploy and manage CRAs in all regions of the globe. |

|

|

• |

Decentralized Solutions. The COVID-19 pandemic has accelerated the adoption of remote engagement with sites and patients, creating increased demand for decentralized solutions capabilities, including the provision of mobile research nursing clinical trial services. This is an area we invested in both before and during the pandemic, allowing us to quickly respond to demand. Our approach brings together our experts, data, process, and technology to create fit-for-purpose solutions to address the nuances of each study. This approach delivers on our goal of achieving decentralized clinical trial operations supporting sites and patients, focused on patient recruitment and retention, engagement, improved access, and patient diversity. |

|

|

• |

Drug Safety/Pharmacovigilance. Our drug safety teams are strategically located across the U.S., Europe, Latin America, and Asia-Pacific. We provide global drug safety expertise in all phases of clinical research for serious adverse event/adverse event collection, evaluation, classification, reporting, reconciliation, post-marketing safety, and pharmacovigilance. |

17

|

|

• |

Quality Assurance. Quality control steps are built into all of our processes. We have an independent quality assurance department that, in addition to conducting independent audits of all ongoing projects and processes as part of our internal quality assurance program, offers quality assurance services to customers, including audits of clinical research sites and of various vendors to the clinical research industry, mock regulatory inspections and clinical research site inspection-readiness training, standard operating procedure development, and quality assurance program development/consultation. |

|

|

• |

Regulatory and Medical Writing. We offer regulatory and medical writing expertise across the entire biopharmaceutical product life cycle. Our team has hands-on regulatory and medical writing knowledge gained through experience from working in large biopharmaceutical companies, as well as high-growth, small and mid-sized biopharmaceutical companies, CROs, and the FDA. Additionally, each member is trained in FDA regulations, including GCP/standard operating practice compliance guidelines and guidelines established by the ICH. |

|

|

• |

Clinical Data Management. Our clinical data management services allow us to confirm that the clinical trial database is ready, accurately populated, and locked in an expeditious manner, with verification and validation procedures throughout every phase of a clinical trial. This processing is done in synchronization with the clinical team, utilizing the information provided from the clinical trial to help ensure efficient processes are employed, regardless of the data collection method used. |

|

|

• |

Electronic Data Capture. To compete in today’s changing global drug and device development environment, companies must collect and distribute data faster than ever. We have the ability to manage electronic data capture (“EDC”) systems and processes to help our customers take advantage of the efficiencies available through EDC, which include improved access to data, reduced cycle time, increased productivity, and improved relationships with customers, vendors, and other parties. |

|

|

• |

Biostatistics. Our biostatistics team has a depth of experience with the FDA and EMA that allows our teams to provide customers with guidance on building a statistical plan to meet regulatory and safety requirements as well as a careful analysis of the resulting study data. In addition, we provide support for independent drug safety monitoring boards and a full range of related services. Our biostatisticians are also heavily involved in our Trusted Process® methodology, so that protocol and project development can be grounded in advanced statistical methodology. As part of a project team, our biostatisticians can provide data oversight throughout a clinical trial and address any data or data handling issues that may arise. |

FSP360

Our FSP360 offering helps sponsors review their approach to key functional areas of clinical research, specifically those areas not core to their clinical development business or in areas where they need to augment internal resources. We are able to customize our full-service offering to provide customers support within an individual clinical study, a single function, multiple functions within a single therapeutic area, or across a customer’s entire product portfolio. Any of our full-service clinical solutions outlined above can be delivered on an unbundled or functional basis or on a hybrid approach, based on our customers’ specific needs. We currently operate FSP360 hubs in North America, South America, Europe, and Asia.

18

Early Phase

Our early phase offering provides a full range of services for Phase I to Phase IIA clinical trial conduct, bioanalytical assay development and analysis, targeted translational science offerings, and clinical pharmacology services, including modeling and simulation. We also provide validation and sample analysis services from pre-clinical development through post-marketing support and purpose-built early phase biometrics support from North America and India. We conduct clinical trial studies at our facilities located in Quebec City, Canada, and Miami, Florida. We have extensive experience in first-in-human, proof-of concept, bioequivalence and bioavailability, biosimilars, and clinical pharmacology study conduct. We collaborate with leading hospitals for the conduct of early development and clinical pharmacology studies that require access to patients. We have a large base of available subjects, including patient populations with specific medical conditions, and healthy volunteers, which provide efficient and rapid patient recruitment. Furthermore, we can also provide early stage and clinical pharmacology studies through our Asia-Pacific Catalyst Model with Phase I to Phase IIA conduct capabilities in Australia, New Zealand, South Korea, and Japan.

Our two bioanalytical laboratories located in Quebec City, Canada and Princeton, New Jersey have extensive experience in method development, validation, and bioanalytical analysis support for both small molecule therapeutics and biologics using a variety of analytical techniques and instrumentation platforms, as well as the provision of critical reagents handling services for biologics.

Real World Evidence and Late Phase Services

Our RWLP group conducts studies to understand how a treatment, service, or method of delivering care works when applied in real world, clinical practice environments. Because real world evidence (“RWE”) provides both clinical and commercial benefits, adding value for customers across the product life cycle, our end-to-end model position allows us to uniquely provide value to our customers in this space.

The market for these services is increasing as regulatory changes are encouraging the use of RWE and payers are demanding these outcomes. Customers are using RWE to supplement clinical efficacy and safety data, to build a value story and in designing and implementing a successful commercialization strategy. RWE shows relatively low levels of outsourcing penetration, offering a growth opportunity for us.

We provide both consultative and operational expertise to our customers in real world data generation, from concept through core development, launch, and commercialization. This is informed by our Dynamic Assembly platform, which allows us to expand our data access and analytic capabilities, enhancing our ability to help customers demonstrate product value. By utilizing our successful drug life cycle management, we ensure we partner with our customers to gain better outcomes for patients, physicians, payers, and regulators. These services allow our customers to make timely and cost-effective advances in clinical treatment by providing data about actual experience of doctors and patients outside of the regulated environment of clinical development. The data and insights from our experience across the commercialization spectrum inform the design and conduct of these studies. Our services include patient registries, surveillance and observational studies, patient/health outcomes research, and economic studies.

Commercial Solutions

Our Commercial Solutions segment provides a broad suite of complementary commercialization services including specialized field teams, communications solutions (advertising, public relations, and medical communications), and consulting services. Additionally, these capabilities provide behavioral and patient insights used by our Clinical Solutions segment to design smarter clinical trials and to accelerate patient recruitment. Our comprehensive capabilities portfolio also allows us to provide full-service commercialization. This integrated approach allows us to maximize product or portfolio performance for customers, by sharing insights and expertise across the integrated commercial outsourcing team.

19

These services are enhanced by our Kinetic offering, our modern customer engagement capability. We use an intelligent and data-enabled approach to digitally enhance our Commercial Solutions by understanding the audiences for our customers’ products, synchronizing their experiences across multiple personal and digital channels and decoding the performance of these interactions to adapt in real-time.

Deployment Solutions

Deployment Solutions include field-based promotional and market access solutions, field-based clinical solutions, inside sales and contact center, insight and strategy design, patient support services, training, talent sourcing, and end-to-end sales operations. We provide contract field promotion teams with a broad array of capabilities, support services, and non-personal engagement solutions including tele-detailing and electronic detailing (“e-detailing”). Our field-based promotional teams are supported by recruiting and training capabilities, clinical and scientific professionals who advocate for and inform markets of novel therapies, and our customized patient behavioral models built on our proprietary insights and data-driven analytics. Services offered include market research, commercial analytics, managed markets access, biotechnology and specialty managed markets, and full-service commercialization. Our field promotion teams can be supported by our communications and consulting services.

|

|

• |

Value Access and Medical Teams. We are a leading provider of outsourced Value Access and Medical Team solutions to the biopharmaceutical industry. Our Teams – consisting of Field Reimbursement and Market Access Specialists, Medical Science Liaisons (“MSLs”), Contract US Medical Directors, and/or Nurse Educators – educate healthcare professionals, patients, advocacy organizations, and others with evidence-based scientific and practical information about disease states, current treatments, reimbursement, access, and the use of customers’ products. |

|

|

• |

Promotional Field Teams and Support. We are an industry leader in providing scalable capabilities to recruit, train, target, deploy, and support successful biopharmaceutical sales teams. As one of the largest providers of outsourced sales teams and sales solutions to the healthcare industry, we have well-established flexible processes and infrastructure to efficiently build, scale, deploy, execute, and retain high-performing field sales teams. |

|

|

• |

Commercial Recruiting Solutions. We are a market leading recruiting partner to the commercial life science industry based on our experience, branding capabilities, talent assessment process, and our proprietary talent database of the top MSL, Nurse Educator, Sales, Sales Management, and Market Access performers. |

|

|

• |

Training and Learning Solutions. We are a full-service provider of practical, high-impact training solutions that combine assessment, instructional design expertise, delivery services, interactive technologies, and deep subject matter expertise to assist customers globally in achieving business results. |

|

|

• |

Operations Support Services. We offer comprehensive, best-in-class operations support services that include field automation hardware/software, data management, targeting and alignment, analytics and reporting, incentive plan design and implementation, quality management, and help desk. These capabilities are used both individually and collectively to ensure that our deployed field teams perform optimally, respond rapidly to changing marketplace dynamics, and continuously improve. |

|

|

• |

Digital Enhancement. Our Deployment Solutions offerings leverage Kinetic to enhance established relationships. The relationships between HCPs and our field representatives remain central to the customer experience. However, Kinetic allows us to create virtually-enabled representatives, especially important for continuity during the pandemic, while overlaying new digital capabilities to optimize brand performance. |

20

Communications Services

Our healthcare focused communications services offering provides advertising, public relations, interactive digital strategies, branding and identity consulting services, and medical communications and education services. These services are scalable, as we can support product commercialization both domestically and internationally. Communications services are deployed throughout a product’s existence, beginning well before commercial launch, encompassing regulatory approval and market introduction, and continuing throughout the life of a product.

|

|

• |

Healthcare Advertising. We are one of the largest independent global communications groups in the world. Our advertising teams are immersed in healthcare data and connected to frontline experts who help them delve deeply into the real-life experience of healthcare, harvesting insights to create optimal communications strategies. We help our customers navigate the most critical challenges in healthcare, including, but not limited to, brand launch, utilization of mass and personalized media, advertising content creation and campaigns, patient analysis, disease state campaigns, and market perception analysis. Our advertising teams have deep therapeutic expertise, with agencies solely dedicated to oncology, chronic disease care and activation, biologics, and industry innovation. |

|

|

• |

Public Relations. Our Public Relations teams develop creative campaigns grounded in deep customer insight and integrated under a multi-channel strategy. These programs raise awareness and produce meaningful, measurable behavior change among audiences. With a diverse set of healthcare communications specialties under one umbrella, we deliver integrated advice and expert insight from a variety of strategic perspectives. We offer best-in-class capabilities spanning public relations, digital and social media, medical and scientific education, and research and analytics. Our teams create communications that enhance brand perception, drive engagement, and activate behavior shifts. |

|

|

• |

Medical Communications. Medical Communications helps our customers to frame their product position in a way that clinicians will find relevant, and creates strategies, campaigns, and tactics to help these stakeholders at the right time, with the right content. Our Medical Communications team provides support through strategic planning, publication planning, content development, and peer-to-peer education. |

Consulting Services

Our consulting services support critical decision points during a biopharmaceutical product’s life cycle, from licensing, to product and portfolio strategy development, to drug commercialization. Consulting services include commercial strategy development and planning, pricing and market access, medical affairs advisory, quality management and regulatory advisory, and risk and program management. We offer specialized practices in business development, managed markets, and brand management, including strategic product launch planning. Consulting services teams generate insights and solutions developed from their deep, functional knowledge of our customers’ core business. These services are centered on maximizing the commercial value of a client’s product pipeline, helping clinical leaders better deploy strategic resources, improve efficiency, and enhance the effectiveness of marketing and sales activities. Our overall consulting services capabilities include the following:

|

|

• |

Commercial Strategy Development and Planning. Our strategic consulting group offers advisory services that include strategic drug development, clinical development plans, registration strategies, exit strategies, transitional clarity, good clinical practice compliance strategies, clinical operations optimization, pricing and reimbursement, and due diligence. |

21

|

|

• |

Pricing and Market Access. Our team offers a full spectrum of market access solutions and services, including market assessment and analysis, comparative effectiveness research, pricing reimbursement, patient assistance services, and legislative and regulatory analysis. |

|

|

• |

Medical Affairs Advisory. Our Medical Affairs Advisory team assesses where customers are in their medical transformation by helping them identify their competitive position, prioritize their needs, understand their brand perception, and inform their market engagement strategy. |

|

|

• |

Quality Management and Regulatory Compliance Advisory. Our quality and compliance team delivers independent quality management services through audit, inspection, and implementation services, and assists our customers with developing and executing a clinical regulatory strategy through our Regulatory Content and Submission Management Services. |

|

|

• |