0001601046false2022FY11http://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpense00016010462021-11-012022-10-3100016010462022-04-30iso4217:USD00016010462022-12-12xbrli:shares0001601046us-gaap:ProductMember2021-11-012022-10-310001601046us-gaap:ProductMember2020-11-012021-10-310001601046us-gaap:ProductMember2019-11-012020-10-310001601046us-gaap:ServiceOtherMember2021-11-012022-10-310001601046us-gaap:ServiceOtherMember2020-11-012021-10-310001601046us-gaap:ServiceOtherMember2019-11-012020-10-3100016010462020-11-012021-10-3100016010462019-11-012020-10-31iso4217:USDxbrli:shares00016010462022-10-3100016010462021-10-3100016010462020-10-3100016010462019-10-310001601046us-gaap:CommonStockMember2019-10-310001601046us-gaap:AdditionalPaidInCapitalMember2019-10-310001601046us-gaap:TreasuryStockMember2019-10-310001601046us-gaap:RetainedEarningsMember2019-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-10-310001601046us-gaap:RetainedEarningsMember2019-11-012020-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-11-012020-10-310001601046us-gaap:CommonStockMember2019-11-012020-10-310001601046us-gaap:AdditionalPaidInCapitalMember2019-11-012020-10-310001601046us-gaap:TreasuryStockMember2019-11-012020-10-310001601046us-gaap:CommonStockMember2020-10-310001601046us-gaap:AdditionalPaidInCapitalMember2020-10-310001601046us-gaap:TreasuryStockMember2020-10-310001601046us-gaap:RetainedEarningsMember2020-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-10-310001601046us-gaap:RetainedEarningsMember2020-11-012021-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-11-012021-10-310001601046us-gaap:CommonStockMember2020-11-012021-10-310001601046us-gaap:AdditionalPaidInCapitalMember2020-11-012021-10-310001601046us-gaap:TreasuryStockMember2020-11-012021-10-310001601046us-gaap:CommonStockMember2021-10-310001601046us-gaap:AdditionalPaidInCapitalMember2021-10-310001601046us-gaap:TreasuryStockMember2021-10-310001601046us-gaap:RetainedEarningsMember2021-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-310001601046us-gaap:RetainedEarningsMember2021-11-012022-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-11-012022-10-310001601046us-gaap:CommonStockMember2021-11-012022-10-310001601046us-gaap:AdditionalPaidInCapitalMember2021-11-012022-10-310001601046us-gaap:TreasuryStockMember2021-11-012022-10-310001601046us-gaap:CommonStockMember2022-10-310001601046us-gaap:AdditionalPaidInCapitalMember2022-10-310001601046us-gaap:TreasuryStockMember2022-10-310001601046us-gaap:RetainedEarningsMember2022-10-310001601046us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310001601046srt:MinimumMember2021-11-012022-10-310001601046srt:MaximumMember2021-11-012022-10-310001601046us-gaap:InProcessResearchAndDevelopmentMember2019-11-012020-10-310001601046us-gaap:InProcessResearchAndDevelopmentMember2020-11-012021-10-310001601046us-gaap:InProcessResearchAndDevelopmentMember2021-11-012022-10-310001601046us-gaap:NonUsMember2022-10-310001601046us-gaap:AccountsReceivableMember2021-11-012022-10-310001601046us-gaap:AccountsReceivableMember2020-11-012021-10-310001601046us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2021-11-012022-10-310001601046us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2021-11-012022-10-310001601046us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-11-012022-10-310001601046us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2021-11-012022-10-310001601046keys:SanjoleMember2020-11-012021-01-310001601046us-gaap:DevelopedTechnologyRightsMemberkeys:SanjoleMember2020-11-012021-01-310001601046us-gaap:CustomerRelationshipsMemberkeys:SanjoleMember2020-11-012021-01-310001601046us-gaap:InProcessResearchAndDevelopmentMemberkeys:SanjoleMember2020-11-012021-01-310001601046keys:OthersMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AmericasMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AmericasMember2021-11-012022-10-310001601046srt:AmericasMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AmericasMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AmericasMember2020-11-012021-10-310001601046srt:AmericasMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AmericasMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AmericasMember2019-11-012020-10-310001601046srt:AmericasMember2019-11-012020-10-310001601046srt:EuropeMemberkeys:CommunicationsSolutionsGroupMember2021-11-012022-10-310001601046srt:EuropeMemberkeys:ElectronicIndustrialSolutionsGroupMember2021-11-012022-10-310001601046srt:EuropeMember2021-11-012022-10-310001601046srt:EuropeMemberkeys:CommunicationsSolutionsGroupMember2020-11-012021-10-310001601046srt:EuropeMemberkeys:ElectronicIndustrialSolutionsGroupMember2020-11-012021-10-310001601046srt:EuropeMember2020-11-012021-10-310001601046srt:EuropeMemberkeys:CommunicationsSolutionsGroupMember2019-11-012020-10-310001601046srt:EuropeMemberkeys:ElectronicIndustrialSolutionsGroupMember2019-11-012020-10-310001601046srt:EuropeMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AsiaPacificMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AsiaPacificMember2021-11-012022-10-310001601046srt:AsiaPacificMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AsiaPacificMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AsiaPacificMember2020-11-012021-10-310001601046srt:AsiaPacificMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMembersrt:AsiaPacificMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMembersrt:AsiaPacificMember2019-11-012020-10-310001601046srt:AsiaPacificMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2021-11-012022-10-310001601046keys:AerospacedefensegovernmentMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2020-11-012021-10-310001601046keys:AerospacedefensegovernmentMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:AerospacedefensegovernmentMember2019-11-012020-10-310001601046keys:AerospacedefensegovernmentMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:CommercialcommunicationsMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:CommercialcommunicationsMember2021-11-012022-10-310001601046keys:CommercialcommunicationsMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:CommercialcommunicationsMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:CommercialcommunicationsMember2020-11-012021-10-310001601046keys:CommercialcommunicationsMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:CommercialcommunicationsMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:CommercialcommunicationsMember2019-11-012020-10-310001601046keys:CommercialcommunicationsMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:ElectronicindustrialMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:ElectronicindustrialMember2021-11-012022-10-310001601046keys:ElectronicindustrialMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:ElectronicindustrialMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:ElectronicindustrialMember2020-11-012021-10-310001601046keys:ElectronicindustrialMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMemberkeys:ElectronicindustrialMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberkeys:ElectronicindustrialMember2019-11-012020-10-310001601046keys:ElectronicindustrialMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2021-11-012022-10-310001601046us-gaap:TransferredAtPointInTimeMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2020-11-012021-10-310001601046us-gaap:TransferredAtPointInTimeMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredAtPointInTimeMember2019-11-012020-10-310001601046us-gaap:TransferredAtPointInTimeMember2019-11-012020-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredOverTimeMember2021-11-012022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredOverTimeMember2021-11-012022-10-310001601046us-gaap:TransferredOverTimeMember2021-11-012022-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredOverTimeMember2020-11-012021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredOverTimeMember2020-11-012021-10-310001601046us-gaap:TransferredOverTimeMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMemberus-gaap:TransferredOverTimeMember2019-11-012020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMemberus-gaap:TransferredOverTimeMember2019-11-012020-10-310001601046us-gaap:TransferredOverTimeMember2019-11-012020-10-310001601046us-gaap:TradeAccountsReceivableMember2022-10-310001601046us-gaap:TradeAccountsReceivableMember2021-10-3100016010462022-11-012022-10-31xbrli:pure00016010462023-11-012022-10-3100016010462024-11-012022-10-3100016010462014-07-1600016010462017-11-160001601046us-gaap:CostOfSalesMember2021-11-012022-10-310001601046us-gaap:CostOfSalesMember2020-11-012021-10-310001601046us-gaap:CostOfSalesMember2019-11-012020-10-310001601046us-gaap:ResearchAndDevelopmentExpenseMember2021-11-012022-10-310001601046us-gaap:ResearchAndDevelopmentExpenseMember2020-11-012021-10-310001601046us-gaap:ResearchAndDevelopmentExpenseMember2019-11-012020-10-310001601046us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-11-012022-10-310001601046us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-11-012021-10-310001601046us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-11-012020-10-310001601046keys:LtppMember2021-11-012022-10-310001601046keys:LtppMember2020-11-012021-10-310001601046keys:LtppMember2019-11-012020-10-310001601046us-gaap:DomesticCountryMember2022-10-310001601046us-gaap:StateAndLocalJurisdictionMember2022-10-310001601046us-gaap:DomesticCountryMember2021-11-012022-10-310001601046us-gaap:DomesticCountryMemberkeys:AcquiredentitiesMember2022-10-310001601046us-gaap:StateAndLocalJurisdictionMember2021-11-012022-10-310001601046country:USus-gaap:ResearchMember2022-10-310001601046us-gaap:ResearchMemberstpr:CA2022-10-310001601046us-gaap:ValuationAllowanceTaxCreditCarryforwardMember2022-10-310001601046us-gaap:ForeignCountryMember2022-10-310001601046us-gaap:ForeignCountryMember2021-11-012022-10-310001601046us-gaap:CapitalLossCarryforwardMemberus-gaap:ForeignCountryMember2022-10-310001601046us-gaap:CapitalLossCarryforwardMemberkeys:ForeignentitiesMemberus-gaap:ForeignCountryMember2022-10-310001601046keys:AcquiredentitiesMember2019-11-012020-10-310001601046us-gaap:EmployeeStockOptionMember2019-11-012020-10-310001601046us-gaap:EmployeeStockOptionMember2021-11-012022-10-310001601046us-gaap:EmployeeStockOptionMember2020-11-012021-10-310001601046keys:CommunicationsSolutionsGroupMember2020-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2020-10-310001601046keys:CommunicationsSolutionsGroupMember2021-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2021-10-310001601046keys:CommunicationsSolutionsGroupMember2022-10-310001601046keys:ElectronicIndustrialSolutionsGroupMember2022-10-310001601046us-gaap:DevelopedTechnologyRightsMember2022-10-310001601046us-gaap:DevelopedTechnologyRightsMember2021-10-310001601046us-gaap:OrderOrProductionBacklogMember2022-10-310001601046us-gaap:OrderOrProductionBacklogMember2021-10-310001601046us-gaap:TrademarksMember2022-10-310001601046us-gaap:TrademarksMember2021-10-310001601046us-gaap:CustomerRelationshipsMember2022-10-310001601046us-gaap:CustomerRelationshipsMember2021-10-310001601046us-gaap:FairValueMeasurementsRecurringMember2022-10-310001601046us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-10-310001601046us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-10-310001601046us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046us-gaap:FairValueMeasurementsRecurringMember2021-10-310001601046us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-10-310001601046us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-10-310001601046us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046us-gaap:InterestRateSwapMember2022-10-310001601046us-gaap:InterestRateSwapMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMembercurrency:EURus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMembercurrency:EURus-gaap:LongMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMembercurrency:GBPus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMembercurrency:GBPus-gaap:ShortMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMembercurrency:SGDus-gaap:LongMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMembercurrency:SGDus-gaap:LongMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMembercurrency:MYRus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMembercurrency:MYRus-gaap:LongMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMembercurrency:JPYus-gaap:ShortMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMembercurrency:JPYus-gaap:ShortMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMemberkeys:OtherCurrencyMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMemberkeys:OtherCurrencyMemberus-gaap:ShortMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForwardContractsMemberus-gaap:ShortMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-310001601046us-gaap:CashFlowHedgingMemberkeys:OtherAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:CashFlowHedgingMemberkeys:OtherAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-310001601046us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMember2022-10-310001601046us-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMember2021-10-310001601046us-gaap:NondesignatedMemberkeys:OtherAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2022-10-310001601046us-gaap:NondesignatedMemberkeys:OtherAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:AccumulatedOtherComprehensiveIncomeMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberkeys:DirectexpenseMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberkeys:DirectexpenseMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberkeys:DirectexpenseMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberkeys:AmortizationMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberkeys:AmortizationMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMemberkeys:AmortizationMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:CashFlowHedgingMemberkeys:AmortizationMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-11-012022-10-310001601046us-gaap:CashFlowHedgingMemberkeys:AmortizationMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-11-012021-10-310001601046us-gaap:CashFlowHedgingMemberkeys:AmortizationMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-11-012020-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-11-012022-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-11-012021-10-310001601046us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2019-11-012020-10-310001601046keys:SeniorNotes2024Member2022-10-310001601046keys:SeniorNotes2024Member2021-10-310001601046keys:SeniorNotes2024Member2022-10-310001601046keys:SeniorNotes2024Member2021-10-310001601046keys:SeniorNotes2027MemberMember2022-10-310001601046keys:SeniorNotes2027MemberMember2021-10-310001601046keys:SeniorNotes2027MemberMember2022-10-310001601046keys:SeniorNotes2027MemberMember2021-10-310001601046keys:SeniorNotes2029Member2022-10-310001601046keys:SeniorNotes2029Member2021-10-310001601046keys:SeniorNotes2029Member2022-10-310001601046keys:SeniorNotes2029Member2021-10-310001601046us-gaap:RevolvingCreditFacilityMember2021-11-012022-10-310001601046us-gaap:RevolvingCreditFacilityMember2022-10-310001601046us-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-11-012022-10-310001601046keys:SeniorNotes2024Member2021-11-012022-10-310001601046keys:SeniorNotes2027MemberMember2021-11-012022-10-310001601046keys:SeniorNotes2029Member2021-11-012022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2021-11-012022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2020-11-012021-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2019-11-012020-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-11-012022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-11-012021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-11-012020-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-11-012022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-11-012021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-11-012020-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2020-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2020-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeSecuritiesMemberus-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2022-10-310001601046us-gaap:FixedIncomeSecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2022-10-310001601046us-gaap:FixedIncomeSecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2022-10-310001601046us-gaap:CashMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2022-10-310001601046us-gaap:CashMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:CashandcashequivalentsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:EquityatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:CashandcashequivalentsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:EquityatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:CashandcashequivalentsatNAVMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberkeys:EquityatNAVMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2022-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:CashandcashequivalentsatNAVMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-10-310001601046country:USus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberkeys:EquityatNAVMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-10-310001601046country:USus-gaap:FixedIncomeFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2021-10-310001601046country:USus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-10-310001601046country:USus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046country:USus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberkeys:EquityatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2022-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberkeys:OtherassetsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:EquitySecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberkeys:EquityatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FixedIncomeFundsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberkeys:FixedIncomesecuritiesatNAVMember2021-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:OtherInvestmentsMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:ForeignPlanMemberkeys:OtherassetsatNAVMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-10-310001601046us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberkeys:TotalassetsatNAVMemberus-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-11-012022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-11-012021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2021-11-012022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2021-11-012022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2020-11-012021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2020-11-012021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2022-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MinimumMember2021-10-310001601046us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2021-10-310001601046us-gaap:LandMember2022-10-310001601046us-gaap:LandMember2021-10-310001601046us-gaap:BuildingAndBuildingImprovementsMember2022-10-310001601046us-gaap:BuildingAndBuildingImprovementsMember2021-10-310001601046us-gaap:MachineryAndEquipmentMember2022-10-310001601046us-gaap:MachineryAndEquipmentMember2021-10-3100016010462021-11-180001601046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2020-10-310001601046us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-10-310001601046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-10-310001601046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-11-012021-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-11-012021-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2020-11-012021-10-310001601046us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-11-012021-10-310001601046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-11-012021-10-310001601046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2021-10-310001601046us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-10-310001601046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-10-310001601046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-11-012022-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-11-012022-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2021-11-012022-10-310001601046us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-11-012022-10-310001601046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-11-012022-10-310001601046us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310001601046us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310001601046us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310001601046us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ProductMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMemberus-gaap:ProductMember2020-11-012021-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-11-012021-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-11-012021-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2020-11-012021-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-11-012021-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-11-012022-10-310001601046us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-11-012021-10-310001601046keys:SegmentTotalMember2021-11-012022-10-310001601046keys:SegmentTotalMember2020-11-012021-10-310001601046keys:SegmentTotalMember2019-11-012020-10-310001601046us-gaap:SalesRevenueNetMember2021-11-012022-10-310001601046us-gaap:SalesRevenueNetMember2020-11-012021-10-310001601046us-gaap:SalesRevenueNetMember2019-11-012020-10-310001601046keys:SegmentTotalMember2022-10-310001601046keys:SegmentTotalMember2021-10-310001601046country:US2021-11-012022-10-310001601046country:CN2021-11-012022-10-310001601046keys:RestOfWorldMember2021-11-012022-10-310001601046country:US2020-11-012021-10-310001601046country:CN2020-11-012021-10-310001601046keys:RestOfWorldMember2020-11-012021-10-310001601046country:US2019-11-012020-10-310001601046country:CN2019-11-012020-10-310001601046keys:RestOfWorldMember2019-11-012020-10-310001601046country:US2022-10-310001601046country:JP2022-10-310001601046country:GB2022-10-310001601046keys:RestOfWorldMember2022-10-310001601046country:US2021-10-310001601046country:JP2021-10-310001601046country:GB2021-10-310001601046keys:RestOfWorldMember2021-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-11-012022-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-11-012021-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-10-310001601046us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-11-012020-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

Form 10-K

_____________________________________________________________

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36334

_____________________________________________________________

KEYSIGHT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | | 46-4254555 |

State or other jurisdiction of

Incorporation or organization | | I.R.S. Employer

Identification No. |

Address of principal executive offices: 1400 Fountaingrove Parkway, Santa Rosa, CA 95403

Registrant's telephone number, including area code: (800) 829-4444

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock

par value $0.01 per share | KEYS | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common equity held by non-affiliates as of April 30, 2022 was approximately $20 billion, based upon the closing price of the Registrant's common stock as quoted on New York Stock Exchange on such date. Shares of stock held by officers, directors and 5 percent or more stockholders have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of December 12, 2022, there were 178,795,460 shares of our common stock outstanding.

____________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE | | | | | | | | |

| Document Description | | 10-K Part |

Portions of the Proxy Statement for the Annual Meeting of Stockholders (the "Proxy Statement") to be held on March 16, 2023 and to be filed pursuant to Regulation 14A within 120 days after registrant's fiscal year ended October 31, 2022 are incorporated by reference into Part III of this Report. | | III |

TABLE OF CONTENTS

Forward-Looking Statements

This report contains forward-looking statements including, without limitation, statements regarding trends, seasonality, cyclicality and growth in, and drivers of, the markets we sell into, our strategic direction, earnings from our foreign subsidiaries, remediation activities, new solution and service introductions, the ability of our solutions to meet market needs, changes to our manufacturing processes, the use of contract manufacturers, the impact of local government regulations on our ability to pay vendors or conduct operations, our liquidity position, our ability to generate cash from operations, growth in our businesses, our investments, the potential impact of adopting new accounting pronouncements, our financial results, our purchase commitments, our contributions to our pension plans, the selection of discount rates and recognition of any gains or losses for our benefit plans, our cost-control activities, savings and headcount reduction recognized from our restructuring programs and other cost saving initiatives, and other regulatory approvals, the integration of our completed acquisitions and other transactions, our transition to lower-cost regions, the existence of political or economic instability, impacts of geopolitical tension and conflict in regions outside of the U.S., including the war between Russia and Ukraine and the risk of increased tensions between China and Taiwan, the impact of increased trade tension and tightening of export control regulations, the impact of compliance with the August 3, 2021 Consent Agreement with the Directorate of Defense Trade Controls, Bureau of Political-Military Affairs, Department of State, the impact of new and ongoing litigation, inflationary pressures, continued impacts to the supply chain, impacts related to endemic and pandemic conditions, impacts related to net zero emissions commitments, the impact of volatile weather caused by environmental conditions such as climate change, increases in attrition and our ability to retain key personnel, and our estimated or anticipated future results of operations, which involve risks and uncertainties. Our actual results could differ materially from the results contemplated by these forward-looking statements due to various factors, including but not limited to those risks and uncertainties discussed in Part 1 Item 1A and elsewhere in this Form 10-K.

PART I

Item 1. Business

Overview

Keysight Technologies, Inc. ("we," "us," "Keysight" or the "company"), incorporated in Delaware on December 6, 2013, is a technology company that helps enterprises, service providers and governments accelerate innovation to connect and secure the world by providing electronic design and test solutions that are used in the simulation, design, validation, manufacture, installation, optimization and secure operation of electronics systems in the communications, networking and electronics industries. We also offer customization, consulting and optimization services throughout the customer's product development lifecycle, including start-up assistance, asset management, up-time services, application services and instrument calibration and repair.

We generated $5.4 billion, $4.9 billion and $4.2 billion of revenue in 2022, 2021 and 2020, respectively. Revenue, income from operations and assets by business segment as of and for the fiscal years ended October 31, 2022, 2021, and 2020, are provided in Note 16, "Segment Information," to our consolidated financial statements. We had more than 18,000 direct customers for our solutions and services in 2022 and over 30,000 customers globally, including indirect channels. No single customer represented 10 percent or more of our revenue.

Strategies

With a focus on electronic design, test and optimization, we deliver market-leading solutions across a wide range of industries, including commercial communications; networking; aerospace, defense and government; automotive; energy; semiconductor; general electronics; and education. Our software and hardware solutions support our customers' design and test challenges across the entire product lifecycle and help accelerate their time to market. We provide simulation, prototype development and validation solutions for research and development ("R&D"), high-volume manufacturing test solutions, as well as handheld and other solutions for operational test and optimization, including user experience in the field. Our objective is to increase the productivity of our customers. Keysight's solutions utilize a common portfolio of market-leading software and hardware technologies along with a suite of valued-added services. This broad portfolio of solutions enables our customers to efficiently develop and deploy their products to address the most rapidly evolving new technologies and market opportunities. The following section represents our significant strategies and the key underlying initiatives:

•Keysight Software Solutions - Expanding our software offerings to meet customer needs and increase recurring revenue

Keysight's software solutions can be characterized in the following three categories:

◦Instrument software applications. Instrument software applications are designed to optimize the value that our customers derive from our instruments by providing faster insight and analytics through a combined hardware and software application solution. This solution includes core software used to run our instruments and related applications that are pre-installed on our instruments.

◦Software application solutions. Software applications unify multiple instruments into industry-specific solutions to provide faster time to insight across industries, technologies and lifecycle phases. Examples include solutions for 5G and 6G communications, autonomous and electric vehicles, defense modernization, Internet of Things ("IoT"), Open Radio Access Network ("ORAN") and quantum computing.

◦Standalone software. Our standalone software solutions enable customers to accelerate their digital design and test workflows and address their design, simulation, emulation, automation, and quality assurance needs in the R&D lab and beyond. These solutions are built on our open and scalable Pathwave software platform and enable our customers to translate virtual designs into real products. Our software test automation platform uses artificial intelligence and machine learnings ("AI/ML") to accelerate customer productivity in software test creation and execution.

•Providing complete solutions with services

◦The breadth of our service offerings enables Keysight to provide customers with complete solutions that incorporate both leading product capabilities with services and support. We have expanded and deepened our service offerings, beyond a strong foundation of calibration and repair to include customization, consulting and optimization services. Support offerings, such as KeysightCare, asset optimization, technology refresh and other value-added services enable us to provide complete customer solutions across a broad set of communications and electronics markets, technologies and industries.

•Investing early to achieve first-to-market solutions

◦Wireless communication measurement solutions.We are investing in the development of new wireless communications design and test solutions to satisfy the commercial communications end market and provide the industry with new capabilities for development of next-generation devices, as well as wireless and wireline networks. Our technical breadth combined with our engagement with market-leading customers has enabled our development of leading-edge and first-to-market solutions in 5G and virtual network applications, such as ORAN. We continue to make strategic investments to support the delivery of a comprehensive, innovative 5G portfolio.

◦6G solution development. Keysight has been investing in solutions and technology for the academic, commercial, and government research communities, who are exploring a wide breadth of technologies required to address another new generation of wireless capabilities. The expansion of large-scale commercial wireless technologies into healthcare, transportation, finance, manufacturing, and agriculture is expected to drive investment in new technologies in radio and satellite systems, new networking technologies, and the pervasive use of artificial intelligence. Keysight is well positioned to be a preferred strategic partner with leading innovative solutions driving the long-term path to 6G.

◦Automotive design and measurement solutions. We are investing in the development of new automotive test solutions to address the rapidly emerging electric, hybrid electric, connected and autonomous vehicle segments. In recent years, we have introduced new design and test solutions covering vehicle intelligence, radar scene emulation, connectivity, power and security, including the first-to-market integrated vehicle-to-everything ("V2X") solution for 4G/5G networks with integrated traffic scenario testing, Advanced Driver Assistance Systems ("ADAS") and an Autonomous Drive Emulation ("ADE") platform that enables real sensor data streaming to a decision-making computer. The Automotive Cybersecurity Program validates the resiliency of connected components of a vehicle. In addition, Keysight delivers extensive security validations of the 4G/5G radio access network (RAN) infrastructure that connects vehicles with back-end data centers. We also deliver application-optimized, customer-specific test solutions for the development and production of charging technology and infrastructure, energy storage, battery management systems, inverters and DC/DC converters. Keysight’s innovative solutions focus on the entire value chain of electric vehicles from battery formation through manufacturing and operations.

◦Network applications. Keysight's market-leading network test solutions provide network equipment manufacturers and service providers with critical capability for testing next-generation network technologies. We continue to invest to

provide first-to-market solutions to meet the needs of our customers in this rapidly evolving market as network speeds and complexity increase with virtualization and software control. Our network visibility solutions allow enterprises and service providers to optimize their network operations by efficiently providing network visibility for enhanced performance and security. We are investing to bring this powerful capability to a broad range of increasingly software-driven environments, such as data centers and the cloud. Together, these solutions enable network and data center operators to continuously update their networks to deliver higher levels of performance, improve quality of service, and enhance network security, necessitated by the rapid growth of high-speed, connected devices and applications.

◦Network transformation solutions. Market drivers are leading to a transformation of both wireless and wired network technologies. In particular, the low-latency and high-bandwidth requirements of 5G are impacting network capabilities. We are making investments to enable the next generation of networks and beyond. We provide both wireless and wired network communications design and test solutions that address all seven layers of the communications stack. In addition, these solutions address customer needs across the entire communications ecosystem, from chipsets to devices to network access and then into the core network, data centers and the cloud.

Strengths

Our electronic measurement business originated in Silicon Valley in 1939. Our legacy encompasses more than 80 years of innovation, measurement science expertise and deep customer relationships. We conduct business annually with over 30,000 customers globally, including many Fortune 1000 companies that are developing new electronic technologies, networks, systems, devices and components. The following strengths are significant:

•Industry-focused organization structure to support customer success. Our industry-focused organization structure enables customer alignment and allows us to partner closely with market leaders to enable new technologies and provide first-to-market solutions for emerging applications. Our solution-centric industry groups provide end-to-end design, test and optimization solutions driven by customer specifications and timetables. Keysight is viewed as a trusted adviser and partner across multiple industries.

•Technology leadership as a competitive differentiator. Proprietary software and hardware technologies unavailable in the commercial market and developed by our R&D technology centers around the world enable many Keysight products to deliver the best design and measurement solution capability available for our customers’ engineering requirements. Some of Keysight’s hardware technologies are designed and manufactured in our own in-house integrated circuit fabrication facilities, which were purpose-built and optimized to deliver leading-edge performance and capabilities across the broad portfolio of Keysight instruments. This differentiation enables Keysight to be recognized as a leader in seven core measurement platforms: radio-frequency ("RF") and microwave design simulation software, network test, network analyzers, oscilloscopes, signal analyzers, signal sources and network emulation solutions. Keysight’s technology leadership supports our strategy to deliver first-to-market solutions for our customers, which in turn enables them to be first to market with their products and gain a competitive advantage.

•Broad portfolio of solutions and products to address customer needs. Keysight has a broad portfolio of electronic design and test solutions and products, which we continue to expand. Our hardware product portfolio spans many technologies and price points. Products are available in various physical form factors, such as benchtop instruments, handheld units, custom or industry-standard modular formats, and others. We address time and frequency domain applications with RF, microwave, high-speed digital and general instrumentation. We also address network test, visibility and security applications. In addition, we have a broad portfolio of software solutions and products to enable our customers' success, including electronic design automation ("EDA") software for RF and high-speed digital design, software tools for programming, automation, and data analysis, and a broad range of application-specific software for our instruments, many of which leverage our open and scalable Pathwave software platform. Finally, we offer an expanding set of services and support delivered under our KeysightCare offering.

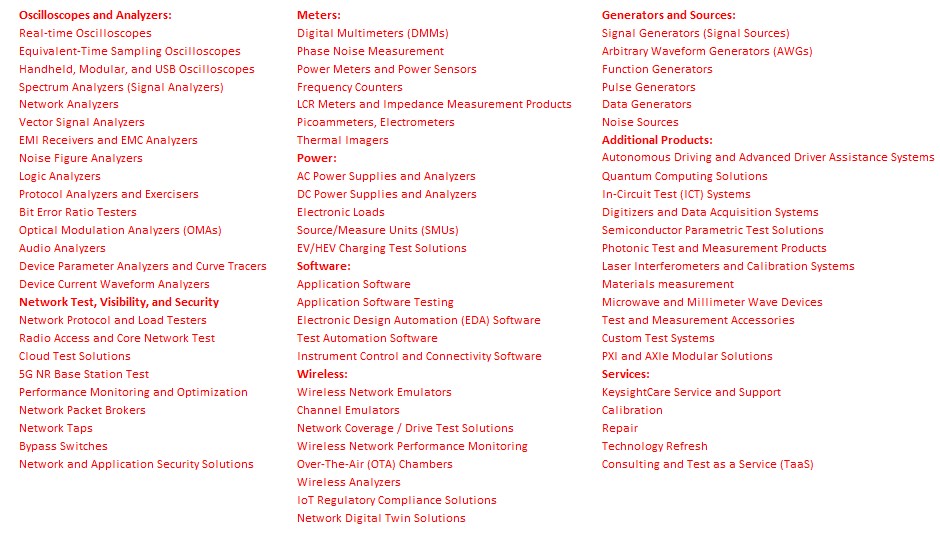

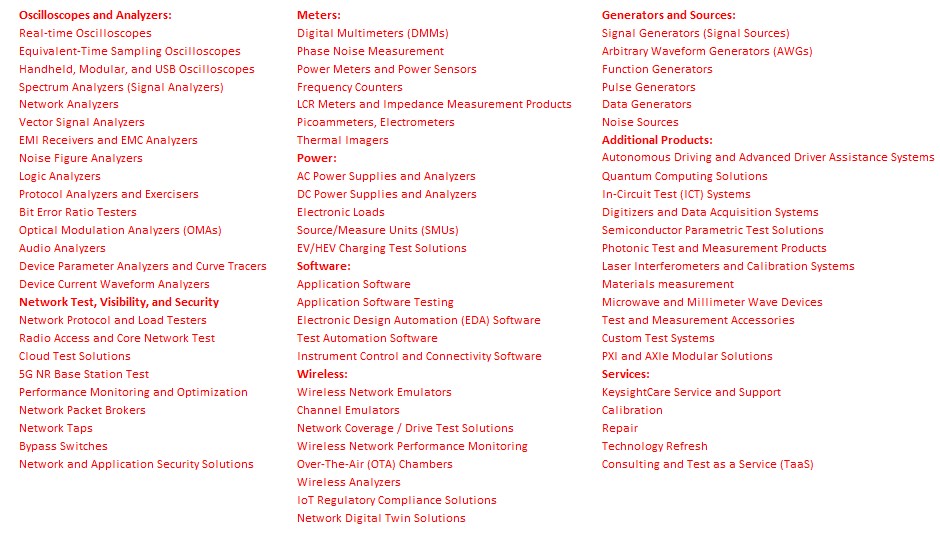

Our broad portfolio of solutions and products includes, among others, the following:

•Industry-leading commitment to product quality and reliability. Keysight has a reputation in the industry for high-quality and high-reliability electronic measurement instrumentation and software. Ensuring quality and reliability is an integral part of our new product development processes.

•Global sales channel and reach. We have a comprehensive global sales channel with experienced management teams and highly technical sales and application engineers, including a strong local presence in emerging markets. As part of our sales channel strategy, we have more than doubled our direct sales force over the past six years. This global direct channel is focused on addressing the needs of our customers by selling Keysight products, systems, solutions and services. A part of this direct sales channel is focused on subscription software and services, which add value to our customers' design workflows and create recurring revenue for Keysight. Approximately 80 percent of our business comes from customer interactions with our direct sales organization. In countries with low sales volumes, sales are made through various representatives and channel and distribution partners. To ensure broad geographic coverage and drive further growth, we maintain a network of over 800 channel partners and an e-commerce platform to complement our direct sales force and extend the digital buying experience for our customers. The combination of our direct and indirect channels contribute to new customer acquisition, resulting in the addition of more than 1,900 new customers in 2022.

•Large installed base. The breadth of our solutions portfolio and our long history of producing high-performance and high-quality solutions have resulted in our large worldwide installed base of equipment. This installed base enables a strong and growing services solutions portfolio, which provides a wide range of calibration and repair services on both a per-incident and contract basis, as well as technical support through KeysightCare. It also provides additional sales opportunities as loyal customers refresh or upgrade their equipment.

•Centralized order fulfillment. Our centralized order fulfillment organization allows us to leverage the scale and scope of our business to provide high-quality, market-leading instrument solutions to our customers while generating competitive gross margins. Keysight has a centralized order fulfillment organization that supplies solutions to customers across geographies. Our Penang, Malaysia site is our largest manufacturing facility, with a proven track record of operational excellence, technology capability and quality. We have an established network of suppliers and subcontractors, especially in Asia, that complements our in-house capabilities.

•Flexible business model. Our operating model incorporates a substantial amount of cost structure flexibility with the intent to be materially profitable across a range of economic and market conditions. Our variable compensation programs, sales channel strategy and the outsourced components of our supply chain have been implemented to improve the flexibility of our cost structure.

The Keysight Leadership Model

The Keysight Leadership Model (“KLM”) is the company's framework to continuously deliver value to our customers, stockholders and employees and provides the structure to execute Keysight's strategy. This model encompasses seven interlinked areas of focus that are centered around our customers and include: Customer Success, Market Insight, Capital Allocation, First-to-Market Solutions, Operational Excellence, Employee Growth and Keysight Values.

•Customer Success is the heart of everything we do, embodying our relentless drive to deeply understand our customers challenges and help them achieve positive, sustained outcomes through the application of new insights and the use of Keysight solutions.

•Market Insight is enabled by our deep customer relationships and focuses our product and solution roadmaps, informs our mergers and acquisitions priorities, and factors into our hiring priorities and talent development plans. Our market insight allows us to move with speed and focus delivering first-to-market solutions that enable customers to address their engineering challenges.

•Capital Allocation is how we direct our financial and human capital to business opportunities, projects and processes that align with our strategy to generate financial returns, which create value for the company, shareholders and employees. The threshold for our capital allocation is an expected return on invested capital that is above our cost to procure that capital.

•First-to-Market Solutions is what we strive to deliver to our customers across the industries we serve. By being first-to-market with the right solutions, we enable our customers to also be first-to-market with their products.

•Operational Excellence across all functions is a relentless focus. It allows us to accelerate R&D by developing common technology platforms, maximize margins through cost reductions and supply optimization, implement LEAN+ processes for continuous improvement, and leverage general and administrative spend as the company grows. We believe this focus drives long-term competitive advantage and growth while building customer loyalty.

•Employee Growth is enabled in a diverse, inclusive and respectful work environment, where employees are offered challenging assignments, development opportunities, competitive salaries and a safe workplace. This environment supports employees throughout their careers with the goal of connecting their passions to business results.

•Keysight Values of Speed and Courage, Uncompromising Integrity, High Performance, Social Responsibility and One Keysight foster a dynamic and inspiring environment conducive to collaboration, innovation and experimentation. Our values help us attract and retain top talent and guide how we work with each other and engage with our customers, suppliers and communities.

More information on the KLM can be found at https://about.keysight.com/en/companyinfo/leadership.shtml.

Operating Segments

We have two reportable operating segments, the Communications Solutions Group and the Electronic Industrial Solutions Group.

Communications Solutions Group

The Communications Solutions Group serves customers spanning the worldwide commercial communications and aerospace, defense and government end markets. The group's solutions consist of electronic design and test software, electronic measurement instruments, systems and related services. These solutions are used in the simulation, design, validation, manufacturing, installation and optimization of electronic equipment and networks. This business generated revenue of $3,803 million in 2022, $3,523 million in 2021 and $3,132 million in 2020.

Communications Solutions Group Markets

Our Communications Solutions Group serves the following two markets:

Commercial Communications Market

We market our electronic design and test solutions to chipset providers, network equipment manufacturers (“NEMs”), wireless device providers and component providers within the supply chain for these customers as well as network operators, including communications and hyperscale cloud service providers and enterprises. Growth in mobile data traffic and increasing complexity in semiconductors and components are driving test demand across the communications ecosystem. We provide end-to-end solutions for design and development of mobile chipsets, connected smart sensors/devices (i.e., IoT), wireless base stations, networks, data centers and cloud. Our leading-edge solutions enable and accelerate critical new technology waves, such as 5G and 6G wireless, O-RAN, Wi-Fi 6, 400/800G+ telecom and optical, and PCIe Gen5 high-speed digital. Our ability to design and deliver first-to-market solutions is enabled by our technical expertise, as well as our strategic engagements with market-leading customers across the commercial communications ecosystem.

NEMs and chipset providers design and manufacture products to enable the transmission of voice, data and video traffic. The NEMs’ customers are communications and hyperscale cloud service providers and enterprises that deploy and operate the networks and deliver services, as well as distribute end‑user subscriber devices such as wireless smart phones, tablets and other connected devices. To meet their customers’ demands, NEMs require test and measurement instruments, systems and solutions for the development, production and installation of each optical, electrical and wireless network technology. The chipset providers' customers are device makers who design and manufacture network infrastructure equipment, smartphones, tablets, wearables, IoT, etc. They are also module makers who design and manufacture communication modules with cellular, bluetooth and/or wireless LAN connection capabilities for laptop, cars and other devices. To meet their customers' requirements, device makers and module makers need test and measurement solutions for development, validation, production and regulatory confirmation to cover all supported communication technologies.

Wireless device providers require design and test solutions for the design, development, manufacture and repair of a variety of mobile and connected devices, including both smart phones and tablets. These mobile devices are used for voice, data and video delivery to individuals who connect wirelessly to the service provider’s network. The device manufacturers’ customers are large and small service providers, enterprises and consumers who purchase directly from retailers.

Component providers design, develop and manufacture electronic and optical components and modules used in network equipment and mobile devices. The component providers require test and measurement products to verify that the components and modules interoperate properly and that their performance meets the specifications of their customers.