UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

| ||

|

OR | ||

|

| ||

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

| ||

|

For the fiscal year ended | ||

|

| ||

|

OR | ||

|

| ||

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

| ||

|

OR | ||

|

| ||

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

| ||

Commission file number

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

General Counsel and Compliance Officer

Telephone: +

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31, 2020, the registrant had outstanding

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Accelerated filer ☐ |

Non-accelerated filer ☐ |

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

International Financial Reporting Standards as issued by the |

Other ☐ |

|

International Accounting Standards Board ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

CYBERARK SOFTWARE LTD.

FORM 20-F

ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

INTRODUCTION

In this annual report, the terms “CyberArk,” “we,” “us,” “our” and “the company” refer to CyberArk Software Ltd. and its subsidiaries.

This annual report includes statistical, market and industry data and forecasts, that we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications. Certain estimates and forecasts involve uncertainties and risks and are subject to change based on various factors, including those discussed under the headings “Special Note Regarding Forward-Looking Statements” and “Item 3.D. Risk Factors” in this annual report.

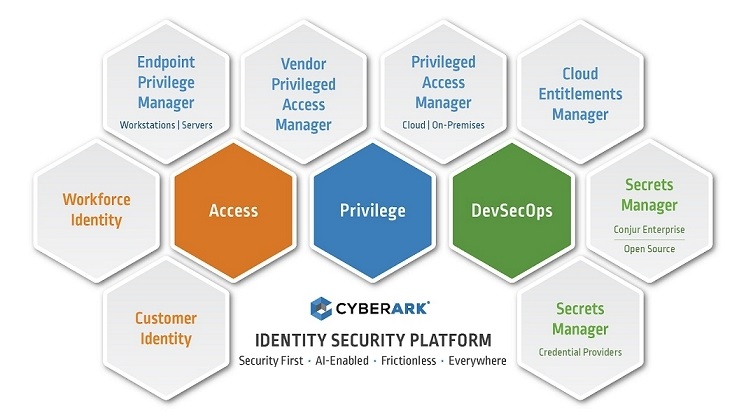

Throughout this annual report, we refer to various trademarks, service marks and trade names that we use in our business. The “CyberArk” design logo is the property of CyberArk Software Ltd. CyberArk® is our registered trademark in the United States and many other countries. We have several other trademarks, service marks and pending applications relating to our solutions. In particular, although we have omitted the “®” and “™” trademark designations in this annual report from each reference to our Privileged Access Security Solution, Enterprise Password Vault, Privileged Session Manager, Privileged Threat Analytics, CyberArk Privilege Cloud, Application Access Manager, Conjur, Endpoint Privilege Manager, On-Demand Privileges Manager, Secure Digital Vault, Web Management Interface, Master Policy Engine and Discovery Engine, CyberArk DNA, Alero, Idaptive, Cloud Entitlements Manager and C3 Alliance, all rights to such names and trademarks are nevertheless reserved. Other trademarks and service marks appearing in this annual report are the property of their respective holders.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts, this annual report contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, or the Securities Act, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, and include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to:

•

changes to the drivers of our growth and our ability to adapt our solutions to IT security market demands;

•

our plan to begin actively transitioning our business to a recurring revenue model in 2021 and our ability to complete the transition in the time frame expected;

•

our sales cycles and multiple pricing and delivery models may cause results to fluctuate;

•

difficulties predicting future financial results, including due to impacts from the COVID-19 pandemic;

•

unanticipated product vulnerabilities or cybersecurity breaches of our or our customers’ systems;

•

our ability to sell into existing and new customers and industry verticals;

•

the ability of our research and development efforts to successfully enhance and develop existing and new products and services;

•

the duration and scope of the COVID-19 pandemic and its impact on global and regional economies and the resulting effect on the demand for our solutions and on our expected revenue growth rates and costs;

•

our ability to hire, retain and motivate qualified personnel;

•

our ability to find, complete, fully integrate or achieve the expected benefits of additional strategic acquisitions;

•

our ability to expand our sales and marketing efforts and expand our channel partnerships across existing and new geographies;

1

•

risks associated with our global sales and operations, such as changes in regulatory requirements or fluctuations in currency exchange rates;

•

our ability to adjust our operations in response to impacts from the COVID-19 pandemic;

•

additional capital expenditures beyond what we currently expect; and

•

any failure to retain our “foreign private issuer” status or the risk that we may be classified, for U.S. federal income tax purposes, as a “passive foreign investment company.”

In addition, you should consider the risks provided under “Item 3.D. Risk Factors” in this annual report.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this annual report, to conform these statements to actual results or to changes in our expectations.

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

A.Selected Financial Data

Not applicable.

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Risks Related to Our Business and Our Industry

The IT security market is rapidly evolving within the increasingly challenging cyber threat landscape. If our solutions fail to adapt to market changes and demands, sales may not continue to grow or may decline.

We offer identity security solutions that safeguard privileged accounts’ credentials and secrets, secure access across both human and non-human identities, and manage entitlements to cloud environments. We operate in a rapidly evolving industry, focused on securing and providing access to organizations’ IT systems and sensitive data.

Accelerated adoption of cloud and Software-as-a-Service (SaaS) and the expansion of remote workforce has led to a proliferation of privileged access in recent years. Breaches of privileged accounts and access have become ubiquitous, yet overall IT security spending is spread across a wide variety of solutions and strategies, including, for example, endpoint, network and cloud security, vulnerability management and identity and access management. Organizations continually evaluate their security priorities and investments and may allocate their IT security budgets to other solutions and strategies and may not adopt or expand use of our solutions. Organizations are also moving portions of their IT systems to be managed by third parties, primarily infrastructure, platform and application service providers, and may rely on such providers’ internal security measures. If customers do not recognize the benefit of our solutions as a critical layer of an effective security strategy, our revenues may decline, which could cause our share price to decrease in value.

2

Security solutions such as ours, which aim to disrupt cyberattacks by insiders and external perpetrators that have penetrated an organization’s IT environment, represent a security layer designed to respond to advanced threats and more rigorous compliance standards and audit requirements. However, advanced cyber attackers are skilled at adapting to new technologies and developing new methods of gaining access to organizations’ sensitive data and technology assets, including those of IT and cybersecurity providers, as demonstrated by the 2020 SolarWinds SUNBURST attack. We expect our customers, and thereby our solutions, to face new and increasingly sophisticated methods of attack, particularly given the increasing complexity of IT and the proliferation of privileged access across identities. We face significant challenges in ensuring that our solutions effectively identify and respond to sophisticated attacks while avoiding disruption to our customers’ IT systems ongoing performance. As a result, we must continually modify and improve our products and services in response to market and technology trends to ensure we are meeting market needs and continue providing valuable solutions that can be deployed in a variety of IT environments, including cloud and hybrid.

We cannot guarantee that we will be able to anticipate future market needs and opportunities or be able to develop or acquire product enhancements or new products or services to meet such needs or opportunities in a timely manner or at all. Even if we are able to anticipate, develop and commercially introduce new products, such as our Cloud Entitlements Manager and our Identity Security offerings, and ongoing enhancements to our existing products, there can be no assurance that such enhancements or new solutions will achieve widespread market acceptance. Delays in developing, completing or delivering new or enhanced solutions could cause our offerings to be less competitive, impair customer acceptance of our solutions and result in delayed or reduced revenue and share price decline.

We are actively transitioning our business to a recurring revenue model. If we fail to successfully manage our licensing and business model transition, including not maintaining existing customers or sufficient renewal rates for maintenance and support and subscriptions, our operating results and share price may be adversely affected.

We began actively transitioning our business to a recurring revenue model in January 2021. Our transition strategy addresses and leverages the significant shifts in the global technology market in 2020, as well as recent years’ changes in IT environments such as the acceleration in the adoption of cloud environments, SaaS applications, software automation tools and DevOps methodologies. Our transition aims at shifting our sales from perpetual licenses to subscriptions, for both SaaS and on-premises offerings. Our strategy requires considerable investments in our go to market and research and development organizations and activities as well as in our systems and adjustments in our operations, reporting and financial resources. We have no assurance that our investments and changes to our operations will result in the desired growth in our subscription revenue. As we execute our strategy, we expect our perpetual license revenue and our operating margin to significantly decline in the near term – before we are able to fully transition into a subscription model – and our maintenance service revenue to gradually decline over the coming years. While we expect the majority of our existing customers to expand their deployment leveraging subscription offerings (whether on-premises or SaaS), and new customers to purchase subscriptions at an increased rate, certain customers may still desire perpetual licenses and our transition may not occur within our planned timeline.

With our transition to a recurring revenue model, we will become significantly more dependent on renewals to meet our total revenue and profitability targets. Our renewal rate for maintenance contracts associated with perpetual license sales in each of the years ending December 31, 2019 and 2020 was approximately 90%. We believe that our maintenance contracts related to our perpetual license business will continue to have strong renewal rates; however, customers may choose to change licensing models from perpetual to subscription and while we expect to generate the same if not higher recurring revenue under a subscription there is a risk that the customer lowers their annual contract value.

Customer subscription renewal rates may decline or fluctuate due to a number of factors, including offering pricing, implementation and adoption rate of our solutions, reductions in customer spending levels or customer activity due to economic downturns or other market uncertainty, competitive offerings and customer satisfaction. In addition, we, along with our service providers or channel partners, may not be able provide adequate services that are responsive, satisfy our customers’ expectations and resolve issues that they encounter with our solutions. Even with adequate support, our customers are ultimately responsible for effectively using our solutions and ensuring that their IT staff and other relevant users are properly trained in the use of our products and complementary security products, methodologies and processes. As a result, customers may become dissatisfied with our products and decide not to renew, which may have a material and adverse effect on our business and results of operations.

3

We may face additional complications or risks in connection with our transition to a recurring revenue model, including the following:

•

our revenues may fluctuate as a result of variations in our booking mix from the different licensing and delivery models and the corresponding timing of revenue recognition – ratably for SaaS subscriptions and the maintenance portion of on-premises subscriptions and upon delivery for perpetual licenses and the license portion of on-premises subscriptions. For example, if our customers prefer to buy our solutions as a subscription at a greater rate than we anticipate, our recognized revenues may lag our expectations and guidance;

•

our operating profitability, net income and cash flow from operating activities are expected to decline during the transition period as more revenues are recognized ratably and due to an increase in annual invoicing. In addition, we continue to make significant short-term investments in our business and operations to drive long-term growth;

•

our revenues and earnings may decline if our customers do not renew, or reduce the scope of, their subscriptions;

•

the introduction of new product offerings and solutions may result in longer sales cycles, lost opportunities or less predictable revenues if our new or existing customers, prospects and partners are less receptive of such advancements (including a transition to SaaS in order to receive certain functionalities) or require a longer period to assess and select the solutions appropriate to them;

•

the introduction of more SaaS offerings may require extended presale processes due to, among others, comprehensive product and security reviews and requirements by customers, extensive contract negotiations and more stringent compliance and operational obligations (such as those related to data protection);

•

our research and development teams may find it difficult to deliver functionality and drive innovation across multiple code bases on a timely basis; and

•

our sales force may struggle with selling multiple pricing, licensing and delivery models to customers, prospects and partners, which may extend sales cycles, reduce the likelihood of sales closing, or lead to increased turnover rates and lower headcount.

Our quarterly results of operations may fluctuate for a variety of reasons. We may, as a result, fail to meet publicly announced financial guidance or other expectations about our business, which could cause our ordinary shares to decline in value.

We offer new and existing customers multiple software pricing and delivery models and have begun actively transitioning our business to a recurring revenue model in January 2021. It may be difficult to predict the mix of the perpetual and subscription bookings in any given quarter, which could impact our financial results and cause us to fail to meet publicly announced financial guidance or other expectations. We recognize revenue differently based on the composition of the selected offering. Specifically, we recognize revenue from perpetual licenses upon their delivery and the license portion of on-premises subscriptions upon the commencement of the subscription period. We recognize revenue from SaaS subscriptions and from maintenance services for perpetual licenses or on-premises subscription ratably over the period of the subscription or maintenance contract. This may cause trends in revenue recognition to lag those in sales, potentially causing us to fall short of investor expectations for revenue even while meeting or exceeding periodic sales targets. Our active transition to a recurring revenue model, starting in 2021, could reduce our overall revenue growth rates, operating margins and cash flow in the short term due to the ratable revenue recognition.

A meaningful portion of our quarterly revenues is generated through transactions of significant size, and purchases of our products and services often occur at the end of each quarter. We also experience quarterly and annual seasonality in our sales, demonstrated by increased sales in the third month of each quarter relative to the first two months and increased sales in the fourth quarter of each year. The timing in which SaaS deals close may further exacerbate the seasonality impact on reported revenues due to the ratable recognition. In addition, our sales cycle can be intensively competitive and last several quarters from proof of concept to the actual sale and initial delivery of our solutions to our customers. This sales cycle can be even longer, less predictable and more resource-intensive for larger sales, or with customers implementing complex digital transformation strategies or facing a complex set of compliance and user requirements. Customers may also require additional internal committee or executive approvals, extensive security reviews, longer product trial periods and prolonged contract negotiation before making a final purchase, all of which may be exacerbated with the increased volume of SaaS transactions. A failure to close a large transaction in a particular quarter may adversely impact our revenues in that quarter. Closing of an exceptionally large transaction in a certain quarter may disproportionately increase our revenues in that quarter, which may make it more difficult for us to meet growth rate expectations of our investors in subsequent quarters. Furthermore, even if we close a sale during a given quarter, we may be unable to recognize the revenues derived from such sale during the same period due to our revenue recognition policy and our transition to a recurring revenue model. As a result of the foregoing factors, the timing of closing sales cycles and the resulting revenue from such sales can be difficult to predict. In some cases, sales have occurred in a quarter that was either earlier than, or subsequent to, the anticipated quarter, and in some cases, sale opportunities expected to close did not close at all.

4

All of these factors impact our quarterly results and our ability to accurately predict them and may result in us missing our guidance or falling short of market expectations regarding our results. If our financial results for a particular period do not meet our guidance or if we reduce our guidance for future periods or refrain from providing guidance, the market price of our ordinary shares may decline.

In addition to fluctuations related to our transition to a recurring revenue model and sales cycles described above, our results of operations may continue to vary as a result of a number of other factors, many of which may be outside of our control or difficult to predict, including:

•

our ability to attract new customers;

•

our ability to retain existing customers by and through renewals of maintenance services and subscriptions;

•

the amount and timing of our operating costs and cash collection, which may vary also as a result of fluctuations in foreign currency exchange rates or changes in taxes or other applicable regulations (see “—We are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and results of operations”);

•

the rate our customers fully deploy their purchased licenses or subscriptions, and our ability to sell additional products and services to current customers;

•

effects from the COVID-19 pandemic or other public health crises, and the global economic changes caused by it (see “—The COVID-19 pandemic, measures globally taken in response to it and the resulting economic environment have adversely affected, and may continue to adversely affect, our business, financial condition, and results of operations”);

•

the ability of our support, service and customer success operations to keep pace with sales to new and existing customers and the expansion of our solution portfolio and to satisfy customer demands for consultancy and professional services;

•

our ability to successfully expand our business globally;

•

the timing and success of new product and service introductions by us or our competitors or any other change in the competitive landscape of the information security market, including consolidation among our competitors;

•

introduction of new accounting pronouncements or changes in our accounting policies or practices;

•

changes in our pricing policies or those of our competitors;

•

changes in the growth rate of the information security market; and

•

the size and discretionary nature of our prospective and existing customers’ IT budgets.

Any of these factors, individually or in the aggregate, may result in significant fluctuations in our financial and other operating results from period to period. These fluctuations could result in our failure to meet our operating plan or the expectations of investors or analysts for any given period. Such failures may cause the market price of our ordinary shares to substantially decrease.

5

Our reputation and business could be harmed due to real or perceived vulnerabilities in our solutions or services or the failure of our customers or third parties to correctly implement, manage and maintain our solutions, resulting in loss of customers, enforcement actions, lawsuits or financial losses.

Security products, solutions and services such as our own are complex in design and deployment and may contain errors that are potentially incapable of being remediated or detected until after their deployment, if at all. Any errors, defects, or misconfigurations could cause our products or services to not meet specifications, be vulnerable to security attacks or fail to secure networks, which could negatively impact customer operations and harm our business and reputation. In particular, we may suffer significant liability as a result of litigation or regulatory enforcement, indemnity claims, adverse publicity and reputational harm, including a downgrade in our industry leadership position by industry analysts, if our solutions or services are associated, or are believed to be associated with, or fail to reasonably protect against, a significant breach or a breach at a high-profile customer, managed service provider network, or third-party system utilized by us as part of our cloud-based security solution.

Several of our solutions are made available to our customers as SaaS. Delivering software as a service involves storage and transmission of customers’ proprietary information, including personal data, related to their assets, employees and users. Security breaches, improper configuration or product defects in our SaaS solutions, production and development environments (including those embedded in third-party technology used by our customers) could result in loss or alteration of this data, unauthorized access to multiple customers’ data and compromise of our networks or our customers’ networks secured by our SaaS solutions. Any such incident, whether or not caused by us, could result in significant liability for us and negative business repercussions.

False detection of threats (referred to as “false positives”), while typical in our industry, may reduce perception of the reliability of our solutions and may therefore adversely impact market acceptance. Our customers’ businesses could be harmed if our solutions restrict legitimate privileged access by authorized personnel to IT systems and applications by falsely identifying those users as attackers or otherwise unauthorized, resulting in significant liability for us and negative business implications. False positives may also reduce perception of the reliability of our solutions and our company’s reputation and may therefore adversely impact our market acceptance and leadership position.

Our solutions not only reinforce but also rely on the common security concept of placing multiple layers of security controls throughout an IT system. The failure of our customers, channel partners, managed service providers or subcontractors to correctly implement or effectively manage and maintain our solutions and the environments in which they are utilized, or to consistently implement and utilize generally accepted and comprehensive, multi-layered security measures and processes in customer networks, may lessen the efficacy of our solutions. Our customers or our channel partners may also independently develop or change existing application programming interfaces (APIs) that we provide to them for interfacing purposes in an incorrect or insecure manner. Such failures or actions may lead to security breaches and data loss, which could result in a perception that our solutions or services failed and associated negative business implications. Further, our failure to provide our customers and channel partners with adequate services or accurate product documentation related to the use, implementation and maintenance of our solutions, could lead to claims against us.

Similarly, and as demonstrated by the 2020 SolarWinds SUNBURST attack, our failure to effectively deploy and maintain multiple layers of security controls and processes to detect threats within our own resources and networks, such as development or customer-serving production environments, could lead to a breach or exploitation of our products or services by threat actors. As a result, such threat actors may gain access to and breach our customers’ deployments and environments (see “— If our internal IT network system, or those of third party service providers associated with us, is compromised by cyber attacks or other data breaches, or by a critical system failure, our reputation, financial condition and operating results could be materially adversely affected.”).

An actual or perceived cyber attack, other security breach or theft of our customers’ data, regardless of whether the breach or theft is actually attributable to the failure of our products, SaaS solutions or the services we provided in relation thereto, could adversely affect the market’s perception of the efficacy of our solutions and our industry standing. Such circumstances could cause current or potential customers to look to our competitors for alternatives to our solutions and subject us to negative media attention, lawsuits, regulatory investigations and other government inquiries, indemnity claims and financial losses, as well as the expenditure of significant financial resources to, among other actions, analyze, correct or eliminate any vulnerabilities. Provisions in our agreements that attempt to limit our liabilities towards our customers, channel partners and relevant third parties may not withstand legal challenges, and certain liabilities may not be limited or capped. Additionally, any insurance coverage we have may not adequately cover all claims asserted against us or may cover only a portion of such claims. An actual or perceived cyber attack could also cause us to suffer reputational harm, lose existing customers, or deter new and existing customers from purchasing or implementing our products.

6

We face intense competition from a wide variety of IT security vendors operating in different market segments and across diverse IT environments, which may challenge our ability to maintain or improve our competitive position or to meet our planned growth rates.

The IT security market in which we operate is characterized by intense competition, constant innovation, rapid adoption of different technological solutions and services, and evolving security threats. We compete with a multitude of companies that offer a broad array of IT security products that employ different approaches and delivery models to address these evolving threats.

Our current competitors in the Privileged Access Management market include BeyondTrust Corporation, NortonLifeLock, Inc. (acquired by Broadcom Inc.), One Identity LLC and Thycotic Software Ltd., some of which may offer solutions at lower price points. Further, we may face competition due to changes in the manner that organizations utilize IT assets and the security solutions applied to them, such as the provision of Privileged Access Management functionalities as part of public cloud providers’ infrastructure offerings, or cloud-based identity management solutions. With the acquisition of Idaptive and our strategy to provide customers with a comprehensive identity security portfolio, and our DevOps security solution, some of the functionality offered in our products may compete with certain solutions in the market such as solutions from Okta Inc., Microsoft Corporation or HashiCorp, Inc. In addition, Limited IT budgets may also result in competition with providers of other advanced threat protection solutions such as Palo Alto Networks, CrowdStrike Holdings, Inc. and NortonLifeLock, Inc.

We also may compete, to a certain extent, with vendors that offer products or services in adjacent or complementary markets to Privileged Access Management, including identity management vendors and cloud platform providers such as Amazon Web Services, Google Cloud Platform, and Microsoft Azure. As the identity and access and Privileged Access Management markets have matured significantly over recent years the entry barrier is now lower, and it is easier for competitors to compete in the market. Some of our competitors are large companies and have wider technical and financial resources and broader customer bases used to bring competitive solutions to the market. These companies may already have existing relationships as an established vendor for other product offerings, and certain customers may prefer one single IT vendor for product security procurement than purchasing solely based on product performance. Such companies may use these advantages to offer products and services that are perceived to be as effective as ours at a lower price or for free as part of a larger product package or solely in consideration for maintenance and services fees, which could result in increased market pressure to offer our solutions and services at lower prices. They may also develop different products to compete with our current solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards or client requirements or enjoy stronger sales and service capabilities in certain regions. Additionally, niche vendors are developing and marketing lower cost solutions with limited Privileged Access Management functionality that may impact our ability to maintain premium market pricing.

Our competitors may enjoy potential competitive advantages over us, such as:

•

greater name recognition, a longer operating history and a larger customer base;

•

larger sales and marketing budgets and resources;

•

broader distribution and established relationships with channel partners, advisory firms and customers;

•

increased effectiveness in protecting, detecting and responding to cyber attacks;

•

greater or localized resources for customer support and provision of services;

7

•

greater speed at which a solution can be deployed and implemented;

•

greater resources to make acquisitions;

•

larger intellectual property portfolios; and

•

greater financial, technical and other resources.

Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources and capabilities. Current or potential competitors have been acquired and consolidated or may be acquired by third parties with greater resources in the future. Similarly, we may also face increased competition following an acquisition of new lines of business that compete with providers of such technologies or from security vendors or other companies in adjacent markets extending their solutions into privilege access management or identity and access management (as relevant). As a result of such acquisitions, our current or potential competitors may be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. Larger competitors with more diverse product offerings may reduce the price of products that compete with ours in order to promote the sale of other products or may bundle them with other products, which would lead to increased pricing pressure on our products and could cause the average sales prices for our products to decline. We may be at a competitive disadvantage to our privately held competitors, as they may not face the same accounting, auditing and legal standards we do as a public company. Such privately held competitors may face less public scrutiny than we do and may be less risk-averse than we are, and therefore may have greater operational flexibility.

Furthermore, an increasing number of independent industry analysts and researchers regularly evaluate, compare and publish reviews regarding the functionality of IT security products, including ours. These reviews may significantly influence the market perception of our products, and our reputation and brand could be harmed from negative reviews of our products or increasingly positive reviews of our competitors’ products, or if such reviews do not view us as a market leader. In addition, other IT security technologies exist or could be developed in the future by current or future competitors, and our business could be materially and adversely affected if such technologies are widely adopted. We may not be able to successfully anticipate or adapt to changing technology or customer requirements on a timely basis, or at all. If we fail to keep up with technological changes or convince our customers and potential customers of the value of our solutions, even in light of new technologies, our business, results of operations and financial condition could be materially and adversely affected.

If we are unable to acquire new customers or sell additional products and services to our existing customers, our future revenues and operating results will be harmed.

Our success and continued growth will depend, in part, on our ability to acquire a sufficient number of new customers while maintaining and expanding our revenues from existing customers, by renewing contracts for our solutions and selling incremental or new licenses or subscriptions or solutions to existing customers. If we are unable to succeed in such efforts, we will likely be unable to fully transition into a subscription-based model or generate revenue growth at desired rates. In addition, competition in the marketplace may lead us to acquire fewer new customers or result in us providing more favorable commercial terms to new or existing customers. Macro-economic effects such as those related to COVID-19 may also affect our ability to maintain our customer base and expand it, and the pandemic and its associated global response may also make establishing relationships and new supplier expertise among potential customers more challenging. (see “-- The COVID-19 pandemic, measures globally taken in response to it and the resulting economic environment have adversely affected, and may continue to adversely affect, our business, financial condition, and results of operations”). Further, the foregoing circumstances would have an even greater impact on our business and operations in relation to sales of our Privileged Access Management (PAM) solution, which generates a majority of our revenue.

As we expand our market reach to gain new business, including entering the Access Management market and securing DevOps environments, we may experience difficulties in gaining traction and raising awareness among potential customers regarding the critical role that our solutions play in securing their organizations or establishing a market leadership position and industry analyst recognition, or may face more competitive pressure in such markets. As a result, it may be difficult for us to add new customers to our customer base, retain our existing customers and generate increased growth from sales of these solutions.

8

With our transition to a recurring revenue model, our sales, research and development, support and customer success teams may have difficulties selling, supporting and maintaining multiple license models and code bases. These may lead to lower software sales, longer sales cycles, customer dissatisfaction, lower renewal rates and a reduction in our ability to sell add-on business to customers or gain new customers. Further, as part of the natural lifecycle of our solutions, we may determine that certain products will be reaching their end of development or end of life and will no longer be supported or receive updates and security patches. Failure to effectively manage our product lifecycles could lead to existing customer dissatisfaction and contractual liabilities.

Further, any changes in compliance standards or audit requirements that reduce the priority for the types of controls, security, monitoring and analysis that our solutions provide would adversely impact demand for our solutions. Additional factors that impact our ability to acquire new customers or sell additional products and services to our existing customers include the consumption of their past purchases, the perceived need for IT security, the size of our prospective and existing customers’ IT budgets, the utility and efficacy of our existing and new offerings, whether proven or perceived, changes in our pricing or licensing models that may impact the size of new business transactions, a downgrade of our recognized industry leadership position by industry analysts and general economic conditions. These factors may have a material negative impact on future revenues and operating results.

If our internal IT network system, or those of third party service providers associated with us, is compromised by cyber attacks or other data breaches, or by a critical system failure, our reputation, financial condition and operating results could be materially adversely affected.

As we provide privileged account and identity security products, we are likely an attractive target for cyber attackers or other data thieves since a breach of our system could provide information regarding not only us, but potentially regarding the customers that our solutions protect. Given the shift to the remote working environment due to COVID-19, we and our customers are exposed to an expanded attack surface. Further, we may be targeted by cyber terrorists, sophisticated criminal groups, or nation-state affiliated and supported actors because we are an Israeli company as well as a prominent security company.

From time to time we encounter intrusion incidents and attempts against our internal network systems, none of which to date has resulted in any material adverse impact to our business or operations. Any such future attacks could materially adversely affect our business or results of operations. In addition, as our market position continues to grow, specifically in the security industry, an increasing number of cyber attackers may focus on finding ways to penetrate our network systems, which might eventually affect our products and services. For example, third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information or otherwise compromise the security of our internal networks, electronic systems and/or physical facilities in order to gain access to our data or our customers’ data. Such attacks could result in significant damage to our market position and lead to costly indemnity claims, litigation or regulatory action.

We may also be subject to information technology system failures or network disruptions caused by natural disasters, accidents, power disruptions, telecommunications failures, acts of terrorism, security breaches, wars, computer viruses, or other events or disruptions. System redundancy and other continuity measures may be ineffective or inadequate, and our business continuity and disaster recovery planning may not be sufficient for all eventualities. These events could adversely affect our operations, reputation, financial condition and operating results.

Additionally, cyber attacks against our company may also be caused by breaches by our contractors, business partners, supply chain network, vendors and other third parties associated with us, or due to human error by those acting on our behalf. We rely on third parties to operate critical functions of our business, including hosting our SaaS products and supporting our customer relationship management and financial operation services (provided by our Enterprise Resource Planning system). If these services are breached or become unavailable due to extended outages or interruptions or because they are no longer available on commercially reasonable terms, our ability to manage our operations could be interrupted, our ability to provide maintenance and support services to our customers could be impacted, our expenses could increase and our processes for managing sales of our products and services be impaired until equivalent services, if available, are identified, obtained and integrated; all of which could materially harm our business.

9

Because we are in the information security industry, an actual or perceived vulnerability, failure, disruption, or breach of our network or privileged account security in our systems also could adversely affect the market perception of our products and services, or of our expertise in this field, as well as perception of us among new and existing customers. Additionally, a significant security breach could subject us to potential liability, litigation and regulatory or other government action (see “—The dynamic legal and regulatory environment around privacy, data protection, cross-border data flows, and cloud computing may limit the offering, use and adoption of, or require modification of, our products and services, which could limit our ability to attract new customers and support our current customers, or we could be subject to investigations, litigation, or enforcement actions alleging that we fail to comply with the regulatory requirements thus harming our operating results and adversely affecting our business.”). We are unable to ensure that any limitations of liability provisions in our contracts with respect to our information security operations or our product liability would be enforceable or adequate or would otherwise protect us from any liabilities or damages with respect to any particular claim, or that we would be able to adequately recover damages from third parties associated with us, who were involved in a security incident. Additionally, any insurance coverage we may have may not adequately cover any of these claims asserted against us or any related damage, or may cover only a portion of such damages. If any of the foregoing were to occur, our business may suffer and our share price may be negatively impacted.

Our research and development efforts may not produce successful products or enhancements to our solutions that result in significant revenue or other benefits in the near future, if at all.

We expect to continue to dedicate significant financial and other resources to our research and development efforts in order to maintain our competitive position. For example, in 2020, we increased our dedicated research and development personnel by 33% compared to 2019. However, investing in research and development personnel, developing new products and enhancing existing products is expensive and time consuming. There is no assurance that such activities will successfully result in significant new marketable products or enhancements to our products, including SaaS solutions, design improvements, cost savings, revenues or other expected benefits. If we spend significant time and effort on research and development and are unable to generate an adequate return on our investment, we may not be able to compete effectively, and our business and results of operations may be materially and adversely affected.

Our investment in product enhancements or new products could fail to attain sufficient market acceptance for many reasons, including:

•

delays in releasing product enhancements or new products;

•

failure to accurately predict market demand and to supply products that meet this demand in a timely fashion;

•

inability to interoperate effectively with the existing or newly introduced technologies, systems or applications of our existing and prospective customers;

•

defects in our products, errors or failures of our solutions to secure and protect privileged accounts against existing and new types of attacks;

•

negative publicity about the performance or effectiveness of our products;

•

introduction or anticipated introduction of competing products by our competitors;

•

installation, configuration or usage errors by our customers; and

•

easing or changing of regulatory requirements related to security.

If we fail to anticipate market requirements or fail to develop and introduce product enhancements or new products to meet those needs in a timely manner, it could cause us to lose existing customers and prevent us from gaining new customers, which would significantly harm our business, financial condition and results of operations.

10

The dynamic legal and regulatory environment around privacy, data protection, cross-border data flows, and cloud computing may limit the offering, use and adoption of, or require modification of, our products and services, which could limit our ability to attract new customers and support our current customers, or we could be subject to investigations, litigation, or enforcement actions alleging that we fail to comply with the regulatory requirements thus harming our operating results and adversely affecting our business.

The legal and regulatory environment relating to the provision of services on the internet, including services such as ours, is increasing, as federal, state and foreign governments continue to adopt, enact, and enforce new laws and regulations addressing cybersecurity, privacy, data protection and the collection, processing, storage and use of personal information.

We are subject to diverse laws and regulations relating to data privacy, including but not limited to the EU General Data Protection Regulation 2016/679 (“GDPR”), the California Consumer Privacy Act (“CCPA”), the U.K. Data Protection Act 2018, national privacy laws of EU Member States and other laws relating to privacy, data protection, and cloud computing. These laws are evolving rapidly, as exemplified by the recent passage by ballot initiative of the California Privacy Rights Act in November 2020 (“CPRA”) and the prospect of a new European “ePrivacy Regulation” (to replace the existing “ePrivacy Directive,” Directive 2002/58 on Privacy and Electronic Communications). Compliance with these laws, as well as efforts required to understand and interpret new legal requirements, require us to expend significant capital and other resources. We could be found to not be in compliance with obligations, or suffer from adverse interpretations of such legal requirements either as directly relating to our business or in the context of legal developments impacting our customers or other businesses, which could impact our ability to offer our products or services, impact operating results, or reduce demand for our products or services.

Compliance with privacy and data protection laws and contractual obligations may require changes in services, business practices, or internal systems resulting in increased costs, lower revenue, reduced efficiency, or greater difficulty in competing with firms that are not subject these laws and regulations. For example, GDPR imposes several stringent requirements for controllers and processors of personal data and increases our obligations including, for example, requiring robust disclosures to individuals, establishing an individual data rights regime, setting timelines for data breach notifications, requiring detailed internal policies and procedures and limiting retention periods. Ongoing compliance with these and other legal and contractual requirements may necessitate changes in services and business practices, which may lead to the diversion of engineering resources from other projects.

As a company that focuses on identity security with a foundation in privilege access management, our customers may rely on our products and services as part of their efforts comply with obligations under GDPR and other laws to implement and demonstrate their own security controls around access to personal and confidential data. If our products or services are found insufficient to meet these standards in the context of an investigation into us or our customers, or we are unable to engineer products that meet these standards, we could experience reduced demand for our products or services. There is also increased international scrutiny, including by the EU, of cross-border transfers of data, including personal data between the EU and countries like the United States. Our work could be impacted if legal mechanisms that permit such cross-border data transfers are challenged or restricted, or if cross-border data transfers are restricted between jurisdictions entirely.

In addition, following the U.K.’s departure from the EU and the expiry of the Brexit transition period, the U.K. will cease to operate as an EU member state, and data flows from the EU to the U.K. (and vice versa) may need additional safeguards, which could affect our operations in the U.K. and in EU countries. These and other regulatory requirements around the privacy or cross-border transfer of personal data could restrict our ability to store and process data as part of our solutions, or, in some cases, impact our ability to offer our solutions or services in certain jurisdictions.

The passage of the CPRA in November 2020 could result in additional uncertainty and additional measures on our behalf to come into compliance or demonstrate compliance to our customers. Enactment of further privacy laws in the U.S., at the state or federal level, may require us to expend considerable resources to comply, and could carry the potential for significant financial or reputational exposure to our business.

Claims that we or our service providers have breached our contractual obligations or failed to comply with applicable privacy and data protection laws, even if we are not found liable, could be expensive and time-consuming to defend and could result in adverse publicity that could harm our business. In addition to litigation, we could face regulatory investigations, negative market perception, potential loss of business, enforcement notices and/or fines (which, for example, under GDPR can be up to four percent of global turnover for the preceding financial year or €20 million, whichever is higher).

11

The COVID-19 pandemic, measures globally taken in response to it and the resulting economic environment have adversely affected, and may continue to adversely affect, our business, financial condition, and results of operations.

The COVID-19 pandemic, its continuing effects, and the diverse measures taken in response by governments and businesses worldwide to contain its spread, have placed constraints on the operations of businesses, decreased consumer mobility and activity, and caused significant global economic volatility. In light of the uncertain and evolving nature of the pandemic and the economic environment, we have taken precautionary measures intended to reduce the risk of virus infection to our employees and our customers and to address the uncertainty in our ability to execute on our operating plans. Such circumstances and uncertainties have adversely affected and are likely to continue to adversely affect our business, workforce and results of operations, as well as that of our customers, suppliers and partners globally. Our business has been affected in various ways, including our ability to engage with customers, hire new employees, a decrease in the size of our perpetual license deals, lower revenue from new customers, and changes to customer purchase patterns and to our sales and marketing operations.

There is considerable uncertainty regarding the duration, scope and severity of the pandemic or its effects on us and our customers, channel partners, managed service providers or subcontractors, which can result in extended customer sales cycles, reduced demand for our solutions, lower renewal rates, delayed spending on our solutions, smaller deal sizes, lower revenue from new customers, impairment of our ability to collect accounts receivable, reduced payment frequencies, and affect our employee productivity or availability. Any of the foregoing may have a material adverse impact on our business and results of operation.

If we are unable to hire, retain and motivate qualified personnel, our business will suffer.

Our future success depends, in part, on our ability to continue to attract and retain highly skilled personnel. Our inability to attract or retain qualified personnel or delays in hiring required personnel may seriously harm our business, financial condition and results of operations. Any of our employees may terminate their employment at any time. Competition for highly skilled personnel, specifically engineers for research and development positions, is often intense and results in increasing wages, especially in Israel, where we are headquartered and most of our research and development positions are located, and where several large multinational corporations have entered the market. We may struggle to retain employees, and due to our profile and market position, competitors actively seek to hire skilled personnel away from us. Furthermore, from time to time, we have been subject to allegations that employees we have hired from competitors may have been improperly solicited or divulged proprietary or other confidential information which could subject us to potential liability and litigation.

Prolonged economic uncertainties or downturns in certain regions or industries could materially adversely affect our business.

Our business depends on our current and prospective customers’ ability and willingness to invest money in IT security, which in turn is dependent upon their overall economic health. Negative economic conditions in the global economy or certain regions, including conditions resulting from financial and credit market fluctuations, could cause a decrease in corporate spending on information security software. Other matters that influence consumer confidence and spending, including COVID-19 and its reverberating economic consequences, could also negatively affect our customers’ spending on our products and services. In 2020, we generated 53% of our revenues from the United States, 31% of our revenues from Europe, the Middle East and Africa and 16% from the rest of the world, which includes countries from the Asia Pacific and Japan region, the Latin America region and Canada.

In addition, a significant portion of our revenue is generated from customers in the financial services industry, including banking and insurance. Negative economic conditions may cause customers generally, and in that industry in particular, to reduce their IT spending. Customers may delay or cancel IT projects perceived to be discretionary, choose to focus on in-house development efforts or seek to lower their costs by renegotiating subscription renewals or maintenance and support agreements. Additionally, customers or channel partners may be more likely to make late payments in worsening economic conditions, which could lead to increased collection efforts and require us to incur additional associated costs to collect expected revenues. If the economic conditions of the general economy or industries in which we operate worsen from present levels, our results of operation could be adversely affected.

12

We may fail to fully execute, integrate, or realize the benefits expected from acquisitions, which may require significant management attention, disrupt our business, dilute shareholder value and adversely affect our results of operations.

As part of our business strategy and in order to remain competitive, we continue to evaluate acquiring or making investments in complementary companies, products or technologies. We may not be able to find suitable acquisition candidates or complete such acquisitions on favorable terms. We may incur significant expenses, divert employee and management time and attention from other business-related tasks and our organic strategy and incur other unanticipated complications while engaging with potential target companies where no transaction is eventually completed. If we do complete acquisitions, we may not ultimately strengthen our competitive position or achieve our goals or expected growth, and any acquisitions we complete could be viewed negatively by our customers, analysts and investors. In addition, if we are unsuccessful at integrating our acquisitions, for example our May 2020 acquisition of Idaptive, including the technologies associated with such acquisitions, or fail to fully attain the expected benefits of these acquisitions, our revenues and results of operations could be adversely affected. Any integration process may require significant time and resources, and we may not be able to manage the process successfully and may experience a decline in our profitability as we incur expenses prior to fully realizing the benefits of the acquisition. We could expend significant cash and incur acquisition related costs and other unanticipated liabilities associated with the acquisition. We may not successfully evaluate or utilize the acquired technology or personnel, or accurately forecast the financial impact of an acquisition transaction, including accounting charges and tax liabilities. Further, the issuance of equity or securities convertible to equity to finance any such acquisitions could result in dilution to our shareholders and the issuance of debt could subject us to covenants or other restrictions that would impede our ability to manage our operations. We could become subject to legal claims following an acquisition or fail to accurately forecast the potential impact of any claims. Any of these issues could have a material adverse impact on our business and results of operations.

If we do not effectively expand, train and retain our sales and marketing personnel, we may be unable to achieve our transition to subscription model, acquire new customers or sell additional products and services to existing customers, and our business will suffer.

We depend significantly on our sales force to attract new customers and expand sales to existing customers. We generate approximately 35% of our revenues from direct sales and the remaining balance from indirect sales. As a result, our ability to grow our revenues depends in part on our success in recruiting, training and retaining sufficient numbers of sales personnel to support our growth. The number of our sales and marketing personnel increased from 656 as of December 31, 2019 to 772 as of December 31, 2020. We expect to continue to expand our sales and marketing personnel significantly and face a number of challenges in achieving our hiring and integration goals. There is intense competition for individuals with sales training and experience. In addition, the training and integration of a large number of sales and marketing personnel in a short time requires the allocation of significant internal resources. While we have been selling subscriptions for a number of years, as we shift our sales from perpetual licenses to increasingly sell more SaaS and on-premises subscriptions, all of our sales and marketing personnel will need to be extensively trained. We invest significant time and resources in training new sales force personnel to understand our solutions, pricing and delivery models and growth strategy. Based on our past experience, it takes an average of approximately six to nine months before a new sales force member operates at target performance levels. However, we may not be able to recruit at our anticipated rate or achieve or maintain our target performance levels with large numbers of new sales personnel as quickly as we have done in the past. Our failure to timely hire the sufficient number of qualified sales force members and train them to operate at target performance levels may materially and adversely impact our projected growth rate.

13

We rely on channel partners to generate a significant portion of our revenue, market our solutions and provide necessary services to our customers. If we fail to maintain successful relationships with our channel partners, or if our channel partners fail to perform, our ability to market, sell and distribute our solutions will be limited, and our business, financial condition and results of operations will be harmed.

In addition to our direct sales force, we rely on our channel partners to market, sell, support and implement our solutions, particularly in Europe and the Asia Pacific and Japan regions. We expect that sales through our channel partners will continue to account for a significant percentage of our revenue. In the year ended December 31, 2020, we generated approximately 65% of our revenues from sales to channel partners such as distributors, systems integrators, value-added resellers and managed security service providers, and we expect that channel partners will represent a substantial portion of our revenues for the foreseeable future. Further, we cooperate with advisory firms in marketing our solutions and providing implementation services to our customers, in both direct and indirect sales. Our agreements with channel partners are non-exclusive, meaning our partners may offer customers IT security products from other companies, including products that compete with our solutions. If our channel partners do not effectively market and sell our solutions or choose to use greater efforts to market and sell their own products and services or the products and services of our competitors, our ability to grow our business will be adversely affected. Our channel partners may cease or de-emphasize the marketing of our solutions with limited or no notice and with little or no penalty. Further, new channel partners require training and may take several months or more to achieve productivity. The loss of key channel partners, the inability to replace them or the failure to recruit additional channel partners could materially and adversely affect our results of operations. Our reliance on channel partners could also subject us to lawsuits or reputational harm if, for example, a channel partner misrepresents the functionality of our solutions to customers, fails to appropriately implement our solutions or violates applicable laws, and may further result in termination of such partner’s agreement and potentially curb future revenues associated with this channel partner. Our ability to grow revenues in the future will depend in part on our success in maintaining successful relationships with our channel partners and training our channel partners to independently sell and install our solutions. If we are unable to maintain our relationships with channel partners or otherwise develop and expand our indirect sales channel, or if our channel partners fail to perform, our business, financial condition and results of operations could be adversely affected.

A portion of our revenues is generated by sales to government entities, which are subject to a number of challenges and risks, such as increased competitive pressures, administrative delays and additional approval requirements.

A portion of our revenues is generated by sales to U.S. and foreign federal, state and local governmental agency customers, and we may in the future increase sales to government entities. Selling to government entities can be highly competitive, expensive and time consuming, often requiring significant upfront time and expense without any assurance that we will complete a sale, or imposing terms of sale which are less favorable than the prevailing market terms. Government demand and payment for our products and services may be impacted by public sector budgetary cycles and funding authorizations, funding reductions, government shutdowns or delays, adversely affecting public sector demand for our products. The foregoing may be enhanced due to the effects of COVID-19. Additionally, for purchases by the U.S. government, the government may require certain products to be manufactured or developed in the United States and other high cost locations, and we may not manufacture or develop all products in locations that meet the requirements of the U.S. government. Finally, some government entities require products such as ours to be certified by industry-approved security agencies as a pre-condition of purchasing them, such as the international Common Criteria certification by the National Information Association Partnership (NIAP), which we have maintained since 2019. We have also initiated the process, and have begun incurring costs, to obtain authorization from the Federal Risk and Authorization Management Program, or FedRAMP, for certain SaaS products. The grant of such certifications depends on the then-current requirements of the certifying agency. We cannot be certain that any certificate will be granted or renewed or that we will be able to satisfy the technological and other requirements to maintain certifications. The loss of any of our product certificates, or the failure to obtain new ones, could cause us to suffer reputational harm, lose existing customers, or deter new and existing customers from purchasing our solutions, additional products or our services.

We are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and results of operations.

Our functional and reporting currency is the U.S. dollar. In 2020, the majority of our revenues were denominated in U.S. dollars and the remainder primarily in euros and British pounds sterling. In 2020, the majority of our cost of revenues and operating expenses were denominated in U.S. dollars and New Israeli Shekels (NIS) and the remainder primarily in euros and British pounds sterling. Our foreign currency-denominated expenses consist primarily of personnel, marketing programs, rent and other overhead costs. Since the portion of our expenses generated in NIS and British pounds sterling is greater than our revenues in NIS and British pounds sterling, respectively, any appreciation of the NIS or the British pounds sterling relative to the U.S. dollar could adversely impact our operating income. In addition, since the portion of our revenues generated in euros is greater than our expenses incurred in euros, any depreciation of the euro relative to the U.S. dollar would adversely impact our operating income. We estimate that a 10% strengthening or weakening in the value of the NIS against the U.S. dollar would have decreased or increased, respectively, our operating income by approximately $9.2 million in 2020. We estimate that a 10% strengthening or weakening in the value of the euro against the U.S. dollar would have increased or decreased, respectively, our operating income by approximately $3.2 million in 2020. We estimate that a 10% strengthening or weakening in the value of the British pounds sterling against the U.S. dollar would have decreased or increased, respectively, our operating income by approximately $0.4 million in 2020. These estimates of the impact of fluctuations in currency exchange rates on our historic results of operations may be different from the impact of fluctuations in exchange rates on our future results of operations since the mix of currencies comprising our revenues and expenses may change. We evaluate periodically the various currencies to which we are exposed and take hedging measures to reduce the potential adverse impact from the appreciation or the depreciation of our non U.S. dollar-denominated operations, as appropriate. We expect that the majority of our revenues will continue to be generated in U.S. dollars with the balance primarily in euros and British pounds sterling for the foreseeable future and that a significant portion of our expenses will continue to be denominated in NIS, U.S. dollars, British pounds sterling and in euros. We cannot provide any assurances that our hedging activities will be successful in protecting us from adverse impacts from currency exchange rate fluctuations. In addition, we have monetary assets and liabilities that are denominated in non-U.S. dollar currencies. For example, starting January 1, 2019, in accordance with a new lease accounting standard, we are required to present a significant NIS linked liability related to our operational leases in Israel. As a result, significant exchange rate fluctuations could have a negative effect on our net income. See “Item 11—Quantitative and Qualitative Disclosures About Market Risk—Foreign Currency Risk.”

14

If our products fail to help our customers achieve and maintain compliance with certain government regulations and industry standards, our business and results of operations could be materially and adversely affected.

We generate a substantial portion of our revenues from our products and services that enable our customers to achieve and maintain compliance with certain government regulations and industry standards, and we expect that to continue for the foreseeable future. Governments and other customers may require our products to comply with certain privacy, security or other certifications and standards with respect to those solutions utilized by them as a control demonstrating compliance with government regulations and industry standards. We have maintained the international Common Criteria certification by the National Information Association Partnership (NIAP) since 2019, and a SOC 2 certification for multiple products. Additionally, we have maintained the ISO 27001 annual certification since April 2017. We have also initiated the process, and have begun incurring costs, to obtain authorization from the Federal Risk and Authorization Management Program (FedRAMP), for certain SaaS products. However, we are unable to guarantee that we will achieve FedRAMP authorization in a timely manner, or at all, for any of our SaaS products. In the future, if our products are late in achieving or fail to achieve or maintain compliance with these certifications and standards, or our competitors achieve compliance with these certifications and standards, we may be disqualified from selling our products to such customers, or may otherwise be at a competitive disadvantage, either of which would harm our business, results of operations, and financial condition.

Additionally, these industry standards may change with little or no notice, including changes that could make them more or less onerous for businesses, including, without limitation, updates to the Common Criteria for Information Technology Security Evaluation (CC). In addition, governments may also adopt new laws or regulations, or make changes to existing laws or regulations, some of which may conflict with each other. This could impact whether our solutions enable our customers to maintain compliance with such laws or regulations. If we are unable to adapt our solutions to changing government regulations and industry standards in a timely manner, or if our solutions fail to expedite our customers’ compliance initiatives, our customers may lose confidence in our products and could switch to products offered by our competitors. In addition, if government regulations and industry standards related to IT security are changed in a manner that makes them less onerous, our customers may view compliance as less critical to their businesses and may be less willing to purchase our products and services. In either case, our sales and financial results would suffer.