false2024Q3Catalent, Inc.6/30FALSEFALSE00015967830.010.011,000,000,0001,000,000,000181,000,000180,000,000180,000,000179,000,0000.010.01100,000,000100,000,000————32461,8421,596REVISIONS OF PREVIOUSLY ISSUED FINANCIAL STATEMENTSAs described in the Amended Fiscal 2022 10-K, in preparing the consolidated financial statements for the three and nine months ended March 31, 2023, the Company identified a $26 million error related to the over-recognition of revenue in the consolidated financial statements it issued with respect to its fiscal year ended June 30, 2022. This error resulted from the misapplication of the contract modification guidance in accordance with ASC 606, Revenue from Contracts with Customers, related to one of the Company’s customer arrangements. The Company assessed the materiality of the error both quantitatively and qualitatively and determined this error to be immaterial to those consolidated financial statements. However, the Company concluded that the effect of correcting the error in the quarter ended March 31, 2023 would materially misstate the Company’s unaudited consolidated financial statements for the three and nine months ended March 31, 2023 and, accordingly, determined that it was necessary to revise the consolidated financial statements it previously issued with respect to the fiscal year ended June 30, 2022.

The following tables reflect the impact of this revision on the Company’s consolidated balance sheet as of June 30, 2022:

| | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheet | | June 30, 2022 |

| (Dollars in millions) | | As Previously | | | | |

| | Reported | | Adjustment | | As Revised |

| Prepaid expenses and other | | $ | 625 | | | $ | 1 | | | $ | 626 | |

| Total current assets | | 2,916 | | | 1 | | | 2,917 | |

| Total assets | | 10,507 | | | 1 | | | 10,508 | |

| Other accrued liabilities | | 620 | | | 26 | | | 646 | |

| Total current liabilities | | 1,072 | | | 26 | | | 1,098 | |

| Deferred income taxes | | 202 | | | (5) | | | 197 | |

| Total liabilities | | 5,712 | | | 21 | | | 5,733 | |

| Retained earnings | | 538 | | | (20) | | | 518 | |

| Total shareholders' equity | | 4,795 | | | (20) | | | 4,775 | |

| Total liabilities and shareholders' equity | | $ | 10,507 | | | $ | 1 | | | 10,508 | |

| | | | | | |

17. SUBSEQUENT EVENTS

Entry Into an Agreement and Plan of Merger

On February 5, 2024, the Company entered into the Agreement and Plan of Merger (the “Merger Agreement”), with Creek Parent, Inc. (“Parent”), a Delaware corporation and a wholly owned subsidiary of Novo Holdings A/S (“Novo Holdings”), and Creek Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”). The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein and in accordance with the General Corporation Law of the State of Delaware (the “DGCL”), Merger Sub will be merged with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent. Parent will acquire all the issued and outstanding shares of common stock of the Company.

At the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.01 per share, of the Company (such shares, collectively, the “Company Common Stock,” and each, a “Share”) that is issued and outstanding immediately prior to the Effective Time (other than any Shares held by (i) the Company, Parent or Merger Sub or any other direct or indirect wholly owned subsidiary of the Company or Parent immediately prior to the Effective Time, or (ii) a holder who has not voted in favor of the adoption of the Merger Agreement and is entitled to demand and properly demands appraisal of such Shares under the DGCL), will be converted automatically into the right to receive an amount in cash equal to $63.50 per Share, without interest (the “Merger Consideration”). The transaction values the Company at $16.5 billion on an enterprise value basis.

Consummation of the Merger is subject to customary closing conditions, including approval of the Merger by the Company’s stockholders (which has not been obtained at this stage). Further conditions include (i) receipt of certain governmental waivers, consents, clearances, decisions, declarations, approvals, and expirations of applicable waiting periods, including the expiration or early termination of the waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976, with respect to (A) the Merger and (B) the sale of three of the Company’s fill-finish sites (which are located in Anagni, Italy, Bloomington, Indiana USA, and Brussels, Belgium) and related assets from Novo Holdings to Novo Nordisk A/S (“Novo Nordisk”), of which Novo Holdings is the controlling shareholder (the “Carve-Out”), and (ii) the absence of any order, injunction or law prohibiting the Merger or the Carve-Out, in each case, without a Burdensome Condition (as defined in the Merger Agreement). Parent’s and Merger Sub’s obligations to close the Merger are also conditioned upon the absence of a Material Adverse Effect (as defined in the Merger Agreement) on the Company.

0.0163.5016.5345March 31, 2024xbrli:sharesiso4217:USDxbrli:sharesiso4217:USDutr:Ratexbrli:purectlt:employees00015967832023-07-012024-03-3100015967832024-04-2500015967832024-03-3100015967832024-01-012024-03-3100015967832023-01-012023-03-3100015967832022-07-012023-03-310001596783us-gaap:RetainedEarningsMember2024-01-012024-03-310001596783us-gaap:RetainedEarningsMember2023-01-012023-03-310001596783us-gaap:RetainedEarningsMember2023-07-012024-06-300001596783us-gaap:RetainedEarningsMember2022-07-012023-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2023-07-012024-03-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-07-012024-03-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2023-01-012023-03-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2023-07-012024-03-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2022-07-012023-03-3100015967832023-06-300001596783us-gaap:CommonStockMember2023-12-310001596783us-gaap:AdditionalPaidInCapitalMember2023-12-310001596783us-gaap:RetainedEarningsMember2023-12-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-3100015967832023-12-310001596783us-gaap:CommonStockMember2024-01-012024-03-310001596783us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001596783us-gaap:CommonStockMember2024-03-310001596783us-gaap:AdditionalPaidInCapitalMember2024-03-310001596783us-gaap:RetainedEarningsMember2024-03-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001596783us-gaap:CommonStockMember2022-12-310001596783us-gaap:AdditionalPaidInCapitalMember2022-12-310001596783us-gaap:RetainedEarningsMember2022-12-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100015967832022-12-310001596783us-gaap:CommonStockMember2023-01-012023-03-310001596783us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001596783us-gaap:CommonStockMember2023-03-310001596783us-gaap:AdditionalPaidInCapitalMember2023-03-310001596783us-gaap:RetainedEarningsMember2023-03-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100015967832023-03-310001596783us-gaap:CommonStockMember2023-06-300001596783us-gaap:AdditionalPaidInCapitalMember2023-06-300001596783us-gaap:RetainedEarningsMember2023-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001596783us-gaap:CommonStockMember2023-07-012024-06-300001596783us-gaap:AdditionalPaidInCapitalMember2023-07-012024-06-3000015967832023-07-012024-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012024-06-300001596783us-gaap:CommonStockMember2022-06-300001596783us-gaap:AdditionalPaidInCapitalMember2022-06-300001596783us-gaap:RetainedEarningsMember2022-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000015967832022-06-300001596783us-gaap:CommonStockMember2022-07-012023-03-310001596783us-gaap:AdditionalPaidInCapitalMember2022-07-012023-03-310001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012023-03-310001596783srt:ScenarioPreviouslyReportedMember2024-06-300001596783ctlt:RevisionAdjustmentsMember2024-06-3000015967832024-06-300001596783srt:RestatementAdjustmentMember2024-06-300001596783srt:ScenarioPreviouslyReportedMember2023-06-300001596783ctlt:RevisionAdjustmentsMember2023-06-300001596783us-gaap:ProductAndServiceOtherMember2023-07-012024-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2024-01-012024-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2024-01-012024-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:TotalCatalentbeforeintersegmentrevenueeliminationMember2024-01-012024-03-310001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2024-01-012024-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2024-01-012024-03-310001596783ctlt:TotalCatalentbeforeintersegmentrevenueeliminationMemberctlt:DevelopmentServicesMember2024-01-012024-03-310001596783us-gaap:OperatingSegmentsMemberctlt:BiologicsMember2024-01-012024-03-310001596783ctlt:PharmaConsumerHealthMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001596783ctlt:OperatingSegmentsExcludingIntersegmentEliminationMember2024-01-012024-03-310001596783us-gaap:IntersegmentEliminationMemberctlt:TotalCatalentSegmentMember2024-01-012024-03-310001596783us-gaap:OperatingSegmentsMember2024-01-012024-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2023-01-012023-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2023-01-012023-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:TotalCatalentbeforeintersegmentrevenueeliminationMember2023-01-012023-03-310001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2023-01-012023-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2023-01-012023-03-310001596783ctlt:TotalCatalentbeforeintersegmentrevenueeliminationMemberctlt:DevelopmentServicesMember2023-01-012023-03-310001596783us-gaap:OperatingSegmentsMemberctlt:BiologicsMember2023-01-012023-03-310001596783ctlt:PharmaConsumerHealthMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001596783ctlt:OperatingSegmentsExcludingIntersegmentEliminationMember2023-01-012023-03-310001596783us-gaap:IntersegmentEliminationMemberctlt:TotalCatalentSegmentMember2023-01-012023-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2023-07-012024-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2023-07-012024-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:TotalCatalentbeforeintersegmentrevenueeliminationMember2023-07-012024-03-310001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2023-07-012024-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2023-07-012024-03-310001596783ctlt:TotalCatalentbeforeintersegmentrevenueeliminationMemberctlt:DevelopmentServicesMember2023-07-012024-03-310001596783us-gaap:OperatingSegmentsMemberctlt:BiologicsMember2023-07-012024-03-310001596783ctlt:PharmaConsumerHealthMemberus-gaap:OperatingSegmentsMember2023-07-012024-03-310001596783ctlt:OperatingSegmentsExcludingIntersegmentEliminationMember2023-07-012024-03-310001596783us-gaap:IntersegmentEliminationMemberctlt:TotalCatalentSegmentMember2023-07-012024-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2022-07-012023-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2022-07-012023-03-310001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:TotalCatalentbeforeintersegmentrevenueeliminationMember2022-07-012023-03-310001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2022-07-012023-03-310001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2022-07-012023-03-310001596783ctlt:TotalCatalentbeforeintersegmentrevenueeliminationMemberctlt:DevelopmentServicesMember2022-07-012023-03-310001596783us-gaap:OperatingSegmentsMemberctlt:BiologicsMember2022-07-012023-03-310001596783ctlt:PharmaConsumerHealthMemberus-gaap:OperatingSegmentsMember2022-07-012023-03-310001596783ctlt:OperatingSegmentsExcludingIntersegmentEliminationMember2022-07-012023-03-310001596783us-gaap:IntersegmentEliminationMemberctlt:TotalCatalentSegmentMember2022-07-012023-03-310001596783ctlt:GeographicalMember2023-07-012024-03-310001596783srt:NorthAmericaMember2024-01-012024-03-310001596783srt:NorthAmericaMember2023-01-012023-03-310001596783srt:NorthAmericaMember2023-07-012024-03-310001596783srt:NorthAmericaMember2022-07-012023-03-310001596783srt:EuropeMember2024-01-012024-03-310001596783srt:EuropeMember2023-01-012023-03-310001596783srt:EuropeMember2023-07-012024-03-310001596783srt:EuropeMember2022-07-012023-03-310001596783ctlt:InternationalOtherMember2024-01-012024-03-310001596783ctlt:InternationalOtherMember2023-01-012023-03-310001596783ctlt:InternationalOtherMember2023-07-012024-03-310001596783ctlt:InternationalOtherMember2022-07-012023-03-310001596783ctlt:GreaterThanOneYearMemberMember2023-03-310001596783ctlt:MetricsMember2022-10-012022-10-010001596783ctlt:MetricsMember2022-10-010001596783ctlt:MetricsMemberus-gaap:CustomerRelationshipsMember2022-10-010001596783ctlt:MetricsMemberus-gaap:CustomerRelationshipsMember2022-10-012022-10-010001596783ctlt:BiologicsMember2023-06-300001596783ctlt:PharmaConsumerHealthMember2023-06-300001596783ctlt:BiologicsMember2023-07-012024-03-310001596783ctlt:PharmaConsumerHealthMember2023-07-012024-03-310001596783ctlt:PharmaConsumerHealthMember2024-01-012024-03-310001596783ctlt:BiologicsMember2024-03-310001596783ctlt:PharmaConsumerHealthMember2024-03-310001596783ctlt:TermLoanThreeFacilityDollarDenominatedMember2024-03-310001596783ctlt:TermLoanThreeFacilityDollarDenominatedMember2023-06-300001596783ctlt:TermLoanFourFacilityDollarDenominatedMember2024-03-310001596783ctlt:RevolvingCreditFacilityTwoMember2024-03-310001596783ctlt:RevolvingCreditFacilityTwoMember2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberctlt:USDollarDenominated500SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberctlt:USDollarDenominated500SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-06-300001596783ctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-03-310001596783ctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMember2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMember2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMember2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMember2023-06-300001596783us-gaap:CapitalLeaseObligationsMember2024-03-310001596783us-gaap:CapitalLeaseObligationsMember2023-06-300001596783ctlt:OtherObligationsMember2024-03-310001596783ctlt:OtherObligationsMember2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberctlt:DebtIssuanceCostsMember2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberctlt:DebtIssuanceCostsMember2023-06-300001596783ctlt:TermLoanFourFacilityDollarDenominatedMemberctlt:SecuredOvernightFinancingRateSOFRMember2024-03-310001596783ctlt:TermLoanFourFacilityDollarDenominatedMembersrt:MinimumMemberctlt:SecuredOvernightFinancingRateSOFRMember2024-03-310001596783us-gaap:RevolvingCreditFacilityMember2024-03-310001596783ctlt:USDollarDenominated500SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783ctlt:USDollarDenominated500SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783ctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783ctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783us-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783us-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMember2024-03-310001596783us-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMember2023-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001596783us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001596783ctlt:DebtIssuanceCostsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001596783ctlt:DebtIssuanceCostsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-3000015967832022-01-012022-03-310001596783ctlt:BiologicsMember2024-01-012024-03-310001596783ctlt:BiologicsMember2023-01-012023-03-310001596783ctlt:BiologicsMember2022-07-012023-03-310001596783ctlt:PharmaConsumerHealthMember2023-01-012023-03-310001596783ctlt:PharmaConsumerHealthMember2022-07-012023-03-310001596783ctlt:CorporateAndEliminationsMember2024-01-012024-03-310001596783ctlt:CorporateAndEliminationsMember2023-01-012023-03-310001596783ctlt:CorporateAndEliminationsMember2023-07-012024-03-310001596783ctlt:CorporateAndEliminationsMember2022-07-012023-03-310001596783ctlt:EuroDenominatedDebtOutstandingMember2024-03-310001596783ctlt:USDenominatedTermLoanMember2024-03-310001596783ctlt:USDenominatedTermLoanMember2021-02-280001596783ctlt:USDenominatedTermLoanMember2023-06-300001596783us-gaap:FairValueInputsLevel1Member2024-03-310001596783us-gaap:FairValueInputsLevel2Member2024-03-310001596783us-gaap:FairValueInputsLevel3Member2024-03-310001596783us-gaap:FairValueInputsLevel1Member2023-06-300001596783us-gaap:FairValueInputsLevel2Member2023-06-300001596783us-gaap:FairValueInputsLevel3Member2023-06-3000015967832023-10-012023-12-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2024-01-012024-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-12-310001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2024-01-012024-03-310001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2024-03-310001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-12-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2022-12-310001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-01-012023-03-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-03-310001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2023-03-310001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2022-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-07-012023-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2022-07-012023-03-3100015967832024-02-050001596783ctlt:MergerAgreementMember2024-02-050001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2024-01-012024-03-310001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2023-01-012023-03-310001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2023-07-012024-03-310001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2022-07-012023-03-310001596783ctlt:CorporateAndEliminationsMember2024-03-310001596783ctlt:CorporateAndEliminationsMember2023-06-30 UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

______________________________ | | | | | | | | | | | | | | |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

For the quarterly period ended March 31, 2024

or | | | | | | | | | | | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

001-36587

(Commission File Number)

_____________________________

Catalent, Inc.

(Exact name of registrant as specified in its charter)

_____________________________ | | | | | | | | |

| Delaware | 20-8737688 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 14 Schoolhouse Road | |

| Somerset, | New Jersey | 08873 |

(Address of principal executive offices)_______ | (Zip code) |

(732) 537-6200

Registrant’s telephone number, including area code

____________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | CTLT | New York Stock Exchange |

____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☒ | | Accelerated filer | | ¨ |

Non-accelerated filer | ¨ | | Smaller reporting company | ¨ |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ☒ No

On April 25, 2024, there were 180,979,849 shares of the Registrant’s common stock, par value $0.01 per share, issued and outstanding.

CATALENT, INC.

Index to Form 10-Q

For the Three and Nine Months Ended March 31, 2024

| | | | | | | | |

| Item | | Page |

| | |

| Part I. | | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Part II. | | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| |

| |

Special Note Regarding Forward-Looking Statements

In addition to historical information, this Quarterly Report on Form 10-Q of Catalent, Inc. (“Catalent” or the “Company”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included in this Quarterly Report on Form 10-Q are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate. Any forward-looking statement is subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements.

Some of the factors that may cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements include, but are not limited to, those summarized below, in addition to those described more fully (i) from time to time in reports that we have filed or in the future may file with the Securities and Exchange Commission (the “SEC”), and (ii) under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “Fiscal 2023 10-K”).

Risks Relating to Our Business and the Industry in Which We Operate

•We may not complete the pending merger with Novo Holdings within the timeframe anticipated, or at all, which could have a material adverse effect on our business, financial condition or results of operations, as well as negatively impact our share price.

•Actions of activist shareholders could impact the pursuit of our business strategies and adversely affect our results of operations, financial condition, or share price.

•We anticipate being subject to increasing focus by our investors, regulators, customers, and other stakeholders on environmental, social, and governance (“ESG”) matters.

•Any failure to implement fully, monitor, and continuously improve our quality management strategy could lead to quality or safety issues and expose us to significant costs, potential liability, and adverse publicity.

•We have experienced, and may continue to experience, productivity issues and higher-than-expected costs at certain of our facilities, which have resulted in, and may continue to result in, material and adverse impacts on our financial condition and results of operations.

•The declining demand for various COVID-19 vaccines and treatments from both patients and governments around the world has affected and may continue to affect sales of the COVID-19 products we manufacture and our financial condition.

•The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products.

•Our results of operations are subject to fluctuations in the costs, availability, and suitability of the components of the products we manufacture, including active pharmaceutical ingredients, excipients, purchased components, and raw materials, and other supplies or equipment we need to run our business.

•Our goodwill has been subject to impairment and may be subject to further impairment in the future, which could have a material adverse effect on our results of operations, financial condition, or future operating results.

•Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

•We may acquire businesses and offerings that complement or expand our business or divest non-strategic businesses or assets. We may not be able to complete desired transactions, and such transactions, if executed, pose significant risks, including risks relating to our ability to successfully and efficiently integrate acquisitions or execute on dispositions and realize anticipated benefits therefrom. The failure to execute or realize the full benefits from any such transaction could have a negative effect on our operations and profitability.

•We may become subject to litigation, other proceedings, and government investigations relating to us or our operations, and the ultimate outcome of any such matter may have an impact on our business, prospects, financial condition, and results of operations.

•Our global operations are subject to economic and political risks, including risks resulting from continuing inflation, disruptions to global supply chains, destabilization of a regional or national banking system, or from the Ukrainian-Russian war or the effect of the evolving nature of the recent war in Gaza between Israel and Hamas and conflict in the Middle East, which could affect the profitability of our operations or require costly changes to our procedures.

•We use advanced information and communication systems to run our operations, compile and analyze financial and operational data, and communicate among our employees, customers, and counterparties, and the risks generally associated with information and communications systems could adversely affect our results of operations. We continuously work to install new, and upgrade existing, systems and provide employee awareness training around phishing, malware, and other cybersecurity risks to enhance the protections available to us, but such protections may be inadequate to address malicious attacks or inadvertent compromises affecting data security or the operability of such systems.

•Artificial intelligence-based platforms present new risks and challenges to our business.

•Our cash, cash equivalents, and financial investments could be adversely affected if the financial institutions in which we hold our cash, cash equivalents, and financial investments fail.

Risks Relating to Our Indebtedness

•The size of our indebtedness and the obligations associated with it could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or in our industry or to deploy capital to grow our business, expose us to interest-rate risk to the extent of our variable-rate debt, or prevent us from meeting our obligations under our indebtedness. These risks may be increased in a recessionary environment, particularly as sources of capital may become less available or more expensive.

•Despite our high indebtedness level, we and our subsidiaries are still capable of incurring significant additional debt, which could further exacerbate the risks associated with our substantial indebtedness.

•Our interest expense on our variable-rate debt may continue to increase if and to the extent that policymakers combat inflation through interest-rate increases on benchmark financial products.

•Despite the limitations in our debt agreements, we retain the ability to take certain actions that may interfere with our ability to timely pay our substantial indebtedness.

•We may not be able to pay our indebtedness when it becomes due.

•We are currently using and may in the future use derivative financial instruments to reduce our exposure to market risks from changes in interest rates on our variable-rate indebtedness or changes in currency exchange rates, and any such instrument may expose us to risks related to counterparty credit worthiness or non-performance of these instruments.

Risks Relating to Ownership of Our Common Stock

•We do not presently maintain effective disclosure controls and procedures due to material weaknesses we have identified in our internal controls over financial reporting. Failure to remediate these material weaknesses or any other material weakness or significant deficiencies have resulted in a revision of our financial statements, in the future could result in material misstatements in our financial statements and have caused, and in the future could cause us to fail to timely meet our periodic reporting obligations.

•Our stock price has historically been and may continue to be volatile, and a holder of shares of our Common Stock may not be able to resell such shares at or above the price such stockholder paid, or at all, and could lose all or part of such investment as a result.

•Future sales, or the perception of future sales, of our Common Stock, by us or our existing stockholders could cause the market price for our Common Stock to decline.

•We are no longer eligible to use the Form S-3 registration statement, which could impair our capital-raising activities.

•Provisions in our organizational documents could delay or prevent a change of control.

We caution that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties, and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. There can be no assurance that (i) we have correctly measured or identified all of the factors affecting our business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct, or (iv) our strategy, which is based in part on this analysis, will be successful. All forward-looking statements in this report apply only as of the date of this report or as of the date they were made and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

Social Media

We use our website (catalent.com), Facebook page (facebook.com/CatalentPharmaSolutions), LinkedIn page (linkedin.com/company/catalent-pharma-solutions/) and Twitter account (@catalentpharma) as channels of distribution of information concerning our activities, our offerings, our various businesses, and other related matters. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings, and public conference calls and webcasts. The information contained on or accessible through our website, our social media channels, or any other website that we may maintain is not a part of this Quarterly Report.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Catalent, Inc.

Consolidated Statements of Operations

(Unaudited; dollars in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | Nine Months Ended

March 31, | | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

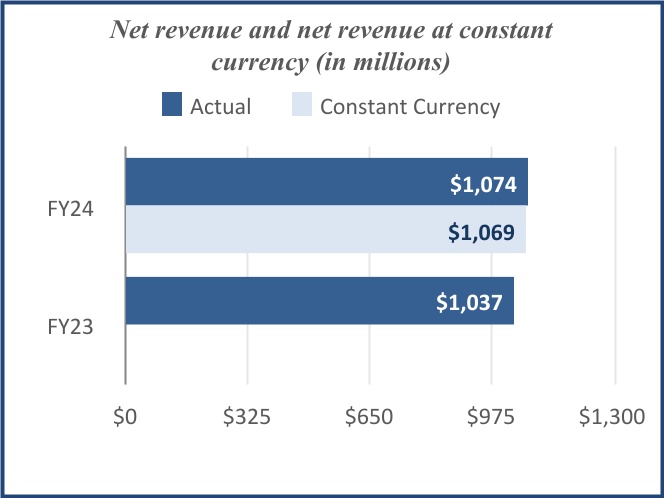

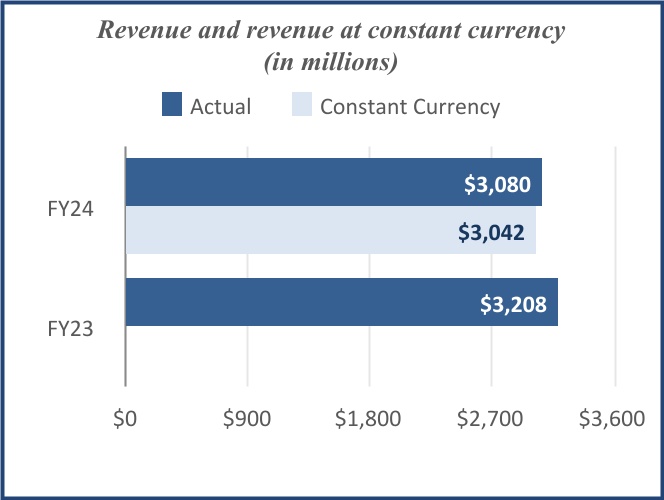

| Net revenue | $ | 1,074 | | | $ | 1,037 | | | $ | 3,080 | | | $ | 3,208 | | | | | |

| Cost of sales | 845 | | | 857 | | | 2,511 | | | 2,383 | | | | | |

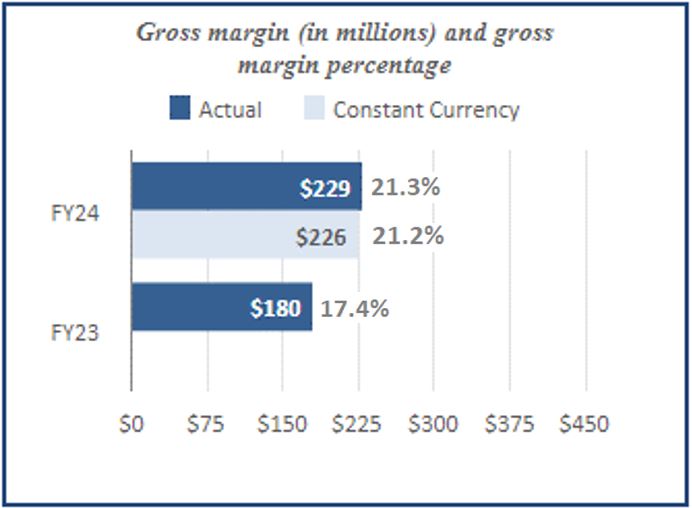

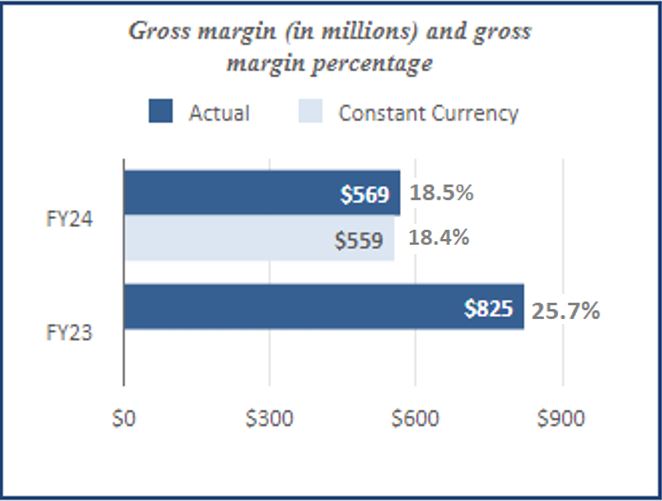

| Gross margin | 229 | | | 180 | | | 569 | | | 825 | | | | | |

| Selling, general, and administrative expenses | 214 | | | 190 | | | 669 | | | 612 | | | | | |

| | | | | | | | | | | |

| Goodwill impairment charges | — | | | 210 | | | 687 | | | 210 | | | | | |

| Other operating expense, net | 32 | | | 15 | | | 68 | | | 40 | | | | | |

| Operating loss | (17) | | | (235) | | | (855) | | | (37) | | | | | |

| Interest expense, net | 65 | | | 51 | | | 189 | | | 130 | | | | | |

| Other expense (income), net | 4 | | | (4) | | | 21 | | | (2) | | | | | |

| Loss before income taxes | (86) | | | (282) | | | (1,065) | | | (165) | | | | | |

| Income tax expense (benefit) | 15 | | | (55) | | | 1 | | | (19) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net loss | $ | (101) | | | $ | (227) | | | $ | (1,066) | | | $ | (146) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | |

| Basic | | | | | | | | | | | |

| | | | | | | | | | | |

| Net loss | $ | (0.56) | | | $ | (1.26) | | | $ | (5.87) | | | $ | (0.81) | | | | | |

| Diluted | | | | | | | | | | | |

| | | | | | | | | | | |

| Net loss | $ | (0.56) | | | $ | (1.26) | | | $ | (5.87) | | | $ | (0.81) | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Comprehensive Loss

(Unaudited; dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | Nine Months Ended

March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (101) | | | $ | (227) | | | $ | (1,066) | | | $ | (146) | |

| Other comprehensive (loss) income, net of tax | | | | | | | |

| Foreign currency translation adjustments | (14) | | | 27 | | | (16) | | | 10 | |

| Pension and other post-retirement adjustments | 7 | | | — | | | 11 | | | — | |

| Net change in marketable securities | — | | | 2 | | | — | | | 4 | |

| | | | | | | |

| | | | | | | |

| Derivatives and hedges | 5 | | | (2) | | | 3 | | | 12 | |

| Other comprehensive (loss) income, net of tax | (2) | | | 27 | | | (2) | | | 26 | |

| Comprehensive loss | $ | (103) | | | $ | (200) | | | $ | (1,068) | | | $ | (120) | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Balance Sheets

(Unaudited; dollars in millions, except share and per share data)

| | | | | | | | | | | |

| March 31,

2024 | | June 30,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 162 | | | $ | 280 | |

Trade receivables, net of allowance for credit losses of $32 and $46, respectively | 875 | | | 1,002 | |

| Inventories | 742 | | | 777 | |

| Prepaid expenses and other | 744 | | | 633 | |

| | | |

| Total current assets | 2,523 | | | 2,692 | |

Property, plant, and equipment, net of accumulated depreciation of $1,842 and $1,596, respectively | 3,735 | | | 3,682 | |

| Other assets: | | | |

| Goodwill | 2,339 | | | 3,039 | |

| Other intangibles, net | 875 | | | 980 | |

| Deferred income taxes | 66 | | | 55 | |

| Other long-term assets | 341 | | | 329 | |

| Total assets | $ | 9,879 | | | $ | 10,777 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Current portion of long-term obligations and other short-term borrowings | $ | 47 | | | $ | 536 | |

| Accounts payable | 377 | | | 424 | |

| Other accrued liabilities | 583 | | | 570 | |

| Total current liabilities | 1,007 | | | 1,530 | |

| Long-term obligations, less current portion | 4,933 | | | 4,313 | |

| Pension liability | 97 | | | 100 | |

| Deferred income taxes | 64 | | | 76 | |

| Other liabilities | 167 | | | 147 | |

| | | |

| | | |

| Total liabilities | 6,268 | | | 6,166 | |

| | | |

| Commitments and contingencies (see Note 14) | | | |

| Shareholders' equity: | | | |

Common stock, $0.01 par value; 1.00 billion shares authorized at March 31, 2024 and June 30, 2023; 181 million and 180 million issued and outstanding at March 31, 2024 and June 30, 2023, respectively | 2 | | | 2 | |

Preferred stock, $0.01 par value; 100 million shares authorized at March 31, 2024 and June 30, 2023; 0 shares issued and outstanding at March 31, 2024 and June 30, 2023 | — | | | — | |

| | | |

| Additional paid in capital | 4,769 | | | 4,701 | |

| (Accumulated deficit) retained earnings | (804) | | | 262 | |

| Accumulated other comprehensive loss | (356) | | | (354) | |

| | | |

| | | |

| Total shareholders' equity | 3,611 | | | 4,611 | |

| Total liabilities and shareholders' equity | $ | 9,879 | | | $ | 10,777 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Changes in Shareholders' Equity

(Unaudited; dollars in millions, except share data in thousands)

Three Months Ended March 31, 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at December 31, 2023 | 180,668 | | | $ | 2 | | | $ | 4,742 | | | | | $ | (703) | | | $ | (354) | | | | | $ | 3,687 | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 246 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 17 | | | | | — | | | — | | | | | 17 | | | |

| | | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 8 | | | | | — | | | — | | | | | 8 | | | |

| Employee stock purchase plan | — | | | — | | | 2 | | | | | — | | | — | | | | | 2 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (101) | | | — | | | | | (101) | | | |

Other comprehensive income, net

of tax | — | | | — | | | — | | | | | — | | | (2) | | | | | (2) | | | |

| Balance at March 31, 2024 | 180,914 | | | $ | 2 | | | $ | 4,769 | | | | | $ | (804) | | | $ | (356) | | | | | $ | 3,611 | | | |

Three Months Ended March 31, 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at December 31, 2022 | 179,988 | | | $ | 2 | | | $ | 4,686 | | | | | $ | 599 | | | $ | (395) | | | | | $ | 4,892 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 169 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 6 | | | | | — | | | — | | | | | 6 | | | |

| | | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 3 | | | | | — | | | — | | | | | 3 | | | |

| Employee stock purchase plan | — | | | — | | | 2 | | | | | — | | | — | | | | | 2 | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (227) | | | — | | | | | (227) | | | |

Other comprehensive loss, net of tax | — | | | — | | | — | | | | | — | | | 27 | | | | | 27 | | | |

| Balance at March 31, 2023 | 180,157 | | | $ | 2 | | | $ | 4,697 | | | | | $ | 372 | | | $ | (368) | | | | | $ | 4,703 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Changes in Shareholders' Equity

(Unaudited; dollars in millions, except share data in thousands)

Nine Months ended March 31, 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at June 30, 2023 | 180,273 | | | $ | 2 | | | $ | 4,701 | | | | | $ | 262 | | | $ | (354) | | | | | $ | 4,611 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 641 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 52 | | | | | — | | | — | | | | | 52 | | | |

| | | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 9 | | | | | — | | | — | | | | | 9 | | | |

| Employee stock purchase plan | — | | | — | | | 7 | | | | | — | | | — | | | | | 7 | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (1,066) | | | — | | | | | (1,066) | | | |

Other comprehensive income,

net of tax | — | | | — | | | — | | | | | — | | | (2) | | | | | (2) | | | |

| Balance at March 31, 2024 | 180,914 | | | $ | 2 | | | $ | 4,769 | | | | | $ | (804) | | | $ | (356) | | | | | $ | 3,611 | | | |

Nine Months Ended March 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | |

| Balance at June 30, 2022 | 179,302 | | | $ | 2 | | | $ | 4,649 | | | | | $ | 518 | | | $ | (394) | | | | | $ | 4,775 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 855 | | | — | | | — | | | | | — | | | — | | | | | — | | |

| | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 35 | | | | | — | | | — | | | | | 35 | | |

| | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 4 | | | | | — | | | — | | | | | 4 | | |

| Employee stock purchase plan | — | | | — | | | 9 | | | | | — | | | — | | | | | 9 | | |

| | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (146) | | | — | | | | | (146) | | |

Other comprehensive income,

net of tax | — | | | — | | | — | | | | | — | | | 26 | | | | | 26 | | |

| Balance at March 31, 2023 | 180,157 | | | $ | 2 | | | $ | 4,697 | | | | | $ | 372 | | | $ | (368) | | | | | $ | 4,703 | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Cash Flows

(Unaudited; dollars in millions)

| | | | | | | | | | | |

| Nine Months Ended March 31, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (1,066) | | | $ | (146) | |

| | | |

| | | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 359 | | | 308 | |

| Goodwill impairment charges | 687 | | | 210 | |

| Non-cash foreign currency transaction loss (gain), net | 10 | | | (6) | |

| Non-cash restructuring charges | 7 | | | 18 | |

Amortization of debt issuance costs | 10 | | | 6 | |

Impairment charges and loss/gain on sale of assets, net | 27 | | | 4 | |

| | | |

| | | |

| | | |

Stock-based compensation | 52 | | | 35 | |

| Benefit from deferred income taxes | (24) | | | (69) | |

| Provision for bad debts and inventory | 87 | | | 99 | |

| Pension settlement charges | 12 | | | — | |

| Change in operating assets and liabilities: | | | |

| Decrease in trade receivables | 130 | | | 18 | |

| Increase in inventories | (61) | | | (135) | |

| Decrease in accounts payable | (58) | | | (39) | |

Other assets/accrued liabilities, net—current and non-current | (118) | | | (245) | |

| | | |

| | | |

| Net cash provided by operating activities | 54 | | | 58 | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | | | |

| Acquisition of property, equipment, and other productive assets | (252) | | | (455) | |

| Proceeds from maturity of marketable securities | — | | | 89 | |

| Proceeds from sale of property and equipment | 1 | | | 8 | |

| | | |

| | | |

| Payment for acquisitions, net of cash acquired | — | | | (474) | |

| Payment for investments | (2) | | | (2) | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (253) | | | (834) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from borrowings | 1,060 | | | 715 | |

| | | |

| | | |

| Payments related to long-term obligations | (971) | | | (176) | |

Financing fees paid | (16) | | | (4) | |

| | | |

| | | |

| | | |

| | | |

| Exercise of stock options | 9 | | | 4 | |

| Other financing activities | 2 | | | 33 | |

| | | |

| | | |

| Net cash provided by financing activities | 84 | | | 572 | |

| Effect of foreign currency exchange on cash and cash equivalents | (3) | | | 7 | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (118) | | | (197) | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 280 | | | 449 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 162 | | | $ | 252 | |

| SUPPLEMENTARY CASH FLOW INFORMATION: | | | |

| Interest paid | $ | 182 | | | $ | 145 | |

| Income taxes paid, net | $ | 64 | | | $ | 83 | |

| Non-cash purchase of property, equipment, and other productive assets | $ | 13 | | | $ | 8 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Notes to Unaudited Consolidated Financial Statements

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Catalent, Inc. (“Catalent” or the “Company”) directly and wholly owns PTS Intermediate Holdings LLC (“Intermediate Holdings”). Intermediate Holdings directly and wholly owns Catalent Pharma Solutions, Inc. (“Operating Company”). The financial results of Catalent are comprised of the financial results of Operating Company and its subsidiaries on a consolidated basis.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three and nine months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending June 30, 2024. The consolidated balance sheet at June 30, 2023 has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information on the Company's accounting policies and footnotes, refer to the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023 filed with the Securities and Exchange Commission (the “SEC”) on December 8, 2023.

Reportable Segments

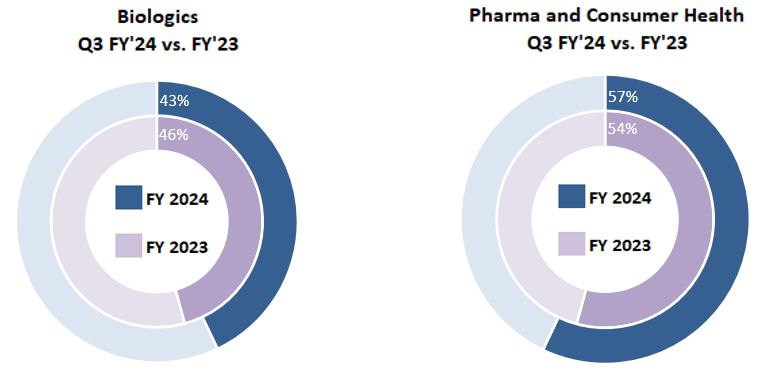

Set forth below is a summary description of the Company's two current operating and reportable segments.

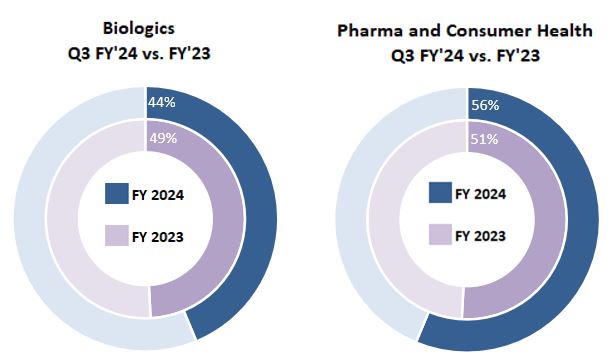

Biologics—The Biologics segment provides development and manufacturing for biologic proteins; cell, gene, and other nucleic acid therapies; plasmid DNA ("pDNA"); induced pluripotent stem cells ("iPSCs"), and oncolytic viruses; and vaccines. It also provides formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, and cartridges; analytical development and testing services for large molecules.

Pharma and Consumer Health—The Pharma and Consumer Health segment comprises the Company’s market-leading capabilities for complex oral solids, softgel formulations, Zydis® fast-dissolve technologies, and gummy, soft chew, and lozenge dosage forms; formulation, development, and manufacturing platforms for oral, nasal, inhaled, and topical dose forms; and clinical trial development and supply services.

Each segment reports through a separate management team and ultimately reports to the Company's President and Chief Executive Officer, who is designated as the Chief Operating Decision Maker for segment reporting purposes. The Company's operating segments are the same as its reportable segments.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation

The financial statements of the Company’s operations are generally measured using the local currency as the functional currency. Adjustments to translate the assets and liabilities of operations outside the United States (“U.S.”) into U.S. dollars are accumulated as a component of other comprehensive income/(loss) utilizing period-end exchange rates. Since July 1, 2018, the Company has accounted for its Argentine operations as highly inflationary.

Concentrations of Credit Risk and Major Customers

Concentration of credit risk, with respect to accounts receivable, is limited due to the large number of customers and their dispersion across different geographic areas. The customers are primarily concentrated in the pharmaceutical, biopharmaceutical and consumer products industries. The Company does not normally require collateral or any other security to support credit sales. The Company performs ongoing credit evaluations of its customers’ financial conditions and maintains reserves for credit losses. Such losses historically have been within the Company’s expectations.

As of March 31, 2024 and June 30, 2023, the Company had one customer that represented 31% and 20%, respectively, of its aggregate net trade receivables and current contract asset values, primarily associated with the Company's Biologics segment. Additionally, the Company had one customer in its Biologics segment that represented approximately 14% and 16% of consolidated net revenue during the three and nine months ended March 31, 2024, respectively. The Company had two customers in its Biologics segment that each represented approximately 11% and 10% of consolidated net revenue during the three and nine months ended March 31, 2023, respectively.

Depreciation

Depreciation expense was $92 million and $72 million for the three months ended March 31, 2024 and 2023, respectively. Depreciation expense was $258 million and $207 million for the nine months ended March 31, 2024 and 2023, respectively. Depreciation expense includes amortization of assets related to finance leases. The Company charges repairs and maintenance costs to expense as incurred.

Amortization

Amortization expense related to other intangible assets was $34 million and $34 million for the three months ended March 31, 2024 and 2023, respectively. Amortization expense related to other intangible assets was $101 million and $101 million for the nine months ended March 31, 2024 and 2023, respectively.

Research and Development Costs

The Company expenses research and development costs as incurred. Research and development costs amounted to $4 million for both the three months ended March 31, 2024 and 2023. Research and development costs amounted to $12 million and $13 million for the nine months ended March 31, 2024 and 2023, respectively. Research and development costs are recorded in selling, general and administrative expenses in the consolidated statement of operations.

2. REVENUE RECOGNITION

The Company recognizes revenue in accordance with ASC 606, Revenue from Contracts with Customers. The Company generally earns its revenue by supplying goods or providing services under contracts with its customers in three primary revenue streams: manufacturing and commercial product supply, development services, and clinical supply services. The Company measures the revenue from customers based on the consideration specified in its contracts, excluding any sales incentive or amount collected on behalf of a third party, that the Company expects to be entitled to receive in exchange for transferring the promised goods to and/or performing services for the customer (the “Transaction Price”). To the extent the Transaction Price includes variable consideration, the Company estimates the amount of variable consideration that should be included in the Transaction Price utilizing either the expected value method or the most likely amount method, depending on which method is expected to better predict the amount of consideration to which the Company will be entitled. The value of variable consideration is included in the Transaction Price if, and to the extent, it is probable that a significant reversal of the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. These estimates are re-assessed each reporting period, as required, and any adjustment required is recorded on a cumulative catch-up basis, which would affect revenue and net income in the period of adjustment.

The Company’s customer contracts generally include provisions entitling the Company to a termination penalty when the customer terminates prior to the contract’s nominal end date. The termination penalties in customer contracts vary but are generally considered substantive for accounting purposes and create enforceable rights and obligations throughout the stated durations of the contracts. The Company accounts for a contract termination as a contract modification in the period in which the customer gives notice of termination. The determination of the contract termination penalty is based on the terms stated in the relevant customer agreement. As of the modification date, the Company updates its estimate of the Transaction Price using the expected value method, subject to constraints, and to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. These estimates are re-assessed each reporting period, as required, and any adjustment required is recorded on a cumulative catch-up basis, which would affect revenue and net income in the period of adjustment.

Where multiple performance obligations exist in a single contract, the Company allocates consideration to each performance obligation using the “relative standalone selling price” as defined under ASC 606. Generally, the Company utilizes observable standalone selling prices in its allocations of consideration. If observable standalone selling prices are not available, the Company estimates the applicable standalone selling price using a cost-plus-margin approach or an adjusted market assessment approach, in each case, representing the amount that the Company believes the market is willing to pay for the applicable service. Payment is typically due 30 to 45 days following the invoice date, based on the payment terms set forth in the applicable customer agreement.

The Company generally expenses sales commissions as incurred because either the amortization period is one year or less, or the balance with an amortization period greater than one year is not material.

Customer contracts that include commitments by the Company to make facility space or equipment available may be deemed to include lease components, which are evaluated under ASC 842, Leases. For arrangements that contain both lease and non-lease components, consideration in the contract is allocated on a relative standalone selling-price basis. Determining the lease term and contract term of non-lease components, as well as the variable and fixed consideration in these arrangements, including when variability is resolved, often requires management judgment in order to determine the allocation to the lease and non-lease components.

Manufacturing & Commercial Product Supply Revenue

Manufacturing and commercial product supply revenue consists of revenue earned by manufacturing products supplied to customers under long-term commercial supply arrangements. In these arrangements, the customer typically owns and supplies the active pharmaceutical ingredient (“API”) or other proprietary materials used in the manufacturing process. The contract generally includes the terms of the manufacturing services and related product quality assurance procedures to comply with regulatory requirements. Due to the regulated nature of the Company’s business, these contract terms are highly interdependent and, therefore, are considered to be a single combined performance obligation. The transaction price is generally stated in the agreement as a fixed price per unit, with no contractual provision for a refund or price concession. In most circumstances, control is transferred to the customer over time, creating a corresponding right to recognize the related revenue, because there is no alternative use to the Company for the asset created and the Company has an enforceable right to payment for performance completed as of that date. The selection of the method for measuring progress towards the completion of the Company’s performance obligation requires judgment and is based on the nature of the products to be manufactured. For the majority of the Company’s arrangements, progress is measured based on the units of product that have successfully completed the contractually required product quality assurance process, because the conclusion of that process defines the time when the applicable contract and the related regulatory requirements permit the customer to exercise control over the product’s disposition. The customer is typically responsible for arranging the shipping and handling of product following completion of the quality assurance process. Payment is typically due 30 to 45 days after invoice date, based on the payment terms set forth in the applicable customer agreement.

Beginning in the third quarter of fiscal 2023, the Company began recognizing commercial revenue for certain contracts in its Biologics segment that have a notably long manufacturing cycle, and for which the customer exercises control over the product throughout the manufacturing process. For these contracts, revenue is recognized over time and progress is measured using an input method based on effort expended, which provides an appropriate depiction of the Company’s progress toward fulfilling its performance obligation.

Development Services and Clinical Supply Revenue

Development services contracts generally take the form of short-term, fee-for-service arrangements. Performance obligations vary, but frequently include biologic cell-line development, performing formulation, analytical stability, or other services related to product development, and providing manufacturing services for products that are under development or otherwise not intended for commercial sale. They can also include a combination of the following services: the manufacturing, packaging, storage, distribution, destruction, and inventory management of customer clinical trial material, as well as the sourcing of comparator drug products on behalf of customers to be used in clinical trials to compare performance with the drug under clinical investigation. The transaction prices for these arrangements are fixed and include amounts stated in the contracts for each promised service, and each service is generally considered to be a separate performance obligation. In most instances, the Company recognizes revenue over time because there is no alternative use to the Company for the asset created and the Company has an enforceable right to payment for performance completed as of that date.

The Company measures progress toward the completion of its performance obligations satisfied over time based on the nature of the services to be performed. For certain types of arrangements, revenue is recognized over time and measured using an output method based on the completion of tasks and activities that are performed to satisfy a performance obligation. For

certain types of arrangements, revenue is recognized over time and measured using an input method based on effort expended. Each of these methods provides an appropriate depiction of the Company’s progress toward fulfilling its performance obligations for its respective arrangement. In certain development services arrangements that require a portion of the contract consideration to be received in advance at the commencement of the contract, such advance payment is initially recorded as a contract liability. In certain clinical supply arrangements, revenue is recognized at the point in time when control transfers, which occurs upon either the delivery of the related output of the service to the customer or the completion of quality testing with respect to the product, and the Company has an enforceable right to payment based on the terms of the arrangement.

The Company records revenue for comparator sourcing arrangements on a net basis because it is acting as an agent that does not control the product or service before it is transferred to the customer. Payment for comparator sourcing activity is typically received in advance at the commencement of the contract and is initially recorded as a contract liability.

The following tables reflect net revenue for the three and nine months ended March 31, 2024 and 2023, by type of activity and reportable segment (in millions):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 261 | | | $ | 402 | | | $ | 663 | |

| Development services & clinical supply | 200 | | | 211 | | | 411 | |

| Total | $ | 461 | | | $ | 613 | | | $ | 1,074 | |

| Inter-segment revenue elimination | | — | |

| Combined net revenue | | $ | 1,074 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 133 | | | $ | 349 | | | $ | 482 | |

| Development services & clinical supply | 342 | | | 214 | | | 556 | |

| Total | $ | 475 | | | $ | 563 | | | $ | 1,038 | |

| Inter-segment revenue elimination | (1) | |

| Combined net revenue | | $ | 1,037 | |

| | | | | | | | | | | | | | | | | |

Nine Months Ended March 31, 2024 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 821 | | | $ | 1,109 | | | $ | 1,930 | |

| Development services & clinical supply | 526 | | | 625 | | | 1,151 | |

| Total | $ | 1,347 | | | $ | 1,734 | | | $ | 3,081 | |

| Inter-segment revenue elimination | | (1) | |

| Combined net revenue | | $ | 3,080 | |

| | | | | | | | | | | | | | | | | |

Nine Months Ended March 31, 2023 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 304 | | | $ | 1,027 | | | $ | 1,331 | |

| Development services & clinical supply | 1,274 | | | 605 | | | 1,879 | |

| Total | $ | 1,578 | | | $ | 1,632 | | | $ | 3,210 | |

| Inter-segment revenue elimination | (2) | |

| Combined net revenue | | $ | 3,208 | |

The following table allocates revenue by the location where the goods were made or the service performed:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | Nine Months Ended

March 31, |

| (Dollars in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| United States | | $ | 690 | | | $ | 685 | | | $ | 1,990 | | | $ | 2,117 | |

| Europe | | 345 | | | 306 | | | 942 | | | 936 | |

| Other | | 88 | | | 79 | | | 261 | | | 249 | |

| Elimination of revenue attributable to multiple locations | | (49) | | | (33) | | | (113) | | | (94) | |

| Total | | $ | 1,074 | | | $ | 1,037 | | | $ | 3,080 | | | $ | 3,208 | |

Contract Liabilities

Contract liabilities relate to cash consideration that the Company receives in advance of satisfying the related performance obligations. The contract liabilities balances (current and non-current) as of March 31, 2024 and June 30, 2023 are as follows:

| | | | | | | | |

| (Dollars in millions) | | |

| | |

| Balance at June 30, 2023 | | $ | 180 | |

| | |

| | |

| | |

| | |

| Balance at March 31, 2024 | | $ | 255 | |

| Revenue recognized in the period from amounts included in contracts liability at the beginning of the period: | | $ | (122) | |

Contract liabilities that will be recognized within 12 months of March 31, 2024 are accounted for in Other accrued liabilities and those that will be recognized longer than 12 months after March 31, 2024 are accounted for in Other liabilities.

Contract Assets

Contract assets primarily relate to the Company's conditional right to receive consideration for services that have been performed for customers as of March 31, 2024 relating to the Company's development and commercial services but had not yet been invoiced as of March 31, 2024. Contract assets are transferred to trade receivables, net when the Company’s right to receive the consideration becomes unconditional. Contract assets totaled $490 million and $417 million as of March 31, 2024 and June 30, 2023, respectively. Contract assets expected to transfer to trade receivables within 12 months are accounted for within Prepaid expenses and other. Contract assets expected to transfer to trade receivables longer than 12 months are accounted for within Other long-term assets.

As of March 31, 2024, the Company's aggregate contract asset balance increased $73 million or 18% compared to June 30, 2023. The majority of this increase is related to large development and commercial programs in the Biologics segment, such as manufacturing and development services for gene therapy offerings, where revenue is recorded over time and the ability to invoice customers is dictated by contractual terms.

Performance Obligations

Remaining performance obligations represent firm orders for future development services as well as manufacturing and commercial product supply, including minimum volume commitments, for which there are incomplete performance obligations for work not yet completed under executed contracts. Remaining performance obligations as of March 31, 2024 were $585 million. The Company expects to recognize approximately 26% of the remaining performance obligations in existence as of March 31, 2024 after June 30, 2025.

3. BUSINESS COMBINATIONS

Metrics Contract Services Acquisition

In October 2022, the Company acquired 100% of Metrics Contract Services (“Metrics”) from Mayne Pharma Group Limited for $474 million in cash. Metrics, based in Greenville, North Carolina, is an oral solids development and manufacturing business specializing in the manufacture of drugs containing highly potent active pharmaceutical ingredients. The operations and facility acquired have become part of the Company’s Pharma and Consumer Health segment.

The Company accounted for the Metrics transaction using the acquisition method in accordance with ASC 805, Business Combinations. The Company funded this acquisition with a portion of the proceeds of an October 2022 drawdown from its senior secured revolving credit facility. The Company estimated fair values at the date of acquisition for the allocation of consideration to the net tangible and intangible assets acquired and liabilities assumed.

The purchase price allocation to assets acquired and liabilities assumed in the transaction is as follows:

| | | | | |

| (Dollars in millions) | Final Purchase Price Allocation |

| Trade receivables, net | $ | 15 | |

| Inventories | 5 | |

| Property, plant, and equipment | 195 | |

| Other intangibles, net | 52 | |

| |

| Other, net | (12) | |

| Goodwill | 219 | |

| Total assets acquired and liabilities assumed | $ | 474 | |

The carrying value of trade receivables, inventory, and trade payables, as well as certain other current and non-current assets and liabilities generally represented the fair value at the date of acquisition.

Other intangibles, net consists of customer relationships of $52 million, which were valued using the multi-period, excess-earnings method, a method that values the intangible asset using the present value of the after-tax cash flows attributable to the intangible asset only. The significant assumptions used in developing the valuation included the estimated annual net cash flows (including application of an appropriate margin to forecasted revenue, selling and marketing costs, return on working capital, contributory asset charges, and other factors), the discount rate that appropriately reflects the risk inherent in each future cash flow stream, and an assessment of the asset’s life cycle, as well as other factors. The assumptions used in the financial forecasts were based on historical data, supplemented by current and anticipated growth rates, management plans, and market-comparable information. Fair-value determinations require considerable judgment and are sensitive to changes in underlying assumptions and factors. The customer relationship intangible asset has a weighted average useful life of 12 years.

Property, plant, and equipment was valued using the cost approach, which is based on current replacement and/or reproduction cost of the asset as new, less depreciation attributable to physical, functional, and economic factors. The Company then determined the remaining useful life based on the anticipated life of the asset and Company policy for similar assets.

Goodwill was allocated to the Pharma and Consumer Health segment. Goodwill is mainly comprised of the growth from an expected increase in capacity utilization and potential new customers. The goodwill resulting from the Metrics acquisition is not deductible for tax purposes.

4. GOODWILL

The following table summarizes the changes between June 30, 2023 and March 31, 2024 in the carrying amount of goodwill in total and by segment:

| | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Biologics | | Pharma and Consumer Health | | | | | | Total |