medovexs1a_june2014.htm

As filed with the Securities and Exchange Commission on July 7, 2014

Registration No. 333- ___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MEDOVEX CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

3841

|

46-3312262

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

3279 Hardee Avenue

Atlanta, Georgia 30341

(844) 633-6839

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Charles Farrahar

Chief Financial Officer

MEDOVEX CORP.

1735 Buford Hwy., Ste 215-113

Cumming, Georgia 30041

(844) 633-6839

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Harvey Kesner, Esq.

Arthur S. Marcus, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

(212) 930-9700

|

Jarrett Gorlin

Chief Executive Officer

MEDOVEX CORP.

1735 Buford Hwy., Ste 215-113

Cumming, Georgia 30040

844-633-6839

|

Joel Mayersohn, Esq.

Roetzel & Andress, LPA

350 East Las Olas Blvd.

Las Olas Centre II, Suite 1150

Fort Lauderdale, Florida 33301

(954) 462-4150

|

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. [ ]

Large accelerated filer [ ]

|

|

|

|

Non-accelerated filer [ ]

(Do not check if a smaller reporting company)

|

|

Smaller reporting company [X]

|

CALCULATION OF REGISTRATION FEE

| Title of each class of

securities to be registered

|

|

Amount

to be

registered

|

|

Proposed

maximum

offering price

per Share (1)

|

|

|

Proposed

maximum

aggregate

offering

price (1)

|

|

|

Amount of

registration fee (2)

|

|

| Units, Each Consisting of One Share of Common Stock, $0.001 Par Value Per Share and One Series A Warrant |

|

1,552,500 units |

|

$ |

6.50 |

|

|

$ |

10,091,250 |

|

|

$ |

1,299.75 |

|

| Shares of Common Stock Included as Part of the Units (3) |

|

1,350,000 shares |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Series A Warrants Included as Part of the Units |

|

1,350,000 warrants |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Shares of Common Stock Underlying the Series A Warrants Included in the Units (3)(5) |

|

1,350,000 shares |

|

$ |

7.80 |

|

|

$ |

10,530,000 |

|

|

$ |

1,356.26 |

|

| Series B Warrants |

|

1,350,000 warrants |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Shares of Common Stock Underlying the Series B Warrants (3)(5) |

|

1,350,000 shares |

|

$ |

7.80 |

|

|

$ |

10,530,000 |

|

|

$ |

1,356.26 |

|

| Units underlying the Representative’s Unit Warrant (“Representative’s Units”) (6) |

|

205,500 units |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Shares of Common Stock underlying the Representative’s Units (3) |

|

202,500 shares |

|

$ |

6.50 |

|

|

$ |

1,316,250 |

|

|

$ |

169.53 |

|

| Series A Warrants Included as Part of the Representative’s Units |

|

202,500 warrants |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Shares of Common Stock Underlying the Series A Warrants included in the Representative’s Units (3)(5) |

|

202,500 shares |

|

$ |

7.80 |

|

|

$ |

1,579,500 |

|

|

$ |

203.44 |

|

| Series B Warrants Included as Part of the Representative’s Units |

|

202,500 warrants |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

- |

|

| Shares of Common Stock Underlying the Series B Warrants included in the Representative’s Units (3)(5) |

|

202,500 shares |

|

$ |

7.80 |

|

|

$ |

1,579,500 |

|

|

$ |

203.44 |

|

| Total |

|

|

|

|

|

|

|

$ |

36,949,000 |

|

|

$ |

4,588.68 |

|

| (1) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the "Securities Act"). Includes the offering price of shares from the units that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) |

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (3) |

Pursuant to Rule 416 under the Securities Act, the shares of Common Stock registered hereby also include an indeterminate number of additional shares of Common Stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transactions. |

| (4) |

No registration fee pursuant to Rule 457(g) under the Securities Act. |

| (5) |

Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 120% of the public offering price per unit. |

| (6) |

Estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative's Units is $3,213,000 (which is equal to 10% of $32,130,000 ). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities or the solicitation of an offer to buy these securities in any state in which such offer, solicitation or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED MAY 1, 2014

|

1,350,000 Units and 1,350,000 Series B Warrants

Each Unit Consisting of One Share of Common Stock and One Series A Warrant to Purchase One Share of Common Stock

We are offering 1,350,000 units and 1,350,000 Series B Warrants in an initial public offering. Each unit consists of one share of common stock and one Series A Warrant. In addition, the holder of each unit will receive one Series B Warrant to purchase one share of common stock per unit purchased, but such Series B Warrants will not be transferable. No public market currently exists for our common stock or warrants. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price to be between $5.50 and $6.50 per unit, including the Series B Warrant. The units will not be certificated and the shares of common stock and Series A Warrants will trade initially as a unit, and will trade separately not later than 90 days from the date hereof, or earlier with the underwriter’s consent.

Each Series A Warrant is exercisable for one share of common stock. The Series A Warrants are immediately exercisable upon issuance in this initial public offering at an initial exercise price of 120% of the initial public offering price of one unit in this offering. The Series A Warrants will expire on the third anniversary of the date of issuance.

Each Series B Warrant is exercisable for one share of common stock. The Series B Warrants are immediately exercisable after issuance at an initial exercise price of 120% of the initial public offering price of one unit in this offering. The Series B Warrants will expire on the fifth anniversary of the date of issuance, and will not be listed on any securities exchange.

The shares of common stock issuable from time to time upon the exercise of the Series A Warrants and the Series B Warrants are also being offered pursuant to this prospectus.

We intend to apply to list our common stock on The NASDAQ Capital Market under the symbol “MDVX,” the Series A Warrants will trade under the symbol “MDVXW,” and our units will trade under the symbol “MDVXU.” No assurance can be given that our application will be approved.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page15 in this prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per Unit and Series B Warrant

|

|

|

Total

|

|

Initial public offering price

|

|

|

6.00 |

|

|

|

8,100,000 |

|

Underwriting discounts and commissions (1)

|

|

|

0.82 |

|

|

|

1,096,000 |

|

Proceeds to us, before expenses

|

|

|

5.18 |

|

|

|

7,004,000 |

|

| |

|

|

|

|

|

|

|

|

(1) The underwriters will receive compensation in addition to the underwriting discount and commissions. See "Underwriting" beginning on page 74 for a description of compensation payable to the underwriters.

We have granted a 45-day option to the representative of the underwriters to purchase up to (i) 202,500 additional units, and Series B Warrants solely to cover over-allotments, if any. The over-allotment option must be used to purchase an equal numbers of units and Series B Warrants, but such purchases cannot exceed an aggregate of 15% of the number of Units and Series B Warrants sold in the primary offering. In addition, the registration statement of which this prospectus forms a part relates to the registration of 135,000 Units and 135,000 Series B Warrants issuable upon exercise of the Representative’s unit warrant

The underwriters expect to deliver our securities to purchasers in the offering on or about , 2014.

.

ViewTrade Securities Inc.

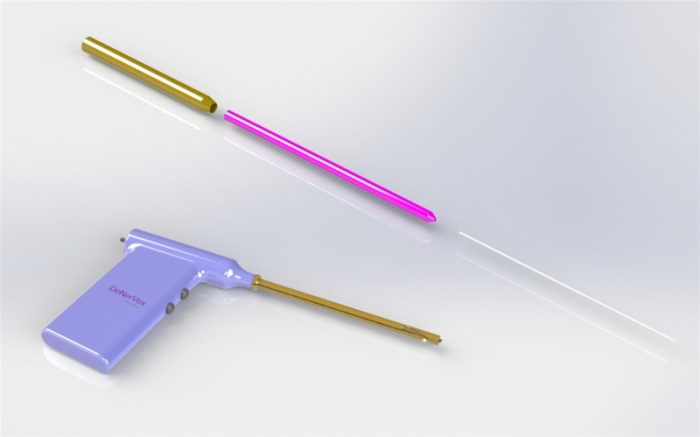

This is a conceptual prototype of the DenerVex device. MEDOVEX has not sold this device and has not applied to any regulatory agency to obtain clearance for this prototype. The final device used to obtain regulatory clearance may appear differently than the image above.

| |

Page

|

| |

|

|

|

1 |

|

|

10 |

|

|

30 |

|

|

30 |

|

|

31 |

|

|

31 |

|

|

33 |

|

|

34 |

|

|

41 |

|

|

57 |

|

|

65 |

|

|

66 |

|

|

69 |

|

|

70 |

|

|

74 |

|

|

76 |

|

|

79 |

|

|

79 |

|

|

79 |

|

|

|

________________________________________

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. This prospectus is not an offer to sell or the solicitation of an offer to buy the shares of common stock in any circumstances under which the offer or solicitation is unlawful.

________________________________________

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

________________________________________

We have applied for trademarks on “MEDOVEX” and “DenerVex”. This prospectus may include trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the "Risk Factors" section of this prospectus and our financial statements and the related notes appearing at the end of this prospectus, before making an investment decision.

As used in this prospectus, unless the context otherwise requires, references to Medovex we, us, our, our company refer to MEDOVEX Corp. and its wholly-owned subsidiary, Debride, Inc. All share numbers give effect to a 2:1 reverse stock split effected in March, 2014.

Overview

MEDOVEX Corp.’s goal is to create better living through better medicine.

We intend to build a portfolio of medical device products in areas where our world-class management team believes the largest, most targetable market opportunities exist. We intend to build this portfolio primarily by acquiring companies or technologies that we believe have promising commercial potential. In September 2013, we acquired Debride, Inc. (Debride). Debride is a development stage company that has acquired a patent, patent applications and other intellectual property rights relating to the use, development, and commercialization of the DenerVex device (the DenerVex). Debride acquired from Scott M.W. Haufe, MD (Dr. Haufe) all right, title and ownership of U.S. Patent 8,167,879 B2, together with all of Dr. Haufe’s rights, title and interest in and to the DenerVex. Dr. Haufe is a director of the Company. In September 2013, we entered into a Co-Development Agreement with Dr. James Andrews, a renowned orthopedic surgeon who also is a director of the Company. Dr. Andrews has agreed to evaluate the DenerVex and to seek to make modifications and improvements to such technology, as well as to strategize in the rollout of the DenerVex. See “Transactions with Related Parties”.

We are a development stage enterprise with no revenues. In their opinion letter for the fiscal year ended December 31, 2013, our auditors included an explanatory paragraph that disclosed conditions that raise concerns about the Company's ability to continue as a going concern. Please refer to the audited financial statements and accompanying auditors report within this filing.

Initial Product

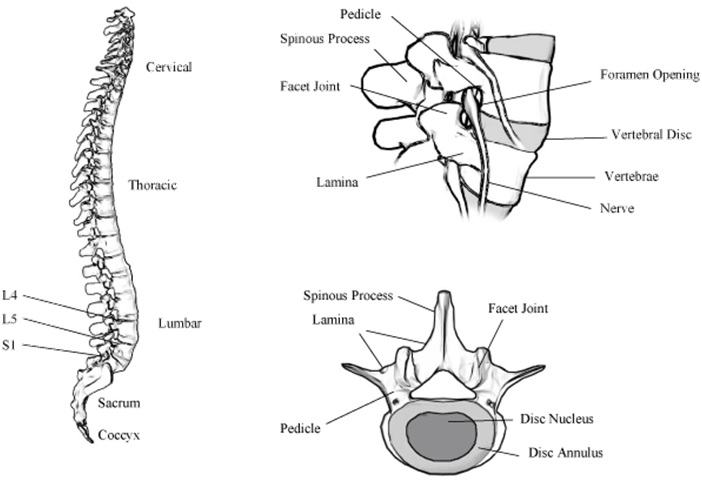

To date, our efforts have focused on the development of the patent-protected DenerVex device (U.S. Patent 8,167,879 B2). The DenerVex is designed to provide long lasting relief of pain associated with Facet Joint Syndrome (FJS), a condition in which the joints in the back of the spine degenerate and subsequently cause back pain. The concept is simple: remove the affected nerve endings sending pain signals to the brain in such a way that they won’t grow back. A current treatment for this pain removes the nerve endings, but the nerve endings regenerate and the pain returns. A patient is forced to return again and again to seek pain relief at a substantial cost over time.

In order to avoid having his patients suffering from chronic back pain associated with FJS have to return to him for repeated treatments, Dr. Haufe performed a 2-step procedure where he first scraped away synovial tissue using an already available deburring device around the facet joints in the spine so nerves would not have tissue that could be used for regrowth. Once this tissue was removed, he then used a standard electrocautery unit to cauterize the nerve endings, as is done with the temporary treatment to render the nerves incapable of sending pain signals to the brain. Due to the complexity and time required to complete this procedure, it is only employed by a small number of other surgeons besides Dr. Haufe.

In order to see if these patients were indeed enjoying pain relief and not experiencing nerve regrowth, Dr. Haufe followed 174 of his patients receiving this treatment over a three year period (temporary approaches generally do not last more than 2 years and often less). Over 70% of patients were still pain free or had greater than 50% reduction in pain. While this follow-up did not constitute a clinical study that could be used for FDA clearance, the results encouraged Dr. Haufe to think of ways to expand the treatment to other patients who did not have the resources to afford a relatively complex procedure (assuming they could even locate a surgeon capable of performing it). The key was simplifying the procedure to the point where doctors specializing in pain management and other areas besides spine surgery could perform the procedure quickly and safely, at a cost much less than the cost of temporary treatments over time. To simplify the procedure, Dr. Haufe conceptualized a hand held device that combined the tissue scraping and electrocautery procedures into one action. A simple solution that, based on our internal research on non-living tissue, produces the same result as the 2-step procedure, but requires significantly less surgical skill and takes much less time.

We believe the DenerVex is the first device of its kind that combines tissue scraping and electrocautery simultaneously in order to achieve a long lasting solution to FJS. The DenerVex is a single use device that will be provided to health care practitioners in a package that contains all of the items necessary in the sterile field of the operating room to carry out the surgery necessary to address FJS. The DenerVex does not require a special power source and can be connected to the cauterizing generator generally found in most operating rooms. While the device is still in the prototype phase, we estimate a sales price of approximately $695.00 per device, which we believe will be an attractive price point for end-users. We arrived at the sales price after conducting focus group meetings with potential end-users and obtaining their feedback on ranges of prices they would be willing to pay for the type of pain relief the DenerVex could provide. These end users included pain management physicians, an anesthesiologist, orthopedic surgeons who perform spinal surgery and neurosurgeons. As reimbursement is available for the treatment of Facet Joint Pain in the United States and in major countries in Europe, they could base their responses on reimbursement rates for currently available treatments.

Besides the potential cost savings from the use of the DenerVex device, we believe the procedure using the DenerVex is less evasive, faster and represents a lower risk of infection from surgery than its competitors, while offering a longer term solution to FJS than is currently available. In the procedure where the DenerVex is used, a tiny incision is made above the facet joint and the DenerVex is inserted through a cannula to the facet joint region. The cannula has a bullet-shaped tip that acts as a retractor system. The physician performing the procedure inserts a guidewire down to the facet joint region and the cannula/retractor is inserted over that wire. The inner bullet is removed, leaving a hollow tube for working space. The device is positioned and manipulated via fluoroscopy. No other devices or tools are required beyond standard surgical tools for closure. The DenerVex is designed to be powered by (and compatible with) currently marketed electrocautery consoles currently in most procedure rooms, so no additional specialized capital equipment is required. Activation of the device results in the combined effect of a tissue removal action with electrocautery to the facet joint surface resulting in removal of the nerves and synovial membrane tissues. The treatment of each joint takes a couple of minutes and the incision is closed with a single suture stitch.

The DenerVex is currently in the prototype development phase. In order to commercialize the device, we will:

|

1.

|

Conduct additional research to further refine the product.

|

|

2.

|

Submit the final version to regulatory agencies for their approval, including conducting additional studies as they may require.

|

|

3.

|

Finalize reimbursement, marketing and distribution strategies.

|

|

4.

|

Source vendor(s) for production and marketing/distribution partners (we currently do not plan to manufacture or distribute the product ourselves).

|

Market

Our first device, the DenerVex, is targeted at the $11.5 billion global spine surgery devices market, which is largely focused on the treatment of lower back pain. It is estimated that 10% of the adult U.S. population, suffer from chronic lower back pain. Chronic lower back pain is the second leading cause of disability in the U.S.

Approximately 31% of chronic lower back pain is attributed to FJS, a condition in which joints located at the back of the spine degenerate and subsequently cause pain. Each joint in the spine has a rich supply of tiny nerve fibers that provide a painful stimulus when the joint is injured or irritated. When such joints degenerate due to wearing or tearing, the cartilage separating the joints in the spine may become thin or disappear. The bone in the joints underneath the cartilage can then produce an overgrowth of bone spurs and an enlargement of the joints, which can repeatedly send pain signals through the nerve fibers in the spine. Such pain signals can result in considerable back pain, especially when a person is in motion.

Initial treatment of FJS includes a number of non-invasive, non-surgical techniques or therapies. Examples of such therapies are activity modification exercises, over-the-counter medication, chiropractic intervention and physical therapy. If those non-invasive, non-surgical approaches fail to provide long-term relief to a patient, there are currently six approaches used to remedy FJS: spinal injections, radiofrequency (“RF”) ablation (also known as radiofrequency rhizotomy or radiofrequency neurotomy), cryodenervation, pulsed RF, manual tissue scraping and electrocautery performed separately and spine fusion surgery. Management believes that the primary downsides of the current surgical approaches are as follows:

|

·

|

Temporary Relief. Spinal injection, cryodenervation, RF ablation, and pulsed RF therapies are temporary, such that patients must return for repeated treatment over the course of the patient’s lifetime. Spinal injections effectiveness only lasts a period measured in months, while cryodenervation, RF ablation, and pulsed RF have generally been shown to be effective for approximately 6 months to 2 years.

|

|

·

|

Difficult to learn and teach. Compared to the temporary relief treatments described above, the long term relief treatment of manual tissue scraping and electrocautery performed separately requires a spinal surgeon with excellent endoscopy skills and special training. Spinal fusion is a very complex procedure requiring hours to complete and a team of medical professionals to perform.

|

|

·

|

Surgical mechanisms are bulky and difficult to use. Spinal injections require large, painful needles. RF ablation requires the purchase of a special power source to power its ablation needles. Manual tissue scraping and electrocautery performed separately requires four separate devices to be used that cannot be deployed simultaneously. Spinal fusion surgery is a very invasive and significant surgical procedure.

|

|

·

|

High cost. Spinal injection, cryodenervation, RF ablation, and pulsed RF therapies must be repeatedly applied to be effective, and the cost of such repeated visits to healthcare facilities can aggregate significantly over the course of a lifetime, not to mention the cost of lost productivity due to lower back pain in between treatments.

|

|

·

|

Invasive with long recovery time. Spinal fusion surgeries are potentially risky, highly invasive surgeries that require significant recovery time with an average cost per patient of up to $108,000 , plus an estimated 3 to 6 months of lost productivity in the workplace.

|

We believe that the DenerVex represents a significant leap forward in FJS treatment, as it addresses the shortcomings listed above in the following ways:

|

·

|

Longer Lasting. The DenerVex is designed to provide long lasting relief from pain for patients that would otherwise be required to undergo repetitive therapies such as spinal injections and RF ablation.

|

|

·

|

Easy to teach and intuitive to use. The DenerVex combines two procedures that are currently carried out in the manual tissue scraping and electrocautery performed separately into one procedure that does not require a specialist to conduct. We intend to offer a simple one-day or weekend course featuring a cadaver lab to train physicians in usage of the DenerVex.

|

|

·

|

Compact, next generation design. The DenerVex is an all-in-one solution that comes in a sterile, single use package.

|

|

·

|

Cost efficient. The DenerVex is a single use device, so there are no sterilization or repair costs that are associated with many medical devices. Unlike RF ablation, the Denervex does not require a specially-purchased power source, and uses the already-existing cauterization power sources currently found in almost every operating room.

|

|

·

|

Less Invasive with minimal recovery time. Use of the DenerVex represents a less invasive solution to FJS than spinal fusion surgery and can be carried out through an out-patient procedure that does not require follow-up surgery to be effective.

|

By addressing the specific product and technology limitations outlined above (that have been raised by both patients and practitioners alike according to our market research), we believe DenerVex has the ability to greatly penetrate and expand the spine surgery device market. In order to begin our anticipated expansion into the spine surgery device market, the primary targets for the sale of the DenerVex device are pain management practitioners. There are an estimated 6,200 pain management specialists in the United States. We expect that the primary users of the DenerVex device will be these specialists, as well as clinicians who currently utilize interventional procedures to treat chronic back pain. Secondary targets for the DenerVex device are orthopedists and neurosurgeons, in addition to the 4,000 interventional radiologists, and 8,672 spine surgeons using one or a combination of the techniques now currently in use to treat FJS.

Our Strategy

Indeed, in order to provide solutions and devices that impact the quality of patient care while simultaneously lowering costs in a rapidly changing healthcare environment, we have assembled a seasoned management team composed of individuals with both medical expertise and experience in monetizing medical devices. Dr. Haufe, who co-developed the DenerVex, was a co-founder of Debride and is a director of the Company, not only has 11 years of experience in carrying out over 450 manual tissue scraping and electrocautery procedures performed separately in order to treat back pain related conditions, but also has eight (8) years of experience designing and developing innovative and proprietary spine technologies and techniques. Patrick Kullmann, who is President and Chief Operating Officer of the Company, has nearly 30 years of experience marketing and growing companies in the healthcare, scientific and technology industries and is the author of the book “The Inventor’s Guide to Medical Technology”. We believe that other members of our management team, particularly our Chief Executive Officer, Jarrett Gorlin, provide us with the management expertise necessary to effectively manage our anticipated growth. We intend to leverage this expertise to accelerate the growth of the businesses or assets we acquire. We believe that our management team’s diverse range of experience also provides us with the flexibility to review growth and turnaround situations for underleveraged or underperforming medical devices and their parent companies. We are pursuing the following strategies:

|

·

|

Promoting the differentiated features of our DenerVex exclusive technology to penetrate the $11.5 billion global spine surgery devices market and establish DenerVex as a standard of care for treating FJS, as well as broadening the clinical applications of the DenerVex;

|

|

·

|

Investing in our infrastructure to broaden our market presence first in Europe, then in the U.S. and eventually worldwide, expand our global distribution footprint, and to ensure regulatory approval internationally; and

|

|

·

|

Leveraging the strength and experience of our world-class management team to selectively pursue opportunities to expand our portfolio of medical device products and businesses.

|

Our marketing strategy will be supported by a solid core of clinical and cost effectiveness data that we intend to develop to support our portfolio of medical companies and assets. We intend to employ the same disciplined approach to all future opportunities that we employed prior to acquiring the assets for the DenerVex device, by careful research, reviewing of existing devices and examination of marketplace possibilities. A compelling value proposition and subsequent market positioning for our devices versus other treatment options will also be developed and tailored as appropriate for the key decision-makers along the course of the patient flow. We believe we are well positioned to create devices and tailor their value propositions to meet a rapidly changing marketplace and fluid regulatory environment, by creating and marketing devices that are designed to result in patients spending less time in the hospital, lower the chance of patient infection, simplify surgical procedures and diminish the potential incidence of hospital and surgery-related accidents. Please see “Management—Board of Directors” for more information regarding the background and experience of our management team.

Risks That We Face

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus beginning on page 15. These risks include, but are not limited to, the following:

|

·

|

our lack of operating history.

|

| · |

our liquidity and the net losses that we expect to incur as we develop our business. If such losses mean that we do not continue as a going concern, investors could lose their entire investment. |

|

·

|

we will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

|

|

·

|

obtaining FDA or other regulatory approvals or clearances for our technology. We are heavily dependent on the success of our first product, the DenerVex, which has not yet received regulatory approval. We will not be able to generate any revenue unless we receive regulatory approval. The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time-consuming, costly and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product, our business will be substantially harmed.

|

|

·

|

implementing and achieving successful outcomes for clinical trials of our products. Our initial product, the DenerVex, is based on a currently clinically unproven approach to back pain treatment.

|

|

·

|

convincing physicians, hospitals and patients of the benefits of our technology and to convert them from current technology.

|

|

·

|

we face substantial competition, which may result in others discovering, developing or commercializing products before, or more successfully, than we do. We expect any product that we commercialize will compete with products from other companies in the medical device industry. Many of our potential competitors have substantially greater commercial infrastructures and financial, technical and personnel resources than we have. If we are not able to compete effectively against our competitors, our business will not grow and our financial condition and operations will suffer.

|

|

·

|

the ability of users of our products (when and as developed) to obtain third-party reimbursement.

|

|

|

any failure to comply with rigorous FDA and other government regulations, which may change or be reformed.

|

|

|

we depend on key personnel.

|

|

|

securing, maintaining and defending patent or other intellectual property protections for our technology. Our inability to obtain adequate patent protection for our products or failure to successfully defend against any claims that our products infringe the rights of third parties could also adversely affect our business. Any challenges relating to our intellectual property may require us to spend a substantial amount of time and money to resolve, if at all possible.

|

Our Corporate Information

MEDOVEX is a development stage company that was incorporated in Nevada on July 30, 2013 as Spinez Corp. and changed its name to MEDOVEX Corp. on March 20, 2014. MEDOVEX is the parent company of Debride, which was incorporated under the laws of Florida on October 1, 2012. MEDOVEX acquired all of the issued and outstanding capital stock of Debride pursuant to an agreement and plan of merger, dated September 13, 2013.

Our principal executive offices are located at 3279 Hardee Avenue, Atlanta, Georgia 30341 and our telephone number is (844) MEDOVEX. Our website address is www.MEDOVEX.com. The information contained on, or that can be accessed through, our website is not incorporated into and is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third party research, surveys and studies are reliable, we have not independently verified such data.

Implications of being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations in this prospectus;

|

|

|

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act;

|

|

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

|

|

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

|

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, (the “Securities Act”), which fifth anniversary will occur in 2019. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies is irrevocable.

The Offering

| |

Securities offered

|

|

1,350,000 units , consisting of one share of common stock and one Series A Warrant to purchase one share of common stock. In addition, the holder of each unit issued in the offering will receive one Series B Warrant to purchase one share of common stock per unit purchased, but such Series B Warrants will not be transferable. The units will not be certificated and the shares of common stock and Series A Warrants will trade initially as a unit, and will trade separately not later than 90 days from the date hereof, or earlier with the underwriter’s consent.

Each Series A Warrant is exercisable for one share of common stock. The Series A Warrants are immediately exercisable upon issuance in this initial public offering at an initial exercise price of 120% of the initial public offering price of one unit in this offering. The Series A Warrants will expire on the third anniversary of the date of issuance, and will not be listed on any securities exchange.

Each Series B Warrant is exercisable for one share of common stock. The Series B Warrants are exercisable immediately after issuance at an initial exercise price of 120% of the initial public offering price of one unit in this offering. The Series B Warrants will expire on the fifth anniversary of the date of issuance.

The shares of common stock issuable from time to time upon the exercise of the Series A Warrants and the Series B Warrants are also being offered pursuant to this prospectus.

|

| |

|

|

|

| |

Common Stock:

|

|

|

| |

Common stock offered by us

|

|

1,350,000 shares

|

| |

Common stock to be outstanding after this offering

|

|

9,131,175 shares

|

| |

|

|

|

| |

Offering price

|

|

|

| |

Over-allotment option

|

|

The underwriters have an option for a period of 45 days to purchase up to fifteen percent (15%) of the units and Series B Warrants being offered under this registration statement to cover over-allotments, as long as such purchases do not exceed an aggregate of fifteen (15%) of the number of units and Series B Warrants sold in the primary offering.

|

| |

|

|

|

| |

Use of proceeds

|

|

We expect to receive approximately $7,000,000 in net proceeds from the sale of our units offered by us in this offering (approximately $8,085,000 if the underwriters exercise their over-allotment option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, assuming the units are offered at $6.00 per unit and Series B Warrant, the midpoint of the estimated price range set forth on the cover of this prospectus. We intend to use the net proceeds from this offering for:

|

| |

|

|

|

Regulatory approval, pre-clinical testing, clinical trials if required, product development and commercialization;

|

| |

|

|

|

continuing research and development related activities with respect to the DenerVex;

|

| |

|

|

|

maintenance and enforcement of existing and future patents, pursuit of existing patent applications and additional future patent applications;

|

| |

|

|

|

the remainder for working capital and general corporate purposes which may include the acquisition of medical products’ companies or their technologies or the development of new technologies.

|

| |

|

|

|

|

| |

|

|

See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering.

|

| |

Risk factors

|

|

You should read the "Risk Factors" section starting on page 15 of this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities.

|

| |

Proposed NASDAQ Capital Market Symbol

|

|

We intend to apply to list our common stock on The NASDAQ Capital Market under the symbol “MDVX,” the Series A Warrants will trade under the symbol “MDVXW,” and our units will trade under the symbol “MDVXU.” No assurance can be given that our application will be approved.

|

The number of shares of our common stock outstanding after this offering is based on 7,781,175 shares of our common stock outstanding as of December 31, 2013, assuming an initial public offering price of $6.00 per unit and Series B Warrant which is the midpoint of the price range set forth on the cover page of this prospectus.

The number of shares of our common stock outstanding after this offering excludes:

|

|

1,150,000 shares of our common stock available for future issuance as of March 31, 2014 under our 2013 Stock Incentive Plan of which options to purchase 60,000 shares of common stock have been granted at a price of $2.50 per share; and

|

|

|

up to shares of common stock issuable upon the full exercise of the Series A Warrants and the Series B Warrants offered hereby;

|

|

|

shares of common stock underlying the Representative’s Unit Warrant to be issued to the representative of the underwriters in connection with this offering, at an exercise price per share equal to 120% of the public offering price, plus up to 202,500 shares, 202,500 Series A Warrants and 202,500 Series B Warrants if the over-allotment unit purchase option is exercised in full.

|

Unless otherwise indicated, all information in this prospectus assumes:

|

|

no exercise of the Representative’s unit warrant included as part of the Representative’s Units described above; and

|

|

|

no exercise by the representative of the underwriters of its over-allotment purchase option.

|

Summary Financial Information

You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the "Capitalization," and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and related notes included elsewhere in this prospectus. We have derived the statements of operations data for the year ended December 31, 2013 from our audited financial statements included in this prospectus. We have derived the balance sheet and statement of operations for March 31, 2014 from our unaudited internal statements. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

| |

|

Period from Inception at February 1, 2013 to December 31, 2013 |

|

|

Three Months

Ended March 31,

2014

(unaudited)

|

|

| |

|

(in thousands, except

per share data)

|

|

|

(in thousands,

except

per share data)

|

|

|

Consolidated Statement of Operations Data:

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

General and administrative

|

|

$ |

583 |

|

$ |

435 |

|

|

Research and development

|

|

|

90 |

|

|

122 |

|

|

Total operating expenses

|

|

|

673 |

|

|

557 |

|

|

Loss from operations

|

|

|

(673 |

) |

|

( 557 |

) |

|

Net loss attributable to common stockholders

|

|

$ |

(673 |

) |

$ |

( 557 |

) |

|

Net loss per share- basic and diluted (1)

|

|

$ |

(0.15 |

) |

$ |

(0.07 |

) |

|

Weighted average shares- basic and diluted

|

|

|

4,469 |

|

|

7,781 |

|

| |

|

As of March 31, 2014 |

|

|

(As

Adjusted(2))

|

|

| |

|

(in thousands)

|

|

|

(unaudited) |

|

|

Consolidated Balance Sheet Data:

|

|

(Actual) |

|

|

|

|

|

Cash

|

|

$ |

2,241 |

|

|

9,241 |

|

|

Working capital

|

|

|

2,047 |

|

|

9,047 |

|

|

Total assets

|

|

|

3,934 |

|

|

10,934 |

|

|

Total stockholders’ equity

|

|

|

3,127 |

|

|

10,127 |

|

| (1) |

See our consolidated financial statements and related notes for a description of the calculation of the weighted-average number of shares used in computing the per common share data. |

| (2) |

Gives effect to the sale of the Units offered hereby, and the receipt of $7,000,000 of net proceeds therefrom. |

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our securities. If any of the following risks actually occur, our business, prospects, operating results and financial condition could suffer materially, the trading price of our securities could decline and you could lose all or part of your investment.

Risks Related to Our Financial Position and Capital Requirements

We are a development stage company and face uncertainties associated with being an early stage venture.

Our operating subsidiary, Debride, was incorporated in October 2012. MEDOVEX was incorporated on July 30, 2013. We currently do not have any material assets, other than the intellectual property relating to the DenerVex obtained from Scott M. W. Haufe, M.D. in connection with our acquisition of Debride. We face all of the potential expenses, delays, uncertainties and complications typically encountered by development stage businesses, many of which may be beyond our control. These include, but are not limited to, lack of sufficient capital, unanticipated problems, delays or expenses relating to product development and licensing and marketing activities, competition, technological changes and uncertain market acceptance. In addition, if we are unable to manage growth effectively, our operating results could be materially and adversely affected.

We are in the early stage of product development and there can be no assurance that we will effectively and successfully develop products for commercialization.

We do not have any presently marketable products. The initial product we are developing has had only limited research and testing in the fields of use we are presently intending to explore and to commercialize. We will have to continue to go through extensive research and testing to develop the initial product and any additional products and to determine or demonstrate the safety and effectiveness of their proposed use. Our products and our proposed testing of those products will require various regulatory approvals and clearances. Accordingly, the products we intend to pursue are not presently marketable in the fields of use for which we hope to develop them, and it is possible that some or all of them may never become legally and commercially marketable. The development and testing of medical devices and related treatments and therapies is difficult, time-consuming and expensive, and the successful development of any products based on innovative technologies is subject to inherent uncertainties and risks of failure. These risks include the possibilities that any or all of the proposed products or procedures may be found to be ineffective, or may otherwise fail to receive necessary regulatory clearances; that the proposed products or procedures may be uneconomical to produce and market or may never achieve broad market acceptance; that third parties may hold proprietary rights that preclude the Company from marketing its intended products or procedures; or that third parties may develop and market superior or equivalent products and procedures. We are unable to predict whether our research and development or acquisition activities will result in any commercially viable products or procedures. Furthermore, due to the extended testing and regulatory review process required before marketing clearances can be obtained, the time frames for commercialization of any products or procedures are long and uncertain.

We expect to continue to incur losses for the immediate future.

We have incurred losses since our inception and have never generated any revenues. We expect to continue to incur losses for the foreseeable future. The principal causes of our losses are likely to be personnel costs, working capital costs, research and development costs, intellectual property protection costs, brand development costs, marketing and promotion costs, and the lack of any significant revenue stream for the foreseeable future. We may never achieve profitability.

Our independent registered public accounting firm has included an explanatory paragraph with respect to our ability to continue as a going concern in its report on our consolidated financial statements for the period ended December 31, 2013.

Our independent registered public accounting firm has included an explanatory paragraph with respect to our ability to continue as a going concern in its report on our consolidated financial statements for the period ended December 31, 2013. The presence of the going concern explanatory paragraph may have an adverse impact on our relationship with third parties with whom we do business, including our customers, vendors and employees and could make it challenging and difficult for us to raise additional debt or equity financing to the extent needed, all of which could have a material adverse impact on our business, results of operations, financial condition and prospects.

Raising additional capital and carrying out further acquisitions may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or products.

We will likely seek additional capital through a combination of private and public equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect stockholder rights. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring debt, making capital expenditures or declaring dividends. If we raise or expend additional funds through strategic partnerships, acquisitions, alliances and/or licensing arrangements with third parties, we may be required to relinquish valuable rights to our technologies or products, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market products that we would otherwise prefer to develop and market ourselves.

Our operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control, which could cause fluctuations in the price of our securities.

We are subject to the following factors that may negatively affect our operating results:

| ● |

the announcement or introduction of new products by our competitors; |

| ● |

our ability to upgrade and develop our systems and infrastructure to accommodate growth; |

| ● |

our ability to attract and retain key personnel in a timely and cost effective manner; |

| ● |

technical difficulties; |

| ● |

the amount and timing of operating costs and capital expenditures relating to the expansion of our business, operations and infrastructure; |

| ● |

our ability to identify and enter into relationships with appropriate and qualified third-party providers such as Devicix, LLC for necessary testing, clinical trials and manufacturing services; |

| ● |

regulation by federal, state or local governments; and |

| ● |

general economic conditions, as well as economic conditions specific to the medical device and healthcare industries.

|

As a result of our lack of any operating history and the nature of the markets in which we compete, it is difficult for us to forecast our revenues or earnings accurately. As a strategic response to changes in the competitive environment, we may from time to time make certain decisions concerning expenditures, pricing, service or marketing that could have a material and adverse effect on our business, results of operations and financial condition. Due to the foregoing factors, our quarterly revenues and operating results are difficult to forecast.

We may be unable to manage growth effectively.

As we seek to advance our product candidates, we will need to expand our development, regulatory, manufacturing, marketing and sales capabilities or contract with third parties to provide these capabilities for us. We anticipate that a period of significant expansion will be required to address potential growth and to handle licensing and research activities. This expansion will place a significant strain on our management, operational and financial resources. To manage the expected growth of our operations and personnel, we must establish appropriate and scalable operational and financial systems, procedures and controls and must establish a qualified finance, administrative and operations staff. As a public company, we will have to implement internal controls to comply with government mandated regulations. Our management may be unable to hire, train, retain, motivate and manage the necessary personnel or to identify, manage and exploit potential strategic relationships and market opportunities. Our failure to manage growth effectively could have a material and adverse effect on our business, results of operations and financial condition.

Risks Related to Development, Clinical Testing and Regulatory Approval of Our Products

Government regulation of our business is extensive and regulatory approvals are uncertain, expensive and time-consuming.

Our research, development, testing and clinical trials, manufacturing and marketing of most of our intended products are subject to an extensive regulatory approval process by the FDA and other regulatory agencies in the U.S. and abroad. The process of obtaining FDA and other required regulatory approvals for medical device products, including the potential for being required to engage in pre-clinical and clinical testing, is lengthy, expensive and uncertain. There can be no assurance that, even after such time and expenditures, the Company will be able to obtain necessary regulatory approvals for clinical testing or for the manufacturing or marketing of any products. In addition, during the regulatory process, other companies may develop other technologies with the same intended use as our products. Even if regulatory clearance is obtained, a marketed product is subject to continual review, and later discovery of previously unknown safety issues or failure to comply with the applicable regulatory requirements may result in restrictions on a product’s marketing or withdrawal of the product from the market, as well as possible civil or criminal sanctions.

If the third-parties on which we may need to rely to conduct any clinical trials and to assist us with pre-clinical development or other key steps do not perform as contractually required or expected, we may not be able to obtain regulatory clearance or approval for or commercialize our product.

We do not have (and do not expect to develop) the independent ability to independently conduct pre-clinical and clinical trials for our products and to the extent we will need to conduct such trials, we will likely need to rely on third-parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories to conduct such trials. We also do not have (and do not expect to develop) the independent ability to manufacture our proposed products, and will therefore need to rely on third parties such as contract manufacturing organizations. If these various third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines, or if the quality or accuracy of the data they obtain or the quality of the products they produce for us is compromised due to the failure to adhere to our clinical or manufacturing protocols or regulatory requirements or for any other reasons, we may have difficulty replacing them with other qualified third-party providers of the necessary services or products and in the meantime, our pre-clinical development activities or clinical trials may be extended, delayed, suspended or terminated, and we may not be able to obtain regulatory clearance or approval for, or successfully commercialize, a product on a timely basis, if at all. As such, our business, operating results and prospects may be adversely affected and may even fail entirely. Furthermore, our third-party clinical trial investigators may be delayed in conducting our clinical trials for reasons outside of their (or our) control.

The results of our clinical trials may not support our product claims or may result in the discovery of adverse side effects.

Even if the clinical trials that we may need to undertake are completed as planned, we cannot be certain that their results will support our product claims or that the FDA or foreign authorities will agree with our conclusions regarding the results of the trials. The clinical trial process may fail to demonstrate that a product is safe and effective for the proposed indicated use, which could cause us to abandon a product and could delay development of other products. Any delay or termination of our clinical trials will delay the filing of our product submissions and, ultimately, our ability to commercialize a product and generate revenue. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product’s profile and not predicted or foreseen on the basis of prior experience. Even if clinical trials are otherwise successful, we may be unable to develop a commercially viable product, treatment or therapy based on those trials.

Risks Related to Our Business and Industry

If our products and products do not gain market acceptance among physicians, patients and the medical community, we may be unable to generate significant revenues, if any.

Even if we obtain regulatory approval for our products, they may not gain market acceptance among physicians, healthcare payers, patients and the medical community. In particular, the US government agency Center for Medicare/Medicaid Service or other private reimbursement agencies may decline to reimburse physicians and health care facilities whose patients are on Medicare or Medicaid or private insurance for use of our product, significantly reducing our potential market. Market acceptance will depend on our ability to demonstrate the benefits of our approved products in terms of safety, efficacy, convenience, ease of administration and cost effectiveness. In addition, we believe market acceptance depends on the effectiveness of our marketing strategy, the pricing of our approved products and the reimbursement policies of government and third party payers with respect to our products. Physicians may not utilize our approved products for a variety of reasons and patients may determine for any reason that our product is not useful to them. If any of our approved products fail to achieve market acceptance, our ability to generate revenues will be limited.

The industry in which we plan to operate is highly competitive and there can be no assurances that we will be able to compete effectively.

We are engaged in a rapidly evolving industry. Competition from other medical device companies and from other research and academic institutions is intense and expected to increase. Many of these companies have substantially greater financial and other resources and development capabilities than we do, have substantially greater experience in undertaking pre-clinical and clinical testing of products, and are commonly regarded in the medical device industries as very aggressive competitors. In addition to competing with universities and other research institutions in the development of products, technologies and processes, we compete with other companies in acquiring rights to products or technologies from universities. There can be no assurance that we can develop products that are more effective or achieve greater market acceptance than competitive products, or that our competitors will not succeed in developing products and technologies that are more effective than those being developed by us and that would therefore render our products and technologies less competitive or even obsolete.

Third parties may claim that we infringe on their proprietary rights and may prevent us from commercializing and selling our products.

There has been substantial litigation in the medical device industry with respect to the manufacture, use and sale of new products. These lawsuits often involve claims relating to the validity of patents supporting the new products and/or the validity and alleged infringement of patents or proprietary rights of third parties. We may be required to defend against challenges to the validity of our patents and against claims relating to the alleged infringement of patent or proprietary rights of third parties.

Litigation initiated by a third party claiming patent invalidity or patent infringement could:

|

|

require us to incur substantial litigation expense, even if we are successful in the litigation;

|

|

|

require us to divert significant time and effort of our management;

|

|

|

result in the loss of our rights to develop, make or market our products; and

|

|

|

require us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties or to satisfy judgments or to settle actual or threatened litigation.

|

Although patent and intellectual property disputes within the medical device industry have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. Furthermore, the required licenses may not be made available to us on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing and selling our products or increase our costs to market our products.

Healthcare policy changes, including the recently enacted legislation to reform the United States healthcare system, may have a material adverse effect on us.

In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively the “PPACA”), which substantially changes the way healthcare is financed by both governmental and private insurers, encourages improvements in the quality of healthcare items and services, and significantly impacts the medical device industry. The PPACA includes, among other things, the following measures:

|

|

a 2.3% excise tax on any entity that manufactures or imports medical devices offered for sale in the United States, with limited exceptions;

|

|

|

a new Patient-Centered Outcomes Research Institute to oversee, identify priorities and conduct comparative clinical effectiveness research;

|

|

|

new reporting and disclosure requirements on device manufacturers for any “transfer of value” made or distributed to physicians and teaching hospitals, as well as reporting of certain physician ownership interests

|

|

|

payment system reforms including a national pilot program on payment bundling to encourage hospitals, physicians and other providers to improve the coordination, quality and efficiency of certain healthcare services through bundled payment models; and

|

|

|

an independent payment advisory board that will submit recommendations to reduce Medicare spending if projected Medicare spending exceeds a specified growth rate.

|

These provisions could meaningfully change the way healthcare is delivered and financed, and could have a material adverse impact on numerous aspects of our business.

In the future, there may continue to be additional proposals relating to the reform of the United States healthcare system. Certain of these proposals could limit the prices we are able to charge for our products or the amounts of reimbursement available for our products, and could limit the acceptance and availability of our products. The adoption of some or all of these proposals could have a material adverse effect on our business, results of operations and financial condition.

Additionally, initiatives sponsored by government agencies, legislative bodies and the private sector to limit the growth of healthcare costs, including price regulation and competitive pricing, are ongoing in markets where we do business. We could experience an adverse impact on our operating results due to increased pricing pressure in the United States and in other markets. Governments, hospitals and other third party payors could reduce the amount of approved reimbursement for our products or deny coverage altogether. Reductions in reimbursement levels or coverage or other cost-containment measures could adversely affect our future operating results.

We depend on key personnel.

We depend greatly on Dr. Scott M. W. Haufe, a member of the board of directors and the co-founder of Debride, Jarrett Gorlin, our Chief Executive Officer, and a member of the board of directors and Patrick Kullmann, our President and Chief Operating Officer, among others. Our success will depend, in part, upon our ability to attract and retain additional skilled personnel, which will require substantial additional funds. There can be no assurance that we will be able to find, attract and retain additional qualified employees, directors, and advisors having the skills necessary to operate, develop and grow our business. Our inability to hire qualified personnel, the loss of services of Dr. Haufe, Mr. Gorlin or Mr. Kullmann, or the loss of services of other executive officers, key employees, or advisors that may be hired in the future, may have a material and adverse effect on our business. We currently do not maintain “key man” insurance policies on the lives of these individuals or the lives of any of our other employees.

In the future, we could experience difficulties attracting and retaining qualified employees. Competition for qualified personnel in the medical products field is intense. We may need to hire additional personnel as we expand our clinical development and commercial activities. We may not be able to attract and retain quality personnel on acceptable terms or at all.

In addition, we may enter into arrangements with consultants and advisors, including scientific and clinical advisors, to assist us in formulating our research and development and commercialization strategy. Our consultants and advisors may be employed by employers other than us and may have commitments under consulting or advisory contracts with other entities that may limit their availability to us.

If we are unable to hire qualified personnel, our business and financial condition may suffer.

Our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. In this regard, we have limited resources and as such we may not able to provide an employee with the same amount of compensation that he or she would likely receive at a larger company and as a result we may face difficulty in finding qualified employees. The inability to attract, retain and motivate any additional highly skilled employees required for the expansion of our activities, could have a materially adverse effect on our ability to conduct our business and as such can impair our operations.

If we obtain approval to commercialize our products outside of the United States, a variety of risks associated with international operations could materially adversely affect our business.

If our products are approved for commercialization outside the United States, we will likely seek to enter into agreements with third parties to market our products outside the United States. We expect that we will be subject to additional risks related to entering into or maintaining international business relationships, including:

|

|

different regulatory requirements for medical devices or treatments in foreign countries;

|

|

|

lack of adequate reimbursement for the use of our product;

|

|

|

differing United States and foreign import and export rules;

|

|

|

reduced protection for intellectual property rights in foreign countries;

|

|

|

unexpected changes in tariffs, trade barriers and regulatory requirements;

|

|

|

economic weakness, including inflation, or political instability in particular foreign economies and markets;

|

|

|

compliance with tax, employment, immigration and labor laws for employees living or traveling abroad;

|

|

|

foreign taxes, including withholding of payroll taxes;

|

|

|

foreign currency fluctuations, which could result in increased operating expenses and reduced revenues, and other obligations incident to doing business in another country;

|

|

|

workforce uncertainty in countries where labor unrest is more common than in the United States;

|

|

|

production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad;

|

|

|

potential liability resulting from development work conducted by these distributors; and

|

|

|

business interruptions resulting from geopolitical actions, including war and terrorism, or natural disasters.

|