UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________ to ____________________

Commission file number: 001-38029

AKOUSTIS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-1229046 | |

| (State

or other jurisdiction of incorporation or organization) |

(IRS

Employer Identification No.) | |

| 9805 Northcross Center Court, Suite A | ||

| Huntersville, NC | 28078 | |

| (Address of principal executive offices) | (Postal Code) |

Registrant’s telephone number, including area code: 1-704-997-5735

Securities registered under Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol | Name of each exchange on which registered: | ||

| Common Stock, $0.001 par value | AKTS | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| Non-Accelerated Filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock, par value $0.001 per share (“Common Stock”), held by non-affiliates on December 31, 2019 was approximately $250.4 million. For purposes of this computation, shares of Common Stock held by all officers, directors, and beneficial owners of 10% or more of the outstanding Common Stock were excluded because such persons may be deemed to be affiliates of the registrant. Such determination should not be deemed an admission that such persons are, in fact, affiliates of the registrant.

As of August 17, 2020, there were 38,067,550 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended June 30, 2020. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (this “Report”) contains forward-looking statements that relate to our plans, objectives, estimates, and goals. Any and all statements contained in this report that are not statements of historical fact may be deemed to be forward-looking statements. Terms such as “may,” “will,” “might,” “would,” “should,” “could,” “project,” “estimate,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “seek,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable radio frequency (“RF”) filters, (ii) projections of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in the management’s discussion and analysis of financial condition or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), (iv) our ability to efficiently utilize cash and cash equivalents to support our operations for a given period of time, (v) our ability to engage customers while maintaining ownership of our intellectual property, and (vi) the assumptions underlying or relating to any statement described in (i), (ii), (iii), (iv) or (v) above.

Forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which are beyond our control. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation,

| ● | our limited operating history, |

| ● | our inability to generate revenues or achieve profitability, | |

| ● | the impact of the COVID-19 pandemic on our operations, financial condition and the worldwide economy, including our ability to access the capital markets, |

| ● | our inability to obtain adequate financing and sustain our status as a going concern, |

| ● | our inability to service the debt represented by our $25.0 million principal amount of senior convertible notes due in 2023, |

| ● | the results of our research and development (“R&D”) activities, |

| ● | our inability to achieve acceptance of our products in the market, |

| ● | general economic conditions, including upturns and downturns in the industry, |

| ● | existing or increased competition, |

| ● | our inability to successfully scale the New York fabrication facility and related operations into our business and to maintain a successful fabrication operation while maintaining quality control and assurance and avoiding delays in output, |

| ● | contracting with customers and other parties with greater bargaining power and agreeing to terms and conditions that may adversely affect our business, |

| ● | risks related to doing business in foreign countries, |

| ● | any security breaches or other disruptions compromising our proprietary information and exposing us to liability, |

| ● | our limited number of patents, |

| ● | failure to obtain, maintain and enforce our intellectual property rights, |

| ● | our inability to attract and retain qualified personnel, |

| ● | results of any present or future arbitration or litigation, |

| ● | our reliance on third parties to complete certain processes in connection with the manufacture of our products, |

| ● | product quality and defects, |

| ● | our ability to market and sell our products, |

ii

| ● | our failure to innovate or adapt to new or emerging technologies, including in relation to our competitors, |

| ● | our failure to comply with regulatory requirements, |

| ● | stock volatility and illiquidity, |

| ● | our failure to implement our business plans or strategies, |

| ● | our failure to maintain effective internal control over financial reporting, and |

| ● | our failure to obtain and maintain the Trusted Foundry accreditation of our New York fabrication facility . |

A description of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. Except as may be required by law, we do not undertake any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

DEFINITIONS

When used in this Report, the terms, “we,” “Akoustis,” the “Company,” “our,” and “us” refers to Akoustis Technologies, Inc., a Delaware corporation, and its wholly owned consolidated subsidiary, Akoustis, Inc., also a Delaware corporation.

Glossary

The following is a glossary of technical terms used herein:

| ● | Acoustic wave - a mechanical wave that vibrates in the same direction as its direction of travel. |

| ● | AlN - Aluminum Nitride. |

| ● | Acoustic wave filter - an electromechanical device that provides radio frequency control and selection, in which an electrical signal is converted into a mechanical wave in a device constructed of a piezoelectric material and then back to an electrical signal. |

| ● | Band, channel or frequency band - a designated range of radio wave frequencies used to communicate with a mobile device. |

| ● | Bulk acoustic wave (BAW) - an acoustic wave traveling through a material exhibiting elasticity, typically vertical or perpendicular to the surface of a piezoelectric material. |

| ● | Digital baseband - the digital transceiver, which includes the main processor for the communication device. |

| ● | Duplexer - a bi-directional device that connects the antenna to the transmitter and receiver of a wireless device and simultaneously filters both the transmit signal and receive signal. |

| ● | Filter - a series of interconnected resonators designed to pass (or select) a desired radio frequency signal and block unwanted signals. |

iii

| ● | Group III element nitrides - a dielectric material comprised of group IIIA element, such as boron (B), aluminum (Al) or gallium (Ga), combined with group 5A (or VA nitrogen) to form a compound semiconductor nitride such as BN, AlN, or GaN. For resonators, the dielectric is typically chosen based upon the piezoelectric constant of the material in order to generate the highest electromechanical coupling. |

| ● | Insertion Loss - the power losses associated with inserting a BAW filter into a circuit. |

| ● | Lossy - resistive losses that result in heat generation. |

| ● | Metrology - techniques used to evaluate materials, devices and circuits. |

| ● | Monolithic topology - a description of an electrical circuit whereby all the elements of the circuit are fabricated at the same time using the same process flow. |

| ● | Power Amplifier Duplexer (PAD) - an RF module containing a power amplifier and duplex filter components for the RFFE of a smartphone. |

| ● | Piezoelectric materials - certain solid materials (such as crystals and certain ceramics) that produce a voltage in response to applied mechanical stress, or that deform when a voltage is applied to them. |

| ● | Quality factor, or Q - energy stored divided by the energy dissipated per cycle. Higher Q represents a higher caliber of resonance and implies mechanical and electrical factors responsible for energy dissipation are minimal. For a given amount of energy stored in a resonator, Q represents the number of cycles resonance will continue without additional input of energy into the system. |

| ● | Resonator - a device whose impedance sharply changes over a narrow frequency range and is characterized by one or more ‘resonance frequency’ due to a standing wave across the resonator’s electrodes. The vibrations in a resonator can be characterized by mechanical “acoustic” waves which travel without a characteristic sound velocity. Resonators are the building blocks for RF filters used in mobile wireless devices. |

| ● | RF - radio frequency. |

| ● | RF front-end (RFFE) - the circuitries in a mobile device responsible for processing the analog radio signals; located between the device’s antenna and the digital baseband. |

| ● | RF spectrum - a defined range of frequencies. |

| ● | Surface acoustic wave (SAW) - an acoustic sound wave traveling horizontally along the surface of a piezoelectric material. |

| ● | TDD LTE - Time Division Duplex- Long-Term Evolution or a wireless standard which shares the bandwidth between transmit and receive. |

| ● | Tier one - a supplier or OEM with substantial market share. |

| ● | Tier two - a supplier or OEM with an established but not substantial market share. |

| ● | Trusted Foundry- The Trusted Foundry Program was initiated by the Department of Defense in 2004 to ensure mission-critical national defense systems access to leading-edge integrated circuits from secure, domestic sources. Defense Microelectronics Activity (DMEA) is the manager of the Trusted Foundry Program for the U.S. Department of Defense (DoD). It is a joint DoD / National Security Agency (NSA) program and is administered by the NSA’s Trusted Access Program Office (TAPO). |

| ● | Wafer - a thin slice of semiconductor material used in electronics for the fabrication of integrated circuits. |

iv

Overview

Akoustis® is an emerging commercial product company focused on developing, designing, and manufacturing innovative RF filter solutions for the wireless industry, including for products such as smartphones and tablets, network infrastructure equipment, WiFi Customer Premise Equipment (“CPE”) and defense applications. Filters are critical in selecting and rejecting signals, and their performance enables differentiation in the modules defining the RF front-end (“RFFE”). Located between the device’s antenna and its digital backend, the RFFE is the circuitry that performs the analog signal processing and contains components such as amplifiers, filters and switches. We have developed a proprietary microelectromechanical system (“MEMS”) based bulk acoustic wave (“BAW”) technology and a unique manufacturing process flow, called “XBAW”, for our filters produced for use in RFFE modules. Our XBAWTM filters incorporate optimized high purity piezoelectric materials for high power, high frequency and wide bandwidth operation. We are developing RF filters for 4G/LTE, 5G, WiFi and defense bands using our proprietary resonator device models and product design kits (PDKs). As we qualify our RF filter products, we are engaging with target customers to evaluate our filter solutions. Our initial designs target UHB, sub 7 GHz 4G/LTE, 5G, WiFi and defense bands. We expect our filter solutions will address problems (such as loss, bandwidth, power handling, and isolation) created by the growing number of frequency bands in the RFFE of mobile devices, infrastructure and premise equipment to support 4G/LTE, 5G, and WiFi. We have prototyped, sampled and begun commercial shipment of our single-band low-loss BAW filter designs for 4G/LTE frequency bands, 5G frequency bands and 5GHz WiFi bands which are suited to competitive BAW solutions and historically cannot be addressed with low-band, lower power handling surface acoustic wave (“SAW”) technology.

We own and/or have filed applications for patents on the core resonator device technology, manufacturing facility and intellectual property (“IP”) necessary to produce our RF filter chips and operate as a “pure-play” RF filter supplier, providing discrete filter solutions direct to Original Equipment Manufacturers (“OEMs”) and aligning with the front-end module manufacturers that seek to acquire high performance filters to expand their module businesses. We believe this business model is the most direct and efficient means of delivering our solutions to the market.

Technology. Our device technology is based upon bulk-mode acoustic resonance, which we believe is superior to surface-mode resonance for high-band and ultra-high-band (“UHB”) applications that include 4G/LTE, 5G, WiFi, and defense applications. Although some of our target customers utilize or manufacture the RFFE module, they may lack access to critical UHB filter technology that we produce, which is necessary to compete in high frequency applications.

Manufacturing. We currently manufacture our high performance RF filter circuits, using our first generation XBAWTM wafer process, in our 120,000-square foot wafer-manufacturing facility located in Canandaigua, New York, which we acquired in June 2017.

Intellectual Property. As of August 17, 2020, our IP portfolio included 33 patents, including a blocking patent that we have licensed from Cornell University. Additionally, as of August 17, 2020, we have 71 pending patent applications. These patents cover our XBAWTM RF filter technology from raw materials through the system architectures. Where possible, we leverage both federal and state level R&D grants to support development and commercialization of our technology.

By designing, manufacturing, and marketing our RF filter products to mobile phone OEMs, defense OEMs, network infrastructure OEMs, and WiFi CPE OEMs, we seek to enable broader competition among the front-end module manufacturers.

1

Since we own and/or have filed applications for patents on the core technology and control access to our intellectual property, we expect to offer several ways to engage with potential customers. First, we intend to engage with multiple wireless markets, providing standardized filters that we design and offer as standard catalog components. Second, we expect to deliver unique filters to customer-supplied specifications, which we will design and fabricate on a customized basis. Finally, we may offer our models and design kits for our customers to design their own filters utilizing our proprietary technology.

To succeed, we must convince mobile phone OEMs, RFFE module manufacturers, cellular infrastructure OEMs, WiFi CPE OEMs and defense customers to use our XBAWTM filter technology in their systems and modules. However, since there are two dominant BAW filter suppliers in the industry that have high-band technology, and both utilize such technology as a competitive advantage at the module level, we expect customers that lack access to high-band filter technology will be open to engage with our pure-play filter company.

We plan to pursue RF filter design and R&D development agreements and potentially joint ventures with target customers and other strategic partners, although we cannot guarantee we will be successful in these efforts. These types of arrangements may subsidize technology development costs and qualification, filter design costs, and offer complementary technology and market intelligence and other avenues to revenue. However, we intend to retain ownership of our core technology, intellectual property, designs, and related improvements. We expect to pursue development of catalog designs for multiple customers and to offer such catalog products in multiple sales channels.

Impact of COVID-19 on our Business

Although the ultimate impact of the COVID-19 pandemic on our business is unknown, in an effort to protect the health and safety of our employees, we have taken proactive, precautionary action and adopted social distancing measures, daily self-health attestations, and mandatory mask policies at our locations, including when warranted by state and local guidelines, the implementation of new staffing plans in our facilities whereby certain employees work remotely and the remaining on-site force is divided into multiple shifts or segregated in different parts of the facility. Our actions continue to evolve in response to new government measures and scientific knowledge regarding COVID-19. In an effort to contain COVID-19 or slow its spread, governments around the world have also enacted various measures, including orders to close all businesses not deemed “essential,” isolate residents to their homes or places of residence, and practice social distancing when engaging in essential activities. These measures have impacted the method and timing of certain business meetings and deliverables to certain customers, as well as our ability to obtain certain materials, equipment and services from suppliers. For example, Executive Orders issued by the Governor of New York introduced potential delays in the procurement of installation and maintenance services from vendors without personnel located in New York, New Jersey or Connecticut.

We anticipate that these actions and the global health crisis caused by COVID-19 will negatively impact business activity across the globe. We have observed delays, declining demand and price reductions in the electronics industry as business and consumer activity decelerates across the globe. When COVID-19 is demonstrably contained, we anticipate a rebound in economic activity, depending on the rate, pace, and effectiveness of the containment efforts deployed by various national, state, and local governments; however, the timing and extent of any such rebound is uncertain.

We will continue to actively monitor the situation and may take further actions altering our business operations that we determine are in the best interests of our employees, customers, partners, suppliers, and stakeholders, or as required by federal, state, or local authorities. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers, employees, and prospects, or on our financial results beyond fiscal year 2020.

2

Business Developments

On July 16, 2019, the Company announced a new purchase order from a strategic Defense customer for five new filter solutions in the 2-4 GHz frequency spectrum. In late July, Akoustis announced its design lock and pre-production of its 5.6GHz WiFi BAW filter solution which complements the Company’s existing 5.2GHz WiFi filter product.

On August 13, 2019, Akoustis announced a follow-on order from a tier-1 wireless telecommunications customer to develop two additional 5G Mobile filter solutions. In early September 2019, The Company announced a first shipment of its pre-production 5.6GHz XBAW filter product to tier-1 WiFi OEM.

On September 19, Akoustis announced its new n79 RF filter along with shipment of first samples to a new global tier-1 OEM. By the end of September, Akoustis shipped its first tandem 5.2 GHz/5.6 GHz WiFi BAW filters to an existing tier-1 SoC customer.

On November 19, 2019 Akoustis shipped 60,000 5.6 GHz filters to an existing distributor partner. In early December 2019, the Company received its first 5G network infrastructure filter order for small cell base stations.

On December 16, 2019, the Company shipped two new XBAW filters to its 5G mobile customer, bringing the total number of mobile filters shipped to the customer to three. In December 2019, Akoustis also shipped the first sample of its wafer level package (WLP), with the small form factor designed to penetrate the mobile device market.

At the end of December 2019, Akoustis shipped five new S-band filters in the 2-4 GHz range to a defense customer for phased array radar applications. The Company also shipped its tandem 5.2/5.6 GHz WiFi filter solutions to a tier-1 OEM and received a second 5G massive MIMO network infrastructure development order from a tier-1 customer.

On January 7, 2020, the Company announced that it had received an order and shipped its 5.2 GHz and 5.6 GHz coexistence WiFi filters to an original equipment manufacturer (OEM).

On January 30, 2020, Akoustis announced that it had locked the design of its Citizen’s Broadband Radio Service 5G network infrastructure filter and had shipped samples to three OEM’s.

On February 3, 2020, the Company announced that it had received its first volume commercial order for 5G network infrastructure filters from a small cell base station provider focused on markets in Asia.

In mid-February, Akoustis announced the entry into a new market with an order for the design and development of XBAW filters for a customer for unmanned aircraft systems (UAS), commonly referred to as drones. The filters will be used for control and non-payload communication links.

On April 8, 2020, the Company announced that it had achieved its first non-defense commercial design win for XBAW filters in the 5G small cell network equipment market.

On April 29, 2020, Akoustis announced that it had achieved design locked and shipped initial samples of its first unmanned aircraft system (drone) filter solution.

On May 4, 2020, the Company announced its first design win for 5.2 and 5.6 GHz WiFi coexistence filters to a tier-1 OEM.

On May 8, 2020, Akoustis announced that it completed the development of its third 5G small cell network infrastructure filter solution and shipped samples to its existing tier-1 customer.

On June 2, 2020, the Company announced the addition of Colin Hunt as the new Vice President of Global Sales, a new position at Akoustis.

3

On June 8, 2020, Akoustis announced the sampling of a new 5.5 GHz XBAWTM filter for the emerging WiFi 6E market. WiFi 6E is a developing standard made possible by the April 23, 2020 FCC ratification of 5.9-7.1 GHz as a new WiFi channel.

On June 11, 2020, the Company announced that it had signed a new strategic agreement with a tier-1 OEM for the development and purchase of new, custom WiFi 6E filters.

Financing

We have earned minimal revenue from operations since inception, and we have funded our operations primarily with issuances of equity and debt securities, as well as development contracts, RF filter and production orders, government grants, MEMS foundry and engineering services. We have incurred losses totaling approximately $103.6 million from our May 2014 inception through June 30, 2020. These losses are primarily the result of material and processing costs associated with developing and commercializing our technology, as well as personnel costs, professional fees (primarily accounting and legal), and other general and administrative (“G&A”) expenses. We expect to continue to incur substantial costs for the commercialization of our technology on a continuous basis because our business model involves materials and solid-state device technology development and engineering of catalog and custom filter design solutions.

As of August 17, 2020, the Company had $39.3 million of cash and cash equivalents to fund our operations, including capital expenditures, R&D, commercialization of our technology, development of our patent strategy and expansion of our patent portfolio, as well as to provide working capital and funds for other general corporate purposes. Our anticipated expenses include employee salaries and benefits, capital costs for research and other equipment, costs associated with development activities (including travel and administration), costs associated with the integration and operation of our New York wafer fabrication facility and related operations, legal expenses, sales and marketing costs, G&A expenses, and other costs typically associated with an early stage, public technology company. We anticipate increasing the number of employees; however, this is highly dependent on the nature of our development efforts, and our success in commercialization. We anticipate adding employees for R&D in both our New York and North Carolina facilities, as well as for G&A functions, to support our efforts. We expect capital expenditures to be between $11 million and $16 million for the purchase of equipment and software during the next 12 months. Commercial development of new technology, by its nature, is unpredictable. The amounts we actually spend for any specific purpose may vary significantly and will depend on a number of factors, including, but not limited to, the pace of progress of our commercialization and development efforts, actual needs with respect to product testing, R&D, market conditions and changes in or revisions to our marketing strategies. Although we will undertake development efforts with commercially reasonable diligence, and we believe that cash and cash equivalents on hand as of August 17, 2020 will be sufficient to fund our operations beyond the following 12 months, there can be no assurance that our current cash position will be sufficient to enable us to commercialize our technology to the extent needed to create future sales to sustain operations. If our current cash is insufficient for these purposes and we are unable to source additional funds on terms acceptable to the Company (or at all), or we experience costs in excess of estimates to continue our R&D plan, it is possible that we would not have sufficient resources to continue as a going concern and we may be required to curtail or suspend our operations. Even if we are able to source sufficient funds to continue as a going concern, our technology may not be accepted, we may never earn revenues sufficient to support our operations, and we may never be profitable.

Recent Financing Activity

During the year ended June 30, 2020, the Company sold a total of 5,520,000 shares of its common stock at a price to the public of $6.25 per share for aggregate gross proceeds of $34.5 million before deducting the underwriting discount and offering expenses payable by the Company of approximately $2.3 million.

Additionally, on May, 8, 2020 the Company entered into an ATM Equity OfferingSM Sales Agreement with BofA Securities, Inc. and Piper & Sandler & Co. pursuant to which the Company may sell from time to time shares of its common stock having an aggregate offering price of up to $50,000,000 (the “ATM Program”). During the year ended June 30, 2020, the Company sold a total of 1,392,661 shares of its common stock at a weighted average price to the public of $8.02 per share through the ATM Program for aggregate gross proceeds of approximately $11.2 million, before deducting compensation paid to the sales agents of approximately $0.2 million and other offering expenses of approximately $0.2 million.

On May 20, 2020, Akoustis, Inc., the operating subsidiary of the Company, issued a promissory note (the “Promissory Note”) in favor of Bank of America, NA (the “Lender”) that provides for a loan in the principal amount of $1.6 million (the “PPP Loan”) pursuant to the Paycheck Protection Program (the “PPP”) under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), which is administered by the United States Small Business Administration (the “SBA”). The PPP Loan is scheduled to mature two years from the date of funding of the PPP Loan (the “Maturity Date”) and accrues interest at a rate of 1.00% per annum.

4

Our Technology

Current RF acoustic wave filters utilize technologies that are limited by the piezoelectric material physical properties, the resonator device structure and/or the manufacturing process technology. Existing BAW filters use an “acoustic wave ladder” that is based on a monolithic topology approach using lossy polycrystalline materials. By contrast, our XBAW technology uses high purity materials, which provides high performance acoustic properties. We have fabricated resonators that demonstrate the feasibility of our approach and believe our technology will yield a new generation of high frequency RF filter products.

XBAW technology consists of novel high purity piezoelectric materials, which are fabricated into bulk-mode, acoustic wave resonators and RF filters. Our innovative piezoelectric materials contain high-purity Group III element nitride materials and possess a unique signature, which can be detected by conventional material metrology tools. We utilize analytical modeling techniques to aid in the design and internal manufacturing of our materials, whereby the raw substrate materials utilized in our XBAW process are sourced from a third party. Once our filter designs are simulated and ready to manufacture, we supply our NY fabrication facility raw materials, a mask design file, and a unique process sequence in order to fabricate our resonators and filters. We hold several issued and pending patents on our wafer process flow, which is compatible with wafer level packaging (WLP) that allows for low profile, cost effective filters to be produced.

Challenges Facing the Mobile Device Industry

Rising consumer demand for always-on wireless broadband connectivity is creating an unprecedented need for high performance RFFE modules for mobile devices. Mobile devices such as smartphones, tablets and wearables are quickly becoming the primary means of accessing the Internet, driving the Internet of Things (IoT). The rapid growth in mobile data traffic is testing the limits of existing wireless bandwidth. Carriers and regulators have responded by opening new spectrums of RF frequencies, driving up the number of frequency bands in mobile devices. This substantial increase in frequency bands has created a demand for more filters, as well as a demand for filters with higher selectivity. The global transition to LTE and adoption of LTE-Advanced with more sophisticated carrier aggregation and multiple-input, multiple-output (MIMO) techniques will continue to push the requirements for increased supply of high-performance filters. Furthermore, the introduction of 5G mobile technologies and their associated frequencies over the next several years will create an even greater need for high-performance, high-frequency filters as the bands being auctioned have primarily been in the 3-6 GHz range, well above the frequencies of current networks.

The new spectrum introduced by 4G/LTE and 5G is driving spectrum licensing at higher frequencies than previous 3G smartphone models. For example, new TDD LTE frequencies allocated for 5G wireless cover frequencies nearly twice as high as those covered in previous generation phones. As a result, the demand for filters represents the single largest opportunity in the RFFE industry, according to a Mobile Experts 2020 report. For traditional “low band” frequencies, SAW filters have been the primary choice, while high band solutions have utilized BAW filters due to their performance and yield. While there are multiple sources of supply for SAW technology, the source of supply for BAW filters is more limited and essentially dominated by two manufacturers worldwide. See “Competition” below.

In addition, signal loss of current generation acoustic wave filters is excessively high, and up to half of the transmit power is wasted as heat, which ultimately constrains battery life. Another challenge is that the allocated spectrum for mobile communication bands requires high bandwidth RF filters, which, in turn, requires wide bandwidth core resonator technology. In addition, filters with inferior selectivity either reduce the number or bandwidth of operating bands the mobile device can support or increase the noise in the operating bands. Each of these problems negatively impacts the end-user’s experience when using the mobile device.

The RFFE must meet growing data demands while reducing cost and improving battery life. Our solution involves a new approach to RFFE component manufacturing, enabled by XBAW technology. We expect our technology to produce filters that will reduce the overall system cost and improve performance of the RFFE.

5

Our Solutions

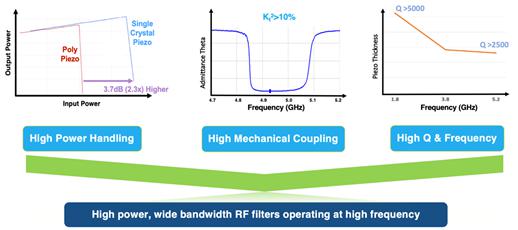

Our immediate focus is on the commercialization of wide bandwidth RF filters operating in the high frequency spectrum known as the sub 6 GHz bands. Using our XBAW technology, we believe these filters enable new PAD module or RFFE competition for high band modules as well as performance-driven low band applications. Initially, we expect to target select strategic RFFE market leaders as well as tier two mobile phone OEMs and/or RFFE module suppliers. Longer term, our focus will be to expand our market share by engaging with additional mobile phone OEMs and RFFE module manufacturers. We manufacture our wafer technology in our Canandaigua, NY fabrication facility where we continue to focus on the commercialization of our filters using our XBAW technology We plan to develop a series of filter designs to be used in the manufacturing of discrete filters, duplexers or more complex multiplexers targeting the 4G/LTE, 5G, WiFi and defense frequency bands. We believe our filter designs will create an alternative for, and replace, filters currently manufactured using materials with fundamentally inferior performance. Figure 1 below illustrates characterization plots that represent the high power, high bandwidth and high frequency capability of our essential single crystal materials.

Figure 1-Characteristics of our high purity piezoelectric materials used to fabricate our BAW RF filters.

Single-Band Discrete Designs, Duplexers and Multiplexers

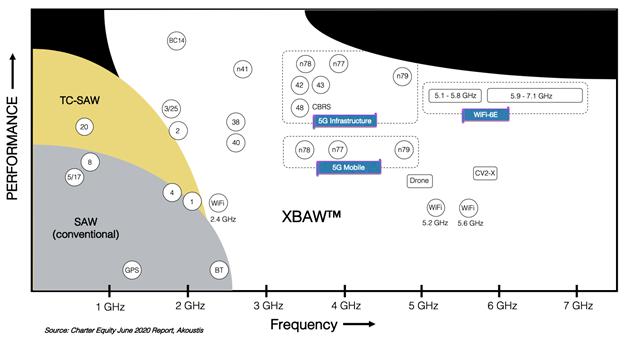

SAW filters are generally desired in modern RFFE because of their performance, small size and low cost. However, traditional SAW ladder designs do not perform well in high frequency bands or bands with closely spaced receive and transmit channels, typical of many new bands. Therefore, BAW filters are preferred for these bands. In our Canandaigua, NY wafer fabrication facility, we fabricate BAW resonators, the building block of BAW filters, that offer high frequency, wide bandwidth and high power performance. We believe the improved efficiency provided by BAW filters will reduce the total cost of RFFE modules, offer efficient use of shared frequency spectrum as well as reduce the battery demand of mobile devices. Additionally, we believe that our XBAW technology will allow for a single manufacturing method that will support all of the BAW filter band range and a significant portion of the SAW band range. Figure 2 below illustrates what we believe will be the frequency range of our XBAW technology.

6

Figure 2- The potential range of our technology.

Pure-Play Filter Provider Enables New Module Competition

Given the high sound velocity in our piezoelectric materials, our technology allows for a wide range of frequency coverage, and we plan to supply filters that will support 4G/LTE, 5G, WiFi and defense bands. We have successfully demonstrated resonators that will support the design and fabrication of 4G/LTE filters, WiFi filters and defense filters, with frequencies adjacent to the emerging 5G mobile auctions. We have transitioned our XBAW technology to high volume manufacturing and aim to be a pure-play filter supplier that will address the increasing RF complexity placed on RFFE manufacturers supporting 4G/LTE 5G,and WiFi. Figure 3 illustrates historical and projected growth in RF complexity.

Figure 3- Projected Increase in Filter content in Mobile Phone Front End Modules (FEMs) from 2019 - 2024 (Source: Mobile Experts 2020).

7

Commercialization

Our immediate focus is on the commercialization of wide bandwidth RF filters to address the WiFi, Network Infrastructure and Defense bands with innovative single-band designs using our XBAWTM sub 6 GHz RF filter technology. We are currently developing commercial single-band filters through our wafer fabrication facility. We are focused on developing fixed-band filters because we believe these designs present the greatest near-term potential for commercialization of our technology, and that once demonstrated, the facility can be more efficiently readied for production compared to alternative technologies.

Our technology development process consists of the following five phases:

| 1. | Pre-Alpha – Demonstrate basic feasibility/capabilities |

| 2. | Alpha – Develop stable recipe (Process freeze) with limited production development |

| 3. | Beta – Complete technology qualification (Process qualification) in factory to enable product design |

| 4. | Pre-Production – Demonstrate lead product production capabilities, release final design tools |

| 5. | Production – Continual improvement of process and parametric performance |

We have completed both the alpha and beta phases for our first generation XBAW process technology called XB1. Additionally, we have received and delivered orders for pre-production products based on our XBAW process technology, and in the fourth quarter of fiscal year 2020 we began the production ramp for our first high volume tier one customer, supporting its WiFi 6 CPE product.

Research and Development

Since inception, the Company’s focus has been on developing an innovative wireless filter technology with a compelling value proposition to our potential customers and a significant and noticeable impact to the end user. Unlike today’s polycrystalline material (used to manufacture RF resonators and filters), our patented XBAW technology employs high purity piezoelectric films in our resonators, which are used as the enabler to create high performance BAW RF filters. Our high purity piezoelectric materials are a key differentiator when compared to the incumbent amorphous thin-film technologies because they increase the acoustic velocity, the electromechanical coupling coefficient in the resonator and/or high-power performance. These technology features allow Akoustis to engineer RF filter solutions for a broad spectrum for multiple radio frequencies and thus multiple end markets.

Research and development expense totaled $20.5 million for the year ended June 30, 2020 and $19.3 million for the year ended June 30, 2019. R&D activities focused on high purity piezoelectric materials development and resonator demonstration. Current R&D investments include materials advancement, resonator development, RF filter design, high yield wafer manufacturing and filter packaging.

As a result of our efforts, we have developed and introduced several new filters which are currently sampling with multiple customers across multiple markets. Our focus remains on improving the electromechanical coupling and quality factor of our resonator technology and the performance of our fabricated filters through design improvements and process optimization experiments.

8

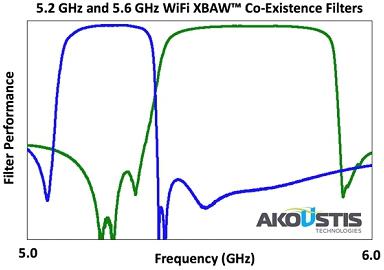

We announced our first filter in March 2018, the AKF-1252, a 5.2 GHz filter for the WiFi premise equipment market. The AKF-1252 is a wideband filter for the U-NII-1&2A bands with typical insertion loss of less than 1dB, high rejection and a high-power rating in an ultra- small footprint module. Offering our customers 23-times size reduction over current dielectric resonator technology, our product is the first BAW RF filter targeting the 5.2 GHz WiFi band having achieved pre-production status in November 2018. In addition, we have announced the sister part to the AKF-1252, called the AKF-1256, which allows the Company to bundle the 5.2 GHz and 5.6 GHz filter solutions to the CPE market. The Company received its first pre-production order in May 2019. The tandem 5.2 GHz and 5.6 GHz filter solutions allow coexistence of WiFi signals in the 5GHz spectrum as shown below.

9

Following the AKF-1252, we also announced the AKF-1652, a 5.2 GHz filter for the WiFi device market, with lower insertion loss in a small footprint, wafer-level package (WLP) that will be required before the expected uptake of 5.2 GHz WiFi in cellular handsets and other devices. We believe that handset makers will be adopting new WiFi bands in the 5-7 GHz bands in the coming years.

We announced our first design win for the sale of our 5.2 GHz and 5.6 GHz coexistence filters on May 4, 2020 with a tier-1 consumer-focused OEM. We expect to begin production for this new design in the September quarter of calendar of the current year.

With the FCC’s decision to increase the available spectrum for WiFi with the ratification of 5.9-7.1 GHz., new filters will be needed that can operate at high frequency with ultra-wide bandwidth. This new spectrum is called WiFi 6E. We expect to deliver both standard products and custom filters to address this new market over the next 12 months and beyond. To this end, we announced our first WiFi 6E filter on June 8, 2020, a 5.5 GHz XBAWTM filter solution with 675 MHz of bandwidth. We are currently sampling this filter with multiple OEMs, ODMs and SoC makers.

In April 2018 we announced the AKF-1938 filter in the 3.8 GHz band, adjacent to emerging 5G mobile frequency auctions. In July 2018, we announced that we signed our first customer, a large military OEM with annual revenue of over $1 billion. We received revenue from this product in the second quarter of fiscal 2019, with follow-on new orders received in calendar 2019. This customer asked us to produce five additional S-band filters on July 19, 2019. We delivered these filters in December 2019 and expect to go into production in the second half of calendar 2020. On February 19, 2020, we received a development order from a second defense customer for an unmanned aircraft system filter for drones. On April 29, 2020, we announced shipment of the first samples to the customer and expect to receive a commercial order for this filter by the end of March 2021.

On December 3, 2019, we announced our first 5G network infrastructure order for small cell base station equipment from a tier-1 OEM. On February 3, 2020, we announced our first volume order for a second 5G small cell network infrastructure filter from the same customer. On April 8, 2020, we announced this volume order which led to our first design win in 5G small cell filters from this customer, which is expected to go into production in the September quarter of calendar 2020. We announced a third filter development order on May 8, 2020, for another 5G small cell filter that is expected to go into production in the second half of calendar 2020. As we announced on May 8, 2020, we are now engaged with over five OEMs and ODMs that are sampling our small cell filters.

On January 30, 2020, we announced that we had design-locked our XBAWTM filter for Citizen’s Broadband Radio Service (CBRS). This network is expected to begin roll-out in the second half of calendar 2020 once the priority access licenses are auctioned off by the FCC. Originally slated for late June, the auction has been delayed by the Coronavirus epidemic, and the timing of the auction could experience further delay.

We have also announced a 4G LTE infrastructure win for two adjacent filters, with engineering revenue attached and follow on production filter revenue expected upon completion of the design. Moving forward, we expect to deliver new catalog components based on the frequencies in highest demand from our customers and will announce additional products as we continue to benefit from our research and development efforts.

On August 13, 2019, we announced an order to develop two additional 5G mobile filters from a tier-1 telecommunications company. We announced the delivery of the two filters to the customer on December 16, 2019 and received an order for additional samples. On January 7, 2020, we announced our first wafer level package demonstrator for mobile devices which we expect to complete and deliver fully qualified samples by the end of calendar 2020.

Akoustis has added 14 filters to its product catalog including a 5.6 GHz WiFi filter, a 5.2 GHz WiFi filter, a 5.5 GHz WiFi-6E filter, three small cell 5G network infrastructure filters including two Band n77 filters and one Band n79 filter, a 3.8 GHz filter and five S-Band filters for defense phased-array radar applications, a 3.6 GHz filter for the CBRS 5G infrastructure market and a C-Band filter for the unmanned aircraft systems (UAS) market. The Company is also developing several new filters for the sub-7 GHz bands targeting 5G mobile device, network infrastructure, WiFi CPE and defense markets. 12 of the 14 filters were completed in fiscal 2020 as our processes and modeling capabilities continue to improve.

10

Raw Materials

Within its internal manufacturing operation, Akoustis sources raw materials, process gases, metals and other miscellaneous supplies to fabricate its BAW RF filter circuits. Materials range from substrates (used to deposit key piezoelectric materials) to standard dielectric-based laminates (used for packaging of the RF filter circuits). The Company sources at least two types of substrate materials for its BAW process and we have more than one supplier for one material and a single source for the other. Multiple process gases are used for material synthesis, process etching and wafer treatment. While there is more than one supplier for most process gases, the purity levels of such gases may change by source. Hence, either purification or process requalification may be required when purchasing from a second source is required. Akoustis sources various high purity metals for electrode formation and interconnect layers for its RF circuits. Such metals are available in various purity levels and are available from more than one supplier. Other process handling hardware common to the semiconductor industry is available in abundance from multiple suppliers. Consistent with other semiconductor manufacturers, the Company may have to work with all its suppliers to ensure adequate supply of raw materials, process gases and metals as the Company ramps from R&D into high volume manufacturing.

Intellectual Property

We rely on a combination of intellectual property rights, including patents and trade secrets, along with copyrights, trademarks and contractual obligations and restrictions to protect our core technology and business.

In the United States and internationally, as of August 17, 2020, our IP portfolio included 33 patents, including one blocking patent that we have licensed from Cornell University. Additionally, we have 71 active and pending patent applications. These patents cover our XBAWTM RF filter technology from the substrate level through the system application layer. Where possible, we leverage both federal and state level R&D grants to support development and commercialization of our technology. Our owned patents expire between 2034 and 2038. We intend to continue to innovate and expand our patent portfolio, and when appropriate, we will look to purchase license(s) that grant access to additional intellectual property that enables, enhances or further expands our technical capabilities and/or product.

11

We believe that Akoustis will have competitive advantages from rights granted under our patent applications. Some applications, however, may not result in the issuance of any patents. In addition, any future patent may be opposed, contested, circumvented or designed around by a third party or found to be unenforceable or invalidated. Others may develop technologies that are similar or superior to our proprietary technologies, duplicate our proprietary technologies or design around patents owned or licensed by us.

We generally control access to, and use of, our confidential information through the use of internal and external controls, including contractual protections with employees, contractors and customers. We rely in part on the United States and international copyright laws to protect our intellectual property. All employees and consultants are required to execute confidentiality and intellectual property assignment agreements in connection with their employment and consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived or made in connection with the employment or consulting relationship.

Competition

The RF filter market is controlled by a relatively small number of RF component suppliers. These companies include, among others, Broadcom Corporation, Murata Manufacturing Co., Ltd., Qorvo, Inc., Skyworks Solutions Inc., Taiyo Yuden Co. Ltd., and Qualcomm Incorporated. Broadcom Corporation and Qorvo, Inc. dominate the high band BAW filter market, controlling a significant portion of the customer base and are increasing capacity to meet the growing RF filter demand of the 4G/LTE market.

Upon completion of our product development, we will compete directly with these companies to secure design slots inside RFFE module targeting companies that procure filters or internally source filters. While many of our competitors have more resources than we have, we believe that our filter designs will be superior in performance, and we will approach prospective customers as a pure-play filter supplier, offering advantages in performance over the full frequency range at competitive costs. Our challenges will include convincing our customers that we have a strong intellectual property position, that we will be able to deliver in volume, that we will meet their price targets, and that we can satisfy quality, reliability and other requirements. For a list of other competitive factors, see “Item 1A. Risk Factors - We are still developing many of our products, and they may not be accepted in the market.”

Employees

We place an emphasis on hiring the best talent at the right time to enable our core technology and business growth. This includes establishing a competitive compensation and benefits package, thereby enhancing our ability to recruit experienced personnel and key technologists. As of June 30, 2020, we had a total of 95 full-time employees plus 7 part-time and temporary employees. We will continue to hire specific and targeted positions to further enable our technology and manufacturing capabilities as and when appropriate.

Government Regulations

Our business and products in development are subject to regulation by various federal and state governmental agencies, including the radio frequency emission regulatory activities of the Federal Communications Commission (the “FCC”), the consumer protection laws of the Federal Trade Commission (the “FTC”), the import/export regulatory activities of the Department of Commerce, the product safety regulatory activities of the Consumer Products Safety Commission, and the environmental regulatory activities of the Environmental Protection Agency (the “EPA”).

The rules and regulations of the FCC limit the RF used by, and level of power emitting from, electronic equipment. Our RF filters, as a key element enabling consumer electronic smartphone equipment, are required to comply with these FCC rules and may require certification, verification or registration of our RF filters with the FCC. Certification and verification of new equipment requires testing to ensure the equipment’s compliance with the FCC’s rules. The equipment must be labeled according to the FCC’s rules to show compliance with these rules. Testing, processing of the FCC’s equipment certificate or FCC registration and labeling may increase development and production costs and could delay the implementation of our XBAW acoustic wave resonator technology for our RF filters and the launch and commercial productions of our filters into the U.S. market. Electronic equipment permitted or authorized to be used by us through FCC certification or verification procedures must not cause harmful interference to licensed FCC users, and may be subject to RF interference from licensed FCC users. Selling, leasing or importing non-compliant equipment is considered a violation of FCC rules and federal law, and violators may be subject to an enforcement action by the FCC. Any failure to comply with the applicable rules and regulations of the FCC could have an adverse effect on our business, operating results and financial condition by increasing our compliance costs and/or limiting our sales in the United States.

12

The semiconductor and electronics industries also have been subject to increasing environmental regulations. A number of domestic and foreign jurisdictions seek to restrict the use of various substances, a number of which have been used in our products in development or processes. While we have implemented a compliance program to ensure our product offering meets these regulations, there may be instances where alternative substances will not be available or commercially feasible, or may only be available from a single source, or may be significantly more expensive than their restricted counterparts. Additionally, if we were found to be non-compliant with any such rule or regulation, we could be subject to fines, penalties and/or restrictions imposed by government agencies that could adversely affect our operating results. We will continue to monitor our quality program and expand as required to maintain compliance and ability to audit our supply chain.

Noncompliance with applicable regulations or requirements could subject us to investigations, sanctions, mandatory product recalls, enforcement actions, disgorgement of profits, fines, damages, civil and criminal penalties, or injunctions. An adverse outcome in any such litigation could require us to pay contractual damages, compensatory damages, punitive damages, attorneys’ fees and costs. These enforcement actions could harm our business, financial condition and results of operations. If any governmental sanctions are imposed, or if we do not prevail in any possible civil or criminal litigation, our business, financial condition and results of operations could be materially adversely affected. In addition, responding to any action will likely result in a significant diversion of management’s attention and resources and an increase in professional fees.

This section is a summary of the risks that we presently believe are material to the operations of the Company. Additional risks of which we are not presently aware or which we presently deem immaterial may also impair the Company’s business, financial condition or results of operations.

Risks Related to our Business and the Industry in which we Operate

We have a limited operating history upon which investors can evaluate our business and future prospects.

We are an emerging commercial company that recently began commercial operations selling advanced single-crystal BAW filter products for RFFEs for use in the mobile wireless device industry. Historically, we have primarily focused on R&D of high efficiency acoustic wave resonator technology utilizing single-crystal piezoelectric materials, and have earned minimal revenue from operations since inception.

Since our expectations of potential customers and future demand for our products are based on only limited experience, it is difficult for our management and our investors to accurately forecast and evaluate our future prospects and our revenues. Our proposed progression of our operations are therefore subject to all of the risks inherent in light of the expenses, difficulties, complications and delays frequently encountered in connection with the growth of any new business and the development of a product, as well as those risks that are specific to our business in particular. The risks include, but are not limited to, our reliance on third parties to complete some processes for the manufacturing and packaging of our products, the possibility that we will not be able to develop functional and scalable products, or that although functional and scalable, our products and/or services will not be accepted in the market. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that the Company can successfully address these challenges. If it is unsuccessful, the Company and its business, financial condition and operating results will be materially and adversely affected.

We may not generate sufficient revenues to achieve profitability.

We have incurred operating losses since our inception and expect to continue to have negative cash flow from operations. We have only generated minimal revenues from shipment of product while our primary sources of funds have been R&D grants, MEMS foundry services, issuances of our equity, and debt. We have experienced net losses of approximately $103.6 million for the period from May 12, 2014 (inception) to June 30, 2020. Our future profitability will depend on our ability to create a sustainable business model and generate sufficient revenues, which is subject to a number of factors, including our ability to successfully implement our strategies and execute our R&D plan, our ability to implement our improved design and cost reductions into manufacturing of our RF filters, the availability of funding, market acceptance of our products, consumer demand for end products incorporating our products, our ability to compete effectively in a crowded field, our ability to respond effectively to technological advances by timely introducing our new technologies and products, and global economic and political conditions.

13

Our future profitability also depends on our expense levels, which are influenced by a number of factors, including the resources we devote to developing and supporting our projects and potential products, the continued progress of our research and development of potential products, our ability to improve R&D efficiencies, license fees or royalties we may be required to pay, and the potential need to acquire licenses to new technology, the availability of intellectual property for licensing or acquisition, or the use of our technology in new markets, which could require us to pay unanticipated license fees and royalties in connection with these licenses.

Our development and commercialization efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues to offset higher expenses. These expenses, among other things, may cause our net income and working capital to decrease. If we fail to generate sufficient revenue and manage our expenses, we may never achieve profitability, which would adversely and materially affect our ability to provide a return to our investors.

We are dependent on the proper functioning of our critical facilities, our supply chain and distribution networks and the financial stability of our customers, all of which have been negatively impacted by the COVID-19 pandemic in a manner that may have a materially adverse effect on our business, financial condition or results of operations.

Our ability to manufacture products may be materially adversely impacted by COVID-19.

The COVID-19 pandemic is impacting worldwide economic activity, which has had a corresponding effect on our sales activity. The virus continues to spread globally, has been declared a pandemic by the World Health Organization and has spread to over 100 countries, including the United States. The impact of this pandemic has been and will likely continue to be extensive in many aspects of society, and has resulted in and will likely continue to result in significant disruptions to the global economy, as well as businesses and capital markets around the world. With the ongoing effect of the COVID-19 pandemic in the United States and other countries, it is unclear how economic activity and workflows will continue to be impacted and for how long. Many employers in the United States are requiring their employees to work from home or not come into their offices or facilities. We manufacture primarily out of one facility in Canandaigua, New York. In order to mitigate the risk posed by COVID-19, we have implemented social distancing measures, daily self-health attestations, and mandatory mask policies, including when warranted by state and local guidelines, the implementation of new staffing plans in our facilities whereby certain employees work remotely and the remaining on-site force is divided into multiple shifts or segregated in different parts of the facility. Our actions continue to evolve in response to new government measures and scientific knowledge regarding COVID-19. To date, these protocols have not resulted in a decrease in the production capabilities of our facility. However, if the manufacturing capabilities of this facility are adversely impacted as a result of COVID-19, whether by a decrease in productivity caused by precautionary measures or by one or more employees becoming ill, it may not be possible for us to timely manufacture relevant products at required levels or at all. A reduction or interruption in any of our manufacturing processes could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We also might be unable to obtain certain supplies, product components, or equipment from our suppliers and vendors due to constraints created by COVID-19. For instance, we have observed delays in certain suppliers’ deliveries of materials necessary for us to manufacture our products and in certain vendors’ ability to manufacture equipment used in our production process. Additionally, travel restrictions and stay-at-home orders or similar mandates of foreign and domestic governments have prevented us from visiting suppliers’ facilities as part of our quality control processes and have constrained or delayed visits by out-of-state employees and suppliers to perform installations, maintenance and service. These impacts may delay our launch of new products, adversely affect our ability to deliver customers’ orders timely or in the requested quantities and inhibit our ability to ensure the quality of supplies used in our products.

14

Our sales may be materially adversely impacted by COVID-19.

Our sales efforts typically function by in-person meetings with customers and potential customers to discuss our products. The method and timing of these meetings has been altered due to stay-at-home orders and travel restrictions relating to COVID-19. This limitation on the ability of our sales personnel to maintain their customary interaction with customers may negatively affect demand for our products. We have also found that potential customers have been forced to slow and reprioritize various product development projects as a result of COVID-19. This disruption to our sales activity and our customers’ businesses, and the resulting delay in the growth of our business, may have a material adverse effect on our results of operations, financial condition and cash flows. Furthermore, a reduction or delay in revenues will prolong our dependence on capital raising to finance our operations.

We previously identified material weaknesses in our internal control over financial reporting that resulted in concluding that our disclosure controls and procedures were not effective as of June 30, 2019. As of June 30, 2020, we had remediated these material weaknesses and have concluded that our disclosure controls and procedures are effective. However, if we fail to maintain effective internal control over financial reporting in the future, material misstatements in our financial statements could occur, harm our reputation or cause investors to lose confidence in the reported financial information, all or any of which could have a material adverse effect on our results of operations and financial condition, which, in turn, could adversely affect the market price of our Common Stock, our access to debt or other capital markets or other aspects of our business, prospects, results of operations or financial condition. Additionally, as we are no longer an “accelerated filer” under SEC rules, we are not required to provide an auditor’s attestation of our assessment of internal control over financial reporting.

As a public company, we are required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis. Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) requires that we evaluate and determine the effectiveness of our internal control over financial reporting and provide a management report on internal control over financial reporting.

In our Annual Report on Form 10-K for the year ended June 30, 2019, we identified certain material weaknesses in our internal control over financial reporting as disclosed in Item 9A. As of June 30, 2020, management determined that those material weaknesses had been remediated and that our disclosure controls and procedures are effective. As we are no longer an “accelerated filer” under SEC rules, we are not required to provide an auditor’s attestation of management’s assessment of internal control over financial reporting as of June 30, 2020, although our auditor did provide such an attestation as of June 30, 2019.

If we fail to maintain proper and effective internal controls, we may not detect errors on a timely basis and our financial statements may be materially misstated. Additionally, if we are unable to assert that our internal control over financial reporting is effective, we may not be able to access debt markets, equity investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Common Stock could be adversely affected, and we could become subject to investigations by Nasdaq, the SEC or other regulatory authorities, which could require additional financial and management resources.

15

The industry and the markets in which the Company operates are highly competitive and subject to rapid technological change. Therefore, in order for our RF filters to be competitive and achieve market acceptance, we need to keep pace with rapid development of new process technologies.

The markets in which we compete are intensely competitive. We operate primarily in the industry that designs and produces semiconductor components for wireless communications and other wireless devices, which is subject to rapid changes in both product and process technologies based on demand and evolving industry standards. The markets for our products are characterized by:

| ● | rapid technological developments and product evolution, |

| ● | rapid changes in customer requirements, |

| ● | frequent new product introductions and enhancements, |

| ● | continuous demand for higher levels of integration, decreased size and decreased power consumption, |

| ● | short product life cycles with declining prices over the life cycle of the product, and |

| ● | evolving industry standards. |

The continuous evolutions of these technologies and frequent introduction of new products and enhancements have generally resulted in short product life cycles for wireless semiconductor products, in general, and for RFFEs, in particular. Our R&D activity and resulting products could become obsolete or less competitive sooner than anticipated because of a faster than anticipated change in one or more of the above-noted factors. Therefore, in order for our RF filters to be competitive and achieve market acceptance, we need to keep pace with rapid development of new process technologies, which requires us to:

| ● | respond effectively to technological advances by timely introducing new technologies and products, |

| ● | successfully implement our strategies and execute our R&D plan in practice, |

| ● | improve the efficiency of our technology, and |

| ● | implement our improved design and cost reductions into manufacturing of our RF filters. |

16

We are still developing many of our products, and they may not be accepted in the market.

Although we believe that our XBAW acoustic wave resonator technology, which utilizes high purity piezoelectric materials, provides material advantages over existing RF filters, and we have developed and are currently developing various methods of integration suitable for implementation of this technology into RF filters, we cannot be certain that our RF filters will be able to achieve or maintain market acceptance. While we have fabricated R&D filters that demonstrate the performance of our XBAW technology, and this technology has been qualified for mass production, the Company is undergoing a critical production ramp to commercial scale. There are no assurances that we can successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields. In addition to our limited operating history, we will depend on a limited number of manufacturers and customers for a significant portion of our revenue in the future and we cannot guarantee their acceptance of our products. Each of these factors may adversely affect our ability to implement our business strategy and achieve our business goals.

The successful development of our XBAW technology and market acceptance of our RF filters will be highly complex and will depend on the following principal competitive factors, including our ability to:

| ● | comply with industry standards and effectively compete against current technology for producing RF acoustic wave filters, |

| ● | differentiate our products from offerings of our competitors by delivering RF filters that are higher in quality, reliability and technical performance, |

| ● | anticipate customer and market requirements, changes in technology and industry standards and timely develop improved technologies that meet high levels of satisfaction of our potential customers, |

| ● | maintain, grow and manage our internal teams to the extent we increase our operations and develop new segments of our business, |

| ● | develop and maintain successful collaborative, strategic, and other relationships with manufacturers, customers and contractors, |

| ● | protect, develop or otherwise obtain adequate intellectual property for our technology and our filters; and |

| ● | obtain strong financial, sales, marketing, technical and other resources necessary to develop, test, manufacture, commercialize and market our filters. |

If we are unsuccessful in accomplishing these objectives, we may not be able to compete successfully against current and potential competitors. As a result, our XBAW technology and our RF filters may not be accepted in the market and we may never attain profitability.

We face risks associated with the operation of our manufacturing facility.

We operate a wafer fabrication facility in Canandaigua, NY that we acquired in June 2017. We currently use several international and domestic suppliers to assemble and test our products, as well as our own test and tape and reel facilities located in the U.S.

A number of factors related to our facilities will affect our business and financial results, including the following:

| ● | our ability to adjust production capacity in a timely fashion in response to changes in demand for our products; |

| ● | the significant fixed costs of operating the facilities; |

| ● | factory utilization rates; |

| ● | our ability to qualify our facilities for new products and new technologies in a timely manner; |

| ● | the availability of raw materials, the impact of the volatility of commodity pricing and tariffs imposed on raw materials, including substrates, gold, platinum and high purity source materials such as gallium, aluminum, arsenic, indium, silicon, phosphorous and palladium; |

17

| ● | our manufacturing cycle times; |

| ● | our manufacturing yields; |

| ● | our ability to hire, train and manage qualified production personnel; |

| ● | our compliance with applicable environmental and other laws and regulations; and |

| ● | our ability to avoid prolonged periods of down-time in our facilities for any reason. |

If we experience poor manufacturing yields, our operating results may suffer.

Our products have unique designs and are fabricated using multiple semiconductor process technologies that are highly complex. In many cases, our products are assembled in customized packages. Many of our products consist of multiple components in a single module and feature enhanced levels of integration and complexity. Our customers insist that our products be designed to meet their exact specifications for quality, performance and reliability. Our manufacturing yield is a combination of yields across the entire supply chain, including wafer fabrication, assembly and test yields. Defects in a single component in an assembled module product can impact the yield for the entire module, which means the adverse economic impacts of an individual defect can be multiplied many times over if we fail to discover the defect before the module is assembled. Due to the complexity of our products, we periodically experience difficulties in achieving acceptable yields and other quality issues, particularly with respect to new products.

Our customers test our products once they have been assembled into their products. The number of usable products that result from our production process can fluctuate as a result of many factors, including:

| ● | design errors; |

| ● | minute impurities and variations in materials used; |

| ● | contamination of the manufacturing environment; |

| ● | equipment failure or variations in the manufacturing processes; |