of our drug discovery process that involve proprietary know-how and technology that is not covered by patent applications, we rely on trade secret protection and confidentiality agreements to protect our interests. We require all of our employees, consultants, and advisors to enter into confidentiality agreements. Where it is necessary to share our proprietary information or data with outside parties, our policy is to make available only that information and data required to accomplish the desired purpose and only pursuant to a duty of confidentiality on the part of those parties.

As of December 31, 2023, we owned a total of 176 issued US patents and 1,002 granted foreign patents, as well as additional pending US patent applications and foreign patent applications. The claims in these various patents and patent applications are typically directed to compositions of matter, including claims covering product candidates, crystalline forms, lead compounds and key intermediates, pharmaceutical compositions, methods of use and/or processes for making our compounds. Our patents and patent applications are also directed to other inventions made during the research and development process. In particular, our wholly-owned subsidiary Theravance Biopharma R&D IP, LLC owns the following US patents that are listed in the FDA Approved Drug Products with Therapeutic Equivalence Evaluations (Orange Book) for YUPELRI (revefenacin) inhalation solution: US Patent No. 7,288,657, expiring on December 23, 2025; US Patent No. 7,491,736, expiring March 10, 2025; US Patent No. 7,521,041, expiring March 10, 2025; US Patent No. 7,550,595, expiring March 10, 2025; US Patent No. 7,585,879, expiring March 10, 2025; US Patent No. 7,910,608, expiring March 10, 2025; US Patent No. 8,034,946, expiring March 10, 2025; US Patent No. 8,053,448, expiring March 10, 2025; US Patent No. 8,273,894, expiring March 10, 2025; US Patent No. 8,541,451, expiring August 25, 2031; US Patent No. 9,765,028, expiring July 14, 2030; US Patent No. 10,106,503, expiring March 10, 2025; US Patent No. 10,343,995, expiring March 10, 2025; US Patent No. 10,550,081, expiring July 14, 2030; US Patent No. 11,008,289, expiring July 14, 2030; US Patent No. 11,247,969, expiring March 10, 2025; US Patent 11,484,531, expiring October 23, 2039; US Patent 11,691,948, expiring July 14, 2030; and US Patent 11,858,898, expiring July 14, 2030 (each of the aforementioned expiration dates not including any patent term extensions that may be available under the Drug Price Competition and Patent Term Restoration Act of 1984). Thus, the last to expire patent currently listed in the Orange Book for YUPELRI (revefenacin) inhalation solution expires on October 23, 2039. On December 19, 2018, we filed patent term extension (“PTE”) applications in the US Patent and Trademark Office (“USPTO”) for US Patent Nos. 7,288,657 and 7,585,879. These PTE applications are currently pending and, if granted, we will be permitted to extend the term of one of these patents for the period determined by the USPTO.

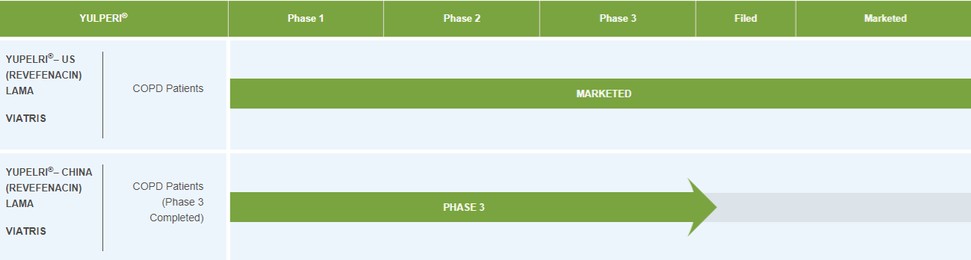

The patent rights relating to YUPELRI (revefenacin) inhalation solution currently consist of issued US patents, pending US patent applications and certain counterpart patents and patent applications in a number of jurisdictions, including Europe and China.

Additionally, some of our patents and patent applications are directed to products in development. Our patent rights relating to ampreloxetine include an issued US composition of matter patent that expires in 2030 and an issued US method of treatment patent that expires in 2037 (in each case, not including any patent term extensions that may be available under the Drug Price Competition and Patent Term Restoration Act of 1984). The patent portfolio for this development product includes additional pending patent applications and granted patents in a number of jurisdictions. Nevertheless, issued patents can be challenged, narrowed, invalidated, or circumvented, which could limit our ability to stop competitors from marketing similar products and threaten our ability to commercialize our product candidates. Our patent position, similar to other companies in our industry, is generally uncertain and involves complex legal and factual questions. To maintain our proprietary position, we will need to obtain effective claims and potentially enforce these claims once granted. It is possible that, before any of our products can be commercialized, any related patent may expire or remain in force only for a short period following commercialization, thereby reducing any advantage of the patent. Also, we do not know whether any of our patent applications will result in any issued patents or, if issued, whether the scope of the issued claims will be sufficient to protect our proprietary position.

Patent Term Restoration, Regulatory Exclusivities, and Hatch-Waxman Litigation

Depending upon the timing, duration, and specifics of FDA approval of our product candidates, some of our US patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, referred to as the Hatch-Waxman Act. The Hatch-Waxman Act permits a patent restoration term of up to five years as compensation for patent term lost during product development and the FDA regulatory review process. However, patent term restoration cannot extend the remaining term of a patent beyond a total of 14 years from the product’s approval date. The patent term restoration period is generally one-half the time between the effective date of