10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) |

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the Fiscal Year Ended December 31, 2015

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to

Commission file number: 001-36153

Criteo S.A.

(Exact name of registrant as specified in its charter)

|

| | |

France

(State or other jurisdiction of incorporation or organization) | | Not Applicable

(I.R.S. Employer Identification Number) |

32, rue Blanche, 75009 Paris—France

(Address of principal executive offices including zip code)

Registrant's telephone number, including area code: +33 1 40 40 22 90

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

American Depositary Shares, each representing one ordinary share, nominal value €0.025 per share |

| Nasdaq Global Select Market |

Ordinary shares, nominal value €0.025 per share* | | Nasdaq Global Select Market * |

(Title of class) | | (Name of exchange on which registered) |

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large Accelerated Filer x | | Accelerated Filer ¨ | | Non-accelerated Filer ¨ (Do not check if a

smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter, was $2.7 billion, based on the closing sale price as reported by the Nasdaq Global Select Market on June 30, 2015. Ordinary shares, nominal value €0.025 per share, held by each officer and director and by each person who owns or may be deemed to own 10% or more of the outstanding ordinary shares have been excluded since such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of January 31, 2016, the registrant had 62,480,517 ordinary shares, nominal value €0.025 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant’s proxy statement for the 2016 Annual Meeting of Shareholders. Such proxy statement will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2015.

CRITEO S.A.

ANNUAL REPORT ON FORM 10-K

For The Fiscal Year Ended December 31, 2015

TABLE OF CONTENTS

|

| | | |

| | | |

Item 1 | | | |

Item 1A | | | |

Item 1B | | | |

Item 2 | | | |

Item 3 | | | |

Item 4 | | | |

| | | |

Item 5 | | | |

Item 6 | | | |

Item 7 | | | |

Item 7A | | | |

Item 8 | | | |

Item 9 | | | |

Item 9A | | | |

Item 9B | | | |

|

| | | |

| | | |

Item 10 | | | |

Item 11 | | | |

Item 12 | | | |

Item 13 | | | |

Item 14 | | | |

| | | |

Item 15 | | | |

General

Except where the context otherwise requires, all references in this Annual Report on Form 10-K (“Form 10-K”) to the “Company,” “Criteo,” “we,” “us,” “our” or similar words or phrases are to Criteo S.A. and its subsidiaries, taken together. In this Form 10-K, references to “$” and “US$” are to United States dollars. Our audited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. Unless otherwise indicated, the statistical and financial data contained in this Form 10-K are presented as of December 31, 2015.

Trademarks

“Criteo,” the Criteo logo and other trademarks or service marks of Criteo S.A. appearing in this Annual Report on Form 10-K are the property of Criteo S.A. Trade names, trademarks and service marks of other companies appearing in this Form 10-K are the property of their respective holders.

Special Note Regarding Forward-Looking Statements

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this Form 10-K, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this Form 10-K, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward- looking statements include, but are not limited to, statements about:

| |

• | our ability to meet the challenges of a growing and international company in a rapidly developing and changing industry, including our ability to forecast accurately; |

| |

• | our ability to maintain an adequate rate of revenue growth and sustain profitability; |

| |

• | the ability of the Criteo Engine to accurately predict engagement by a user; |

| |

• | our ability to continue to collect and utilize data about user behavior and interaction with advertisers; |

| |

• | our ability to adapt to regulatory, legislative or self-regulatory developments regarding internet privacy matters; |

| |

• | our ability to protect users’ information and adequately address privacy concerns; |

| |

• | our ability to acquire an adequate supply of advertising inventory from publishers on terms that are favorable to us; |

| |

• | our ability to predict and adapt to changes in widely adopted industry platforms and other new technologies; |

| |

• | the effects of increased competition in our market; |

| |

• | our ability to enter new marketing channels and to effectively scale our technology platform in new industry verticals; |

| |

• | our ability to manage our international operations and expansion and the integration of our acquisitions; |

| |

• | our ability to maintain, protect and enhance our brand and intellectual property; |

| |

• | failures in our systems or infrastructure; and |

| |

• | our ability to attract and retain qualified employees and key personnel. |

You should refer to Item 1A “Risk Factors” of this Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Form 10-K and the documents that we reference in this Form 10-K and have filed as exhibits to this Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Form 10-K contains market data and industry forecasts that were obtained from industry publications. These data and forecasts involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this Form 10-K is generally reliable, such information is inherently imprecise.

PART I

Item 1. Business

History and Development of the Company

Criteo S.A. was incorporated as a société par actions simplifiée, or S.A.S., under the laws of the French Republic on November 3, 2005, for a period of 99 years and subsequently converted to a société anonyme, or S.A. We are registered at the Paris Commerce and Companies Register under the number 484 786 249. Our agent for service of process in the United States is National Registered Agents, Inc. We began selling our solution in France in 2007 and expanded our business into other countries in Western Europe. In 2009, we expanded our business into North America and entered the Asia-Pacific region in late 2010.

Business Overview

We are a global technology company specializing in digital performance marketing. We strive to deliver post-click sales to our advertiser clients at scale and according to the client’s targeted return on investment. We use our proprietary predictive software algorithms, coupled with large volumes of granular shopping intent data and deep insights gained from the analysis of expressed consumer intent and purchasing habits, to price and deliver in real time highly relevant and personalized digital performance advertisements to consumers. By measuring our value delivered on a post-click sales basis, we make the return on investment transparent and easy to measure for our advertiser clients.

We partner with our clients to capture activity on their digital properties, which we define as websites and/or mobile applications, and optimize our advertisement placement decisions based on that activity and other data. Demonstrating the depth and scale of our data, we collected data on over $439 billion in sales transactions1 on our clients' digital properties in the year ended December 31, 2015, whether or not a consumer saw or clicked on an advertisement displayed by Criteo. Based on this data and our other assets, we delivered targeted advertisements that generated approximately 5.2 billion clicks in the year ended December 31, 2015. Based on these clicks, our clients generated approximately $21 billion in post-click sales2 during this period. A post-click sale is defined as a purchase made by a user from one of our clients’ digital properties within a certain period of time following the user clicking on an advertisement we delivered for that client. This period of time varies by client, but is a maximum of 30 days. We believe post-click sales is a key performance indicator that our clients use to measure the effectiveness of our solution in driving sales and the return on their marketing spend with us. As of December 31, 2015, we had over 10,000 clients and in each of the last three years our average client retention rate was over 90%.

___________________________________________________

1 We have changed the method to measure our clients’ sales transactions and aligned it with our method to measure post-click sales in 2015. Previously, we collected data on purchases with an average order value between €10 and €1,000 (or euro equivalent for transactions denominated in currencies other than the euro) made by visitors representing less than 50% of all monthly visitors to a client's digital properties. Now, we collect data on purchases made by visitors representing less than 30% of all visitors to a client's digital properties over the last three months, where our client's cost of sales is between 0.5% and 40%. Using this new method, our clients’ sales transactions were $279 billion in 2014 and $439 billion in 2015.

2 We have changed our method to measure post-click sales and aligned it with our method to measure client sales. Previously, we collected data on purchases with average order value between €10 and €1,000 (or euro equivalent for transactions denominated in currencies other than the euro) made by visitors representing less than 30% of all visitors to a client's digital properties in the last 12 months. Now, we collect data on purchases made by visitors representing less than 30% of all visitors to a client's digital properties over the last three months, where our client’s cost of sales is between 0.5% and 40%. Using this new methodology, our clients’ post-click sales were $15.3 billion in 2014 and $20.9 billion in 2015.

Our technology enables digital performance marketing through four key steps.

First, we capture consumers' shopping intent directly from the product catalogs and stores on our advertiser clients' digital properties. Second, our proprietary technology predicts the best offer for each user of our advertiser clients by recommending the right product or service for that user, predicting in real time the value of that user for the advertiser client and bidding an appropriate price for the advertising inventory on which our advertisement will be displayed. Third, we create a customized advertisement and deliver the advertisement to the user across a wide range of inventory available to us. Fourth, we measure in real time the success of the advertisement and relay that information to our advertiser clients. This entire process can be executed in under 100 milliseconds and, throughout the process, our technology monitors and adjusts each of these steps in order to optimize performance in real time. Every day we are presented with billions of opportunities to connect individuals that are browsing the internet or using mobile applications, whom we refer to as consumers or users, with relevant marketing messages from our clients. For each of these opportunities, our algorithms analyze massive volumes of data to observe and predict user intent and deliver specific messaging for products or services that are likely to engage that particular user and result in a sale for our client. The accuracy of our algorithms improves with every advertisement we deliver, as they incorporate new data, while continuing to learn from previous data.

Our solution is comprised of the Criteo Engine, our data assets, access to inventory, and our advertiser and publisher platforms. The Criteo Engine has been developed over the past 10 years and consists of multiple machine learning algorithms—in particular our prediction, recommendation, bidding and creative algorithms—and the proprietary global hardware and software infrastructure that enables our solution to operate in real time and at significant scale. The Criteo Engine delivers advertisements through multiple marketing channels and formats, including display advertising banners, native advertising banners (including on social media platforms) and marketing messages delivered to opt-in e-mail addresses. Advertisements are delivered on all devices and screens, including web browsers on desktops and laptops, mobile web browsers on smartphones and tablets, as well as mobile applications.

Access to high quality data assets fuels the accuracy of our algorithms. These data assets include our clients' sensitive and proprietary data, such as: transaction activity on their digital properties; publisher-specific data, such as the performance of advertisements we previously delivered; as well as internally developed data that includes vast knowledge we have extracted from having delivered and measured responses to over 2.4 trillion advertising impressions. We obtain large volumes of expressed consumer purchase intent, browsing behavior and transaction data through integration with substantially all of our clients, which enables us to track users' interactions with our clients' digital properties at an individual product level.

We believe this deep access to highly granular information demonstrates the trust that our clients place in us. For example, for most of our clients, we typically have real-time access to the products or services a customer has viewed, researched or bought from them and we continuously receive updated information on more than 600 million products or services, including pricing, images and descriptions. The combination of these data sets gives us powerful insights into consumer purchasing habits that we use to create the most relevant advertisements to drive user engagement and ultimately sales for our clients.

We also benefit from broad access to inventory through our direct relationships with close to 14,000 publisher partners, as well as a leading presence on real-time-bidding display advertising exchanges. We define inventory as the combination of display advertising impressions as well as opt-in e-mail addresses. We believe that many of our direct publisher partners have granted us preferred access to portions of their inventory as a result of our ability to effectively monetize that inventory. This access means we are able to select, buy and price inventory on an impression-by-impression basis that a publisher might otherwise only sell subject to minimum volume commitments. In addition, in some instances, we get exclusive access to inventory or priority access before a publisher makes that inventory available to others.

The accuracy and efficiency of the Criteo Engine enables us to charge our clients only when users engage with an advertisement we deliver, usually by clicking on it. In contrast, traditional display solutions typically charge clients when an advertisement is displayed, whether or not the advertisement is seen or clicked on. We believe our pay-for-performance pricing model provides a clear link between the cost of a marketing campaign and its effectiveness and is valued as such by our clients. Our revenue retention rate was 135%, 147% and 138% for the years ended December 31, 2013, 2014 and 2015. We define our revenue retention rate as (i) revenue recognized during a period from clients that contributed to revenue recognized in the prior corresponding period divided by (ii) total revenue recognized in such prior corresponding period. We believe our ability to retain and grow revenue from our existing clients is a useful indicator of the stability of our revenue base and the long-term value of our client relationship.

Our clients have 24/7 access to a unified dashboard to manage their campaigns. As a result, we reduce unnecessary complexity and cost associated with manual processes and multiple vendors for our clients, delivering efficiencies even as clients' campaigns grow in size and complexity. Our solution is available as a unique and comprehensive offering and cannot be broken down and purchased as separate products or services.

As clients have embraced our solution, we have achieved significant growth since our inception and have established a global footprint, including a significant presence in Europe, the Americas and Asia-Pacific. As of December 31, 2015, we had more than 10,000 clients that used our solution, including some of the largest and most sophisticated e-commerce companies in the world.

Our financial results include:

| |

• | revenue of $589.4 million, $988.2 million and $1,323.0 million for the years ended December 31, 2013, 2014 and 2015, respectively; |

| |

• | revenue excluding traffic acquisition costs, which we refer to as Revenue ex-TAC, which is a non-GAAP financial measure, of $237.7 million, $402.8 million and $534.0 million for the years ended December 31, 2013, 2014 and 2015, respectively; |

| |

• | net income of $1.8 million, $46.9 million and $62.3 million for the years ended December 31, 2013, 2014 and 2015, respectively; and |

| |

• | Adjusted EBITDA, which is a non-GAAP financial measure, of $41.6 million, $105.4 million and $143.4 million for the years ended December 31, 2013, 2014 and 2015, respectively. |

Please see footnotes 3 and 5 to the "Other Financial and Operating Data" table in Part II Item 6. Selected Financial Data in this Form 10-K for a reconciliation of Revenue ex-TAC to revenue and Adjusted EBITDA to net income, in each case the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

Industry Background

The ability to engage and convert customers is a critical driver of success for businesses, especially for businesses in the e-commerce sector, who often dedicate a significant portion of their cost base to developing such an ability. Business to consumer retail e-commerce was approximately a $1.6 trillion industry globally in 2015, and is expected to grow at a 16% compound annual growth rate, or CAGR, to $2.5 trillion in 2018, according to eMarketer. The internet and mobile devices are becoming increasingly important mediums for businesses to generate customer engagement and leads that ultimately result in sales, both online and offline. However, these mediums are also complex and fragmented, making it difficult and costly to engage and convert customers. For example, the global cart abandonment rate, or the percentage of online customers leaving their order behind instead of purchasing, was 76% in 2015 according to SaleCycle, including 78% in the Retail vertical and 83% in the Travel vertical. It is therefore important for businesses to develop and execute marketing campaigns across all screens (desktop, laptops, tablets and smartphones) effectively harnessing consumer intent, big data, technology, measurability and the ability to target, at scale. According to eMarketer, marketers spent $170.2 billion on digital advertising in 2015, including on search, display and classifieds, with this spend expected to grow at a 14.5% CAGR to over $255 billion in 2018.

There are two primary channels for customer engagement and conversion online – search and display.

Search marketing, which mainly consists of placing text-based advertisements alongside user query results, represented 48.2% of internet advertising spend in 2015. It is expected to grow from $82.0 billion in 2015 at a 14.0% CAGR to $121.4 billion in 2018, according to eMarketer. Historically, search has been effective at capturing consumer intent and quickly delivering highly targeted advertisements based on query keywords, showing measurable results through simple, pay-for-results pricing, and creating an automated and efficient marketplace for advertising inventory.

Internet display advertising involves placing images, video or advertisements that incorporate animation, sound and/or interactivity, which we refer to as rich media content, alongside website and mobile application content. According to ZenithOptimedia, display advertising accounted for 44% of the $170 billion total internet advertising market in 2015. It is projected to grow at a 16.8% CAGR to $119.2 billion in 2018. The display market is highly fragmented as compared to search and is growing at a rate faster than search, due in part to the rapid rise of mobile internet usage, as well as the continued proliferation of content across the internet, including on social media platforms. Through internet display advertising, businesses can deliver impactful advertisements integrating imagery, sound, motion and interactivity with the user. These attributes have led display advertising to be well suited to broad marketing objectives, including generating awareness and favorability for brands as opposed to the intent-driven performance objectives of search.

Currently, internet display advertising faces a number of important challenges as an effective intent-driven medium for customer engagement and conversion, including:

Difficult to Deliver Targeted, Relevant Ads. Businesses strive for targeted, relevant advertisements to minimize wasted spend and maximize their chances of generating engagement, and ultimately a sale. Relevant advertisements are ones that target a specific audience with a message that matches that audience's purchase intent or interest and that are delivered at the right moment. Achieving relevance, however, is particularly difficult because users are scattered across online destinations and devices, and consumer purchase intent and interest can be hard to determine or can change rapidly. Against this backdrop, traditional internet display advertising solutions have incorporated limited audience targeting capabilities, and even more limited personalization. In addition, these solutions have generally not been effective in utilizing consumer intent as a signal for the delivery of advertisements. As a result, targeting and messaging have mainly been done by placing generic advertisements alongside certain types of content (e.g., non-personalized automotive advertisements on sites related to cars), without incorporating purchase intent or interests. These traditional campaigns often lack relevance, and as a consequence result in poor user engagement.

Difficult to Deliver Performance at Scale. Many internet display advertising solutions are unable to sustain performance for larger campaigns or longer trials due in part to the highly fragmented nature of the internet display landscape, increasing amounts of data and lack of robust technology. Therefore, the challenges described above are amplified for larger and more complex campaigns.

Pricing Disconnected from Performance. Internet display advertising inventory has historically been sold on a cost per impression, or CPM, basis, meaning that an advertiser is charged each time an advertisement is displayed, whether or not a user interacted with the advertisement. This makes it difficult for advertisers to determine the true cost of an advertising campaign and evaluate the relationship of that cost to the effectiveness of the campaign in driving engagement and sales. Today, there are a few different pricing models generally available in the internet advertising market, including the traditional CPM pricing model, as well as cost per click, or CPC, pricing model, where an advertiser is charged when a user clicks on the advertisement, cost per action, or CPA, pricing model, where an advertiser is charged when a user takes a specific action which may be completing a form or making a purchase, and hybrid pricing models, which reflect a combination of one or more of these models. While the search segment of the internet advertising market is generally priced on a CPC model, we believe the internet display advertisement segment of the internet advertising market is generally priced on a CPM basis.

Inefficient Campaign Execution. Deployment of internet display advertising campaigns can be inefficient and costly. Traditional solutions are often a combination of many point solutions, requiring businesses to connect and manage multiple intermediaries and complex elements of the advertising campaign execution process, including media planning, data analysis, targeting, creative assembly, media buying, optimization, advertisement serving and reporting. In addition, meaningful portions of campaign planning, execution and management remain a highly manual exercise.

We believe internet display advertising has now reached a critical inflection point where its potential to be both a brand building medium and a more effective engagement and conversion tool has finally materialized. This transformation is being driven by powerful technology trends including:

Big Data. According to IDC, from now until 2020, the digital universe is expected to double every two years. The large and diverse data sets that make up this digital information are often referred to as big data and are generally categorized into business application data, human-generated content and machine data. New computational approaches and the falling costs of computing power enable technology companies to process and draw insights from this data using machine learning approaches. These insights can be used to optimize display advertising campaigns in ways that were not previously possible. The ability to collect, collate and analyze shopping intent data points is becoming a key differentiator for advertiser clients.

Programmatic Buying. Technologies for more automated and efficient buying and selling of display advertising have been gaining traction for several years with both advertisers and publishers. Programmatic buying from real-time, automated buying platforms and bidding exchanges, as well as through relationships with publishers, provide advertisers with dynamic, targeted and efficient ways to access the proper inventory, and help publishers to maximize the value of their advertising inventory. Worldwide spending in programmatic display advertising is expected to grow from $14.2 billion in 2015 to $36.8 billion in 2019 according to MAGNA GLOBAL, representing a CAGR of 31.0%.

Mobile Commerce and Multi-Device Usage. Penetration of smartphones and tablets is driving rapid growth of global mobile commerce. Mobile commerce represented $298 billion globally in 2015, and is expected to grow at a 28.1% CAGR between 2015 and 2018 according to Goldman Sachs. Mobile devices accounted for 35% of the global e-commerce transactions of our retail clients in the fourth quarter of 2015. In mature markets such as Korea, Japan and the United Kingdom, close to or more than 50% of e-commerce transactions were done on a mobile device over the same period. In addition, consumers increasingly use multiple devices to access the internet and interact with ecommerce websites. Accordingly, transactions involving the usage of multiple devices, referred to as “cross-device” transactions, represent a fast-growing share of ecommerce, and mobile commerce in particular. Close to 40% of the ecommerce transactions of our clients occurred across multiple devices in the fourth quarter of 2015.

Competitive Strengths of Our Solution

We believe our solution is transforming the way our clients use digital performance marketing to drive sales by making digital performance marketing, and in particular internet display advertising, a more efficient and effective medium for engaging consumers and converting them into buyers. We believe the following competitive strengths will enable us to capture increasingly greater digital performance marketing budgets:

Powerful, Scalable Technology & Network Effects. Our solution is the result of 10 years of research and development and investment in our technology platform. The Criteo Engine is supported by a flexible and scalable high-performance computing infrastructure, made of 22,340 processing cores with total storage capacity of 39 petabytes. Every day, our platform can process 26 terabytes of additional compressed data. We own over 14,000 servers through a global network of seven data centers and have a team of over 700 professionals dedicated to operating and constantly enhancing our technology platform. We believe our core assets are increasingly hard to replicate by other market participants. Our technology platform operates at significant scale and is powered by machine learning algorithms whose accuracy and performance improve with each new piece of information about a user and the billions of advertising impressions we analyze daily, creating a cycle of increasing network effects. As clients spend more with us and we attract more publisher inventory and deliver more advertisements, our data assets grow, enabling us to deliver even more precisely targeted and personalized advertisements and generate additional sales for our clients. As a result, we believe more businesses will use our solution and increase their spend with us. This, in turn, will enable us to increase advertising revenue for our publishers, further expanding our publisher network and enhancing our access to their advertising inventory. We expect this cycle of self-reinforcing network effects will continue to contribute to fueling our growth.

Highly Relevant, Targeted Ads. Through our deep data-driven understanding of consumer intent and behavior, we are able to deliver highly relevant, targeted and personalized advertisements across a number of devices, including desktops, laptops, smartphones and tablets. We have access to two types of differentiating high quality data: (1) valuable consumer purchase intent and behavior data, including products that a consumer has recently viewed or purchased; and (2) our own operating data and insights, accumulated through the delivery of over 2.4 trillion internet display advertisements. Substantially all of our clients grant us access to their detailed consumer purchase intent and behavior data through integration with their websites and mobile applications. More broadly, our own operating data includes insights from user responses to each advertisement that we provide, which we use to continually improve our performance. The scale and breadth of our data is constantly growing as users interact with our clients and as we deliver advertising impressions. For example, in 2015, we analyzed over 9 trillion ad impressions and delivered over 710 billion targeted advertisements. By dynamically matching what we believe to be a user's intent or interest with a personalized advertisement, we are able to deliver more relevant and engaging advertisements to users, which are more likely to lead to sales. Our average click-through rate, or the ratio of clicks generated by our advertisements over the number of advertising impressions we purchased (“CTR”), was 0.66% in 2015, which represents a factor of over four times the average click-through rate for Standard Media in 2015 of 0.16%, as measured by the DoubleClick display benchmark tool. We believe our superior click-through rate illustrates the strength of our solution.

Performance Driven Business Model and Transparency of Return-On-Investment. We only get paid when a user engages with one of our advertisements, usually by clicking on it. This model is well proven in search marketing, and our clients value pay-for-performance pricing for providing a clear link between the cost of a marketing campaign and its effectiveness. In addition, as the Criteo Engine becomes more sophisticated, we are increasingly optimizing our solution not just to maximize clicks at a target cost per click, but to maximize post-click purchases at a target cost of sales. As a result, most of our clients now set their budgets with us whereby their total spend with us is effectively constrained only by our ability to find enough relevant opportunities for them that achieve their specific return objectives. For example, for the year ended December 31, 2015, 78% of our Revenue ex-TAC was derived from clients whose budgets were either uncapped or so large that the budget constraint did not restrict purchases of advertisements by us. In addition, existing advertiser clients continue to increase their advertising spend with us as demonstrated by an increase in Revenue ex-TAC per client. Our revenue retention rate for the year ended December 31, 2015 was 138%, demonstrating our ability to drive revenue expansion within our existing client base.

We use the industry-standard last-click attribution model to measure the effectiveness of our solution for our advertiser clients. We believe that our return-on-investment calculation methodology, based on post-click sales, is a relevant proxy for the sales we generate for our clients. For the year ended December 31, 2015, we estimate that our solution helped generate 8.9% of the total online sales of our retail clients with uncapped budgets. As a result, we believe that marketers view their spend with Criteo as a transparent and elastic cost of sales, as opposed to a traditional discretionary marketing spend.

Deep Liquidity of Demand and Supply. Over multiple years, we have built an extensive network of relationships with our advertiser clients and publishers, creating a highly liquid marketplace for internet display advertising inventory, as well as for opt-in e-mail inventory. As of December 31, 2015, we have over 10,000 advertiser clients, including some of the largest e-commerce companies in the world and approximately 73% of our advertiser relationships are directly with the advertiser. For the year ended December 31, 2015, our top 10 clients represented 12.7% of our revenue. As we continue to grow our client base, we will continue to grow the number of users who interact with our advertisements, which will allow us to benefit from greater scale when we purchase inventory from publisher partners. On the supply side, we have direct relationships with close to 14,000 publisher partners and are also integrated with the leading advertising exchanges and networks. A dedicated team of approximately 130 professionals is focused on building and maintaining our direct relationships with publishers, many of whom have granted us preferred access to portions of their internet display advertising inventory. For the month of September 2015, comScore data indicated that over 1.1 billion unique users saw Criteo advertisements on the desktop alone, representing the second largest reach worldwide. Our deep and liquid marketplace has enabled us to increase our reach and access to a quality supply of advertising inventory, allowing us to quickly match an advertisement to a user before purchase intent has diminished.

Complete Performance Solution. Our solution works seamlessly across digital devices (desktops, laptops, tablets and smartphones), across digital environments (web browsers and mobile applications) and across operating systems, including on the two major mobile environments: Google’s Android and Apple’s iOS. We believe that, for advertisers looking to engage with their prospects or customers irrespective of the screen, device, digital environment or operating system where the user may be, our complete performance solution provides a clear advantage over other solutions available on the market. In addition, with the dramatic increase in smartphone and tablet usage in an increasingly fragmented digital landscape, it has become critical for marketers to engage and convert their customers across multiple digital devices. In the fourth quarter of 2015, 91% of our clients used our multi-screen solution, including on the desktop and mobile devices. In December 2015, 47% of our Revenue ex-TAC was generated by clicks on advertisements delivered on mobile devices. At the end of 2014, we launched our "Universal Match" cross-device matching solution that allows us to capture shopping intent data from one device, show an ad on another device and track sale conversion on a third device. We believe the addition of our "Universal Match" cross-device solution will increasingly become a competitive strength.

Complementary Performance-Based Marketing Channels. We deliver our solution through complementary marketing channels: display advertising banners, native advertising banners (including on social media platforms) and marketing messages delivered to opt-in e-mail addresses. Our marketer clients have the choice to maximize the reach and engagement of their customers through a combination of our marketing channels, while always using a single, integrated solution, optimizing their marketing spend and only paying for performance.

Simple End-To-End Solution and Highly Efficient Campaign Execution at Scale. Our solution is end-to-end as it encompasses the integration of our advertiser clients' digital property, the tracking of users, the real-time buying of impressions on publisher partners' digital properties, the real-time creation of customized advertisements for each specific client and its prospective end customer, the serving and delivery of the advertisements and the provision of real-time analytics on the performance of marketing campaigns to clients. In addition, our clients have 24/7 access to a unified dashboard to manage their performance marketing. Our platform automates most of the processes associated with executing a performance marketing campaign, such as creative assembly, real-time buying of inventory and campaign optimization, and billing. Using our platform, our clients are able to drive sales based on their specific cost of sales or return on investment objectives in large volumes with real-time control over the prices they pay.

As a result, we reduce unnecessary complexity and cost associated with manual processes and multiple providers involved in performance marketing campaign management. Further, we are able to continue to deliver these efficiencies even as marketing campaigns scale and become more complex.

Extensive Reach and Global Presence. We do business in 87 countries and have a direct operating presence in 18 countries. For 2015, 44.3% of our revenue was derived from clients who conducted marketing campaigns with us in more than one national market. We have achieved this global presence by replicating and scaling our business model across geographic markets. Large businesses are increasingly seeking comprehensive marketing solutions that are effective across multiple geographies and we are able to meet this demand by leveraging our global network of relationships. We believe we are well positioned to serve our clients in nearly every market in which they seek to drive sales.

Commitment to Privacy. We are committed to consumer privacy. The user information we collect relates solely to purchase intent and is therefore not considered Personally-Identifiable Information, or PII. In 2009, we became one of the first companies to include a link in all the advertisements we deliver, which gives users access to clear, transparent, detailed and user-friendly information about personalized advertisements and the data practices associated with the advertisements they receive. In addition, we provide consumers with an easy-to-use and easy-to-access mechanism to control their advertising experience and opt out of receiving targeted advertisements we deliver or send either for all campaigns or for a specific client or specific period of time. We believe that this transparent consumer-centric approach to privacy empowers consumers to make better-informed decisions about our use of their data. We also actively encourage our advertiser clients and publishers to provide information to consumers about our collection and use of data relating to advertisements we deliver and track.

Our Growth Opportunities

Our vision is to become our clients' preferred partner for digital performance marketing across all digital marketing channels and across all screens. Our goal is to drive sales at scale for our clients at their target return-on-investment through customer engagement and conversion. Our growth drivers relate to two primary areas: (1) expanding our client base and (2) increasing the value we deliver to clients. The core elements of our growth strategy include:

Continuing to Innovate and Invest in Technology and Data. We intend to continue to make substantial investments in research and development to further increase the efficiency and effectiveness of our solution. In addition to improving our algorithms and underlying technology platform, we also intend to continue to develop ways of extracting greater value from the data we collect for the benefit of our clients. We believe these investments will enhance our value proposition for both existing and prospective clients and publisher partners.

Selectively Broadening our Spectrum of Marketing Channels. We started delivering our solution in internet display for web browsers on the desktop. Since then, we have expanded into native display, including on social media platforms, and into e-mail marketing. Our marketing channels work across all screens, including desktop and laptop web, mobile web and mobile applications. We intend to continue to expand selectively into additional marketing channels in order to help our clients optimize their performance marketing spend and generate more sales across a broader range of marketing channels, while always using a single solution priced on a transparent performance-based model. In particular, we are currently exploring potential ways to help our clients optimize their performance on search engine marketing. In addition, we are also exploring the possibility of measuring the impact of our digital campaigns on our clients' in-store sales. We believe a broader platform of complementary marketing channels will enhance our value proposition for existing and prospective clients.

Leveraging our Cross-Device Capabilities to Reach and Convert our Clients' Customers. We deliver performance digital marketing across a number of devices, including desktops, laptops, smartphones and tablets, both through internet browsers and applications. With the dramatic increase in smartphone and tablet usage in an increasingly fragmented digital landscape, we believe it is critical for marketers to engage and convert their customers across multiple digital devices. At the end of 2014, we launched our cross-device matching solution, allowing us to match consumers' shopping behavior in real time and deliver relevant user-centric marketing messages across different devices.

At the end of 2015, 65% of our advertiser clients were participating in our "Universal Match" cross-device initiative by contributing data points that enable the exact match of users. We believe our "Universal Match" cross-device solution will continue to enhance our value proposition for existing and prospective clients.

Expanding Our Presence in Core Markets and Penetrating New Geographic Markets. We believe significant opportunities remain for us to grow our business in geographic markets where we already operate, such as Europe, the United States and Japan. Additionally, we plan to leverage and grow our existing sales teams as we enter and expand operations in new geographic markets, such as China, South-East Asia, India, Eastern Europe, the Middle East and Latin America. We have a strong track record of entering new markets successfully and rapidly achieving commercial traction.

Continuing to Grow our Client Base Across Market Segments. We intend to continue growing our client base, both in the large client and the midmarket segments. During 2014 and 2015, we invested significantly to capture the midmarket opportunity and intend to continue investing in this promising market segment. In particular, we plan to expand our midmarket presence in the Americas, Europe, the Middle East and Africa, or EMEA, and Japan, as well as to launch midmarket operations in new geographies, including in South-East Asia and China.

Pursuing Strategic Acquisitions. We selectively evaluate technologies and businesses that we believe have potential to enhance, complement or expand our technology platform and product portfolio or strengthen our research and development team. As part of our strategy to build upon our market and technology leadership, in July 2013, we acquired all of the shares of Ad-X Limited, or Ad-X, a mobile analytics and attribution technology company with strong expertise in mobile application technology. In February 2014, we acquired all of the equity of Tedemis S.A., or Tedemis, a provider of real-time personalized e-mail marketing solutions to help advertisers turn web visitors into customers. In April 2014, we completed the acquisition of AdQuantic SAS, or AdQuantic, a bidding technology company headquartered in Paris. Through the acquisition of AdQuantic, we added a team of seven experts in bidding technology, reinforcing our focus on research and development. In February 2015, we acquired DataPop, Inc., or DataPop, a Los Angeles-based company specializing in the optimization of shopping campaigns on large search engines. Both the AdQuantic and DataPop acquisitions have provided us with key assets in our efforts to explore the opportunity to build an offering in search engine marketing. We target acquisitions that can be efficiently integrated into our technology infrastructure and global operations, while preserving the quality and performance of our offering. We believe we are an acquirer of choice among prospective acquisition targets due to our entrepreneurial culture, growth, global scale, strong brand and market position.

Our Solution

Our technology delivers digital performance marketing. We generate post-click sales for our clients by efficiently and effectively engaging and converting customers. Our solution is comprised of the Criteo Engine, our data assets, access to inventory, and our advertiser and publisher platforms.

Criteo Engine

The Criteo Engine leverages the vast and high-quality data assets developed through our extensive relationships with thousands of clients and publishers, as well as our significant operational history, with the goal of delivering, in real time, highly relevant and personalized digital performance advertisements that engage and convert consumers.

The Criteo Engine consists of:

| |

• | Recommendation algorithms. These algorithms dynamically create and tailor advertisements to specific user interest by determining the specific products and services to include in the advertisement. These products and services may be ones that a user has already been exposed to, or to a large extent, that the algorithms predict the user could be interested in. Alternatively, these products and services may be ones that other users, who have been exposed to some of the same products and services as such user, have been interested in. |

| |

• | Prediction algorithms. These algorithms predict the probability and nature of a user’s engagement with a given advertisement, for example in the form of clicks, conversions, basket value, or even specific product categories purchased. This predicted engagement incorporates data from our advertiser clients, publishers and third-party sources, including user intent, who the client is, the products offered by the client, as well as data on the creative content of the advertisement and the publisher context in which the advertisement is viewed. Together with our recommendation algorithms, the prediction algorithms allow us to determine the most appropriate price to pay for an advertising impression based on an individual user's predicted engagement, conversion and conversion value, as well as what a client is willing to pay for that engagement. |

| |

• | Bidding engine. Our bidding engine executes campaigns based on certain objectives set by our clients (for example, cost-per-click limits and number of sales). After a bid is placed and won, the Criteo Engine assembles and delivers individualized advertisements and provides campaign reporting, all in near-real time. |

| |

• | Dynamic creative optimization. Based on the results of our algorithms, the Criteo Engine automatically assembles customized advertising content on an impression-by-impression basis in real time, by optimizing each individual creative component in the advertisement, from the font, color, size of product pictures to the “call to action” or price discount. |

| |

• | Software systems and processes. Our algorithms are supported by robust software infrastructure that allows our solution to operate seamlessly at scale. The architecture and processing capabilities of this technology have been designed to match the massive computational demands and complexity of the algorithms. This technology enables data synchronization, storage and analysis across a large-scale distributed computing infrastructure in multiple geographies, as well as fast data collection and retrieval using multi-layered caching infrastructure. |

| |

• | Experimentation platform. This offline/online platform is used to improve the prediction abilities of our models, by measuring the correlation of specific parameters with user engagement, usually clicks. A dedicated team is constantly testing new types and sources of data to determine whether they help to diminish the gap between predicted engagement and actual observed engagement over the course of live campaigns. |

Data Assets

The accuracy of our algorithms improves with both the increasing quantity and quality of data we obtain from our clients and publishers, as well as insights gained through our extensive operational history. Using cookies and similar tracking technologies, we collect information about the interaction of users with our advertisers’ and publishers’ digital properties (including, for example, information about the placement of advertisements and users’ shopping or other interactions with our clients’ digital properties or advertisements). The information we collect does not enable us to identify the particular user. We have access to large volumes of granular data from our clients, which carry consumer intent and are directly relevant to those clients’ campaigns. Our clients grant us access to this valuable data through direct integration with us, which requires our clients to place Criteo software code throughout their digital properties. This integration gives us privileged insight into users’ behavioral history at the product level for each client, representing a very high-quality data asset. We use the shopping intent data from each specific client only for the benefit of that specific client’s marketing campaigns.

In addition to client data, we seek to use as much information as possible about the context or intent of a given user to further refine our prediction accuracy. We collect this data directly from our clients or publishers.

Access to Inventory

Through our relationships with the leading real-time bidding, or "RTB," internet display exchanges, and close to 14,000 publisher partners, including through PuMP, our Publisher Marketplace, we provide extensive access to advertising inventory. In some cases, we have negotiated direct and privileged access with publishers, giving us the opportunity to purchase on an impression-per-impression basis and in real time: (1) inventory that a publisher might otherwise only sell subject to minimum volume commitments; and/or (2) particular advertising impressions before such impressions are made available to other potential buyers. For example, in Japan, we have entered into a strategic relationship with Yahoo! Japan, giving us privileged access to its advertising inventory for delivering personalized display advertisements. This marked the first time that Yahoo! Japan, one of Japan’s largest publishers, had allowed a third-party technology to monetize their inventory.

Across both our direct publisher relationships and inventory purchasing done on advertising exchanges, we leverage the Criteo Engine’s ability to quickly and accurately value available advertising inventory, and utilize that information to bid for inventory on a programmatic, automated basis. Our ability to efficiently access and value inventory results in deep liquidity, allowing us to deliver effective advertisements at the right price for our clients, even as the size and complexity of campaigns increases.

We purchase inventory from our direct publishers generally through insertion orders consistent with industry standard terms and conditions for the purchase of internet advertising inventory. Pursuant to such arrangements, we purchase impressions on a CPM basis for users that Criteo recognizes on the publishers’ network. Such arrangements are cancellable upon short notice and without penalty.

Through the direct relationships we have with publishers, we take steps to determine that the publisher’s inventory meets our content requirements and the content requirements of our clients to ensure that their display advertisements are not shown in inappropriate content categories, such as adult or political content. With respect to our inventory purchased through RTB exchanges, we utilize third-party software to verify that the inventory where the advertisement placement is shown conforms to our advertising guidelines and the content expectations of our advertisers.

In addition to display advertising inventory, we also source opt-in e-mail addresses from third-party marketing e-mail databases, usually from publishers with whom we have a direct relationship. E-mail addresses are collected by publishers on an opt-in basis for usage for commercial purposes. The recipients of these e-mail messages have provided their positive consent to receive commercial e-mail messages.

Advertiser and Publisher Platforms

We offer our clients an integrated technology platform that enables comprehensive visibility and includes a unified and easy-to-use dashboard and a suite of software and services that automates key campaign processes. As a result, we reduce unnecessary complexity and cost associated with manual processes and multiple vendors, delivering efficiencies even as campaigns grow in size and complexity.

Our integrated solution includes a comprehensive suite of services and software tools, including:

| |

• | A unified dashboard to manage campaigns. This dashboard automates a number of campaign execution and management tasks. Key attributes of the dashboard include: |

| |

• | granular control, with the ability to specify product categories and bid at the category level; and |

| |

• | transparent and detailed reporting of key campaign metrics, such as CPCs, impressions served, effective cost per thousand impressions, or eCPM, and post-click sales. |

| |

• | Business intelligence. We provide consulting services to our larger clients through a team of advisors that aid them in setting goals for, extracting insights from, and evaluating trends and performance of their marketing campaigns across our different marketing channels. |

| |

• | Publisher Marketplace. We also offer small- and medium-sized publishers direct access to advertisers by providing a comprehensive inventory management platform that we call PuMP, which allows us to access the inventory of these publishers, without directly managing that inventory. Through this platform, our small- and medium-sized publisher partners have access to: |

| |

• | an easy-to-use interface; |

| |

• | control to specify minimum prices for each publisher’s inventory; and |

| |

• | reporting that allows each publisher to monitor the amount of money they have made selling their inventory to us. |

Strategic Relationship with Yahoo! Japan

In August 2012, we entered into a strategic relationship with Yahoo! Japan, a leading provider of advertising inventory in Japan, which provides us with privileged access to their performance-based display inventory. In connection with this strategic relationship, Yahoo! Japan invested in our subsidiary, Criteo K.K. We retain 66% ownership of Criteo K.K. and Yahoo! Japan holds 34% ownership. Yahoo! Japan has the right to require us to buy back its interest, and we have the right to require them to sell their interest, in Criteo K.K. under specified circumstances, such as a termination of the commercial relationship. This strategic relationship may be terminated by either party for material breach and other customary events. The term of this strategic relationship was renewed to August 2017 and will renew automatically thereafter for one-year terms if neither party provides advance written notice of termination within a specified period of time.

Infrastructure

Our ability to deliver our solution depends on our highly sophisticated global technology software and hardware infrastructure. Our global infrastructure includes over 14,000 servers and two Hadoop clusters providing a storage capacity exceeding 39 petabytes. Our global infrastructure is divided into four independent geographical zones in the Americas, Asia-Pacific, EMEA and mainland China. In each of the zones, our services are delivered through data centers that support these zones. We generally rely on more than one data center in any given zone. The data centers are strategically placed within large zones to be close to our advertiser clients, publishers and users. This has the benefit of minimizing the impact of network latency within a particular zone, especially for time-constrained services such as RTB. In addition, we replicate data across multiple data centers to maximize availability and performance. We also generally seek to distribute workload across multiple locations in order to avoid overloads in our systems and increase reliability through redundancy.

Within each data center, computing power is provided by horizontal build-outs of commodity servers arranged in multiple, highly redundant pools. Some of these pools are dedicated to handling incoming traffic and delivering advertisements, including web servers, caches, and database applications.

Other pools are devoted to the data analytics involved in creating these advertisements. In particular, we use clusters using software specifically designed for processing large data sets, such as Hadoop, to run the offline data analysis; the results are then fed back to refresh and improve our prediction and recommendation algorithms.

We use multiple layered security controls to protect the Criteo Engine and data assets, including hardware- and software-based access controls for our source code and production systems, segregated networks for different components of our production systems and centralized production systems management.

Our Clients

Our client base consists primarily of companies in the digital retail, travel and classifieds verticals and includes some of the largest and most sophisticated e-commerce companies in the world. These companies range from large, diversified e-commerce companies to mid-size regional companies. As of December 31, 2015, we had more than 10,000 advertiser clients, representing clients who had a marketing campaign that was live on any given day over a 12 trailing-month period. In 2015, approximately 73% of our client relationships were held directly with the advertiser.

We believe our business is not substantially dependent on any particular client. In 2013, 2014 and 2015, our largest client represented 5.1%, 2.9% and 1.9% of our revenue, respectively, and in 2015 our largest 10 clients represented 12.7% of our revenue in the aggregate.

We define a client to be a unique party from whom we have received an insertion order and delivered an advertisement during the previous 12 months. We count specific brands or divisions within the same business as distinct clients so long as those entities have separately signed insertion orders with us. On the other hand, we count a client who runs campaigns in multiple geographies as a single client, even though multiple insertion orders may be involved. When the insertion order is with an advertising agency, we generally consider the client on whose behalf the marketing campaign is conducted as the “client” for purposes of this calculation. In the event a client has its marketing spend with us managed by multiple agencies, that client is counted as a single client.

Our client base is composed of two client segments: the large client segment and the midmarket segment. We define large clients typically as the top-100 or the top-200 advertiser websites per vertical in a given geographic market, depending on the depth of that market, based on the number of monthly unique visitors as measured by comScore or other third-party providers of such information. We define a midmarket client as any client outside of the top-100 or top-200 advertisers per vertical in a given geographic market, depending on the depth of that market, and with a certain minimum threshold number of unique monthly visitors to their digital property, as measured by comScore or other third-party providers of such information. This minimum threshold varies by market, but is generally around 40,000 for our more developed markets.

Research and Development

We invest substantial resources in research and development to enhance our solution and technology infrastructure, develop new features, conduct quality assurance testing and improve our core technology. Our engineering group is primarily located in research and development centers in Paris, France and Palo Alto, California. We expect to continue to expand capabilities of our technology in the future and to invest significantly in continued research and development efforts. We had approximately 400 employees primarily engaged in research and development at December 31, 2015. Research and development expense totaled $42.7 million, $60.1 million and $86.8 million for 2013, 2014 and 2015, respectively.

Intellectual Property

Our intellectual property rights are a key component of our success. We rely on a combination of patent, trademark, copyright and trade secret laws, as well as confidentiality procedures and contractual restrictions, to establish, maintain and protect our proprietary rights. We generally require employees, consultants, clients, publishers, suppliers and partners to execute confidentiality agreements with us that restrict the disclosure of our intellectual property. We also generally require our employees and consultants to execute invention assignment agreements with us that protect our intellectual property rights.

Intellectual property laws, together with our efforts to protect our proprietary rights, provide only limited protection, and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. The laws of certain countries do not protect proprietary rights to the same extent as the laws of France and the United States and, therefore, in certain jurisdictions, we may be unable to protect our proprietary technology.

Agreements with our employees and consultants may also be breached, and we may not have adequate remedies to redress any breach. Further, to the extent that our employees or consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights to know-how and inventions relating thereto or resulting therefrom. Finally, our trade secrets may otherwise become known or be independently discovered by competitors and unauthorized parties may attempt to copy aspects of our solution or obtain and use information that we regard as proprietary.

As of December 31, 2015, we held one issued French patent and four issued U.S. patents. In addition, we have filed 18 non-provisional U.S. patent applications, two European applications, one Japanese application and one international patent application under the Patent Cooperation Treaty. We also own and use registered and unregistered trademarks on or in connection with our products and services in numerous jurisdictions. In addition, we have also registered numerous internet domain names.

Our industry is characterized by the existence of a large number of patents and frequent claims and related litigation regarding patent and other intellectual property rights. In particular, leading companies in the technology industry have extensive patent portfolios. From time to time, third parties, including certain of these leading companies, have asserted and may assert patent, copyright, trademark and other intellectual property rights against us, our advertiser clients or our publishers. Litigation and associated expenses may be necessary to enforce our proprietary rights.

Privacy, Data Protection and Content Control

Privacy and Data Protection

Privacy and data protection laws play a significant role in our business. In the United States, at both the state and federal level, there are laws that govern activities such as the collection and use of data by companies like us. Online advertising activities in the United States have primarily been subject to regulation by the Federal Trade Commission, or the FTC, which has regularly relied upon Section 5 of the Federal Trade Commission Act, or Section 5, to enforce against unfair and deceptive trade practices. Section 5 has been the primary regulatory tool used to enforce against alleged violations of consumer privacy interests. In addition, our solution reaches users throughout the world, including in Europe, Australia, Canada, South America and Asia-Pacific. As a result, some of our activities may also be subject to the laws of foreign jurisdictions. In particular, European data protection laws can be more restrictive regarding the collection and use of data than those in U.S. jurisdictions. As we continue to expand into other foreign countries and jurisdictions, we may be subject to additional laws and regulations that may affect how we conduct business.

Additionally, U.S. and foreign governments have enacted, considered or are considering legislation or regulations that could significantly restrict industry participants’ ability to collect, augment, analyze, use and share anonymous data, such as by regulating the level of consumer notice and consent required before a company can employ cookies or other electronic tools to track people online. The European Union, or E.U., and some E.U. member states have already implemented legislation and regulations requiring websites to obtain specific types of notice and consent from individuals before using cookies or other technologies to track individuals and their online behavior and deliver targeted advertisements. It remains a possibility that additional legislation and regulations may be passed or otherwise issued in the future.

We also participate in industry self-regulatory programs, mainly initiated by Internet Advertising Bureau E.U. & U.S., Network Advertising Initiative, Digital Advertising Alliance, and European Digital Advertising Alliance, and under which, in addition to other compliance obligations, we provide consumers with notice about our use of cookies and our collection and use of data in connection with the delivery of targeted advertising and allow them to opt out from the use of data we collect for the delivery of targeted advertising. In an effort to harmonize the industry’s approach to internet-based advertising, these programs also facilitate a user’s ability to disable services of integrated providers but also educate users on the potential benefits of online advertising, including access to free content and display of more relevant advertisements to users. The rules and policies of the self-regulatory programs that we participate in are updated from time to time and may impose additional restrictions upon us in the future.

In 2009, we became one of the first companies to broadly include a link in the advertisements we deliver, which gives access to clear, transparent, detailed and user-friendly information describing why a user is seeing an advertisement, as well as prominently describing our service and data management practices. In addition, we provide users with an easy-to-use and easy-to-access mechanism to opt out of receiving advertisements we deliver or being tracked by us either for all campaigns or for a specific client or time period. We believe that this user-centric approach in addressing privacy matters empowers users to make informed decisions on the use of their data. We also actively encourage our clients to provide greater transparency and information about the collection and use of data.

Content Control

To protect against unlawful advertiser and publisher content, we include restrictions on content in our terms and conditions. We also manually review the websites of new publisher partners and use third-party software to screen impressions we acquire through advertising exchanges.

Government Regulation

In addition to the laws and regulations governing privacy and data protection described above, we are subject to numerous domestic and foreign laws and regulations covering a wide variety of subject matters. New laws and regulations (or new interpretations of existing laws and regulations) may also impact our business. The costs of compliance with these laws and regulations are high and are likely to increase in the future and any failure on our part to comply with these laws may subject us to significant liabilities and other penalties.

Competition

We compete primarily in the market for digital performance marketing. Our market is rapidly evolving, highly competitive, complex and fragmented. We face significant competition in this market, which we expect to intensify in the future, partially as a result of potential new entrants in our market, including but not limited to large well-established internet publishers. We currently compete with large, well-established companies, such as Alliance Data Systems, Corp. ("Alliance Data"), Amazon.com, Inc. ("Amazon"), eBay Inc. ("eBay"), Facebook, Inc. ("Facebook"), Google Inc. ("Google"), Sociomantic Labs ("Sociomantic"), which is owned by Tesco plc, and Twitter, Inc. ("Twitter") as well as smaller, privately held companies. We believe the principal competitive factors in our industry include:

| |

• | technology-based ability to deliver return on marketing spend at scale; |

| |

• | comprehensiveness and efficiency of solution; |

| |

• | relevance and breadth of products; |

| |

• | breadth and depth of publisher relationships; |

We believe that we are well positioned with respect to all of these factors and expect to continue to grow and capture an increasing share of digital performance marketing budgets globally.

Seasonality

Our client base consists primarily of businesses in the digital retail, travel and classifieds industries. In the digital retail industry in particular, many businesses devote the largest portion of their budgets to the fourth quarter of the calendar year, to coincide with increased holiday spending by consumers. Our e-commerce retail clients typically conduct fewer advertising campaigns in the first and second quarters than they do in other quarters, while our travel clients typically increase their travel campaigns in the first and third quarters and conduct fewer advertising campaigns in the second quarter. As a result, our revenue tends to be seasonal in nature but the impact of this seasonality has, to date, been partly offset by our significant growth and geographic expansion. If the seasonal fluctuations become more pronounced, our operating cash flows could fluctuate materially from period to period.

Employees

As of December 31, 2015, we had 1,841 employees. Our employees employed by French entities are represented by a labor union, employee representative bodies (works' council, employee delegates and a health and safety committee) and covered by collective bargaining agreements. We consider labor relations to be good and have not experienced any work stoppages, slowdowns or other serious labor problems that have materially impeded our business operations.

Financial Information about Segments and Geographic Areas

We manage our operations as a single reportable segment. For information about revenues, net income and total assets of our reporting segment, please see our audited consolidated financial statements included elsewhere in this Form 10-K. For a breakdown of our revenue and non-current assets by geographic region, please see note 26 to our audited consolidated financial statements included elsewhere in this Form 10-K. For information regarding risks associated with our international operations, please refer to the section entitled “Risk Factors” in Item 1A of Part I in this Form 10-K.

Available Information

We intend to make available, free of charge on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the "SEC"). These documents may be accessed through our website at www.criteo.com under “Investors.”

Information contained on, or that can be accessed through, our website does not constitute a part of this Form 10-K. We have included our website address in this Form 10-K solely as an inactive textual reference.

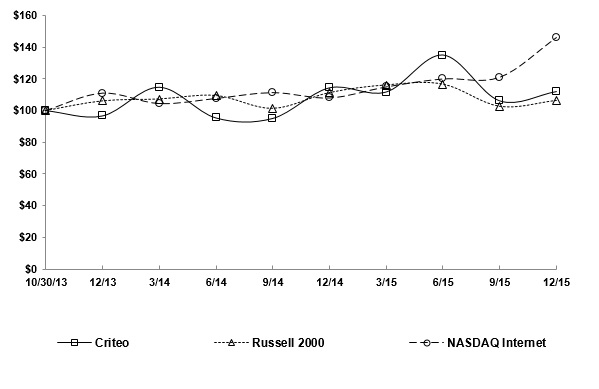

You may also review a copy of this Form 10-K, including exhibits and any schedule filed with this Form 10-K, and obtain copies of such materials at prescribed rates, at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549-0102. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding registrants, such as Criteo, that file electronically with the SEC.