0001571949false2023Q212/31P3YP3Y34900015719492023-01-012023-06-3000015719492023-08-01xbrli:shares00015719492023-06-30iso4217:USD00015719492022-12-31iso4217:USDxbrli:shares0001571949ice:ExchangesMember2023-01-012023-06-300001571949ice:ExchangesMember2022-01-012022-06-300001571949ice:ExchangesMember2023-04-012023-06-300001571949ice:ExchangesMember2022-04-012022-06-300001571949us-gaap:TechnologyServiceMember2023-01-012023-06-300001571949us-gaap:TechnologyServiceMember2022-01-012022-06-300001571949us-gaap:TechnologyServiceMember2023-04-012023-06-300001571949us-gaap:TechnologyServiceMember2022-04-012022-06-300001571949ice:MortgageTechnologyMember2023-01-012023-06-300001571949ice:MortgageTechnologyMember2022-01-012022-06-300001571949ice:MortgageTechnologyMember2023-04-012023-06-300001571949ice:MortgageTechnologyMember2022-04-012022-06-3000015719492022-01-012022-06-3000015719492023-04-012023-06-3000015719492022-04-012022-06-300001571949us-gaap:CommonStockMember2022-12-310001571949us-gaap:TreasuryStockCommonMember2022-12-310001571949us-gaap:AdditionalPaidInCapitalMember2022-12-310001571949us-gaap:RetainedEarningsMember2022-12-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001571949us-gaap:NoncontrollingInterestMember2022-12-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001571949us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001571949us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001571949us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001571949us-gaap:CommonStockMember2023-01-012023-06-300001571949us-gaap:RetainedEarningsMember2023-01-012023-06-300001571949us-gaap:CommonStockMember2023-06-300001571949us-gaap:TreasuryStockCommonMember2023-06-300001571949us-gaap:AdditionalPaidInCapitalMember2023-06-300001571949us-gaap:RetainedEarningsMember2023-06-300001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001571949us-gaap:NoncontrollingInterestMember2023-06-300001571949us-gaap:CommonStockMember2023-03-310001571949us-gaap:TreasuryStockCommonMember2023-03-310001571949us-gaap:AdditionalPaidInCapitalMember2023-03-310001571949us-gaap:RetainedEarningsMember2023-03-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001571949us-gaap:NoncontrollingInterestMember2023-03-3100015719492023-03-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001571949us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001571949us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001571949us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001571949us-gaap:CommonStockMember2023-04-012023-06-300001571949us-gaap:RetainedEarningsMember2023-04-012023-06-300001571949us-gaap:CommonStockMember2021-12-310001571949us-gaap:TreasuryStockCommonMember2021-12-310001571949us-gaap:AdditionalPaidInCapitalMember2021-12-310001571949us-gaap:RetainedEarningsMember2021-12-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001571949us-gaap:NoncontrollingInterestMember2021-12-3100015719492021-12-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001571949us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001571949us-gaap:TreasuryStockCommonMember2022-01-012022-06-300001571949us-gaap:CommonStockMember2022-01-012022-06-300001571949us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001571949us-gaap:RetainedEarningsMember2022-01-012022-06-300001571949us-gaap:CommonStockMember2022-06-300001571949us-gaap:TreasuryStockCommonMember2022-06-300001571949us-gaap:AdditionalPaidInCapitalMember2022-06-300001571949us-gaap:RetainedEarningsMember2022-06-300001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001571949us-gaap:NoncontrollingInterestMember2022-06-3000015719492022-06-300001571949us-gaap:CommonStockMember2022-03-310001571949us-gaap:TreasuryStockCommonMember2022-03-310001571949us-gaap:AdditionalPaidInCapitalMember2022-03-310001571949us-gaap:RetainedEarningsMember2022-03-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001571949us-gaap:NoncontrollingInterestMember2022-03-3100015719492022-03-310001571949us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001571949us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001571949us-gaap:TreasuryStockCommonMember2022-04-012022-06-300001571949us-gaap:RetainedEarningsMember2022-04-012022-06-300001571949us-gaap:NoncontrollingInterestMember2022-04-012022-06-30ice:segment0001571949ice:BlackKnightIncMember2023-03-072023-03-070001571949ice:BlackKnightIncMember2023-03-07xbrli:pureutr:D0001571949us-gaap:SubsequentEventMemberice:OptimalBlueMemberice:BlackKnightIncMember2023-07-170001571949us-gaap:SubsequentEventMemberice:OptimalBlueMemberice:BlackKnightIncMember2023-07-172023-07-170001571949ice:EuroclearMember2022-06-300001571949ice:EuroclearMember2022-04-012022-06-300001571949ice:OptionsClearingCorporationMember2023-01-012023-06-300001571949ice:OptionsClearingCorporationMember2022-01-012022-06-300001571949ice:OptionsClearingCorporationMember2023-04-012023-06-300001571949ice:OptionsClearingCorporationMember2022-04-012022-06-300001571949ice:OptionsClearingCorporationMember2023-06-300001571949ice:BakktLLCMember2023-06-300001571949ice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:ExchangesSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001571949us-gaap:TransferredAtPointInTimeMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMember2023-01-012023-06-300001571949ice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:ExchangesSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberus-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001571949us-gaap:TransferredAtPointInTimeMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMember2023-04-012023-06-300001571949ice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:ExchangesSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001571949us-gaap:TransferredAtPointInTimeMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMember2022-01-012022-06-300001571949ice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:ExchangesSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberus-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001571949us-gaap:TransferredAtPointInTimeMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMember2022-04-012022-06-3000015719492023-07-01us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMemberus-gaap:FinancialServiceMember2023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberus-gaap:FinancialServiceMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberus-gaap:FinancialServiceMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberus-gaap:FinancialServiceMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberus-gaap:FinancialServiceMember2022-04-012022-06-300001571949ice:ListingRevenueMemberus-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:ListingRevenueMemberus-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:ListingRevenueMemberus-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:ListingRevenueMemberus-gaap:TransferredOverTimeMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberice:RegulatoryFeesTradingPermitsAndSoftwareLicensesMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberice:RegulatoryFeesTradingPermitsAndSoftwareLicensesMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberice:RegulatoryFeesTradingPermitsAndSoftwareLicensesMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangesSegmentMemberice:RegulatoryFeesTradingPermitsAndSoftwareLicensesMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMemberus-gaap:FinancialServiceMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMemberus-gaap:FinancialServiceMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMemberus-gaap:FinancialServiceMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:FixedIncomeAndDataServicesSegmentMemberus-gaap:FinancialServiceMember2022-04-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMemberice:SubscriptionRevenuesMember2023-01-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMemberice:SubscriptionRevenuesMember2022-01-012022-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMemberice:SubscriptionRevenuesMember2023-04-012023-06-300001571949us-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMemberice:SubscriptionRevenuesMember2022-04-012022-06-300001571949us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949us-gaap:ProductAndServiceOtherMemberus-gaap:TransferredOverTimeMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:AnnualListingRevenueMember2022-12-310001571949ice:DataServicesandOtherRevenueMember2022-12-310001571949ice:MortgageTechnologyMember2022-12-310001571949ice:AnnualListingRevenueMember2023-01-012023-06-300001571949ice:DataServicesandOtherRevenueMember2023-01-012023-06-300001571949ice:AnnualListingRevenueMember2023-06-300001571949ice:DataServicesandOtherRevenueMember2023-06-300001571949ice:MortgageTechnologyMember2023-06-300001571949ice:AnnualListingRevenueMember2021-12-310001571949ice:DataServicesandOtherRevenueMember2021-12-310001571949ice:MortgageTechnologyMember2021-12-310001571949ice:AnnualListingRevenueMember2022-01-012022-06-300001571949ice:DataServicesandOtherRevenueMember2022-01-012022-06-300001571949ice:AnnualListingRevenueMember2022-06-300001571949ice:DataServicesandOtherRevenueMember2022-06-300001571949ice:MortgageTechnologyMember2022-06-300001571949us-gaap:SeniorNotesMemberice:A2025SeniorNotesDueMayMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2025SeniorNotesDueMayMember2022-12-310001571949ice:A2025SeniorNotesMemberus-gaap:SeniorNotesMember2023-06-300001571949ice:A2025SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:A2027SeniorNotesDueSeptemberMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2027SeniorNotesDueSeptemberMember2022-12-310001571949us-gaap:SeniorNotesMemberice:A2027SeniorNotesMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2027SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:A2028SeniorNotesMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2028SeniorNotesMember2022-12-310001571949ice:A2029SeniorNotesMemberus-gaap:SeniorNotesMember2023-06-300001571949ice:A2029SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310001571949ice:SeniorNotesDueJune2030Memberus-gaap:SeniorNotesMember2023-06-300001571949ice:SeniorNotesDueJune2030Memberus-gaap:SeniorNotesMember2022-12-310001571949ice:SeniorNotesDueSeptember2032Memberus-gaap:SeniorNotesMember2023-06-300001571949ice:SeniorNotesDueSeptember2032Memberus-gaap:SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:A2033SeniorNotesMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2033SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueSeptember2040Member2023-06-300001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueSeptember2040Member2022-12-310001571949ice:A2048SeniorNoteMemberus-gaap:SeniorNotesMember2023-06-300001571949ice:A2048SeniorNoteMemberus-gaap:SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueJune2050Member2023-06-300001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueJune2050Member2022-12-310001571949ice:A4952052SeniorNotesMemberus-gaap:SeniorNotesMember2023-06-300001571949ice:A4952052SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueSeptember2060Member2023-06-300001571949us-gaap:SeniorNotesMemberice:SeniorNotesDueSeptember2060Member2022-12-310001571949us-gaap:SeniorNotesMemberice:A2062SeniorNotesMember2023-06-300001571949us-gaap:SeniorNotesMemberice:A2062SeniorNotesMember2022-12-310001571949us-gaap:SeniorNotesMember2023-06-300001571949us-gaap:SeniorNotesMember2023-01-012023-06-300001571949us-gaap:RevolvingCreditFacilityMember2023-06-300001571949ice:TermLoanMemberus-gaap:LineOfCreditMember2022-05-250001571949ice:TermLoanMemberus-gaap:LineOfCreditMember2022-05-252022-05-250001571949us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberice:TermLoanMemberus-gaap:LineOfCreditMember2022-05-252022-05-250001571949srt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberice:TermLoanMemberus-gaap:LineOfCreditMember2022-05-252022-05-250001571949us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMemberice:TermLoanMemberus-gaap:LineOfCreditMember2022-05-252022-05-250001571949srt:MinimumMemberice:TermLoanMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2022-05-252022-05-250001571949srt:MaximumMemberice:TermLoanMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2022-05-252022-05-250001571949ice:IndiaSubsidiariesMember2023-06-300001571949us-gaap:RevolvingCreditFacilityMemberus-gaap:CommercialPaperMember2023-06-300001571949us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-06-300001571949us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-06-300001571949ice:PerformanceBasedRestrictedStockUnitsMembersrt:MaximumMember2023-02-280001571949ice:PerformanceBasedRestrictedStockUnitsMember2023-02-280001571949ice:PerformanceBasedRestrictedStockUnitsMember2023-02-012023-02-280001571949ice:PerformanceBasedRestrictedStockUnitsMember2023-01-012023-06-300001571949ice:PerformanceBasedRestrictedStockUnitsMember2023-04-012023-06-300001571949ice:PerformanceBasedRestrictedStockUnitsMember2023-06-3000015719492022-01-010001571949ice:Rule10b51TradingPlanMember2022-01-012022-06-300001571949ice:OpenMarketTradingPeriodMember2022-01-012022-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2022-12-310001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001571949us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2023-01-012023-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2023-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2023-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2023-03-310001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001571949us-gaap:AccumulatedTranslationAdjustmentMember2023-04-012023-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2023-04-012023-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-012023-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2021-12-310001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001571949us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2022-01-012022-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2022-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300001571949us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2022-03-310001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-03-310001571949us-gaap:AccumulatedTranslationAdjustmentMember2022-04-012022-06-300001571949ice:AOCIAccumulatedGainLossEquityMethodInvestmentParentMember2022-04-012022-06-300001571949us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-04-012022-06-30ice:clearing_house0001571949ice:ICEClearUSIncMember2023-06-300001571949ice:ICEClearEuropeLimitedMember2023-06-300001571949ice:ICEClearEuropeLimitedMember2022-12-310001571949ice:ICEClearUSIncMember2022-12-310001571949ice:IceClearCreditMember2023-06-300001571949ice:IceClearCreditMember2022-12-310001571949ice:ICEClearNetherlandsMember2023-06-300001571949ice:ICEClearNetherlandsMember2022-12-310001571949ice:ICEClearSingaporeMember2023-06-300001571949ice:ICEClearSingaporeMember2022-12-310001571949ice:NGXMember2023-06-300001571949ice:NGXMember2022-12-3100015719492022-09-012022-09-300001571949ice:IceClearUsMember2023-06-300001571949us-gaap:LetterOfCreditMemberice:NGXMember2023-06-300001571949ice:OtherICEClearingHousesMember2023-06-300001571949ice:OtherICEClearingHousesMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberice:FuturesandOptionsProductsMember2023-06-300001571949ice:CDSProductsMemberice:ICEClearEuropeLimitedMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberice:FuturesandOptionsProductsMember2022-12-310001571949ice:CDSProductsMemberice:ICEClearEuropeLimitedMember2022-12-31iso4217:EUR0001571949ice:ICEClearEuropeLimitedMemberice:NationalBankAccountMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberice:NationalBankAccountMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberice:ReverseRepurchaseAgreementsMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberice:ReverseRepurchaseAgreementsMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberus-gaap:SovereignDebtMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberus-gaap:SovereignDebtMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberus-gaap:DemandDepositsMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberus-gaap:DemandDepositsMember2022-12-310001571949ice:IceClearCreditMemberice:NationalBankAccountMember2023-06-300001571949ice:IceClearCreditMemberice:NationalBankAccountMember2022-12-310001571949ice:IceClearCreditMemberice:ReverseRepurchaseAgreementsMember2023-06-300001571949ice:IceClearCreditMemberice:ReverseRepurchaseAgreementsMember2022-12-310001571949ice:IceClearCreditMemberus-gaap:DemandDepositsMember2023-06-300001571949ice:IceClearCreditMemberus-gaap:DemandDepositsMember2022-12-310001571949ice:ReverseRepurchaseAgreementsMemberice:IceClearUsMember2023-06-300001571949ice:ReverseRepurchaseAgreementsMemberice:IceClearUsMember2022-12-310001571949us-gaap:SovereignDebtMemberice:IceClearUsMember2023-06-300001571949us-gaap:SovereignDebtMemberice:IceClearUsMember2022-12-310001571949ice:OtherICEClearingHousesMemberus-gaap:DemandDepositsMember2023-06-300001571949ice:OtherICEClearingHousesMemberus-gaap:DemandDepositsMember2022-12-310001571949ice:UnsettledVariationMarginandDeliveryContractsReceivablePayableMemberice:NGXMember2023-06-300001571949ice:UnsettledVariationMarginandDeliveryContractsReceivablePayableMemberice:NGXMember2022-12-310001571949ice:InvestedDepositsSovereignDebtMemberice:ICEClearEuropeLimitedMember2023-06-300001571949ice:InvestedDepositsSovereignDebtMemberice:ICEClearEuropeLimitedMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMemberice:DeNederlandscheBankMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMemberice:DeNederlandscheBankMember2023-01-012023-06-300001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnPoundSterlingAndUSDollarExchangeRateMember2023-06-30iso4217:GBP0001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnPoundSterlingAndUSDollarExchangeRateMember2023-01-012023-06-300001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMember2023-06-300001571949ice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMemberice:DeNederlandscheBankMember2022-12-310001571949ice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMemberice:DeNederlandscheBankMember2023-01-012023-03-310001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnPoundSterlingAndUSDollarExchangeRateMember2022-12-310001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnPoundSterlingAndUSDollarExchangeRateMember2023-01-012023-03-310001571949ice:BankofEnglandMemberice:ICEClearEuropeLimitedMemberice:CashDepositBasedOnEuroAndUSDollarExchangeRateMember2022-12-310001571949ice:OriginalMarginMemberice:ICEClearEuropeLimitedMember2023-06-300001571949ice:OriginalMarginMemberice:IceClearCreditMember2023-06-300001571949ice:OriginalMarginMemberice:ICEClearUSIncMember2023-06-300001571949ice:OriginalMarginMemberice:NGXMember2023-06-300001571949ice:OriginalMarginMember2023-06-300001571949ice:GuarantyFundMemberice:ICEClearEuropeLimitedMember2023-06-300001571949ice:GuarantyFundMemberice:IceClearCreditMember2023-06-300001571949ice:GuarantyFundMemberice:ICEClearUSIncMember2023-06-300001571949ice:GuarantyFundMemberice:NGXMember2023-06-300001571949ice:GuarantyFundMember2023-06-300001571949ice:OriginalMarginMemberice:ICEClearEuropeLimitedMember2022-12-310001571949ice:OriginalMarginMemberice:IceClearCreditMember2022-12-310001571949ice:OriginalMarginMemberice:ICEClearUSIncMember2022-12-310001571949ice:OriginalMarginMemberice:NGXMember2022-12-310001571949ice:OriginalMarginMember2022-12-310001571949ice:GuarantyFundMemberice:ICEClearEuropeLimitedMember2022-12-310001571949ice:GuarantyFundMemberice:IceClearCreditMember2022-12-310001571949ice:GuarantyFundMemberice:ICEClearUSIncMember2022-12-310001571949ice:GuarantyFundMemberice:NGXMember2022-12-310001571949ice:GuarantyFundMember2022-12-310001571949ice:GuarantyFundMember2023-01-012023-06-300001571949ice:GuarantyFundMember2022-01-012022-06-300001571949ice:GuarantyFundMember2023-04-012023-06-300001571949ice:GuarantyFundMember2022-04-012022-06-300001571949ice:CanadianCharteredBankMemberice:NGXMember2023-06-300001571949ice:CanadianCharteredBankMemberus-gaap:LetterOfCreditMemberice:NGXMember2023-06-300001571949ice:NGXMember2023-01-012023-06-300001571949us-gaap:LetterOfCreditMemberice:NGXMember2023-01-012023-06-300001571949us-gaap:EnergyServiceMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949us-gaap:EnergyServiceMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949us-gaap:EnergyServiceMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949us-gaap:EnergyServiceMember2023-01-012023-06-300001571949ice:ExchangesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-01-012023-06-300001571949ice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-01-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2023-01-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2023-01-012023-06-300001571949ice:CashEquityandEquityOptionsMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:CashEquityandEquityOptionsMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:CashEquityandEquityOptionsMember2023-01-012023-06-300001571949ice:CashEquityandEquityOptionsMember2023-01-012023-06-300001571949ice:ExchangesSegmentMemberice:OTCandOtherTransactionsMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OTCandOtherTransactionsMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:OTCandOtherTransactionsMember2023-01-012023-06-300001571949ice:OTCandOtherTransactionsMember2023-01-012023-06-300001571949ice:ExchangeDataMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:ExchangeDataMember2023-01-012023-06-300001571949ice:ExchangeDataMember2023-01-012023-06-300001571949ice:ListingsMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:ListingsMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:ListingsMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:ListingsMember2023-01-012023-06-300001571949ice:FixedIncomeExecutionMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:FixedIncomeExecutionMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:FixedIncomeExecutionMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:FixedIncomeExecutionMember2023-01-012023-06-300001571949ice:CDSClearingMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:CDSClearingMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:CDSClearingMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:CDSClearingMember2023-01-012023-06-300001571949ice:ExchangesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-01-012023-06-300001571949ice:FixedIncomeDataAndAnalyticsMember2023-01-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:OtherDataAndNetworkServicesMember2023-01-012023-06-300001571949ice:OriginationTechnologyMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:OriginationTechnologyMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:OriginationTechnologyMemberice:MortgageTechnologySegmentMember2023-01-012023-06-300001571949ice:OriginationTechnologyMember2023-01-012023-06-300001571949ice:ClosingSolutionsMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:ClosingSolutionsMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:ClosingSolutionsMember2023-01-012023-06-300001571949ice:ClosingSolutionsMember2023-01-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:ExchangesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:FixedIncomeAndDataServicesSegmentMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:MortgageTechnologyDataAndAnalyticsMember2023-01-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMember2023-01-012023-06-300001571949ice:ExchangesSegmentMemberice:OtherMember2023-01-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OtherMember2023-01-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:OtherMember2023-01-012023-06-300001571949ice:OtherMember2023-01-012023-06-300001571949us-gaap:EnergyServiceMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949us-gaap:EnergyServiceMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949us-gaap:EnergyServiceMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949us-gaap:EnergyServiceMember2023-04-012023-06-300001571949ice:ExchangesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-04-012023-06-300001571949ice:AgriculturalandMetalsFuturesandOptionsContractsMember2023-04-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2023-04-012023-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2023-04-012023-06-300001571949ice:CashEquityandEquityOptionsMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:CashEquityandEquityOptionsMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:CashEquityandEquityOptionsMember2023-04-012023-06-300001571949ice:CashEquityandEquityOptionsMember2023-04-012023-06-300001571949ice:ExchangesSegmentMemberice:OTCandOtherTransactionsMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OTCandOtherTransactionsMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:OTCandOtherTransactionsMember2023-04-012023-06-300001571949ice:OTCandOtherTransactionsMember2023-04-012023-06-300001571949ice:ExchangeDataMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:ExchangeDataMember2023-04-012023-06-300001571949ice:ExchangeDataMember2023-04-012023-06-300001571949ice:ListingsMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:ListingsMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:ListingsMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:ListingsMember2023-04-012023-06-300001571949ice:FixedIncomeExecutionMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:FixedIncomeExecutionMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:FixedIncomeExecutionMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:FixedIncomeExecutionMember2023-04-012023-06-300001571949ice:CDSClearingMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:CDSClearingMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:CDSClearingMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:CDSClearingMember2023-04-012023-06-300001571949ice:ExchangesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:FixedIncomeDataAndAnalyticsMember2023-04-012023-06-300001571949ice:FixedIncomeDataAndAnalyticsMember2023-04-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:OtherDataAndNetworkServicesMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:OtherDataAndNetworkServicesMember2023-04-012023-06-300001571949ice:OriginationTechnologyMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:OriginationTechnologyMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:OriginationTechnologyMemberice:MortgageTechnologySegmentMember2023-04-012023-06-300001571949ice:OriginationTechnologyMember2023-04-012023-06-300001571949ice:ClosingSolutionsMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:ClosingSolutionsMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:ClosingSolutionsMember2023-04-012023-06-300001571949ice:ClosingSolutionsMember2023-04-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:ExchangesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:FixedIncomeAndDataServicesSegmentMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:MortgageTechnologyDataAndAnalyticsMember2023-04-012023-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMember2023-04-012023-06-300001571949ice:ExchangesSegmentMemberice:OtherMember2023-04-012023-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OtherMember2023-04-012023-06-300001571949ice:MortgageTechnologySegmentMemberice:OtherMember2023-04-012023-06-300001571949ice:OtherMember2023-04-012023-06-300001571949us-gaap:EnergyServiceMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949us-gaap:EnergyServiceMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949us-gaap:EnergyServiceMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949us-gaap:EnergyServiceMember2022-01-012022-06-300001571949ice:ExchangesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-01-012022-06-300001571949ice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-01-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2022-01-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2022-01-012022-06-300001571949ice:CashEquityandEquityOptionsMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:CashEquityandEquityOptionsMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:CashEquityandEquityOptionsMember2022-01-012022-06-300001571949ice:CashEquityandEquityOptionsMember2022-01-012022-06-300001571949ice:ExchangesSegmentMemberice:OTCandOtherTransactionsMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OTCandOtherTransactionsMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:OTCandOtherTransactionsMember2022-01-012022-06-300001571949ice:OTCandOtherTransactionsMember2022-01-012022-06-300001571949ice:ExchangeDataMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:ExchangeDataMember2022-01-012022-06-300001571949ice:ExchangeDataMember2022-01-012022-06-300001571949ice:ListingsMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:ListingsMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:ListingsMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:ListingsMember2022-01-012022-06-300001571949ice:FixedIncomeExecutionMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:FixedIncomeExecutionMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:FixedIncomeExecutionMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:FixedIncomeExecutionMember2022-01-012022-06-300001571949ice:CDSClearingMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:CDSClearingMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:CDSClearingMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:CDSClearingMember2022-01-012022-06-300001571949ice:ExchangesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-01-012022-06-300001571949ice:FixedIncomeDataAndAnalyticsMember2022-01-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:OtherDataAndNetworkServicesMember2022-01-012022-06-300001571949ice:OriginationTechnologyMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:OriginationTechnologyMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:OriginationTechnologyMemberice:MortgageTechnologySegmentMember2022-01-012022-06-300001571949ice:OriginationTechnologyMember2022-01-012022-06-300001571949ice:ClosingSolutionsMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:ClosingSolutionsMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:ClosingSolutionsMember2022-01-012022-06-300001571949ice:ClosingSolutionsMember2022-01-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:ExchangesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:FixedIncomeAndDataServicesSegmentMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:MortgageTechnologyDataAndAnalyticsMember2022-01-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMember2022-01-012022-06-300001571949ice:ExchangesSegmentMemberice:OtherMember2022-01-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OtherMember2022-01-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:OtherMember2022-01-012022-06-300001571949ice:OtherMember2022-01-012022-06-300001571949us-gaap:EnergyServiceMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949us-gaap:EnergyServiceMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949us-gaap:EnergyServiceMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949us-gaap:EnergyServiceMember2022-04-012022-06-300001571949ice:ExchangesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-04-012022-06-300001571949ice:AgriculturalandMetalsFuturesandOptionsContractsMember2022-04-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2022-04-012022-06-300001571949ice:InterestRatesandOtherFinancialFuturesandOptionContractsMember2022-04-012022-06-300001571949ice:CashEquityandEquityOptionsMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:CashEquityandEquityOptionsMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:CashEquityandEquityOptionsMember2022-04-012022-06-300001571949ice:CashEquityandEquityOptionsMember2022-04-012022-06-300001571949ice:ExchangesSegmentMemberice:OTCandOtherTransactionsMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OTCandOtherTransactionsMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:OTCandOtherTransactionsMember2022-04-012022-06-300001571949ice:OTCandOtherTransactionsMember2022-04-012022-06-300001571949ice:ExchangeDataMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:ExchangeDataMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:ExchangeDataMember2022-04-012022-06-300001571949ice:ExchangeDataMember2022-04-012022-06-300001571949ice:ListingsMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:ListingsMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:ListingsMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:ListingsMember2022-04-012022-06-300001571949ice:FixedIncomeExecutionMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:FixedIncomeExecutionMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:FixedIncomeExecutionMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:FixedIncomeExecutionMember2022-04-012022-06-300001571949ice:CDSClearingMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:CDSClearingMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:CDSClearingMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:CDSClearingMember2022-04-012022-06-300001571949ice:ExchangesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:FixedIncomeDataAndAnalyticsMember2022-04-012022-06-300001571949ice:FixedIncomeDataAndAnalyticsMember2022-04-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:OtherDataAndNetworkServicesMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:OtherDataAndNetworkServicesMember2022-04-012022-06-300001571949ice:OriginationTechnologyMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:OriginationTechnologyMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:OriginationTechnologyMemberice:MortgageTechnologySegmentMember2022-04-012022-06-300001571949ice:OriginationTechnologyMember2022-04-012022-06-300001571949ice:ClosingSolutionsMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:ClosingSolutionsMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:ClosingSolutionsMember2022-04-012022-06-300001571949ice:ClosingSolutionsMember2022-04-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:ExchangesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMemberice:FixedIncomeAndDataServicesSegmentMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:MortgageTechnologyDataAndAnalyticsMember2022-04-012022-06-300001571949ice:MortgageTechnologyDataAndAnalyticsMember2022-04-012022-06-300001571949ice:ExchangesSegmentMemberice:OtherMember2022-04-012022-06-300001571949ice:FixedIncomeAndDataServicesSegmentMemberice:OtherMember2022-04-012022-06-300001571949ice:MortgageTechnologySegmentMemberice:OtherMember2022-04-012022-06-300001571949ice:OtherMember2022-04-012022-06-300001571949us-gaap:CustomerConcentrationRiskMemberice:ExchangesSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-06-30ice:member0001571949us-gaap:CustomerConcentrationRiskMemberice:ExchangesSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2023-04-012023-06-300001571949us-gaap:CustomerConcentrationRiskMemberice:ExchangesSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-06-300001571949us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001571949us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001571949ice:MarthaATirinnanziMember2023-01-012023-06-300001571949ice:MarthaATirinnanziMember2023-04-012023-06-300001571949ice:MarthaATirinnanziMember2023-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| | | | | |

| |

(Mark One) | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

| | | | | |

| Or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 001-36198

INTERCONTINENTAL EXCHANGE, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 46-2286804 |

(State or other jurisdiction of

incorporation or organization) | (IRS Employer

Identification Number) |

| | | | | |

5660 New Northside Drive, Atlanta, Georgia | 30328 |

| (Address of principal executive offices) | (Zip Code) |

(770) 857-4700

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value per share | ICE | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

Large accelerated filer | ☑ | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of August 1, 2023, the number of shares of the registrant’s Common Stock outstanding was 560,301,373 shares.

INTERCONTINENTAL EXCHANGE, INC.

Form 10-Q

Quarterly Period Ended June 30, 2023

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

PART I. | Financial Statements | |

Item 1. | | |

| Consolidated Balance Sheets as of June 30, 2023 and December 31, 2022 | |

| Consolidated Statements of Income for the six months and three months ended June 30, 2023 and 2022 | |

| Consolidated Statements of Comprehensive Income for the six months and three months ended June 30, 2023 and 2022 | |

| Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest for the six months and three months ended June 30, 2023 and 2022 | |

| Consolidated Statements of Cash Flows for the six months ended June 30, 2023 and 2022 | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

PART II. | Other Information | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

| |

PART I. Financial Statements

Item 1. Consolidated Financial Statements

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Balance Sheets

(In millions, except per share amounts)

| | | | | | | | | | | |

| As of | | As of

December 31, 2022 |

| June 30, 2023 | |

| (Unaudited) | |

Assets: | | | |

Current assets: | | | |

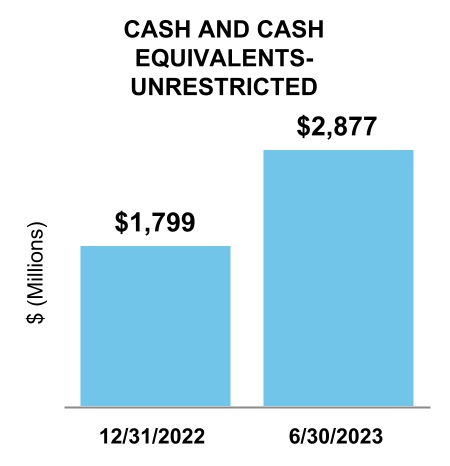

Cash and cash equivalents | $ | 2,877 | | | $ | 1,799 | |

Short-term restricted cash and cash equivalents | 5,413 | | | 6,149 | |

| Restricted short-term investments | 735 | | | — | |

| Cash and cash equivalent margin deposits and guaranty funds | 86,917 | | | 141,990 | |

| Invested deposits, delivery contracts receivable and unsettled variation margin | 1,412 | | | 5,382 | |

Customer accounts receivable, net of allowance for doubtful accounts of $25 and $22 at June 30, 2023 and December 31, 2022, respectively | 1,313 | | | 1,169 | |

Prepaid expenses and other current assets | 555 | | | 458 | |

Total current assets | 99,222 | | | 156,947 | |

Property and equipment, net | 1,718 | | | 1,767 | |

Other non-current assets: | | | |

Goodwill | 21,134 | | | 21,111 | |

Other intangible assets, net | 12,814 | | | 13,090 | |

Long-term restricted cash and cash equivalents | 205 | | | 405 | |

| Long-term restricted investments | 199 | | | — | |

Other non-current assets | 991 | | | 1,018 | |

Total other non-current assets | 35,343 | | | 35,624 | |

Total assets | $ | 136,283 | | | $ | 194,338 | |

| | | |

Liabilities and Equity: | | | |

Current liabilities: | | | |

Accounts payable and accrued liabilities | $ | 919 | | | $ | 866 | |

Section 31 fees payable | 173 | | | 223 | |

Accrued salaries and benefits | 226 | | | 352 | |

Deferred revenue | 437 | | | 170 | |

Short-term debt | — | | | 4 | |

Margin deposits and guaranty funds | 86,917 | | | 141,990 | |

| Invested deposits, delivery contracts payable and unsettled variation margin | 1,412 | | | 5,382 | |

Other current liabilities | 120 | | | 184 | |

Total current liabilities | 90,204 | | | 149,171 | |

Non-current liabilities: | | | |

Non-current deferred tax liability, net | 3,256 | | | 3,493 | |

Long-term debt | 18,128 | | | 18,118 | |

Accrued employee benefits | 156 | | | 160 | |

Non-current operating lease liability | 218 | | | 254 | |

Other non-current liabilities | 432 | | | 381 | |

Total non-current liabilities | 22,190 | | | 22,406 | |

Total liabilities | 112,394 | | | 171,577 | |

Commitments and contingencies | | | |

| | | | | | | | | | | |

| | | |

Equity: | | | |

Intercontinental Exchange, Inc. stockholders’ equity: | | | |

Preferred stock, $0.01 par value; 100 shares authorized; none issued or outstanding | — | | | — | |

Common stock, $0.01 par value; 1,500 shares authorized; 636 and 634 issued at June 30, 2023 and December 31, 2022, respectively, and 560 and 559 shares outstanding at June 30, 2023 and December 31, 2022, respectively | 6 | | | 6 | |

Treasury stock, at cost; 76 and 75 shares at June 30, 2023 and December 31, 2022, respectively | (6,276) | | | (6,225) | |

Additional paid-in capital | 14,449 | | | 14,313 | |

Retained earnings | 15,925 | | | 14,943 | |

Accumulated other comprehensive loss | (284) | | | (331) | |

Total Intercontinental Exchange, Inc. stockholders’ equity | 23,820 | | | 22,706 | |

Non-controlling interest in consolidated subsidiaries | 69 | | | 55 | |

Total equity | 23,889 | | | 22,761 | |

Total liabilities and equity | $ | 136,283 | | | $ | 194,338 | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Income

(In millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Three Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Revenues: | | | | | | | |

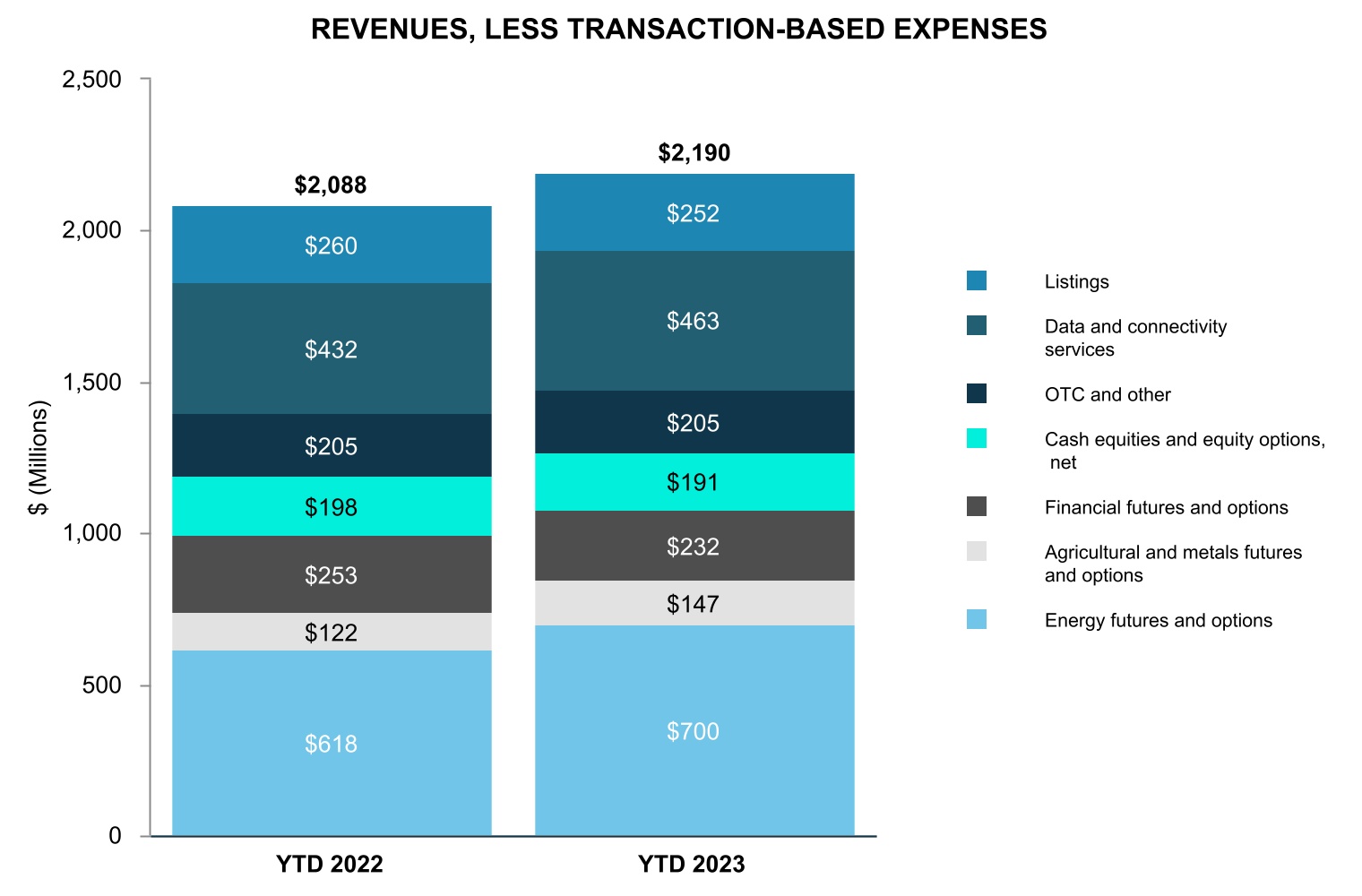

Exchanges | $ | 3,214 | | | $ | 3,247 | | | $ | 1,541 | | | $ | 1,604 | |

Fixed income and data services | 1,109 | | | 1,021 | | | 546 | | | 512 | |

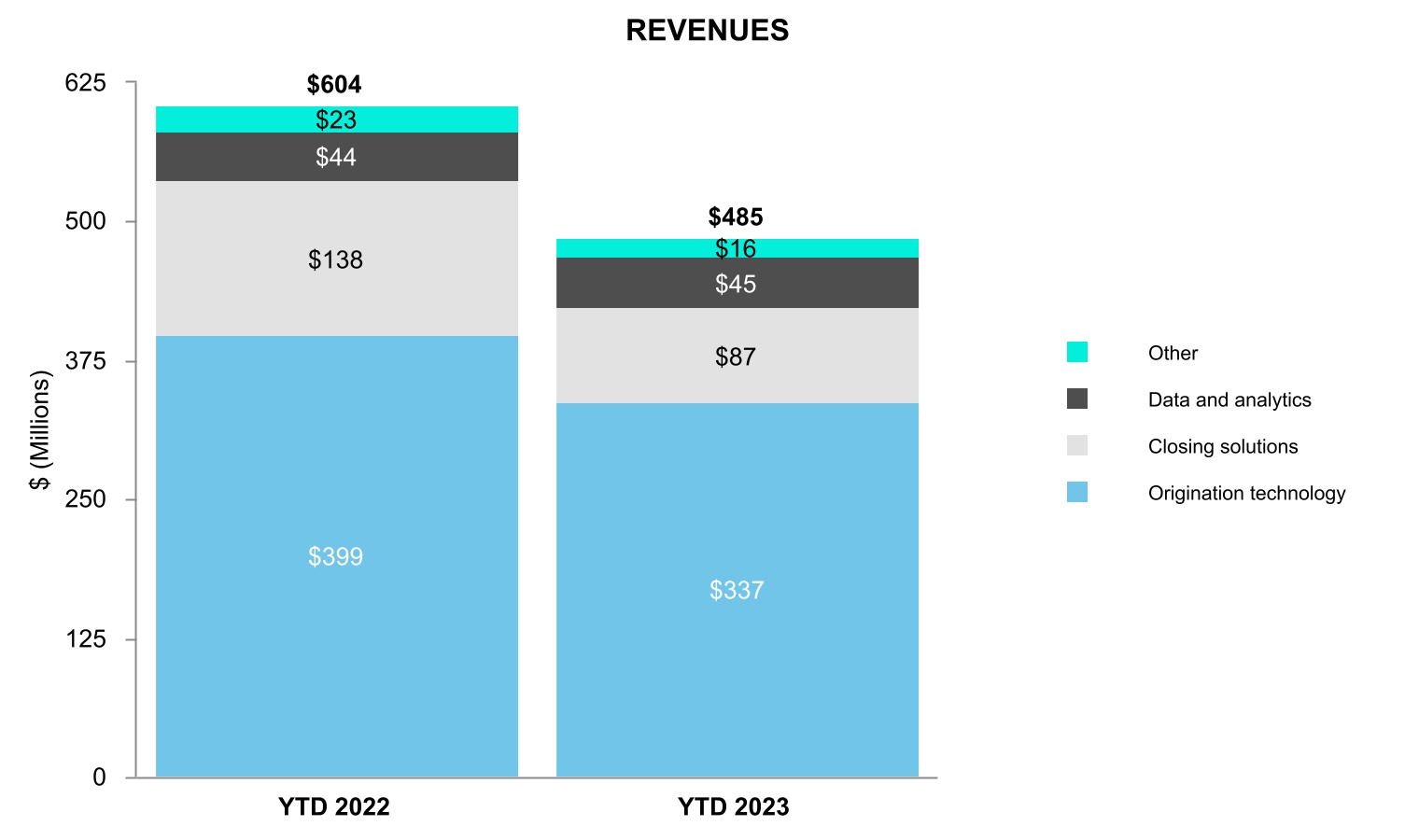

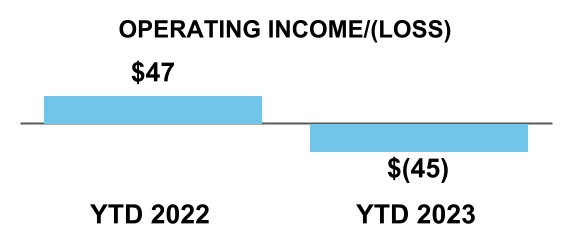

Mortgage technology | 485 | | | 604 | | | 249 | | | 297 | |

Total revenues | 4,808 | | | 4,872 | | | 2,336 | | | 2,413 | |

Transaction-based expenses: | | | | | | | |

Section 31 fees | 175 | | | 174 | | | 56 | | | 123 | |

Cash liquidity payments, routing and clearing | 849 | | | 985 | | | 392 | | | 476 | |

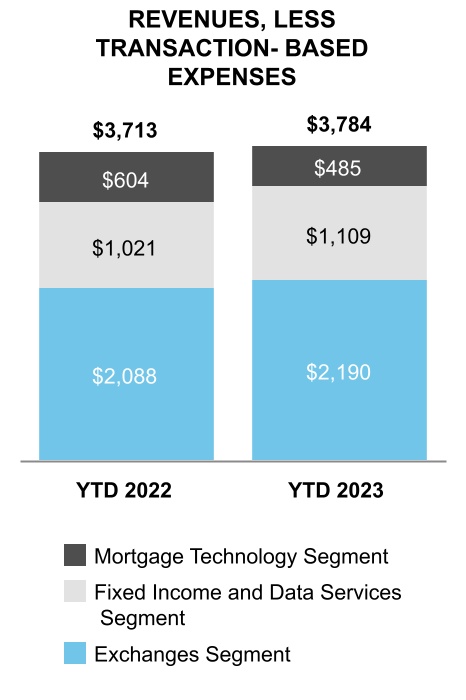

Total revenues, less transaction-based expenses | 3,784 | | | 3,713 | | | 1,888 | | | 1,814 | |

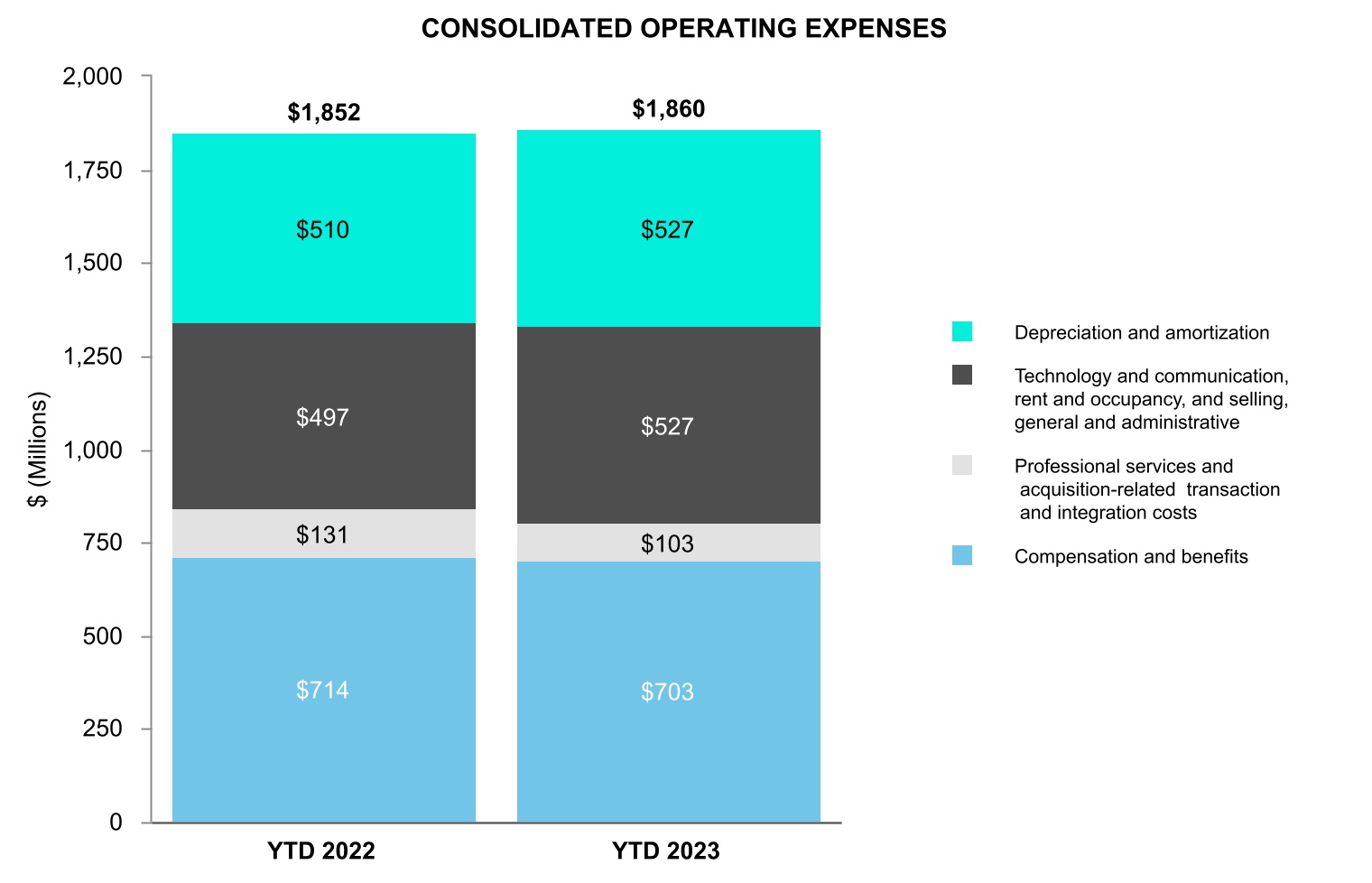

Operating expenses: | | | | | | | |

Compensation and benefits | 703 | | | 714 | | | 351 | | | 355 | |

Professional services | 57 | | | 69 | | | 29 | | | 35 | |

Acquisition-related transaction and integration costs | 46 | | | 62 | | | 25 | | | 53 | |

Technology and communication | 345 | | | 344 | | | 173 | | | 169 | |

Rent and occupancy | 45 | | | 41 | | | 25 | | | 20 | |

Selling, general and administrative | 137 | | | 112 | | | 63 | | | 57 | |

Depreciation and amortization | 527 | | | 510 | | | 267 | | | 256 | |

Total operating expenses | 1,860 | | | 1,852 | | | 933 | | | 945 | |

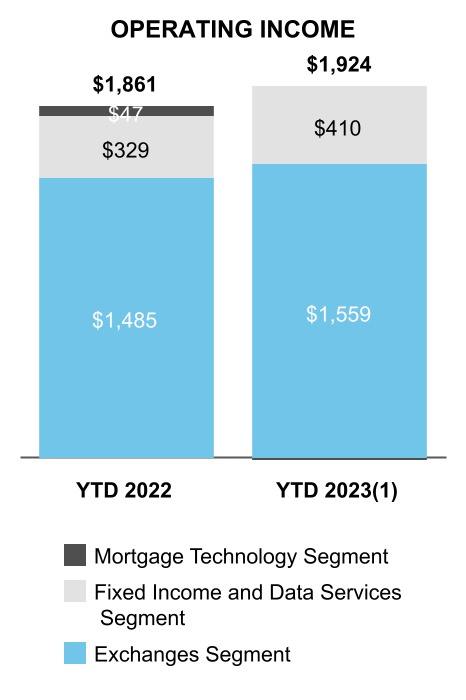

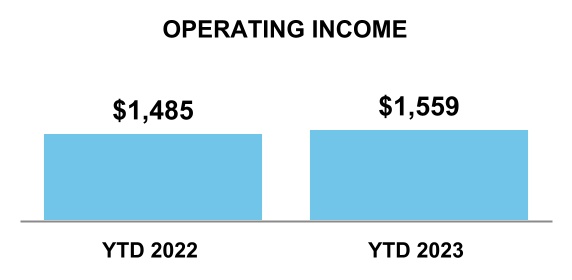

Operating income | 1,924 | | | 1,861 | | | 955 | | | 869 | |

| Other income/(expense): | | | | | | | |

Interest income | 193 | | | 9 | | | 102 | | | 8 | |

Interest expense | (351) | | | (264) | | | (175) | | | (161) | |

Other income/(expense), net | (70) | | | (35) | | | (35) | | | 23 | |

Total other income/(expense), net | (228) | | | (290) | | | (108) | | | (130) | |

Income before income tax expense | 1,696 | | | 1,571 | | | 847 | | | 739 | |

Income tax expense | 207 | | | 338 | | | 32 | | | 173 | |

Net income | $ | 1,489 | | | $ | 1,233 | | | $ | 815 | | | $ | 566 | |

Net income attributable to non-controlling interest | (35) | | | (21) | | | (16) | | | (11) | |

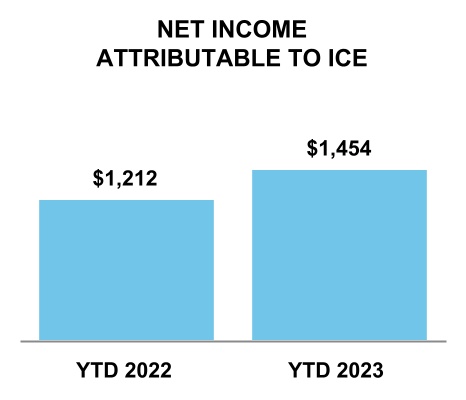

Net income attributable to Intercontinental Exchange, Inc. | $ | 1,454 | | | $ | 1,212 | | | $ | 799 | | | $ | 555 | |

| Earnings per share attributable to Intercontinental Exchange, Inc. common stockholders: | | | | | | | |

Basic | $ | 2.60 | | | $ | 2.17 | | | $ | 1.43 | | | $ | 0.99 | |

Diluted | $ | 2.59 | | | $ | 2.16 | | | $ | 1.42 | | | $ | 0.99 | |

Weighted average common shares outstanding: | | | | | | | |

Basic | 560 | | | 560 | | | 560 | | | 558 | |

Diluted | 561 | | | 562 | | | 561 | | | 560 | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Three Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 1,489 | | | $ | 1,233 | | | $ | 815 | | | $ | 566 | |

| Other comprehensive income/(loss): | | | | | | | |

| Foreign currency translation adjustments | 47 | | | (109) | | | 31 | | | (84) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other comprehensive income/(loss) | 47 | | | (109) | | | 31 | | | (84) | |

| Comprehensive income | $ | 1,536 | | | $ | 1,124 | | | $ | 846 | | | $ | 482 | |

Comprehensive income attributable to non-controlling interest | (35) | | | (21) | | | (16) | | | (11) | |

| Comprehensive income attributable to Intercontinental Exchange, Inc. | $ | 1,501 | | | $ | 1,103 | | | $ | 830 | | | $ | 471 | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | | |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

Balance, as of December 31, 2022 | 634 | | | $ | 6 | | | (75) | | | $ | (6,225) | | | $ | 14,313 | | | $ | 14,943 | | | $ | (331) | | | $ | 55 | | | $ | 22,761 | | | |

Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 47 | | | — | | | 47 | | | |

| | | | | | | | | | | | | | | | | | | |

Exercise of common stock options | — | | | — | | | — | | | — | | | 24 | | | — | | | — | | | — | | | 24 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Payments relating to treasury shares | — | | | — | | | (1) | | | (51) | | | — | | | — | | | — | | | — | | | (51) | | | |

Stock-based compensation | — | | | — | | | — | | | — | | | 94 | | | — | | | — | | | — | | | 94 | | | |

Issuance under the employee stock purchase plan | — | | | — | | | — | | | — | | | 18 | | | — | | | — | | | — | | | 18 | | | |

Contribution from equity partners | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 9 | | | 9 | | | |

Issuance of restricted stock | 2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | | | | | |

Distributions of profits | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (30) | | | (30) | | | |

Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (472) | | | — | | | — | | | (472) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (35) | | | — | | | 35 | | | — | | | |

Net income | — | | | — | | | — | | | — | | | — | | | 1,489 | | | — | | | — | | | 1,489 | | | |

Balance, as of June 30, 2023 | 636 | | | $ | 6 | | | (76) | | | $ | (6,276) | | | $ | 14,449 | | | $ | 15,925 | | | $ | (284) | | | $ | 69 | | | $ | 23,889 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | | |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

| Balance, as of March 31, 2023 | 635 | | | $ | 6 | | | (76) | | | $ | (6,274) | | | $ | 14,388 | | | $ | 15,362 | | | $ | (315) | | | $ | 44 | | | $ | 23,211 | | | |

Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 31 | | | — | | | 31 | | | |

| | | | | | | | | | | | | | | | | | | |

Exercise of common stock options | — | | | — | | | — | | | — | | | 14 | | | — | | | — | | | — | | | 14 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Payments relating to treasury shares | — | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | (2) | | | |

Stock-based compensation | — | | | — | | | — | | | — | | | 47 | | | — | | | — | | | — | | | 47 | | | |

| | | | | | | | | | | | | | | | | | | |

Contribution from equity partners | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 9 | | | 9 | | | |

Issuance of restricted stock | 1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (236) | | | — | | | — | | | (236) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (16) | | | — | | | 16 | | | — | | | |

Net income | — | | | — | | | — | | | — | | | — | | | 815 | | | — | | | — | | | 815 | | | |

Balance, as of June 30, 2023 | 636 | | | $ | 6 | | | (76) | | | $ | (6,276) | | | $ | 14,449 | | | $ | 15,925 | | | $ | (284) | | | $ | 69 | | | $ | 23,889 | | | |

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Changes in Equity and Redeemable Non-Controlling Interest - (Continued)

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

Balance, as of December 31, 2021 | 631 | | | $ | 6 | | | (70) | | | $ | (5,520) | | | $ | 14,069 | | | $ | 14,350 | | | $ | (196) | | | $ | 39 | | | $ | 22,748 | |

Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (109) | | | — | | | (109) | |

Exercise of common stock options | — | | | — | | | — | | | — | | | 20 | | | — | | | — | | | — | | | 20 | |

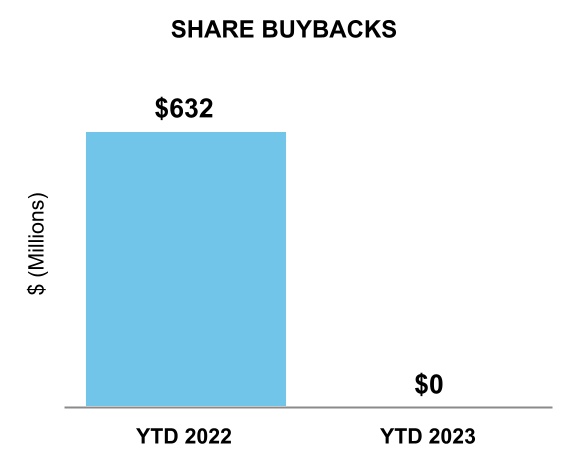

Repurchases of common stock | — | | | — | | | (4) | | | (632) | | | — | | | — | | | — | | | — | | | (632) | |

Payments relating to treasury shares | — | | | — | | | (1) | | | (71) | | | — | | | — | | | — | | | — | | | (71) | |

Stock-based compensation | — | | | — | | | — | | | — | | | 88 | | | — | | | — | | | — | | | 88 | |

Issuance under the employee stock purchase plan | — | | | — | | | — | | | — | | | 24 | | | — | | | — | | | — | | | 24 | |

Issuance of restricted stock | 2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Distributions of profits | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (13) | | | (13) | |

Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (427) | | | — | | | — | | | (427) | |

| | | | | | | | | | | | | | | | | |

Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (21) | | | — | | | 21 | | | — | |

Net income | — | | | — | | | — | | | — | | | — | | | 1,233 | | | — | | | — | | | 1,233 | |

Balance, as of June 30, 2022 | 633 | | | $ | 6 | | | (75) | | | $ | (6,223) | | | $ | 14,201 | | | $ | 15,135 | | | $ | (305) | | | $ | 47 | | | $ | 22,861 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Intercontinental Exchange, Inc. Stockholders’ Equity | | Non-

Controlling

Interest in

Consolidated

Subsidiaries | | Total

Equity | | |

| Common

Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income/(Loss) | |

| Shares | | Value | | Shares | | Value | |

| Balance, as of March 31, 2022 | 633 | | | $ | 6 | | | (74) | | | $ | (6,064) | | | $ | 14,153 | | | $ | 14,793 | | | $ | (221) | | | $ | 36 | | | $ | 22,703 | | | |

Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (84) | | | — | | | (84) | | | |

| | | | | | | | | | | | | | | | | | | |

Exercise of common stock options | — | | | — | | | — | | | — | | | 5 | | | — | | | — | | | — | | | 5 | | | |

| | | | | | | | | | | | | | | | | | | |

| Repurchases of common stock | — | | | — | | | (1) | | | (157) | | | — | | | — | | | — | | | — | | | (157) | | | |

Payments relating to treasury shares | — | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | (2) | | | |

Stock-based compensation | — | | | — | | | — | | | — | | | 43 | | | — | | | — | | | — | | | 43 | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Dividends paid to stockholders | — | | | — | | | — | | | — | | | — | | | (213) | | | — | | | — | | | (213) | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net income/(loss) attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | (11) | | | — | | | 11 | | | — | | | |

Net income | — | | | — | | | — | | | — | | | — | | | 566 | | | — | | | — | | | 566 | | | |

Balance, as of June 30, 2022 | 633 | | | $ | 6 | | | (75) | | | $ | (6,223) | | | $ | 14,201 | | | $ | 15,135 | | | $ | (305) | | | $ | 47 | | | $ | 22,861 | | | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In millions)

(Unaudited) | | | | | | | | | | | | |

| Six Months Ended June 30, | |

| 2023 | | 2022 | |

| Operating activities: | | | | |

Net income | $ | 1,489 | | | $ | 1,233 | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation and amortization | 527 | | | 510 | | |

Stock-based compensation | 85 | | | 76 | | |

Deferred taxes | (239) | | | (147) | | |

| Gain on sale of Euroclear investment | — | | | (41) | | |

| | | | |

| | | | |

| Net losses from unconsolidated investees | 65 | | | 57 | | |

| | | | |

Other | 26 | | | 21 | | |

| Changes in assets and liabilities: | | | | |

Customer accounts receivable | (181) | | | (177) | | |

| Other current and non-current assets | (66) | | | (48) | | |

Section 31 fees payable | (50) | | | 115 | | |

Deferred revenue | 279 | | | 292 | | |

Other current and non-current liabilities | (130) | | | (166) | | |

Total adjustments | 316 | | | 492 | | |

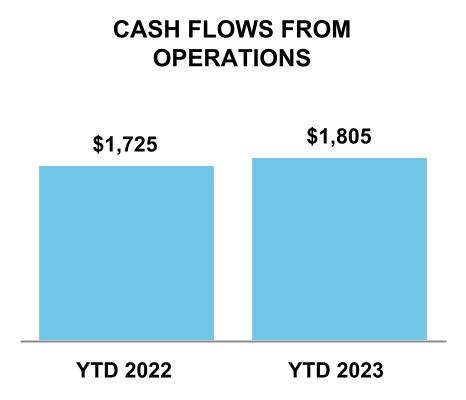

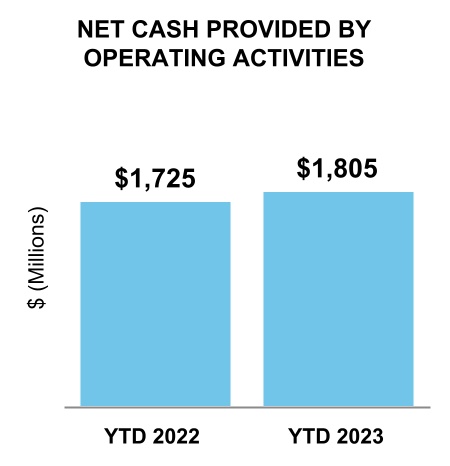

Net cash provided by operating activities | 1,805 | | | 1,725 | | |

| | | | |

| Investing activities: | | | | |

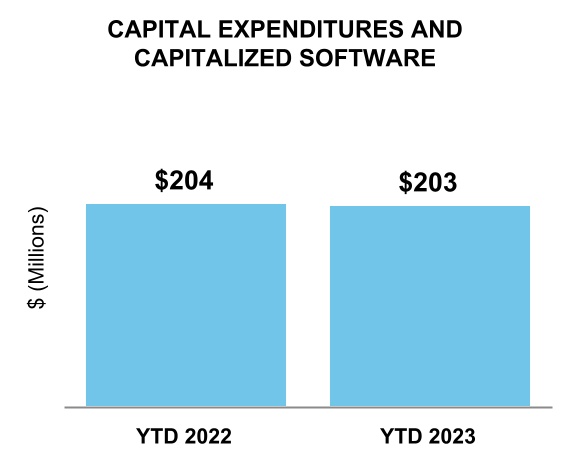

Capital expenditures | (61) | | | (70) | | |

Capitalized software development costs | (142) | | | (134) | | |

| Purchases of invested margin deposits | (771) | | | (1,431) | | |

| Proceeds from sales of invested margin deposits | 3,078 | | | 3,815 | | |

Cash paid for acquisitions, net of cash acquired | (5) | | | (36) | | |

| | | | |

| Purchases of equity and equity method investments | (6) | | | (43) | | |

| Proceeds from sale of Euroclear investment | — | | | 741 | | |

| | | | |

| Purchases of investments | (949) | | | — | | |

| | | | |

Other | — | | | 1 | | |

| | | | |

Net cash provided by investing activities | 1,144 | | | 2,843 | | |

| | | | |

| Financing activities: | | | | |

| | | | |

| | | | |

| Proceeds from/(repayments of) debt facilities, net | (4) | | | 5,186 | | |

| | | | |

| Redemption of commercial paper, net | — | | | (1,012) | | |

| Capital contributions from non-controlling interests | 9 | | | — | | |

Repurchases of common stock | — | | | (632) | | |

Dividends to stockholders | (472) | | | (427) | | |

| Change in cash and cash equivalent margin deposits and guaranty funds | (57,380) | | | 16,163 | | |

Payments relating to treasury shares received for restricted stock tax payments and stock option exercises | (50) | | | (71) | | |

| | | | |

| | | | |

| | | | |

Other | 11 | | | 31 | | |

Net cash provided by/(used in) financing activities | (57,886) | | | 19,238 | | |

| Effect of exchange rate changes on cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | 6 | | | (19) | | |

Net increase/(decrease) in cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds | (54,931) | | | 23,787 | | |

Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at beginning of period | 150,343 | | | 147,976 | | |

Cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds at end of period | $ | 95,412 | | | $ | 171,763 | | |

| | | | |

Intercontinental Exchange, Inc. and Subsidiaries

Consolidated Statements of Cash Flows (Continued)

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | |

| | As of June 30, 2023 | | As of June 30, 2022 | |

| Supplemental cash flow disclosure: | | | | | |

Cash paid for income taxes | | $ | 536 | | | $ | 524 | | |

Cash paid for interest | | $ | 341 | | | $ | 226 | | |

| | | | | |

| Reconciliation of the components of cash, cash equivalents, restricted cash and cash equivalents, and cash and cash equivalent margin deposits and guaranty funds to the balance sheet: | | | | | |

| Cash and cash equivalents | | $ | 2,877 | | | $ | 830 | | |

| Short-term restricted cash and cash equivalents | | 5,413 | | | 6,045 | | |

| Long-term restricted cash and cash equivalents | | 205 | | | 405 | | |

| Cash and cash equivalent margin deposits and guaranty funds | | 86,917 | | | 164,483 | | |

| Total | | $ | 95,412 | | | $ | 171,763 | | |

See accompanying notes.

Intercontinental Exchange, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1.Description of Business

Nature of Business and Organization

Intercontinental Exchange, Inc. is a provider of market infrastructure, data services and technology solutions to a broad range of customers including financial institutions, corporations and government entities. These products, which span major asset classes including futures, equities, fixed income and United States, or U.S., residential mortgages provide our customers with access to mission critical tools that are designed to increase asset class transparency and workflow efficiency. Our business is conducted through three reportable business segments:

•Exchanges: We operate regulated marketplaces for the listing, trading and clearing of a broad array of derivatives contracts and financial securities.

•Fixed Income and Data Services: We provide fixed income pricing, reference data, indices, analytics and execution services as well as global credit default swap, or CDS, clearing and multi-asset class data delivery solutions.

•Mortgage Technology: We provide a technology platform that offers customers comprehensive, digital workflow tools that aim to address the inefficiencies that exist in the U.S. residential mortgage market, from application through closing and the secondary market.

We operate marketplaces, technology and provide data services in the U.S., United Kingdom, or U.K., European Union, or EU, Canada, Asia Pacific and the Middle East.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP, pursuant to the rules and regulations of the Securities and Exchange Commission, or SEC, regarding interim financial reporting. Accordingly, the unaudited consolidated financial statements do not include all of the information and footnotes required by U.S. GAAP for complete financial statements and should be read in conjunction with our audited consolidated financial statements and related notes thereto for the year ended December 31, 2022. The accompanying unaudited consolidated financial statements reflect all adjustments that are, in our opinion, necessary for a fair presentation of results for the interim periods presented. We believe that these adjustments are of a normal recurring nature.

Preparing financial statements in conformity with U.S. GAAP requires us to make certain estimates and assumptions that affect the amounts that are reported in our consolidated financial statements and accompanying disclosures. Actual amounts could differ from those estimates. The results of operations for the six months and three months ended June 30, 2023 are not necessarily indicative of the results to be expected for any future period or the full fiscal year.

These statements include the accounts of our wholly-owned and controlled subsidiaries. All intercompany balances and transactions between us and our wholly-owned and controlled subsidiaries have been eliminated in consolidation. For consolidated subsidiaries in which our ownership is less than 100% and for which we have control over the assets and liabilities and the management of the entity, the outside stockholders’ interests are shown as non-controlling interests.

We have considered the impacts of macroeconomic conditions during the quarter, including interest rates, the inflationary environment, geopolitical events and military conflicts, including repercussions from the conflict in Ukraine, and the impact that any of the foregoing may have on the global economy and on our business. As of June 30, 2023, our businesses and operations, including our exchanges, clearing houses, listings venues, data services businesses and mortgage platforms, have not suffered a material negative impact as a result of these events. There continues to be uncertainty surrounding the current macroeconomic environment and the impact that it may have on the global economy and on our business.

Recently Adopted Accounting Pronouncements

During the six months ended June 30, 2023, there were no significant changes to the new and recently adopted accounting pronouncements applicable to us from those disclosed in Note 2 to the consolidated financial statements in Part II, Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2022, or the 2022 Form 10-K.

3. Pending Acquisition

Pending Acquisition of Black Knight, Inc.