UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM to

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

(

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Aggregate market value of Common Stock held by non-affiliates of the registrant as of June 30, 2021 was $

The number of outstanding shares of the registrant's Common Stock, par value $0.01 per share as of February 28, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement related to its 2022 Annual Stockholders’ Meeting to be filed within 120 days of the end of the fiscal year ended December 31, 2021, are incorporated by reference into Part III hereof. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, the registrant’s proxy statement is not deemed to be filed as part hereof.

Auditor’s PCAOB ID Number:

TABLE OF CONTENTS

2

Forward‑Looking Statements

This Annual Report on Form 10-K contains forward‑looking statements within the meaning of federal securities law. The forward‑looking statements may include, without limitation, statements concerning our current expectations, estimates, assumptions, and beliefs concerning future events, conditions, plans, and strategies that are not historical fact. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “could,” “will,” “future” and the negative of these or similar phrases.

Forward‑looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Although we believe the expectations reflected in the forward‑looking statements are reasonable, we can give no assurance that these expectations will prove to have been correct. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. Such forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties.

Many factors mentioned in “Item 1A. Risk Factors” will be important in determining future results. Should one or more of these risks or assumptions materialize, or should the underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. You are advised, however, to consult any further disclosures we make on related subjects in the quarterly, periodic and annual reports we file with the United States Securities and Exchange Commission (the “SEC”). All forward‑looking statements speak only as of the date made and we undertake no obligation to update or revise publicly any forward‑looking statements, whether as a result of new information, future events or otherwise.

The following text is qualified in its entirety by reference to the more detailed information and consolidated financial statements (including the notes thereto) appearing elsewhere in this Annual Report on Form 10-K. Unless the context otherwise requires, references in this Annual Report to “we,” “our,” “us,” “Victory” or the “Company” shall mean Victory Capital Holdings, Inc., (“VCH”) a Delaware corporation, and its wholly-owned subsidiaries. All references to years, unless otherwise noted, refer to our fiscal year which ends on December 31.

Note Regarding Third-Party Information

This Annual Report on Form 10-K includes certain market and industry data and forecasts related thereto that we rely on and refer to. We obtained this information and these statistics from sources other than us, which we have supplemented where necessary with information from publicly available sources and our own internal estimates. We use these sources and estimates and believe them to be reliable, but we cannot give any assurance that any of the projected results will be achieved.

Item 1. Business

Overview

We are a diversified global asset management firm with $183.7 billion in total assets under management (“AUM”) as of December 31, 2021. Our differentiated business model combines boutique investment qualities of traditional and alternative investment managers with the benefits of an integrated, centralized operating and distribution platform.

Victory Capital provides specialized investment strategies to institutions, intermediaries, retirement platforms and individual investors. With 12 autonomous Investment Franchises and a Solutions Platform, Victory Capital offers a wide array of investment products, including actively and passively managed mutual funds, rules-based and active exchange traded funds (“ETFs”), institutional separate accounts, variable insurance products (“VIPs”), Environmental, Social, and Governance (“ESG”) and impact investment strategies, alternative investments, private closed end funds, and a 529 Education Savings Plan. Victory Capital’s strategies are also offered through third-party investment products, including mutual funds, third-party ETF model strategies, retail separately managed accounts (“SMAs”) and unified managed accounts (“UMAs”) through wrap account

3

programs, Collective Investment Trusts (“CITs”), and undertakings for the collective investment in transferrable securities (“UCITs”). As of December 31, 2021, our Franchises and our Solutions Platform collectively managed a diversified set of 130 investment strategies for a wide range of institutional and retail clients and direct investors.

Our design logos and the marks “Victory Capital,” “Victory Capital Management,” “Victory Funds,” “VictoryShares,” “CEMP,” “CEMP Volatility Weighted Indexes,” “INCORE Capital Management,” “Integrity,” “Integrity Asset Management,” “Munder,” “Munder Capital Management,” “New Energy Capital,” “THB,” “The Munder Funds,” “NewBridge,” “NewBridge Asset Management,” “RS Funds,” “RS Investments,” “Sophus Capital,” “Sycamore Capital,” “Trivalent Investments,” “USAA Investments,” and “USAA Mutual Funds” are owned or licensed for a period of time by us or one of our subsidiaries. All other trademarks, service marks and trade names appearing in this report are the property of their respective owners.

Business History and Organization

Victory Capital Holdings, Inc. was formed in 2013 for the purpose of acquiring Victory Capital Management (“VCM”) and Victory Capital Services, Inc. (“VCS”) from KeyCorp. VCM is a U.S. registered investment adviser (“RIA”) managing assets through open-end mutual funds, institutional separate accounts, CITs, wrap account programs, UCITs, private funds, and ETFs. VCM also provides mutual fund administrative services for the Victory Portfolios, Victory Variable Insurance Funds and the mutual fund series of the Victory Portfolios II (collectively, the “Victory Funds”), a family of open-end mutual funds; and, VictoryShares (the Company’s ETF brand), as well as USAA branded investment products, which includes the USAA Mutual Fund Trust, a family of open-end mutual funds (the “USAA Funds”). In 2021, the Company acquired WestEnd Advisors (“WestEnd”), which maintains its own RIA, which is an affiliate RIA that receives certain services from VCM. VCM employs all the Company’s United States investment professionals across all 12 Franchises and its Solutions Platform. VCM’s wholly owned subsidiaries include RS Investment Management (Singapore) Pte. Ltd., RS Investments (Hong Kong) Limited, and RS Investments (UK) Limited. VCS is registered with the SEC as an introducing broker-dealer and serves as distributor and underwriter for the Victory Funds and USAA Funds and for municipal fund securities issued by the Nevada College Savings Trust Fund under the USAA 529 Education Savings Plan. VCS also serves as placement agent for certain private funds managed by VCM. VCH indirectly holds Victory Capital Transfer Agency, Inc. (“VCTA”), a transfer agent registered with the SEC that acts as transfer agent for the USAA Funds.

Our Growth Strategy

We have a purposeful strategy designed to achieve continued profitable growth and success for our Company, our employees, and our shareholders. The growth we pursue is both organic and inorganic.

Organic Growth – We seek to grow organically by offering strategies that are value-added and solution oriented to investment portfolios with strong performance track records over the long term. A key driver of our growth strategy lies in enhancing the strength of our existing Franchises. We primarily do this by providing them with access to our operating platform, technology, centralized distribution, marketing, and other support functions. Largely unencumbered by the burdens of administrative and operational tasks, our investment professionals can focus on delivering investment excellence and maintaining strong client relationships. We also help our Franchises through new product development and product packaging. We believe we are well positioned to help our Franchises grow their product offerings and diversify their client base, with the ability to offer their strategies in multiple investment vehicles to meet the unique needs of diverse clients.

We continually evaluate and make investments to improve our operating platform and our Company. Recent initiatives include investments in data and analytics, technology, distribution, and marketing to enhance organic growth in our direct investor business and increase efficiencies in our other distribution channels.

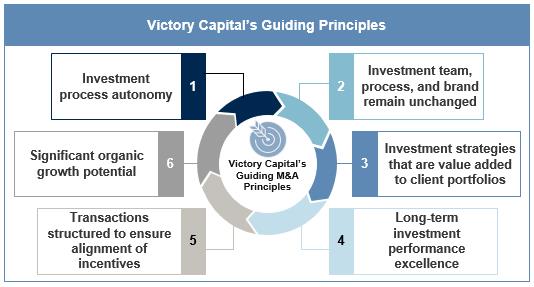

Inorganic Growth – We supplement our organic growth through strategic acquisitions. We primarily seek to acquire investment management firms that will add high quality investment teams, enhance our growth and financial profile, improve our diversification by asset class and investment strategy, achieve our integration expectations, expand our distribution capabilities, optimize our use of technology and improve our operating platform.

4

One of our key advantages in a competitive mergers and acquisition environment is our ability to provide access to multiple distribution channels. Our centralized distribution and marketing platform drive organic growth at our acquired Franchises both by opening new distribution channels and penetrating deeper into existing ones. This support received from our sales and marketing professionals allows our investment professionals to focus exclusively on delivering investment excellence.

Since our management‑led buyout with Crestview Partners II GP, L.P. (“Crestview GP”) from KeyCorp in 2013, we have successfully closed seven acquisitions, made two minority investments, and through December 31, 2021, grown our AUM more than 10-fold from $17.9 billion to $183.7 billion. We understand the need to execute transactions while minimizing disruption to the investment teams and to the client experience. Our team is very experienced and has a history of success in meeting those objectives. Previous acquisitions have evolved and diversified our products resulting in a mix of compelling investment strategies in asset classes where we can be successful and earn sustainable management fees.

1Strategic minority investments in 2016 and 2018, exited with a gain in 2019

2Strategic minority investment

We regularly evaluate potential acquisition candidates and maintain a strong network of industry participants and advisors who provide opportunities to establish potential target relationships and source transactions. Our management team leads and participates in our acquisition strategy, leveraging their many years of experience actively operating our Company on a day‑to‑day basis to successfully source, execute, integrate, and ultimately operate acquired businesses.

We believe, based on our successful acquisition track record, that there is a significant opportunity for us to continue to profitably grow through additional acquisitions, as industry dynamics have expanded the universe of potential acquisition targets.

Alternative Investments – In 2021, we launched our alternative investments platform with the acquisition of New Energy Capital (“NEC”). This broadened and further diversified our product offering into private markets and added a new growth vertical. Given our multi-faceted distribution channels, combined with our ability to develop investment vehicles to deliver these strategies, we are ideally situated to play a meaningful role in democratizing access to alternative investments for retail investors.

With attractive fee rates, margins, longer capital commitments compared with our liquid products, and less likelihood of being disintermediated by non-active strategies, we remain interested in adding additional alternative investment capabilities. We are committed to maintaining the same guiding principles with alternative Investment Franchises that led to success with our traditional Investment Franchises.

5

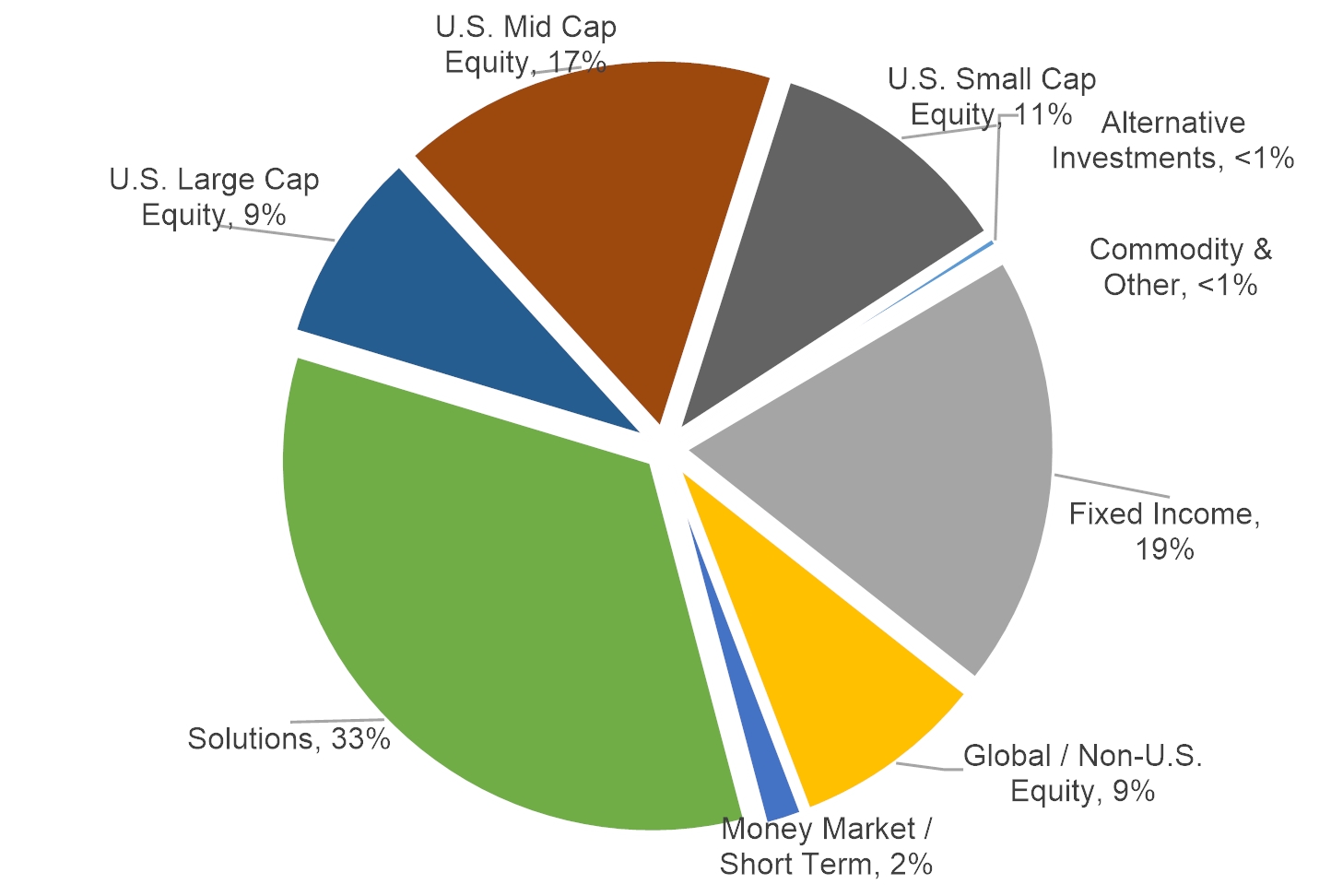

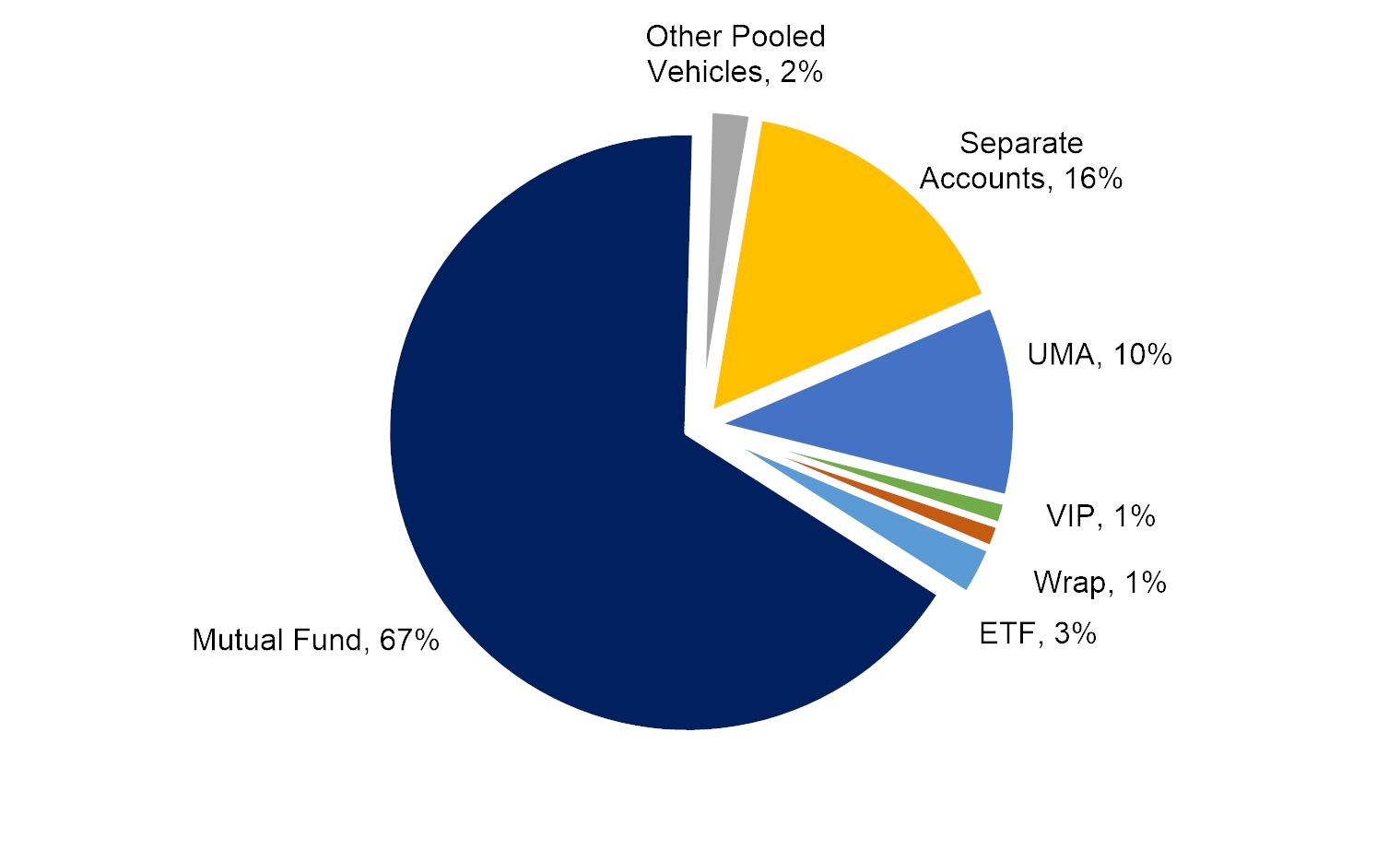

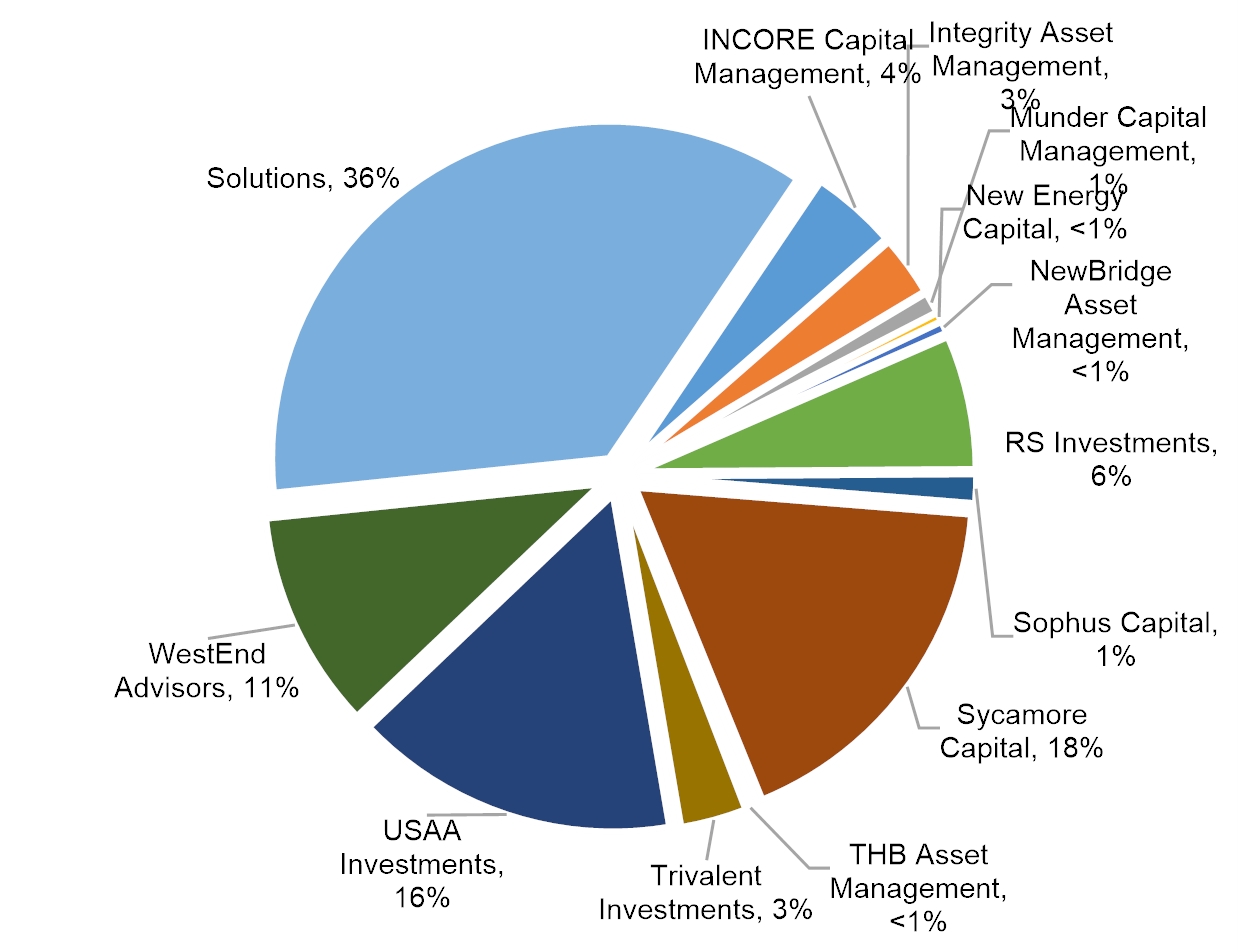

Diversification Strategy

We offer an array of equity, fixed income, investment models, alternative investments, closed end private funds, and solutions strategies that encompass a diverse spectrum of market capitalization segments, industry sectors, investment styles and approaches. We believe that these strategies are positioned to attract positive net flows and sustainable fee rates over the long term and provide us with a next generation investment management platform. As illustrated below, as of December 31, 2021, our current business is well diversified from multiple perspectives, including by asset class, by investment vehicle, and by Franchises and our Solutions Platform.

Asset Class Mix

6

Vehicle Mix

Franchise/Platform Mix

Data as of December 31, 2021.

Within individual asset classes and strategies, our Franchises employ different investment approaches. This diversification reduces the correlation between return streams generated by multiple Franchises investing within the same asset class. For example, we have two Franchises (Trivalent and Sophus) focused on Emerging Markets within global/non‑U.S. equity, each with a different investment approach. Trivalent’s investment team primarily focuses on quantitative analysis for stock selection, combined with some fundamental analysis. Sophus employs a front‑end quantitative screen to first rank stocks, then further applies fundamental research to make its investment decisions. Due to the differences in investment approaches, each Franchise has a different return profile for investors in different market environments while maintaining desired asset class exposure.

7

Our multi‑channel distribution capabilities provide another degree of diversification, with approximately 37% of our AUM from direct investor clients, 36% from retail clients, and 27% from institutional clients, as of December 31, 2021. Within these channels, clients are further diversified among intermediary (broker dealer and RIAs) platforms, sub advisory relationships, corporate and public entities, insurance companies, 529 Education Saving Plan participants, Taft-Hartley plans, endowments, and family offices. We believe this broad diversification of customers has a stabilizing effect on revenue, as various types of investors have unique demand patterns and respond differently to trends and market cycles.

Our Investment Franchises

As of December 31, 2021, we owned 100% of the equity in each of our 12 Investment Franchises. With no Investment Franchise accounting for more than 18% of total AUM, we are well diversified across asset classes and investment approaches. Our Franchises are independent from one another from an investment process perspective, maintain their own separate brands and logos, which have been built over time, and are led by dedicated Chief Investment Officers (“CIOs”). We customize each Franchise’s integration with our centralized operating platform to optimize their investment processes.

INCORE Capital Management – INCORE Capital Management is comprised of three teams managing convertible bond strategies, short-term U.S. government securities, and niche and customized fixed income strategies focusing on exploiting structural inefficiencies in the U.S. fixed income markets. INCORE conducts extensive research that includes identifying slower prepayment rates on mortgages, market inefficiencies along areas of the yield curve, and proprietary quantitative credit quality modeling. INCORE is based in Birmingham, MI, and Brooklyn, OH and managed $7.5 billion in AUM as of December 31, 2021. INCORE’s investment team consists of 14 professionals with an average industry experience of approximately 21 years.

Integrity Asset Management – Integrity Asset Management utilizes a dynamic value‑oriented approach to U.S. mid‑ and small‑capitalization companies. Integrity conducts fundamental stock research to find attractive companies that have compelling discounts to the prevailing market conditions. Integrity is based in Rocky River, OH, and managed $5.3 billion in AUM as of December 31, 2021. Integrity’s investment team consists of 13 professionals with an average industry experience of approximately 22 years.

Munder Capital Management – Munder Capital Management has an experienced team utilizing a “Growth‑at‑a‑Reasonable‑Price” strategy in the U.S. equity markets designed to generate consistently strong performance over a market cycle. Munder performs extensive fundamental research in order to find attractive growth companies that it expects will exceed market expectations. Of the companies with independently determined growth attributes, valuation is applied to find the most inexpensive growth companies. Munder is based in Birmingham, MI, and managed $1.9 billion in AUM as of December 31, 2021. Munder’s investment team consists of eight professionals with an average industry experience of approximately 28 years.

New Energy Capital – NEC manages alternative investments in private closed end funds, with investment periods ranging between five and 10 years. NEC was one of the first investors to focus on clean energy and infrastructure investments of small-and mid-sized clean energy infrastructure projects and companies. NEC’s investments provide growth capital in all forms across the capital structure from credit to equity, as well as hybrid financing arrangements.

The investment team has extensive experience in all aspects of clean infrastructure investing, including evaluating energy markets, projects, and technologies; developing and financing domestic and international power generation, fuels, wastewater management, and distributed generation facilities; founding and managing renewable energy companies; and understanding the public policies that currently shape the landscape for the energy and related infrastructure markets. Based in Hanover, NH, NEC managed $0.8 billion as of December 31, 2021. NEC’s investment team consists of 10 investment professionals with an average industry experience of approximately 13 years.

NewBridge Asset Management – NewBridge Asset Management applies a high conviction growth‑oriented strategy focusing on U.S. large‑capitalization companies experiencing superior long‑term growth rates with strong management teams. Most of NewBridge’s team has worked together since 1996 doing fundamental research on high growth companies. NewBridge portfolios usually holds between 25 and 35 securities.

8

NewBridge is based in New York, NY, and managed $1.0 billion in AUM as of December 31, 2021. NewBridge’s investment team consists of four professionals with an average industry experience of approximately 25 years.

RS Investments – RS Investments is made up of three distinct investment teams: (i) RS Value, (ii) RS Growth and (iii) RS Global. RS Value and RS Growth apply an original and proprietary fundamental approach to investing in value and growth‑oriented U.S. equity strategies. The RS Value and RS Growth teams conduct hundreds of company research meetings each year. RS Global utilizes a highly disciplined quantitative approach to managing core‑oriented global and international equity strategies. RS Investments is based in San Francisco, CA, and managed $11.8 billion in AUM as of December 31, 2021. RS Investments’ three investment teams consist of 21 professionals with an average industry experience of approximately 22 years.

Sophus Capital – Sophus Capital utilizes a disciplined quantitative process that accesses market conditions in emerging equity markets and rank orders attractive companies that are further researched from a fundamental basis. Sophus’ team members travel to companies to conduct fundamental research. Sophus is based in Des Moines, IA, with employees in London, Hong Kong, and Singapore, and managed $2.5 billion in AUM as of December 31, 2021. Sophus’ investment team consists of 10 professionals with an average industry experience of approximately 21 years.

Sycamore Capital – Sycamore Capital applies a quality value‑oriented approach to U.S. mid‑ and small‑ capitalization companies. Sycamore conducts fundamental research to find companies with strong high‑quality balance sheets that are undervalued versus comparable high-quality companies. Sycamore is based in Cincinnati, OH, and managed $32.3 billion in AUM as of December 31, 2021. Sycamore’s investment team consists of 11 professionals with an average industry experience of approximately 18 years.

THB Asset Management – Founded in 1982, and formerly known as Thomson, Hortsmann & Bryant, THB Asset Management (“THB”) manages equity assets in capacity constrained, micro-cap, small-cap, and mid-cap asset classes, including strategies managing U.S., international and global portfolios. THB was an early adopter of introducing ESG factors into their investment process and security selection. THB serves clients in the U.S. and in Europe and Australia. Based in Norwalk, CT, THB’s investment team is comprised of eight professionals with an average industry experience of approximately 13 years.

Trivalent Investments – Trivalent Investments utilizes a disciplined approach to stock selection across large to small companies in the international and emerging markets space. Trivalent’s investment strategy is primarily a proprietary quantitative process that drives stock selection across various countries. Trivalent frequently conducts reviews of stock selection rankings within a portfolio construction and risk management context in order to isolate performance to stock selection. Trivalent is based in Boston, MA, and managed $5.8 billion in AUM as of December 31, 2021. Trivalent’s investment team consists of seven professionals with an average industry experience of approximately 25 years.

USAA Investments – The team at USAA Investments utilizes a rigorous process rooted in a team-oriented approach among portfolio managers, research analysts and traders. Their taxable and tax-exempt portfolios are built bond by bond using a fundamental, bottom up, credit and yield-focused analysis. USAA Investments is based in San Antonio, TX, and managed $28.6 billion in AUM as of December 31, 2021. USAA’s investment team consists of 39 professionals with an average industry experience of approximately 24 years.

WestEnd Advisors – WestEnd, is a third-party ETF model strategist providing turnkey, core model allocation strategies serving as holistic solutions and complementary sources of alpha. WestEnd is based in Charlotte, NC, and had assets under advisement (“AUA”) and AUM totaling $19.3 billion as of December 31, 2021. The WestEnd team consists of 25 members averaging approximately 12 years of industry experience.

Solutions Platform

Our Solutions Platform consists of multi‑asset, multi-manager, quantitative, rules-based, factor-based, and customized portfolios. These strategies are designed to achieve specific return characteristics, with products that include values-based and thematic outcomes and exposures. We offer our Solutions Platform through a variety of vehicles, including separate accounts, mutual funds, UMA accounts, rules-based and active ETFs under our VictoryShares ETF brand. Like our Franchises, our Solutions Platform is operationally integrated and supported by our centralized distribution, marketing and operational support functions. Our Solutions Platform

9

is based in San Antonio, TX, and managed $66.3 billion in AUM as of December 31, 2021. The Solutions Platform team consists of 13 professionals with an average industry experience of approximately 15 years.

Our Products and Investment Performance

As of December 31, 2021, our 12 Franchises and Solutions Platform offered 130 investment strategies with the majority consisting of fixed income, U.S. small‑ and mid‑cap equities, global/non‑U.S. equities and solutions. These asset classes collectively comprised 89% of our $183.7 billion of total AUM, and 91% of long-term AUM, as of December 31, 2021.

Product Mix – Our investment strategies are offered through open‑end mutual funds, institutional separate accounts, CITs, private closed end funds, UCITs, other pooled vehicles, SMAs and UMAs through wrap separate account programs, ETFs, and ETF model strategies. Our product mix could expand, as we can add investment vehicles to strategies offered by our Franchises.

Investment Performance – Our Franchises have established a long track record of benchmark‑relative outperformance, including prior to their acquisition by us. As of December 31, 2021, 77% of our strategies by AUM had returns in excess of their respective benchmarks over a ten‑year period, 82% over a five‑year period, 77% over a three‑year period, and 64% over a one-year period. On an equal‑weighted basis, 71% of our strategies have outperformed their benchmarks over a ten‑year period, 67% over a five‑year period, 60% over a three‑year period, and 70% over a one-year period. We consider both the AUM‑weighted and equal‑weighted metrics in evaluating our investment performance. The advantage of the AUM‑weighted metric is that it reflects the investment performance of our Company as a whole, indicating whether we tend to outperform our benchmarks for the assets we manage. The disadvantage is that the metric fails to capture the overall effectiveness of our individual investment strategies; it does not capture whether most of our strategies tend to outperform their respective benchmarks. Conversely, the equal‑weighted metric reflects the overall effectiveness of our individual investment strategies but fails to capture the investment performance of our Company as a whole.

The table below sets forth our 10 largest strategies by AUM as of December 31, 2021 and their average annual total returns compared to their respective benchmark index over the one‑, three‑, five‑ and 10‑year periods ended December 31, 2021. These strategies represented approximately 42% of our total AUM as of December 31, 2021.

|

Strategy/Benchmark Index |

|

1 year |

|

3 years |

|

5 years |

|

10 years |

|

|

Sycamore Mid Cap Value |

|

32.68 |

% |

23.20 |

% |

14.61 |

% |

15.67 |

% |

|

Russell Midcap Value |

|

28.34 |

% |

19.62 |

% |

11.22 |

% |

13.44 |

% |

|

Excess Return |

|

4.34 |

% |

3.58 |

% |

3.39 |

% |

2.23 |

% |

|

Victory US 500 |

|

27.80 |

% |

26.88 |

% |

18.92 |

% |

16.77 |

% |

|

S&P 500 |

|

28.71 |

% |

26.07 |

% |

18.47 |

% |

16.55 |

% |

|

Excess Return |

|

(0.91) |

% |

0.81 |

% |

0.45 |

% |

0.22 |

% |

|

Sycamore Small Cap Value |

|

26.63 |

% |

19.69 |

% |

12.38 |

% |

14.60 |

% |

|

Russell 2000 Value |

|

28.27 |

% |

17.99 |

% |

9.07 |

% |

12.03 |

% |

|

Excess Return |

|

(1.64) |

% |

1.70 |

% |

3.31 |

% |

2.57 |

% |

|

USAA Income |

|

0.83 |

% |

6.96 |

% |

5.19 |

% |

4.60 |

% |

|

Bloomberg Barclays US Aggregate |

|

(1.54) |

% |

4.79 |

% |

3.57 |

% |

2.90 |

% |

|

Excess Return |

|

2.37 |

% |

2.17 |

% |

1.62 |

% |

1.70 |

% |

|

Trivalent International Small-Cap Equity |

|

13.47 |

% |

19.48 |

% |

13.60 |

% |

13.55 |

% |

|

S&P Developed ex-US SmallCap |

|

9.15 |

% |

15.52 |

% |

10.55 |

% |

9.89 |

% |

|

Excess Return |

|

4.32 |

% |

3.96 |

% |

3.05 |

% |

3.66 |

% |

|

USAA Tax Exempt Intermediate-Term |

|

2.61 |

% |

5.09 |

% |

4.65 |

% |

4.14 |

% |

|

Bloomberg Barclays Municipal Bond Blend 1-15 Yr. |

0.86 |

% |

3.98 |

% |

3.57 |

% |

3.05 |

% |

|

|

Excess Return |

|

1.75 |

% |

1.11 |

% |

1.08 |

% |

1.09 |

% |

|

Victory NASDAQ-100 |

|

27.49 |

% |

38.37 |

% |

28.65 |

% |

23.14 |

% |

10

|

NASDAQ-100 |

|

27.51 |

% |

38.34 |

% |

28.63 |

% |

23.15 |

% |

|

Excess Return |

|

(0.02) |

% |

0.03 |

% |

0.02 |

% |

(0.01) |

% |

|

RS Small Cap Growth |

|

(9.81) |

% |

20.70 |

% |

17.64 |

% |

16.38 |

% |

|

Russell 2000 Growth |

|

2.83 |

% |

21.17 |

% |

14.53 |

% |

14.14 |

% |

|

Excess Return |

|

(12.64) |

% |

(0.47) |

% |

3.11 |

% |

2.24 |

% |

|

RS Large Cap Growth |

|

21.39 |

% |

29.79 |

% |

22.35 |

% |

18.73 |

% |

|

Russell 1000 Growth |

|

27.60 |

% |

34.08 |

% |

25.32 |

% |

19.79 |

% |

|

Excess Return |

|

(6.21) |

% |

(4.29) |

% |

(2.97) |

% |

(1.06) |

% |

|

USAA Intermediate Term Bond |

|

1.49 |

% |

7.64 |

% |

5.78 |

% |

5.44 |

% |

|

Bloomberg Barclays US Aggregate |

|

(1.54) |

% |

4.79 |

% |

3.57 |

% |

2.90 |

% |

|

Excess Return |

|

3.03 |

% |

2.85 |

% |

2.21 |

% |

2.54 |

% |

A high percentage of our mutual fund and ETF assets have four- or five-star Morningstar ratings. As of December 31, 2021, 43 of our Victory Capital mutual funds and ETFs, with Morningstar ratings, earned ratings of four or five stars overall and 64% of our mutual fund and ETF AUM were rated four or five stars overall by Morningstar. Over a three‑year and five‑year basis, 61% and 62% of our fund AUM achieved four- or five-star ratings, respectively.

Competitive Strengths

We believe we have significant competitive strengths that position us for sustained growth and shareholder value creation over the long term.

Integrated Model Providing Centralized Distribution, Marketing, and Support Functions to Investment Franchises, which maintain complete Investment Autonomy – Our highly integrated model allows us to achieve benefits from both our substantial scale and the focus of our specialized investment managers. Our Franchises retain investment autonomy while benefiting from our centralized operating platform. We have demonstrated an ability to incorporate our Franchises onto our flexible infrastructure without significantly increasing incremental fixed costs, which is a key component to the scalability of our business model. This structure enables our Franchises to focus their efforts on the investment process, providing them with a scaled platform to enhance their investment performance and consequently their growth prospects. Centralized operations allow our Franchises to customize their desired investment support functions in ways that are best suited for their investment workflow. Through our unified distribution platform, our Franchises can efficiently sell their products to institutional investors, retirement plans, wealth managers, as well as through retail and retirement intermediaries of all sizes, where it can be challenging for smaller managers to gain access, and directly to investors.

Within our model, each Franchise retains its own brand and logo, which has been built over time. Unlike other models with unified branding, there is no requirement for newly acquired Franchises to adjust their product set due to pre‑existing products on our platform; they are marketed under their own brand as they were previously. Because of this dynamic, we have the flexibility to add new Franchises either to gain greater exposure to certain asset classes or increase capacity in places where we already have exposure.

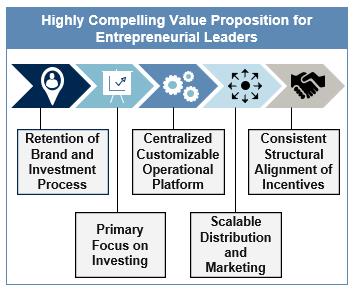

Proven Acquirer with Compelling Value Proposition – We believe our platform allows us to continue to be a strategic acquirer within the investment management industry, providing us with an opportunity to further grow and scale our business. Through numerous transactions, we have demonstrated an ability to successfully source, execute and integrate new Franchises.

We believe our unique business model is compelling for potential acquisition prospects. Under our model, Franchises retain the brands they have built as well as autonomy over their investment decisions, while simultaneously benefiting from the ability to leverage our centralized distribution, marketing and operations platform. Our model reduces the administrative burdens borne by our Investment Franchises and allows them instead to focus on the investment process, which we believe can enhance their investment performance. By offering a platform on which Franchises can focus on their core competencies, grow their client base faster and participate in a revenue share program, we believe we are providing an attractive proposition. Furthermore, we

11

believe equity in Victory Capital is attractive to Franchise investment personnel, as these personnel receive the advantage of sharing in the potential upside of the entirety of our diversified investment management business.

Because we integrate a significant portion of most of our Franchises’ distribution, operational and administrative functions, we have been able to extract significant expense synergies from certain acquisitions, enabling us to create greater value from transactions.

We will seek to continue to augment our differentiated investment management platform by focusing on acquisition candidates that can make our investment platform better, that expand our distribution or investment capabilities, that optimize our operating platform and achieve our integration and synergy expectations.

Portfolio of Investment Strategies with Potential for Outperformance – In assembling our portfolio of Franchises, we have selected investment managers offering strategies in asset classes where active managers have shown an established track record of outperformance relative to benchmarks through security and sector selection, and portfolio construction. We continue to build our platform to address the needs of clients who would like exposure to asset classes that have potential for alpha generation. We find that macro industry trends of asset flows moving from actively managed strategies to passive ones are less pronounced in certain of our asset classes.

Diversified Platform Across Investment Strategies, Franchises and Client Type – We have strategically built an investment platform that is diversified by investment strategy, Franchise, and client type. Within each asset class, Franchises with overlapping investment mandates still contribute to our diversification by pursuing different investment philosophies and/or processes. For example, U.S. mid cap equities, which accounted for approximately 17% of total AUM as of December 31, 2021, consists of five Franchises, each following a different investment strategy. We believe the diversity in investment styles reduces the correlation between the return profiles of strategies within the same asset class, and consequently provides an additional layer of diversification of AUM and revenue stability.

Our AUM also is well diversified at the Franchise level, with no Franchise accounting for more than 18% of total AUM. Furthermore, we believe our Franchises’ brand independence reduces the impact of each individual Franchise’s performance on clients’ perceptions of the other Franchises. The distribution of AUM by Franchise and the number of Franchises, as well as succession planning, mitigates the level of key man risk typically associated with investment management businesses.

We believe our client base serves as another important diversifying element, as different client segments have shown to have distinct characteristics, including asset class and product preferences, sales and redemptions trends, and exposure to secular trends. We strive to maintain a balance between direct investor, retail clients, and institutional clients with 37%, 36% and 27% of our AUM as of December 31, 2021 in each of these channels, respectively. We also have the capability to deliver our strategies in investment vehicles designed to

12

meet the needs and preferences of investors in each channel. These investment vehicles include actively and passively managed open-end mutual funds with channel‑specific share classes, rules-based and active ETFs, third-party ETF model strategies, SMAs, UMAs, VIPs, CITs, wrap account programs, UCITs, alternative investments, private closed end funds, and a 529 Education Savings Plan. If a strategy is currently not offered in the wrapper of choice for a client, we have the infrastructure and ability to create a new investment vehicle, which helps our Franchises further diversify their client bases.

Attractive Financial Profile – Our revenues are recurring in nature, as they are based on the level of client assets we manage. Most of our strategies are in asset classes that require specialized skill, are in demand and typically command attractive fee rates. With the growth of our Solutions Platform and third-party ETF model strategies, our average fee rate is likely to decline as those businesses continue to grow and represent an increasing proportion of our total AUM. Despite their lower average fee rates, by managing these competitively priced strategies on our integrated platform we can earn higher than our average margins on these products.

Because we largely outsource our middle‑ and back‑office functions, as well as technology support, we have relatively minimal capital expenditure requirements. Our integrated platform allows us the ability to make investments that can benefit each Franchise and our Solutions Platform. Approximately two‑thirds of our operating expenses are variable in nature, consisting of the incentive compensation pool for employees, sales commissions, third‑party distribution costs, sub‑advising and the fees we pay to certain of our vendors. This automatic flexing of our expense base helps to support profitability throughout various market cycles.

We have identified three primary net income growth drivers; (i) we grow our AUM organically through inflows into our strategies and the market appreciation of those strategies; (ii) we have a proven ability to grow via strategic and synergistic acquisitions; and (iii) we have constructed a scalable and efficient platform.

Economic and Structural Alignment of Interests Promotes Ownership Culture – Through our revenue share compensation model for our Franchises and broad employee ownership, we have structurally aligned our employees’ interests with those of our clients and other shareholders and have created an ownership culture that encourages employees to act in the best interests of clients and our Company shareholders, as well as to think long term. We believe the high percentage of employee ownership creates a collective alignment with our success. Additionally, our employees invest in products managed by our Franchises and Solutions Platform, providing direct alignment with the interests of our clients. As of December 31, 2021, our employees beneficially owned approximately 20% of our shares. In addition to being aligned with our financial success through their equity ownership, our current employees collectively have invested approximately $250.0 million in products we manage as of December 31, 2021.

We directly align the compensation paid to our investment teams with the performance of their respective Franchises by structuring formula‑based revenue sharing on the products they manage. We believe that compensation based on revenue rather than profits encourages investment professionals to focus their attention on investment performance, while encouraging them to provide good client service, focus on client retention and attract new assets. We believe the formula‑based, client‑aligned nature of our revenue sharing reduces complexity and fosters a culture of transparency where Franchises understand how, and on what terms, they are being measured to earn compensation.

Integrated Distribution, Marketing and Operations

The centralization of our distribution, marketing and operational functions is a key component in our model, allowing our Franchises to focus on their core competencies of security and sector selection, portfolio construction, and client service. In addition, we believe it provides our Franchises with the benefits of operating at scale, providing them with access to a larger number of clients as well as a more streamlined cost structure. As of December 31, 2021, we had 485 full-time employees with 174 in investment management, 218 in sales and marketing roles and 93 in management and support functions.

Our centralized distribution and marketing functions lead the sales effort for our institutional, retail intermediary, and direct investor channels. Our sales teams are staffed with accomplished professionals that are given specific training on how to position each of our strategies. Our distribution teams have historically focused on developing strategic long-term relationships with institutional consultants, institutional asset owners, retail and retirement intermediaries, RIAs, Family Offices, and bank trust departments. Complementing these

13

relationships, we use data extensively to enhance the effectiveness of our distribution teams. Investments in data packs from intermediaries, artificial intelligence initiatives, and predictive analytics—used to determine specific financial advisors’ propensities to buy or sell products—further enhance efficiencies.

These relationships can enhance our platform’s overall reach and allow our Franchises and Solutions Platform to access more clients. To ensure high levels of client service, our sales teams liaise regularly with product specialists at our Franchises. The specialists are tasked with responding to institutional client and retail inquiries on product performance and educating prospective investors and retail partners in coordination with the relevant internal sales team members. Our distribution and marketing professionals collaborate closely with our Franchises’ product specialists in order to attract new clients while also servicing and generating additional sales from existing clients.

Direct Investor Business – In 2020, we launched a new digital platform to directly serve investors which features a client-centric modern design. Visitors to the site are presented with channel-specific content, useful investment tools and calculators, and timely investment insights from the Company’s investment experts. At our direct investor business contact center, we have approximately 200 sales and service professionals focused on assisting our direct investors (the “Investors”). They engage with thousands of investors everyday via phone, chat or email depending on the investor’s preference. We also have a mobile application that streamlines service for investors and enhances internal efficiency. Through these interactions we provide Investors with account servicing, portfolio reviews, college planning assistance and investment guidance at no additional cost to the Investor. Many of our direct investor business contact center professionals are Financial Industry Regulatory Authority (“FINRA”) licensed, so they are well qualified to serve the Investors’ investment needs. We have a referral agreement in place with USAA to ensure all USAA members who are interested in investing directly in a USAA Mutual Fund, certain Victory Mutual Funds, or the USAA 529 Education Savings Plan, or interacting with us otherwise, are seamlessly directed to us, either by phone or online.

Institutional Sales – Our institutional sales team attracts and builds relationships with institutional clients, a wide range of institutional consultants and mutual fund complexes and other organizations seeking sub‑advisers. Our institutional clientele includes more than 400 corporations, public funds, non‑profit organizations, Taft‑Hartley plans, sub‑advisory clients, international clients, sovereign wealth funds, and insurance companies. Our institutional sales and client‑service professionals manage existing client relationships, serve consultants and prospects and/or focus on specific segments. They have extensive experience and a comprehensive understanding of our investment activities. Our client‑facing institutional sales professionals have an average of more than 20 years of industry tenure.

Retail Sales – Our retail sales team includes regional external wholesalers, retirement specialists, RIA specialists, national account specialists, all of whom are supported by an internal sales desk. We also have a team of nine distribution professionals specializing in the sale of third-party ETF model strategies. Additionally, we have a growing team focused on RIA, Bank Trust & Multi Family Offices with exceptional product knowledge to enhance the growth in this sub-channel within our retail sales. In the retail channel, we focus on gathering assets through intermediaries, such as banks, broker‑dealers, wirehouses, retirement platforms and RIA networks. We offer mutual funds, ETFs, third-party ETF models, and separately managed wrap and unified managed accounts on intermediary and retirement platforms. We have agreements with many of the largest platforms in our retail channel, which has provided an opportunity to place our retail products on those platforms. Further, to enhance our presence on large distribution platforms, we have focused our efforts on servicing intermediary home offices and research departments. These efforts have led to strong growth in platform penetration, as measured by investment products on approved and recommended lists, as well as our inclusion in model portfolios. This penetration provides the opportunity for us to sell more products through distribution platforms. We have several products on the research recommended/model portfolios of the top U.S. intermediary platforms. We also have several products on the recommended list of the top retirement platforms.

Marketing – Our distribution efforts are supplemented by our marketing function, which is primarily responsible for enhancing the visibility and quality of our portfolio of brands. They are specifically tasked with managing corporate, Franchise and Solutions Platform branding efforts, database management, the development of marketing materials, our website, digital marketplace, digital marketing and social media efforts, and the publishing of white papers. They are also a key component in our responses to requests for proposals received from prospective clients.

14

Operations – Our highly centralized operations functions provide our Franchises and Solutions Platform with the support they need so that they can focus on their investment processes. Our Investment Franchises share operating functions such as trading platforms, risk and compliance, middle- and back‑office support, technology, finance, human resources, accounting and legal. Although our operations are highly centralized, we do allow our Franchises a degree of customization with respect to their desired investment support functions, which we believe helps them maintain their unique investment processes and minimize disruptions.

We outsource certain middle‑ and back‑office activities, such as sub-transfer agent, trade settlement, portfolio analytics, custodian reconciliation, portfolio accounting, corporate action processing, performance calculation and client reporting, to scaled, recognized service providers, who provide their services to us on a variable‑cost basis. Systems and processes are customized as necessary to support our investment processes and operations. We maintain relationships with multiple vendors for most of our outsourced functions, which we believe mitigates vendor‑specific risk. We also have cyber and information security, business continuity and data privacy programs in place to help mitigate risk.

Outsourcing these functions enables us to grow our AUM, both organically and through acquisitions, without the incremental capital expenditures and working capital that would typically be needed. Under our direction and oversight, our outsourced model enhances our ability to integrate our acquisitions, as we are experienced in working with our vendors to efficiently bring additional Franchises onto our platform in a cost‑efficient manner.

We believe both the scalability of our business and our cost structure, in which approximately two‑thirds of our operating expenses are variable, drives industry-leading margins and facilitates free cash flow conversion. Additionally, we believe having most of our expenses tied to AUM and the number of client accounts provides downside margin protection should there be sustained net outflows or adverse market conditions.

Competition

Our investment products are sold in the traditional institutional segments, via intermediary and retirement distribution platforms, and directly to investors. We face competition with other investment firms in attracting and retaining assets. Additionally, we compete with other acquirers of investment management firms, including independent, integrated investment management firms and multi‑boutique businesses, insurance companies, banks, private equity firms and other financial institutions.

We compete with other managers offering similar strategies. Some of these organizations have greater financial resources and capabilities than we can offer and have strong performance track records. We effectively compete with other investment management firms for client assets based on the following primary factors: (i) our investment performance track record of delivering alpha; (ii) the specialized nature of our investment strategies; (iii) fees charged; (iv) access to distribution channels; (v) client service; and (vi) our employees’ alignment of interests with investors.

We compete with other potential acquirers of investment management firms primarily on the basis of the following factors: (i) the strength of our distribution relationships; (ii) the value we add through our shared distribution, marketing and operations platforms; (iii) the investment autonomy Franchises retain post acquisition; (iv) the tenure and continuity of our management and investment professionals; and (v) the value that can be delivered to the seller through realization of synergies created by the combination of the businesses.

Our ability to continue to compete effectively will also depend upon our ability to retain our current investment professionals and employees and to attract highly qualified new investment professionals and employees. For additional information concerning the competitive risks that we face, refer to “Risk Factors—Industry Risks—The investment management industry is intensely competitive.”

Human Capital

We have created a strong alignment of interests with clients and shareholders through employee ownership, our Franchise revenue share structure, and employee investments in our products. Notably, a significant number of our employee shareholders acquired their equity in connection with the management‑led buyout with Crestview GP from KeyCorp, as well as in connection with the acquisitions of RS and Munder. We believe the

15

opportunity to own equity in a well‑diversified investment management company promotes long-term thinking and client alignment and is attractive, both to existing employees and those who join as part of acquisitions. We principally compensate our investment professionals through a revenue share program, which we believe further incentivizes our investment professionals to focus on investment performance, while simultaneously minimizing potential distractions from an expense allocation process that would be involved in a profit‑sharing program. We believe the combination of these mechanisms promotes long‑term thinking and enhances both the client experience and the creation of value for our shareholders.

Our senior management team, Franchises’ CIOs and sales leaders are highly experienced in the industry, each bringing significant expertise to his or her role, having tenures on average of more than 20 years.

As an asset management firm, we are in the human capital business. As such, we value and appreciate our most important asset—our people. We employ “owners”, not employees. Accordingly, we strive to offer competitive compensation and employee benefits to all employees. We want them to own their contribution to Victory Capital’s success. In recognition of this mission, Victory Capital has established an equity awards program that most employees participate in. As of December 31, 2021, we had 485 employees, with more than 70% holding ownership interests in our Company that totaled approximately 20% of the equity in our firm. Our employees also held approximately $250.0 million of their personal assets in our investment products at year-end.

We believe that doing our part to maintain the health and welfare of our employees is a critical element for achieving commercial success. As such, we provide our employees with comprehensive health benefits and offer a wellness program which focuses on employee health strategies and includes a discount to employee medical premiums for the completion of certain wellness initiatives. We have taken a proactive approach to addressing the ongoing coronavirus (“COVID-19”) pandemic’s impact on our employees in order to protect their health, encouraging and in some instances requiring working from home, and balancing these steps with a carefully considered return to office policy that complies with respective local guidelines for each of our offices. In addition, we offer employee assistance programs, including confidential assistance for financial, mental, and physical well-being. Finally, the well-being of our employees is enhanced when they can give back to their local communities or charities and we have programs that encourage our employees to give back to their local communities.

We recognize and appreciate the importance of creating an environment in which all employees feel valued, included, and empowered to do their best work and as a result our Diversity, Inclusion, Cohesion, and Engagement Committee is charged with integrating a diversity strategy that drives best practices, goals and objectives. The Committee’s mission is to foster an environment that attracts the best talent, values diversity of life experiences and perspectives, and encourages innovation and excellence.

We encourage you to review our Corporate Responsibility Report (located on our website) for more detailed information regarding our human capital programs and initiatives. Nothing on our website is deemed incorporated by reference into this Report.

Regulatory Environment and Compliance

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level, as well as regulation by self‑regulatory organizations, and outside the United States. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

16

SEC Investment Adviser and Investment Company Registration / Regulation – VCM and WestEnd are both registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and the Victory Funds, USAA Funds, VictoryShares and several of the investment companies we sub‑advise are registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Advisers Act and the 1940 Act, together with the SEC’s regulations and interpretations thereunder, impose substantive and material restrictions and requirements on the operations of advisers and registered funds. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act and the 1940 Act, ranging from fines and censures to termination of an adviser’s registration. As an investment adviser, we have a fiduciary duty to our clients. The SEC has interpreted that duty to impose standards, requirements and limitations on, among other things: trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; our use of soft dollars; execution of transactions; and recommendations to clients. We manage accounts for clients on a discretionary basis, with authority to buy and sell securities for each portfolio, select broker‑dealers to execute trades and negotiate brokerage commission rates. In connection with certain of these transactions, we receive soft dollar credits from broker‑dealers that have the effect of reducing certain of our expenses. All our soft dollar arrangements are intended to be within the safe harbor provided by Section 28(e) of the Exchange Act. If our ability to use soft dollars were reduced or eliminated as a result of the implementation of statutory amendments or new regulations, our operating expenses would increase. In addition, we also advise clients on a non-discretionary basis where we provide actively managed models using non-proprietary products. This is often referred to as assets under advisement.

As registered investment advisers, VCM and WestEnd are subject to many additional requirements that cover, among other things: disclosure of information about our business to clients; maintenance of written policies and procedures; maintenance of extensive books and records; restrictions on the types of fees we may charge; custody of client assets; client privacy; advertising; and solicitation of clients. The SEC has authority to inspect any investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities (i) in accordance with applicable laws, (ii) in a manner that is consistent with disclosures made to clients and (iii) with adequate systems and procedures to ensure compliance.

For the year ended December 31, 2021, 86% of our total revenues were derived from our services to investment companies registered under the 1940 Act—i.e., mutual funds and ETFs. The 1940 Act imposes significant requirements and limitations on a registered fund, including with respect to its capital structure, investments and transactions. While we exercise broad discretion over the day‑to‑day management of the business and affairs of the Victory Funds, USAA Funds, VictoryShares and the investment portfolios of the Victory Funds, USAA Funds, and VictoryShares and the funds we sub‑advise, the funds are subject to oversight of and governance by each fund’s board of directors. Under the 1940 Act, a majority of the directors of our registered funds must not be “interested persons” with respect to us (sometimes referred to as the “independent director” requirement) in order to rely on certain exemptive rules under the 1940 Act relevant to the operation of registered funds. The responsibilities of the fund’s board include, among other things: approving our investment advisory agreement with the fund (or, for sub‑advisory arrangements, our sub‑advisory agreement with the fund’s investment adviser); approving other service providers; determining the method of valuing assets; and monitoring transactions involving affiliates. Our investment advisory agreements with these funds may be terminated by the funds on not more than 60 days’ notice and are subject to annual renewal by the fund’s board after the initial term of one to two years. The 1940 Act also imposes on investment advisers or sub‑advisers to a registered fund a fiduciary duty with respect to the receipt of the advisers’ investment management fees or the sub-advisers’ sub‑advisory fees. That fiduciary duty may be enforced by the SEC, by administrative action or by litigation by investors in the fund pursuant to a private right of action.

As required by the Advisers Act, our investment advisory agreements may not be assigned without the client’s consent. Under the 1940 Act, investment advisory agreements with registered funds (such as the mutual funds and ETFs we manage) terminate automatically upon assignment. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a “controlling block” of our outstanding voting securities. Refer to “Risk Factors—Business Risks—An assignment could result in termination of our investment advisory agreements to manage SEC‑registered funds and could trigger consent requirements in our other investment advisory agreements.”

SEC Broker‑Dealer Registration / FINRA Regulation – VCS is subject to regulation by the SEC, FINRA and various states. In addition, certain of our employees are registered with FINRA and such states and subject to

17

SEC, state and FINRA regulation. The failure of these companies and/or employees to comply with relevant regulation could have a material adverse effect on our business.

SEC Transfer Agent Registration – VCTA is a SEC-registered transfer agent. Our registered transfer agent is subject to the 1934 Act and the rules and regulations promulgated thereunder. These laws and regulations generally grant the SEC and other supervisory bodies broad administrative powers to address non-compliance with regulatory requirements. Sanctions that may be imposed for non-compliance with these requirements include the suspension of individual employees, limitations on engaging in certain activities for specified periods of time or for specified types of clients, the revocation of registrations, other censures and significant fines.

ERISA‑Related Regulation – We are a fiduciary under Employee Retirement Income Security Act (“ERISA”) with respect to assets that we manage for benefit plan clients subject to ERISA. ERISA, the regulations promulgated thereunder, and applicable provisions of the Internal Revenue Code impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving ERISA plan clients and impose monetary penalties for violations of these prohibitions. The duties under ERISA require, among other obligations, that fiduciaries perform their duties solely in the interests of ERISA plan participants and beneficiaries.

CFTC Regulation – VCM is registered with the Commodity Futures Trading Commission (the “CFTC”) as a commodity operator and is a member of the National Futures Association (“NFA”), a self‑regulatory organization for the U.S. derivatives industry. In addition, certain of our employees are registered with the CFTC and members of NFA. Registration with the CFTC and NFA membership subjects VCM to regulation by the CFTC and the NFA including, but not limited to, reporting, recordkeeping, disclosure, self‑examination and training requirements. Registration with the CFTC also subjects VCM to periodic on‑site audits. Each of the CFTC and NFA is authorized to institute proceedings and impose sanctions for violations of applicable regulations.

Non‑U.S. Regulation – In addition to the extensive regulation to which we are subject in the United States, we are subject to regulation internationally. Our business also is subject to the rules and regulations of the countries in which we market our funds or services and conduct investment activities.

In Singapore, we are subject to, among others, the Securities and Futures Act (“SFA”), the Financial Advisers Act (“FAA”), and the subsidiary legislation promulgated pursuant to these acts, which are administered by the Monetary Authority of Singapore (“MAS”). We and our employees conducting regulated activities specified in the SFA and/or the FAA are required to be licensed with the MAS. Failure to comply with applicable laws, regulations, codes, directives, notices and guidelines issued by the MAS may result in penalties including fines, censures and the suspension or revocation of licenses granted by the MAS.

VCM is also authorized by the Central Bank of Ireland, which regulates our Irish business activities, to act as an investment manager to Irish UCITS fund. We have historically operated in Australia based on a “sufficient equivalence relief” exemption from local licensing with the Australian Securities and Investments commission. In 2021, we applied for a Foreign Australian Financial Services License (AFS) which was granted on June 15, 2021.

Compliance – Our legal and compliance functions consist of 13 professionals as of December 31, 2021. This group is responsible for all legal and regulatory compliance matters, as well as for monitoring adherence to client investment guidelines. Our legal and compliance teams work through a well‑established reporting and communication structure to ensure we have a consistent and holistic program for legal and regulatory compliance. Senior management also is involved at various levels in all these functions. We cannot assure that our legal and compliance functions will be effective to prevent all losses. Refer to “Item 1A. Risk Factors—General Risks—If our techniques for managing risk are ineffective, we may be exposed to material unanticipated losses.”

For more information about our regulatory environment, refer to “Risk Factors—Legal and Regulatory Risks—As an investment management firm, we are subject to extensive regulation” and “Risk Factors— Legal and Regulatory Risks —The regulatory environment in which we operate is subject to continual change and regulatory developments designed to increase oversight may materially adversely affect our business.”

18

Available Information

We routinely file annual, quarterly and current reports, proxy statements and other information required by the SEC. Our SEC filings are available to the public from the SEC’s public internet site at https://www.sec.gov.

We maintain a public internet site at ir.vcm.com and make available free of charge through this site our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers, as well as any amendments to those reports filed or furnished pursuant to the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also post on our website the charters for our board of directors’ Audit Committee, Nominating, Governance and Sustainability Committee and Compensation Committee, as well as our Corporate Governance Guidelines, our Corporate Responsibility Statement, and our Code of Business Conduct and Ethics governing our directors, officers, and employees. The information on our website is not incorporated by reference into this annual report.

Item 1A. Risk Factors.

The risks described below are not the only ones facing us. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. In such case the trading price of our common stock could decline. This report also contains forward‑looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward‑looking statements as a result of specific factors, including the risks and uncertainties described below.

Risk Factors Summary

The following is a summary of risks and uncertainties that affect our business, financial condition or results of operations. We are providing the following summary of risk factors to enhance readability of our risk factor disclosure. Material risks that may adversely affect our business, financial condition or results of operations include, but are not limited to, the following:

Market and Investment Performance Risks

|

|

• |

We earn substantially all of our revenues based on AUM, and any reduction in AUM would reduce our revenues and profitability. |

|

|

• |

The ongoing conflict in Ukraine has, and will likely continue to, negatively impact the global economy. |

|

|

• |

If our strategies perform poorly, clients could redeem their assets and we could suffer a decline in our AUM, which would reduce our earnings. |

|

|

• |

The historical returns of our strategies may not be indicative of their future results or of the strategies we may develop in the future. |

|

|

• |

We may support our money market funds to maintain their stable net asset values, or other products we manage, which could affect our revenues or operating results. |

|

|

• |

The performance of our strategies or the growth of our AUM may be constrained by unavailability of appropriate investment opportunities. |

Business Risks

|

|

• |

The ongoing COVID-19 pandemic has, and will likely continue to, negatively impact the global economy and interrupt normal business activity. |

19

|

|

• |

The loss of key investment professionals or members of our senior management team could have a material adverse effect on our business. |

|

|

• |

We derive substantially all of our revenues from contracts and relationships that may be terminated upon short or no notice. |

|

|

• |

Investors in certain funds that we advise can redeem their assets from those funds at any time without prior notice. |

|

|

• |

Investment recommendations provided to our direct investor channel may not be suitable or fulfill regulatory requirements; representatives may not disclose or address conflicts of interest, conduct inadequate due diligence, provide inadequate disclosure; mutual fund transactions may be subject to human error or fraud. |

|

|

• |

The significant growth we have experienced over the past few years may be difficult to sustain and our growth strategy is dependent in part upon our ability to make and successfully integrate new strategic acquisitions. |

|

|

• |

Our expenses are subject to fluctuations that could materially impact our results of operations. |

|

|

• |

A significant proportion of our existing AUM is managed in long‑only investments. |

|

|

• |

Our efforts to establish and develop new teams and strategies may be unsuccessful and could negatively impact our results of operations and could negatively impact our reputation and culture. |

|

|

• |

An assignment could result in termination of our investment advisory agreements to manage SEC‑registered funds and could trigger consent requirements in our other investment advisory agreements. |

|

|

• |

Our failure to comply with investment guidelines set by our clients, including the boards of registered funds, and limitations imposed by applicable law, could result in damage awards against us and a loss of AUM, either of which could adversely affect our results of operations or financial condition. |

|

|

• |

We provide a broad range of services to the Victory Funds, USAA Funds, VictoryShares and sub‑advised mutual funds which may expose us to liability. |

|

|

• |

Potential impairment of goodwill and intangible assets could result in not realizing the value of these assets. |

|

|

• |

If we were deemed an investment company required to register under the the Investment Company Act of 1940 (the “Investment Company Act”), we would become subject to burdensome regulatory requirements and our business activities could be restricted. |

Merger and Acquisition Risks

|

|

• |

We may not realize the benefits we expect from mergers and acquisitions because of integration difficulties and other challenges. |

|

|

• |

Certain liabilities resulting from acquisitions are estimated and could lead to a material impact on earnings. |

Indebtedness Risks

|

|

• |

Our substantial indebtedness may expose us to material risks. |

20

|

|

• |

The phase out of LIBOR may have a negative impact on our funds and our debt obligations and may require significant operational work. |

Capital Structure and Public Company Risks

|

|

• |

A relatively large percentage of our common stock is concentrated with a small number of shareholders, which could increase the volatility in our stock trading and affect our share price. |

|

|

• |

The market price of our common stock is likely to be volatile and could decline. |

|

|

• |

Future sales of shares by shareholders could cause our stock price to decline. |

|

|

• |

If securities or industry analysts publish misleading or unfavorable research about our business, our stock price and trading volume could decline. |

|

|

• |

We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our Common Stock less attractive to investors. |

|

|

• |