UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22780

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc.

(Exact name of registrant as specified in charter)

280 Park Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Dana DeVivo

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 832-3232

Date of fiscal year end: November 30

Date of reporting period: May 31, 2020

Item 1. Reports to Stockholders.

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

To Our Shareholders:

We would like to share with you our report for the six months ended May 31, 2020. The total returns for Cohen & Steers MLP Income and Energy Opportunity Fund, Inc. (the Fund) and its comparative benchmarks were:

| Six Months Ended May 31, 2020 |

||||

| Cohen & Steers MLP Income and Energy Opportunity Fund at Net Asset Valuea |

–54.61 | % | ||

| Cohen & Steers MLP Income and Energy Opportunity Fund at Market Valuea |

–62.20 | % | ||

| Blended Benchmark—90% Alerian MLP Index/10% ICE BofA Fixed Rate Preferred Securities Indexb |

–20.37 | % | ||

| Alerian MLP Indexb |

–24.26 | % | ||

| S&P 500 Indexb |

–2.10 | % | ||

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance results reflect the effects of leverage, resulting from borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund’s returns assume the reinvestment of all dividends and distributions at prices obtained under the Fund’s dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Distribution Policy

The Fund makes regular monthly distributions at a level rate (the Policy). Dividends from net investment income, if any, are declared quarterly and paid monthly. As a result of the Policy, the Fund may pay distributions in excess of the Fund’s current or accumulated earnings and profits. This excess would be a return of capital distributed from the Fund’s assets. Distributions of capital decrease the Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

| a | As a closed-end investment company, the price of the Fund’s exchange-traded shares will be set by market forces and can deviate from the net asset value (NAV) per share of the Fund. |

| b | The Alerian MLP Index (Total Return) is a capped, float-adjusted, capitalization-weighted index, whose constituents represent approximately 85% of total Master Limited Partnership (MLP) float-adjusted market capitalization. The ICE BofA Fixed Rate Preferred Securities Index tracks the performance of fixed-rate U.S. dollar-denominated preferred securities issued in the U.S. domestic market. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance. |

1

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

Market Review

In the six months ended May 31, 2020, MLP and midstream energy equities saw wide swings in performance and finished the period with significant declines. The group began on a positive note, rising in December 2019 as pressures from year-end tax-loss selling abated. However, conditions quickly deteriorated in the early months of 2020 as crude oil prices plunged amid a negative mix of rising supply and falling demand.

The disruption to global economic activity stemming from COVID-19 containment efforts resulted in an unprecedented collapse in oil demand. On the supply side, the March 2020 meeting of the Organization of the Petroleum Exporting Countries and other major producers (OPEC+) resulted in an abandonment of supply discipline and prompted a price war between Saudi Arabia and Russia, both of which began producing oil at maximum capacity to gain market share. The increased production added to an already oversupplied market, sending oil prices to 18-year lows and briefly driving West Texas Intermediate crude prices below zero for the first time in history—meaning producers were effectively willing to pay someone to move their oil.

While most midstream energy companies have only modest direct exposure to energy prices, the decline in crude oil prices lowered pipeline throughput volume expectations and cash flows for 2020 and increased credit risks for key midstream customers, such as exploration and production companies (E&Ps). In March many E&Ps announced widespread wellhead shutdowns given the low crude oil prices, impacting cash flow estimates for many midstream companies in the second quarter of 2020 and potentially the third quarter as well. These concerns weighed heavily on midstream share prices in March, with selling often seeming indiscriminate and affecting all companies in the group.

Although crude oil prices are a key driver of sentiment and confidence for the industry, we believe it remains important to note that midstream energy derives about half of its revenues from natural gas related activities, about a third coming from crude oil and refined products, and about 10% from natural gas liquids (NGLs). The group gained back some of its declines in April and May as OPEC reversed course and recommitted to supply discipline and global economies began to reopen, helping oil prices to recover into the $30 per barrel range.

Fund Performance

The Fund had a negative total return in the period and underperformed its blended benchmark.

Expectations of reduced drilling activity in response to sharply lower energy prices had a significant impact on the gathering & processing sector. The Fund’s overweight in the sector had a negative effect on relative performance.

Diversified midstream energy companies had mostly negative returns in the period. Stock selection in the sector detracted from the Fund’s relative performance, as we were underweight Tallgrass Energy, which rallied on a takeover offer from Blackstone. An overweight in Energy Transfer, which underperformed, hindered performance as well.

Natural gas pipelines declined but held up relatively well, as demand for natural gas is relatively inelastic and cost-of-service contracts has often resulted in utility-like cash flows for natural gas pipeline companies. The Fund’s underweight in the sector hampered relative performance. An out-of-index allocation to marine shipping companies also detracted from performance, as they were pressured by

2

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

concerns about the global economy and retaliatory tariffs on U.S. liquid natural gas. We did not own these companies at the end of the period.

The gathering sector, which tends to be more sensitive to energy prices, underperformed in the period. Stock selection in the sector aided the Fund’s relative performance, led by an out-of-index allocation to Antero Midstream that had a gain. Stock selection in the storage/terminals sector also helped performance The Fund’s non-investment in the water sector, which was one of the poorest performers in the period, helped performance, as did an underweight in refinery logistics companies.

Preferred securities had a slight overall decline in the period, as concerns about the economy were countered by a supportive environment for interest rates, with the yield on the 10-year Treasury falling below 1%. The Fund’s underweight in preferreds compared with the blended benchmark detracted from relative performance, as did security selection in the group.

Impact of Leverage on Fund Performance

The Fund employs leverage as part of a yield-enhancement strategy. Leverage, which can increase total return in rising markets (just as it can have the opposite effect in declining markets), significantly detracted from the Fund’s NAV performance for the period. Following a period of extreme volatility and price depreciation in the market for MLPs, the Fund reduced its outstanding borrowings by $87,500,000 during the period, and incurred $2,780,305 in breakage costs relating to these paydowns.

Sincerely,

|

|

| |

| BEN MORTON | TYLER S. ROSENLICHT | |

| Portfolio Manager | Portfolio Manager | |

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds specializes in liquid real assets, including real estate securities, listed infrastructure and natural resource equities, as well as preferred securities and other income solutions.

3

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

Our Leverage Strategy

(Unaudited)

Our current leverage strategy utilizes borrowings up to the maximum permitted by the Investment Company Act of 1940 to provide additional capital for the Fund, with an objective of increasing the net income available for shareholders. As of May 31, 2020, leverage represented 18% of the Fund’s managed assets.

Through fixed-rate financing, the Fund has locked in interest rates on this additional capital for the period expiring in May 2022. Locking in our leveraging costs is designed to protect the dividend-paying ability of the Fund. The use of leverage increases the volatility of the Fund’s NAV in both up and down markets. However, we believe that locking in the Fund’s leveraging costs partially protects the Fund’s expenses from an increase in short-term interest rates.

Leverage Factsa,b

| Leverage (as a % of managed assets) |

18% | |

| % Fixed Rate |

100% | |

| Weighted Average Rate on Financing |

3.4% | |

| Weighted Average Term on Financing |

2.0 years |

The Fund seeks to enhance its dividend yield through leverage. The use of leverage is a speculative technique and there are special risks and costs associated with leverage. The NAV of the Fund’s shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for the shareholders. On the other hand, to the extent that the total cost of leverage exceeds the incremental income gained from employing such leverage, shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may incur breakage fees under the Fund’s credit arrangement and may need to liquidate investments, including under adverse economic conditions which may result in capital losses potentially reducing returns to shareholders. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

| a | Data as of May 31, 2020. Information is subject to change. |

| b | See Note 6 in Notes to Financial Statements. |

4

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

| May 31, 2020 Top Ten Holdingsa (Unaudited)

|

||||||||

| Security |

Value | % of Managed Assets |

||||||

| Energy Transfer LP |

$ | 11,309,319 | 11.9 | |||||

| Plains All American Pipeline LP |

10,591,614 | 11.1 | ||||||

| MPLX LP |

10,010,655 | 10.5 | ||||||

| Magellan Midstream Partners LP |

9,271,894 | 9.7 | ||||||

| Enterprise Products Partners LP |

8,748,698 | 9.2 | ||||||

| NuStar Energy LP |

5,668,491 | 6.0 | ||||||

| Phillips 66 Partners LP |

4,508,346 | 4.7 | ||||||

| Crestwood Equity Partners LP |

3,727,823 | 3.9 | ||||||

| EQM Midstream Partners LP |

3,003,051 | 3.2 | ||||||

| Equitrans Midstream Corp. |

2,649,750 | 2.8 | ||||||

| a | Top ten holdings (excluding short-term investments) are determined on the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Schedule of Investments for additional details on such other positions. |

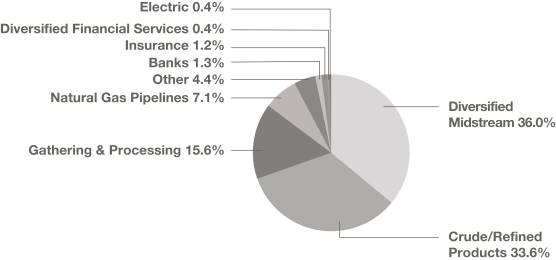

Sector Breakdown

(Based on Managed Assets)

(Unaudited)

5

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

SCHEDULE OF INVESTMENTS

May 31, 2020 (Unaudited)

| Shares/Units | Value | |||||||||||

| MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES |

113.6% | |||||||||||

| CRUDE/REFINED PRODUCTS |

41.2% | |||||||||||

| BP Midstream Partners LPa |

|

32,032 | $ | 400,720 | ||||||||

| Genesis Energy LPa |

|

164,691 | 1,320,822 | |||||||||

| Magellan Midstream Partners LPa |

|

204,497 | 9,271,894 | |||||||||

| NuStar Energy LPa |

|

326,338 | 5,668,491 | |||||||||

| PBF Logistics LP |

|

25,500 | 265,200 | |||||||||

| Phillips 66 Partners LPa |

|

100,903 | 4,508,346 | |||||||||

| Plains All American Pipeline LPa |

|

1,091,919 | 10,591,614 | |||||||||

|

|

|

|||||||||||

| 32,027,087 | ||||||||||||

|

|

|

|||||||||||

| DIVERSIFIED MIDSTREAM |

44.1% | |||||||||||

| Energy Transfer LPa |

|

1,385,946 | 11,309,319 | |||||||||

| Enterprise Products Partners LPa |

|

458,047 | 8,748,698 | |||||||||

| Kinder Morgan, Inc.a |

|

145,906 | 2,305,315 | |||||||||

| MPLX LPa |

|

527,154 | 10,010,655 | |||||||||

| Williams Cos., Inc.a |

|

91,387 | 1,867,036 | |||||||||

|

|

|

|||||||||||

| 34,241,023 | ||||||||||||

|

|

|

|||||||||||

| ELECTRIC |

0.5% | |||||||||||

| NextEra Energy Partners LP |

|

7,211 | 368,554 | |||||||||

|

|

|

|||||||||||

| GATHERING & PROCESSING |

19.2% | |||||||||||

| Antero Midstream Corp.a |

|

155,058 | 741,177 | |||||||||

| CNX Midstream Partners LPa |

|

38,978 | 282,980 | |||||||||

| Crestwood Equity Partners LPa |

|

262,338 | 3,727,823 | |||||||||

| Enable Midstream Partners LPa |

|

165,766 | 689,587 | |||||||||

| EnLink Midstream LLCa |

|

869,946 | 2,053,073 | |||||||||

| EQM Midstream Partners LPa |

|

152,827 | 3,003,051 | |||||||||

| Hess Midstream LP, Class Aa |

|

57,275 | 1,112,280 | |||||||||

| Keyera Corp. (Canada)a |

|

50,778 | 804,718 | |||||||||

| ONEOK, Inc. |

|

23,476 | 861,334 | |||||||||

| Tidewater Midstream & Infrastructure Ltd. (Canada)a |

|

848,264 | 437,424 | |||||||||

| Western Midstream Partners LPa |

|

126,355 | 1,180,156 | |||||||||

|

|

|

|||||||||||

| 14,893,603 | ||||||||||||

|

|

|

|||||||||||

| NATURAL GAS PIPELINES |

5.4% | |||||||||||

| Equitrans Midstream Corp.a |

|

327,534 | 2,649,750 | |||||||||

| TC PipeLines LPa |

|

45,061 | 1,583,894 | |||||||||

|

|

|

|||||||||||

| 4,233,644 | ||||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

6

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

May 31, 2020 (Unaudited)

| Shares/Units | Value | |||||||||||

| PIPELINES—FOREIGN |

3.2% | |||||||||||

| Enbridge, Inc. (Canada)a |

|

76,649 | $ | 2,492,895 | ||||||||

|

|

|

|||||||||||

| TOTAL MASTER LIMITED

PARTNERSHIPS AND RELATED COMPANIES |

|

88,256,806 | ||||||||||

|

|

|

|||||||||||

| PREFERRED SECURITIES—$25 PAR VALUE |

2.4% | |||||||||||

| BANKS |

0.3% | |||||||||||

| Regions Financial Corp., 5.70% to 5/15/29, Series Ca,b,c |

|

9,000 | 231,390 | |||||||||

|

|

|

|||||||||||

| CHEMICALS |

0.3% | |||||||||||

| CHS, Inc., 7.50%, Series 4a,b |

|

8,341 | 223,956 | |||||||||

|

|

|

|||||||||||

| DIVERSIFIED FINANCIAL SERVICES |

0.5% | |||||||||||

| Morgan Stanley, 6.375% to 10/15/24, Series Ia,b,c |

|

6,136 | 167,451 | |||||||||

| Morgan Stanley, 5.85% to 4/15/27, Series Ka,b,c |

|

5,553 | 148,210 | |||||||||

| Synchrony Financial, 5.625%, Series Aa,b |

|

3,946 | 80,696 | |||||||||

|

|

|

|||||||||||

| 396,357 | ||||||||||||

|

|

|

|||||||||||

| INSURANCE |

0.8% | |||||||||||

| LIFE/HEALTH INSURANCE |

0.2% | |||||||||||

| Athene Holding Ltd., 6.35% to 6/30/29, Series Aa,b,c |

|

4,056 | 101,968 | |||||||||

| Unum Group, 6.25%, due 6/15/58a |

|

1,754 | 42,412 | |||||||||

|

|

|

|||||||||||

| 144,380 | ||||||||||||

|

|

|

|||||||||||

| MULTI-LINE |

0.1% | |||||||||||

| Allstate Corp./The, 5.10%, Series Ha,b |

|

3,839 | 99,737 | |||||||||

|

|

|

|||||||||||

| MULTI-LINE—FOREIGN |

0.2% | |||||||||||

| Aegon Funding Co. LLC, 5.10%, due 12/15/49 (Netherlands)a |

|

5,500 | 129,030 | |||||||||

|

|

|

|||||||||||

| PROPERTY CASUALTY—FOREIGN |

0.2% | |||||||||||

| Enstar Group Ltd., 7.00% to 9/1/28, Series D (Bermuda)a,b,c |

|

6,000 | 152,940 | |||||||||

|

|

|

|||||||||||

| REINSURANCE |

0.1% | |||||||||||

| Arch Capital Group Ltd., 5.45%, Series Fa,b |

|

4,700 | 119,145 | |||||||||

|

|

|

|||||||||||

| TOTAL INSURANCE |

|

645,232 | ||||||||||

|

|

|

|||||||||||

| PIPELINES |

0.3% | |||||||||||

| Energy Transfer Operating LP, 7.625% to 8/15/23, Series Da,b,c |

|

9,390 | 203,763 | |||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

7

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

May 31, 2020 (Unaudited)

| Shares/Units | Value | |||||||||||

| UTILITIES |

0.1% | |||||||||||

| South Jersey Industries, Inc., 5.625%, due 9/16/79a |

|

1,806 | $ | 45,258 | ||||||||

|

|

|

|||||||||||

| UTILITIES—FOREIGN |

0.1% | |||||||||||

| Algonquin Power & Utilities Corp., 6.20% to 7/1/24, due 7/1/79, Series 19-A (Canada)a,c |

|

3,860 | 104,220 | |||||||||

|

|

|

|||||||||||

| TOTAL PREFERRED

SECURITIES—$25 PAR VALUE |

|

1,850,176 | ||||||||||

|

|

|

|||||||||||

| Principal Amount |

||||||||||||

| PREFERRED SECURITIES—CAPITAL SECURITIES |

1.9% | |||||||||||

| BANKS |

1.3% | |||||||||||

| Bank of America Corp., 8.05%, due 6/15/27, Series Ba |

|

$ | 200,000 | 246,450 | ||||||||

| CoBank ACB, 6.25% to 10/1/22, Series Fa,b,c |

|

2,300 | † | 236,037 | ||||||||

| Corestates Capital III, 0.96% (3 Month US LIBOR + 0.57%), due 2/15/27, 144A (TruPS) (FRN)a,d,e |

|

280,000 | 247,186 | |||||||||

| Wells Fargo & Co., 5.95%, due 12/15/36a |

|

270,000 | 313,092 | |||||||||

|

|

|

|||||||||||

| 1,042,765 | ||||||||||||

|

|

|

|||||||||||

| INSURANCE |

0.6% | |||||||||||

| LIFE/HEALTH INSURANCE |

0.3% | |||||||||||

| Brighthouse Financial, Inc., 4.70%, due 6/22/47a |

|

240,000 | 212,162 | |||||||||

|

|

|

|||||||||||

| MULTI-LINE |

0.2% | |||||||||||

| American International Group, Inc., 8.175% to 5/15/38, due 5/15/58a,c |

|

103,000 | 127,503 | |||||||||

|

|

|

|||||||||||

| MULTI-LINE—FOREIGN |

0.1% | |||||||||||

| AXA SA, 6.379% to 12/14/36, 144A (France)a,b,c,e |

|

100,000 | 126,136 | |||||||||

|

|

|

|||||||||||

| TOTAL INSURANCE |

465,801 | |||||||||||

|

|

|

|||||||||||

| TOTAL PREFERRED

SECURITIES—CAPITAL SECURITIES |

|

1,508,566 | ||||||||||

|

|

|

|||||||||||

| Shares | ||||||||||||

| SHORT-TERM INVESTMENTS |

3.5% | |||||||||||

| MONEY MARKET FUNDS |

||||||||||||

| State Street Institutional Treasury Money Market Fund, Premier Class, 0.12%f |

|

2,739,352 | 2,739,352 | |||||||||

|

|

|

|||||||||||

| TOTAL SHORT-TERM

INVESTMENTS |

|

2,739,352 | ||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

8

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

May 31, 2020 (Unaudited)

| Value | ||||||||||||

| TOTAL INVESTMENTS IN

SECURITIES |

121.4% | $ | 94,354,900 | |||||||||

|

|

|

|||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS |

(21.4) | (16,643,177 | ) | |||||||||

|

|

|

|

|

|||||||||

| NET ASSETS (Equivalent to $2.89 per share based on 26,903,236 shares of common stock outstanding) |

100.0% | $ | 77,711,723 | |||||||||

|

|

|

|

|

|||||||||

Glossary of Portfolio Abbreviations

| FRN |

Floating Rate Note | |

| LIBOR |

London Interbank Offered Rate | |

| TruPS |

Trust Preferred Securities |

Note: Percentages indicated are based on the net assets of the Fund.

| † | Represents shares. |

| a | All or a portion of the security is pledged as collateral in connection with the Fund’s credit agreement. $83,822,938 in aggregate has been pledged as collateral. |

| b | Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. |

| c | Security converts to floating rate after the indicated fixed-rate coupon period. |

| d | Variable rate. Rate shown is in effect at May 31, 2020. |

| e | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. Aggregate holdings amounted to $373,322 which represents 0.5% of the net assets of the Fund, of which 0.0% are illiquid. |

| f | Rate quoted represents the annualized seven-day yield. |

See accompanying notes to financial statements.

9

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2020 (Unaudited)

| ASSETS: |

||||

| Investments in securities, at value (Identified cost—$132,392,005) |

$ | 94,354,900 | ||

| Foreign currency, at value (Identified cost—$16) |

12 | |||

| Prepaid line of credit fees |

1,132,564 | |||

| Receivable for: |

||||

| Investment securities sold |

82,397 | |||

| Dividends, distributions and interest |

80,395 | |||

| Other assets |

16,444 | |||

|

|

|

|||

| Total Assets |

95,666,712 | |||

|

|

|

|||

| LIABILITIES: |

||||

| Payable for: |

||||

| Credit agreement |

17,500,000 | |||

| Investment advisory fees |

75,193 | |||

| Interest expense |

51,492 | |||

| Dividends declared |

13,660 | |||

| Administration fees |

6,015 | |||

| Directors’ fees |

1,562 | |||

| Other liabilities |

307,067 | |||

|

|

|

|||

| Total Liabilities |

17,954,989 | |||

|

|

|

|||

| NET ASSETS |

$ | 77,711,723 | ||

|

|

|

|||

| NET ASSETS consist of: |

||||

| Paid-in capital |

$ | 359,478,661 | ||

| Total distributable earnings/(accumulated loss) |

(281,766,938 | ) | ||

|

|

|

|||

| $ | 77,711,723 | |||

|

|

|

|||

| NET ASSET VALUE PER SHARE: |

||||

| ($77,711,723 ÷ 26,903,236 shares outstanding) |

$ | 2.89 | ||

|

|

|

|||

| MARKET PRICE PER SHARE |

$ | 2.41 | ||

|

|

|

|||

| MARKET PRICE PREMIUM (DISCOUNT) TO NET ASSET VALUE PER SHARE |

(16.61 | )% | ||

|

|

|

See accompanying notes to financial statements.

10

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended May 31, 2020 (Unaudited)

| Investment Income: |

||||

| Distributions from master limited partnerships and related companies (net of $15,979 of foreign withholding tax) |

$ | 8,517,247 | ||

| Less return of capital on distributionsa |

(8,768,627 | ) | ||

|

|

|

|||

| Net distributions from master limited partnerships and related companies |

(251,380 | ) | ||

| Dividend income |

194,775 | |||

| Interest income |

259,182 | |||

|

|

|

|||

| Total Investment Income |

202,577 | |||

|

|

|

|||

| Expenses: |

||||

| Line of credit fees |

1,647,741 | |||

| Interest expense |

1,104,133 | |||

| Investment advisory fees |

985,260 | |||

| Professional fees |

146,198 | |||

| Administration fees |

109,803 | |||

| Shareholder reporting expenses |

18,965 | |||

| Custodian fees and expenses |

14,454 | |||

| Transfer agent fees and expenses |

9,905 | |||

| Directors’ fees and expenses |

5,125 | |||

| Miscellaneous |

22,980 | |||

|

|

|

|||

| Total Expenses |

4,064,564 | |||

|

|

|

|||

| Net Investment Income (Loss), net of income taxes |

(3,861,987 | ) | ||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss): |

||||

| Net realized gain (loss) on: |

||||

| Investments in securities |

(105,903,026 | ) | ||

| Foreign currency transactions |

(9,372 | ) | ||

|

|

|

|||

| Net realized gain (loss), net of income taxes |

(105,912,398 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments in securities |

10,147,210 | |||

| Foreign currency translations |

935 | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation), net of income taxes |

10,148,145 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss), net of income taxes |

(95,764,253 | ) | ||

|

|

|

|||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | (99,626,240 | ) | |

|

|

|

| a | For the six months ended May 31, 2020, the Fund estimated that $7,878,276 of the MLP distributions received would be classified as a return of capital. |

Additionally, based on final information received from the Fund’s MLP investments for the fiscal year ended November 30, 2019, the Fund recorded a $890,351 increase in return of capital from MLPs and related companies (see Note 1).

See accompanying notes to financial statements.

11

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| For the Six Months Ended May 31, 2020 |

For the Year Ended November 30, 2019 |

|||||||

| Change in Net Assets: |

||||||||

| From Operations: |

||||||||

| Net investment income (loss), net of |

$ | (3,861,987 | ) | $ | (3,061,960 | ) | ||

| Net realized gain (loss), net of |

(105,912,398 | ) | 2,415,387 | |||||

| Net change in unrealized appreciation (depreciation), net of income taxes |

10,148,145 | (48,372,049 | ) | |||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

(99,626,240 | ) | (49,018,622 | ) | ||||

|

|

|

|

|

|||||

| Distributions to Shareholders |

— | (3,241,651 | ) | |||||

| Tax return of capital to shareholders |

(7,708,752 | ) | (21,523,467 | ) | ||||

|

|

|

|

|

|||||

| Total distributions |

(7,708,752 | ) | (24,765,118 | ) | ||||

|

|

|

|

|

|||||

| Capital Stock Transactions: |

||||||||

| Increase (decrease) in net assets from Fund share transactions |

251,319 | 400,659 | ||||||

|

|

|

|

|

|||||

| Total increase (decrease) in |

(107,083,673 | ) | (73,383,081 | ) | ||||

| Net Assets: |

||||||||

| Beginning of period |

184,795,396 | 258,178,477 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 77,711,723 | $ | 184,795,396 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

12

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

STATEMENT OF CASH FLOWS

For the Six Months Ended May 31, 2020 (Unaudited)

| Increase (Decrease) in Cash: |

||||

| Cash Flows from Operating Activities: |

||||

| Net increase (decrease) in net assets resulting from operations |

$ | (99,626,240 | ) | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by operating activities: |

||||

| Purchases of long-term investments |

(46,406,923 | ) | ||

| Proceeds from sales and maturities of long-term investments |

136,379,663 | |||

| Return of capital on distributions |

8,768,627 | |||

| Net purchases, sales and maturities of short-term investments |

1,407,345 | |||

| Net amortization of premium on investments in securities |

16,138 | |||

| Net decrease in dividends and interest receivable and other assets |

256,788 | |||

| Net decrease in interest expense payable, accrued expenses and other liabilities |

(474,878 | ) | ||

| Line of credit fees |

1,647,741 | |||

| Net change in unrealized appreciation on investments in securities |

(10,147,210 | ) | ||

| Net realized loss on investments in securities |

105,903,026 | |||

|

|

|

|||

| Cash provided by operating activities |

97,724,077 | |||

|

|

|

|||

| Cash Flows from Financing Activities: |

||||

| Repayment on credit agreement |

(87,500,000 | ) | ||

| Line of credit fees paid |

(2,780,305 | ) | ||

| Dividends paid |

(7,443,773 | ) | ||

|

|

|

|||

| Cash used for financing activities |

(97,724,078 | ) | ||

|

|

|

|||

| Increase (decrease) in cash |

(1 | ) | ||

| Cash at beginning of period (including foreign currency) |

13 | |||

|

|

|

|||

| Cash at end of period (including foreign currency) |

$ | 12 | ||

|

|

|

Supplemental Disclosure of Cash Flow Information and Non-Cash Activities:

For the six months ended May 31, 2020, interest paid was $1,365,777.

For the six months ended May 31, 2020, reinvestment of dividends was $251,319.

See accompanying notes to financial statements.

13

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| For the Six Months Ended May 31, 2020 |

For the Year Ended November 30, | |||||||||||||||||||||||

| Per Share Operating Data: |

2019 | 2018 | 2017 | 2016 | 2015a | |||||||||||||||||||

| Net asset value, beginning of period |

$6.88 | $9.64 | $10.11 | $11.87 | $13.01 | $22.50 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)b |

(0.14 | ) | (0.11 | ) | (0.16 | ) | (0.15 | ) | (0.17 | ) | 0.06 | |||||||||||||

| Net realized and unrealized gain (loss) |

(3.56 | ) | (1.73 | ) | 0.61 | (0.69 | ) | 0.20 | (8.24 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

(3.70 | ) | (1.84 | ) | 0.45 | (0.84 | ) | 0.03 | (8.18 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to |

||||||||||||||||||||||||

| Net investment income |

— | (0.12 | ) | (0.55 | ) | (0.20 | ) | — | (0.18 | ) | ||||||||||||||

| Tax return of capital |

(0.29 | ) | (0.80 | ) | (0.37 | ) | (0.72 | ) | (1.17 | ) | (1.14 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.29 | ) | (0.92 | ) | (0.92 | ) | (0.92 | ) | (1.17 | ) | (1.32 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Anti-dilutive effect from the repurchase of shares |

— | — | — | — | — | 0.01 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

(3.99 | ) | (2.76 | ) | (0.47 | ) | (1.76 | ) | (1.14 | ) | (9.49 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$2.89 | $6.88 | $9.64 | $10.11 | $11.87 | $13.01 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Market value, end of period |

$2.41 | $6.89 | $8.74 | $9.38 | $10.37 | $11.09 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total net asset value returnc |

–54.61 | %d | –20.67 | % | 4.50 | % | –7.27 | % | 2.75 | % | –37.40 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total market value returnc |

–62.20 | %d | –12.37 | % | 2.12 | % | –1.52 | % | 5.31 | % | –40.71 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in millions) |

$77.7 | $184.8 | $258.2 | $271.0 | $318.1 | $348.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expensese |

6.17 | %f,g | 3.24 | % | 2.59 | % | 2.32 | % | 2.95 | % | (0.74 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses (excluding deferred tax |

6.17 | %f,g | 3.24 | % | 2.59 | % | 2.32 | % | 2.95 | % | 2.47 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses (excluding deferred tax benefit/expense and interest expense) |

4.50 | %f | 1.80 | % | 1.66 | % | 1.66 | % | 2.16 | % | 1.73 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss)e |

(5.87 | )%f | (1.23 | )% | (1.52 | )% | (1.25 | )% | (1.63 | )% | 4.10 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) (excluding deferred tax benefit/expense allocated to realized and unrealized gain (loss)) |

(5.87 | )%f | (1.23 | )% | (1.52 | )% | (1.25 | )% | (1.63 | )% | 0.34 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratio of expenses to average daily |

4.13 | %f | 2.21 | % | 1.87 | % | 1.74 | % | 2.09 | % | (0.51 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

24 | %d | 74 | % | 58 | % | 46 | % | 54 | % | 29 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

See accompanying notes to financial statements.

14

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| For the Six Months Ended May 31, 2020 |

For the Year Ended November 30, | |||||||||||||||||||||||

| Credit Agreement | 2019 | 2018 | 2017 | 2016 | 2015a | |||||||||||||||||||

| Asset coverage ratio for credit agreement |

544 | % | 276 | % | 321 | % | 358 | % | 403 | % | 255 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Asset coverage per $1,000 for credit agreement |

$5,441 | $2,760 | $3,207 | $3,581 | $4,029 | $2,549 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Amount of loan outstanding (in millions) |

$17.5 | $105.0 | $117.0 | $105.0 | $105.0 | $225.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| a | Consolidated with Cohen & Steers MLP Investment Fund (the Subsidiary). After the close of business on November 30, 2015, all of the assets and liabilities of the Subsidiary were transferred to the Fund in a tax-free transaction. |

| b | Calculation based on average shares outstanding. |

| c | Total net asset value return measures the change in net asset value per share over the period indicated. Total market value return is computed based upon the Fund’s market price per share and excludes the effects of brokerage commissions. Dividends and distributions are assumed, for purposes of these calculations, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| d | Not annualized. |

| e | Ratio includes the deferred tax benefit/expense allocated to net investment income (loss) and the deferred tax benefit/expense allocated to realized and unrealized gain (loss), if any. |

| f | Annualized. |

| g | Ratio includes line of credit fees for the six months ended May 31, 2020. Without these expenses, the annualized ratio of expenses to average daily net assets and expenses (excluding deferred tax/benefit expense) to average daily net assets would have been 3.67%. |

| h | Average daily managed assets represent net assets plus the outstanding balance of the credit agreement. |

See accompanying notes to financial statements.

15

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Organization and Significant Accounting Policies

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc. (the Fund) was incorporated under the laws of the State of Maryland on December 13, 2012 and is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a non-diversified, closed-end management investment company. The Fund’s investment objective is to provide attractive total return, comprised of high current income and price appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter (OTC) market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment advisor) to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Fixed-income securities are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities. The pricing services or broker-dealers use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services or broker-dealers may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services or broker-dealers also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or characteristics such as benchmark

16

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features which are then used to calculate the fair values.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at net asset value (NAV).

The policies and procedures approved by the Fund’s Board of Directors delegate authority to make fair value determinations to the investment advisor, subject to the oversight of the Board of Directors. The investment advisor has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment advisor determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund’s investments is summarized below.

| • | Level 1—quoted prices in active markets for identical investments |

| • | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.) |

| • | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

17

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

The inputs or methodology used for valuing investments may or may not be an indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the inputs used as of May 31, 2020 in valuing the Fund’s investments carried at value:

| Total | Quoted Prices in Active Markets for Identical Investments (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

|||||||||||||

| Master Limited Partnerships and Related Companies |

$ | 88,256,806 | $ | 88,256,806 | $ | — | $ | — | ||||||||

| Preferred Securities—$25 Par Value |

1,850,176 | 1,850,176 | — | — | ||||||||||||

| Preferred Securities—Capital Securities |

1,508,566 | — | 1,508,566 | — | ||||||||||||

| Short-Term Investments |

2,739,352 | — | 2,739,352 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total

Investments |

$ | 94,354,900 | $ | 90,106,982 | $ | 4,247,918 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| a | Portfolio holdings are disclosed individually on the Schedule of Investments. |

The following is a reconciliation of investments for which significant unobservable inputs (Level 3) were used in determining fair value:

| Master Limited Partnerships and Related Companies |

||||

| Balance as of November 30, 2019 |

$ | 1,256,040 | ||

| Sales |

(423,233 | ) | ||

| Realized gain (loss) |

(895,895 | ) | ||

| Change in unrealized appreciation (depreciation) |

63,088 | |||

|

|

|

|||

| Balance as of May 31, 2020 |

$ | — | ||

|

|

|

|||

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income, which includes the amortization of premiums and accretion of discounts, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from Master Limited Partnerships (MLPs) and related companies are recorded as income and return of capital based on information reported by the MLPs and related companies as well as

18

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

management’s estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the MLPs and related companies. Actual amounts may differ from the estimated amounts. For the six months ended May 31, 2020, the Fund has estimated approximately 92.5% of distributions from MLPs and related companies as return of capital.

Master Limited Partnerships: Entities commonly referred to as MLPs are generally organized under state law as limited partnerships or limited liability companies. The Fund invests in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986, as amended (the Code), and whose interest or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real property rents, gains on dispositions of real property, income and gains from mineral or natural resources activities, income and gains from the transportation or storage of certain fuels, and, in certain circumstances, income and gains from commodities or futures, forwards and options on commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership or limited liability company. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The Fund’s investments in MLPs consist only of limited partner or member interests ownership. The MLPs themselves generally do not pay U.S. federal income taxes and unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign currency transaction gains or losses arise from sales of foreign currencies, (excluding gains and losses on forward foreign currency exchange contracts, which are presented separately, if any) currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency translation gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting

19

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Dividends and Distributions to Shareholders: The Fund makes regular monthly distributions pursuant to the Policy. Dividends from net investment income, if any, are declared quarterly and paid monthly. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund in accordance with the Fund’s Reinvestment Plan, unless the shareholder has elected to have them paid in cash.

Distributions paid by the Fund are subject to recharacterization for tax purposes. Based upon the results of operations for the six months ended May 31, 2020, the investment advisor considers it likely that a significant portion of the distributions will be characterized as distributions from return of capital upon the final determination of the Fund’s taxable income after November 30, 2020, the Fund’s fiscal year end.

Distributions Subsequent to May 31, 2020: The following distributions have been declared by the Fund’s Board of Directors and are payable subsequent to the period end of this report.

|

Ex-Date |

Record |

Payable Date |

Amount | |||||

| 6/16/20 | 6/17/20 |

6/30/20 | $0.015 | |||||

| 7/14/20 | 7/15/20 |

7/31/20 | $0.015 | |||||

| 8/18/20 | 8/19/20 |

8/31/20 | $0.015 | |||||

| 9/15/20 | 9/16/20 |

9/30/20 | $0.015 | |||||

Income Taxes: The Fund, which is treated as a C corporation for U.S. Federal income tax purposes, is obligated to pay federal and state income tax on its taxable income. The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLPs taxable income in computing its own taxable income. Deferred income taxes reflect (i) taxes on unrealized gains (losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes and (iii) the net tax benefit of accumulated net operating and capital losses. To the extent the Fund has a deferred tax asset, consideration is given as to whether or not a valuation allowance, which would offset some or all of the deferred tax asset, is required. A valuation allowance is required if based on the evaluation criterion provided by ASC 740, Income Taxes, it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused. From time to time, as new information becomes available, the Fund modifies its estimates or assumptions regarding the deferred tax asset or liability.

20

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

For all open tax years and for all major jurisdictions, management of the Fund has analyzed and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund’s tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and by state departments of revenue.

Note 2. Investment Advisory Fees, Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: Cohen & Steers Capital Management, Inc. serves as the Fund’s investment advisor pursuant to an investment advisory agreement (the investment advisory agreement). Under the terms of the investment advisory agreement, the investment advisor provides the Fund with day-to-day investment decisions and generally manages the Fund’s investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the investment advisor receives a fee, accrued daily and paid monthly, at the annual rate of 1.00% of the average daily managed assets of the Fund. Managed assets are equal to the net assets of the common shares plus the amount of any borrowings, used for leverage, outstanding.

Under subadvisory agreements between the investment advisor and each of Cohen & Steers Asia Limited and Cohen & Steers UK Limited (collectively, the subadvisors), affiliates of the investment advisor, the subadvisors are responsible for managing the Fund’s investments in certain non-U.S. holdings. For their services provided under the subadvisory agreements, the investment advisor (not the Fund) pays the subadvisors. The investment advisor allocates 50% of the investment advisory fee received from the Fund among itself and each subadvisor based on the portion of the Fund’s average daily managed assets managed by the investment advisor and each subadvisor.

Administration Fees: The Fund has entered into an administration agreement with the investment advisor under which the investment advisor performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.08% of the average daily managed assets of the Fund. For the six months ended May 31, 2020, the Fund incurred $78,821 in fees under this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as co-administrator under a fund accounting and administration agreement.

Directors’ and Officers’ Fees: Certain directors and officers of the Fund are also directors, officers and/or employees of the investment advisor. The Fund does not pay compensation to directors and officers affiliated with the investment advisor except for the Chief Compliance Officer, who received compensation from the investment advisor, which was reimbursed by the Fund, in the amount of $775 for the six months ended May 31, 2020.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended May 31, 2020, totaled $46,377,347 and $136,159,381, respectively.

21

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 4. Income Tax Information

As of May 31, 2020, the federal tax cost and net unrealized appreciation (depreciation) in value of investments held were as follows:

| Cost of investments in securities for federal income tax purposes |

$ | 120,985,060 | ||

|

|

|

|||

| Gross unrealized appreciation on investments |

$ | 7,427,901 | ||

| Gross unrealized depreciation on investments |

(34,058,049 | ) | ||

|

|

|

|||

| Net unrealized appreciation (depreciation) on investments |

$ | (26,630,148 | ) | |

|

|

|

The Fund’s income tax expense/(benefit) for the six months ended May 31, 2020 consists of the following:

| Deferred | ||||

| Federal |

$ | (20,953,161 | ) | |

| State |

(1,574,724 | ) | ||

| Valuation allowance |

22,527,885 | |||

|

|

|

|||

| Total tax expense/(benefit) |

$ | — | ||

|

|

|

|||

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. Components of the Fund’s deferred tax assets and liabilities as of May 31, 2020, are as follows:

| Deferred tax assets: |

||||

| Net operating loss |

$ | 20,672,564 | ||

| Capital loss carryforward |

35,054,975 | |||

| Passive activity losses |

135,912 | |||

| Unrealized loss on investments |

6,038,776 | |||

| Other |

145,501 | |||

| Valuation allowance |

(62,047,728 | ) | ||

|

|

|

|||

| Total deferred tax asset |

$ | — | ||

|

|

|

Other deferred tax assets represents net operating and capital losses for certain MLP securities held in the portfolio at May 31, 2020 which will be available upon disposition of these securities.

The Fund reviews the recoverability of its deferred tax assets based upon the weight of the available evidence. When assessing, the Fund’s management considers available carrybacks, reversing temporary taxable differences, and tax planning, if any. As a result of management’s analysis of the recoverability of the Fund’s deferred tax assets, as of May 31, 2020, the Fund recorded a valuation allowance of $62,047,728. The Fund will continue to assess the need for a valuation allowance in the future. Significant increases in the fair value of its portfolio of investments may change the Fund’s

22

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

assessment of the recoverability of these assets and may result in the removal of the valuation allowance against all or a portion of the Fund’s gross deferred tax assets.

Total income tax expense/(benefit) (current and deferred) has been computed by applying the federal statutory income tax rate of 21% plus a blended state income tax rate of 1.6% to the Fund’s net investment income and realized and unrealized gains (losses) on investments before taxes for the six months ended May 31, 2020, as follows:

| Deferred | ||||

| Application of statutory income tax expense |

$ | (20,921,510 | ) | |

| State income taxes, net of federal benefit |

(1,624,007 | ) | ||

| Tax benefit on permanent items |

(34,082 | ) | ||

| Change in estimated state deferred tax rate |

51,714 | |||

| Change in valuation allowance |

22,527,885 | |||

|

|

|

|||

| Total tax expense/(benefit) |

$ | — | ||

|

|

|

|||

The Fund’s tax expense or benefit, if any, is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates.

The Fund has net operating loss (NOL) carryforwards of $91,002,685 that are available to offset future taxable income. The Coronavirus Aid, Relief, and Economic Stability Act (CARES Act) was signed into law on March 27, 2020. Under current tax law, NOLs have different carryback and carryforward periods and limitation depending on the date incurred. Under the CARES Act, NOLs generated in tax years ending prior to December 31, 2018 can be carried back 2 years and forward 20 years. In addition, the CARES Act delays the application of the 80% net operating loss limitation, established under the Tax Cuts and Jobs Act of 2017, to tax years ending November 30, 2022 and beyond. As a result, NOLs generated in tax years beginning after December 31, 2018 cannot be carried back but can be carried forward indefinitely subject to the aforementioned 80% limitation. The Fund has NOL carryforwards for federal income tax purposes as follows:

| Year Ended |

Amount | Expiration | ||||||||

| 11/30/2014 | $ | 17,239,860 | November 30, 2034 | |||||||

| 11/30/2015 | 36,870,973 | November 30, 2035 | ||||||||

| 11/30/2016 | 9,144,606 | November 30, 2036 | ||||||||

| 11/30/2017 | 17,021,291 | November 30, 2037 | ||||||||

| 11/30/2018 | 10,329,019 | November 30, 2038 | ||||||||

| 11/30/2020a | 396,936 | Indefinite | ||||||||

| a | Estimated as of May 31, 2020. |

23

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Net capital loss carryforwards of $154,904,197 are available to offset future capital gains. Capital loss carryforwards can be carried forward for 5 years and, accordingly, would begin to expire as of November 30, 2021. The Fund has net capital loss carryforwards for federal income tax purposes as follows:

| Year Ended |

Amount | Expiration | ||||||||

| 11/30/2016 | $ | 61,502,391 | November 30, 2021 | |||||||

| 11/30/2020a | 93,401,806 | November 30, 2025 | ||||||||

| a | Estimated as of May 31, 2020. |

Note 5. Capital Stock

The Fund is authorized to issue 250 million shares of common stock at a par value of $0.001 per share.

During the six months ended May 31, 2020, the Fund issued 62,127 shares of common stock at $251,319 for the reinvestment of dividends. During the year ended November 30, 2019, the Fund issued 47,769 shares of common stock at $400,659 for the reinvestment of dividends.

On December 4, 2018, the Board of Directors approved the continuation of the delegation of its authority to management to effect repurchases, pursuant to management’s discretion and subject to market conditions and investment considerations, of up to 10% of the Fund’s common shares outstanding (Share Repurchase Program) as of January 1, 2019 through December 31, 2019. On December 10, 2019, the Board of Directors of the Fund approved continuation of the Share Repurchase Program of up to 10% of the Fund’s common shares outstanding as of January 1, 2020 through December 31, 2020.

During the six months ended May 31, 2020 and year ended November 30, 2019, the Fund did not effect any repurchases.

Note 6. Borrowings

The Fund has entered into an amended and restated credit agreement (the credit agreement) with BNP Paribas Prime Brokerage International, Ltd. (BNPP) in which the Fund pays a monthly financing charge based on a combination of LIBOR-based variable and fixed rates. The Fund may pay a fee of 0.45% per annum on any unused portion of the credit agreement. Under the amended agreement, the Fund may draw on the credit line up to the maximum $225,000,000 commitment amount on one day’s notice to, and with approval by, BNPP and subject to 1940 Act limitations.

BNPP may not change certain terms of the credit agreement except upon 360 days’ notice. Also, if the Fund violates certain other conditions, the credit agreement may be terminated. The Fund is required to pledge portfolio securities as collateral in an amount up to two times the loan balance outstanding (or more depending on the terms of the credit agreement) and has granted a security interest in the securities pledged to, and in favor of, BNPP as security for the loan balance outstanding.

24

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

If the Fund fails to meet certain requirements, or maintain other financial covenants required under the credit agreement, the Fund may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, necessitating the sale of portfolio securities at potentially inopportune times. Under the terms of the credit agreement, the Fund may, upon prior written notice to BNPP, prepay all or a portion of the fixed rate portions of the credit facility. In the event of such prepayment, the Fund will receive or pay any gain or loss associated with BNPP’s interest rate hedge with respect to the applicable fixed rate portions of the credit facility, which could be material in certain circumstances (breakage fee).

Following a period of extreme volatility and price depreciation in the market for MLPs, the Fund paid down the $52,500,000 5-year fixed-rate tranche and $35,000,000 of the 6-year fixed-rate tranche under the credit agreement with BNPP. In accordance with the terms of the credit agreement, the Fund paid breakage fees of $2,780,305 to BNPP in connection with these paydowns, a portion of which was expensed, with the remainder being amortized based upon the 360 day notice period of the credit facility. For the six months ended May 31, 2020 the Fund has expensed a total of $1,647,741. This amount is reflected as line of credit fees on the Statement of Operations.

As of May 31, 2020, the Fund had outstanding borrowings of $17,500,000. The fair value of these borrowings at May 31, 2020 was $18,323,279, including estimated breakage fees of $823,279 in the event of a prepayment of all of the fixed rate financing. The borrowings are classified as Level 2 within the fair value hierarchy. During the six months ended May 31, 2020, the Fund borrowed an average daily balance of $65,393,443 at a weighted average borrowing cost of 3.4%.

Note 7. Other Risks

MLP Investment Risk: An investment in MLPs involves risks that differ from a similar investment in equity securities, such as common stock, of a corporation. Holders of equity securities issued by MLPs have the rights typically afforded to limited partners in a limited partnership. As compared to common shareholders of a corporation, holders of such equity securities have more limited control and limited rights to vote on matters affecting the partnership. MLPs may have additional expenses, as some MLPs pay incentive distribution fees to their general partners. Additionally, conflicts of interest may exist among common unit holders, subordinated unit holders and the general partner or managing member of an MLP; for example, a conflict may arise as a result of incentive distribution payments.

MLPs may have comparatively smaller capitalizations relative to issuers whose securities are included in major benchmark indexes which presents unique investment risks. MLPs and other small capitalization companies often have limited product lines, markets, distribution channels or financial resources, and the management of such companies may be dependent upon one or a few key people. The market movements of equity securities issued by MLPs and other small capitalization companies may be more abrupt or erratic than the market movements of equity securities of larger, more established companies or the stock market in general. MLPs and other smaller capitalization companies have sometimes gone through extended periods when they did not perform as well as larger companies. In addition, equity securities of smaller capitalization companies generally are less liquid than those of larger companies. This means that the Fund could have greater difficulty selling such securities at the time and price that the Fund would like.

25

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment. The value of MLPs depends largely on the MLPs being treated as partnerships for U.S. federal income tax purposes. If MLPs were subject to U.S. federal income taxation as a corporation, the MLPs would be required to pay U.S. federal income tax on their taxable income which would have the effect of reducing the amount of cash available for distribution to the MLP unitholders. This would also cause any such distributions received by the Fund to be taxed as dividend income to the extent of the MLP’s current or accumulated earnings and profits. As a result, after-tax returns could be reduced, which could cause a decline in the value of MLPs.

Energy Sector Risk: The Fund is subject to more risks related to the energy sector than if the Fund were more broadly diversified over numerous sectors of the economy. A downturn in the energy sector of the economy could have a larger impact on the Fund than on an investment company that does not concentrate in the sector. Recent uncertainty in the energy markets has had an adverse effect on energy-related securities, including MLPs, and it is unclear when these markets may stabilize. In addition, there are several specific risks associated with investments in the energy sector, including the following: Commodity Price Risk, Depletion Risk, Supply and Demand Risk, Regulatory Risk, Acquisition Risk, Weather Risks, Exploration Risk, Catastrophic Event Risk, Interest Rate Transaction Risk, Affiliated Party Risk and Limited Partner Risk and Risks of Subordinated MLP Units. MLPs which invest in the energy industry may be highly volatile due to significant fluctuation in the prices of energy commodities as well as political and regulatory developments.