As filed with the Securities and Exchange Commission on July 23, 2021

1933 Act File No. 333‑184477

1940 Act File No. 811-22761

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

|

|

|

|

|

|

|

| |

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

|

☒ |

|

|

|

|

Pre‑Effective Amendment No. |

|

☐ |

|

|

|

|

Post-Effective Amendment No. 77 |

|

☒ |

|

|

|

|

and/or |

|

|

|

|

|

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

|

☒ |

|

|

|

|

Amendment No. 79 |

|

☒ |

|

|

(Check appropriate box or boxes.)

STONE RIDGE TRUST

(Exact Name of Registrant as Specified in Charter)

510 Madison Avenue, 21st Floor

New York, New York 10022

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code:

855‑609‑3680

Stone Ridge Trust

510 Madison Avenue, 21st Floor

New York, New York 10022

(Name and Address of Agent for Service)

Copies of Communication To:

Elizabeth J. Reza

Gregory C. Davis

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199

It is proposed that this filing will become effective (check appropriate box):

| |

☐ |

immediately upon filing pursuant to paragraph (b) |

| |

☒ |

on July 26, 2021 pursuant to paragraph (b) |

| |

☐ |

60 days after filing pursuant to paragraph (a)(1) |

| |

☐ |

on (date) pursuant to paragraph (a)(1) |

| |

☐ |

75 days after filing pursuant to paragraph (a)(2) |

| |

☐ |

on (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| |

☐ |

this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

This Post-Effective Amendment No. 77 to the Registration Statement of Stone Ridge Trust on Form N-1A (File No. 333‑184477) is being filed pursuant to Rule 485(b) under the Securities Act of 1933, as amended, to include a prospectus and statement of additional information relating to the Stone Ridge Bitcoin Strategy Fund, a new series of the Registrant. No information contained herein is intended to amend or supersede any prior filing relating to any other series of the Registrant.

PROSPECTUS

STONE RIDGE ASSET MANAGEMENT LLC

STONE RIDGE BITCOIN STRATEGY FUND

|

|

|

|

|

|

|

| |

|

Share Class |

|

Ticker Symbol |

|

|

|

|

Class I |

|

BTCIX |

|

|

|

|

Class M |

|

BTCMX |

|

|

This prospectus describes Class I Shares and Class M Shares of the Stone Ridge Bitcoin Strategy Fund (the “Fund”). The Fund’s shares do not charge sales commissions or loads.

Neither the Securities and Exchange Commission (the “Commission”), the Commodity Futures Trading Commission (“CFTC”) nor any state securities commission has approved or disapproved of these securities or determined this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus contains important information about the Fund and the services available to shareholders. Please save it for reference.

As permitted by regulations adopted by the Commission, paper copies of the Fund’s shareholder reports are not sent by mail, unless you specifically request paper copies of the reports from your financial intermediary or, if you invest directly through the Fund’s transfer agent, U.S. Bancorp Fund Services, LLC (the “Transfer Agent”), from the Transfer Agent. Instead, the reports are made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary or, if you invest directly through the Transfer Agent, by contacting the Transfer Agent at (855) 609‑3680. Your election to receive reports in paper will apply to all funds held in your account if you invest through a financial intermediary or all funds within the fund complex if you invest directly through the Transfer Agent.

STONE RIDGE TRUST

TABLE OF CONTENTS

|

|

|

|

|

| |

|

Page |

|

|

|

| |

|

|

S‑1 |

|

|

|

| |

|

|

S‑1 |

|

|

|

| |

|

|

1 |

|

|

|

| |

|

|

1 |

|

| |

|

|

9 |

|

| |

|

|

30 |

|

|

|

| |

|

|

30 |

|

|

|

| |

|

|

30 |

|

| |

|

|

31 |

|

| |

|

|

31 |

|

| |

|

|

31 |

|

|

|

| |

|

|

31 |

|

|

|

| |

|

|

31 |

|

| |

|

|

31 |

|

|

|

| |

|

|

33 |

|

|

|

| |

|

|

33 |

|

| |

|

|

33 |

|

| |

|

|

33 |

|

|

|

| |

|

|

34 |

|

|

|

| |

|

|

34 |

|

| |

|

|

35 |

|

|

|

| |

|

|

35 |

|

|

|

| |

|

|

35 |

|

| |

|

|

36 |

|

| |

|

|

36 |

|

| |

|

|

39 |

|

|

|

| |

|

|

39 |

|

|

|

| |

|

|

39 |

|

|

|

| |

|

|

40 |

|

|

|

| |

|

|

41 |

|

FUND SUMMARY

Stone Ridge Bitcoin Strategy Fund

Investment Objective

The Stone Ridge Bitcoin Strategy Fund’s (the “Fund”) investment objective is capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

Fees and Expenses

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

|

|

|

|

|

|

|

|

|

| Annual Fund Operating Expenses |

|

Class I |

|

|

Class M |

|

| (expenses you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

|

|

|

|

|

|

| Management Fees |

|

|

0.50% |

|

|

|

0.50% |

|

|

|

|

| Distribution and/or Service (12b‑1) Fees |

|

|

None |

|

|

|

0.15% |

|

|

|

|

| Other Expenses(1) |

|

|

0.68% |

|

|

|

0.68% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Annual Fund Operating Expenses |

|

|

1.18% |

|

|

|

1.33% |

|

|

|

|

| (Fee Waiver and/or Expense Reimbursement)(2) |

|

|

0.00% |

|

|

|

0.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses After

(Fee Waiver/Expense Reimbursement) |

|

|

1.18% |

|

|

|

1.33% |

|

|

|

|

|

|

|

|

|

|

| (1) |

Other Expenses are based on estimated amounts for the current fiscal year. Other Expenses includes 0.30% of interest expense incurred in the course of implementing the Fund’s investment strategy. Total Annual Fund Operating Expenses After (Fee Waiver/Expense Reimbursement) excluding such interest expenses are 0.88% for Class I Shares and 1.03% for Class M shares. |

| (2) |

Through the one‑year anniversary of the date the Fund commences investment operations, the Adviser (defined below) has contractually agreed to waive its management fee and/or pay or otherwise bear operating and other expenses of the Fund or a Class thereof (including organizational and offering expenses, but excluding the Fund’s investment management fee, brokerage and transactional expenses, borrowing and other investment-related costs and fees including interest payments on borrowed funds, interest and commitment fees, short dividend expense, acquired fund fees and expenses, taxes, litigation and indemnification expenses, judgments and extraordinary expenses not incurred in the ordinary course of the Fund’s business (collectively, the “Excluded Expenses”)) solely to the extent necessary to limit the Total Annual Fund Operating Expenses, other than Excluded Expenses, of the applicable Class to 0.50% for Class I shares and 0.65% for Class M shares of the average daily net assets attributable to such Class of shares. The Adviser shall be entitled to recoup in later periods expenses attributable to a Class that the Adviser has paid or otherwise borne (whether through reduction of its management fee or otherwise) to the extent that the expenses for the Class of shares (including offering expenses, but excluding Excluded Expenses) after such recoupment do not exceed the lower of (i) the annual expense limitation rate in effect at the time of the actual waiver/reimbursement and (ii) the annual expense limitation rate in effect at the time of the recoupment; provided that the Adviser shall not be permitted to recoup any such fees or expenses beyond three years from the end of the month in which such fee was reduced or such expense was reimbursed. The expense limitation agreement may only be modified by a majority vote of the trustees who are not “interested persons” of the Fund (as defined by the Investment Company Act of 1940, as amended (the, “1940 Act”)) and the consent of the Adviser. |

Example. This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated, regardless of whether or not you redeem your shares at the end of such periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses (as described above) remain the same and takes into account the effect of the expense reimbursement (if any) during the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

3 Years |

| Class I Shares |

|

|

$ |

120 |

|

|

|

$ |

375 |

|

| Class M Shares |

|

|

$ |

135 |

|

|

|

$ |

421 |

|

S-1

Portfolio Turnover

A change in the securities held by the Fund is known as “portfolio turnover.” A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. Portfolio turnover will not be a limiting factor should the Adviser deem it advisable to purchase or sell securities. Portfolio turnover information for the Fund is not presented because the Fund has not commenced investment operations as of the date of this prospectus.

Principal Investment Strategies

The Stone Ridge Bitcoin Strategy Fund seeks capital appreciation. The Fund pursues its investment strategy primarily by investing in bitcoin futures contracts and in pooled investment vehicles that invest directly or indirectly in bitcoin (collectively, “bitcoin-related investments”). The Fund does not invest in bitcoin or other digital assets directly. In addition, the Fund expects to have significant holdings of cash, U.S. government securities, mortgage-backed securities issued or guaranteed by U.S. government agencies, instrumentalities or sponsored enterprises of the U.S. government (whether or not the securities are U.S. government securities, “Agency MBS”), municipal debt securities, money market funds and investment grade securities issued by foreign governments, supranational entities and, to a lesser extent, corporations (the “Cash and Fixed Income Investments”). The Cash and Fixed Income Investments are intended to provide liquidity, to serve as collateral for the Fund’s futures contracts and to support the Fund’s use of leverage.

The Fund seeks to invest in bitcoin-related investments so that the total value of the bitcoin to which the Fund has economic exposure is between 100% and 125% of the net assets of the Fund (the “Target Exposure”). The Fund’s Target Exposure will generally not be changed based on the daily price changes of bitcoin or the Fund’s bitcoin-related investments. There can be no assurance that the Fund will be able to achieve or maintain the Target Exposure. The Fund generally expects to seek to maintain exposure to the value of bitcoin equal to 100% of its net assets, but may increase such exposure to try to offset any negative futures basis that may exist, although the Fund is not required to do so. “Futures basis” refers to the difference between the current market value of bitcoin (the “spot” price) and the price of the cash-settled bitcoin futures contracts. A negative futures basis exists when cash-settled bitcoin futures contracts generally trade at a premium to the current market value of bitcoin. If a negative futures basis exists, the Fund’s investments in bitcoin futures contracts will generally underperform a direct investment in bitcoin. The Fund may also experience tracking error (i.e., the Fund may underperform a direct investment in bitcoin) for other reasons. To the extent that the Fund’s economic exposure to bitcoin exceeds 100% of the net assets of the Fund, the Fund will generally have leveraged exposure to the value of bitcoin. This means that any changes in value of bitcoin will generally result in proportionally larger changes in the Fund’s NAV, including the potential for greater losses than if the Fund’s exposure to the value of bitcoin were unleveraged.

The Fund may also obtain leverage in the form of borrowings, which would typically be in the form of loans from banks, may be on a secured or unsecured basis and at fixed or variable rates of interest. The value of an investment in the Fund will be more volatile and other risks tend to be compounded to the extent that the Fund is exposed to leverage. See “Investment Objective, Strategies and Risks — Risks of Investing — Borrowing and Leverage Risk” below.

The Fund’s size will be limited by Chicago Mercantile Exchange (“CME”) position limits, which prevent any single investor, such as the Fund (together with all other accounts required to be aggregated), from holding more than a specified number of a particular type of futures contract. As of June 30, 2021, the CME’s position limits would limit the Fund to holding no more than 2,000 spot month bitcoin futures contracts (fewer if the other accounts required to be aggregated also held any such contracts or options on such contracts). Because the Fund seeks to obtain a Target Exposure equal to at least 100% of the Fund’s net assets, and assuming the Fund only obtains such exposure using spot month bitcoin futures contracts (as opposed to investing in other bitcoin-related investments), the CME position limits would limit the Fund’s net assets to a maximum of approximately $347 as

S-2

of such date. The Fund generally expects that it will close to new investments at any time that it becomes necessary to do so in order to comply with the CME position limits and, during such closings, the Fund may choose to permit only the reinvestment of dividends by existing shareholders, or it may choose to prohibit such reinvestment will be permitted. The Fund may re‑open to new investment and subsequently close again to new investment at any time at the discretion of the Adviser. During any time the Fund is closed to new investments, Fund shareholders will continue to be able to redeem their shares.

Bitcoin and bitcoin futures contracts are a relatively new asset class and are subject to unique and substantial risks, including the risk that the value of the Fund’s investments could decline rapidly, including to zero. Bitcoin and bitcoin futures contracts have historically been more volatile than traditional asset classes. You should be prepared to lose your entire investment.

Bitcoin

Bitcoin is a digital asset, the ownership and behavior of which are determined by participants in an online, peer‑to‑peer network that connects computers that run publicly accessible, or “open source,” software that follows the rules and procedures governing the Bitcoin network, commonly referred to as the Bitcoin protocol. The value of bitcoin, like the value of other digital assets, is not backed by any government, corporation or other identified body. Ownership and the ability to transfer or take other actions with respect to bitcoin is protected through public‑key cryptography. The supply of bitcoin is constrained formulaically by the Bitcoin protocol instead of being explicitly delegated to an identified body (e.g., a central bank or corporate treasury) to control. Units of bitcoin are treated as fungible. Bitcoin and certain other types of digital assets are sometimes referred to as digital currencies or cryptocurrencies. No single entity owns or operates the Bitcoin network, the infrastructure of which is collectively maintained by (1) a decentralized group of participants who run computer software that results in the recording and validation of transactions (commonly referred to as “miners”), (2) developers who propose improvements to the Bitcoin protocol and the software that enforces the protocol and (3) users who choose what Bitcoin software to run. Bitcoin was released in 2009 and, as a result, there is relatively little data on its long-term investment potential. Bitcoin is not backed by a government-issued legal tender or other assets or currency.

Bitcoin Futures Contracts

The Fund seeks to achieve the Target Exposure by purchasing bitcoin futures contracts. Futures contracts are financial contracts the value of which depends on, or is derived from, the underlying reference asset. In the case of bitcoin futures contracts, the underlying reference asset is bitcoin. Futures contracts may be physically-settled or cash-settled. The only futures contracts in which the Fund invests are cash-settled bitcoin futures contracts traded on commodity exchanges registered with the CFTC. “Cash-settled” means that when the relevant futures contract expires, if the value of the underlying asset exceeds the futures contract price, the seller pays to the purchaser cash in the amount of that excess, and if the futures contract price exceeds the value of the underlying asset, the purchaser pays to the seller cash in the amount of that excess. In a cash-settled futures contract on bitcoin, the amount of cash to be paid is equal to the difference between the value of the bitcoin underlying the futures contract at the close of the last trading day of the contract and the futures contract price specified in the agreement. The CME has specified that the value of bitcoin underlying bitcoin futures contracts traded on the CME will be determined by reference to a volume-weighted average of bitcoin trading prices on multiple bitcoin trading venues. The Fund generally does not intend to close out, sell or redeem its futures contracts except (i) to meet redemptions or (ii) when a bitcoin futures contract is nearing expiration, at which point the Fund will generally sell it and use the proceeds to buy a bitcoin futures contract with a later expiration date in order to maintain its futures exposure. This is commonly referred to as “rolling”.

Pooled Investment Vehicles

The Fund intends to invest in pooled investment vehicles that invest directly or indirectly in bitcoin and are managed by unaffiliated third parties if such investments are available in the market and meet the Adviser's investment criteria.

S-3

Cash and Fixed Income Investments

In addition to the Fund’s bitcoin-related investments, the Fund expects to have significant holdings of Cash and Fixed Income Investments. The Cash and Fixed Income Investments are intended to provide liquidity, to serve as collateral for the Fund’s bitcoin futures contracts and to support the Fund’s use of leverage. Although the amount of Cash and Fixed Income Investments held by the Fund may change over time and will be determined primarily by the amount needed to seek to achieve or maintain the Target Exposure, the Fund intends, under normal circumstances, to invest at least 40% of its total assets in investment-grade fixed income investments that are Agency MBS, municipal debt securities or that are issued by foreign governments, supranational entities or corporations (with the remaining assets of the Fund invested in cash, cash equivalents, U.S. government securities and a wholly-owned and controlled subsidiary (the “Subsidiary”) organized in the Cayman Islands and advised by the Stone Ridge Asset Management LLC). In addition, because the Fund intends to qualify as a RIC under the Code, the Fund will generally hold Cash and Fixed Income Investments such that, at the end of each fiscal quarter, at least 50% of the value of the Fund’s total assets is represented by cash, U.S. government securities, and other securities limited in respect of any one issuer to a value not greater than 5% of the value of the Fund’s total assets and not more than 10% of the outstanding voting securities of such issuer.

Principal Investment Risks

Investors should carefully consider the Fund’s risks and investment objective, as an investment in the Fund may not be appropriate for all investors or clients and is not designed to be a complete investment program. An investment in the Fund involves a high degree of risk and may be considered a speculative investment. It is possible that investing in the Fund may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age, and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment.

The Fund is subject to the principal risks described below, whether through its direct investments, investments by the Subsidiary or other pooled investment vehicles or the Fund’s derivatives positions. As with any mutual fund, there is no guarantee that the Fund will achieve its investment objective. You could lose all or part of your investment in the Fund, and the Fund could underperform other investments.

The following is a summary of certain risks of investing in the Fund. Before investing, please be sure to read the additional information under “Investment Objective, Strategies and Risks —Risks of Investing” below.

Market and Volatility Risk. The value of certain of the Fund’s investments, including bitcoin-related investments, is subject to market risk. Market risk is the risk that the value of the investments to which the Fund is exposed will fall, which could occur due to general market or economic conditions or other factors.

Bitcoin has historically exhibited higher price volatility than more traditional asset classes; for example, during the period from December 17, 2017 to December 14, 2018, bitcoin experienced a decline of roughly 84%.

The value of bitcoin and, therefore, of the Fund’s bitcoin-related investments, could decline rapidly, including to zero. You should be prepared to lose your entire investment.

Passive Investment Risk. The Fund will generally hold its bitcoin-related investments during periods in which the value of bitcoin is flat or declining as well as during periods in which the value of bitcoin is rising, and the Adviser will generally not seek to change the Fund’s Target Exposure based on daily price changes. For example, if the Fund’s bitcoin-related investments are declining in value, the Fund generally will not close out, sell or redeem its positions except in order to meet redemption requests.

S-4

Risks Related to the Bitcoin Market in General.

Bitcoin Adoption Risk. The further development and acceptance of the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. The slowing, stopping or reversing of the development or acceptance of the Bitcoin network may adversely affect the price of bitcoin and therefore cause the Fund to suffer losses.

The growth of this industry is subject to a high degree of uncertainty, and the factors affecting its further development, include, but are not limited to, the continued growth or possible reversal in the adoption of bitcoin, government regulation over bitcoin, the maintenance and development of the Bitcoin network, the availability and popularity of other mediums of exchange for buying and selling goods and services and consumer or public perception of bitcoin specifically or other digital assets generally. Currently, there is relatively limited use of bitcoin in the retail and commercial marketplace in comparison to relatively extensive use as a store of value, thus contributing to price volatility (meaning prices may fluctuate widely) that could adversely affect the Fund’s bitcoin-related investments.

Miner Collusion Risk. Miners, functioning in their transaction confirmation capacity, collect fees for each bitcoin transaction they confirm. Miners have historically accepted relatively low transaction confirmation fees. If miners collude in an anticompetitive manner to reject low transaction fees, then bitcoin users could be forced to pay higher fees, thus reducing the attractiveness of the Bitcoin network. Any collusion among miners may adversely impact the attractiveness of the Bitcoin network and may adversely impact the Fund’s bitcoin-related investments.

Bitcoin Cybersecurity Risk. Cybersecurity exploitations or attacks against the Bitcoin protocol and of entities that custody or facilitate the transfers or trading of bitcoin could result in a significant theft of bitcoin and a loss of public confidence in bitcoin, which could lead to a decline in the value of bitcoin and, as a result, adversely impact the Fund’s bitcoin-related investments.

Additionally, if a malicious actor or botnet (i.e., a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains control of more than 50% of the processing power of the Bitcoin network, such actor or botnet could alter the blockchain and adversely affect the value of bitcoin, which would adversely affect the Fund’s bitcoin-related investments.

Bitcoin Regulatory Risk. Regulatory changes or actions may alter the nature of an investment in bitcoin or restrict the use of bitcoin or the operations of the Bitcoin network or venues on which bitcoin trades in a manner that adversely affects the price of bitcoin and, therefore, the Fund’s bitcoin-related investments. For example, it may become difficult or illegal to acquire, hold, sell or use bitcoin in one or more countries, which could adversely impact the price of bitcoin.

Future Regulatory Action Risk. There is a possibility of future regulatory change altering, perhaps to a material extent, the ability to buy and sell bitcoin and bitcoin futures. Similarly, future regulatory changes could impact the ability of the Fund to achieve its investment objective or alter the nature of an investment in the Fund or the ability of the Fund to continue to operate as planned.

Bitcoin Trading Venues Operational Risk. Over the past several years, a number of venues through which bitcoin trades have been closed due to fraud, failure or security breaches. In many of these instances, the customers of such exchanges were not compensated or made whole for the partial or complete losses of their account balances in such exchanges. In addition, some academics and market observers have put forth evidence to support claims that manipulative trading activity has occurred on certain bitcoin exchanges. Operational problems or failures by bitcoin trading venues and fluctuations in bitcoin prices may reduce confidence in these venues or in bitcoin generally, which could adversely affect the price of bitcoin and therefore adversely affect the Fund’s bitcoin-related investments.

S-5

Bitcoin Futures Contract Risk. The Fund expects to obtain exposure to bitcoin through futures contracts. Bitcoin futures are financial contracts the value of which depends on, or is derived from, bitcoin as the underlying reference asset. Bitcoin futures contracts involve the risk that changes in their value may not move as expected relative to changes in the value of bitcoin. Futures contracts exhibit “futures basis,” which refers to the difference between the current market value of bitcoin (the “spot” price) and the price of the cash-settled bitcoin futures contracts. A negative futures basis exists when cash-settled bitcoin futures contracts generally trade at a premium to the current market value of bitcoin. If a negative futures basis exists, the Fund’s investments in bitcoin futures contracts will generally underperform a direct investment in bitcoin, and, therefore, it may be more difficult for the Fund to maintain the Target Exposure. There can also be no guarantee that there will be a correlation between price movements in bitcoin futures contracts and in the price of bitcoin. As a result, the use of bitcoin futures contracts involves risks that are in addition to, and potentially greater than, the risks of investing directly in securities and other more traditional assets, and may be considered a speculative investment.

While the bitcoin futures market has grown substantially since bitcoin futures commenced trading, there can be no assurance that this growth will continue. Bitcoin futures are subject to collateral requirements and daily limits that may limit the Fund’s ability to achieve the Target Exposure, resulting in losses or otherwise preventing the Fund from achieving its objective.

The underlying cash or spot markets for bitcoin are generally not regulated by the SEC or the CFTC. Underlying bitcoin markets may not be subject to registration, licensing or fitness requirements, audit trail or trade reporting rules, market integrity rules, wash sale, spoofing or other anti-fraud rules, disaster recovery or cybersecurity requirements, surveillance requirements, or anti-money laundering rules that are as stringent as those to which national securities exchanges and futures exchanges are subject. Because of these factors, bitcoin markets may be more susceptible to fraud and manipulation, which could adversely affect the price of bitcoin and thereby the Fund’s investment in bitcoin futures.

Pooled Investment Vehicle Risk. The Fund’s investments in pooled investment vehicles that invest in bitcoin are subject to the bitcoin-related risks described herein. In addition, such pooled investment vehicles are subject to risk with respect to the custody of their bitcoin holdings. As an investor in a pooled investment vehicle, the Fund will generally have no right or power to take part in the management of the vehicle, and no assurance can be given that the vehicle will be successful in achieving its investment objective. Private pooled investment vehicles that invest in bitcoin are generally not registered investment companies under the 1940 Act, the Securities Act of 1933, as amended or any state securities laws, and therefore, investors (like the Fund) will not benefit from the same protections and restrictions afforded under such laws. The Fund will also be subject to management fees and other expenses for its investments pooled investment vehicles.

Target Exposure and Rebalancing Risk. Although the Fund seeks to achieve and maintain exposure to bitcoin equal to the Target Exposure, it is possible in certain circumstances that the Fund may not succeed in achieving or maintaining this exposure, possibly maintaining substantially lower exposure for extended periods of time. This could happen if the Fund’s futures commission merchants (“FCMs”) or the exchange increase the amount of collateral the Fund is required to post to the point that the Fund is not able to purchase sufficient futures contracts to reach the Target Exposure or if the futures contracts held by the Subsidiary do not have sufficient exposure to bitcoin to reach the Target Exposure without the Fund having to invest more than 25% of its total assets in the Subsidiary. There can be no assurance that the Fund’s FCM(s) or the exchange will not increase the amount of collateral the Fund is required to post, thereby causing the Fund to reduce its exposure to bitcoin.

Tracking Error Risk. There are several factors that may cause the returns of the Fund to differ substantially from the returns from holding an amount of bitcoin equal to the Target Exposure directly.

Borrowing and Leverage Risk. The Fund seeks to achieve and maintain the Target Exposure by using leverage inherent in futures contracts and through reverse repurchase agreements, and may also obtain leverage in the form of borrowings, which would typically be in the form of loans from banks, may be on a secured or unsecured basis and at fixed or variable rates of interest. Therefore, the Fund is subject to leverage risk. Leverage can have

S-6

the effect of magnifying the Fund’s exposure to changes in the value of its assets and may also result in increased volatility in the Fund’s net asset value (“NAV”), including the potential for greater losses than if the Fund owned its assets on an unleveraged basis.

Reverse Repurchase Agreement Risk. Reverse repurchase agreements involve substantial risk, including the risk of loss due to adverse movements in the price or value of the underlying reference, failure of a counterparty or tax or regulatory constraints.

Illiquidity Risk. Illiquidity risk is the risk that the investments held by the Fund may be difficult or impossible to sell at the time that the Fund would like without significantly changing the market value of the investment. The Fund may invest at the time of purchase up to 15% of its net assets in illiquid securities.

Debt Investing Risk. The values of debt securities to which the Fund is exposed change in response to interest rate changes. In general, the value of a debt security is likely to fall as interest rates rise. This risk is generally greater for obligations with longer maturities or for debt securities that do not pay current interest (such as zero‑coupon securities). Interest rate changes can be sudden and unpredictable, and the Fund may lose money as a result.

Non‑Diversification Risk. The Fund is classified as a “non‑diversified” fund under the 1940 Act. Accordingly, the Fund may invest a greater portion of its assets in the securities of a single issuer than if it were a “diversified” fund. To the extent that the Fund invests a higher percentage of its assets in the securities of a single issuer, the Fund is subject to a higher degree of risk associated with and developments affecting that issuer than a fund that invests more widely.

Portfolio Turnover Risk. The Fund’s portfolio turnover and frequent trading of futures contracts may result in higher transaction costs than if the Fund traded less frequently.

Limited Operating History Risk. The Fund has a limited operating history. As a result, prospective investors have a limited track record and history on which to base their investment decision.

Tax Risk. The Fund currently intends to qualify for treatment as a regulated investment company (“RIC”) under Subchapter M of Chapter 1 of the Code. In order to qualify for such treatment, the Fund must derive at least 90% of its gross income each taxable year from qualifying income, meet certain asset diversification tests at the end of each fiscal quarter, and distribute at least 90% of its investment company taxable income. The Fund’s investment strategy will potentially be limited by its intention to qualify for treatment as a RIC, and income generated from pooled investment vehicles could also cause the Fund to fail to qualify for treatment as a RIC under the Code.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance

In the future, this section will show how the Fund’s total return has varied from year‑to‑year, along with a broad-based market index for reference. Because the Fund has not operated for a full calendar year as of the date of this prospectus, there is no past performance to report. Past performance (before and after taxes) is not an indication of future performance. Performance data current to the most recent month end may be obtained by calling (855) 609‑3680.

Management

Investment Adviser

Stone Ridge Asset Management LLC (“Stone Ridge” or the “Adviser”) is the Fund’s investment adviser.

S-7

Portfolio Managers

Paul Germain, Li Song and Allen Steere (the “Portfolio Managers”) are jointly and primarily responsible for the day‑to‑day management of the Fund. Mr. Germain, Mr. Song and Mr. Steere have been Portfolio Managers since the Fund’s inception.

Purchase and Sale of Fund Shares

The minimum initial investment (which may be waived or reduced in certain circumstances) is $500,000 for Class I Shares and $2,500 for Class M shares. These minimums may be modified and/or applied in the aggregate for certain intermediaries that submit trades on behalf of underlying investors (e.g., registered investment advisers or benefit plans). Differences in the policies of different intermediaries may include different minimum investment amounts. There is no minimum for subsequent investments. All share purchases are subject to approval of the Adviser.

Fund shares may be redeemed on any business day, which is any day the New York Stock Exchange is open for business, by writing to Stone Ridge Trust, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, or by calling (855) 609‑3680. Investors who invest in the Fund through an intermediary should contact their intermediary regarding redemption procedures.

Tax Information

The Fund’s distributions are expected to be taxed as ordinary income and/or capital gains, unless you are exempt from taxation or investing through a tax‑advantaged arrangement, such as a 401(k) plan or an individual retirement account. If you are investing through a tax‑advantaged arrangement, you may be taxed upon withdrawals from that arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

The Fund is not generally sold through financial intermediaries other than certain registered investment advisers, and no sales loads are charged to investors or paid to financial intermediaries. See “Distribution Arrangements” below.

S-8

INVESTMENT OBJECTIVE, STRATEGIES AND RISKS

When used in this prospectus, the term “invest” includes both direct investing, and indirect investing and the term “investments” includes both direct investments and indirect investments. The Fund will also invest through an investment in the Subsidiary.

Investment Objective and Principal Investment Strategies

The Stone Ridge Bitcoin Strategy Fund seeks capital appreciation. The Fund pursues its investment strategy primarily by investing in bitcoin futures contracts and in pooled investment vehicles that invest directly or indirectly in bitcoin (collectively, “bitcoin-related investments”). The Fund does not invest in bitcoin or other digital assets directly. In addition, the Fund expects to have significant holdings of cash, U.S. government securities, mortgage-backed securities issued or guaranteed by U.S. government agencies, instrumentalities or sponsored enterprises of the U.S. government (whether or not the securities are U.S. government securities, “Agency MBS”), municipal debt securities, money market funds and investment grade securities issued by foreign governments, supranational entities and, to a lesser extent, corporations (the “Cash and Fixed Income Investments”). The Cash and Fixed Income Investments are intended to provide liquidity, to serve as collateral for the Fund’s futures contracts and to support the Fund’s use of leverage. In selecting fixed income investments, the Fund will generally seek to invest in high-quality fixed income securities that offer a combination of liquidity and yield that the Fund considers favorable while having a maturity of five years or less, though the Fund may invest in fixed income securities with a longer maturity from time to time. The Fund’s investments in fixed income securities are expected to have an incremental impact on Fund returns and will serve as both potential sources of liquidity and as collateral for the Fund’s use of leverage through reverse repurchase agreements.

The Fund seeks to invest in bitcoin-related investments so that the total value of the bitcoin to which the Fund has economic exposure is between 100% and 125% of the net assets of the Fund (the “Target Exposure”). The Fund’s Target Exposure will generally not be changed based on the daily price changes of bitcoin or the Fund’s bitcoin-related investments. There can be no assurance that the Fund will be able to achieve or maintain the Target Exposure. The Fund generally expects to seek to maintain exposure to the value of bitcoin equal to 100% of its net assets, but may increase such exposure to try to offset any negative futures basis that may exist, although the Fund is not required to do so. “Futures basis” refers to the difference between the current market value of bitcoin (the “spot” price) and the price of the cash-settled bitcoin futures contracts. A negative futures basis exists when cash-settled bitcoin futures contracts generally trade at a premium to the current market value of bitcoin. If a negative futures basis exists, the Fund’s investments in bitcoin futures contracts will generally underperform a direct investment in bitcoin. The Fund may also experience tracking error (i.e., the Fund may underperform a direct investment in bitcoin) for other reasons. To the extent that the Fund’s economic exposure to bitcoin exceeds 100% of the net assets of the Fund, the Fund will generally have leveraged exposure to the value of bitcoin. This means that any changes in value of bitcoin will generally result in proportionally larger changes in the Fund’s NAV, including the potential for greater losses than if the Fund’s exposure to the value of bitcoin were unleveraged.

The Fund may also obtain leverage in the form of borrowings, which would typically be in the form of loans from banks, may be on a secured or unsecured basis and at fixed or variable rates of interest. The value of an investment in the Fund will be more volatile and other risks tend to be compounded to the extent that the Fund is exposed to leverage. See “Investment Objective, Strategies and Risks — Risks of Investing — Borrowing and Leverage Risk” below.

The Fund’s size will be limited by CME position limits, which prevent any single investor, such as the Fund (together with all other accounts required to be aggregated), from holding more than a specified number of a particular type of futures contract. As of June 30, 2021, the CME’s position limits would limit the Fund to holding no more than 2,000 spot month bitcoin futures contracts (fewer if the other accounts required to be aggregated also held any such contracts or options on such contracts). Because the Fund seeks to obtain a Target Exposure equal to at least 100% of the Fund’s net assets, and assuming the Fund only obtains such exposure

1

using spot month bitcoin futures contracts (as opposed to investing in other bitcoin-related investments), the CME position limits would limit the Fund’s net assets to a maximum of approximately $347 as of such date. The Fund generally expects that it will close to new investments at any time that it becomes necessary to do so in order to comply with the CME position limits and, during such closings, the Fund may choose to permit only the reinvestment of dividends by existing shareholders, or it may choose to prohibit such reinvestment will be permitted. The Fund may re‑open to new investment and subsequently close again to new investment at any time at the discretion of the Adviser. During any time the Fund is closed to new investments, Fund shareholders will continue to be able to redeem their shares.

Bitcoin and bitcoin futures contracts are a relatively new asset class and are subject to unique and substantial risks, including the risk that the value of the Fund’s investments could decline rapidly, including to zero. Bitcoin and bitcoin futures contracts have historically been more volatile than traditional asset classes. You should be prepared to lose your entire investment.

For cash management or temporary defensive purposes in times of adverse or unstable market, economic or political conditions, the Fund can invest up to 100% of its assets in investments that may be inconsistent with its principal investment strategy. Generally, the Fund would invest in money market instruments or in other short-term U.S. or foreign government securities. The Fund might also hold these types of securities as interim investments pending the investment of proceeds from the sale of its shares or the sale of its portfolio investments or to meet anticipated redemptions of its shares.

Bitcoin

The Fund invests in bitcoin futures contracts, the value of which, at expiration of the futures contract, is based on the value of bitcoin. The Fund may also invest in pooled investment vehicles that invest in bitcoin if such investments are available in the market and meet the Adviser's investment criteria. Bitcoin is a digital asset, the ownership and behavior of which are determined by participants in an online, peer‑to‑peer network known as the Bitcoin network. Bitcoin may be used to pay for goods and services, stored for future use, or converted to a fiat currency. The value of bitcoin is determined by the supply of and demand for bitcoin on venues organized to facilitate the trading of bitcoin. In addition, the value of bitcoin, like the value of other digital assets, is not backed by any government, corporation or other identified body.

No single entity owns or operates the Bitcoin network, the infrastructure of which is collectively maintained by (1) a decentralized group of participants who run computer software that results in the recording and validation of transactions (commonly referred to as “miners”), (2) developers who propose improvements to the Bitcoin protocol and the software that enforces the protocol and (3) users who choose what Bitcoin software to run. Anyone can be a miner, developer or user. The Bitcoin network is governed by a publicly accessible, or “open source,” software commonly referred to as the Bitcoin protocol.

Bitcoin is not an income-generating asset, and as a result the Fund’s bitcoin-related investments are not expected to pay dividends or other distributions in the way common stock of companies may. Therefore, any positive return on an investment in the Fund is expected to result only from appreciation of the Fund’s bitcoin-related investments and from income generated by the Fund’s Cash and Fixed Income Investments.

The Bitcoin Network. Bitcoin is “stored” or reflected on a digital transaction ledger commonly known as a “blockchain.” A blockchain is a type of shared and continually reconciled database, stored in a decentralized manner on the computers of certain users of the digital asset. A blockchain is a canonical record of every digital asset: the blockchain records every “coin” or “token,” balances of digital assets, every transaction and every address associated with a quantity of a particular digital asset. Bitcoin utilizes the blockchain to record transactions into and out of different addresses, facilitating a determination of how much bitcoin is in each address.

Bitcoin is created by “mining.” Mining involves miners using a sophisticated computer program to repeatedly solve complex mathematical problems on specialized computer hardware. The mathematical problem involves a

2

computation involving all or some bitcoin transactions that have been proposed by the Bitcoin network’s participants. When this problem is solved, the computer creates a “block” consisting of these transactions. As each newly solved block refers back to and “connects” with the immediately prior solved block, the addition of a new block adds to the blockchain in a manner similar to a new link being added to a chain. A miner’s proposed block is added to the blockchain once a majority of the nodes on the network confirm the miner’s work. A miner that is successful in adding a block to the blockchain is automatically awarded a fixed amount of bitcoin for its efforts plus any transaction fees paid by transferors whose transactions are recorded in the block. This reward system is the means by which new bitcoin enter circulation. This reward system also ensures that the local copies of the Bitcoin blockchain maintained by participants in the Bitcoin network are kept in consensus with one another. As of December 31, 2020, there are approximately 18.6 million bitcoin that have been created, a number that is not permitted grow to more than 21 million, which is estimated to occur by the year 2140.

The Bitcoin network was initially contemplated in a white paper purportedly authored by an individual named Satoshi Nakamoto; however, no individual with that name has been reliably identified as bitcoin’s creator, and the general consensus is that the name is a pseudonym for the actual inventor or inventors. The first bitcoin was created in 2009 after Nakamoto released the Bitcoin network source code and mined the first block. Since its introduction, bitcoin has been under active development by a group of engineers known as Core developers, who work on a specific distribution of Bitcoin software known as the “Bitcoin Core”. There are many other compatible versions of the Bitcoin software, but Bitcoin Core is the most widely adopted and currently provides the de facto standard for the Bitcoin protocol.

The Bitcoin and Bitcoin Futures Markets. Bitcoin is the oldest, best-known and largest market-capitalization digital asset. Since the advent of bitcoin, numerous other digital assets have been created. The website CoinMarketCap.com tracks the U.S. dollar price and total market capitalization for each of more than 4,000 traded digital assets. As of June 30, 2021, bitcoin had a total market capitalization in excess of $650 billion and represented more than 46% of the entire digital asset market.

The first trading venues for bitcoin were informal exchange services marketed primarily in public online forums. Transactions on these services were effected via anonymous email, and the fiat currency portions of these transactions were effected through payment services such as PayPal. These services required their operators to manually match buyers and sellers in order to process transactions.

Later, automated exchanges that matched buyers and sellers began to form. Many such exchanges have been created in the U.S. and abroad. In the U.S., a number of exchanges now operate under licensing from the New York Department of Financial Services (“NYDFS”).

Beginning in 2016, more institutional investors entered the bitcoin market. As a result, an increasing number of transactions have occurred in OTC markets instead of exchanges. This type of trading allows for bespoke trading arrangements that may ease of the burden of trade operations or reduce different types of risks (e.g., counterparty risk).

As a result, there is not a single source for pricing bitcoin. The Fund believes that prices on the bitcoin trading venues are generally formed by the levels of demand on either side of the exchange’s order book, and arbitrage between exchanges typically prevents larger and/or more persistent differences in prices between bitcoin trading venues. Factors that the Fund believes may influence the relative balance of buyers and sellers on the bitcoin trading venues include trading activity in the OTC markets, global or regional economic conditions, expected levels of inflation, growth or reversal in the adoption and use of bitcoin, developments in the regulation of bitcoin, changes in the preference of market participants between bitcoin and other digital assets, maintenance and development of the open-source software protocol of the Bitcoin network, and negative consumer or public perception of bitcoin specifically or digital assets generally. See “Risks of Investing — Market and Volatility Risk,” “ — Bitcoin Adoption Risk,” and “ — Bitcoin Cybersecurity Risk.”

3

Bitcoin spot trading occurs on venues in the U.S. that are licensed to conduct that business by the NYDFS, other venues in the U.S. and non‑U.S. venues. In addition, bitcoin futures contract trading occurs on exchanges in the U.S. regulated by the CFTC. The market for NYDFS-licensed and CFTC-regulated trading of bitcoin and bitcoin derivatives has developed substantially.

Bitcoin and bitcoin futures contracts have generally exhibited high price volatility relative to traditional asset classes. The table below provides historical information about the price and volatility of bitcoin and bitcoin futures contracts for the period from January 1, 2020 through June 30, 2021. The column labeled “Daily Return Volatility” shows the standard deviation of daily (4 p.m. to 4 p.m.) price returns on business days, annualized by a 252‑day factor for both bitcoin and bitcoin futures contracts. It shows that a one standard deviation move in a year is 71.93% for spot bitcoin and 75.77% for bitcoin futures contracts, which means that it is reasonably likely that the price of bitcoin and bitcoin futures contracts will increase or decrease by a large percentage during any given year. There can be no assurance as to the future performance of bitcoin or bitcoin futures contracts; past performance and volatility should not be taken as an indication of future performance or volatility.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset |

|

Start Price |

|

|

Low Price |

|

|

High Price |

|

|

End Price |

|

|

Maximum

Price Range(1) |

|

|

Daily Return

Volatility(2) |

|

| Bitcoin(3) |

|

$ |

7,145 |

|

|

$ |

3,906 |

|

|

$ |

64,889 |

|

|

$ |

34,760 |

|

|

|

42.90 |

% |

|

|

71.93 |

% |

| Bitcoin Futures(4) |

|

$ |

7,210 |

|

|

$ |

4,210 |

|

|

$ |

65,975 |

|

|

$ |

34,725 |

|

|

|

36.14 |

% |

|

|

75.77 |

% |

| (1) |

Maximum Price Range is calculated by first adding together the highest and lowest price for the relevant business day and dividing by two to determine the daily mid‑point price. Next, the day’s low price is subtracted from the day’s high price to determine the maximum daily price change. The “Maximum Price Range” is equal to the maximum daily price change expressed as a percentage of the daily mid‑point price. Maximum Price Range shows the maximum peak‑to‑trough daily price change as a percentage of the mid‑point price for each business day, and is meant to illustrate the intraday volatility of bitcoin and bitcoin futures contracts. It is not a measure of investment returns.. |

| (2) |

Daily Return Volatility is the standard deviation of daily (4 p.m. to 4 p.m.) price returns on business days, annualized by a 252‑day factor. |

| (3) |

Prices represented by the 4pm Coindesk Bitcoin Price Index. |

| (4) |

Prices represented by the daily CME settlement prices. |

The following table shows the aggregate annual trading volume for bitcoin across the three largest NYDFS-licensed exchanges, as well as the aggregate annual trading volume and average daily open interest (i.e., the average total number of bitcoin futures contracts held by market participants at the end of each trading day) for bitcoin futures contracts on the CME. The bitcoin data shown is for trading volumes of bitcoin against US dollars and exclude trading transactions of bitcoin against other digital assets (e.g., Tether) or other fiat currencies (e.g., euros). As the data in the table illustrates, the trading volume in both spot bitcoin and CME bitcoin futures contracts has increased substantially over the past five years, which indicates that these markets have grown rapidly and have become increasingly more liquid. However, there can be no assurance as to the future liquidity of bitcoin or bitcoin futures contracts.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year |

|

Bitcoin Volume ($000’s) |

|

|

Futures Volume ($000’s) |

|

|

Futures Average

Open Interest

($000’s) |

|

| 2016 |

|

|

2,692,758 |

|

|

|

— |

|

|

|

— |

|

| 2017 |

|

|

68,044,599 |

|

|

|

736,828 |

|

|

|

41,498 |

|

| 2018 |

|

|

83,127,690 |

|

|

|

31,977,850 |

|

|

|

86,360 |

|

| 2019 |

|

|

66,699,394 |

|

|

|

60,958,390 |

|

|

|

155,438 |

|

| 2020 |

|

|

104,395,865 |

|

|

|

132,284,440 |

|

|

|

525,047 |

|

| 2021 (through 6/30) |

|

|

273,726,294 |

|

|

|

322,809,068 |

|

|

|

2,170,340 |

|

Source: Respective exchanges.

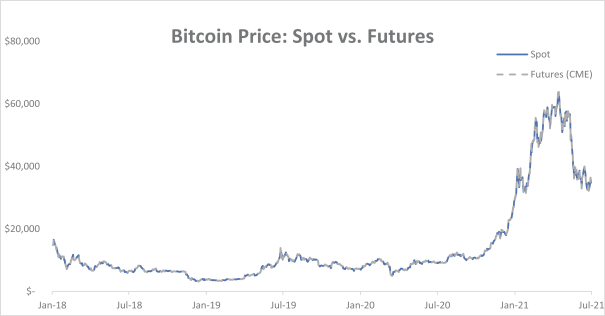

The following chart shows the movements in the market price of bitcoin (also referred to as “spot” bitcoin, which is represented by the 4pm Coindesk Bitcoin Price Index) and bitcoin futures contracts for the period from January 1, 2018 through June 30, 2021. There can be no assurance that bitcoin futures contracts will successfully track the price of bitcoin over time or at any particular time in the future.

4

Forks and Air Drops. A “hard fork” of the Bitcoin network (or any other digital asset network) occurs when there is a disagreement among users and miners over modifications to the network, which are typically made through software upgrades and subsequently accepted or rejected through downloads or lack thereof of the relevant software upgrade by users. If less than a substantial majority of users and miners consent to a proposed modification, and the modification is not compatible with the software prior to its modification, a fork in the blockchain results, with one prong running the pre‑modified software and the other running the modified software. The effect of such a fork is the existence of two versions of the network running in parallel, yet lacking interchangeability. After a fork, holders of the original digital asset typically end up holding equal amounts of the original digital asset and the new digital asset.

For example, in August 2017, bitcoin “forked” into bitcoin and a new digital asset, bitcoin cash, as a result of a several-year dispute over how to increase transaction throughput.

A fork may also be introduced by an unintentional, unanticipated software flaw in the multiple versions of otherwise compatible software users run for any given digital asset. Such a fork could adversely affect bitcoin’s viability. It is possible, however, that a substantial number of users and miners could adopt an incompatible version of the network while resisting community‑led efforts to merge the two chains, resulting in a permanent fork.

A hard fork can introduce new security risks. Another possible result of a hard fork is an inherent decrease in the level of security. After a hard fork, it may become easier for an individual miner or mining pool’s hashing power to exceed 50% of the processing power of the Bitcoin network, thereby making the network more susceptible to attack. A fork in the Bitcoin network could adversely affect the Fund’s bitcoin-related investments.

In addition to forks, bitcoin (or any other digital asset) may become subject to a similar occurrence known as an “air drop.” In an air drop, the promoters of a new digital asset announce to holders of another digital asset that they will be entitled to claim a certain amount of the new digital asset for free simply by virtue of having held the original digital asset at a certain point in time leading up to the air drop. For example, in March 2017, the promoters of Stellar Lumens announced that anyone that owned bitcoin as of June 26, 2017 could claim, until August 27, 2017, a certain amount of Stellar Lumens.

Government Oversight. Regulatory guidance and the possibility of government action have been significant in shaping the evolution of the bitcoin market. A number of U.S. federal and state agencies and foreign

5

governments and agencies have finalized or proposed rules or guidance, conducted investigations and issued subpoenas, engaged in successful prosecutions, and issued consumer advisories related to bitcoin and other digital assets. Continued government and agency actions are likely to continue to be significant to the development of the market and the price of bitcoin, as described in more detail under “Risks of Investing—Bitcoin Regulatory Risk.”

Bitcoin Futures Contracts

The Fund seeks to achieve the Target Exposure by purchasing bitcoin futures contracts. Futures contracts are financial contracts the value of which depends on, or is derived from, the underlying reference asset. In the case of bitcoin futures contracts, the underlying reference asset is bitcoin. Futures contracts may be physically-settled or cash-settled. The only futures contracts in which the Fund invests are cash-settled bitcoin futures contracts traded on commodity exchanges registered with the CFTC. “Cash-settled” means that when the relevant futures contract expires, if the value of the underlying asset exceeds the futures contract price, the seller pays to the purchaser cash in the amount of that excess, and if the futures contract price exceeds the value of the underlying asset, the purchaser pays to the seller cash in the amount of that excess. In a cash-settled futures contract on bitcoin, the amount of cash to be paid is equal to the difference between the value of the bitcoin underlying the futures contract at the close of the last trading day of the contract and the futures contract price specified in the agreement. The CME has specified that the value of bitcoin underlying bitcoin futures contracts traded on the CME will be determined by reference to a volume-weighted average of bitcoin trading prices on multiple bitcoin trading venues. The Fund generally does not intend to close out, sell or redeem its futures contracts except (i) to meet redemptions or (ii) when a bitcoin futures contract is nearing expiration, at which point the Fund will generally sell it and use the proceeds to buy a bitcoin futures contract with a later expiration date in order to maintain its futures exposure. This is commonly referred to as “rolling”.

Futures contracts exhibit “futures basis,” which refers to the difference between the current market value of the underlying bitcoin (the “spot” price) and the price of the cash-settled bitcoin futures contracts. A negative futures basis exists when cash-settled bitcoin futures contracts generally trade at a premium to the current market value of bitcoin. If a negative futures basis exists, the Fund’s investments in bitcoin futures contracts will generally underperform a direct investment in bitcoin, and, therefore, it may be more difficult for the Fund to maintain the Target Exposure.

The Fund expects to gain exposure to bitcoin futures contracts by investing in bitcoin futures contracts through the Subsidiary. Because the Fund intends to qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”), the size of the Fund’s investment in the Subsidiary will generally be limited to 25% of the Fund’s total assets, tested at the end of each fiscal quarter (the “Subsidiary Asset Cap”).

Pooled Investment Vehicles

The Fund intends to invest in pooled investment vehicles that invest directly or indirectly in bitcoin and are managed by unaffiliated third parties if such investments are available in the market and meet the Adviser's investment criteria. The Fund’s investments in such pooled investment vehicles will be subject to management fees and other expenses of such pooled investment vehicles, and the Fund will bear its pro rata share of such fees and expenses in addition to the other Fund fees and expenses described in this prospectus. Partly as a result of such fees and expenses, any pooled investment vehicles in which the Fund invests may at any time underperform or outperform relative to a direct investment in bitcoin (such underperformance or outperformance, “tracking error”). Such pooled investment vehicles may offer a variety of liquidity terms, including vehicles the interests in which do not trade in a secondary market but that offer redemption daily, weekly, monthly or quarterly, as well as vehicles that do not offer to redeem interests in such vehicles but the interests in which trade in a secondary market. Depending on the terms of the pooled investment vehicles in which it invests, there can be no assurance that a liquid market or other means of liquidation (such as redemption) will exist at the time the Fund would like to liquidate its investment in such vehicles, and as a result

6

the Fund may not be able to liquidate its investments in such vehicles at the time or for the price that it would like, which could adversely affect the Fund’s performance. See “Risks of Investing — Pooled Investment Vehicle Risk” and “ — Illiquidity Risk” below.

Cash and Fixed Income Investments

In addition to the Fund’s bitcoin-related investments, the Fund expects to have significant holdings of Cash and Fixed Income Investments. The Cash and Fixed Income Investments are intended to provide liquidity, to serve as collateral for the Fund’s bitcoin futures contracts and to support the Fund’s use of leverage. Although the amount of Cash and Fixed Income Investments held by the Fund may change over time and will be determined primarily by the amount needed to seek to achieve or maintain the Target Exposure, the Fund intends, under normal circumstances, to invest at least 40% of its total assets in investment-grade fixed income investments that are Agency MBS, municipal debt securities or that are issued by foreign governments, supranational entities or corporations (with the remaining assets of the Fund invested in cash, cash equivalents, U.S. government securities and the Subsidiary). In addition, because the Fund intends to qualify as a RIC under the Code, the Fund will generally hold Cash and Fixed Income Investments such that, at the end of each fiscal quarter, at least 50% of the value of the Fund’s total assets is represented by cash, U.S. government securities, and other securities limited in respect of any one issuer to a value not greater than 5% of the value of the Fund’s total assets and not more than 10% of the outstanding voting securities of such issuer.

Target Exposure, Borrowing and Leverage

Although the Fund seeks to maintain the Target Exposure to bitcoin, the maximum exposure to bitcoin that the Fund is able to achieve will be primarily determined by: (1) the Subsidiary Asset Cap, (2) the amount of exposure to bitcoin provided by the bitcoin futures contracts held by the Subsidiary, and (3) the availability and terms of pooled investment vehicles that invest in bitcoin. In addition, the Fund expects to periodically rebalance its positions in bitcoin-related investments in order to seek to achieve or maintain the Target Exposure or to maintain compliance with the Subsidiary Asset Cap, as applicable, and may carry out any such rebalancing over a period of time in order to allow the Fund to rebalance its positions in a manner intended to reduce transaction costs.

In addition, the Fund’s actual exposure to bitcoin at any particular point in time may be less than the Target Exposure, and may be materially less. This could happen if the Fund’s FCMs or the exchange increase the amount of collateral the Fund is required to post to the point that the Fund is not able to purchase sufficient futures contracts to reach the Target Exposure or if the futures contracts held by the Subsidiary do not have sufficient exposure to bitcoin to reach the Target Exposure without the Fund having to invest more than 25% of its total assets in the Subsidiary. At any time at which the Fund’s exposure to bitcoin is less than the Target Exposure — i.e., less than 100% of the Fund’s net asset value — any changes in value of bitcoin will generally result in proportionally smaller changes in the Fund’s NAV. At any time at which the Fund’s exposure to bitcoin is greater than 100% of the Fund’s net asset value, any changes in value of bitcoin will generally result in proportionally larger changes in the Fund’s NAV. In addition, because the Fund does not invest directly in bitcoin, the Fund is exposed to futures basis and to tracking error, so any changes in value of bitcoin may result in proportionally smaller or larger changes in the value of the Fund’s bitcoin-related investments. As a result, there can be no assurance that changes in the value of the Fund resulting from the Fund’s investments will track changes in the value of bitcoin.

The Fund seeks to achieve and maintain the Target Exposure by using leverage inherent in futures contracts and through reverse repurchase agreements, and may also obtain leverage in the form of borrowings, which would typically be in the form of loans from banks, may be on a secured or unsecured basis and at fixed or variable rates of interest. The Fund’s bitcoin futures contracts will provide leverage to the extent they give the Fund exposure to an amount of underlying bitcoin with a greater value than the amount of collateral the Fund is required to post to its futures commission merchant (“FCM”). An FCM is a brokerage firm that solicits or

7

accepts orders to buy or sell futures contracts and accepts money or other assets from customers to support such orders. FCMs are required to be registered with the CFTC and to be members of the National Futures Association.

The Fund’s investments in futures contracts and reverse repurchase agreements will be treated as “derivatives” under Rule 18f‑4 (“Rule 18f‑4”) under the 1940 Act. Rule 18f‑4 regulates the use of derivative instruments and certain related transactions by mutual funds. Pursuant to Rule 18f‑4, the Fund has adopted and implemented a derivatives risk management program to govern its use of derivatives, and the Fund’s derivatives exposure (including its use of futures contracts and reverse repurchase agreements) is limited through a value‑at‑risk (“VaR”) test. Very generally, VaR is an estimate of an instrument’s or portfolio’s potential losses over a given time horizon and at a specified confidence level. Rule 18f‑4 may restrict the Fund’s ability to engage in certain derivatives transactions and/or increase the costs of such derivatives transactions, which could adversely affect the value of the Fund’s investments and/or the performance of the Fund.

The 1940 Act requires the Fund to maintain continuous asset coverage of not less than 300% with respect to all borrowings. This means that the value of the Fund’s total indebtedness may not exceed one‑third of the value of its total assets (including such indebtedness). The Fund also may borrow money from banks or other lenders for temporary purposes in an amount not to exceed 5% of the Fund’s assets. Such temporary borrowings are not subject to the asset coverage requirements discussed above. Investments or trading practices that involve contractual obligations to pay in the future may be subject to the same requirements unless the Fund designates liquid assets in an amount the Fund believes to be equal to the Fund’s contractual obligations (marked‑to‑market on a daily basis) or, for certain instruments, appropriately “covers” such obligations with offsetting positions.

Leverage can have the effect of magnifying the Fund’s exposure to changes in the value of its assets and may also result in increased volatility in the Fund’s NAV, including the potential for greater losses than if the Fund owned its assets on an unleveraged basis. Leverage may help to offset the impact of negative futures basis in a rising market, but may cause the Fund to suffer greater losses than it otherwise would have in a falling market. The value of an investment in the Fund will be more volatile, and other risks tend to be compounded if and to the extent that the Fund is exposed to leverage.

Additional Information on the Fund’s Investments Generally

Illiquid Investments. The Board has delegated to the Adviser the responsibility for determining the liquidity of the Fund’s investments, which Stone Ridge carries out on a case‑by‑case basis based on procedures approved by the Board that set forth various factors relating to the Fund’s ability to dispose of such investments in an appropriate manner. Certain of the instruments in which the Fund invests may be treated as illiquid. The Board will monitor and periodically review liquidity determinations. The Fund may invest at the time of purchase up to 15% of its net assets in illiquid investments, which may be difficult to value properly and may involve greater risks than liquid investments. For certain risks related to the Fund’s investments in illiquid instruments, see “Risks of Investing — Illiquidity Risk” below.

Subsidiary. Under an investment management agreement with the Subsidiary, the Adviser provides the Subsidiary with the same type of management services as the Adviser provides to the Fund. To the extent the Adviser receives compensation for providing such services to the Subsidiary, the Adviser will not receive compensation from the Fund in respect of the assets of the Fund that are invested in the Subsidiary. The Fund does not currently intend to sell or transfer all or any portion of its ownership interest in the Subsidiary. The Fund reserves the right to establish an additional subsidiary or subsidiaries, subject to approval of the Board. The size of the Fund’s investment in the Subsidiary will generally be limited to 25% of the Fund’s total assets, tested at the end of each fiscal quarter.

Cash Management and Temporary Defensive Positions. During unusual market conditions, the Fund may invest up to 100% of its assets in cash or cash equivalents temporarily, which may be inconsistent with its investment objective and other policies. The Fund might not use all of the strategies and techniques or invest in all of the

8

types of instruments described in this prospectus or the Statement of Additional Information. While at times the Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so.

Changes to the Fund’s Investment Policies. The Fund’s investment objective and policies may be changed without notice to or approval by shareholders unless an objective or policy is identified in the prospectus or in the Statement of Additional Information as “fundamental.”

Risks of Investing

Investors should carefully consider the Fund’s risks and investment objective, as an investment in the Fund may not be appropriate for all investors or clients and is not designed to be a complete investment program. An investment in the Fund involves a high degree of risk and may be considered a speculative investment. It is possible that investing in the Fund may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age, and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment.