SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2015 |

Commission file number 001-37581 |

ACLARIS THERAPEUTICS, INC.

|

Incorporated under the Laws of the |

|

I.R.S. Employer Identification No. |

|

State of Delaware |

|

46-0571712 |

101 Lindenwood Drive, Suite 400

Malvern, PA 19355

(484) 324-7933

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class: |

Name of Each Exchange on which Registered |

|

|

Common Stock, $0.00001 par value |

|

The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ◻ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ◻

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ◻ |

|

Accelerated filer ◻ |

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company) |

|

Smaller reporting company ◻ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ☒

There was no aggregate market value of shares of common stock held by non-affiliates of the registrant as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, because the registrant’s common stock was not trading on any exchange on that date.

As of March 23, 2016, 20,157,503 shares of common stock, $0.00001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's definitive proxy statement, to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, for its 2016 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve substantial risks and uncertainties. The forward-looking statements are contained principally in Part I, Item 1. “Business,” Part I, Item 1A. “Risk Factors,” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this Annual Report. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements include statements about:

|

· |

our plans to develop and commercialize our drug candidates; |

|

· |

the timing of our planned clinical trials of A-101 in patients with SK and our other drug candidates; |

|

· |

the timing of our NDA filing for A-101 for the treatment of SK; |

|

· |

the timing of and our ability to obtain and maintain regulatory approvals for our drug candidates; |

|

· |

the clinical utility of our drug candidates; |

|

· |

our commercialization, marketing and manufacturing capabilities and strategy; |

|

· |

our expectations about the willingness of patients to pay out of pocket for procedures using our drug candidates for the treatment of SK; |

|

· |

our expectations about the willingness of dermatologists to use A-101 for the treatment of SK; |

|

· |

our intellectual property position; |

|

· |

our plans to in-license or acquire additional drug candidates for other dermatological conditions to build a fully integrated dermatology company; and |

|

· |

our estimates regarding future revenue, expenses and needs for additional financing. |

You should refer to “Item 1A. Risk Factors” in this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward‑looking statements. As a result of these factors, we cannot assure you that the forward‑looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward‑looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward‑looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this Annual Report represent our views as of the date of this Annual Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we undertake no obligation to publicly update any forward‑looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report.

2

3

Overview

We are a clinical-stage specialty pharmaceutical company focused on identifying, developing and commercializing innovative and differentiated drugs to address significant unmet needs in dermatology. Our lead drug candidate, A-101 Topical Solution, is a proprietary high-concentration hydrogen peroxide topical solution that we are developing as a prescription treatment for seborrheic keratosis, or SK, a common non-malignant skin tumor. We have completed three Phase 2 clinical trials of A-101 in over 300 patients with SK. In these trials, following one or two applications of A-101, we observed clinically relevant and statistically significant improvements in clearing SK lesions on the face, trunk and extremities of the body. In the first quarter of 2016, we initiated two multi-center, double blind Phase 3 clinical trials and one open label Phase 3 clinical trial of A-101 in patients with SK. If the results of these trials are favorable, we plan to submit a New Drug Application, or NDA, for A-101 for the treatment of SK to the U.S. Food and Drug Administration, or FDA, in the fourth quarter of 2016. We also intend to develop A-101 as a prescription treatment for common warts, also known as verruca vulgaris, and A-102, a proprietary gel dosage form of hydrogen peroxide, as a prescription treatment for SK and common warts. In the fourth quarter of 2015, we initiated a Phase 2 clinical trial to evaluate A-101 for the treatment of common warts. We have also in-licensed the exclusive, worldwide rights to inhibitors of the Janus kinase, or JAK, family of enzymes, for specified dermatological conditions. We plan to develop these JAK inhibitors, A-201 and A-301, as potential treatments for hair loss associated with an autoimmune skin disease known as alopecia areata, or AA, and potentially for other dermatological conditions. We intend to in-license or acquire additional drug candidates and technologies to build a fully integrated dermatology company.

SK lesions are among the most common non-malignant skin tumors and one of the most frequent diagnoses made by dermatologists. SK lesions typically have a waxy, scaly, slightly elevated appearance, and multiple lesions are often present. Though the lesions are non-malignant, patients often elect to have their condition treated by a dermatologist, either because the lesions have become inflamed or because the patient feels they are cosmetically unattractive. SK lesions are usually treated by cryosurgery, electrodesiccation, curettage or excision. Each of these methods may be painful or can result in pigmentary changes or scarring at the treatment site. No drugs have been approved by the FDA for the treatment of SK.

A study published in the Journal of The American Academy of Dermatology in 2006, which we refer to as the AAD study, estimated that SK affects over 83 million people in the United States. Based on a market survey we commissioned in 2014, we estimate that there are 18.5 million patient visits to dermatologists for SK and dermatologists perform approximately 8.3 million procedures to remove SK lesions annually in the United States. We estimate that the cost of these procedures to third-party payors and patients is more than $1.2 billion annually.

In June 2014, we completed our Phase 2 clinical trial of A-101 in 35 patients with four SK lesions on the trunk; in December 2014, we completed our Phase 2 clinical trial of A-101 in 172 patients with four SK lesions on the trunk and extremities; and in March 2015, we completed our Phase 2 clinical trial of A-101 in 119 patients with a single SK lesion on the face. In each of these trials, following one or two applications of the two highest concentrations of A-101, we observed clinically relevant and statistically significant improvements in clearing SK lesions.

In the first quarter of 2016, we initiated three Phase 3 clinical trials of A-101 in patients with SK lesions on the face, trunk and extremities. Two of these trials are being conducted on a double-blind basis, while the third is open label. If the results of these Phase 3 clinical trials are favorable, we intend to submit our NDA for A-101 for the treatment of SK to the FDA in the fourth quarter of 2016 and build a specialty sales force to market the product to dermatologists in the United States. We plan to seek a collaborator to commercialize A-101, if approved, in the European Union. We have the exclusive right to commercialize A-101, if approved, in various countries throughout the world.

We also plan to develop A-101 for the treatment of common warts. Although common warts are generally not harmful and in most cases eventually clear without any medical treatment, they may be painful and aesthetically unattractive and are contagious. On an annual basis, 1.9 million people are diagnosed with common warts. The AAD study estimated that annual direct expenditures for patients seeking treatment for warts of all types in a medical office were $939 million, including the cost of the office visit as well as the treatments. We estimate that approximately one-half of those expenditures were for the treatment of common warts. Common warts can be removed with slow-acting,

4

over-the-counter products containing salicylic acid. As with SK, cryosurgery is the most frequently used in-office treatment for common warts. No prescription drugs have been approved by the FDA for the treatment of common warts. We completed toxicology studies and commenced a Phase 2 clinical trial of A-101 for the treatment of common warts in the fourth quarter of 2015. In addition to A-101, we are also developing A-102, a proprietary topical gel dosage form of hydrogen peroxide, for the treatment of both SK and common warts.

In addition, we plan to develop the JAK inhibitors, A-201 and A-301, which we in-licensed from Rigel Pharmaceuticals, Inc., or Rigel, as potential treatments for AA. AA is an autoimmune dermatologic condition typically characterized by patchy non-scarring hair loss on the scalp and body. More severe forms of AA include total scalp hair loss, known as alopecia totalis, and total hair loss on the scalp and body, known as alopecia universalis. AA affects up to 0.2% of people globally, with two-thirds of affected individuals being 30 years old or younger at the time of disease onset. Treatment options for the less severe, patchy forms of AA include corticosteroids, either topically applied or injected directly into the scalp where the bare patches are located, or the induction of an allergic reaction at the site of hair loss using a topical contact sensitizing agent, an approach known as topical immunotherapy. The same treatment options are utilized for the more severe forms of AA, although utilization of these treatment options for the more severe forms of AA is limited due to limited efficacy, certain side effects, and their impracticality for extensive surface areas. We plan to develop A-201 as an oral treatment for alopecia totalis and alopecia universalis and A-301 as a topical treatment for patchy AA. We plan to submit an investigational new drug application, or IND, in the second half of 2016 for A-201 and commence clinical trials in the first half of 2017. For A-301, we plan to submit an IND and commence clinical trials in the first half of 2017.

Our intellectual property portfolio contains issued patents directed to methods of use for A-101 and our lead JAK inhibitors, A-201 and A-301. With respect to A-101, our issued patents begin to expire in 2022, subject to any applicable patent term extension that may be available in a particular country. Our intellectual property portfolio also contains a U.S. and a Patent Cooperation Treaty, or PCT, patent application directed to, among other things, formulations and methods of use for A-101 and a single-use, self-contained, pre-filled, disposable pen-type applicator for use with such formulations, including A-101. Our pending U.S. and PCT patent applications, if they issue as patents, would be expected to expire in 2035, subject to any applicable patent term adjustment or extension that may be available in a particular country. With respect to our JAK inhibitor drug candidates, the issued U.S. and foreign patents expire between 2023 and 2030, subject to any applicable patent term extension that may be available in a particular country. Our intellectual property portfolio also contains pending applications directed to, among other things, the use of JAK inhibitors that, if issued as patents, would be expected to expire in 2034, subject to any applicable patent term adjustment or extension that may be available in a particular country.

5

Our Drug Candidates

We have utilized our experience to establish a pipeline of drug candidates that we believe will address significant unmet needs in dermatology. Our pipeline of drug candidates is summarized in the table below:

Our Lead Drug Candidate: A-101 for the Treatment of Seborrheic Keratosis

Overview

We are developing A-101 for the treatment of SK. SK lesions typically have a waxy, scaly, slightly elevated appearance, and multiple lesions are often present. The lesions can vary in color from light tan to dark brown or black and typically appear on the face, trunk and extremities. Though the lesions are non-malignant, patients often elect to have their condition treated by a dermatologist, either because the lesions have become inflamed or because the patient feels they are cosmetically unattractive.

6

We have completed three Phase 2 clinical trials in over 300 patients with SK and observed clinically relevant and statistically significant improvements in clearing SK lesions on the face, trunk and extremities of the body following one or two applications of A-101. The following table summarizes the design of these clinical trials:

|

Name of Clinical Trial and |

|

SK Lesion Area |

|

Date |

|

Trial Design |

|

Trial Objective |

|

SEBK-203 |

|

Face |

|

March 2015 |

|

● Multi-center, randomized, double-blind, vehicle-controlled, parallel group ● One lesion treated ● A-101 concentrations: 32.5%, 40.0% ● Duration: 106 days |

|

● Evaluate safety, efficacy, tolerability and dose-response profile of two concentrations of A-101 vs. vehicle control |

|

|

|

|

|

|

|

|

|

|

|

SEBK-202 |

|

Trunk and Extremities |

|

December 2014 |

|

● Multi-center, randomized, double-blind, vehicle-controlled, parallel group ● Four lesions treated ● A-101 concentrations: 32.5%, 40.0% ● Duration: 106 days |

|

● Evaluate safety, efficacy, tolerability and dose-response profile of two concentrations of A-101 vs. vehicle control |

|

|

|

|

|

|

|

|

|

|

|

SEBK-201 |

|

Trunk (Back) |

|

June 2014 |

|

● Double-blind, vehicle-controlled intra-subject ● Four lesions treated ● A-101 concentrations: 25.0%, 32.5%, 40.0% ● Duration: 78 days |

|

● Evaluate safety, efficacy and tolerability of three concentrations of A-101 vs. vehicle control |

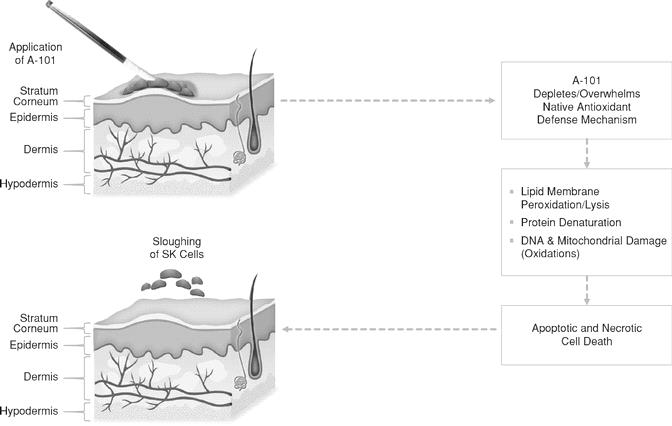

A-101 Mechanism of Action

SK is a slowly growing epidermal tumor consisting of an abnormal accumulation of hyper-adherent senescent cells exhibiting decreased cell death. Senescent cells are no longer capable of dividing but are still alive and metabolically active. SK lesions may be amenable to a topically delivered agent that could both break down the abnormal intercellular connections between the cells and promote death of the abnormal SK cells.

Hydrogen peroxide is a potent and important oxidizing agent in the human body. Local concentrations of hydrogen peroxide are carefully controlled by a complex antioxidant defense system consisting of both enzymes and nonenzymatic components. The topical application of high concentrations of hydrogen peroxide to SK lesions can locally overwhelm this antioxidant defense system in the skin, allowing hydrogen peroxide to penetrate the surface of the lesion, react with the abnormal SK cells, and remove or dissolve the SK lesions.

Through a process known as lipid peroxidation, free radical molecules generated by hydrogen peroxide degrade the phospholipids of the cell membrane, leading to the breakdown, or lysis, of the lipid membrane of the cell. This chemical reaction is followed by the denaturation, or loss of structure, of proteins within the cell, as well as oxidative DNA and mitochondrial damage. This series of events induces cell death of abnormal SK cells, either through the process of programmed cell death, known as apoptosis, or through cell injury, known as necrosis.

7

The following graphic illustrates this mechanism of action for A-101:

Response of Seborrheic Keratosis Cells to A-101

Clinical Development

We submitted an IND for A-101 for the treatment of SK to the FDA in September 2013 and have completed three Phase 2 clinical trials under this IND. In February 2015, we held a Type C meeting with the FDA at which we discussed clinical endpoints to support a claim of efficacy, as well as the statistical methodology we plan to use in our Phase 3 clinical trials. In May 2015, we held an end-of-Phase 2 meeting with the FDA to discuss our A-101 development program leading to a potential NDA submission.

Phase 2 Clinical Trial of A-101 in Subjects with Seborrheic Keratosis on the Face (SEBK-203)

Trial Design

We commenced a Phase 2 clinical trial in October 2014 that was a multi-center, randomized, double-blind, vehicle-controlled, parallel group trial designed to evaluate the safety, tolerability, initial efficacy and dose-response profile of A-101 topical solution at 32.5% and 40.0% concentrations and a topical solution vehicle control. We completed the trial in March 2015. We enrolled 119 subjects in the trial at four sites in the United States, and 116 subjects completed the trial. Three of the 119 subjects withdrew from the trial due to unrelated adverse events. Of the 116 subjects who completed the trial, 37 subjects received the 40.0% concentration, 39 subjects received the 32.5% concentration and 40 subjects received the vehicle control. The age of the subjects ranged from 33 to 93, with a mean age of 70. Of the 116 subjects who completed the trial, 53 were male, 63 were female and all were Caucasian, with a variety of skin types. Inclusion criteria included a clinical diagnosis of stable, clinically typical SK and one appropriate SK target lesion on the subject's face of specified size and thickness. Exclusion criteria included clinically atypical or rapidly growing SK lesions and the use of specified topical or systemic therapies within a defined time period prior to the first visit.

The evaluation period consisted of 15 weeks after initial treatment. At the first visit, the investigator identified a single target lesion on the face of each subject for treatment. During the second visit, or baseline, which occurred on Day 1 of the evaluation period, eligible subjects were randomized to receive the vehicle control or one of the two active concentrations of A-101 and the applications were performed by non-physician staff. No applications were made at a visit on Day 8. At Day 22, any target lesion that met the retreatment criteria received a second application of the assigned concentration of A-101 or vehicle control. The subjects were evaluated at multiple visits through Day 106, but no applications were made after Day 22.

8

Endpoints

The primary endpoint of this clinical trial was the mean change from baseline in the Physician's Lesion Assessment, or PLA, score at the end of the trial. The PLA score is a method we have developed and validated to measure the severity of lesions and uses a scale ranging from zero to three. Secondary endpoints included responder analysis of PLA scores of zero or one. In this trial, a PLA score of zero represented no visible lesion; a PLA score of one represented near clearance, meaning a visible lesion that, while not elevated, has a surface appearance that is different from the surrounding skin; a PLA score of two represented a visible lesion that is elevated but with a thickness of less than or equal to one millimeter; and a PLA score of three represented a visible lesion with a thickness exceeding one millimeter.

Efficacy Results

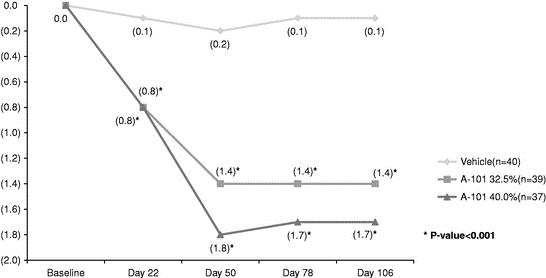

As shown in the table below, for the primary endpoint, mean change from baseline in PLA score, we observed statistically significant improvements as compared to the vehicle for both concentrations of A-101 evaluated, with the 40.0% concentration being the most effective. The results for the active treatment groups were statistically significant with a p-value of less than 0.001. P-value is a conventional statistical method for measuring the statistical significance of clinical results. A p-value of less than 0.05 is generally considered to represent statistical significance, meaning that there is a less than five percent likelihood that the observed results occurred by chance.

Mean Change from Baseline in PLA Score — Face

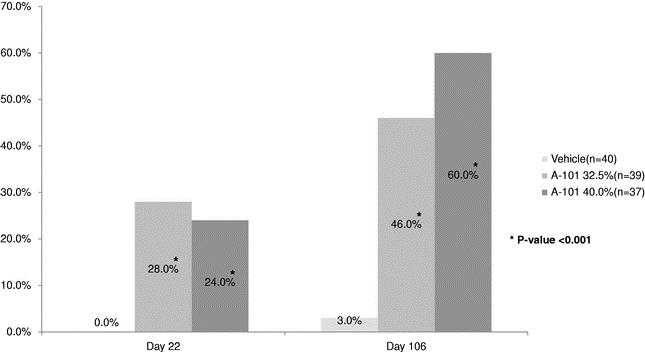

In addition, we measured the percentage of subjects who achieved total clearance, or a PLA of zero, at Day 22 and Day 106. These results are presented in the table below. At Day 22, 24.0% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance and 28.0% of the subjects receiving A-101 at the 32.5% concentration achieved total clearance, compared to none in the vehicle control group. At Day 106, 60.0% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance and 46.0% of subjects receiving A-101 at the 32.5% concentration achieved total clearance, compared to 3.0% in the vehicle control group. These results were statistically significant, with a p-value of less than 0.001.

9

Percentage of Subjects with Clear Lesions — Face

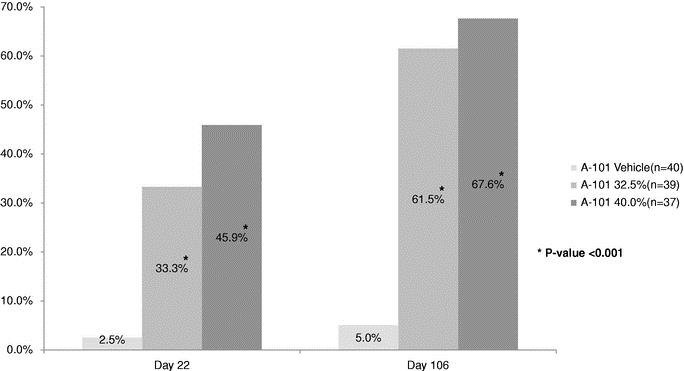

We also measured the percentage of subjects who achieved either total clearance or near clearance, or a PLA score of either zero or one, at Day 22 and Day 106. These results are presented in the table below. At Day 22, 45.9% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance or near clearance and 33.3% of the subjects receiving A-101 at the 32.5% concentration achieved total clearance or near clearance, compared to 2.5% in the vehicle control group. At Day 106, 67.6% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance or near clearance and 61.5% of subjects receiving A-101 at the 32.5% concentration achieved total clearance or near clearance, compared to 5.0% in the vehicle control group. These results were statistically significant, with a p-value of less than 0.001.

Percentage of Subjects with Clear or Near-Clear Target Lesions — Face

10

Safety Results

A-101 was generally well tolerated at both the 32.5% and 40.0% concentrations. While two subjects in each of the 32.5% and 40.0% concentration treatment groups reported severe stinging after administration, most local skin reactions were considered to be transient and mild or moderate. Treatment-emergent adverse events were reported by 29 subjects. However, only one of these adverse events, slight bleeding at the sight of administration, was determined by the investigator to be drug-related. Four subjects reported serious adverse events, but none were considered to be related to treatment by the investigator. Three subjects dropped out of the trial due to adverse events unrelated to treatment.

Phase 2 Clinical Trial of A-101 in Subjects with Seborrheic Keratosis on the Trunk and Extremities (SEBK-202)

Trial Design

In June 2014, we commenced a Phase 2 clinical trial that was a multi-center, randomized, double-blind, vehicle-controlled, parallel group trial designed to evaluate the safety, tolerability, initial efficacy and dose-response profile of A-101 topical solution with concentrations of 32.5% and 40.0% and a topical solution vehicle control. We completed the trial in December 2014. We enrolled 172 subjects in the trial at five sites in the United States, and 169 subjects completed the trial. Of the 172 subjects enrolled in the trial, 57 subjects received the 40.0% concentration, 57 subjects received the 32.5% concentration and 58 subjects received the vehicle control. Of the three subjects who withdrew from the trial, one subject withdrew due to inconvenience, one subject moved and one subject withdrew due to lack of follow-up by the investigator. The age of the subjects ranged from 48 to 97, with a mean age of 69. Of the 172 subjects enrolled in the trial, 91 were male, 81 were female and all but two were Caucasian. There were a variety of skin types within the trial population. Inclusion criteria included a clinical diagnosis of stable, clinically typical SK and at least four SK target lesions on the subject's trunk, defined as the upper body excluding the head and limbs, or extremities with a PLA of at least 2.0 and of specified size and thickness. Exclusion criteria included clinically atypical or rapidly growing SK lesions and the use of specified topical or systemic therapies within a defined time period prior to the first visit.

The evaluation period consisted of 15 weeks after initial treatment. At the first visit, the investigator identified four target lesions on the trunk or extremities of each subject for treatment. During the second visit, or baseline, which occurred on Day 1 of the evaluation period, eligible subjects were randomized to receive the vehicle control or one of the two active concentrations of A-101 and the applications were performed by non-physician staff. No applications were made at a visit on Day 8. At Day 22, any target lesion that met the retreatment criteria received a second application of the assigned concentration of A-101 or vehicle control. The subjects were then evaluated at multiple visits through Day 106, but no applications were made after Day 22.

Endpoints

The primary endpoint of this clinical trial was the percentage of the four target SK lesions judged to be clear, meaning a PLA of zero, for each patient at the end of the trial. Secondary endpoints included the change from baseline PLA. In this trial, we used the same PLA score we used in our trial in subjects with SK lesions on the face (SEBK-203).

Efficacy Results

As shown in the table below, for the primary endpoint, the mean percentage of the four target SK lesions that were judged to be cleared for each patient at Day 106, we observed clinically relevant and statistically significant improvement for both concentrations of A-101 evaluated, with mean per-subject clearance of 26.8% and 45.1% at the

11

32.5% and 40.0% concentrations, respectively, compared to only 4.8% mean per-subject clearance in the vehicle control group. The results for the active treatment groups were statistically significant with a p-value of less than 0.001.

Mean Per-Subject Percentage Clearance — Trunk and Extremities

We also measured the percentage of subjects who achieved total clearance, or a PLA score of zero, in all four of their lesions. These results are presented in the table below. Of the subjects receiving A-101 with 40.0% and 32.5% concentrations, 19.6% and 16.1%, respectively, had clearance of all lesions at Day 106, compared to none in the vehicle control group. These results were statistically significant, with a p-value of less than 0.01. At Day 22, 14.3% of the subjects receiving A-101 at the 40.0% concentration had achieved clearance of all lesions, a result that was also statistically significant, with a p-value of less than 0.01. Only 5.4% of subjects receiving A-101 at the 32.5% concentration achieved clearance of all lesions at Day 22, compared to none in the vehicle control group, but this result for the 32.5% group was not statistically significant.

Percentage of Subjects Achieving Total Clearance — Trunk and Extremities

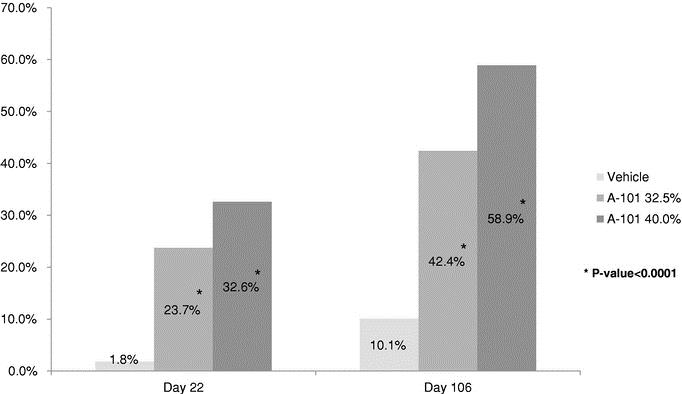

We also measured the percentage of subjects who achieved either total clearance or near clearance, or a PLA score of either zero or one, in all four of their lesions. These results are presented in the table below. At Day 22, 32.6% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance or near clearance and 23.7% of the subjects receiving A-101 at the 32.5% concentration achieved total clearance or near clearance, compared to 1.8% in the vehicle control group. At Day 106, 58.9% of the subjects receiving A-101 at the 40.0% concentration achieved total clearance or near clearance and 42.4% of the subjects receiving A-101 at the 32.5% concentration achieved total

12

clearance or near clearance, compared to 10.1% in the vehicle control group. These results were statistically significant with a p-value of less than 0.0001.

Percentage of Subjects Achieving Total Clearance or Near Clearance — Trunk and Extremities

Safety Results

A-101 was generally well tolerated at both the 32.5% and 40.0% concentrations. Local skin reactions were treatment- and dose-related, and most were considered to be transient and mild to moderate. Treatment-emergent adverse events were reported by 45 subjects. Only one of these events, moderate tenderness at a treatment site on the subject's thigh, was determined by the investigator to be drug-related. Three subjects reported serious adverse events, but none were considered to be related to treatment by the investigator. None of the subjects dropped out of the trial due to adverse events.

Phase 2 Clinical Trial of A-101 in Subjects with Seborrheic Keratosis on the Trunk (Back) (SEBK-201)

Trial Design

We commenced a Phase 2 clinical trial of A-101 in November 2013 that was a double-blind, vehicle-controlled intra-subject clinical trial designed to evaluate the safety, tolerability and initial efficacy of A-101 in clearing SK lesions. The trial compared three active concentrations of A-101, 40.0%, 32.5% and 25.0%, with a vehicle solution control. In the trial, each subject received each of the four treatments on four separate lesions on the back. We enrolled 35 adult subjects in the trial at one site in the United States. We completed the trial in June 2014. Of the 35 subjects enrolled in the trial, one subject withdrew from participation in the trial due to the distance between the subject's home and the clinical trial site. The age of the subjects ranged from 55 to 85, with a mean of 69 years. Of the 35 subjects enrolled in the trial, 20 of the subjects were female and 15 were male, and all subjects were Caucasian. Inclusion criteria included a clinical diagnosis of stable clinically typical SK and at least four appropriate SK target lesions on the subject's back. Exclusion criteria included clinically atypical or rapidly growing SK lesions and the use of specified topical or systemic therapies within a defined time period prior to the first visit.

13

The evaluation period consisted of 11 weeks after initial treatment. At the first visit, the investigator identified four target lesions on the back for treatment. During a second visit, or baseline, which occurred on Day 1 of the evaluation period, lesions on each subject were randomized to receive the vehicle control or one of the three active concentrations of A-101, and the applications were performed by non-physician staff. No applications were made at visits on Day 8 and Day 15. On Day 22, any target lesion that met the retreatment criteria received a second application of the assigned concentration of A-101 or vehicle control. No applications were made at subsequent visits, which occurred on Days 29, 43, 57 and 78.

Endpoints

The primary endpoint of this clinical trial was reduction in PLA score from baseline over a period of 78 days, as well as the physician's subjective assessment of the condition of the lesion. In this trial, we used an earlier version of the PLA scale in which a PLA score of zero was considered to be complete clearance of the lesion, a PLA score of one represented the lesion was barely evident on examination, a PLA score of two represented an obvious lesion, while a PLA score of three represented a severe, prominent lesion. This PLA scale was subsequently refined in our later trials to make it more clinically objective.

Efficacy Results

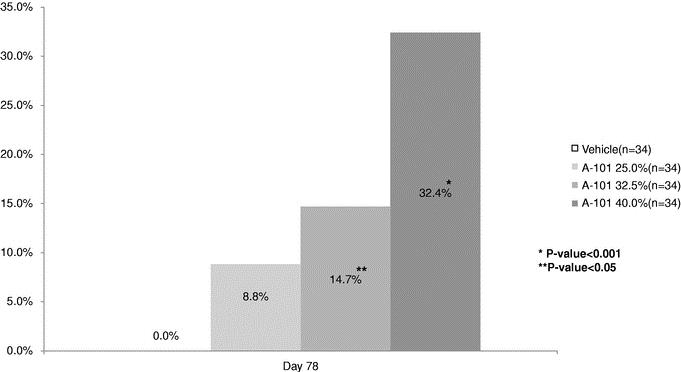

For the 34 subjects that completed the trial, the efficacy results are presented in the table below. We measured the proportion of PLA complete responders, defined as a PLA score of zero at Day 78, in each treatment group. Of the 34 lesions treated with the 40.0% concentration, 11 lesions, or 32.4%, completely responded, a result that was statistically significant with a p-value of less than 0.001. Of the 34 lesions treated with the 32.5% concentration, 5 lesions, or 14.7%, completely responded, a result that was statistically significant with a p-value of less than 0.05. Of the 34 lesions treated with the 25.0% concentration, 3 lesions, or 8.8%, completely responded, a result that was not statistically significant. There were no complete responders in the vehicle control group.

Percentage of Complete Responders — Trunk (Back)

14

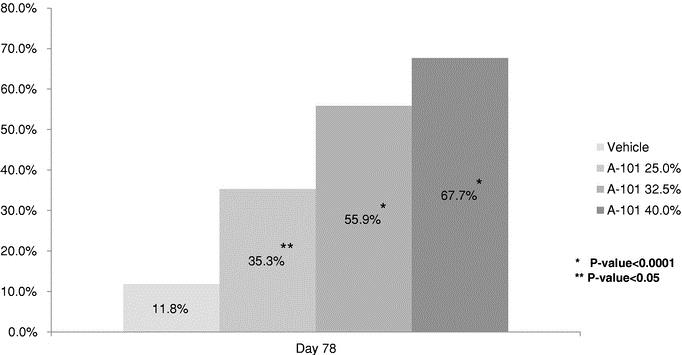

We also measured the proportion of PLA complete responders or near complete responders, defined as a PLA score of zero or one, at Day 78, in each treatment group. These results are presented in the table below. Of the 34 lesions treated with the 40.0% concentration, 23 lesions, or 67.7%, were complete or near complete responders, a result that was statistically significant with a p-value of less than 0.0001. Of the 34 lesions treated with the 32.5% concentration, 19 lesions, or 55.9%, were complete or near complete responders, a result that was statistically significant with a p-value of less than 0.0001. Of the 34 lesions treated with the 25.0% concentration, 12 lesions, or 35.3%, were complete or near complete responders, a result that was statistically significant with a p-value of less than 0.05. Four lesions, or 11.8%, of the lesions treated with vehicle control either were complete or near complete responders.

Percentage of Complete or Near Complete Responders — Trunk (Back)

Safety Results

A-101 was generally well tolerated at the 25.0%, 32.5% and 40.0% concentrations. Local skin reactions were transient and treatment- and dose-related, and most were considered to be mild to moderate. Treatment-emergent adverse events were reported by nine subjects, and none of those reported were considered to be treatment-related. The only treatment-emergent adverse events reported by more than one subject were seasonal allergy in ten subjects and arthritis in four subjects. One subject had a serious adverse event of kidney infection, which was considered by the investigator to be unrelated to treatment. None of the subjects dropped out of the trial due to an adverse event and no adverse event led to trial discontinuation.

Phase 3 Clinical Program

In the first quarter of 2016, we initiated two multi-center, double-blind Phase 3 clinical trials and a third open-label Phase 3 clinical trial with subjects with SK lesions on the face, trunk and extremities.

We expect to enroll a total of approximately 1,000 subjects with SK on the face, trunk and extremities in these three trials, which are designed to evaluate the efficacy and safety of treatment with A-101 relative to vehicle. The first two clinical trials are randomized, multi-center, double-blinded, vehicle-controlled, parallel group Phase 3 clinical trials being conducted in the United States. We expect to enroll approximately 400 subjects with four SK lesions on the face, trunk and extremities in each of these two trials. In each of these two trials, subjects will be randomized to receive A-101 topical solution at the 40.0% concentration or vehicle on Day 1 and, if needed, on Day 22. In the third Phase 3 clinical trial, approximately 200 subjects with four SK lesions on the face, trunk and extremities will receive up to four treatments of A-101 twenty-one days apart on an open-label basis in order to gather additional safety data on the extended use of A-101. The primary endpoint for the two multi-center, double-blind Phase 3 clinical trials will be the percentage of subjects who experience a complete clearance, meaning a PLA score of zero, for all four of the target SK lesions. The open label Phase 3 clinical trial will evaluate the safety of A-101 in subjects with four SK lesions on the face, trunk and extremities.

15

We anticipate that our NDA and Marketing Authorization Application, or MAA, in the European Union for A-101 in SK will be based on the data collected from each of the three Phase 3 clinical trials. We believe that if these results are favorable, such results would be sufficient to support an NDA for the treatment of SK in the United States and may be sufficient to support a MAA for the treatment of SK in the European Union.

Additional Development Programs — A-101 for Common Warts

Ongoing Phase 2 Clinical Trial

Following a 12-week toxicology study in minipigs, in December 2015, we commenced a Phase 2 clinical trial of A-101 for the treatment of common warts. This double-blinded, randomized Phase 2 trial is being conducted at six sites in the United States and is designed to evaluate the safety, tolerability and dose-response of two concentrations of A-101 compared with a vehicle control consisting of placebo. We intend to enroll approximately 108 subjects in this clinical trial. Subjects will be randomized in three equal groups to receive either A-101 topical solution at the 40.0% or 45.0% concentrations or placebo. The primary endpoint for this clinical trial is the mean change in the Physician’s Wart Assessment (PWA) score at the end of the study. We expect to receive results from this clinical trial in the third quarter of 2016.

Investigator-Sponsored Trial

A trial was conducted by Dr. Steven Grekin, a dermatologist, using A-101 topical solution in subjects with common warts. This physician's IND for the treatment of common warts was submitted to the FDA in March 2014. This trial was a double-blind, vehicle-controlled trial comparing the 40.0% concentration of A-101 and a vehicle control. This trial was conducted at the Grekin Skin Institute in Michigan. In this trial, each subject received four treatments on one target wart. Twenty-two subjects were enrolled in the trial, with fifteen subjects completing the trial. Four subjects who were receiving vehicle control did not complete the trial because they were not satisfied with the results and three subjects who were receiving A-101 did not complete the trial for reasons unrelated to treatment. Of the subjects who completed the trial, nine subjects received the 40.0% concentration of A-101 and six subjects received the vehicle control. Subjects were at least 18 years old with a common wart on the hand.

We believe the results of the investigator-sponsored trial provided proof-of-concept data for the treatment of common warts with A-101. Efficacy measures were evaluated at week 6, two weeks after the last treatment. The trial evaluated the mean change from baseline using a wart severity assessment scale ranging from zero to three. A wart severity assessment score of zero means the subject has no clinically diagnosable wart, a score of one means the subject has a barely evident clinically diagnosable wart, a score of two represents an obvious wart and a score of three represents a conspicuous wart. All of the subjects enrolled in this trial had a wart severity assessment score of at least two. The wart severity assessment score results are presented in the table below. The data from the trial showed statistically significant improvements in subjects treated with A-101 compared to vehicle control in the mean wart severity assessment score.

Mean Change from Baseline in Wart Severity Assessment Score

16

The trial also evaluated the mean wart improvement assessment score in subjects. The wart improvement assessment scale measures the level of improvement and ranges from zero to five. A wart improvement assessment score of zero means the common wart is completely cleared, a score of one means the wart markedly improved compared to baseline, a score of two means the wart moderately improved compared to baseline, a score of three means the wart mildly improved compared to baseline, a score of four means there was no change and a score of five means the wart worsened compared to baseline. The mean wart improvement assessment score results are presented in the table below. The data from the trial showed statistically significant improvements in subjects treated with A-101 compared to vehicle control in the mean wart improvement assessment score.

Mean Wart Improvement Assessment Score

A-101 was well tolerated in these subjects with no adverse events reported.

Additional Development Programs — A-201 and A-301 for Alopecia Areata

Overview

We plan to develop A-201 and A-301 as potential treatments for AA. AA is an autoimmune dermatologic condition, typically characterized by patchy, non-scarring hair loss on the scalp and body. More severe forms of AA include alopecia totalis and alopecia universalis. Treatment options for the less severe, patchy forms of AA include corticosteroids, either topically applied or injected directly into the scalp where the bare patches are located, and the induction of an allergic reaction at the site of hair loss using a topical contact sensitizing agent, an approach known as topical immunotherapy. The same treatment options are utilized for the more severe forms of AA, although utilization of these treatment options for the more severe forms of AA is limited due to limited efficacy, side effects, and their impracticality for use on extensive surface areas. We plan to develop A-201 as an oral treatment for alopecia totalis and alopecia universalis and A-301 as a topical treatment for patchy AA. For A-201, we plan to submit an IND in the second half of 2016 and commence clinical trials in the first half of 2017. For A-301, we plan to submit an IND and commence clinical trials in the first half of 2017.

A-201 and A-301 Mechanism of Action

Though the exact cause of AA remains unclear, clinical and physiological evidence suggests that the primary pathologic process of AA is a T-cell mediated autoimmune attack on the hair follicles.

Cytokines are proteins that bind to cell surface receptors and initiate a signaling process that ultimately leads to modulation of gene expression. The JAK family of enzymes plays an essential role in regulating the signaling process of most cytokines in cells by linking cytokine signaling from the cell surface membrane receptors to signal transducers and activators of transcription, or STATs, within the cells. The binding of a cytokine to the appropriate receptor on the cell surface results in the activation of the JAK protein, which in turn activates the STATs.

17

The JAK proteins are essential for modulating many immunological and inflammatory processes, and, in conditions characterized by an abnormally upregulated immune response, JAK inhibitors have been found to be effective in downregulating the abnormally activated JAK-STAT pathway and alleviating manifestations of disease.

Most recently, it has been reported that systemically administered JAK inhibitors may be potentially efficacious in the treatment of AA, both in its patchy and more severe forms. In a mouse model of AA, systemically administered JAK inhibitors prevented the development of AA, and topically administered JAK inhibitors promoted hair regrowth. In a clinical trial evaluating ruxolitinib, an oral JAK inhibitor, as a potential treatment for cancer, three human patients with moderate-to-severe AA treated with ruxolitinib achieved near-complete hair regrowth within three to five months of treatment. In another clinical trial evaluating baricitinib, an oral JAK inhibitor, for the treatment of a rare autoinflammatory disorder called CANDLE syndrome, a patient with concomitant AA exhibited complete resolution of his hair loss after nine months of therapy.

Manufacturing

We do not have any manufacturing facilities or personnel. We rely on third parties for the manufacture of A-101 for preclinical studies and clinical trials, and will continue to rely on third parties for the commercial manufacture of A-101 if it receives marketing approval. For hydrogen peroxide, the active pharmaceutical ingredient, or API, in A-101, we have entered into an exclusive, ten-year, automatically renewable supply agreement with PeroxyChem LLC, or PeroxyChem, a manufacturer of hydrogen peroxide, to provide the API that can be used in A-101 for the treatment of SK and a number of other specified dermatological indications. We or PeroxyChem may terminate the supply agreement with prior written notice immediately for specified financial reasons, after a 10-day and 60-day cure period for material monetary and non-monetary material breaches, respectively, and in the event of a force majeure event, including if the FDA does not approve A-101 for commercial sale in the United States, that continues for 90 consecutive days. In addition, we may terminate the PeroxyChem supply agreement, with prior written notice, for PeroxyChem's failure to supply API to us for more than 90 cumulative days in a year.

For some of the components used in connection with the manufacture and assembly of the pen-type applicator for A-101, we purchase our components from third-party manufacturers on a purchase order basis and do not have supply arrangements in place. In addition, we have engaged third parties for the supply and assembly of components of the pen-type applicator and the assembly, labeling and packaging of the finished drug product to be used in our planned Phase 3 clinical trials and for commercial purposes, if A-101 is approved for marketing.

Replacement of any of these third-party manufacturers would require us to qualify new manufacturers and negotiate and execute contractual agreements with them. If any of our supply or service agreements with third-party manufacturers are terminated, we will experience delays and additional expenses in the completion of the development of and obtaining regulatory approval for our lead drug candidate, A-101 for the treatment of SK.

Commercialization

For A-101, we expect to retain U.S. commercial rights and to establish collaborations with third parties to commercialize A-101 outside the United States. We have not established any meaningful sales, marketing or product distribution operations to date because A-101 is still in clinical development. We plan to establish the required capabilities within an appropriate time frame ahead of any potential drug approval and commercialization in order to support a commercial product launch. If we commercialize A-101, or any other drug candidates that we may successfully develop, in the United States, we intend to build a targeted sales force to establish relationships with dermatologists. We believe a scientifically oriented, customer-focused team of approximately 50 to 60 sales representatives would allow us to reach the approximately 5,000 dermatologists in the United States with the highest potential for using A-101, who we estimate will continue to account for over 70% of in-office SK treatments performed. We expect that our sales force will be supported by sales and marketing management, internal sales and marketing support and commercial product distribution support.

We believe dermatologists will be inclined to adopt A-101 to treat their patients with SK, if it is approved, not only because of its clinical profile, but also because it may provide an expanded source of revenue for their practices. Dermatologists expect declining reimbursements from third-party payors for providing medical services. In addition, a greater portion of the cost of medical care has been shifted to patients, in the form of higher deductibles and co‑insurance. Collecting from patients can be difficult and costly for physician practices. We believe many

18

dermatologists are interested in expanding the cash-pay aesthetic portion of their practices, meaning the portion of procedures that are not medically necessary and not reimbursed by third-party payors, by treating new aesthetic patients and by offering new services to current aesthetic patients. Though SK patients typically come into the dermatology practice seeking a medical diagnosis, we believe they often are willing to pay for removal of SK lesions to improve appearance even after they learn that the lesions are non-malignant and that removal may not be reimbursed. In addition, since A-101 can be administered by non-physician staff, we believe it could provide incremental practice revenue with minimal time commitment by the dermatologist after the diagnosis is made.

In 2014, there were approximately 10,000 dermatologists practicing in the United States. We believe dermatologists tend to be particularly focused on the safety of pharmaceutical products because, while skin diseases can have profound effects on patients' quality of life, few are life-threatening. As a result, we believe that dermatologists, as well as their patients, often prefer to use topical treatments when possible to limit the risk of systemic side effects. Dermatologists also tend to place a high level of emphasis on products that are easy to use because they often manage high volumes of patients. We believe this also contributes to a general preference for topical treatments. Finally, in our experience, dermatologists tend to engage with sales and medical affairs personnel from the pharmaceutical industry regarding the scientific evidence supporting dermatology products and the challenges experienced by physicians and patients in the use of these products. Dermatologists often rely on trusted relationships with scientifically oriented, customer-focused sales representatives who can provide them with the necessary information to support their use of appropriate treatments.

Competition

The pharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary drugs. While we believe that our knowledge, experience and scientific resources provide us with competitive advantages, we face potential competition from many different sources, including major pharmaceutical and specialty pharmaceutical companies, academic institutions and governmental agencies and public and private research institutions. Any drug candidates that we successfully develop and commercialize will compete with existing treatments and new treatments that may become available in the future.

The key competitive factors affecting the success of A-101, if approved for the treatment of SK, are likely to be its efficacy, safety, non-invasiveness, pain profile and ability to be administered by non-physician staff. With respect to A-101 for the treatment of SK, we are aware of one biopharmaceutical company, BioLineRx Ltd., that is developing a combination drug candidate that targets SK, and another company, Skincential Sciences, Inc., that currently markets a line of cosmetic products targeting skin conditions, including SK. We are also aware of early research being conducted with Akt inhibitors as a potential treatment for SK. None of these products have been approved by the FDA for the treatment of SK in the United States.

With respect to A-101 for the treatment of common warts, we are aware of one company, Nielsen BioSciences, that is developing a prescription treatment for common warts. We are aware of another company, G&E Herbal Biotechnology Co., LTD, that intends to initiate a Phase 2 clinical trial of a gel as a prescription treatment for common warts. In addition, other drugs have been used off-label as treatments for common warts. We could also encounter competition from over-the-counter treatments for common warts.

With respect to A-201 and A-301 for the treatment of AA, we anticipate competing with sensitizing agents such as diphencyprone, or DPCP, and topical, intralesional and systemic corticosteroids, which have been found to occasionally reduce symptoms of AA. Other treatments utilized for patchy AA include anthralin and minoxidil solution. We may also compete with companies developing chemical agents to be used in topical immunotherapies, as well as companies developing biologics, immunosuppressive agents, laser therapy, phototherapy, other JAK inhibitors and prostaglandin analogues to treat AA.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize drugs that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than A-101 or any other drug that we may develop. Our competitors also may obtain FDA or other regulatory approval for their drugs more rapidly than we may obtain approval for our drug, which could result in our competitors establishing a strong market position before we are able to enter the market. Many of the companies against which we are competing, or against which we may compete in the future, have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and

19

marketing approved drugs than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and subject registration for clinical trials, as well as in acquiring technologies complementary to, or that may be necessary for, our programs.

Intellectual Property

Our success depends in large part upon our ability to obtain and maintain proprietary protection for our drug candidates and to operate without infringing the proprietary rights of others. We seek to avoid the latter by monitoring patents and publications that may affect our business, and to the extent we identify such developments, evaluate and take appropriate courses of action. Our policy is to protect our proprietary position by, among other methods, filing for patent applications on inventions that are important to the development and conduct of our business with the U.S. Patent and Trademark Office, or USPTO, and its foreign counterparts.

With respect to A-101, we own two issued U.S. patents, one issued patent in each of Australia, Germany, United Kingdom, India, New Zealand, Mexico, and Singapore, and a pending U.S. and PCT patent application. We do not currently rely on licenses to any third party's intellectual property for A-101. The two U.S. patents include claims that cover the use of high-concentration hydrogen peroxide for the alleviation of SK and acrochordons. The patents in Australia, New Zealand and India include claims that cover the use of high-concentration hydrogen peroxide for the alleviation of various skin conditions, including SK, acrochordons, corns, tags, acne, warts and rosacea. The patents in Germany, the United Kingdom, Mexico and Singapore include claims that cover the use of high-concentration hydrogen peroxide for the alleviation of acrochordons. The issued patents relating to the use of A-101 begin to expire in 2022, subject to any applicable patent term extension that may be available in a particular country.

Our pending U.S. and PCT patent application are directed to various formulations comprising high-concentration hydrogen peroxide, dosing regimens for such formulations, applicators for use with such formulations, and methods of treating various skin conditions, including SK and common warts, by the topical administration of such formulations. We plan to pursue the PCT application in numerous foreign countries, including in the European Union. Any claims that issue from these formal filings will expire in 2035, subject to any applicable patent term adjustment or extension that may be available in a particular country.

With respect to the JAK inhibitors we licensed from Rigel, we exclusively licensed in the field of dermatology multiple families of patents and applications relating to these compounds and the uses thereof. In particular, we exclusively licensed patents and applications with claims that specifically cover the composition of matter for these compounds in the United States, the European Union, and other major foreign markets. The issued patents specifically directed to these compounds begin to expire in 2030, subject to any applicable patent term adjustment or extension that may be available in a particular country. We also exclusively licensed applications in the United States, Australia, Canada, Europe and Japan with claims that cover the use of these compounds for the treatment of autoimmune alopecia. Any claims that issue from these applications will expire in 2034, subject to any applicable patent term adjustment or extension that may be available in a particular country. We also licensed a family of patents and applications that relate to A-201 and A-301 that expire in 2023, subject to any applicable patent term adjustment or extension that may be available in a particular country.

With respect to the JAK inhibitors that we have licensed from other third parties, we exclusively licensed in the field of dermatology a family of applications relating to specific JAK 3 inhibitors and methods of use. In particular, we exclusively licensed a U.S. patent with claims directed to the use of these specific JAK 3 inhibitors to inhibit activity of JAK 3 in a patient, which patent expires in 2030, subject to any applicable patent term extension that may be available. We also exclusively licensed patent applications in the United States, Canada and Europe relating to these specific JAK 3 inhibitors and methods of use, which, if they were to issue as patents, would expire in 2030, subject to any applicable patent term adjustment or extension that may be available in a particular country.

We also use other forms of protection, such as trademark, copyright, and trade secret protection, to protect our intellectual property, particularly where we do not believe patent protection is appropriate or obtainable. We aim to take advantage of all of the intellectual property rights that are available to us and believe that this comprehensive approach will provide us with proprietary positions for our drug candidates, where available.

20

Patents extend for varying periods according to the date of patent filing or grant and the legal term of patents in various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary from country to country, depends on the type of patent, the scope of its coverage and the availability of legal remedies in the country. In most countries in which we file, the patent term is 20 years from the earliest date of filing a non-provisional patent application. In the United States, a patent term may be shortened if a patent is terminally disclaimed over another patent or as a result of delays in patent prosecution by the patentee, and a patent's term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the USPTO in granting a patent or by patent term extension, which compensates a patentee for delays at the FDA. The patent term of a European patent is 20 years from its filing date; however, unlike in the United States, the European patent does not grant patent term adjustments. The European Union does have a compensation program similar to patent term extension called supplementary patent certificate that would effectively extend patent protection for up to five years.

We also protect our proprietary information by requiring our employees, consultants, contractors and other advisors to execute nondisclosure and assignment of invention agreements upon commencement of their respective employment or engagement. Agreements with our employees also prevent them from bringing the proprietary rights of third parties to us. In addition, we also require confidentiality or service agreements from third parties that receive our confidential information or materials.

Assignment Agreement and Finder's Services Agreement

In August 2012, we entered into an assignment agreement with the Estate of Mickey Miller, or the Miller Estate, under which we acquired some of the intellectual property rights covering A-101. The assignment of intellectual property rights covers specified know-how, along with modifications of, improvements to and variations on A-101 that meet defined chemical properties. Under the agreement, we have the sole and exclusive right, but not the duty, to develop, obtain regulatory approval for and commercialize A-101 in various countries throughout the world. We are required to use commercially reasonable efforts to develop and commercialize at least one product for at least one indication in the United States. In connection with obtaining the assignment of the intellectual property from the Miller Estate, we also entered into a separate finder's services agreement with KPT Consulting, LLC.

Under the terms of the assignment agreement and the finder's services agreement, we made aggregate upfront payments of $0.6 million in 2012 and one-time milestone payments of $0.4 million in 2013 upon the dosing of the first human subject with A-101 in our Phase 2 clinical trial. There are no remaining potential milestone payments under the assignment agreement. Under the finder's services agreement, we made a one-time milestone payment of $0.3 million in February 2016 upon the dosing of the first human subject with A-101 in our Phase 3 clinical trial, and we are obligated to make additional milestone payments of up to $1.0 million in the aggregate upon the achievement of specified development and regulatory milestones and up to $4.5 million upon the achievement of specified commercial milestones. Under each of the assignment agreement and the finder's services agreement, we are also obligated to pay royalties on sales of A-101 or related products, at low single-digit percentages of net sales, subject to reduction in specified circumstances. We have not made any royalty payments to date under either agreement. Both agreements will terminate upon the expiration of the last pending, viable patent claim of the patents acquired under the assignment agreement, but no sooner than 15 years from the effective date of the agreements.

License Agreement with Rigel

In August 2015, we entered into an exclusive, worldwide license and collaboration agreement with Rigel for the development and commercialization of products containing two specified JAK inhibitors. Under this agreement, we intend to develop these JAK inhibitors for the treatment of AA and potentially for other dermatological conditions. We paid Rigel an upfront non-refundable payment of $8.0 million and have agreed to make aggregate payments of up to $80.0 million upon the achievement of specified pre-commercialization milestones, such as clinical trials and regulatory approvals. Further, we have agreed to pay up to an additional $10.0 million to Rigel upon the achievement of a second set of development milestones. With respect to any products we commercialize under the agreement, we will pay Rigel quarterly tiered royalties on our annual net sales of each product at a high single-digit percentage of annual net sales, subject to specified reductions, until the date that all of the patent rights for that product have expired, as determined on a country-by-country and product-by-product basis or, in specified countries under specified circumstances, ten years from the first commercial sale of such product.

21

The agreement terminates on the date of expiration of all royalty obligations unless earlier terminated by either party for a material breach. We may also terminate the agreement without cause at any time upon advance written notice to Rigel. Rigel, after consultation with us, will be responsible for maintaining and prosecuting the patent rights, and we will have final decision-making authority regarding such patent rights for a product in the United States and the European Union. To the extent that we jointly develop intellectual property, we will confer and decide which party will be responsible for filing, prosecuting and maintaining those patent rights. The agreement also establishes a joint steering committee composed of an equal number of representatives for each party, which will monitor progress in the development of products.

Government Regulation and Product Approval

Governmental authorities in the United States, at the federal, state and local level, and analogous authorities in other countries extensively regulate, among other things, the research, development, testing, manufacture, safety surveillance, efficacy, quality control, labeling, packaging, distribution, record keeping, promotion, storage, advertising, distribution, marketing, sale, export and import, and the reporting of safety and other post-market information of products such as the one we are developing. A drug candidate, such as A-101, must be approved by the FDA before it may be legally promoted in the United States and by comparable foreign regulatory authorities before marketing in other jurisdictions. A-101 and any future drug candidates we may develop will be subject to similar requirements in other countries outside of the European Union and the United States prior to marketing in those countries. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulations require the expenditure of substantial time and resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval may subject an applicant and/or sponsor to a variety of administrative or judicial sanctions, including refusal by regulatory authorities to approve applications, withdrawal of an approval, imposition of a clinical hold, import/export delays, issuance of warning letters and untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement of profits, or civil or criminal investigations and penalties brought by FDA and the Department of Justice or other governmental entities.

United States Government Regulation

NDA Approval Processes

In the United States, the FDA regulates drug and medical device products under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations. Our drug candidates are comprised of both a drug component (the hydrogen peroxide solution or gel) and a pen-type applicator. In the case of our drug candidates, the FDA's Center for Drug Evaluation and Research has primary jurisdiction over the premarket development, review and approval of our drug candidates. Accordingly, we are investigating our drug candidates pursuant to IND applications and expect to seek approval through the NDA pathway. Based on our discussions with the FDA to date, we do not anticipate that the FDA will require us to submit a separate marketing application for the pen-type applicator that will be used with our drug candidates, but this could change during the course of the FDA's review of our NDA.

An applicant seeking approval to market and distribute a new drug product in the United States must typically undertake the following:

|

· |

completion of preclinical laboratory tests, animal studies and formulation studies in compliance with the FDA's good laboratory practice regulations; |

|

· |

submission to the FDA of an IND which must take effect before clinical trials may begin; |

|

· |

approval by an independent institutional review board, or IRB, representing each clinical site before clinical testing may be initiated at the clinical site; |

|

· |

performance of adequate and well-controlled clinical trials in accordance with good clinical practice, or GCP, regulations to establish the safety and efficacy of the proposed drug product for each indication; |

|

· |

preparation and submission to the FDA of an NDA; |

|

· |

review of the NDA by a FDA advisory committee, if applicable; |

|

· |

satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the product or its components are produced to assess compliance with current good manufacturing practices, or |

22

cGMP, regulations to assure that the facilities, methods and controls are adequate to preserve the product's identity, strength, quality and purity; |

|

· |

payment of user fees and securing FDA approval of the NDA; and |

|

· |

compliance with any post-approval requirements, including potential requirements for a risk evaluation and mitigation strategy and post-approval studies required by the FDA. |

Once a drug candidate is identified for development, it enters the preclinical or nonclinical testing stage. Preclinical studies include laboratory evaluations of product chemistry, pharmacology, toxicity and formulation. An IND sponsor must submit the results of the preclinical studies, together with manufacturing information and analytical data, to the FDA as part of the IND. Some preclinical studies may continue even after the IND is submitted. In addition to including the results of the preclinical studies, the IND will also include a protocol detailing, among other things, the objectives of the clinical trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated if the first phase lends itself to an efficacy determination. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, places the IND on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. A clinical hold may occur at any time during the life of an IND, and may affect one or more specific clinical trials or all clinical trials conducted under the IND.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with current Good Clinical Practices regulations. They must be conducted under protocols detailing the objectives of the trial, dosing procedures, research subject selection and exclusion criteria and the safety and effectiveness criteria to be evaluated. Each protocol must be submitted to the FDA as part of the IND, and progress reports detailing the status of the clinical trials must be submitted to the FDA annually. Sponsors also must timely report to FDA serious and unexpected adverse reactions, any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator brochure, or any findings from other studies or animal or in vitro testing that suggest a significant risk in humans exposed to the drug. An institutional review board, or IRB, at each institution participating in the clinical trial must review and approve the protocol before the clinical trial commences at that institution and must also approve the information regarding the trial and the consent form that must be provided to each research subject or the subject's legal representative, monitor the study until completed and otherwise comply with IRB regulations.

Clinical trials are typically conducted in three sequential phases that may overlap or be combined:

|

· |

Phase 1. The drug is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and elimination. In the case of some products for severe or life-threatening diseases, such as cancer, and especially when the product may be inherently too toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients who already have the condition. |

|

· |

Phase 2. Clinical trials are performed on a limited patient population intended to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. |

|

· |

Phase 3. If a drug candidate is found to be potentially effective and to have an acceptable safety profile in Phase 2 clinical trials, the clinical trial program will be expanded to Phase 3 clinical trials to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical trial sites. These studies are intended to establish the overall risk-benefit ratio of the product and provide an adequate basis for product approval and labeling claims. |

Phase 4 clinical trials are conducted after approval to gain additional experience from the treatment of patients in the intended therapeutic indication and to document a clinical benefit in the case of drugs approved under accelerated approval regulations, or when otherwise requested by the FDA in the form of post-market requirements or commitments. Failure to promptly conduct any required Phase 4 clinical trials could result in withdrawal of approval.

Clinical trials are inherently uncertain and Phase 1, Phase 2 and Phase 3 testing may not be successfully completed. The FDA or the sponsor may suspend a clinical trial at any time for a variety of reasons, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB's requirements or if the drug has been associated with unexpected serious harm to patients. In some cases, clinical trials are overseen by an independent group of qualified experts organized by the trial sponsor, which is called the clinical monitoring board or data safety monitoring board. This group provides authorization for whether or not a trial

23

may move forward at designated check points. These decisions are based on the limited access to data from the ongoing trial.