UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 001-35733

Silvercrest Asset Management Group Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

45-5146560 |

|

(State or other jurisdiction of incorporation) |

|

(I.R.S. Employer Identification No.) |

1330 Avenue of the Americas, 38th Floor

New York, New York 10019

(Address of principal executive offices and zip code)

(212) 649-0600

(Registrant’s telephone number, including area code)

Not Applicable

(Formed name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Class A common stock, $0.01 par value per share

(Title of each class)

The Nasdaq Global Market

(Name of each exchange in which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging Growth Company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common equity held by non-affiliates of the registrant (assuming for purposes of this computation only that the directors and executive officers may be affiliates) at June 30, 2017, which was the last business day of the registrant’s most recently completed second fiscal quarter was approximately $95.1 million based on the closing price of $13.45 for one share of common stock, as reported on The Nasdaq Global Market on June 30, 2017.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, as of March 6, 2018 were 8,142,120 and 5,059,319, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2017.

|

|

|

|

|

|

|

Item 1. |

|

|

2 |

|

|

Item 1A. |

|

|

15 |

|

|

Item 1B. |

|

|

34 |

|

|

Item 2. |

|

|

34 |

|

|

Item 3. |

|

|

34 |

|

|

|

|

|

|

|

|

Item 5. |

|

|

35 |

|

|

Item 6. |

|

|

38 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

39 |

|

Item 7A. |

|

|

60 |

|

|

Item 8. |

|

|

60 |

|

|

Item 9A. |

|

|

60 |

|

|

|

|

|

|

|

|

Item 10. |

|

|

61 |

|

|

Item 11. |

|

|

61 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

61 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

61 |

|

Item 14. |

|

|

61 |

|

|

|

|

|

|

|

|

Item 15. |

|

|

62 |

|

|

Item 16 |

|

|

63 |

Except where the context requires otherwise and as otherwise set forth herein, in this report, references to the “Company”, “we”, “us” or “our” refer to Silvercrest Asset Management Group Inc. (“Silvercrest”) and its consolidated subsidiary, Silvercrest L.P., the managing member of our operating subsidiary (“Silvercrest L.P.” or “SLP”). SLP is a limited partnership whose existing limited partners are referred to in this report as “principals”. On June 26, 2013, Silvercrest completed its corporate reorganization, and on July 2, 2013, Silvercrest closed its initial public offering. Prior to that date, Silvercrest was a private company.

Forward-Looking Statements

This report contains, and from time to time our management may make, forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may”, “might”, “will”, “should”, “expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue”, the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions, may include projections of our future financial performance, future expenses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in our business or financial results. These statements are only predictions based on our current expectations and projections about future events. Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those indicated by such forward-looking statements include but are not limited to: incurrence of net losses, fluctuations in quarterly and annual results, adverse economic or market conditions, our expectations with respect to future levels of assets under management, inflows and outflows of assets under management, our ability to retain clients from whom we derive a substantial portion of our assets under management, our ability to maintain our fee structure, our particular choices with regard to investment strategies employed, our ability to hire and retain qualified investment professionals, the cost of complying with current and future regulation, coupled with the cost of defending ourselves from related investigations or litigation, failure of our operational safeguards against breaches in data security, privacy, conflicts of interest or employee misconduct, our expected tax rate, and our expectations with respect to deferred tax assets, adverse economic or market conditions, adverse effects of management focusing on implementation of a growth strategy, failure to develop and maintain the Silvercrest brand and other factors disclosed under “Risk Factors” in this annual report on Form 10-K. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Our Guiding Principles

We operate our business in accordance with the following guiding principles:

|

|

• |

We will create, build and maintain an environment that encourages innovation and original thought and apply this fresh thinking to the needs of our clients and firm. |

|

|

• |

We will attract, motivate and retain unusually talented and ambitious professionals who share a passion for the investment business and an antipathy for corporate bureaucracy and office politics. |

|

|

• |

We will conduct ourselves in all our dealings as highly ethical, responsible and competent professionals who always place our clients’ financial interests ahead of our own. |

|

|

• |

We will encourage and nurture an entrepreneurial, collegial and action-oriented business culture in which “fun” is inevitable and decisions are generally consensual. |

Our Company

We are a full-service wealth management firm focused on providing financial advisory and related family office services to ultra-high net worth individuals and institutional investors. In addition to a wide range of investment capabilities, we offer a full suite of complementary and customized family office services for families seeking comprehensive oversight of their financial affairs. As of December 31, 2017, our assets under management were $21.3 billion.

We were founded 15 years ago on the premise that if we staffed and organized our business to deliver a combination of excellent investment performance together with high-touch client service, we would differentiate our business from a crowded field of firms nominally in the wealth management business. We seek to attract and serve a base of individuals and families with $10 million or more of investable assets, and we believe we are well-positioned to offer comprehensive investment and family office service solutions to families with over $25 million of investable assets. As of December 31, 2017, we had 719 client relationships with an average size of $29 million that represented approximately 98% of our assets under management. Our top 50 relationships averaged $254 million in size, and such amount represented approximately 1.2% of our assets under management. As a boutique, we are large enough to provide an array of comprehensive capabilities, yet agile enough to coordinate and deliver highly personalized client service.

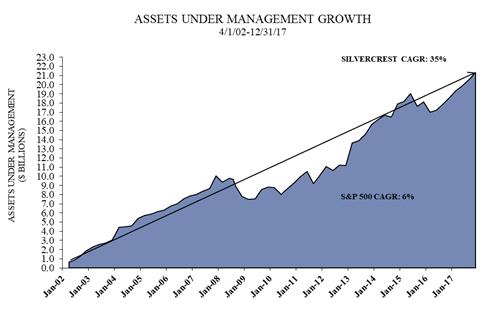

Our annual client retention rate has averaged 98% since 2006 and, as shown below, the compound annual growth rate, or CAGR, in our assets under management since inception is 35%. Our growth rate in any 12-month period ending on the last day of a fiscal quarter since inception ranged from (23)% to 1,142%, with a mean of 42%. We believe our record of growth is a direct result of our demonstrated record of delivering excellent performance together with highly personalized service to our clients.

2

Our organic growth has been complemented by selective hiring and by seven successfully completed strategic acquisitions that have expanded not only assets under management, but also our professional ranks, geographic footprint and service capabilities. We believe additional acquisitions will allow us to extend our geographic presence nationally. As we grow, we will maintain our value proposition to continue to deliver to our clients excellent investment performance together with excellent client service, the essence of what differentiates us from our competitors.

Our clients engage us to advise them on traditional investment strategies focused on equities, fixed income and cash as well as non-traditional investment strategies including hedge funds, private equity funds, real estate and commodities. Our clients receive a full menu of proprietary investment capabilities together with a focused array of complementary non-proprietary capabilities offered by unaffiliated firms selected by us. In addition to our investment capabilities, we also provide our clients with family office services and related administrative services, which include financial planning, tax planning and preparation, partnership accounting and fund administration, and consolidated wealth reporting. Our fees for our investment advisory services, non-proprietary services and family office and related administrative services are structured to align our financial incentives with those of our clients to ensure they receive unconflicted advice. The vast majority of our fees are derived from discretionary assets under management, and are based on the value of the assets we manage for our clients. These fees increase if our clients’ assets grow in value; on the other hand, these fees decrease if our clients’ assets decline in value. Unlike our management fees, our fees for family office services and related administrative services are generally not based on or correlated to market values. For these services, we generally charge our clients a negotiated fee based on the scope of work. These services create strong client relationships and contribute meaningfully to our record of client retention.

As of December 31, 2017, approximately 76% of our discretionary assets under management were held for individual clients and 24% for institutional clients. Based on the results we have achieved in a number of our equity strategies, we continue to attract a significant amount of institutional investor interest. Our equity capabilities are on the approved lists of several prominent institutional consultants and, as a result, we believe significant institutional growth is likely to continue in future years.

History, Organization and Philosophy

When forming our company, our founders had the objective of creating a large full-service boutique operation focused on managing portfolios and delivering financial advice to wealthy individuals and select institutions. We commenced operations in April of 2002. Our first partners and employees came almost entirely from Donaldson, Lufkin & Jenrette (“DLJ”) Asset Management Group, which had been acquired by Credit Suisse Asset Management in late 2000. In 2002, we carefully recruited and hired the same equity, fixed income and client service teams with whom our clients had worked at DLJ Asset Management Group. As of December 31, 2017, approximately eleven percent of our 122 employees are veterans of DLJ. Many of our principals, therefore, have worked together for 21 years and, in some cases, even longer.

Our headquarters are located in New York City with additional offices in Massachusetts, Virginia and New Jersey. From inception, we have embraced an organizational structure in which the primary functions of client service, investments, technology and operations, and business administration are organized and staffed with professionals who specialize in each of those functions. This structure permits each professional to focus on his or her area of expertise without the distraction of other business responsibilities. At many other firms, the senior professionals are expected to serve multiple roles simultaneously, which we believe dilutes the value to clients and makes scaling the business effectively unachievable. We firmly believe that our business structure represents a better approach and will permit us to greatly expand our business on our existing platform.

In meeting our primary objective to deliver strong investment results, we seek to add value through our asset allocation advice, as well as through our proprietary equity and fixed income strategies and outsourced investment capabilities. We recruited and hired a team of seasoned securities analysts who have an institutional caliber approach to security selection and a long record of success in implementing their strategies. We encourage them to focus 100% of their professional time on the task of securities selection. Our in-house equity analysts are focused on U.S. large cap, small cap, smid cap, multi cap, equity income and focused value equity strategies. On the fixed income side, our analysts are focused on high-grade municipals, high-yield municipals and high-grade taxables.

In order to deliver excellent client service, our portfolio managers are charged with the responsibility of working individually with each client to help define investment objectives, risk tolerance, cash flow requirements and other financial needs. Client-facing portfolio managers, their support staffs and the family office services group, account for 58% of our total employees, a reflection of our high commitment to excellent client service. We are staffed to ensure that each client receives senior level personal attention.

3

We have a staff of eight professionals who work with our portfolio managers to deliver family office services to interested clients. The fees for family office services are negotiated with the client and generally are not asset-based. For this reason, the revenues generated by our family office services are non-correlated to market movements and provide us with a diversified source of earnings. We believe these family office services have been an attractive component of our overall value proposition and engender a stronger relationship with our clients, leading to greater client retention and the institutionalization of client relationships.

Our Growth Strategy

We built our company to take market share from financial services firms whose wealth management models we believe are flawed. Our growth strategy has been and will continue to be to grow our business organically, to complement our organic growth with strategic hires and acquisitions and to expand our presence in the institutional market. In support of each of these initiatives we plan to continue to invest in establishing our brand through continued selective advertising and public relations.

Organic Growth

We have a proven ability to identify, attract and retain ultra-high net worth clients who seek a firm designed to deliver excellent investment performance and excellent client service. Our organizational model of separate and distinct business functions has proven scalable and our company’s assets under management have grown to $21.3 billion as of December 31, 2017 without a commensurate increase in headcount. Importantly, we have achieved our growth while maintaining our profitability during one of the most challenging periods in the history of the U.S. financial markets. Going forward, we will continue to execute our business plan for attracting ultra-high net worth clients.

The business of attracting ultra-high net worth clients is the business of obtaining referrals and gaining trust. At our company, these responsibilities reside principally with our portfolio managers. Our senior portfolio managers have on average nearly 35 years of industry experience and they have developed a wealth of contacts and professional referral sources as a result of that experience. In spearheading the effort to deliver excellent performance and service to their clients, our portfolio managers have developed very close relationships with their clients and in many cases these relationships are much older than our company itself. Much of our new business results from referrals from existing clients. In this regard, it is critical that our portfolio managers work closely with each of their clients to establish and maintain the trust that is at the heart of the relationship.

Where appropriate, our portfolio managers are also encouraged to introduce our clients to our family office services capabilities and we have capacity for growth in client utilization of these services. Four of our ten largest clients use our family office services and some of these clients have closed their own family offices to consolidate those activities with us. This is a profitable business for us and it serves to tighten our ties to those clients who avail themselves of the services we offer. It is also extremely useful to us in new business competitions where we use these services as a differentiator from our competitors. We continue to see the opportunity for greater penetration with our current clients in future years.

Complementing the efforts of our senior portfolio managers to cultivate client referrals, our business development team is charged with identifying newly-formed wealth (resulting from merger, acquisition or corporate finance) and then creating customized solicitations. Our objective is two-fold: we will expand awareness of our company and its capabilities by distributing our marketing materials to this new audience and we will attract a certain amount of new business. The basis of this effort is careful research designed to ascertain if the prospect has any relationship with us-or any of our clients or friends-and then our solicitation is tailored to those circumstances.

In all of our business development efforts we devote a great deal of time and effort to developing highly customized and detailed proposals for our prospects. In order to do so, we spend as much time as is required to thoroughly understand the prospect’s circumstances and goals as well as the sources of its dissatisfaction with its existing adviser. Where appropriate our proposals include the integration of our entire suite of family office services. We believe our customized new business presentations distinguish us from both our much larger competitors, which have substantial resources, but whose size, we believe, may impede them from easily tailoring solutions to suit clients’ needs, as well as from our smaller competitors whom, we believe, do not have our depth of resources or capabilities.

4

Acquired Growth

From our inception, our organic growth has been complemented by selective hiring and strategic acquisitions, which have served to enlarge our client base, expand our professional ranks, increase our geographic presence and broaden our service capabilities. We therefore expect to continue to recruit and hire senior portfolio managers with significant client relationships as well as successful investment professionals with capabilities currently not available internally to us. We have used acquisitions to extend our presence into new geographies (Boston, Virginia and New Jersey) and to gain new investment expertise. The seven strategic acquisitions we have successfully completed have allowed us to benefit from economies of scale and scope.

In making acquisitions, we look for firms with compatible professionals of the highest integrity who believe in our high service-high performance model for the business. It is important that their clientele be principally clients of high net worth and it is helpful if they have a similar value-based investment methodology. These firms are attracted to our company by the strength of our brand, the breadth of our services and the integrity of our people. Often these firms are extremely limited in the investment products and services they can offer their clients and it is not uncommon that they have succession or other management issues to resolve. In addition, the high and growing cost of compliance with federal and state laws governing their business is often an added inducement. We believe we will become the partner of choice for many such firms.

Continuing our short-term growth strategy, we intend to establish offices in major wealth centers on the West Coast, in the Southwest and in the Midwest in order to be closer to both our clients and to prospective clients.

Our past acquisitions have sharpened our ability to integrate acquired businesses, and we believe that once we identify an acquisition target we will be able to complete the acquisition and integrate the acquired business expeditiously.

Institutional Growth

After nine years of effort focused on cultivating relationships with institutional investment consultants, we continue to regularly make new business presentations to institutional investors, including public and corporate pension funds, endowments, foundations, and their consultants.

We are on the “approved” lists of certain prominent institutional investment consultants, which means that these consultants would be prepared to recommend our firm to clients in search of a particular investment strategy for their clients. This has significantly enhanced our ability to win mandates these consultants seek for their institutional clients and as a result we have won institutional mandates in our equity strategies. We expect this trend to continue once it is publicly known that these and other institutions have engaged us to manage significant portfolios for them. The importance of institutional growth to our company is noteworthy: institutional assets will likely expand not only our assets under management but also our profit margins; and the due diligence conducted by these institutions before selecting us will ratify and confirm the decisions to hire us made by our individual clients.

Brand Management

We have invested heavily to build, maintain and extend our brand. We have done so in the belief that creating awareness of our company and its differentiated characteristics would support all aspects of our business but most notably our growth.

With limited resources, we have created a focused national advertising campaign, which has drawn praise from clients, prospects and competitors alike. We have carefully chosen media outlets that reach our target audience efficiently and we estimate that the new business that we get directly as a result of our advertising now finances its cost.

Complementing our advertising strategy and again with limited resources, we have also invested in an effort to get media coverage of our company in some of the nation’s most prestigious national publications as well as in industry journals and newsletters. This effort has resulted in press coverage by the Wall Street Journal, Barron’s, Bloomberg, the Financial Times and The New York Times as well as various trade publications distributed within our industry. This public relations effort has proven very helpful in establishing our company as a leader in our industry.

Our Business Model

We were founded in 2002 to provide independent investment advisory and related family office services to ultra-high net worth individuals and endowments, foundations and other institutional investors. To this end, we are structured to provide our clients with institutional-quality investment management with the superior level of service expected by wealthy individuals.

5

To provide this high level of service, we rely on portfolio management teams and our family office services team to provide objective, conflict-free investment management selection and a fully integrated, customized family-centric approach to wealth management. We believe the combination of comprehensive family office service, excellent investment capabilities and a high level of personal service allows us to take advantage of economies of scale to service the needs of our ultra-high net worth clients.

We have dedicated investment management teams tasked with successfully implementing their respective investment strategies. To increase the probability of success in meeting this objective, our analysts are not responsible for client interaction, management of our business, marketing or compliance oversight. This enables us to effectively serve ultra-high net worth clients as well as institutions that typically perform in-depth due diligence before selecting a manager.

Delivering Investment Performance

The Investment Policy & Strategy Group, or IPSG, which is comprised of our chief strategist and several of our senior portfolio managers, is charged with the responsibility of adding value through asset allocation and manager selection. This is done through the use of our proprietary investment management by our internal analysts, and by those whom we believe are best-of-breed external managers.

The IPSG develops model asset allocations assuming differing levels of risk, liquidity and income tolerance as well as conducting outside manager due diligence. Our proprietary model portfolio structures are not merely a backward-looking, mechanical exercise based on the past performance of different asset classes. Instead, our IPSG overlays our judgment on the likely future performance of different asset classes in arriving at optimal portfolio structures. None of our dedicated investment analysts serves on this committee, which safeguards the independence of the IPSG’s recommendations.

Our portfolio managers are responsible for creating a customized investment program for each client based upon the IPSG’s work. An interactive dialogue ensures that each portfolio plan is based upon each client’s defined written objectives. Each client’s portfolio strategy takes into account that client’s risk tolerance, income and liquidity requirements as well as the effect of diversifying out of low-basis and/or sentimental holdings.

Historically, the IPSG has added value to our clients’ portfolios through asset allocation weightings and manager selection.

From inception, we have employed a system of peer group reviews to ensure that client portfolios have been constructed in a manner consistent with our best collective thinking. In annual peer group reviews, the asset allocation within each client portfolio is compared with such portfolio’s defined objectives and portfolios that are not fully aligned with the investment objective are then singled out for further review and discussion. Our objective is for all clients to receive our best thinking and for portfolio managers to manage portfolios consistently with our policy. As a combination of these various factors, the client relationship is with us and not merely with an individual at our company.

We believe that it is impossible for a single manager to perform all forms of investing equally well. Thus, our core proprietary investment capabilities are focused on a narrow range of highly disciplined U.S. equity and fixed income management strategies. Our investment teams have exhibited strong performance records. With respect to these strategies, roughly 63% of our total assets under management are managed in our proprietary investment strategies.

Our outsourced investment capabilities include alternative investments as well as traditional investment approaches in the categories of domestic large, mid and small cap growth equity, international equities and high-yield bonds.

Proprietary Equity Strategies

Our equity strategies rely on a team-based investment approach and a rigorous investment process. This approach has resulted in returns that exceed relevant market benchmarks. We believe this team approach has provided and will continue to provide consistency to our investment process and results over the long-term. Our investment analysts are generalists who employ a “bottom-up” value oriented equity selecting methodology. Our analysts collectively monitor a universe of approximately 100 stocks that are deemed to be attractively valued relative to their business outlook and management’s history of adding value.

6

Once stocks have been approved for investment from this body of research, they become part of one or more model equity portfolios. These are generally large cap, small cap, smid cap, multi-cap, equity income and focused value. Each stock position is continually monitored against its investment thesis to ensure investment discipline, and we employ a strict discipline to trim or sell securities in the following circumstances:

|

|

• |

when a stock is excessively valued in our models or the best case scenario is reflected in the stock price; |

|

|

• |

due to a stock’s outperformance, which can adversely affect a portfolio’s diversification; |

|

|

• |

due to underperformance, when a stock trails relevant benchmarks by more than 10%; or |

|

|

• |

when the investment thesis changes, due to a loss of confidence in management, a change in business prospects or the deterioration in earnings quality. |

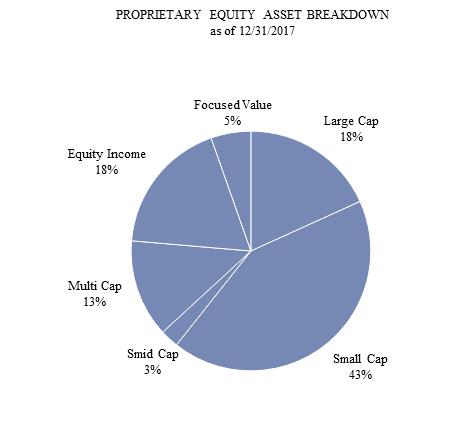

Below is a breakdown of assets among the various proprietary equity strategies as of December 31, 2017:1

_____________________________________________

1 As of the filing of this annual report our small cap strategy is closed to new investors. The strategy may be reopened if one or more of our investors elects to rebalance its assets, which may occur at any time.

7

Each of our equity strategies has outperformed its benchmark since inception as illustrated by the following chart:

|

PROPRIETARY EQUITY PERFORMANCE 1, 2 |

|

ANNUALIZED PERFORMANCE |

|

||||||||||||||||||||

|

AS OF 12/31/17 |

|

INCEPTION |

|

|

|

1-YEAR |

|

|

|

3-YEAR |

|

|

|

5-YEAR |

|

|

|

7-YEAR |

|

|

|

INCEPTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large Cap Value Composite |

|

4/1/02 |

|

|

|

24.9 |

|

|

|

13.3 |

|

|

|

16.5 |

|

|

|

13.6 |

|

|

|

9.3 |

|

|

Russell 1000 Value Index |

|

|

|

|

|

13.7 |

|

|

|

8.7 |

|

|

|

14.0 |

|

|

|

12.5 |

|

|

|

7.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Small Cap Value Composite |

|

4/1/02 |

|

|

|

12.2 |

|

|

|

12.7 |

|

|

|

16.0 |

|

|

|

13.8 |

|

|

|

11.7 |

|

|

Russell 2000 Value Index |

|

|

|

|

|

7.8 |

|

|

|

9.6 |

|

|

|

13.0 |

|

|

|

10.8 |

|

|

|

8.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Smid Cap Value Composite |

|

10/1/05 |

|

|

|

15.4 |

|

|

|

14.2 |

|

|

|

16.3 |

|

|

|

14.1 |

|

|

|

10.9 |

|

|

Russell 2500 Value Index |

|

|

|

|

|

10.4 |

|

|

|

9.3 |

|

|

|

13.3 |

|

|

|

11.5 |

|

|

|

8.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multi Cap Value Composite |

|

7/1/02 |

|

|

|

19.5 |

|

|

|

12.6 |

|

|

|

16.4 |

|

|

|

14.0 |

|

|

|

10.3 |

|

|

Russell 3000 Value Index |

|

|

|

|

|

13.2 |

|

|

|

8.7 |

|

|

|

14.0 |

|

|

|

12.3 |

|

|

|

8.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Income Composite |

|

12/1/03 |

|

|

|

20.1 |

|

|

|

13.4 |

|

|

|

17.1 |

|

|

|

14.9 |

|

|

|

12.5 |

|

|

Russell 3000 Value Index |

|

|

|

|

|

13.2 |

|

|

|

8.7 |

|

|

|

14.0 |

|

|

|

12.3 |

|

|

|

8.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Focused Value Composite |

|

9/1/04 |

|

|

|

18.3 |

|

|

|

13.8 |

|

|

|

17.3 |

|

|

|

13.6 |

|

|

|

11.6 |

|

|

Russell 3000 Value Index |

|

|

|

|

|

13.2 |

|

|

|

8.7 |

|

|

|

14.0 |

|

|

|

12.3 |

|

|

|

8.4 |

|

|

1 |

Returns are based upon a time weighted rate of return of various fully discretionary equity portfolios with similar investment objectives, strategies and policies and other relevant criteria managed by Silvercrest Asset Management Group LLC (“SAMG LLC”), a subsidiary of Silvercrest. Performance results are gross of fees and net of commission charges. An investor’s actual return will be reduced by the advisory fees and any other expenses it may incur in the management of the investment advisory account. SAMG LLC’s standard advisory fees are described in Part 2 of its Form ADV. Actual fees and expenses will vary depending on a variety of factors, including the size of a particular account. Returns greater than one year are shown as annualized compounded returns and include gains and accrued income and reinvestment of distributions. Past performance is no guarantee of future results. This report contains no recommendations to buy or sell securities or a solicitation of an offer to buy or sell securities or investment services or adopt any investment position. This report is not intended to constitute investment advice and is based upon conditions in place during the period noted. Market and economic views are subject to change without notice and may be untimely when presented here. Readers are advised not to infer or assume that any securities, sectors or markets described were or will be profitable. SAMG LLC is an independent investment advisory and financial services firm created to meet the investment and administrative needs of individuals with substantial assets and select institutional investors. SAMG LLC claims compliance with the Global Investment Performance Standards (GIPS®). |

|

2 |

The market indices used to compare to the performance of our strategies are as follows: |

8

Proprietary Fixed Income Strategies

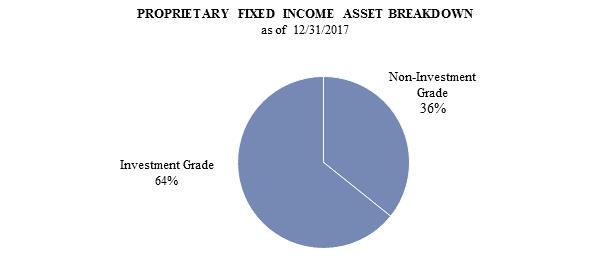

In the management of fixed income investments, clients typically give us the mandate to produce stable returns to dampen the volatility of their portfolios as a counter-weight to equities as part of their complete asset allocation. For those investors who can take advantage of the tax exemption of municipal bonds, we have developed two high-yield municipal bond products designed to add value to the returns possible from high-grade bonds in a low interest rate environment. Below is the breakdown of assets under management by strategy as of December 31, 2017:

Our fixed income strategy employs a bottom-up fundamental value approach designed to minimize the risk of loss. Almost all of our bond portfolios are highly customized and focused on income and liquidity generation as opposed to capital appreciation.

Outsourced Manager Selection

Recognizing the value of diversification to our clients, we offer a variety of outsourced investment capabilities designed to complement our proprietary capabilities. These outsourced capabilities include managers who have long records of success in managing growth equities, international equities, taxable high-yield bonds, hedge funds and other strategies not offered on a proprietary basis by us. In selecting these managers, we utilize an investment manager database for initial screening and then a dedicated staff conducts on-site due diligence. Potential managers are reviewed and selected by our IPSG. Our selection criteria include the following:

|

|

• |

Highly Consistent Returns. We emphasize consistency of performance over strong performance marked by high volatility. |

|

|

• |

Tax Sensitivity. We seek managers with a low turnover style of management designed to achieve attractive after-tax rates of return. |

|

|

• |

Solid Operations and Technology. We require each manager to produce evidence that it has strong technology and operations capabilities as well as vigorous compliance adherence. |

|

|

• |

Alignment of Interest. We require evidence that the strategy’s key people have significant equity in their company and are motivated to stay in place. |

|

|

• |

Willingness to Negotiate Fees. We require our managers to accept a significant discount in their management fees because we expect to manage all aspects of the client relationship. Their only responsibility is to manage the capital entrusted to them. No manager has refused to offer the discounts we seek. |

For large clients with significant hedge fund exposure, we offer a hedge fund advisory service that creates customized hedge fund portfolios. Each of our funds of funds appears below:

|

|

• |

Silvercrest Hedged Equity Fund is designed to complement and diversify long-only equity portfolios through investments with managers who employ long and short strategies; |

|

|

• |

Silvercrest Emerging Markets Fund provides international and non-dollar exposure and diversification focused on long, short, credit and other managers who invest in emerging markets; |

9

|

|

• |

Silvercrest International Fund provides investors with broad coverage of international markets, spanning developed, emerging and frontier markets; |

|

|

• |

Silvercrest Special Situations Fund is designed to outperform traditional benchmarks with less volatility; and |

|

|

• |

Silvercrest Jefferson Fund is designed to outperform its benchmarks on a risk-adjusted basis for investors who seek to minimize risk and preserve capital. |

We have two types of fee arrangements with outsourced managers. Clients either pay a discounted fee, negotiated by us, directly to the manager who retains the entire fee or directly to the manager who distributes a portion of the fee to us. Clients are informed of the applicable arrangement and sign a written acknowledgement.

Delivering Client Service

We take a holistic approach to client service, whereby a senior portfolio manager spearheads the coordination of the IPSG recommendations, family office services work and the investment management team in order to deliver the full range of our capabilities to the client.

Four out of our ten largest high net worth clients use one or more components of our family office services. We believe that this is an attractive growth area for our company and we have initiated plans to increase the provision of these services to both broaden relationships with existing clients and to attract potential clients. Our family office services are profitable and are not used as a loss-leader for attracting clients. Our family office capabilities include the following:

|

|

• |

Financial Planning; |

|

|

• |

Tax Planning and Preparation; |

|

|

• |

Partnership Accounting and Fund Administration; |

|

|

• |

Consolidated Wealth Reporting; |

|

|

• |

Estate or Trust Agency; and |

|

|

• |

Art Consultancy and Management. |

For institutional client relationships, contact with our clients is handled by a dedicated institutional client service team headed by a Managing Director who also maintains our relationships with institutional investment consultants. This structure permits our investment professionals to maintain their focus on achieving superior investment results without the distraction of client demands.

Competition

The wealth management industry is highly competitive and is comprised of many players. We compete directly with some of the largest financial service companies, as well as some of the smallest. We primarily compete on the basis of several factors, including our level of service, the quality of our advice, independence, stability, performance results, breadth of our capabilities and fees. In general, these competitors fall into one of the following categories:

|

|

• |

Diversified Financial Institutions have divisions aimed at providing wealth management solutions to the high net worth segment that are usually staffed by brokers. |

|

|

• |

Asset Management Firms offer proprietary institutional and retail asset management services catering to the high net worth segment largely with off-the-shelf products. |

|

|

• |

Trust Companies combine fiduciary and investment services as well as ancillary financial services. |

|

|

• |

MFO/RIAs focus exclusively on the high net worth segment and are frequently dominated by one or two families. |

As a registered investment adviser that is not affiliated with other financial firms, we are free from the conflicts associated with brokerage or investment banking firms. In advising our clients on portfolio strategies, we are motivated to meet our clients’ investment objectives—not to generate commissions or placement fees—and to focus solely on providing excellent service and investment performance.

We have the size and resources to compete with larger organizations, and unlike many smaller firms, to provide our clients with fully customized, full-service wealth management and integrated family office solutions.

10

While many competitors outsource investment management, we have chosen to compete with excellent proprietary investment capabilities coupled with a focused array of complementary non-proprietary capabilities offered by unaffiliated firms. This combination enables us to compete for and win the business of wealthy investors. We believe this is a key to our past and future success.

Employees

As of December 31, 2017, we had 119 full-time employees and three part-time employees. None of our employees are subject to a collective bargaining agreement. We believe that relations with our employees continue to remain strong.

Our Structure and Reorganization

Holding Company Structure

Our only business is acting as the general partner of Silvercrest L.P. and, as such, we will continue to operate and control all of its business and affairs and consolidate its financial results into our financial statements. The ownership interests of holders of limited partnership interests of Silvercrest L.P. are accounted for as a non-controlling interest in our consolidated financial statements.

Net profits, net losses and distributions of Silvercrest L.P. are allocated and made to each of its partners on a pro rata basis in accordance with the number of partnership units of Silvercrest L.P. held by each of them. In addition, Silvercrest L.P. has issued deferred equity units and restricted stock units exercisable for Class B units that entitle the holders thereof to receive distributions from Silvercrest L.P. to the same extent as if the underlying Class B units were outstanding.

11

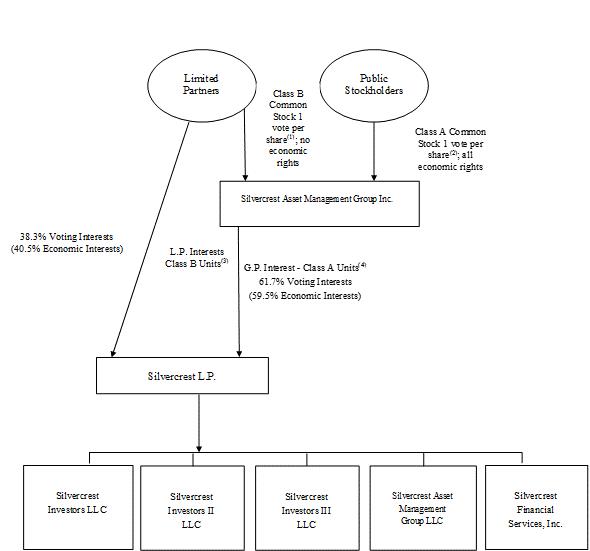

Set forth below is our holding company structure and ownership as of December 31, 2017.

|

(1) |

Each share of Class B common stock is entitled to one vote per share. Class B stockholders have the right to receive the par value of the Class B common stock upon our liquidation, dissolution or winding-up. |

|

(2) |

Each share of Class A common stock is entitled to one vote per share. Class A common stockholders have 100% of the rights of all classes of our capital stock to receive distributions, and substantially all assets, after payment in full to creditors and holders of preferred stock, if any. |

|

(3) |

Each Class B unit held by a principal is exchangeable for one share of Class A common stock. The principals collectively hold 5,059,319 Class B units as of December 31, 2017, which represents the right to receive approximately 40.5% of the distributions made by Silvercrest L.P. The principals also collectively hold 486,098 restricted stock units which are exercisable for one Class B unit, which collectively represent the right to receive approximately 3.6% of the distributions made by Silvercrest L.P. The 486,098 restricted stock units which have been issued to our principals entitle the holders thereof to participate in distributions from Silvercrest L.P. as if the underlying Class B units are outstanding and thus are taken into account to determine the economic interest of each holder of units in Silvercrest L.P. However, because the Class B units underlying the restricted stock units have not been issued and are not deemed outstanding, the holders of restricted stock units have no voting rights with respect to the underlying Class B units. We will not issue shares of Class B common stock in respect of restricted stock units of Silvercrest L.P. until such time that the underlying Class B units are issued. |

|

(4) |

We hold 8,142,120 Class A units, which represents the right to receive approximately 59.5% of the distributions made by Silvercrest L.P. The 486,098 restricted stock units which have been issued to our principals entitle the holders thereof to participate in distributions from Silvercrest L.P. as if the underlying Class B units are outstanding and thus are taken into account to determine the economic interest of each holder of units in Silvercrest L.P. However, because the Class B units underlying the restricted stock units have not been issued and are not deemed outstanding, the holders of restricted stock units have no voting rights with respect to those Class B units. We will not issue shares of Class B common stock in respect of restricted stock units of Silvercrest L.P. until such time that the underlying Class B units are issued. |

12

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level. Under these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

The legislative and regulatory environment in which we operate has undergone significant changes in recent years. New laws or regulations, or changes in the enforcement of existing laws or regulations, applicable to us, our activities and our clients may adversely affect our business. Our ability to function in this environment will depend on our ability to monitor and promptly react to legislative and regulatory changes. There have been a number of highly publicized regulatory inquiries that have focused on the investment management industry. These inquiries have resulted in increased scrutiny of the industry and new rules and regulations for investment advisers. This regulatory scrutiny may limit our ability to engage in certain activities that might be beneficial to our stockholders.

In addition, as a result of market events, acts of serious fraud in the investment management industry and perceived lapses in regulatory oversight, U.S. and non-U.S. governmental and regulatory authorities may increase regulatory oversight of our businesses. We may be adversely affected as a result of new or revised legislation or regulations imposed by the Securities and Exchange Commission, or the SEC, the U.S. Commodity Futures Trading Commission, or the CFTC, other U.S. or non-U.S. regulatory authorities or self-regulatory organizations that supervise the financial markets. We also may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations, as well as by U.S. and non-U.S. courts. It is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed on us or the markets in which we trade, or whether any of the proposals will become law. Compliance with any new laws or regulations could add to our compliance burden and costs and affect the manner in which we conduct our business.

SEC Regulation

SAMG LLC is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act. The Advisers Act, together with the SEC’s regulations and interpretations thereunder, imposes substantive and material restrictions and requirements on the operations of investment advisers. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from fines and censures to termination of an adviser’s registration.

The Advisers Act imposes substantive regulation on virtually all aspects of our business and relationships with our clients. As a registered investment adviser, we are subject to many requirements that cover, among other things, disclosure of information about our business to clients; maintenance of written policies and procedures; maintenance of extensive books and records; restrictions on the types of fees we may charge, including performance fees; solicitation arrangements; engaging in transactions with clients; maintaining an effective compliance program; custody of client assets; client privacy; advertising; pay-to-play; cybersecurity and proxy voting. The SEC has authority to inspect any registered investment adviser from time to time to determine whether the adviser is conducting its activities (i) in accordance with applicable laws, (ii) consistent with disclosures made to clients and (iii) with adequate systems and procedures to ensure compliance.

As an investment adviser, we have a fiduciary duty to our clients. The SEC has interpreted this duty to impose standards, requirements and limitations on, among other things: trading for proprietary, personal and client accounts; allocations of investment opportunities among clients; use of soft dollars; execution of transactions; and recommendations to clients. We manage 67% of our accounts on a discretionary basis, with authority to buy and sell securities for each portfolio, select broker-dealers to execute trades and negotiate brokerage commission rates. In connection with these transactions, we receive soft dollar credits from broker-dealers that have the effect of reducing certain of our expenses. Section 28(e) of the Securities Exchange Act of 1934, or the Exchange Act, provides a “safe harbor” to an investment adviser against claims that it breached its fiduciary duty under state or federal law (including The Employee Retirement Income Security Act of 1974, as amended, or ERISA) solely because the adviser caused its clients’ accounts to pay more than the lowest available commission for executing a securities trade in return for brokerage and research services. To rely on the safe harbor offered by Section 28(e), (i) we must make a good-faith determination that the amount of commissions is reasonable in relation to the value of the brokerage and research services being received and (ii) the brokerage and research services must provide lawful and appropriate assistance to us in carrying out our investment decision-making responsibilities. In permissible circumstances, we may receive technology-based research, market quotation and/or market survey services which are paid for in whole or in part by soft dollar brokerage arrangements. If our ability to use soft dollars were reduced or eliminated as a result of the implementation of statutory amendments or new regulations, our operating expenses would increase.

13

Under the Advisers Act, our investment management agreements may not be assigned without the client’s consent. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in an investment adviser.

The failure of SAMG LLC to comply with the requirements of the Advisers Act, and the regulations and interpretations thereunder, could have a material adverse effect on us.

CFTC Regulation

SAMG LLC is registered with the CFTC and the National Futures Association, or the NFA, as a commodity pool operator and/or commodity trading advisor. Registration subjects us and our affiliates to substantive and material restrictions and requirements, including, among other things, reporting, recordkeeping, disclosure, self-examination and training requirements. Registration also subjects us to periodic on-site audits, and the CFTC is authorized to institute proceedings and impose sanctions for violations of the Commodity Exchange Act and/or CFTC rules.

Dodd-Frank

The Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, was signed into law on July 21, 2010. The Dodd-Frank Act will not cause us to reconsider our basic strategy. However, certain provisions have, and others may continue to increase regulatory burdens related to compliance costs. The scope of many provisions of the Dodd-Frank Act has been, or will be, determined by implementing regulations, some of which will require lengthy proposal and promulgation periods.

Pursuant to the mandate of the Dodd-Frank Act, the SEC and the CFTC have adopted certain reporting requirements that require us to report certain information about a number of our private funds, commodity pools and commodity trading advisers, including regulations promulgated under the authority given to the SEC and CFTC under Sections 404 and 406 of the Dodd-Frank Act requiring a Form-PF and/or a CTA-PQR and CTA-PR to be filed by us. These filings have required and will continue to require investments in people and systems to ensure timely and accurate reporting. Further, we will need to monitor compliance with new SEC and CFTC rules concerning swaps and other derivatives including, among other things, designated trading venues, mandated central clearing arrangements and other conduct requirements.

The Dodd-Frank Act affects a broad range of market participants with whom we interact or may interact. Regulatory changes that will affect other market participants are likely to change the way in which we conduct business with our counterparties. Although many aspects of the Dodd-Frank Act have been implemented, there remains significant uncertainty regarding implementation of other aspects of the Dodd-Frank Act. While its impact on the investment management industry and us cannot be predicted at this time, it will continue to be a risk for our business.

ERISA-Related Regulation

To the extent that SAMG LLC or any other of our affiliates is a “fiduciary” under ERISA with respect to benefit plan clients (including IRAs), it is subject to ERISA (and/or applicable provisions of the Internal Revenue Code of 1986, as amended, referred to as the Internal Revenue Code) and to regulations promulgated thereunder. Among other things, ERISA and applicable provisions of the Internal Revenue Code of 1986, as amended, referred to as the Internal Revenue Code, impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving benefit plan clients and provide monetary penalties and taxes for violations of these prohibitions. Our failure to comply with these requirements could have a material adverse effect on our business.

Other Jurisdictions

The Alternative Investment Fund Managers Directive (“AIFMD”) went into effect in the European Union (“EU”) on July 22, 2013. The AIFMD imposes significant regulatory requirements on alternative investment fund managers ("AIFMs''), operating within the EU, as well as prescribing certain conditions with regard to regulatory standards, cooperation and transparency that will need to be satisfied for non-EU AIFMs to market alternative investment funds ("AIFs'') into EU Member States. To date, we have not registered any funds in EU Member States pursuant to the AIFMD, but may do so in the future. Should SAMG LLC or any other our other affiliates market AIFs in the EU, it and such funds may be subject to significant conditions on their respective operations.

Similarly, revisions to the EU’s Markets in Financial Instruments Directive (MiFID II) which took effect in January 2018 introduced new requirements for certain non-EU portfolio managers who provide certain investment services to EU investors. Should SAMG LLC or any other our other affiliates provide such services in the EU, it and such funds may be subject to the regulatory requirements of MiFID II.

14

In addition, we and/or our affiliates may become subject to additional regulatory demands in the future to the extent we expand our investment advisory business in existing and new jurisdictions. There are also a number of pending or recently enacted legislative and regulatory initiatives in the United States and in other jurisdictions that could significantly impact our business.

Compliance

Our legal and compliance functions are integrated into a team of professionals. This group is responsible for all legal and regulatory compliance matters, as well as monitoring adherence to client investment guidelines. Senior management is involved at various levels in all of these functions.

Available Information

We maintain a website at http://ir.silvercrestgroup.com/. We provide access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports free of charge through this website as soon as reasonably practicable after such material is electronically filed with the SEC. Paper copies of annual and periodic reports filed with the SEC may be obtained free of charge upon written request by contacting our headquarters at the address located on the front cover of this report or under Investor Relations on our website. In addition, our Corporate Governance Guidelines, Code of Business Conduct and Ethics, By-Laws, Audit Committee Charter, Compensation Committee Charter and Nominating and Governance Committee Charter are available on our website (under Corporate Governance) and are available in print without charge to any stockholder requesting them. You may obtain and copy any document we furnish or file with the SEC at the SEC's public reference room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the SEC's public reference facilities by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, information statements, and other information regarding issuers like us who file electronically with the SEC. The SEC's website is located at www.sec.gov.

Risks Related to our Investment Performance and the Financial Markets

Volatile market conditions could adversely affect our business in many ways, including by reducing the value of our assets under management and causing clients to withdraw funds, either of which could materially reduce our revenues and adversely affect our financial condition.

The fees we earn under our investment management agreements with clients are based on the value of our assets under management. The prices of the securities held in the portfolios we manage and, therefore, our assets under management, may decline due to any number of factors beyond our control, including, among others, a declining stock or bond market, general economic downturn, political uncertainty or acts of terrorism. In connection with the severe market dislocations of 2008 and early 2009, the value of our assets under management declined substantially due primarily to the significant decline in stock prices worldwide. In future periods of difficult market conditions we may experience accelerated client redemptions or withdrawals if clients move assets to investments they perceive as offering greater opportunity or lower risk, which could further reduce our assets under management in addition to market depreciation. The economic outlook remains uncertain and we continue to operate in a challenging business environment. If market conditions, or actions taken by clients in response to market conditions, cause a decline in our assets under management, it would result in lower investment management fees and other revenue. If our revenues decline without a commensurate reduction in our expenses, our net income will be reduced and our business will be negatively affected.

If market conditions improve greatly, driving the prices of the securities in our clients’ accounts higher, it may lead to withdrawals or redemptions. In many cases, we advise only a portion of our clients’ complete financial portfolio. This is because many clients prefer to diversify their portfolio among more than one asset manager or investment type. As to those clients, if the portion of their portfolio held by us increases significantly, it may become too large a percentage of their overall portfolio, and they may withdraw assets from our management and invest it elsewhere, thereby rebalancing their overall portfolio and returning their allocation to us to its prior level.

15

If our investment strategies perform poorly, clients could withdraw their assets and we could suffer a decline in our assets under management and/or become the subject of litigation, either of which would reduce our earnings.

The performance of our investment strategies is critical in retaining existing client assets as well as attracting new client assets. If our investment strategies perform poorly for any reason on an absolute basis or relative to other investment advisers, or the rankings of mutual funds we sub-advise decline, our earnings could decline because:

|

|

• |

our existing clients may withdraw funds from our investment strategies or terminate their relationships with us, or investors in the mutual funds we sub-advise may redeem their investments, which would cause a decline in the revenues that we generate from investment management and other fees; or |

|

|

• |

third-party financial intermediaries, advisers or consultants may rate our investment products poorly, which may lead our existing clients to withdraw funds from our investment strategies or reduce asset inflows from these third parties or their clients. |

Our investment strategies can perform poorly for a number of reasons, including general market conditions, investment decisions that we make and the performance of the companies in which we invest on behalf of our clients. In addition, while we seek to deliver long-term value to our clients, volatility may lead to under-performance in the near term, which could adversely affect our results of operations.

While clients do not generally have legal recourse against us solely on the basis of poor investment results, if our investment strategies perform poorly, we are more likely to become subject to litigation brought by dissatisfied clients. In addition, to the extent clients are successful in claiming that their losses resulted from fraud, gross negligence, willful misconduct, breach of contract or other similar misconduct, these clients may have remedies against us and/or our investment professionals under the federal securities laws and/or state law.

The historical returns of our existing investment strategies may not be indicative of their future results or of the future results of investment strategies we may develop in the future.

We have presented the historical returns of our existing investment strategies outlined under “Business” in this report. The historical returns of our strategies should not be considered indicative of the future results of these strategies or of the results of any other strategies that we may develop in the future. The investment performance we achieve for our clients varies over time and the variance can be wide. The historical performance presented herein is as of December 31, 2017 and for the period then ended. The performance we achieve as of a subsequent date and for a subsequent period may be higher or lower and the difference may be material. Our strategies’ returns have benefited during some periods from investment opportunities and positive economic and market conditions. In other periods, such as in 2008, the first quarter of 2009, the second quarter of 2010 and the third quarter of 2015, general economic and market conditions have negatively affected investment opportunities and our strategies’ returns. These negative conditions may occur again, and in the future, we may not be able to identify and invest in profitable investment opportunities within our current or future strategies.

We derive a substantial portion of our revenues from a limited number of our strategies.

As of December 31, 2017, $15.5 billion of our assets under management were concentrated in discretionary managed accounts, and the revenue from these discretionary managed accounts represents approximately 93% of our investment management fees for the twelve months ended December 31, 2017. In addition, $0.5 billion of our assets under management were invested in private partnerships as of December 31, 2017, and the revenue from these private partnerships represents approximately 7% of our investment management fees for the twelve months ended December 31, 2017. As a result, a substantial portion of our operating results depends upon the performance of a limited number of investment strategies used to manage those discretionary managed accounts and private partnerships, and our ability to retain client assets. If a significant portion of the investors in our larger strategies decided to withdraw their investments or terminate their investment management agreements for any reason, including poor investment performance or adverse market conditions, our revenues from those strategies would decline, which would have a material adverse effect on our results of operations and financial condition.

A significant portion of our assets under management are or may be derived from a small number of clients, the loss of which could significantly reduce our investment management fees and have a material adverse effect on our results of operations.

Certain of our strategies are or may derive a significant portion of their total assets under management from assets of a single client or a small number of clients. If any such clients withdraw all or a portion of their assets under management, our business would be significantly affected, which would negatively impact our investment management fees and could have a material adverse effect on our results of operations and financial condition.

16

We may not be able to maintain our current fee structure as a result of poor investment performance, competitive pressures or as a result of changes in our business mix, which could have a material adverse effect on our profit margins and results of operations.

We may not be able to maintain our current fee structure for any number of reasons, including as a result of poor investment performance, competitive pressures or changes in our business mix. In recent years, there has been a general trend toward lower fees in the investment management industry, and some of our investment strategies, because they tend to invest in larger-capitalization companies and were designed to have larger capacity and to appeal to larger clients, have lower fee schedules. In order to maintain our fee structure in a competitive environment, we must be able to continue to provide clients with investment returns and service that our clients believe justify our fees. We may not succeed in providing the investment returns and service that will allow us to maintain our current fee structure. If our investment strategies perform poorly, we may be forced to lower our fees in order to retain current, and attract additional, assets to manage. Furthermore, if a larger part of our assets under management are invested in our larger capacity, lower fee strategies, our revenue could be adversely affected.

We derive substantially all of our revenues from contracts and relationships that may be terminated upon no notice.

We derive our revenues principally from our assets under management, which may be reduced by our clients, or investors in the mutual funds we sub-advise, at any time. A client may reduce his assets under management with us by re-allocating all or any portion of the assets that we manage away from us at any time with little or no notice. In addition, investors in the mutual funds we advise can redeem their investments in those funds at any time without prior notice. A client may also reduce his assets under management with us through the termination of his investment advisory agreement with us. Our investment management agreements are terminable by our clients upon short notice or no notice. These investment management agreements and client relationships may be terminated or not renewed for any number of reasons. The decrease in revenues that could result from a reduction in assets under management or the termination of a material client relationship or group of client relationships could have a material adverse effect on our business.

The long-only, equity investment focus of the majority of our strategies exposes us to greater risk than certain of our competitors whose investment strategies may also include non-equity securities or hedged positions.

Our largest equity investment strategies hold long positions in publicly traded equity securities of companies across a wide range of market capitalizations, geographies and industries. Accordingly, under market conditions in which there is a general decline in the value of equity securities, each of our equity strategies is likely to perform poorly on an absolute basis. Aside from our privately managed funds and funds of funds, we do not have strategies that invest in privately held companies or take short positions in equity securities, which could offset some of the poor performance of our long-only, equity strategies under such market conditions. Even if our investment performance remains strong during such market conditions relative to other long-only, equity strategies, investors may choose to withdraw assets from our management or allocate a larger portion of their assets to non-long-only or non-equity strategies. In addition, the prices of equity securities may fluctuate more widely than the prices of other types of securities, making the level of our assets under management and related revenues more volatile.

The performance of our investment strategies or the growth of our assets under management may be constrained by the unavailability of appropriate investment opportunities.