0001548187--12-312019FYfalseP3YP5YP5YP4YP1YP1YP4Y0M0DP5Y0M0DP5YP5YP5YP4Y00015481872019-01-012019-12-31iso4217:USD00015481872019-06-30xbrli:shares00015481872020-02-2000015481872019-12-3100015481872018-12-31iso4217:USDxbrli:shares0001548187us-gaap:SeriesAPreferredStockMember2018-12-310001548187us-gaap:SeriesAPreferredStockMember2019-12-310001548187us-gaap:SeriesBPreferredStockMember2018-12-310001548187us-gaap:SeriesBPreferredStockMember2019-12-3100015481872018-01-012018-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2017-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2017-12-310001548187us-gaap:CommonStockMember2017-12-310001548187us-gaap:AdditionalPaidInCapitalMember2017-12-310001548187us-gaap:RetainedEarningsMember2017-12-3100015481872017-12-310001548187us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001548187soly:StockIssuanceExcludingPipeDealMemberus-gaap:CommonStockMember2018-01-012018-12-310001548187us-gaap:AdditionalPaidInCapitalMembersoly:StockIssuanceExcludingPipeDealMember2018-01-012018-12-310001548187soly:StockIssuanceExcludingPipeDealMember2018-01-012018-12-310001548187us-gaap:RetainedEarningsMember2018-01-012018-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2018-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2018-12-310001548187us-gaap:CommonStockMember2018-12-310001548187us-gaap:AdditionalPaidInCapitalMember2018-12-310001548187us-gaap:RetainedEarningsMember2018-12-310001548187us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2019-01-012019-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2019-01-012019-12-310001548187us-gaap:CommonStockMember2019-01-012019-12-310001548187soly:JunePrivateInvestmentInPublicEquityOfferingMemberus-gaap:CommonStockMember2019-01-012019-12-310001548187soly:JunePrivateInvestmentInPublicEquityOfferingMemberus-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001548187soly:JunePrivateInvestmentInPublicEquityOfferingMember2019-01-012019-12-310001548187soly:OctoberPrivateInvestmentInPublicEquityOfferingMemberus-gaap:CommonStockMember2019-01-012019-12-310001548187soly:OctoberPrivateInvestmentInPublicEquityOfferingMemberus-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001548187soly:OctoberPrivateInvestmentInPublicEquityOfferingMember2019-01-012019-12-310001548187soly:StockIssuanceExcludingPipeDealMemberus-gaap:CommonStockMember2019-01-012019-12-310001548187us-gaap:AdditionalPaidInCapitalMembersoly:StockIssuanceExcludingPipeDealMember2019-01-012019-12-310001548187soly:StockIssuanceExcludingPipeDealMember2019-01-012019-12-310001548187us-gaap:RetainedEarningsMember2019-01-012019-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2019-12-310001548187us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2019-12-310001548187us-gaap:CommonStockMember2019-12-310001548187us-gaap:AdditionalPaidInCapitalMember2019-12-310001548187us-gaap:RetainedEarningsMember2019-12-3100015481872019-02-192019-02-190001548187soly:PrivateInvestmentInPublicEquityOfferingMember2019-06-162019-06-160001548187soly:June19Member2018-01-012018-12-310001548187soly:PrivateInvestmentInPublicEquityOfferingMember2019-10-102019-10-100001548187soly:October19Member2018-01-012018-12-31soly:segment00015481872019-02-190001548187soly:ConversionOfPreferredStockIntoCommonStockMember2019-02-192019-02-19xbrli:pure0001548187soly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-1600015481872019-06-162019-06-160001548187soly:PrivateInvestmentInPublicEquityOfferingMember2019-06-160001548187soly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-190001548187soly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-10-100001548187soly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-10-102019-10-100001548187us-gaap:SubsequentEventMember2020-02-110001548187srt:MinimumMember2019-01-012019-12-310001548187srt:MaximumMember2019-01-012019-12-310001548187us-gaap:TrademarksMember2019-12-310001548187us-gaap:TrademarksMember2018-12-310001548187us-gaap:PatentsMember2018-01-012018-12-3100015481872019-02-280001548187us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001548187us-gaap:RestrictedStockMember2019-01-012019-12-310001548187us-gaap:ConvertibleDebtSecuritiesMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001548187soly:ConversionOfPreferredStockIntoCommonStockMember2018-01-012018-12-310001548187us-gaap:RestrictedStockMember2018-01-012018-12-310001548187us-gaap:ConvertibleDebtSecuritiesMember2018-01-012018-12-310001548187us-gaap:ComputerEquipmentMember2019-12-310001548187us-gaap:ComputerEquipmentMember2018-12-310001548187soly:ResearchAndDevelopmentEquipmentMember2019-12-310001548187soly:ResearchAndDevelopmentEquipmentMember2018-12-310001548187us-gaap:EquipmentMember2019-12-310001548187us-gaap:EquipmentMember2018-12-310001548187us-gaap:LeaseholdImprovementsMember2019-12-310001548187us-gaap:LeaseholdImprovementsMember2018-12-310001548187us-gaap:FurnitureAndFixturesMember2019-12-310001548187us-gaap:FurnitureAndFixturesMember2018-12-310001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMember2017-01-182017-01-180001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMember2017-01-182017-01-180001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMembersoly:ConversionOfConvertibleDebtToCommonStockMember2017-01-182017-01-180001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMember2017-01-180001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:FirstAmendmentMember2017-06-190001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:FirstAmendmentMember2017-06-192017-06-190001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMember2017-01-012017-12-310001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMember2019-01-012019-12-310001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:SecondNoteMembersoly:ConversionOfConvertibleDebtToCommonStockMember2017-11-012017-11-010001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-11-012017-11-010001548187us-gaap:ConvertibleDebtMembersoly:FirstNoteMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMember2017-11-012017-11-010001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-11-010001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-11-092017-11-090001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-12-012017-12-010001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-12-262017-12-260001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2018-01-082018-01-080001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2018-01-252018-01-250001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2018-02-132018-02-130001548187us-gaap:ConvertibleDebtMembersoly:SecondNoteMember2017-11-092018-02-130001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:SecondNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:SecondNoteMembersoly:ConversionOfConvertibleDebtToCommonStockMember2019-01-012019-12-310001548187us-gaap:ConvertibleDebtMembersoly:ThirdNoteMember2018-08-100001548187us-gaap:ConvertibleDebtMembersoly:ThirdNoteMember2018-08-102018-08-100001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:ThirdNoteMember2019-01-012019-12-310001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:ThirdNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMembersoly:ASingleRelatedPartyMembersoly:ThirdNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:ThirdNoteMember2019-01-012019-12-310001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:ThirdNoteMember2019-08-012019-09-300001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:ConversionOfConvertibleDebtToCommonStockMembersoly:ThirdNoteMember2019-12-312019-12-310001548187us-gaap:ConvertibleDebtMembersoly:FourthNoteMember2018-04-170001548187us-gaap:ConvertibleDebtMembersoly:FourthNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMemberus-gaap:InvestorMembersoly:FourthNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:FourthNoteMember2019-12-310001548187us-gaap:ConvertibleDebtMembersoly:NonRelatedPartyInvestorsMembersoly:FourthNoteMembersoly:ConversionOfConvertibleDebtToCommonStockMember2019-01-012019-12-310001548187soly:WarrantIssuedUnderFourthNoteMember2019-12-310001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-08-070001548187soly:WarrantIssuedWithFifthNoteMember2018-08-070001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-08-072018-08-070001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-08-312018-08-310001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-12-212018-12-210001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-12-210001548187soly:RelatedPartyMembersoly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-10-012018-10-310001548187soly:RelatedPartyMembersoly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2019-02-012019-02-280001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2019-02-152019-02-150001548187soly:WarrantsIssuedInConnectionWithFifthNoteMember2018-01-012018-12-310001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-12-310001548187soly:RelatedPartyMembersoly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-12-310001548187soly:NonRelatedPartyInvestorsMembersoly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2018-12-310001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2019-01-012019-12-310001548187soly:WarrantsIssuedInConnectionWithFifthNoteMember2019-01-012019-01-310001548187soly:WarrantsIssuedInConnectionWithFifthNoteMember2019-02-012019-02-280001548187soly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2019-12-310001548187soly:NonRelatedPartyInvestorsMembersoly:FifthNoteMembersoly:NonconvertiblePromissoryNotesMember2019-12-3100015481872019-06-012019-06-300001548187soly:MdAndersonMember2019-01-012019-12-310001548187soly:MdAndersonMember2018-01-012018-12-310001548187soly:OfficeSpaceLeaseArrangementMember2016-02-010001548187soly:OfficeSpaceLeaseArrangementMember2016-02-012016-02-010001548187soly:ConversionOfPreferredStockToCommonStockMember2019-02-192019-02-190001548187us-gaap:SeriesAPreferredStockMember2019-01-012019-12-310001548187us-gaap:SeriesBPreferredStockMember2019-01-012019-12-310001548187us-gaap:SeriesBPreferredStockMember2019-02-190001548187soly:ConversionOfAccruedDividendsIntoCommonStockMember2019-02-192019-02-190001548187soly:LongTermIncentivePlan2012Member2012-11-300001548187soly:LongTermIncentivePlan2012Member2019-12-310001548187soly:StockPlan2018Member2019-12-310001548187us-gaap:RestrictedStockMember2017-12-310001548187us-gaap:RestrictedStockMember2018-01-012018-12-310001548187us-gaap:RestrictedStockMember2018-12-310001548187us-gaap:RestrictedStockMember2019-01-012019-12-310001548187us-gaap:RestrictedStockMember2019-12-310001548187soly:ThreeConsultantsMemberus-gaap:RestrictedStockMember2019-05-082019-05-080001548187us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2019-05-082019-05-080001548187us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockMember2019-05-082019-05-080001548187us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-09-192019-09-190001548187us-gaap:RestrictedStockMember2019-05-092019-12-3100015481872017-01-012017-12-310001548187soly:EmployeesMember2018-01-012018-12-310001548187us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001548187us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2018-01-012018-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MinimumMember2018-01-012018-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MaximumMember2018-01-012018-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MinimumMember2018-12-3100015481872019-01-012019-01-310001548187soly:CertainIndividualsMember2019-01-012019-01-310001548187us-gaap:EmployeeStockOptionMember2019-01-012019-01-310001548187us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2019-01-012019-01-310001548187us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-01-012019-01-310001548187us-gaap:EmployeeStockOptionMembersrt:MinimumMember2019-01-310001548187soly:CertainIndividualsMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MinimumMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-01-012019-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MinimumMember2019-12-310001548187us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-12-310001548187us-gaap:EmployeeStockOptionMember2019-12-310001548187soly:WarrantIssuedUnderFourthAndFifthNoteMember2018-12-310001548187soly:FifthNoteMember2019-01-310001548187soly:FifthNoteMember2019-02-280001548187soly:WarrantsIssuedToUnderwritersMember2019-02-190001548187us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMember2019-02-190001548187us-gaap:MeasurementInputDiscountRateMembersrt:MaximumMember2019-02-190001548187us-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2019-02-190001548187us-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMember2019-02-190001548187us-gaap:MeasurementInputExpectedDividendPaymentMember2019-02-190001548187us-gaap:MeasurementInputSharePriceMember2019-02-190001548187us-gaap:ConvertibleDebtMembersoly:FifthNoteMember2019-02-190001548187us-gaap:MeasurementInputDiscountRateMembersoly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-160001548187us-gaap:MeasurementInputExpectedTermMembersoly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-160001548187us-gaap:MeasurementInputPriceVolatilityMembersoly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-160001548187us-gaap:MeasurementInputExpectedDividendPaymentMembersoly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-160001548187us-gaap:MeasurementInputSharePriceMembersoly:WarrantsIssuedInPrivateInvestmentInPublicEquityOfferingMember2019-06-1600015481872019-10-100001548187us-gaap:MeasurementInputDiscountRateMember2019-10-100001548187us-gaap:MeasurementInputPriceVolatilityMembersrt:MinimumMember2019-10-100001548187us-gaap:MeasurementInputSharePriceMember2019-10-100001548187us-gaap:SubsequentEventMembersoly:CertainIndividualsMember2020-02-042020-02-040001548187us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMember2020-02-042020-02-040001548187us-gaap:EmployeeStockOptionMemberus-gaap:SubsequentEventMember2020-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| | | | | |

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to ___________________

Commission File Number: 001-38815

SOLITON, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 3841 | | 36-4729076 |

| (State or Other Jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer Identification No.) |

| Incorporation or Organization) | | Classification Code Number) | | |

5304 Ashbrook Drive

Houston, Texas 77081

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code:

(844) 705-4866

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

Common Stock, par value $0.001 per share | SOLY | The Nasdaq Stock Market |

Securities Registered Pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ | | Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | | | | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $78,221,596 based on the closing sale price of the common stock as reported on the The Nasdaq Stock Market on June 30, 2019.

The number of shares of the registrant’s common stock outstanding as of February 20, 2020 was 16,932,184.

TABLE OF CONTENTS

References in this Form 10-K to “we”, “us”, ”its”, “our” or the “Company” are to Soliton, Inc. (“Soliton”), as appropriate to the context.

Cautionary Statement About Forward-Looking Statements

We make forward-looking statements under the “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other sections of this Form 10-K. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “should,” “would,” “could,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties described under “Risk Factors.”

While we believe we have identified material risks, these risks and uncertainties are not exhaustive. Other sections of this Form 10-K describe additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Form 10-K to conform our prior statements to actual results or revised expectations, and we do not intend to do so.

Forward-looking statements include, but are not limited to, statements about:

•our ability to obtain additional funding to commercialize our Rapid Acoustic Pulse (“RAP”) for tattoo removal, develop the RAP device for other indications and develop our dermatological technologies;

•the need to obtain regulatory approval, and the timing of such approval, for our Generation 1 RAP device, and the potential to obtain an additional approval when we modify the Generation 1 RAP device to become our Generation 2 device before our commercial launch and to become our Generation 3 device;

•the success of our future clinical trials;

•compliance with obligations under our intellectual property license with The University of Texas M.D. Anderson Cancer Center (“MD Anderson”);

•market acceptance of the RAP device;

•competition from existing products or new products that may emerge;

•potential product liability claims;

•our dependency on third-party manufacturers to supply or manufacture our products;

•our ability to establish or maintain collaborations, licensing or other arrangements;

•our ability and third parties’ abilities to protect intellectual property rights;

•our ability to adequately support future growth;

•our ability to attract and retain key personnel to manage our business effectively;

•risks associated with our identification of material weaknesses in our control over financial reporting;

•natural disasters affecting us, our primary manufacturer or our suppliers;

•our ability to establish relationships with health care professionals and organizations;

•general economic uncertainty that adversely effects spending on cosmetic procedures;

•volatility in the market price of our stock;

•potential dilution to current stockholders from the issuance of equity awards.

We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this Form 10-K in the case of forward-looking statements contained in this Form 10-K. Except for ongoing obligations to disclose material information under the federal securities laws, we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based.

You should not rely upon forward-looking statements as predictions of future events. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. Although we believe that the expectations reflected in the forward looking-statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Therefore, you should not rely on any of the forward-looking statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

PART I

Item 1. Business

Overview

We are a medical device company with a novel and proprietary platform technology licensed from The University of Texas MD Anderson Cancer Center ("MD Anderson"). Our Rapid Acoustic Pulse (“RAP”) device uses rapid pulses of designed acoustic shockwaves to disrupt cellular and subcellular structures in the dermis and subcutaneous tissue. The uniqueness of our designed shockwave allows us to target the changes in stiffness between cellular structures and generate a shearing effect that we believe represents a platform technology potentially useful in tattoo removal, cellulite reduction, fibrotic scar treatment and other indications. We believe the high repetition rate, rapid rise and fall of the wave, and significant peak pressure delivered in a non-focused manner make our shockwave significantly different from other available shockwave technologies. Importantly, our technology allows the disruption of targeted structures within the skin without significant pain and without treatment-related downtime.

We received clearance for our RAP device for tattoo removal from the U.S. Food and Drug Administration ("FDA") in May 2019 allowing our device to be used as an accessory to a 1064 nm Q-switched laser for tattoo removal on patients with skin tones on the Fitzpatrick scale between I and III. When used in conjunction with existing lasers for tattoo removal, our technology allows a doctor to treat a patient multiple times in a single office visit and significantly reduces the number of office visits required to remove a tattoo, allowing a dramatic acceleration of the tattoo removal process.

We plan to launch our RAP device for tattoo removal in mid-2020 into select dermatologist offices. We expect to generate revenue from both the initial sale of the device and from the recurring sales of disposable cartridges that are required by the device. We refer to this as our "razor and blade" recurring revenue model. Cartridges are designed to be specific to the intended indication (for example, tattoo cartridges will be different from potential future cellulite cartridges, if approved) and each treatment session would require one or more cartridges. We expect that one tattoo cartridge will facilitate up to five standard laser treatments in a single office visit for the average-sized tattoo (about five square centimeters). Therefore, a patient with an average-sized tattoo that requires three office visits will require the use of three cartridges.

We also have ongoing clinical programs in several indications, which, if successful, will allow us to expand commercialization of our products into additional markets. Importantly, we are undertaking ongoing clinical trials of our RAP device to support an application with the FDA for the treatment of cellulite. As a stand-alone device, we believe our RAP device has the potential to reduce the effects of fibrosis and stimulate beneficial fibroblast behavior. This capability enables the targeting of cellulite and fibrotic (keloid and hypertrophic) scars, as well as smoothing and tightening skin. We also intend to pursue regulatory approval in international markets and we are currently developing a regulatory strategy for these additional markets.

Our Technology

Our RAP device is composed of three parts: a console, a hand piece and a disposable cartridge. The console houses a pulse power system used to provide high voltage power to a pair of electrodes housed within the cartridge. The cartridge is snapped in and out of the hand piece for easy replacement and forms the basis for our planned “razor and blade” recurring revenue model. The proprietary nature of our technology is supported by eight patent families and over 100 patents issued or pending.

Our RAP device uses electrohydraulics to generate designed acoustic shockwaves at a rate of up to 100 per second to effectively target differences in stiffness at the cellular level. The first two indications we are targeting with our RAP technology are tattoo removal and cellulite reduction.

•In tattoo removal, our RAP device is used in conjunction with a laser and disperses both tattoo ink particles and the superficial and dermal vacuoles that are formed when a laser interacts with the ink particles during the use of the laser. Removing these vacuoles allows for subsequent laser treatments in the same treatment session, thereby rapidly accelerating the tattoo removal process.

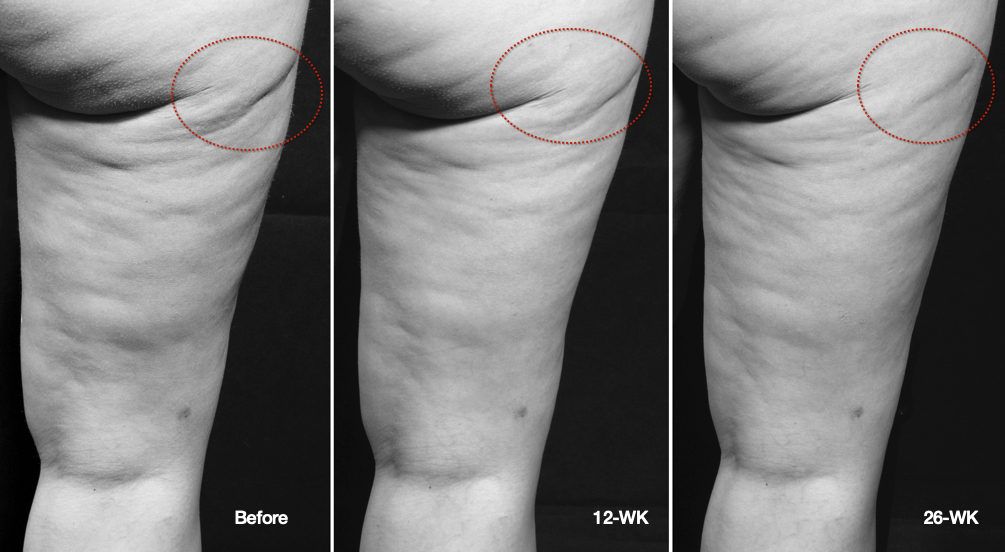

•In cellulite reduction, our RAP device is used as a stand-alone device that disrupts the stiff, sclerotic septa structures that run through the subcutaneous fat layer causing the dimples and ridges associated with cellulite. Importantly, it

does this without breaking the skin. We call this “acoustic subcision” and the disruption of these structures allows cellulite dimples and ridges to be released and the appearance of the cellulite to be improved. Until now, such disruption of sclerotic septa could only be achieved using surgical procedures that require penetrating the skin and involve significant pain and treatment-related downtime.

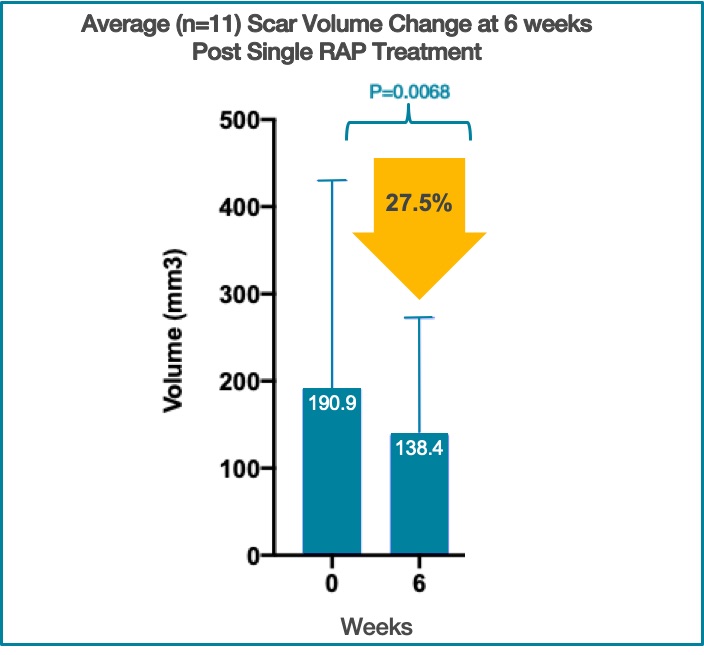

Our RAP device is also in clinical development for treating certain fibrotic conditions. We have completed a proof-of-concept study for the treatment of keloid and hypertophic scars and early data suggests that our technology can impact the overactive fibroblasts that generate these scars. This supports our belief that our technology can potentially have an impact on a much broader set of fibrotic conditions. Scientific publications suggest that fibroblasts become over-active when they are located in a stiffened environment and that disrupting the stiff environment may lead to fibroblast apoptosis, ultimately resulting in a resolution of the fibrosis. On this basis, we believe that our technology could have efficacy in a number of fibrotic diseases, including within the extracellular matrix, such as radiation induced fibrosis and capsular contracture, and in other systems of the body such as peripheral artery disease and even Liver Fibrosis. To date, other than the proof-of-concept study for the treatment of keloid and hypertophic scars, we have not begun any substantive pre-clinical work on these fibrotic diseases.

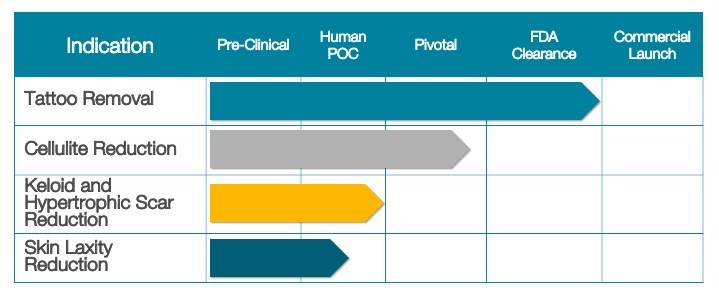

Our Clinical Pipeline

Set forth below is a table presenting the current status of our clinical pipeline:

Our Market Opportunity

Tattoo Removal

Approximately one-third of all adults in the United States have a tattoo. In 2015, we commissioned our own survey of individuals with one or more tattoos in an effort to better understand their interest in, motivations for and concerns about tattoo removal. This survey was designed to be representative of the US population with 95% confidence (+/- 3%) and indicated that 63% of individuals with tattoos were interested in some form of removal. At these rates, an estimated 44 million Americans are interested in tattoo removal. In fact, based upon third party market research, the global tattoo removal market is estimated to be approximately $4 billion by 2023.

The current standard of care for tattoo removal is to use a Q-switched (pulsed) laser to ablate the tattoo ink particles into pieces small enough for the body’s natural processes to remove them. Unfortunately, this current method is highly inefficient, requiring, on average, 10 or more office visits to achieve acceptable results. An independent clinical trial has demonstrated that using our RAP device in conjunction with a Q-switched laser has the potential to achieve removal of an average-sized tattoo in just 2 to 3 office visits. We believe this “Soliton” method can not only dramatically accelerate tattoo removal, but also has the potential to lower removal cost for patients, while increasing profitability to practitioners, and to reduce the potential for unwanted scarring and ghosting (a lingering silhouette image of the tattoo).

Cellulite Reduction

Between 80-90% of women suffer from cellulite. Based on third party market research, the global market for cellulite treatment was estimated to be approximately $2.4 billion in 2018 and is expected to grow to approximately $4 billion by 2025.

This is a significant addressable market, but we believe currently available treatment options are limited. A 2015 review of a variety of studies into the effectiveness of different non-surgical techniques for treating cellulite indicated that either the procedures did not work or the research methodology was flawed. Furthermore, most of these non-surgical techniques offer only a temporary reduction in the appearance of cellulite. The American Academy of Dermatology (AAD) reviewed a number of surgical techniques that may be successful in reducing the appearance of cellulite by cutting the bands of connective tissue under the skin's surface. However, these techniques are often painful and expensive. As a non-invasive technique, if a version of our device is capable of reducing the appearance of cellulite with results that approach those of the surgical techniques, we believe this could become an important new indication for our technology.

Keloid and Hypertrophic Scars

Keloids are a type of raised scar. They typically occur where the skin has healed after an injury. They can grow to be much larger than the original injury that caused the scar. A hypertrophic scar is a cutaneous condition characterized by deposits of excessive amounts of collagen which gives rise to a raised scar, but not to the degree observed with keloids. Like keloids, they form most often at the sites of pimples, body piercings, cuts and burns.

The American Osteopathic College of Dermatology estimates that keloids affect around 10% of people, whereas hypertrophic scars are more common. Keloid scars are more prevalent among populations with darker skin pigmentation. Hypertrophic scars affect men and women from any racial group equally, although people between 10 and 30 years old are more likely to be affected. Based on third party market research, the global market for hypertrophic and keloid scar treatment was estimated to be approximately $4.8 billion in 2017 and is expected to grow at a CAGR of 9.9% through 2025.

Planned Commercialization

We intend to begin selling our RAP device in the United States in mid-2020 for the removal of tattoos by marketing to a narrow group of key dermatologists. We are diligently working with our sole manufacturer, Sanmina Corporation, to complete the design and build of the device that will be used in our initial commercial market launch. We will be conservative in the building of our sales team during the initial stages of the launch and intend to grow this team as we achieve traction in the marketplace.

Should we have favorable results with our pivotal cellulite FDA trial and receive FDA clearance for the cellulite reduction indication, we intend to introduce this indication to the marketplace through the sale of new cartridges designed specifically for treating cellulite.

Why Soliton?

•Large addressable markets with significant growth potential.

•Platform technology that is non-invasive and that dermatologists will be able to use across multiple indications.

•“Razor and blade” revenue model with a true consumable.

•Targeted indications are cash pay.

•In clinical trials, treatment across indications has shown no significant or adverse events and has been well-tolerated by patients.

Our Growth Strategy

Our goal is to provide safe, effective, and science-based solutions to the marketplace that truly improve our patients’ lives. We believe the following strategies will enable us to achieve this goal and help us to succeed and grow.

•Focus on launching aesthetic indications that are treated in the dermatologist office and are cash-pay.

•Execute on our clinical plan to expand our indications and support the clinical proposition in further medical indications.

•Recognize the importance of building awareness of our product offerings in both the physician and patient communities and plan our marketing strategies and spending accordingly.

•Build our specialized sales force and practice development managers gradually as we grow to support the success of each device placed in service.

The Rapid Acoustic Pulse (RAP) Device

Description of Technology

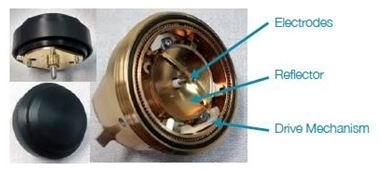

The RAP device uses electrohydraulics to generate the designed acoustic shockwaves at a rate of up to 100 per second to effectively disperse ink particles and superficial and dermal vacuoles. The RAP device for commercial launch is composed of three parts: a console, a hand piece and a disposable cartridge. The console houses a pulse power system used to provide high voltage power to a pair of electrodes housed within the cartridge. Additionally, the console contains a fluid management system that circulates saline through the cartridge. The cartridge is snapped in and out of the hand piece for easy replacement and forms the basis for our planned “razor and blade” recurring revenue model.

Figure 1

Our RAP device generates high-energy designed acoustic shockwaves when electricity is applied to the electrodes immersed in the circulating saline contained in the cartridge enclosure. An electrical arc with a very short duration of 100 to 200 nanoseconds is formed within the saline between the electrodes. When this arc is formed, a small amount of water is vaporized between the electrodes creating a nearly instantaneous expansion and collapse of a plasma bubble. This creates a shockwave that propagates outward through the saline, most of which is reflected off a curved surface surrounding the electrodes designed to form a shockwave front that passes through the cartridge’s acoustically transparent window. This window is placed against the patient’s skin above the tattoo to be removed allowing the acoustic energy to penetrate to a depth of 1 to 2 mm, which corresponds with the typical depth of tattoo pigment. These shockwaves are generated at a rate of up to 100 times per second.

The high repetition rate of Soliton shockwaves is a key component of our patent-pending technology. Specifically, a single shockwave from our RAP device is delivering .25 to 12 MPa (Megapascals) of acoustic pressure. Although this is a significant level of pressure, a single shockwave will pass through a typical skin cell with relatively little disruption. This is because the general elasticity of the cell is capable of deforming slightly to absorb that single impact and then returning to its original shape. The rate at which the cell returns to its normal shape is referred to as its “relaxation rate,” and this rate is well understood in the field of biomechanics. By increasing the repetition rate of Soliton shockwaves above approximately 25 times per second, we begin to exceed the relaxation rate of skin cells, which triggers their natural “viscoelastic” property and causes them to stiffen. In that stiffened state, the cells are quite vulnerable and shear waves created by the interaction of subsequent shockwaves with the tattoo ink particles in macrophages is now enough to rupture the cell membranes and disperse the particles.

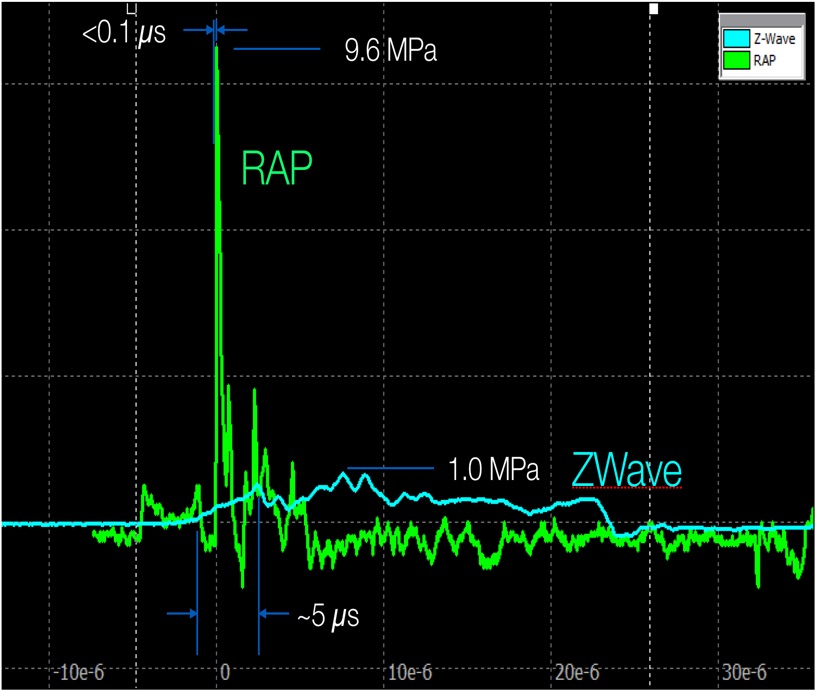

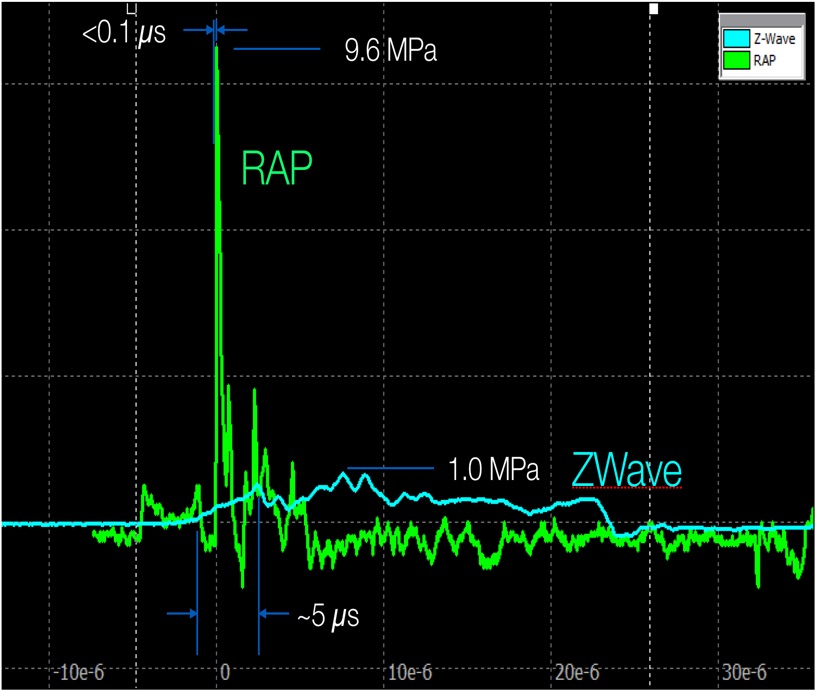

The graphic below (Figure 2) is a graphical representation of hydrophone measurements and compares the Soliton wave form with a competing shockwave technology that is cleared by the FDA as a massage device. Many dermatologists have this particular device in their practice and use it in conjunction with Coolsculpting to massage the treatment area post treatment. The difference in height of the two ways represents the difference in acoustic pressure or the strength of the pulse delivered.

Figure 2

The shockwaves generated by our RAP device are designed and proprietary, comprised of high acoustic energy delivered with a very short rise time (less than 5 nano seconds). Very high electrical energy (approximately 3000 volts at 3000 amps) is discharged in the treatment head with nanosecond precision to minimize unwanted acoustic frequencies (which helps minimize pain and collateral tissue damage and extend electrode life). A proprietary custom-shaped reflector designed through finite element computer simulation technology directs the bulk of the acoustic energy to the patient’s skin in uniform waves that are nearly planar (perpendicular) to the surface of the skin but slightly diverging in order to deliver maximum acoustic pressure to the depth of a typical tattoo, but then rapidly dissipate beyond that distance. The pressure mapping diagram in Figure 3 provides an example of how our reflector design controls energy density at varying treatment depths. The brighter yellow colors indicate maximum pressure at tattoo ink depth (top layer) and the darker red colors indicate lower pressures deeper in the skin (lower levels).

Figure 3

While our RAP device designed acoustic shockwaves are measured in the ultrasound spectrum, they should not be confused with typical therapeutic ultrasound that is focused and creates significant heat through cavitation (bubble formation) within the skin. In contrast Soliton designed acoustic shockwaves are deliberately unfocused and produce little to no heat within the skin. The specific frequency and rise time of Soliton shockwaves allow them to pass harmlessly through normal skin cells but when encountering a significant mass differential like that of tattoo ink particles, they create shear waves that break apart macrophage structures containing the particles and dissipate dermal vacuoles resulting from laser treatment.

Figure 4

Given the high level of energy involved with each electrical discharge and the high repetition rate (up to 100 times per second), the tungsten electrodes in the treatment head have a limited life, hence the need for a replaceable cartridge. The cartridge designed for tattoo removal (Figure 4) is capable of delivering as many as 120,000 shockwaves before replacement, which we believe is enough to treat an average sized tattoo throughout one office visit. This length of service life is only possible through the use of a proprietary drive mechanism for feeding electrode material into the electrical arc without changing the focal point established by the cartridge’s reflector.

In total, we have eight patent families pending relating to the technologies that makes our RAP device and certain variations possible, as well as various applications of our RAP device, with still more potential patent applications under way. As of December 31, 2019, our patent portfolio is comprised of 11 pending U.S. patent applications, 28 granted and 59 pending foreign counterpart patent applications, and three pending PCT patent applications, each of which we either own directly or we are the exclusive licensee.

Approved Indications

Tattoo Removal

The RAP device is initially being commercialized to be used in conjunction with the 1064 nm Q-switched laser to enable effective multiple pass laser treatments in a single office session to accelerate removal of tattoos on the arms, legs and torso in Fitzpatrick Skin Type I-III individuals. Our animal testing suggests that the RAP device is as effective on other tattoo ink colors using alternate wavelength lasers and analytical modeling supports the expectation that RAP should also work well with Pico-switched lasers. Use of the device on other colors and with a Pico-switched laser would be considered an off-label

use until further FDA clearance is achieved. The RAP device uses repeated, rapidly rising acoustic waves to both disrupt pigment laden cells and provide dermal clearing of both superficial and dermal vacuoles generated during the laser process. The clearing of these vacuoles allows for multiple laser treatments within one office visit and animal testing data suggests that remaining agglomerations of ink particles will be dispersed providing greater access for subsequent laser passes.

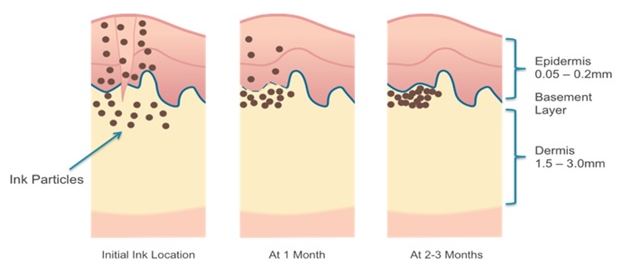

Understanding Tattoos

Tattooing involves the placement of pigment into the skin's dermis, the layer of dermal tissue underlying the epidermis. As illustrated in Figure 5, ink particles are typically injected by being placed on the tips of needles that puncture the skin with the ink particles being left behind as the needles are withdrawn. While the keratinaceous cycle will eventually remove pigment particles from the epidermis, with the dermis pigment particles are consumed by and remain trapped within macrophages, ultimately concentrating in a layer just below the dermis/epidermis boundary as the macrophage becomes pigment laden and immobile. Its presence there is stable, but in the long term (decades) the pigment tends to migrate deeper into the dermis, accounting for the degraded detail of old tattoos.

Figure 5

As macrophages collect individual ink particles, many are carried away by the circulatory and lymphatic systems and it has been estimated that more than half of the injected ink particles are carried away within the first several months after a tattoo is applied. However, many macrophages over consume ink particles to the point where they can no longer be absorbed into the circulatory and lymphatic systems. These “pigment laden macrophages” thereby form the relatively permanent tattoo that remains.

Current Standard of Care for Tattoo Removal

Tattoo removal has been performed with various tools during the history of tattooing. While tattoos were once considered permanent, it is now possible to remove them, fully or partially, with treatments. Non-laser tattoo removal methods include dermabrasion, TCA (Trichloroacetic acid, an acid that removes the top layers of skin, reaching as deep as the layer in which the tattoo ink resides), salabrasion (scrubbing the skin with salt), cryosurgery and excision that is sometimes still used along with skin grafts for larger tattoos. Tattoo removal by laser was performed with continuous-wave lasers initially, later with Q-switched (short-pulse) lasers, which became commercially available in the early 1990s, and more recently with Pico-switched lasers that deliver shorter pulse bursts of energy than Q-switched lasers. Today, "laser tattoo removal" usually refers to the non-invasive removal of tattoo pigments using (primarily or most commonly) Q-switched lasers with some increasing use of the Pico-switched lasers.

This “laser tattoo removal” is further described as using lasers to fragment pigment particles, as well as break-apart pigment laden macrophages resulting in the dispersion of the ink particles they contain. The fragmented ink particles are then absorbed by the body, repeating the same natural immune response by macrophages that accounted for the loss of 50% or more of the ink originally injected when the tattoo was applied.

All tattoo pigments have specific light absorption spectra. A tattoo removal laser must be capable of emitting adequate energy within the given absorption spectrum of the pigment to provide an effective treatment. To specifically target tattoos, laser wavelength and pulse duration must be chosen appropriately. Certain tattoo pigments, such as yellows, greens and fluorescent inks, are more challenging to treat with a Q-switched laser than darker blacks and blues because they have absorption spectra that fall outside or on the edge of the emission spectra available in the device.

There are several types of short-pulse lasers appropriate for tattoo removal, with one differentiating factor being the color spectrum for which it is optimized. Q-switched lasers can provide multiple wavelengths and are used to treat a much broader range of tattoo pigments than previous lasers. The more recently developed Pico-switched lasers claim to be more effective on those colors that present the greatest challenge for Q-switched lasers and are used either in conjunction with or replacement of Q-switched lasers. The amount of energy to be delivered is determined prior to each treatment, as well as the spot size and treatment speed. Light is optically scattered in the skin, like automobile headlights in fog. Larger spot sizes slightly increase the effective penetration depth of the laser light, thus enabling more effective targeting of deeper tattoo pigments, and can also help make treatments faster by covering a larger area with each pulse.

Laser tattoo removal can be described as ranging from uncomfortable to quite painful. The pain is often described to be similar to that of hot oil on the skin, or a "slap" from an elastic band. To mitigate pain one common method is to cool the area during treatment with a medical-grade chiller/cooler and to use a topical anesthetic. Pre-treatment options include the application of an anesthetic cream under occlusion for 45 to 90 minutes prior to the laser treatment session. In other cases, anesthesia is administered locally by injections of 1% to 2% lidocaine, sometimes including epinephrine. The addition of epinephrine to the injection must be done with careful consideration as the drug restricts blood flow, and reduced blood flow makes it more difficult for the body to remove the residual heat from the laser.

A common risk for patients treated with lasers for tattoo removal is the appearance of darkening of the normal skin pigmentation (hyperpigmentation). These changes may resolve in 6 to 12 months but may also be permanent. Hyperpigmentation is more commonly related to patients with darker skin tone. Another common risk is scarring as a result of collateral tissue damage caused by the residual heat caused by lasers. The potential for more extreme keloid scarring also increases with darker skin tone. The standard measure for skin tone is called the Fitzpatrick Scale, a scale from I to VI, with I being extremely fair and VI being extremely dark. Generally speaking, great care must be used when treating patients who are Fitzpatrick IV and above to avoid hyperpigmentation and keloid scarring, and as a result, clinicians generally use lower energy settings, which in turn means each treatment is likely to be less effective and more treatments are likely to be needed for satisfactory tattoo removal.

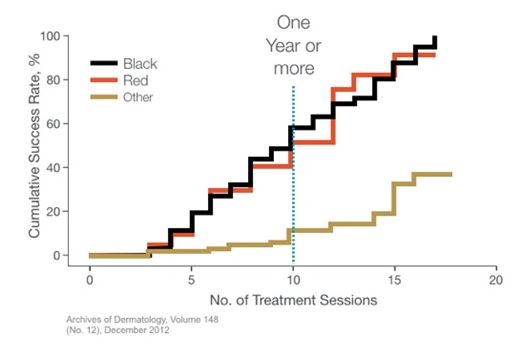

As illustrated in Figure 6, “complete” laser tattoo removal usually involves numerous treatment sessions typically spaced at least six to eight weeks apart. Treating more quickly than six weeks increases the risk of adverse effects and does not necessarily increase the rate of tattoo fading. At each session, some, but not all, of the tattoo pigment particles are fragmented, and the body removes the smallest fragments over the course of several weeks. The result is that the tattoo is lightened over time. Remaining large agglomerations of tattoo pigment are then targeted at subsequent treatment sessions, causing further lightening. The number of sessions and spacing between treatments depends on various parameters, including the area of the body treated and skin color. Tattoos located on the extremities, such as the ankle, require even more treatments. As tattoos fade, clinicians may recommend that patients wait many months between treatments to facilitate fragmented ink particle absorption and minimize unwanted side effects.

Figure 6

We believe the amount of time or the number of treatments required to “completely” remove a tattoo is a critical hurdle to tattoo owner adoption of the current laser tattoo removal procedure. The Wall Street Journal reported a research study conducted at a laser surgery center in Milan, Italy, from 1995 through 2010. There were 352 people in the study, of which 201 were men, with a median age of 30 years old. Overall, the study found about 47% of people had their tattoos successfully removed after 10 laser treatments and it took 15 treatments to remove tattoos from 75% of patients. Black and red pigments in tattoos were most easily removed. The researchers also found that the amount of time between Q-switched laser treatment sessions was important to the technique's success. Treatment intervals of eight weeks or less were found to be less effective for

tattoo removal. Patient frustration and dissatisfaction with removal success and with the time to achieve success results in a significant number of patients discontinuing treatments, or “dropping out.”

A more recent study of 237 patients treated with Q-switched lasers showed very similar results, which are plotted below. As can be seen on the graph in Figure 7, only about half of the patients with black or red tattoos achieved complete removal after 10 treatments, which if spaced only six weeks apart will still require over a year’s worth of time-consuming and uncomfortable office visits.

Many studies accepted by the FDA deem 75% or greater removal to be a "successful removal," while others simply do not define what a successful removal is, using the word “complete” without clarification. Many successful removals do not remove all traces of the original tattoo, but instead reduce the visible tattoo to the point where it is difficult to see with the naked eye. Generally speaking, we consider a removal procedure to be complete when 75% or more of the visible ink is gone and the patient and the physician are satisfied that whatever residual ink particles remain are likely to be absorbed by the body through natural immune, healing, and skin remodeling processes.

Figure 7

How the RAP Device Makes Laser Tattoo Removal More Effective

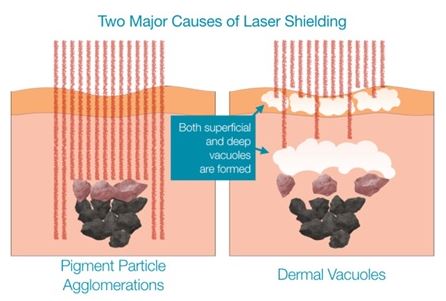

Our marketing research has shown that, for most patients interested in tattoo removal, the poor efficacy of the standard of care presents too much of a barrier for them to move forward with tattoo removal. Our laboratory research into the problem of tattoo removal has led us to the conclusion that laser shielding is a major cause of this poor efficacy. This laser shielding can be broken down into two subtypes: Particle Shielding and Vacuole Shielding, as depicted below in Figure 8.

Figure 8

Particle Shielding

Lasers are essentially “line of sight” dependent, meaning the laser light pulses can only ablate particles that are directly in their path. Because tattoo ink particles tend to aggregate into clusters within the skin, the particles at the top of the clusters (closest to the surface of the skin) effectively shield the rest of the particles from the laser energy (particle shielding). This leads to two conclusions: each laser pass only affects a small percentage of ink particles, explaining why multiple passes are important, and, if we can spread these particles out, each subsequent laser pass has an opportunity to hit more targets.

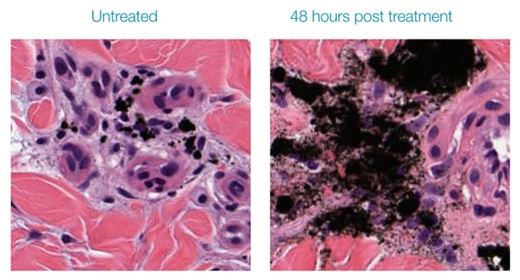

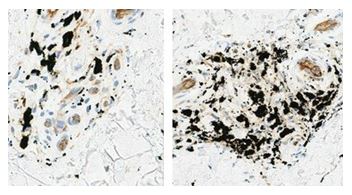

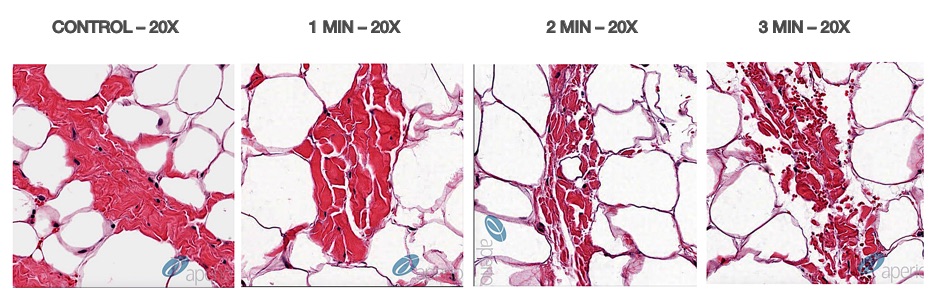

Much of our research utilized tattooed pig skin, because pig skin is considered the most like human skin when it comes to dermatology treatments. Biopsies from pigs with mature tattoos allow us to see the effect the RAP device has on pigment particle agglomerations. A microscopic histological comparison in Figure 9 shows an untreated tattoo on the left with intact tightly formed (macrophage) agglomerations of tattoo ink and a similar tattoo on the right treated with the RAP device. The result of the RAP device treatment is a noticeable destruction of the macrophages and dispersal of the pigment particles. We have effectively created more targets for the laser to hit.

Figure 9

Vacuole Shielding

A second, and more limiting problem arises the moment that the laser light contacts ink particles within its path. Almost instantly, a plasma event occurs that quickly results in the formation of steam vacuoles. These vacuoles appear white in color and result in “optical scattering” that immediately blocks any additional laser energy from reaching ink particles below the vacuoles. Until those vacuoles are gone, subsequent laser passes will have very little effect. In the picture shown below in Figure 10, you can see the emergence of a white frost or crust that forms immediately with each pulse of the laser.

Figure 10

Several efforts have been made to address these vacuole formations in an attempt to facilitate multiple laser passes in a single office visit, but they have failed to gain traction for lack of sufficient improvement in results or due to their relative impracticality in practice.

A relatively new treatment protocol has been studied, referred to as the “R20 method.” The “R” stands for Repeating, while the “20” represents 20 minutes. The R20 Method suggests administering a single pass of the laser every 20 minutes, with up to 4 passes, providing effectively 4 removal treatments during one office visit. The 20-minute pause between passes of the laser allows the epidermal or surface vacuoles to dissipate, presumably increasing the ability of the laser to reach more pigment with each subsequent pass.

The R20 method has not been heavily adopted by the medical community as the “wait” time between treatments presents two hurdles: the recommended 20-minute wait between treatments in practice grows to an hour or more between treatments as the physician moves to treat other patients during the “wait,” and keeping the patient properly anesthetized for the entire treatment session becomes a challenge. While the level of improved results has not justified this cumbersome routine, data varies as to the number of R20 treatment sessions required to successfully remove a tattoo; most seem to center on 6-8 laser passes, or 2 treatment sessions (likely separated by at least eight weeks).

A company called OnLight (recently acquired by Merz Pharma) introduced a transparent patch infused with a clear chemical called Perfluorodecalin (PFD), which they claimed was capable of reducing the formation of surface vacuoles, thereby enabling multiple laser passes in succession. And, while a study has shown that the PFD patch appears to enable 3 to 4 laser passes in a single office visit (without long interruptions between treatments), any improvement in tattoo fading only occurred in about 2 out of 3 of patients and, in most of those patients, the degree of improvement was only marginal.

Data from our research presented at the American Society for Laser Medicine & Surgery in April 2017 offers an explanation. A histology image (Figure 7) of a biopsy taken 2 hours after laser treatment reveal that, while the surface vacuoles have dissipated, deeper “dermal vacuoles” persist and continue to shield the remaining particles from subsequent laser passes. And, our studies have shown that these deep dermal vacuoles persist for up to 48 hours. The histology image in Figure 11 shows the presence of these vacuoles 2 hours after laser treatment, well beyond what the R20 method could hope to avoid, and importantly, below the reach of Perfluorodecalin in the PFD patch, which cannot penetrate below the epidermis and into the dermis where these vacuoles occur.

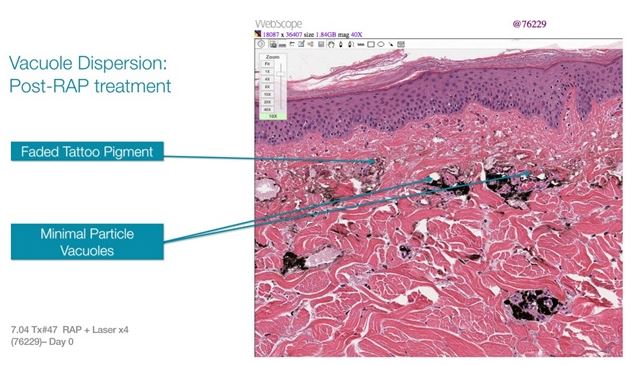

Figure 11

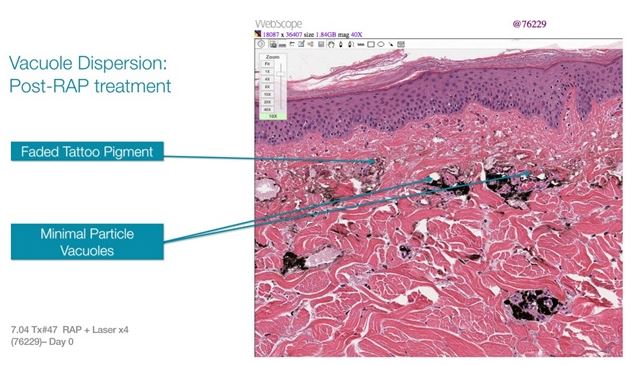

However, if you apply the RAP device immediately following a laser treatment (Figure 12), histology reveals that these deep dermal vacuoles are dispersed, allowing lasers to again have line of sight access to pigment particles.

Figure 12

With traditional laser treatment tattoo removal, efficacy is limited by particle shielding resulting from the natural clustering or agglomeration of pigment particles and the formation of laser-induced dermal vacuoles, both of which block access of laser energy to the particles being targeted (see Particle Shielding and Vacuole Shielding above). Importantly, the dermal vacuoles inhibit any additional passes of the laser from effectively reaching the remaining tattoo pigment agglomerations due to optical scattering. The shape, frequency and repetition rate of the RAP device’s acoustic shockwave pulses are designed to increase dispersion of ink particles and to diffuse and disperse both superficial and dermal vacuoles, while minimizing damage to adjacent non-pigmented tissue as well as pain perceived by the patient. With RAP dermal clearing, loss of laser efficacy due to optical scattering is thereby minimized. In addition, we believe more ink is exposed to each successive laser pass due to increased particle dispersion. As a result, effective, fast, multi-pass laser treatment of tattoo sites in a single office session may be realized.

Market for RAP Tattoo Removal

Over the past two decades or so, the tattoo has become an attractive, artistic expression among many people. The popularity of tattoos continues to rise as they become more accepted in popular culture. Approximately one-third of all adults in the United States have a tattoo. People 18-29 years old have the most tattoos, according to a 2010 study by the Pew Research Center with 38% of that age group having at least one. Nearly half of this group with tattoos have between two and five tattoos, while 18% have six or more. Among other generations, the following indicates the percentages by age with at least one tattoo:

•30-45 year-olds: 32%;

•46-64 year-olds: 15%; and

•> 65 years old: 6%

Currently Americans spend $3.4 billion per year on tattoos, and as social acceptance of body art steadily increases spending on tattoos will likely continue to grow. With the tremendous growth in the number of people getting tattoos, there is a corresponding increase in demand for tattoo removal. Estimates of the size of the tattoo removal market vary widely. One independent source estimates that, globally, the market for tattoo removal is expected to grow at the rate of about 15.6% from 2017 to 2023 and that the global market for tattoo removal is expected to reach several billion in revenue by 2023. Our own research and analysis suggests that regardless of its potential, the current tattoo removal market is significantly underdeveloped.

Tattoo removal is a process of removing a permanent tattoo from the skin. The removal process is undertaken by using laser, surgery, creams, and various other processes. The use of laser techniques for tattoo removal is the predominant tattoo removal process with 66% of the market. Different type of lasers such as Q-switched ruby laser, Q-Switched Nd:YAG laser, and Q-Switched Alexandrite laser are used to remove black as well as colored tattoos. The other options available for tattoo removal include surgical excision, tattoo removal creams, dermabrasion, plastic surgery, and others. Creams are less painful than laser and surgical procedures to remove tattoos, but the use is time consuming and inefficient.

Laser tattoo removal is an elective, private pay procedure performed on an outpatient basis. The procedure is primarily performed at laser centers and dermatology clinics with laser centers performing 60.9% of the procedures in 2016. Because the cost of tattoo removal is many times the cost of tattoo application, the procedure only attracts those who can pay. Laser tattoo removal practitioners charge a premium for their time. Each treatment is generally priced from $100 to $500, and most patients require 10 or more treatments, depending on the size and complexity of the tattoo, to achieve comprehensive removal. Because tattoo removal is a painful, time-consuming and expensive process, patients need to be very motivated for removal. Here are some of the most common reasons people seek tattoo removal:

•Tattoo includes the name of a former spouse or significant other;

•Limited clothing options to hide tattoo;

•Do not want their children to see it;

•Curtails job prospects;

•Poor quality tattoo;

•Tattoo has faded; and

•The importance of getting the tattoo has lessened.

We commissioned our own survey of individuals with one or more tattoos in an effort to better understand their interest in, motivations for and concerns about tattoo removal. This survey was designed to be representative of the US population with 95% confidence (+/- 3%) and indicated that 63% of individuals with tattoos were interested in some form of removal. Importantly, a majority of these individuals didn’t regret having tattoos, they simply wanted to make a change. From this observation we conclude that the total available market in the US alone could be calculated as 63% of the estimated 70 million US adults with one or more tattoos (29% of the 2016 US population), or 44 million potential customers.

In this survey we also asked what barriers prevented these individuals from taking action to have a tattoo removed. The primary reasons were cost, pain and efficacy (time required for removal). With this in mind, we believe the dramatic reduction in the number of office visits required for tattoo removal using the Soliton method may be sufficient to motivate many individuals who have been considering tattoo removal to finally take action, which we, in turn believe may result in a material acceleration of the current rate of growth for tattoo removal.

Clinical Trial Results

Our RAP device has received institutional review board (IRB) approval as a non-significant risk device. Subsequent to receiving this status, we have conducted several human clinical trials to study the use of the RAP device to accelerate tattoo fading.

Human Correlation Trial - 1 (HCT-1)

An initial human clinical trial was conducted to demonstrate the dispersion of tattoo pigment. In the first part of the HCT-1 study, three patients with black tattoos in various locations (lower back, lower leg and shoulder) were selected. Two tattoo sites on each patient were treated with a single pass of the RAP device. One site was treated and then immediately biopsied and the other was treated with a biopsy taken 24 hours post treatment. All biopsies in all patients demonstrated pigment dispersion from macrophages. As seen in Figure 13, the images present the tattoo site untreated (left image) and 24 hours post-treatment with the RAP device (right image). Note the significant dispersion of the tattoo ink pigment at 24 hours post treatment in the right image.

Figure 13

In the second part of the HCT-1 study, six patients were selected for a single treatment session to demonstrate tattoo fading. For each patient, a single black tattoo was selected and divided into three adjacent areas. Two of the areas were treated (i.e. test areas) and the third area remained untreated as a control for comparison to the test areas. One test area was treated with a single laser treatment (Laser Only). The other test area was treated with multiple laser passes, with each laser pass followed by a treatment with the RAP device (Laser+RAP). After each laser pass, the laser was adjusted to increase the laser fluence.

Dermal vacuolization was immediately identified in all tattoos treated with a laser. Minimal dermal clearing was detected 5 minutes post treatment in the Laser Only treatment areas. Significant dermal clearing was immediately identified in the Laser+RAP treatment areas. The Laser+RAP treated test area, demonstrated accelerated tattoo fading at 24 hours post treatment when compared to the non-treated tattoo test site and to tattoos treated with Laser Only.

The trial also offered important conclusions to the treatment therapy. The importance of preventing thermal damage to the tattoo site resulting from multiple laser passes is critical and includes avoiding the use of epinephrine, maintaining the hydrogel dressing throughout the procedure, and titrating the increase of laser fluence and spot size with each laser pass (titrating these increases can be done by listening for a treatment ‘snap’ during the laser treatment process or by watching for new vacuole formation).

Human Correlation Trial- 2 (HCT-2)

To further demonstrate accelerated tattoo fading in a single office session when the RAP device is used as an accessory to the 1064 nm Q-switched laser, the multi-pass method was again tested in humans in a pivotal clinical trial (HCT-2). The RAP device was evaluated in a single-center (Skin Care Physicians, Chestnut Hill, MA), prospective study.

A total of 32 black tattoos, from 22 participants, were divided into three zones. Two zones in each tattoo, separated by a control zone, were treated with either multiple laser passes, each separated by RAP device applications (“Laser + RAP”) or a single-pass laser treatment (“Laser Only”). The treatment sites were assessed for the number of laser passes and adverse events immediately following the treatment as well as at six weeks and 12 weeks following the treatment session. The treatment sites were also assessed for the degree of fading at 12 weeks post treatment using blinded review.

The HCT-2 study confirmed the feasibility of using the RAP device to enable safe, multi-pass laser treatments in a single session. The observed mean number of laser passes in the Laser + RAP treated participants was 4.16. Studies of the PFD Patch demonstrated an ability to achieve a mean of 3.7 passes with use of the patch. The average number of deliverable passes in a single treatment session of the RAP device, as an alternative accessory device instead of the PFD Patch, was determined to be at least comparable to the average number of deliverable passes in a single treatment session of the PFD Patch. Based on these results, the primary objective of this study was considered met.

The secondary objective was to assess the degree of tattoo fading from a single treatment session for both the Laser + RAP treatment and the Laser Only treatment. Assessment by blinded reviewers at 12 weeks indicated that there was accelerated fading for Laser + RAP in comparison to Laser Only. Specifically, 72% of the tattoos treated with the Laser + RAP had a good, excellent or complete response (>25% fading) compared to 40% of the tattoos treated with Laser Only. Furthermore, 41% of the tattoos treated with the Laser + RAP had an excellent or complete response (≥50% fading) compared to 12% of the tattoos treated with Laser Only. Finally, 19% of the tattoos treated with the Laser + RAP had a complete response (>75% fading) compared to 3% of the tattoos treated with Laser Only.

As an additional comparison, assessment of tattoo fading at 12 weeks was performed by the treating physicians (non-blinded reviewers). The non-blinded reviewers scored 81% of the tattoos treated with the Laser + RAP as having a good, excellent, or complete response (>25% fading) compared to 16% of the tattoos treated with Laser Only. On average, the tattoos treated with the Laser + RAP had 49% fading in a single treatment session, as compared with only 16% for the tattoos treated with Laser Only. The difference between the blinded and non-blinded reviewers in terms of fading scores is believed to be a result of the non-blinded reviewers’ direct examination the tattoos at 12 weeks compared to the blinded reviewers’ use of photographs only. However, the differences were not statistically significant using chi-square analysis.

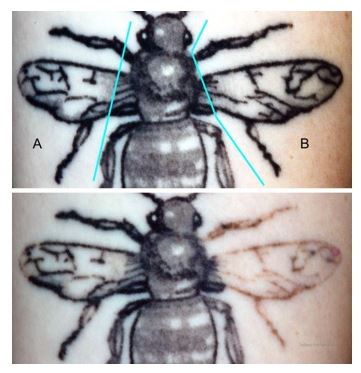

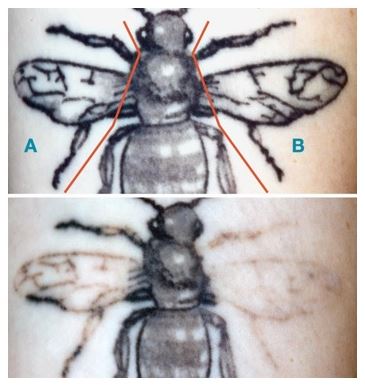

A representative cross-polarized images of one participant’s tattoo, before treatment and 12 weeks after treatment, are shown in Figure 14. In these images, the tattoo zone marked with ‘A’ was treated with Laser Only and the tattoo zone marked with ‘B’ was treated with Laser+RAP. As can be seen with these images, after 12 weeks, the tattoo zone treated with Laser+RAP demonstrated a significant degree of fading in comparison with the tattoo zone treated with Laser Only.

The conclusion of the HCT-2 study was that the RAP device, as an accessory to the 1064 nm Q-switched laser, safely enables multiple laser treatments in a single office visit. More importantly, the RAP device enables accelerated tattoo fading in a single treatment session.

Figure 14

Human Correlation Trial - 3 (HCT-3)

HCT-3 built upon HCT-2 by bringing back 10 HCT-2 subjects (12 tattoos) for up to an additional two separate treatment sessions. The first session performed as part of the HCT-2 multi-pass laser treatment study was followed by a second session 20 weeks after the first session. The third and final session (where needed) was performed 28 weeks after the first session (eight weeks after the second session). As described for the HCT-2 study above, each test site was treated with either Laser + RAP or Laser Only. The test sites were assessed for degree of fading at 40 weeks following the first session (12 weeks following the third session).

The Laser + RAP in HCT-3 again outperformed Laser Only, with subjects showing an average of 80% fading after only two visits vs. 44% for Laser Only. After 3 “Soliton” treatments, 100% of the treated tattoos had a ‘Complete’ (76-100% faded) response; in comparison, only 16% of the tattoos treated with the Laser Only had a ‘Complete’ response.

The same representative image from Figure 14 is shown in Figure 15 before treatment and a new image taken after three treatment sessions is shown below it. Hence, the top photo in Figure 15 is taken before any treatments began and the bottom photo is taken at week 40--12 weeks post the third treatment. In the top photo, the section marked with an "A" was treated with Laser Only and the section marked with "B" was treated with Laser + RAP. As can be seen with these images, after 40 weeks, the tattoo zone treated with Laser + RAP demonstrated a significant degree of fading in comparison with the tattoo zone treated with Laser Only.

The conclusion from HCT-3 was that RAP, used as an accessory to the 1064 nm Q-Switched laser, enabled accelerated tattoo fading in just three office visits.

Figure 15

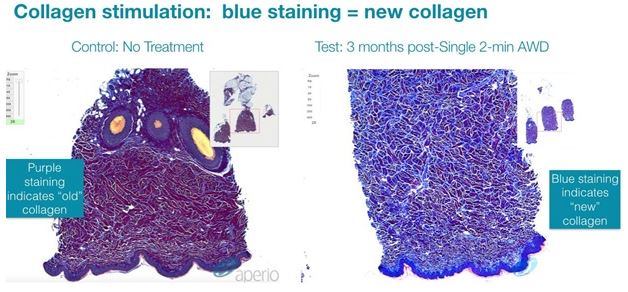

Research and Development

While we are initially targeting the tattoo removal market, higher-energy versions of our technology also show promise in a number of other indications. We have conducted animal studies and some limited human trials in some of these other indications as discussed below. The results observed in our proof-of-concept cellulite and keloid studies underlie our belief that our technology may impact a much broader set of fibrotic conditions. Scientific publications suggest that fibroblasts become over-active when they are located in a stiffened environment and that disrupting the stiff environment may lead to fibroblast apoptosis, ultimately resulting in a resolution of the fibrosis. On this basis, we believe that our technology could have efficacy in a number of fibrotic diseases both in the extracellular matrix, such as radiation induced fibrosis, and in other systems of the body such as peripheral artery disease and even non-alcoholic SteatoHepatitis ("NASH").

Clinical Stage Indications

Reduction of Cellulite

Cellulite is a condition that primarily affects women, usually occurring in the buttock and thigh area, where the skin has a dimpled or lumpy appearance. Between 80 and 90 percent of women will probably experience cellulite sometime in their lives. There is a very large global market for cellulite treatment. In the U.S. alone, women spend roughly one billion dollars a year on cellulite therapy, with approximately 85% of U.S. women reporting concerns about cellulite. Based on third party market research, the global market for cellulite treatment was estimated to be approximately $2.4 billion in 2018 and is expected to grow to approximately $4 billion by 2025. There are numerous treatments available, but the effect is mostly temporary. A 2015 review of a variety of studies into the effectiveness of different techniques indicated that either the procedures did not work, or the research methodology was flawed. The American Academy of Dermatology (AAD) reviewed a number of surgical techniques that may be successful in reducing the appearance of cellulite by breaking up the bands of connective tissue under the skin's surface. As a non-invasive technique, if a version of our device is capable of reducing the appearance of cellulite with results that approach those of the surgical techniques, we believe this could become an important new indication for our technology.

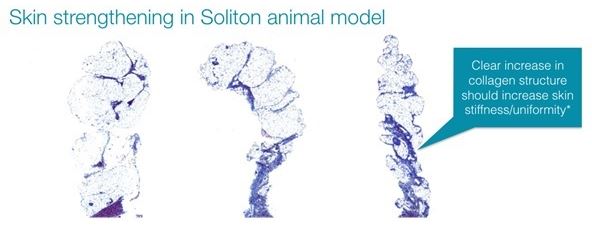

Cellulite is characterized by relief alterations (lumpiness) of the skin surface, which give the skin an orange peel, cottage cheese, or mattress-like appearance. Some factors leading to the appearance of cellulite are believed to include sclerotic septa connecting the dermis to the fascia below the subcutaneous fat layer and inadequate collagen in the dermis leading to a weak dermal extracellular matrix (ECM). Excess subcutaneous fat can then protrude into pockets formed between the sclerotic septa within the weakened ECM resulting in a mottled or lumpy appearance to the skin. This same weakening of the ECM can also be associated with skin laxity whereby the skin appears loose, wrinkled and creped.