UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

OR

For the transition period from _______________ to _______________

Commission file number:

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

(Address of Principal Executive Offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |

| Non-accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 6, 2023, the issuer had

VANECK MERK GOLD TRUST

TABLE OF CONTENTS

i

VANECK MERK GOLD TRUST

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or Quarterly Report, includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Quarterly Report that address activities, events or developments that may occur in the future, including such matters as changes in commodity prices and market conditions (for gold and the shares), the operations of VanEck Merk Gold Trust, or Trust, the plans of Merk Investments LLC, the sponsor of the Trust, or Sponsor, and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the Sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions is subject to a number of risks and uncertainties, including the special considerations referenced in this Quarterly Report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this Quarterly Report are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the shares. Moreover, neither the Sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor undertakes an obligation to publicly update or conform to actual results any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

ii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

VanEck Merk Gold Trust

Statements of Assets and Liabilities

| April 30, 2023 | January 31, 2023 | |||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Investments in gold bullion (cost $ | $ | $ | ||||||

| Capital shares receivable | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities | ||||||||

| Gold Bullion purchased payable | ||||||||

| Sponsor’s fee payable | ||||||||

| Other payables | ||||||||

| Total liabilities | ||||||||

| Net assets | $ | $ | ||||||

| Net assets consists of: | ||||||||

| Paid-in-capital | $ | $ | ||||||

| Accumulated earnings | ||||||||

| $ | $ | |||||||

| Shares issued and outstanding (no par value) | ||||||||

| Net asset value per share | $ | $ | ||||||

See notes to unaudited financial statements.

1

VanEck Merk Gold Trust

Statements of Operations

| For the Three Months Ended April 30, 2023 | For the Three Months Ended April 30, 2022 | |||||||

| (unaudited) | (unaudited) | |||||||

| Expenses | ||||||||

| Sponsor’s fees | $ | $ | ||||||

| Total expenses | ||||||||

| Net investment loss | ( | ) | ( | ) | ||||

| Net realized and unrealized gain (loss) | ||||||||

| Net realized gain from gold bullion distributed for redemptions | ||||||||

| Net change in unrealized appreciation (depreciation) on investment in gold bullion | ||||||||

| Net realized and unrealized gain (loss) from operations | ||||||||

| Net increase (decrease) in net assets resulting from operations | $ | $ | ||||||

See notes to unaudited financial statements.

2

VanEck Merk Gold Trust

Statements of Changes in Net Assets

| For the Three Months Ended April 30, 2023 | For the Three Months Ended April 30, 2022 | |||||||

| (unaudited) | (unaudited) | |||||||

| Net assets, beginning of period | $ | $ | ||||||

| Creations | ||||||||

| Redemptions | ( | ) | ( | ) | ||||

| Net investment loss | ( | ) | ( | ) | ||||

| Net realized gain from gold bullion distributed for redemptions | ||||||||

| Net change in unrealized appreciation (depreciation) on investment in gold bullion | ||||||||

| Net assets, end of period | $ | $ | ||||||

See notes to unaudited financial statements.

3

VanEck Merk Gold Trust

Financial Highlights

Per Share Performance (for a share outstanding throughout each period)

| For the Three Months Ended April 30, 2023 | For the Three Months Ended April 30, 2022 | |||||||

| (unaudited) | (unaudited) | |||||||

| Net asset value per share, beginning of period | $ | $ | ||||||

| Net investment loss(a) | ( | ) | ( | ) | ||||

| Net realized and unrealized gain (loss) on investment in gold bullion | ||||||||

| Net change in net assets from operations | ||||||||

| Net asset value per share, end of period | $ | $ | ||||||

| Total return, at net asset value(b) | % | % | ||||||

| Ratio to average net assets(c) | ||||||||

| Net investment loss | ( | )% | ( | )% | ||||

| Net expenses | % | % | ||||||

| (a) | |

| (b) | |

| (c) |

See notes to unaudited financial statements.

4

VanEck Merk Gold Trust

Schedules of Investment

April 30, 2023 (unaudited)

| Fine Ounces | Cost | Value | % of Net Assets | |||||||||||||

| Gold bullion | $ | $ | % | |||||||||||||

| Total investments | $ | $ | % | |||||||||||||

| Liabilities in excess of other assets | ( | ) | ( | )%(a) | ||||||||||||

| Net assets | $ | % | ||||||||||||||

January 31, 2023

| Fine Ounces | Cost | Value | % of Net Assets | |||||||||||||

| Gold bullion | $ | $ | % | |||||||||||||

| Total investments | $ | $ | % | |||||||||||||

| Liabilities in excess of other assets | ( | ) | ( | )%(a) | ||||||||||||

| Net assets | $ | % | ||||||||||||||

| (a) |

See notes to unaudited financial statements.

5

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

1. ORGANIZATION

The VanEck Merk Gold Trust (the “Trust”; known as the Merk Gold Trust prior to October 26, 2015 and then as the Van Eck Merk Gold Trust prior to April 28, 2016) is an investment trust formed on May 6, 2014 under New York law pursuant to a depositary trust agreement. After consideration of Financial Accounting Standards Topic 946, Merk Investments LLC (the “Sponsor”) has concluded the Trust meets the fundamental characteristics of an investment company. In addition, while the Trust does not currently possess all of the typical characteristics of an investment company, it believes its activities are consistent with those of an investment company and will therefore apply the guidance in Financial Accounting Standards Topic 946, including disclosure of the financial support contractually required to be provided by an investment company to any of its investees. The Sponsor is responsible for, among other things, overseeing the performance of The Bank of New York Mellon (the “Trustee”) and the Trust’s principal service providers, including the preparation of financial statements. The Trustee is responsible for the day-to-day administration of the Trust.

Virtu Financial, also known as the Lead Market

Maker, was the Initial Purchaser and contributed

The Trust’s primary objective is to provide investors with an opportunity to invest in gold through the shares and be able to take delivery of physical gold bullion and gold coins (physical gold) in exchange for their shares (the “Shares”). The Trust’s secondary objective is for the shares to reflect the performance of the price of gold less the expenses of the Trust’s operations. The Trust is not actively managed.

The fiscal year end of the Trust is January 31st.

2. SIGNIFICANT ACCOUNTING POLICIES

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”), management makes estimates and assumptions that affect the reported amounts of assets, liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as the reported amount of revenue and expenses reported during the period. Actual results could differ from these estimates.

The accompanying audited and unaudited financial statements were prepared in accordance with GAAP and with the instructions for the Form 10-Q and the rules and regulations of the United States Securities and Exchange Commission. In the opinion of the Trust’s management, all adjustments (which consists of normal recurring adjustments) necessary to present fairly the financial position and the results of operations, as presented, have been made.

The following is a summary of significant accounting policies followed by the Trust.

2.1. Valuation of Gold

Financial Accounting Standards Board Accounting Standards Codification 820, “Fair Value Measurements and Disclosures” (“ASC 820”), provides a single definition of fair value, a hierarchy for measuring fair value and expanded disclosures about fair value adjustments.

Various inputs are used in determining the fair value of the Trust’s assets or liabilities. These inputs are categorized into three broad levels. Level 1 includes unadjusted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market based inputs (including prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include management’s own assumptions in determining the fair value of investments. The Trust does not hold any derivative instruments, and its assets only consist of allocated gold bullion and gold receivable; representing gold covered by contractually binding orders for the creation of shares where the gold has not yet been transferred to the Trust’s account and, from time to time, cash, which is used to pay expenses.

6

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

(continued)

The following table summarizes the inputs used as of April 30, 2023 in determining the Trust’s investments at fair value for purposes of ASC 820:

| Level 1 | Level 2 | Level 3 | ||||||||||

| Investment in gold | $ | $ | $ | |||||||||

| Total | $ | $ | $ | |||||||||

The following table summarizes the inputs used as of January 31, 2023 in determining the Trust’s investments at fair value for purposes of ASC 820:

| Level 1 | Level 2 | Level 3 | ||||||||||

| Investment in gold | $ | $ | $ | |||||||||

| Total | $ | $ | $ | |||||||||

London Gold Delivery Bars are held by JPMorgan Chase Bank, N.A. (the “Custodian”), on behalf of the Trust, at the London, United Kingdom vaulting premises. All gold is valued based on its Fine Ounce content, calculated by multiplying the weight of gold by its purity; the same methodology is applied independent of the type of gold held by the Trust; similarly, the value of up to 430 Fine Ounces of unallocated gold the Trust may hold is calculated by multiplying the number of Fine Ounces with the price of gold determined by the Trustee as follows. The Trustee determines the net asset value (the “NAV”) of the Trust on each day that NYSE Arca is open for regular trading, as promptly as practical after 4:00 PM New York time. The NAV of the Trust is the aggregate value of the Trust’s assets less its estimated accrued but unpaid liabilities (which include accrued expenses). The Trustee computes the NAV per Share by dividing the net assets of the Trust by the number of the shares outstanding on the date the computation is made.

In determining the Trust’s NAV, the Trustee values the gold held by the Trust based on the afternoon session of the twice daily fix of the price of a Fine Ounce of gold which starts at 3:00 PM London, England time and is performed in London by the ICE Benchmark Administration as an independent third-party administrator (the “LBMA PM Gold Price”). The Trustee also determines the NAV per Share. If on a day when the Trust’s NAV is being calculated the LBMA PM Gold Price for that day is not available, the Trustee will value the gold held by the Trust based on that day’s morning session of the twice daily fix of the price of a Fine Ounce of gold, which starts at 10:30 AM London, England time and is performed in London by the ICE Benchmark Administration as an independent third-party administrator (the “LBMA AM Gold Price,” and together with the LBMA PM Gold Price, the “LBMA Gold Price”). If no fix is available for the day, the Trustee will value the Trust’s gold based on the most recently announced LBMA AM Gold Price or LBMA PM Gold Price. Prior to March 20, 2015, the Trustee utilized the daily fix of the price of a Fine Ounce of gold as performed by the five members of the London gold fix, which has now been replaced by the ICE Benchmark Administration as an independent third-party administrator.

2.2. Expenses

The Trustee issues shares to pay the Sponsor’s fee; the Sponsor pays the Trust’s ordinary expenses. The NAV of the Trust is used to compute the Sponsor’s fee, and the Trustee subtracts from the NAV of the Trust the amount of accrued Sponsor’s fee. To the extent the Trust issues additional shares to pay the Sponsor’s fee or sells gold to cover expenses or liabilities, the amount of gold represented by each share will decrease. New deposits of gold, received in exchange for new shares issued by the Trust, would not reverse this trend.

2.3. Creations and Redemptions of Shares

Shares are issued and redeemed by the Trust in blocks of

7

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

(continued)

Authorized Participants

The Trust issues and redeems Baskets only to Authorized Participants. The creation and redemption of Baskets will only be made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of gold represented by the Baskets being created or redeemed, the amount of which will be based on the combined Fine Ounces represented by the number of shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received.

Orders to create and redeem Baskets may be placed

only by Authorized Participants. An Authorized Participant must: (1) be a registered broker-dealer or other securities market participant,

such as a bank or other financial institution, which, but for an exclusion from registration, would be required to register as a broker-dealer

to engage in securities transactions, (2) be a participant in DTC, and (3) must have an agreement with the Custodian establishing an unallocated

account in London or have an existing unallocated account meeting the standards described herein. To become an Authorized Participant,

a person must enter into an Authorized Participant Agreement with the Sponsor and the Trustee. The Authorized Participant Agreement provides

the procedures for the creation and redemption of Baskets and for the delivery of the gold required for such creations and redemptions.

The Authorized Participant Agreement and the related procedures attached thereto may be amended by the Trustee and the Sponsor, without

the consent of any investor or Authorized Participant. A transaction fee of $

Authorized Participants who make deposits with the Trust in exchange for Baskets will receive no fees, commissions or other form of compensation or inducement of any kind from either the Sponsor or the Trust, and no such person has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of shares.

Delivery Applicants

In exchange for its shares and payment of a processing fee, a Delivery Applicant will be entitled to one or more bars or coins of physical gold having approximately the total Fine Ounces represented by the shares on the day on which the Delivery Applicant’s broker-dealer submits his or her shares to the Trust in exchange for physical gold. As it is unlikely that the total Fine Ounces of physical gold will exactly correspond to the Fine Ounces represented by a specific number of shares, a Delivery Applicant will likely receive some cash representing the net sale proceeds of any excess Fine Ounces (the “Cash Proceeds”). To minimize the Cash Proceeds of any exchange, the delivery application requires that the number of shares submitted closely correspond in Fine Ounces to the Fine Ounces of physical gold that is held or that is to be acquired by the Trust for which the delivery is sought. Share submissions are processed in the order approved.

Changes in the shares for the three-month period ended April 30, 2023 are as follows:

| Shares | Amount | |||||||

| Shares, beginning of period at February 1, 2023 | $ | |||||||

| Shares issued | ||||||||

| Shares redeemed | ( | ) | ( | ) | ||||

| Shares, end of period at April 30, 2023 | $ | |||||||

Changes in the shares for the year ended January 31, 2023 are as follows:

| Shares | Amount | |||||||

| Shares, beginning of period at February 1, 2022 | $ | |||||||

| Shares issued | ||||||||

| Shares redeemed | ( | ) | ( | ) | ||||

| Shares, end of period at January 31, 2023 | $ | |||||||

8

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

(continued)

2.4. Income Taxes

The Trust is treated as a “grantor trust” for U.S. federal tax purposes. As a result, the Trust itself is not subject to U.S. federal income tax. Instead, the Trust’s income and expenses “flow through” to the shareholders and the Trustee reports the Trust’s income, gains, losses and deductions to the Internal Revenue Service on that basis.

The Sponsor has evaluated whether or not there are uncertain tax positions that require financial statement recognition and has determined that no reserves for uncertain tax positions are required as of April 30, 2023.

2.5. Revenue Recognition Policy

A gain or loss is recognized based on the difference between the selling price and the average cost method of the gold sold on a trade date basis.

3. INVESTMENT IN GOLD

The following represents the changes in Ounces of gold and the respective fair value at April 30, 2023:

| Ounces | Fair Value | |||||||

| Beginning balance as of February 1, 2023 | $ | |||||||

| Gold bullion contributed | ||||||||

| Gold bullion distributed | ( | ) | ( | ) | ||||

| Realized gain (loss) from gold distributed from in-kind | ||||||||

| Change in unrealized appreciation (depreciation) | ||||||||

| Ending balance as of April 30, 2023 | $ | |||||||

The following represents the changes in Ounces of gold and the respective fair value at January 31, 2023:

| Ounces | Fair Value | |||||||

| Beginning balance as of February 1, 2022 | $ | |||||||

| Gold bullion contributed | ||||||||

| Gold bullion distributed | ( | ) | ( | ) | ||||

| Realized gain (loss) from gold distributed from in-kind | ||||||||

| Change in unrealized appreciation (depreciation) | ||||||||

| Ending balance as of January 31, 2023 | $ | |||||||

4. RELATED PARTIES—SPONSOR, TRUSTEE, CUSTODIAN AND MARKETING FEES

Fees paid are to the Sponsor as compensation for services performed

under the Trust Agreement.

The Sponsor has agreed to assume the following administrative and marketing

expenses incurred by the Trust: the Trustee’s monthly fee and out-of-pocket expenses; the Custodian’s fee; the marketing support

fees and expenses (including the fees and expenses of Foreside Fund Services, LLC); expenses reimbursable under the Custody Agreement;

the precious metals dealer’s fees and expenses reimbursable under its agreement with the Sponsor; exchange listing fees; Securities

and Exchange Commission (the “SEC”) registration fees; printing and mailing costs; maintenance expenses for the Trust’s

website; audit fees; and up to $

9

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

(continued)

Affiliates of the Trustee, as well as affiliates of the Custodian may from time to time act as Authorized Participants to purchase or sell gold or shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

On October 22, 2015, the Sponsor, for the benefit of the Trust, entered into a Marketing Agent Agreement (as amended to date, the “Marketing Agreement”) with Van Eck Securities Corporation (“VanEck” or “Marketing Agent”). Pursuant to the Marketing Agreement, VanEck provides assistance in the marketing of the shares. The obligations created by the Marketing Agreement are obligations of the Sponsor of the Trust and any fees payable under the Marketing Agreement to VanEck are payable from the Sponsor’s fee (as calculated and defined in the Trust Agreement). The Trust will not incur additional financial or other performance obligations pursuant to the Marketing Agreement.

5. CONCENTRATION OF RISK

The Trust’s sole business activity is the investment in gold bullion. Several factors could affect the price of gold: (i) global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries; (ii) investors’ expectations with respect to the rate of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the shares to decline proportionately. Each of these events could have a material adverse effect on the Trust’s financial position and results of operations.

6. UNCERTAINTY REGARDING THE EFFECT OF COVID-19

The price of the Shares could be adversely affected by the effects of COVID-19

COVID-19 has not had a significant impact on the Trust. There have been some signs of increased demand for physical gold as well as some supply constraints for certain coins at times during the pandemic. As a result, precious metals dealers have increased coin and bar premiums at times. The Sponsor regularly updates available coins and Processing Fees on merkgold.com/fees.

7. INDEMNIFICATION

Under the Trust’s organizational documents, each of the Trustee (and its directors, employees and agents) and the Sponsor (and its members, managers, directors, officers, employees, affiliates) is indemnified against any liability, cost or expense it incurs without gross negligence, bad faith or willful misconduct on its part and without reckless disregard on its part of its obligations and duties under the Trust’s organizational documents. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on industry experience, management believes the risk of loss is remote.

8. SUBSEQUENT EVENTS

The pricing index the Sponsor uses in relation to the Shares issued by the Trust intends to change to the Solactive Gold Spot Index (the “Solactive Index”) in lieu of the LBMA Gold Price. The change is expected to become effective July 11, 2023 or as soon as practicable thereafter (“Index Change Date”).

Following the Index Change Date, the Trustee will value the gold held by the Trust based on the Solactive Index. Solactive AG (“Solactive”) will own, calculate, and disseminate the Solactive Index. The Solactive Index is a U.S. Dollar denominated index that aims to provide a price fixing for the gold spot price quoted as U.S. Dollars per Troy Ounce (“XAU”) and determined for the close of trading on the New York Stock Exchange (“NYSE”). The Solactive Index calculates gold bullion fixing prices by taking Time Weighted Average Prices (“TWAP”) of XAU trading prices provided via ICE Data Services (“IDS”) data feed.

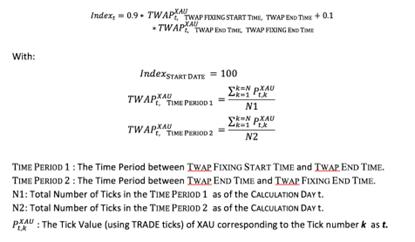

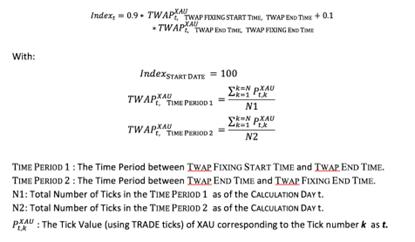

Specifically, the Solactive Index uses a TWAP

calculation to determine an average price that is time-weighted, using price values of actual transactions (“Trade Ticks”)

for two specified time periods around the scheduled close of trading on the NYSE (generally, 4:00 PM Eastern Time). The TWAP is derived

for (1) the period ahead of the fixing (“Time Period 1”), which consists of the five minutes before the close of trading,

and (2) the period directly after the fixing (“Time Period 2”), which consists of the six seconds after the close of trading.

The TWAPs for Time Period 1 and Time Period 2 are then aggregated, with

10

VanEck Merk Gold Trust

Notes to Unaudited Financial Statements

(continued)

For any calculation day t, the Solactive Index (Indext), is determined in accordance with the following formula:

The Solactive Index is calculated and published by Solactive no later than 30 minutes following the close of trading on the NYSE, disseminated to major financial data providers, and made publicly available via the Trust’s website.

The Solactive Index calculation is based on XAU market data from IDS, which is a major provider of financial market data. The data is available through IDS’s data streaming service, which covers 2,700 spot rates and over 7,500 forwards and non-deliverable forwards, with an average of over 130 million updates per day for spot. IDS compiles data from over 100 sources, including market makers, execution venues, banks and brokers from across the globe, and every updating Trade Tick of spot streaming data is available via IDS’s Integrated Data Viewer service in a file-based format.

It is unlikely that, on any given trading day for the Shares, there would be no Trade Ticks recorded for XAU in either Time Period 1 or Time Period 2, such that the Solactive Index calculation could not be performed on such day. Trade Ticks representing XAU are the closing prices for specific gold bullion transactions posted in a 24-hour, global, over-the-counter gold bullion market, which is not subject to trading suspensions, trading halts, or market closures. However, in the unlikely event that IDS is unable to publish pricing information for XAU, for whatever reason, during either Time Period 1 or Time Period 2 on a given trading day, the last available Solactive Index calculation will be used in accordance with Solactive’s published and publicly available disruption policy.

If the Sponsor determines that such price is inappropriate to use, it shall identify an alternate basis for evaluation to be employed by the Trustee. The Sponsor may instruct the Trustee to use a different publicly available price which the Sponsor determines to fairly represent the commercial value of the Trust’s gold.

The Sponsor has given 60 day notice of the Index Change Date by formally notifying the Trustee and issuing a press release and filing a Current Report on Form 8-K.

Management has evaluated the events and transactions that have occurred through the date the financial statements were issued and, except as set forth above, noted no items requiring adjustment of the financial statements or additional disclosures.

* * *

This report is submitted for the general information of the shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Trust’s risks, objectives, fees and expenses and other information.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This information should be read in conjunction with the unaudited financial statements and notes to the unaudited financial statements included in Item 1 of Part 1 of this Form 10-Q. The discussion and analysis that follows may contain forward-looking statements with respect to the VanEck Merk Gold Trust’s financial conditions, operations, future performance and business. These statements can be identified by the use of the words “may,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or similar words and phrases. These statements are based upon certain assumptions and analyses Merk Investments LLC, the Sponsor, has made based on its perception of historical trends, current conditions and expected future developments. Neither the Trust nor the Sponsor is under a duty to update any of the forward looking statements, to conform such statements to actual results or to reflect a change in management’s expectations or predictions.

Introduction

The VanEck Merk Gold Trust (the “Trust”), formerly known as the Merk Gold Trust prior to October 26, 2015 and then as the Van Eck Merk Gold Trust prior to April 28, 2016, is an investment trust formed on May 6, 2014 under New York law pursuant to a depositary trust agreement (as amended, the “Trust Agreement”). The Trust is not managed like a corporation or an active investment vehicle. It does not have any officers, directors, or employees and is administered by The Bank of New York Mellon (the “Trustee”) pursuant to the Trust Agreement. The Trust is not registered as an investment company under the Investment Company Act of 1940, as amended, and is not required to register under such act. It will not hold or trade in commodity futures contracts, nor is it a commodity pool, or subject to regulation as a commodity pool operator or a commodity trading adviser in connection with issuing shares.

The Trust’s primary objective is to provide investors with an opportunity to invest in gold through the shares and be able to take delivery of physical gold bullion and gold coins (“physical gold”) in exchange for those shares. The Trust’s secondary objective is for the shares to reflect the performance of the price of gold less the expenses of the Trust’s operations. Each share represents a fractional undivided beneficial interest in the Trust’s net assets. The Trust’s assets consist principally of gold held on the Trust’s behalf in financial institutions for safekeeping. Physical gold that the Trust will hold includes London Bars and, for the limited purposes described herein, other gold bars and coins, without numismatic value, having a minimum fineness (or purity) of 995 parts per 1,000 (99.5%) or, for American Gold Eagle gold coins, with a minimum fineness of 91.67%.

Shares are issued by the Trust only in blocks of 50,000 shares called “Baskets” in exchange for gold from certain registered broker-dealers or other securities market participants (“Authorized Participants”). See “Creation and Redemption of Shares—Authorized Participants” in the notes to our financial statements for requirements to qualify as an Authorized Participant. Baskets may be redeemed by the Trust in exchange for the amount of gold corresponding to their redemption value. The Trust issues and redeems Baskets on an ongoing basis at net asset value to Authorized Participants who have entered into a contract with the Sponsor and the Trustee.

Shares of the Trust trade on the New York Stock Exchange (the “NYSE”) Arca under the symbol “OUNZ”.

Valuation of Gold and Computation of Net Asset Value

On each business day that the NYSE Arca is open for regular trading, as promptly as practicable after 4:00 PM (New York time) the Trustee will value the gold held by the Trust and will determine the net asset value (“NAV”) of the Trust, as described below.

The NAV of the Trust is the aggregate value of gold and other assets, if any, of the Trust (other than any amounts credited to the Trust’s reserve account, if any) and cash, if any, less liabilities of the Trust, which include estimated accrued but unpaid fees, expenses and other liabilities.

All gold is valued based on its Fine Ounce content, calculated by multiplying the weight of gold by its purity; the same methodology is applied independent of the type of gold held by the Trust; similarly, the value of up to 430 Fine Ounces of unallocated gold the Trust may hold is calculated by multiplying the number of Fine Ounces with the price of gold determined by the Trustee as follows. The Trustee values the gold held by the Trust based on the afternoon session of the twice daily fix of the price of a Fine Ounce of gold which starts at 3:00 PM London, England time and is performed in London by the ICE Benchmark Administration as an independent third-party administrator (the “LBMA PM Gold Price”). The Trustee also determines the NAV per Share. If on a day when the Trust’s NAV is being calculated the LBMA PM Gold Price for that day is not available, the Trustee will value the gold held by the Trust based on that day’s morning session of the twice daily fix of the price of a Fine Ounce of gold, which starts at 10:30 AM London, England time and is performed in London by the ICE Benchmark Administration as an independent third-party administrator (the “LBMA AM Gold Price,” and together with the LBMA PM Gold Price, the “LBMA Gold Price”). If no fix is available for the day, the Trustee will value the Trust’s gold based on the most recently announced LBMA AM Gold Price or LBMA PM Gold Price.

12

Prospective Change in Pricing Index

The Sponsor intends to change the pricing index it uses in relation to the Shares issued by the Trust to reference the Solactive Gold Spot Index (the “Solactive Index”) in lieu of the LBMA Gold Price. The change is expected to become effective July 11, 2023 or as soon as practicable thereafter (“Index Change Date”).

Following the Index Change Date, in determining the Trust’s NAV, the Trustee will value the gold held by the Trust based on the Solactive Index. Solactive AG (“Solactive”) will own, calculate, and disseminate the Solactive Index. The Solactive Index is a U.S. Dollar denominated index that aims to provide a price fixing for the gold spot price quoted as U.S. Dollars per Troy Ounce (“XAU”) and determined for the close of trading on the New York Stock Exchange (“NYSE”). The Solactive Index calculates gold bullion fixing prices by taking Time Weighted Average Prices (“TWAP”) of XAU trading prices provided via ICE Data Services (“IDS”) data feed.

Specifically, the Solactive Index uses a TWAP calculation to determine an average price that is time-weighted, using tick values of actual transactions (“Trade Ticks”) for two specified time periods around the scheduled close of trading on the NYSE (generally, 4:00 PM Eastern Time). The TWAP is derived for (1) the period ahead of the fixing (“Time Period 1”), which consists of the five minutes before the close of trading, and (2) the period directly after the fixing (“Time Period 2”), which consists of the six seconds after the close of trading. The TWAPs for Time Period 1 and Time Period 2 are then aggregated, with 90% weighting given to Time Period 1 and 10% weighting given to Time Period 2, to calculate the Solactive Index.

For any calculation day t, the Solactive Index (Indext), is determined in accordance with the following formula:

The Solactive Index is calculated and published by Solactive no later than 30 minutes following the close of trading on the NYSE, disseminated to major financial data providers, and made publicly available via the Trust’s website.

The Solactive Index calculation is based on XAU market data from IDS, which is a major provider of financial market data. The data is available through IDS’s data streaming service, which covers 2,700 spot rates and over 7,500 forwards and non-deliverable forwards, with an average of over 130 million updates per day for spot. IDS compiles data from over 100 sources, including market makers, execution venues, banks and brokers from across the globe, and every updating Trade Tick of spot streaming data is available via IDS’s Integrated Data Viewer service in a file-based format.

It is unlikely that, on any given trading day for the Shares, there would be no Trade Ticks recorded for XAU in either Time Period 1 or Time Period 2, such that the Solactive Index calculation could not be performed on such day. Trade Ticks representing XAU are the closing prices for specific gold bullion transactions posted in a 24-hour, global, over-the-counter gold bullion market, which is not subject to trading suspensions, trading halts, or market closures. However, in the unlikely event that IDS is unable to publish pricing information for XAU, for whatever reason, during either Time Period 1 or Time Period 2 on a given trading day, the last available Solactive Index calculation will be used in accordance with Solactive’s published and publicly available disruption policy.

If the Sponsor determines that such price is inappropriate to use, it shall identify an alternate basis for evaluation to be employed by the Trustee. The Sponsor may instruct the Trustee to use a different publicly available price which the Sponsor determines to fairly represent the commercial value of the Trust’s gold.

13

The Sponsor has given 60 day notice of the Index Change Date by issuing a press release and filing an 8-K.

Material Events

On October 22, 2015, the Sponsor and the Trustee entered into a First Amendment To Depositary Trust Agreement (the “First Trust Amendment”), amending the Trust Agreement, dated as of May 6, 2014, to effectuate a change in the name of the Trust from “Merk Gold Trust” to “Van Eck Merk Gold Trust,” effective as of October 26, 2015. As a result of the name change, all references to “Merk Gold Trust” in the Trust Agreement were amended to read “Van Eck Merk Gold Trust,” and the shares offered by the Trust were known as the “Van Eck Merk Gold Shares” (“Shares”).

On October 22, 2015, the Sponsor, for the benefit of the Trust, entered into a Marketing Agent Agreement (as amended to date, the “Marketing Agreement”) with Van Eck Securities Corporation (“VanEck” or “Marketing Agent”). Pursuant to the Marketing Agreement, VanEck now provides assistance in the marketing of the Shares. The obligations created by the Marketing Agreement are obligations of the Sponsor of the Trust and any fees payable under the Marketing Agreement to VanEck are payable from the Sponsor’s fee (as calculated and defined in the Trust Agreement). The Trust will not incur additional financial or other performance obligations pursuant to the Marketing Agreement.

The Sponsor entered into the First Trust Amendment and effectuated the name change of the Trust in satisfaction of a term of the Marketing Agreement. The Marketing Agreement further grants VanEck the right to elect to replace Merk as the sponsor of the Trust under specific qualifying circumstances, subject to the execution and consummation of definitive agreements addressing all regulatory requirements applicable to such transaction and satisfaction of such requirements, and announcement and related reporting at such time. Specifically, VanEck has a right of first refusal for the purchase of the sponsorship of the Trust, and all rights attributable thereto, upon the earlier of a commitment for a change of control of Merk or 15 years from the date of the Marketing Agreement. Additionally, VanEck may elect to replace Merk as the sponsor of the Trust upon the earlier of the average daily net assets of the Trust during a calendar quarter not attributable to Shares held by Merk or its affiliates (“Third Party Assets”) equaling $500 million, or VanEck’s compensation under the fee provisions of the Marketing Agreement reaching in aggregate 10% of the gross proceeds from sale of the Shares (the “Maximum Fee”).

Merk further agreed that if the Third Party Assets equal or exceed $500 million, for such period as Merk remains sponsor of the Trust, VanEck may propose the rate of the Sponsor’s fee to Merk, which Merk shall not unreasonably reject and shall timely adopt if reasonable, provided, VanEck acknowledges that only the formal named sponsor of the Trust shall have the right to set the Sponsor’s fee at any time.

On April 28, 2016, the Sponsor and the Trustee entered into a Second Amendment to Depositary Trust Agreement (the “Second Trust Amendment”), amending the Trust Agreement to effectuate a second change in the name of the Trust from “Van Eck Merk Gold Trust” to “VanEck Merk Gold Trust,” at the request of the Marketing Agent to reflect its rebranding as “VanEck”. As a result of the name change, all references to “Van Eck Merk Gold Trust” in the Trust Agreement were amended to read “VanEck Merk Gold Trust,” and the Shares offered by the Trust are now known as the “VanEck Merk Gold Shares”. Except for the name change effected pursuant to the Second Trust Amendment, the Trust Agreement remains in full force and effect on its existing terms.

Effective July 24, 2020, the Sponsor exercised its rights under the Trust Agreement to adjust the Sponsor’s fee upon written notice to the Trustee and publication of the proposed change on its website. Prior to July 24, 2020, the Sponsor’s fee accrued at an annualized rate of 0.40% of the Trust’s NAV. Effective July 24, 2020, the Sponsor’s fee is payable at an annualized rate of 0.25% of the Trust’s NAV, accrued on a daily basis computed on the prior Business Day’s NAV and paid monthly in arrears.

On the Index Change Date, the Sponsor intends to change the pricing index it uses in relation to the Shares issued by the Trust intends to change to reference the Solactive Index in lieu of the LBMA Gold Price. Following the Index Change Date, in determining the Trust’s NAV, the Trustee will value the gold held by the Trust based on the Solactive Index.

14

Change in Settlement Cycle and Amendment to Authorized Participant Agreements

On March 22, 2017, the Securities and Exchange Commission adopted an amendment to reduce by one business day the standard settlement cycle for most broker-dealer securities transactions. Prior to the implementation of the shorter settlement cycle, the standard settlement cycle for such transactions was three business days, known as T+3. The amended rule shortens the settlement cycle to two business days, or T+2. This change in the settlement cycle affects both the creation and redemption procedures for Baskets and trading in the Shares. Compliance with the new settlement cycle went into effect on September 5, 2017.

Due to the fact that the aforementioned creation and redemption procedures are addressed in the Authorized Participant Agreements by among the Authorized Participants, the Trustee and the Sponsor, the Trustee and the Sponsor exercised their rights to amend each such agreement to address the new T+2 settlement cycle and executed First Amendments to each of the Authorized Participant Agreements, effective as of September 5, 2017, and provided timely notice of such amendment to the Authorized Participants. Except for the foregoing amendments, the Authorized Participant Agreements remain in full force and effect on their existing terms.

Results from Operations

The Trust is a trust formed on May 6, 2014 under New York law pursuant to the Trust Agreement. After consideration of Financial Accounting Standards Topic 946, however, the Sponsor has concluded that for financial statement reporting purposes the Trust meets the fundamental characteristics of an investment company. In addition, while the Trust does not currently possess all of the typical characteristics of an investment company, the Sponsor believes the Trust’s activities are consistent with those of an investment company and will therefore apply the guidance in Financial Accounting Standards Topic 946, including disclosure of the financial support contractually required to be provided by an investment company to any of its investees. The Sponsor is responsible for, among other things, overseeing the performance of the Trustee and the Trust’s principal service providers, including the preparation of financial statements. The Trustee is responsible for the day-to-day administration of the Trust.

The Three Months Ended April 30, 2023 Compared to the Three Months Ended April 30, 2022

The Trust’s NAV increased from $656,592,798 on January 31, 2023 to $712,154,665 on April 30, 2023, an 8.46% increase, compared to a 15.43% increase from $586,245,772 on January 31, 2022 to $676,703,604 on April 30, 2022. The increase in the Trust’s NAV in the quarter ended April 30, 2023 resulted from an increase in the value of investments in gold bullion as compared to the prior period. The number of outstanding Shares increased from 35,203,259 Shares on January 31, 2023 to 37,075,156 Shares on April 30, 2023 due to the creation of Shares by Authorized Participants and the creation of 21,897 Shares in the quarter for Sponsor’s fees, as compared to 21,240 Shares for such purpose in the quarter ended April 30, 2022. The number of outstanding Shares on April 30, 2022 was 36,451,520. The Sponsor’s fees are payable at an annualized rate of 0.25% of the Trust’s NAV, accrued on a daily basis computed on the prior Business Day’s NAV and paid monthly in arrears. Prior to July 24, 2020, the Sponsor’s fees accrued at an annualized rate of .40% of the Trust’s NAV. Due to the daily accrual but monthly payment, the number of Sponsor’s fee Shares issued can vary and possibly decrease, even as the number of Shares outstanding increases slightly.

The Trust’s NAV per Share increased 3.00% during the quarter ended April 30, 2023, starting at $18.65 per Share and ending at $19.21 per Share, compared to an increase of 6.36%, from $17.45 to $18.56 during the quarter ended April 30, 2022. The Trust’s NAV per share increased slightly less than the price per ounce of gold on a percentage basis due to the Sponsor’s fees, which were 21,897 Shares in total for the quarter ended April 30, 2023, compared with 21,240 Shares paid as Sponsor’s fees in the quarter ended April 30, 2022. The NAV per share of $19.85 on April 13, 2023 was the highest during the quarter, compared with a low of $17.55 on February 24, 2023.

The change in net assets from operations for the quarter ended April 30, 2023 was $20,060,387, resulting from the Sponsor’s fees of $(409,800), a net realized gain of $609,442 from gold bullion distributed for redemptions, and a net change in unrealized appreciation on investment in gold bullion of $19,860,745. In comparison, change in net assets from operations for the quarter ended April 30, 2022 was $36,392,542, resulting from the Sponsor’s fees of $(396,568), a net realized gain of $54,381 from gold bullion distributed for redemptions, and a net change in unrealized appreciation on investment in gold bullion of $36,734,729.

Other than the Sponsor’s fee, the Trust had no expenses during the quarter ended April 30, 2023 or the quarter ended April 30, 2022.

For the calendar quarter ended April 30, 2023, the Marketing Agent earned a fee of $54,701 which was paid by the Sponsor on May 22, 2023; since the initiation of the Marketing Agent’s efforts on behalf of the Trust on October 22, 2015, a total of $792,258 in Fees has been paid, representing 0.9994% of the Maximum Fee potentially payable to the Marketing Agent pursuant to the Marketing Agent Agreement. Effective July 24, 2020, the Sponsor and the Marketing Agent amended the fee structure under the Marketing Agent Agreement, however the financial obligations created thereunder remain the obligations of the Sponsor of the Trust, any fees payable thereunder remain payable from the Sponsor’s fee and the cap on the fees payable to the Marketing Agent remains unchanged.

15

Liquidity and Capital Resources

The Trust is not aware of any trends, demands, commitments, events or uncertainties that are reasonably likely to result in material changes to its liquidity needs. In exchange for the Sponsor’s fee, the Sponsor has agreed to assume most of the expenses incurred by the Trust. As a result, the only ordinary expense of the Trust during the period covered by this report was the Sponsor’s fee.

The Trustee will, at the direction of the Sponsor or in its own discretion, sell the Trust’s gold as necessary to pay the Trust’s expenses not otherwise assumed by the Sponsor. The Trustee will not sell gold to pay the Sponsor’s fee but will pay the Sponsor’s fee in Shares in lieu of cash. At April 30, 2023 and April 30, 2022, the Trust did not have any cash balances.

Off-Balance Sheet Arrangements

The Trust has no off-balance sheet arrangements.

Critical Accounting Policies

The unaudited financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these unaudited financial statements relies on estimates and assumptions that impact the Trust’s financial position and results of operations. These estimates and assumptions affect the Trust’s application of accounting policies. In addition, please refer to Note 2 to the unaudited financial statements for further discussion of accounting policies.

Effective May 6, 2014, the Trust has adopted the provisions of Financial Accounting Standards Topic 946, Investment Companies, and follows specialized accounting.

Investment by Certain Retirement Plans

Section 408(m) of the Internal Revenue Code, as amended (the “Code”), provides that the purchase of a “collectible” as an investment for an individual retirement account (an “IRA”), or for a participant-directed account maintained under any plan that is tax-qualified under Code section 401(a) (“Tax-Qualified Account”), is treated as a taxable distribution from the account to the owner of the IRA, or to the participant for whom the Tax-Qualified Account is maintained, of an amount equal to the cost to the account of acquiring the collectible. The Trust, through the Sponsor, has received a private letter ruling from the Internal Revenue Service that provides that (1) the acquisition of Shares by an IRA or a Tax-Qualified Account will not constitute the acquisition of a collectible and (2) an IRA or such an account’s owning Shares will not be treated as having made a distribution to the IRA owner or plan participant under Code section 408(m) solely by virtue of owning those Shares. If a redemption of Shares results in the delivery of gold to an IRA or Tax-Qualified Account, however, that exchange would constitute the acquisition of a collectible to the extent provided under that section. See also “ERISA and Related Considerations.”

Investors who are considering exchanging their Shares for gold coins or gold bullion should consult with their tax advisors regarding the tax implications thereof before doing so.

ERISA and Related Considerations

The Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and section 4975 of the Code impose certain requirements on employee benefit plans and certain other plans and arrangements, including IRAs and individual retirement annuities, Keogh plans and certain collective investment funds or insurance company general or separate accounts in which such plans, accounts, annuities or arrangements are invested, that are subject to ERISA or the Code, respectively (collectively, “Plans”), and on persons who are fiduciaries with respect to the investment of assets treated as “plan assets” of a Plan. Investments by Plans are subject to the fiduciary requirements and the applicability of prohibited transaction restrictions under ERISA.

16

Government plans and some church plans are not subject to the fiduciary responsibility provisions of ERISA or the provisions of Code section 4975 but may be subject to substantially similar rules under state or other federal law. Fiduciaries of any such plans are advised to consult with their counsel prior to an investment in Shares.

In contemplating an investment of a portion of Plan assets in Shares, the Plan fiduciary responsible for making such investment should carefully consider, taking into account the facts and circumstances of the Plan, the “Risk Factors” discussed below and whether such investment is consistent with its fiduciary responsibilities, including (1) whether the fiduciary has the authority to make the investment under the appropriate governing Plan instrument, (2) whether the investment would constitute a direct or indirect non-exempt prohibited transaction with a “party in interest” or “disqualified person,” (3) the Plan’s funding objectives, and (4) whether under the general fiduciary standards of investment prudence and diversification such investment is appropriate for the Plan, taking into account the Plan’s overall investment policy, the composition of its investment portfolio and its need for sufficient liquidity to pay benefits when due.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Trust does not engage in transactions in foreign currencies which could expose the Trust or holders of Shares to any foreign currency related market risk. The Trust does not invest in any derivative financial instruments or long-term debt instruments.

Item 4. Controls and Procedures

The Trust maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to the principal executive officer and principal financial officer of the Sponsor, and to the auditor, as appropriate, to allow timely decisions regarding required disclosure.

Under the supervision and with the participation of the principal executive officer and principal financial officer of the Sponsor, the Sponsor conducted an evaluation of the Trust’s disclosure controls and procedures, as defined under Exchange Act Rules 13a-15(e) and 15d-15(e). Based on this evaluation, the principal executive officer and principal financial officer of the Sponsor concluded that, as of April 30, 2023, the Trust’s disclosure controls and procedures were effective.

There have been no changes in the Trust’s or Sponsor’s internal control over financial reporting that occurred during the Trust’s fiscal quarter ended April 30, 2023 that have materially affected, or are reasonably likely to materially affect, the Trust’s or Sponsor’s internal control over financial reporting.

17

PART II—OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

You should carefully consider the factors discussed under the caption “Risk Factors” beginning on page 20 of our Annual Report on Form 10-K for the fiscal year ended January 31, 2023 (the “Annual Report”), filed with the Securities and Exchange Commission on April 13, 2023, which could materially affect our business, financial condition or future results. There have been no material changes in our risk factors from those disclosed in the Annual Report.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

| (a) | None. |

| (b) | Not applicable. |

| (c) |

| Shares Redeemed Per Month in the Quarter ended April 30, 2023 | Total Shares Redeemed | Average Ounces of Gold Per Share | ||||||

| Period | ||||||||

| 02/01/23 to 02/29/23 | - | 0.00969364 | ||||||

| 03/01/23 to 03/31/23 | - | 0.00969062 | ||||||

| 04/01/23 to 04/30/23 | 200,000 | 0.00968965 | ||||||

| 200,000 | ||||||||

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information

None.

18

Item 6. Exhibits

| # | The information in Exhibit 32 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act (including this report), unless the Company specifically incorporates the foregoing information into those documents by reference. |

19

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in its capacities* thereunto duly authorized.

| MERK INVESTMENTS LLC | |

| Sponsor of the VanEck Merk Gold Trust | |

| Date: June 6, 2023 | /s/ Axel Merk |

| Axel Merk | |

| President and Chief Investment Officer | |

| (Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer) |

| * | The Registrant is a trust and the person is signing in his capacities as officers of Merk Investments LLC, the Sponsor of the Registrant. |

20