|

Exhibit 99.1 |

EMPIRE STATE REALTY TRUST ANNOUNCES FOURTH QUARTER AND FULL YEAR 2014 RESULTS

– Reports Core FFO of $0.25 Per Fully Diluted Share For the Fourth Quarter –

New York, New York, February 25, 2015—Empire State Realty Trust, Inc. (NYSE: ESRT) (the “Company”), a real estate investment trust with office and retail properties in Manhattan and the greater New York metropolitan area, today reported operational and financial results for the fourth quarter and full year 2014.

“We are pleased to report strong operating and financial performance in the fourth quarter, driven by overall strength in leasing, along with continued progress in our redevelopment program for new leases of consolidated larger spaces” stated Anthony E. Malkin, Empire State Realty Trust’s Chairman and Chief Executive Officer. “Over the full year, we leased approximately 785,000 square feet of office and retail space to high quality tenants and achieved increases in starting cash rents of over 20% overall, and 31.5% on all new leasing in our Manhattan office portfolio. At the Empire State Building, we delivered attractive new amenities to tenants as part of our “Urban Campus,” while the Observatory again achieved record attendance and revenues. We expanded our portfolio with the acquisition of two buildings, one located in Times Square South on Broadway and one directly opposite Macy’s on 34th Street. We continued to improve our low leveraged balance sheet as we unencumbered assets, extended the weighted average term maturity and converted our secured corporate credit facility to an unsecured facility. All these balance sheet changes support our ability to fund our future capital plan and acquisitions as, and when, we make them. We are very happy to have our new President and Chief Operating Officer John B. Kessler added to our already outstanding senior executive team. We continue to execute on our strategy and create lasting value for our shareholders.”

Fourth Quarter Highlights

| • | Achieved Core Funds From Operations (“Core FFO”) of $0.25 per fully diluted share and net income attributable to the Company of $0.04 per fully diluted share; |

| • | Total portfolio was 88.6% occupied; including signed leases not commenced (“SLNC”), the total portfolio was 89.6% leased at December 31, 2014; |

| • | Same store portfolio (defined as the total portfolio excluding 112 West 34th Street and 1400 Broadway) was 89.2% occupied, unchanged from September 30, 2014; including SLNC, the same store portfolio was 90.4% leased at December 31, 2014; |

1

| • | Manhattan office portfolio (excluding the retail component of these properties) was 87.5% occupied; including SLNC, the Manhattan office portfolio was 88.5% leased at December 31, 2014. On a same store basis, the Manhattan office portfolio was 88.2% occupied, up 10 basis points from September 30, 2014; including SLNC, the Manhattan office portfolio same store was 89.4% leased at December 31, 2014; |

| • | Retail portfolio was 93.2% occupied at December 31, 2014, up 90 basis points from September 30, 2014; |

| • | Empire State Building was 84.8% occupied, down 120 basis points from September 30, 2014; including SLNC, the Empire State Building was 86.3% leased at December 31, 2014; |

| • | Executed 63 leases, representing 200,480 rentable square feet across the total portfolio, achieving a 26.2% increase in mark-to-market rent over previously fully escalated rents on new, renewal, and expansion leases; 46 of these leases, representing 146,474 rentable square feet, were within the Manhattan office portfolio capturing a 19.8% increase in mark-to-market rent over previously fully escalated rents on new, renewal and expansion leases; |

| • | Signed 24 new leases representing 96,751 rentable square feet in the fourth quarter 2014 for the Manhattan office portfolio (excluding the retail component of these properties), achieving an increase of 24.1% in mark-to-market rent over expired previously fully escalated rents; |

| • | The Empire State Building Observatory revenue for the fourth quarter 2014 grew 10.9% to $28.2 million, from $25.4 million in the fourth quarter 2013; and |

| • | Declared a $0.085 per share dividend which was paid on December 31, 2014. |

Full Year Highlights

| • | Achieved Core FFO of $0.89 per fully diluted share and net income attributable to the Company of $0.27 per fully diluted share; |

| • | Executed 239 leases, representing 784,801 rentable square feet across the total portfolio, achieving a 20.2% increase in mark-to-market rent over previously fully escalated rents on new, renewal, and expansion leases; 181 of these leases, representing 621,224 rentable square feet, were within the Manhattan office portfolio capturing a 23.4% increase in mark-to-market rent over previously fully escalated rents on new, renewal and expansion leases; |

| • | Signed 98 new leases representing 457,052 rentable square feet in 2014 for the Manhattan office portfolio (excluding the retail component of these properties), achieving an increase of 31.5% in mark-to-market rent over expired previously fully escalated rents; |

2

| • | Acquired the ground and operating leases at 112 West 34th Street and the ground lease at 1400 Broadway for a total of approximately $734 million in assumption of debt, cash, common stock and operating partnership units; |

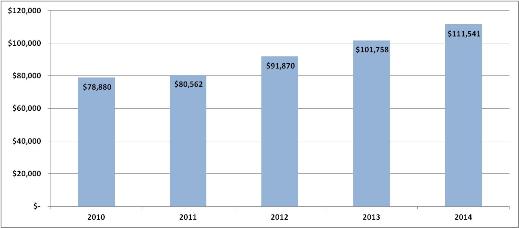

| • | The Empire State Building Observatory revenue grew 9.5% to $111.5 million, from $101.8 million in 2013; and |

| • | Declared and paid aggregate dividends of $0.34 per share and operating partnership unit during 2014. |

Financial Results for the Fourth Quarter 2014

The Company began operations upon the completion of its formation transactions and initial public offering in October 2013. Accordingly, the fourth quarter 2013 results noted below are not directly comparable.

Going forward the Company will report Modified Funds From Operations (“Modified FFO”) in addition to the Funds From Operations (“FFO”) and Core FFO measures already provided. Modified FFO is defined as FFO plus adjustments for any above or below market ground lease amortization. Under the NAREIT definition of FFO, the July 15, 2014 acquisitions of 1400 Broadway’s and 112 West 34th Street’s significantly below market ground leases require the Company to charge non-cash amortization that is material to the Company’s FFO calculation. This non-cash charge reduces FFO, and is consistent and predictable over the remaining terms of the ground leases on a straight line basis, with a fourth quarter 2014 impact of $2.0 million, or $0.01 per fully diluted share. The Company considers Modified FFO as a useful supplemental measure in evaluating the operating performance of the Company due to the non-cash accounting treatment under GAAP.

Core FFO was $65.2 million, or $0.25 per fully diluted share. In the period from October 7, 2013 through December 31, 2013, Core FFO was $41.8 million or $0.17 per fully diluted share.

Modified FFO was $61.4 million, or $0.23 per fully diluted share. In the period from October 7, 2013 through December 31, 2013, Modified FFO was $221.2 million or $0.90 per fully diluted share. Modified FFO for 2013 included a gain on consolidation of non-controlled entities.

FFO was $59.4 million, or $0.22 per fully diluted share, compared to $220.8 million or $0.90 per fully diluted share in the period from October 7, 2013 through December 31, 2013. FFO for 2013 included a gain on consolidation of non-controlled entities.

3

Net income attributable to common stockholders was $4.1 million, or $0.04 per fully diluted share, compared to $75.2 million or $0.79 per fully diluted share in the period from October 7, 2013 through December 31, 2013. Net income for 2013 included a gain on consolidation of non-controlled entities.

Financial Results for the Twelve Months Ended December 31, 2014

The Company began operations upon the completion of its formation transactions and initial public offering in October 2013. Accordingly, 2013 results noted below are not directly comparable.

Core FFO was $227.4 million, or $0.89 per fully diluted share. In the period from October 7, 2013 through December 31, 2013, Core FFO was $41.8 million or $0.17 per fully diluted share.

Modified FFO was $219.5 million, or $0.86 per fully diluted share. In the period from October 7, 2013 through December 31, 2013, Modified FFO was $221.2 million or $0.90 per fully diluted share. As stated above, from the July 15, 2014 acquisitions of 112 West 34th and 1400 Broadway, the Company recorded below market ground lease amortization expense of $4.6 million for the year ended December 31, 2014, or $0.02 per fully diluted share. Modified FFO for 2013 included a gain on consolidation of non-controlled entities.

FFO was $214.8 million, or $0.84 per fully diluted share, compared to $220.8 million or $0.90 per fully diluted share in the period from October 7, 2013 through December 31, 2013. FFO for 2013 included a gain on consolidation of non-controlled entities.

Net income attributable to common stockholders was $26.7 million, or $0.27 per fully diluted share, compared to $75.2 million or $0.79 per fully diluted share in the period from October 7, 2013 through December 31, 2013. Net income for 2013 included a gain on consolidation of non-controlled entities.

Portfolio Operations

The Company reported that its total portfolio as of December 31, 2014, containing 10.0 million rentable square feet of office and retail space, was 88.6% occupied at the end of the fourth quarter 2014. Including SLNC, the Company’s portfolio was 89.6% leased at December 31, 2014.

The Company’s same store portfolio, defined as the total portfolio excluding 112 West 34th Street and 1400 Broadway and containing 8.4 million rentable square feet of office and retail space, was 89.2% occupied at the end of the fourth quarter 2014. Percentage occupied was unchanged from 89.2% at the end of the third quarter 2014, and up 310 basis points from 86.1% at the end of the fourth quarter 2013. Including SLNC, the Company’s same store portfolio was 90.4% leased at December 31, 2014.

4

The Company’s office portfolio (excluding the retail component of these properties) as of December 31, 2014, containing 9.3 million rentable square feet, was 88.2% occupied at the end of the fourth quarter 2014. On a same store basis, the office portfolio was 88.9% occupied, down 10 basis points from the end of the third quarter 2014, and up 330 basis points from the end of the fourth quarter 2013. Including SLNC, the Company’s office portfolio (excluding the retail component of these properties) was 89.4% leased at December 31, 2014.

The Manhattan office portfolio (excluding the retail component of these properties) as of December 31, 2014, containing 7.4 million rentable square feet was 87.5% occupied at the end of the fourth quarter 2014. On a same store basis, the Manhattan office portfolio was 88.2% occupied, up 10 basis points from the end of the third quarter 2014, and up 380 basis points from the end of the fourth quarter 2013. Including SLNC, the Company’s Manhattan office portfolio (excluding the retail component of these properties), was 88.5% leased at December 31, 2014.

The Company’s retail portfolio as of December 31, 2014, containing approximately 728,000 rentable square feet, was 93.2% occupied at the end of the fourth quarter 2014, which compares to 92.3% at the end of the third quarter of 2014.

Leasing

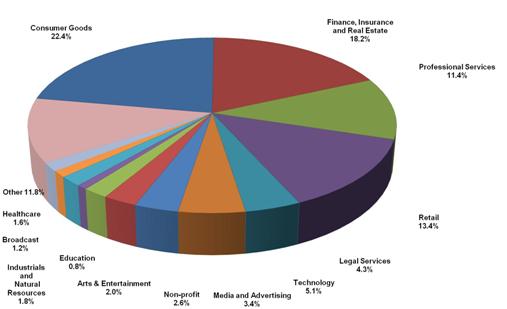

For the three months ended December 31, 2014, the Company executed 63 leases within the total portfolio, comprising 200,480 rentable square feet. Total leasing volume included 58 office leases, comprising 192,409 rentable square feet, and five retail leases, comprising 8,071 rentable square feet.

On a blended basis, the 63 new, renewal and expansion leases signed within the total portfolio during the quarter had an average starting rental rate of $55.67 per rentable square foot, representing an increase of 26.2% over the prior in-place rent on a fully escalated basis.

Leases signed in the Fourth Quarter 2014 for the Manhattan office portfolio included

| • | 24 new leases comprising 96,751 rentable square feet, with an average starting rental rate of $54.04 per rentable square foot, representing an increase of 24.1% over the prior in-place rent on a fully escalated basis, and |

| • | 22 renewal leases, comprising 49,723 rentable square feet, with an average starting rental rate of $38.84 per rentable square foot, representing an increase of 9.4% over the prior in-place rent on a fully escalated basis. |

5

Empire State Building

The Company continues to renovate and re-lease the 2.8 million rentable square foot Empire State Building, its flagship property. At December 31, 2014, the Empire State Building was 84.8% occupied; including SLNC, the Empire State Building was 86.3% leased.

During the fourth quarter 2014, the Company executed six office leases at the Empire State Building, representing 17,140 rentable square feet in the aggregate. During the full year 2014, the Company executed 27 office leases at the Empire State Building, representing 199,212 rentable square feet in the aggregate.

The Observatory revenue for the fourth quarter 2014 grew 10.9% to $28.2 million, from $25.4 million in the fourth quarter 2013. The increase in Observatory revenue was driven by a combination of more visitors, higher admission prices, and a better mix of tickets purchased. The Observatory hosted approximately 997,000 visitors in the fourth quarter 2014, representing a 1.8% increase from the same period of 2013.

For the twelve months ended December, 2014, Observatory attendance recovered from weather-impacted volumes in the quarter ended March 31, 2014 and hosted 4.3 million visitors, an increase from the record numbers in 2013. Observatory revenue was $111.5 million, a 9.5% increase from $101.8 million for the twelve months ended December 31, 2013.

Significant Leases Executed Subsequent to Quarter-End

The Company signed several significant leases after the close of the fourth quarter, including:

| • | At the Empire State Building, the Company signed a 26,782 rentable square foot new lease with LIN Media, owned by Media General, Inc., one of the nation’s largest multimedia companies, for a term of 10.8 years. |

| • | At 112 West 34th Street, the Company signed an 11,334 rentable square foot new lease with Sephora USA, LLC, a beauty-retail concept owned by LVMH Moët Hennessy Louis Vuitton S.A., one of the world’s leading luxury goods retailers. |

| • | At One Grand Central Place, the Company signed a 14,011 rentable square foot new lease with Marketfield Asset Management LLC, a registered investment advisor to private and institutional clients, for a term of 10.3 years. |

6

Balance Sheet and Financial Transactions

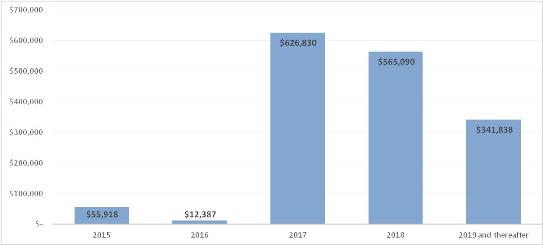

As of December 31, 2014, the outstanding balance on the Company’s secured term loan and credit facility was $470.0 million.

On January 23, 2015, the Company terminated the secured term loan and credit facility and entered into a new $800 million unsecured revolving credit facility, which has an accordion feature, allowing for an increase in its maximum aggregate principal balance to $1.25 billion under certain circumstances. The facility matures in January 2019 with an ability to extend for two additional six-month periods, under certain conditions. As of January 23, 2015, the outstanding balance on the Company’s unsecured revolving credit facility was $470.0 million.

During the fourth quarter 2014, the Company refinanced at a lower rate the mortgage loan on its Metro Center property, located in Stamford, Connecticut. The new $100 million mortgage loan has a ten year term and bears interest at a fixed rate of 3.59% with amortization on a 30 year schedule.

The Company refinanced the mortgage loans on One Grand Central Place with a new $91.0 million mortgage loan due 2017 which bears interest at LIBOR plus 1.35%.

The Company repaid the mortgage loans on 500 Mamaroneck Avenue and 250 West 57th Street and the second lien mortgage loan on 1350 Broadway using proceeds from borrowings under its credit facility.

The Company extended the mortgage loan on 1359 Broadway to August 2015.

At December 31, 2014, the Company had total debt outstanding of approximately $1.6 billion, with a weighted average interest rate of 3.55% per annum, and a weighted average term to maturity of 3.6 years, as compared to approximately $1.6 billion with a weighted average interest rate of 4.29% per annum and a weighted average term to maturity of 3.0 years at September 30, 2014. At December 31, 2014, the Company has approximately $44.1 million of debt maturing in 2015 and no maturities in 2016.

7

Dividend

The Company paid a dividend of $0.085 per share for the fourth quarter 2014 to holders of the Company’s Class A common stock and Class B common stock and to holders of the operating partnership’s Series ES, Series 250 and Series 60 operating partnership units (NYSE Arca: ESBA, FISK and OGCP, respectively) and Series PR operating partnership units on December 31, 2014. The Company paid a dividend of $0.15 per unit for the fourth quarter 2014 to holders of the operating partnership’s private perpetual preferred units.

Webcast and Conference Call Details

Empire State Realty Trust will host a webcast and conference call, open to the general public, on Thursday, February 26, 2015 at 8:30 am Eastern time.

The webcast will be available in the Investors section of the Company’s website at www.empirestaterealtytrust.com. To listen to a live broadcast, go to the site at least five minutes prior to the scheduled start time in order to register, download and install any necessary audio software. Shortly after the call, a replay of the webcast will be available for 90 days on the Company’s website.

The conference call can be accessed by dialing 1-877-407-3982 for domestic callers or 1-201-493-6780 for international callers. A replay will be available shortly after the call and can be accessed by dialing 1-877-870-5176 for domestic callers or 1-858-384-5517 for international callers. The passcode for the replay is 13599402. A replay of the conference call will be available until March 5, 2015.

The Supplemental Package will be available prior to the conference call in the Investors section of the Company’s website, www.empirestaterealtytrust.com.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT), a leading real estate investment trust (REIT), owns, manages, operates, acquires and repositions office and retail properties in Manhattan and the greater New York metropolitan area, including the Empire State Building, the world’s most famous office building. Headquartered in New York, New York, the Company’s office and retail portfolio covers 10.0 million rentable square feet, as of December 31, 2014, consisting of 9.3 million rentable square feet in 14 office properties, including nine in Manhattan, three in Fairfield County, Connecticut and two in Westchester County, New York; and approximately 728,000 rentable square feet in the retail portfolio. The Company also owns land at the Stamford, Connecticut Transportation Center that supports the development of an approximately 380,000 rentable square foot office building and garage.

8

Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press release. A reconciliation of each non-GAAP financial measure and the comparable GAAP financial measure can be found on pages 18 and 19 of this release and in the Company’s supplemental package.

Forward-Looking Statements

This press release includes “forward looking statements”. Forward-looking statements may be identified by the use of words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates,” “contemplates,” “aims,” “continues,” “would” or “anticipates” or the negative of these words and phrases or similar words or phrases. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the factors included in (i) the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, including those set forth under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” and “Properties” and (ii) in future periodic reports filed by the Company under the Securities and Exchange Act of 1934, as amended. While forward-looking statements reflect the Company’s good faith beliefs, they are not guarantees of future performance. The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events or other changes after the date of this press release, except as required by applicable law. For a further discussion of these and other factors that could impact the Company’s future results, performance or transactions, see the section entitled “Risk Factors” in the Annual Report on Form 10-K for the year ended December 31, 2013, and in the Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 and other risks described in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission. Prospective investors should not place undue reliance on any forward-looking statements, which are based only on information currently available to the Company (or to third parties making the forward-looking statements).

9

Contact:

Investors

Empire State Realty Trust Investor Relations

(212) 850-2678

IR@empirestaterealtytrust.com

Media

Brandy Bergman/Hugh Burns

Sard Verbinnen & Co.

(212) 687-8080

10

Empire State Realty Trust, Inc.

Condensed Consolidated Statements of Income

(unaudited and amounts in thousands, except per share data)

| Three Months Ended December 31, 2014 |

Period from October 7, 2013 through December 31, 2013 |

|||||||

| Revenues |

||||||||

| Rental revenue |

$ | 112,259 | $ | 79,987 | ||||

| Tenant expense reimbursement |

18,160 | 15,836 | ||||||

| Observatory revenue |

28,167 | 23,735 | ||||||

| Construction revenue |

4,918 | 5,265 | ||||||

| Third-party management and other fees |

451 | 550 | ||||||

| Other revenue and fees |

6,456 | 2,210 | ||||||

|

|

|

|

|

|||||

| Total revenues |

170,411 | 127,583 | ||||||

| Operating expenses |

||||||||

| Property operating expenses |

41,748 | 34,055 | ||||||

| Ground rent expenses |

2,375 | 398 | ||||||

| Marketing, general and administrative expenses |

9,251 | 16,379 | ||||||

| Observatory expenses |

7,831 | 5,687 | ||||||

| Construction expenses |

5,423 | 5,468 | ||||||

| Real estate taxes |

23,702 | 17,191 | ||||||

| Acquisition expenses |

— | 138,140 | ||||||

| Depreciation and amortization |

48,799 | 27,375 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

139,129 | 244,693 | ||||||

|

|

|

|

|

|||||

| Total operating income (loss) |

31,282 | (117,110 | ) | |||||

| Other income (expense) |

||||||||

| Interest expense |

(19,816 | ) | (13,147 | ) | ||||

| Gain on consolidation of non-controlled entities |

— | 322,563 | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

11,466 | 192,306 | ||||||

| Income tax (expense) benefit |

(502 | ) | 1,125 | |||||

|

|

|

|

|

|||||

| Net income |

10,964 | 193,431 | ||||||

| Preferred unit distributions |

(235 | ) | — | |||||

| Net income attributable to non-controlling interests |

(6,587 | ) | (118,186 | ) | ||||

|

|

|

|

|

|||||

| Net income attributable to common stockholders |

$ | 4,142 | $ | 75,245 | ||||

|

|

|

|

|

|||||

| Total weighted average shares |

||||||||

| Basic |

103,022 | 95,463 | ||||||

|

|

|

|

|

|||||

| Diluted |

265,779 | 244,420 | ||||||

|

|

|

|

|

|||||

| Net income per share attributable to common stockholders |

||||||||

| Basic |

$ | 0.04 | $ | 0.79 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.04 | $ | 0.79 | ||||

|

|

|

|

|

|||||

Empire State Realty Trust, Inc.

Condensed Consolidated Statements of Income

(unaudited and amounts in thousands, except per share data)

| Year Ended December 31, 2014 |

Period from October 7, 2013 through December 31, 2013 |

|||||||

| Revenues |

||||||||

| Rental revenue |

$ | 400,825 | $ | 79,987 | ||||

| Tenant expense reimbursement |

67,651 | 15,836 | ||||||

| Observatory revenue |

111,541 | 23,735 | ||||||

| Construction revenue |

38,648 | 5,265 | ||||||

| Third-party management and other fees |

2,376 | 550 | ||||||

| Other revenue and fees |

14,285 | 2,210 | ||||||

|

|

|

|

|

|||||

| Total revenues |

635,326 | 127,583 | ||||||

| Operating expenses |

||||||||

| Property operating expenses |

151,048 | 34,055 | ||||||

| Ground rent expenses |

5,339 | 398 | ||||||

| Marketing, general and administrative expenses |

39,037 | 16,379 | ||||||

| Observatory expenses |

29,041 | 5,687 | ||||||

| Construction expenses |

38,596 | 5,468 | ||||||

| Real estate taxes |

82,131 | 17,191 | ||||||

| Acquisition expenses |

3,382 | 138,140 | ||||||

| Depreciation and amortization |

145,431 | 27,375 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

494,005 | 244,693 | ||||||

|

|

|

|

|

|||||

| Total operating income (loss) |

141,321 | (117,110 | ) | |||||

| Other income (expense) |

||||||||

| Interest expense |

(66,456 | ) | (13,147 | ) | ||||

| Gain on consolidation of non-controlled entities |

— | 322,563 | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

74,865 | 192,306 | ||||||

| Income tax (expense) benefit |

(4,655 | ) | 1,125 | |||||

|

|

|

|

|

|||||

| Net income |

70,210 | 193,431 | ||||||

| Preferred unit distributions |

(476 | ) | — | |||||

| Net income attributable to non-controlling interests |

(43,067 | ) | (118,186 | ) | ||||

|

|

|

|

|

|||||

| Net income attributable to common stockholders |

$ | 26,667 | $ | 75,245 | ||||

|

|

|

|

|

|||||

| Total weighted average shares |

||||||||

| Basic |

97,941 | 95,463 | ||||||

|

|

|

|

|

|||||

| Diluted |

254,506 | 244,420 | ||||||

|

|

|

|

|

|||||

| Net income per share attributable to common stockholders |

||||||||

| Basic |

$ | 0.27 | $ | 0.79 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.27 | $ | 0.79 | ||||

|

|

|

|

|

|||||

Empire State Realty Trust, Inc.

Reconciliation of Net Income to Funds From Operations (“FFO”),

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”)

(unaudited and amounts in thousands, except per share data)

| Three Months Ended December 31, 2014 |

Period from October 7, 2013 through December 31, 2013 |

|||||||

| Net income |

$ | 10,964 | $ | 193,431 | ||||

| Preferred unit distributions |

(235 | ) | — | |||||

| Real estate depreciation and amortization |

48,711 | 27,352 | ||||||

|

|

|

|

|

|||||

| FFO |

59,440 | 220,783 | ||||||

| Amortization of below-market ground leases |

2,001 | 398 | ||||||

|

|

|

|

|

|||||

| Modified FFO |

61,441 | 221,181 | ||||||

| Prepayment penalty expense and deferred financing costs write-off |

3,771 | — | ||||||

| Acquisition expenses |

— | 138,140 | ||||||

| Gain on consolidation of non-controlled entities |

— | (322,563 | ) | |||||

| Severance expenses |

— | 2,738 | ||||||

| Retirement equity compensation expenses |

— | 2,297 | ||||||

|

|

|

|

|

|||||

| Core FFO |

$ | 65,212 | $ | 41,793 | ||||

|

|

|

|

|

|||||

| Total weighted average shares and Operating Partnership Units |

| |||||||

| Basic |

265,779 | 244,420 | ||||||

|

|

|

|

|

|||||

| Diluted |

265,779 | 244,420 | ||||||

|

|

|

|

|

|||||

| FFO per share |

||||||||

| Basic |

$ | 0.22 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.22 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Modified FFO per share |

||||||||

| Basic |

$ | 0.23 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.23 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Core FFO per share |

||||||||

| Basic |

$ | 0.25 | $ | 0.17 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.25 | $ | 0.17 | ||||

|

|

|

|

|

|||||

Empire State Realty Trust, Inc.

Reconciliation of Net Income to Funds From Operations (“FFO”),

Modified Funds From Operations (“Modified FFO”) and Core Funds From Operations (“Core FFO”)

(unaudited and amounts in thousands, except per share data)

| Year Ended December 31, 2014 |

Period from October 7, 2013 through December 31, 2013 |

|||||||

| Net income |

$ | 70,210 | $ | 193,431 | ||||

| Preferred unit distributions |

(476 | ) | — | |||||

| Real estate depreciation and amortization |

145,115 | 27,352 | ||||||

|

|

|

|

|

|||||

| FFO |

214,849 | 220,783 | ||||||

| Amortization of below-market ground leases |

4,603 | 398 | ||||||

|

|

|

|

|

|||||

| Modified FFO |

219,452 | 221,181 | ||||||

| Gain on settlement of lawsuit related to the Observatory, net of income taxes |

(540 | ) | — | |||||

| Private perpetual preferred exchange offering expenses |

1,357 | — | ||||||

| Prepayment penalty expense and deferred financing costs write-off |

3,771 | — | ||||||

| Acquisition expenses |

3,382 | 138,140 | ||||||

| Gain on consolidation of non-controlled entities |

— | (322,563 | ) | |||||

| Severance expenses |

— | 2,738 | ||||||

| Retirement equity compensation expenses |

— | 2,297 | ||||||

|

|

|

|

|

|||||

| Core FFO |

$ | 227,422 | $ | 41,793 | ||||

|

|

|

|

|

|||||

| Total weighted average shares and Operating Partnership Units |

||||||||

| Basic |

254,506 | 244,420 | ||||||

|

|

|

|

|

|||||

| Diluted |

254,506 | 244,420 | ||||||

|

|

|

|

|

|||||

| FFO per share |

||||||||

| Basic |

$ | 0.84 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.84 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Modified FFO per share |

||||||||

| Basic |

$ | 0.86 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.86 | $ | 0.90 | ||||

|

|

|

|

|

|||||

| Core FFO per share |

||||||||

| Basic |

$ | 0.89 | $ | 0.17 | ||||

|

|

|

|

|

|||||

| Diluted |

$ | 0.89 | $ | 0.17 | ||||

|

|

|

|

|

|||||

Empire State Realty Trust, Inc.

Condensed Consolidated Balance Sheets

(unaudited and amounts in thousands)

| December 31, | December 31, | |||||||

| 2014 | 2013 | |||||||

| Assets |

||||||||

| Commercial real estate properties, at cost |

$ | 2,139,863 | $ | 1,649,423 | ||||

| Less: accumulated depreciation |

(377,552 | ) | (295,351 | ) | ||||

|

|

|

|

|

|||||

| Commercial real estate properties, net |

1,762,311 | 1,354,072 | ||||||

| Cash and cash equivalents |

45,732 | 60,743 | ||||||

| Restricted cash |

60,273 | 55,621 | ||||||

| Tenant and other receivables |

23,745 | 24,817 | ||||||

| Deferred rent receivables |

102,104 | 62,689 | ||||||

| Prepaid expenses and other assets |

48,504 | 35,407 | ||||||

| Deferred costs, net |

80,212 | 78,938 | ||||||

| Acquired below market ground leases, net |

391,887 | 62,312 | ||||||

| Acquired lease intangibles, net |

290,248 | 249,983 | ||||||

| Goodwill |

491,479 | 491,479 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 3,296,495 | $ | 2,476,061 | ||||

|

|

|

|

|

|||||

| Liabilities and equity |

||||||||

| Mortgage notes |

$ | 903,985 | $ | 883,112 | ||||

| Term loan and credit facility |

470,000 | 325,000 | ||||||

| Senior unsecured notes |

237,667 | — | ||||||

| Accounts payable and accrued expenses |

96,563 | 81,908 | ||||||

| Acquired below market leases, net |

138,859 | 129,882 | ||||||

| Deferred revenue and other liabilities |

27,876 | 21,568 | ||||||

| Tenants’ security deposits |

40,448 | 31,406 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

1,915,398 | 1,472,876 | ||||||

| Total equity |

1,381,097 | 1,003,185 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 3,296,495 | $ | 2,476,061 | ||||

|

|

|

|

|

|||||