UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

Or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36304

PHIO PHARMACEUTICALS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 45-3215903 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

257 Simarano Drive, Suite 101, Marlborough, Massachusetts 01752

(Address of principal executive offices and Zip Code)

(508) 767-3861

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class of securities: | Trading Symbol(s): | Name of exchange on which registered: |

| Common Stock, par value $0.0001 | PHIO | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s common stock, $0.0001 par value per share (“Common Stock”), held by non-affiliates of the registrant, based on the closing sale price of the registrant’s Common Stock on June 28, 2019, was $9,357,037. Shares of Common Stock held by each officer and director and by each person who is known to own 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 20, 2020, the registrant had 2,867,851 shares of Common Stock, par value $0.0001, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

PHIO PHARMACEUTICALS CORP.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2019

| i |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,” “suggests,” “may,” “would,” “should,” “potential,” “designed to,” “will,” “ongoing,” “estimate,” “forecast,” “predict,” “could,” and similar references, although not all forward-looking statements contain these words. Forward-looking statements are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Risks that could cause actual results to vary from expected results expressed in our forward-looking statements include, but are not limited to:

| · | our business and operations may be materially and adversely affected by the recent coronavirus outbreak; | |

| · | our product candidates are in an early stage of development and may fail or experience significant delays or may never advance to the clinic, which may materially and adversely impact our business; | |

| · | we are dependent on collaboration partners for the successful development of our adoptive cell therapy product candidates; | |

| · | the approach we are taking to discover and develop novel therapeutics using RNAi may never lead to marketable products; | |

| · | a number of different factors could prevent us from advancing into clinical development, obtaining regulatory approval, and ultimately commercializing our product candidates on a timely basis, or at all; | |

| · | the FDA could impose a unique regulatory regime for our therapeutics; | |

| · | we may be unable to protect our intellectual property rights licensed from other parties; our intellectual property rights may be inadequate to prevent third parties from using our technologies or developing competing products; and we may need to license additional intellectual property from others; | |

| · | we are subject to significant competition and may not be able to compete successfully; | |

| · | if we fail to attract, hire and retain qualified personnel, we may not be able to design, develop, market or sell our products or successfully manage our business; | |

| · | future financing may be obtained through, and future development efforts may be paid for by, the issuance of debt or equity, which may have an adverse effect on our stockholders or may otherwise adversely affect our business; and | |

| · | the price of our common stock has been and may continue to be volatile. |

Our actual results and financial condition may differ materially from those indicated in the forward-looking statements as a result of the foregoing factors, including those identified in this Annual Report on Form 10-K under the heading Risk Factors,” for the reasons described elsewhere in this Annual Report on Form 10-K and in other filings Phio Pharmaceuticals Corp. periodically makes with the Securities and Exchange Commission. Therefore, you should not rely unduly on any of these forward-looking statements. Forward-looking statements contained in this Annual Report on Form 10-K speak as of the date hereof and Phio Pharmaceuticals Corp. does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this report.

| 1 |

Unless otherwise noted, (1) the term “Phio” refers to Phio Pharmaceuticals Corp. and our subsidiary, MirImmune, LLC and (2) the terms “Company,” “we,” “us” and “our” refer to the ongoing business operations of Phio and MirImmune, LLC, whether conducted through Phio or MirImmune, LLC.

| ITEM 1. | BUSINESS |

Overview

Phio Pharmaceuticals Corp. is a biotechnology company developing the next generation of immuno-oncology therapeutics based on our self-delivering RNAi (“INTASYL™”) therapeutic platform. The Company's efforts are focused on silencing tumor-induced suppression of the immune system through our proprietary INTASYL™ platform with utility in immune cells and/or the tumor micro-environment. Our goal is to develop powerful INTASYL™ therapeutic compounds that can weaponize immune effector cells to overcome tumor immune escape, thereby providing patients a powerful new treatment option that goes beyond current treatment modalities.

Our development efforts are based on our broadly patented INTASYL™ technology platform. Our INTASYL™ compounds do not require a delivery vehicle to penetrate into tissues and cells and are designed to “silence” or down-regulate, the expression of a specific gene which is over-expressed in cancer. We believe that our INTASYL™ platform uniquely positions the Company in the field of immuno-oncology because of this and the following reasons:

| · | Efficient uptake of INTASYL™ to immune cells obviating the need for facilitated delivery (mechanical or formulation); |

| · | Can target multiple genes (i.e. multiple immunosuppression pathways) in a single therapeutic entity; |

| · | Gene silencing by INTASYL™ has been shown to have a sustained, or long-term, effect in vivo; |

| · | Favorable clinical safety profile of INTASYL™ with local administration; and |

| · | Can be readily manufactured under current good manufacturing practices. |

| 2 |

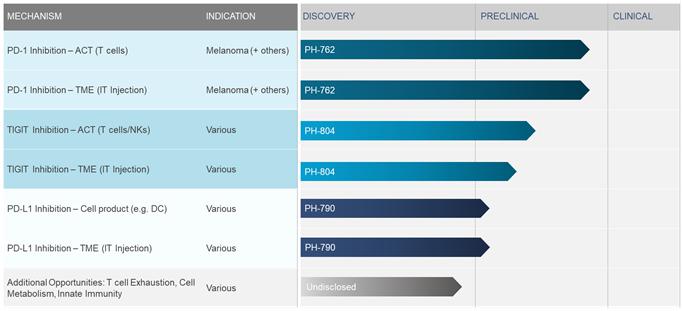

Our Development Pipeline

The table below sets forth the Company’s stage of development for its programs and product candidates:

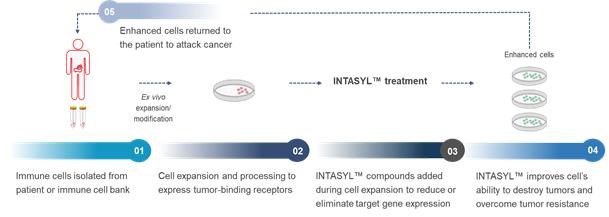

The self-delivering nature of our compounds makes INTASYL™ ideally suited for use with adoptive cell transfer (“ACT”) treatments and direct therapeutic use. ACT consists of the infusion of immune cells with antitumor properties. These cells can be derived from unmodified (i.e. naturally occurring) immune cells, immune cells isolated from resected tumors, or genetically engineered immune cells recognizing tumor neoantigen/neoepitope cells.

Currently, ACT therapies for the treatment of solid tumors face several hurdles. Multiple inhibitory mechanisms restrain immune cells used in ACT from effectively eradicating tumors, including immune checkpoints, reduced cell fitness and cell persistence. Furthermore, the immunosuppressive tumor micro-environment (the “TME”) can pose a formidable barrier to immune cell infiltration and function.

Phio has developed a product platform based on our INTASYL™ technology that allows easy, precise, rapid, and selective non-genetically modified programming of ACT cells (ex vivo, during manufacturing) and of the TME (in vivo, by local application), resulting in improved immunotherapy.

| 3 |

Adoptive Cell Transfer

ACT includes a number of different types of immunotherapy treatments. These treatments use immune cells, that are grown in a lab to large numbers, followed by administering them to the body to fight the cancer cells. Sometimes, immune cells that naturally recognize a tumor are used, while other times immune cells are modified or “engineered” to make them recognize and kill the cancer cells. There are several types of ACT, including: a.) non-engineered cell therapy in which immune cells are grown from the patient’s tumor or blood, such as tumor infiltrating lymphocytes (“TILs”), or from donor blood or tissue such as natural killer (“NK”) cells, dendritic cells (“DC”) and macrophages, and b.) engineered immune cells that are genetically modified to recognize specific tumor proteins and to remain in an activated state (such as T cell receptor technology (“TCRs”), chimeric antigen receptor (“CAR”) T cells, or CAR-NK cells).

In ACT, immune cells are isolated from patients, donors or retrieved from allogeneic immune cell banks. The immune cells are then expanded and modified before being returned and used to treat the patient. We believe our INTASYL™ compounds are ideally suited to be used in combination with ACT, in order to make these immune cells more effective.

Our approach to immunotherapy builds on well-established methodologies of ACT and involves the treatment of immune cells with our INTASYL™ compounds while they are grown in the lab and before administering them to the patient. Because our INTASYL™ compounds do not require a delivery vehicle to penetrate into the cells, we are able to enhance the function of these cells (for example, by inhibiting the expression of immune checkpoint genes) by merely adding our INTASYL™ compounds during the expansion process and without the need for genetic engineering. After enhancing these cells ex vivo, they are returned to the patient for treatment.

Our method introduces an important step in the ex vivo processing of immune cells. This step uses our INTASYL™ technology to reduce or eliminate the expression of genes that make the immune cells less effective. For example, with our INTASYL™ compounds, we can reduce the expression of immunosuppressive receptors or proteins by the therapeutic immune cells, potentially enabling them to overcome tumor resistance mechanisms and thus improving their ability to destroy the tumor cells. In various types of immune cells tested to date, INTASYL™ treatment results in potent silencing while maintaining close to 100% transfection efficiency and nearly full cell viability.

One of the main issues with ACT is that the cells are very susceptible to the cancer signals that turn down the immune response and continuous activation of these cells causes them to become exhausted. These factors, among others, may reduce their efficacy and lifespan. A technology that can reprogram the immune cells used in ACT, such as with INTASYL™ technology, is of key interest now in the current immuno-oncology world. In comparison to other technologies available, reprogramming cells with INTASYL™ does not require genetic engineering, its use is not limited to specific cell types and can be easily integrated with cell manufacturing approaches.

| 4 |

We currently have two product candidates that are being developed for use in ACT, PH-762 and PH-804. PH-762, our most advanced program and lead pipeline compound, targets the checkpoint protein PD-1, a checkpoint protein on immune cells. PD-1 normally acts as a type of “off switch” that helps keep the T cells from attacking other cells in the body. T cells are immune cells that protect the body from cancer cells and are important for the activation of immune cells to fight infection. Our second pipeline compound, PH-804, targets the suppressive immune receptor TIGIT, which is a checkpoint protein present on T cells and NK cells.

Data developed in-house and with our collaborators, which include both leading academic centers and corporate institutions, has shown that PH-762 can elicit PD-1 checkpoint blockade by silencing PD-1 receptor expression resulting in enhanced T cell activation and tumor cytotoxicity. We have also shown with studies completed with our collaborators that PH-804 can silence the expression of TIGIT in NK cells and T cells, overcoming their exhaustion and thereby becoming “weaponized.”

Recent data shown by the Company as well as with our collaborators, Iovance Biotherapeutics, Inc. and the Karolinska Institutet, at the 2019 Society for Immunotherapy of Cancer annual meeting further supports the application of INTASYL™ technology in immunotherapy of cancer. PH-762 has shown to silence the expression of checkpoint molecule PD-1 in target human T cells in a potent and durable manner suitable for both ACT and intra-tumoral injection, and increases function of patient derived TILs for ACT. The application of INTASYL™ compounds to novel immuno-oncology targets was shown by the silencing of BRD4, a regulator of gene expression impacting cell differentiation and function, by a BRD4 targeting INTASYL™ compound in human T cells during expansion for ACT, which has the potential to confer superior anti-tumor activity.

We expect that PH-762 can be ready to enter into the clinic with a partner in ACT therapy in the second half of 2020 and we are developing PH-804 with the aim to enter the clinic with a partner in ACT in 2021.

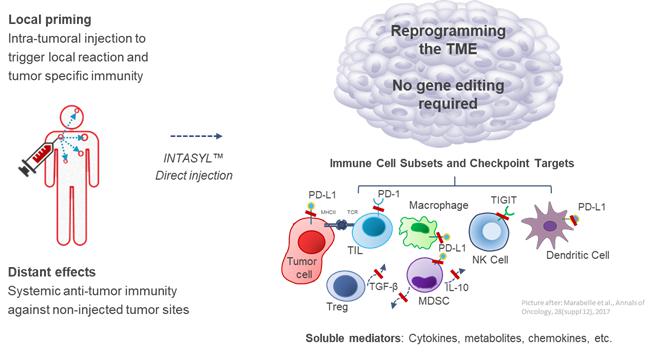

Tumor Micro-Environment

The TME is the environment that surrounds and feeds a tumor, including normal cells, blood vessels, immune cells and the extracellular matrix. A tumor can change the microenvironment and the microenvironment can affect how a tumor grows and spreads and can create an immunosuppressive microenvironment that inhibits the immune system’s natural ability to recognize and destroy tumor cells. This attracts immunosuppressive cells, induces and activates immune checkpoint expression and excludes and exhausts T cells. Reprogramming different components of the TME may overcome its resistance to immunotherapy.

Such reprogramming of the TME by INTASYL™ compounds through direct local administration into the tumor, could potentially become an important form of (neo)adjuvant therapy. We believe that this will also show that our contributions with our INTASYL™ compounds in immuno-oncology are not limited to use with a cell therapy platform. Additionally, the Company has shown in a clinical setting that its INTASYL™ compounds are safe and well-tolerated following local administration.

| 5 |

Our INTASYL™ compounds being developed for use in ACT, are also being developed for use directly towards the TME, including PH-762 and PH-804. We are also working on other relevant compounds for TME targets, such as PH-790, an INTASYL™ compound targeting PD-L1. PD-L1 is a protein that keeps immune cells from attacking nonharmful cells in the body. If cancer cells have large amounts of PD-L1, this “tricks” the immune system into not recognizing and attacking the tumor. Our approach with PH-790 is to block the PD-L1 protein, which may prevent cancer cells from inactivating T cells and attack the cancer.

Our collaborative research agreement with Gustave Roussy, a leading comprehensive cancer center in France, concentrates on determining the feasibility of our INTASYL™ platform to target the TME via intra-tumoral injection. An in vivo study completed with Gustave Roussy demonstrated that an INTASYL™ compound delivered via intra-tumoral injection showed silencing of gene expression with our INTASYL™ compounds with greater than 90% reduction of the target gene expression in a mouse model of melanoma.

Recent in vivo studies performed by the Company showed that intra-tumoral injections of a mouse version of PH-804 reduced the tumor growth in colorectal carcinoma tumor bearing mice, which was shown to be correlated with the silencing of TIGIT messenger RNA (“mRNA”) expression and an increase in cytotoxic effector T cells in the TME.

The Company expects to move PH-762 for intra-tumoral injection into the clinical development stage in 2021.

| 6 |

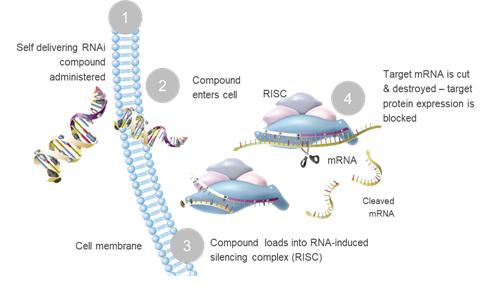

Our INTASYL™ Platform

Diseases are often related to the wrong protein being made, excessive amounts of a specific protein being made, or the correct protein being made but at the wrong location or time. Overall, RNA is involved in the synthesis, regulation and processing of proteins. RNA interference (“RNAi’) is a biological process in which RNA molecules inhibit gene expression or translation into proteins by preventing certain RNA from being read. RNAi offers a novel approach to the drug development process because RNAi compounds can potentially be designed to target any one of the thousands of human genes, many of which are “undruggable” by other modalities. Supported by numerous gene-silencing reports and our own research, we believe that this sequence information can be used to design RNAi compounds to interfere with the expression of almost any specific gene.

The first design of RNAi compounds to be pursued for the development of human therapeutics were short, double-stranded RNAs that included limited modifications, known as small-interfering RNA (“siRNA”). Since the initial discovery of RNAi, drug delivery has been the primary challenge in developing RNAi-based therapeutics. One conventional solution to the delivery problem involves encapsulation of siRNA into a lipid-based particle, such as a liposome, to improve circulation time and cellular uptake. We have developed an alternative approach where delivery and drug-like properties are built directly into the RNAi compound itself. These novel compounds are termed self-delivering RNAi compounds, or INTASYL™.

Our INTASYL™ compounds are hybrid oligonucleotide compounds that the Company believes combines the beneficial properties of both conventional RNAi and antisense technologies. Traditional, single-stranded antisense compounds have favorable tissue distribution and cellular uptake properties. However, they do not have the intracellular potency that is a hallmark of double-stranded RNAi compounds. Conversely, the duplex structure and hydrophilic character of traditional RNAi compounds results in poor tissue distribution and cellular uptake. In an attempt to combine the best properties of both technologies, INTASYL™ compounds have a single-stranded phosphorothioate region, a short duplex region, and contain a variety of nuclease-stabilizing and lipophilic chemical modifications. The combination of these features allows INTASYL™ compounds to achieve efficient spontaneous cellular uptake and potent, long-lasting intracellular activity.

| 7 |

We believe that our next generation INTASYL™ compounds offer significant advantages over siRNAs used by other companies developing RNAi therapeutics, which are highlighted by the following characteristics:

| · | Efficient cellular uptake in the absence of a delivery vehicle; |

| · | Potent RNAi activity; |

| · | More resistant to nuclease degradation than unmodified oligonucleotides; |

| · | Ability to suppress long non-coding RNAs, both in cytoplasm and the nucleus; |

| · | Readily manufactured; |

| · | Potentially more specific for the target gene; and |

| · | Reduced immune side effects compared to classic siRNA. |

The route by which our INTASYL™ compounds are brought into contact with the body depends on the intended organ or tissue to be treated. Delivery routes can be simplified into two major categories: (1) local, or when a drug is delivered directly to the tissue of interest, and (2) systemic, when a drug accesses the tissue of interest through the circulatory system. The key to therapeutic success with RNAi lies in delivering intact RNAi compounds to the target tissue and the interior of the target cells. To accomplish this, our chemically synthesized INTASYL™ compounds are optimized for stability and efficacy and have unique properties that improve tissue and cell uptake.

Intellectual Property

We protect our proprietary information by means of United States and foreign patents, trademarks and copyrights. In addition, we rely upon trade secret protection and contractual arrangements to protect certain of our proprietary information and products. We have pending patent applications that relate to potential drug targets, compounds we are developing to modulate those targets, methods of making or using those compounds and proprietary elements of our drug discovery platform.

Much of our technology and many of our processes depend upon the knowledge, experience and skills of key scientific and technical personnel. To protect our rights to our proprietary know-how and technology, we require all employees, as well as our consultants and advisors when feasible, to enter into confidentiality agreements that require disclosure and assignment to us of ideas, developments, discoveries and inventions made by these employees, consultants and advisors in the course of their service to us, and we vigorously defend that position with partners, as well as with employees who leave the Company.

We have also obtained rights to various patents and patent applications under licenses with third parties, which require us to pay royalties, milestone payments, or both. The degree of patent protection for biotechnology products and processes, including ours, remains uncertain, both in the United States and in other important markets, because the scope of protection depends on decisions of patent offices, courts and lawmakers in these countries. There is no certainty that our existing patents or others, if obtained, will afford us substantial protection or commercial benefit. Similarly, there is no assurance that our pending patent applications or patent applications licensed from third parties will ultimately be granted as patents or that those patents that have been issued or are issued in the future will stand if they are challenged in court. We assess our license agreements on an ongoing basis and may from time to time terminate licenses to technology that we do not intend to employ in our technology platforms, or in our product discovery or development activities.

| 8 |

Patents and Patent Applications

We are actively seeking protection for our intellectual property and are prosecuting a number of patents and pending patent applications covering our compounds and technologies. A combined summary of these patents and patent applications is set forth below in the following table:

| | Pending Applications | Issued Patents | ||||||

| United States | 24 | 41 | ||||||

| Canada | 10 | 4 | ||||||

| Europe | 14 | 45 | ||||||

| Japan | 12 | 13 | ||||||

| Other Markets | 16 | 9 |

Our portfolio includes 112 issued patents, 45 of which cover our INTASYL™ platform. There are 16 patent families broadly covering both the composition and methods of use of our self-delivering platform technology and uses of our INTASYL™ compounds targeting immune checkpoint, cellular differentiation and metabolism targets for ex vivo cell-based cancer immunotherapies. These patents are scheduled to expire between 2029 and 2038. Furthermore, there are 71 patent applications, encompassing what we believe to be important new RNAi compounds and their use as therapeutics, chemical modifications of RNAi compounds that improve the compounds’ suitability for therapeutic uses (including delivery) and compounds directed to specific targets (i.e., that address specific disease states). The patents and any patents that may issue from these pending patent applications will, if issued, be set to expire between 2022 and 2038, not including any patent term extensions that may be afforded under the Federal Food, Drug, and Cosmetic Act (“FFDCA”) (and the equivalent provisions in foreign jurisdictions) for any delays incurred during the regulatory approval process relating to human drug products (or processes for making or using human drug products).

Option and License Agreements

Medigene AG and the Helmholtz Zentrum München. On March 6, 2020, we entered into a Collaboration and Option Agreement (the “Collaboration Agreement”) with Medigene AG and the Helmholtz Zentrum München (“HMGU”). The Collaboration Agreement expands upon the Company’s outstanding research agreement with HMGU to design and develop novel candidates for the use of INTASYL™ compounds in ACT to enhance immune cell function. Under the Collaboration Agreement, Medigene will contribute expertise regarding clinical development, as well as proprietary research material, and has an option to an exclusive license for the clinical and/or commercial exploitation of the potential immune cell enhancers against certain fee payments.

We have secured exclusive and non-exclusive rights to develop therapeutics by licensing key RNAi technologies and patent rights from third parties. These rights relate to chemistry and configuration of compounds, delivery technologies of compounds to cells and therapeutic targets. As we continue to develop our own proprietary compounds, we continue to evaluate both our in-licensed portfolio as well as the field for new technologies that could be in-licensed to further enhance our intellectual property portfolio and unique position in the RNAi and immuno-oncology space.

Advirna LLC. In September 2011, we entered into an agreement with Advirna, LLC (“Advirna”) pursuant to which Advirna assigned to us its existing patent and technology rights related to the INTASYL™ technology in exchange for our agreement to issue to Advirna common stock equal to 5% of the Company’s fully-diluted shares, pay an annual maintenance fee of $100,000 and pay a one-time milestone payment of $350,000 upon the issuance of the first patent with valid claims covering the assigned technology. The common shares of the Company were issued to Advirna in 2012 upon the completion of the spin-out from our former parent company and the one-time milestone payment was paid in 2014. Additionally, we will be required to pay a 1% royalty to Advirna on any license revenue received by us with respect to future licensing of the assigned Advirna patent and technology rights. To date, royalties owed to Advirna under the agreement have been minimal. We also granted back to Advirna a license under the assigned patent and technology rights for fields of use outside human therapeutics and diagnostics.

Our rights under the Advirna agreement will expire upon the later of: (i) the expiration of the last-to-expire of the “patent rights” (as defined therein) or (ii) the abandonment of the last-to-be abandoned of such patents, unless earlier terminated in accordance with the provisions of the agreement.

| 9 |

We may terminate the Advirna agreement at any time upon 90 days’ written notice to Advirna, and Advirna may terminate the agreement upon 90 days’ prior written notice in the event that we cease using commercially reasonable efforts to research, develop, license or otherwise commercialize the patent rights or “royalty-bearing products” (as defined therein), provided that we may refute such claim within such 90-day period by showing budgeted expenditures for the research, development, licensing or other commercialization consistent with other technologies of similar stage of development and commercial potential as the patent rights or royalty-bearing products. Further, either party at any time may provide to the other party written notice of a material breach of the agreement. If the other party fails to cure the identified breach within 90 days after the date of the notice, the aggrieved party may terminate the agreement by written notice to the party in breach.

Legacy Dermatology and Ophthalmology Programs

In January 2018, the Company announced that it was exploring strategic alternatives, including a potential sale or out-license, with respect to the Company’s legacy dermatology and ophthalmology programs following the Company’s change in strategic direction to focus solely on immuno-oncology. Due to resource constraints, the Company has significantly reduced its efforts to out-license or sell these programs and does not expect to provide further updates on these assets going forward.

Research and Development

Our research and development expense primarily consists of compensation and benefits for research and development personnel, facility-related expenses, supplies, external services, costs to acquire technology licenses, expenses associated with preclinical and clinical development activities and other operating costs.

Total research and development expense for the years ended December 31, 2019 and 2018 was $4,300,000 and $4,326,000, respectively.

Competition

The biotechnology and pharmaceutical industries, including the immuno-oncology field, are a constantly evolving landscape with rapidly advancing technologies and significant competition. There are a number of competitors in the immuno-oncology field including large and small pharmaceutical and biotechnology companies, academic institutions, government agencies and other private and public research organizations.

A variety of cell-based autologous and allogeneic approaches are being researched and developed, including but not limited to: CAR-T cells, TCR-T cells, Gamma Delta T cells, CAR-NK cells, NK cells, NKT cells and cytotoxic T cells. We believe that competitors in this field include, but are not limited to: Adicet Bio, Inc., Allogene Therapeutics, Inc., Atara Biotherapeutics, Inc., Autolus Therapeutics plc, Baylor College of Medicine, Bellicum Pharmaceuticals, Inc., bluebird bio, Inc., Celyad S.A., Celgene Corporation, Cell Medica Ltd., Cellectis S.A., Celularity, Inc., CiMaas B.V., CRISPR Therapeutics AG, Fate Therapeutics, Inc., Formula Therapeutics, Inc., Fortress Biotech, Inc., GAIA Biomedicine Inc., Glycostem Therapeutics BV, Immatics Biotechnologies GmbH, Iovance Biotherapeutics, Inc., Intrexon Corporation, Janssen Biotech, Inc., Kite Pharma, Inc.(a Gilead company), Medigene AG, Mustang Bio, Inc., NantKwest, Inc., BioNTech NE, Novartis International AG, Precigen, Inc., Refuge Biotechnologies, Inc., Sorrento Therapeutics, Inc., Tactiva Therapeutics, Inc., TC BioPharm Limited and Ziopharm Oncology, Inc.

A number of technological approaches to modulating gene expression in the field of immuno-oncology have been identified and are being researched and developed, including but not limited to: antisense oligodeoxynucleotides, RNAi, zinc-finger nucleases, transcription activator-like effector nucleases, mRNA, and genetic engineering techniques such as clustered regularly interspaced short palindromic repeats, or CRISPR, and various others. We believe that competitors in this field include, but are not limited to: BioNTech NE, Cellectis S.A., CRISPR Therapeutics AG, Dicerna Pharmaceuticals, Inc., Editas Medicine, Inc., eTheRna immunotherapies NV, Horizon Discovery Group plc, Intellia Therapeutics, Inc., Kymera Therapeutics Inc., miRagen Therapeutics, Inc., Moderna, Inc., Noxxon Pharma N.V., Obsidian Therapeutics, Inc., OliPass Corporation, OncoSec Medical Incorporated, Mateon Therapeutics, Inc., PTC Therapeutics, Inc., Sangamo Therapeutics, Inc., Sirnaomics, Inc., Stemirna Therapeutics Co., Ltd. and Takara Bio Inc.

Government Regulation

The United States and many other countries extensively regulate the preclinical and clinical testing, manufacturing, labeling, storage, record-keeping, advertising, promotion, export, marketing and distribution of drugs and biologic products. The U.S. Food and Drug Administration (“FDA”) regulates pharmaceutical and biologic products under the FFDCA, the Public Health Service Act and other federal statutes and regulations.

| 10 |

To obtain approval of our future product candidates from the FDA, we must, among other requirements, submit data supporting safety and efficacy for the intended indication as well as detailed information on the manufacture and composition of the product candidate. In most cases, this will require extensive laboratory tests and preclinical and clinical trials. The collection of these data, as well as the preparation of applications for review by the FDA involve significant time and expense. The FDA also may require post-marketing testing to monitor the safety and efficacy of approved products or place conditions on any approvals that could restrict the therapeutic claims and commercial applications of these products. Regulatory authorities may withdraw product approvals if we fail to comply with regulatory standards or if we encounter problems at any time following initial marketing of our products.

The first stage of the FDA approval process for a new biologic or drug involves completion of preclinical studies and the submission of the results of these studies to the FDA. These data, together with proposed clinical protocols, manufacturing information, analytical data and other information submitted to the FDA in an investigational new drug (“IND”) application, must become effective before human clinical trials may commence. Preclinical studies generally involve FDA regulated laboratory evaluation of product characteristics and animal studies to assess the efficacy and safety of the product candidate.

After the IND becomes effective, a company may commence human clinical trials. These are typically conducted in three sequential phases, but the phases may overlap. Phase 1 trials consist of testing the product candidate in a small number of patients or healthy volunteers, primarily for safety at one or more doses. Phase 2 trials, in addition to safety, evaluate the efficacy of the product candidate in a patient population somewhat larger than Phase 1 trials. Phase 3 trials typically involve additional testing for safety and clinical efficacy in an expanded population at multiple test sites. A company must submit to the FDA a clinical protocol, accompanied by the approval of the Institutional Review Board (“IRB”) at the institutions participating in the trials, prior to commencement of each clinical trial.

To obtain FDA marketing authorization, a company must submit to the FDA the results of the preclinical and clinical testing, together with, among other things, detailed information on the manufacture and composition of the product candidate, in the form of a new drug application (“NDA”), or, in the case of a biologic, a biologics license application (“BLA”).

The amount of time taken by the FDA for approval of an NDA or BLA will depend upon a number of factors, including whether the product candidate has received priority review, the quality of the submission and studies presented, the potential contribution that the compound will make in improving the treatment of the disease in question and the workload at the FDA.

The FDA may, in some cases, confer upon an investigational product the status of a fast track product. A fast track product is defined as a new drug or biologic intended for the treatment of a serious or life-threatening condition that demonstrates the potential to address unmet medical needs for this condition. The FDA can base approval of an NDA or BLA for a fast track product on an effect on a surrogate endpoint, or on another endpoint that is reasonably likely to predict clinical benefit. If a preliminary review of clinical data suggests that a fast track product may be effective, the FDA may initiate review of entire sections of a marketing application for a fast track product before the sponsor completes the application.

We anticipate that our products will be manufactured by our strategic partners, licensees or other third parties. Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is manufactured and will not approve the product unless the manufacturing facilities are in compliance with the FDA’s current good manufacturing practice regulations (“cGMP”), which are regulations that govern the manufacture, holding and distribution of a product. Manufacturers of biologics also must comply with the FDA’s general biological product standards. Our manufacturers also will be subject to regulation under the Occupational Safety and Health Act, the Nuclear Energy and Radiation Control Act, the Toxic Substance Control Act and the Resource Conservation and Recovery Act and other applicable environmental statutes. Following approval, the FDA periodically inspects drug and biologic manufacturing facilities to ensure continued compliance with the cGMP. Our manufacturers will have to continue to comply with those requirements. Failure to comply with these requirements subjects the manufacturer to possible legal or regulatory action, such as suspension of manufacturing or recall or seizure of product. Adverse patient experiences with the product must be reported to the FDA and could result in the imposition of marketing restrictions through labeling changes or market removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

| 11 |

The labeling, advertising, promotion, marketing and distribution of a drug or biologic product also must be in compliance with FDA and Federal Trade Commission requirements which include, among others, standards and regulations for off-label promotion, industry sponsored scientific and educational activities, promotional activities involving the internet, and direct-to-consumer advertising. We also will be subject to a variety of federal, state and local regulations relating to the use, handling, storage and disposal of hazardous materials, including chemicals and radioactive and biological materials. In addition, we will be subject to various laws and regulations governing laboratory practices and the experimental use of animals. In each of these areas, as above, the FDA has broad regulatory and enforcement powers, including the ability to levy fines and civil penalties, suspend or delay issuance of product approvals, seize or recall products and deny or withdraw approvals.

We will also be subject to a variety of regulations governing clinical trials and sales of our products outside the United States. Whether or not FDA approval has been obtained, approval of a product candidate by the comparable regulatory authorities of foreign countries and regions must be obtained prior to the commencement of marketing the product in those countries. The approval process varies from one regulatory authority to another and the time may be longer or shorter than that required for FDA approval. In the European Union, Canada and Australia, regulatory requirements and approval processes are similar, in principle, to those in the United States.

Environmental Compliance

Our research and development activities involve the controlled use of potentially harmful biological materials as well as hazardous materials, chemicals and various radioactive compounds. We are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specific waste products. We are also subject to numerous environmental, health and workplace safety laws and regulations, including those governing laboratory procedures, exposure to blood-borne pathogens and the handling of bio-hazardous materials. The cost of compliance with these laws and regulations could be significant and may adversely affect capital expenditures to the extent we are required to procure expensive capital equipment to meet regulatory requirements.

Employees

As of March 20, 2020, we had eleven full-time employees. None of our employees are represented by a labor union or covered by a collective bargaining agreement nor have we experienced any work stoppages.

Corporate Information

On January 10, 2020, the Board of Directors of the Company approved a 1-for-55 reverse stock split of the Company’s outstanding common stock, which was effected on January 15, 2020. All share and per share amounts have been adjusted to give effect to the reverse stock split.

We were incorporated in the state of Delaware in 2011 as RXi Pharmaceuticals Corporation. On November 19, 2018, the Company changed its name to Phio Pharmaceuticals Corp., to reflect its transition from a platform company to one that is fully committed to developing groundbreaking immuno-oncology therapeutics. Our executive offices are located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752, and our telephone number is (508) 767-3861.

The Company’s website address is http://www.phiopharma.com. We make available on our website, free of charge, copies of our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) as soon as reasonably practicable after these reports are filed electronically with, or otherwise furnished to, the Securities and Exchange Commission (the “SEC”). We also make available on our website the charters of our audit committee, compensation committee and nominating and corporate governance committee, as well as our corporate code of ethics and conduct.

You may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding Phio and other issuers that file electronically with the SEC. The SEC’s website address is http://www.sec.gov. The contents of these websites are not incorporated by reference into this report and should not be considered to be part of this report.

| 12 |

| ITEM 1A. | RISK FACTORS |

Risks Relating to Our Business and Industry

Our business and operations may be materially and adversely affected by the recent coronavirus outbreak.

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China and has since spread to other parts of the world, including the United States and Europe. In March 2020, the World Health Organization declared the outbreak a pandemic. The coronavirus pandemic is affecting the United States and global economies. If the outbreak continues to spread, it may affect the Company’s operations and those of third parties on which the Company relies, including causing disruptions in the supply of the Company’s product candidates and the conduct of current and planned preclinical and clinical studies. We may need to limit operations or implement limitations, and may experience limitations in employee resources. There are risks that it may be more difficult to contain if the outbreak reaches a larger population or broader geography, in which case the risks described herein could be elevated significantly. The extent to which the coronavirus impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

Additionally, while the potential economic impact brought by, and the duration of, the coronavirus pandemic is difficult to assess or predict, the impact of the coronavirus on the global financial markets may reduce the Company’s ability to access capital, which could negatively impact the Company’s short-term and long-term liquidity and the Company’s ability to complete its preclinical studies on a timely basis, or at all. For instance, our preclinical and clinical may be temporarily delayed or paused, and the operations of our contracted third parties may be significantly delayed as well. The ultimate impact of coronavirus is highly uncertain and subject to change. The Company does not yet know the full extent of potential delays or impacts on its business, financing or preclinical and clinical trial activities or the global economy as a whole. However, these effects could have a material impact on the Company’s liquidity, capital resources, operations and business and those of the third parties on which we rely.

Our product candidates are in an early stage of development and may fail or experience significant delays or may never advance to the clinic, which may materially and adversely impact our business.

All of our pipeline programs are in preclinical development and our future success heavily depends on the successful development of our INTASYL™ product candidates, which may never occur. These product candidates could be delayed, not advance into the clinic or unexpectedly fail at any stage of development. Before we can commence clinical trials for a product candidate, we must conduct extensive preclinical and other non-clinical tests in order to support an IND application, including IND-enabling good laboratory practice (“GLP”) toxicology studies, in the United States or their equivalents with regulatory authorities in other jurisdictions. Preclinical studies and clinical trials are expensive, difficult to design and can take many years. There is no assurance that we will be able to successfully develop our product candidates, and we may focus our efforts and resources on product candidates that may prove to be unsuccessful.

We cannot be certain of the outcome of preclinical testing and clinical studies and results from these studies may not predict the results that will be obtained in later phase trials of our product candidates. Even if we are able to complete our preclinical studies and planned clinical trials in line with our projected timelines, results from such studies and trials may be not replicated in subsequent preclinical studies or clinical trial results. Additionally, such studies may be delayed due to events beyond our control including as a result of natural disasters, epidemics or pandemic outbreaks such as the novel coronavirus. Further, the FDA, or equivalent regulatory authority, may not accept the results of our preclinical studies or proposed clinical study designs and may require the Company to complete additional preclinical studies or impose stricter approval conditions than we expect. As a result, we cannot guarantee that we will be able to submit INDs, or similar applications, within our projected timelines, if at all, or that the FDA, or similar regulatory authorities, will allow us to commence clinical trials.

We are dependent on collaboration partners for the successful development of our adoptive cell therapy product candidates.

We are not a cell company and expect to depend on third-party collaborators to support the clinical development of our ACT product candidates. We have entered into research agreements with our academic and industry collaborators, each of which is terminable by the relevant party at any time, subject to applicable notice periods. We may not be successful in negotiating agreements with these collaborators to continue the development and commercialization of our ACT product candidates through collaborations such as joint development or licensing agreements. Our ability to successfully negotiate such agreements will depend on, among other things, potential partners’ evaluation of the superiority of our technology over competing technologies, the quality of preclinical data that we have generated, the perceived risks specific to developing our product candidates and our partners’ own strategic and corporate objectives. If we fail to negotiate these agreements, we may not be able commence clinical trials with our ACT product candidates or we may be required to obtain licenses from third-party cell companies and our business, financial condition, results of operations and prospects could be materially and adversely affected.

| 13 |

We rely upon third-party relationships to conduct preclinical studies, and any future clinical trials, for our product candidates and may not be able to establish or maintain the third-party relationships that are necessary to support their development.

We depend upon third-party contract research organizations (“CROs”), medical institutions, clinical investigators, consultants and other third parties to support our preclinical research efforts such as through managing and conducting research studies, formulating our product candidates and manufacturing our product candidates and expect to rely on the same for our future clinical trials. Because we rely on these third parties, we cannot necessarily control the timing, quality of work or amount of resources that our contract partners will devote to these activities and we cannot guarantee that these parties will fulfill their obligations to us under these arrangements. Furthermore, we compete with many other companies for the resources of these third parties, some of which may be our competitors, and may detract from our programs. Additionally, our contracted CROs and other third parties we rely upon may be impacted by the coronavirus outbreak, resulting in delays or interruptions, If these third parties do not successfully carry out their responsibilities, as well as within a timely fashion, our preclinical and clinical development may be delayed, unsuccessful or otherwise adversely affected.

We cannot guarantee that we will be able to successfully negotiate agreements with or maintain relationships with these third parties on favorable terms, if at all. If we are unable to obtain or maintain these agreements, we may not be able to develop, formulate, manufacture, obtain regulatory approval(s) or commercialize our product candidates. The third parties whom we rely on generally may terminate their agreements with us at any time, subject to applicable notice periods, and we may not be able to readily terminate any such agreements with contract partners even if such partners do not fulfill their obligations to us. If we have to enter into alternative arrangements it may delay or adversely affect the development of our product candidates and our business operations.

We rely upon third parties for the manufacture of our product candidates.

We rely on third party suppliers and manufacturers to provide us with the materials and services to manufacture our INTASYL™ compounds and product candidates for certain of our preclinical research and expect that we will rely on them for our future clinical trials. While we do have in-house expertise and capacity to manufacture our INTASYL™ compounds, we do not own or lease manufacturing facilities or have our own supply source for the required materials. Accordingly, we will be dependent upon third party suppliers and our contract manufacturers to obtain supplies, and we will need to either develop, contract for, or otherwise arrange for the necessary manufacturers for these supplies. If for any reason we are unable to obtain the supplies for our INTASYL™ compounds from our current manufacturer, we would have to seek to obtain it from another major manufacturer. There is no assurance that we will be able to timely secure needed supply arrangements on satisfactory terms, or at all.

Although we have used multiple contract manufacturers, we currently contract with only one manufacturer for the supply of our clinical product candidates. There is no assurance that our supply of our clinical drug product will not be limited, interrupted, of satisfactory quality or be available at acceptable prices. If for any reason we are unable to obtain the clinical supply of our product candidates from our current manufacturer, we would have to seek to contract with another major manufacturer. While we believe that we currently have sufficient supply of our PH-762 product candidate for our planned preclinical and clinical studies, some of our other product candidates or the materials contained therein, may come from facilities in areas impacted by the coronavirus, which may result in delays or shortages due to ongoing efforts to address the outbreak. Our failure to secure these arrangements as needed could have a material adverse effect on our ability to complete the development of our clinical product candidates or, if we obtain regulatory approval, to commercialize them.

The FDA, or equivalent regulatory authority, governs the manufacturing process for product candidates and will inspect the facilities at which the product manufactured. Approval of the product will not occur unless the manufacturing facilities are in compliance with the FDA’s cGMP regulations, or equivalent foreign authority. If our suppliers or manufacturers do not comply with the FDA or foreign regulations for our product candidates, we may experience delays in timing or supply, be forced to manufacture our product candidates ourselves or seek to enter contract with another supplier or manufacturer. If we are required to switch suppliers or manufacturers, we will be required to verify that the new supplier or manufacturer maintains facilities and processes in line with cGMP regulations, which may result in delays, additional expenses, and may have a material adverse effect on our ability to complete the development of our product candidates.

| 14 |

Natural disasters, epidemic or pandemic disease outbreaks, trade wars, political unrest or other events could disrupt our business or operations or those of our development partners, manufacturers, regulators or other third parties with whom we conduct business now or in the future.

A wide variety of events beyond our control, including natural disasters, epidemic or pandemic disease outbreaks (such as the recent novel coronavirus outbreak), trade wars, political unrest or other events could disrupt our business or operations or those of our manufacturers, regulatory authorities, or other third parties with whom we conduct business. These events may cause businesses and government agencies to be shut down, supply chains to be interrupted, slowed, or rendered inoperable, and individuals to become ill, quarantined, or otherwise unable to work and/or travel due to health reasons or governmental restrictions. For example, Massachusetts recently ordered most businesses closed, mandating work-from-home arrangements, where feasible, in response to the coronavirus pandemic. These limitations could negatively affect our business operations and continuity, and could negatively impact our development timelines and ability to timely perform basic business functions, including making SEC filings and preparing financial reports. If our operations or those of third parties with whom we have business are impaired or curtailed as a result of these events, the development and commercialization of our products and product candidates could be impaired or halted, which could have a material adverse impact on our business.

The approach we are taking to discover and develop novel therapeutics using RNAi may never lead to marketable products.

Our research and development efforts and our future success is based on our INTASYL™ technology platform. We plan to develop our INTASYL™ products for the treatment of cancer to be delivered via direct injection for use intratumorally and with ACT by isolating immune cells from patients, treating the cells ex vivo and then returning them to the patient for treatment. We believe that our INTASYL™ compounds may offer a new treatment option to current standards of care, such as antibodies, and potentially with a more cost-effective approach. Successful development of our INTASYL™ compounds by us, or by our collaborative partners, is highly uncertain and depends on a number of factors, many of which are beyond our control. The scientific research used to support our efforts and approach to developing RNAi therapeutics is limited. Decisions made by the Company to advance the development of our pipeline, including those related to our technology or manufacturing processes, may show to be incorrect based on further work by us or our collaborators.

The use of RNAi is a relatively new scientific discovery and the scientific evidence to support the feasibility of developing drugs based on these discoveries, or INTASYL™, is limited. Therefore, it is difficult to accurately predict challenges we may face with our product candidates as they move through the discovery, preclinical and clinical development stages. We may spend large amounts of money trying to develop our INTASYL™ technology and may never succeed in doing so. In addition, our research methodology by be unsuccessful in identifying product candidates and results from preclinical and clinical studies may not predict the results that will be obtained in later phase trials of our product candidates or our product candidates may interact with patients in unforeseen or harmful ways that may make it impractical to manufacture, market or receive regulatory approval. If we are not successful in bringing an INTASYL™ product candidate to market, it could negatively impact our business and financial condition and we may not be able to identify and successfully implement an alternative product development strategy.

A number of different factors could prevent us from advancing into clinical development, obtaining regulatory approval, and ultimately commercializing our product candidates on a timely basis, or at all.

Before obtaining regulatory approval for the sale of any drug candidate, we must conduct extensive preclinical tests and successful clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Before human clinical trials may commence, we must submit to the FDA an IND application. An IND application involves the completion of preclinical studies and the submission of the results, together with proposed clinical protocols, manufacturing information, analytical data and other data in the IND submission. The FDA may require us to complete additional preclinical studies or disagree with our clinical trial study design. Also, animal models may not exist for some of the disease areas we choose to develop our INTASYL™ product candidates for. As a result, our clinical trials may be delayed or we may be required to incur more expense than we anticipated.

Clinical trials require the review and oversight of IRBs, which approve and continually review clinical investigations and protect the rights and welfare of human subjects. Before our clinical trials can begin, we must also submit to the FDA a clinical protocol accompanied by the approval of the IRB at the institution(s) participating in the clinical trial. An inability or delay in obtaining IRB approval could prevent or delay the initiation and completion of our clinical trials, and the FDA may decide not to consider any data or information derived from a clinical investigation not subject to initial and continuing IRB review and approval.

Clinical trials of a new drug candidate require the enrollment of a sufficient number of subjects, including subjects who are suffering from the disease or condition the drug candidate is intended to treat and who meet other eligibility criteria. Rates of subject enrollment are affected by many factors, and delays in subject enrollment can result in increased costs and longer development times.

| 15 |

Clinical testing is lengthy and expensive, and its outcome is highly uncertain. Historical failure rates are high due to number of factors, such as safety and efficacy of drug candidates. We, our collaborators, the FDA, or an IRB may suspend clinical trials of a drug candidate at any time for various reasons, including if we or they believe the subjects participating in such trials are being exposed to unacceptable health risks. Among other reasons, adverse side effects of a drug candidate on subjects in a clinical trial could result in the FDA or other regulatory authorities suspending or terminating the trial and refusing to approve a particular drug candidate for any or all indications of use.

An additional number of factors could affect the timing, cost or outcome of our drug development efforts, including the following:

| · | Delays in filing or acceptance of initial drug applications for our product candidates; |

| · | Difficulty in securing centers to conduct clinical trials; |

| · | Conditions imposed on us by the FDA or comparable foreign authorities regarding the scope or design of our clinical trials; |

| · | Problems in engaging IRBs to oversee trials or problems in obtaining or maintaining IRB approval of studies; |

| · | Difficulty in enrolling subjects in conformity with required protocols or projected timelines; |

| · | Third-party contractors failing to comply with regulatory requirements or to meet their contractual obligations to us in a timely manner; |

| · | Our drug candidates having unexpected and different chemical and pharmacological properties in humans than in laboratory testing and interacting with human biological systems in unforeseen, ineffective or harmful ways; |

| · | The need to suspend or terminate clinical trials if the participants are being exposed to unacceptable health risks; |

| · | Insufficient or inadequate supply or quality of our drug candidates or other necessary materials necessary to conduct our clinical trials; |

| · | Effects of our drug candidates not having the desired effects or including undesirable side effects or the drug candidates having other unexpected characteristics; |

| · | The cost of our clinical trials being greater than we anticipate; |

| · | Negative or inconclusive results from our clinical trials or the clinical trials of others for similar drug candidates or inability to generate statistically significant data confirming the efficacy of the product being tested; |

| · | Changes in the FDA’s requirements for testing during the course of that testing; |

| · | The impact from the recent coronavirus outbreak; |

| · | Reallocation of our limited financial and other resources to other clinical programs; and |

| · | Adverse results obtained by other companies developing similar drugs. |

A failure of any preclinical study or clinical trial can occur at any stage of testing. The results of preclinical and initial clinical testing of these products may not necessarily indicate the results that will be obtained from later or more extensive testing. Preliminary observations made in early stages of clinical trials with small numbers of subjects are inherently uncertain and initial clinical trial results are not necessarily indicative of results that will be obtained when full data sets are analyzed or in subsequent clinical trials. Because of these factors, it is difficult to predict the time and cost of the development of our product candidates. Any delay or failure in obtaining required approvals may prevent us from completing our preclinical or clinical studies and could have a material adverse effect on our ability to initiate or commercialize any drug candidate on a timely basis, or at all.

| 16 |

We also are subject to numerous foreign regulatory requirements governing the conduct of clinical trials, manufacturing and marketing authorization, pricing and third-party reimbursement. The foreign regulatory approval process includes all of the risks associated with the FDA approval described above, as well as risks attributable to the satisfaction of local regulations in foreign jurisdictions. Approval by the FDA does not assure approval by regulatory authorities outside of the United States.

We are dependent on the success of our product candidates and even if we complete the necessary preclinical and clinical studies, we may not receive or be delayed in receiving regulatory approval and as a result, we will not be able to commercialize or will be delayed in commercializing our product candidates.

We have no commercial products and currently generate no revenue from product sales and may never be able to develop marketable products. The FDA or similar foreign governmental agencies must approve our products in development before they can be marketed. We, and any of our collaborators, must demonstrate and establish our product candidate’s safety, purity and effectiveness to patients through extensive clinical trials before we can submit an NDA or BLA to the FDA for approval. Even if we complete the necessary preclinical and clinical studies, it is possible that none of the product candidates that we may attempt to develop will obtain the appropriate regulatory approvals needed to begin selling them or they may be subject to limitations on the indicated uses for which we may market the product.

The process for obtaining FDA and other approval is both time consuming and costly, with no certainty of a successful outcome, and can often take years following the commencement of clinical trials, depending on the complexity of the drug candidate. Any analysis we perform of data from clinical activities is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. The FDA has substantial discretion in the approval process and may deny our application, may decide our data is insufficient or require additional information from us regarding our current or planned clinical trials at any time, and such information may be costly to provide or cause potentially significant delays in development. Any changes in marketing approval policies or regulatory statutes and regulations during product development, trials and the review process, may cause delays in the approval of an application. There is no assurance that we will be able to successfully develop any of our product candidates, and we may spend large amounts of money trying to resolve these issues and may never succeed in doing so.

We have no experience in filing the applications necessary to obtain marketing approval and expect that we and need to rely on CROs and regulatory consultants to assist us with this process. Regulatory approval also requires the submission about the product manufacturing process and inspection of the manufacturing facilities, to the relevant regulatory authority. Any product candidates we develop may not be effective, may prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude our obtaining marketing approval or prevent or limit commercial use.

If we experience delays or fail to obtain marketing approval for any of our product candidates that we may develop, we would be prevented from being able to commercialize our product candidates and our commercial prospects and ability to generate revenues may be materially impaired.

The FDA could impose a unique regulatory regime for our therapeutics.

The compounds we intend to develop may represent a new class of drug, and even though the first RNAi therapeutic was approved in August 2018, the FDA has not yet established any definitive policies, practices or guidelines in relation to these drugs. While we expect any product candidates that we develop will be regulated as a new drug under the Federal Food, Drug, and Cosmetic Act, the FDA could decide to regulate them or other products we may develop as biologics under the Public Health Service Act. The lack of policies, practices or guidelines may hinder or slow review by the FDA of any regulatory filings that we may submit. Moreover, the FDA may respond to these submissions by defining requirements that we may not have anticipated.

| 17 |

Even if we receive regulatory approval to market our product candidates, our product candidates may not be accepted commercially, which may prevent us from becoming profitable.

Even if we receive regulatory approval for a product candidate, we may not generate or sustain revenues from sales of the product. The product candidates that we are developing are based on new technologies and therapeutic approaches, which are largely unproven. Additionally, RNAi products do not readily cross the so-called blood brain barrier, are rapidly eliminated from circulating blood and, for various applications, are likely to require injection or implantation, which will make them less convenient to administer than drugs administered orally. Key participants in the pharmaceutical marketplace, such as physicians, medical professionals working in large reference laboratories, public health laboratories and hospitals, third-party payors and consumers may not accept products intended to improve therapeutic results based on our technologies. For example, RNAi products may be more expensive to manufacture than traditional small molecule drugs, which may make them costlier than competing small molecule drugs. As a result, it may be more difficult for us to convince the medical community and third-party payors to accept and use our products or to provide favorable reimbursement. If medical professionals working with large reference laboratories, public health laboratories and hospitals choose not to adopt and use our technologies, our products may not achieve broader market acceptance.

Additionally, although we expect that we will have intellectual property protection for our technology, certain governments may elect to deny patent protection for drugs targeting diseases with high unmet medical need (e.g., as in the case of HIV) and allow in their country internationally unauthorized generic competition. If this were to happen, our commercial prospects for developing any such drugs would be substantially diminished in these countries.

We are dependent on technologies we license, and if we lose the right to license such technologies or fail to license new technologies in the future, our ability to develop new products would be harmed.

Many patents in the fields we are pursuing have already been exclusively licensed to third parties, including our competitors. If any of our existing licenses are terminated, the development of the products contemplated by the licenses could be delayed or terminated and we may not be able to negotiate additional licenses on acceptable terms, if at all, which would have a material adverse effect on our business.

We may be unable to protect our intellectual property rights licensed from other parties; our intellectual property rights may be inadequate to prevent third parties from using our technologies or developing competing products; and we may need to license additional intellectual property from others.

Therapeutic applications of gene silencing technologies, formulations, delivery methods and other technologies that we license from third parties are claimed in a number of pending patent applications, but there is no assurance that these applications will result in any issued patents or that those patents would withstand possible legal challenges or protect our technologies from competition. The United States Patent and Trademark Office and patent granting authorities in other countries have upheld stringent standards for the RNAi patents that have been prosecuted so far. Consequently, pending patents that we have licensed and those that we own may continue to experience long and difficult prosecution challenges and may ultimately issue with much narrower claims than those in the pending applications. Third parties may hold or seek to obtain additional patents that could make it more difficult or impossible for us to develop products based on our technologies without obtaining a license to such patents, which licenses may not be available on attractive terms, or at all.

In addition, others may challenge the patents or patent applications that we currently license or may license in the future or that we own and, as a result, these patents could be narrowed, invalidated or rendered unenforceable, which would negatively affect our ability to exclude others from using the technologies described in these patents. There is no assurance that these patent or other pending applications or issued patents we license or that we own will withstand possible legal challenges. Moreover, the laws of some foreign countries may not protect our proprietary rights to the same extent as do the laws of the United States. Any patents issued to us or our licensors may not provide us with any competitive advantages, and there is no assurance that the patents of others will not have an adverse effect on our ability to do business or to continue to use our technologies freely. Our efforts to enforce and maintain our intellectual property rights may not be successful and may result in substantial costs and diversion of management time. Even if our rights are valid, enforceable and broad in scope, competitors may develop products based on technology that is not covered by our licenses or patents or patent applications that we own.

| 18 |

There is no guarantee that future licenses will be available from third parties for our product candidates on timely or satisfactory terms, or at all. To the extent that we are required and are able to obtain multiple licenses from third parties to develop or commercialize a product candidate, the aggregate licensing fees and milestones and royalty payments made to these parties may materially reduce our economic returns or even cause us to abandon development or commercialization of a product candidate.

Our success depends upon our ability to obtain and maintain intellectual property protection for our products and technologies.

The applications based on RNAi technologies claim many different methods, compositions and processes relating to the discovery, development, delivery and commercialization of RNAi therapeutics. Because this field is so new, very few of these patent applications have been fully processed by government patent offices around the world, and there is a great deal of uncertainty about which patents will issue, when, to whom and with what claims. Although we are not aware of any blocking patents or other proprietary rights, it is likely that there will be significant litigation and other proceedings, such as interference and opposition proceedings in various patent offices, relating to patent rights in the RNAi field. It is possible that we may become a party to such proceedings.

We are subject to significant competition and may not be able to compete successfully.

The biotechnology and pharmaceutical industries, including immuno-oncology, have intense competition and contain a high degree of risk. We face a number of competitors that have substantially greater experience and greater research and development capabilities, staffing, financial, manufacturing, marketing, technical and other resources than us, and we may not be able to successfully compete with them. These companies include large and small pharmaceutical and biotechnology companies, academic institutions, government agencies and other private and public research organizations.

In addition, even if we are successful in developing our product candidates, in order to compete successfully we may need to be first to market or to demonstrate that our products are superior to therapies based on different technologies. Some of our competitors may develop and commercialize products that are introduced to market earlier than our product candidates or on a more cost-effective basis. A number of our competitors have already commenced clinical testing of product candidates and may be more advanced than we are in the process of developing products. If we are not first to market or are unable to demonstrate superiority, on a cost-effective basis or otherwise, any products for which we are able to obtain approval may not be successful.