C. |

Organizational Structure |

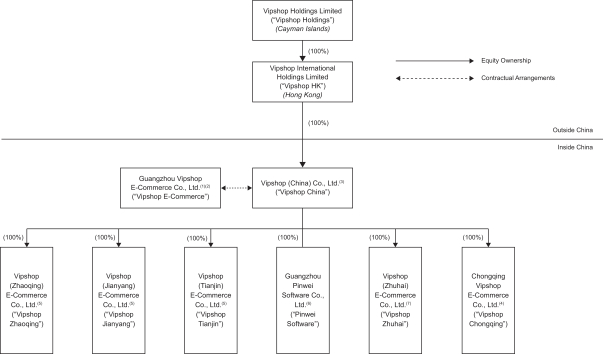

Corporate Structure

The following diagram illustrates our corporate structure, including our principal subsidiaries and consolidated affiliated entity as of the date of this annual report:

Notes:

| (1) | Shareholders of Vipshop E-Commerce include our co-founders and shareholders Eric Ya Shen and Arthur Xiaobo Hong, holding 66.7% and 33.3% of the total equity interests in Vipshop E-Commerce, respectively. |

| (2) | A subsidiary primarily engaged in operating e-commerce platform. |

| (3) | A subsidiary primarily engaged in warehousing, logistics, product procurement, research and development, technology development, and consulting businesses. |

| (4) | A subsidiary primarily engaged in product procurement business. |

| (5) | Subsidiaries primarily engaged in retail businesses and warehousing services in the cities of Jianyang, Tianjin, and Zhaoqing, and the regions around them. |

| (6) | A subsidiary primarily engaged in software development and information technology support. |

| (7) | A subsidiary primarily engaged in supplier chain services. |

Foreign ownership of Internet-based businesses is subject to significant restrictions under current PRC laws and regulations. The PRC government regulates Internet access, the distribution of online information and the conduct of online commerce through strict business licensing requirements and other government regulations. We are a Cayman Islands company and our PRC subsidiaries, including Vipshop China, are WFOEs. As a WFOE, Vipshop China is restricted from holding the licenses that are necessary for our online operation in China. To comply with these restrictions, our Vipshop Online Platform is operated by our consolidated affiliated entities in China. Following our efforts to streamline our contractual arrangements among our consolidated affiliated entities during 2018, 2019, and 2020, we began to use Vipshop

E-Commerce

to operate our main businesses, which had been previously operated by Vipshop Information, without materially altering the substance of our operations. Vipshop E-Commerce

currently holds the primary licenses necessary to conduct our Internet-related operations in China. Most of the business contracts relating to our Vipshop Online Platform previously entered into by Vipshop Information have been replaced with new business contracts entered into by 79