graystone-s1_011113.htm

Commission Number 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

THE GRAYSTONE COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

7310

|

27-3051592

|

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(IRS Employer Identification No.)

|

|

2620 Regatta Drive, Ste 102, Las Vegas, NV 89128

|

|

(Address of principal executive offices) (zip code)

|

|

(702) 582-5535

|

|

(Registrant’s telephone number, including area code)

|

Approximate date of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered(1)

|

|

Amount to be registered

|

|

|

Proposed maximum offering price per share(2)

|

|

|

Proposed maximum aggregate offering price (US$)

|

|

|

Amount of

registration fee(3)

|

|

Class A Common Stock, par value $.001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

An indeterminate number of additional shares of Class A Common Stock shall be issue-able pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions and in such an event the number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416 under the Securities Act.

|

| |

|

|

(2)

|

The offering price has been arbitrarily determined and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

|

| |

|

|

(3)

|

Estimated in accordance with Rule 457(c) solely for the purpose of computing the amount of the registration fee based on a bona fide estimate of the maximum offering price.

|

| |

|

|

(4)

|

The Offering will be valid for 180 days after this registration statement becomes effective.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON THE DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON THE DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS, Dated _________

THE GRAYSTONE COMPANY, INC.

A DELAWARE CORPORATION

65,000,000 Shares of Class A Common Stock

$0.003 per share

This prospectus relates to the resale of up to 65,000,000 shares of Class A common stock of The Graystone Company, Inc. (“we” or the “Company”), par value $0.001 per share, issuable to SC Capital, Inc., a California Corporation (“SC Capital”), pursuant to an investment between us and SC Capital. The investment agreement permits us to “put” up to $1,500,000 in shares of our Class A common stock to SC Capital over a period of up to thirty-six (36) months. We will not receive any proceeds from the resale of these shares of common stock. However, we will receive proceeds from the sale of securities pursuant to our exercise of the put right offered by SC Capital. SC Capital is deemed an underwriter for our common stock.

The Selling Shareholders may sell all or a portion of the Common Stock from time to time, in amounts, at prices and on terms determined at the time of the offering. The Class A Common Stock may be sold by any means described in the section of this prospectus entitled "Plan of Distribution" beginning on page 12.

Our auditor has expressed substantial doubt about our ability to continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to those matters are also described in Note 1 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We will pay all expenses incurred in this offering.

Our Common Stock is presently quoted on the Over-the-Counter (OTC) under the ticker symbol “GYST”. On January 9, 2013 the closing price of our Class A common stock was $0.003.

THE SECURITIES OFFERED IN THIS PROSPECTUS INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING "RISK FACTORS" BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Until ________, 2013, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this prospectus is ___________

| |

Page

|

|

|

1

|

|

|

1

|

|

|

3

|

|

|

4

|

|

|

11

|

|

|

11

|

|

|

11

|

|

|

12

|

|

|

12 |

|

|

15 |

|

|

17 |

|

|

17 |

|

|

17 |

|

|

17

|

|

|

20

|

|

|

20

|

|

|

21

|

|

|

22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This following information specifies certain forward-looking statements of management of the Company. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue, or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. We cannot guaranty that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

Item 3: Summary Information and Risk Factors.

The following summary highlights material information contained in this prospectus. This summary does not contain all of the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the risk factors section, the financial statements and the notes to the financial statements. You should also review the other available information referred to in the section entitled “Where you can find more information” in this prospectus and any amendment or supplement hereto. Unless otherwise indicated, the terms the “Company,” “Graystone” “we,” “us,” and “our” refer and relate to The Graystone Company, Inc.

The Graystone Company, Inc. (“Graystone”, “we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of New York on May 27, 2010 under the name of Argentum Capital, Inc. Graystone was reincorporated in Delaware on January 10, 2011 and subsequently changed our name to The Graystone Company, Inc on January 14, 2011. Graystone is domiciled in the state of Delaware, and its corporate headquarters are located in Lima, Peru and maintains it US executive office in Las Vegas, Nevada for mailing purposes. The Company selected December 31 as its fiscal year end.

The Graystone Company, Inc. is a holding company whose primary operating activities involve acquiring and developing mining properties amenable to low cost production. In January 2012, the Company launched a new division that sells gold, silver and other precious metals to retail buyers. The Company also operates other divisions that include a marketing division, real estate division, and consulting division. Information about the Company, including a link to our most recent financial reports filed with the Securities and Exchange Commission (“SEC”), can be viewed on our website at www.graystone1.com.

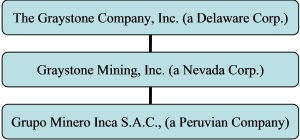

The Company began mining operations in January 2011 and operates through the Company’s wholly owned subsidiary Graystone Mining, Inc., a Nevada Company. This Division is engaged in the business of acquiring gold, silver, precious metal and gems and other mineral properties with proven and/or probable reserves. The Company has currently begun mining operations in Peru and recently entered into a joint venture in Suriname.

Graystone Mining focuses on acquiring properties that require a lower capital investment to begin mining operations. This approach may reduce the size of the deposits that the Company can acquire. However, by generating revenue from smaller mining ventures, the Company can build a solid foundation and the needed infrastructure to undertake larger and more costly ventures, such as hard rock projects. Thereby the Company is focusing initially on alluvial mining (surface mining) projects, the Company can begin generating a positive cash flow for a smaller capital investment. As such, the Company does not engage in general exploration activities. Exploration involves the prospecting, sampling, mapping, drilling and other work involved in searching for ore on properties. Exploration is time consuming and costly as it requires an evaluation of the land's geology, analyst of the geochemistry of soil sediment and water, and drilling of numerous test holes and testing these for the presence of minerals. The Company instead focuses on acquiring or entering into joint ventures with entities that have already found, through exploration, proven or probable mineral ore reserves. This allows the Company to focus its attention on processing mineral resources instead of having to also have exploration activities to locate new sites that may have mineral ore deposits.

In 2011, the Company acquired Grupo Minero Inca S.A.C., a Peruvian Company (“GMI”). GMI is a wholly owned subsidiary of the Company. GMI provides the Company a local Peruvian entity. Acting through GMI, the Company can acquire concessions in its own name and directly hire employees and staff in Peru instead of using third parties for these purposes.

Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America or GAAP applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company does not have significant cash or other current assets, nor does it have an established source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern.

Under the going concern assumption, an entity is ordinarily viewed as continuing in business for the foreseeable future with neither the intention nor the necessity of liquidation, ceasing trading, or seeking protection from creditors pursuant to laws or regulations. Accordingly, assets and liabilities are recorded on the basis that the entity will be able to realize its assets and discharge its liabilities in the normal course of business.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

The Company’s address is 2620 Regatta Drive, Suite 102, Las Vegas, NV 89128 and our phone number is (702) 582-5535.

Market Value of Company's Securities.

The aggregate market value of the Class A Common Stock is $1,143,665.based on a $.003 per share price. The total stockholders' equity as of September 30, 2012 was ($295,099)

Investment Agreement with SC Capital

On January 10, 2013, we entered into an investment agreement, with SC Capital, Inc. a California Company. Pursuant to the terms of the Investment Agreement, SC Capital committed to purchase up to $1,500,000 of our Class A common stock over a period of up to thirty-six (36) months. From time to time during the thirty-six (36) months period commencing from the effectiveness of the registration statement, we may deliver a put notice to SC Capital which states the dollar amount that we intend to sell to SC Capital on a date specified in the put notice. The maximum investment amount per notice shall be no more than two hundred percent (200%) of the average daily volume of the common stock for the ten consecutive trading days immediately prior to date of the applicable put notice. The purchase price per share to be paid by SC Capital shall be calculated at a Ten Percent Discount (10%) discount to the lowest closing price of the common stock as reported by Bloomberg, L.P. during the ten (10) consecutive trading days immediately prior to the receipt by SC Capital of the put notice. We have reserved 250,000,000 shares of our common stock for issuance under the SC Capital agreement.

The 65,000,000 shares to be registered herein represent 18.8% of the shares issued and outstanding, assuming that the selling stockholder will sell all of the shares offered for sale.

At an assumed purchase price of $0.0027 (equal to 90% of the closing price of our common stock of $0.003 on January 9, 2013), we will be able to receive up to $175,500 in gross proceeds, assuming the sale of the entire 65,000,000 shares being registered hereunder pursuant to agreement. Accordingly, we would be required to register additional 490,555,555 shares to obtain the balance of $1,500,000 under the agreement. We are currently authorized to issue 5,000,000,000 shares of our common stock. We may be required to increase our authorized shares in order to receive the entire purchase price. SC Capital has agreed to refrain from holding an amount of shares which would result in SC Capital owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the agreement. These risks include dilution of stockholders’ percentage ownership, significant decline in our stock price and our inability to draw sufficient funds when needed.

SC Capital will periodically purchase our common stock under the agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to SC Capital to raise the same amount of funds, as our stock price declines.

The aggregate investment amount of $1.5 million was determined based on numerous factors, including the following: $1 million in expected capital expenses to grow the mining projects in Peru. We believe we need the remaining funds for corporate expenses. While it is difficult to estimate the likelihood that the Company will need the full investment amount, we believe that the Company may need the full amount of $1.5 million funding under the agreement.

|

|

|

The Graystone Company, Inc,.

|

| |

|

|

|

|

|

Our Common Stock is described in further detail in the section of this prospectus titled “DESCRIPTION OF SECURITIES –Common Stock.”

|

| |

|

|

|

|

|

|

| |

|

|

Total shares of Class A Common Stock outstanding prior to the offering

|

|

|

| |

|

|

Shares of Class A Common Stock being offered by selling shareholders:

|

|

|

| |

|

|

Total shares of Class A Common Stock outstanding after the offering:

|

|

|

| |

|

|

Total shares of Class B Common Stock outstanding before and after the offering:

|

|

|

| |

|

|

Total shares of Class B Common Stock outstanding before and after the offering:

|

|

|

| |

|

|

|

|

|

We estimate the total cost relating to the registration herein to be approximately $9,000.

|

| |

|

|

|

|

|

We will not receive any of the proceeds from the sale of the common stock by the selling stockholders under this prospectus. See “Use of Proceeds” beginning on page 10.

|

| |

|

|

|

|

|

There are substantial risk factors involved in investing in our Company. For a discussion of certain factors you should consider before buying shares of our Common Stock, see the section entitled "Risk Factors."

|

| |

|

|

|

|

|

The Company’s Class A Common Stock trades on the OTC under the ticker symbol GYST.

|

An investment in our Common Stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our Class A Common Stock could decline, and an investor in our securities may lose all or part of their investment. Currently, shares of our Class A Common Stock are not publicly traded.

The Company has limited capitalization and lack of working capital and as a result is dependent on raising funds to grow and expand its business.

Our management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company will endeavor to finance its need for additional working capital through debt or equity financing. Additional debt financing would be sought only in the event that equity financing failed to provide the Company necessary working capital. Debt financing may require the Company to mortgage, pledge or hypothecate its assets, and would reduce cash flow otherwise available to pay operating expenses and acquire additional assets. Debt financing would likely take the form of short-term financing provided by officers and directors of the Company, to be repaid from future equity financing. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. However, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

The Company has minimal revenue, has not acquired any real property or any properties containing natural resources as a result the Company needs to engage in additional, substantial development work within each of its division.

The Company has had minimal revenue from its operations which make an evaluation of our future performance and prospects difficult. Additionally, the Company has not acquired any real property or properties that contain any natural resources. The company has substantial development work with each of its division. Our prospects must be considered in light of the risks, expenses, delays, problems and difficulties that may be encountered in the expansion of our business based on our planned operations. Furthermore, the Company faces risks and uncertainties relating to its ability to successfully implement it proposed operations, which are described in more detail below beginning on page 21.

The Company is dependent on key personnel and loss of the services of any of these individuals could adversely affect the conduct of the company's business.

Initially, success of the Company is entirely dependent upon the management efforts and expertise of Messrs. Joseph Mezey and Paul Howarth. A loss of the services of any of these individuals could adversely affect the conduct of the Company's business. In such event, the Company would be required to obtain other personnel to manage and operate the Company, and there can be no assurance that the Company would be able to employ a suitable replacement for either of such individuals, or that a replacement could be hired on terms which are favorable to the Company. The Company currently maintains no key man insurance on the lives of any of its officers or directors.

The Company’s dividends policy may be terminated at any time as such you may not receive dividends from your investment.

Even though the Company has issued dividends in the past and intends to continue paying dividends. Such dividends will be directly dependent upon the earnings of the Company, its financial requirements, ability to raise capital and other factors. As a result of these factors, the Board of Directors may determine it is in the Company’s best interest to cease paying dividends in the future.

We cannot guarantee that an active trading market will develop for our Class A Common Stock which may restrict your ability to sell your shares.

There is no public market for our Class A Common Stock and there can be no assurance that a regular trading market for our Class A Common Stock will ever develop or that, if developed, it will be sustained. Therefore, purchasers of our Class A Common Stock should have a long-term investment intent and should recognize that it may be difficult to sell the shares, notwithstanding the fact that they are not restricted securities. There has not been a market for our Class A Common Stock. We cannot predict the extent to which a trading market will develop or how liquid a market might become.

Our shares may be subject to the “penny stock” rules which might subject you to restrictions on marketability and you may not be able to sell your shares

Broker-dealer practices in connection with transactions in "Penny Stocks" are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risk associated with the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker- dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker- dealer must make a written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. If the Company's securities become subject to the penny stock rules, investors in this offering may find it more difficult to sell their securities.

Due to the control by management of 50% of issued and outstanding Class A Common Stock and 79.9% of the total voting power our non-management shareholders will have no power to choose management or impact operations.

Management currently maintains a voting power of 79.9% of our issued and outstanding Common Stock. Consequently, management has the ability to influence control of our operations and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

o Election of the Board of Directors;

o Removal of directors;

o Amendment to the our certificate of incorporation or bylaws; and

These stockholders will thus have substantial influence over our management and affairs and other stockholders possess no practical ability to remove management or effect the operations of our business. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Class A Common Stock.

This registration statement contains forward-looking statements and information relating to us, our industry and to other businesses. Our actual results may differ materially from those contemplated in our forward looking statements which may negatively impact our company.

These forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. When used in this registration statement, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that may cause our actual results to differ materially from those contemplated in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this registration statement. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this registration statement or to reflect the occurrence of unanticipated events.

We may need additional financing which we may not be able to obtain on acceptable terms. If we are unable to raise additional capital, as needed, the future growth of our business and operations would be severely limited.

A limiting factor on our growth, and is our limited capitalization which could impact our ability to penetrate new markets, attract new customers and execute on our divisions business plans. While we are currently able to fund all basic operating costs it is possible that we may require additional funding in the future to achieve all of our proposed objectives.

If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our Class A Common Stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

Future sales by our stockholders may adversely affect our stock price and our ability to raise funds.

Sales of our Class A Common Stock in the public market could lower our market price for our Class A Common Stock. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that management deems acceptable or at all.

Due to limited liquidity in our shares, if a public market does develop, the market price of our Class A Common Stock may fluctuate significantly which could cause a decline in value of your shares.

There is no public market for our Class A Common Stock and there can be no assurance that a regular trading market for our Class A Common Stock will ever develop or that, if developed, it will be sustained. If a public market does develop, the market price of our Class A Common Stock may fluctuate significantly in response to factors, some of which are beyond our control. The market price of our common stock could be subject to significant fluctuations and the market price could be subject to any of the following factors:

|

o

|

our failure to achieve and maintain profitability;

|

|

o

|

changes in earnings estimates and recommendations by financial analysts;

|

|

o

|

actual or anticipated variations in our quarterly and annual results of operations;

|

|

o

|

changes in market valuations of similar companies;

|

|

o

|

announcements by us or our competitors of significant contracts, new services, acquisitions, commercial relationships, joint ventures or capital commitments;

|

|

o

|

loss of significant clients or customers;

|

|

o

|

loss of significant strategic relationships; and

|

|

o

|

general market, political and economic conditions.

|

Recently, the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of shares of our Class A Common Stock, which could cause a decline in the value of our shares. Price volatility may be worse if the trading volume of our Class A Common Stock is low.

Our by-laws provide for indemnification of our officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our bylaws require that we indemnify and hold harmless our officers and directors, to the fullest extent permitted by law, from certain claims, liabilities and expenses under certain circumstances and subject to certain limitations and the provisions of Delaware law. Under Delaware law, a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer, employee or agent of the corporation, against expenses, attorneys fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with an action, suit or proceeding if the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation.

We may not realize sufficient proceeds from this offering to implement our business plan, as we are offering shares on a direct participation basis with no minimum offering required which may adversely impact the implementation of our business plan.

We are offering shares on a direct participation basis and with no minimum offering. As such we may not receive sufficient proceeds to fund our planned operations or the costs of this offering. If we are not able to receive sufficient proceeds would cause a delay in the implementation of our planned operations. If we do not raise sufficient funds in this offering to fund our proposed operations or even cover the costs of this offering, you may lose your entire investment.

Risks Related to our Natural Resource Division

We currently do not have any mineral rights or own any properties that may contain such mineral rights as a result the Company needs to engage in additional, substantial development work before it may begin full operations of its mining division.

The Company currently does not possess any mineral claims or any property that may contain such mineral rights. The Company intended to shortly begin looking at properties for mineral right claims. The Company does not intend to be in the exploration business but rather will acquire proven mineral rights from mining exploration companies or mining trusts. There are no assurances that the Company will be able to locate any properties with mineral rights or be able to come to acceptable terms to acquire such a property.

Our mining production activities are highly speculative and involve substantial risks which could result in material adverse effect on our results and financial condition.

The mining production work on any acquired mining properties may not result in the discovery of mineable deposits of ore in a commercially economical manner. However if mineable deposits of ore does exist, there may be limited availability of water, which is essential to mining operations, and interruptions may be caused by adverse weather conditions. Our operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls. Our exploration activities are subject to substantial hazards, some of which are not insurable or may not be insured for economic reasons. Any of these factors could have a material adverse effect on our results and financial condition.

We are sensitive to fluctuations in the price of gold and other minerals, which is beyond our control. The price of gold and other metals is volatile and price changes are beyond our control. These fluctuations may have a material adverse effect on the price in which we can sell any gold that we may obtain and therefore result in a reduction in the Company’s cash position and the viability of our projects.

The prices for gold and other metals fluctuate and are affected by numerous factors beyond our control. Factors that affect the price of gold and other metals include consumer demand, economic conditions, over supply from secondary sources and costs of production. Price volatility and downward price pressure, which can lead to lower prices, could have a material adverse effect on the costs of and the viability of our projects.

Mineral production and prospecting is highly competitive and speculative business therefore we may not be successful in obtaining properties that have commercially viable ore deposits.

The process of mineral production and prospecting is a highly competitive and speculative business. In seeking available opportunities, we will compete with a number of other companies, including established, multi-national companies that have more experience and financial and human resources than us. Because we may not have the financial and managerial resources to compete with other companies, we may not be successful in our efforts to acquire new projects. However, while we compete with other exploration companies, once we acquire a claim there is no competition for the exploration or removal of mineral from such claim in which we acquire.

Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects. The historical trend toward stricter environmental regulation may continue, and, as such, represents an unknown factor in our planning processes which could adversely impact our production and profitability.

All mining in United States is regulated by the government agencies at the Federal and State levels. Compliance with such regulation could have a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs will be related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property, in order to obtain governmental approval to mine on the properties, is also a part of the overall operating costs of a mining company.

The gold and mineral mining business is subject not only to worker health and safety, and environmental risks associated with all mining businesses, but is also subject to additional risks uniquely associated with gold and other minerals mining. Although we believe that our operations will be in compliance, in all material respects, with all relevant permits, licenses and regulations involving worker health and safety, as well as the environment, the historical trend toward stricter environmental regulation may continue. The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project.

Mining activities are subject to extensive regulation by Federal and State governments. Future changes in governments, regulations and policies, could adversely affect our results of operations for a particular period and our long-term business prospects.

Mining and exploration activities are subject to extensive regulation by Federal and State Governments. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing, operating mines and other facilities. Furthermore, future changes in governments, regulations and policies, could adversely affect our results of operations in a particular period and its long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside of our control.

Because of the inherent dangers involved in mineral production, there is a risk that we may incur liability or damages as we conduct our business which could have a material adverse effect on the Company’s financial position.

Exploration and establishment of mining operations and production involves numerous hazards. As a result, the Company may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which the Company cannot insure or against which the Company may elect not to insure. The payment of such liabilities may have a material adverse effect on the Company’s financial position.

Once the Company obtains a mineral claim if we do not conduct mineral production on our mineral claims and keep the claims in good standing, then our right to the mineral claims will lapse and we will lose everything that we have invested and expended towards these claims.

Once the Company obtains a mineral claim we must begin mineral production work on our mineral claims and keep the claims in good standing. If we do not fulfill our work commitment requirements on our claims or keep the claims in good standing, then our right to the claims may lapse and we will lose all interest that we have in these mineral claims.

We cannot accurately predict whether commercial quantities of ores will be established on the properties that we acquire which could impact the viability of our projects.

Whether an ore body will be commercially viable depends on a number of factors beyond our control, including the particular attributes of the deposit such as size, grade and proximity to infrastructure, as well as mineral prices and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We cannot predict the exact effect of these factors, but the combination of these factors may result in a mineral deposit being unprofitable which would have a material adverse effect on our business. We have no mineral producing properties at this time.

We may not be able to establish the presence of minerals on a commercially viable basis which could result in a part or complete lose of your entire investment.

Substantial expenditures will be required to develop the exploration infrastructure at any site chosen for exploration, to establish ore reserves through drilling, to carry out environmental and social impact assessments, and to develop metallurgical processes to extract the metal from the ore. We may not be able to discover minerals in sufficient quantities to justify commercial operation, and we may not be able to obtain funds required for exploration on a timely basis. Accordingly, you could lose your entire investment.

We will need to incur substantial expenditures in an attempt to establish the economic feasibility of mining operations by identifying mineral deposits and establishing ore reserves through drilling and other techniques, developing metallurgical processes to extract metals from ore, designing facilities and planning mining operations. The economic feasibility of a project depends on numerous factors beyond our control, including the cost of mining and production facilities required to extract the desired minerals, the total mineral deposits that can be mined using a given facility, the proximity of the mineral deposits to a user of the minerals, and the market price of the minerals at the time of sale. Our existing or future exploration programs or acquisitions may not result in the identification of deposits that can be mined profitably and you could lose your entire investment.

Our exploration activities are subject to various local laws and regulations which may have a material adverse effect on our result and financial conditions.

We are subject to local laws and regulation governing the exploration, development, mining, production, importing and exporting of minerals; taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and other matters. We require licenses and permits to conduct exploration and mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a material adverse impact on our Company. Applicable laws and regulations will require us to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, we may be required to close an operation once it is started until a particular problem is remedied or to undertake other remedial actions. This would have a material adverse effect on our results and financial condition.

We have uninsurable risks which could require Company resources to be spent to cover any loses from such risks which may have a material adverse effect on our financial position.

We may be subject to unforeseen hazards such as unusual or unexpected formations and other conditions. We may become subject to liability for pollution, cave-ins or hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

We are subject to the volatility of metal and mineral prices such volatility may result in prices at levels that will make it not feasible to continue our exploration activities, or commence or continue commercial production which could adversely impact our production and profitability.

The economics of developing metal and mineral properties are affected by many factors beyond our control including, without limitation, the cost of operations, variations in the grade ore or resource mined, and the price of such resources. The market prices of the metals for which we are exploring are highly speculative and volatile. Depending on the price of gold or other resources, we may determine that it is impractical to commence or continue commercial production. The price of gold has fluctuated widely in recent years. The price of gold and other metals and minerals may not remain stable, and such prices may not be at levels that will make it feasible to continue our exploration activities, or commence or continue commercial production.

We may not have clear title to our properties which could result in a material effect on our business and may cause temporary or complete cessation of mining activities.

Acquisition of title to mineral properties is a very detailed and time-consuming process, and title to our properties may be affected by prior unregistered agreements or transfer, or undetected defects. There is a risk that we may not have clear title to all our mineral property interests, or they may be subject to challenge or impugned in the future, which would have a material adverse effect on our business and may result in temporary or complete cessation of mining activates.

Our mineral property interests may be subject to other mining licenses which could result in an inability to mining properties that we acquire which could adversely impact the viability of our mining claims and concessions.

There can be no guarantee that we will be successful in negotiating with mining license owners to acquire their rights if we determine that we need their permission to drill or mine on the land covered by such mining licenses. If we are unable to obtain the necessary rights, viability of our mining claims and concessions could be materially impacted we may not be able to develop any such properties.

Risks Related to the Investment Agreement

SC Capital will pay less than the then-prevailing market price for our Class A Common Stock which could have a negative impact of the stock price.

The Class A common stock to be issued to SC Capital pursuant to the agreement will be purchased at a 10% discount to the lowest closing price of our common stock during the ten (10) consecutive trading days immediately before SC Capital receives our notice of sale. SC Capital has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If SC Capital sells the shares, the price of our common stock could decrease. If our stock price decreases, SC Capital may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value of our common stock may decline by exercising the put right pursuant to the SC Capital which could result in loss of your capital investment.

Pursuant to the agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to SC Capital at a price equal to a 10% discount to the lowest trading price of our stock for the ten (10) consecutive trading days before SC Capital receives our notice of sale. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We may not have access to the full amount available under the agreement which would limit our ability to grow.

We have not drawn down funds and have not issued shares of our common stock under the agreement. Our ability to draw down funds and sell shares under the agreement requires that the registration statement, of which this prospectus is a part, be declared effective by the SEC, and that this registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 65,000,000 shares issuable under the agreement, and our ability to sell any remaining shares issuable under the agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability to sell the shares of common stock to SC Capital under the agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the agreement to be declared effective by the SEC in a timely manner, we may not be able to sell the shares unless certain other conditions are met. For example, we might have to increase the number of our authorized shares in order to issue the shares to SC Capital. Accordingly, because our ability to draw down any amounts under the agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the proceeds of $1,500,000 under the agreement.

We are registering an aggregate of 65,000,000 shares of common stock to be issued under the SC Capital Agreement. The sales of such shares could depress the market price of our common stock.

We are registering an aggregate of 65,000,000 shares of common stock under this prospectus pursuant to the agreement. Notwithstanding SC Capital ownership limitation, the 65,000,000 shares would represent approximately 18.8% of our shares of common stock outstanding immediately after our exercise of the put right under the Investment Agreement. The sale of these shares into the public market by SC Capital could depress the market price of our common stock.

At an assumed purchase price of $0.027 (equal to 90% of the closing price of our common stock of $0.003 on January 9, 2013), we will be able to receive up to $175,500 in gross proceeds, assuming the sale of the entire 65,000,000 shares being registered hereunder pursuant to the agreement. Accordingly, we would be required to register additional 490,555,555 shares to obtain the entire amount of $1,500,000 under the agreement. Due to the floating offering price, we are not able to determine the exact number of shares that we will issue under the SC Capital.

Summary

We believe it is important to communicate our expectations to investors. There may be events in the future, however, that we are unable to predict accurately or over which we have no control. The risk factors listed on the previous pages as well as any cautionary language in this registration statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward looking statements. The occurrence of the events our business described in the previous risk factors and elsewhere in this registration statement could negatively impact our business, cash flows, results of operation, prospects, financial condition and stock price.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains certain forward-looking statements. When used in this Prospectus or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this Prospectus are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Prospectus might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

Dividend Policy

We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any of the proceeds from the resale of these shares. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

Item 5: Determination of Offering Price.

The following information is based upon the Company’s unaudited balance sheet as filed in the Company’s Form 10-Q on November 19, 2012, for the period ended September 30, 2012, the net tangible book value of the Company’s assets as of September 30, 2012 is $(295,099).

“Dilution” as used herein represents the difference between the offering price per share of shares offered hereby and the net tangible book value per share of the Company’s common stock after completion of the offering. Dilution in the offering is primarily due to the losses previously recognized by the Company.

The net book value of the Company at September 30, 2012 was $(295,099) or $0.00 per share. Net tangible book value represents the amount of total tangible assets less total liabilities. Assuming that 65,000,000 of the shares offered hereby were purchased by investors (a fact of which there can be no assurance) as of September 30, 2012, the then outstanding 350,604,200 shares of common stock, which would constitute all of the issued and outstanding equity capital of the Company, would have a net tangible book value $(119,599) (after deducting commissions and offering expenses) or approximately $0.0027 per share.

At an assumed purchase price of $0.0027 (equal to 10% of the closing price of our common stock of $0.003 on January 9, 2013), we will be required to issue an aggregate of 555,555,555 shares of common stock, if the full amount of $1,500,000 is exercised pursuant to the agreement.

Assuming a 50% decrease to the purchase price of $0.0027 (equal to 10% of the closing price of our common stock of $0.003 on January 9, 2013), we will be required to issue an aggregate of 1,111,111,111 shares of common stock, if the full amount of $1,500,000 is exercised pursuant to the agreement.

Assuming a 75% decrease to the purchase price of $0.0027 (equal to 10% of the closing price of our common stock of $0.003 on January 9, 2013), we will be required to issue an aggregate of 2,222,222 shares of common stock, if the full amount of $1,500,000 is exercised pursuant to the agreement.

The dilution associated with the offering and each of the above scenarios is as follows:

| Offering |

|

|

|

|

490,555,556

shares issued

|

|

|

1,046,111,111

shares issued

|

|

|

2,157,222,222

shares issued

|

|

|

Offering price

|

|

$ |

0.0027 |

|

|

$ |

0.0027 |

|

|

$ |

0.00135 |

|

|

$ |

0.000675 |

|

|

Net Tangible Book Value Before Offering (per share)

|

|

$ |

0.0000 |

|

|

$ |

0.0000 |

|

|

$ |

0.0000 |

|

|

$ |

0.0000 |

|

|

Net Tangible Book Value After Offering (per share)

|

|

$ |

0.0000 |

|

|

$ |

0.0012 |

|

|

$ |

0.0008 |

|

|

$ |

0.0005 |

|

|

Dilution per share to Investors

|

|

$ |

0.0027 |

|

|

$ |

0.0015 |

|

|

$ |

0.0006 |

|

|

$ |

0.0002 |

|

|

Dilution percentage to Investors

|

|

|

100.00 |

% |

|

|

54.95 |

% |

|

|

40.97 |

% |

|

|

31.55 |

% |

Item 7: Selling Security Holders.

We are registering for resale shares of our Class A Common Stock that are issued and outstanding held by the selling stockholder identified below. We are registering the shares to permit the selling stockholder to resell the shares when and as it deems appropriate in the manner described in the “Plan of Distribution.” As of the date of this Prospectus, there are 381,221,678 shares of common stock issued and outstanding.

The following table sets forth:

|

·

|

the name of the selling stockholder,

|

|

·

|

the number of shares of our common stock that the selling stockholder beneficially owned prior to the offering for resale of the shares under this Prospectus,

|

|

·

|

the maximum number of shares of our common stock that may be offered for resale for the account of the selling stockholder under this Prospectus, and

|

|

·

|

the number and percentage of shares of our common stock to be beneficially owned by the selling stockholder after the offering of the shares (assuming all of the offered shares are sold by the selling stockholder).

|

The selling stockholder has never served as our officer or director or any of its predecessors or affiliates within the last three years, nor has the selling stockholder had a material relationship with us. The selling stockholder is neither a broker-dealer nor an affiliate of a broker-dealer. The selling stockholder did not have any agreement or understanding, directly or indirectly, to distribute any of the shares being registered at the time of purchase.

The selling stockholder may offer for sale all or part of the shares from time to time. The table below assumes that the selling stockholder will sell all of the shares offered for sale. The selling stockholder is under no obligation, however, to sell any shares pursuant to this Prospectus.

|

Name

|

|

Shares of Class A Common Stock Beneficially Owned Prior to Offering (1)

|

|

|

Maximum Number of Shares of Class A Common Stock to be Offered

|

|

|

Number of Shares of Class A Common Stock Beneficially Owned after Offering

|

|

|

Percent ownership after Offering

|

|

|

SC Capital, Inc. (2)

|

|

|

65,000,000 |

|

|

|

65,000,000 |

|

|

|

0 |

|

|

|

0 |

% |

|

(1)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our common stock, or convertible or exercisable into shares of our common stock within 60 days of the date hereof are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to the following table, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder’s name.

|

|

(2)

|

As the President of SC Capital, Valerie Baugher has the voting and dispositive power over the shares owned by SC Capital, Inc.

|

Item 8: Plan of Distribution.

We are registering the Common Stock issued to the Selling Stockholders to permit the resale of these shares of Common Stock by the holders of the Common Stock from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Stockholders of the Common Stock. We will bear all fees and expenses incident to our obligation to register the Common Stock.

The Selling Stockholders may sell all or a portion of the Common Stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the Common Stock is sold through underwriters or broker-dealers, the Selling Stockholders will be responsible for underwriting discounts or commissions or agent's commissions. The Common Stock may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions. The Selling Stockholders may use any one or more of the following methods when selling shares:

| |

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

|

|

·

|

broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The Selling Shareholders and any underwriters, broker-dealers or agents who participate in the sale or distribution of the Common Stock may be deemed to be "underwriters" within the meaning of the Securities Act. As a result, any profits on the sale of the Common Stock by such Selling Shareholders and any discounts, commissions or agent's commissions or concessions received by any such broker-dealer or agents may be deemed to be underwriting discounts and commissions under the Securities Act. Selling Shareholders who are deemed to be "underwriters" within the meaning of Section 2(11) of the Securities Act will be subject to prospectus delivery requirements of the Securities Act. Underwriters are subject to certain statutory liabilities, including, but not limited to, Sections 11, 12 and 17 of the Securities Act.

The Common Stock may be sold in one or more transactions at:

|

•

|

fixed prices;

|

|

•

|

prevailing market prices at the time of sale;

|

|

•

|

prices related to such prevailing market prices;

|

|

•

|

varying prices determined at the time of sale; or

|

|

•

|

negotiated prices.

|

The sales may be effected in one or more transactions:

|

•

|

on any national securities exchange or quotation on which the Common Stock may be listed or quoted at the time of the sale;

|

|

•

|

in the over-the-counter market;

|

|

•

|

in transactions other than on such exchanges or services or in the over-the-counter market;

|

|

•

|

through the writing of options (including the issuance by the Selling Shareholders of derivative securities), whether the options or such other derivative securities are listed on an options exchange or otherwise;

|

|

•

|

in a public auction; or

|

|

•

|

through any combination of the foregoing.

|

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade. The Selling Stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, as permitted by that rule, or Section 4(1) under the Securities Act, if available, rather than under this prospectus, provided that they meet the criteria and conform to the requirements of those provisions.

In connection with the sales of the Common Stock, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions which in turn may:

|

•

|

engage in short sales of the Common Stock in the course of hedging their positions;

|

|

•

|

sell the Common Stock short and deliver the Common Stock to close out short positions;

|

|

•

|

loan or pledge the Common Stock to broker-dealers or other financial institutions that in turn may sell the Common Stock;

|

|

•

|

enter into option or other transactions with broker-dealers or other financial institutions that require the delivery to the broker-dealer or other financial institution of the Common Stock, which the broker-dealer or other financial institution may resell under the prospectus; or

|

|

•

|

enter into transactions in which a broker-dealer makes purchases as a principal for resale for its own account or through other types of transactions.

|

To our knowledge, there are currently no plans, arrangements or understandings between any Selling Shareholders and any underwriter, broker-dealer or agent regarding the sale of the Common Stock by the Selling Shareholders.

There can be no assurance that any Selling Shareholder will sell any or all of the Common Stock under this prospectus. Further, we cannot assure you that any such Selling Shareholder will not transfer, devise or gift the Common Stock by other means not described in this prospectus. The Common Stock covered by this prospectus may also be sold to non-U.S. persons outside the U.S. in accordance with Regulation S under the Securities Act rather than under this prospectus. The Common Stock may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Shareholders and any other person participating in the sale of the Common Stock will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Common Stock by the Selling Shareholders and any other such person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Common Stock to engage in market-making activities with respect to the Common Stock being distributed. This may affect the marketability of the Common Stock and the ability of any person or entity to engage in market-making activities with respect to the Common Stock.

We have agreed to indemnify the Selling Shareholders against certain liabilities, including liabilities under the Securities Act.

We have agreed to pay the entire expenses incidental to the registration of the Common Stock, including all registration, filing and listing fees, printing expenses, fees and disbursements of counsel for the Company and blue sky fees and expenses. The Selling Shareholders will be required to pay all discounts, selling commission and stock transfer taxes applicable to the sale of the Common Stock and fees and disbursements of counsel for any Selling Shareholder.

We anticipate applying for trading of our Class A Common Stock on the over-the-counter (OTC) Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms a part. To have our securities quoted on the OTC Bulletin Board we must: (1) be a company that reports its current financial information to the Securities and Exchange Commission, banking regulators or insurance regulators; and (2) has at least one market maker who completes and files a Form 211 with FINRA Regulation, Inc. The OTC Bulletin Board differs substantially from national and regional stock exchanges because it (1) operates through communication of bids, offers and confirmations between broker-dealers, rather than one centralized market or exchange; and, (2) securities admitted to quotation are offered by one or more broker-dealers rather than "specialists" which operate in stock exchanges. We have not yet engaged a market maker to assist us to apply for quotation on the OTC Bulletin Board and we are not able to determine the length of time that such application process will take. Such time frame is dependent on comments we receive, if any, from the FINRA regarding our Form 211 application.

There is currently no market for our shares of Class A Common Stock. There can be no assurance that a market for our Class A Common Stock will be established or that, if established, such market will be sustained. Therefore, purchasers of our shares registered hereunder may be unable to sell their securities, because there may not be a public market for our securities. As a result, you may find it more difficult to dispose of, or obtain accurate quotes of our Class A Common Stock. Any purchaser of our securities should be in a financial position to bear the risks of losing their entire investment.

Penny Stock Regulation

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, that:

| |

●

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

| |

●

|

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties;

|

| |

●

|