000151029512/312022Q2FALSEP5Y00015102952022-01-012022-06-3000015102952022-07-29xbrli:shares00015102952022-04-012022-06-30iso4217:USD00015102952021-04-012021-06-3000015102952021-01-012021-06-30iso4217:USDxbrli:shares0001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-04-012022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-04-012021-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2022-04-012022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2021-04-012021-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-06-300001510295mpc:AccumulatedGainLossOtherMember2022-04-012022-06-300001510295mpc:AccumulatedGainLossOtherMember2021-04-012021-06-300001510295mpc:AccumulatedGainLossOtherMember2022-01-012022-06-300001510295mpc:AccumulatedGainLossOtherMember2021-01-012021-06-3000015102952022-06-3000015102952021-12-3100015102952020-12-3100015102952021-06-300001510295us-gaap:CommonStockMember2021-12-310001510295us-gaap:TreasuryStockMember2021-12-310001510295us-gaap:AdditionalPaidInCapitalMember2021-12-310001510295us-gaap:RetainedEarningsMember2021-12-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001510295us-gaap:NoncontrollingInterestMember2021-12-310001510295mpc:RedeemableNoncontrollingInterestMember2021-12-310001510295us-gaap:RetainedEarningsMember2022-01-012022-03-310001510295us-gaap:NoncontrollingInterestMember2022-01-012022-03-3100015102952022-01-012022-03-310001510295mpc:RedeemableNoncontrollingInterestMember2022-01-012022-03-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001510295us-gaap:TreasuryStockMember2022-01-012022-03-310001510295us-gaap:CommonStockMember2022-01-012022-03-310001510295us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001510295us-gaap:CommonStockMember2022-03-310001510295us-gaap:TreasuryStockMember2022-03-310001510295us-gaap:AdditionalPaidInCapitalMember2022-03-310001510295us-gaap:RetainedEarningsMember2022-03-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001510295us-gaap:NoncontrollingInterestMember2022-03-3100015102952022-03-310001510295mpc:RedeemableNoncontrollingInterestMember2022-03-310001510295us-gaap:RetainedEarningsMember2022-04-012022-06-300001510295us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001510295mpc:RedeemableNoncontrollingInterestMember2022-04-012022-06-300001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001510295us-gaap:TreasuryStockMember2022-04-012022-06-300001510295us-gaap:CommonStockMember2022-04-012022-06-300001510295us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001510295us-gaap:CommonStockMember2022-06-300001510295us-gaap:TreasuryStockMember2022-06-300001510295us-gaap:AdditionalPaidInCapitalMember2022-06-300001510295us-gaap:RetainedEarningsMember2022-06-300001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001510295us-gaap:NoncontrollingInterestMember2022-06-300001510295mpc:RedeemableNoncontrollingInterestMember2022-06-300001510295us-gaap:CommonStockMember2020-12-310001510295us-gaap:TreasuryStockMember2020-12-310001510295us-gaap:AdditionalPaidInCapitalMember2020-12-310001510295us-gaap:RetainedEarningsMember2020-12-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001510295us-gaap:NoncontrollingInterestMember2020-12-310001510295mpc:RedeemableNoncontrollingInterestMember2020-12-310001510295us-gaap:RetainedEarningsMember2021-01-012021-03-310001510295us-gaap:NoncontrollingInterestMember2021-01-012021-03-3100015102952021-01-012021-03-310001510295mpc:RedeemableNoncontrollingInterestMember2021-01-012021-03-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001510295us-gaap:CommonStockMember2021-01-012021-03-310001510295us-gaap:TreasuryStockMember2021-01-012021-03-310001510295us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001510295us-gaap:CommonStockMember2021-03-310001510295us-gaap:TreasuryStockMember2021-03-310001510295us-gaap:AdditionalPaidInCapitalMember2021-03-310001510295us-gaap:RetainedEarningsMember2021-03-310001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001510295us-gaap:NoncontrollingInterestMember2021-03-3100015102952021-03-310001510295mpc:RedeemableNoncontrollingInterestMember2021-03-310001510295us-gaap:RetainedEarningsMember2021-04-012021-06-300001510295us-gaap:NoncontrollingInterestMember2021-04-012021-06-300001510295mpc:RedeemableNoncontrollingInterestMember2021-04-012021-06-300001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001510295us-gaap:TreasuryStockMember2021-04-012021-06-300001510295us-gaap:CommonStockMember2021-04-012021-06-300001510295us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001510295us-gaap:CommonStockMember2021-06-300001510295us-gaap:TreasuryStockMember2021-06-300001510295us-gaap:AdditionalPaidInCapitalMember2021-06-300001510295us-gaap:RetainedEarningsMember2021-06-300001510295us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001510295us-gaap:NoncontrollingInterestMember2021-06-300001510295mpc:RedeemableNoncontrollingInterestMember2021-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:CommercialPaperMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CommercialPaperMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:CashAndCashEquivalentsMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:ShortTermInvestmentsMember2022-06-300001510295us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-06-300001510295us-gaap:CashAndCashEquivalentsMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-06-300001510295us-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-06-300001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-06-300001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-06-300001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2022-06-300001510295us-gaap:CashAndCashEquivalentsMember2022-06-300001510295us-gaap:ShortTermInvestmentsMember2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:CommercialPaperMember2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CommercialPaperMember2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:CashAndCashEquivalentsMember2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:ShortTermInvestmentsMember2021-12-310001510295us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001510295us-gaap:CashAndCashEquivalentsMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001510295us-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001510295us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMember2021-12-310001510295us-gaap:CashAndCashEquivalentsMember2021-12-310001510295us-gaap:ShortTermInvestmentsMember2021-12-310001510295mpc:SpeedwayMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-05-142021-05-140001510295us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-04-012021-06-300001510295us-gaap:DiscontinuedOperationsDisposedOfBySaleMember2021-01-012021-06-300001510295mpc:MarathonPetroleumCorporationMembermpc:MPLXLPMember2022-06-30xbrli:pure0001510295srt:SubsidiariesMember2020-11-020001510295srt:SubsidiariesMember2022-01-012022-06-300001510295srt:SubsidiariesMember2022-04-012022-06-300001510295srt:SubsidiariesMember2021-04-012021-06-300001510295srt:SubsidiariesMember2021-01-012021-06-300001510295srt:SubsidiariesMember2022-06-300001510295us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001510295us-gaap:AdditionalPaidInCapitalMember2021-01-012021-06-300001510295us-gaap:VariableInterestEntityPrimaryBeneficiaryMembermpc:MPLXLPMember2022-06-300001510295us-gaap:VariableInterestEntityPrimaryBeneficiaryMembermpc:MPLXLPMember2021-12-310001510295us-gaap:StockCompensationPlanMember2022-04-012022-06-300001510295us-gaap:StockCompensationPlanMember2021-04-012021-06-300001510295us-gaap:StockCompensationPlanMember2022-01-012022-06-300001510295us-gaap:StockCompensationPlanMember2021-01-012021-06-300001510295mpc:ShareRepurchaseAuthorizationFebruary2022Member2022-02-02mpc:Segment0001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2022-04-012022-06-300001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2021-04-012021-06-300001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2022-01-012022-06-300001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2021-01-012021-06-300001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001510295us-gaap:OperatingSegmentsMember2022-04-012022-06-300001510295us-gaap:OperatingSegmentsMember2021-04-012021-06-300001510295us-gaap:OperatingSegmentsMember2022-01-012022-06-300001510295us-gaap:OperatingSegmentsMember2021-01-012021-06-300001510295us-gaap:CorporateNonSegmentMember2022-04-012022-06-300001510295us-gaap:CorporateNonSegmentMember2021-04-012021-06-300001510295us-gaap:CorporateNonSegmentMember2022-01-012022-06-300001510295us-gaap:CorporateNonSegmentMember2021-01-012021-06-300001510295mpc:RefiningAndMarketingMember2022-04-012022-06-300001510295mpc:RefiningAndMarketingMember2021-04-012021-06-300001510295mpc:RefiningAndMarketingMember2022-01-012022-06-300001510295mpc:RefiningAndMarketingMember2021-01-012021-06-300001510295us-gaap:IntersegmentEliminationMembermpc:RefiningAndMarketingMember2022-04-012022-06-300001510295us-gaap:IntersegmentEliminationMembermpc:RefiningAndMarketingMember2021-04-012021-06-300001510295us-gaap:IntersegmentEliminationMembermpc:RefiningAndMarketingMember2022-01-012022-06-300001510295us-gaap:IntersegmentEliminationMembermpc:RefiningAndMarketingMember2021-01-012021-06-300001510295mpc:MidstreamMember2022-04-012022-06-300001510295mpc:MidstreamMember2021-04-012021-06-300001510295mpc:MidstreamMember2022-01-012022-06-300001510295mpc:MidstreamMember2021-01-012021-06-300001510295mpc:MidstreamMemberus-gaap:IntersegmentEliminationMember2022-04-012022-06-300001510295mpc:MidstreamMemberus-gaap:IntersegmentEliminationMember2021-04-012021-06-300001510295mpc:MidstreamMemberus-gaap:IntersegmentEliminationMember2022-01-012022-06-300001510295mpc:MidstreamMemberus-gaap:IntersegmentEliminationMember2021-01-012021-06-300001510295us-gaap:IntersegmentEliminationMember2022-04-012022-06-300001510295us-gaap:IntersegmentEliminationMember2021-04-012021-06-300001510295us-gaap:IntersegmentEliminationMember2022-01-012022-06-300001510295us-gaap:IntersegmentEliminationMember2021-01-012021-06-300001510295mpc:WatsonCogenerationCompanyMember2022-06-010001510295mpc:WatsonCogenerationCompanyMember2022-06-012022-06-010001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2022-06-300001510295us-gaap:OperatingSegmentsMembermpc:RefiningAndMarketingMember2021-12-310001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2022-06-300001510295mpc:MidstreamMemberus-gaap:OperatingSegmentsMember2021-12-310001510295us-gaap:CorporateNonSegmentMember2022-06-300001510295us-gaap:CorporateNonSegmentMember2021-12-310001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Member2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2022-06-300001510295us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2022-06-300001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2022-06-300001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMemberus-gaap:FairValueInputsLevel1Member2022-06-300001510295us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-06-300001510295us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-06-300001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-06-300001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Member2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2021-12-310001510295us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2021-12-310001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2021-12-310001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001510295us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310001510295us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310001510295us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-12-310001510295us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMembersrt:MinimumMember2022-06-300001510295us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMembersrt:MaximumMember2022-06-300001510295us-gaap:FairValueInputsLevel3Member2022-06-30iso4217:USDutr:gal0001510295us-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-01-012022-06-300001510295us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2022-01-012022-06-300001510295us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001510295us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-06-300001510295us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001510295us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001510295us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2022-06-300001510295us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMember2021-12-310001510295us-gaap:OtherCurrentLiabilitiesMemberus-gaap:CommodityContractMember2022-06-300001510295us-gaap:OtherCurrentLiabilitiesMemberus-gaap:CommodityContractMember2021-12-310001510295us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-06-300001510295us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2021-12-310001510295srt:CrudeOilMemberus-gaap:ExchangeTradedMember2022-01-012022-06-300001510295srt:CrudeOilMemberus-gaap:ExchangeTradedMemberus-gaap:LongMember2022-06-30utr:bbl0001510295srt:CrudeOilMemberus-gaap:ExchangeTradedMemberus-gaap:ShortMember2022-06-30utr:gal0001510295us-gaap:ExchangeTradedMembersrt:FuelMember2022-01-012022-06-300001510295us-gaap:ExchangeTradedMemberus-gaap:LongMembersrt:FuelMember2022-06-300001510295us-gaap:ExchangeTradedMemberus-gaap:ShortMembersrt:FuelMember2022-06-300001510295us-gaap:ExchangeTradedMembermpc:BlendingproductsMember2022-01-012022-06-300001510295us-gaap:ExchangeTradedMembermpc:BlendingproductsMemberus-gaap:LongMember2022-06-300001510295us-gaap:ExchangeTradedMembermpc:BlendingproductsMemberus-gaap:ShortMember2022-06-300001510295mpc:SoybeanOilMemberus-gaap:ExchangeTradedMember2022-01-012022-06-300001510295mpc:SoybeanOilMemberus-gaap:ExchangeTradedMemberus-gaap:LongMember2022-06-300001510295mpc:SoybeanOilMemberus-gaap:ExchangeTradedMemberus-gaap:ShortMember2022-06-300001510295srt:CrudeOilMemberus-gaap:ExchangeTradedMemberus-gaap:LongMemberus-gaap:OtherContractMember2022-06-300001510295srt:CrudeOilMemberus-gaap:ExchangeTradedMemberus-gaap:ShortMemberus-gaap:OtherContractMember2022-06-300001510295us-gaap:ExchangeTradedMemberus-gaap:LongMemberus-gaap:OtherContractMembersrt:FuelMember2022-06-300001510295us-gaap:ExchangeTradedMemberus-gaap:ShortMemberus-gaap:OtherContractMembersrt:FuelMember2022-06-300001510295us-gaap:SalesMemberus-gaap:CommodityContractMember2022-04-012022-06-300001510295us-gaap:SalesMemberus-gaap:CommodityContractMember2021-04-012021-06-300001510295us-gaap:SalesMemberus-gaap:CommodityContractMember2022-01-012022-06-300001510295us-gaap:SalesMemberus-gaap:CommodityContractMember2021-01-012021-06-300001510295us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2022-04-012022-06-300001510295us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2021-04-012021-06-300001510295us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2022-01-012022-06-300001510295us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2021-01-012021-06-300001510295us-gaap:OtherIncomeMemberus-gaap:CommodityContractMember2022-04-012022-06-300001510295us-gaap:OtherIncomeMemberus-gaap:CommodityContractMember2021-04-012021-06-300001510295us-gaap:OtherIncomeMemberus-gaap:CommodityContractMember2022-01-012022-06-300001510295us-gaap:OtherIncomeMemberus-gaap:CommodityContractMember2021-01-012021-06-300001510295us-gaap:CommodityContractMember2022-04-012022-06-300001510295us-gaap:CommodityContractMember2021-04-012021-06-300001510295us-gaap:CommodityContractMember2022-01-012022-06-300001510295us-gaap:CommodityContractMember2021-01-012021-06-300001510295srt:ParentCompanyMemberus-gaap:SeniorNotesMember2022-06-300001510295srt:ParentCompanyMemberus-gaap:SeniorNotesMember2021-12-310001510295srt:ParentCompanyMemberus-gaap:NotesPayableOtherPayablesMember2022-06-300001510295srt:ParentCompanyMemberus-gaap:NotesPayableOtherPayablesMember2021-12-310001510295srt:ParentCompanyMember2022-06-300001510295srt:ParentCompanyMember2021-12-310001510295us-gaap:LineOfCreditMembersrt:SubsidiariesMember2022-06-300001510295us-gaap:LineOfCreditMembersrt:SubsidiariesMember2021-12-310001510295srt:SubsidiariesMemberus-gaap:SeniorNotesMember2022-06-300001510295srt:SubsidiariesMemberus-gaap:SeniorNotesMember2021-12-310001510295srt:SubsidiariesMember2021-12-310001510295srt:SubsidiariesMembermpc:SeniorNotesDueMarch2052Memberus-gaap:SeniorNotesMember2022-03-140001510295mpc:MPCRevolvingCreditFacilityDueOctober2023Member2022-06-300001510295mpc:TradeReceivablesSecuritizationDueSeptember2022Member2022-06-300001510295srt:SubsidiariesMembermpc:MPLXRevolvingCreditFacilitydueJuly2024Member2022-06-300001510295mpc:PurchaseCrudeOilFromStrategicPetroleumReserveMembermpc:TradeReceivablesSecuritizationDueSeptember2022Member2022-06-300001510295mpc:MPCRevolvingCreditFacilityDueJuly2027Memberus-gaap:SubsequentEventMember2022-07-070001510295srt:ParentCompanyMembermpc:MPCRevolvingCreditFacilityDueJuly2027Memberus-gaap:SubsequentEventMember2022-07-072022-07-070001510295mpc:MPLXRevolvingCreditFacilityDueJuly2027Membersrt:SubsidiariesMemberus-gaap:SubsequentEventMember2022-07-070001510295mpc:MPLXRevolvingCreditFacilityDueJuly2027Membersrt:SubsidiariesMemberus-gaap:SubsequentEventMemberus-gaap:LetterOfCreditMember2022-07-070001510295mpc:MPLXRevolvingCreditFacilityDueJuly2027Membersrt:SubsidiariesMemberus-gaap:SubsequentEventMember2022-07-072022-07-070001510295mpc:RefinedProductsMembermpc:RefiningAndMarketingMember2022-04-012022-06-300001510295mpc:RefinedProductsMembermpc:RefiningAndMarketingMember2021-04-012021-06-300001510295mpc:RefinedProductsMembermpc:RefiningAndMarketingMember2022-01-012022-06-300001510295mpc:RefinedProductsMembermpc:RefiningAndMarketingMember2021-01-012021-06-300001510295srt:CrudeOilMembermpc:RefiningAndMarketingMember2022-04-012022-06-300001510295srt:CrudeOilMembermpc:RefiningAndMarketingMember2021-04-012021-06-300001510295srt:CrudeOilMembermpc:RefiningAndMarketingMember2022-01-012022-06-300001510295srt:CrudeOilMembermpc:RefiningAndMarketingMember2021-01-012021-06-300001510295mpc:ServicesAndOtherMembermpc:RefiningAndMarketingMember2022-04-012022-06-300001510295mpc:ServicesAndOtherMembermpc:RefiningAndMarketingMember2021-04-012021-06-300001510295mpc:ServicesAndOtherMembermpc:RefiningAndMarketingMember2022-01-012022-06-300001510295mpc:ServicesAndOtherMembermpc:RefiningAndMarketingMember2021-01-012021-06-300001510295mpc:MidstreamMembermpc:RefinedProductsMember2022-04-012022-06-300001510295mpc:MidstreamMembermpc:RefinedProductsMember2021-04-012021-06-300001510295mpc:MidstreamMembermpc:RefinedProductsMember2022-01-012022-06-300001510295mpc:MidstreamMembermpc:RefinedProductsMember2021-01-012021-06-300001510295mpc:MidstreamMembermpc:ServicesAndOtherMember2022-04-012022-06-300001510295mpc:MidstreamMembermpc:ServicesAndOtherMember2021-04-012021-06-300001510295mpc:MidstreamMembermpc:ServicesAndOtherMember2022-01-012022-06-300001510295mpc:MidstreamMembermpc:ServicesAndOtherMember2021-01-012021-06-300001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001510295mpc:AccumulatedGainLossNetOtherMember2020-12-310001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-06-300001510295mpc:AccumulatedGainLossNetOtherMember2021-01-012021-06-300001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-06-300001510295mpc:AccumulatedGainLossNetOtherMember2021-06-300001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001510295mpc:AccumulatedGainLossNetOtherMember2021-12-310001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-06-300001510295mpc:AccumulatedGainLossNetOtherMember2022-01-012022-06-300001510295us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300001510295us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-06-300001510295mpc:AccumulatedGainLossNetOtherMember2022-06-300001510295us-gaap:PensionPlansDefinedBenefitMember2022-04-012022-06-300001510295us-gaap:PensionPlansDefinedBenefitMember2021-04-012021-06-300001510295us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-06-300001510295us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-06-300001510295us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-04-012022-06-300001510295us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-04-012021-06-300001510295us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-06-300001510295us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-06-300001510295us-gaap:OtherPensionPlansDefinedBenefitMember2022-01-012022-06-300001510295us-gaap:PendingLitigationMember2022-01-012022-06-3000015102952020-07-012020-07-3100015102952020-12-152020-12-150001510295us-gaap:GuaranteeOfIndebtednessOfOthersMemberus-gaap:FinancialGuaranteeMembermpc:LoopAndLocapLlcMember2022-06-300001510295mpc:BakkenPipelineSystemMember2022-06-300001510295mpc:BakkenPipelineSystemMemberus-gaap:GuaranteeOfIndebtednessOfOthersMemberus-gaap:FinancialGuaranteeMember2022-06-300001510295mpc:CrowleyOceanPartnersLLCMember2022-06-300001510295us-gaap:GuaranteeOfIndebtednessOfOthersMemberus-gaap:FinancialGuaranteeMembermpc:CrowleyOceanPartnersLLCMember2022-06-300001510295mpc:CrowleyBlueWaterPartnersLLCMember2022-06-300001510295us-gaap:GuaranteeOfIndebtednessOfOthersMemberus-gaap:FinancialGuaranteeMembermpc:CrowleyBlueWaterPartnersLLCMember2022-06-300001510295us-gaap:GuaranteeTypeOtherMember2022-06-300001510295mpc:ShareRepurchaseAuthorizationAugust2022Memberus-gaap:SubsequentEventMember2022-08-020001510295mpc:ShareRepurchaseAuthorizationAugust2022Membersrt:SubsidiariesMemberus-gaap:SubsequentEventMember2022-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35054

Marathon Petroleum Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 27-1284632 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

539 South Main Street, Findlay, Ohio 45840-3229

(Address of principal executive offices) (Zip code)

(419) 422-2121

(Registrant’s telephone number, including area code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.01 | MPC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☑ Accelerated Filer ☐ Non-accelerated Filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☑

There were 498,624,055 shares of Marathon Petroleum Corporation common stock outstanding as of July 29, 2022.

MARATHON PETROLEUM CORPORATION

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2022

TABLE OF CONTENTS

Unless otherwise stated or the context otherwise indicates, all references in this Form 10-Q to “MPC,” “us,” “our,” “we” or “the Company” mean Marathon Petroleum Corporation and its consolidated subsidiaries.

GLOSSARY OF TERMS

Throughout this report, the following company or industry specific terms and abbreviations are used:

| | | | | |

| ANS | Alaska North Slope crude oil, an oil index benchmark price |

| ASU | Accounting Standards Update |

| barrel | One stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to crude oil or other liquid hydrocarbons |

| CARB | California Air Resources Board |

| CARBOB | California Reformulated Gasoline Blendstock for Oxygenate Blending |

| CBOB | Conventional Blending for Oxygenate Blending |

| EBITDA | Earnings Before Interest, Tax, Depreciation and Amortization (a non-GAAP financial measure) |

| EPA | U.S. Environmental Protection Agency |

| GAAP | Accounting principles generally accepted in the United States |

| LCM | Lower of cost or market |

| LIFO | Last in, first out, an inventory costing method |

| mbpd | Thousand barrels per day |

| MEH | Magellan East Houston crude oil, an oil index benchmark price |

| MMBtu | One million British thermal units, an energy measurement |

| NGL | Natural gas liquids, such as ethane, propane, butanes and natural gasoline |

| NYMEX | New York Mercantile Exchange |

| PP&E | Property, plant and equipment |

| RFS2 | Revised Renewable Fuel Standard program, as required by the Energy Independence and Security Act of 2007 |

| RIN | Renewable Identification Number |

| SEC | U.S. Securities and Exchange Commission |

| SOFR | Secured overnight financing rate |

| ULSD | Ultra-low sulfur diesel |

| USGC | U.S. Gulf Coast |

| VIE | Variable interest entity |

| WTI | West Texas Intermediate crude oil, an oil index benchmark price |

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

MARATHON PETROLEUM CORPORATION

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per share data) | 2022 | | 2021 | | 2022 | | 2021 |

| Revenues and other income: | | | | | | | |

| Sales and other operating revenues | $ | 53,795 | | | $ | 29,615 | | | $ | 91,853 | | | $ | 52,326 | |

| Income from equity method investments | 147 | | | 93 | | | 289 | | | 184 | |

| Net gain on disposal of assets | 39 | | | — | | | 21 | | | 3 | |

| Other income | 257 | | | 119 | | | 459 | | | 196 | |

| Total revenues and other income | 54,238 | | | 29,827 | | | 92,622 | | | 52,709 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenues (excludes items below) | 44,207 | | | 27,177 | | | 79,275 | | | 48,261 | |

| Depreciation and amortization | 819 | | | 871 | | | 1,624 | | | 1,715 | |

| Selling, general and administrative expenses | 694 | | | 625 | | | 1,297 | | | 1,200 | |

| Other taxes | 190 | | | 189 | | | 382 | | | 351 | |

| Total costs and expenses | 45,910 | | | 28,862 | | | 82,578 | | | 51,527 | |

| | | | | | | |

| Income from continuing operations | 8,328 | | | 965 | | | 10,044 | | | 1,182 | |

| Net interest and other financial costs | 312 | | | 372 | | | 574 | | | 725 | |

| Income from continuing operations before income taxes | 8,016 | | | 593 | | | 9,470 | | | 457 | |

| Provision for income taxes on continuing operations | 1,799 | | | 5 | | | 2,081 | | | 39 | |

| Income from continuing operations, net of tax | 6,217 | | | 588 | | | 7,389 | | | 418 | |

| Income from discontinued operations, net of tax | — | | | 8,214 | | | — | | | 8,448 | |

| Net income | 6,217 | | | 8,802 | | | 7,389 | | | 8,866 | |

| Less net income attributable to: | | | | | | | |

| Redeemable noncontrolling interest | 21 | | | 21 | | | 42 | | | 41 | |

| Noncontrolling interests | 323 | | | 269 | | | 629 | | | 555 | |

| Net income attributable to MPC | $ | 5,873 | | | $ | 8,512 | | | $ | 6,718 | | | $ | 8,270 | |

| | | | | | | |

Per share data (See Note 8) | | | | | | | |

| Basic: | | | | | | | |

| Continuing operations | $ | 11.03 | | | $ | 0.46 | | | $ | 12.24 | | | $ | (0.27) | |

| Discontinued operations | — | | | 12.63 | | | — | | | 12.98 | |

| Net income per share | $ | 11.03 | | | $ | 13.09 | | | $ | 12.24 | | | $ | 12.71 | |

| | | | | | | |

| Weighted average shares outstanding | 532 | | | 650 | | | 549 | | | 651 | |

| | | | | | | |

| Diluted: | | | | | | | |

| Continuing operations | $ | 10.95 | | | $ | 0.45 | | | $ | 12.15 | | | $ | (0.27) | |

| Discontinued operations | — | | | 12.55 | | | — | | | 12.98 | |

| Net income per share | $ | 10.95 | | | $ | 13.00 | | | $ | 12.15 | | | $ | 12.71 | |

| | | | | | | |

| Weighted average shares outstanding | 536 | | | 654 | | | 553 | | | 651 | |

The accompanying notes are an integral part of these consolidated financial statements.

MARATHON PETROLEUM CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (Millions of dollars) | 2022 | | 2021 | | 2022 | | 2021 |

| Net income | $ | 6,217 | | | $ | 8,802 | | | $ | 7,389 | | | $ | 8,866 | |

| Defined benefit plans: | | | | | | | |

Actuarial changes, net of tax of $7, $61, $11 and $64, respectively | 21 | | | 183 | | | 33 | | | 192 | |

Prior service, net of tax of $(4), $(2), $(8) and $(5), respectively | (12) | | | (8) | | | (25) | | | (16) | |

Other, net of tax of $—, $(2), $(2) and $(2), respectively | — | | | (4) | | | (6) | | | (4) | |

| Other comprehensive income | 9 | | | 171 | | | 2 | | | 172 | |

| Comprehensive income | 6,226 | | | 8,973 | | | 7,391 | | | 9,038 | |

| Less comprehensive income attributable to: | | | | | | | |

| Redeemable noncontrolling interest | 21 | | | 21 | | | 42 | | | 41 | |

| Noncontrolling interests | 323 | | | 269 | | | 629 | | | 555 | |

| Comprehensive income attributable to MPC | $ | 5,882 | | | $ | 8,683 | | | $ | 6,720 | | | $ | 8,442 | |

The accompanying notes are an integral part of these consolidated financial statements.

MARATHON PETROLEUM CORPORATION

CONSOLIDATED BALANCE SHEETS (Unaudited)

| | | | | | | | | | | |

| (Millions of dollars, except share data) | June 30,

2022 | | December 31,

2021 |

| Assets | | | |

| Cash and cash equivalents | $ | 9,078 | | | $ | 5,291 | |

| Short-term investments | 4,241 | | | 5,548 | |

Receivables, less allowance for doubtful accounts of $39 and $40, respectively | 17,305 | | | 11,034 | |

| Inventories | 11,048 | | | 8,055 | |

| Other current assets | 741 | | | 568 | |

| | | |

| Total current assets | 42,413 | | | 30,496 | |

| Equity method investments | 5,508 | | | 5,409 | |

| Property, plant and equipment, net | 37,062 | | | 37,440 | |

| Goodwill | 8,244 | | | 8,256 | |

| Right of use assets | 1,276 | | | 1,372 | |

| Other noncurrent assets | 2,234 | | | 2,400 | |

| Total assets | $ | 96,737 | | | $ | 85,373 | |

| | | |

| Liabilities | | | |

| Accounts payable | $ | 22,502 | | | $ | 13,700 | |

| Payroll and benefits payable | 619 | | | 911 | |

| Accrued taxes | 2,584 | | | 1,231 | |

| Debt due within one year | 1,087 | | | 571 | |

| Operating lease liabilities | 391 | | | 438 | |

| Other current liabilities | 1,254 | | | 1,047 | |

| | | |

| Total current liabilities | 28,437 | | | 17,898 | |

| Long-term debt | 25,687 | | | 24,968 | |

| Deferred income taxes | 5,542 | | | 5,638 | |

| Defined benefit postretirement plan obligations | 1,133 | | | 1,015 | |

| Long-term operating lease liabilities | 879 | | | 927 | |

| Deferred credits and other liabilities | 1,390 | | | 1,346 | |

| Total liabilities | 63,068 | | | 51,792 | |

| | | |

Commitments and contingencies (see Note 23) | | | |

| Redeemable noncontrolling interest | 965 | | | 965 | |

| | | |

| Equity | | | |

Preferred stock, no shares issued and outstanding (par value $0.01 per share, 30 million shares authorized) | — | | | — | |

| Common stock: | | | |

Issued – 989 million and 984 million shares (par value $0.01 per share, 2 billion shares authorized) | 10 | | | 10 | |

Held in treasury, at cost – 476 million and 405 million shares | (26,000) | | | (19,904) | |

| Additional paid-in capital | 33,378 | | | 33,262 | |

| Retained earnings | 18,983 | | | 12,905 | |

| Accumulated other comprehensive loss | (65) | | | (67) | |

| Total MPC stockholders’ equity | 26,306 | | | 26,206 | |

| Noncontrolling interests | 6,398 | | | 6,410 | |

| Total equity | 32,704 | | | 32,616 | |

| Total liabilities, redeemable noncontrolling interest and equity | $ | 96,737 | | | $ | 85,373 | |

The accompanying notes are an integral part of these consolidated financial statements.

MARATHON PETROLEUM CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| (Millions of dollars) | 2022 | | 2021 |

| Operating activities: | | | |

| Net income | $ | 7,389 | | | $ | 8,866 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Amortization of deferred financing costs and debt discount | 33 | | | 41 | |

| Depreciation and amortization | 1,624 | | | 1,715 | |

| Pension and other postretirement benefits, net | 117 | | | (34) | |

| Deferred income taxes | (92) | | | (49) | |

| Net gain on disposal of assets | (21) | | | (3) | |

| Income from equity method investments | (289) | | | (184) | |

| Distributions from equity method investments | 336 | | | 303 | |

| Income from discontinued operations | — | | | (8,448) | |

| Changes in income tax receivable | 11 | | | 20 | |

| Changes in the fair value of derivative instruments | (169) | | | (1) | |

| Changes in: | | | |

| Current receivables | (6,282) | | | (3,947) | |

| Inventories | (2,979) | | | (880) | |

| Current accounts payable and accrued liabilities | 10,106 | | | 4,477 | |

| Right of use assets and operating lease liabilities, net | 2 | | | 4 | |

| All other, net | (277) | | | (79) | |

| Cash provided by operating activities - continuing operations | 9,509 | | | 1,801 | |

| Cash provided by (used in) operating activities - discontinued operations | (44) | | | 33 | |

| Net cash provided by operating activities | 9,465 | | | 1,834 | |

| | | |

| Investing activities: | | | |

| Additions to property, plant and equipment | (993) | | | (606) | |

| Acquisitions, net of cash acquired | (74) | | | — | |

| Disposal of assets | 72 | | | 81 | |

| Investments – acquisitions and contributions | (160) | | | (113) | |

| – redemptions, repayments and return of capital | — | | | 3 | |

| Purchases of short-term investments | (2,581) | | | (5,417) | |

| Sales of short-term investments | 1,075 | | | — | |

| Maturities of short-term investments | 2,811 | | | — | |

| All other, net | 470 | | | 220 | |

| Cash provided by (used in) investing activities - continuing operations | 620 | | | (5,832) | |

| Cash provided by investing activities - discontinued operations | — | | | 21,235 | |

| Net cash provided by investing activities | 620 | | | 15,403 | |

| | | |

| Financing activities: | | | |

| Commercial paper – issued | — | | | 7,414 | |

| – repayments | — | | | (8,437) | |

| Long-term debt – borrowings | 2,385 | | | 10,775 | |

| – repayments | (1,237) | | | (13,056) | |

| Debt issuance costs | (16) | | | — | |

| Issuance of common stock | 167 | | | 53 | |

| Common stock repurchased | (6,177) | | | (984) | |

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| (Millions of dollars) | 2022 | | 2021 |

| Dividends paid | (643) | | | (760) | |

| Distributions to noncontrolling interests | (599) | | | (613) | |

| | | |

| Repurchases of noncontrolling interests | (135) | | | (310) | |

| All other, net | (41) | | | (36) | |

| Net cash used in financing activities | (6,296) | | | (5,954) | |

| | | |

| Net change in cash, cash equivalents and restricted cash | $ | 3,789 | | | $ | 11,283 | |

| | | |

Cash, cash equivalents and restricted cash balances:(a) | | | |

| Continuing operations - beginning of period | $ | 5,294 | | | $ | 416 | |

| Discontinued operations - beginning of period | — | | | 140 | |

| Less: Discontinued operations - end of period | — | | | — | |

| Continuing operations - end of period | $ | 9,083 | | | $ | 11,839 | |

| | | |

(a)Restricted cash is included in other current assets on our consolidated balance sheets.

The accompanying notes are an integral part of these consolidated financial statements.

MARATHON PETROLEUM CORPORATION

CONSOLIDATED STATEMENTS OF EQUITY AND REDEEMBALE NONCONTROLLING INTEREST

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | MPC Stockholders’ Equity | | | | | | | |

| Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Non-controlling Interests | | Total Equity | | | Redeemable Non-controlling Interest |

(Shares in millions;

amounts in millions of dollars) | Shares | | Amount | | Shares | | Amount | | | | | | | |

| Balance as of December 31, 2021 | 984 | | | $ | 10 | | | (405) | | | $ | (19,904) | | | $ | 33,262 | | | $ | 12,905 | | | $ | (67) | | | $ | 6,410 | | | $ | 32,616 | | | | $ | 965 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 845 | | | — | | | 306 | | | 1,151 | | | | 21 | |

Dividends declared on common stock ($0.58 per share) | — | | | — | | | — | | | — | | | — | | | (330) | | | — | | | — | | | (330) | | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (290) | | | (290) | | | | (21) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | — | | | (7) | | | — | | | (7) | | | | — | |

| Shares repurchased | — | | | — | | | (37) | | | (2,807) | | | — | | | — | | | — | | | — | | | (2,807) | | | | — | |

| Stock-based compensation | 3 | | | — | | | — | | | — | | | 90 | | | — | | | — | | | (1) | | | 89 | | | | — | |

| Equity transactions of MPLX | — | | | — | | | — | | | — | | | (25) | | | — | | | — | | | (63) | | | (88) | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2022 | 987 | | | $ | 10 | | | (442) | | | $ | (22,711) | | | $ | 33,327 | | | $ | 13,420 | | | $ | (74) | | | $ | 6,362 | | | $ | 30,334 | | | | $ | 965 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 5,873 | | | — | | | 323 | | | 6,196 | | | | 21 | |

Dividends declared on common stock ($0.58 per share) | — | | | — | | | — | | | — | | | — | | | (310) | | | — | | | — | | | (310) | | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (267) | | | (267) | | | | (21) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 9 | | | — | | | 9 | | | | — | |

| Shares repurchased | — | | | — | | | (34) | | | (3,285) | | | — | | | — | | | — | | | — | | | (3,285) | | | | — | |

| Stock-based compensation | 2 | | | — | | | — | | | (4) | | | 71 | | | — | | | — | | | 2 | | | 69 | | | | — | |

| Equity transactions of MPLX | — | | | — | | | — | | | — | | | (20) | | | — | | | — | | | (22) | | | (42) | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2022 | 989 | | | $ | 10 | | | (476) | | | $ | (26,000) | | | $ | 33,378 | | | $ | 18,983 | | | $ | (65) | | | $ | 6,398 | | | $ | 32,704 | | | | $ | 965 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | MPC Stockholders’ Equity | | | | | | | |

| Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Non-controlling Interests | | Total Equity | | | Redeemable Non-controlling Interest |

(Shares in millions;

amounts in millions of dollars) | Shares | | Amount | | Shares | | Amount | | | | | | | |

| Balance as of December 31, 2020 | 980 | | | $ | 10 | | | (329) | | | $ | (15,157) | | | $ | 33,208 | | | $ | 4,650 | | | $ | (512) | | | $ | 7,053 | | | $ | 29,252 | | | | $ | 968 | |

| Net income (loss) | — | | | — | | | — | | | — | | | — | | | (242) | | | — | | | 286 | | | 44 | | | | 20 | |

Dividends declared on common stock ($0.58 per share) | — | | | — | | | — | | | — | | | — | | | (379) | | | — | | | — | | | (379) | | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (300) | | | (300) | | | | (20) | |

| | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 1 | | | — | | | 1 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | 1 | | | — | | | — | | | (1) | | | 18 | | | — | | | — | | | — | | | 17 | | | | — | |

| Equity transactions of MPLX | — | | | — | | | — | | | — | | | (4) | | | — | | | — | | | (120) | | | (124) | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2021 | 981 | | | $ | 10 | | | (329) | | | $ | (15,158) | | | $ | 33,222 | | | $ | 4,029 | | | $ | (511) | | | $ | 6,919 | | | $ | 28,511 | | | | $ | 968 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 8,512 | | | — | | | 269 | | | 8,781 | | | | 21 | |

Dividends declared on common stock ($0.58 per share) | — | | | — | | | — | | | — | | | — | | | (381) | | | — | | | — | | | (381) | | | | — | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (272) | | | (272) | | | | (21) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 171 | | | — | | | 171 | | | | — | |

| Shares repurchased | — | | | — | | | (16) | | | (984) | | | — | | | — | | | — | | | — | | | (984) | | | | — | |

| Stock-based compensation | 2 | | | — | | | — | | | (5) | | | 50 | | | — | | | — | | | 2 | | | 47 | | | | — | |

| Equity transactions of MPLX | — | | | — | | | — | | | — | | | (34) | | | — | | | — | | | (114) | | | (148) | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2021 | 983 | | | $ | 10 | | | (345) | | | $ | (16,147) | | | $ | 33,238 | | | $ | 12,160 | | | $ | (340) | | | $ | 6,804 | | | $ | 35,725 | | | | $ | 968 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. DESCRIPTION OF THE BUSINESS AND BASIS OF PRESENTATION

Description of the Business

We are a leading, integrated, downstream energy company headquartered in Findlay, Ohio. We operate the nation's largest refining system. We sell refined products to wholesale marketing customers domestically and internationally, to buyers on the spot market and to independent entrepreneurs who operate branded outlets. We also sell transportation fuel to consumers through direct dealer locations under long-term supply contracts. MPC’s midstream operations are primarily conducted through MPLX LP (“MPLX”), which owns and operates crude oil and light product transportation and logistics infrastructure as well as gathering, processing and fractionation assets. We own the general partner and a majority limited partner interest in MPLX. See Note 5.

Basis of Presentation

All significant intercompany transactions and accounts have been eliminated.

These interim consolidated financial statements are unaudited; however, in the opinion of our management, these statements reflect all adjustments necessary for a fair statement of the results for the periods reported. All such adjustments are of a normal, recurring nature unless otherwise disclosed. These interim consolidated financial statements, including the notes, have been prepared in accordance with the rules of the SEC applicable to interim period financial statements and do not include all of the information and disclosures required by GAAP for complete financial statements. Certain information and disclosures derived from our audited annual financial statements, prepared in accordance with GAAP, have been condensed or omitted from these interim financial statements.

These interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2021. The results of operations for the three and six months ended June 30, 2022 are not necessarily indicative of the results to be expected for the full year.

2. ACCOUNTING STANDARDS

Recently Adopted

ASU 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance

In November 2021, the FASB issued guidance requiring disclosures for certain types of government assistance that have been accounted for by analogy to grant or contribution models. Disclosures will include information about the type of transactions, accounting and the impact on financial statements. We prospectively adopted this standard in the first quarter of 2022. The adoption of this standard did not have a material impact on our financial statements or disclosures.

3. SHORT-TERM INVESTMENTS

Investments Components

The components of investments were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 |

| (In millions) | | Fair Value Level | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value | | Cash and Cash Equivalents | | Short-term Investments |

| Available-for-sale debt securities | | | | | | | | | | | | | | |

| Commercial paper | | Level 2 | | $ | 3,300 | | | $ | — | | | $ | (6) | | | $ | 3,294 | | | $ | 583 | | | $ | 2,711 | |

| Certificates of deposit and time deposits | | Level 2 | | 5,313 | | | — | | | (4) | | | 5,309 | | | 3,830 | | | 1,479 | |

| U.S. government securities | | Level 1 | | 23 | | | — | | | — | | | 23 | | | — | | | 23 | |

| Corporate notes and bonds | | Level 2 | | 28 | | | — | | | — | | | 28 | | | — | | | 28 | |

| Total available-for-sale debt securities | | | | $ | 8,664 | | | $ | — | | | $ | (10) | | | $ | 8,654 | | | $ | 4,413 | | | $ | 4,241 | |

| Cash | | | | | | | | | | 4,665 | | | 4,665 | | | — | |

| Total | | | | | | | | | | $ | 13,319 | | | $ | 9,078 | | | $ | 4,241 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2021 |

| (In millions) | | Fair Value Level | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value | | Cash and Cash Equivalents | | Short-term Investments |

| Available-for-sale debt securities | | | | | | | | | | | | | | |

| Commercial paper | | Level 2 | | $ | 4,905 | | | $ | — | | | $ | (1) | | | $ | 4,904 | | | $ | 868 | | | $ | 4,036 | |

| Certificates of deposit and time deposits | | Level 2 | | 2,024 | | | — | | | — | | | 2,024 | | | 750 | | | 1,274 | |

| U.S. government securities | | Level 1 | | 28 | | | — | | | — | | | 28 | | | — | | | 28 | |

| Corporate notes and bonds | | Level 2 | | 271 | | | — | | | — | | | 271 | | | 61 | | | 210 | |

| Total available-for-sale debt securities | | | | $ | 7,228 | | | $ | — | | | $ | (1) | | | $ | 7,227 | | | $ | 1,679 | | | $ | 5,548 | |

| Cash | | | | | | | | | | 3,612 | | | 3,612 | | | — | |

| Total | | | | | | | | | | $ | 10,839 | | | $ | 5,291 | | | $ | 5,548 | |

Our investment policy includes concentration limits and credit rating requirements which limits our investments to high quality, short term and highly liquid securities.

Unrealized losses on debt investments held from May 14, 2021, which coincides with the sale of Speedway, to June 30, 2022 were not material. Realized gains/losses were not material. All of our available-for-sale debt securities held as of June 30, 2022 mature within one year or less or are readily available for use.

4. DISCONTINUED OPERATIONS

On May 14, 2021, we completed the sale of Speedway, our company-owned and operated retail transportation fuel and convenience store business, to 7-Eleven for cash proceeds of approximately $21.38 billion. After-tax proceeds were approximately $17.22 billion. This transaction resulted in a pretax gain of $11.68 billion ($8.02 billion after income taxes) after deducting the book value of the net assets and certain other adjustments.

The proceeds and related Speedway sale gain may be adjusted in future periods based on provisions of the purchase and sale agreement that allow for adjustments of working capital amounts and other miscellaneous items subsequent to the transaction closing date of May 14, 2021.

Results of operations for Speedway are reflected through the close of the sale. The following table presents Speedway results and the gain on sale as reported in income from discontinued operations, net of tax, within our consolidated statements of income.

| | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Six Months Ended |

| (In millions) | | | June 30, 2021 |

| Revenues, other income and net gain on disposal of assets: | | | | | | | |

| Revenues and other income | | | $ | 3,081 | | | | | $ | 8,420 | |

| Net gain on disposal of assets | | | 11,682 | | | | | 11,682 | |

| Total revenues, other income and net gain on disposal of assets | | | 14,763 | | | | | 20,102 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenues (excludes items below) | | | 2,748 | | | | | 7,654 | |

| Depreciation and amortization | | | 1 | | | | | 3 | |

| Selling, general and administrative expenses | | | 48 | | | | | 121 | |

| Other taxes | | | 24 | | | | | 75 | |

| Total costs and expenses | | | 2,821 | | | | | 7,853 | |

| | | | | | | |

| Income from operations | | | 11,942 | | | | | 12,249 | |

| Net interest and other financial costs | | | 2 | | | | | 6 | |

| Income before income taxes | | | 11,940 | | | | | 12,243 | |

| Provision for income taxes | | | 3,726 | | | | | 3,795 | |

| Income from discontinued operations, net of tax | | | $ | 8,214 | | | | | $ | 8,448 | |

| | | | | | | |

Fuel Supply Agreements

During the second quarter of 2021, we entered into various 15-year fuel supply agreements through which we continue to supply fuel to Speedway.

5. MASTER LIMITED PARTNERSHIP

We own the general partner and a majority limited partner interest in MPLX, which owns and operates crude oil and light product transportation and logistics infrastructure as well as gathering, processing and fractionation assets. We control MPLX through our ownership of the general partner interest. As of June 30, 2022, we owned approximately 64 percent of the outstanding MPLX common units.

Unit Repurchase Program

On November 2, 2020, MPLX announced the board authorization of a unit repurchase program for the repurchase of up to $1.0 billion of MPLX’s outstanding common units held by the public.

Total unit repurchases were as follows for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per share data) | 2022 | | 2021 | | 2022 | | 2021 |

| Number of common units repurchased | 1 | | | 6 | | | 4 | | | 12 | |

| Cash paid for common units repurchased | $ | 35 | | | $ | 155 | | | $ | 135 | | | $ | 310 | |

| Average cost per unit | $ | 33.74 | | | $ | 27.40 | | | $ | 32.48 | | | $ | 26.02 | |

As of June 30, 2022, MPLX had $202 million remaining under its unit repurchase authorization.

Agreements

We have various long-term, fee-based commercial agreements with MPLX. Under these agreements, MPLX provides transportation, storage, distribution and marketing services to us. With certain exceptions, these agreements generally contain minimum volume commitments. These transactions are eliminated in consolidation but are reflected as intersegment transactions between our Refining & Marketing and Midstream segments. We also have agreements with MPLX that establish fees for operational and management services provided between us and MPLX and for executive management services and certain general and administrative services provided by us to MPLX. These transactions are eliminated in consolidation but are reflected as intersegment transactions between our Corporate and Midstream segments.

Noncontrolling Interest

As a result of equity transactions of MPLX, we are required to adjust non-controlling interest and additional paid-in capital. Changes in MPC’s additional paid-in capital resulting from changes in its ownership interests in MPLX were as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Decrease due to change in ownership | $ | (13) | | | $ | (41) | | | $ | (50) | | | $ | (76) | |

| Tax impact | (7) | | | 7 | | | 5 | | | 38 | |

| Decrease in MPC's additional paid-in capital, net of tax | $ | (20) | | | $ | (34) | | | $ | (45) | | | $ | (38) | |

6. VARIABLE INTEREST ENTITIES

Consolidated VIE

We control MPLX through our ownership of its general partner. MPLX is a VIE because the limited partners do not have substantive kick-out or participating rights over the general partner. We are the primary beneficiary of MPLX because in addition to our significant economic interest, we also have the ability, through our ownership of the general partner, to control the decisions that most significantly impact MPLX. We therefore consolidate MPLX and record a noncontrolling interest for the interest owned by the public. We also record a redeemable noncontrolling interest related to MPLX’s Series A preferred units.

The creditors of MPLX do not have recourse to MPC’s general credit through guarantees or other financial arrangements, except as noted. MPC has effectively guaranteed certain indebtedness of LOOP LLC (“LOOP”) and LOCAP LLC (“LOCAP”), in which

MPLX holds an interest. See Note 23 for more information. The assets of MPLX can only be used to settle its own obligations and its creditors have no recourse to our assets, except as noted earlier.

The following table presents balance sheet information for the assets and liabilities of MPLX, which are included in our balance sheets. | | | | | | | | | | | |

| (In millions) | June 30,

2022 | | December 31,

2021 |

| Assets | | | |

| Cash and cash equivalents | $ | 298 | | | $ | 13 | |

| Receivables, less allowance for doubtful accounts | 798 | | | 660 | |

| Inventories | 157 | | | 142 | |

| Other current assets | 46 | | | 55 | |

| Equity method investments | 4,099 | | | 3,981 | |

| Property, plant and equipment, net | 19,767 | | | 20,042 | |

| Goodwill | 7,645 | | | 7,657 | |

| Right of use assets | 300 | | | 268 | |

| Other noncurrent assets | 817 | | | 891 | |

| | | |

| Liabilities | | | |

| Accounts payable | $ | 808 | | | $ | 671 | |

| Payroll and benefits payable | 3 | | | 6 | |

| Accrued taxes | 86 | | | 75 | |

| Debt due within one year | 1,000 | | | 499 | |

| Operating lease liabilities | 45 | | | 59 | |

| Other current liabilities | 442 | | | 304 | |

| Long-term debt | 18,775 | | | 18,072 | |

| Deferred income taxes | 14 | | | 10 | |

| Long-term operating lease liabilities | 250 | | | 205 | |

| Deferred credits and other liabilities | 602 | | | 559 | |

7. RELATED PARTY TRANSACTIONS

Transactions with related parties were as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Sales to related parties | $ | 21 | | | $ | 11 | | | $ | 40 | | | $ | 54 | |

| Purchases from related parties | 297 | | | 219 | | | 579 | | | 422 | |

Sales to related parties, which are included in sales and other operating revenues, consist primarily of refined product sales to certain of our equity affiliates.

Purchases from related parties are included in cost of revenues. We obtain utilities, transportation services and purchase ethanol from certain of our equity affiliates.

8. EARNINGS PER SHARE

We compute basic earnings per share by dividing net income attributable to MPC less income allocated to participating securities by the weighted average number of shares of common stock outstanding. Since MPC grants certain incentive compensation awards to employees and non-employee directors that are considered to be participating securities, we have calculated our earnings per share using the two-class method. Diluted income per share assumes exercise of certain stock-based compensation awards, provided the effect is not anti-dilutive.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per share data) | 2022 | | 2021 | | 2022 | | 2021 |

| Income from continuing operations, net of tax | $ | 6,217 | | | $ | 588 | | | $ | 7,389 | | | $ | 418 | |

| Less: Net income attributable to noncontrolling interest | 344 | | | 290 | | | 671 | | | 596 | |

| Net income allocated to participating securities | 3 | | | — | | | 3 | | | — | |

| Income (loss) from continuing operations available to common stockholders | 5,870 | | | 298 | | | 6,715 | | | (178) | |

| Income from discontinued operations, net of tax | — | | | 8,214 | | | — | | | 8,448 | |

| Income available to common stockholders | $ | 5,870 | | | $ | 8,512 | | | $ | 6,715 | | | $ | 8,270 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 532 | | | 650 | | | 549 | | | 651 | |

| Effect of dilutive securities | 4 | | | 4 | | | 4 | | | — | |

| Diluted | 536 | | | 654 | | | 553 | | | 651 | |

| | | | | | | |

| Income available to common stockholders per share: | | | | | | | |

| Basic: | | | | | | | |

| Continuing operations | $ | 11.03 | | | $ | 0.46 | | | $ | 12.24 | | | $ | (0.27) | |

| Discontinued operations | — | | | 12.63 | | | — | | | 12.98 | |

| Net income per share | $ | 11.03 | | | $ | 13.09 | | | $ | 12.24 | | | $ | 12.71 | |

| | | | | | | |

| Diluted: | | | | | | | |

| Continuing operations | $ | 10.95 | | | $ | 0.45 | | | $ | 12.15 | | | $ | (0.27) | |

| Discontinued operations | — | | | 12.55 | | | — | | | 12.98 | |

| Net income per share | $ | 10.95 | | | $ | 13.00 | | | $ | 12.15 | | | $ | 12.71 | |

The following table summarizes the shares that were anti-dilutive and, therefore, were excluded from the diluted share calculation.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Shares issuable under stock-based compensation plans | — | | | 3 | | | — | | | 8 | |

9. EQUITY

On February 2, 2022, we announced our board of directors approved an incremental $5.0 billion share repurchase authorization. The authorization has no expiration date.

We may utilize various methods to effect the repurchases, which could include open market repurchases, negotiated block transactions, tender offers, accelerated share repurchases or open market solicitations for shares, some of which may be effected through Rule 10b5-1 plans. The timing and amount of future repurchases, if any, will depend upon several factors, including market and business conditions, and such repurchases may be suspended or discontinued at any time.

Total share repurchases were as follows for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per share data) | 2022 | | 2021 | | 2022 | | 2021 |

| Number of shares repurchased | 34 | | | 16 | | | 71 | | | 16 | |

| Cash paid for shares repurchased | $ | 3,331 | | | $ | 984 | | | $ | 6,177 | | | $ | 984 | |

| Average cost per share | $ | 95.46 | | | $ | 63.00 | | | $ | 85.31 | | | $ | 63.00 | |

As of June 30, 2022, MPC had $4.17 billion remaining under its share repurchase authorizations,

10. SEGMENT INFORMATION

We have two reportable segments: Refining & Marketing and Midstream. Each of these segments is organized and managed based upon the nature of the products and services it offers.

•Refining & Marketing – refines crude oil and other feedstocks, including renewable feedstocks, at our refineries in the Gulf Coast, Mid-Continent and West Coast regions of the United States, purchases refined products and ethanol for resale and distributes refined products, including renewable diesel, through transportation, storage, distribution and marketing services provided largely by our Midstream segment. We sell refined products to wholesale marketing customers domestically and internationally, to buyers on the spot market, to independent entrepreneurs who operate primarily Marathon® branded outlets and through long-term fuel supply contracts with direct dealers who operate locations mainly under the ARCO® brand.

•Midstream – transports, stores, distributes and markets crude oil and refined products principally for the Refining & Marketing segment via refining logistics assets, pipelines, terminals, towboats and barges; gathers, processes and transports natural gas; and gathers, transports, fractionates, stores and markets NGLs. The Midstream segment primarily reflects the results of MPLX.

During the first quarter of 2022, our chief operating decision maker (“CODM”) began to evaluate the performance of our segments using segment adjusted EBITDA. We have modified our presentation of segment performance to be consistent with this change, including prior periods presented for consistent and comparable presentation. Amounts included in income from continuing operations before income taxes and excluded from segment adjusted EBITDA include: (i) depreciation and amortization; (ii) net interest and other financial costs; (iii) turnaround expenses and (iv) other adjustments as deemed necessary. These items are either: (i) believed to be non-recurring in nature; (ii) not believed to be allocable or controlled by the segment; or (iii) are not tied to the operational performance of the segment. Assets by segment are not a measure used to assess the performance of the company by the CODM and thus are not reported in our disclosures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Segment adjusted EBITDA for reportable segments | | | | | | | |

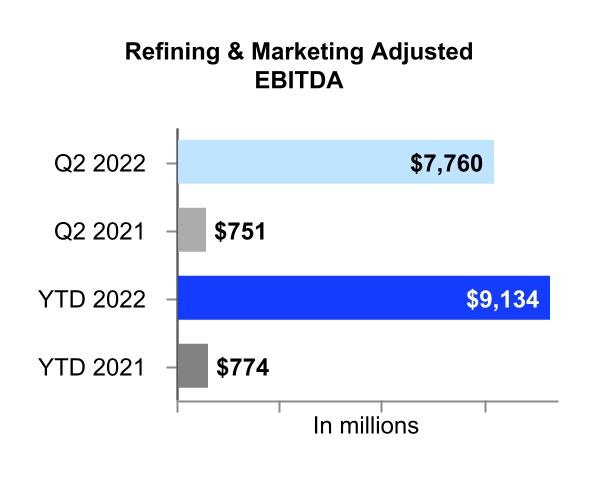

| Refining & Marketing | $ | 7,760 | | | $ | 751 | | | $ | 9,134 | | | $ | 774 | |

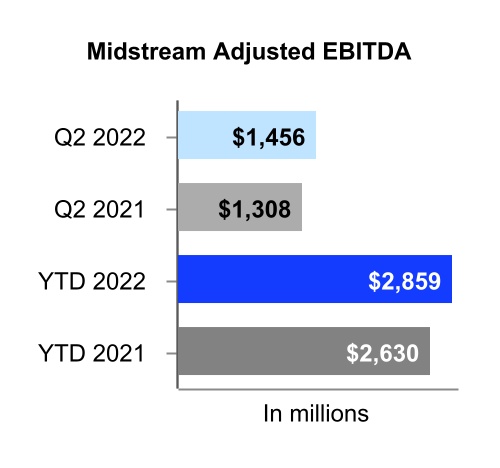

| Midstream | 1,456 | | | 1,308 | | | 2,859 | | | 2,630 | |

| Total reportable segments | $ | 9,216 | | | $ | 2,059 | | | $ | 11,993 | | | $ | 3,404 | |

| | | | | | | |

| Reconciliation of segment adjusted EBITDA for reportable segments to income from continuing operations before income taxes | | | | | | | |

| Total reportable segments | $ | 9,216 | | | $ | 2,059 | | | $ | 11,993 | | | $ | 3,404 | |

| Corporate | (156) | | | (149) | | | (294) | | | (274) | |

| Refining planned turnaround costs | (151) | | | (61) | | | (296) | | | (173) | |

| Storm impacts | — | | | — | | | — | | | (47) | |

| Renewable volume obligation requirements | 238 | | | — | | | 238 | | | — | |

| Litigation | — | | | — | | | 27 | | | — | |

Impairments(a) | — | | | (13) | | | — | | | (13) | |

| | | | | | | |

Depreciation and amortization(b) | (819) | | | (871) | | | (1,624) | | | (1,715) | |

| Net interest and other financial costs | (312) | | | (372) | | | (574) | | | (725) | |

| Income from continuing operations before income taxes | $ | 8,016 | | | $ | 593 | | | $ | 9,470 | | | $ | 457 | |

(a) Impairment of equity method investments.

(b) The three and six months ended June 30, 2021 includes $43 million of impairments of long lived assets.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Sales and other operating revenues | | | | | | | |

| Refining & Marketing | | | | | | | |

Revenues from external customers(a) | $ | 52,300 | | | $ | 28,554 | | | $ | 89,092 | | | $ | 50,215 | |

| Intersegment revenues | 47 | | | 30 | | | 83 | | | 58 | |

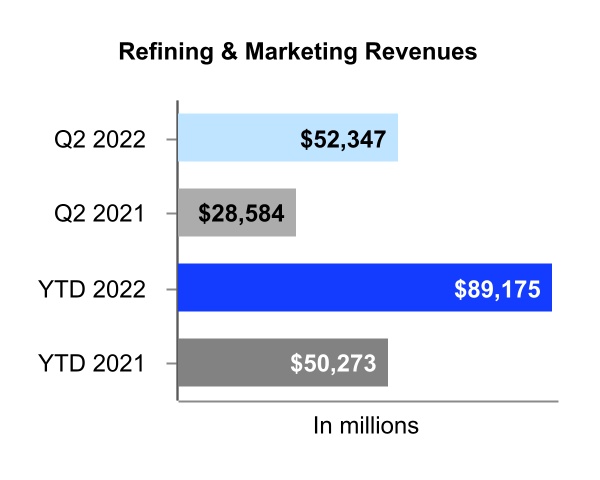

| Refining & Marketing segment revenues | 52,347 | | | 28,584 | | | 89,175 | | | 50,273 | |

| | | | | | | |

| Midstream | | | | | | | |

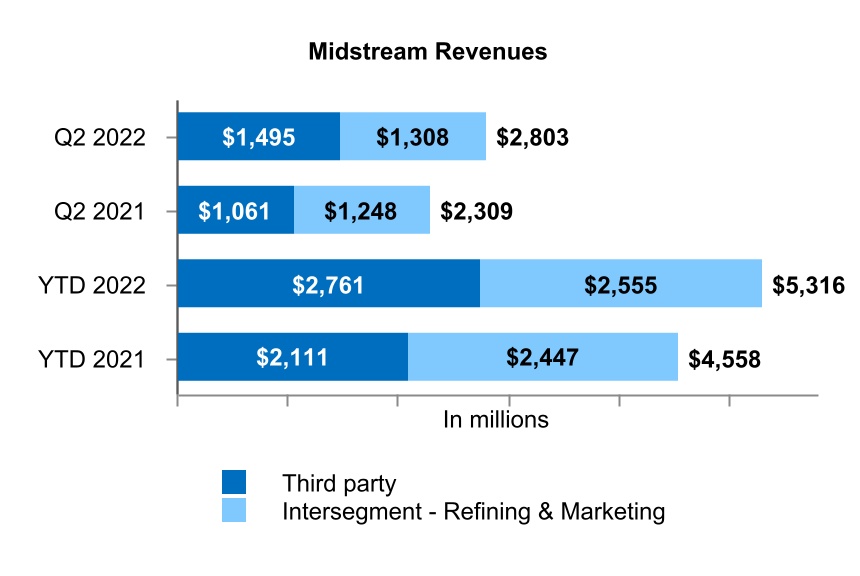

Revenues from external customers(a) | 1,495 | | | 1,061 | | | 2,761 | | | 2,111 | |

| Intersegment revenues | 1,308 | | | 1,248 | | | 2,555 | | | 2,447 | |

| Midstream segment revenues | 2,803 | | | 2,309 | | | 5,316 | | | 4,558 | |

| | | | | | | |

| Total segment revenues | 55,150 | | | 30,893 | | | 94,491 | | | 54,831 | |

| Less: intersegment revenues | 1,355 | | | 1,278 | | | 2,638 | | | 2,505 | |

Consolidated sales and other operating revenues(a) | $ | 53,795 | | | $ | 29,615 | | | $ | 91,853 | | | $ | 52,326 | |

(a)Includes related party sales. See Note 7 for additional information.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Income (loss) from equity method investments | | | | | | | |

| Refining & Marketing | $ | 6 | | | $ | 14 | | | $ | 18 | | | $ | 19 | |

| Midstream | 141 | | | 92 | | | 271 | | | 178 | |

Corporate(a) | — | | | (13) | | | — | | | (13) | |

| Consolidated income from equity method investments | $ | 147 | | | $ | 93 | | | $ | 289 | | | $ | 184 | |

| | | | | | | |

| Depreciation and amortization | | | | | | | |

| Refining & Marketing | $ | 475 | | | $ | 466 | | | $ | 936 | | | $ | 944 | |

| Midstream | 330 | | | 331 | | | 661 | | | 665 | |

| Corporate | 14 | | | 74 | | | 27 | | | 106 | |

| Consolidated depreciation and amortization | $ | 819 | | | $ | 871 | | | $ | 1,624 | | | $ | 1,715 | |

| | | | | | | |

| Capital expenditures | | | | | | | |

| Refining & Marketing | $ | 315 | | | $ | 176 | | | $ | 559 | | | $ | 310 | |

| Midstream | 222 | | | 178 | | | 505 | | | 316 | |

| Segment capital expenditures and investments | 537 | | | 354 | | | 1,064 | | | 626 | |

| Less investments in equity method investees | 48 | | | 62 | | | 160 | | | 113 | |

| Plus: | | | | | | | |

| Corporate | 15 | | | 23 | | | 38 | | | 44 | |

| Capitalized interest | 25 | | | 16 | | | 48 | | | 30 | |

Consolidated capital expenditures(b) | $ | 529 | | | $ | 331 | | | $ | 990 | | | $ | 587 | |

(a)Impairment of equity method investment.

(b)Includes changes in capital expenditure accruals. See Note 20 for a reconciliation of total capital expenditures to additions to property, plant and equipment for the six months ended June 30, 2022 and 2021 as reported in the consolidated statements of cash flows.

11. NET INTEREST AND OTHER FINANCIAL COSTS

Net interest and other financial costs were as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | 2022 | | 2021 | | 2022 | | 2021 |

| Interest income | $ | (18) | | | $ | (2) | | | $ | (23) | | | $ | (3) | |

| Interest expense | 324 | | | 337 | | | 634 | | | 688 | |

| Interest capitalized | (25) | | | (19) | | | (48) | | | (36) | |

Pension and other postretirement non-service costs(a) | 32 | | | 56 | | | 11 | | | 56 | |

| Other financial costs (credits) | (1) | | | — | | | — | | | 20 | |

| Net interest and other financial costs | $ | 312 | | | $ | 372 | | | $ | 574 | | | $ | 725 | |

(a)See Note 22.

12. INCOME TAXES

We recorded a combined federal, state and foreign income tax provision of $1.799 billion and $2.081 billion for the three and six months ended June 30, 2022, respectively, which was higher than the tax computed at the U.S. statutory rate primarily due to state taxes offset by net income attributable to noncontrolling interests.

We recorded a combined federal, state and foreign income tax provision of $5 million and $39 million for the three and six months ended June 30, 2021, respectively, which was lower than the tax computed at the U.S. statutory rate primarily due to income attributable to noncontrolling interests.

13. INVENTORIES

| | | | | | | | | | | |

| (In millions) | June 30,

2022 | | December 31,

2021 |

| Crude oil | $ | 4,174 | | | $ | 2,639 | |

| Refined products | 5,814 | | | 4,460 | |

| Materials and supplies | 1,060 | | | 956 | |

| Total | $ | 11,048 | | | $ | 8,055 | |

Inventories are carried at the lower of cost or market value. Costs of crude oil and refined products are aggregated on a consolidated basis for purposes of assessing whether the LIFO cost basis of these inventories may have to be written down to market values.

14. EQUITY METHOD INVESTMENTS

On June 1, 2022, MPC purchased the remaining 49 percent interest in Watson Cogeneration Company from NRG Energy, Inc. for approximately $59 million. This entity will now be consolidated and included in our consolidated results. It was previously accounted for as an equity method investment.

The excess of the estimated $62 million fair value over the $25 million book value of our 51 percent ownership interest in Watson Cogeneration Company resulted in a $37 million non-cash gain, which is included in the net gain on disposal of assets line of the accompanying consolidated statements of income.

15. PROPERTY, PLANT AND EQUIPMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| (In millions) | | Gross

PP&E | | Accumulated Depreciation | | Net

PP&E | | Gross

PP&E | | Accumulated Depreciation | | Net

PP&E |

| Refining & Marketing | | $ | 32,147 | | | $ | 16,018 | | | $ | 16,129 | | | $ | 31,089 | | | $ | 14,876 | | | $ | 16,213 | |

| Midstream | | 28,325 | | | 7,904 | | | 20,421 | | | 28,098 | | | 7,384 | | | 20,714 | |

| Corporate | | 1,470 | | | 958 | | | 512 | | | 1,446 | | | 933 | | | 513 | |

| Total | | $ | 61,942 | | | $ | 24,880 | | | $ | 37,062 | | | $ | 60,633 | | | $ | 23,193 | | | $ | 37,440 | |

16. FAIR VALUE MEASUREMENTS

Fair Values—Recurring

The following tables present assets and liabilities accounted for at fair value on a recurring basis as of June 30, 2022 and December 31, 2021 by fair value hierarchy level. We have elected to offset the fair value amounts recognized for multiple derivative contracts executed with the same counterparty, including any related cash collateral as shown below; however, fair value amounts by hierarchy level are presented on a gross basis in the following tables.