Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________

FORM 10-Q

_______________________

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended March 31, 2019

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from to

Commission file number 001-38872

Pinterest, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

Delaware | 26-3607129 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

505 Brannan Street San Francisco, California | 94107 |

(Address of Principal Executive Offices, including zip code) | (Zip Code) |

(415) 762-7100

Registrant’s Telephone Number, Including Area Code

_______________________

Not applicable

Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report.

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Class A Common Stock, $0.00001 par value | PINS | New York Stock Exchange (NYSE) |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | x | Smaller reporting company | o |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of May 10, 2019 there were 86,250,000 shares of the Registrant’s Class A common stock, $.00001 par value per share, outstanding, and 456,286,871 shares of the Registrant’s Class B common stock outstanding.

PINTEREST, INC.

TABLE OF CONTENTS

|

| | |

| | Page |

| |

| |

|

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

|

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 6. | | |

| | |

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risk and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions. Such forward-looking statements involve known and unknown risks, uncertainties, assumptions and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from historical results or any future results, performance or achievements expressed, suggested or implied by such forward-looking statements. These include, but are not limited to, statements about:

| |

• | our financial performance, including revenue, cost of revenue and operating expenses; |

| |

• | our ability to attract and retain Pinners and their level of engagement; |

| |

• | our ability to provide content that is useful and relevant to Pinners’ personal taste and interests; |

| |

• | our ability to develop successful new products or improve existing ones; |

| |

• | our ability to maintain and enhance our brand and reputation; |

| |

• | potential harm caused by compromises in security; |

| |

• | potential harm caused by changes in internet search engines’ methodologies, particularly search engine optimization methodologies and policies; |

| |

• | discontinuation, disruptions or outages in third-party single sign-on access; |

| |

• | our ability to compete effectively in our industry; |

| |

• | our ability to scale our business, including our monetization efforts; |

| |

• | our ability to attract and retain advertisers and scale our revenue model; |

| |

• | our ability to develop effective products and tools for advertisers, including measurement tools; |

| |

• | our ability to expand and monetize our platform internationally; |

| |

• | our ability to effectively manage the growth of our business; |

| |

• | our lack of operating history and ability to attain and sustain profitability; |

| |

• | decisions that reduce short-term revenue or profitability or do not produce the long-term benefits we expect; |

| |

• | fluctuations in our operating results; |

| |

• | our ability to raise additional capital; |

| |

• | our ability to receive, process, store, use and share data, and compliance with laws and regulations related to data privacy and content; |

| |

• | our ability to comply with modified or new laws and regulations applying to our business, and potential harm to our business as a result of those laws and regulations; |

| |

• | real or perceived inaccuracies in metrics related to our business; |

| |

• | disruption of, degradation in or interference with our use of Amazon Web Services and our infrastructure; and |

| |

• | our ability to attract and retain personnel. |

These statements are based on our historical performance and on our current plans, estimates and projections in light of information currently available to us, and therefore you should not place undue reliance on them. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Forward-looking statements made in this Quarterly Report on Form 10-Q speak only as of the date on which such statements are made, and we undertake no obligation to update them in light of new information or future events, except as required by law.

You should carefully consider the above factors, as well as the factors discussed elsewhere in this Quarterly Report on Form 10-Q, including under “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. The factors identified above should not be construed as an exhaustive list of factors that could affect our future results and should be read in conjunction with the other cautionary statements that are included in this quarterly report. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. If any of these trends, risks or uncertainties actually occurs or continues, our business, revenue and financial results could be harmed, the trading price of our Class A common stock could decline and you could lose all or part of your investment.

Unless expressly indicated or the context requires otherwise, the terms "Pinterest," "company," "we," "us," and "our" in this document refer to Pinterest, Inc., a Delaware corporation, and, where appropriate, its wholly owned subsidiaries. The term "Pinterest" may also refer to our products, regardless of the manner in which they are accessed. For references to accessing Pinterest on the "web" or via a "website," such terms refer to accessing Pinterest on personal computers. For references to accessing Pinterest on "mobile," such term refers to accessing Pinterest via a mobile application or via a mobile-optimized version of our website such as m.pinterest.com, whether on a mobile phone or tablet.

LIMITATIONS OF KEY METRICS AND OTHER DATA

The numbers for our key metrics, which include our monthly active users (MAUs) and average revenue per user (ARPU), are calculated using internal company data based on the activity of user accounts. While these numbers are based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there are inherent challenges in measuring usage of our products across large online and mobile populations around the world. In addition, we are continually seeking to improve our estimates of our user base, and such estimates may change due to improvements or changes in our methodology.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

PINTEREST, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

(Unaudited)

|

| | | | | | | |

| March 31, | | December 31, |

| 2019 | | 2018 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 134,648 |

| | $ | 122,509 |

|

Marketable securities | 507,568 |

| | 505,304 |

|

Accounts receivable net of allowances of $2,600 and $3,097 as of March 31, 2019 and December 31, 2018, respectively | 161,108 |

| | 221,932 |

|

Prepaid expenses and other current assets | 43,623 |

| | 39,607 |

|

Total current assets | 846,947 |

| | 889,352 |

|

Property and equipment, net | 83,031 |

| | 81,512 |

|

Operating lease right-of-use assets | 160,802 |

| | 145,203 |

|

Goodwill and intangible assets, net | 13,728 |

| | 14,071 |

|

Restricted cash | 25,724 |

| | 11,724 |

|

Other assets | 11,008 |

| | 10,869 |

|

Total assets | $ | 1,141,240 |

| | $ | 1,152,731 |

|

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) |

Current liabilities: | | | |

Accounts payable | $ | 30,320 |

| | $ | 22,169 |

|

Accrued expenses and other current liabilities | 93,206 |

| | 86,258 |

|

Total current liabilities | 123,526 |

| | 108,427 |

|

Operating lease liabilities | 162,359 |

| | 151,395 |

|

Other liabilities | 23,945 |

| | 22,073 |

|

Total liabilities | 309,830 |

| | 281,895 |

|

| | | |

Commitments and contingencies |

|

| |

|

|

| | | |

Redeemable convertible preferred stock, $0.00001 par value, 928,676 shares authorized; 308,373 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | 1,465,399 |

| | 1,465,399 |

|

| | | |

Stockholders’ equity (deficit): | | | |

Common stock, $0.00001 par value, 1,932,500 shares authorized; 127,371 and 127,298 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | 1 |

| | 1 |

|

Additional paid-in capital | 253,016 |

| | 252,212 |

|

Accumulated other comprehensive loss | (231 | ) | | (1,421 | ) |

Accumulated deficit | (886,775 | ) | | (845,355 | ) |

Total stockholders’ equity (deficit) | (633,989 | ) | | (594,563 | ) |

Total liabilities, redeemable convertible preferred stock, and stockholders’ equity (deficit) | $ | 1,141,240 |

| | $ | 1,152,731 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

PINTEREST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Revenue | $ | 201,911 |

| | $ | 131,359 |

|

Costs and expenses: | | | |

Cost of revenue | 73,694 |

| | 51,653 |

|

Research and development | 72,444 |

| | 60,047 |

|

Sales and marketing | 76,394 |

| | 55,774 |

|

General and administrative | 24,205 |

| | 18,867 |

|

Total costs and expenses | 246,737 |

| | 186,341 |

|

Loss from operations | (44,826 | ) | | (54,982 | ) |

Other income (expense), net: | | | |

Interest income | 4,059 |

| | 2,638 |

|

Interest expense and other income (expense), net | (500 | ) | | (242 | ) |

Loss before provision for income taxes | (41,267 | ) | | (52,586 | ) |

Provision for income taxes | 153 |

| | 123 |

|

Net loss | $ | (41,420 | ) | | $ | (52,709 | ) |

Net loss per share attributable to common stockholders, basic and diluted | $ | (0.33 | ) | | $ | (0.42 | ) |

Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | 127,346 |

| | 126,857 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

PINTEREST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Net loss | $ | (41,420 | ) | | $ | (52,709 | ) |

Other comprehensive income, net of taxes: | | | |

Change in unrealized gain (loss) on available-for-sale marketable securities | 1,189 |

| | (1,127 | ) |

Change in foreign currency translation adjustment | 1 |

| | 68 |

|

Comprehensive loss | $ | (40,230 | ) | | $ | (53,768 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

Pinterest, Inc.

Condensed Consolidated Statements of Redeemable Convertible Preferred Stock and Stockholders’ Deficit

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2019 |

| | | | | | | | | | | | |

| Redeemable Convertible Preferred Stock | | |

Common Stock | | Additional

Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Stockholders’ Equity (Deficit) |

| Shares | | Amount | | | Shares | | Amount | |

Balance as of December 31, 2018 | 308,373 |

| | $ | 1,465,399 |

| | | 127,298 |

| | $ | 1 |

| | $ | 252,212 |

| | $ | (1,421 | ) | | $ | (845,355 | ) | | $ | (594,563 | ) |

Issuance of common stock for cash upon exercise of stock options, net | — |

| | — |

| | | 73 |

| | — |

| | 110 |

| | — |

| | — |

| | 110 |

|

Share-based compensation | — |

| | — |

| | | — |

| | — |

| | 694 |

| | — |

| | — |

| | 694 |

|

Other comprehensive loss | — |

| | — |

| | | — |

| | — |

| | — |

| | 1,190 |

| | — |

| | 1,190 |

|

Net loss | — |

| | — |

| | | — |

| | — |

| | — |

| | — |

| | (41,420 | ) | | (41,420 | ) |

Balance as of March 31, 2019 | 308,373 |

| | $ | 1,465,399 |

| | | 127,371 |

| | $ | 1 |

| | $ | 253,016 |

| | $ | (231 | ) | | $ | (886,775 | ) | | $ | (633,989 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2018 |

| | | | | | | | | | | | |

| Redeemable Convertible Preferred Stock | | |

Common Stock | | Additional

Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Stockholders’ Equity (Deficit) |

| Shares | | Amount | | | Shares | | Amount | |

Balance as of December 31, 2017 | 308,373 |

| | $ | 1,465,399 |

| | | 126,771 |

| | $ | 1 |

| | $ | 236,682 |

| | $ | (766 | ) | | $ | (782,381 | ) | | $ | (546,464 | ) |

Issuance of common stock for cash upon exercise of stock options, net | — |

| | — |

| | | 140 |

| | — |

| | 435 |

| | — |

| | — |

| | 435 |

|

Share-based compensation | — |

| | — |

| | | — |

| | — |

| | 4,834 |

| | — |

| | — |

| | 4,834 |

|

Other comprehensive loss | — |

| | — |

| | | — |

| | — |

| | — |

| | (1,059 | ) | | — |

| | (1,059 | ) |

Net loss | — |

| | — |

| | | — |

| | — |

| | — |

| | — |

| | (52,709 | ) | | (52,709 | ) |

Balance as of March 31, 2018 | 308,373 |

| | $ | 1,465,399 |

| | | 126,911 |

| | $ | 1 |

| | $ | 241,951 |

| | $ | (1,825 | ) | | $ | (835,090 | ) | | $ | (594,963 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

9

PINTEREST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Operating activities | | | |

Net loss | $ | (41,420 | ) | | $ | (52,709 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

Depreciation and amortization | 5,696 |

| | 4,787 |

|

Share-based compensation | 694 |

| | 4,834 |

|

Other | (993 | ) | | 654 |

|

Changes in assets and liabilities: | | | |

Accounts receivable | 61,329 |

| | 39,309 |

|

Prepaid expenses and other assets | 510 |

| | 7,102 |

|

Operating lease right-of-use assets | 6,427 |

| | 4,551 |

|

Accounts payable | 7,481 |

| | 4,484 |

|

Accrued expenses and other liabilities | (2,024 | ) | | 2,696 |

|

Operating lease liabilities | (4,578 | ) | | (2,174 | ) |

Net cash provided by operating activities | 33,122 |

| | 13,534 |

|

Investing activities | | | |

Purchases of property and equipment | (3,706 | ) | | (8,240 | ) |

Purchases of marketable securities | (113,952 | ) | | (83,569 | ) |

Sales of marketable securities | 28,953 |

| | 36,408 |

|

Maturities of marketable securities | 84,883 |

| | 142,428 |

|

Net cash provided by (used in) investing activities | (3,822 | ) | | 87,027 |

|

Financing activities | | | |

Proceeds from exercise of stock options, net | 110 |

| | 435 |

|

Other financing activities | (3,279 | ) | | — |

|

Net cash provided by (used in) financing activities | (3,169 | ) | | 435 |

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 8 |

| | 48 |

|

Net increase in cash, cash equivalents, and restricted cash | 26,139 |

| | 101,044 |

|

Cash, cash equivalents, and restricted cash, beginning of period | 135,290 |

| | 83,969 |

|

Cash, cash equivalents, and restricted cash, end of period | $ | 161,429 |

| | $ | 185,013 |

|

|

| | | | | | | |

Supplemental cash flow information | | | |

Accrued property and equipment | $ | 4,484 |

| | $ | 7,779 |

|

Operating lease right-of-use assets obtained in exchange for operating lease liabilities | $ | 22,862 |

| | $ | 2,356 |

|

| | | |

Reconciliation of cash, cash equivalents and restricted cash to condensed consolidated balance sheets |

Cash and cash equivalents | $ | 134,648 |

| | $ | 172,512 |

|

Restricted cash included in prepaid expenses and other current assets | 1,057 |

| | 851 |

|

Restricted cash | 25,724 |

| | 11,650 |

|

Total cash, cash equivalents, and restricted cash | $ | 161,429 |

| | $ | 185,013 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

10

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| |

1. | Description of Business and Summary of Significant Accounting Policies |

Description of Business

Pinterest was incorporated in Delaware in 2008 and is headquartered in San Francisco, California. Pinterest is a visual discovery engine that people around the globe use to find the inspiration to create a life they love. We generate revenue by delivering advertising on our website and mobile application.

Basis of Presentation and Consolidation

We prepared the accompanying condensed consolidated financial statements in accordance with generally accepted accounting principles in the United States ("GAAP"). The condensed consolidated financial statements include the accounts of Pinterest, Inc. and its wholly owned subsidiaries. We have eliminated all intercompany balances and transactions.

The condensed consolidated balance sheet as of December 31, 2018 included herein was derived from the audited financial statements as of that date. We have condensed or omitted certain information and notes normally included in complete financial statements prepared in accordance with GAAP. As such, these unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements as of and for the year ended December 31, 2018, which are included in our prospectus filed pursuant to Rule 424(b) on April 18, 2019.

In our opinion, the accompanying condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, comprehensive loss and cash flows for the interim periods, but they are not necessarily indicative of the results of operations to be expected for the year ending December 31, 2019.

Initial Public Offering

On April 23, 2019, we closed our initial public offering ("IPO") in which we issued and sold 75,000,000 shares of Class A common stock at $19.00 per share. We received net proceeds of $1,368.0 million after deducting underwriting discounts and commissions and before deducting estimated offering costs of $8.7 million, of which $5.6 million was included in other assets as of March 31, 2019. Immediately prior to the completion of our IPO, all shares of our outstanding redeemable convertible preferred stock and redeemable convertible preferred stock warrants converted into 308,621,636 shares of Class B common stock on a one-for-one basis, and immediately thereafter but still prior to the completion of our IPO, all of our outstanding common stock were reclassified into 456,213,756 shares of Class B common stock on a one-for-one basis.

On April 29, 2019, we issued and sold an additional 11,250,000 shares of Class A common stock at $19.00 per share pursuant to the underwriters’ option to purchase additional shares. We received additional net proceeds of $205.2 million after deducting underwriting discounts and commissions.

The shares and proceeds from our IPO and the underwriters’ exercise of their option to purchase additional shares are not reflected in the condensed consolidated financial statements as of and for the three months ended March 31, 2019.

Stock Split

On March 28, 2019, we effected a 1-for-3 reverse split of our capital stock. We have adjusted all share and per share amounts in the accompanying condensed consolidated financial statements and notes to reflect the reverse stock split.

Use of Estimates

Preparing our condensed consolidated financial statements in conformity with GAAP requires us to make estimates and judgments that affect amounts reported in the condensed consolidated financial statements and accompanying notes. We base these estimates and judgments on historical experience and various other assumptions that we consider reasonable. GAAP requires us to make estimates and assumptions in several areas, including the fair values of financial instruments, assets acquired and liabilities assumed through business combinations, common stock prior to our IPO and share-based awards, and contingencies as well as the collectability of our accounts receivable, the useful lives of our intangible assets

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

and property and equipment, the incremental borrowing rate we use to determine our operating lease liabilities, and revenue recognition, among others. Actual results could differ materially from these estimates and judgments.

Segments

We operate as a single operating segment. Our chief operating decision maker is our Chief Executive Officer, who reviews financial information presented on a consolidated basis, accompanied by disaggregated information about our revenue, for purposes of making operating decisions, assessing financial performance and allocating resources.

Revenue Recognition

We generate revenue by delivering ads on our website and mobile application. We recognize revenue only after transferring control of promised goods or services to customers, which occurs when a user clicks on an ad contracted on a cost per click (“CPC”) basis or views an ad contracted on a cost per thousand impressions (“CPM”) basis. We typically bill customers on a CPC or CPM basis, and our payment terms vary by customer type and location. The term between billing and payment due dates is not significant.

We occasionally offer customers free ad inventory or measurement studies that demonstrate the effectiveness of their advertising campaigns on our platform. In either case, we recognize revenue only after satisfying our contractual performance obligation. When contracts with our customers contain multiple performance obligations, we allocate the overall transaction price, which is the amount of consideration to which we expect to be entitled in exchange for promised goods or services, to each of the distinct performance obligations based on their relative standalone selling prices. We generally determine standalone selling prices based on the effective price charged per contracted click or impression or based on expected cost plus margin, and we do not disclose the value of unsatisfied performance obligations because the original expected duration of our contracts is generally less than one year.

We record sales commissions in sales and marketing expense as incurred because we would amortize these over a period of less than one year.

Deferred revenue was not material as of March 31, 2019 and December 31, 2018.

Share-Based Compensation

We have granted restricted stock units ("RSUs") since March 2015. We measure RSUs based on the fair market value of our common stock on the grant date. RSUs granted under our 2009 Stock Plan (the "2009 Plan") are subject to both a service condition, which is typically satisfied over four years, and a performance condition, which was deemed satisfied upon the pricing of the shares of Class A common stock sold in connection with our IPO. Because the performance condition had not been satisfied as of March 31, 2019, we had not recorded any share-based compensation expense for our RSUs at that date. Had our IPO occurred on March 31, 2019, we would have recorded cumulative share-based compensation expense using the accelerated attribution method for those RSUs for which the service condition had been satisfied at that date and would have begun recording the remaining unrecognized share-based compensation expense over the remainder of the requisite service period.

We account for forfeitures as they occur.

Valuation of Common Stock and Redeemable Convertible Preferred Stock Warrants

Until our IPO, we determined the fair value of our common stock and redeemable convertible preferred stock warrants using the most observable inputs available to us, including recent sales of our stock as well as income and market valuation approaches. The income approach estimates the value of our business based on the future cash flows we expect to generate discounted to their present value using an appropriate discount rate to reflect the risk of achieving the expected cash flows. The market approach estimates the value of our business by applying valuation multiples derived from the observed valuation multiples of comparable public companies to our expected financial results.

We used the Probability Weighted Expected Return Method ("PWERM") to allocate the value of our business among our outstanding stock and share-based awards. We applied the PWERM by first defining the range of potential future liquidity

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

outcomes for our business, such as an IPO, and then allocating its value to our outstanding stock and share-based awards based on the relative probability that each outcome will occur. We used the Option Pricing Method to allocate the value of our business to our outstanding stock and share-based awards under the non-IPO outcome we considered within the PWERM.

Applying these valuation and allocation approaches involved the use of estimates, judgments, and assumptions that are highly complex and subjective, such as those regarding our expected future revenue, expenses, and cash flows, discount rates, valuation multiples, the selection of comparable public companies, and the probability of future events. Changes in any or all of these estimates and assumptions, or the relationships between these assumptions, impacted our valuation as of each valuation date and may have a material impact on the valuation of our common stock and redeemable convertible preferred stock warrants.

Following our IPO, there is an active market for our Class A common stock and the warrants to purchase shares of our redeemable convertible preferred stock are no longer outstanding, so we no longer apply these valuation and allocation approaches.

Leases and Operating Lease Incremental Borrowing Rate

We lease office space under operating leases with expiration dates through 2033. We determine whether an arrangement constitutes a lease and record lease liabilities and right-of-use assets on our condensed consolidated balance sheets at lease commencement. We measure lease liabilities based on the present value of the total lease payments not yet paid discounted based on the more readily determinable of the rate implicit in the lease or our incremental borrowing rate, which is the estimated rate we would be required to pay for a collateralized borrowing equal to the total lease payments over the term of the lease. We estimate our incremental borrowing rate based on an analysis of publicly traded debt securities of companies with credit and financial profiles similar to our own. We measure right-of-use assets based on the corresponding lease liability adjusted for (i) payments made to the lessor at or before the commencement date, (ii) initial direct costs we incur and (iii) tenant incentives under the lease. We begin recognizing rent expense when the lessor makes the underlying asset available to us, we do not assume renewals or early terminations unless we are reasonably certain to exercise these options at commencement, and we do not allocate consideration between lease and non-lease components.

For short-term leases, we record rent expense in our condensed consolidated statements of operations on a straight-line basis over the lease term and record variable lease payments as incurred.

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

2. Fair Value of Financial Instruments

The fair values of the financial instruments we measure at fair value on a recurring basis are as follows (in thousands):

|

| | | | | | | | | | | | | | | |

| March 31, 2019 |

| Level 1 | | Level 2 | | Level 3 | | Total |

Cash equivalents: | | | | | | | |

Commercial paper | $ | — |

| | $ | 76,897 |

| | $ | — |

| | $ | 76,897 |

|

Money market funds | 546 |

| | — |

| | — |

| | 546 |

|

Marketable securities: | | | | | | | |

Corporate bonds | — |

| | 214,819 |

| | — |

| | 214,819 |

|

Asset-backed securities | — |

| | 108,059 |

| | — |

| | 108,059 |

|

Certificates of deposit | — |

| | 64,418 |

| | — |

| | 64,418 |

|

Commercial paper | — |

| | 100,212 |

| | — |

| | 100,212 |

|

U.S. treasury securities | 20,060 |

| | — |

| | — |

| | 20,060 |

|

Prepaid expenses and other current assets: | | | | | | | |

Certificates of deposit | — |

| | 1,057 |

| | — |

| | 1,057 |

|

Restricted cash: | | | | | | | |

Certificates of deposit | — |

| | 25,724 |

| | — |

| | 25,724 |

|

Other liabilities: | | | | | | | |

Redeemable convertible preferred stock warrants | $ | — |

| | $ | — |

| | $ | 5,005 |

| | $ | 5,005 |

|

|

| | | | | | | | | | | | | | | |

| December 31, 2018 |

| Level 1 | | Level 2 | | Level 3 | | Total |

Cash equivalents: | | | | | | | |

Money market funds | $ | 785 |

| | $ | — |

| | $ | — |

| | $ | 785 |

|

Commercial paper | — |

| | 73,486 |

| | — |

| | 73,486 |

|

Marketable securities: | | | | | | | |

Corporate bonds | — |

| | 204,170 |

| | — |

| | 204,170 |

|

U.S. treasury securities | 35,921 |

| | — |

| | — |

| | 35,921 |

|

Asset-backed securities | — |

| | 106,658 |

| | — |

| | 106,658 |

|

Certificates of deposit | — |

| | 68,359 |

| | — |

| | 68,359 |

|

Commercial paper | — |

| | 90,196 |

| | — |

| | 90,196 |

|

Prepaid expenses and other current assets: | | | | | | | |

Certificates of deposit | — |

| | 1,057 |

| | — |

| | 1,057 |

|

Restricted cash: | | | | | | | |

Certificates of deposit | — |

| | 11,724 |

| | — |

| | 11,724 |

|

Other liabilities: | | | | | | | |

Redeemable convertible preferred stock warrants | $ | — |

| | $ | — |

| | $ | 4,934 |

| | $ | 4,934 |

|

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

We classify our marketable securities within Level 1 or Level 2 because we determine their fair values using quoted market prices or alternative pricing sources and models utilizing market observable inputs.

We classify our redeemable convertible preferred stock warrants within Level 3 because we determine their fair values using significant unobservable inputs, including the fair value of our redeemable convertible preferred stock, which we determine in the same manner as our common stock. Refer to our significant accounting policies in Note 1 for additional information.

We record changes in the fair value of our redeemable convertible preferred stock warrants in interest expense and other income (expense), net. These amounts were not material for the three months ended March 31, 2019 and 2018.

Gross unrealized gains and losses on our marketable securities were immaterial in the aggregate as of March 31, 2019 and December 31, 2018, and gross unrealized losses for marketable securities that had been in an unrealized loss position for greater than 12 consecutive months were also immaterial as of March 31, 2019 and December 31, 2018. We evaluated all available evidence and concluded that our marketable securities are not other than temporarily impaired as of March 31, 2019 and December 31, 2018.

The fair value of our marketable securities by contractual maturity is as follows (in thousands):

|

| | | |

| March 31, 2019 |

Due in one year or less | $ | 319,271 |

|

Due after one to five years | 188,297 |

|

Total | $ | 507,568 |

|

Net realized gains and losses from sales of available-for-sale securities were not material for any period presented.

3. Commitments and Contingencies

Commitments

In March 2019, we entered into a lease for approximately 490,000 square feet of office space to be constructed near our current headquarters campus in San Francisco, California. The estimated commencement and expiration dates are in 2022 and 2033, respectively. We may terminate the lease prior to commencement if certain contingencies are not satisfied. We will be subject to total noncancelable minimum lease payments of approximately $420.0 million if these contingencies are met, and if the lease commences we will record a right-of-use asset and related lease liability of no more than that amount at lease commencement using our incremental borrowing rate at that date.

Legal Matters

We are involved in various lawsuits, claims and proceedings that arise in the ordinary course of business. While the results of legal matters are inherently uncertain, we do not believe the ultimate resolution of these matters, either individually or in aggregate, will have a material adverse effect on our business, financial position, results of operations or cash flows.

Letters of Credit

We had $24.6 million and $10.6 million of secured letters of credit outstanding as of March 31, 2019 and December 31, 2018, respectively. These primarily relate to our office space leases and are fully collateralized by certificates of deposit which we record in prepaid expenses and other current assets or restricted cash in our condensed consolidated balance sheets based on the term of the remaining restriction.

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

4. Share-Based Compensation

Equity Incentive Plan

In June 2009, our board of directors adopted and approved our 2009 Plan, which provides for the issuance of stock options, restricted stock and RSUs to qualified employees, directors and consultants. Stock options granted under our 2009 Stock Plan have a maximum life of 10 years and an exercise price not less than 100% of the fair market value of our common stock on the date of grant. RSUs granted under our 2009 Plan have a maximum life of seven years. 22,641,049 shares of our common stock were reserved for future issuance under our 2009 Plan as of March 31, 2019. In connection with the closing of our IPO, all remaining shares available for future issuance under our 2009 Plan ceased to be available for issuance under our 2009 Plan, and an equal number of shares of our Class A common stock became available for issuance under our 2019 Omnibus Incentive Plan (the “2019 Plan”), as described below.

Our 2019 Plan became effective upon closing of our IPO and succeeds our 2009 Plan. Our 2019 Plan provides for the issuance of stock options, restricted stock, RSUs and other equity- or cash-based awards to qualified employees, directors and consultants. We initially reserved 48,200,000 shares of our Class A common stock for issuance under the 2019 Plan. There are 86,807,385 shares of our Class B common stock reserved for future issuance under our 2019 Plan following the closing of our IPO, which includes the 48,200,000 shares of Class A common stock originally reserved, the 22,641,049 shares of our Class B common stock reserved for future issuance under our 2009 Plan as of March 31, 2019 and 15,966,336 shares of our Class B common stock we withheld to satisfy our tax withholding and remittance obligations related to RSUs for which the performance condition was deemed satisfied upon pricing of our shares of Class A common stock sold in connection with our IPO. The withheld shares were automatically retired and cancelled, and an equal number of shares of our Class A common stock became available for issuance under our 2019 Plan.

The number of shares of our Class A common stock available for issuance under the 2019 Plan will be further increased by the number of shares of our Class B common stock subject to awards outstanding under our 2009 Plan as of the closing of our IPO that would, but for the terms of the 2019 Plan, have returned to the share reserves of the 2009 Plan pursuant to the terms of such awards, including as the result of forfeiture, repurchase, expiration or retention by us in order to satisfy an award’s exercise price or tax withholding obligations. In addition, the number of shares of our Class A common stock reserved for issuance under our 2019 Plan will automatically increase on the first day of each fiscal year, commencing on January 1, 2020 and ending on (and including) January 1, 2029, in an amount equal to 5% of the total number of shares of our Class A common stock and our Class B common stock outstanding on the last day of the calendar month before the date of each automatic increase, or a lesser number of shares determined by our board of directors.

Stock Option Activity

Stock option activity during the three months ended March 31, 2019, was as follows (in thousands, except per share amounts):

|

| | | | | | | | | | | | |

| | Stock Options Outstanding |

| Shares | | Weighted-Average Exercise Price | | Weighted-Average Remaining Contractual Term | | Aggregate Intrinsic Value (1) |

| | | | | (in years) | | |

Outstanding as of December 31, 2018 | 76,635 | | $ | 2.22 |

| | 4.5 | | $ | 1,285,338 |

|

Exercised | (73) | | 2.58 |

| | | | |

Forfeited | (6) | | 3.84 |

| | | | |

Outstanding as of March 31, 2019 | 76,556 | | $ | 2.22 |

| | 4.3 | | $ | 1,339,176 |

|

Exercisable as of March 31, 2019 | 76,351 | | $ | 2.21 |

| | 4.3 | | $ | 1,335,964 |

|

| | | | | | | | |

| |

(1) | We calculate intrinsic value based on the difference between the exercise price of in-the-money-stock options and the fair value of our common stock as of the respective balance sheet date. |

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The total grant-date fair value of stock options vested during the three months ended March 31, 2019 and 2018, was $0.6 million and $18.6 million, respectively. The aggregate intrinsic value of stock options exercised during the three months ended March 31, 2019 and 2018, was $1.2 million and $5.9 million, respectively.

Restricted Stock Unit Activity

RSU activity during the three months ended March 31, 2019, was as follows (in thousands, except per share amounts):

|

| | | | | |

| Restricted Stock Units Outstanding |

| Shares | | Weighted Average Grant Date Fair Value |

Outstanding as of December 31, 2018 | 77,882 | | $ | 17.79 |

|

Granted | 28,531 | | 19.60 |

|

Forfeited | (2,486) | | 18.43 |

|

Outstanding as of March 31, 2019 | 103,927 | | $ | 18.27 |

|

Share-Based Compensation

Share-based compensation expense during the three months ended March 31, 2019 and 2018, was as follows (in thousands):

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Cost of revenue | $ | 15 |

| | $ | 32 |

|

Research and development | 626 |

| | 4,054 |

|

Sales and marketing | 29 |

| | 241 |

|

General and administrative | 24 |

| | 507 |

|

Total share-based compensation | $ | 694 |

| | $ | 4,834 |

|

We began granting RSUs in March 2015. RSUs granted under our 2009 Plan are subject to both a service condition, which is typically satisfied over four years, and a performance condition, which was deemed satisfied in connection with our IPO. Because the performance condition had not been satisfied as of March 31, 2019, we had not recorded any share-based compensation expense for our RSUs at that date. Had our IPO occurred on March 31, 2019, we would have recorded cumulative share-based compensation expense of $974.9 million using the accelerated attribution method, and we would have expected to recognize the remaining $924.5 million of unrecognized share-based compensation expense over a weighted-average period of 3.7 years.

Unrecognized share-based compensation expense relating to stock options was not material as of March 31, 2019.

5. Net Loss Per Share Attributable to Common Stockholders

We present net loss per share attributable to common stockholders in conformity with the two-class method required for participating securities, and we consider all series of our redeemable convertible preferred stock participating securities. We have not allocated net loss attributable to common stockholders to our redeemable convertible preferred stock because the holders of our redeemable convertible preferred stock are not contractually obligated to share in our losses.

We calculate basic net loss per share attributable to common stockholders by dividing net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share attributable to common stockholders gives effect to all potential shares of common stock, including common

PINTEREST, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

stock issuable upon conversion of our redeemable convertible preferred stock and redeemable convertible preferred stock warrants, stock options, RSUs and common stock warrants to the extent these are dilutive.

We calculated basic and diluted net loss per share attributable to common stockholders as follows (in thousands, except per share amounts):

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Numerator: | | | |

Net loss attributable to common stockholders | $ | (41,420 | ) | | $ | (52,709 | ) |

Denominator: | | | |

Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | 127,346 |

| | 126,857 |

|

Net loss per share attributable to common stockholders, basic and diluted | $ | (0.33 | ) | | $ | (0.42 | ) |

Basic net loss per share is the same as diluted net loss per share because we reported net losses for all periods presented. We excluded the following weighted-average potential shares of common stock from our calculation of diluted net loss per share attributable to common stockholders because these would be anti-dilutive (in thousands):

|

| | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Redeemable convertible preferred stock | 308,373 |

| | 308,373 |

|

Outstanding stock options | 76,584 |

| | 77,341 |

|

Unvested restricted stock units | 81,498 |

| | 58,447 |

|

Redeemable convertible preferred stock warrants | 249 |

| | 89 |

|

Common stock warrants | — |

| | 167 |

|

Total | 466,704 |

| | 444,417 |

|

6. Income Taxes

We determine our income tax provision for interim periods using an estimate of our annual effective tax rate adjusted for discrete items occurring during the periods presented. The primary difference between our effective tax rate and the federal statutory rate is the full valuation allowance we have established on our federal and state net operating losses and credits. Income taxes from international operations are not material for the three months ended March 31, 2019 and 2018.

7. Geographical Information

Revenue disaggregated by geography based on our customers’ billing addresses is as follows (in thousands):

|

| | | | | | | | |

| | Three Months Ended March 31, |

| 2019 | | 2018 |

United States | $ | 181,762 |

| | $ | 121,382 |

|

International(1) | 20,149 |

| | 9,977 |

|

Total revenue | $ | 201,911 |

| | $ | 131,359 |

|

| | | | |

PINTEREST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Property and equipment, net and operating lease right-of-use assets by geography is as follows (in thousands):

|

| | | | | | | | |

| | March 31, | | December 31, |

| 2019 | | 2018 |

United States | $ | 234,794 |

| | $ | 222,188 |

|

International(1) | 9,039 |

| | 4,527 |

Total property and equipment, net and operating lease right-of-use assets | $ | 243,833 |

| | $ | 226,715 |

|

| | | | |

PINTEREST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. Subsequent Events

Dual Class Structure

Immediately prior to the closing of our IPO on April 23, 2019, we filed an amended certificate of incorporation, which created Class A common stock and Class B common stock. All shares of our common stock outstanding immediately prior to the completion of our IPO, including shares of our common stock issued upon conversion of our redeemable convertible preferred stock and redeemable convertible preferred stock warrants and shares of our common stock underlying stock options and RSUs granted under our 2009 Plan, were converted into shares of Class B common stock. The rights of holders of our Class A common stock and Class B common stock are identical, except with respect to voting, conversion and transfer rights. Each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to twenty votes.

Initial Public Offering

On April 23, 2019, we closed our IPO in which we issued and sold 75,000,000 shares of Class A common stock at $19.00 per share. We received net proceeds of $1,368.0 million after deducting underwriting discounts and commissions and before deducting estimated offering costs of $8.7 million, of which $5.6 million was included in other assets as of March 31, 2019. Immediately prior to the completion of our IPO, all shares of our outstanding redeemable convertible preferred stock and redeemable convertible preferred stock warrants automatically converted into 308,621,636 shares of Class B common stock on a one-for-one basis, and immediately thereafter but still prior to the completion of our IPO all of our outstanding common stock were reclassified into 456,213,756 shares of Class B common stock on a one-for-one basis.

On April 29, 2019, we issued and sold an additional 11,250,000 shares of Class A common stock at $19.00 per share pursuant to the underwriters’ option to purchase additional shares. We received additional net proceeds of $205.2 million after deducting underwriting discounts and commissions.

The shares and proceeds from our IPO and the underwriters’ exercise of their option to purchase additional shares are not reflected in the condensed consolidated financial statements as of and for the three months ended March 31, 2019. The pro forma condensed consolidated balance sheet data below reflects the aforementioned conversions as well as:

| |

i. | An increase to additional paid-in capital related to our receipt of total net proceeds of $1,573.2 million after deducting total underwriting discounts and commissions of $65.6 million and before deducting estimated offering costs of $8.7 million. |

| |

ii. | An increase to additional paid-in capital and accumulated deficit related to the recognition of $974.9 million of share-based compensation expense related to RSUs granted prior to our IPO, which were subject to both a service condition, which is typically satisfied over four years, and a performance condition, which was satisfied upon completion of our IPO. Upon satisfaction of the performance condition, we released 20,221,114 shares of Class B common stock, net, and made cash payments of $303.3 million to satisfy the related tax withholding and remittance obligations. These payments are reflected as a decrease to additional paid-in capital. |

PINTEREST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The table below presents our pro forma condensed consolidated balance sheet data (in thousands except per share amounts):

|

| | | | | | | | | | | |

| March 31, 2019 |

| Actual | | Pro Forma Adjustments | | Pro Forma |

Other liabilities | $ | 23,945 |

| | $ | (5,005 | ) | | $ | 18,940 |

|

| | | | | |

Redeemable convertible preferred stock, $0.00001 par value, 928,676 shares authorized; 308,373 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively; no shares authorized, issued and outstanding, pro forma | 1,465,399 |

| | (1,465,399 | ) | | — |

|

Stockholders’ equity (deficit): | | | | | |

Common stock, $0.00001 par value, 1,932,500 shares authorized; 127,371 and 127,298 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively; no shares issued and outstanding, pro forma | 1 |

| | (1 | ) | | — |

|

Class A common stock, $0.00001 par value, no shares authorized, issued and outstanding as of March 31, 2019 and December 31, 2018; 6,666,667 shares authorized, 86,250 shares issued and outstanding, pro forma; Class B common stock, $0.00001 par value, no shares authorized, issued and outstanding as of March 31, 2019 and December 31, 2018; 1,333,333 shares authorized, 456,214 shares issued and outstanding, pro forma | — |

| | 5 |

| | 5 |

|

Additional paid-in capital | 253,016 |

| | 3,706,496 |

| | 3,959,512 |

|

Accumulated other comprehensive loss | (231 | ) | | — |

| | (231 | ) |

Accumulated deficit | (886,775 | ) | | (974,851 | ) | | (1,861,626 | ) |

Total stockholders’ equity (deficit) | $ | (633,989 | ) | | $ | 2,731,649 |

| | $ | 2,097,660 |

|

ITEM 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read together with our condensed consolidated financial statements and related notes and other financial information appearing elsewhere in this Quarterly Report on Form 10-Q. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results could differ materially from these forward-looking statements as a result of many factors, including those discussed in “Risk Factors” and “Note About Forward-Looking Statements.”

Overview of First Quarter Results

Our key financial and operational results as of and for the three months ended March 31, 2019 are as follows:

| |

• | Revenue was $201.9 million, an increase of 54% compared to the three months ended March 31, 2018. |

| |

• | Monthly active users ("MAUs") were 291 million, an increase of 22% compared to March 31, 2018. |

| |

• | Total costs and expenses were $246.7 million. |

| |

• | Loss from operations was $44.8 million. |

| |

• | Net loss was $41.4 million. |

| |

• | Adjusted EBITDA was $(38.4) million. |

| |

• | Cash, cash equivalents and marketable securities were $642.2 million. |

| |

• | We now serve ads in 13 countries, up from six at March 31, 2018. |

Trends in User Metrics

Monthly Active Users. We define a monthly active user as a logged-in Pinterest user who visits our website or opens our mobile application at least once during the 30-day period ending on the date of measurement. We present MAUs based on the number of MAUs measured on the last day of the current period. We calculate average MAUs based on the average of the number of MAUs measured on the last day of the current period and the last day prior to the beginning of the current period. MAUs are the primary metric by which we measure the scale of our active user base.

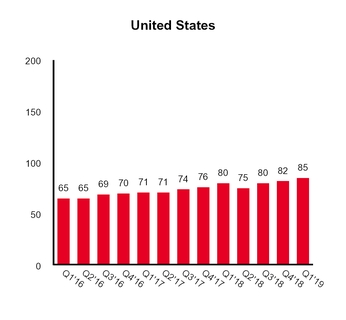

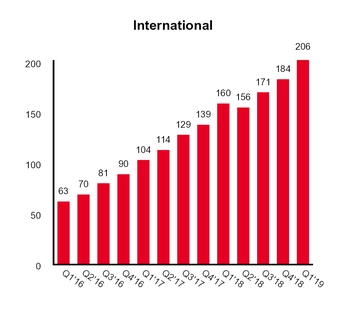

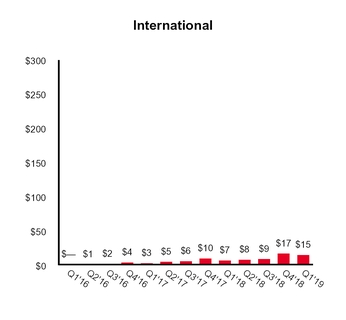

Quarterly Monthly Active Users

(in millions)

Note: United States and International may not sum to Global due to rounding.

We have experienced significant growth in our global MAUs over the last several years. In particular, our international MAUs have grown significantly as a result of our recent focus on localizing content in international markets. We expect this international user growth to continue to outpace U.S. user growth in the near term.

Trends in Monetization Metrics

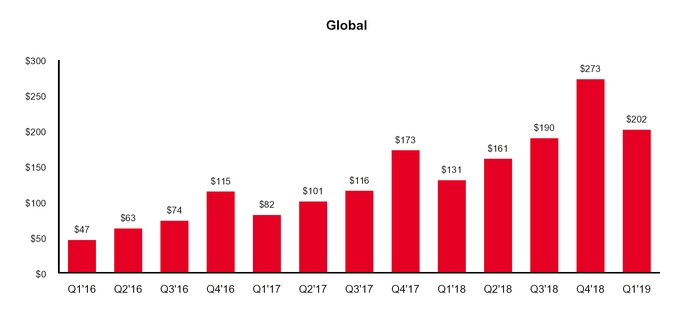

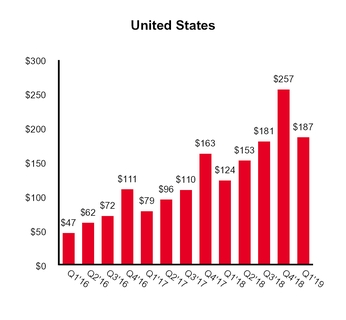

Revenue. We calculate revenue by user geography based on our estimate of the geography in which ad impressions are delivered. The geography of our users affects our revenue and financial results because we currently only monetize certain countries and currencies and because we monetize different geographies at different average rates. Our revenue in the United States is higher primarily due to our decision to focus our earliest monetization efforts there and also due to the relative size and maturity of the U.S. digital advertising market.

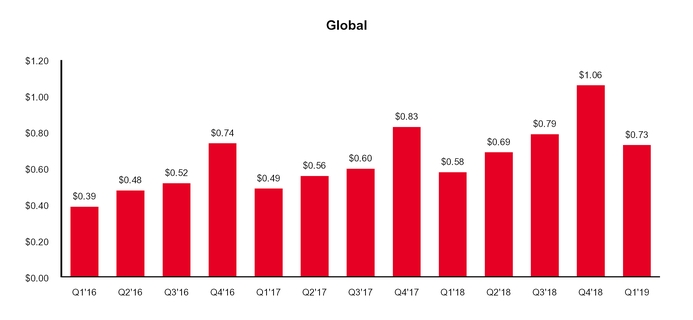

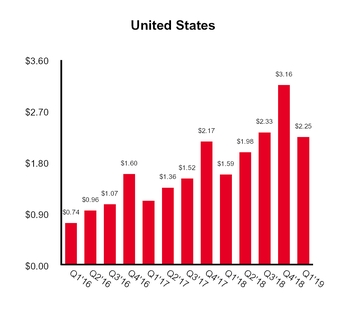

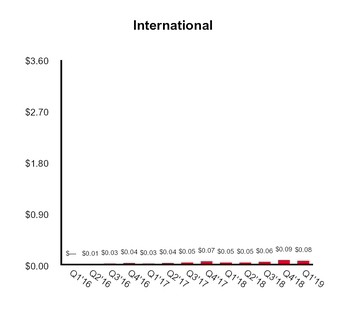

Quarterly Revenue

(in millions)

Note: Revenue by geography in the charts above is geographically apportioned based on our estimate of the geographic location of our users when they perform a revenue-generating activity. This allocation differs from our disclosure of revenue disaggregated by geography in the notes to our condensed consolidated financial statements where revenue is geographically apportioned based on our customers’ billing addresses. United States and International may not sum to Global due to rounding; quarterly amounts may not sum to annual due to rounding.

Average Revenue per User (“ARPU”). We measure monetization of our platform through our average revenue per user metric. We define ARPU as our total revenue in a given geography during a period divided by average MAUs in that geography during the period. We calculate ARPU by geography based on our estimate of the geography in which revenue-generating activities occur. We present ARPU on a U.S. and international basis because we currently monetize users in different geographies at different average rates. U.S. ARPU is higher primarily due to our decision to focus our earliest monetization efforts there and also due to the relative size and maturity of the U.S. digital advertising market.

Quarterly Average Revenue per User

For the three months ended March 31, 2019, global ARPU was $0.73, which represents an increase of 26% compared to the three months ended March 31, 2018. For the three months ended March 31, 2019, U.S. ARPU was $2.25 and international ARPU was $0.08, which represent increases of 41% and 59%, respectively, compared to the three months ended March 31, 2018.

Non-GAAP Financial Measure

To supplement our condensed consolidated financial statements presented in accordance with GAAP, we consider Adjusted EBITDA, a financial measure which is not based on any standardized methodology prescribed by GAAP.

We define Adjusted EBITDA as net loss adjusted to exclude depreciation and amortization expense, share-based compensation expense, interest income, interest expense and other income (expense), net and provision for income taxes.

We use Adjusted EBITDA to evaluate our operating results and for financial and operational decision-making purposes. We believe Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the income and expenses that it excludes. We also believe Adjusted EBITDA provides useful information about our operating results, enhances the overall understanding of our past performance and future prospects, and allows for greater transparency with respect to key metrics we use for financial and operational decision-making. We are presenting Adjusted EBITDA to assist potential investors in seeing our operating results through the eyes of management, and because we believe that this measure provides an additional tool for investors to use in comparing our core business operating results over multiple periods with other companies in our industry. However, our definition of Adjusted EBITDA may not be the same as similarly titled measures used by other companies.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net loss, the nearest GAAP equivalent. For example, Adjusted EBITDA excludes:

| |

• | certain recurring, non-cash charges such as depreciation of fixed assets and amortization of acquired intangible assets, although these assets may have to be replaced in the future; and |

| |

• | share-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense and an important part of our compensation strategy. |

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including net loss and our other financial results presented in accordance with GAAP. The following table presents a reconciliation of net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA (in thousands):

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Net Income (Loss) | $ | (41,420 | ) | | $ | (52,709 | ) |

Depreciation and amortization | 5,696 |

| | 4,787 |

|

Share-based compensation | 694 |

| | 4,834 |

|

Interest income | (4,059 | ) | | (2,638 | ) |

Interest expense and other (income) expense, net | 500 |

| | 242 |

|

Provision for income taxes | 153 |

| | 123 |

|

Adjusted EBITDA | $ | (38,436 | ) | | $ | (45,361 | ) |

Components of Results of Operations

Revenue. We generate revenue by delivering ads on our website and mobile application. Advertisers purchase ad products directly with us or through their relationships with advertising agencies. We recognize revenue only after transferring control of promised goods or services to customers, which occurs when a user clicks on an ad contracted on a CPC basis or views an ad contracted on a CPM basis.

Cost of Revenue. Cost of revenue consists primarily of expenses associated with the delivery of our service, including the cost of hosting our website and mobile application. Cost of revenue also includes personnel-related expense, including salaries, benefits and share-based compensation for employees on our operations teams, payments associated with partner arrangements, credit card and other transaction processing fees, and allocated facilities and other supporting overhead costs.

Research and Development. Research and development consists primarily of personnel-related expense, including salaries, benefits and share-based compensation for our engineers and other employees engaged in the research and development of our products, and allocated facilities and other supporting overhead costs.

Sales and Marketing. Sales and marketing consists primarily of personnel-related expense, including salaries, commissions, benefits and share-based compensation for our employees engaged in sales, sales support, marketing, business development and customer service functions, advertising and promotional expenditures, professional services and allocated facilities and other supporting overhead costs. Our marketing efforts also include user- and advertiser-focused marketing expenditures.

General and Administrative. General and administrative consists primarily of personnel-related expense, including salaries, benefits and share-based compensation for our employees engaged in finance, legal, human resources and other administrative functions, professional services, including outside legal and accounting services, and allocated facilities and other supporting overhead costs.

Other Income (Expense), Net. Other income (expense), net consists primarily of interest earned on our cash equivalents and marketable securities.

Provision for Income Taxes. Provision for income taxes consists primarily of income taxes in foreign jurisdictions and U.S. federal and state income taxes.

Adjusted EBITDA. We define Adjusted EBITDA as net loss adjusted to exclude depreciation and amortization expense, share-based compensation expense, interest and other income (expense), net and provision for income taxes. See “Non-GAAP Financial Measure” for more information and for a reconciliation of net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA.

Results of Operations

The following tables set forth our condensed consolidated statements of operations data (in thousands):

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

Revenue | $ | 201,911 |

| | $ | 131,359 |

|

Costs and expenses (1): | | | |

Cost of revenue | 73,694 |

| | 51,653 |

|

Research and development | 72,444 |

| | 60,047 |

|

Sales and marketing | 76,394 |

| | 55,774 |

|

General and administrative | 24,205 |

| | 18,867 |

|

Total costs and expenses | 246,737 |

| | 186,341 |

|

Loss from operations | (44,826 | ) | | (54,982 | ) |

Other income (expense), net: | | | |

Interest income | 4,059 |

| | 2,638 |

|

Interest expense and other income (expense), net | (500 | ) | | (242 | ) |

Loss before provision for income taxes | (41,267 | ) | | (52,586 | ) |

Provision for income taxes | 153 |

| | 123 |

|

Net loss | $ | (41,420 | ) | | $ | (52,709 | ) |

Adjusted EBITDA (2) | $ | (38,436 | ) | | $ | (45,361 | ) |

| | | | |

| |

(1) | Includes share-based compensation expense as follows (in thousands): |

|

| | | | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Cost of revenues | $ | 15 |

| | $ | 32 |

|

Research and development | 626 |

| | 4,054 |

|

Sales and marketing | 29 |

| | 241 |

|

General and administrative | 24 |

| | 507 |

|

Total share-based compensation | $ | 694 |

| | $ | 4,834 |

|

We began granting RSUs in March 2015. Our RSUs granted under our 2009 Plan are subject to both a service condition, which is typically satisfied over four years, and a performance condition, which was satisfied in connection with our IPO. Because the performance condition had not been satisfied as of March 31, 2019, we had not recorded any share-based compensation expense for our RSUs at that date. Had our IPO occurred on March 31, 2019, we would have recorded cumulative share-based compensation expense of $974.9 million using the accelerated attribution method, and we would have expected to recognize the remaining $924.5 million of unrecognized share-based compensation expense over a weighted-average period of 3.7 years. Because our IPO was completed in April 2019, our expenses for the three months ending June 30, 2019 will include substantial share-based compensation expense with respect to our RSUs.

| |

(2) | See “Non-GAAP Financial Measure” for more information and for a reconciliation of net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA. |

The following table sets forth our condensed consolidated statements of operations data (as a percentage of revenue):

|

| | | | | |

| Three Months Ended March 31, |

| 2019 | | 2018 |

Revenue | 100 | % | | 100 | % |

Costs and expenses: | | | |

Cost of revenue | 36 |

| | 39 |

|

Research and development | 36 |

| | 46 |

|

Sales and marketing | 38 |

| | 42 |

|

General and administrative | 12 |

| | 14 |

|

Total costs and expenses | 122 |

| | 142 |

|

Loss from operations | (22 | ) | | (42 | ) |

Other income (expense), net: | | | |

Interest income | 2 |

| | 2 |

|

Interest expense and other income (expense), net | — |

| | — |

|

Loss before provision for income taxes | (20 | ) | | (40 | ) |

Provision for income taxes | — |

| | — |

|

Net loss | (21 | )% | | (40 | )% |

Three Months Ended March 31, 2019 and 2018

Revenue

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Revenue | $ | 201,911 |

| | $ | 131,359 |

| | 54 | % |

Revenue for the three months ended March 31, 2019 increased by $70.6 million compared to the three months ended March 31, 2018. Revenue based on the geographic location of our users increased by 51% in the United States to $187.0 million and by 107% internationally to $14.9 million. U.S. revenue growth was driven by a 7% increase in average U.S. MAUs and a 41% increase in U.S. ARPU. International revenue growth was driven by a 30% increase in average international MAUs and a 59% increase in international ARPU. ARPU growth in the U.S. and internationally was driven by higher monetization of both of those user bases largely due to an increase in the number of advertisements delivered as a result of an increase in the overall number of advertisers on our platform and increased demand from existing advertisers. The impact of the pricing of advertisements was not significant for the three months ended March 31, 2019 compared to the three months ended March 31, 2018.

Cost of Revenue

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Cost of revenue | $ | 73,694 |

| | $ | 51,653 |

| | 43 | % |

Percentage of revenue | 36 | % | | 39 | % | | |

Cost of revenue for the three months ended March 31, 2019 increased by $22.0 million compared to the three months ended March 31, 2018. The increase was primarily due to higher absolute hosting costs due to user growth.

Research and Development

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Research and development | $ | 72,444 |

| | $ | 60,047 |

| | 21 | % |

Percentage of revenue | 36 | % | | 46 | % | | |

Research and development for the three months ended March 31, 2019, increased by $12.4 million compared to the three months ended March 31, 2018. The increase was primarily due to a 28% increase in average headcount, which drove higher personnel and facilities-related expenses.

Sales and Marketing

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Sales and marketing | $ | 76,394 |

| | $ | 55,774 |

| | 37 | % |

Percentage of revenue | 38 | % | | 42 | % | | |

Sales and marketing for the three months ended March 31, 2019, increased by $20.6 million compared to the three months ended March 31, 2018. The increase was primarily due to a 38% increase in average headcount, which drove higher personnel and facilities-related expenses, as well as higher consulting and marketing expenses.

General and Administrative

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

General and administrative | $ | 24,205 |

| | $ | 18,867 |

| | 28 | % |

Percentage of revenue | 12 | % | | 14 | % | | |

General and administrative for the three months ended March 31, 2019, increased by $5.3 million compared to the three months ended March 31, 2018. The increase was primarily due to a 31% increase in average headcount, which drove higher personnel and facilities-related expenses.

Other Income (Expense), Net

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Interest income | $ | 4,059 |

| | $ | 2,638 |

| | 54 | % |

Interest expense and other income (expense), net | (500 | ) | | (242 | ) | | (107 | )% |

Other income (expense), net | $ | 3,559 |

| | $ | 2,396 |

| | 49 | % |

Other income (expense), net for the three months ended March 31, 2019, increased by $1.2 million compared to the three months ended March 31, 2018. The increase was primarily due to higher returns on our marketable securities as a result of higher interest rates.

Provision for Income Taxes

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Provision for income taxes | $ | 153 |

| | $ | 123 |

| | 24 | % |

Provision for income taxes was primarily due to profits generated by our foreign subsidiaries for both of the periods presented.

Net Loss and Adjusted EBITDA

|

| | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2019 | | 2018 | | % change |

| (in thousands) | | |

Net loss | $ | (41,420 | ) | | $ | (52,709 | ) | | 21 | % |

Adjusted EBITDA | $ | (38,436 | ) | | $ | (45,361 | ) | | 15 | % |

Net loss for the three months ended March 31, 2019 was $41.4 million, as compared to $52.7 million for the three months ended March 31, 2018. Adjusted EBITDA was $(38.4) million for the three months ended March 31, 2019, as compared to $(45.4) million for the three months ended March 31, 2018, due to the factors described above. See “Non-GAAP Financial Measure” for more information and for a reconciliation of net loss, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA.

Liquidity and Capital Resources

We have historically financed our operations primarily through private sales of our stock and payments received from our customers. Our primary uses of cash are personnel-related costs and the cost of hosting our website and mobile application. As of March 31, 2019, we had $642.2 million in cash, cash equivalents and marketable securities. Our cash equivalents and marketable securities are primarily invested in short-duration fixed income securities, including government and investment-grade corporate debt securities and money market funds. As of March 31, 2019, $19.1 million of our cash and cash equivalents was held by our foreign subsidiaries.

In November 2018, we entered into a five-year $500.0 million revolving credit facility with an accordion option which, if exercised, would allow us to increase the aggregate commitments by the greater of $100.0 million and 10% of our consolidated total assets, provided we are able to secure additional lender commitments and satisfy certain other conditions. Interest on any borrowings under the revolving credit facility accrues at either LIBOR plus 1.50% or at an alternative base rate plus 0.50%, at our election, and we are required to pay an annual commitment fee that accrues at 0.15% per annum on the unused portion of the aggregate commitments under the revolving credit facility.

The revolving credit facility also allows us to issue letters of credit, which reduce the amount we can borrow. We are required to pay a fee that accrues at 1.50% per annum on the average aggregate daily maximum amount available to be drawn under any outstanding letters of credit.

The revolving credit facility contains customary conditions to borrowing, events of default and covenants, including covenants that restrict our ability to incur indebtedness, grant liens, make distributions to holders of our stock or the stock of our subsidiaries, make investments or engage in transactions with our affiliates. The revolving credit facility also contains two financial maintenance covenants: a consolidated total assets covenant and a minimum liquidity balance of $350.0 million, which includes any available borrowing capacity. The obligations under the revolving credit facility are secured by liens on substantially all of our domestic assets, including certain domestic intellectual property assets. We are in compliance with all covenants and there were no amounts outstanding under this facility as of March 31, 2019.

On April 23, 2019, we closed our IPO in which we issued and sold 75,000,000 shares of Class A common stock at $19.00 per share. We received net proceeds of $1,368.0 million after deducting underwriting discounts and commissions and before deducting estimated offering costs of $8.7 million, of which $5.6 million was included in other assets as of March 31, 2019. We utilized a portion of the net proceeds from this offering to pay approximately $303.3 million to satisfy the related tax withholding and remittance obligations.

On April 29, 2019, we issued and sold an additional 11,250,000 shares of Class A common stock at $19.00 per share pursuant to the underwriters’ option to purchase additional shares. We received additional net proceeds of $205.2 million after deducting underwriting discounts and commissions.

The shares and proceeds from our IPO and the underwriters’ exercise of their option to purchase additional shares are not reflected in the condensed consolidated financial statements as of and for the three months ended March 31, 2019.