0001503707false2023FYhttp://fasb.org/us-gaap/2023#RealEstateInvestmentPropertyNethttp://fasb.org/us-gaap/2023#RealEstateInvestmentPropertyNethttp://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#GainLossOnInvestmentshttp://fasb.org/us-gaap/2023#GainLossOnInvestments000015037072023-01-012023-12-3100015037072023-06-30iso4217:USD00015037072024-03-21xbrli:shares00015037072023-12-3100015037072022-12-310001503707us-gaap:RelatedPartyMember2023-12-310001503707us-gaap:RelatedPartyMember2022-12-310001503707us-gaap:NonrelatedPartyMember2023-12-310001503707us-gaap:NonrelatedPartyMember2022-12-31iso4217:USDxbrli:shares0001503707nshi:NorthstarHealthcareIncomeOperatingPartnershipLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-3100015037072022-01-012022-12-3100015037072021-01-012021-12-3100015037072023-12-312023-12-3100015037072022-12-312022-12-3100015037072021-12-312021-12-310001503707us-gaap:CommonStockMember2020-12-310001503707us-gaap:AdditionalPaidInCapitalMember2020-12-310001503707us-gaap:RetainedEarningsMember2020-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001503707us-gaap:ParentMember2020-12-310001503707us-gaap:NoncontrollingInterestMember2020-12-3100015037072020-12-310001503707us-gaap:CommonStockMember2021-01-012021-12-310001503707us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001503707us-gaap:ParentMember2021-01-012021-12-310001503707us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001503707us-gaap:RetainedEarningsMember2021-01-012021-12-310001503707us-gaap:CommonStockMember2021-12-310001503707us-gaap:AdditionalPaidInCapitalMember2021-12-310001503707us-gaap:RetainedEarningsMember2021-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001503707us-gaap:ParentMember2021-12-310001503707us-gaap:NoncontrollingInterestMember2021-12-3100015037072021-12-310001503707us-gaap:CommonStockMember2022-01-012022-12-310001503707us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001503707us-gaap:ParentMember2022-01-012022-12-310001503707us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001503707us-gaap:RetainedEarningsMember2022-01-012022-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001503707us-gaap:CommonStockMember2022-12-310001503707us-gaap:AdditionalPaidInCapitalMember2022-12-310001503707us-gaap:RetainedEarningsMember2022-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001503707us-gaap:ParentMember2022-12-310001503707us-gaap:NoncontrollingInterestMember2022-12-310001503707us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001503707us-gaap:ParentMember2023-01-012023-12-310001503707us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001503707us-gaap:CommonStockMember2023-01-012023-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001503707us-gaap:RetainedEarningsMember2023-01-012023-12-310001503707us-gaap:CommonStockMember2023-12-310001503707us-gaap:AdditionalPaidInCapitalMember2023-12-310001503707us-gaap:RetainedEarningsMember2023-12-310001503707us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001503707us-gaap:ParentMember2023-12-310001503707us-gaap:NoncontrollingInterestMember2023-12-310001503707nshi:AdvisoroftheRegistrantMember2023-01-012023-12-310001503707nshi:SpecialUnitsHolderMember2023-01-012023-12-310001503707nshi:NorthstarHealthcareIncomeOperatingPartnershipLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-31xbrli:pure0001503707nshi:DividendReinvestmentPlanMember2023-01-012023-12-310001503707us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001503707nshi:EspressoJointVentureMember2023-01-012023-06-300001503707nshi:EspressoJointVentureMember2023-06-300001503707nshi:EspressoJointVentureMember2023-07-012023-12-310001503707srt:MinimumMemberus-gaap:BuildingMember2023-12-310001503707us-gaap:BuildingMembersrt:MaximumMember2023-12-310001503707srt:MinimumMemberus-gaap:LandImprovementsMember2023-12-310001503707srt:MaximumMemberus-gaap:LandImprovementsMember2023-12-310001503707srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001503707us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310001503707nshi:RochesterPortfolioPropertyMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-11-300001503707nshi:RochesterPortfolioMember2023-01-012023-12-31nshi:property0001503707us-gaap:LeasesAcquiredInPlaceMember2023-12-310001503707us-gaap:LeasesAcquiredInPlaceMember2022-12-310001503707us-gaap:InterestRateCapMember2023-12-310001503707us-gaap:InterestRateCapMember2022-12-31nshi:day0001503707nshi:OperatingRealEstateNetMember2023-01-012023-12-310001503707nshi:RochesterPortfolioMembernshi:FacilityMember2023-01-012023-12-31nshi:facility0001503707nshi:ArborsPortfolioMembernshi:FacilityMember2023-01-012023-12-310001503707nshi:RochesterPortfolioMembernshi:LandParcelMember2023-01-012023-12-310001503707nshi:OperatingRealEstateNetMember2022-01-012022-12-310001503707nshi:ArborsPortfolioMember2022-01-012022-12-310001503707nshi:WinterfellPortfolioMember2022-01-012022-12-310001503707nshi:RochesterPortfolioMember2022-01-012022-12-310001503707nshi:AvamerePortfolioMember2022-01-012022-12-310001503707nshi:EspressoJointVentureMember2023-06-012023-06-300001503707nshi:DiversifiedUSUKMember2022-01-012022-12-310001503707nshi:DiversifiedUSUKMember2022-12-310001503707nshi:DiversifiedUSUKMember2023-05-012023-05-31nshi:home0001503707nshi:DiversifiedUSUKMember2023-01-012023-12-310001503707nshi:TheTrilogyJointVentureMember2023-01-012023-12-310001503707nshi:TheTrilogyJointVentureMember2022-01-012022-12-310001503707us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001503707us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001503707nshi:OperatingRealEstateNetMember2021-01-012021-12-310001503707nshi:SolsticeSeniorLivingLLCMember2023-12-31nshi:unit0001503707nshi:SolsticeSeniorLivingLLCMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMembernshi:SolsticeSeniorLivingLLCMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001503707nshi:WatermarkRetirementCommunitiesMember2023-12-310001503707nshi:WatermarkRetirementCommunitiesMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMembernshi:WatermarkRetirementCommunitiesMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001503707nshi:AvamereHealthServicesMember2023-12-310001503707nshi:AvamereHealthServicesMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembernshi:AvamereHealthServicesMember2023-01-012023-12-310001503707nshi:IntegralMember2023-12-310001503707nshi:IntegralMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembernshi:IntegralMember2023-01-012023-12-310001503707nshi:ArcadiaMember2023-12-310001503707nshi:ArcadiaMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembernshi:ArcadiaMember2023-01-012023-12-310001503707nshi:OtherPropertiesMember2023-12-310001503707nshi:OtherPropertiesMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembernshi:OtherPropertiesMember2023-01-012023-12-310001503707nshi:TotalPropertiesMember2023-12-310001503707nshi:TotalPropertiesMember2023-01-012023-12-310001503707us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembernshi:TotalPropertiesMember2023-01-012023-12-310001503707nshi:SolsticeSeniorLivingLLCMember2023-12-310001503707nshi:TheTrilogyJointVentureMember2023-12-310001503707nshi:TheTrilogyJointVentureMember2022-12-310001503707nshi:SolsticeSeniorLivingLLCMember2023-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-12-310001503707nshi:EspressoJointVentureMember2023-12-310001503707nshi:EspressoJointVentureMember2022-12-310001503707nshi:TrilogyEspressoSolsticeMember2023-12-310001503707nshi:TrilogyEspressoSolsticeMember2022-12-310001503707us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMember2024-01-012024-12-31nshi:campus0001503707srt:MinimumMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMember2024-12-310001503707us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMembersrt:MaximumMember2024-12-310001503707nshi:March312024Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMember2024-01-012024-12-310001503707us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMembernshi:December312024Member2024-01-012024-12-31nshi:uSDollarsPerDay0001503707us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:QualifyingIPOOf200MillionHasOccurredMembernshi:TheTrilogyJointVentureMember2024-01-012024-12-310001503707us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMembernshi:TerminatedPriorToMarch312025Member2024-01-012024-12-310001503707nshi:TerminatedPriorToSeptember302025Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembersrt:ScenarioForecastMembernshi:TheTrilogyJointVentureMember2024-01-012024-12-310001503707nshi:WinterfellPortfolioMembernshi:SolsticeSeniorLivingLLCMember2023-12-310001503707nshi:WinterfellPortfolioMembernshi:SolsticeSeniorLivingLLCMember2023-12-310001503707nshi:EspressoJointVentureMember2023-01-012023-12-310001503707nshi:DiversifiedUSUKMember2023-06-300001503707nshi:DiversifiedUSUKMember2023-06-012023-06-300001503707nshi:EclipseJointVentureMember2023-06-300001503707nshi:EclipseJointVentureMember2023-06-012023-06-300001503707nshi:FormerSponsorAndAffiliatesMember2023-06-012023-06-300001503707nshi:FormerSponsorAndAffiliatesMember2023-06-300001503707nshi:TheTrilogyJointVentureMember2021-01-012021-12-310001503707nshi:SolsticeSeniorLivingLLCMember2023-01-012023-12-310001503707nshi:SolsticeSeniorLivingLLCMember2022-01-012022-12-310001503707nshi:SolsticeSeniorLivingLLCMember2021-01-012021-12-310001503707nshi:EspressoJointVentureMember2022-01-012022-12-310001503707nshi:EspressoJointVentureMember2021-01-012021-12-310001503707nshi:EnvoyJointVentureMember2023-01-012023-12-310001503707nshi:EnvoyJointVentureMember2022-01-012022-12-310001503707nshi:EnvoyJointVentureMember2021-01-012021-12-310001503707nshi:InvestmentsSoldMember2023-01-012023-12-310001503707nshi:InvestmentsSoldMember2022-01-012022-12-310001503707nshi:InvestmentsSoldMember2021-01-012021-12-310001503707nshi:EspressoAndSolsticeMember2023-12-310001503707nshi:EspressoAndSolsticeMember2022-12-310001503707nshi:EspressoAndSolsticeMember2023-01-012023-12-310001503707nshi:EspressoAndSolsticeMember2022-01-012022-12-310001503707nshi:EspressoAndSolsticeMember2021-01-012021-12-310001503707nshi:DiversifiedUSUKAndEclipseMember2023-06-090001503707nshi:DiversifiedUSUKAndEclipseMember2022-12-310001503707nshi:DiversifiedUSUKAndEclipseMember2023-01-012023-06-090001503707nshi:DiversifiedUSUKAndEclipseMember2022-01-012022-12-310001503707nshi:DiversifiedUSUKAndEclipseMember2021-01-012021-12-310001503707us-gaap:MortgagesMembernshi:FriscoTXNonRecourseFebruary2026Membernshi:FriscoTXMember2023-12-310001503707us-gaap:MortgagesMembernshi:FriscoTXNonRecourseFebruary2026Membernshi:FriscoTXMember2022-12-310001503707nshi:SecuredOvernightFinancingRateSOFRMemberus-gaap:MortgagesMembernshi:MilfordOHNonRecourseSeptember2026Membernshi:MilfordOHMember2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:MilfordOHNonRecourseSeptember2026Membernshi:MilfordOHMember2023-12-310001503707us-gaap:MortgagesMembernshi:MilfordOHNonRecourseSeptember2026Membernshi:MilfordOHMember2022-12-310001503707nshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMembernshi:RochesterNYMember2023-12-310001503707nshi:RochesterNYNonrecourseFebruary2025Memberus-gaap:MortgagesMembernshi:RochesterNYMember2022-12-310001503707nshi:SecuredOvernightFinancingRateSOFRMemberus-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonRecourseJuly2023Member2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonRecourseJuly2023Member2023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonRecourseJuly2023Member2022-12-310001503707nshi:SecuredOvernightFinancingRateSOFRMemberus-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2024Member2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2024Member2023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonrecourseAugust2024Member2022-12-310001503707us-gaap:MortgagesMemberus-gaap:NonrecourseMembernshi:ArborsPortfolioMember2023-12-310001503707us-gaap:MortgagesMemberus-gaap:NonrecourseMembernshi:ArborsPortfolioMember2022-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:MortgagesMemberus-gaap:NonrecourseMember2023-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:MortgagesMemberus-gaap:NonrecourseMember2022-12-310001503707us-gaap:MortgagesMemberus-gaap:NonrecourseMembernshi:AvamerePortfolioMember2023-12-310001503707us-gaap:MortgagesMemberus-gaap:NonrecourseMembernshi:AvamerePortfolioMember2022-12-310001503707nshi:MortgagesAndOtherNotesPayableMember2023-12-310001503707nshi:MortgagesAndOtherNotesPayableMember2022-12-310001503707us-gaap:MortgagesMembernshi:FloatingRateDebtOneMonthLIBORMember2023-12-310001503707nshi:SecuredOvernightFinancingRateSOFRMemberus-gaap:MortgagesMembernshi:FriscoTXNonRecourseFebruary2026Membernshi:FriscoTXMember2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMember2023-01-012023-12-31nshi:debt_instrument0001503707us-gaap:MortgagesMembernshi:ArborsPortfolioMember2023-01-012023-12-310001503707nshi:WinterfellPortfolioMemberus-gaap:MortgagesMember2023-01-012023-12-310001503707nshi:WinterfellPortfolioMember2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:AvamerePortfolioMember2023-01-012023-12-310001503707us-gaap:MortgagesMembernshi:RochesterNYMember2023-07-012023-07-310001503707us-gaap:MortgagesMembernshi:RochesterNYMembernshi:RochesterNYNonRecourseJuly2023Member2023-07-310001503707nshi:RochesterNYMembernshi:RochesterNYNonRecourseJuly2023Member2023-12-310001503707us-gaap:MortgagesMembernshi:ArborsPortfolioMember2021-02-012021-02-280001503707nshi:GeneralAndAdministrativeExpensesAndTransactionCostsMembernshi:AdvisoroftheRegistrantMember2022-12-310001503707nshi:OperatingCostsIncurredMembernshi:GeneralAndAdministrativeExpensesAndTransactionCostsMembernshi:AdvisoroftheRegistrantMember2023-01-012023-12-310001503707nshi:GeneralAndAdministrativeExpensesAndTransactionCostsMembernshi:AdvisoroftheRegistrantMembernshi:OperatingCostsPaidMember2023-01-012023-12-310001503707nshi:GeneralAndAdministrativeExpensesAndTransactionCostsMembernshi:AdvisoroftheRegistrantMember2023-12-310001503707us-gaap:RelatedPartyMembernshi:IncentiveFeesMember2023-01-012023-12-310001503707nshi:WinterfellPortfolioMembernshi:SolsticeSeniorLivingLLCMember2023-12-310001503707nshi:WinterfellPortfolioMembernshi:SolsticeSeniorLivingLLCMember2023-01-012023-12-310001503707us-gaap:RestrictedStockMember2023-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockMember2023-12-310001503707srt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2023-12-310001503707us-gaap:RestrictedStockMember2023-01-012023-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2023-12-310001503707us-gaap:RestrictedStockUnitsRSUMember2022-12-310001503707us-gaap:CommonStockMember2015-12-172016-01-190001503707us-gaap:CommonStockMembernshi:DividendReinvestmentPlanMember2015-12-172022-04-300001503707nshi:DividendReinvestmentPlanMember2015-12-172022-04-3000015037072022-05-020001503707nshi:DiversifiedUSUKAndEclipseMember2023-12-310001503707nshi:DiversifiedUSUKAndEclipseMember2023-01-012023-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel1Member2023-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel2Member2023-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel3Member2023-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel1Member2022-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel2Member2022-12-310001503707us-gaap:InterestRateCapMemberus-gaap:FairValueInputsLevel3Member2022-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel1Member2023-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel2Member2023-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel3Member2023-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel1Member2022-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel2Member2022-12-310001503707nshi:EspressoJointVentureMemberus-gaap:FairValueInputsLevel3Member2022-12-310001503707us-gaap:MortgagesMember2023-12-310001503707us-gaap:MortgagesMember2022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001503707nshi:OperatingRealEstateNetMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001503707nshi:OperatingRealEstateNetMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001503707nshi:OperatingRealEstateNetMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2023-01-012023-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2022-01-012022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateJointVentureMember2021-01-012021-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMembernshi:AssetHeldForSaleMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMembernshi:AssetHeldForSaleMemberus-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001503707us-gaap:FairValueMeasurementsNonrecurringMembernshi:AssetHeldForSaleMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001503707nshi:TerminalCapitalizationRateMembersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:RealEstateInvestmentMember2023-12-310001503707nshi:TerminalCapitalizationRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:RealEstateInvestmentMembersrt:MaximumMember2023-12-310001503707srt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:RealEstateInvestmentMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001503707us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:RealEstateInvestmentMemberus-gaap:MeasurementInputDiscountRateMembersrt:MaximumMember2023-12-310001503707nshi:TerminalCapitalizationRateMembersrt:MinimumMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001503707nshi:TerminalCapitalizationRateMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMembersrt:MaximumMember2023-12-310001503707srt:MinimumMemberus-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310001503707us-gaap:CorporateJointVentureMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:MeasurementInputDiscountRateMembersrt:MaximumMember2023-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsNetLeaseMember2023-01-012023-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsOperatingMember2023-01-012023-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001503707us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001503707us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsNetLeaseMember2022-01-012022-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsOperatingMember2022-01-012022-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001503707us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001503707us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsNetLeaseMember2021-01-012021-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsOperatingMember2021-01-012021-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001503707us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001503707us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsNetLeaseMember2023-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2023-12-310001503707us-gaap:CorporateNonSegmentMember2023-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsNetLeaseMember2022-12-310001503707us-gaap:OperatingSegmentsMembernshi:DirectInvestmentsOperatingMember2022-12-310001503707nshi:UnconsolidatedInvestmentsSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001503707us-gaap:CorporateNonSegmentMember2022-12-310001503707nshi:RochesterPortfolioPropertyMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:SubsequentEventMember2024-02-290001503707nshi:RochesterPortfolioPropertyMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberus-gaap:SubsequentEventMember2024-02-012024-02-290001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:MilfordOHTwoMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FriscoTXOneMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:AppleValleyCAMember2023-12-310001503707nshi:AuburnCAMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:AustinTXMember2023-12-310001503707nshi:BakersfieldCAMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BangorMEMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:BellinghamWAMember2023-12-310001503707nshi:ClovisCAMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:ColumbiaMOMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:CorpusChristiTXMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:EastAmherstNYMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElCajonCAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:ElPasoTXMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FairportNYMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FentonMOMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GrandJunctionCOOneMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GrandJunctionCOTwoMember2023-12-310001503707nshi:GrapevineTXMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GrotonCTMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GulifordCTMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:JolietILMember2023-12-310001503707nshi:KennewickWAMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:LasCrucesNMMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:LeesSummitMOMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:LodiCAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:NormandyParkWAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PalatineILMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PlanoTXMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RentonWAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SandyUTMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SantaRosaCAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SunCityWestAZMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:TacomaWAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:FriscoTXTwoMember2023-12-310001503707nshi:AlbanyMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:PortTownsendWAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:RoseburgORMember2023-12-310001503707nshi:SandyORMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:SantaBarbaraCAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:WenatcheeWAMember2023-12-310001503707nshi:DirectInvestmentsOperatingMembernshi:GreeceNYOneMember2023-12-310001503707nshi:RochesterNYOneMembernshi:DirectInvestmentsOperatingMember2023-12-310001503707nshi:UndevelopedLandMembernshi:RochesterNYThreeMember2023-12-310001503707nshi:UndevelopedLandMembernshi:PenfieldNYThreeMember2023-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:BohemiaNYMember2023-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:HauppagueNYMember2023-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:IslandiaNYMember2023-12-310001503707nshi:DirectInvestmentsNetLeaseMembernshi:WestburyNYMember2023-12-310001503707nshi:DirectInvestmentOperatingAndNetLeaseMember2023-12-310001503707nshi:HeldForSaleMembernshi:VictorNYTwoMember2023-12-310001503707nshi:PropertiesInReceivershipMember2023-12-310001503707nshi:DirectInvestmentOperatingAndNetLeaseMember2022-12-310001503707nshi:DirectInvestmentOperatingAndNetLeaseMember2021-12-310001503707nshi:EspressoJointVentureMember2018-12-310001503707nshi:EspressoJointVentureMember2021-12-3100015037072023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-55190

NORTHSTAR HEALTHCARE INCOME, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Maryland | 27-3663988 |

| (State or Other Jurisdiction of | (IRS Employer |

| Incorporation or Organization) | Identification No.) |

16 East 34th Street, 18th Floor, New York, NY 10016

(Address of Principal Executive Offices, Including Zip Code)

(929) 777-3125

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | None | None |

Securities registered pursuant to Section 12(g) of the Act : Common Stock, $0.01 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

There is no established trading market for the registrant’s common stock and therefore the aggregate market value of the registrant’s common stock held by non-affiliates cannot be determined.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 185,712,103 shares outstanding as of March 21, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive proxy statement related to the registrant’s 2024 Annual Meeting of Stockholders to be filed hereafter are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K.

NORTHSTAR HEALTHCARE INCOME, INC.

FORM 10-K

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders; our ability to retain our senior executives and other sufficient personnel to manage our business; our ability to realize substantial efficiencies as well as anticipated strategic and financial benefits of the internalization of our management function; the operating performance of our investments, our financing needs, the effects of our current strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements.

All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the U.S. Securities and Exchange Commission, or the SEC, including in this Annual Report on Form 10-K under the heading “Risk Factor Summary” and Item 1A. “Risk Factors” below. The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

RISK FACTOR SUMMARY

Investing in our securities involves a high degree of risk. Below is a summary of principal factors that make an investment in our securities speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, as well as other risks that we face, can be found under the heading Item 1A. “Risk Factors” below.

Risks Related to Our Business and Strategy

•Macroeconomic trends, including rising labor costs and historically low unemployment, increases in inflation and rising interest rates may adversely affect our business and financial results.

•Market conditions and the actual and perceived state of the capital markets generally could negatively impact our business, financial condition and results of operations.

•Our strategy depends upon identifying and executing on disposition opportunities that achieve a desired return.

•We may be forced to dispose of assets at suboptimal times due to debt maturities.

•We may not be able to sell our properties quickly in response to changes in economic and other conditions, which may result in losses to us.

•We are directly exposed to operational risks at substantially all of our properties and are dependent on the managers of these properties to manage these risks.

•Our Arbors portfolio does not currently generate sufficient cash flow to satisfy all debt service obligations.

•We depend on the manager of our Winterfell portfolio, Solstice Senior Living, or Solstice, and Trilogy Management Services, or TMS, for a significant majority of our revenues and net operating income, either directly or through our unconsolidated investments. Adverse developments in Solstice or TMS’s business and affairs or financial condition could have a material adverse effect on us.

•If we must replace any of our operators or managers, we might be unable to reposition the properties or fully restore value, and we could be subject to delays, limitations and expenses, all of which could have a material adverse effect on us.

•We are subject to risks associated with capital expenditures, and our failure to adequately manage such risks could have a material adverse effect on our business, financial condition and results of operations.

•Events that adversely affect the ability of seniors and their families to afford resident fees at our seniors housing facilities could cause our occupancy rates, revenues and results of operations to decline.

•Increased competition could adversely affect future occupancy rates, operating margins and profitability at our properties.

•Our joint venture partners could take actions that decrease the value of an investment to us and lower our overall return.

•We may have limited ability to influence material decisions for our unconsolidated investment in the Trilogy portfolio.

•Failure to comply with certain healthcare laws and regulations, and changes in such laws and regulations, could adversely affect our operations.

•Insurance may not cover all potential losses or may not be available on acceptable terms.

Risks Related to Our Capital Structure

•We may not be able to generate sufficient cash flow to meet all of our existing or potential future debt service obligations.

•We require capital in order to operate our business, and the failure to obtain such capital would have a material adverse effect on our business, financial condition and results of operations.

•We are exposed to increases in interest rates, which could reduce our cash flows and adversely impact our ability to refinance existing debt or sell assets.

•We use significant leverage in connection with our investments, which increases the risk of loss associated with our investments and restricts our ability to engage in certain activities.

•We may be adversely affected by our concentration of borrowings with Fannie Mae.

•If we are required to make payments under any “bad boy” non-recourse carve-out guaranties for our mortgage loans, we could be materially and adversely affected.

•Our distribution policy is subject to change. We may not be able to make distributions in the future.

•Stockholders are not currently able to sell any of their shares of our common stock back to us pursuant to our share repurchase program, or the Share Repurchase Program, and if they do sell their shares on any limited market that may develop, they may not receive the price they paid upon subscription.

•Our board of directors determined an estimated value per share of $2.64 for our common stock as of June 30, 2023, which may not reflect the current value of shares of our common stock.

•No public trading market for our shares currently exists, and as a result, it will be difficult for stockholders to sell their shares and, if stockholders are able to sell their shares, stockholders will likely sell them at a substantial discount to the price paid for those shares.

•If we do not successfully implement a liquidity transaction, stockholders may have to hold their investments for an indefinite period.

Risks Related to Our Company and Corporate Structure

•As a self-managed REIT without the resources of our former sponsor, we may encounter unforeseen costs and difficulties.

•Our ability to operate our business successfully would be harmed if key personnel terminate their employment with us.

•We are subject to substantial litigation risks and may face significant liabilities as a result of litigation allegations and negative publicity.

•We are subject to substantial regulation, numerous contractual obligations and extensive internal policies and failure to comply with these matters could have a material adverse effect on our business, financial condition and results of operations.

•Failure to implement effective information and cybersecurity policies, procedures and capabilities could disrupt our business and harm our results of operations.

Risks Related to Regulatory Matters and Our REIT Tax Status

•Maintenance of our Investment Company Act exemption imposes limits on our operations.

•Our failure to continue to qualify as a real estate investment trust, or REIT, would subject us to federal income tax.

PART I

Item 1. Business

References to “we,” “us” or “our” refer to NorthStar Healthcare Income, Inc. and its subsidiaries, unless context specifically requires otherwise.

Overview

We own a diversified portfolio of seniors housing properties, including independent living facilities, or ILFs, assisted living facilities, or ALFs, and memory care facilities, or MCFs, located throughout the United States. In addition, we have an investment through a non-controlling interest in a joint venture that invests in integrated senior health campuses, which provide services associated with ILFs, ALFs, MCFs and skilled nursing facilities, or SNFs, across the Midwest region of the United States.

We were formed in October 2010 as a Maryland corporation and commenced operations in February 2013. We elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, commencing with the taxable year ended December 31, 2013. We conduct our operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

We raised $2.0 billion in total gross proceeds from the sale of shares of our common stock in our continuous, public offerings, including $232.6 million pursuant to our distribution reinvestment plan, or our DRP, collectively referred to as our Offering.

The Internalization

From inception through October 21, 2022, we were externally managed by CNI NSHC Advisors, LLC or its predecessor, or the Former Advisor, an affiliate of NRF Holdco, LLC, or the Former Sponsor. The Former Advisor was responsible for managing our operations, subject to the supervision of our board of directors, pursuant to an advisory agreement. On October 21, 2022, we completed the internalization of our management function, or the Internalization. In connection with the Internalization, we agreed with the Former Advisor to terminate the advisory agreement.

Our Strategy

Our primary objective is to maximize value and generate liquidity for shareholders. The key elements of our strategy include:

•Grow the Operating Income Generated by Our Portfolio. We are focused on growing the net operating income generated by our properties, through active portfolio management and selectively deploying capital expenditures to improve occupancy and resident rates while managing expenses, in an effort to enhance the overall value of our assets.

•Pursue Disposition Opportunities that Maximize Value. We will pursue dispositions of assets and portfolios where we believe the disposition will achieve a desired return or strategic outcome, with the goal of maximizing value for shareholders overall.

Our Investments

Our investments are categorized in the following reportable segments:

•Direct Operating Investments - Properties operated pursuant to management agreements with managers, in which we own a controlling interest.

•Direct Net Lease Investments - Properties operated under net leases with an operator, in which we own a controlling interest.

•Unconsolidated Investments - Joint venture investments, in which we own a minority, non-controlling interest.

For financial information regarding our reportable segments, refer to Note 11, “Segment Reporting” in our accompanying consolidated financial statements included in Part II, Item 8. “Financial Statements and Supplementary Data.”

The following table presents a summary of investments as of December 31, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Properties(1) | | | | |

| Investment Type / Portfolio | | Amount(2) | | ILF | | ALF | | MCF | | | | Integrated Campus | | Total | | Primary Locations | | Ownership

Interest |

| Direct Operating Investments | | | | | | | | | | | | | | | | | | |

| Winterfell | | $ | 745,696 | | | 32 | | — | | — | | | | — | | 32 | | 12 U.S. States | | 100.0% |

| Avamere | | 94,633 | | | — | | 5 | | — | | | | — | | 5 | | Washington/Oregon | | 100.0% |

| Aqua | | 84,559 | | | 2 | | 1 | | 1 | | | | — | | 4 | | Texas/Ohio | | 97.0% |

Rochester(3) | | 47,231 | | | 1 | | 1 | | — | | | | — | | 2 | | New York | | 97.0% |

| Oak Cottage | | 18,719 | | | — | | — | | 1 | | | | — | | 1 | | California | | 100.0% |

| Subtotal | | $ | 990,838 | | | 35 | | 7 | | 2 | | | | — | | 44 | | | | |

| | | | | | | | | | | | | | | | | | |

| Direct Net Lease Investments | | | | | | | | | | | | | | | | | | |

| Arbors | | $ | 98,315 | | | — | | 4 | | — | | | | — | | 4 | | New York | | 100.0% |

| Total Direct Investments | | $ | 1,089,153 | | | 35 | | 11 | | 2 | | | | — | | 48 | | | | |

| | | | | | | | | | | | | | | | | | |

| Unconsolidated Investments | | | | | | | | | | | | | | | | | | |

Trilogy(4) | | $ | 122,339 | | | — | | — | | — | | | | 125 | | 125 | | 4 U.S. States | | 23.4% |

| | | | | | | | | | | | | | | | | | |

Solstice(5) | | 468 | | | — | | — | | — | | | | — | | — | | | | 20.0% |

| Total Unconsolidated Investments | | $ | 122,807 | | | — | | — | | — | | | | 125 | | 125 | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Investments | | $ | 1,211,960 | | | 35 | | 11 | | 2 | | | | 125 | | 173 | | | | |

_______________________________________

(1)Classification based on predominant services provided, but may include other services.

(2)For direct investments, amount represents gross real estate carrying value, net of impairment, before accumulated depreciation as presented in our consolidated financial statements as of December 31, 2023. For unconsolidated investments, amount represents the carrying value of the investments in unconsolidated ventures as presented in our consolidated financial statements as of December 31, 2023. For additional information, refer to “Note 3, Operating Real Estate” and “Note 4, Investments in Unconsolidated Ventures” of Part II, Item 8. “Financial Statements.”

(3)Rochester portfolio excludes one property classified as held for sale and seven healthcare real estate properties, or the Rochester Sub-Portfolio, securing seven individual mortgage notes payable, or the Rochester Sub-Portfolio Loan, which were placed into a receivership in October 2023. Refer to “—Transaction and Financing Activities” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

(4)Property count includes properties owned and leased by the joint venture and excludes its institutional pharmacy and therapy businesses.

(5)Represents our investment in Solstice Senior Living, LLC, or Solstice, the manager of the Winterfell portfolio. Solstice is a joint venture between affiliates of Integral Senior Living, LLC, or ISL, a management company of ILF, ALF and MCF founded in 2000, which owns 80.0%, and us, which owns 20.0%.

Our investments include the following types of properties:

•Independent living facilities. ILFs are properties with central dining facilities that provide services that include security, housekeeping, nutrition and laundry services. ILFs are designed specifically for independent seniors who are able to live on their own, but desire the security and conveniences of community living. ILFs typically offer several services covered under a regular monthly fee. Fees at these communities are paid from private sources. As of December 31, 2023, we had 35 ILFs in our direct operating investments segment.

•Assisted living facilities. ALFs provide services that include minimal assistance for activities in daily living and permit residents to maintain some of their privacy and independence as they do not require constant supervision and assistance. Services may be bundled within one monthly fee or based on the care needs of the resident and usually include meals and dining, daily housekeeping, laundry, medical reminders and 24-hour availability of assistance. Revenues generated by ALFs primarily come from private pay sources, including private insurance, and government reimbursement programs, such as Medicaid, to a lesser extent. As of December 31, 2023, we had seven properties that are predominantly ALFs in our direct operating investments segment and four properties that are predominantly ALFs in our direct net lease investments segment.

•Memory care facilities. MCFs offer specialized options for seniors with Alzheimer’s disease and other forms of dementia. These facilities offer dedicated care and specialized programming for various conditions relating to memory loss in a secured environment. Residents require a higher level of care and more assistance with activities of daily living than in ALFs. Therefore, these facilities have staff available 24 hours a day to respond to the unique needs of their residents. Fees at these communities are paid primarily from private sources and, to a lesser extent, government reimbursement, such as Medicaid. As of December 31, 2023, we had two properties that are predominantly MCFs in our direct operating investments segment.

•Integrated Senior Health Campuses. Provide a range of services in an integrated campus, including those described above for ILFs, ALFs, MCFs, as well as SNFs. SNFs provide services that include daily nursing, therapeutic rehabilitation, social services, housekeeping, nutrition and administrative services for individuals requiring certain assistance for activities in daily living. Revenues generated from Integrated Senior Health Campuses come from government reimbursement programs, including Medicare and Medicaid, as well as private pay sources, including private insurance. As of December 31, 2023, we had 125 Integrated Health Campuses in our unconsolidated investments segment.

Operators and Managers

The following table presents the operators and managers of our direct investments and our unconsolidated investments (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2023 | | Year Ended December 31, 2023 |

| Operator / Manager | | Properties Under Management | | Units Under Management(1) | | Property and Other Revenues(2) | | % of Total Property and Other Revenues |

| Direct Investments | | | | | | | | |

Solstice Senior Living(3) | | 32 | | | 3,969 | | | $ | 127,765 | | | 62.3 | % |

Watermark Retirement Communities(4) | | 6 | | | 723 | | | 45,001 | | | 22.0 | % |

| Avamere Health Services | | 5 | | | 453 | | | 21,780 | | | 10.6 | % |

| Integral Senior Living | | 1 | | | 40 | | | 4,880 | | | 2.4 | % |

| Arcadia Management | | 4 | | | 564 | | | 1,709 | | | 0.8 | % |

Other(5) | | — | | | — | | | 3,843 | | | 1.9 | % |

| Total Direct Investments | | 48 | | | 5,749 | | | $ | 204,978 | | | 100.0 | % |

| Unconsolidated Investments | | | | | | | | |

Trilogy Management Services(6) | | 125 | | | 14,146 | | | $ | 341,692 | | | N/A |

_______________________________________

(1)Represents rooms for ALFs, ILFs and MCFs.

(2)Includes rental income received from our net lease properties, rental income, ancillary service fees and other related revenue earned from ILF residents and resident fee income derived from our ALFs and MCFs, which includes resident room and care charges, ancillary fees and other resident service charges.

(3)Solstice is a joint venture of which affiliates of ISL own 80%.

(4)Property count and units exclude one property within the Rochester portfolio designated as held for sale as of December 31, 2023 and the properties within the Rochester Sub-Portfolio, which were placed into a receivership in October 2023.

(5)Consists primarily of interest income earned on corporate-level cash and cash equivalents.

(6)The table presents the total properties and units managed by Trilogy Management Services and our 23.4% ownership share of the property and other revenues generated by the Trilogy joint venture.

Direct Operating Investments

Our operating properties allow us to participate in the risks and rewards of the operations of the facilities as compared to receiving only contractual rent under a net lease. We engage independent managers to operate these facilities pursuant to management agreements, including procuring supplies, hiring and training all employees, entering into all third-party contracts for the benefit of the property, including resident/patient agreements, complying with laws and regulations, including but not limited to healthcare laws, and providing resident care and services, in exchange for a management fee. As a result, we must rely on our managers’ personnel, expertise, technical resources and information systems, risk management processes, proprietary information, good faith and judgment to manage our operating properties efficiently and effectively. We also rely on our managers to set appropriate resident fees, to provide accurate property-level financial results in a timely manner and otherwise operate our seniors housing facilities in compliance with the terms of our management agreements and all applicable laws and regulations.

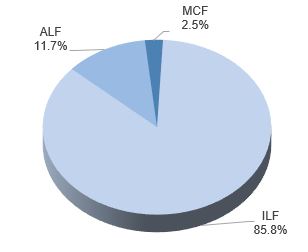

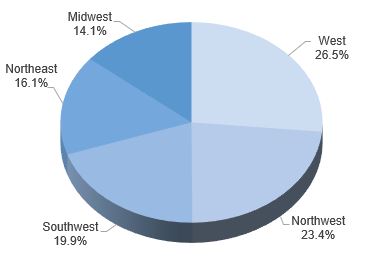

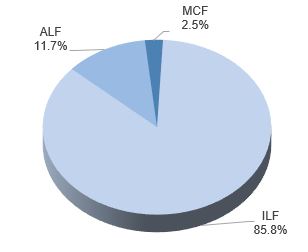

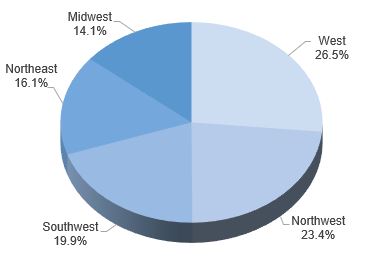

As of December 31, 2023, we had 44 senior housing facilities in our direct operating investments segment with four different managers. The following presents the facilities by property type and geographic location as of December 31, 2023:

| | | | | | | | |

Property Type(1) | | Geographic Location |

| | |

_______________________________________

(1)Classification based on predominant services provided, but may include other services.

Our management agreements generally provide for monthly management fees which are calculated based on various performance measures, including revenue, net operating income and other objective financial metrics. We are also required to reimburse our managers for expenses incurred in the operation of the properties, as well as to indemnify our managers in connection with potential claims and liabilities arising out of the operation of the properties. Our management agreements are terminable after a stated term with certain renewal rights, though we have the ability to terminate earlier upon certain events with or without the payment of a fee.

The following table presents a summary of the terms of our management agreements:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Manager | | Portfolio | | Properties | | Expiration Date | | Management Fees |

| Solstice Senior Living | | Winterfell | | 32 | | October 2025 | | •5% of monthly gross revenues, subject to certain exclusions •7% of actual costs of certain capital projects •Additional fees if net operating income exceeds annual target •Additional fees if net operating income long-term growth is achieved |

Watermark Retirement Communities(1) | | Aqua | | 2 | | December 2024 | | •5% of monthly gross revenues, subject to certain exclusions •Eligible for promote in connection with disposition |

| Aqua | | 2 | | February 2025 | |

| Rochester(2) | | 2 | | August 2024 | |

| Avamere Health Services | | Avamere | | 5 | | January 2025 | | •4% of monthly gross revenues, plus 3% of monthly net operating income subject to certain exclusions •Additional fees based on net operating income exceeds annual target |

| Integral Senior Living | | Oak Cottage | | 1 | | April 2024 | | •Greater of 5% of monthly gross revenues, subject to certain exclusions, or $12,000 per month •Additional fees if net operating income exceeds annual target |

_______________________________________

(1)Affiliates of Watermark also own a 3% non-controlling interest in the Rochester and Aqua portfolios, which may impact various rights and economics under the management agreements.

(2)Property count excludes one property within the Rochester portfolio designated as held for sale as of December 31, 2023 and the properties within the Rochester Sub-Portfolio, which were placed into a receivership in October 2023.

Certain of our properties in our direct operating investments segment are held through joint ventures, where an affiliate of the manager owns a 3% non-controlling interest, primarily to create alignment and incentives for the manager to perform. In addition, we own a 20.0% interest in Solstice Senior Living, the manager of the Winterfell portfolio, which gives us additional rights and minority protections.

Direct Net Lease Investments

As of December 31, 2023, we had four ALF properties located in New York operated by Arcadia Management under net leases. These leases obligate Arcadia to pay a fixed rental amount and pay all property-level expenses, with a lease term that expires in August 2029. However, Arcadia has been unable to satisfy its obligations under its leases since February 2021, and instead remits rent and pays property-level expenses based on its available cash. On March 27, 2023, we entered into a forbearance agreement with Arcadia, pursuant to which we are entitled to receive all cash flow in excess of permitted expenses, and are required to fund any operating deficits, through 2025, subject to the terms and conditions thereof. As a result, we participate in the risks and rewards of this portfolio similar to our operating properties. If Arcadia performs under the forbearance agreement, it will be entitled to forgiveness of accrued and unpaid rent during the forbearance period and a potential incentive fee tied to disposition of the portfolio above a certain value. During 2023, cash flow, net of expenses, paid by Arcadia to us in accordance with the forbearance agreement was not sufficient to cover our related debt service, resulting in $3.3 million of cash reserves being used to cover debt service in 2023. We continue to monitor Arcadia’s performance and cash flows closely, as well as evaluate potential options for this portfolio.

Unconsolidated Investments

As of December 31, 2023, our unconsolidated investment segment primarily consists of our 23.4% interest in Trilogy Investors, LLC, or Trilogy. Trilogy indirectly owns 125 Integrated Senior Health Campuses located in the Midwest, which are all operating properties managed pursuant to a management agreement with Trilogy Management Services, as well as ancillary services businesses, including a therapy business and a pharmacy business. Affiliates of American Healthcare REIT, Inc., or AHR, own approximately 74.1% of Trilogy, with management of Trilogy owning the remaining 2.5%.

Our joint venture agreement with AHR, through which we hold our interest in Trilogy, provides that AHR is generally responsible for the day-to-day affairs of the joint venture, subject to certain limitations and exceptions, including our right to consent to certain significant decisions. The joint venture agreement also contains provisions relating to rights and obligations to call capital to fund the joint venture, distributions of available cash flow, customary forced sale and other liquidity rights.

In November 2023, we entered into an agreement giving AHR the right to purchase our ownership interests in Trilogy at any time prior to September 30, 2025, assuming AHR exercises all of its extension options and subject to satisfaction of certain closing conditions, ranging from $240.5 million to up to $260 million depending upon the purchase price consideration, timing of the closing and certain additional fees that AHR may pay us in the interim. A minimum of 10% of the purchase price consideration must be paid in cash, with the balance payable in either cash or new Series A Cumulative Convertible Preferred Stock to be issued by AHR in connection with the closing. The portion of the purchase price consideration paid in cash may be subject to a 7.5% or 5% discount, respectively, if the transaction closes prior to March 31, 2024 or December 31, 2024, respectively. In addition, we may be entitled to a supplemental cash payment of $25,600 per day for the period between July 1, 2023 until the closing date, for up to approximately $21 million, reduced by any distributions received from Trilogy by us during the interim period. AHR may terminate the agreement at any time, subject to payment of a termination fee equal to: (i) if terminated prior to the initial outside date, September 30, 2024, $7.8 million, (ii) if extended and terminated prior March 31, 2025, $11.7 million and (iii) if further extended and terminated prior to September 30, 2025, $15.6 million. Although there can be no assurance that AHR will consummate the purchase of our interests in Trilogy on these terms, or at all, we believe that this proposed transaction presents an attractive opportunity for us to exit our position in this portfolio in furtherance of our disposition strategy.

In addition to our investment in Trilogy, as discussed above, we also have a 20.0% minority interest in Solstice, a management platform formed with ISL exclusively to manage our Winterfell portfolio.

During 2023, we sold our unconsolidated investments in the Diversified US/UK and Eclipse portfolios and our unconsolidated investment in the Espresso portfolio was substantially liquidated through the sale of all of its remaining assets. Refer to “—Transaction and Financing Activities” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

Seasonality

Our revenues are dependent on occupancy and may fluctuate based on seasonal trends. It is difficult to predict the magnitude of seasonal trends and the related potential impact of the cold and flu season, occurrence of epidemics or any other widespread illnesses on the occupancy of our facilities. A decrease in occupancy could affect our operating income.

Competition

Our investments will experience local and regional market competition for residents, operators and staff. Competition will be based on quality of care, reputation, physical appearance of properties, services offered, family preference, physicians, staff and

price. Competition will come from independent operators as well as companies managing multiple properties, some of which may be larger and have greater resources than our operators. Some of these properties are operated for profit while others are owned by governmental agencies or tax-exempt, non-profit organizations. Competitive disadvantages may result in vacancies at facilities, reductions in net operating income and ultimately a reduction in shareholder value.

Inflation

Macroeconomic trends such as increases in inflation can have a substantial impact on our business and financial results. Many of our costs are subject to inflationary pressures. These include labor, repairs and maintenance, food costs, utilities, insurance and other operating costs. Our managers’ ability to offset increased costs by increasing the rates charged to residents may be limited by competitive pressures, affordability and timing, which may lag behind cost volatility. As a result, cost inflation will substantially affect the net operating income of our properties.

Portfolio Management

The portfolio management process for our investments includes oversight by our executive and asset management teams, regular management meetings and an operating results review process. These processes are designed to evaluate and proactively identify asset-specific issues and trends on a portfolio-wide, sub-portfolio or asset type basis. The teams work in conjunction with our managers and operators to create tailored action plans to address issues identified.

Our executive and asset management teams are experienced and use many methods to actively manage our investments to enhance or preserve our income, value and capital and to mitigate risk. Our teams seek to identify opportunities for our investments that may involve replacing or renovating facilities in our portfolio which, in turn, would allow us to improve occupancy and resident rates and enhance the overall value of our assets. To manage risk, our teams engage in frequent review and dialogue with operators/managers/third party advisors and periodic inspections of our owned properties. In addition, our teams consider the impact of regulatory changes on the performance of our portfolio.

Our teams will continue to monitor the performance of, and actively manage, all of our investments. However, there can be no assurance that our investments will continue to perform in accordance with our expectations.

Profitability and Performance Metrics

We calculate Funds from Operations, or FFO, Modified Funds from Operations, or MFFO, and net operating income, or NOI, to evaluate the profitability and performance of our business. See “Non-GAAP Financial Measures” for a description of these metrics.

Human Capital

On October 21, 2022, as a result of completing the Internalization, we became a self-managed REIT. Prior to the Internalization, we had no employees and were externally managed by the Former Advisor or its affiliates, who provided management, acquisition, advisory, marketing, investor relations and certain administrative services for us. As of December 31, 2023, we had ten full-time employees.

The decision to internalize, and to be able to employ directly the personnel that advance the Company’s strategic objectives, was a turning point for the Company. We believe our employees are critical to our success. All of our employees are provided with a comprehensive benefits and wellness package, which may include medical, dental and vision insurance, life insurance, 401(k) matching, long-term incentive plans, among other things. In connection with the Internalization, we worked with a compensation consultant to evaluate and benchmark the competitiveness of our compensation programs focused on pay practices that reward performance and support the needs of the Company. Our executive management team oversees our human capital resources and employment practices to ensure that an asset as important as our employees is strategically integrated with our goals and business plan as a healthcare REIT.

We are also committed to providing a safe and healthy workplace. We continuously strive to meet or exceed compliance with all laws, regulations and accepted practices pertaining to workplace safety.

We utilize a professional employer organization, or PEO, who is the employer of record of our employees and administers our benefits, payroll and other human resource management services.

Regulation

We are subject, in certain circumstances, to supervision and regulation by state and federal governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things:

•require compliance with applicable REIT rules;

•regulate healthcare operators with respect to licensure, certification for participation in government programs and relationships with patients, physicians, tenants and other referral sources;

•regulate occupational health and safety;

•regulate removal or remediation of hazardous or toxic substances;

•regulate land use and zoning;

•regulate removal of barriers to access by persons with disabilities and other public accommodations;

•regulate tax treatment and accounting standards; and

•regulate use of derivative instruments and our ability to hedge our risks related to fluctuations in interest rates and exchange rates.

Tax Regulation

We elected to be taxed as a REIT under the Internal Revenue Code, commencing with our taxable year ended December 31, 2013. If we maintain our qualification as a REIT for federal income tax purposes, we will generally not be subject to federal income tax on our taxable income that we distribute as dividends to our stockholders. If we fail to maintain our qualification as a REIT in any taxable year after electing REIT status, we will be subject to federal income tax on our taxable income at regular corporate income tax rates and will generally not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year in which our qualification is denied. Such an event could materially and adversely affect our net income. However, we believe that we are organized and operate in a manner that enables us to qualify for treatment as a REIT for federal income tax purposes and we intend to continue to operate so as to remain qualified as a REIT for federal income tax purposes. In addition, we operate certain healthcare properties through structures permitted under the REIT Investment Diversification and Empowerment Act of 2007, which permit the Company, through taxable REIT subsidiaries, or TRSs, to have direct exposure to resident fee income and incur related operating expenses.

U.S. Healthcare Regulation

Overview

ALFs, MCFs and SNFs are subject to extensive and complex federal, state and local laws, regulations and industry standards governing their operations. Although the properties within our portfolio may be subject to varying levels of governmental scrutiny, we expect that the healthcare industry, in general, will continue to face increased regulation and pressure. Changes in laws, regulations, reimbursement and enforcement activity can all have a significant effect on our operations and financial condition, as set forth below and under Item 1A. “Risk Factors.”

Fraud and Abuse Enforcement

Healthcare providers are subject to federal and state laws and regulations that govern their operations, including those that require providers to furnish only medically necessary services and submit to third-party payors valid and accurate statements for each service, as well as kickback laws, self-referral laws and false claims laws. In particular, enforcement of the federal False Claims Act has resulted in increased enforcement activity for healthcare providers and can involve significant monetary damages and awards to private plaintiffs who successfully bring “whistleblower” lawsuits. Sanctions for violations of these laws, regulations and other applicable guidance may include, but are not limited to, loss of licensure, loss of certification or accreditation, denial of reimbursement, imposition of civil and criminal penalties and fines, suspension or exclusion from federal and state healthcare programs or closure of the facility.

Reimbursements

Sources of revenues for our seniors housing properties are primarily private payors, including private insurers and self-pay patients, and payments from state Medicaid programs. By contrast, skilled nursing services in our unconsolidated investment in Trilogy receive the majority of their revenues from the Medicare and Medicaid programs, with the balance representing

payments from private payors. Medicare is a federal health insurance program for persons aged 65 and over, some disabled persons and persons with end-stage renal disease. Medicaid is a medical assistance program for eligible needy persons that is funded jointly by federal and state governments and administered by the states. Medicaid eligibility requirements and benefits vary by state. The Medicare and Medicaid programs are highly regulated and subject to frequent and substantial changes resulting from legislation, regulations and administrative and judicial interpretations of existing law.

Federal, state and private payor reimbursement methodologies applied to healthcare providers are continuously evolving. Congress as well as federal and state healthcare financing authorities are continuing to implement new or modified reimbursement methodologies that shift risk to healthcare providers and generally reduce payments for services, which may negatively impact healthcare property operations. With significant budgetary pressures, federal and state governments continue to seek ways to reduce Medicare and Medicaid spending through reductions in reimbursement rates and increased enrollment in managed care programs, among other things. Private payors, such as insurance companies, are also continuously seeking opportunities to control healthcare costs. Legislation introduced in the U.S. Congress and certain state legislatures include changes that directly or indirectly affect reimbursement and promote shifts from traditional fee-for-service reimbursement models to alternative payment models that tie reimbursement to quality and cost of care, such as accountable care organizations and bundled payments. It is difficult to predict the nature and success of future financial or delivery system reforms, but changes to reimbursement rates and related policies could adversely impact our results of operations, particularly within our unconsolidated investment in Trilogy.

Licensure, CON, Certification and Accreditation

SNFs, seniors housing facilities and other healthcare providers that operate healthcare properties in our portfolio may be subject to extensive state licensing and certificate of need, or CON, laws and regulations, which may restrict the ability to add new properties, expand an existing facility’s size or services, or transfer responsibility for operating a particular facility to a new operator. The failure of our operators or managers to obtain, maintain or comply with any required license, CON or other certification, accreditation or regulatory approval (which could be required as a condition of licensure or third-party payor reimbursement) could result in loss of licensure, loss of certification or accreditation, denial of reimbursement, imposition of civil and/or criminal penalties and fines, suspension or exclusion from federal and state healthcare programs or closure of the facility, any of which could have an adverse effect on our operations and financial condition.

Enrollment

The federal government has taken steps to require SNFs to disclose detailed information regarding owners, operators, and managers of nursing homes, including both direct and indirect owning or managing entities, with a particular focus on ownership by private equity companies or REITs. This disclosed data will also be made publicly available. We do not know how this increased transparency will impact government scrutiny into the operations and standard of care provided at our facilities, or create additional exposure to private litigants or reputational harm. In addition, the federal government has increased enforcement efforts, including revocation proceedings, for failure to comply with enrollment requirements.

Health Information Privacy and Security

Healthcare providers, including those in our portfolio, are subject to numerous state and federal laws that protect the privacy and security of patient health information. The federal and state governments have significantly increased enforcement of these laws. The failure of our operators and managers to maintain compliance with privacy and security laws could result in the imposition of penalties and fines, which in turn may adversely impact us.

CARES ACT and Similar Governmental Funding Programs

A variety of federal, state and local government efforts were initiated in response to the COVID-19 pandemic, including the Coronavirus Aid, Relief and Economic Security Act, or the CARES Act. The CARES Act includes provisions reimbursing eligible health care providers for certain health care-related expenses or lost revenues not otherwise reimbursed that were directly attributable to COVID-19 through the U.S. Department of Health and Human Services, or HHS, Provider Relief Fund.

We applied for and received grants from the Provider Relief Fund for our seniors housing properties. Our operators and unconsolidated investments, such as Trilogy, also received grants from the Provider Relief Fund. As a recipient of funds from the Provider Relief Fund, we are required to comply with detailed reporting requirements specified by HHS, including in some instances by providing a third-party audit of the use of the funds received. In addition, the HHS Office of Inspector General and the Pandemic Response Accountability Committee each have the right to conduct their own audits of our use of funds from the Provider Relief Fund and HHS has the right to recoup some or all of the payments if it determines those payments were not made or the funds were not used in compliance with its rules, regulations and interpretive guidance. Federal law enforcement authorities are expected to scrutinize COVID-19 pandemic-related payments to providers as well as compliance with various reporting and transparency disclosures arising under the CARES Act and similar programs.

Investment Company Act

We believe that we are not, and intend to conduct our operations so as not to become, regulated as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. We have relied, and intend to continue to rely, on current interpretations of the staff of the SEC in an effort to continue to qualify for an exemption from registration under the Investment Company Act. For more information on the exemptions that we use, refer to Item 1A. “Risk Factors—Risks Related to Regulatory Matters and Our REIT Tax Status—Maintenance of our Investment Company Act exemption imposes limits on our operations.”

For additional information regarding regulations applicable to us, refer to below and Item 1A. “Risk Factors.”

Independent Directors’ Review of Our Policies

As required by our charter, our independent directors have reviewed our policies, including but not limited to our policies regarding investments, leverage and conflicts of interest and determined that they are in the best interests of our stockholders.

Corporate Governance and Internet Address