Use these links to rapidly review the document

Table of contents

Index to consolidated financial statements

As filed with the Securities and Exchange Commission on November 9, 2017.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

QUANTERIX CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3826 (Primary Standard Industrial Classification Code Number) |

20-8957988 (I.R.S. Employer Identification Number) |

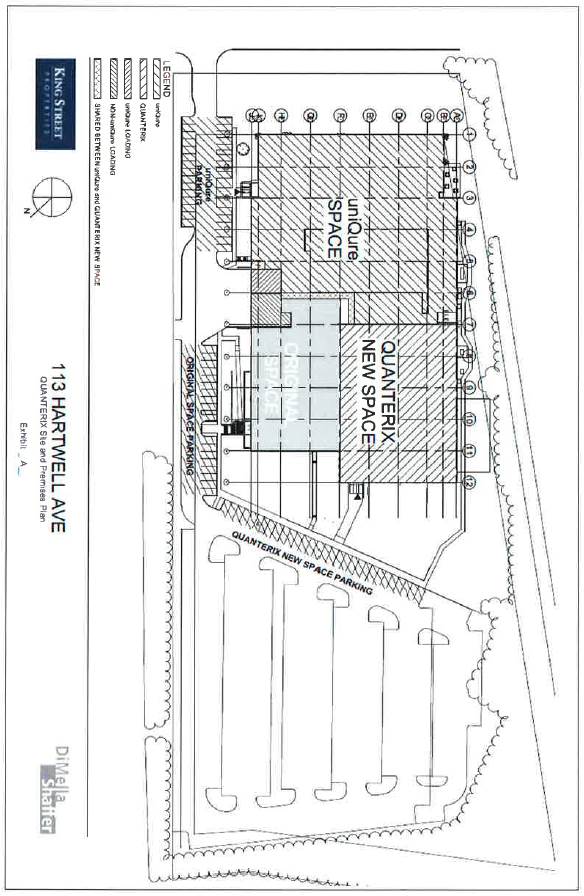

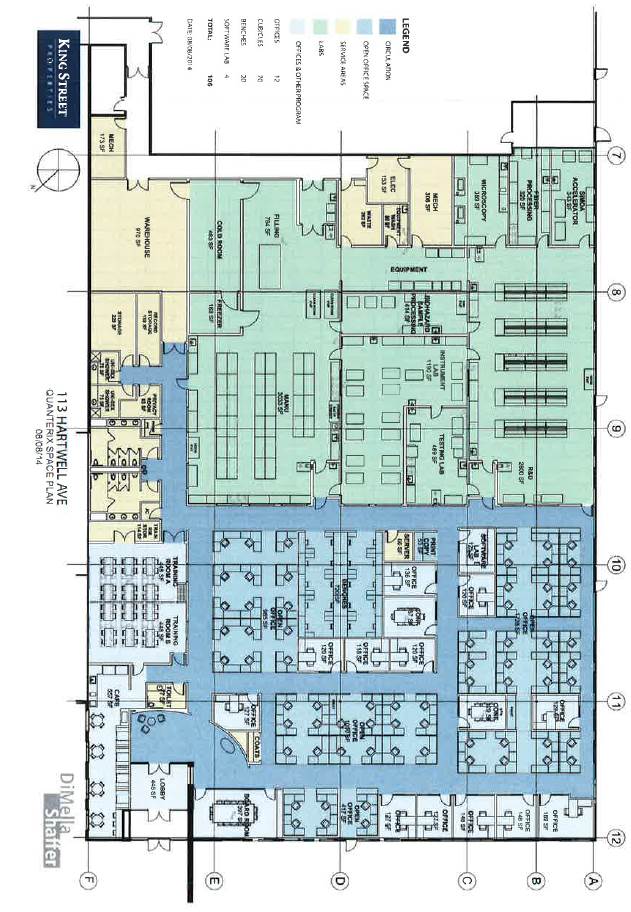

113 Hartwell Avenue

Lexington, MA 02421

(617) 301-9400

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

E. Kevin Hrusovsky

Executive Chairman, President and Chief Executive Officer

Quanterix Corporation

113 Hartwell Avenue

Lexington, MA 02421

(617) 301-9400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

William T. Whelan, Esq. Megan N. Gates, Esq. John P. Condon, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 |

Brian P. Keane, Esq. General Counsel Quanterix Corporation 113 Hartwell Avenue Lexington, MA 02421 (617) 301-9400 |

Patrick O'Brien, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(2) |

||

|---|---|---|---|---|

Common stock, $0.001 par value per share |

$57,500,000 | $7,158.75 | ||

|

||||

(1) Includes initial public offering price of shares that the underwriters have the option to purchase to cover overallotments, if any. Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(2) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate initial public offering price.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated November 9, 2017

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Prospectus

shares

Common stock

This is an initial public offering of common stock by Quanterix Corporation. We are offering shares of our common stock. The estimated initial public offering price is between $ and $ per share.

Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on The Nasdaq Global Market under the symbol "QTRX."

We are an "emerging growth company" under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

| | | | | | | | |

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Initial public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ |

$ |

|||||

Proceeds to Quanterix Corporation, before expenses |

$ |

$ |

|||||

| | | | | | | | |

(1) The underwriters will receive compensation in addition to the underwriting discount. See "Underwriting" beginning on page 155.

The underwriters have the option to purchase up to an additional shares from us at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus to cover overallotments, if any.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2017.

Joint book running managers

| J.P. Morgan | Leerink Partners | |||

Co-managers |

||||

BTIG |

Evercore ISI |

|||

, 2017

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside of the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Market and other industry data

Unless otherwise indicated, market data and certain industry forecasts used throughout this prospectus were obtained from various sources, including internal surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management's knowledge of the industry, have not been independently verified. This prospectus also contains estimates and other statistical data from a custom market research report by an independent third-party research firm, which was commissioned by us and was issued in June 2017. Such data involves a number of assumptions and

i

limitations and contains projections and estimates of the future performance of the markets in which we operate and intend to operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates. The future performance of the industry and markets in which we operate and intend to operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections entitled "Risk factors" and "Special note regarding forward-looking statements" and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications and reports.

ii

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes thereto and the information set forth under the "Risk factors" and "Management's discussion and analysis of financial condition and results of operations," sections of this prospectus. Unless the context otherwise requires, the terms "Quanterix," the "Company," "we," "us" and "our" in this prospectus refer to Quanterix Corporation.

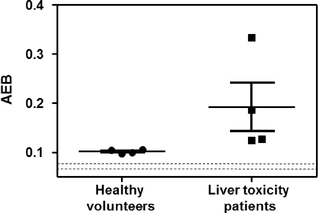

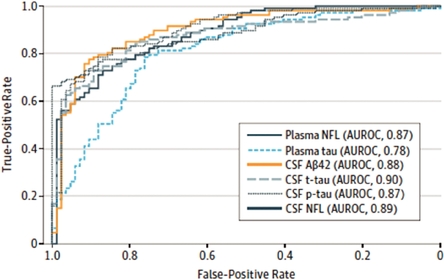

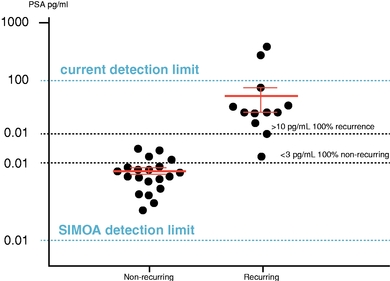

We are a life sciences company that has developed a next generation, ultra-sensitive digital immunoassay platform that advances precision health for life sciences research and diagnostics. Our platform enables customers to reliably detect protein biomarkers in extremely low concentrations in blood, serum and other fluids that, in many cases, are undetectable using conventional, analog immunoassay technologies. These capabilities provide our customers with insight into the role of protein biomarkers in human health that has not been possible with other existing technologies and enable researchers to better characterize the continuum between health and disease. We believe this greater insight provided by our platform, in research applications today and in diagnostic and precision health settings in the future, will enable the development of novel therapies and diagnostics and facilitate a paradigm shift in healthcare from an emphasis on treatment to a focus on earlier detection, monitoring, prognosis and, ultimately, prevention. In addition to enabling new applications and insights in protein analysis, we are also developing our Simoa technology to detect nucleic acids in biological samples.

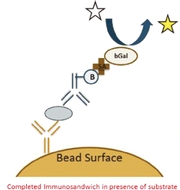

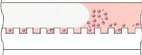

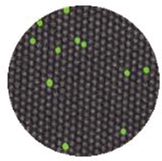

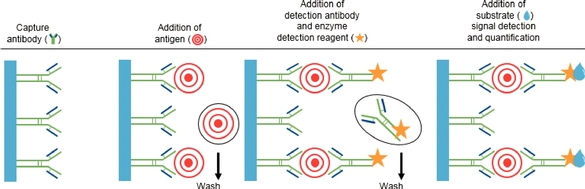

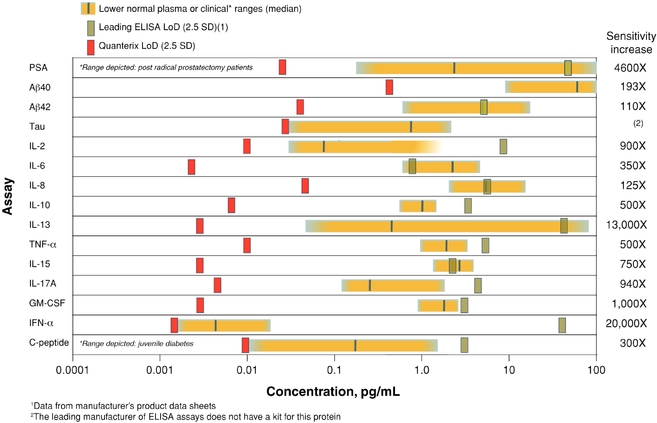

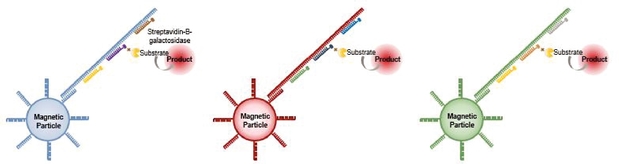

Our platform is based on our proprietary digital single molecule array, or Simoa, detection technology, which is the most sensitive commercially available protein detection technology. Simoa significantly advances ELISA technology, which has been the industry standard for protein detection for over forty years, through its ability to trap single molecules in tiny microwells that are 2.5 billion times smaller than traditional ELISA wells, allowing for an analysis and digital readout of each individual molecule, which is not possible with conventional ELISA technology. We believe Simoa's unprecedented sensitivity, combined with our target customers' familiarity with the core ELISA technology, provides us a significant competitive advantage in driving market adoption of our platform as well as integrating our products into our customers' workflows. We currently sell our Simoa products for research use only, but intend to expand into the diagnostic and precision health screening markets.

Researchers and clinicians rely extensively on protein biomarkers for use as research and clinical tools. However, normal physiological levels of many proteins are not detectable using conventional, analog immunoassay technologies, and many of these technologies can only detect proteins once they have reached levels that reflect more advanced disease or injury. We believe that the early detection of nascent disease or injury processes enabled by Simoa's sensitivity holds the key to intervention before disease or injury has advanced and more significant clinical signs and symptoms have appeared. Simoa's sensitivity also enables researchers to define and validate the function of novel protein biomarkers that are only present in very low concentrations and have been discovered using technologies such as mass spectrometry.

Protein expression reflects both genetic and environmental factors through a process whereby genetic information encoded in DNA is transcribed into RNA, which in turn is translated into proteins. Recently there have been significant advancements in understanding genetics due to the development of genomic

1

analytical technologies, such as polymerase chain reaction, or PCR, and next generation sequencing, which have significantly expanded the market for genetic analysis tools. While genomic analysis provides valuable information about the role of genes in health and disease, proteins are more prevalent than nucleic acids and, we believe, more relevant to understanding precisely the continuum between health and disease. Unlike the advancements in analytical tools for genomics, there has not been a corresponding advancement in tools for the analysis and detection of proteins. With our ultra-sensitive Simoa detection technology, researchers can assess the symptoms of disease or injury and compare them to the presence and levels of relevant proteins that are not detectable using conventional technologies, leading to a better understanding of how proteins individually and/or collectively impact and influence important biological processes and the health and well-being of individuals. We believe understanding the individual characteristics and functioning of proteins enabled by Simoa will be central to the development of novel therapies as well as to earlier disease detection, monitoring, prognosis and, ultimately, prevention, by providing researchers with the ability to assess the impact of low abundance and other proteins on the progress of disease and injury from the time of early onset of symptoms.

While our initial focus has been on the use of Simoa to detect protein biomarkers, Simoa is also able to directly detect nucleic acids in biological samples. In nucleic acid analysis, Simoa has the potential to provide the same sensitivity as traditional PCR-based assays without some of its inherent drawbacks, such as amplification bias. We believe the ability of our platform to provide our customers with both proteomic and genomic solutions will further drive adoption of our technology.

We intend to commercialize our Simoa technology in the life science research, diagnostics and precision health screening markets. Our initial target market has been the life science research market, and all of our product and service revenue to date has been in this market. While we have received revenue from upfront and milestone payments related to collaborations with diagnostic companies, neither we nor any of our diagnostic partners have sold Simoa products or services in the diagnostics or precision health screening markets. We have focused on areas of high growth and unmet need where existing platforms have significant shortcomings that our technology addresses. Specifically, our focus areas include: neurology, oncology, cardiology, infectious disease and inflammation. As our customers continue to gain experience with our proprietary Simoa technology, we believe the opportunity to access markets beyond research will be significant. According to estimates in a report commissioned by us from an independent third-party research firm, referred to herein as the Third-Party Research Report, we believe the current total life science research market addressable by Simoa, including both proteomics and genomics research, is currently $3 billion per year and has the potential to reach $8 billion per year. In addition, according to the Third-Party Research Report, we estimate that the future aggregate market opportunity for us or others using our Simoa technology has the potential to expand to approximately $38 billion, approximately $30 billion of which would be addressable by the Simoa technology upon receipt of the necessary regulatory approvals to market products using this technology in areas other than life science research, which neither we nor our partners have begun the process to obtain. To the extent any collaborators or licensees, such as bioMérieux SA, pursue a portion of this addressable market using Simoa technology licensed from us, our participation in this market size could be limited to receipt of royalties and milestone payments rather than through direct sales.

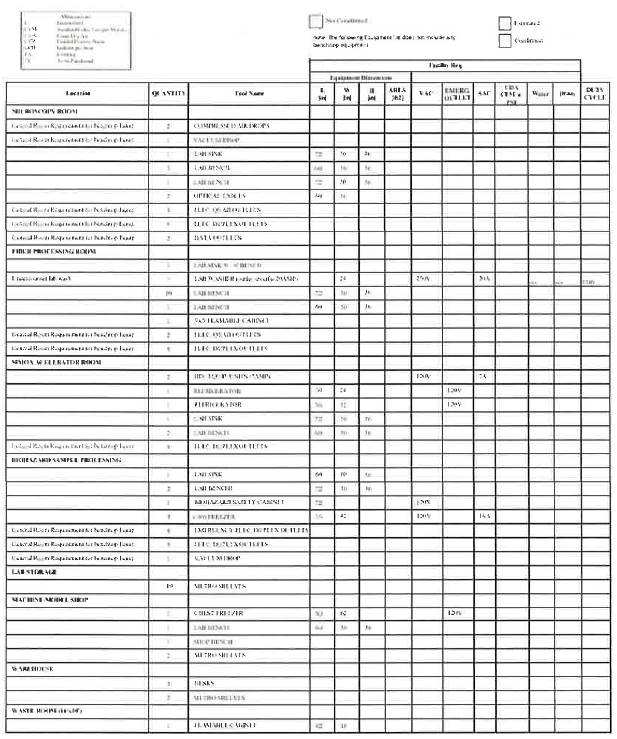

- •

- Life science research. We believe Simoa is well-positioned to capture a significant share of the large and growing life science research market because of its superior sensitivity. It has the ability to detect both proteins that are currently undetectable by other technologies, and nucleic acids directly. According to estimates in the Third-Party Research Report, we believe that the total life science research market addressable by Simoa is currently $3 billion per year and has the potential to reach $8 billion per year.

2

- •

- Diagnostics. We believe existing

diagnostics can be improved by Simoa's sensitivity to enable earlier detection of diseases and injuries, and that new diagnostics may be developed using protein biomarkers that are undetectable using

conventional, analog immunoassay technologies but are detectable using Simoa. We also believe that our platform can enable the development of new diagnostic tests based on blood, serum, saliva and

other fluids that have the potential to replace current more invasive, expensive and inconvenient diagnostic methods, such as spinal tap, diagnostic imaging and biopsy. Simoa also has significant

potential in the emerging field of companion diagnostics based on novel biomarkers.

- •

- Precision health screening. We believe that Simoa's ability to detect and quantify normal physiological levels of proteins in low abundance that are undetectable using conventional, analog immunoassay technologies may enable our technology to be used to monitor protein biomarker levels of seemingly healthy, asymptomatic people, and potentially to signal and provide earlier detection of the onset of disease.

According to estimates in the Third-Party Research Report, we believe that the total diagnostic and precision health screening markets addressable by us and others using Simoa have the potential to reach an aggregate of $30 billion per year, which would be addressable upon receipt of the necessary regulatory approvals to market our products in areas other than life science research, which we have not yet begun the process to obtain.

Products sold by us or collaborators in the diagnostics and precision health screening markets will be subject to regulation by the United States Food and Drug Administration, or FDA, or comparable international agencies, including requirements for regulatory clearance or approval of such products before they can be marketed. To date, neither we nor any of our diagnostic partners have received or applied for regulatory approvals for Simoa products. See "Risk factors—Risks related to governmental regulation and diagnostic product reimbursement" and "Business—Government regulation" for a more detailed discussion regarding the regulatory approvals that may be required.

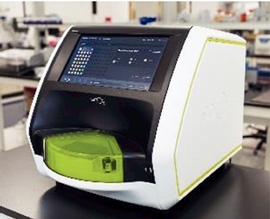

Our Simoa HD-1 Analyzer, which was launched in January 2014, is the most sensitive protein detection platform commercially available and is currently capable of analyzing up to six biomarkers per test, with anticipated expansion capability to up to 35 biomarkers per test in 2018. Assays run on the HD-1 Analyzer are fully automated, which we believe provides us with an additional significant competitive advantage with biopharmaceutical customers. We have currently developed more than 80 Simoa digital biomarker assays and continue to expand our assay menu. We have sold more than 160 HD-1 Analyzers to over 100 customers around the world. We also have seven HD-1 Analyzers in our own Simoa Accelerator Laboratory.

We have developed a new instrument, the Quanterix SR-X, which we plan to introduce through an early adopter program and launch commercially in 2018. The Quanterix SR-X will utilize the same core Simoa technology and assay kits as the HD-1 Analyzer in a compact benchtop form with a lower price point, more flexible assay preparation, and a wider range of applications, including direct detection of nucleic acids.

We also provide contract research services for customers through our Simoa Accelerator Laboratory which provides customers with access to Simoa's technology, and supports multiple projects and services, including sample testing, homebrew assay development and custom assay development. To date, we have completed over 340 projects for more than 145 customers from all over the world using our Simoa platform.

In order to accelerate the use of our technology to develop applications in the diagnostics market, we have entered into a collaboration with bioMérieux SA, a leading diagnostic company, pursuant to which we have granted them an exclusive license to develop and sell in vitro diagnostic products used in clinical lab

3

applications and for food quality control testing, and pharmaceutical quality control testing based on our Simoa technology and a co-exclusive license for other in vitro diagnostic products, relating to point-of-care testing and laboratory developed testing. Given the exclusive nature of the license rights granted to bioMérieux in the areas of in vitro diagnostics used in clinical lab applications, food quality control testing, and pharmaceutical quality control testing, our ability to collaborate with others in these areas is limited, subject to our right to make and sell the current version of the Simoa HD-1 Analyzer for use in clinical lab applications, either directly or through a partner. Neither we nor bioMérieux have begun the process to secure regulatory approvals or clearances to market products using our Simoa technology in areas other than life science research. See "Business—Key agreements—License agreement with bioMérieux SA" for a more detailed description of this collaboration arrangement.

- •

- Proprietary ultra-sensitive digital immunoassay Simoa technology platform, enabling researchers and clinicians to

obtain information from less invasive procedures and smaller sample sizes. Simoa's sensitivity allows researchers and clinicians to measure critical protein biomarkers at

earlier stages in the progression of a disease or injury, which we believe will enable the development of novel therapies and diagnostics and facilitate a paradigm shift in healthcare from an emphasis

on treatment to a focus on earlier detection, monitoring, prognosis and, ultimately, prevention. The sensitivity of our Simoa technology allows researchers to gather biomarker information from smaller

samples that can be collected less invasively than samples required by other assay technologies.

- •

- Technology platform that leverages and improves upon industry standard ELISA

technology. Simoa uses the basic principles of conventional bead-based ELISA. However, unlike ELISA, which runs the enzyme-substrate reactions on

all molecules in one well, Simoa reactions are run on individual molecules in tiny microwells, 40 trillionths of a milliliter, that are 2.5 billion times smaller than traditional ELISA

wells. We believe Simoa's unprecedented sensitivity, combined with our target customers' familiarity with the core ELISA technology, provides us a significant competitive advantage as well as the

ability to integrate into our customers' workflows.

- •

- Leader in large and growing market for detecting proteins in low

abundance. Simoa is the most sensitive commercially available protein detection technology. We believe our growing market acceptance is

establishing Simoa as the reference platform for detecting proteins in low abundance across sample types in our end markets.

- •

- Deep and expanding scientific

validation. Our Simoa technology has been cited in approximately 160 articles in peer reviewed publications covering over 150 biomarkers, and is

becoming a vital tool in cutting edge life sciences research. Our company has established relationships with key opinion leaders, and our growing base of over 200 customers includes some of the

world's leading academic and government research centers, as well as 17 of the 20 largest pharmaceutical and biotechnology companies.

- •

- Leading position in market solidified by robust customization capabilities, assay design flexibility and automation of our HD-1 Analyzer. Our technical capabilities and expertise allow our customers to design high-quality, customized assays utilizing our Simoa platform. The flexibility of the Simoa detection technology allows us to provide innovative, low cost solutions for customers in multiple markets across various applications. In addition, the Simoa HD-1 Analyzer provides fully automated analysis from sample introduction to analytical results. Furthermore, our proprietary array approach to ELISA digitization enables rapid digital data acquisition and assay results.

4

- •

- Highly attractive business model that leverages growing installed base of

instruments. We have sold more than 160 HD-1 Analyzers to over 100 customers around the world and plan to commercially launch our latest

instrument, the Quanterix SR-X, in 2018. As we continue to grow our installed base, optimize workflows and expand our assay menu, we expect to increase our revenues derived from consumables. The

integration of our technology in our customers' projects also provides ongoing sales of assays and consumables, resulting in a growing revenue stream.

- •

- Our highly experienced senior management team. We are led by a dedicated and highly experienced senior management team with significant industry experience and proven ability to develop novel solutions. Each of the members of our senior management has more than 20 years of relevant experience.

Proteins are versatile macromolecules and serve critical functions in nearly all biological processes. They are complex molecules that organisms require for the structure, function and regulation of the body's tissues and organs. For example, proteins provide immune protection, generate movement, transmit nerve impulses and control cell growth and differentiation. Understanding an organism's proteome, the complete set of proteins and their expression levels, can provide a powerful and unique window into its health, a window that other types of research, such as genomics, cannot provide.

The human body contains approximately 20,000 genes. One of the core functions of genes, which are comprised of DNA, is to regulate protein production—which ones are produced, the volume of each, and for how long—influenced by both biological and environmental factors. These 20,000 genes help govern the expression of over 100,000 proteins, approximately 10,500 of which are known to be secreted in blood, and fewer than 1,300 of which can be consistently detected in healthy individuals using conventional immunoassay technologies. Accordingly, the study of much of the proteome has not been practical given the limited level of sensitivity of existing technologies. To date, we have developed assays that address approximately 80 of the proteins secreted in blood. We estimate that the current sensitivity of our Simoa technology has the potential to detect and measure up to one-third of the approximately 9,200 proteins secreted in blood that are not consistently detectable using conventional immunoassay technologies.

While research on nucleic acids provides valuable information about the role of genes in health and disease, proteins are both more prevalent than nucleic acids and, we believe, more relevant to understand precisely the nuanced continuum between health and disease. Genes may indicate the risk of developing a certain disease later in life, but they are not able to account for the impact of environmental factors and lifestyle, such as diet and exercise, or provide insight into what is happening in a patient's body in real time.

Much like the sequencing of the human genome with the Human Genome Project and the development of both PCR and next generation sequencing technologies to detect nucleic acids, both of which accelerated biomedical genomic research, we believe the ability to study more of the proteome will be enabled by a more sensitive protein detection technology and will have a profound impact on proteomic research. Using our Simoa technology, researchers can gain insight into how these proteins are individually and/or collectively important contributors to health and well-being, as well as injury and disease.

5

Existing technologies and their limitations

Protein analysis

The enzyme-linked immunosorbent assay, or ELISA, has been the most widely used method of sensitive detection of proteins for over 40 years. In ELISA, an unknown amount of antigen (e.g., protein, peptide, antibody, hormone) is affixed to a solid surface, usually a polystyrene multiwall plate, either directly, or indirectly through use of a conjugated secondary or "capture" antibody (sandwich ELISA). A specific "detection" antibody is applied over the surface to bind to the antigen. This detection antibody is linked to an enzyme, and in the final step, a substance called an enzyme substrate is added, and the enzyme converts to colored or fluorescent product molecules, which are detected by a plate reader.

Aside from ELISA, there are other technologies available for protein analysis today, such as Western blotting, mass spectrometry, chromatography, surface plasmon resonance, Raman-enhanced signal detection, immune-PCR and biobarcode assay. However, the proteins detectable by these conventional, analog immunoassay technologies are fewer than 1,300 of what is estimated to be approximately 10,500 secreted proteins in circulation in human blood. While a number of techniques have been used to attempt to increase sensitivity of detection, we believe all of these approaches have limitations, including:

- •

- dilution of colored or fluorescent product molecules due to large volume of liquid in traditional-sized wells, limiting sensitivity;

- •

- narrow dynamic range (i.e., the range of concentration of proteins being detected), that may require sample dilution, diluting molecules

and increasing sample volume requiring additional enzymes to reach detection limit;

- •

- low detection limit of readers restrict sensitivity and ability to detect low-abundance proteins, particularly when proteins are at normal

physiological levels; and

- •

- limited success in increasing sensitivity of detection due to procedural complexity and length.

Genomic analysis

Over the past few decades, scientists have developed a variety of genomic analysis methods to measure an increasing number of genomic biomarkers aimed at more effectively detecting diseases. The most widely used method for genetic testing is PCR, which involves amplifying, or generating billions of copies of, the DNA sequence in question and then detecting the DNA with the use of fluorescent dyes. The expression of the nucleic acid is then inferred based on the number of amplification cycles required for the target to become detectable. The wide availability of PCR chemistry makes it a popular approach for measuring the expression of nucleic acids, but the use of enzymes in numerous cycles of amplification can introduce distortion and bias into the data, potentially compromising the reliability of results, particularly at low concentrations.

Our Simoa platform is highly flexible, and provides superior sensitivity, automated workflow capabilities, multiplexing and works with a broad range of sample types. We believe these characteristics will drive adoption of Simoa in life science research, diagnostics and precision health screening markets.

6

We believe our platform provides the following advantages over other technologies available for protein analysis today:

- •

- Simoa digital technology measurements are independent of sample concentration intensity and rely on a binary signal/no signal readout, enabling

detection sensitivity that was not previously possible;

- •

- Enables direct detection of low abundant and previously undetectable biomarkers;

- •

- Simoa multiplexing maintains single plex precision, while competitive platforms can lose sensitivity when multiplexing is used; and

- •

- Simoa's automation and speed provides customers high research and development productivity through greater throughput and lab efficiency.

Our initial focus has been on the use of Simoa to detect protein biomarkers. However, the role of genomic information in research and medicine is evolving rapidly, and our Simoa technology is also able to detect nucleic acids in biological samples. While methods for measuring nucleic acid molecules have advanced substantially, currently available techniques such as PCR still have drawbacks. In nucleic acid analysis, we believe that Simoa has the potential to provide the same sensitivity as traditional PCR-based assays with the following benefits:

- •

- No need for amplification of the targeted nucleic acid, which can result in amplification distortion and bias;

- •

- Reduced cross-contamination because of direct detection of single molecules as compared to the detection of a large number of copies of the

nucleic acid; and

- •

- The ability to detect nucleic acids directly from samples, such as from environmental water, without requiring purification.

Our goal is to enable new research into proteins and nucleic acids to allow greater insight into their role in human health in ways that have not been possible with any other current research and diagnostic technologies. We believe this greater insight will facilitate a paradigm shift in healthcare from an emphasis on treatment to a focus on earlier detection, monitoring, prognosis and, ultimately, prevention.

Our strategy to achieve this includes:

- •

- Focus on the highly attractive, expanding market for protein detection and analysis;

- •

- Continue to drive adoption of the Simoa platform in the research, diagnostics and precision health screening markets;

- •

- Leverage the Simoa "ecosystem" to grow our customer base and further penetrate our existing customer base;

- •

- Utilize the flexibility of the Simoa platform to expand into complementary markets, including nucleic acid detection;

- •

- Leverage the data generated by Simoa to drive adoption of our technology; and

- •

- Grow into new markets organically with our customers and through strategic collaborations.

7

Investing in our common stock involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common stock. There are several risks related to our business that are described under "Risk factors" elsewhere in this prospectus. Among these important risks are the following:

- •

- We have incurred losses since we were formed and expect to incur losses in the future. We cannot be certain that we will achieve or sustain

profitability;

- •

- Our quarterly and annual operating results and cash flows have fluctuated in the past and might continue to fluctuate, causing the value of our

common stock to decline substantially;

- •

- We are an early, commercial-stage company and have a limited operating history, which may make it difficult to evaluate our current business

and predict our future performance;

- •

- If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be

harmed;

- •

- Our future capital needs are uncertain and we may need to raise additional funds in the future;

- •

- If our products fail to achieve and sustain sufficient market acceptance, our revenue will be adversely affected;

- •

- Our future success is dependent upon our ability to further penetrate our existing customer base and attract new customers;

- •

- Some of the reagents used in our products are labeled "research use only" and will have to undergo additional testing before we could use them

in a product intended for clinical use;

- •

- In the near term, our business will depend on levels of research and development spending by academic and governmental research institutions

and biopharmaceutical companies, a reduction in which could limit demand for our products and adversely affect our business and operating results;

- •

- If we do not successfully develop and introduce new assays for our technology, we may not generate new sources of revenue and may not be able

to successfully implement our growth strategy;

- •

- If the FDA determines that our products are medical devices or if we seek to market our products for clinical diagnostic or health screening

use, we will be required to obtain regulatory clearance(s) or approval(s), and any such regulatory process would be expensive, time-consuming, and uncertain both in timing and in outcome;

- •

- If we are unable to protect our intellectual property, it may reduce our ability to maintain any technological or competitive advantage over

our competitors and potential competitors, and our business may be harmed; and

- •

- Our principal stockholders and management own a significant percentage of our stock and will be able to exercise significant influence over matters subject to stockholder approval.

Implications of being an emerging growth company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the last day of the fiscal year in which we are deemed to be a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value

8

of our common stock held by non-affiliates exceeded $700.0 million as of the last business day of the second fiscal quarter of such fiscal year or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company,

- •

- we may present only two years of audited financial statements, plus unaudited condensed financial statements for any interim period, and

related management's discussion and analysis of financial condition and results of operations in our initial registration statement;

- •

- we may avail ourselves of the exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our

internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley;

- •

- we may provide reduced disclosure about our executive compensation arrangements; and

- •

- we may not require stockholder non-binding advisory votes on executive compensation or golden parachute arrangements.

We have elected to take advantage of the extended transition period afforded by the JOBS Act for the implementation of new or revised accounting standards and, as a result, will comply with new or revised accounting standards not later than the relevant dates on which adoption of such standards is required for non-public companies. There are currently accounting standards that are expected to affect the financial reporting of many public companies as early as the first calendar quarter of 2018, including ASC 606, Revenue from contracts with customers. As a result of this election, the timeline to comply with these standards will in many cases be delayed as compared to other public companies that are not eligible to have made or have not made this election. For more information on the effect of this election, including the timing of when we currently plan to adopt certain accounting standards that could materially affect our financial statements, refer to Note 2 to our consolidated financial statements appearing at the end of this prospectus.

We were incorporated under the laws of the State of Delaware in April 2007 under the name "Digital Genomics, Inc." In August 2007, we changed our name to "Quanterix Corporation." Our principal executive offices are located at 113 Hartwell Avenue, Lexington, MA 02421, and our telephone number is (617) 301-9400. Our website address is www.quanterix.com. The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference. Investors should not rely on any such information in deciding whether to purchase our common stock.

"Quanterix," "Simoa," "Simoa HD-1," "SR-X," "HD-1 Analyzer" and our logo are our trademarks. All other service marks, trademarks and trade names appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

9

| Common stock offered by us | shares | |

Common stock to be outstanding after this offering |

shares |

|

Option to purchase additional shares |

The underwriters have an option within 30 days of the date of this prospectus to purchase up to additional shares of our common stock to cover over-allotments, if any. |

|

Use of proceeds |

We estimate the net proceeds from this offering will be approximately $ million (or $ million if the underwriters exercise their option to purchase additional shares in full), assuming an initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

|

We intend to use the net proceeds from the offering: (1) to expand our life sciences commercial operations to grow and support the installed base of our products among life sciences research customers in the United States and internationally; (2) to improve and update our Simoa technology and instruments and to develop additional assays, including assays for nucleic acid detection; (3) to support the launch of our new Quanterix SR-X instrument, currently scheduled for launch in 2018; (4) to potentially move into a larger corporate headquarters in order to have the appropriate infrastructure to support the increase in our employee base in addition to an increase in our manufacturing footprint; (5) to pursue regulatory approvals or clearances to develop instruments, assay kits and consumables in areas outside of life science research, including potentially LDTs, IVD tests and other markets, and, subject to the receipt of such necessary regulatory approvals or clearances, to develop such instruments, assay kits and consumables; (6) to potentially pursue acquisitions or other business development opportunities; and (7) for working capital and other general corporate purposes. See "Use of proceeds" for additional information. |

||

Risk factors |

You should read the "Risk factors" section of this prospectus beginning on page 14 and other information included in this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

Proposed Nasdaq Global Market symbol |

"QTRX" |

10

The number of shares of our common stock to be outstanding after this offering is based on 54,330,740 shares of our common stock outstanding as of October 31, 2017, including 676,121 shares of unvested restricted common stock, after giving effect to the assumptions set forth below and excluding the following:

- •

- 7,327,673 shares of common stock issuable upon the exercise of outstanding stock options as of October 31, 2017, having a

weighted-average exercise price of $1.83 per share;

- •

- 387,811 shares of common stock issuable upon the exercise of outstanding warrants as of October 31, 2017, having a

weighted-average exercise price of $2.98 per share; and

- •

- shares of common stock reserved for issuance pursuant to future awards under our 2017 Equity Incentive Plan, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under this plan, which will become effective upon the closing of this offering.

Except as otherwise indicated, all information contained in this prospectus assumes or gives effect to:

- •

- the automatic conversion of all of our outstanding shares of preferred stock into an aggregate of 45,561,745 shares of common stock

prior to the completion of this offering;

- •

- the automatic conversion of warrants to purchase (i) 64,441 shares of our Series A-2 preferred stock into warrants to

purchase 64,441 shares of common stock, (ii) 284,542 shares of our Series C preferred stock into warrants to purchase 284,542 shares of common stock and

(iii) 38,828 shares of our Series D preferred stock into warrants to purchase 38,828 shares of common stock prior to the completion of this offering;

- •

- no exercise by the underwriters of their option purchase up to an

additional shares of our common stock in this offering;

- •

- the adoption of our restated certificate of incorporation and restated by-laws prior to the closing of this offering; and

- •

- a one-for- reverse stock split of our common stock effected on , 2017.

11

You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the "Selected financial data" and "Management's discussion and analysis of financial condition and results of operations" sections of this prospectus. We have derived the statement of operations data for the years ended December 31, 2015 and 2016 from our audited consolidated financial statements included elsewhere in this prospectus. The statement of operations data for the nine months ended September 30, 2016 and 2017 and the balance sheet data as of September 30, 2017 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus and which have been prepared on the same basis as the audited consolidated financial statements. In the opinion of management, the unaudited data reflects all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial information in those statements. Our historical results are not necessarily indicative of results that should be expected in the future.

Consolidated statement of operations data (in thousands, except per share data)

| | | | | | | | | | | | | | |

| |

Year ended December 31 |

Nine months ended September 30 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 |

2016 |

2016 |

2017 |

|||||||||

| | | | | | | | | | | | | | |

| |

|

|

(unaudited) |

||||||||||

Total revenue |

$ | 12,180 | $ | 17,585 | $ | 10,906 | $ | 16,285 | |||||

Cost of revenue |

6,465 |

9,837 |

6,746 |

9,179 |

|||||||||

Research and development |

10,083 | 16,993 | 10,192 | 12,377 | |||||||||

Selling, general and administrative |

10,155 | 12,466 | 8,866 | 13,641 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

26,703 | 39,296 | 25,804 | 35,197 | |||||||||

| | | | | | | | | | | | | | |

Loss from operations |

(14,523 |

) |

(21,711 |

) |

(14,898 |

) |

(18,912 |

) |

|||||

Interest expense, net |

(1,040 |

) |

(1,298 |

) |

(1,012 |

) |

(735 |

) |

|||||

Other income (expense), net |

(380 | ) | (164 | ) | 51 | 10 | |||||||

| | | | | | | | | | | | | | |

Net loss |

(15,943 | ) | (23,173 | ) | (15,859 | ) | (19,637 | ) | |||||

Accretion and accrued dividends on redeemable convertible preferred stock |

(4,355 |

) |

(4,445 |

) |

(3,325 |

) |

(3,349 |

) |

|||||

| | | | | | | | | | | | | | |

Net loss attributable to common stockholders |

$ | (20,298 | ) | $ | (27,618 | ) | $ | (19,184 | ) | $ | (22,986 | ) | |

| | | | | | | | | | | | | | |

Net loss per share attributable to common stockholders, basic and diluted |

$ | (3.48 | ) | $ | (4.01 | ) | $ | (2.83 | ) | $ | (2.96 | ) | |

| | | | | | | | | | | | | | |

Weighted-average common shares outstanding |

5,828 | 6,887 | 6,782 | 7,768 | |||||||||

| | | | | | | | | | | | | | |

12

Consolidated balance sheet data (in thousands)

| |

|

|

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| |

As of September 30, 2017 | |||||||||

| |

Actual |

Pro forma(1) |

Pro forma as adjusted(2) |

|||||||

| | | | | | | | | | | |

| |

|

(unaudited) |

|

|||||||

Cash and cash equivalents |

$ | 18,690 | $ | 18,690 | $ | |||||

Total assets |

30,515 | 30,515 | ||||||||

Total long term debt |

9,328 | 9,328 | 9,328 | |||||||

Total redeemable convertible preferred stock |

142,387 | — | — | |||||||

Total stockholders' (deficit) equity |

(136,544 | ) | 6,624 | |||||||

| | | | | | | | | | | |

(1) The summary pro forma balance sheet data as of September 30, 2017 has been prepared to give effect to the conversion of all outstanding shares of preferred stock into an aggregate of 45,561,745 shares of our common stock prior to the completion of this offering and the conversion of warrants to purchase 387,811 shares of our preferred stock into warrants to purchase 387,811 shares of common prior to the completion of this offering. The summary pro forma balance sheet data is for informational purposes only and does not purport to indicate balance sheet data as of any future date.

(2) The summary pro forma as adjusted balance sheet data as of September 30, 2017 has been prepared to give effect to the pro forma adjustments and to further reflect the issuance and sale by us of shares of our common stock in this offering, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, at an assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this prospectus. The summary pro forma as adjusted balance sheet data is for informational purposes only and does not purport to indicate balance sheet data as of any future date.

13

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described below, which we believe are the material risks associated with our business and this offering. If any of the following risks were to materialize, our business, financial condition, results of operations, and future growth prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to all of the other information contained in this prospectus, including our financial statements and related notes.

Risks related to our financial condition and need for additional capital

We have incurred losses since we were formed and expect to incur losses in the future. We cannot be certain that we will achieve or sustain profitability.

We incurred net losses of $15.9 million and $23.2 million for the years ended December 31, 2015 and 2016, respectively, and $19.6 million for the nine months ended September 30, 2017. As of September 30, 2017, we had an accumulated deficit of $136.6 million. We cannot predict if we will achieve sustained profitability in the near future or at all. We expect that our losses will continue at least through the next 24 months as we plan to invest significant additional funds toward expansion of our commercial organization and the development of our technology and related assays. In addition, as a public company, we will incur significant legal, accounting, and other expenses that we did not incur as a private company. These increased expenses will make it harder for us to achieve and sustain future profitability. We may incur significant losses in the future for a number of reasons, many of which are beyond our control, including the other risks described in this prospectus, the market acceptance of our products, future product development and our market penetration and margins.

Our quarterly and annual operating results and cash flows have fluctuated in the past and might continue to fluctuate, causing the value of our common stock to decline substantially.

Numerous factors, many of which are outside our control, may cause or contribute to significant fluctuations in our quarterly and annual operating results. These fluctuations may make financial planning and forecasting difficult. In addition, these fluctuations may result in unanticipated decreases in our available cash, which could negatively affect our business and prospects. In addition, one or more of such factors may cause our revenue or operating expenses in one period to be disproportionately higher or lower relative to the others. As a result, comparing our operating results on a period-to-period basis might not be meaningful. You should not rely on our past results as indicative of our future performance. Moreover, our stock price might be based on expectations of future performance that are unrealistic or that we might not meet and, if our revenue or operating results fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially.

Our operating results have varied in the past. In addition to other risk factors listed in this section, some of the important factors that may cause fluctuations in our quarterly and annual operating results include:

- •

- adoption of our Simoa technology platform and products by customers;

- •

- the timing of customer orders to purchase our Simoa instruments;

- •

- the rate of utilization of consumables by our customers;

- •

- receipt and timing of revenue for services provided in our Simoa Accelerator Laboratory;

- •

- the timing of the introduction of new products, product enhancements and services; and

14

- •

- the receipt and timing of revenue from collaborations.

In addition, a significant portion of our operating expense is relatively fixed in nature, and planned expenditures are based in part on expectations regarding future revenue. Accordingly, unexpected revenue shortfalls might decrease our gross margins and could cause significant changes in our operating results from quarter to quarter. If this occurs, the trading price of our common stock could fall substantially.

We are an early, commercial-stage company and have a limited operating history, which may make it difficult to evaluate our current business and predict our future performance.

We are an early, commercial-stage company and have a limited commercial history. Our revenues are derived from sales of our instruments, consumables and services, which are all based on our Simoa technology, which we launched commercially in 2014. Our limited commercial history may make it difficult to evaluate our current business and makes predictions about our future success or viability subject to significant uncertainty. We will continue to encounter risks and difficulties frequently experienced by early, commercial-stage companies, including scaling up our infrastructure and headcount. If we do not address these risks successfully, our business will suffer.

If we are unable to maintain adequate revenue growth or do not successfully manage such growth, our business and growth prospects will be harmed.

We have experienced significant revenue growth in a short period of time. We may not achieve similar growth rates in future periods. Investors should not rely on our operating results for any prior periods as an indication of our future operating performance. To effectively manage our anticipated future growth, we must continue to maintain and enhance our financial, accounting, manufacturing, customer support and sales administration systems, processes and controls. Failure to effectively manage our anticipated growth could lead us to over-invest or under-invest in development, operational, and administrative infrastructure; result in weaknesses in our infrastructure, systems, or controls; give rise to operational mistakes, losses, loss of customers, productivity or business opportunities; and result in loss of employees and reduced productivity of remaining employees.

Our continued growth could require significant capital expenditures and might divert financial resources from other projects such as the development of new products and services. As additional products are commercialized, we may need to incorporate new equipment, implement new technology systems, or hire new personnel with different qualifications. Failure to manage this growth or transition could result in turnaround time delays, higher product costs, declining product quality, deteriorating customer service, and slower responses to competitive challenges. A failure in any one of these areas could make it difficult for us to meet market expectations for our products, and could damage our reputation and the prospects for our business.

If our management is unable to effectively manage our anticipated growth, our expenses may increase more than expected, our revenue could decline or grow more slowly than expected and we may be unable to implement our business strategy. The quality of our products and services may suffer, which could negatively affect our reputation and harm our ability to retain and attract customers.

Our future capital needs are uncertain and we may need to raise additional funds in the future.

We believe that the net proceeds from this offering, together with our cash generated from commercial sales and our existing cash and cash equivalents as of September 30, 2017, excluding any future available borrowings under our debt facility, will enable us to fund our operating expenses and capital expenditure

15

requirements for at least the next 24 months. However, we may need to raise substantial additional capital to:

- •

- expand our sales and marketing efforts to further commercialize our products;

- •

- expand our research and development efforts to improve our existing products and develop and launch new products, particularly if any of our

products are deemed by the United States Food and Drug Administration, or FDA, to be medical devices or otherwise subject to additional regulation by the FDA;

- •

- seek PMA approval or 510(k) clearance from the FDA for our existing products or new products if or when we decide to market products for use in

the prevention, diagnosis or treatment of a disease or other condition (see "Risk Factors—If the FDA determines that our products are medical devices or if we seek to market our products

for clinical diagnostic or health screening use, we will be required to obtain regulatory clearance(s) or approval(s), and may be required to cease or limit sales of our then marketed products, which

could materially and adversely affect our business, financial condition and results of operations. Any such regulatory process would be expensive, time-consuming and uncertain both in timing and in

outcome." and "Government regulation—501(k) clearance pathway;" "Government regulation—Premarket approval pathway" and "Government regulation—Clinical trials" for

further information about the FDA approvals that we may be required to seek and obtain in that circumstance);

- •

- lease a larger facility or build out our existing facility as we continue to grow our employee headcount;

- •

- hire additional personnel;

- •

- enter into collaboration arrangements, if any, or in-license other products and technologies;

- •

- add operational, financial and management information systems; and

- •

- incur increased costs as a result of operating as a public company.

Our future funding requirements will depend on many factors, including:

- •

- market acceptance of our products, including our Quanterix SR-X instrument that we expect to launch commercially in 2018;

- •

- the cost and timing of establishing additional sales, marketing and distribution capabilities;

- •

- the cost of our research and development activities;

- •

- the success of our existing collaborations and our ability to enter into additional collaborations in the future; and

- •

- the effect of competing technological and market developments.

We cannot assure you that we will be able to obtain additional funds on acceptable terms, or at all. If we raise additional funds by issuing equity or equity-linked securities, our stockholders may experience dilution. Future debt financing, if available, may involve covenants restricting our operations or our ability to incur additional debt. Any debt or equity financing may contain terms that are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish some rights to our technologies or our products, or grant licenses on terms that are not favorable to us. If we do not have, or are not able to obtain, sufficient funds, we may have to delay development or commercialization of our products. We also may have to reduce marketing, customer support or other resources devoted to our products or cease operations. Any

16

of these factors could have a material adverse effect on our financial condition, operating results and business.

Our ability to use net operating losses to offset future income may be subject to certain limitations.

As of December 31, 2016, we had federal net operating loss carry forwards, or NOLs, to offset future taxable income of approximately $87.9 million, which expire at various dates through 2035, if not utilized. A lack of future taxable income would adversely affect our ability to utilize these NOLs. In addition, under Section 382 of the Internal Revenue Code of 1986, as amended, or the Code, a corporation that undergoes an "ownership change" is subject to limitations on its ability to utilize its NOLs to offset future taxable income. We have already experienced one or more ownership changes as defined under Section 382 of the Code. Depending on the timing of any future utilization of our NOLs, we may be limited as to the amount that can be utilized each year as a result of such previous ownership changes. In addition, future changes in our stock ownership, including this or future offerings, as well as other changes that may be outside of our control, could result in additional ownership changes under Section 382 of the Code. Our NOLs may also be impaired under similar provisions of state law. We have recorded a full valuation allowance related to our NOLs and other deferred tax assets due to the uncertainty of the ultimate realization of the future benefits of those assets.

U.S. taxation of international business activities or the adoption of tax reform policies could materially impact our future financial position and results of operations.

Limitations on the ability of taxpayers to claim and utilize foreign tax credits and the deferral of certain tax deductions until earnings outside of the United States are repatriated to the United States, as well as changes to U.S. tax laws that may be enacted in the future, could impact the tax treatment of future foreign earnings. Should the scale of our international business activities expand, any changes in the U.S. taxation of such activities could increase our worldwide effective tax rate and harm our future financial position and results of operations.

Provisions of our secured term loan facility with Hercules Capital, Inc. may restrict our ability to pursue our business strategies. In addition, repayment of our outstanding debt and other obligations under our secured term loan facility with Hercules is subject to acceleration upon the occurrence of an event of default, which would have a material adverse effect on our business, financial condition and results of operations.

Our secured term loan facility with Hercules Capital, Inc., or Hercules, requires us, and any debt instruments we may enter into in the future may require us, to comply with various covenants that limit our ability to take on new indebtedness, to permit new liens, to pay dividends, to dispose of our property (including to license in certain situations), to engage in mergers or acquisitions and make certain other changes in our business. Debt instruments we may enter into in the future may also include financial covenants such as a requirement to maintain a specified minimum liquidity level or achieve a minimum annual revenue level. These restrictions could inhibit our ability to pursue our business strategies, including our ability to raise additional capital and make certain dispositions or investments without the consent of our lenders.

The obligations under our secured term loan facility with Hercules are subject to acceleration upon the occurrence of specified events of default, including our failure to make payments when due, our breach or default in the performance of our covenants and obligations under the facility following a cure period, bankruptcy and similar events, and the occurrence of a circumstance that would reasonably be expected to have a material adverse effect on (i) our business, operations, properties, assets or financial condition,

17

(ii) our ability to perform our obligations in accordance with the facility documents, (iii) the lender's ability to enforce any of its rights or remedies with respect to our obligations, or (iv) the collateral, the liens on the collateral or the first priority of the lender's liens. While we do not believe it is probable that the lender would accelerate the obligations under the facility, the definition of a material adverse effect is inherently subjective in nature, and we cannot assure that a material adverse effect will not occur or be deemed to have occurred by the lender.

If our products fail to achieve and sustain sufficient market acceptance, our revenue will be adversely affected.

Our success depends on our ability to develop and market products that are recognized and accepted as reliable, enabling and cost-effective. Most of the potential customers for our products already use expensive research systems in their laboratories that they have used for many years and may be reluctant to replace those systems with ours. Market acceptance of our Simoa technology will depend on many factors, including our ability to convince potential customers that our technology is an attractive alternative to existing technologies. Compared to some competing technologies, our Simoa technology is new and complex, and many potential customers have limited knowledge of, or experience with, our products. Prior to adopting our systems, some potential customers may need to devote time and effort to testing and validating our systems. Any failure of our systems to meet these customer benchmarks could result in potential customers choosing to retain their existing systems or to purchase systems other than ours. In addition, it is important that our Simoa technology be perceived as accurate and reliable by the scientific and medical research community as a whole. Historically, a significant part of our sales and marketing efforts has been directed at demonstrating the advantages of our technology to industry leaders and encouraging such leaders to publish or present the results of their evaluation of our system. If we are unable to continue to motivate leading researchers to use Simoa technology, or if such researchers are unable to achieve or unwilling to publish or present significant experimental results using our systems, acceptance and adoption of our systems will be slowed and our ability to increase our revenue would be adversely affected.

Our future success is dependent upon our ability to further penetrate our existing customer base and attract new customers.

Our current customer base is primarily composed of academic and governmental research institutions, as well as biopharmaceutical and contract research companies. Our success will depend upon our ability to respond to the evolving needs of, and increase our market share among, existing customers and additional potential customers, marketing new products as we develop them. Identifying, engaging and marketing to customers who are unfamiliar with our current products requires substantial time, expertise and expense and involves a number of risks, including:

- •

- our ability to attract, retain and manage the sales, marketing and service personnel necessary to expand market acceptance for our Simoa

technology;

- •

- the time and cost of maintaining and growing a specialized sales, marketing and service force; and

- •

- our sales, marketing and service force may be unable to execute successful commercial activities.

We have utilized third parties to assist with sales, distribution and customer support in certain regions of the world. There is no guarantee, when we enter into such arrangements, that we will be successful in attracting desirable sales and distribution partners. There is also no guarantee that we will be able to

18

enter into such arrangements on favorable terms. Any failure of our sales and marketing efforts, or those of any third-party sales and distribution partners, would adversely affect our business.

Some of the reagents used in our products are labeled for "research use only" and will have to undergo additional testing before we could use them in a product intended for clinical use.

Some of the materials that are used in our consumable products, including certain reagents, are purchased from suppliers with a restriction that they be used for research use only, or RUO. While we have focused initially on the life sciences research market, part of our business strategy is to expand our product line, either alone or in collaboration with third parties, to encompass systems and products that can be used for clinical purposes. Whether or not we continue to use the same RUO materials that we currently use, or obtain similar materials that are not labeled with the RUO restriction, we will be required to demonstrate that the use of our system and products as a clinical test complies with all applicable requirements. In addition, if we were to change the supplier of any material or component used in a clinical test, we would be required to confirm through additional testing that the change does not adversely affect the reliability of the test. Any such additional testing may be expensive and time-consuming and delay our introduction of new products and systems.

In the near term, our business will depend on levels of research and development spending by academic and governmental research institutions and biopharmaceutical companies, a reduction in which could limit demand for our products and adversely affect our business and operating results.

In the near term, we expect that our revenue will be derived primarily from sales of our instruments and consumables to academic and governmental research institutions, as well as biopharmaceutical and contract research companies worldwide for research applications. The demand for our products will depend in part upon the research and development budgets of these customers, which are impacted by factors beyond our control, such as:

- •

- changes in government programs that provide funding to research institutions and companies;

- •

- macroeconomic conditions and the political climate;

- •

- changes in the regulatory environment;

- •

- differences in budgetary cycles; and

- •

- market acceptance of relatively new technologies, such as ours.

For example, in March 2017, the federal government announced the intent to cut federal biomedical research funding by as much as 18%. While there has been significant opposition to these funding cuts, the uncertainty regarding the availability of research funding for potential customers may adversely affect our operating results. Our operating results may fluctuate substantially due to reductions and delays in research and development expenditures by these customers. Any decrease in customers' budgets or expenditures, or in the size, scope or frequency of capital or operating expenditures, could materially and adversely affect our business, operating results and financial condition.

The sales cycle for our Simoa instruments can be lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

The sales process for our Simoa instruments generally involves numerous interactions with multiple individuals within an organization, and often includes in-depth analysis by potential customers of our technology and products and a lengthy review process. Our customers' evaluation processes often involve a number of factors, many of which are beyond our control. As a result of these factors, the capital

19

investment required to purchase our systems and the budget cycles of our customers, the time from initial contact with a customer to our receipt of a purchase order can vary significantly. Given the length and uncertainty of our sales cycle, we have in the past experienced, and expect to in the future experience, fluctuations in our sales on a period-to-period basis. In addition, any failure to meet customer expectations could result in customers choosing to retain their existing systems, use existing assays not requiring capital equipment or purchase systems other than ours.

Our long-term results depend upon our ability to improve existing products and introduce and market new products successfully.

Our business is dependent on the continued improvement of our existing Simoa products and our development of new products utilizing our Simoa or other potential future technology. As we introduce new products or refine, improve or upgrade versions of existing products, we cannot predict the level of market acceptance or the amount of market share these products will achieve, if any. We cannot assure you that we will not experience material delays in the introduction of new products in the future. In addition, introducing new products could result in a decrease in revenues from our existing products. For example, introduction of the Quanterix SR-X may result in a decrease in revenue from our existing Simoa HD-1 Analyzer instrument. Consistent with our strategy of offering new products and product refinements, we expect to continue to use a substantial amount of capital for product development and refinement. We may need additional capital for product development and refinement than is available on terms favorable to us, if at all, which could adversely affect our business, financial condition or results of operations.