UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment No. 1

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

Commission file number: 000-56558

SMC ENTERTAINMENT, INC.

(Exact Name of Registrant as specified in its charter)

| Nevada | 20-0108910 | |

| (State of Incorporation) | (IRS Employer ID No.) |

9170 Glades Road Suite 150

Boca Raton, FL 33434

(Address of principal executive offices)

(360) 820-5973

(Registrant’s telephone number, including area code)

Securities to be registered under Section 12(b) of the Act: None

Securities to be registered under Section 12(g) of the Act:

Common Stock, $0.001 par value per share

(Title of each class to be so registered)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting Company” and “emerging growth Company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting Company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

The cross-reference table below identifies where the items required by Form 10 can be found in the statement.

i

As used in this registration statement, unless the context otherwise requires, the terms the “Company,” “Registrant,” “we,” “us,” “our,” or “SMCE,” refer to SMC Entertainment, Inc., a Nevada corporation.

FORWARD-LOOKING STATEMENTS

Except for statements of historical fact, some information in this document contains “forward-looking statements” that involve substantial risks and uncertainties. You can identify these forward-looking statements by words such as “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. The statements that contain these or similar words should be read carefully because these statements discuss our future expectations, contain projections of our future results of operations or of our financial position, or state other forward-looking information. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able accurately to predict or control. Further, we urge you to be cautious of the forward-looking statements which are contained in this registration statement because they involve risks, uncertainties and other factors affecting our operations, market growth, service, products and licenses. The factors listed in the sections captioned “Risk Factors” and “Description of Business,” as well as other cautionary language in this registration statement and events in the future may cause our actual results and achievements, whether expressed or implied, to differ materially from the expectations we describe in our forward-looking statements. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this registration statement are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise. The occurrence of any of the events described as risk factors or other future events could have a material adverse effect on our business, results of operations and financial position. Since our common stock is considered a “penny stock,” we are ineligible to rely on the safe harbor for forward-looking statements provided in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

When this registration statement becomes effective, we will begin to file reports, proxy statements, information statements and other information with the United States Securities and Exchange Commission (the “SEC”). You may read and copy this information, for a copying fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on its Public Reference Room. Our SEC filings will also be available to the public from commercial document retrieval services, and at the Web site maintained by the SEC at http://www.sec.gov.

When this registration statement is effective, we will make available, through a link to the SEC’s Web site, electronic copies of the materials we file with the SEC (including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, the Section 16 reports filed by our executive officers, directors and 10% stockholders and amendments to those reports). To receive paper copies of our SEC filings, please contact us by mail addressed to Investor Relations, SMC Entertainment, Inc., 9170 Glades Road Suite 150, Boca Raton, FL 33434.

ii

Our wholly owned subsidiary, Fyniti Global Equities EBT Inc. markets a software-as-a-service (“SaaS”) proprietary platform for Certified Public Accountants (“CPAs”) Financial Institutions and Registered Investment Advisors (“RIAs”) (the “Platform”). The Platform is a SaaS platform enabling the institutions to see the developing market trends and have the ability to use the software to create customizable baskets if applicable. The SaaS is ready to implement, and we are currently talking to different CPAs and RIAs about beta testing the Platform beginning in the first quarter of 2024. The Company plans on using a model of an initial set up fee with a monthly content fee. Each CPA, Financial Institution and RIA will be charged an initial fee of $50,000 and a monthly maintenance fee for the software of up to $100,000 per month. The Company anticipates signing a beta test contract when its Form 10 Registration Statement is effective.

As well the company plans to roll out the platform as an information standalone portal. Along the lines of a Bloomberg the intail set fee would be the same but the monthly fee would be around five thousand per month per client

he Platform enables the RIA to see changes occurring on the underlying indexes daily and provides alternatives based on machine learning (“ML”) and artificial intelligence (“AI”) if the RIA chooses to act.

Our AI and ML Capabilities:

Fyniti Global Equities EBT employs state-of-the-art AI/ML technologies along with Quant algorithms, to enhance our quantitative investing strategies and wealth management solutions. The primary purpose of our AI/ML capabilities is to optimize trading strategies, risk management, and portfolio allocation.

Operation of the IQ Engine:

The IQ Engine operates by continuously analyzing vast amounts of financial data, market indicators, and historical trading patterns. It employs advanced statistical models and machine learning algorithms to identify trends, correlations, and anomalies in the data. These insights are then used to make data-driven decisions regarding the execution of trades, asset allocation, and risk mitigation. By using the IQ engine, Financial Institutions, RIAs,and CPAs will have more access to information flow with which to make better decisions for their clients.

Datasets Utilized:

Our AI/ML algorithms utilize a wide range of datasets to inform their decision-making processes. These datasets include but are not limited to:

Market Data: Real-time and historical price data, trading volumes, bid-ask spreads, and order book information.

Economic Indicators: Macro-economic data such as GDP, inflation rates, and interest rates.

News and Sentiment Analysis: News articles, social media sentiment, and other textual data sources to gauge market sentiment.

Fundamental Data: Company financials, earnings reports, and analyst recommendations.

Alternative Data: Non-traditional data sources also incorporated to enhance the capabilities.

1

Third-Party AI Products:

While we primarily rely on our proprietary AI models and Quant algorithms, we also utilize third-party AI products and services for specialized analyses or data enhancements. These third-party tools are carefully vetted to ensure their accuracy, reliability, and compliance with regulatory standards.

Going Concern:

Since inception through the present, we have been dependent on raising capital to support our working capital needs. During this same period, we have recorded net accumulated losses and are yet to achieve profitability. Our ability to achieve profitability depends upon many factors, including its ability to develop and commercialize our websites. There can be no assurance that we will ever achieve any significant revenues or profitable operations. The Company has suffered recurring losses since inception and has no assurance of future profitability. The Company will continue to require financing from external sources to finance its operating and investing activities until sufficient positive cash flows from operations can be generated. There is no assurance that financing or profitability will be achieved, accordingly, there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements of the Company do not include any adjustments that may result from the outcome of these uncertainties.

Our auditors have expressed substantial doubt as to our ability to continue as a going concern. The accompanying financial statements have been prepared on a going concern basis. For the year ended December 31, 2022, the Company had a net loss of $1,230,295, had net cash used in operating activities of $189,253, and an accumulated deficit of $16,000,004. For the six months ended June 30, 2023, the Company had a net loss of $687,475, had net cash used in operating activities of $71,184 and an accumulated deficit of $16,687,479. These matters raise substantial doubt about the Company’s ability to continue as a going concern for a period of one year from the date of this filing. The Company’s ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due, to fund possible future acquisitions, and to generate profitable operations in the future. Management plans to provide for the Company’s capital requirements by continuing to issue additional equity and debt securities. The outcome of these matters cannot be predicted at this time and there are no assurances that, if achieved, the Company will have sufficient funds to execute its business plan or generate positive operating results.

The accompanying unaudited financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has suffered recurring losses since inception and has no assurance of future profitability. The Company will continue to require financing from external sources to finance its operating and investing activities until sufficient positive cash flows from operations can be generated. There is no assurance that financing or profitability will be achieved, accordingly, there is substantial doubt about the Company’s ability to continue as a going concern.

History and Prior Operations

SMC Entertainment, Inc. (“SMC” or the “Company”) was incorporated in Nevada on January 23, 1998, under the name of Professional Recovery Systems, Ltd.

SMC is a versatile holding company focused on acquisition and support of proven commercialized technology (Fintech) companies. SMC has assembled a team of individuals adept at solving market needs, primarily within the merger and acquisition business landscape.

On March 1, 2021, the Company rescinded its agreement with FiberSKY Networks, Inc. (“FiberSKY”). The Company issued 2,000,000 shares of common stock to Ted Lasser, a controlling person of FiberSKY, for consideration of the cancellation.

2

On March 25, 2021, the Company terminated its agreement with WiMundo. The Company received a waiver of share issuance for the 20,000,000 shares of common stock never issued to WiMundo. The Company issued 1,500,000 shares each to two individuals related to the WiMundo.

On March 30, 2021, the Company sold, transferred and assigned all rights and ownership to SMC’s wholly owned subsidiary iPTerra Technologies, Inc. (“iPTerra”), iPMine software intellectual property (“iPMine-IP”), and Aktiv-Trak software intellectual property (Aktiv-Trak-IP”) to Wyoming-based privately held Aktiv-Trak, Inc. (“Aktiv-Trak”).

On October 12, 2021, the Company announced it entered in discussion with the former members of Spectrum Entertainment LLC (“Spectrum”) to rescind SMC’s acquisition of Spectrum. As part of the rescission agreement, SMC is seeking (i) the repayment of $145,274.93 which includes payments made to Spectrum’s lenders, legal and accounting fees paid by the Company; and (ii) the return and cancellation of 40,000,000 common shares issued to Spectrum members as consideration for acquiring Spectrum. The Company’s acquisition of Spectrum was initiated, lead, and concluded by the Company’s former Chief Executive Officer.

On November 2, 2021, the Company filed a Uniform Commercial Code (UCC) filing in the states of Michigan and Wisconsin against Spectrum to secure its rightful ownership until Spectrum repays amounts owed and the return of 40,000,000 shares for cancellation. The Company took these extra measures to secure its ownership title, protect and preserve shareholders equity.

In settlement of the dispute between the Company and Spectrum, on January 20, 2022, the 40,000,000 shares of common stock originally issued to MICRME LLC were cancelled and returned to the Company. Spectrum’s majority member, Mr. Daniel Barbacovi, formed MICRME LLC in 2021 and requested the 40,000,000 shares of common stock to be issued to MICRME LLC.

On December 12, 2022, the Company entered into a Rescission and Release Agreement with Genesis Financial, Inc (“GFL”), that effectively terminated its Stock Purchase Agreement, that was executed on November 18, 2021. Per the terms of the Agreement GFL agreed to pay a rescission fee of $300,000, $50,000 of which was to be paid within 21 days and the balance within 60 days. As certain requirements to complete the acquisition were never completed, there was never a formal closing and the financial statements of the Company were never consolidated, the transaction has been unwound and is not reflected in the financial statements of the Company.

3

Present Operations

On April 21, 2023, the Company completed its acquisition of AI-enabled wealth management technology platform provider, Fyniti Global Equities EBT Inc. (“Fyniti”). Summary of acquisition agreement:

| ● | The aggregate purchase price to be paid by the Company to Fyniti will be Twenty-five Million Dollars ($25,000,000.00) to be paid by delivery of Two Million, Five Hundred Thousand (2,500,000) unregistered shares (the “Shares”) of the Company’s $10.00 Series B Preferred Stock; |

| ● | The Preferred Stock is convertible into the Company’s common stock at a discount of ten percent (10%) to the preceding 10-day weighted average price prior to the conversion date; |

| ● | The Company agrees to raise up to $2,000,000 with $250,000 to be paid to Fyniti upon the Closing. The balance of the $2,000,000 raise will be paid to Fyniti in quarterly installments of $250,000 based on the milestone achievements. The Company has paid $50,000 of the $250,000 commitment. The Company is in discussions with a number of investors to raise the balance of the commitment. In addition, the Company is still waiting to be receive $300,000 from GFL for expenses incurred by the Company. |

The Company extends a consulting agreement to Mr. Jayakumar Gopalan; refer to Exhibit 10.9

The Company does not consider the transaction a related party transaction, as the terms were negotiated at arm’s length and did not result in change of control. Fyniti operates as a wholly owned subsidiary of the Company.

Our current business operation is conducted thru our only wholly owned subsidiary asset, Fyniti Global Equities EBT Inc. (“Fyniti”) (www.fyniti.com, www.fynitiiq.com). Fyniti is a Fintech developer and provider of technology that combines Artificial Intelligence/Machine Learning (AI/ML) driven Quantitative investing (IQ Engine) with AI-enabled wealth management Electronic Block Trading (“EBT”) technology. EBT is focused in democratizing Basket Trading, Direct Indexing, Tax Loss Harvesting and bringing Separately Managed Accounts (SMAs) to the upper end of the retail segment as well as the lower to middle market financial institutions. Fyniti’s IQ Engine is an AI driven contextual analyzer that creates a repository of all equity research. Fyniti continues to embark on its journey to create next-generation technology offerings. Using the AI engine as a SaaS will enable institutions to better position themselves to changes in the market versus an ETF which is more rigid in its weighting. The SaaS allows the institution the ability to customize a basket removing ant vertical the institution chooses.

4

Trends in Our Addressable Market

| The ETFs are an $8 trillion dollar market worldwide with over 80% being passive ETFs. Some of the issues with passive ETFs are: | |||

| ● | Tax: | does not offer tax efficiency | |

| ● | Liquidity: | Low liquidity | |

| ● | Trends: | Inability to exploit short term trends and themes | |

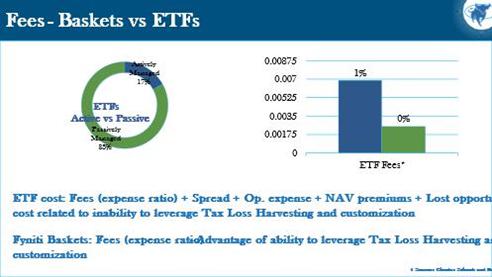

| ● | Cost: | Cost Prohibitive despite 80% passively managed ETFs | |

The SaaS allows the institution the ability to see the macro trends evolving on a daily basis. This allows the institutions greater flexibility in managing the underlying portfolio. Compared to an ETF where the weighting is more rigid and set, Basket Trading is a portfolio management strategy used by Investment Firms and Institutional Traders the software creates the basket and gives the institution the ability to adjust the portfolio if they choose..

The wealth management platform market is roughly $1.2 trillion worldwide. The EBT market is forecasted to generate $6.2 billion in fees and presents a great opportunity for using AI/ML driven portfolio management as a SaaS for enhancing returns.

Our Competitive Advantages

With the help of AI and Quant algorithms, Fyniti SaaS Baskets will offer the following advantages:

| ● | Tax Loss Harvesting | |

| ● | Reduced Fees | |

| ● | 1-Click Order Execution | |

| ● | Direct Indexing Investment | |

| ● | Event / Trend based Investing | |

| ● | Value / Faith based investing | |

| ● | Actively managed by Subject Matter Experts | |

| ● | Capital gains distributions | |

| ● | Gamified risk diversification | |

| ● | Highly liquid as good as individual stocks | |

| ● | Better Customization |

In order to leverage the trends and events, Fyniti leverages AI / ML & Quant algos to create those Baskets and this further can be highly customized to individual investor scenario.

5

Fyniti’s SaaS Basket trading charges the institutions a fee to use the platform. It is provided as Software-as-a-Service (SaaS) along with the initial fee subscription fees for using certain advanced features like customization are charged monthly

|

|

6

Marketing Strategy

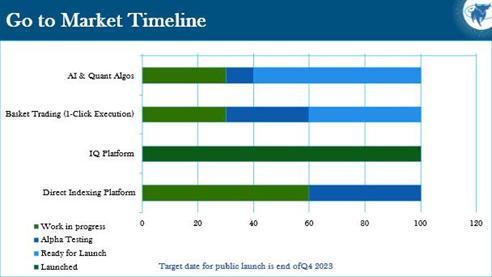

| Our go-to market timeline for public launch is end of Q1/2024. We are currently exploring early adopters to partner with for product beta testing. | ||

| Our marketing strategy is multi-fold and comprises the following components: | ||

| ● | Direct to retail investors utilizing social media (Twitter, LinkedIn, FB, etc.) | |

| ● | Small-medium CPA firms with clients looking for tax loss harvesting | |

| ● |

Financial institutions including banks and broker/dealers exploring to offer our platform to their clients. The Company plans to offer a suite of software as a service to the end user. Each RIA, Financial Institution and CPA will customize the SaaS to their needs. | |

It’s critical for us to deploy our platform with early adopters to validate our technology. Equally critical, we will require the capital to product official launch.

Employees

SMC currently has five (5) full time employees plus seven (7) full time contractors. Our officers currently work approximately 35 hours per week on the Company’s business.

7

Other Corporate Information

General information

Our business address is 9170 Glades Road Suite 150, Boca Raton, FL33434. Our phone number is (360) 820-5973. Our website is www.smceinc.com. Our email address is ron.hughes.operations@smceinc.com. The information contained in, or that can be accessed through, our website is not part of this registration statement.

Reports to Security Holders.

The Company will file reports with the SEC. The Company will be a reporting company and will comply with the requirements of the Exchange Act.

The public may read and copy any materials the Company files with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

You should carefully consider the risks described below together with all of the other information included in this registration statement before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment. In addition to other information in this registration statement and in other filings we make with the Securities and Exchange Commission, the following risk factors should be carefully considered in evaluating our business as they may have a significant impact on our business, operating results and financial condition. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects could be materially and adversely affected. Because of the following factors, as well as other variables affecting our operating results, past financial performance should not be considered as a reliable indicator of future performance and investors should not use historical trends to anticipate results or trends in future periods.

8

Risks Related to Our Business

WE HAVE A LIMITED OPERATING HISTORY.

The Company was incorporated under the laws of the State of Nevada on January 23, 1998. The Company has limited operating history with which you can evaluate its business and prospects. An investor in the Company must consider its business and prospects in light of the risks, uncertainties and difficulties frequently encountered by early-stage companies, including limited capital, delays in product development, possible marketing and sales obstacles and delays, inability to gain customer and merchant acceptance or inability to achieve significant distribution of our products and services to customers. The Company cannot be certain that it will successfully address these risks. Its failure to address any of these risks could have a material adverse effect on its business.

WE ARE NOT PROFITABLE AND MAY NEVER BE PROFITABLE.

Since inception through the present, we have been dependent on raising capital to support our working capital needs. During this same period, we have recorded net accumulated losses and are yet to achieve profitability. Our ability to achieve profitability depends upon many factors, including its ability to develop and commercialize our websites. There can be no assurance that we will ever achieve any significant revenues or profitable operations. The Company has suffered recurring losses since inception and has no assurance of future profitability. The Company will continue to require financing from external sources to finance its operating and investing activities until sufficient positive cash flows from operations can be generated. There is no assurance that financing or profitability will be achieved, accordingly, there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements of the Company do not include any adjustments that may result from the outcome of these uncertainties.

OUR OPERATING EXPENSES EXCEED OUR REVENUES AND WILL LIKELY CONTINUE TO DO SO FOR THE FORESEEABLE FUTURE.

We are in an early stage of our development and we have not generated any revenues to offset our operating expenses. Our operating expenses will likely continue to exceed our operating income for the foreseeable future, until such time as we are able to monetize our brands and generate substantial revenues, particularly as we undertake payment of the increased costs of operating as a public company.

WE WILL NEED ADDITIONAL CAPITAL, WHICH MAY BE DIFFICULT TO RAISE AS A RESULT OF OUR LIMITED OPERATING HISTORY OR ANY NUMBER OF OTHER REASONS.

We expect that we will have adequate financing for the next 8-10 months. However, in the event that we exceed our expected growth, we would need to raise additional capital. There is no assurance that additional equity or debt financing will be available to us when needed, on acceptable terms or even at all. Our limited operating history makes investor evaluation and an estimation of our future performance substantially more difficult. As a result, investors may be unwilling to invest in us or such investment may be on terms or conditions which are not acceptable. In the event that we are not able to secure financing, we may have to scale back our growth plans or cease operations.

WE HAVE NOT ADOPTED VARIOUS CORPORATE GOVERNANCE MEASURES, AND AS A RESULT STOCKHOLDERS MAY HAVE LIMITED PROTECTIONS AGAINST INTERESTED DIRECTOR TRANSACTIONS, CONFLICTS OF INTEREST AND SIMILAR MATTERS.

Certain Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of corporate management and the securities markets. Because our securities are not yet listed on a national securities exchange, we are not required to adopt these corporate governance measures and have not done so voluntarily in order to avoid incurring the additional costs associated with such measures. Among these measures is the establishment of independent committees of the Board of Directors. However, to the extent a public market develops for our securities, such legislation will require us to make changes to our current corporate governance practices. Those changes may be costly and time-consuming. Furthermore, the absence of the governance measures referred to above with respect to our Company may leave our shareholders with more limited protection in connection with interested director transactions, conflicts of interest and similar matters.

9

WE MAY BE UNABLE TO DEVELOP NEW PRODUCTS AND SERVICES AND THE DEVELOPMENT OF NEW PRODUCTS AND SERVICES MAY EXPOSE US TO ADDITIONAL COSTS OR OPERATIONAL RISK.

Our financial performance depends, in part, on its ability to develop, market and manage new products and services. The development and introduction of new products and services require continued innovative efforts and may require significant time and resources as well as ongoing support and investment. Substantial risk and uncertainties are associated with the introduction of new products and services, including the implementation of new and appropriate operational controls and procedures, shifting client and market preferences, the introduction of competing products or services and compliance with regulatory requirements.

WE MAY BECOME SUBJECT TO LEGAL PROCEEDINGS THAT COULD HAVE A MATERIAL ADVERSE IMPACT ON OUR FINANCIAL POSITION AND RESULTS OF OPERATIONS.

From time to time and in the ordinary course of our business, we and certain of our subsidiaries may become involved in various legal proceedings. All such legal proceedings are inherently unpredictable and, regardless of the merits of the claims, litigation may be expensive, time-consuming and disruptive to our operations and distracting to management. If resolved against us, such legal proceedings could result in excessive verdicts, injunctive relief or other equitable relief that may affect how we operate our business. Similarly, if we settle such legal proceedings, it may affect how we operate our business. Future court decisions, alternative dispute resolution awards, business expansion or legislative activity may increase our exposure to litigation and regulatory investigations. In some cases, substantial noneconomic remedies or punitive damages may be sought. We currently do not maintain liability insurance coverage, but even if we had such insurance, there can be no assurance that such coverage will cover any particular verdict, judgment or settlement that may be entered against us, that such coverage will prove to be adequate or that such coverage will continue to remain available on acceptable terms, if at all. If we obtain such insurance, we could still incur liability that exceeds our insurance coverage or that is not within the scope of the coverage in legal proceedings brought against us, it could have an adverse effect on our business, financial condition and results of operations.

WE INTEND TO CONTINUE STRATEGIC BUSINESS ACQUISITIONS AND OTHER COMBINATIONS, WHICH ARE SUBJECT TO INHERENT RISKS.

We may continue to seek and complete strategic business acquisitions and other combinations that we believe are complementary to our business. Acquisitions have inherent risks which may have a material adverse effect on our business, financial condition, operating results or prospects, including, but not limited to: 1) failure to successfully integrate the business and financial operations, services, intellectual property, solutions or personnel of an acquired business and to maintain uniform standard controls, policies and procedures; 2) diversion of management’s attention from other business concerns; 3) entry into markets in which we have little or no direct prior experience; 4) failure to achieve projected synergies and performance targets; 5) loss of clients or key personnel; 6) incurrence of debt or assumption of known and unknown liabilities; 7) write-off of software development costs, goodwill, client lists and amortization of expenses related to intangible assets; 8) dilutive issuances of equity securities; and, 9) accounting deficiencies that could arise in connection with, or as a result of, the acquisition of an acquired company, including issues related to internal control over financial reporting and the time and cost associated with remedying such deficiencies. If we fail to successfully integrate acquired businesses or fail to implement our business strategies with respect to these acquisitions, we may not be able to achieve projected results or support the amount of consideration paid for such acquired businesses.

IF WE ARE UNABLE TO MANAGE OUR GROWTH IN THE NEW MARKETS IN WHICH WE OFFER SOLUTIONS OR SERVICES, OUR BUSINESS AND FINANCIAL RESULTS COULD SUFFER.

Our future financial results will depend in part on our ability to profitably manage our business in the new markets that we enter. Difficulties in managing future growth in new markets could have a significant negative impact on our business, financial condition and results of operations.

10

WE RELY HEAVILY ON OUR MANAGEMENT, AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

Our success is highly dependent upon the continued services of our management including our Chief Executive Officer and Director, Erik Blum. The loss of Mr. Blum’s services would have a material adverse effect on the Company and its business operations.

WE MAY NOT BE ABLE TO IMPLEMENT OUR GROWTH AND MARKETING STRATEGY SUCCESSFULLY OR ON A TIMELY BASIS OR AT ALL.

Our future success depends, in large part, on our ability to implement our growth strategy of organic growth along with acquisitions in the Fintech space.

Our sales and operating results will be adversely affected if we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful.

CYBER SECURITY RISKS AND THE FAILURE TO MAINTAIN THE INTEGRITY OF DATA BELONGING TO OUR COMPANY COULD EXPOSE US TO DATA LOSS, LITIGATION AND LIABILITY, AND OUR REPUTATION COULD BE SIGNIFICANTLY HARMED.

We may from time to time collect and retain large volumes of data relating to our business and from our customers for business purposes, including for transactional and promotional purposes, and our various information technology systems enter, process, summarize and report such data. The integrity and protection of this data is critical to our business. Maintaining compliance with the evolving regulations and requirements applicable to data security and information privacy protection could be difficult and may increase our expenses. In addition, a penetrated or compromised data system or the intentional, inadvertent or negligent release or disclosure of data could result in theft, loss or fraudulent or unlawful use of data relating to our company or our employees, independent distributors or preferred customers, which could harm our reputation, disrupt our operations, or result in remedial and other costs, fines or lawsuits.

COMPUTER MALWARE, VIRUSES, HACKING, PHISHING ATTACKS AND SPAMMING COULD HARM OUR BUSINESS AND RESULTS OF OPERATIONS.

Computer malware, viruses, physical or electronic break-ins and similar disruptions could lead to interruption and delays in our services and operations and loss, misuse or theft of data. Computer malware, viruses, computer hacking and phishing attacks against online networking platforms have become more prevalent and may occur on our systems in the future.

Any attempts by hackers to disrupt our internal systems, if successful, could harm our business, be expensive to remedy and damage our reputation or brand. We currently do not maintain network security business disruption insurance, but even if we obtain such coverage, it may not be sufficient to cover significant expenses and losses related to direct attacks on our website or internal systems. Efforts to prevent hackers from entering our computer systems are expensive to implement and may limit the functionality of our services. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security and availability of our products and services and technical infrastructure may harm our reputation. Any significant disruption to our website or internal computer systems could adversely affect our business and results of operations.

11

OUR INABILITY TO PROTECT OUR INTELLECTUAL PROPERTY COULD IMPAIR OUR COMPETITIVE ADVANTAGE, REDUCE OUR REVENUE, AND INCREASE OUR COSTS.

Our success and ability to compete depends and will depend in part on our ability to obtain and maintain the proprietary aspects of our technologies and products. We rely on a combination of trade secrets, patents, copyrights, trademarks, confidentiality agreements, and other contractual provisions to protect our intellectual property, but these measures may provide only limited protection. We may not always be able to enforce these agreements and may fail to enter into any such agreement in every instance when appropriate. We may from time to time license from third party’s their brands or certain technology used in and for our products. These third-party licenses are granted with restrictions; therefore, such third-party technology may not remain available to us on terms beneficial to us. Our failure to enforce and protect our intellectual property rights or obtain from third parties the right to use necessary technology could have a material adverse effect on our business, operating results, and financial condition. In addition, the laws of some foreign countries do not protect proprietary rights as fully as do the laws of the United States.

WE MAY FAIL TO RECRUIT AND RETAIN KEY PERSONNEL, WHICH COULD IMPAIR OUR ABILITY TO MEET KEY OBJECTIVES.

Our success depends on our ability to attract and retain highly-skilled technical, managerial, sales, and marketing personnel. Changes in key personnel may be disruptive to our business. It could be difficult, time consuming and expensive to replace key personnel. Integrating new key personnel may be difficult and costly. Volatility, lack of positive performance in our stock price or changes to our overall compensation program including our stock incentive program may adversely affect our ability to retain key employees, many of whom may be compensated, in part, based on the performance of our stock price. The loss of services of any of our key personnel, the inability to retain and attract qualified personnel in the future or delays in hiring required personnel could make it difficult to meet key objectives. Any of these impairments related to our key personnel could negatively affect our business, financial condition and financial results.

To remain competitive in our market, we must attract, motivate and retain highly skilled managerial, sales, marketing, consulting and technical personnel, including executives and consultants. Our failure to attract additional qualified personnel to meet our needs could have a material adverse effect on our prospects for long-term growth. Our success is dependent to a significant degree on the continued contributions of key management. The unexpected loss of key personnel could have a material adverse impact on our business and results.

12

Risks Related to Our Common Stock

OUR STOCK PRICE MAY BE VOLATILE OR MAY DECLINE REGARDLESS OF OUR OPERATING PERFORMANCE, AND YOU MAY LOSE PART OR ALL OF YOUR INVESTMENT.

The market price of our common stock may fluctuate widely in response to various factors, some of which are beyond our control, including:

| ● | actions by competitors; |

| ● | actual or anticipated growth rates relative to our competitors; |

| ● | the public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC; |

| ● | economic, legal and regulatory factors unrelated to our performance; |

| ● | any future guidance we may provide to the public, any changes in such guidance or any difference between our guidance and actual results; |

| ● | changes in financial estimates or recommendations by any securities analysts who follow our common stock; |

| ● | speculation by the press or investment community regarding our business; |

| ● | litigation; |

| ● | changes in key personnel; and |

| ● | future sales of our common stock by our officers, directors and significant shareholders. |

In addition, the stock markets, including the grey market and the over-the-counter markets where we were quoted, have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These broad market fluctuations may materially affect our stock price, regardless of our operating results. Furthermore, the market for our common stock historically has been limited and we cannot assure you that a larger market will ever be developed or maintained. The price at which investors purchase shares of our common stock may not be indicative of the price that will prevail in the trading market. Market fluctuations and volatility, as well as general economic, market and political conditions, could reduce our market price. As a result, these factors may make it more difficult or impossible for you to sell our common stock for a positive return on your investment. In the past, shareholders have instituted securities class action litigation following periods of market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources and the attention of management could be diverted from our business.

13

FUTURE SALES OF SHARES OF OUR COMMON STOCK, OR THE PERCEPTION IN THE PUBLIC MARKETS THAT THESE SALES MAY OCCUR, MAY DEPRESS OUR STOCK PRICE.

The market price of our common stock could decline significantly as a result of sales of a large number of shares of our common stock. In addition, if our significant shareholders sell a large number of shares, or if we issue a large number of shares, the market price of our stock could decline. Any issuance of additional common stock by us in the future, or warrants or options to purchase our common stock, if exercised, would result in dilution to our existing shareholders. Such issuances could be made at a price that reflects a discount or a premium to the then-current trading price of our common stock. Moreover, the perception in the public market that shareholders might sell shares of our stock or that we could make a significant issuance of additional common stock in the future could depress the market for our shares. These sales, or the perception that these sales might occur, could depress the market price of our common stock or make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

We have issued shares of common stock, and convertible notes which are convertible into shares of our common stock in connection with our private placements. In addition, we issued shares of our common stock, and convertible notes which are convertible into shares of our preferred stock, in financing transactions that are deemed to be “restricted securities,” as that term is defined in Rule 144 promulgated under the Securities Act. From time to time, certain of our shareholders may be eligible to sell all or some of their restricted shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, subject to certain limitations. The resale pursuant to Rule 144 of shares acquired from us in private transactions could cause our stock price to decline significantly.

“PENNY STOCK” RULES MAY MAKE BUYING OR SELLING OUR COMMON STOCK DIFFICULT.

If the market price for our common stock is below $5.00 per share, trading in our common stock may be subject to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules would require that any broker-dealer that would recommend our common stock to persons other than prior customers and accredited investors, must, prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations would require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our common stock.

SALES OF OUR CURRENTLY ISSUED AND OUTSTANDING STOCK MAY BECOME FREELY TRADABLE PURSUANT TO RULE 144 AND MAY DILUTE THE MARKET FOR YOUR SHARES AND HAVE A DEPRESSIVE EFFECT ON THE PRICE OF THE SHARES OF OUR COMMON STOCK.

A substantial majority of our outstanding shares of common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act. As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws. Rule 144 provides in essence that an Affiliate (as such term is defined in Rule 144(a)(1)) of an issuer who has held restricted securities for a period of at least six months (one year after filing Form 10 information with the SEC for shell companies and former shell companies) may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted on the OTC Bulletin Board). Rule 144 also permits, under certain circumstances, the sale of securities, without any limitation, by a person who is not an Affiliate of the Company and who has satisfied a one-year holding period. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

14

POTENTIAL FUTURE FINANCINGS MAY DILUTE THE HOLDINGS OF OUR CURRENT SHAREHOLDERS.

In order to provide capital for the operation of our business, in the future we may enter into financing arrangements. These arrangements may involve the issuance of new shares of common stock, preferred stock that is convertible into common stock, debt securities that are convertible into common stock or warrants for the purchase of common stock. Any of these items could result in a material increase in the number of shares of common stock outstanding, which would in turn result in a dilution of the ownership interests of existing common shareholders. In addition, these new securities could contain provisions, such as priorities on distributions and voting rights, which could affect the value of our existing common stock.

WE CURRENTLY DO NOT INTEND TO PAY DIVIDENDS ON OUR COMMON STOCK. AS A RESULT, YOUR ONLY OPPORTUNITY TO ACHIEVE A RETURN ON YOUR INVESTMENT IS IF THE PRICE OF OUR COMMON STOCK APPRECIATES.

We currently do not expect to declare or pay dividends on our common stock. In addition, in the future we may enter into agreements that prohibit or restrict our ability to declare or pay dividends on our common stock. As a result, your only opportunity to achieve a return on your investment will be if the market price of our common stock appreciates and you sell your shares at a profit.

YOU MAY EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST DUE TO THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK.

We do not have sufficient funds to finance the growth of our business on hand. As a result, we will require additional funds from future equity or debt financings, including tax equity financing transactions or sales of preferred shares or convertible debt, to complete the development of new projects and pay the general and administrative costs of our business. We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of holders of our common stock. We are currently authorized to issue 1,450,000,000 shares of common stock. The potential issuance of such additional shares of common stock or preferred stock or convertible debt may create downward pressure on the trading price of our common stock. We may also issue additional shares of common stock or other securities that are convertible into or exercisable for common stock in future public offerings or private placements for capital raising purposes or for other business purposes. The future issuance of a substantial number of common shares into the public market, or the perception that such issuance could occur, could adversely affect the prevailing market price of our common shares. A decline in the price of our common shares could make it more difficult to raise funds through future offerings of our common shares or securities convertible into common shares.

OUR SHARES OF COMMON STOCK ARE CURRENTLY TRADED ON THE OTC MARKETS PINK MARKET TIER, ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE.

Our shares of common stock are very thinly traded, and the price, if traded, may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to increase awareness of our Company with investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for loans.

15

WE HAVE A SIGNIFICANT NUMBER OF SHARES OF OUR COMMON STOCK ISSUABLE UPON CONVERSION OF CERTAIN OUTSTANDING OPTIONS, AND CONVERTIBLE NOTES, AND THE ISSUANCE OF SUCH SHARES UPON EXERCISE OR CONVERSION WILL HAVE A SIGNIFICANT DILUTIVE IMPACT ON OUR STOCKHOLDERS. SALES OF A SUBSTANTIAL NUMBER OF SHARES OF OUR COMMON STOCK FOLLOWING THE EXPIRATION OF LOCK-UPS MAY ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON STOCK AND THE ISSUANCE OF ADDITIONAL SHARES WILL DILUTE ALL OTHER STOCKHOLDERS.

As of June 30, 2023, there are 1,162,060,743 shares of Common Stock issuable upon conversion of our convertible notes, subject to the provisions in such convertible notes which limit the holder’s beneficial ownership to a maximum of 4.99% or 9.99% of the issued and outstanding shares of the Company’s Common Stock.

FUTURE ISSUANCE OF OUR COMMON STOCK, PREFERRED STOCK, OPTIONS AND WARRANTS COULD DILUTE THE INTERESTS OF EXISTING STOCKHOLDERS.

We may issue additional shares of our common stock, preferred stock, options and warrants in the future. The issuance of a substantial amount of common stock, options and warrants could have the effect of substantially diluting the interests of our current stockholders. In addition, the sale of a substantial amount of common stock or preferred stock in the public market, or the exercise of a substantial number of warrants and options either in the initial issuance or in a subsequent resale by the target company in an acquisition which received such common stock as consideration or by investors who acquired such common stock in a private placement could have an adverse effect on the market price of our common stock.

WE DO NOT INTEND TO PAY DIVIDENDS FOR THE FORESEEABLE FUTURE, AND YOU MUST RELY ON INCREASES IN THE MARKET PRICES OF OUR COMMON STOCK FOR RETURNS ON YOUR INVESTMENT.

For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Accordingly, investors must be prepared to rely on sales of their common stock after price appreciation to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase our common stock. Any determination to pay dividends in the future will be made at the discretion of our Board and will depend on our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors the Board deems relevant.

OUR EXECUTIVE OFFICERS AND DIRECTORS POSSESS SIGNIFICANT VOTING POWER WITH RESPECT TO OUR COMMON STOCK, WHICH WILL LIMIT YOUR INFLUENCE ON CORPORATE MATTERS.

As of June 30, 2023, our directors and executive officers collectively beneficially own approximately 305,000,000 of the shares of our common stock, 205,000,000 which is beneficially owned by Ronald Hughes, and 100,000,000 which is beneficially owned by Erik Blum, representing 29.3% of the shares of our common stock.

As a result, our insiders have the ability to significantly influence our management and affairs through the election and removal of our Board and all other matters requiring stockholder approval, including any future merger, consolidation or sale of all or substantially all of our assets. This concentrated voting power could discourage others from initiating any potential merger, takeover or other change-of-control transaction that may otherwise be beneficial to our stockholders. Furthermore, this concentrated control will limit the practical effect of your influence over our business and affairs, through any stockholder vote or otherwise. Any of these effects could depress the price of our common stock.

16

OUR ARTICLES OF INCORPORATION GRANTS OUR BOARD THE POWER TO ISSUE ADDITIONAL SHARES OF COMMON AND PREFERRED SHARES AND TO DESIGNATE OTHER CLASSES OF PREFERRED SHARES, ALL WITHOUT STOCKHOLDER APPROVAL.

Our authorized capital consists of 1,450,000,000 shares of common stock and 5,500,000 shares preferred stock. Our Board, without any action by our stockholders, may designate and issue shares of preferred stock in such series as it deems appropriate and establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights, provided it is consistent with Nevada law.

The rights of holders of our preferred stock that may be issued could be superior to the rights of holders of our shares of common stock. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock (common or preferred) will dilute the percentage of ownership interest of then-current holders of our capital stock and may dilute our book value per share.

17

Item 2. Financial Information.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This registration statement on Form 10 and other reports filed by the Company from time to time with the SEC (collectively, the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used in the Filings, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks relating to the Company’s business, industry, and the Company’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application. There are also areas in which management’s judgment in selecting any available alternative would not produce a materially different result. The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this report.

Management’s discussion and analysis of results of operations and financial condition (“MD&A”) is a supplement to the accompanying condensed financial statements and provides additional information on SMC Entertainment, Inc.’s (“SMC” or the “Company’) business, current developments, financial condition, cash flows and results of operations.

18

Overview

SMC Entertainment, Inc (“SMC” or the “Company”) was incorporated in Nevada on January 23, 1998, under the name of Professional Recovery Systems, Ltd.

On March 1, 2021, the Company rescinded its agreement with FiberSKY Networks, Inc. (“FiberSKY”). The Company issued 2,000,000 shares of common stock to Ted Lasser, a controlling person of FiberSKY, for consideration of the cancellation.

On March 25, 2021, the Company terminated its agreement with WiMundo. The Company received a waiver of share issuance for the 20,000,000 shares of common stock never issued to WiMundo. The Company issued 1,500,000 shares each to two individuals related to the WiMundo.

On March 30, 2021, the Company sold, transferred and assigned all rights and ownership to SMC’s wholly owned subsidiary iPTerra Technologies, Inc. (“iPTerra”), iPMine software intellectual property (“iPMine-IP”), and Aktiv-Trak software intellectual property (Aktiv-Trak-IP”) to Wyoming-based privately held Aktiv-Trak, Inc. (“Aktiv-Trak”).

On October 12, 2021, the Company announced it entered in discussion with the former members of Spectrum Entertainment LLC (“Spectrum”) to rescind SMC’s acquisition of Spectrum. As part of the rescission agreement, SMC is seeking (i) the repayment of $145,274.93 which includes payments made to Spectrum’s lenders, legal and accounting fees paid by the Company; and (ii) the return and cancellation of 40,000,000 common shares issued to Spectrum members as consideration for acquiring Spectrum. The Company’s acquisition of Spectrum was initiated, lead, and concluded by the Company’s former Chief Executive Officer.

On November 2, 2021, the Company filed a Uniform Commercial Code (UCC) filing in the states of Michigan and Wisconsin against Spectrum to secure its rightful ownership until Spectrum repays amounts owed and the return of 40,000,000 shares for cancellation. The Company took these extra measures to secure its ownership title, protect and preserve shareholders equity.

In settlement of the dispute between the Company and Spectrum, on January 20, 2022, the 40,000,000 shares of common stock originally issued to MICRME LLC were cancelled and returned to the Company. Spectrum’s majority member, Mr. Daniel Barbacovi, formed MICRME LLC in 2021 and requested the 40,000,000 shares of common stock to be issued to MICRME LLC.

On December 12, 2022, the Company entered into a Rescission and Release Agreement with Genesis Financial, Inc (“GFL”), that effectively terminated its Stock Purchase Agreement, that was executed on November 18, 2021. Per the terms of the Agreement GFL agreed to pay a rescission fee of $300,000, $50,000 of which was to be paid within 21 days and the balance within 60 days. As certain requirements to complete the acquisition were never completed, there was never a formal closing and the financial statements of the Company were never consolidated, the transaction has been unwound and is not reflected in the financial statements of the Company.

On April 21, 2023, the Company completed its acquisition of AI-enabled wealth management technology platform provider, Fyniti Global Equities EBT Inc. (“Fyniti”) for 2,500,000 shares of Series B $10.00 Preferred Stock.

Fyniti, (www.fyniti.com, www.fynitiiq.com) is a Fintech developer and provider of technology that combines Artificial Intelligence/Machine Learning (AI/ML) driven Quantitative investing (IQ Engine) with AI-enabled wealth management Electronic Block Trading (“EBT”) technology.

On August 14, 2023, the Company filed a Certificate of Change with the Nevada Secretary of State to increase the authorized shares of the Company’s common stock to 3,000,000,000.

19

Results of Operations

Three Months Ended June 30, 2023 Compared to the Three Months Ended June 30, 2022

Revenue

We had no revenue for the three months ended June 30, 2023 and 2022.

General and Administrative Expenses

General and Administrative expenses for the three months ended June 30, 2023 was $92,575 as compared to $51,665 for the comparable prior period, an increase of $40,910 or 79%. The increase in the current period is primarily due to an increase in legal fees of $20,500 and $14,000 for public relation expense.

Compensation Expense – Related Party

Compensation Expense – Related Party for the three months ended June 30, 2023 was $144,050 as compared to $145,675 for the comparable prior period, a decrease of $1,625 or 1%. We incur compensation expenses for our CEO and COO. In the current period we accrued a total of $140,000 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $4,050. In the prior period we accrued a total of $127,500 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $18,175.

Other Income (Expense)

Total other expense for the three months ended June 30, 2023, was $19,943 as compared to $310,356 for the comparable prior period. In the current period we had interest expense of $5,470, a gain on conversion of convertible debt of $52,699 and a loss of $67,172 related to the change in fair value of derivatives. In the prior period we had interest expense of $16,899 and a loss of $293,457 related to the change in the fair value of derivatives.

Net Loss

Our net loss for the three months ended June 30, 2023, was $256,568 as compared with a net loss of $507,696 for the comparable prior period, a decrease of $251,128. The decrease in net loss is primarily due to the decrease in the loss related to the change in the fair value of derivatives.

20

Six Months Ended June 30, 2023 Compared to the Six Months Ended June 30, 2022

Revenue

We had no revenue for the six months ended June 30, 2023 and 2022.

General and Administrative Expenses

General and Administrative expenses for the six months ended June 30, 2023 was $134,850 as compared to $160,107 for the comparable prior period, a decrease of $25,257 or 16%. The decrease in the current period is primarily due to a decrease in investor relation expense of $93,000. We also had a decrease in accounting fees of $8,700 and payments to OTC Markets of $8,500. These decreases were offset with an increase in legal fees of $45,500.

Compensation Expense – Related Party

Compensation Expense – Related Party for the six months ended June 30, 2023 was $288,400 as compared to $2,668,475 for the comparable prior period, a decrease of $2,380,075 or 89%. We incur compensation expenses for our CEO and COO. In the current period we accrued a total of $280,000 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $8,400. In the prior period we accrued a total of $255,000 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $2,413,475.

Other Income (Expense)

Total other expense for the six months ended June 30, 2023, was $264,225 as compared to total other income of $1,102,105 for the comparable prior period. In the current period we had interest expense of $13,426, a gain on conversion of convertible debt of $52,699 and a loss of 303,498 related to the change in fair value of derivatives. In the prior period we had interest expense of $39,840 and a gain of $1,141,945 related to the change in the fair value of derivatives.

Net Loss

Our net loss for the six months ended June 30, 2023, was $687,475 as compared with a net loss of $1,726,477 for the comparable prior period, a decrease of $1,039,002. The decrease in net operating loss is primarily due to the decrease in stock compensation expense.

Liquidity and Capital Resources

During the six months ended June 30, 2023, we used $71,184 of cash in operations compared to $161,646 used in the prior period.

As of June 30, 2023, we had convertible notes, including accrued interest, due of $1,193,424.

Off-Balance Sheet Arrangements

As of June 30, 2023, the Company had no off-balance sheet arrangements.

21

Results of Operations

For the Years Ended December 31, 2022 Compared to December 31, 2021

Revenue

We had no revenue for the years ended December 31, 2022 and 2021.

General and Administrative Expenses

General and Administrative expenses for the year ended December 31, 2022, was $229,258 as compared to $242,930 for the year ended December 31, 2021, a decrease of $13,672 or 5.6%. In the current period we had a decrease of deal development expense of $96,000, which was offset by an increase in professional fees of $115,000. We also had a $15,500 decrease in consulting fees.

Compensation Expense – Related Party

Compensation Expense – Related Party for the year ended December 31, 2022, was $2,936,475 as compared to $1,865,950 for the year ended December 31, 2021, an increase of $1,070,525. We incur compensation expenses for our CEO and COO. In the current year we accrued a total of $522,500 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $2,413,975. In the prior year we accrued a total of $82,500 per the terms of their consulting agreements and granted shares of common stock for total non-cash expense of $1,783,450.

Other Income (Expense)

Total other income for the year ended December 31, 2022, was $1,935,438 as compared to of $1,872,250 for the year ended December 31, 2021. In the current period we had interest expense of $64,144 and a gain of $1,679,582 related to the change in fair value of derivatives and other income of $320,000. In the prior year we had interest expense of $107,708 and a gain of $1,343,636 related to the change in the fair value of derivatives, a loss on the issuance of derivatives of $65,658, a gain on extinguishment of debt of $600,000 and other income of $101,980.

Net Operating Loss

Our net operating loss for the year ended December 31, 2022, was $1,230,295 as compared with a net loss of $236,630 for the year ended December 31, 2021, an increase of $993,662. The decrease in net operating loss is primarily due to the decrease in non-cash compensation expense. The decrease in net operating loss is primarily due non-cash stock compensation expense and the increase loss on fair value of our derivatives.

Going Concern

Our auditors have expressed substantial doubt as to our ability to continue as a going concern. The accompanying financial statements have been prepared on a going concern basis. For the year ended December 31, 2022, the Company had a net loss of $1,230,295, had net cash used in operating activities of $189,253, and an accumulated deficit of $16,000,004. For the six months ended June 30, 2023, the Company had a net loss of $687,475, had net cash used in operating activities of $71,184 and an accumulated deficit of $16,687,479. These matters raise substantial doubt about the Company’s ability to continue as a going concern for a period of one year from the date of this filing. The Company’s ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due, to fund possible future acquisitions, and to generate profitable operations in the future. Management plans to provide for the Company’s capital requirements by continuing to issue additional equity and debt securities. The outcome of these matters cannot be predicted at this time and there are no assurances that, if achieved, the Company will have sufficient funds to execute its business plan or generate positive operating results. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

22

Off-Balance Sheet Arrangements

As of June 30, 2023 and December 31, 2022, the Company had no off-balance sheet arrangements.

Critical Accounting Policies

Our significant accounting policies are summarized in Note 2 to our audited financial statements for the years ended December 31, 2022 and 2021. Certain of our accounting policies require the application of significant judgment by our management, and such judgments are reflected in the amounts reported in our financial statements. In applying these policies, our management uses judgment to determine the appropriate assumptions to be used in the determination of estimates. Those estimates are based on our historical experience, terms of existing contracts, our observance of market trends, information provided by our strategic partners and information available from other outside sources, as appropriate. Actual results may differ significantly from the estimates contained in our condensed consolidated financial statements.

23

We maintain our current principal office at 9170 Glades Road Suite 150, Boca Raton, FL 33434. Our telephone number at this office is (360) 820-5973. We do not currently lease office space as it is provided by our CEO.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

(a) Security ownership of certain beneficial owners.

The following table sets forth, as of June 30, 2023, the number of shares of common stock owned of record and beneficially by our executive officers, directors and persons who hold 5% or more of the outstanding shares of common stock of the Company.

The amounts and percentages of our common stock beneficially owned are reported on the basis of SEC rules governing the determination of beneficial ownership of securities. Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has the right to acquire beneficial ownership within 60 days through the exercise of any stock option, warrant or other right. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Unless otherwise indicated, each of the shareholders named in the table below, or his or her family members, has sole voting and investment power with respect to such shares of our common stock. Except as otherwise indicated, the address of each of the shareholders listed below is: c/o SMC Entertainment, Inc., 9170 Glades Road Suite 150, Boca Raton, FL 33434.

Applicable percentage ownership is based on 1,162,060,743 shares of Common Stock outstanding as of Juen 30, 2023. In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of Common Stock as held by that person or entity that are currently exercisable or that will become exercisable within 60 days of June 30, 2023.

| Name and Address of Beneficial Owner | Common Stock

Owned | Percent of Class* | ||||||

| Named Executive Officers and Directors | ||||||||

| Erik Blum, President, Chief Executive Officer, Chief Financial Officer and Director(1) | 100,000,000 | 8.6 | % | |||||

| Ronald E. Hughes, Chief Operating Officer, Director and Chairman of the Board | 205,000,000 | 17.6 | % | |||||

| Jayakumar Gopalan, Chief Technical Officer and Director(2) | 25,000,000 | 2.2 | % | |||||

| All directors and officers as a group (3 persons) | 330,000,000 | 28.4 | % | |||||

| 5% or greater shareholders | ||||||||

| Rich Bjorkland | 200,000,000 | 17.2 | % | |||||

| Total | 530,000,000 | 45.6 | % | |||||

| (1) | Includes 100,000,000 shares of common stock held in the name of JW Price, LLC, a limited liability company beneficially controlled by Erik Blum as its President. |

| (2) | Includes 25,000,000 shares of common stock, presuming a full conversion of all 2,500,000 shares of Series B Preferred Stock owned by Fyniti Global Equities EBT Inc. (“Fyniti”). Per the amendment to the Certificate of Designation for Series B Preferred Stock filed on August 14, 2023, each 1 share of Series B Preferred Stock converts into 10 shares of common stock. |

Changes in Control

Other than as disclosed above, we are not aware of any arrangements that may result in “changes in control” as that term is defined by the provisions of Item 403(c) of Regulation S-K.

24

Item 5. Directors and Executive Officers.

The following table contains information with respect to our directors and executive officers. To the best of our knowledge, none of our directors or executive officers have an arrangement or understanding with any other person pursuant to which he or she was selected as a director or officer. There are no family relationships between any of our directors or executive officers. Directors serve one-year terms. Our executive officers are appointed by and serve at the pleasure of the Board of Directors.

| Name | Current Age | Position | ||

| Erik Blum | 58 | President, and Chief Executive Officer (Principal Executive Officer) and Chief Financial Officer (Principal Accounting Officer) (Appointed President on November 15, 2021, and later Director on May 16,2023). | ||

| Ronald E. Hughes | 61 | VP Communications as of May 13, 2020. Chief Operating Officer and Chairman of the Board of Directors (Serving as Chairman and Director, Chief Executive Officer and Chief Financial Officer since October 1, 2021, until being appointed as Chief Operating Officer on November 15, 2021). | ||

| Jayakumar Gopalan | 46 | Chief Technical Officer and Director (Appointed on May 16, 2023) |

Erik Blum, President, Chief Executive Officer, Chief Financial Officer and Director

With over 30 years of experience in debt, corporate finance and company management, Mr. Blum’s career started at Lehman Brothers and Drexel Burnham California underwriting junk bonds in the late 1980’s. While at Drexel, Mr. Blum worked with Steve Nassau and Michael Milken on the 7UP and NWA LBO’s. After Drexel, Mr. Blum moved to Shearson and later found a home at Tucker Anthony /John Hancock, structuring debt, raising equity, and participating in corporate finance. Mr. Blum then joined D. Blech & Company as an officer and principal in 1993 and was instrumental in bringing more than 50 Bio Tech companies to market including Gilead, Human Genome Sciences, Texas Biotech, VISX Laser, Guilford, and many others. In 2001 Mr. Blum moved to Florida and began structuring CMO’S specializing in the inverse floater side of Fannie Mae and Freddie Mac. In 2005 Mr. Blum successfully created a reverse convertible bond desk based on volatility for Stern Agee. Mr. Blum left Wall Street in 2010 to branch off privately.