UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended October 31, 2020

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from ___________ to ___________ | |||||

Commission file number 001-38175

(Exact Name of Registrant as Specified in Its Charter)

| State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. | |||||||||||||

| Address of Principal Executive Offices | Zip Code | |||||||||||||

(480 ) 407-7365

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

The (The Nasdaq Global Market) | ||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ | |||||||

Smaller reporting company | ||||||||

Emerging growth company | ||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

| Class | Outstanding as of December 10, 2020 | |||||||

| Common Stock, $0.001 par value per share | ||||||||

TABLE OF CONTENTS

| Page Number | ||||||||

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| October 31, 2020 | April 30, 2020 | ||||||||||

| (Unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

Accounts receivable, net of allowance of $ | |||||||||||

| Prepaid expenses | |||||||||||

| Other receivables | |||||||||||

| Other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment: | |||||||||||

| Computer equipment and hardware | |||||||||||

| Furniture and fixtures | |||||||||||

| Leasehold improvements | |||||||||||

| Instructional equipment | |||||||||||

| Software | |||||||||||

| Construction in progress | |||||||||||

| Less accumulated depreciation and amortization | ( | ( | |||||||||

| Total property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Courseware, net | |||||||||||

Accounts receivable, net of allowance of $ | |||||||||||

| Long term contractual accounts receivable | |||||||||||

| Debt issue cost, net | |||||||||||

| Operating lease right of use assets, net | |||||||||||

| Deposits and other assets | |||||||||||

| Total assets | $ | $ | |||||||||

(Continued)

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

1

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (CONTINUED)

| October 31, 2020 | April 30, 2020 | ||||||||||

| (Unaudited) | |||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued expenses | |||||||||||

| Deferred revenue | |||||||||||

| Due to students | |||||||||||

| Operating lease obligations, current portion | |||||||||||

| Other current liabilities | |||||||||||

| Total current liabilities | |||||||||||

Convertible notes, net of discount of $ | |||||||||||

| Operating lease obligations, less current portion | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies – see Note 10 | |||||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

Treasury stock ( | ( | ||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

2

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended October 31, | Six Months Ended October 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Revenues | $ | $ | $ | $ | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Bad debt expense | |||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Operating loss | ( | ( | ( | ( | |||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||

| Other (expense) income, net | ( | ( | |||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Total other expense, net | ( | ( | ( | ( | |||||||||||||||||||

| Loss before income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Income tax expense | |||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Net loss per share - basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Weighted average number of common stock outstanding - basic and diluted | |||||||||||||||||||||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

3

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Three Months Ended October 31, 2020 and 2019

(Unaudited)

| Common Stock | Additional Paid-In Capital | Treasury Stock | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at Balance at July 31, 2020 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Common stock issued for stock options exercised for cash | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for cashless stock options exercised | ( | — | — | ||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Convertible Notes | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for vested restricted stock units | ( | — | — | ||||||||||||||||||||||||||||||||

| Amortization of warrant based cost | — | — | — | — | |||||||||||||||||||||||||||||||

| Cancellation of Treasury Stock | ( | ( | ( | — | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance at October 31, 2020 | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Treasury Stock | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at July 31, 2019 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Common stock issued for stock options exercised for cash | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for cashless stock options exercised | ( | — | — | ||||||||||||||||||||||||||||||||

| Common stock issued for cashless warrant exercise | ( | — | — | ||||||||||||||||||||||||||||||||

| Amortization of warrant based cost | — | — | — | — | |||||||||||||||||||||||||||||||

| Amortization of restricted stock issued for services | — | — | — | — | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance at October 31, 2019 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

4

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (CONTINUED)

Six Months Ended October 31, 2020 and 2019

(Unaudited)

| Common Stock | Additional Paid-In Capital | Treasury Stock | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at April 30, 2020 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Common stock issued for stock options exercised for cash | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for cashless stock options exercised | ( | — | — | ||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Convertible Notes | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for vested restricted stock units | ( | — | — | ||||||||||||||||||||||||||||||||

| Common stock issued for warrants exercised for cash | — | — | |||||||||||||||||||||||||||||||||

| Modification charge for warrants exercised | — | — | — | — | |||||||||||||||||||||||||||||||

| Amortization of warrant based cost | — | — | — | — | |||||||||||||||||||||||||||||||

| Cancellation of Treasury Stock | ( | ( | ( | — | |||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance at October 31, 2020 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Treasury Stock | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||||||||

| Balance at April 30, 2019 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | |||||||||||||||||||||||||||||||

| Common stock issued for stock options exercised for cash | — | — | |||||||||||||||||||||||||||||||||

| Common stock issued for cashless stock options exercised | ( | — | — | ||||||||||||||||||||||||||||||||

| Common stock issued for cashless warrant exercise | ( | — | — | ||||||||||||||||||||||||||||||||

| Amortization of warrant based cost | — | — | — | — | |||||||||||||||||||||||||||||||

| Amortization of restricted stock issued for services | — | — | — | — | |||||||||||||||||||||||||||||||

| Restricted Stock Issued for Services, subject to vesting | ( | — | — | ||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||

| Balance at October 31, 2019 | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

5

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended October 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Bad debt expense | |||||||||||

| Depreciation and amortization | |||||||||||

| Stock-based compensation | |||||||||||

| Amortization of warrant based cost | |||||||||||

| Loss on asset disposition | |||||||||||

| Amortization of debt discounts | |||||||||||

| Amortization of debt issue costs | |||||||||||

| Modification charge for warrants exercised | |||||||||||

| Non-cash payments to investor relations firm | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | ( | ( | |||||||||

| Prepaid expenses | ( | ( | |||||||||

| Other receivables | |||||||||||

| Other current assets | ( | ( | |||||||||

| Deposits and other assets | ( | ||||||||||

| Accounts payable | ( | ||||||||||

| Accrued expenses | |||||||||||

| Deferred Rent | ( | ||||||||||

| Due to students | ( | ||||||||||

| Deferred revenue | |||||||||||

| Other current liabilities | ( | ( | |||||||||

| Net cash used in operating activities | ( | ( | |||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of courseware and accreditation | ( | ( | |||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from warrants exercised | |||||||||||

| Proceeds from stock options exercised | |||||||||||

| Net cash provided by financing activities | |||||||||||

(Continued)

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

6

ASPEN GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

(Unaudited)

| Six Months Ended October 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Net decrease in cash, cash equivalents and restricted cash | $ | ( | $ | ( | |||||||

| Cash, cash equivalents and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||||||

| Supplemental disclosure cash flow information | |||||||||||

| Cash paid for interest | $ | $ | |||||||||

| Cash paid for income taxes | $ | $ | |||||||||

| Supplemental disclosure of non-cash investing and financing activities | |||||||||||

| Common stock issued for conversion of Convertible Notes | $ | $ | |||||||||

| Right-of-use lease asset offset against operating lease obligations | $ | $ | |||||||||

| Common stock issued for services | $ | $ | |||||||||

The following table provides a reconciliation of cash and restricted cash reported within the unaudited consolidated balance sheets that sum to the same such amounts shown in the unaudited consolidated statements of cash flows:

| October 31, 2020 | October 31, 2019 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash, cash equivalents and restricted cash | $ | $ | |||||||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

7

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Note 1. Nature of Operations and Liquidity

Overview

Aspen Group, Inc. ("AGI") is an educational technology holding company. AGI has five subsidiaries, Aspen University Inc. ("Aspen University") organized in 1987, Aspen Nursing of Arizona, Inc. ("ANAI"), Aspen Nursing of Florida, Inc. ("ANFI"), Aspen Nursing of Texas, Inc. ("ANTI"), and United States University Inc. ("United States University" or "USU"). ANAI, ANFI and ANTI are subsidiaries of Aspen University Inc.

All references to the “Company”, “AGI”, “Aspen Group”, “we”, “our” and “us” refer to Aspen Group, Inc., unless the context otherwise indicates.

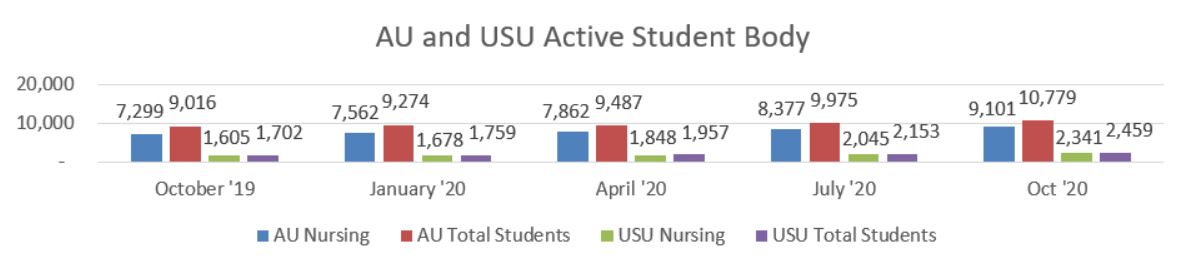

AGI leverages its education technology infrastructure and expertise to allow its two universities, Aspen University and United States University, to deliver on the vision of making college affordable again. Because we believe higher education should be a catalyst to our students’ long-term economic success, we exert financial prudence by offering affordable tuition that is one of the greatest values in higher education. AGI’s primary focus relative to future growth is to target the high growth nursing profession. As of October 31, 2020, 11,442 of 13,238 or 86 % of all active students across both universities are degree-seeking nursing students.

Since 1993, Aspen University has been nationally accredited by the Distance Education and Accrediting Council (“DEAC”), a national accrediting agency recognized by the United States Department of Education (the “DOE”) and Council for Higher Education Accreditation ("CHEA"). On February 25, 2019, the DEAC informed Aspen University that it had renewed its accreditation for five years through January 2024.

Since 2009, USU has been regionally accredited by WASC Senior College and University Commission. (“WSCUC”).

Both universities are qualified to participate under the Higher Education Act of 1965, as amended (HEA) and the Federal student financial assistance programs (Title IV, HEA programs). USU has a provisional certification resulting from the ownership change of control in connection with the acquisition by AGI on December 1, 2017.

Basis of Presentation

Interim Financial Statements

The interim consolidated financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). In the opinion of the Company’s management, all adjustments (consisting of normal recurring adjustments and reclassifications and non-recurring adjustments) necessary to present fairly our results of operations for the three and six months ended October 31, 2020 and 2019, our cash flows for the six months ended October 31, 2020 and 2019, and our financial position as of October 31, 2020 have been made. The results of operations for such interim periods are not necessarily indicative of the operating results to be expected for the full year.

Certain information and disclosures normally included in the notes to the annual consolidated financial statements have been condensed or omitted from these interim consolidated financial statements. Accordingly, these interim consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2020 as filed with the SEC on July 7, 2020. The April 30, 2020 balance sheet is derived from those statements.

COVID-19 Update

The COVID-19 crisis did not have a material impact on the Company’s consolidated financial results for the second quarter of fiscal year 2021, as evidenced by our record revenues of $17.0 million. In fact, the Company’s two highest LTV programs, USU’s MSN-FNP and Aspen’s BSN Pre-Licensure program, saw enrollment tailwinds this quarter related to COVID-19. RN’s, looking to attain their nurse practitioner license to broaden their career options, drove MSN-FNP enrollment. Additionally,

8

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

millennials, aspiring to become RNs, enrolled in the BSN Pre-Licensure program in Phoenix in record numbers, given that many were furloughed or laid off since the pandemic first started.

In our current, third fiscal quarter ending January 31, 2021, which has been historically a seasonally slower quarter given it falls during the holiday months of November and December, Aspen University is seeing slightly lower course registrations than seasonally expected in our Aspen Nursing + Other unit. We believe COVID-19 ‘Wave Two’ is partly a factor given that all the states in the country are now affected – not just some of the major metros. Our predominant student demographic of RNs has been especially overwhelmed over the past few months, so this isn’t unexpected.

Liquidity

At October 31, 2020, the Company had a cash and cash equivalents balance of $12,237,710 and $4,644,618 of restricted cash.

In March 2019, the Company entered into two loan agreements for a principal amount of $5 10 million. In connection with the loan agreements, the Company issued 18 month senior secured promissory term notes, with the Company having the right to extend the term of the loans for an additional 12 months by paying a 1 % one-time extension fee. On January 22, 2020, the term notes were exchanged for convertible notes maturing January 22, 2023. On September 14, 2020, the Convertible Notes automatically converted into shares of the Company’s common stock. (See Note 6)

On January 22, 2020, the Company closed on an underwritten public offering of common stock for net proceeds of approximately $16 million. The public offering was a condition precedent to the closing of the above refinancing. (See Note 6)

On November 5, 2018 the Company entered into a three year , $5,000,000 senior revolving credit facility. There is currently no outstanding balance under that facility. (See Note 6)

During the six months ended October 31, 2020 the Company's net cash and restricted cash decreased by $1,024,437 , which included using $2,076,821 in operating activities.

The Company has analyzed its liquidity position and believes its current resources are adequate to meet anticipated liquidity needs for the next 12 months from the issuance date of this report.

Note 2. Significant Accounting Policies

Basis of Presentation and Consolidation

The Company prepares its consolidated financial statements in accordance with U.S. generally accepted accounting principles ("GAAP").

The consolidated financial statements include the accounts of AGI and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Accounting Estimates

Management of the Company is required to make certain estimates, judgments and assumptions during the preparation of its consolidated financial statements in accordance with GAAP. These estimates, judgments and assumptions impact the reported amounts of assets, liabilities, revenue and expenses and the related disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Significant estimates in the accompanying consolidated financial statements include the allowance for doubtful accounts and other receivables, the valuation of lease liabilities and the carrying value of the related right-of-use ("ROU") assets, depreciable lives of property and equipment, amortization periods and valuation of courseware, intangibles and software development costs, valuation of goodwill, valuation of loss contingencies, valuation of stock-based compensation and the valuation allowance on deferred tax assets.

9

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

For the purposes of the consolidated statements of cash flows, the Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents.

As of October 31, 2020, restricted cash of $4,644,618 consists of $934,125 which is collateral for letters of credit for the Aspen University and USU facility operating leases, $379,345 which is collateral for a letter of credit issued by the bank, a $250,000 compensating balance under a secured credit line and $49,021 for employee payroll taxes to be remitted. Also included are funds held for students for unbilled educational services that were received from Title IV and non-Title IV programs totaling $3,032,127 . As an administrator of these Title IV program funds, the Company is required to maintain and restrict these funds pursuant to the terms of the program participation agreement with the U.S. Department of Education.

As of April 30, 2020, restricted cash of $3,556,211 consists of $692,293 which is collateral for letters of credit for the Aspen University and USU facility operating leases and $255,708 which is collateral for a letter of credit issued by the bank and $71,828 which is related to USU’s receipt of Title IV funds and is required by the Department of Education ("DOE") in connection with the change of control of USU. Also included are funds held for students for unbilled educational services that were received from Title IV and non-Title IV programs totaling $2,536,382 . As an administrator of these Title IV program funds, the Company is required to maintain and restrict these funds pursuant to the terms of the program participation agreement with the U.S. Department of Education.

Goodwill and Intangibles

Goodwill currently represents the excess of purchase price over the fair market value of assets acquired and liabilities assumed from the 2017 acquisition of USU. Goodwill has an indefinite life and is not amortized. Goodwill is tested annually for impairment or if indicators are present.

Fair Value Measurements

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. The Company classifies assets and liabilities recorded at fair value under the fair value hierarchy based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market data obtained from independent sources, while unobservable inputs (lowest level) reflect internally developed market assumptions. The fair value measurements are classified under the following hierarchy:

Level 1—Observable inputs that reflect quoted market prices (unadjusted) for identical assets and liabilities in active markets;

Level 2—Observable inputs, other than quoted market prices, that are either directly or indirectly observable in the marketplace for identical or similar assets and liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets and liabilities; and

Level 3—Unobservable inputs that are supported by little or no market activity that are significant to the fair value of assets or liabilities.

10

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Accounts Receivable and Allowance for Doubtful Accounts Receivable

All students are required to select both a primary and secondary payment option with respect to amounts due to AGI for tuition, fees and other expenses. As of October 31, 2020, the monthly payment plan represents approximately 62 % of the payments that are made by active students, making it the most common payment type. In instances where a student selects financial aid as the primary payment option, he or she often selects personal cash as the secondary option. If a student who has selected financial aid as his or her primary payment option withdraws prior to the end of a course but after the date that AGI’s institutional refund period has expired, the student will have incurred the obligation to pay the full cost of the course. If the withdrawal occurs before the date at which the student has earned 100 % of his or her financial aid, AGI may have to return all or a portion of the Title IV funds to the DOE and the student will owe AGI all amounts incurred that are in excess of the amount of financial aid that the student earned, and that AGI is entitled to retain. In this case, AGI must collect the receivable using the student’s second payment option.

For accounts receivable from students, AGI records an allowance for doubtful accounts for estimated losses resulting from the inability, failure or refusal of its students to make required payments, which includes the recovery of financial aid funds advanced to a student for amounts in excess of the student’s cost of tuition and related fees. AGI determines the adequacy of its allowance for doubtful accounts using an allowance method based on an analysis of its historical bad debt experience, current economic trends, aging of the accounts receivable and each student’s status. AGI estimates the amounts to increase the allowance based upon the risk presented by the age of the receivables and student status. AGI writes off accounts receivable balances at the time the balances are deemed uncollectible. AGI continues to reflect accounts receivable with an offsetting allowance as long as management believes there is a reasonable possibility of collection.

For accounts receivable from primary payors other than students, AGI estimates its allowance for doubtful accounts by evaluating specific accounts where information indicates the primary payors may have an inability to meet financial obligations, such as bankruptcy proceedings and receivable amounts outstanding for an extended period beyond contractual terms. In these cases, AGI uses assumptions and judgment, based on the best available facts and circumstances, to record a specific allowance for those primary payors against amounts due to reduce the receivable to the amount expected to be collected. These specific allowances are re-evaluated and adjusted as additional information is received. The amounts calculated are analyzed to determine the total amount of the allowance. AGI may also record a general allowance as necessary.

Direct write-offs are taken in the period when AGI has exhausted its efforts to collect overdue and unpaid receivables or otherwise evaluate other circumstances that indicate that AGI should abandon such efforts. (See Note 8)

When a student signs up for the monthly payment plan, there is a contractual amount that the Company can expect to earn over the life of the student’s program. This contractual amount cannot be recorded as an accounts receivable because, the student does have the option to stop attending. As a student takes a class, revenue is earned over the class term. Some students accelerate their program, taking two or more classes every eight week period, which increases the student’s accounts receivable balance. If any portion of that balance will be paid in a period greater than 12 months, that portion is reflected as long-term accounts receivable. At October 31, 2020 and April 30, 2020, those balances were $10,246,622 and $6,701,136 , respectively, which amounts are evaluated and included in the allowance analysis as discussed above. The Company has determined that the long term accounts receivable do not constitute a significant financing component as the list price, cash selling price and promised consideration are equal. Further, the interest free financing portion of the monthly payment plans are not considered significant to the contract.

Property and Equipment

Property and equipment are recorded at cost less accumulated depreciation and amortization. Depreciation and amortization is computed using the straight-line method over the estimated useful lives of the related assets per the following table.

11

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

| Category | Useful Life | |||||||

| Computer equipment and hardware | ||||||||

| Software | ||||||||

| Instructional equipment | ||||||||

| Furniture and fixtures | ||||||||

| Leasehold improvements | The lesser of | |||||||

Costs incurred to develop internal-use software during the preliminary project stage are expensed as incurred. Internal-use software development costs are capitalized during the application development stage, which is after: (i) the preliminary project stage is completed; and (ii) management authorizes and commits to funding the project and it is probable the project will be completed and used to perform the function intended. Capitalization ceases at the point the software project is substantially complete and ready for its intended use, and after all substantial testing is completed. Upgrades and enhancements are capitalized if it is probable that those expenditures will result in additional functionality. Amortization is provided for on a straight-line basis over the expected useful life of five years of the internal-use software development costs and related upgrades and enhancements. When existing software is replaced with new software, the unamortized costs of the old software are expensed when the new software is ready for its intended use.

Leasehold improvements are amortized using the straight-line method over the lesser of eight years or lease term.

The Company has construction in progress which includes property and equipment amounts for new campuses. These assets are not yet being depreciated as of October 31, 2020.

Upon the retirement or disposition of property and equipment, the related cost and accumulated depreciation or amortization are removed and a gain or loss is recorded in the consolidated statements of operations. Repairs and maintenance costs are expensed in the period incurred.

Courseware and Accreditation

The Company records the costs of courseware and accreditation in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 350 “Intangibles - Goodwill and Other”.

Long-Lived Assets

The Company assesses potential impairment to its long-lived assets when there is evidence that events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events and circumstances considered by the Company in determining whether the carrying value of identifiable intangible assets and other long-lived assets may not be recoverable include, but are not limited to: significant changes in performance relative to expected operating results, significant changes in the use of the assets, significant negative industry or economic trends, a significant decline in the Company’s stock price for a sustained period of time, and changes in the Company’s business strategy. An impairment loss is recorded when the carrying amount of the long-lived asset is not recoverable and exceeds its fair value. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. Any required impairment loss is measured as the amount by which the carrying amount of a long-lived asset exceeds fair value and is recorded as a reduction in the carrying value of the related asset and an expense to operating results.

Due to Students

The Company receives Title IV funds from the Department of Education to cover tuition and living expenses. After deducting tuition and fees, the Company sends checks for the remaining balances to the students.

12

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Leases

The Company enters into various lease agreements in conducting its business. At the inception of each lease, the Company evaluates the lease agreement to determine whether the lease is an operating or financing lease. Leases may contain initial periods of free rent and/or periodic escalations. When such items are included in a lease agreement, the Company records rent expense on a straight-line basis over the initial term of a lease. The difference between the rent payment and the straight-line rent expense is recorded as additional amortization. The Company expenses any additional payments under its operating leases for taxes, insurance or other operating expenses as incurred.

In February 2016, the FASB issued Accounting Standards Update ("ASU") No. 2016-2, Leases (Topic 842). This standard requires entities to recognize most operating leases on their balance sheets as right-of-use assets with a corresponding lease liability, along with disclosing certain key information about leasing arrangements. The Company adopted the standard effective May 1, 2019 using the cumulative effect adjustment transition method, which applies the provisions of the standard at the effective date without adjusting the comparative periods presented. The Company adopted the following practical expedients and elected the following accounting policies related to this standard:

•Carry forward of historical lease classification;

•Short-term lease accounting policy election allowing lessees to not recognize right-of-use assets and lease liabilities for leases with a term of 12 months or less; and

•Not separate lease and non-lease components for office space and campus leases.

The adoption of this standard resulted in the recognition of an initial operating lease right-of-use assets (“ROU’s”) and corresponding lease liabilities of approximately $8

Disclosures related to the amount, timing, and uncertainty of cash flows arising from leases are included in Note 9.

Treasury Stock

Purchases and sales of treasury stock are accounted for using the cost method. Under this method, shares acquired are recorded at the acquisition price directly to the treasury stock account. Upon sale, the treasury stock account is reduced by the original acquisition price of the shares and any difference is recorded in equity. This method does not allow the company to recognize a gain or loss to income from the purchase and sale of treasury stock.

The Company canceled the remaining 16,667 treasury shares on October 16, 2020. See Note 7.

Revenue Recognition and Deferred Revenue

The Company follows Accounting Standards Codification 606 (ASC 606). ASC 606 is based on the principle that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This ASC also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer purchase orders, including significant judgments. Our adoption of this ASC resulted in no change to our consolidated results of operations or our consolidated balance sheet and there was no cumulative effect adjustment.

Revenues consist primarily of tuition and course fees derived from courses taught by the Company online as well as from related educational resources and services that the Company provides to its students. Under ASC 606, tuition fee revenue is recognized pro-rata over the applicable period of instruction and are not considered separate performance obligations. Non-tuition related revenue and fees are recognized as services are provided or when the goods are received by the student. (See Note 8)

13

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Cost of Revenues

Cost of revenues consists of two categories of cost, instructional costs and services, and marketing and promotional costs.

Instructional Costs and Services

Instructional costs and services consist primarily of costs related to the administration and delivery of the Company's educational programs. This expense category includes compensation costs associated with online faculty, technology license costs and costs associated with other support groups that provide services directly to the students and are included in cost of revenues.

General and Administrative

General and administrative expenses include compensation of employees engaged in corporate management, finance, human resources, information technology, academic operations, compliance and other corporate functions. General and administrative expenses also include professional services fees, financial aid processing costs, non-capitalizable courseware and software costs, travel and entertainment expenses and facility costs.

Legal Expenses

All legal costs for litigation are charged to expense as incurred.

Income Tax

The Company uses the asset and liability method to compute the differences between the tax basis of assets and liabilities and the related financial statement amounts. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount that more likely than not will be realized. The Company has deferred tax assets and liabilities that reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are subject to periodic recoverability assessments. Realization of the deferred tax assets, net of deferred tax liabilities, is principally dependent upon achievement of projected future taxable income.

The Company records a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. The Company accounts for uncertainty in income taxes using a two-step approach for evaluating tax positions. Step one, recognition, occurs when the Company concludes that a tax position, based solely on its technical merits, is more likely than not to be sustained upon examination. Step two, measurement, is only addressed if the position is more likely than not to be sustained. Under step two, the tax benefit is measured as the largest amount of benefit, determined on a cumulative probability basis, which is more likely than not to be realized upon ultimate settlement. The Company recognizes interest and penalties, if any, related to unrecognized tax benefits in income tax expense.

14

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

The Company evaluates its convertible instruments, options, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for under ASC Topic 815, “Derivatives and Hedging”. The result of this accounting treatment is that the fair value of the derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income (expense). Upon conversion, exercise, or other extinguishment (transaction) of a derivative instrument, the instrument is marked to fair value at the transaction date and then that fair value is recognized as an extinguishment gain or loss. Equity instruments that are initially classified as equity that become subject to reclassification under ASC Topic 815 are reclassified to liability at the fair value of the instrument on the reclassification date.

The Company follows FASB ASU 2017-11, which simplifies the accounting for certain equity-linked financial instruments and embedded features with down round features that reduce the exercise price when the pricing of a future round of financing is lower. This allows the Company to treat such instruments or their embedded features as equity instead of considering them as a derivative. If such a feature is triggered in a stand-alone instrument treated as equity, the value is measured pre-trigger and post-trigger. The difference in these two measurements is treated as a dividend, reducing income. The value recognized as a dividend is not subsequently remeasured, but in instances where the feature is triggered multiple times each instance is recognized.

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date fair value of the award and is expensed over the requisite service period, which is included in general and administrative expense in the consolidated statement of operations. For employee stock-based awards, the Company calculates the fair value of the award on the date of grant using the Black-Scholes option pricing model. Determining the fair value of stock-based awards at the grant date under this model requires judgment, including estimating volatility, employee stock option exercise behaviors and forfeiture rates. The assumptions used in calculating the fair value of stock-based awards represent the Company's best estimates, but these estimates involve inherent uncertainties and the application of management judgment. For non-employee stock-based awards, the Company follows ASU 2018-7, which substantially aligns share based compensation for employees and non-employees.

RSUs are awards in the form of shares denominated in the equivalent number of shares of ASPU common stock and with the value of each RSU being equal to the fair value of ASPU common stock at the date of grant. RSU awards are subject to service-based vesting, where a specific period of continued employment must pass before an award vests as well as other vesting restrictions based on the nature and recipient of the award. For RSU awards, the expense is measured at the grant date as the fair value of ASPU common stock and expensed as stock-based compensation over the vesting term, which is included in general and administrative expense in the consolidated statement of operations.

Business Combinations

We include the results of operations of businesses we acquire from the date of the respective acquisition. We allocate the purchase price of acquisitions to the assets acquired and liabilities assumed at fair value. The excess of the purchase price of an acquired business over the amount assigned to the assets acquired and liabilities assumed is recorded as goodwill. We expense transaction costs associated with business combinations as incurred.

Net Loss Per Share

Net loss per share is based on the weighted average number of shares of common stock outstanding during each period. Options to purchase 1,744,354 and 3,021,131 shares, 669,800 and 0 restricted stock units ("RSUs"), warrants to purchase 374,174 and 566,223 shares, and unvested restricted stock of 16,448 and 69,672 were outstanding at October 31, 2020 and October 31, 2019, respectively. Additionally, $10,000,000 of convertible debt (convertible into 1,398,602 shares of common stock) was outstanding at April 30, 2020. All shares mentioned above were not included in the computation of diluted net loss per share because the effects would have been anti-dilutive. The options, warrants and convertible debt are considered to be common stock equivalents and are only included in the calculation of diluted earnings per share of common stock when their effect is dilutive.

15

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Recent Accounting Pronouncement not Yet Adopted

ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which significantly changes how entities will measure credit losses for most financial assets, including accounts receivable. ASU No. 2016-13 will replace today’s “incurred loss” approach with an “expected loss” model, under which companies will recognize allowances based on expected rather than incurred losses. On November 15, 2019, the FASB delayed the effective date of Topic 326 for certain small public companies and other private companies until fiscal years beginning after December 15, 2022 for SEC filers that are eligible to be smaller reporting companies under the SEC’s definition, as well as private companies and not-for-profit entities. The Company is currently evaluating the new guidance and has not yet determined whether the adoption of the new standard will have a material impact on its consolidated financial statements or the method of adoption.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

Bad debt expense, which was previously included in general and administrative expense for the three and six months ended October 31, 2019 of $407,759 and $648,658 , respectively, is now reported separately as a component of operating expenses for all periods presented. See Statements of operations for additional information.

Note 3. Property and Equipment

As property and equipment reach the end of their useful lives, the fully expired assets are written off against the associated accumulated depreciation. There is no expense impact for such write offs.

Property and equipment consisted of the following at October 31, 2020 and April 30, 2020:

| October 31, 2020 | April 30, 2020 | ||||||||||

| Computer equipment and hardware | $ | $ | |||||||||

| Furniture and fixtures | |||||||||||

| Leasehold improvements | |||||||||||

| Instructional equipment | |||||||||||

| Software | |||||||||||

| Construction in Progress | |||||||||||

| Accumulated depreciation and amortization | ( | ( | |||||||||

| Property and equipment, net | $ | $ | |||||||||

Software consisted of the following at October 31, 2020 and April 30, 2020:

| October 31, 2020 | April 30, 2020 | ||||||||||

| Software | $ | $ | |||||||||

| Accumulated amortization | ( | ( | |||||||||

| Software, net | $ | $ | |||||||||

16

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Depreciation and amortization expense for property and equipment as well as the portion for just software amortization is presented below for the three and six months ended October 31, 2020 and 2019:

| Three Months Ended October 31, | Six Months Ended October 31, | |||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||||||

| Depreciation and amortization expense | $ | $ | $ | $ | ||||||||||||||||

| Software amortization expense | $ | $ | $ | $ | ||||||||||||||||

The following is a schedule of estimated future amortization expense of software at October 31, 2020 (by fiscal year):

| Future Expense | ||||||||

| 2021 (remaining) | $ | |||||||

| 2022 | ||||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| Thereafter | ||||||||

| Total | $ | |||||||

Note 4. USU Goodwill and Intangibles

In connection with the acquisition of the USU business on December 1, 2017, the amount paid over the estimated fair values of the identifiable net assets was $5,011,432 , which has been reflected in the consolidated balance sheet as goodwill.

The goodwill resulting from the acquisition may become deductible for tax purposes in the future. The goodwill resulting from the acquisition is principally attributable to the future earnings potential associated with enrollment growth and other intangibles that do not qualify for separate recognition such as the assembled workforce.

We assigned an indefinite useful life to the accreditation and regulatory approvals and the trade name and trademarks as we believe they have the ability to generate cash flows indefinitely. In addition, there are no legal, regulatory, contractual, economic or other factors to limit the intangibles’ useful life and the Company intends to renew the intangibles, as applicable, and renewal can be accomplished at little cost. We determined all other acquired intangibles are finite-lived and we are amortizing them on either a straight-line basis or using an accelerated method to reflect the pattern in which the economic benefits of the assets are expected to be consumed. The finite-lived assets became fully amortized during fiscal 2020. Amortization expense for the three months ended October 31, 2020 and 2019 were $0 and $275,000 , respectively. Amortization expense for the six months ended October 31, 2020 and 2019 were $0 and $550,000 , respectively.

Intangible assets consisted of the following at October 31, 2020 and April 30, 2020:

| October 31, 2020 | April 30, 2020 | ||||||||||

| Intangible assets | $ | $ | |||||||||

| Accumulated amortization | ( | ( | |||||||||

| Net intangible assets | $ | $ | |||||||||

Note 5. Courseware and Accreditation

17

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

Courseware and accreditation consisted of the following:

| October 31, 2020 | April 30, 2020 | ||||||||||

| Courseware | $ | $ | |||||||||

| Accreditation | |||||||||||

| Accumulated amortization | ( | ( | |||||||||

| Courseware and accreditation, net | $ | $ | |||||||||

Amortization expense of courseware and accreditation is as follows:

| Three Months Ended October 31, | Six Months Ended October 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Amortization expense | $ | $ | $ | $ | |||||||||||||||||||

The following is a schedule of estimated future amortization expense of courseware and accreditation at October 31, 2020 (by fiscal year):

| Future Expense | ||||||||

| 2021 (remaining) | $ | |||||||

| 2022 | ||||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| Thereafter | ||||||||

| Total | $ | |||||||

Note 6. Debt

Convertible Notes

On January 22, 2020, the Company issued $5 million in principal amount convertible notes (“Convertible Notes”) to each of two lenders in exchange for the two $5 million notes issued under senior secured term loans entered into in March 2019 as discussed below (the “Term Loans”). The Company recorded a beneficial conversion feature on these Convertible Notes of $1,692,309 . The Convertible Notes have been automatically converted into common stock as explained below.

The closing of the refinancing was conditioned upon the Company conducting an equity financing resulting in gross proceeds to the Company of at least $10 million. On January 22, 2020, the Company closed on an underwritten public offering for net proceeds of approximately $16 million and the condition precedent to the closing of the refinancing was satisfied. The key terms of the Convertible Notes were as follows:

•After six months from the issuance date, the lenders had the right to convert the principal into our shares of the Company’s common stock at a conversion price of $7.15 per share;

•The Convertible Notes automatically convert into shares of the Company’s common stock if the average closing price of our common stock is at least $10.725 over a 20 consecutive trading day period;

•The Convertible Notes were due January 22, 2023 or approximately three years from the closing;

•The interest rate of the Convertible Notes was 7 % per annum (payable monthly in arrears); and

•The Convertible Notes were secured.

The former term notes under the Senior Secured Term Loans were due in September 2020, as noted below, and were subject to a one-year extension and the payment of an extension fee for each note of $50,000 (total of $100,000 ), which was not required to be paid since the Senior Secured Term Loans were not extended. The Company also paid each lender $40,400 at closing of

18

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

the Convertible Notes offering to cover taxes they would incur as part of the note exchange and paid their legal fees arising from the re-financing, which is included in general and administrative expense in the consolidated statement of operations.

The Company’s obligations under the Convertible Notes were secured by a first priority lien in certain deposit accounts of the Company, all current and future accounts receivable of Aspen University and USU, certain of the deposit accounts of Aspen University and USU, and all of the outstanding capital stock of Aspen University and USU (the “Collateral”).

On March 6, 2019, in connection with entering into the Term Loan Agreements, the Company also entered into an intercreditor agreement (the “Intercreditor Agreement”) among the Company, the Lenders and the Foundation, individually. The Intercreditor Agreement provides among other things that the Company’s obligations under this agreement, and the security interests in the Collateral granted pursuant to the Term Loan Agreements and the Amended and Restated Facility Agreement shall rank pari passu to one another. The Security Agreement was amended on January 22, 2020 to give effect to the Convertible Note issuances.

On September 14, 2020, after the closing price of our common stock was at least $10.725 over a 20 consecutive trading day period the Convertible Notes automatically converted into 1,398,602 shares of the Company’s common stock at a conversion price of $7.15 per share. (See Note 7.) The accelerated amortization charge related to unamortized debt discounts as a result of the debt extinguishment in the second quarter of fiscal year 2021 was approximately $1.4 million, which was included in interest expense in the consolidated statement of operations. The Company did not recognize any gains or losses as a result of this conversion.

Revolving Credit Facility

On November 5, 2018, the Company entered into a loan agreement (the “Credit Facility Agreement”) with the Leon and Toby Cooperman Family Foundation (the “Foundation”). The Credit Facility Agreement provides for a $5,000,000 revolving credit facility (the “Facility”) evidenced by a revolving promissory note (the “Revolving Note”). Borrowings under the Credit Facility Agreement bear interest at 12 % per annum. The Facility matures on November 4, 2021.

Pursuant to the terms of the Credit Facility Agreement, the Company agreed to pay to the Foundation a $100,000 one-time upfront Facility fee. The Company also agreed to pay the Foundation a commitment fee, payable quarterly at the rate of 2 % per annum on the undrawn portion of the Facility. At October 31, 2020 and April 30, 2020, there were no outstanding borrowings under the Revolving Credit Facility.

The Credit Facility Agreement contains customary representations and warranties, events of default and covenants. Pursuant to the Loan Agreement and the Revolving Note, all future or contemporaneous indebtedness incurred by the Company, other than indebtedness expressly permitted by the Credit Facility Agreement and the Revolving Note, will be subordinated to the Facility.

Pursuant to the Credit Facility Agreement, on November 5, 2018 the Company issued to the Foundation warrants to purchase 92,049 shares of the Company’s common stock exercisable for five years from the date of issuance at the exercise price of $5.85 per share which were deemed to have a relative fair value of $255,071 (the "2018 Cooperman Warrants"). These warrants were exercised on June 8, 2020, see Note 7. The relative fair value of the warrants along with the upfront Facility fee were treated as debt issue costs, as the facility has not been drawn on, assets to be amortized over the term of the loan. Total unamortized costs at October 31, 2020 and April 30, 2020 were $34,722 and $182,418 , respectively.

On March 6, 2019, in connection with entering into the Senior Secured Term Loans, the Company amended and restated the Credit Facility Agreement (the “Amended and Restated Facility Agreement”) and the Revolving Note. The Amended and Restated Facility Agreement provides among other things that the Company’s obligations thereunder are secured by a first priority lien in the Collateral, on a pari passu basis with the Lenders.

Term Loans

On March 6, 2019, the Company entered into two loan agreements (each a “Loan Agreement” and together, the “Loan Agreements”) with the Foundation, of which Mr. Leon Cooperman, a stockholder of the Company, is the trustee, and another stockholder of the Company (each a “Lender” and together, the “Lenders”). Each Loan Agreement provides for a $5,000,000 term loan (each a “Loan” and together, the “Loans”), evidenced by a term promissory note and security agreement (each a

19

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

“Term Note” and together, the “Term Notes”), for combined total proceeds of $10,000,000 million. The Company borrowed $5,000,000 from each Lender that day. The Term Notes bear interest at 12 % per annum and were to mature on September 6, 2020, subject to one 12-month extension upon the Company’s option, and upon payment of a 1 % one-time extension fee.

Pursuant to the Loan Agreements and the Term Notes, all future or contemporaneous indebtedness incurred by the Company, other than indebtedness expressly permitted by the Loan Agreements and the Term Notes, will be subordinated to the Loans.

Pursuant to the Loan Agreements, on March 6, 2019 the Company issued to each Lender warrants to purchase 100,000 shares of the Company’s common stock exercisable for five years from the date of issuance at the exercise price of $6.00 per share. The two warrants were deemed to have a combined relative fair value of $360,516 . The relative fair value along with closing costs of $33,693 were treated as debt discounts to be amortized over the term of the Loans. One Lender exercised 100,000 of these warrants (the "2019 Cooperman Warrants") on June 5, 2020, see Note 7.

On January 22, 2020, the Senior Secured Term Loans were cancelled and exchanged for convertible notes as discussed above. In connection with this transaction, the Company wrote off approximately $182,000 of unamortized debt issuance costs included in interest expense on the consolidated statements of operations as the transaction qualified as a debt extinguishment.

Note 7. Stockholders’ Equity

Preferred Stock

The Company is authorized to issue 1,000,000 shares of “blank check” preferred stock with designations, rights and preferences as may be determined from time to time by our Board of Directors. As of October 31, 2020 and April 30, 2020, we had no

Common Stock

The Company is authorized to issue 40,000,000 shares of common stock.

On August 31, 2020, the Company entered into an Equity Distribution Agreement (the “Agreement”) with Canaccord Genuity LLC (“Canaccord”), pursuant to which the Company may issue and sell from time to time, through Canaccord, up to $12,309,750 of shares of the Company’s common stock (the “Shares”). The Shares are being offered and sold pursuant to a prospectus supplement filed with the Securities and Exchange Commission on August 31, 2020. The purpose of this Agreement is to allow the Company to sell common stock that has been surrendered from executive officers and director vesting events to pay their portion of withholding taxes as well as to pay the Company the strike price of options upon cashless exercise. As of the date of this filing, 292,000 shares have been sold under the Agreement.

Sales of the Shares may be made by any method permitted by law deemed to be an “at-the-market” offering as defined in Rule 415 of the Securities Act of 1933, including without limitation sales made directly on or through The Nasdaq Global Market, the trading market for the Company’s common stock, on any other existing trading market in the United States for the Company’s common stock, or to or through a market maker. Canaccord may also sell the Shares by any other method permitted by law, including in privately negotiated transactions. Canaccord will use commercially reasonable efforts to sell on the Company’s behalf all of the Shares requested to be sold by the Company, consistent with its normal trading and sales practices, subject to the terms of the Agreement. Under the Agreement, Canaccord is entitled to compensation of 3 % of the gross proceeds from the sales of the Shares sold under the Agreement. The Company also reimbursed Canaccord for certain specified expenses, including the fees and disbursements of its legal counsel, in an amount of $50,000 . Total expenses for the offering, excluding compensation and reimbursement payable to Canaccord under the terms of the Agreement, was approximately $50,000 , which is included in general and administrative expense in the consolidated statement of operations.

During the three months ended October 31, 2020, the Company issued 502,412 shares of common stock upon the exercise of stock options for cash and received proceeds of $945,332 . As of October 31, 2020, approximately 36,000 shares of common stock were surrendered to the Company by the executive officers to pay their portion of withholding taxes for stock options exercised, and to pay the Company the strike price of options upon cashless exercise for a director; but were not yet sold through Canaccord. The Company did remit the withholding taxes on behalf of the executive officers for their stock option

20

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

exercises from the Company's operating bank account. As a result, upon sale of these shares through the Agreement approximately $350,000 will be received by the Company and credited to additional paid in capital.

During the three months ended October 31, 2020, the Company issued 22,339 shares of common stock upon the cashless exercise of 36,111 stock options.

During the three months ended October 31, 2020, the Company issued 132,109 shares of common stock upon the vesting of Restricted Stock Units (“RSUs”).

On September 14, 2020, after the closing price of our common stock was at least $10.725 over a 20 consecutive trading day period, the $10 million Convertible Notes (see Note 6) automatically converted into 1,398,602 shares of the Company’s common stock at a conversion price of $7.15 per share.

During the three months ended July 31, 2020, the Company issued 415,175 shares of common stock upon the exercise of stock options for cash and received proceeds of $1,269,982 .

During the three months ended July 31, 2020, the Company issued 192,049 shares of common stock upon the exercise of warrants for cash and received proceeds of $1,081,792 .

Restricted Stock

As of October 31, 2020 and 2019, there were 16,448 and 69,672 unvested shares of restricted common stock outstanding, respectively. Total unrecognized compensation expense related to the unvested shares as of October 31, 2020 and 2019 amounted to $49,125 and $249,000 respectively.

Restricted Stock Units

A summary of the Company’s RSU activity which were granted under the 2012 and 2018 Equity Incentive Plans during the six months ended October 31, 2020 is presented below:

| Restricted Stock Units | Number of Shares | Weighted Average Grant Price | ||||||||||||

| Unvested Balance Outstanding, April 30,2020 | $ | |||||||||||||

| Granted | ||||||||||||||

| Exercised | ||||||||||||||

| Forfeits | ( | |||||||||||||

| Vested | ( | |||||||||||||

| Expired | ||||||||||||||

| Unvested Balance Outstanding, October 31,2020 | $ | |||||||||||||

In connection with 169,043 RSU grants, the grant date fair value of these awards range from $6.95 to $12.78 per share and the awards vest annually over three years .

There were approximately 669,800 unvested RSUs as of October 31, 2020. Total unrecognized compensation expense related to the unvested RSUs is approximately $4.5 million which will be amortized over the remaining vesting periods. Included in this amount is approximately $1.8 million of total unrecognized compensation expense related to the $12 tranche of the executive RSU grant discussed below.

On February 4, 2020, the Compensation Committee approved a 375,000 RSU grant to executives under the Company’s 2018 Equity Incentive Plan. As modified on June 18, 2020, one-half of the RSUs vest four years from the grant date, if the executives are still employed by the Company on the vesting date and subject to accelerated vesting for all RSUs as follows: (i) if the closing price of the Company’s common stock is at least $9 for 20 consecutive trading days, 10 % of the RSUs will vest immediately; (ii) if the closing price of the Company’s common stock is at least $10 for 20 consecutive trading days, 25 % of the RSUs will vest immediately; and (iii) if the closing price of the Company’s common stock is at least $12 for 20 consecutive

21

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

trading days, all of the unvested RSUs will vest immediately. On the grant date, the closing price of the Company’s common stock on The Nasdaq Global Market was $9.49 per share. The Company determined that because the terms of the grant include both a market condition and a service condition that must be achieved simultaneously, the appropriate treatment under ASC 718 Stock-based Compensation is to amortize the fair market value over the longer of the explicit service period of four years and not the shorter of the derived service period of .64 years.

On August 31, 2020, the closing price of the Company’s common stock was at least $9 for 20 consecutive trading days, resulting in 10 % or 37,500 of the February 4, 2020 RSU grants to executives vesting immediately. Additionally, on September 2, 2020, the Company’s common stock was at least $10 for 20 consecutive trading days and 25 % or 93,750 of the RSUs granted vested immediately. On the grant date, the closing price of the Company's common stock on The Nasdaq Global Market was $9.49 per share. The accelerated amortization expense related to these transactions in the second quarter of fiscal year 2021 was approximately $1.2 million, for the vesting of these 131,250 RSUs, which is included in general and administrative expense in the consolidated statements of operations.

Warrants

A summary of the Company’s warrant activity during the six months ended October 31, 2020 is presented below:

| Warrants | Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | Aggregate Intrinsic Value | ||||||||||||||||||||||

| Balance Outstanding, April 30, 2020 | $ | $ | ||||||||||||||||||||||||

| Granted | $ | — | — | |||||||||||||||||||||||

| Exercised | ( | $ | — | — | ||||||||||||||||||||||

| Surrendered | $ | — | — | |||||||||||||||||||||||

| Expired | $ | — | — | |||||||||||||||||||||||

| Balance Outstanding, October 31, 2020 | $ | $ | ||||||||||||||||||||||||

| Exercisable, October 31, 2020 | $ | $ | ||||||||||||||||||||||||

| OUTSTANDING WARRANTS | EXERCISABLE WARRANTS | |||||||||||||||||||||||||||||||

| Exercise Price | Weighted Average Exercise Price | Outstanding No. of Warrants | Weighted Average Exercise Price | Weighted Average Remaining Life In Years | Exercisable No. of Warrants | |||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||||||||

On June 5, 2020, the Company, as an inducement to exercise, reduced by 5 % the exercise price of the common stock purchase warrants issued to The Leon and Toby Cooperman Family Foundation (the “Foundation”), of which Mr. Leon Cooperman, a stockholder of the Company, is the trustee. The warrants were issued on November 5, 2018 (the “2018 Cooperman Warrants”) and on March 5, 2019 (the “2019 Cooperman Warrants”). The 2018 Cooperman Warrants exercise price was reduced from $5.85 to $5.56 per share. The 2019 Cooperman Warrants exercise price was reduced from $6.00 to $5.70 per share. On June 8, 2020, the Foundation immediately exercised the 2018 and 2019 Cooperman Warrants paying the Company $1,081,792 and the Company issued 192,049 shares of common stock to the Foundation. The warrant modification and acceleration charge related to this transaction in the first quarter of fiscal year 2021 was approximately $26,000 .

Stock Incentive Plan and Stock Option Grants to Employees and Directors

22

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

On March 13, 2012, the Company adopted the Aspen Group, Inc. 2012 Equity Incentive Plan (the “2012 Plan”) that provides for the grant of 3,500,000 shares in the form of incentive stock options, non-qualified stock options, restricted shares, stock appreciation rights and RSUs to employees, consultants, officers and directors.

On December 13, 2018, the stockholders of the Company approved the Aspen Group, Inc. 2018 Equity Incentive Plan (the “2018 Plan”) that provides for the grant of 500,000 shares in the form of incentive stock options, non-qualified stock options, restricted shares, stock appreciation rights and RSUs to employees, consultants, officers and directors.

On December 30, 2019, the Company held its Annual Meeting of Shareholders at which the shareholders voted to amend the 2018 Plan to increase the number of shares of common stock available for issuance under the 2018 Plan from 500,000 to 1,100,000 shares.

As of October 31, 2020 and 2019, there were 27,560 and 194,286 shares remaining available for future issuance under the 2012 Plan and the 2018 Plan.

The Company estimates the fair value of share-based compensation utilizing the Black-Scholes option pricing model, which is dependent upon several variables such as the expected option term, expected volatility of the Company’s stock price over the expected term, expected risk-free interest rate over the expected option term and expected dividend yield rate over the expected option term. The Company believes this valuation methodology is appropriate for estimating the fair value of stock options granted to employees and directors which are subject to ASC Topic 718 requirements. These amounts are estimates and thus may not be reflective of actual future results, nor amounts ultimately realized by recipients of these grants. The Company recognizes compensation on a straight-line basis over the requisite service period for each award.

There were no The following table summarizes the assumptions the Company utilized to record compensation expense for stock options granted to employees during the period ended:

| October 31, 2020 | |||||

| Expected life (years) | n/a | ||||

| Expected volatility | n/a | ||||

| Risk-free interest rate | n/a | ||||

| Dividend yield | n/a | ||||

| Expected forfeiture rate | n/a | ||||

The Company utilized the simplified method to estimate the expected life for stock options granted to employees. The simplified method was used as the Company does not have sufficient historical data regarding stock option exercises. The expected volatility is based on historical volatility. The risk-free interest rate is based on the U.S. Treasury yields with terms equivalent to the expected life of the related option at the time of the grant. Dividend yield is based on historical trends. While the Company believes these estimates are reasonable, the compensation expense recorded would increase if the expected life was increased, a higher expected volatility was used, or if the expected dividend yield increased.

23

ASPEN GROUP, INC. AND SUBSIDIARIES

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

October 31, 2020

(Unaudited)

A summary of the Company’s stock option activity for employees and directors during the six months ended October 31, 2020, is presented below:

| Options | Number of Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term | Aggregate Intrinsic Value | ||||||||||||||||||||||

| Balance Outstanding, April 30, 2020 | $ | $ | ||||||||||||||||||||||||

| Granted | $ | — | — | |||||||||||||||||||||||

| Exercised | ( | $ | — | — | ||||||||||||||||||||||

| Forfeited | ( | $ | — | — | ||||||||||||||||||||||

| Expired | $ | — | — | |||||||||||||||||||||||

Balance Outstanding, October 31, 2020 | $ | $ | ||||||||||||||||||||||||

Exercisable, October 31, 2020 | $ | $ | ||||||||||||||||||||||||

| OUTSTANDING OPTIONS | EXERCISABLE OPTIONS | |||||||||||||||||||||||||||||||

| Exercise Price | Weighted Average Exercise Price | Outstanding No. of Options | Weighted Average Exercise Price | Weighted Average Remaining Life In Years | Exercisable No. of Options | |||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

$ | $ | $ | ||||||||||||||||||||||||||||||

| Options only | ||||||||||||||||||||||||||||||||

For the three months ended October 31, 2020, the Company recorded compensation expense of $142,397 , $1,678,622 and $10,529 , respectively, in connection with stock option, restricted stock units and restricted stock grants.