Table of Contents

As filed with the Securities and Exchange Commission on April 30, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Ireland | Trane Technologies plc | 98-0626632 | ||

| Delaware | Trane Technologies HoldCo Inc. | 85-0886257 | ||

| Ireland | Trane Technologies Financing Limited | N/A | ||

| Luxembourg | Trane Technologies Lux International Holding Company S.à r.l. | N/A | ||

| Delaware | Trane Technologies Americas Holding Corporation | 46-4716676 | ||

| Delaware | Trane Technologies Global Holding II Company Limited | 93-4260675 | ||

| Ireland | Trane Technologies Irish Holdings Unlimited Company | 98-1780224 | ||

| Delaware | Trane Technologies Company LLC | 13-5156640 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Exact Name of Registrant as Specified in Its Charter) | (I.R.S. Employer Identification Number) |

Trane Technologies plc

Trane Technologies HoldCo Inc.

Trane Technologies Financing Limited

Trane Technologies Lux International Holding Company S.à r.l.

Trane Technologies Americas Holding Corporation

Trane Technologies Global Holding II Company Limited

Trane Technologies Irish Holdings Unlimited Company

Trane Technologies Company LLC

c/o Trane Technologies plc

170/175 Lakeview Dr.

Airside Business Park

Swords, Co. Dublin Ireland

+(353) (1) 8953200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrants’ Principal Executive Offices)

Evan M. Turtz, Esq.

Senior Vice President, General Counsel and Secretary

c/o Trane Technologies Company LLC

800-E Beaty Street

Davidson, North Carolina 28036

(704) 655-4000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With copies to:

Keith M. Townsend

Zachary J. Davis

King & Spalding LLP

1180 Peachtree Street, NE

Suite 1600

Atlanta, Georgia 30309

(404) 572-4600

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ | |||

| Non-accelerated filer (Do not check if a smaller reporting company) |

☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

Table of Contents

PROSPECTUS

Trane Technologies plc

Debt Securities

Guarantees of Debt Securities

Ordinary Shares

Preferred Shares

Depositary Shares

Share Purchase Contracts

Share Purchase Units

Warrants

Trane Technologies HoldCo Inc.

Trane Technologies Financing Limited

Trane Technologies Lux International Holding

Company S.à r.l.

Trane Technologies Global Holding II Company Limited

Trane Technologies Irish Holdings Unlimited Company

Trane Technologies Americas Holding Corporation

Trane Technologies Company LLC

Debt Securities

Guarantees of Debt Securities

We may offer, issue and sell the types of securities set forth above from time to time, together, separately or in some combination. This prospectus describes some of the general terms that may apply to these securities. We will provide a prospectus supplement each time we offer, issue and sell any of these securities. The specific terms of any securities to be offered will be described in the related prospectus supplement. The prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before making an investment decision.

We may offer, issue and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

Our ordinary shares are listed on the New York Stock Exchange under the trading symbol “TT.”

Investing in our securities involves risks. Please read “Risk Factors” on page 7 of this prospectus, in any applicable prospectus supplement and the risk factors included in our periodic reports that we file with the Securities and Exchange Commission before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

April 30, 2024

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 23 | ||||

| 24 | ||||

| 38 | ||||

| DESCRIPTION OF SHARE PURCHASE CONTRACTS AND SHARE PURCHASE UNITS |

41 | |||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

i

Table of Contents

You should rely on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement or any applicable free writing prospectus. We have not authorized any person to provide you with any information other than the information contained in this prospectus, any prospectus supplement, any applicable free writing prospectuses and those documents incorporated by reference herein or therein. This prospectus and any applicable prospectus supplement or free writing prospectus do not constitute an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus and any such prospectus supplement or free writing prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. Neither the delivery of this prospectus or any prospectus supplement or free writing prospectus, nor any sale made hereunder or thereunder, implies that there has been no change in our affairs or that the information in this prospectus is correct as of any date after the date of this prospectus.

As used in this prospectus and any prospectus supplement, “we,” “our,” “us” and “Trane Technologies” mean Trane Technologies plc, an Irish public limited company, together with its consolidated subsidiaries, unless otherwise specified or the context otherwise requires.

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “Commission” or “SEC”), using a “shelf” registration process. Pursuant to this registration statement, we may offer, issue and sell securities as set forth on the cover page of this prospectus.

We may offer, issue and sell the securities from time to time, together, separately or in some combination. This prospectus describes some of the general terms that may apply to these securities. We will provide a prospectus supplement each time we offer, issue and sell any of these securities. The specific terms of any securities to be offered will be described in the related prospectus supplement. The prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the prospectus supplement.

In addition, we may prepare and deliver one or more “free writing prospectuses” to you in connection with any offering of securities under this prospectus. Any such free writing prospectus may contain additional information about us, our business, the offered securities, the manner in which such securities are being offered, our intended use of the proceeds from the sale of such securities, risks relating to our business or an investment in such securities, or other information.

This prospectus and certain of the documents incorporated by reference into this prospectus contain, and any accompanying prospectus supplement or free writing prospectus that we deliver to you may contain, summaries of information contained in documents that we have filed or will file as exhibits to our SEC filings. Such summaries do not purport to be complete, and are subject to, and qualified in their entirety by reference to, the actual documents filed with the SEC. You should read this prospectus and any applicable prospectus supplement or free writing prospectus, together with the additional information described under the heading “Where You Can Find More Information.”

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-3 with the SEC. This prospectus is part of the registration statement and does not contain all the information in the registration statement. You will find additional information about us in the registration statement. Any statement made in this prospectus concerning a contract or other document of ours is not necessarily complete, and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter. Each such statement is qualified in all respects by reference to the document to which it refers.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov and on our corporate website at www.tranetechnologies.com. Information on our website does not constitute part of this prospectus, and any references to this website or any other website are inactive textual references only.

Our ordinary shares are listed on the New York Stock Exchange (the “NYSE”) under the trading symbol “TT.” Our SEC filings are also available at the office of the NYSE located at 11 Wall Street, New York, New York 10005.

2

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC permits us to “incorporate by reference” the information contained in documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to be part of this prospectus and you should read the information with the same care that you read this prospectus. Later information that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus, and will be considered to be a part of this prospectus from the date those documents are filed. We have filed with the SEC, and incorporate by reference in this prospectus, the following documents:

| • | Trane Technologies’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on February 8, 2024; |

| • | Trane Technologies’ Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, as filed with the SEC on April 30, 2024; |

| • | Trane Technologies’ Definitive Proxy Statement on Schedule 14A, as filed with the SEC on April 26, 2024 (excluding any portions that were not incorporated by reference into Part III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023); |

| • | Trane Technologies’ Current Reports on Form 8-K, as filed with the SEC on January 10, 2024 and February 8, 2024; and |

| • | Trane Technologies’ Current Report on Form 8-K12B, filed with the SEC on July 1, 2009, which includes a description of Trane Technologies’ ordinary shares. |

All future filings that we make under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), until all the securities offered by this prospectus have been issued as described in this prospectus, are deemed incorporated into and part of this prospectus once filed. We are not, however, incorporating, in each case, any documents (or portions thereof) or information that we are deemed to furnish and not file in accordance with SEC rules. Any statement in this prospectus, in any prospectus supplement, or in any document incorporated by reference that is different from any statement contained in any later-filed document should be regarded as changed by that later statement. Once so changed, the earlier statement is no longer considered part of this prospectus or any prospectus supplement.

You may request by phone or in writing a copy of any of the materials incorporated (other than exhibits, unless the exhibits are themselves specifically incorporated) into this prospectus and we will provide to you these materials free of charge. Please make your request to Evan M. Turtz, Secretary, c/o Trane Technologies Company LLC, 800-E Beaty Street, Davidson, North Carolina 28036, telephone (704) 655-4000.

3

Table of Contents

This summary highlights selected information included or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before investing in our securities. You should read this entire prospectus, including the information incorporated by reference, before making an investment decision. See “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this prospectus.

Trane Technologies plc

Trane Technologies, a public limited company incorporated in Ireland in 2009, together with its consolidated subsidiaries, is a global climate innovator. We bring sustainable and efficient solutions to buildings, homes and transportation through our strategic brands Trane® and Thermo King®, and our environmentally responsible portfolio of products, services and connected intelligent controls. We generate revenue and cash primarily through the design, manufacture, sales and service of solutions for Heating, Ventilation and Air Conditioning (HVAC), transport refrigeration, and custom refrigeration solutions.

As an industry leader with an extensive global install base, our growth strategy includes expanding recurring revenue through services and rental options. Our unique business operating system, uplifting culture and highly engaged team around the world are also central to our earnings and cash flow growth.

Through our sustainability-focused strategy and purpose to boldly challenge what’s possible for a sustainable world, we meet critical needs and growing global demand for innovation that reduces greenhouse gas emissions while enabling healthier, efficient indoor environments and safe, reliable delivery of essential temperature-controlled cargo. We have announced certain defined sustainability commitments with a goal of achieving these commitments by 2030 (2030 Sustainability Commitments). Trane Technologies’ bold 2030 Sustainability Commitments have been verified by the Science Based Targets initiative (SBTi) and include our ‘Gigaton Challenge’ to reduce customer greenhouse gas emissions by a billion metric tons, ‘Leading by Example’ through carbon-neutral operations across our own footprint, and ‘Opportunity for All’ by building a diverse workforce reflective of our communities.

We operate under three reportable segments:

Americas

Our Americas segment innovates for customers in North America and Latin America. The Americas segment encompasses commercial heating, cooling and ventilation systems, building controls and solutions, and energy services and solutions; residential heating and cooling; and transport refrigeration systems and solutions.

EMEA

Our EMEA segment innovates for customers in the Europe, Middle East and Africa region. The EMEA segment encompasses heating, cooling and ventilation systems, services and solutions for commercial buildings and transport refrigeration systems and solutions.

Asia Pacific

Our Asia Pacific segment innovates for customers throughout the Asia Pacific region. The Asia Pacific segment encompasses heating, cooling and ventilation systems, services and solutions for commercial buildings and transport refrigeration systems and solutions.

4

Table of Contents

The principal executive office of Trane Technologies is located at 170/175 Lakeview Dr., Airside Business Park, Swords, Co. Dublin, Ireland, telephone +(353) (1) 8953200.

Trane Technologies HoldCo Inc.

Trane Technologies HoldCo Inc. (“Trane Holdco”), a corporation incorporated in Delaware in April 2020, is an indirect, wholly owned subsidiary of Trane Technologies.

The principal executive office of Trane Holdco is located at 800-E Beaty Street, Davidson, NC, 28036, telephone (704) 655-4000.

Trane Technologies Financing Limited

Trane Technologies Financing Limited (“TTFL”), an Irish private limited company incorporated in April 2018, is an indirect, wholly owned subsidiary of Trane Technologies.

The registered office of TTFL is located at 170/175 Lakeview Dr., Airside Business Park, Swords, Co. Dublin, Ireland, telephone +(353) (1) 8953200.

Trane Technologies Lux International Holding Company S.à r.l.

Trane Technologies Lux International Holding Company S.à r.l. (“Lux International”), a Luxembourg private limited liability company (société à responsabilité limitée) incorporated on November 20, 2013 and registered with the Luxembourg Register of Commerce and Companies (R.C.S. Luxembourg) under number B182.971, is an indirect, wholly owned subsidiary of Trane Technologies.

The registered office of Lux International is located 20 rue des Peupliers, L-2328 Luxembourg, telephone +(352) 28571620.

Trane Technologies Global Holding II Company Limited

Trane Technologies Global Holding II Company Limited (“TTGH”), a corporation incorporated in Delaware in November 2023, is an indirect, wholly owned subsidiary of Trane Technologies.

The principal executive office of TTGH is located at 800-E Beaty Street, Davidson, NC, telephone (704) 655-4000.

Trane Technologies Irish Holdings Unlimited Company

Trane Technologies Irish Holdings Unlimited Company (“Irish Holdings”), an Irish private unlimited company incorporated in November 1998, is a wholly owned subsidiary of Trane Technologies.

The registered office of Irish Holdings is located at 170/175 Lakeview Drive, Airside Business Park, Swords Co. Dublin, K67 Ew96, Ireland, telephone +(353) (1) 8953200.

Trane Technologies Americas Holding Corporation

Trane Technologies Americas Holding Corporation (“TTAHC”), a corporation incorporated in Delaware, was formerly a Kentucky limited liability company until it was incorporated under the laws of Delaware on November 15, 2023 pursuant to a domestication transaction and is an indirect, wholly owned subsidiary of Trane Technologies.

5

Table of Contents

The principal executive office of TTAHC is located at 800-E Beaty Street, Davidson, NC, telephone (704) 655-4000.

Trane Technologies Company LLC

Trane Technologies Company LLC (“TTC”), a limited liability company formed in Delaware in May 2020 upon conversion from a Texas limited liability company, is an indirect, wholly owned subsidiary, of Trane Technologies.

The principal executive office of TTC is located at 800-E Beaty Street, Davidson, NC, 28036, telephone (704) 655-4000.

6

Table of Contents

Investment in any securities offered pursuant to this prospectus involves risks. Before acquiring any such securities, you should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and each subsequently filed Quarterly Report on Form 10-Q, the other information contained or incorporated by reference in this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement.

7

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in or incorporated by reference in this prospectus, other than purely historical information, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “intend,” “strategy,” “plan,” “potential,” “predict,” “target,” “may,” “might” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements.

Forward-looking statements may relate to such matters as projections of revenue, margins, expenses, tax provisions, earnings, cash flows, benefit obligations, share or debt repurchases or other financial items; any statements of the plans, strategies and objectives of management for future operations, including those relating to any statements concerning expected development, performance or market share relating to our products and services; any statements regarding future economic conditions or our performance; any statements regarding our sustainability and Environmental, Social, and Governance (ESG) commitments; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. These statements are based on currently available information and our current assumptions, expectations and projections about future events. While we believe that our assumptions, expectations and projections are reasonable in view of the currently available information, you are cautioned not to place undue reliance on our forward-looking statements. You are advised to review any further disclosures we make on related subjects in materials we file with or furnish to the SEC. Forward-looking statements speak only as of the date they are made and are not guarantees of future performance. They are subject to future events, risks and uncertainties - many of which are beyond our control - as well as potentially inaccurate assumptions, that could cause actual results to differ materially from our expectations and projections. We do not undertake to update any forward-looking statements.

Factors that might affect our forward-looking statements include, among other things:

| • | overall economic, political and business conditions in the markets in which we operate including recessions, economic downturns, price instability, slow economic growth and social and political instability; |

| • | impacts of global health crises, epidemics, pandemics, or other contagious outbreaks on our business operations, financial results and financial position and on the world economy; |

| • | commodity and raw material shortages, supply chain risks and price increases; |

| • | national and international conflict, including war, civil disturbances and terrorist acts, and other geopolitical hostilities and tensions; |

| • | trade protection measures such as import or export restrictions and requirements, the imposition of tariffs and quotas or revocation or material modification of trade agreements; |

| • | competitive factors in the markets in which we compete; |

| • | the development, commercialization and acceptance of new and enhanced products and services; |

| • | attracting and retaining talent; |

| • | work stoppages, union negotiations, labor disputes and similar issues; |

| • | other capital market conditions, including availability of funding sources, interest rate fluctuations and other changes in borrowing costs; |

| • | currency exchange rate fluctuations, exchange controls and currency devaluations; |

8

Table of Contents

| • | the outcome of any litigation, governmental investigations, claims or proceedings; |

| • | risks and uncertainties associated with the asbestos-related bankruptcy for our deconsolidated subsidiaries Aldrich Pump LLC and Murray Boiler LLC; |

| • | the impact of potential information technology system failures, vulnerabilities, data security breaches or other cybersecurity issues; |

| • | evolving data privacy and protection laws; |

| • | intellectual property infringement claims and the inability to protect our intellectual property rights; |

| • | changes in laws and regulations; |

| • | climate change, changes in weather patterns, natural disasters and seasonal fluctuations; |

| • | national, regional and international regulations and policies associated with climate change and the environment; |

| • | the outcome of any income tax audits or settlements; |

| • | the strategic acquisition or divestiture of businesses, product lines and joint ventures; |

| • | impairment of our goodwill, indefinite-lived intangible assets and/or our long-lived assets; and |

| • | changes in tax laws and requirements (including tax rate changes, new tax laws, new and/or revised tax law interpretations and any legislation that may limit or eliminate potential tax benefits resulting from our incorporation in a non-U.S. jurisdiction, such as Ireland). |

Some of the significant risks and uncertainties that could cause actual results to differ materially from our expectations and projections are described more fully in the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and each subsequently filed Quarterly Report on Form 10-Q, the other information contained or incorporated by reference in this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement. You should read that information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K, and each subsequently filed Quarterly Report on Form 10-Q, and our Consolidated Financial Statements and related notes in our most recent Annual Report on Form 10-K, and each subsequently filed Quarterly Report on Form 10-Q.

9

Table of Contents

Except as may be otherwise set forth in the applicable prospectus supplement accompanying this prospectus, we plan to add the net proceeds we receive from sales of the securities offered by this prospectus to our general funds and to use the funds for general corporate purposes. These could include, but are not limited to, capital expenditures, the repayment of debt, investment in subsidiaries, additions to working capital, the repurchase, redemption or retirement of securities, including ordinary shares, acquisitions and other business opportunities.

10

Table of Contents

DESCRIPTION OF THE DEBT SECURITIES

The following description of debt securities sets forth certain general terms and provisions of the debt securities which may be offered hereunder. This summary does not contain all of the information that you may find useful.

As used herein, “Trane Parent” refers to Trane Technologies plc and its successors and, in respect of a series of the debt securities, “Guarantors” mean, collectively, (a)(i) each person named as a “Guarantor” pursuant to the applicable prospectus supplement and (ii) Trane Parent, in the case of debt securities issued by Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC or TTC in each case until such person ceases to be a Guarantor pursuant to the terms of the indenture, and (b) any successor company thereof that shall have become a Guarantor pursuant to the applicable provisions of the indenture.

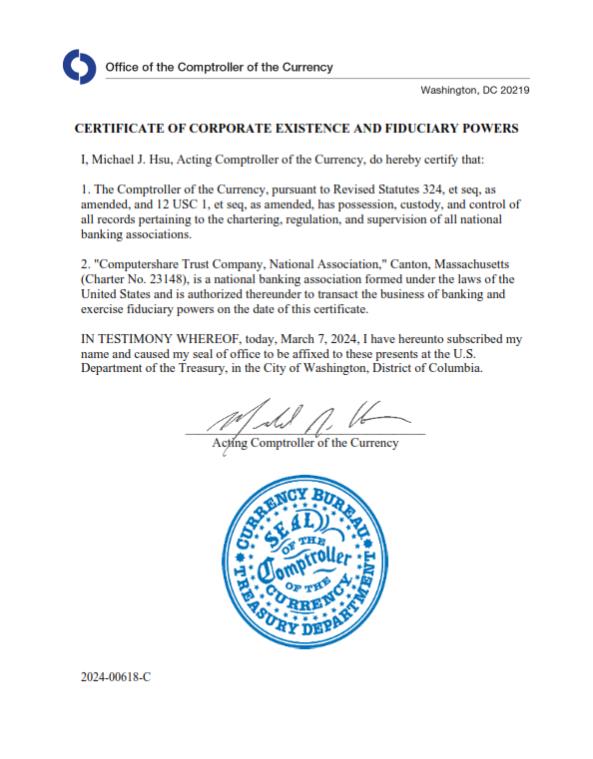

Under this prospectus, debt securities issued by Trane Parent, Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC or TTC (as applicable, the “Issuer”) will be offered. The debt securities offered will be issued under an indenture (as supplemented, the “indenture”) to be entered into by and among Trane Parent, Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC, TTC and Computershare Trust Company, N.A., as trustee.

Debt securities issued by Trane Parent may be guaranteed by certain subsidiaries of Trane Parent, including Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC and/or TTC, as may be specified in the applicable prospectus supplement. Debt securities issued by Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC or TTC, as applicable, will be guaranteed by Trane Parent and may also be guaranteed by certain other subsidiaries of Trane Parent not acting as the Issuer, including Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC and/or TTC, as may be specified in the applicable prospectus supplement.

When we offer to sell a particular series of debt securities, we will describe the specific terms and conditions of the series in a prospectus supplement. We will also indicate in the applicable prospectus supplement whether the general terms and conditions described in this prospectus apply to the series of debt securities. In addition, the terms and conditions of the debt securities of a series may be different in one or more respects from the terms and conditions described below. If so, those differences will be described in the applicable prospectus supplement and will supersede this prospectus.

The following description only summarizes the terms of the indenture and the debt securities. For more information you should read the indenture. In addition, the following description is qualified in all respects by reference to the actual text of the indenture and the forms of the debt securities.

General

Trane Parent, Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC and TTC may issue debt securities either separately, or together with, or upon the conversion of or in exchange for, other securities. The debt securities will be issued in one or more series under the indenture.

The trustee for each series of debt securities will be Computershare Trust Company, N.A., unless otherwise specified in the applicable prospectus supplement.

The indenture does not limit the amount of debt securities that may be issued and provides that debt securities may be issued thereunder from time to time in one or more series.

You should review the prospectus supplement for the following terms of the series of debt securities being offered:

| • | the Issuer of such series of debt securities; |

11

Table of Contents

| • | the designation, aggregate principal amount and authorized denominations of such series of debt securities; |

| • | whether the debt securities rank as senior debt or subordinated debt and the terms of any subordination; |

| • | the purchase price of such series of debt securities; |

| • | the date or dates on which such series of debt securities will mature; |

| • | the rate or rates per annum, if any (which may be fixed or variable), at which the debt securities of such series will bear interest or the method by which such rate or rates will be determined; |

| • | the dates on which the interest will be payable and the record dates for payment of interest, if any; |

| • | the coin or currency in which payment of the principal of (and premium, if any, on) and interest, if any, on such series of debt securities will be payable; |

| • | the terms of any mandatory or optional redemption (including any sinking fund) or any obligation of us to repurchase such series of debt securities; |

| • | whether such series of debt securities are to be issued in whole or in part in the form of one or more temporary or permanent global notes and, if so, the identity of the depositary, if any, for such note or notes; |

| • | the terms, if any, upon which such series of debt securities may be convertible into or exchangeable for other securities; |

| • | whether such series of debt securities will be guaranteed by any person other than as identified in this prospectus; |

| • | any special tax implications of such series of debt securities; |

| • | whether the debt securities of the series will be secured by any collateral and, if so, the terms and conditions upon which those debt securities will be secured and, if applicable, upon which those liens may be subordinated to other liens securing other indebtedness of us or of any guarantor; |

| • | any addition to or change or deletion of any event of default or any covenant specified in the indenture; and |

| • | any other additional provisions or specific terms which may be applicable to that series of debt securities. |

Unless otherwise indicated in the prospectus supplement, the debt securities will be issued only in fully registered form without coupons in denominations of $2,000 or multiples of $1,000.

The debt securities may be issued as discounted debt securities (bearing no interest or interest at a rate which at the time of issuance is below market rates) to be sold at a substantial discount below their stated principal amount. Federal income tax consequences and other special considerations applicable to any of these discounted debt securities will be described in the applicable prospectus supplement.

The indenture provides that each holder of debt securities offered pursuant to this prospectus consents to the Issuer or any Guarantor (as defined in “—Guarantees” below) applying to a court of competent jurisdiction for an order sanctioning, approving, consenting to or confirming a reduction in any of its share capital accounts including, without limitation, by re-characterizing any sum standing to the credit of an undenominated capital account as a distributable reserve.

Guarantees

Under this prospectus, debt securities issued by Trane Parent, Trane Holdco, TTFL, Lux International TTGH, Irish Holdings, TTAHC and/or TTC, as the case may be, will be offered. Debt securities issued by Trane

12

Table of Contents

Parent may be guaranteed by certain subsidiaries of Trane Parent, including Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC and/or TTC, as may be specified in the applicable prospectus supplement. Debt securities issued by Trane Holdco, TTFL, Lux International, TTGH, Irish Holdings, TTAHC or TTC, as applicable, will be guaranteed by Trane Parent and may also be guaranteed by certain other subsidiaries of Trane Parent not acting as the Issuer, including Trane Holdco, Lux International, TTGH, Irish Holdings, TTAHC and/or TTC, as may be specified in the applicable prospectus supplement.

The guarantees of the debt securities of any series will be structurally subordinated to all the liabilities of the subsidiaries of Trane Parent that are not themselves Guarantors or the Issuer of such series.

The obligations of any Guarantor under its guarantee will be limited as necessary to prevent such guarantee from constituting a fraudulent conveyance or fraudulent transfer under applicable law.

Conversion and Exchange

The terms, if any, on which debt securities of any series are convertible into or exchangeable for ordinary shares, preferred shares, other debt securities or any other securities will be set forth in the related prospectus supplement. The terms may include provisions for conversion or exchange, either mandatory, at the option of the holders, the Issuer (if other than Trane Parent) or Trane Parent.

Registration of Transfer and Exchange

Subject to the terms of the indenture and the limitations applicable to global securities, debt securities may be transferred or exchanged at the corporate trust office of the trustee or at any other office or agency maintained by the Issuer for that purpose. No service charge will be made for any registration of transfer or exchange of the debt securities, but the Issuer may require a payment by the holder to cover any tax or other governmental charge. The Issuer will not be required to register the transfer of or exchange debt securities of any series:

| • | during a period beginning at the opening of business 15 days before the day of mailing of a notice of redemption of securities of that series selected for redemption; or |

| • | selected for redemption in whole or in part, except the unredeemed portion of any debt security being redeemed in part. |

Payment

Unless otherwise indicated in the applicable prospectus supplement, principal, interest and any premium on the debt securities will be paid at the place or places that the Issuer will designate for such purposes. However, the Issuer, at its option, may make interest payments by check mailed to persons in whose names the debt securities are registered. Unless otherwise indicated in the applicable prospectus supplement, payment of interest on a debt security that is payable and is punctually paid or duly provided for on any interest payment date will be made to the person in whose name that debt security is registered at the close of business on the regular record date for that interest payment. The Issuer will pay the principal of (and premium, if any, on) registered debt securities only against surrender of those debt securities.

Global Notes

The debt securities of a series may be issued in whole or in part in the form of one or more global notes that will be deposited with or on behalf of a depositary located in the United States identified in the prospectus supplement relating to the applicable series.

The specific terms of the depositary arrangement with respect to any debt securities of a series will be described in the prospectus supplement relating to the series. The following provisions are expected to apply to all depositary arrangements.

13

Table of Contents

Unless otherwise specified in an applicable prospectus supplement, debt securities which are to be represented by a global note to be deposited with or on behalf of a depositary will be represented by a global note registered in the name of such depositary or its nominee. Upon the issuance of a global note in registered form, the depositary for the global note will credit, on its book-entry registration and transfer system, the principal amounts of the debt securities represented by the global note to the accounts of institutions that have accounts with the depositary or its nominee (“participants”). The accounts to be credited shall be designated by the underwriters or agents of the debt securities or by the Issuer, if the debt securities are offered and sold directly by the Issuer. Ownership of beneficial interests in the global notes will be limited to participants or persons that may hold interests through participants. Ownership of beneficial interests by participants in the global notes will be shown on, and the transfer of that ownership interest will be effected only through, records maintained by the depositary or its nominee for the global notes. Ownership of beneficial interests in global notes by persons that hold the beneficial interests through participants will be shown on, and the transfer of that ownership interest within such participant will be effected only through, records maintained by the participant.

So long as the depositary for a global note in registered form, or its nominee, is the registered owner of the global note, the depositary or the nominee, as the case may be, will be considered the sole owner or holder of the debt securities represented by the global note for all purposes under the indenture. Except as described below, owners of beneficial interests in the global notes will not be entitled to have debt securities of the series represented by the global notes registered in their names, will not receive or be entitled to receive physical delivery of debt securities of the series in definitive form and will not be considered the owners or holders thereof under the indenture.

Payment of principal of (and premium, if any, on) and interest, if any, on debt securities registered in the name of or held by a depositary or its nominee will be made to the depositary or its nominee, as the case may be, as the registered owner or the holder of the global note representing the debt securities. The Issuer will not, nor will the Guarantors, the trustee, any paying agent or the security registrar for the debt securities have any responsibility or liability for any aspect of the records relating to or payments made on account of beneficial ownership interests in a global note for the debt securities or for maintaining, supervising or reviewing any records relating to the beneficial ownership interests.

It is expected that the depositary for debt securities of a series, upon receipt of any payment of principal, premium or interest in respect of a permanent global note, will credit immediately participants’ accounts with payments in amounts proportionate to their respective beneficial interests in the principal amount of the global note as shown on the records of the depositary. It is also expected that payments by participants to owners of beneficial interests in the global note held through the participants will be governed by customary practices. Each person owning a beneficial interest in a global security must rely on the procedures of the depositary (and, if such person is not a participant, on procedures of the participant through which such person owns its interest) to exercise any rights of a holder under the indenture.

A global note may not be transferred except as a whole by the depositary for the global note to a nominee of the depositary or by a nominee of the depositary to the depositary or another nominee of the depositary or by the depositary or any nominee to a successor of the depositary or a nominee of the successor. If a depositary for debt securities of a series is at any time unwilling or unable to continue as a depositary and a successor depositary is not appointed by us within ninety days, the Issuer will issue debt securities in definitive registered form in exchange for the global note or notes representing the debt securities. In addition, the Issuer may at any time and in its sole discretion determine not to have any debt securities in registered form represented by one or more global notes and, in that event, the Issuer will issue debt securities in definitive form in exchange for the global note or notes representing the debt securities.

14

Table of Contents

Certain Covenants of the Debt Securities

The debt securities will include the following covenants:

Limitation on Liens. Unless otherwise indicated in the prospectus supplement relating to a series of debt securities, Trane Parent will not, and will not permit any restricted subsidiary to, create, assume or guarantee any indebtedness for money borrowed secured by any mortgage, lien, pledge, charge or other security interest or encumbrance of any kind (hereinafter referred to as a “mortgage” or “mortgages”) on any principal property of Trane Parent or a restricted subsidiary or on any shares or funded indebtedness of a restricted subsidiary (whether such principal property, shares or funded indebtedness are now owned or hereafter acquired) without, in any such case, effectively providing concurrently with the creation, assumption or guaranteeing of such indebtedness that the debt securities (together, if Trane Parent shall so determine, with any other indebtedness then or thereafter existing, created, assumed or guaranteed by Trane Parent or such restricted subsidiary ranking equally with the debt securities) shall be secured equally and ratably with (or prior to) such indebtedness. The indenture excludes, however, from the foregoing any indebtedness secured by a mortgage (including any extension, renewal or replacement, or successive extensions, renewals or replacements, of any mortgage hereinafter specified or any indebtedness secured thereby, without increase of the principal of such indebtedness or expansion of the collateral securing such indebtedness):

| 1) | on property, shares or funded indebtedness of any Person existing at the time such Person becomes a restricted subsidiary; |

| 2) | on property existing at the time of acquisition of such property, or to secure indebtedness incurred for the purpose of financing the purchase price of such property or improvements or construction thereon, which indebtedness is incurred prior to, at the time of or within 360 days after the later of such acquisition, the completion of such construction or the commencement of commercial operation of such property; provided, however, that in the case of any such acquisition, construction or improvement the mortgage shall not apply to any property previously owned by Trane Parent or a restricted subsidiary, other than any previously unimproved real property on which the property is constructed or the improvement is located; |

| 3) | on property, shares or funded indebtedness of a Person existing at the time such Person is merged into or consolidated with Trane Parent or a restricted subsidiary, or at the time of a sale, lease or other disposition of the properties of a corporation as an entirety or substantially as an entirety to Trane Parent or a restricted subsidiary; |

| 4) | on property of a restricted subsidiary to secure indebtedness of such restricted subsidiary to Trane Parent or another restricted subsidiary; |

| 5) | on property of Trane Parent or property of a restricted subsidiary in favor of the United States or any State thereof, Luxembourg or the jurisdiction of organization of Trane Parent, or any department, agency or instrumentality or political subdivision of the United States or any State thereof, Luxembourg or the jurisdiction of organization of Trane Parent, to secure partial, progress, advance or other payments pursuant to any contract or statute or to secure any indebtedness incurred for the purpose of financing all or any part of the purchase price or the cost of constructing or improving the property subject to such mortgage; or |

| 6) | existing at the date of the indenture; |

provided, however, that any mortgage permitted by any of clauses (1), (2), (3) and (5) above shall not extend to or cover any property of Trane Parent or such restricted subsidiary, as the case may be, other than the property specified in such clauses and improvements to that property.

Notwithstanding the above, Trane Parent or any restricted subsidiary may create, assume or guarantee secured indebtedness for money borrowed which would otherwise be prohibited in an aggregate amount which, together with all other such indebtedness for money borrowed of Trane Parent and its restricted subsidiaries and

15

Table of Contents

the attributable debt of Trane Parent and its restricted subsidiaries in respect of sale and leaseback transactions (as defined below) existing at such time (other than sale and leaseback transactions entered into prior to the date of the indenture and sale and leaseback transactions the proceeds of which have been applied in accordance with the indenture), does not at the time exceed 10% of the shareholders’ equity in Trane Parent and its consolidated subsidiaries, as shown on the audited consolidated balance sheet contained in the latest annual report to shareholders of Trane Parent.

“attributable debt” means, as of any particular time, the lesser of (i) the fair value of the property subject to the applicable sale and leaseback transaction (as determined by the board of directors of Trane Parent) and (ii) the then present value (discounted at a rate equal to the weighted average of the rate of interest on all securities issued by the applicable Issuer then issued and outstanding under the indenture, compounded semi-annually) of the total net amount of rent required to be paid under such lease during the remaining term thereof (excluding any renewal term unless the renewal is at the option of the lessor) or, if earlier, until the earliest date on which the lessee may terminate such lease upon payment of a penalty (in which case the obligation of the lessee for rental payments shall include such penalty). The net amount of rent required to be paid for any such period shall be the aggregate amount of the rent payable by the lessee with respect to such period after excluding amounts required to be paid on account of, or measured or determined by, any variable factor, including, without limitation, the cost-of-living index and costs of maintenance and repairs, insurance, taxes, assessments, water rates and similar charges and after excluding any portion of rentals based on a percentage of sales made by the lessee. In the case of any lease which is terminable by the lessee upon the payment of a penalty, such net amount shall also include the amount of such penalty, but no rent shall be considered as required to be paid under such lease subsequent to the first date upon which it may be so terminated;

“mortgage” means, on any specified property, any mortgage, lien, pledge, charge or other security interest or encumbrance of any kind in respect of such property;

“Person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof or any other entity; and

“shareholders’ equity in Trane Parent and its consolidated subsidiaries” means the share capital, share premium, contributed surplus and retained earnings of Trane Parent and its consolidated subsidiaries, excluding the cost of shares of Trane Parent held by its affiliates, all as determined in accordance with United States generally accepted accounting principles.

Limitation on Sale and Leaseback Transactions. Unless otherwise indicated in the prospectus supplement relating to a series of debt securities, Trane Parent will not, and will not permit any restricted subsidiary to, enter into any sale and leaseback transactions (which are defined in the indenture to exclude leases expiring within three years of making, leases between Trane Parent and a restricted subsidiary or between restricted subsidiaries and any lease of a part of a principal property which has been sold, for use in connection with the winding up or termination of the business conducted on such principal property), unless (a) Trane Parent or such restricted subsidiary would be entitled to incur indebtedness secured by a mortgage on such principal property without equally and ratably securing the debt securities or (b) an amount equal to the fair value of the principal property so leased (as determined by the board of directors of Trane Parent) is applied within one year (i) to the retirement (other than by payment at maturity or pursuant to mandatory sinking, purchase or analogous fund or prepayment provision) of (x) the debt securities or (y) other funded indebtedness of Trane Parent or any restricted subsidiary ranking on a parity with the debt securities, provided, however, that the amount to be applied to the retirement of any funded indebtedness as provided under this clause (i) shall be reduced by (A) the principal amount of any debt securities delivered within 360 days after such sale or transfer to the trustee for the debt securities of such series for retirement and cancellation and (B) the principal amount of other funded indebtedness ranking on parity with the debt securities voluntarily retired by Trane Parent within 360 days after such sale or transfer; or (ii) to purchase, improve or construct principal properties, provided that if only a portion of such proceeds is

16

Table of Contents

designated as a credit against such purchase, improvement or construction, Trane Parent shall apply an amount equal to the remainder as provided in (i) above.

Restrictions Upon Merger and Sales of Assets. The Issuer of any series of debt securities shall not consolidate, amalgamate or merge with or into any other Person (whether or not affiliated with such Issuer) and such Issuer or its successor or successors shall not be a party or parties to successive consolidations, amalgamations or mergers and such Issuer shall not sell, convey or lease all or substantially all of its property to any other Person (whether or not affiliated with such Issuer) authorized to acquire and operate the same, unless (i) upon any such consolidation, amalgamation, merger, sale, conveyance or lease, the due and punctual payment of the principal of (and premium, if any, on) and interest, if any, on all of the debt securities of such series, according to their tenor, and the due and punctual performance and observance of all of the covenants and conditions of the indenture to be performed by such Issuer shall be expressly assumed, by supplemental indenture reasonably satisfactory in form to the trustee for such series of the debt securities, executed and delivered to each such trustee by the Person (if other than such Issuer) formed by such consolidation or amalgamation, or into which such Issuer shall have been merged, or by the Person which shall have acquired or leased such property, and (ii) such Person shall be a solvent corporation, partnership, limited liability company, trust or any other entity organized under the laws of the United States of America or a State thereof or the District of Columbia, any Member State of the European Union (the “EU”), the United Kingdom, Cayman Islands, British Virgin Islands, Gibraltar, the British Crown Dependencies, any member country of the Organisation for Economic Co-operation and Development, or any political subdivision of any of the foregoing. Such Issuer will not so consolidate, amalgamate or merge, or make any such sale, lease or other conveyance, and such Issuer will not permit any other Person to merge into it, unless immediately after the proposed consolidation, amalgamation, merger, sale, lease or other conveyance, and after giving effect thereto, no default in the performance or observance by such Issuer or such successor Person, as the case may be, of any of the terms, covenants, agreements or conditions contained in the indenture with respect to the debt securities shall have occurred and be continuing.

If upon any such consolidation, amalgamation, merger, sale, conveyance or lease, any principal property or any shares or funded indebtedness of any restricted subsidiary would become subject to any mortgage (other than a mortgage to which such principal property or such shares of stock or funded indebtedness of such restricted subsidiary may become subject as provided under “—Limitations on Liens” without equally and ratably securing the notes) (the “Triggering Mortgage”), Trane Parent will secure the due and punctual payment of the principal of (and premium, if any, on) and interest, if any, on the debt securities (together with, if Trane Parent shall so determine, any other indebtedness of or guarantee by Trane Parent or such restricted subsidiary ranking equally with the debt securities) by a mortgage on such principal property or such shares of stock or funded indebtedness of such restricted subsidiary, the lien of which will rank prior to the lien of such Triggering Mortgage.

Each Guarantor, if any, of any series of debt securities shall not consolidate, amalgamate or merge with or into any other Person or corporations (whether or not affiliated with such Guarantor) and such Guarantor and its successor or successors shall not be a party or parties to successive consolidations, amalgamations or mergers and such Guarantor shall not sell, convey or lease all or substantially all of its property to any other Person (whether or not affiliated with such Guarantor) authorized to acquire and operate the same, unless (i) upon any such consolidation, amalgamation, merger, sale, conveyance or lease, the performance of the obligations under the guarantee of such Guarantor, and the due and punctual performance and observance of all of the covenants and conditions of the indenture to be performed by such Guarantor shall be expressly assumed, by supplemental indenture reasonably satisfactory in form to the trustee for each series of the debt securities, executed and delivered to each such trustee by the Person (if other than the Issuer or a Guarantor for such series) formed by such consolidation or amalgamation, or into which such Guarantor shall have been merged, or by the Person which shall have acquired or leased such property, and (ii) such Person shall be a solvent corporation, partnership, limited liability company, trust or any other entity organized under the laws of the United States of America or a State thereof or the District of Columbia, any Member State of the EU, the United Kingdom, Cayman Islands, British Virgin Islands, Gibraltar, the British Crown Dependencies, any member country of the

17

Table of Contents

Organisation for Economic Co-operation and Development, or any political subdivision of any of the foregoing. Furthermore, such Guarantor will not so consolidate, amalgamate or merge, or make any such sale, lease or other conveyance, and such Guarantor will not permit any other Person to merge into it, unless immediately after the proposed consolidation, amalgamation, merger, sale, lease or other conveyance, and after giving effect thereto, no default in the performance or observance by such Guarantor or such successor Person, as the case may be, of any of the terms, covenants, agreements or conditions in respect of the debt securities contained in the indenture or the guarantee of such Guarantor shall have occurred and be continuing.

Certain Definitions. The term “funded indebtedness” means indebtedness created, assumed or guaranteed by a person for money borrowed which matures by its terms, or is renewable by the borrower to a date, more than one year after the date of its original creation, assumption or guarantee.

The term “principal property” means any manufacturing plant or other manufacturing facility of Trane Parent or any restricted subsidiary, which plant or facility is located within the United States, except any such plant or facility which the board of directors of Trane Parent by resolution declares is not of material importance to the total business conducted by Trane Parent and its restricted subsidiaries.

The term “restricted subsidiary” means any subsidiary which owns a principal property excluding, however, any entity the greater part of the operating assets of which are located, or the principal business of which is carried on, outside the United States.

The term “subsidiary” means any corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust or any other entity of which at least a majority of the outstanding stock or equity interests having voting power under ordinary circumstances to elect a majority of the board of directors or similar body of said entity shall at the time be owned by Trane Parent or by Trane Parent and one or more subsidiaries or by one or more subsidiaries of Trane Parent.

Events of Default

As to each series of debt securities, an event of default is defined in the indenture as being any:

| • | default in payment of any interest on any debt security of such series when it becomes due and payable which continues for 30 days (subject to the deferral of any interest payment in the case of an extension period); |

| • | default in payment of any principal of (or premium, if any, on) any debt security of such series when due either at its stated maturity date, upon redemption, upon acceleration or otherwise; |

| • | default in payment of any sinking fund installment, when and as due by the terms of a note of such series, and continuance of such default for a period of 30 days; |

| • | default in performance of any other covenant of the Issuer or any Guarantor of such series in the indenture (other than a covenant included solely for the benefit of debt securities of another series) which continues for 90 days after receipt of written notice; |

| • | certain events of bankruptcy, insolvency or reorganization relating to the Issuer of such series and, if the debt securities of that series are guaranteed by one or more Guarantors, certain events of bankruptcy, insolvency or reorganization relating to any such Guarantors; |

| • | scenario in which the debt securities of that series are guaranteed by one or more Guarantors, a guarantee of the debt securities of such series shall for any reason cease to be, or shall for any reason be asserted in writing by the Issuer or the Guarantors not to be, in full force and effect and enforceable in accordance with its terms except to the extent contemplated by the indenture and such guarantee; or |

| • | other events of default specified in or pursuant to a board resolution or officer’s certificate or in a supplemental indenture. |

18

Table of Contents

The indenture provides that the trustee may withhold notice to the holders of debt securities of such series of any default (except in payment of principal, premium, if any, or interest, if any, on such series or in payment of any sinking fund installment on such series) if the trustee considers it is in the interest of such holders to do so.

Holders of the debt securities of any series may not enforce the indenture or the debt securities of such series except as provided in the indenture. In case an event of default (other than a default resulting from bankruptcy, insolvency or reorganization) shall occur and be continuing with respect to the debt securities of any series, the trustee or the holders of not less than 25% in aggregate principal amount of the debt securities then outstanding of such series may declare the principal amount on all the debt securities of such series (or, if the debt securities of that series were issued at a discount, such portion of the principal as may be specified in the terms of that series) to be due and payable. If an event of default results from bankruptcy, insolvency or reorganization, the principal amount of all the debt securities of that series (or, if the debt securities of that series were issued at a discount, such portion of the principal as may be specified in the terms of that series) will automatically become due and payable. Any event of default with respect to the debt securities of any series (except defaults in payment of principal of (or premium, if any, on) or interest, if any, on the debt securities of such series or a default in respect of a covenant or provision that cannot be modified without the consent of the holder of each outstanding security of such series) may be waived by the holders of at least a majority in aggregate principal amount of the debt securities of that series then outstanding.

Subject to the provisions of the indenture relating to the duties of the trustee in case an event of default shall occur and be continuing, the trustee is under no obligation to exercise any of the rights or powers under such indenture at the request, order or direction of any of the holders of debt securities, unless such holders shall have offered to the trustee security or indemnity reasonably satisfactory to it. Subject to such provisions for the indemnification of the trustee and certain limitations contained in the indenture, the holders of a majority in principal amount of the debt securities of any series then outstanding shall have the right to direct the time, method and place of conducting any proceeding for any remedy available to the trustee, or exercising any trust or power conferred on the trustee, with respect to the debt securities of such series. In respect of each series of debt securities, Trane Parent is required annually to deliver to the trustee an officer’s certificate stating whether or not the signers have knowledge of any default in the performance by each of the Issuer and any Guarantors of the covenants of the indenture. In addition, promptly (and in any event within five business days) upon Trane Parent becoming aware of the occurrence of any default or event of default in respect of any series of debt securities, Trane Parent is required to deliver to the trustee an officer’s certificate setting forth the details of such default or event of default and the actions which Trane Parent, the Issuer and Guarantors, as applicable, propose to take with respect to such default or event of default.

Discharge

The indenture with respect to the debt securities of any series may be discharged (with the exception of specified provisions as provided in the indenture) when the Issuer requests such discharge in writing accompanied by an officer’s certificate and an opinion of counsel, in each case stating that all conditions precedent to discharge under the indenture have been satisfied and either:

| (A) | all debt securities, with the exceptions provided for in the indenture, of that series have been delivered to the trustee for cancellation; or |

| (B) | all debt securities of that series not theretofore delivered to the trustee for cancellation (1) have become due and payable; (2) will become due and payable at their stated maturity within one year; (3) are to be called for redemption within one year; or (4) been deemed paid and discharged pursuant to the terms of the indenture; |

and the Issuer, in the case of clauses (B)(1), (B)(2) and (B)(3), has deposited or caused to be deposited with the trustee in trust an amount of (a) money, or (b) in the case of clauses (B)(2) and (B)(3), (I) United States government obligations which through the payment of interest and principal in respect thereof in accordance with

19

Table of Contents

their terms will provide not later than one day before the stated maturity or redemption date, as the case may be, money in an amount or (II) a combination of money or United States government obligations as provided in (I) above, in each case sufficient (if United States government obligations, as certified in the opinion of a nationally recognized firm of independent certified public accountants) to pay and discharge the entire indebtedness on such debt securities not theretofore delivered to the trustee for cancellation, for principal, premium, if any, and interest, if any, to the date of such deposit in the case of debt securities which have become due and payable or to the stated maturity or redemption date, as the case may be.

Defeasance

The indenture provides that the Issuer may discharge the entire indebtedness of all outstanding debt securities of a series and the provisions of the indenture as they relate to such debt securities will no longer be in effect in respect of the Issuer and the Guarantors (with the exception of specified provisions as provided in the indenture) if the Issuer deposits or causes to be deposited with the trustee, in trust, money, or United States government obligations, or a combination thereof, which, through the payment of interest thereon and principal thereof in accordance with their terms, will provide money, in an amount sufficient, in the opinion of a nationally recognized firm of independent certified public accountants, to pay all the principal (including any mandatory sinking fund payments, if any) of, premium, if any, and interest, if any, on the debt securities of such series on the dates such payments are due in accordance with the terms of such debt securities to their stated maturities or to, but excluding, a redemption date which has been irrevocably designated by the Issuer for redemption of such debt securities. To exercise any such option, the Issuer is required to meet specified conditions, including delivering to the trustee an opinion of counsel to the effect that (a) the Issuer has received from, or there has been published by, the Internal Revenue Service a ruling, or (b) since the date of an offering, there has been a change in the applicable federal income tax law, in either case to the effect that, and based thereon such opinion of counsel shall confirm that, holders of the debt securities of such series will not recognize income, gain or loss for United States federal income tax purposes as a result of such deposit, defeasance and discharge and will be subject to United States federal income tax on the same amounts, in the same manner and at the same times as would have been the case if such deposit, defeasance and discharge had not occurred and that no event of default or default shall have occurred and be continuing.

The indenture provides that, at the election of the Issuer, the Issuer and the Guarantors need not comply with certain restrictive covenants of the indenture as to any series of debt securities (in the case of debt securities as described above under “—Certain Covenants of the Debt Securities—Limitation on Liens,” “—Limitation on Sale and Leaseback Transactions” and the third paragraph of “—Restrictions Upon Merger and Sales of Assets”), upon the deposit by the Issuer with the trustee, in trust, of money, or United States government obligations, or a combination thereof, which, through the payment of interest thereon and principal thereof in accordance with their terms, will provide money, in an amount sufficient, in the opinion of a nationally recognized firm of independent certified public accountants, to pay all the principal (including any mandatory sinking fund payments, if any) of, premium, if any, and interest, if any, on the debt securities of such series on the dates such payments are due in accordance with the terms of such debt securities to their stated maturities or to, but excluding a redemption date which has been irrevocably designated by us for redemption of such debt securities. To exercise any such option, the Issuer may be required to meet specified conditions, including delivering to the trustee an opinion of counsel to the effect that the deposit and related defeasance would not cause the holders of the debt securities to recognize income, gain or loss for federal income tax purposes.

Modification of the Indenture

The indenture contains provisions permitting the Issuer, the Guarantors and the trustee, with the consent of the holders of not less than a majority in principal amount of the outstanding debt securities of all series affected by such modification (voting as one class), to modify such indenture or the rights of the holders of the debt

20

Table of Contents

securities, except that no such modification shall, without the consent of the holder of each debt security so affected:

| • | change the maturity of any debt security, or reduce the rate or extend the time of payment of interest thereon, or reduce the principal amount thereof (including, in the case of a discounted debt security, the amount payable thereon in the event of acceleration) or any redemption premium thereon, or change the place or medium or currency of payment of such debt security, or impair the right of any holder to institute suit for payment thereof, or release any Guarantor from any of its obligations under its guarantee otherwise than in accordance with the terms of the indenture; |

| • | reduce the percentage of debt securities, the consent of the holders of which is required for any such modification or for certain waivers or other modifications under such indenture; |

| • | make the debt securities of any series payable in currency other than that stated herein; |

| • | expressly subordinate in right of payment the debt securities of any series or a guarantee thereof; or |

| • | modify certain provisions of the indenture related to entry into a supplemental indenture with consent of holders, waiver of past defaults and waiver of certain covenants, except under certain circumstances specified in the indenture. |

The indenture contains provisions permitting the Issuer, the Guarantors and the trustee, without the consent of any holders, to modify the indenture for any of the following purposes:

| • | to evidence the succession of another corporation, partnership, limited liability company, trust or any other entity to the Issuer or any Guarantor and the assumption by any such successor of the Issuer’s covenants in the indenture and the debt securities or such Guarantor’s covenants in the indenture and the guarantee, as the case may be; |

| • | to add to the Issuer’s or any Guarantor’s covenants for the benefit of the holders of all or any series of debt securities or to surrender any right or power conferred upon the Issuer or such Guarantor, as the case may be, in the indenture; |

| • | to add any additional events of defaults; |

| • | to add or change any provisions of the indenture to such extent as may be necessary to permit or facilitate the issuance of debt securities in bearer form registrable or not registrable as to principal, and with or without interest or coupons; |

| • | to change or eliminate any provision of the indenture, provided that any such change or elimination shall become effective only when there is no debt security outstanding of any series created prior to such modification which is entitled to the benefit of such provision; |

| • | to secure the debt securities; |

| • | to establish the form or terms of any debt securities of any series as permitted by the indenture; |

| • | to establish the form or terms of a related guarantee of any debt securities as permitted by the indenture; |

| • | to evidence and provide for the acceptance of appointment under the indenture by a successor trustee with respect to the debt securities of one or more series and to add or change any of the provisions of the indenture as shall be necessary to provide for or facilitate the administration of the trusts under the indenture by more than one trustee; |

| • | to evidence and provide for the acceptance of appointment of a trustee other than Computershare Trust Company, N.A., as trustee for a series of debt securities and to add or change any of the provisions of the indenture as shall be necessary to provide for or facilitate the administration of the trusts under the indenture by more than one trustee; |

21

Table of Contents

| • | to provide for any rights of the holder of debt securities of any series to require the repurchase of debt securities of such series from the Issuer; |

| • | to cure any ambiguity, omission, mistake or defect, to correct or supplement any provision of the indenture which may be inconsistent with any other provision of the indenture, or to make any other provisions with respect to matters or questions arising under the indenture, provided such action shall not adversely affect the interests of the holders of debt securities of any series in any material respect; |

| • | to provide for the issuance of additional debt securities of any series in accordance with the indenture; |

| • | to add guarantees with respect to the debt securities; |

| • | to amend the provisions of the indenture relating to the transfer and legending of the debt securities of any series, including, without limitation, to facilitate the issuance and administration of the debt securities of any series; provided that compliance with the indenture as so amended would not result in the debt securities of such series being transferred in violation of the Securities Act or any applicable securities law; |

| • | to conform the text of the indenture, guarantee or debt securities of any series to any provision of the description thereof set forth in this prospectus or any prospectus supplement to the extent that such provision in this prospectus or any prospectus supplement was intended to be a verbatim recitation of a provision in the indenture, guarantee or debt securities of any series; |

| • | for any other reason specified in the board resolution, officer’s certificate or supplemental indenture establishing the applicable series of debt securities; |

| • | to continue its qualification under the Trust Indenture Act of 1939 or as may be necessary or desirable in accordance with amendments to that Act; or |

| • | for any other reason specified in the applicable prospectus supplement. |

Concerning the Trustee