Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-54010

GREAT AMERICAN GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 27-0223495 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 21860 Burbank Boulevard, Suite 300 South Woodland Hills, CA |

91367 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(818) 884-3737

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes: ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes: x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes: ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ | |||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates, based on the closing price of the registrant’s common stock as reported on the OTC Bulletin Board on June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $10.8 million. For purposes of this calculation, it has been assumed that all shares of the registrant’s common stock held by directors, executive officers and shareholders beneficially owning five percent or more of the registrant’s common stock are held by affiliates. The treatment of these persons as affiliates for purposes of this calculation is not conclusive as to whether such persons are, in fact, affiliates of the registrant.

The number of shares outstanding of the registrant’s common stock as of March 25, 2011 was 30,741,794.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement relating to the registrant’s 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report.

Table of Contents

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

TRADEMARKS

We have registered U.S. trademarks for Great American Group and the Great American logo. Each trademark, trade name or service mark of another company appearing in this Annual Report on Form 10-K belongs to its holder, and does not belong to us.

2

Table of Contents

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” and similar expressions are generally intended to identify forward-looking statements, but are not exclusive means of identifying forward-looking statements in this Annual Report. Because these forward-looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements, including our plans, objectives, expectations and intentions and other factors discussed in “Part I—Item 1A. Risk Factors” contained in this Annual Report. You should not place undue reliance on such forward-looking statements, which are based on the information currently available to us and speak only as of the date on which this Annual Report was filed with the Securities and Exchange Commission (the “SEC”). We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Except as otherwise required by the context, references in this Annual Report to:

| • | “Great American,” “the “Company,” “we,” “us” or “our” refer to the combined business of Great American Group, Inc. and all of its subsidiaries after giving effect to (i) the contribution to Great American Group, Inc. of all of the membership interests of Great American Group, LLC by the members of Great American, which transaction is referred to herein as the “Contribution”, and (ii) the merger of Alternative Asset Management Acquisition Corp. with and into its wholly-owned subsidiary, AAMAC Merger Sub, Inc., referred to herein as “Merger Sub”, in each case, which occurred on July 31, 2009, referred to herein as the “Merger”. The Contribution and Merger are referred to herein collectively as the “Acquisition”; |

| • | “GAG, Inc.” refers to Great American Group, Inc.; |

| • | “GAG, LLC” refers to Great American Group, LLC; |

| • | “the Great American Members” refers to the members of Great American Group, LLC prior to the Acquisition; |

| • | “Phantom Equityholders” refers to certain members of senior management of Great American Group, LLC prior to the Acquisition that were participants in a deferred compensation plan; and |

| • | “AAMAC” refers to Alternative Asset Management Acquisition Corp. |

3

Table of Contents

| Item 1. | BUSINESS |

General

We are a leading provider of asset disposition and valuation and appraisal services to a wide range of retail, wholesale and industrial clients, as well as lenders, capital providers, private equity investors and professional service firms. We operate our business in two segments: liquidation and auction solutions and valuation and appraisal services. The divisions in our auction and liquidation segment assist clients in maximizing return and recovery rates through the efficient disposition of assets. Such assets include multi-location retail inventory, wholesale inventory, trade fixtures, machinery and equipment, intellectual property and real property. Our valuation and appraisal services division provides our clients with independent appraisals in connection with asset based loans, acquisitions, divestitures and other business needs. The financial statements in this Annual Report are presented in a manner consistent with our operating structure. For additional information regarding our operating segments, see Note 20 of the Notes to our Consolidated Financial Statements.

Our significant industry experience, network of highly skilled employees and scalable network of independent contractors and industry-specific advisors allow us to tailor our auction and liquidation solutions to the specific needs of a multitude of clients, logistical challenges and distressed circumstances. We have established appraisal and valuation methodologies and practices in a broad array of asset categories which have made us a recognized industry leader. Furthermore, our scale and pool of resources allow us to offer our services on a nationwide basis, setting us apart from many of our competitors. As a result of this market expertise and flexibility, our proven track record and our ability to offer cost-attractive services, we believe that we are well positioned to generate revenue growth and increase our market share across all of our service offerings.

Great American, together with our predecessors, has been in business since 1973. For over 35 years, Great American and its predecessors have provided retail, wholesale and industrial auction and liquidation solutions to clients. Past clients include Boeing, Apple Computers, Borders Group, Circuit City, Friedman’s Jewelers, Hechinger, Mervyns, Tower Records, Eaton’s, Hancock Fabrics, Movie Gallery, Linens N Things, Kmart, Sears, Montgomery Ward, Whitehall Jewelers, Gottschalks, Fortunoff, and Ritz Camera. Since 1995, we have participated in liquidations involving over $23 billion in aggregate asset value and auctioned assets with an estimated aggregate value of over $6 billion.

Our valuation and appraisal services division provides valuation and appraisal services to financial institutions, lenders, private equity investors and other providers of capital. These services primarily include the valuation of assets (i) for purposes of determining and monitoring the value of collateral securing financial transactions and loan arrangements and (ii) in connection with potential business combinations. Our valuation and appraisal services divisions operate through limited liability companies that are majority owned by us. Our clients include major financial institutions such as Bank of America, Credit Suisse, GE Capital, JPMorgan Chase, Union Bank of California, and Wells Fargo. Our clients also include private equity firms such as Apollo Management, Goldman Sachs Capital Partners, Laurus Funds, Sun Capital Partners and UBS Capital.

We were incorporated in Delaware in May 2009 as a subsidiary of AAMAC. On July 31, 2009, we closed the Acquisition, pursuant to which (i) the Great American Members contributed all of their membership interests in GAG, LLC to us in exchange for 10,560,000 shares of our common stock and a subordinated unsecured promissory note in an initial principal amount of $60.0 million issued in favor of the Great American Members and the Phantom Equityholders and (ii) AAMAC merged with and into Merger Sub, our wholly owned subsidiary. As a result of the Acquisition, GAG, LLC and AAMAC became our wholly-owned subsidiaries. The Acquisition has been accounted for as a reverse merger accompanied by a recapitalization and is more fully described in Note 1 and 2 of our Consolidated Financial Statements.

Recent Developments

In April 2009, we expanded our operations into Europe by opening an office in the United Kingdom. We provide services to help retailers downsize through inventory liquidation and store closures in addition to providing appraisal and valuation services. In 2010, we hired a number of key employees to increase our presence and expand the operations of our retail liquidations solutions business throughout Europe. During 2010, we generated approximately $0.6 million of revenues from services and fees from appraisal and auction and liquidation services engagement in the United Kingdom.

4

Table of Contents

In January 2011, the Keen Consultants’ real estate team joined us and will operate as GA Keen Realty Advisors. This newly formed division will provide real estate analysis, valuation and strategic planning services, brokerage, mergers and acquisition, auction services, lease restructuring services, and real estate capital market services as part of our auction and liquidation segment. GA Keen Realty Advisors will continue to offer its services to traditional clients of Keen Consultants, including property owners, tenants, secured and unsecured creditors, attorneys, and financial advisors.

Generation of Revenue

We provide services to clients on a guarantee, fee or outright purchase basis.

Guarantee. When providing services on a guarantee basis, we guarantee the client a specific recovery often expressed as a percentage of retail inventory value or wholesale inventory cost or, in the case of machinery or equipment, a set dollar amount. This guarantee is often required to be supported by a letter of credit, a cash deposit or a combination thereof. Cash deposits are typically funded in part with available cash together with short term borrowings under our credit facilities. Often when we provide auction or liquidation services on a guarantee basis, we do so through a collaborative arrangement with other service providers. In this situation, each collaborator agrees to provide a certain percentage of the guaranteed amount to the client through a combination of letters of credit, cash and financing. If we are engaged individually, we receive 100% of the net profit, less debt financing fees, sale related expenses (if any) and any share of the profits due to the client as a result of any profit sharing arrangement entered into based on a pre-negotiated formula. If the engagement was conducted through a collaborative arrangement, the profits or losses are divided among us and our partner or partners as set forth in the agreement governing the collaborative arrangement. If the net sales proceeds after expenses are less than the guarantee, we, together with our partners if the engagement was conducted through a collaborative arrangement, are responsible for the shortfall and will recognize a loss on the engagement.

Fee. When we provide services on a fee basis, clients pay a pre-negotiated flat fee for the services provided, a percentage of asset sales generated or a combination of both.

Outright Purchase. When providing services on an outright purchase basis, we purchase the assets from the client and typically sell them at auction, orderly liquidation, through a third-party broker or, less frequently, as augmented inventory in conjunction with another liquidation that we are conducting. In an outright purchase, we take, together with any collaboration partners, title to the assets and absorb the profit or loss associated with the asset disposition.

Services

We provide a wide variety of services to clients seeking auction and liquidation solutions or valuation and appraisal services.

Auction and Liquidation Solutions

Retail

We enable our clients to quickly and efficiently dispose of under-performing assets and generate cash from excess inventory by conducting or assisting in store closings, going out of business sales, bankruptcy sales and fixture sales. With the goal of providing a single-source solution to our retail clients, we also provide merger and acquisition due diligence through our auction and liquidation segment and reverse logistics and appraisal services through our valuation and appraisal services segment. Financial institution and other capital providers rely on us to maximize recovery rates in distressed asset sales and in retail bankruptcy situations. Additionally, healthy, mature retailers utilize our proven inventory management and strategic disposition solutions, relying on our extensive network of retail professionals, to close unproductive stores and dispose of surplus inventory and fixtures as existing stores are updated.

For example, in a potential bankruptcy engagement, the debtor provides potential disposition firms with a snapshot of inventory and other assets available for sale. The disposition firms must analyze the inventory data and generate an estimate of potential recovery based on their valuation expertise and past liquidation experience. Typically, this process takes one to four weeks. The disposition firms then submit bids that guarantee a minimum recovery based on a percentage of retail value or cost. The successful bidder assumes management of the debtor’s stores on a contract basis and conducts the orderly disposition of the inventory and assets in these stores. Profits are generated by efficiently merchandizing inventory, managing the orderly closing of store locations and pricing remaining products to balance margin with speed of sale and liquidation expenses. Unlike merchandisers who employ a “top down” approach by focusing only on driving total sales (because overhead costs are fixed), disposition firms take a “bottom up” approach by focusing on balancing cost savings with maximizing proceeds. A typical retail disposition process spans eight to twelve weeks from the bankruptcy court’s approval of the successful bid to the final store closure.

5

Table of Contents

We often conduct large retail liquidations that entail significant capital requirements through collaborative arrangements with other liquidators. By entering into an agreement with one or more collaborators, we are able to bid on larger engagements that we couldn’t conduct on our own due to the significant capital outlay involved, number of independent contractors required or financial risk associated with the particular engagement. We act as the lead partner in many of the collaborative arrangements that we enter into, meaning that we have primary responsibility for the due diligence, contract negotiation and execution of the engagement.

We provide retail auction and liquidation services on a fee and guarantee basis. In guarantee retail liquidation engagements, we take title to any unsold inventory. In these rare instances, we typically utilize the unsold inventory as augmented inventory in other liquidations we conduct.

Wholesale and Industrial

We design and implement customized disposition programs for our clients seeking to convert excess wholesale and industrial inventory and operational assets into capital. We manage projects of all sizes and scopes across a variety of asset categories. We believe that our databases of information regarding potential buyers that we have collected from past transactions and engagements, our nationwide name recognition and experience with alternative distribution channels allow us to provide superior wholesale and industrial disposition services. We offer clients the following wholesale and industrial disposition strategies:

Orderly Liquidations. Assets in an orderly liquidation are available for sale on a privately negotiated basis over a period of months. Orderly liquidations work well for assets in large and repetitive quantities. This sale method is often employed to dispose of furniture, fixtures and equipment in connection with retail liquidations as well as wholesale inventory or industrial equipment for which a short term public auction sale is not feasible due to limited market demand or specialized application of the equipment.

Live Auctions. The live public auction is the most traditional sales technique for wholesale and industrial asset dispositions and one of our most frequently utilized services. In live auctions, bidders gather at a specified date and time to competitively bid against one another, with each item selling to the highest bidder. We believe that our auctioneers are recognized throughout the industry for their auctioneering skills, project experience, engaging personalities and ability to extract top prices. Our live auctions can cover single sites or multiple locations, and we utilize point-of-sale software to generate customized sales reports and invoices and to track assets.

Webcast Auctions. Increasingly, we have been webcasting our live auctions over the Internet. This auction format allows online bidders to compete in real time against bidders at the live auction. Bidders can log onto the auction from personal computers, view and bid on lots as they come up for sale, hear the auctioneers as the sale is being conducted and, in some cases, view live streaming video of the auctioneer calling the bids on-site. We believe that this auction format maximizes proceeds by providing access to otherwise unavailable potential bidders, including international participants, thereby increasing competition. In some cases, particularly when assets are located in remote areas that are not easily accessible to bidders, we may determine, in consultation with the client, that a webcast only auction is the most appropriate format.

Online Auctions. In the online auction format, the sale of assets takes place exclusively online, without a live auctioneer calling the sale. Similar to the timed auctions popularized by online auction sites such as eBay, assets are posted for sale online and buyers can bid on lots and items for a set period of time, usually one week. The online auction format is optimal for clients that have idle assets in quantities insufficient to justify the cost of a live auction.

6

Table of Contents

Wind Down Services. When businesses or manufacturers discontinue operations in whole or in part, they are often faced with the challenge of converting large quantities of raw materials, work-in-process inventory and equipment into cash. We have the resources and expertise to analyze the cost effectiveness of continuing production to deplete inventory on hand as an alternative to conducting an auction of the inventory. We also provides advisory services relating to the wind down process from beginning to end, including negotiation of early lease terminations, sale of intellectual property and sale of completed inventory through the client’s historical distribution channels.

Reverse Logistics. We assist clients with managing the disposition of customer returns, obsolete inventory, extraneous fixtures and dated equipment. We serve as a broker, providing assistance in reaching target markets and potential buyers or marketing to our extensive database of buyers and end users. Alternatively, we can conduct a liquidation or auction sale to dispose of these assets.

Private Sales. In private sales, we step into the shoes of the seller and handle all negotiations with a single buyer, based upon terms provided by the seller. This type of sale is tailored to a specific target market when specialized assets are involved. This type of sale may be required by certain legal rulings or mediation between multiple parties.

Sealed Bid Sales. We perform sealed bid sales in situations where asset disposition requires anonymity of the buyer or seller or involves other confidentiality concerns. In this process, potential buyers submit bids without knowledge of the amount bid by other participants. At the conclusion of the bidding timeframe, the highest bidder wins the right to purchase the asset.

We provide wholesale and industrial services on a fee, guarantee and an outright purchase basis.

Capital Advisory Services

We provide capital advisory services to clients with a concentration and focus in the retail industry that are in need of junior secured loans for growth capital, working capital, and turnaround financing. We advise borrowers and source loans between $10 million and $100 million to be secured by collateral assets of the borrowers, including inventory, accounts receivable, real estate and intellectual property.

Home Auctions and Loan Sales

We partnered with Kelly Capital to launch Great American Real Estate, LLC through which we commenced auctions for foreclosed residential real estate properties in the fourth quarter of 2009 and we commenced residential and commercial loan sales to third parties on behalf of financial institutions and other private parties in the first quarter of 2010.

We target foreclosed residential real estate properties nationally across a range of sizes, styles and prices and we target financial institutions, finance companies and other lenders nationally to serve as the broker for the sale of residential and commercial real estate loans. During 2010, the market for providers of services for foreclosed residential real estate properties was challenging. The flow of new inventory of residential home foreclosures into the market was impacted by legislation at the state and federal levels. This impacted our ability to establish new relationships as an auction broker with major financial institutions, lenders, portfolio managers and investment firms, which hold title to foreclosed homes. During the fourth quarter of 2010, we limited operations of the joint venture with Kelly Capital to the sale of certain residential and commercial loans that the joint venture purchased through an investment with a third party. We will continue to monitor the market for foreclosed residential properties.

7

Table of Contents

Valuation and Appraisal Services

Our valuation and appraisal teams provide independent appraisals to financial institutions, lenders and other providers of capital and other professional service firms for estimated liquidation values of assets. These teams include experts specializing in particular industry niches and asset classes. We provide valuation and appraisal services across five general categories:

Consumer and Retail Inventory. Representative types of appraisals and valuations include inventory of specialty apparel retailers, department stores, jewelry retailers, sporting goods retailers, mass and discount merchants, home furnishing retailers and footwear retailers.

Wholesale and Industrial Inventory. Representative types of appraisals and valuations include inventory held by manufacturers or distributors of automotive parts, chemicals, food and beverage products, wine and spirits, building and construction products, industrial products, metals, paper and packaging.

Machinery and Equipment. Representative types of asset appraisals and valuations include a broad range of equipment utilized in manufacturing, construction, transportation and healthcare.

Intangible Assets. Representative types of asset appraisals and valuations include intellectual property, goodwill, brands, logos, trademarks and customer lists.

Real Estate. Representative types of asset appraisals and valuations include owned and leased manufacturing and distribution facilities, retail locations and corporate offices. We do not perform appraisals of residential properties.

We provide valuation and appraisal services on a pre-negotiated flat fee basis.

Sales and Marketing

Our sales and marketing efforts benefit from dedicated business development officers focused on each of our primary service offerings. We actively promote the cross-selling of our services and market our single-source solution services to existing and potential clients.

Our marketing programs incorporate a range of strategies as a result of our diverse universe of potential referral sources, clients and buyers. Key marketing programs include public relations initiatives and news releases, industry trade journal advertising, local television, newspaper and radio advertising, participation in industry trade shows and conferences, speaking engagements, direct marketing, email blasts and Internet based advertising.

As of December 31, 2010, we employed 15 business development officers located throughout the United States and in London.

Our retail business development efforts target accounting and consulting firms, bankruptcy professionals, attorneys and financial institution restructuring groups focused on the retail industry as sources for referrals.

Our business development officers who are tasked with identifying and obtaining wholesale and industrial auction and liquidation engagements are industry experts and market directly to management at companies in their specific areas of expertise. These individuals also develop and maintain relationships with secondary market participants, such as equipment dealers, who are often sources of referrals for disposition opportunities. The business development officers leverage our years of experience in the auction business, valuation expertise and database of historical auction results to provide potential clients with accurate estimates of asset values.

Our valuation and appraisal business development efforts target lenders, private equity groups, other debt and equity providers, turnaround and crisis management firms, restructuring firms, investment banks and large financial institutions. We focus on developing and managing relationships with clients to produce ongoing valuation and appraisal opportunities, but will also pursue single opportunities as they arise.

Our capital advisory business development efforts target clients primarily in the retail industry that are in need of junior secured loans for growth capital, working capital, and turnaround financing. We advise borrowers and source loans between $10 million and $100 million to be secured by collateral assets of the borrowers, including inventory, accounts receivable, real estate and intellectual property.

8

Table of Contents

Customers

We serve retail, corporate, capital provider and individual customers across our services lines. No revenues from individual liquidation services contracts represented more than 10% of total revenues during the year ended December 31, 2010. Revenues from two liquidation service contracts represented 19.6% and 11.3% of total revenues during the year ended December 31, 2009. Revenues from one liquidation service contract represented 11.2% of total revenues during the year ended December 31, 2008. The services provided to these customers were under short-term liquidation contracts that generally do not exceed a period of six months. There were no recurring revenues from year to year in connection with the services we performed under these contracts.

Auction and Liquidation Solutions

Retail

Our retail auction and liquidation solution clients include financially healthy retailers as well as distressed retailers, bankruptcy professionals, financial institution workout groups and a wide range of professional service providers. Some retail segments in which we specialize include apparel, arts and crafts, department stores, discount stores, drug / health and beauty, electronics, footwear, grocery stores, hardware / home improvement, home goods and linens, jewelry, office / party supplies, specialty stores, and sporting goods. Recent clients include Borders Group, Circuit City, Friedman’s Jewelers, Hechinger, Mervyns, Tower Records, Eaton’s, Hancock Fabrics, Movie Gallery, Linens N Things, KB Toys, Kmart, Sears, Montgomery Ward, Whitehall Jewelers, Fortunoff, Gottschalks and Ritz Camera.

Wholesale and Industrial

We provide auction services and customized disposition programs to a wide range of clients. Specifically, we have experience in providing auction and liquidation solutions to the following industries: aircraft / aerospace, casino / hospitality, construction / mining / earthmoving, food and beverage processing, hospital / medical, machine tools / metalworking, material handling, packaging / bottling, plastics and rubber processing, printing / bindery, pulp processing / paper converting, restaurant / bar / bakery, retail / trade fixtures, stadium / arena, textile / apparel, transportation / rolling stock, warehouse / distribution centers, and woodworking / lumber. Representative recent clients include the Stardust Hotel & Casino, Boeing, Midas International, Callaway Golf, Lillian Vernon, Saint Vincent Medical Center of New York and Dreyer’s Ice Cream.

Valuation and Appraisal Services

We are engaged by financial institutions, lenders, private equity investors and other capital providers, as well as professional service providers, to provide valuation and advisory services. We have extensive experience in the appraisal and valuation of retail and consumer inventories, wholesale and industrial inventories, machinery and equipment, intellectual property and real estate. We maintain ongoing client relationships with major asset based lenders including Bank of America, CIT Group, Citibank, Credit Suisse, Deutsche Bank, GE Capital, HSBC, JPMorgan Chase, Union Bank of California, US Bank, Wells Fargo Foothill and Wells Fargo Retail Finance. In addition, our clients include private equity firms such as Apollo Management, Goldman Sachs Capital Partners, H.I.G. Capital, Harvest Partners, Laurus Funds, Sun Capital Partners and UBS Capital.

Competition

We face competition in each of our primary service areas. While some competitors are unique to specific service offerings, some competitors cross multiple service offerings. A number of companies provide services or products to the auction and liquidation and valuation and appraisal markets, and existing and potential clients can, or will be able to, choose from a variety of qualified service providers. Competition in certain of our service offerings is intense. Some of our competitors may even be able to offer discounts or other preferred pricing arrangements. In a cost-sensitive environment, such arrangements may prevent us from acquiring new clients or new engagements with existing clients. Some of our competitors may be able to negotiate secure alliances with clients and affiliates on more favorable terms, devote greater resources to marketing and promotional campaigns or to the development of technology systems than us. In addition, new technologies and the expansion of existing technologies with respect to the online auction business may increase the competitive pressures on us. We must also compete for the services of skilled professionals. There can be no assurance that we will be able to compete successfully against current or future competitors, and competitive pressures we face could harm our business, operating results and financial condition.

9

Table of Contents

We face competition for our retail services from traditional liquidators as well as Internet-based liquidators such as overstock.com and eBay. Our wholesale and industrial services competitors include traditional auctioneers and fixed site auction houses that may specialize in particular industries or geographic regions as well as other large, prestigious or well-recognized auctioneers. We also face competition and pricing pressure from the internal remarketing groups of our clients and potential clients and from companies that may choose to liquidate or auction assets and/or excess inventory without assistance from service providers like us. We face competition for our home auction services from established real estate auctioneers, foreclosure/courthouse auctions, short sales and traditional real estate services. We face competition for our valuation and appraisal services from large accounting, consulting and other professional service firms as well as other valuation, appraisal and advisory firms.

Regulation

We are subject to federal and state consumer protection laws, including regulations prohibiting unfair and deceptive trade practices. In addition, numerous states and municipalities regulate the conduct of auctions and the liability of auctioneers. We and/or our auctioneers are licensed or bonded in the following states where we conduct, or have conducted, retail, wholesale or industrial asset auctions: California, Florida, Georgia, Illinois, Massachusetts, Ohio, South Carolina, Texas, Virginia and Washington. In addition, we are licensed or obtain permits in cities and/or counties where we conduct auctions, as required. If we conduct an auction in a state where we are not licensed or where reciprocity laws do not exist, we will work with an auctioneer of record in such state.

Great American Real Estate, LLC has a real estate brokerage license in California and is in the process of obtaining real estate brokerage licenses in the remaining 49 states. In states where Great American Home Auctions intends to hold auction events but is not yet licensed, we intend to work with a broker of record.

Employees

As of December 31, 2010, we had 136 full time employees and three part time employees. We are not a party to any collective bargaining agreements. We have never experienced a work stoppage or strike and believe that relations with our employees are good.

We rely significantly on the expertise of independent contractors whom we engage in connection with specific transactions. As of December 31, 2010, we maintained a network of approximately 162 independent contractors who it engages from time to time to provide services pursuant to the terms of independent contractor agreements.

Available Information

We make available on our website, www.greatamerican.com , our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to such reports as soon as reasonably practical after we file such material with, or furnish such material to, the SEC. The information on Great American’s website is not a part of, or incorporated in, this Annual Report.

| Item 1A. | RISK FACTORS |

Given the nature of our operations and services we provide, a wide range of factors could materially affect our operations and profitability. Changes in competitive, market and economic conditions also affect our operations. The risks and uncertainties described below are not the only risks and uncertainties facing us. Additional risks and uncertainties not presently known or that are currently considered to be immaterial may also materially and adversely affect our business operations or stock price. If any of the following risks or uncertainties occurs, our business, financial condition or operating results could materially suffer.

10

Table of Contents

Our revenues and results of operations are volatile and difficult to predict.

Our revenues and results of operations fluctuate significantly from quarter to quarter, due to a number of factors. These factors include, but are not limited to, the following:

| • | our ability to attract new clients and obtain additional business from our existing client base; |

| • | the number, size and timing of our engagements; |

| • | the extent to which we acquire assets for resale, or guarantee a minimum return thereon, and our ability to resell those assets at favorable prices; |

| • | variability in the mix of revenues from the auction and liquidation solutions business and the valuation and appraisal services business; |

| • | the rate of growth of new service areas, including the new real estate services division and international expansion; |

| • | the types of fees we charge clients, or other financial arrangements we enter into with clients; and |

| • | changes in general economic and market conditions. |

We have limited or no control over some of the factors set forth above and, as a result, may be unable to forecast our revenues accurately. We rely on projections of revenues in developing our operating plans for the future and will base our expectations regarding expenses on these projections and plans. If we inaccurately forecast revenues and/or earnings, or fail to accurately project expenses, we may be unable to adjust our spending in a timely manner to compensate for these inaccuracies and, as a result, may suffer operating losses and such losses could have a negative impact on our financial condition and results of operations. If, for any reason, we fail to meet company, investor or analyst projections of revenue, growth or earnings, the market price of the common stock could decline and you may lose all or part of your investment.

We have experienced losses and may not achieve or maintain profitability.

Although we have had profitable quarterly and annual periods, we incurred a loss from operations in the year ended December 31, 2010. Our operations in 2010 were negatively impacted by fewer liquidation engagements during the year as economic conditions for retailers and credit markets improved from the prior years and a decline in revenues from the auction of machinery and equipment. In the past, we also incurred losses from discontinued operations relating to our former retail furniture liquidation solutions business. It is possible that we will continue to experience losses with respect to our current operations as we expand our operations through new business areas. In addition, we expect that our operating expenses will increase to the extent that we grow our business. We may not be able to generate sufficient revenues to maintain profitability.

Our substantial level of indebtedness may make it difficult for us to satisfy our debt obligations and may adversely affect our ability to obtain financing for working capital, capitalize on business opportunities or respond to adverse changes in our industry.

In connection with the consummation of the Acquisition on July 31, 2009, we issued subordinated unsecured promissory notes in the principal amount of $55.6 million payable to the Great American Members and the Phantom Equityholders, which includes our Vice Chairman and CEO who own or control, in the aggregate, 10,560,000 shares of our common stock or 34.6% of our outstanding common stock as of December 31, 2010. As of December 31, 2010, an aggregate principal amount of $53.9 million remains outstanding on the promissory notes. On May 3, 2010, we entered into individual amendments to an aggregate of $52.4 million of the notes, which reduced the interest rate on the amended notes from 12.0% to 3.75% per annum, and further amended the $47.0 million in notes held by the Great American Members to provide for the extension of the maturity date to July 31, 2018 (subject to annual prepayments based upon our cash flow, with certain limitations). On October 27, 2010, we entered into individual waivers related to $51.3 million of the $53.9 million in notes then outstanding, whereby the noteholders agreed to permit us to defer payment of the interest payments that would otherwise be due on each of October 31, 2010, January 31, 2011, and April 30, 2011 until July 31, 2011. However, despite these amendments to the promissory notes and the waivers of our obligation to make interest payments described above, we may not have sufficient funds available to make payments of interest or principal on the promissory notes in the future, and we may be unable to obtain further waivers or amendments from the noteholders. If we are required to make such payments, we may be required to use funds that would otherwise be required to operate our business, which could have a material impact on our business and financial results. This indebtedness could have material consequences for our business, operations and liquidity position, including the following:

| • | it may be more difficult for us to satisfy our other debt obligations; |

11

Table of Contents

| • | our ability to obtain additional financing for working capital, debt service requirements, general corporate or other purposes may be impaired; |

| • | a substantial portion of our cash flow will be used to pay interest and principal on our indebtedness, which will reduce the funds available for other purposes; and |

| • | our ability to refinance indebtedness may be limited. |

Because of their significant stock ownership, some of our existing stockholders will be able to exert control over us and our significant corporate decisions.

Our executive officers, directors and their affiliates own or control, in the aggregate, approximately 36.3% of our outstanding common stock as of December 31, 2010. In particular, our Vice Chairman and CEO own or control, in the aggregate, 10,560,000 shares of our common stock or 34.6% of our outstanding common stock as of December 31, 2010. These stockholders are able to exercise influence over matters requiring stockholder approval, such as the election of directors and the approval of significant corporate transactions, including transactions involving an actual or potential change of control of the company or other transactions that non-controlling stockholders may not deem to be in their best interests. This concentration of ownership may harm the market price of our common stock by, among other things:

| • | delaying, deferring, or preventing a change in control of our company; |

| • | impeding a merger, consolidation, takeover, or other business combination involving our company; |

| • | causing us to enter into transactions or agreements that are not in the best interests of all stockholders; or |

| • | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of our company. |

We may incur losses as a result of “guarantee” based engagements that we enter into in connection with our auction and liquidation solutions business.

In many instances, in order to secure an engagement, we are required to bid for that engagement by guaranteeing to the client a minimum amount that such client will receive from the sale of inventory or assets. Our bid is based on a variety of factors, including: our experience, expertise, perceived value added by engagement, valuation of the inventory or assets and the prices we believe potential buyers would be willing to pay for such inventory or assets. An inaccurate estimate of any of the above or inaccurate valuation of the assets or inventory could result in us submitting a bid that exceeds the realizable proceeds from any engagement. If the liquidation proceeds, net of direct operating expenses, are less than the amount we guaranteed in our bid, we will incur a loss. Therefore, in the event that the proceeds, net of direct operating expenses, from an engagement are less than the bid, the value of the assets or inventory decline in value prior to the disposition or liquidation, or the assets are overvalued for any reason, we may suffer a loss and our financial condition and results of operations could be adversely affected.

12

Table of Contents

Losses due to any auction or liquidation engagement may cause us to become unable to make payments due to our creditors and may cause us to default on our debt obligations.

We have three engagement structures: (i) a “fee” based structure under which we are compensated for our role in an engagement on a commission basis, (ii) purchase on an outright basis (and take title to) the assets or inventory of the client, and (iii) “guarantee” to the client that a certain amount will be realized by the client upon the sale of the assets or inventory based on contractually defined terms in the auction or liquidation contract. We bear the risk of loss under the purchase and guarantee structures of auction and liquidation contracts. If the amount realized from the sale or disposition of assets, net of direct operating expenses, does not equal or exceed the purchase price (in purchase transaction), we will recognize a loss on the engagement, or should the amount realized, net of direct operating expenses, not equal or exceed the “guarantee,” we are still required to pay the guaranteed amount to the client.

We could incur losses in connection with outright purchase transactions in which we engage as part of our auction and liquidation solutions business.

When we conduct an asset disposition or liquidation on an outright purchase basis, we purchase from the client the assets or inventory to be sold or liquidated and therefore, we hold title to any assets or inventory that we are not able to sell. In other situations, we may acquire assets from our clients if we believe that we can identify a potential buyer and sell the assets at a premium to the price paid. We store these unsold or acquired assets and inventory until they can be sold or, alternatively, transported to the site of a liquidation of comparable assets or inventory that we are conducting. If we are forced to sell these assets for less than we paid, or are required to transport and store assets multiple times, the related expenses could have a material adverse effect on our results of operations.

We depend on financial institutions as primary clients for our valuation and appraisal services business. Consequently, the loss of any financial institutions as clients may have an adverse impact on our business.

A majority of the revenue from our valuation and appraisal services business is derived from engagements by financial institutions. As a result, any loss of financial institutions as clients of our valuation and advisory services, whether due to changing preferences in service providers, failures of financial institutions or mergers and consolidations within the finance industry, could significantly reduce the number of existing, repeat and potential clients, thereby adversely affecting our revenues. In addition, any larger financial institutions that result from mergers or consolidations in the financial services industry could have greater leverage in negotiating terms of engagements with us, or could decide to internally perform some or all of the valuation and appraisal services which we currently provide to one of the constituent institutions involved in the merger or consolidation or which we could provide in the future. Any of these developments could have a material adverse effect on our valuation and appraisal services business.

Our business may be impacted by changing economic and market conditions.

Certain aspects of our business are cyclical in nature and changes in the current economic environment may require us to adjust our sales and marketing practices and react to different business opportunities and modes of competition. For example, we are more likely to conduct auctions and liquidations in connection with insolvencies and store closures during periods of economic downturn relative to periods of economic expansion. In addition, during an economic downturn, financial institutions that provide asset-based loans typically reduce the number of loans made, which reduces their need for our valuation and appraisal services. If we are not successful in reacting to changing economic conditions, we may lose business opportunities which could harm our financial condition.

We may face liability or harm to our reputation as a result of a claim that we provided an inaccurate appraisal or valuation and our insurance coverage may not be sufficient to cover the liability.

We could face liability in connection with a claim by a client that we provided an inaccurate appraisal or valuation on which the client relied. Any claim of this type, whether with or without merit, could result in costly litigation, which could divert management’s attention and company resources and harm our reputation. Furthermore, if we are found to be liable, we may be required to pay damages. While our appraisals and valuations are typically provided only for the benefit of our clients, if a third party relies on an appraisal or valuation and suffers harm as a result, we may become subject to a legal claim, even if the claim is without merit. We carry insurance for liability resulting from errors or omissions in connection with our appraisals and valuations; however, the coverage may not be sufficient if we are found to be liable in connection with a claim by a client or third party.

13

Table of Contents

We could be forced to mark down the value of certain assets acquired in connection with outright purchase transactions.

In most instances, inventory is reported on the balance sheet at its historical cost; however, according to U.S. Generally Accepted Accounting Principles, inventory whose historical cost exceeds its market value should be valued conservatively, which dictates a lower value should apply. Accordingly, should the replacement cost (due to technological obsolescence or otherwise), or the net realizable value of any inventory we hold be less than the cost paid to acquire such inventory (purchase price), we will be required to “mark down” the value of such inventory held. If the value of any inventory held on our balance sheet, including, but not limited to, oil rigs and other equipment related to the oil exploration business and airplane parts, is required to be written down, such write down could have a material adverse effect on our financial position and results of operations.

We operate in highly competitive industries. Some of our competitors may have certain competitive advantages, which may cause us to be unable to effectively compete with or gain market share from our competitors.

We face competition with respect to all of our service areas. The level of competition depends on the particular service area and category of assets being liquidated or appraised. We compete with other companies in bidding for assets and inventory to be liquidated. In addition, we compete with online services for liquidating assets and inventory, the demand for which are rapidly growing. These online competitors include other e-commerce providers, auction websites such as eBay, as well as government agencies and traditional liquidators and auctioneers that have created websites to further enhance their product offerings and more efficiently liquidate assets. We expect the market to become even more competitive as the demand for such services continues to increase and traditional and online liquidators and auctioneers continue to develop online and offline services for disposition, redeployment and remarketing of wholesale surplus and salvage assets. In addition, manufacturers, retailers and government agencies may decide to create their own websites to sell their own surplus assets and inventory and those of third parties.

We also compete with other providers of valuation and advisory services. Competitive pressures within the valuation and appraisal services market, including a decrease in the number of engagements and/or a decrease in the fees which can be charged for these services, could affect revenues from our valuation and appraisal services as well as our ability to engage new or repeat clients. We believe that given the relatively low barriers to entry in the valuation and appraisal services market, this market may become more competitive as the demand for such services increases.

Some of our competitors may be able to devote greater financial resources to marketing and promotional campaigns, secure merchandise from sellers on more favorable terms, adopt more aggressive pricing or inventory availability policies and devote more resources to website and systems development than we are able to do. Any inability on our part to effectively compete could have a material adverse effect on our financial condition, growth potential and results of operations.

If we are unable to attract and retain qualified personnel, we may not be able to compete successfully in our industry.

Our future success depends to a significant degree upon the continued contributions of senior management and the ability to attract and retain other highly qualified management personnel. We face competition for management from other companies and organizations; therefore, we may not be able to retain our existing personnel or fill new positions or vacancies created by expansion or turnover at existing compensation levels. Although we have entered into employment agreements with key members of the senior management team, there can be no assurances such key individuals will remain with us. The loss of any of our executive officers or other key management personnel would disrupt our operations and divert the time and attention of our remaining officers and management personnel which could have an adverse effect on our results of operations and potential for growth.

We also face competition for highly skilled employees with experience in our industry, which requires a unique knowledge base. We may be unable to recruit or retain other existing technical, sales and client support personnel that are critical to our ability to execute our business plan.

14

Table of Contents

Expanding our services internationally exposes us to additional operational challenges, and if we fail to meet these challenges, our growth will be limited and our results of operations may be harmed.

We recently expanded our operations into the United Kingdom and plan to enter other European and Asian markets, either through acquisition, partnership, joint venture or by expansion. Our management has limited experience in operating a business at the international level. As a result, we may be unsuccessful in carrying out any of our plans for expansion in a timely fashion, if at all, obtaining the necessary licensing, permits or market saturation, or in successfully navigating other challenges posed by operating an international business. Such international expansion is expected to require a significant amount of start up costs, as well. If we fail to execute this strategy, our growth will be limited and our results of operations may be harmed.

We frequently use borrowings under credit facilities in connection with our guaranty engagements, in which we guarantee a minimum recovery to the client, and outright purchase transactions.

In engagements where we operate on a guaranty or purchase basis, we are typically required to make an upfront payment to the client. If the upfront payment is less than 100% of the guarantee or the purchase price in a “purchase” transaction, we may be required to make successive cash payments until the guarantee is met or we may issue a letter of credit in favor of the client. Depending on the size and structure of the engagement, we may borrow under our credit facilities and may be required to issue a letter of credit in favor of the client for these additional amounts. If we lose any availability under our credit facilities, are unable to borrow under credit facilities and/or issue letters of credit in favor of clients, or borrow under credit facilities and/or issue letters of credit on commercially reasonable terms, we may be unable to pursue large liquidation and disposition engagements, engage in multiple concurrent engagements, pursue new engagements or expand our operations. We are required to obtain approval from the lenders under our existing credit facilities prior to making any borrowings thereunder in connection with a particular engagement. Any inability to borrow under our credit facilities, or enter into one or more other credit facilities on commercially reasonable terms may have a material adverse effect on our financial condition, results of operations and growth.

Defaults under our credit agreements could have an adverse impact on our ability to finance potential engagements.

The terms of our credit agreements contain a number of events of default and, in the past, we have defaulted under the credit agreements for failing to provide timely financial statements and for failing to maintain minimum net worth requirements. Should we default under any of our credit agreements in the future, lenders may take any or all remedial actions set forth in such credit agreement, including, but not limited to, accelerating payment and/or charging us a default rate of interest on all outstanding amounts, refusing to make any further advances or issue letters of credit, or terminating the line of credit. As a result of our reliance on lines of credit and letters of credit, any default under a credit agreement, or remedial actions pursued by lenders following any default under a credit agreement, may require us to immediately repay all outstanding amounts, which may preclude us from pursuing new liquidation and disposition engagements and may increase our cost of capital, each of which may have a material adverse effect on our financial condition and results of operations.

If we cannot meet our future capital requirements, we may be unable to develop and enhance our services, take advantage of business opportunities and respond to competitive pressures.

We may need to raise additional funds in the future to grow our business internally, invest in new businesses, expand through acquisitions, enhance our current services or respond to changes in our target markets. If we raise additional capital through the sale of equity or equity derivative securities, the issuance of these securities could result in dilution to our existing stockholders. If additional funds are raised through the issuance of debt securities, the terms of that debt could impose additional restrictions on our operations or harm our financial condition. Additional financing may be unavailable on acceptable terms.

15

Table of Contents

Our common stock price may fluctuate substantially, and your investment could suffer a decline in value.

The market price of our common stock may be volatile and could fluctuate substantially due to many factors, including, among other things:

| • | actual or anticipated fluctuations in our results of operations; |

| • | announcements of significant contracts and transactions by us or our competitors; |

| • | sale of common stock or other securities in the future; |

| • | the trading volume of our common stock; |

| • | changes in our pricing policies or the pricing policies of our competitors; and |

| • | general economic conditions. |

In addition, the stock market in general and the market for shares traded on the OTCBB in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. These broad market factors may materially harm the market price of our common stock, regardless of our operating performance.

There is a limited market for our common shares and the trading price of our common shares is subject to volatility.

Our common shares began trading on the OTCBB in August 2009, following the completion of the Acquisition. The trading market for our common shares is limited and an active trading market may not develop. Selling our common shares may be difficult because the limited trading market for our shares on the OTCBB could result in lower prices and larger spreads in the bid and ask prices of our shares, as well as lower trading volume.

In addition, our stock may be defined as a “penny stock” under Rule 3a51-1 under the Exchange Act. “Penny stocks” are subject to Rule 15g-9, which imposes additional sales practice requirements on broker-dealers that sell low-priced securities to persons other than established customers and institutional accredited investors. For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. Consequently, the rule may affect the ability of broker-dealers to sell our common stock and affect the ability of holders to sell their shares of our common stock in the secondary market. To the extent our common stock is subject to the penny stock regulations, the market liquidity for the shares will be adversely affected.

Our certificate of incorporation authorizes our board of directors to issue new series of preferred stock that may have the effect of delaying or preventing a change of control, which could adversely affect the value of your shares.

Our certificate of incorporation, as amended, provides that our board of directors will be authorized to issue from time to time, without further stockholder approval, up to 10,000,000 shares of preferred stock in one or more series and to fix or alter the designations, preferences, rights and any qualifications, limitations or restrictions of the shares of each series, including the dividend rights, dividend rates, conversion rights, voting rights, rights of redemption, including sinking fund provisions, redemption price or prices, liquidation preferences and the number of shares constituting any series or designations of any series. Such shares of preferred stock could have preferences over our common stock with respect to dividends and liquidation rights. We may issue additional preferred stock in ways which may delay, defer or prevent a change of control of our company without further action by our stockholders. Such shares of preferred stock may be issued with voting rights that may adversely affect the voting power of the holders of our common stock by increasing the number of outstanding shares having voting rights, and by the creation of class or series voting rights.

16

Table of Contents

Anti-takeover provisions under our charter documents and Delaware law could delay or prevent a change of control and could also limit the market price of our stock.

Our certificate of incorporation, as amended, and our bylaws, as amended, contain provisions that could delay or prevent a change of control of our company or changes in our board of directors that our stockholders might consider favorable. For example, our certificate of incorporation and bylaws provide that our board of directors is classified into three classes of directors, with each class elected at a separate election. The existence of a staggered board could delay or prevent a potential acquirer from obtaining majority control of our board, and thus defer potential acquisitions. We are also governed by the provisions of Section 203 of the Delaware General Corporate Law, which may prohibit certain business combinations with stockholders owning 15% or more of our outstanding voting stock. These and other provisions in our certificate of incorporation, our bylaws and Delaware law could make it more difficult for stockholders or potential acquirors to obtain control of our board of directors or initiate actions that are opposed by the then-current board of directors, including delaying or impeding a merger, tender offer, or proxy contest or other change of control transaction involving our company. Any delay or prevention of a change of control transaction or changes in our board of directors could prevent the consummation of a transaction in which our stockholders could receive a substantial premium over the then current market price for their shares.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

17

Table of Contents

| Item 2. | PROPERTIES |

Our headquarters are located in Woodland Hills, California in a leased facility. The following table sets forth the location and use of each of our properties, all of which are leased as of December 31, 2010.

| Location |

Use | |

| Woodland Hills, California |

Headquarters; Accounting, Information Technology and Human Resources offices; Appraisal and Auction offices | |

| San Francisco, California |

Appraisal and Marketing offices | |

| Atlanta, Georgia |

Marketing offices | |

| Chicago, Illinois |

Appraisal and Marketing offices | |

| Deerfield, Illinois |

Executive offices; Marketing and Legal offices | |

| Boston, Massachusetts |

Appraisal and Marketing offices | |

| Needham, Massachusetts |

Appraisal offices | |

| New York, New York |

Real Estate Services, Appraisal and Marketing offices | |

| Charlotte, North Carolina |

Marketing offices | |

| London, England |

Appraisal and Marketing offices | |

We believe that our existing facilities are suitable and adequate for the business conducted therein, appropriately used and have sufficient capacity for their intended purpose.

| Item 3. | LEGAL PROCEEDINGS |

From time to time, we are involved in litigation which arises in the normal course of our business operations. We believe that we are not currently a party to any proceedings the adverse outcome of which, individually or in the aggregate, would have a material adverse effect on our financial position or results of operations.

| Item 4. | (RESERVED) |

18

Table of Contents

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock Market and Other Information

Our common stock is traded on the OTC Bulletin Board under the symbol: “GAMR”.

The following table sets forth the high and low closing sale prices of a share of our common stock as reported by the OTC Bulletin Board on a quarterly basis for the period from the start of the trading of our common stock after the completion of the Acquisition through December 31, 2010.

| High | Low | |||||||

| Period from August 7, 2009 to Quarter Ended September 30, 2009 (1) |

$ | 4.55 | 3.25 | |||||

| Quarter ended December 31, 2009 |

4.40 | 3.18 | ||||||

| Quarter ended March 31, 2010 |

3.95 | 2.20 | ||||||

| Quarter ended June 30, 2010 |

2.34 | 1.51 | ||||||

| Quarter ended September 30, 2010 |

1.50 | 0.35 | ||||||

| Quarter ended December 31, 2010 |

0.71 | 0.40 | ||||||

| (1) | Following the Acquisition on July 31, 2009, our common stock commenced trading on the OTC Bulletin Board on August 7, 2009. |

As of December 31, 2010, there were approximately 19 holders of record of our common stock. This number does not include beneficial owners holding shares through nominees or in “street” name.

19

Table of Contents

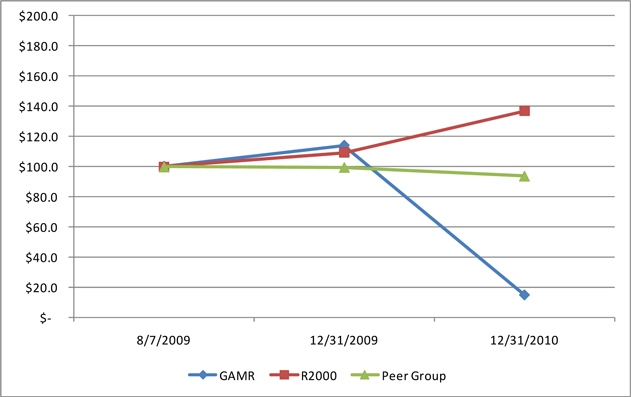

Performance Graph

The performance graph compares the cumulative total shareholder return for the period beginning on the market close for the period from the start of the trading of our common stock after the completion of the Acquisition through December 31, 2010.

The peer group includes the following companies: FTI Consulting, Inc. (NYSE: FCN), Liquidity Services, Inc. (Nasdaq Global Market: LQDT), Navigant Consulting, Inc. (NYSE: NCI), and Ritchie Bros. Auctioneers Incorporated (NYSE: RBA).

The graph assumes that $100.00 was invested on August 7, 2009 in (a) our common stock, (b) The Russell 2000 Index and (c) the companies comprising the peer group described above. The graph assumes that all dividends were reinvested. Historical stock price performance is not necessarily indicative of future stock price performance.

Comparison of Cumulative Total Return*

Assumes Initial Investment of $100.00

August 7, 2009 through December 31, 2010

Among Great American Group, Inc.,

The Russell 2000 Index and A Peer Group

| * | $100.00 invested on August 7, 2009 in stock and index-including reinvestment of dividends. |

The following table provides the same information in Tabular form for the period from August 7, 2009 to December 31, 2010:

| August 7, | December 31, | December 31, | ||||||||||

| 2009 | 2009 | 2010 | ||||||||||

| GAMR |

100.00 | 113.85 | 15.08 | |||||||||

| The Russell 2000 Composite |

100.00 | 109.26 | 136.91 | |||||||||

| Peer Group |

100.00 | 99.70 | 93.86 | |||||||||

20

Table of Contents

The performance graph, and the related chart and text, are being furnished solely to accompany this Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, and are not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and are not to be incorporated by reference into any filing of ours, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Dividend Policy

We have not paid any cash dividends since the consummation of the Acquisition on July 31, 2009 and anticipate that we will retain any available funds for use in the operation of our business. We do not currently intend to pay any cash dividends in the foreseeable future. Our Board of Directors will determine the payment of future cash dividends, if any. Certain of our current bank credit facilities restrict the payment of cash dividends and future borrowings may contain similar restrictions.

21

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The following table sets forth our selected consolidated financial data as of and for each of the five fiscal years ended December 31, 2010, and is derived from our Consolidated Financial Statements. The Consolidated Financial Statements as of December 31, 2010 and 2009, and for each of the years in the three-year period ended December 31, 2010, are included elsewhere in this report. The following data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and Notes thereto included elsewhere in this report.

Consolidated Statement of Operations Data:

(Dollars in thousands)

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Services and fees |

$ | 37,026 | $ | 70,810 | $ | 48,496 | $ | 40,247 | $ | 42,169 | ||||||||||

| Sale of goods |

5,119 | 12,611 | 4,673 | 11,703 | 37,151 | |||||||||||||||

| Total revenues |

42,145 | 83,421 | 53,169 | 51,950 | 79,320 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Direct cost of services |

15,417 | 17,491 | 20,595 | 24,807 | 24,806 | |||||||||||||||

| Cost of goods sold |

6,674 | 12,669 | 4,736 | 10,470 | 35,880 | |||||||||||||||

| Selling, general and administrative |

31,413 | 35,743 | 21,696 | 21,320 | 17,605 | |||||||||||||||

| Total operating expenses |

53,504 | 65,903 | 47,027 | 56,597 | 78,291 | |||||||||||||||

| Operating income (loss) |

(11,359 | ) | 17,518 | 6,142 | (4,647 | ) | 1,029 | |||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income |

522 | 32 | 158 | 393 | 268 | |||||||||||||||

| Other income |

— | 18 | 112 | 56 | 51 | |||||||||||||||

| Loss from equity investment in Great American Real Estate, LLC |

(1,640 | ) | (861 | ) | (17 | ) | — | — | ||||||||||||

| Interest expense |

(3,667 | ) | (11,273 | ) | (4,063 | ) | (1,037 | ) | (3,767 | ) | ||||||||||

| Income (loss) from continuing operations before benefit for income taxes |

(16,144 | ) | 5,434 | 2,332 | (5,235 | ) | (2,419 | ) | ||||||||||||

| Benefit for income taxes |

5,106 | 11,664 | — | — | — | |||||||||||||||

| Income (loss) from continuing operations |

(11,038 | ) | 17,098 | 2,332 | (5,235 | ) | (2,419 | ) | ||||||||||||

| Loss from discontinued operations, net of tax |

— | (142 | ) | (2,069 | ) | (5,072 | ) | (5,960 | ) | |||||||||||

| Net income (loss) |

$ | (11,038 | ) | $ | 16,956 | $ | 263 | $ | (10,307 | ) | $ | (8,379 | ) | |||||||

| Basic earnings (loss) per share, continuing operations |

$ | (0.39 | ) | $ | 0.96 | $ | 0.22 | $ | (0.59 | ) | $ | (0.34 | ) | |||||||

| Basic earnings (loss) per share, discontinued operations |

0.00 | (0.01 | ) | (0.20 | ) | (0.56 | ) | (0.85 | ) | |||||||||||

| Basic earnings (loss) per share |

$ | (0.39 | ) | $ | 0.95 | $ | 0.02 | $ | (1.15 | ) | $ | (1.19 | ) | |||||||

| Diluted earnings (loss) per share, continuing operations |

$ | (0.39 | ) | $ | 0.92 | $ | 0.22 | $ | (0.59 | ) | $ | (0.34 | ) | |||||||

| Diluted loss per share, discontinued operations |

0.00 | (0.01 | ) | (0.20 | ) | (0.56 | ) | (0.85 | ) | |||||||||||

| Diluted earnings (loss) per share |

$ | (0.39 | ) | $ | 0.91 | $ | 0.02 | $ | (1.15 | ) | $ | (1.19 | ) | |||||||

| Weighted average basic shares outstanding |

28,075,758 | 17,786,686 | 10,560,000 | 8,934,644 | 7,040,000 | |||||||||||||||

| Weighted average diluted shares outstanding |

28,075,758 | 18,664,049 | 10,560,000 | 8,934,644 | 7,040,000 | |||||||||||||||

22

Table of Contents

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| PRO FORMA COMPUTATION RELATED TO CONVERSION TO |

| |||||||||||||||||||

| Historical income (loss) from continuing operations before income taxes |

$ | 5,434 | $ | 2,332 | $ | (5,235 | ) | $ | (2,419 | ) | ||||||||||

| Pro forma benefit (provision) for income taxes |

(2,141 | ) | (919 | ) | 2,063 | 953 | ||||||||||||||

| Pro forma income (loss) from continuing operations |

3,293 | 1,413 | (3,172 | ) | (1,466 | ) | ||||||||||||||

| Pro forma loss from discontinued operations, net of tax |

(116 | ) | (1,254 | ) | (3,074 | ) | (3,612 | ) | ||||||||||||

| Pro forma net income (loss) |

$ | 3,177 | $ | 159 | $ | (6,246 | ) | $ | (5,078 | ) | ||||||||||

| Pro forma basic earnings (loss) per share, continuing operations |

$ | 0.19 | $ | 0.13 | $ | (0.36 | ) | $ | (0.21 | ) | ||||||||||

| Pro forma basic loss per share, discontinued operations |

(0.01 | ) | (0.11 | ) | (0.34 | ) | (0.51 | ) | ||||||||||||

| Pro forma basic earnings (loss) per share |

$ | 0.18 | $ | 0.02 | $ | (0.70 | ) | $ | (0.72 | ) | ||||||||||

| Pro forma diluted earnings (loss) per share, continuing operations |

$ | 0.18 | $ | 0.13 | $ | (0.36 | ) | $ | (0.21 | ) | ||||||||||

| Pro forma diluted loss per share, discontinued operations |

(0.01 | ) | (0.11 | ) | (0.34 | ) | (0.51 | ) | ||||||||||||

| Pro forma diluted earnings (loss) per share |

$ | 0.17 | $ | 0.02 | $ | (0.70 | ) | $ | (0.72 | ) | ||||||||||

| Pro forma weighted average basic shares outstanding |

17,786,686 | 10,560,000 | 8,934,644 | 7,040,000 | ||||||||||||||||

| Pro forma weighted average diluted shares outstanding |

18,664,049 | 10,560,000 | 8,934,644 | 7,040,000 | ||||||||||||||||

| Consolidated Balance Sheet Data: (Dollars in thousands) |

||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Cash and cash equivalents |

$ | 20,080 | $ | 37,989 | $ | 16,965 | $ | 16,029 | $ | 9,965 | ||||||||||

| Restricted cash |

— | 459 | 3,653 | — | — | |||||||||||||||

| Total assets |