Use these links to rapidly review the document

Table of Contents

Index to Financial Statements

TABLE OF CONTENTS 3

TABLE OF CONTENTS 4

TABLE OF CONTENTS 5

TABLE OF CONTENTS 6

La Luna Oil Co. L.T.D. January 31, 2012

La Luna Oil Co. L.T.D. December 31, 2011

TABLE OF CONTENTS 9

TABLE OF CONTENTS 10

TABLE OF CONTENTS 11

TABLE OF CONTENTS 12

As filed with the Securities and Exchange Commission on September 9, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GeoPark Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

| Bermuda (State or other jurisdiction of incorporation or organization) |

1311 (Primary Standard Industrial Classification Code Number) |

NOT APPLICABLE (I.R.S. Employer Identification Number) |

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

+56 (2) 2242-9600

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, NY 10011

212-894-8940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

Maurice Blanco Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 Phone: (212) 450-4000 Fax: (212) 701-5800 |

Pedro Aylwin Nuestra Señora de los Ángeles 179 Las Condes, Santiago, Chile Phone: +56 (2) 2242-9600 Fax: +56 (2) 2242-9600 ext. 2016 |

John R. Vetterli White & Case LLP 1155 Avenue of the Americas, New York, NY 10036 Phone: (212) 819-8200 Fax: (212) 354-8113 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee |

||

|---|---|---|---|---|

Common shares, par value US$0.001 per share |

US$100,000,000 | US$13,640 | ||

|

||||

- (1)

- Includes

common shares which the underwriters have the option to purchase.

- (2)

- Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED SEPTEMBER 9, 2013

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus

Common Shares

GeoPark Limited

(an exempted company incorporated under the laws of Bermuda)

US$ per common share

This is an initial public offering in the United States of common shares, par value US$0.001 per share, of GeoPark Limited. We are offering common shares.

We expect the public offering price of our common shares to be between US$ and US$ per common share. We intend to apply to list our common shares on the New York Stock Exchange, or NYSE, under the symbol "GPRK." Prior to this offering, our common shares have traded, and immediately subsequent to this offering will continue to trade, on the Alternative Investment Market of the London Stock Exchange, or the AIM, under the symbol "GPK" and on the Santiago Offshore Stock Exchange under the symbol "GPK." We intend to cancel admission of our common shares to the AIM and the Santiago Offshore Stock Exchange following the listing of our common shares on the NYSE.

We are an emerging growth company, as defined in Section 2(a) of the United States Securities Act of 1933, as amended, or the Securities Act, and, as such, may elect to comply with certain reduced United States public company reporting requirements.

Investing in our common shares involves risks. See "Risk factors" beginning on page 32 of this prospectus.

| |

Per common share |

Total |

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

US$ | US$ | |||||

Underwriting discounts and commissions(1) |

US$ | US$ | |||||

Proceeds to us, before expenses |

US$ | US$ | |||||

- (1)

- See "Underwriting—Underwriting discounts and commissions" for a description of the compensation payable to the underwriters.

We have granted the underwriters an option, exercisable at any time in whole, or from time to time in part, on or before the thirtieth day following the date of this prospectus, upon written notice from J.P. Morgan Securities LLC to us, with a copy to the other underwriters, to purchase up to additional common shares, at the public offering price less an amount per common share equal to any dividends or distributions, if any, declared by us and payable on our common shares but not payable on these additional common shares, to cover over-allotments, if any, provided that the decision to over-allocate the common shares is made jointly by the underwriters at the time the price per common share is determined. See "Underwriting—Over-allotment option."

Delivery of our common shares will be made on or about , 2013.

Neither the United States Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| J.P. Morgan | BTG Pactual | Itaú BBA |

The date of this prospectus is , 2013.

We expect to begin operating in our Brazilian blocks following the completion of our pending Brazil Acquisitions.

Table of contents

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to "GeoPark," the "Company," "we," "our," "ours," "us" or similar terms refer to GeoPark Limited, together with its consolidated subsidiaries.

This prospectus has been prepared by us solely for use in connection with the proposed offering of our common shares in the United States and elsewhere. J.P. Morgan Securities LLC, Banco BTG Pactual S.A.—Cayman Branch, and Itau BBA USA Securities, Inc., or the underwriters, will act as underwriters with respect to the offering of our common shares.

i

Neither we nor the underwriters or their affiliates have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus prepared by us or on our behalf. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is not an offer to sell or solicitation of an offer to buy these common shares in any circumstances under which the offer or solicitation is unlawful.

Until , 2013, all dealers effecting transactions in our common shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

ii

Presentation of financial and other information

Certain definitions

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to:

- •

- "GeoPark Limited," "GeoPark," "we," "us," "our," the "company" and words of a similar effect, are to GeoPark Limited

(formerly GeoPark Holdings Limited), an exempted company incorporated under the laws of Bermuda, together with its consolidated subsidiaries;

- •

- "Agencia" are to GeoPark Latin America Limited Agencia en Chile, an established branch, under the laws of Chile, of

GeoPark Latin America Limited, an exempted company incorporated under the laws of Bermuda;

- •

- "GeoPark Latin America" are to our subsidiary GeoPark Latin America Limited, an exempted company incorporated under the

laws of Bermuda;

- •

- "GeoPark Fell" are to our subsidiary GeoPark Fell SpA., a sociedad por acciones incorporated under the laws of Chile;

- •

- "GeoPark Chile" are to our subsidiary GeoPark Chile S.A., a sociedad anónima cerrada incorporated

under the laws of Chile;

- •

- "GeoPark Colombia" are to our subsidiary GeoPark Colombia S.A., a sociedad anónima cerrada

incorporated under the laws of Chile;

- •

- "Winchester" are to our subsidiary Winchester Oil and Gas S.A., now GeoPark Colombia PN S.A. Sucursal

Colombia, a Colombian branch of a sociedad anónima incorporated under the laws of Panama;

- •

- "Luna" are to our subsidiary La Luna Oil Company Limited S.A., a sociedad anónima incorporated under

the laws of Panama;

- •

- "Cuerva" are to our subsidiary GeoPark Cuerva LLC, formerly known as Hupecol Caracara LLC, a limited

liability company incorporated under the laws of the state of Delaware;

- •

- "LGI" are to LG International Corp., a company incorporated under the laws of Korea;

- •

- "Panoro" are to Panoro Energy do Brasil Ltda., a limited liability company incorporated under the laws of Brazil

and a subsidiary of Panoro Energy ASA, a company incorporated under the laws of Norway, with assets in Brazil and Africa;

- •

- "Rio das Contas" are to Rio das Contas Produtora de Petróleo Ltda., a limited liability company

incorporated under the laws of Brazil;

- •

- our "Brazil Acquisitions" are to our acquisition of Rio das Contas and the separate award to us of seven new concessions

in Brazil, each expected to be completed by the end of 2013;

- •

- "Chile" are to the Republic of Chile;

- •

- "Colombia" are to the Republic of Colombia;

- •

- "Brazil" are to the Federative Republic of Brazil;

- •

- "Argentina" are to the Argentine Republic;

iii

- •

- "Peru" are to the Republic of Peru;

- •

- "US$" and "U.S. dollars" are to the official currency of the United States of America;

- •

- "Ch$" and "Chilean pesos" are to the official currency of Chile;

- •

- "Col$" and "Colombian pesos" are to the official currency of Colombia;

- •

- "GBP" are to the official currency of the United Kingdom;

- •

- "AR$" and "Argentine pesos" are to the official currency of Argentina;

- •

- "real," "reais" and "R$" are to the official currency of Brazil;

- •

- "IFRS" are to International Financial Reporting Standards as adopted by the International Accounting Standards Board, or

IASB;

- •

- "US GAAP" are to generally accepted accounting principles in the United States;

- •

- "ANP" are to the Brazilian National Petroleum, Natural Gas and Biofuels Agency (Agência Nacional do

Petróleo, Gás Natural e Biocombustíveis);

- •

- "CNPE" are to the Brazilian National Council on Energy Policy (Conselho Nacional de Política

Energética);

- •

- "ANH" are to the Colombian National Hydrocarbons Agency (Agencia Nacional de Hidrocarburos);

- •

- "economic interest" means an indirect participation interest in the net revenues from a given block based on bilateral

agreements with the concessionaires; and

- •

- "working interest" means the right granted to the lessee of a property to explore for and to produce and own oil, gas, or other minerals. The working interest owners bear the exploration, development and operating costs on either a cash, penalty or carried basis.

Financial statements

Our consolidated financial statements

This prospectus includes our audited consolidated financial statements as of and for each of the years ended December 31, 2012 and 2011, or our Annual Consolidated Financial Statements, and our unaudited interim consolidated financial statements as of June 30, 2013 and for the six-month periods ended June 30, 2013 and 2012, or our Interim Consolidated Financial Statements. We refer to our Annual Consolidated Financial Statements and our Interim Consolidated Financial Statements collectively as our Consolidated Financial Statements.

Our Consolidated Financial Statements are presented in U.S. dollars and are prepared in accordance with IFRS. Our Annual Consolidated Financial Statements have been audited by Price Waterhouse & Co. S.R.L., Buenos Aires, Argentina, a member firm of PricewaterhouseCoopers Network, or PwC, an independent registered public accounting firm, as stated in their report included elsewhere in this prospectus.

Our fiscal year ends December 31. References in this prospectus to a fiscal year, such as "fiscal year 2012," relate to our fiscal year ended on December 31 of that calendar year.

iv

Colombian acquisitions

In the first quarter of 2012, we extended our operations into Colombia, through our acquisitions of Winchester and Luna on February 14, 2012 and the acquisition of Cuerva on March 27, 2012. For accounting purposes, such acquisitions were computed as if they had occurred on January 31, 2012 and March 31, 2012, respectively. In addition, we disposed of 20% of our interest in our Colombian operations to LGI on December 31, 2012. Included in this prospectus are the audited consolidated financial statements of each of Winchester and Luna, each in accordance with IFRS, and Cuerva, in accordance with US GAAP, as of and for the year ended December 31, 2011, which we refer to as the Winchester Annual Consolidated Financial Statements, the Luna Annual Consolidated Financial Statements and the Cuerva Annual Consolidated Financial Statements, respectively, and as the Colombian Acquisitions Audited Consolidated Financial Statements, collectively. Also included in this prospectus are the consolidated financial statements for the one-month period ended January 31, 2012 of each of Winchester and Luna, each in accordance with IFRS, and the consolidated financial statements for the three-month period ended March 31, 2012 for Cuerva, in accordance with US GAAP, which we refer to collectively as the Colombian Acquisitions Interim Consolidated Financial Statements. Accordingly, our results for the six-month period ended June 30, 2013 and the year ended December 31, 2012 are not fully comparable with each other and prior periods.

The Colombian Acquisitions Audited Consolidated Financial Statements have been audited by PricewaterhouseCoopers Ltda., Colombia, a member firm of PricewaterhouseCoopers Network, independent accountants, as stated in their reports appearing herein. We refer to the Colombian Acquisitions Audited Consolidated Financial Statements and the Colombian Acquisitions Consolidated Financial Statements collectively as the Colombian Acquisitions Consolidated Financial Statements.

Acquisition of Rio das Contas

On May 14, 2013, we agreed to acquire all of the issued and outstanding shares of Rio das Contas from Panoro, for a total cash consideration of US$140.0 million subject to certain purchase price and easement adjustments. The closing of the acquisition is subject to certain conditions, including approval by the ANP, among others. We expect the acquisition to close by the end of 2013.

This prospectus includes the consolidated financial statements in accordance with IFRS of Rio das Contas as of and for the years ended December 31, 2012 and 2011, or the Rio das Contas Audited Consolidated Financial Statements, which have been audited by Ernst & Young Terco Auditores Independentes S.S., or Ernst & Young Terco, as stated in their report appearing herein, and the unaudited condensed consolidated interim financial statements of Rio das Contas as of June 30, 2013 and for the six-month periods ended June 30, 2013 and 2012, or the Rio das Contas Interim Consolidated Financial Statements. References to Rio das Contas Consolidated Financial Statements are to the Rio das Contas Audited Consolidated Financial Statements and the Rio das Contas Interim Consolidated Financial Statements. Accordingly, our results as reflected in our Consolidated Financial Statements included in this prospectus are not comparable to our results for any period following the future date on which we consolidate the results of Rio das Contas.

Pro forma financial data

In light of our Colombian acquisitions and our pending Rio das Contas acquisition, we include in this prospectus unaudited pro forma condensed combined financial data to illustrate:

- •

- the combined results of operations for GeoPark for the year ended December 31, 2012 to give pro forma effect to the acquisitions of Winchester, Luna, Cuerva and Rio das Contas and to the disposition of the 20% equity interest in GeoPark Colombia as if such transactions had occurred as of January 1, 2012;

v

- •

- the combined results of operations for GeoPark for the six-month period ended June 30, 2013 to give pro forma effect to the acquisition of Rio

das Contas as if such acquisition had occurred as of January 1, 2012; and

- •

- the combined statement of financial position for GeoPark as of June 30, 2013 to give pro forma effect to the acquisition of Rio das Contas as if such acquisition had occurred as of June 30, 2013.

We refer to the above-described pro forma financial statements as our Unaudited Condensed Combined Pro Forma Financial Data. For purposes of preparing our Unaudited Condensed Combined Pro Forma Financial Data, we have made certain adjustments to the historical and pre-acquisition financial information of Winchester, Luna, Cuerva and Rio das Contas. See "Prospectus summary—Summary unaudited condensed combined pro forma financial data" and "Unaudited condensed combined pro forma financial data." Our Unaudited Condensed Combined Pro Forma Financial Data is presented for informational purposes only and does not purport to represent our results of operations or financial condition had our acquisitions of Winchester, Luna, Cuerva or Rio das Contas and to the disposition of the 20% equity interest in GeoPark Colombia occurred at the respective dates indicated above.

Our historical financial information and pro forma financial data should be read in conjunction with "Management's discussion and analysis of financial condition and results of operations," our Consolidated Financial Statements, the Colombian Acquisitions Consolidated Financial Statements and the Rio das Contas Consolidated Financial Statements, including, in each case, the accompanying notes thereto, included elsewhere in this prospectus.

Non-IFRS financial measures

Adjusted EBITDA

Adjusted EBITDA is a supplemental non-IFRS financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies.

We define Adjusted EBITDA as profit for the period before net finance cost, income tax, depreciation, amortization and certain non-cash items such as impairments and write-offs of unsuccessful efforts, accrual of stock options and stock awards and bargain purchase gain on acquisition of subsidiaries. Adjusted EBITDA is not a measure of profit or cash flows as determined by IFRS.

Our management believes Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above from profit for the period in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, profit for the period or cash flows from operating activities as determined in accordance with IFRS or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company's financial performance, such as a company's cost of capital and tax structure and significant and/or recurring write-offs, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

For a reconciliation of Adjusted EBITDA to the IFRS financial measure of profit for the period/year, see "Prospectus summary—Summary historical financial data."

vi

We have also included pro forma Adjusted EBITDA in this prospectus to show our Adjusted EBITDA after giving pro forma effect to our recent acquisitions. For a reconciliation of pro forma Adjusted EBITDA to the IFRS financial measure of pro forma profit for the period/year, see "Unaudited condensed combined pro forma financial data."

Oil and gas reserves and production information

D&M Year-end Reserves Report

The information included in this prospectus regarding estimated quantities of proved reserves, the future net revenues from those reserves and their present value in Chile, Colombia and Argentina is derived, in part, from estimates of the proved reserves and present values of proved reserves as of December 31, 2012. The reserves estimates are derived from the report prepared by DeGolyer and MacNaughton, or D&M, independent reserves engineers, or the D&M Year-end Reserves Report, included as an exhibit to the registration statement of which this prospectus forms a part, prepared by D&M. The D&M Year-end Reserves Report was prepared by D&M for us and presents an appraisal as of December 31, 2012 of oil and gas reserves located in the Fell Block in Chile, the Del Mosquito, Cerro Doña Juana and Loma Cortaderal Blocks in Argentina and the La Cuerva, Llanos 32, Llanos 34 and Yamú Blocks in Colombia. We have also included a third-party summary report prepared by D&M pertaining to these blocks as an exhibit to the registration statement of which this prospectus forms a part.

D&M Brazil and Colombia Reserves Report

The information included in this prospectus regarding estimated quantities of proved reserves, the future net revenues from those reserves and their present value for certain new discoveries in Colombia made since December 31, 2012, as of June 30, 2013, is derived, in part, from estimates of the proved reserves and present values of proved reserves as of June 30, 2013. The reserves estimates are derived from the report prepared by D&M, or the D&M Brazil and Colombia Reserves Report, included as an exhibit to the registration statement of which this prospectus forms a part. The information included in this prospectus regarding estimated quantities of proved reserves, the future net revenues from those reserves and their present value attributable to Rio das Contas in Brazil is derived from estimates of the proved reserves and present values of proved reserves as of June 30, 2013, also presented in the D&M Brazil and Colombia Reserves Report, included as an exhibit to the registration statement of which this prospectus forms a part, prepared by D&M. We have also included a third-party summary report prepared by D&M pertaining to these blocks as an exhibit to the registration statement of which this prospectus forms a part.

The reserves information presented in this prospectus based on the D&M Reserves Reports only presents reserves estimates for our working interests in the blocks covered by such reports as of the respective dates of such reports. We refer to the D&M Year-end Reserves Report and the D&M Brazil and Colombia Reserves Report collectively as the D&M Reserves Reports. These estimates and the D&M Reserves Reports are included in this prospectus in reliance upon the authority of such firm as an expert in these matters.

Market share and other information

Market data, other statistical information, information regarding recent developments in Chile, Colombia, Brazil and Argentina and certain industry forecast data used in this prospectus were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the SEC website) and industry publications. Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly,

vii

internal reports and studies, estimates and market research, which we believe to be reliable and accurately extracted by us for use in this prospectus, have not been independently verified. However, we believe such data is accurate and agree that we are responsible for the accurate extraction of such information from such sources and its correct reproduction in this prospectus.

Measurements, oil and natural gas terms and other data

In this prospectus, we use the following measurements:

- •

- "m" or "meter" means one meter, which equals approximately 3.28084 feet;

- •

- "km" means one kilometer, which equals approximately 0.621371 miles;

- •

- "sq km" means one square kilometer, which equals approximately 247.1 acres;

- •

- "bbl" or "barrel of oil" means one stock tank barrel, which is equivalent to approximately 0.15898 cubic meters;

- •

- "boe" means one barrel of oil equivalent, which equals approximately 160.2167 cubic meters, determined using the ratio of

6,000 cubic feet of natural gas to one barrel of oil;

- •

- "cf" means one cubic foot;

- •

- "m," when used before bbl, boe or cf, means one thousand bbl, boe or cf, respectively;

- •

- "mm," when used before bbl, boe or cf, means one million bbl, boe or cf, respectively; and

- •

- "b," when used before bbl, boe or cf, means one billion bbl, boe or cf, respectively.

In addition, we have provided definitions for certain industry terms used in this prospectus in the "Glossary of oil and natural gas terms" included as Appendix A to this prospectus.

Rounding

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

viii

This summary highlights certain information appearing elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus carefully, including the "Risk factors," "Forward-looking statements," "Management's discussion and analysis of financial condition and results of operations" and "Unaudited condensed combined pro forma financial data" sections, our Consolidated Financial Statements and the related notes, the Colombian Acquisitions Consolidated Financial Statements and the related notes, and the Rio das Contas Consolidated Financial Statements and the related notes, included in this prospectus, before deciding to invest in our common shares. Although we believe that the estimates and projections included in this prospectus are based on reasonable assumptions, you should be aware that these estimates and projections are subject to many risks and uncertainties as described in "Risk factors" and "Forward-looking statements." We have provided definitions for certain industry terms used in this prospectus in the "Glossary of oil and natural gas terms" included as Appendix A to this prospectus.

Our business

Overview

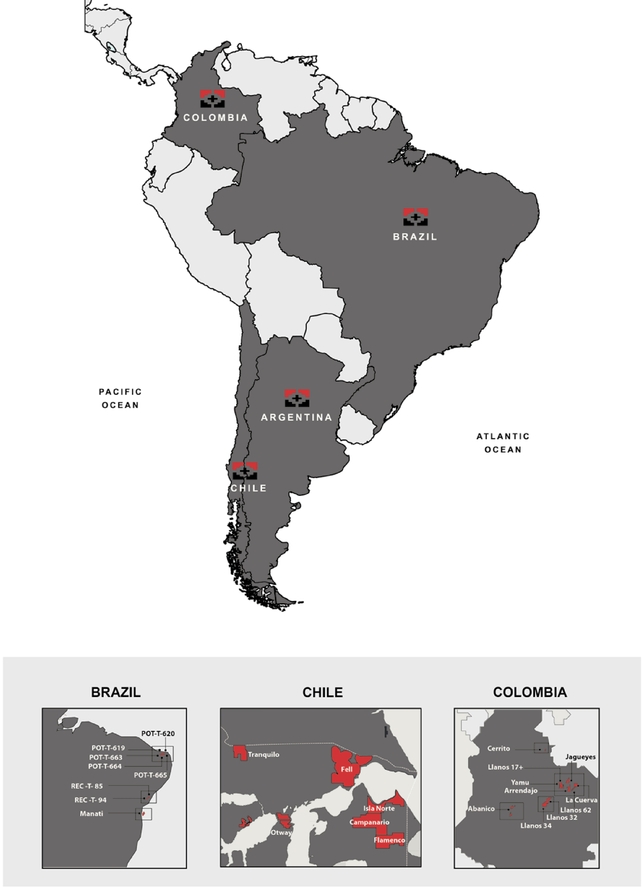

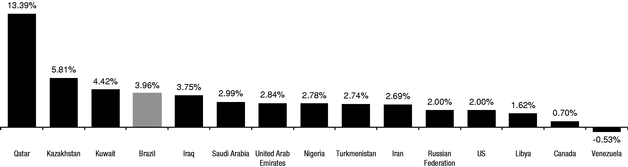

We are an independent oil and natural gas exploration and production, or E&P, company with operations in South America and a proven track record of growth in production, reserves and cash flows since 2006. We operate in Chile, Colombia and, to a lesser extent, in Argentina, and we expect to begin operating in Brazil by the end of 2013, following the closing of our pending Rio das Contas acquisition and the separate award to us of seven new concessions in Brazil (which we refer to collectively as our Brazil Acquisitions). See "—Recent developments."

We have a well-balanced portfolio of assets that includes working and/or economic interests in 19 onshore hydrocarbons blocks, with nine blocks currently in production, and eight additional blocks upon the closing of the pending Brazil Acquisitions. We produced a net average of 13,221 boepd during the first half of 2013, 58% of which was produced in Chile, 42% of which was produced in Colombia and 0.4% of which was produced in Argentina, and of which 80% was oil. Accounting for our pending Rio das Contas acquisition, on a pro forma basis, we would have produced an average of 17,135 boepd during the first half of 2013, with Chile, Colombia and Brazil representing 44%, 32% and 23% of our production, respectively, and with oil representing 62% of our total production. As of December 31, 2012, we had net proved reserves of 16.8 mmboe (composed of 71% oil and 29% natural gas), of which 10.2 mmboe, or 61%, and 6.6 mmboe, or 39%, were in Chile and Colombia, respectively. According to the D&M Brazil and Colombia Reserves Report, our net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe (composed of 100% oil). Additionally, according to this report, as of June 30, 2013, Rio das Contas had net proved reserves of 8.1 mmboe (composed of approximately 99% natural gas).

We have developed our company around three principal abilities:

- •

- to successfully explore the subsurface in the search for oil and gas;

- •

- to efficiently operate, drill, produce and market hydrocarbons from our properties; and

- •

- to acquire and consolidate assets in the main oil- and natural gas-producing regions in South America.

We believe that our risk and capital management policies have enabled us to compile a geographically diverse portfolio of properties that balances exploration, development and production of oil and gas. These attributes have also allowed us to raise capital and to partner with premier international companies.

1

Finally, we believe we have developed a distinctive culture within our organization that promotes and rewards partnership, entrepreneurship and merit. Consistent with this approach, all of our employees are eligible to participate in our long-term incentive program, or our Performance-Based Employee Long-Term Incentive Program. See "Management—Compensation—Executive compensation—Performance-Based Employee Long-Term Incentive Program."

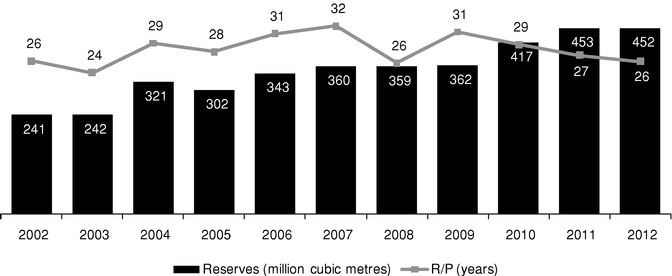

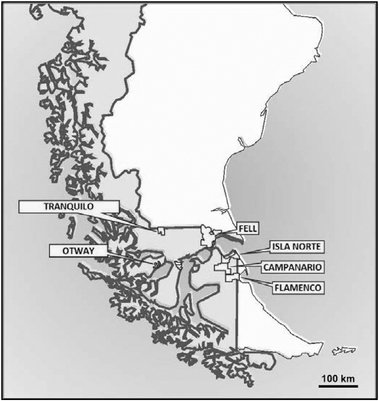

In Chile, we are the first and the largest non-state-controlled oil and gas producer. We began operations in 2006 in the Fell Block and have evolved from having a non-operated, non-producing interest to having a fully-operated and producing asset with over 10.2 mmboe of net proved reserves as of December 31, 2012 and average production of 7,615 boepd in the first six months of 2013. In addition, we operate five other hydrocarbon blocks in Chile with significant prospective resources.

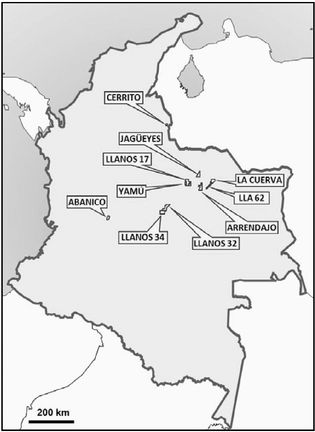

In Colombia, following our successful acquisitions of Winchester, Luna and Cuerva in early 2012, we have an asset base of 10 hydrocarbon blocks where we were able to increase average production to 5,550 boepd in the first six months of 2013, an increase of 83% (on a pro forma basis, giving effect to our Colombian acquisitions) as compared to the first six months of 2012. As of December 31, 2012, we had net proved reserves of 6.6 mmboe in Colombia. Furthermore, according to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe of net proved reserves.

In May 2013, we expanded our footprint to Brazil, and were awarded, subject to entry into concession agreements with the ANP, seven new concessions in the onshore Recôncavo Basin in the State of Bahia and in the onshore Potiguar Basin in the State of Rio Grande do Norte. We also agreed, in May 2013, to acquire Rio das Contas from Panoro, which holds a 10% working interest in the shallow offshore Manati Field, the largest non-associated gas field in Brazil, which produced, in the year ended December 31, 2012, approximately 8.7% of the gas produced in Brazil. Rio das Contas's 10% working interest in the Manati Field represented 3,914 boepd of production during the first half of 2013. See "—Recent developments."

The table below sets forth certain of our financial and operating data for the periods indicated, as well as pro forma data reflecting our acquisitions of Winchester, Luna and Cuerva in Colombia and our pending Brazil Acquisitions.

| |

For the six-month period ended June 30, |

For the year ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2013 |

2012 |

2012 |

2011 |

|||||||||

| |

(unaudited) |

(unaudited) |

|

|

|||||||||

Financial data |

|||||||||||||

Revenues (US$ thousands) |

160,806 | 121,991 | 250,478 | 111,580 | |||||||||

Pro forma revenues (US$ thousands) (unaudited)(1) |

185,422 | — | 325,403 | — | |||||||||

Adjusted EBITDA(2) (US$ thousands) |

84,014 | 70,274 | 121,404 | 63,391 | |||||||||

Pro forma Adjusted EBITDA(1)(2) (US$ thousands) (unaudited) |

101,191 | — | 168,708 | — | |||||||||

Operating data (unaudited) |

|||||||||||||

Average net production (boepd) |

13,221 | 11,939 | 11,292 | 7,593 | |||||||||

% oil and liquids |

80% | 62% | 66% | 33% | |||||||||

Pro forma average net production (boepd)(3) |

17,135 | 15,428 | 14,952 | — | |||||||||

Pro forma % oil and liquids(4) |

62% | 49% | 50% | — | |||||||||

(1) Pro forma revenues and pro forma Adjusted EBITDA are revenues and Adjusted EBITDA, respectively, after giving effect to the acquisitions of Winchester, Luna, Cuerva and Rio das Contas for the year ended December 31, 2012 and, after giving effect to the acquisition of Rio das

2

Contas, for June 30, 2013, in each case as if such acquisitions had occurred as of January 1, 2012. For a reconciliation of pro forma Adjusted EBITDA to the IFRS financial measure of profit for the period before income tax, see "Unaudited Condensed Combined Pro Forma Financial Data—Note 6."

(2) We define Adjusted EBITDA as profit for the period before net finance cost, income tax, depreciation, amortization and certain non-cash items such as impairments and write-offs of unsuccessful efforts, accrual of stock options and stock awards and bargain purchase gain on acquisition of subsidiaries. Adjusted EBITDA is not a measure of profitability or cash flows as determined by IFRS. See "Presentation of financial and other information—Non-IFRS financial measures." For a reconciliation of pro forma Adjusted EBITDA to the IFRS financial measure of profit before income tax, see "Unaudited Condensed Combined Pro Forma Financial Data—Note 6."

(3) Pro forma average net production is production after giving effect to the acquisitions of Winchester, Luna, Cuerva and Rio das Contas for the year ended December 31, 2012 and, after giving effect to the acquisition of Rio das Contas, for June 30, 2013, in each case as if such acquisitions had occurred as of January 1, 2012.

(4) Pro forma % oil and liquids is % oil and liquids after giving effect to the acquisitions of Winchester, Luna, Cuerva and Rio das Contas for the year ended December 31, 2012 and, after giving effect to the acquisition of Rio das Contas, for June 30, 2013, in each case as if such acquisitions had occurred as of January 1, 2012.

Our history

We were founded in 2002 by Gerald E. O'Shaughnessy and James F. Park, who have over 25 and 35 years of international oil and natural gas experience, respectively, and who, as of August 19, 2013, collectively held approximately 33.76% of our common shares and are involved in our operations and strategy. Mr. O'Shaughnessy currently serves as our Executive Chairman and Mr. Park currently serves as our Chief Executive Officer and Deputy Chairman, and both actively contribute to our ongoing operations and business decisions.

Our history commenced with the purchase of AES Corporation's upstream oil and natural gas assets in Chile and Argentina. Those assets included a non-operating working interest in the Fell Block in Chile, which at that time was operated by the Empresa Nacional de Petróleo, or ENAP, the Chilean state-owned hydrocarbon company, and operating working interests in the Del Mosquito, Cerro Doña Juana and Loma Cortaderal blocks in Argentina, which we collectively refer to as the Argentina Blocks. Since 2002, our business has grown significantly.

In 2006, after demonstrating our technical expertise and committing to an exploration and development plan, we obtained a 100% operating working interest in the Fell Block by the Republic of Chile. Also in 2006, the International Finance Corporation, or the IFC, a member of the World Bank Group, became one of our principal shareholders, and we listed our common shares on the Alternative Investment Market of the London Stock Exchange, or the AIM, in an initial public offering of common shares outside the United States. Subsequently, in 2008 and 2009, we issued and sold additional common shares outside the United States.

In 2008 and 2009, we continued our growth in Chile by acquiring operating working interests in each of the Otway and Tranquilo Blocks, and by forming partnerships with Pluspetrol, Wintershall, Methanex and IFC.

In 2010, we formed a strategic partnership with LGI, a Korean conglomerate, to jointly acquire and develop upstream oil and gas projects in South America. LGI's business includes a portfolio of energy and raw material projects, including oil and gas projects in the Middle East and in Southeast and Central Asia.

In 2011, we were awarded by ENAP the opportunity to obtain operating working interests in each of the Isla Norte, Flamenco and Campanario blocks in Tierra del Fuego, Chile, which we refer to collectively as the Tierra del Fuego Blocks, and in 2012, we formalized and jointly with ENAP entered into special operation contracts (Contratos Especiales de Operación para la Exploración y Explotación de Yacimientos de Hidrocarburos), each of which we refer to as a CEOP, with Chile for the exploration and exploitation of these blocks.

3

Also in 2011, LGI acquired a 20% equity interest in GeoPark Chile and a 14% equity interest in GeoPark TdF S.A., or GeoPark TdF, for US$148.0 million. LGI also provided to GeoPark TdF US$84.0 million in stand-by letters of credit to partially secure the US$101.4 million performance bond required by the Chilean government to guarantee GeoPark TdF's obligations with respect to the minimum work program under the Tierra del Fuego CEOPs. Our agreement with LGI in the Tierra del Fuego Blocks allows us to earn back up to 12% equity participation in GeoPark TdF, depending on the success of our operations in Tierra del Fuego. See "Business—Significant agreements—Agreements with LGI."

In the first quarter of 2012, we moved into Colombia by acquiring three privately held E&P companies, Winchester, Luna and Cuerva. These acquisitions provide us with an attractive platform in Colombia that includes working interests and/or economic interests in 10 blocks located in the Llanos, Magdalena and Catatumbo Basins and covering an area of approximately 575,000 gross acres.

In December 2012, LGI acquired a 20% equity interest in GeoPark Colombia for US$20.1 million, including the assumption of existing debt and the commitment to provide additional funding to cover LGI's share of required future investments in Colombia. In addition, our agreement with LGI in Colombia allows us to earn back up to 12% of equity participation in GeoPark Colombia, depending on the success of our operations in Colombia. See "Business—Significant agreements—Agreements with LGI." We and LGI also agreed that we would extend our strategic partnership to build a portfolio of upstream oil and gas assets throughout South America through 2015. We believe our partnership with LGI represents a positive independent assessment and validation of the quality of our Chilean and Colombian asset inventory, the extent of our technical and operational expertise and the ability of our management to structure and effect significant transactions.

In May 2013, we entered into agreements to expand our operations to Brazil. See "—Recent developments."

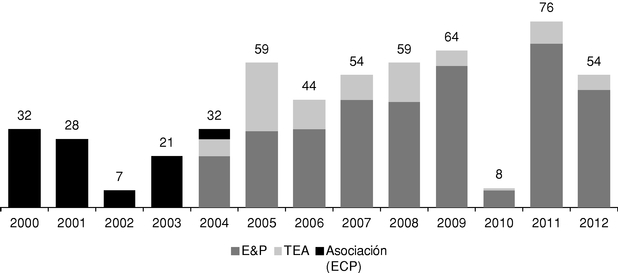

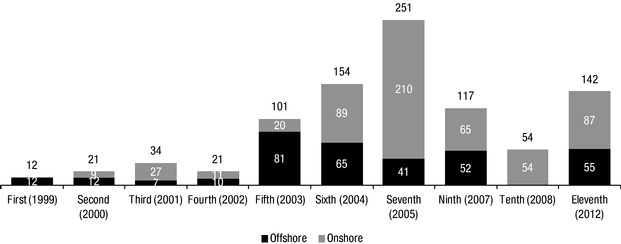

Our operations

We have been able to successfully develop our assets through drilling, with a 69% success ratio, resulting from 95 of the 138 wells that we drilled from 2006 through June 30, 2013 having become productive wells. We have grown our business through winning new licenses and acquiring strategic assets and businesses, with 15 new blocks incorporated into our portfolio since January 1, 2006 and eight more concessions expected to be incorporated upon the completion of our pending Brazil Acquisitions. Since our inception, we have supported our growth through our prospect development efforts and our drilling program, as well as by developing long-term strategic partnerships and alliances with key industry participants, accessing debt and equity capital markets and developing and retaining a technical team with vast experience and a successful track record of finding and producing oil and gas in South America. A key factor behind our success ratio is our experienced team of geologists, geophysicists and engineers, including professionals with specialized expertise in geological conditions in each of Chile, Colombia, Brazil and Argentina.

Currently, we are in the midst of our most significant exploration and drilling plan to date. For the first six months of 2013, we drilled 25 new wells (nine in Chile and 16 in Colombia) in blocks in which we have working interests and/or economic interests. We invested US$147.1 million (US$91.2 million and US$55.9 million in Chile and Colombia, respectively) for the first six months of 2013, of which US$84.0 million related to exploration. We intend to continue this program through the rest of 2013, and expect our total investments for 2013 to be between US$200 to US$230 million in Chile and Colombia, which will include the drilling of 35 to 45 wells.

In addition, in Brazil, we expect to spend US$140 million to acquire Rio das Contas, which we intend to finance through the incurrence of a R$166.0 million (approximately US$70 million at the August 30, 2013

4

exchange rate of R$2.3719 to US$1.00) loan and cash on hand. We have also paid R$10.2 million in license fee payments to the ANP, relating to seven of our eight pending Brazilian concessions. We may also be required to spend approximately US$5 million to US$7.5 million to finance in part the construction of a gas compression plant in 2013 or 2014 in the Manati Field following the closing of our pending Rio das Contas acquisition.

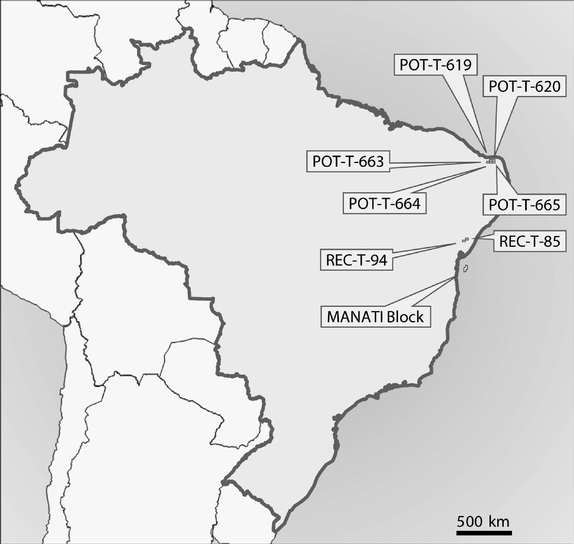

The following map shows the countries in which we have blocks with working and/or economic interests. For information on our working interests in each of these blocks, see "—Our assets" below.

(1) We entered into an agreement on May 10, 2013 with Panoro to acquire Rio das Contas, which holds a 10% working interest in the BCAM-40 Concession. We were also awarded seven new concessions in the Recôncavo and Potiguar Basins in Brazil. We expect these acquisitions to be completed by the end of 2013. See "—Recent developments."

5

The following table sets forth our net proved reserves and other data as of and for the year ended December 31, 2012.

| Country |

Oil (mmbbl) |

Gas (bcf) |

Oil equivalent (mmboe) |

% Oil |

Revenues (in thousands of US$) |

% of total revenues |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

For the year ended December 31, 2012 | ||||||||||||||||||

Chile |

5.3 | 29.6 | 10.2 | 52% | 149,927 | 60% | |||||||||||||

Colombia |

6.6 | — | 6.6(1 | ) | 100% | 99,501 | 40% | ||||||||||||

Argentina |

— | — | — | — | 1,050 | — | |||||||||||||

Total |

11.9 | 29.6 | 16.8 | 71% | 250,478 | 100% | |||||||||||||

(1) According to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, our net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe of net proved reserves.

As of June 30, 2013, according to the D&M Brazil and Colombia Reserves Report, the net proved reserves attributable to our pending acquisition of Rio das Contas in Brazil were 8.1 mmboe (composed of approximately 99% natural gas), which generated revenues of US$24.6 million for the six-month period ended June 30, 2013.

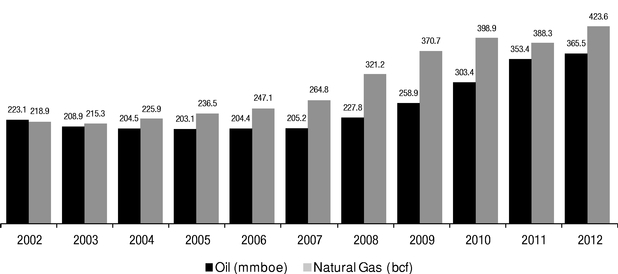

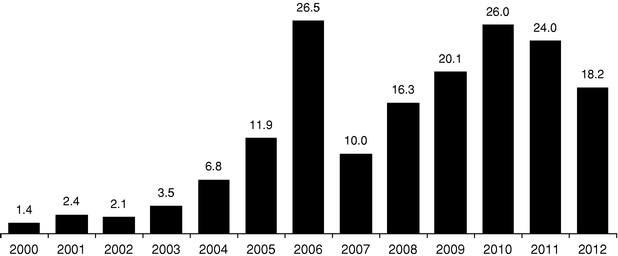

Our commitment to growth has translated into a strong compounded annual growth rate, or CAGR, of 51.3% for production in the period from 2007 to 2012, as measured by boepd in the table below.

| |

For the year ended December 31, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

|||||||||||||

Average net production (mboepd) |

11.3 | 7.6 | 6.9 | 6.3 | 3.4 | 1.4 | |||||||||||||

% oil |

66.3% | 33.0% | 28.4% | 19.5% | 9.8% | 12.0% | |||||||||||||

During the year ended December 31, 2012, Rio das Contas produced 3.7 mboepd.

The following table sets forth our production of oil and natural gas in the blocks in which we have a working interest and/or economic interest as of June 30, 2013.

| |

Average daily production | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

For the six-month period ended June 30, 2013 | |||||||||

| |

Chile |

Colombia |

Argentina |

|||||||

Oil production |

||||||||||

Total crude oil production (bopd) |

5,048 | 5,547 | 44 | |||||||

Average sales price of crude oil (US$/bbl) |

81.4 | 79.7 | 68.2 | |||||||

Natural gas production |

||||||||||

Total natural gas production (mcf/day) |

15,399 | 17 | 73 | |||||||

Average sales price of natural gas (US$/mcf) |

4.5 | 4.2 | 1.2 | |||||||

Oil and natural gas production cost |

||||||||||

Weighted average production cost (US$/boe) |

24.4 | 46.5 | 70.4 | |||||||

For the six-month period ended June 30, 2013, Rio das Contas produced an average of 3,914 boepd (including 98% natural gas and 2% oil), with an average sales price of US$41.8/boe and an average production cost of US$26.2/boe.

6

Our assets

According to the D&M Year-end Reserves Report, as of December 31, 2012, the blocks in Chile, Colombia and Argentina in which we have a working interest had 16.8 mmboe of net proved reserves, with 61%, or 10.2 mmboe, and 39%, or 6.6 mmboe, of such net proved reserves located in Chile and Colombia, respectively. According to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe of net proved reserves, and net proved reserves attributable to our pending acquisition of Rio das Contas in Brazil were 8.1 mmboe. For the six-month period ended June 30, 2013, we produced an average of 13,221 boepd, 58% of which, or 7,615 boepd, was produced in the Fell Block, 42% of which, or 5,550 boepd, was produced in the Colombian blocks and 0.4%, or 56 boepd, was produced in the Argentine blocks.

We are the operator of a majority of the blocks in which we have a working interest. The following table summarizes certain information about our Chilean, Colombian and Argentine blocks as of June 30, 2013, except as otherwise indicated.

| Country |

Block |

Operator |

Working interest (%)(1)(2) |

Basin |

Gross area (thousand acres)(3) |

Net proved reserves (mmboe)(4) |

% of oil |

Net production (boepd)(6) |

% of oil |

Concession expiration year |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Chile |

Fell | GeoPark | 100% | Magallanes | 367.8 | 10.2 | 52% | 7,615 | 66% | Exploitation: 2032 | ||||||||||||||||

Chile |

Tranquilo | GeoPark | 29% | Magallanes | 92.4 | — | — | — | — | Exploitation: 2043 | ||||||||||||||||

Chile |

Otway | GeoPark | 100% | Magallanes | 49.4(8 | ) | — | — | — | — | Exploitation: 2044 | |||||||||||||||

Chile |

Isla Norte | GeoPark | 60%(7 | ) | Magallanes | 130.2 | — | — | — | — | Exploration: 2019 Exploitation: 2044 |

|||||||||||||||

Chile |

Campanario, | GeoPark | 50%(7 | ) | Magallanes | 192.2 | — | — | — | — | Exploration: 2020 Exploitation: 2045 |

|||||||||||||||

Chile |

Flamenco. | GeoPark | 50%(7 | ) | Magallanes | 141.3 | — | — | — | — | Exploration: 2019 Exploitation: 2044 |

|||||||||||||||

Subtotal Chile |

973.3 | 10.2 | 52% | 7,615 | 66% | |||||||||||||||||||||

Colombia |

La Cuerva | GeoPark | 100% | Llanos | 47.8 | 2.2 | 100% | 1,955 | 100% | Exploration: 2014 Exploitation: 2038 |

||||||||||||||||

Colombia |

Llanos 34 | GeoPark | 45% | Llanos | 82.2 | 3.9(5) | 100% | 2,557 | 100% | Exploration: 2015 Exploitation: 2039 |

||||||||||||||||

Colombia |

Llanos 62 | GeoPark | 100% | Llanos | 44.0 | — | — | — | — | Exploration: 2017 Exploitation: 2041 |

||||||||||||||||

Colombia |

Yamú | GeoPark | 54.5/75%(9 | ) | Llanos | 11.2 | 0.4(5) | 100% | 565 | 100% | Exploration: 2013 Exploitation: 2036 |

|||||||||||||||

Colombia |

Llanos 17 | Ramshorn | 36.8%(10 | ) | Llanos | 108.8 | — | — | — | — | Exploration: 2015 Exploitation: 2039 |

|||||||||||||||

Colombia |

Llanos 32 | P1 Energy | 10%(10 | ) | Llanos | 100.3 | 0.02 | 100% | 218 | 100% | Exploration: 2015 Exploitation: 2039 |

|||||||||||||||

Colombia |

Jagüeyes 3432A | Columbus | 5% | Llanos | 61.0 | — | — | — | — | Exploration: 2014 Exploitation: 2038 |

||||||||||||||||

Subtotal Colombia |

455.3 | 6.6 | 100% | 5,294 | 100% | |||||||||||||||||||||

Argentina |

Del Mosquito | GeoPark | 100% | Austral | 17.3 | — | — | 56 | 78% | Exploitation: 2016 | ||||||||||||||||

Argentina |

Cerro Doña Juana | GeoPark | 100% | Neuquén | 19.6 | — | — | — | — | Exploitation: 2017 | ||||||||||||||||

Argentina |

Loma Cortaderal | GeoPark | 100% | Neuquén | 28.3 | — | — | — | — | Exploitation: 2017 | ||||||||||||||||

Subtotal Argentina |

65.2 | — | — | 56 | 78% | |||||||||||||||||||||

Total GeoPark |

1,493.8 | 16.8 | 12,965 | |||||||||||||||||||||||

(1) Working interest corresponds to the working interests held by our respective subsidiaries in such block, net of any working interests and/or economic interests held by other parties in such block.

(2) As of the date of this prospectus, LGI has a 20% equity interest in our Chilean operations through GeoPark Chile and a 20% equity interest in our Colombian operations through GeoPark Colombia.

(3) Gross area refers to the total acreage of each block.

(4) Reflects net proved reserves as of December 31, 2012.

(5) According to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, our net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe, composed of 2.2 mmboe in the Llanos 34 Block and 0.2 mmboe in the Yamú Block, to our net proved reserves.

7

(6) Reflects net average production for the first six months of 2013. Net production refers to average production for each block, net of any working interests or economic interests held by others in such block but gross of any royalties due to others.

(7) LGI has a 14% direct equity interest in our Tierra del Fuego operations through GeoPark TdF and a 20% direct equity interest in GeoPark Chile, for a total of a 31.2% effective equity interest in our Tierra del Fuego operations. See "Business—Our operations—Operations in Chile—Tierra del Fuego Blocks (Isla Norte, Campanario and Flamenco Blocks)."

(8) In April 2013, we voluntarily relinquished to the Chilean government all of our acreage in the Otway Block, except for 49,421 acres. In May 2013, our partners under the joint operating agreement governing the Otway Block decided to withdraw from such joint operating agreement, and applied for an assignment of rights permit on August 5, 2013, pursuant to which, and subject to the Chilean Ministry of Energy's approval, we will be the sole participant, and have a working interest of 100%, in our two remaining areas under the Otway Block CEOP. See "Business—Our operations—Operations in Chile—Otway and Tranquilo Blocks."

(9) Although we are the sole title holder of the working interest in the Yamú Block, other parties have been granted economic interests in fields in this block. Taking those other parties' interests into account, we have a 54.5% interest in the Carupana Field and a 75% interest in the Yamú Field, both located in the Yamú Block.

(10) We currently have a 40% working interest in the Llanos 17 Block, although we have assigned a 3.2% economic interest to a third party. We expect to apply to formalize this assignment with the ANH so that it will be recognized as a working interest.

(11) We currently have a 10% economic interest in the Llanos 32 Block, although we expect to apply to the ANH to recognize this as a working interest in the block.

Additionally, according to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, the net proved reserves attributable to our pending acquisition of Rio das Contas in Brazil were 8.1 mmboe.

The table below summarizes information as of June 30, 2013 regarding the concessions in Brazil in which we expect to have a working interest following the completion of our pending Brazil Acquisitions.

| Block |

Gross acres (thousand acres) |

% working interest(1) |

Partners |

Operator |

Net proved reserves (mmboe) |

Production (boepd) |

Basin |

Concession expiration year |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

BCAM-40 |

22.8 | 10% | Petrobras; QGEP; Brasoil |

Petrobras | 8.1 | 3,914 | Camamu-Almada | Exploitation: 2029(2)-2034(3 | ) | |||||||||||||

REC-T 94 |

7.7 | 100% | — | GeoPark | — | — | Recôncavo | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

REC-T 85 |

7.7 | 100% | — | GeoPark | — | — | Recôncavo | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

POT-T 664 |

7.9 | 100% | — | GeoPark | — | — | Potiguar | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

POT-T 665 |

7.9 | 100% | — | GeoPark | — | — | Potiguar | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

POT-T 619 |

7.9 | 100% | — | GeoPark | — | — | Potiguar | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

POT-T 620 |

7.9 | 100% | — | GeoPark | — | — | Potiguar | Exploration: 2018 Exploitation: 2045 |

||||||||||||||

POT-T 663 |

7.9 | 100% | — | GeoPark | — | — | Potiguar | Exploration: 2018 | ||||||||||||||

Total Brazil |

77.7 | 8.1 | 3,914 | Exploitation: 2045 | ||||||||||||||||||

(1) Working interest corresponds to the working interests we expect to hold in such concession, net of any working interests held by other parties in such concession, following the completion of our pending Brazil Acquisitions.

(2) Corresponds to Manati Field.

(3) Corresponds to Camarão Norte Field.

Our strengths

We believe that we benefit from the following competitive strengths:

High quality and diversified asset base built through a successful track record of organic growth and acquisitions

Our assets include a diverse portfolio of oil- and natural gas-producing reserves, operating infrastructure, operating licenses and valuable geological surveys. According to the D&M Year-end Reserves Report, as of December 31, 2012, we had 16.8 mmboe of net proved reserves in Chile and Colombia, of which 71%, or 11.9 mmboe, was in oil, and 29%, or 4.9 mmboe, was in gas, and of which 37%, or 6.2 mmboe, were net proved developed reserves. Throughout our history, we have delivered continuous growth in our production, and our management team has been able to identify under-exploited assets and turn them into

8

valuable, productive assets. For example, in 2002, we acquired a non-operating working interest in the Fell Block in Chile, which at the time had no material oil and gas production or reserves despite having been actively explored and drilled over the course of more than 50 years. Since 2006, when we became the operator of the Fell Block, through June 30, 2013, we have invested more than US$410 million and drilled approximately 89 wells in the block, with 72% of such wells becoming productive during that period. Currently, we are the operator and sole concessionaire of the Fell Block, which, during the six-month period ended June 30, 2013, produced approximately 7,615 boepd from 59 active wells. As of June 30, 2013, we generated 69% of Chile's total oil production and 18% of its gas production, according to information provided by the Chilean Ministry of Energy.

The acquisitions of Winchester, Luna and Cuerva in Colombia in the first quarter of 2012 gave us access to an additional 574,979 of gross exploratory and productive acres across 10 blocks in what we believe to be one of South America's most attractive oil and gas geographies. According to the D&M Year-end Reserves Report, as of December 31, 2012, the blocks in Colombia in which we have a working interest had 6.6 mmboe of net proved reserves, all of which were in oil. Additionally, according to the D&M Brazil and Colombia Reserves Report, as of June 30, 2013, our net proved reserves for certain new discoveries made in Colombia since December 31, 2012 resulted in an additional 2.4 mmboe to our net proved reserves. Since we acquired Winchester, Luna and Cuerva, we were able to increase average production to 5,550 boepd in Colombia in the first six months of 2013, an increase of 83% (on a pro forma basis, giving effect to our Colombian acquisitions) as compared to the first six months of 2012. Also, we have been able to leverage our technical expertise and have made several discoveries in the Llanos Basin, including a discovery of oil located in the hanging wall of a normal fault in our Llanos 34 Block.

In addition, in line with our growth strategy, we announced the expansion of our footprint to Brazil. See "—Recent developments."

Significant drilling inventory and resource potential from existing asset base

Our portfolio includes large land holdings in high-potential hydrocarbon basins and blocks with multiple drilling leads and prospects in different geological formations, which provide a number of attractive opportunities with varying levels of risk. Our drilling inventory consists of over 200 identified drilling locations, and our development plans target locations that we believe are low-cost, provide attractive economics and support a predictable production profile. Currently, we are in the midst of our most significant exploration and drilling plan to date:

- •

- in Chile, we recently completed a 3D seismic survey covering 296,000 gross acres, or 64% of the gross acres in our Tierra

Del Fuego Blocks, and drilled our first successful exploratory well (Chercán 1) in the Flamenco Block which resulted in our first oil and gas discovery in Tierra del Fuego. We

are currently completing the construction of a flowline to connect this well to existing infrastructure and put it into production. Our Tierra del Fuego Blocks have similar geological characteristics

to the Fell Block, and we intend to replicate the exploration and development strategy we successfully executed in the Fell Block in these blocks. In 2011, we expanded into a new play concept

following our first oil discovery in the Konawertru well in the Tobifera formation, a volcanic rock that lies below the Springhill formation, the traditional sandstone of the Magallanes Basin. Since

then, we have significantly increased our oil production from the drilling of additional wells in the formation and we plan to continue exploring this formation. We have also recently initiated a

technical assessment of the oil and gas shale potential in the Estratos con Favrella shale formation in some of our blocks in Chile; and

- •

- in Colombia, following our identification of several leads and prospects in our Llanos 34 Block, our most prospective Colombian block, we have begun a 3D seismic survey on most of the remaining 50% of the

9

acreage that had not been previously surveyed. Furthermore, in the second quarter of 2013, we successfully put into production our third discovery, the Potrillo 1 well in the Yamú Block, and our fourth discovery, the Tarotaro 1 well in the Llanos 34 Block.

Our geoscience team continues to identify new potential accumulations and expand our inventory of prospects and drilling opportunities, including the seven new exploratory concessions that were awarded to us by the ANP, subject to entry into concession agreements with the ANP.

Strong liquidity and financial flexibility to fund expansion

We benefit from both historically consistent cash flows and access to debt and equity capital markets, as well as other funding sources, which have provided us with strong liquidity and the financial flexibility to finance our organic growth and the pursuit of potential new opportunities. We generated US$96.9 million and US$131.8 million in cash from operations in the six-month period ended June 30, 2013 and the year ended December 31, 2012, respectively, and had US$149.4 million and US$38.3 million in cash and cash equivalents as of June 30, 2013 and December 31, 2012, respectively.

In February 2006, the IFC became a significant shareholder by contributing US$10 million. Later that year, we entered into a loan agreement for US$20 million with the IFC, which we have since fully repaid, to partially finance our investment program.

In 2006, we completed an initial public offering of our common shares outside the United States on the AIM and, in 2008 and 2009, we issued and sold additional common shares outside the United States.

In 2007, we obtained financing from Methanex Chile S.A., or Methanex, the Chilean subsidiary of the Methanex Corporation, a leading global methanol producer, in an amount of US$40 million, structured as a gas pre-sale agreement with a six-year term at an interest rate equal to LIBOR.

In 2010, we issued US$133.0 million aggregate principal amount of 7.75% senior secured notes in the international markets, or the Notes due 2015, which were redeemed following our issuance in 2013 of US$300.0 million aggregate principal amount of 7.50% senior secured notes due 2020, or the Notes due 2020.

Highly committed founding shareholders and technical and management teams with proven industry expertise and technically-driven culture

Our founding shareholders, management and operating teams have significant experience in the oil and gas industry and a proven technical and commercial performance record in onshore fields, as well as complex projects in South America and around the world, including expertise in identifying acquisition and expansion opportunities. Moreover, we differentiate ourselves from other E&P companies through our technically-driven culture, which fosters innovation, creativity and timely execution. Our geoscientists, geophysicists and engineers are pivotal to the success of our business strategy, and we have created an environment and supplied the resources that enable our technical team to focus its knowledge, skills and experience on finding and developing oil and gas fields.

In addition, we strive to provide a safe and motivating workplace for employees in order to attract, protect, retain and train a quality team in the competitive marketplace for capable energy professionals.

Our CEO, Mr. James Park, has been involved in E&P projects in South America since 1978. He has been closely involved in grass-roots exploration activities, drilling and production operations, surface and pipeline construction, legal and regulatory issues, crude oil marketing and transportation and capital raising for the industry. Mr. Park currently holds 16.44% of our outstanding common shares.

10

Our Chairman, Mr. Gerald O'Shaughnessy, has been actively involved in the oil and gas business internationally and in North America since 1976. Mr. O'Shaughnessy currently holds 17.32% of our outstanding common shares.

Our management and operating team has an average experience in the energy industry of approximately 25 years in companies such as Chevron, San Jorge, Petrobras, Total, Pluspetrol, ENAP and YPF, among others. Throughout our history, our management and operating team has had success in unlocking unexploited value from previously underdeveloped assets.

In addition, on a fully diluted basis, as of June 30, 2013, our executive directors, management and employees (excluding our founding shareholders, Mr. Gerald E. O'Shaughnessy and Mr. James F. Park) owned 7.8% of our outstanding common shares, aligning their interests with those of all our shareholders and helping retain the talent we need to continue to support our business strategy. See "Management—Compensation." Our founding shareholders are also involved in our daily operations and strategy.

Long-term strategic partnerships and strong strategic relationships, such as with LGI provide us with additional funding flexibility to pursue further acquisitions

We benefit from a number of strong partnerships and relationships. In March 2010, we entered into a framework agreement with LGI to establish a strategic growth partnership to jointly acquire and invest in oil and natural gas projects throughout South America. In May 2011, our partnership with LGI was strengthened by LGI's acquisition of a 10% interest in our existing Chilean operations. In October 2011, LGI acquired an additional 10% in GeoPark Chile and a 14% equity interest in GeoPark TdF, and agreed to provide additional financial support for the further development of the Tierra del Fuego Blocks. Our relationship with LGI continues to grow. In December 2012, LGI acquired a 20% interest in our Colombian business. We also agreed with LGI to extend our strategic partnership in order to build a portfolio of upstream oil and gas assets throughout South America through 2015. We are currently the only independent E&P company in which LGI has equity investments in South America. See "Business—Significant agreements—Agreements with LGI" for additional information relating to these agreements.

In addition, the IFC has been one of our shareholders since 2006, holding an 8% interest in us. In Chile, we have strong long-term commercial relationships with Methanex and ENAP, and in Colombia, through our acquisitions of Winchester, Luna and Cuerva, we have inherited a strong relationship with Ecopetrol, the Colombian state-owned oil and gas company.

In Brazil, following the closing of our Rio das Contas acquisition, we expect to benefit from Rio das Contas' long-term relationship with Petrobras.

Our strategy

Continue to grow a risk-balanced asset portfolio

We intend to continue to focus on maintaining a risk-balanced portfolio of assets, combining cash flow-generating assets with upside potential opportunities, and on increasing production and reserves through finding, developing and producing oil and gas reserves in the countries in which we operate. For example, in our recently announced expansion into Brazil, we have secured steady cash flows through the acquisition of Rio das Contas, as well as exploratory potential through our success in an ANP international bidding round in which we were awarded seven concessions in Brazil, subject to entry into concession agreements with the ANP. We believe this approach will allow us to sustain continuous and profitable growth and also participate in higher-risk growth opportunities with upside potential.

11

Maintain conservative financial policies

We seek to maintain a prudent and sustainable capital structure and a strong financial position to allow us to maximize the development of our assets and capitalize on business opportunities as they arise. We intend to remain financially disciplined by limiting substantially all our debt incurrence to identified projects with repayment sources. We expect to continue benefiting from diverse funding sources such as our partners and customers in addition to the international capital markets.

Pursue strategic acquisitions in South America

We have historically benefited from, and intend to continue to grow through, strategic acquisitions. Our recent Colombian acquisitions highlight our ability to identify and execute opportunities at what we believe to be attractive prices. These acquisitions have provided us with, and we expect that our pending Brazil Acquisitions will provide us with, attractive platforms in those countries. Our enhanced regional portfolio, primarily in investment-grade countries, and strong partnerships position us as a regional consolidator. We intend to continue to grow through strategic acquisitions and potentially in other countries in South America, including Peru which has an investment-grade rating. Our acquisition strategy is aimed at maintaining a balanced portfolio of lower-risk cash flow-generating properties and assets that have upside potential, keeping a balanced mix of oil- and gas-producing assets (though we expect to remain weighted toward oil) and focusing on both assets and corporate targets.

Continue to foster a technically-driven culture and to capitalize on local knowledge

We intend to continue to build and strengthen an environment that will allow us to fully consider and understand risk and reward and to deliberately and collectively pursue strategies that maximize value. For this purpose, we intend to continue expanding our technical teams and to foster a culture that rewards talent according to results. For example, we have been able to maintain the technical teams we inherited through our Colombian acquisitions and intend to do so in Brazil following the closing of our Rio das Contas acquisition. We believe local technical and professional knowledge is key to operational and long-term success and intend to continue to secure local talent as we grow our business in different locations.

Maintain a high degree of operatorship

We currently are, and intend to continue to be, the operator of a majority of the blocks and concessions in which we have working interests. Operating the majority of our blocks and concessions gives us the flexibility to allocate our capital and resources opportunistically and efficiently. We believe that this strategy has allowed, and will continue to allow, us to leverage our unique culture and our talented technical, operating and management teams. As of December 31, 2012, 99.9% of our net proved reserves and 97% of our production came from blocks in which we are the operator. On a pro forma basis, accounting for our pending Rio das Contas acquisition, approximately 74% of our production as of June 30, 2013 would have come from blocks that we operate.

Maintain our commitment to environmental and social responsibility

A major component of our business strategy is our focus on our environmental and social responsibility. We are committed to minimizing the impact of our projects on the environment. We also aim to create mutually beneficial relationships with the local communities in which we operate in order to enhance our ability to create sustainable value in our projects. In line with the IFC's standards, our commitment to our environmental and social responsibilities is a major component of our business strategy. These commitments are embodied in our in-house designed Environmental, Health, Safety and Security management program, which we refer to as "S.P.E.E.D." (Safety, Prosperity, Employees, Environment and

12

Community Development). Our S.P.E.E.D. program was developed in accordance with several international quality standards, including ISO 14001 for environmental management issues, OHSAS 18001 for occupational health and safety management issues, SA 8000 for social accountability and workers' rights issues, and applicable World Bank standards. See "Business—Health, safety and environmental matters."

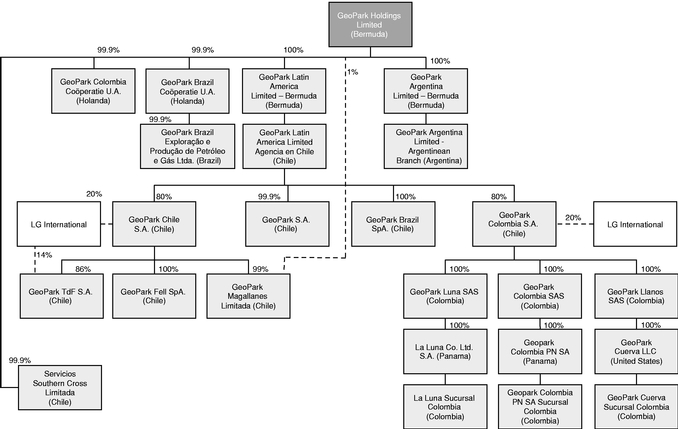

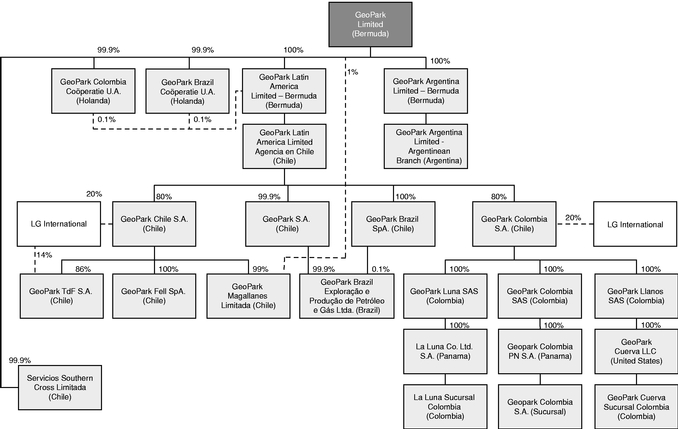

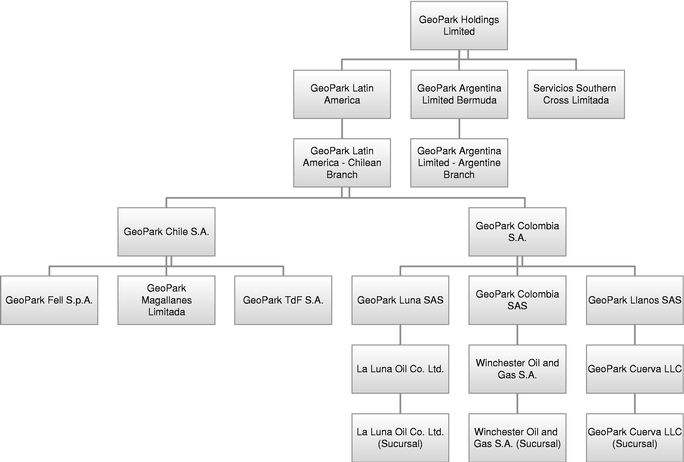

Our corporate structure

We are an exempted company incorporated pursuant to the laws of Bermuda. We operate and own our assets directly and indirectly through a number of subsidiaries.

The following chart shows our corporate structure as of June 30, 2013.

Following the completion of our pending Brazil Acquisitions, we expect GeoPark Brasil Exploracão e Producão de Petróleo e Gás Ltda. (Brazil), or GeoPark Brazil, will hold the assets we acquire in Brazil.

Recent developments

Award of seven licenses in Brazil

On May 14, 2013, following an invitation for bids from the ANP, we were awarded, in an international bidding round, seven new concessions in Brazil, in the following basins:

- •

- the Recôncavo Basin in the State of Bahia: REC T 94 and REC T 85 Concessions; and

- •

- the Potiguar Basin in the State of Rio Grande do Norte: POT-T 664, POT-T 665, POT-T 619, POT-T 620 and POT-T 663 Concessions.

13

Our winning bids are subject to entry into concession agreements with the ANP and the completion of administrative formalities, which are expected to occur in the third quarter of 2013. For our winning bids on these seven concessions, we have committed to invest a minimum of US$15.3 million (including bonuses and work program commitment) during the first three years of the exploratory period for the concessions, which is expected to begin in the third quarter of 2013. The new concessions cover an area of approximately 54,850 gross acres.

Acquisition of Rio das Contas

On May 14, 2013, we agreed to acquire Rio das Contas, which holds a 10% working interest in the BCAM-40 Concession in the shallow-depth offshore Manati Field in the Camamu Almada Basin, from Panoro. The total cash consideration for the acquisition is US$140.0 million, subject to certain purchase price and easement adjustments. The Manati Field, which is in the production phase, is operated by Petróleo Brasileiro S.A.—Petrobras, or Petrobras (with a 35% working interest), the Brazilian national company and the largest oil and gas operator in Brazil, in partnership with Queiroz Galvão Exploração e Produção, or QGEP (with a 45% working interest), and Brasoil Manati Exploração Petrolífera S.A., or Brasoil (with a 10% working interest).

We believe the Manati Field will provide us with a strategically important upstream asset in Brazil. The shallow offshore Manati Field is the largest non-associated gas field in Brazil, which produced in the year ended December 31, 2012 approximately 8.7% of the gas produced in Brazil. During the year ended December 31, 2012 and the first half of 2013, net production attributable to Rio das Contas was approximately 3,677 boepd and 3,914 boepd, respectively, sourced from the Manati Field.

We expect that our pending Rio das Contas acquisition in Brazil will provide us with a long-term off-take contract with Petrobras that covers approximately 74% of net proved gas reserves in the Manati Field, a valuable relationship with Petrobras and an established geoscience and administrative team to manage our Brazilian assets and to seek new growth opportunities.

In the year ended December 31, 2012, Rio das Contas generated net income of approximately US$23.2 million and revenues of approximately US$51.1 million.