UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2018

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________________ to __________________________

Commission file number 000-54329

ORGENESIS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0583166 |

| State or Other Jurisdiction | (I.R.S. Employer |

| of Incorporation or Organization | Identification No.) |

20271 Goldenrod Lane, Germantown, MD 20876

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (480) 659-6404

Securities registered pursuant to Section 12(b) of the Act:

Common stock, par value $0.0001 per share

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| Emerging growth company [ ] |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The registrant had 15,620,971 shares of common stock outstanding as of February 13, 2019. The aggregate market value of the common stock held by non-affiliates of the registrant as of May 31, 2018 was $92,456,008, as computed by reference to the closing price of such common stock on The Nasdaq Capital Market on such date.

ORGENESIS INC.

2018 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTSs

| Page | |

|

PART I

|

|

| ITEM 1. BUSINESS | 4 |

| ITEM 1A. RISK FACTORS | 32 |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | 53 |

| ITEM 2. PROPERTIES | 53 |

| ITEM 3. LEGAL PROCEEDINGS | 54 |

| ITEM 4. MINE SAFETY DISCLOSURES | 54 |

|

PART II

|

|

| ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 54 |

| ITEM 6. SELECTED FINANCIAL DATA | 56 |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 56 |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 72 |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 72 |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 72 |

| ITEM 9A. CONTROLS AND PROCEDURES | 72 |

| ITEM 9B. OTHER INFORMATION | 73 |

|

PART III

|

|

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 74 |

| ITEM 11. EXECUTIVE COMPENSATION | 79 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 85 |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 88 |

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES |

89 |

|

PART IV

|

|

| ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 90 |

| ITEM 16. FORM 10-K SUMMARY | 93 |

| SIGNATURES | 94 |

FORWARD-LOOKING STATEMENTS

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The following discussion should be read in conjunction with the financial statements and related notes contained elsewhere in this Annual Report on Form 10-K. Certain statements made in this discussion are “forward-looking statements” within the meaning of 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used herein, the words “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other factors, including the risks relating to the Company’s business, industry, and the Company’s operations and results of operations. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this report.

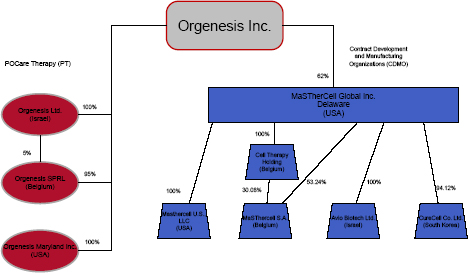

Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our,” the “Company” or “our Company” or “Orgenesis” refer to Orgenesis Inc., a Nevada corporation, and its majority-owned subsidiary, Masthercell Global Inc., a Delaware corporation (“Masthercell Global”), and Orgenesis SPRL, a Belgian-based entity which is engaged in development and manufacturing activities, together with clinical development studies in Europe (the “Belgian Subsidiary”), and its wholly-owned subsidiaries Orgenesis Ltd., an Israeli corporation (the “Israeli Subsidiary”), Orgenesis Maryland Inc., a Maryland corporation (the “Maryland Subsidiary”), and Cell Therapy Holdings S.A. Masthercell Global’s wholly-owned subsidiaries include MaSTherCell S.A (“MaSTherCell”), a Belgian-based subsidiary and a Contract Development and Manufacturing Organization (“CDMO”) specialized in cell therapy development and manufacturing for advanced medicinal products, Masthercell U.S., LLC, a U.S.-based CDMO, Atvio Biotech Ltd. (“Atvio”), an Israeli-based CDMO, and CureCell Co. Ltd. (“CureCell”), a Korea-based CDMO.

Forward-looking statements made in this annual report on Form 10-K include statements about:

Corporate

| · | our ability to achieve profitability; |

| · | our ability to increase revenues and raise sufficient capital or strategic business arrangements to expand our CDMO global network; |

| · | our ability to grow the size and capabilities of our organization through further collaboration and strategic alliances; |

| · | our ability to manage the growth of our CDMO business; |

| · | our ability to attract and retain key scientific or management personnel and to expand our management team; |

| · | the accuracy of estimates regarding expenses, future revenue, capital requirements, profitability, and needs for additional financing; |

| · | our belief that our therapeutic related developments have competitive advantages such as our cell trans-differentiation technology being developed by our Israeli Subsidiary and being able to compete favorably and profitably in the cell and gene therapy industry; |

CDMO Business

| · | our ability to grow the business of Masthercell Global (including each of its subsidiaries, MaSTherCell, Atvio and CureCell, which we consolidated into Masthercell Global in 2018); |

| · | our ability to attract and retain customers; |

| · | our ability to expand and maintain our CDMO business through strategic alliances, joint ventures and internal growth; |

| · | our ability to fund the operational and capital requirements of the global expansion of Masthercell Global and our CDMO business; |

| · | our expectations regarding Masthercell Global’s expenses and revenue, including our expectations that our research and development expenses and selling, general and administrative expenses may increase in absolute dollars; |

| · | the successful integration of our clinical and CDMO strategy through Masthercell Global and its subsidiaries; |

| · | our ability to contract (through Masthercell Global and its subsidiaries) with third-party suppliers and manufacturers and their ability to perform adequately; |

| · | extensive industry regulation, and how that will continue to have a significant impact on our business, especially our product development, manufacturing and distribution capabilities; |

| · | the ability of Masthercell Global to receive future payments pursuant to that certain Stock Purchase Agreement dated June 28, 2018 by and between the Company, Masthercell Global and GPP-II Masthercell, LLC (“GPP-II”); |

| · | our and our shareholders’ ability to receive value on par with GPP-II upon its forced sale of Masthercell Global; |

| · | our ability to control, direct the activities of or hold any shares in Masthercell Global if GPP-II were to assume control of the Board of Directors of Masthercell Global or if it were to purchase our shares in Masthercell Global; |

| · | our ability to receive benefits or value from Masthercell Global in the event of a spin-off effectuated by GPP-II; and |

| · | the significant potential dilution to our existing shareholders due to GPP-II’s option to exchange its Masthercell Global Preferred Stock for shares of our common stock. |

PT Business

| · | our ability to adequately fund and scale our various collaboration, license, partnership and joint venture agreements for the development of therapeutic products and technologies; |

| · | our ability to develop, through our Israeli Subsidiary and Belgian Subsidiary, to the clinical stage a new technology to transdifferentiate liver cells into functional insulin-producing cells, thus enabling normal glucose regulated insulin secretion, via cell therapy; |

| · | our ability to advance our therapeutic collaborations in terms of industrial development, clinical development, regulatory challenges, commercial partners and manufacturing availability; |

| · | our ability to implement our point-of-care (“POCare”) cell therapy (“PT”) strategy in order to further develop and advance autologous therapies to reach patients; |

| · | expectations regarding the ability of our Maryland Subsidiary, Israeli Subsidiary and Belgian Subsidiary to obtain additional and maintain existing intellectual property protection for our technologies and therapies; |

| · | our ability to commercialize products in light of the intellectual property rights of others; |

| · | our ability to obtain funding necessary to start and complete such clinical trials; |

| · | our belief that Diabetes Mellitus will be one of the most challenging health problems in the 21st century and will have staggering health, societal and economic impact; |

| · | our belief that our diabetes-related treatment seems to be safer than other options; |

| · | our relationship with Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”) and the risk that THM may cancel the License Agreement; and |

| · | expenditures not resulting in commercially successful products. |

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” set forth in this Annual Report on Form 10-K for the year ended November 30, 2018, any of which may cause our Company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks may cause the Company’s or its industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. The Company is under no duty to update any forward-looking statements after the date of this report to conform these statements to actual results.

PART I

ITEM 1. BUSINESS

Business Overview

We are a biotechnology company specializing in the development, manufacturing and provision of technologies and services in the cell and gene therapy industry. We operate through two platforms: (i) a point-of-care (“POCare”) cell therapy platform (“PT”) and (ii) a Contract Development and Manufacturing Organization (“CDMO”) platform conducted through our subsidiary, Masthercell Global. Through our PT business, our aim is to further the development of Advanced Therapy Medicinal Products (“ATMPs”) through collaborations and in-licensing with other pre-clinical and clinical-stage biopharmaceutical companies and research and healthcare institutes to bring such ATMPs to patients. We out-license these ATMPs through regional partners to whom we also provide regulatory, pre-clinical and training services to support their activity in order to reach patients in a point-of-care hospital setting. Through our CDMO platform, we are focused on providing contract manufacturing and development services for biopharmaceutical companies.

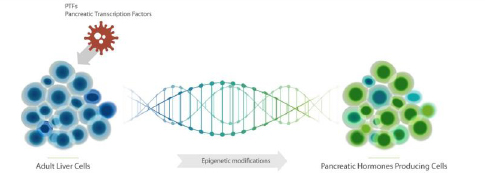

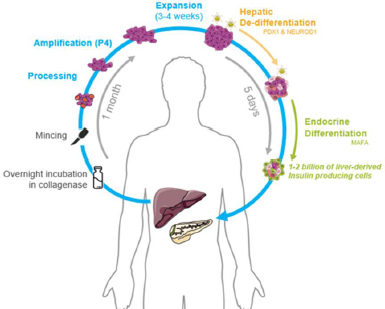

Activities in our PT business include a multitude of cell therapies, including autoimmune, oncologic, neurologic and metabolic diseases and other indications. We provide services for our joint venture (“JV”) partners, pharmaceutical and biotech companies as well as research institutions and hospitals that have cell therapies in clinical development. Each of these customers and collaborations represents a revenue and growth opportunity upon regulatory approval. Furthermore, our trans-differentiation technology demonstrates the capacity to induce a shift in the developmental fate of cells from the liver or other tissues and transdifferentiating them into “pancreatic beta cell-like” Autologous Insulin Producing (“AIP”) cells for patients with Type 1 Diabetes, acute pancreatitis and other insulin deficient diseases. This technology, which has yet to be proven in human clinical trials, has shown in pre-clinical animal models that the human derived AIP cells produce insulin in a glucose-sensitive manner. This trans-differentiation technology is licensed by our Israeli Subsidiary and is based on the work of Prof. Sarah Ferber, our Chief Scientific Officer and a researcher at Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”) in Israel. Our development plan calls for conducting additional pre-clinical safety and efficacy studies with respect to diabetes and other potential indications prior to initiating human clinical trials. With respect to this trans-differentiation technology, we own or have exclusive rights to ten (10) United States and nineteen (19) foreign issued patents, nine (9) pending applications in the United States, thirty-two (32) pending applications in foreign jurisdictions, including Europe, Australia, Brazil, Canada, China, Eurasia, Israel, Japan, South Korea, Mexico, and Singapore, and four (4) international Patent Cooperation Treaty (“PCT”) patent applications. These patents and applications relate, among others, to (1) the trans-differentiation of cells (including hepatic cells) to cells having pancreatic β-cell-like phenotype and function and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis, and (2) scaffolds, including alginate and sulfated alginate scaffolds, polysaccharides thereof, and scaffolds for use for cell propagation, transdifferentiation, and transplantation in the treatment of autoimmune diseases, including diabetes.

Our CDMO platform operates through Masthercell Global, which currently consists of the following subsidiaries: MaSTherCell in Belgium, Atvio in Israel and CureCell in South Korea and Masthercell U.S., LLC in the United States, each having unique know-how and expertise for manufacturing in a multitude of cell types. As part of our United States (“U.S.”) activity, we intend to also set up a CDMO facility in the United States. We believe that, in-order to provide the optimal service to our customers, we need to have a global presence. We target the international market as a key priority through our network of facilities that provide development, manufacturing and logistics services, utilizing our advanced quality management system and experienced staff. All of these capabilities offered to third-parties are utilized for our internal development projects, with the goal of allowing us to be able to bring new products to patients faster and in a more cost-effective way. Masthercell Global strives to provide services that are all compliant with Good Manufacturing Practice, or GMP, requirements, ensuring identity, purity, stability, potency and robustness of cell therapy products for clinical phase I, II, III and through commercialization.

We operate our CDMO and the PT platforms as two separate business segments.

Overview for Advanced Therapy Medicinal Products (ATMPs)

Advanced Therapy Medicinal Product (“ATMP”) means any of the following medicinal products for human use:

| · | a somatic cell therapy medicinal product (“STMP”); |

| · | a tissue engineered product (“TEP”); |

| · | a gene therapy medicinal product (“GTMP”); or |

| · | a combined ATMP. |

An STMP contains cells or tissues that have been manipulated to change their biological characteristics or cells or tissues not intended to be used for the same essential functions in the body. A TEP contains cells or tissues that have been modified so they can be used to repair, regenerate or replace human tissue. A GTMP contains genes that lead to a therapeutic, prophylactic or diagnostic effect and work by inserting “recombinant” genes into the body, usually to treat a variety of diseases, including genetic disorders, cancer or long-term diseases. A recombinant gene is a stretch of DNA that is created in the laboratory, bringing together DNA from different sources. Combined ATMPs contain one or more medical devices as an integral part of the medicine, such as cells embedded in a biodegradable matrix or scaffold. Although STMPs and GTMPs currently dominate the market, in order to access the market potential and trends in the future, other cell products are likely to be essential in all these categories.

Furthermore, we believe that autologous therapies will be a substantial segment of the ATMP market. Autologous therapies are produced from a patients’ own cells, instead of mass-cultivated donor-cells, or allogeneic cells. Allogeneic therapies are derived from donor cells and, through the construction of master and working cell banks, are produced on a large scale. Autologous therapies are derived from the treated patient and manufactured through a defined protocol before re-administration and generally demand a more complex supply chain. Currently with the ATMP network relying heavily on production and supply chain of manufacturing sites, we believe our POCare model may help overcome some of the development and supply challenges with bringing these therapies to patients.

CDMO Business

Companies developing cell therapies need to make a decision early on in their approach to the transition from the lab to the clinic regarding the process development and manufacturing of the cells necessary for their respective therapeutic treatments. Of the companies active in this market, only a small number have developed their own GMP manufacturing facilities due to the high costs and expertise required to develop these processes. In addition to the limitations imposed by a limited number of trained personnel and high infrastructure/operational costs, the industry faces a need for custom innovative process development and manufacturing solutions. Due to the complexity and diversity of the industry, such solutions are often customized to the particular needs of a company and, accordingly, a multidisciplinary team of engineers, cell therapy experts, cGMP and regulatory experts is required. Such a unique group of experts can exist only in an organization that both specializes in developing characterization assays and solutions and manufactures cell therapies.

Companies can establish their own process and GMP manufacturing facility or engage a contract manufacturing organization for each step. A CDMO is an entity that serves other companies in the pharmaceutical industry on a contract basis to provide comprehensive services from cell therapy development through cell therapy manufacturing for and end-to-end solution. Due to the complexity, global outreach needs, redundancy and operational costs of manufacturing biologics and cell therapies, the CDMO business is expanding. With more than 861 companies in the field of cell therapy worldwide (versus 580 in 2015) and 959 clinical trials underway by the end of the first quarter of 2018 (versus 486 in first quarter of 2015), we believe that the industry shows a rapid growth rate accompanied by a lack of sufficient GMP manufacturing capacities (Source: Informa, 2015 and 2018). Over recent years, advances in the field of cell therapy, including the growth of autologous CAR T-cell therapies, led to a significant increase in investment in the industry. T-cells, the backbone of CAR T-cell therapy, are often called the workhorses of the immune system because of their critical role in orchestrating the immune response and killing cells infected by pathogens. The therapy requires drawing blood from patients and separating out the T-cells. Next, using a disarmed virus, the T-cells are genetically engineered to produce receptors on their surface called Chimeric Antigen Receptors, or CARs. The genetically modified T-cells that are re-injected into the patient are then much more effective at targeting and killing tumors.

Two landmark U.S. Food Drug Administration (the “FDA”) approvals in CAR T-cell therapy significantly impacted the cell therapy industry. In August 2017, Novartis’s CAR T-cell therapy, Kymriah, was approved for relapsed/refractory acute lymphoblastic leukemia for pediatric and young adult patients, making it the first cell-base immunotherapy to move across the finish line in the United States. Kymriah received a second FDA approval to treat appropriate relapsed/refractory patients with large B-cell lymphoma in May 2018. Europe has also followed this path as, in August 2018, the European Commission approved Kymriah based on the first global CAR-T registration trials, which included patients from eight European countries and demonstrated durable responses and a consistent safety profile in relapsed/refractory pediatric B-cell ALL and r/r DLBCL. Furthermore, after Gilead's acquisition of Kite Pharma, Inc. for $12 billion in 2017, Kite Pharma’s CAR T-cell therapy, Yescarta, was approved for adult patients with relapsed/refractory large B cell lymphoma after two or more lines of systemic therapy (Source: Alliance for Regenerative Medicine). We believe that these approvals are indicative of the future potential of many more cellular therapies that address a wide range of diseases. Celgene Corporation (“Celgene”) acquired Juno Therapeutics, Inc., another pioneer in the CAR-T space, in January 2018 for approximately $9 billion. Then, Bristol-Myers Squibb Company, in their pursuit of this new space of cancer treatments, acquired Celgene in January 2019 for approximately $74 billion.

The complexity of manufacturing individual cell therapy treatments poses a fundamental challenge for cell therapy-based companies as they enter the field. This complexity potentially casts a spotlight on improved cGMP, large-scale manufacturing processes, such as the services provided by Masthercell Global. Manufacturing and delivery can be more complex in cell therapy products than for a typical drug. In the U.S., only a few dozen specialized hospitals are currently qualified to provide CAR T treatments, which require retrieving, processing and then returning immune cells to the patient, all done under strict cGMP, as well as monitoring and treating side effects. These factors provide real incentives for cell therapy companies to seek third-party partners, or contract manufacturers, who possess technical, manufacturing, and regulatory expertise in cell therapy development and manufacturing such as cell therapy CDMOs like MaSTherCell. Additionally, establishing a manufacturing facility for cell therapy requires specific expertise and significant capital which can delay the clinical trials by at least 2 years. As companies are looking to expedite their market approval, utilization of a CDMO can result in faster time to market and overall lower expenditure.

Integration of development and manufacturing and logistics services through Masthercell Global (and its subsidiaries) provide the basis for generating a recurring revenue stream, as well as carefully managing our fixed cost structure to maximize optionality and drive down production cost. We believe that Masthercell Global is also beneficial for our own manufacturing needs and provides us, and our customers, with enhanced control of material supply for both clinical trials and the commercial market.

Consolidation of CDMO Entities and Strategic Funding

On June 28, 2018, the Company, Masthercell Global, Great Point Partners, LLC, a manager of private equity funds focused on growing small to medium sized heath care companies (“Great Point”), and certain of Great Point’s affiliates, entered into a series of definitive strategic agreements intended to finance, strengthen and expand Orgenesis’ CDMO business. In connection therewith, the Company, Masthercell Global and GPP-II Masthercell, LLC, a Delaware limited liability company (“GPP-II”) and an affiliate of Great Point, entered into a Stock Purchase Agreement (the “SPA”) pursuant to which GPP-II purchased 378,000 shares of newly designated Series A Preferred Stock of Masthercell Global (the “Masthercell Global Preferred Stock”), representing 37.8% of the issued and outstanding share capital of Masthercell Global, for cash consideration to be paid into Masthercell Global of up to $25 million, subject to certain adjustments (the “Consideration”). Orgenesis holds 622,000 shares of Masthercell Global’s Common Stock, representing 62.2% of the issued and outstanding equity share capital of Masthercell Global. An initial cash payment of $11.8 million of the Consideration was remitted at closing by GPP-II, with a follow up payment of $6,600,000 to be made in each of years 2018 and 2019 (the “Future Payments”), or an aggregate of $13.2 million, if (a) Masthercell Global achieves specified EBITDA and revenues targets during each of these years, and (b) the Orgenesis’ shareholders approve certain provisions of the Stockholders’ Agreement referred to below on or before December 31, 2019. None of the future Consideration amounts, if any, will result in an increase in GPP-II’s equity holdings in Masthercell Global beyond the 378,000 shares of Series A Preferred Stock issued to GPP-II at closing. The proceeds of the investment will be used to fund the activities of Masthercell Global and its consolidated subsidiaries. Notwithstanding the foregoing, GPP-II may, in its sole discretion, elect to pay all or a portion of the future Consideration amounts even if the financial targets described above have not been achieved and the Orgenesis Stockholder Approval has not been obtained. In satisfaction of the two conditions described above, Masthercell Global achieved the specified EBITDA and revenues targets in 2018 as described in the SPA and obtained the approval from its requisite shareholders on October 23, 2018. As such, Masthercell Global received the First Future Payment of $6,600,000 on January 16, 2019.

In connection with the entry into the SPA, and pursuant to the terms hereof, described above, each of the Company, Masthercell Global and GPP-II entered into the Masthercell Global Inc. Stockholders’ Agreement (the “Stockholders’ Agreement”) providing for certain restrictions on the disposition of Masthercell Global securities, the provisions of certain options and rights with respect to the management and operations of Masthercell Global, certain favorable, preferential rights to GPP-II (including, without limitation, a tag right, drag right and certain protective provisions), a right to exchange the Masthercell Global Preferred Stock for shares of Orgenesis common stock and certain other rights and obligations. In addition, after the earlier of the second anniversary of the closing or certain enumerated circumstances, GPP-II is entitled to effectuate a spinoff of Masthercell Global and the Masthercell Global Subsidiaries (the “Spinoff”). The Spinoff is required to reflect a market value determined by one of the top ten independent accounting firms in the U.S. selected by GPP, provided that under certain conditions, such market valuation shall reflect a valuation of Masthercell Global and the Masthercell Global Subsidiaries of at least $50 million. In addition, upon certain enumerated events as described below, GPP-II is entitled, at its option, to put to the Company (or, at Company’s discretion, to Masthercell Global if Masthercell Global shall then have the funds available to consummate the transaction) its shares in Masthercell Global or, alternatively, purchase from the Company its share capital in Masthercell Global at a purchase price equal to the fair market value of such equity holdings as determined by one of the top ten independent accounting firms in the U.S. selected by GPP-II, provided that the purchase price shall not be greater than three times the price per share of Masthercell Global Preferred Stock paid by GPP-II and shall not be less than the price per share of Masthercell Global Preferred Stock paid by GPP-II. GPP-II may exercise its put or call option upon the occurrence of any of the following: (i) there is an Activist Shareholder of the Company; (ii) the Chief Executive Officer and/or Chairman of the board of directors of the Company resigns or is replaced, removed, or terminated for any reason prior to June 28, 2023; (iii) there is a Change of Control event of the Company; or (iv) the industry expert director appointed to the board of directors of Masthercell Global is removed or replaced (or a new such director is appointed) without the prior written consent of GPP-II. For the purposes of the foregoing, the following definitions shall apply: (A) “Activist Shareholder” shall mean any Person who acquires shares of capital stock of the Company who either: (x) acquires more than a majority of the voting power of the Company, (y) actively takes over and controls a majority of the board of directors of the Company, or (z) is required to file a Schedule 13D with respect to such Person’s ownership of the Company and has described a plan, proposal or intent to take action with respect to exerting significant pressure on the management of or directors of, the Company; and (B) “Change of Control” shall mean any of: (a) the acquisition, directly or indirectly (in a single transaction or a series of related transactions) by a Person or group of Persons of either (I) a majority of the common stock of the Company (whether by merger, consolidation, stock purchase, tender offer, reorganization, recapitalization or otherwise), or (II) all or substantially all of the assets of the Company and its Subsidiaries (but only if such transaction includes the transfer of Securities held by the Company), (b) if any four (4) of the directors of the Company as of June 28, 2018 are removed or replaced or for any other reason cease to serve as directors of the Company, (c) the filing of a petition in bankruptcy or the commencement of any proceedings under bankruptcy laws by or against the Company, provided that such filing or commencement shall be deemed a Change of Control immediately if filed or commenced by the Company or after sixty (60) days if such filing is initiated by a creditor of the Company and is not dismissed; (d) insolvency of the Company that is not cured by the Company within thirty (30) days; (e) the appointment of a receiver for the Company, provided that such appointment shall constitute an Change of Control immediately if the appointment was consented to by the Company or after sixty (60) days if not consented to by the Company and such appointment is not terminated; or (f) or dissolution of the Company.

The Stockholders’ Agreement further provides that GPP-II is entitled, at any time, to convert its share capital in Masthercell Global for the Company’s common stock in an amount equal to the lesser of (a)(i) the fair market value of GPP-II’s shares of Masthercell Global Preferred Stock to be exchanged, as determined by one of the top ten independent accounting firms in the U.S. selected by GPP-II and the Company, divided by (ii) the average closing price per share of Orgenesis Common Stock during the thirty (30) day period ending on the date that GPP-II provides the exchange notice (the “Exchange Price”) and (b)(i) the fair market value of GPP-II’s shares of Masthercell Global Preferred Stock to be exchanged assuming a value of Masthercell Global equal to three and a half (3.5) times the revenue of Masthercell Global during the last twelve (12) complete calendar months immediately prior to the exchange divided by (ii) the Exchange Price; provided, that in no event will (A) the Exchange Price be less than a price per share that would result in Orgenesis having an enterprise value of less than $250,000,000 and (B) the maximum number of shares of Orgenesis Common Stock to be issued shall not exceed 2,704,247 shares of outstanding Orgenesis Common Stock (representing approximately 19.99% of then outstanding Orgenesis Common Stock), unless Orgenesis obtains shareholder approval for the issuance of such greater amount of shares of Orgenesis Common Stock in accordance with the rules and regulations of the Nasdaq Stock Market. Such shareholder approval for a greater number was obtained on October 23, 2018.

Great Point and Masthercell Global entered into an advisory services agreement pursuant to which Great Point is to provide management services to Masthercell Global for which Great Point will be compensated at an annual base compensation equal to the greater of (i) $250,000 per each 12 month period or (ii) 5% of the EBITDA for such 12 month period, payable in arrears in quarterly installments; provided, that these payments will (A) begin to accrue immediately, but shall not be paid in cash to Great Point until such time as Masthercell Global generates EBITDA of at least $2,000,000 for any 12 month period or the sale of or change in control of Masthercell Global, and (B) shall not exceed an aggregate annual amount of $500,000. Such compensation accrues but is not owed to Great Point until the earlier of (i) Masthercell Global generating EBITDA of at least $2 million for any 12 months period following the date of the agreement or (ii) a Sale of the Company or Change of Control of the Company (as both terms are defined therein).

GPP Securities, LLC, a Delaware limited liability company and an affiliate of Great Point and Masthercell Global entered into a transaction services agreement pursuant to which GPP Securities, LLC is to provide certain brokerage services to Masthercell Global for which GPP Securities LLC will be entitled to a certain Exit Fee and Transaction Fee (as both terms are defined in the agreement), such fees not to be less than 2% of the applicable transaction value.

Corporate Reorganization

Contemporaneous with the execution of the SPA and the Stockholders’ Agreement, Orgenesis and Masthercell Global entered into a Contribution, Assignment and Assumption Agreement pursuant to which Orgenesis contributed to Masthercell Global the Orgenesis’ assets relating to the CDMO Business (as defined below), including the CDMO subsidiaries (the “Corporate Reorganization”). In furtherance thereof, Masthercell Global, as Orgenesis’ assignee, acquired all of the issued and outstanding share capital of Atvio, the Company’s Israel based CDMO partner since May 2016, and 94.12% of the share capital of CureCell, the Company’s Korea based CDMO partner since March 2016. Orgenesis exercised the "call option" to which it was entitled under the joint venture agreements with each of these entities to purchase from the former shareholders their equity holding. The consideration for the outstanding share equity in each of Atvio and CureCell consisted solely of Orgenesis common stock. In respect of the acquisition of Atvio, Orgenesis issued to the former Atvio shareholders an aggregate of 83,965 shares of Orgenesis common stock. In respect of the acquisition of CureCell, Orgenesis issued to the former CureCell shareholders an aggregate of 202,846 shares of Orgenesis common stock subject to a third-party valuation. Together with MaSTherCell S.A., Atvio and CureCell are directly held subsidiaries under Masthercell Global (collectively, the “Masthercell Global Subsidiaries”).

Masthercell Global, through the Masthercell Global Subsidiaries, will be engaged in the business of providing manufacturing and development services to third parties related to cell and gene therapy products, processes and solutions and providing related manufacturing or development services, and the creation and development of technology, intellectual property, tools and optimizations in connection with such manufacturing and development services for third parties (the “CDMO Business”). Under the terms of the Stockholders’ Agreement and SPA, Orgenesis has agreed that so long as it owns equity in Masthercell Global and for two years thereafter it will not engage in the CDMO Business, except through Masthercell Global. Notwithstanding the foregoing, nothing in the Stockholders’ Agreement or the SPA prohibits or restricts the Company’s ability to conduct any business outside the CDMO Business and the Company retained the right to research, manufacture, develop and conduct all other activities related to the development, discovery, manufacturing and commercialization of therapeutic products, and the process, methods and services thereof (including, without limitation, such therapeutic products for itself and in which the Company has an economic interest or any relationship with any Third Party in which the Company has an economic interest or that are created, developed, manufactured or sold by a joint venture, partnership or collaboration between the Company and a Third Party) with a Third Party. For purposes hereof, the term “Third Party” shall mean any entity (other than our Company or our subsidiaries) with whom we (or our subsidiaries) has a collaboration, joint venture, partnership or similar economic relationship for the development of a product with therapeutic use where the primary purpose of such collaboration, joint venture, partnership or relationship is not the manufacturing related to such product. We intend, through our direct subsidiaries, to continue engaging in such research, marketing, development, selling and commercialization of such therapeutic products either for our own internal purposes or with Third Parties.

Masthercell Global’s Business

Our subsidiary, Masthercell Global, is a CDMO specialized in cell therapy development for advanced therapeutically products. In the last decade, cell therapy medicinal products have gained significant importance, particularly in the fields of ex-vivo gene therapy and immunotherapy. While academic and industrial research has led scientific development in the sector, industrialization and manufacturing expertise remains insufficient. Masthercell Global plans to fill this gap by providing three types of services to its customers: (i) process and assay development services and (ii) current Good Manufacturing Practices (cGMP) contract manufacturing services and (iii) technology innovation and engineering services. These services offer a double advantage to Masthercell Global’s customers. First, customers can continue allocating their financial and human resources on their product/therapy, while relying on a long-term reliable and trusted partner for their process development/production. Second, through its subsidiaries, it allows customers to benefit from Masthercell Global’s expertise in cell therapy manufacturing and all related aspects.

Masthercell Global continues to invest in its manufacturing capabilities and services to offer a “one-stop-shop” service to its customers from pre-clinical up to commercial development. MaSTherCell S.A., Masthercell Global’s Belgian subsidiary, has recently inaugurated a new production center in Gosselies, doubling its manufacturing capacity from 600 sqm GMP area to 1,200 sqm. This new facility can also accommodate commercial manufacturing. Masthercell Global’s Israeli-based CDMO, Atvio, has relocated its process engineering activities into a new and larger facility located at Bar-Lev industrial park. These subsidiaries, including Masthercell Global’s Korea-based CDMO, have started to offer viral vector CDMO services. Our target customers are primarily cell therapy companies that are in clinical trials with the aim of accompanying them as their manufacturing and logistic partner once their product candidates reach commercial stage.

We devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates for our customers, as well as our cost of goods and time to market. This integration of development, manufacturing and logistics services through Masthercell Global aims to provide the basis for generating a recurring revenue stream, as well as carefully managing our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible. We believe that operating our own manufacturing facility provides us with enhanced control of material supply for both clinical trials and the commercial market, will enable the more rapid implementation of process changes, and will allow for better long-term margins.

Masthercell Global continues to invest resources to maintain best practices in quality service, quality control, quality assurance and permanent staff training to uphold the highest standards to serve its customers. Masthercell Global (through itself and its subsidiaries) has built-up a team of more than 140 industry experts in Belgium, 30 experts in Korea, 19 experts in Israel and 3 people in the US. The entire team is dedicated to support process development and manufacturing efforts in a fast, safe and cost-effective way. Masthercell Global’s strategy is to build long term relationships with its customers in order to help them bring highly potent cell therapy products faster to the market and in cost-effective ways. To provide these services, Masthercell Global relies on a team of dedicated experts both from academic and industry backgrounds. It operates through state-of-the-art facilities organized as a global network in Belgium, Israel, Korea and soon in the U.S. This network of facilities operates on a common Quality Management System backbone enabling for streamlined technology transfers among the different sites.

Our Growth Strategy

In light of the globalization of the industry in general and the therapeutics industry in particular, adding to that the high cost of reaching the market, developers of cell therapies see themselves as global organizations and build their models on global markets. As cell therapies are based on living cells, they are limited in their ability to be centrally manufactured. An additional challenge for globalization is the fact that the regulatory requirements for the therapies is not harmonized between jurisdictions, presenting additional operational challenges.

We have leveraged the recognized quality expertise and experience in cell process development and manufacturing of our Belgian subsidiary, MaSTherCell S.A., to first-class entities in Israel and Korea and to build a global CDMO in the cell therapy development and manufacturing area. We believe that cell therapy companies need to be global in order to truly succeed. We target the international manufacturing market as a key priority through joint-venture agreements that provide development capabilities, along with manufacturing facilities and experienced staff.

The main revenue drivers of our growth strategy on a global reach are the number of batches and the number of patients per manufacturing batch. These parameters vary along the development cycle of the new treatments (starting from as few as 20 patients in Phase I to thousands of patients when reaching commercialization). When a client reaches the commercial stage, their demand for manufacturing substantially increases, while barriers preventing the client from switching to another manufacturing organization remain extremely high. The difficulty in transferring CDMOs is a function of the tech transfer of such complex manufacturing processes being extremely lengthy, requiring many months of training highly specialized employees, while also possibly requiring new regulatory approvals. Therefore, we believe we are well positioned to continue expanding our revenue for the following reasons:

| (1) | A higher number of companies in later phases of clinical trials and soon potentially in commercial phases; |

| (2) | Therapy companies requiring higher manufacturing abilities concurrent with a global reach; and |

| (3) | An increasing need for the manufacturing scalability provided by a CDMO. |

Current CDMO Facilities

MaSTherCell S.A.

MaSTherCell S.A. in Belgium is in the European hub for the continental activities of the global CDMO network and the globally-recognized center of excellence of the GMP manufacturing activities of the group. At the heart of MaSTherCell is a team of more than 140 highly dedicated experts combining strong experience in cGMP cell therapy manufacturing with a technology-focused approach and a substantial knowledge of the industry. As a one-stop shop, they provide services from technology selection, business modeling to GMP manufacturing, process development, quality management and assay development. MaSTherCell's teams are fully committed to helping their clients fulfill their objective of providing sustainable and affordable therapies to their patients. The company operates in a validated and flexible facility located in Biowin, the strategic center of Europe within the Walloon healthcare cluster. The facility in Belgium has received the final cGMP manufacturing authorization from the Belgian Drug Agency (AFMPS) in September 2013 and a renewal in October 2017 for cell-based therapies manufacturing. It spreads over 2,000 sqm including 1,200 sqm of GMP area.

Atvio Biotech Ltd.

Atvio Biotech Ltd. in Israel is a specialized process and technology development firm focused on custom-made process development, upscaling design from lab to industry innovation and automation procedures, which are extremely essential in the cell therapy industry. Atvio is located in Bar-Lev Industrial Park utilizing the exclusive Israeli innovative ecosystem and highly experienced and talented associates including Ph.D. holders and biotechnology engineers. The center provides end to end solutions to cell therapy industries, process development capabilities and proficiency, custom-made engineering and a unique platform for creative design and process optimization. The company spreads over 1300 sqm2 of labs and offices resulting in an efficient and unique environment for cell therapy development.

CureCell Co. Ltd.

CureCell Co. Ltd. in Korea has a particular focus on developing innovative cell therapies for both the Korean and international markets. Together, with promising in-house research programs, the foreign technologies are currently under development for the rapidly growing Asian market well beyond the Korean market offering the most favorable environment for the cell therapy industry in the world. Through close collaboration with leading medical and academic facilities, CureCell is accelerating the development of foreign technologies in Korea and is well positioned to expand international markets for Korean technologies.

Planned CDMO Facilities

We are currently preparing to launch a new production center in Houston, Texas in the United States, which we expect will become operational during fiscal 2020. We will continue to engage in discussions with other strategic partners throughout the world to set up CDMO facilities in other geographic locations.

Our Competitive Advantages

We believe that we offer the following benefits to our CDMO clients:

We enable our clients to go faster to the market in a cost-effective way. We continue to invest in our manufacturing capabilities and expertise to offer a “one-stop-shop” service to our customers from pre-clinical up to commercial development. This can also include preferred access to critical raw materials supplies. This stems from the finding that these companies' processes have to be set up right from the start in order for them to obtain approved products that have the simplest possible process and with the lowest possible cost of goods sold (COGS).

Quality. We work alongside our customers to transform the promises of their cell-based therapies into a robust and scalable process, compliant with GMP requirements. Our stringent quality system is applied throughout the process and ensures identity, purity, stability, potency and robustness of cell therapy products from clinical phase I, II, III to commercialization. We continue to invest resources to maintain best practices in quality service, quality control, quality assurance and permanent staff training to uphold the highest standards.

Transforming academic technology to clinical and commercial manufacturing. One of the major issues with moving cell therapy products from “bench to manufacturing bedside” has been manufacturing bottlenecks. The heterogeneous nature of cell therapy products has introduced manufacturing complexity and regulatory concerns, as well as scale-up complexities that are not present within traditional pharmaceutical manufacturing. Over the years, MaSTherCell has developed experience and expertise necessary for transforming academic concepts into a clinical manufacturing program to support all phases of clinical trials. This includes assessing the clinical efficiency of the laboratory concept but also the development of efficient, robust and scalable manufacturing processes, including technology engineering service, when needed.

Access to a global network. Many companies developing autologous cell therapies envision using multiple manufacturing sites and processing centers to distribute the workload and minimize the shipping distances for such time- sensitive products. Many cell therapy products are fragile preparations that must be shipped and applied to a patient rapidly. This time pressure means that standard product-release testing procedures are not feasible. In particular, sterility testing often cannot be completed before patient treatment. This unique challenge in cell-therapy manufacturing requires tighter environmental and handling controls to greatly reduce any risk of sterility failure. Biotechnology companies have to anticipate their success and the logistics to cure at point of care. Therefore, the setup of a global CDMO meets this requirement and is the strategy behind our establishment of our CDMO facilities in Korea and Israel, and in the U.S. in the future. To comply with anticipated regulatory harmonization, we have also invested in our Quality and Management Systems (QMS) and to structure them in a way they could be shared with either affiliated companies or business partners, and even with customers or prospects. South Korea, Israeli and European requirements are essentially the same, allowing Masthercell Global to implement its QMS model in a quick and efficient way. This truly international footprint will give us a unique competitive advantage, thereby filling the gap of biotechnology companies’ requirement of “quality comparability” between the respective regional sites.

Central continental locations to deal with key logistics challenges. With respect to this challenge, through our subsidiaries, Masthercell Global has built up the following:

| · | Team of dedicated experts both from academic and industry backgrounds with a strong experience in cGMP dealing with not yet harmonized regulatory requirements (European Medicines Agency (the “EMA”), FDA); |

| · | State-of-the-art facilities located next to airports; and |

| · | Multi-continental footprints to deal with therapies administration at or nearby point of care as many cell therapy products have a short shelf life. |

Providing value-added manufacturing capacity. One of the biggest challenges is developing reliable (quality) and robust manufacturing processes for cell-based therapy products that ensure adequate product safety, potency, and consistency at an economically viable cost. Additionally, manufacturing quality and comparability is at the heart of biotechnology companies’ challenges. MaSTherCell has built-up a strong expertise to customize the production and manufacturing process to suit the particular needs of a given client. This process facilitates a deep understanding of clients’ needs and facilitates a long term revenue generating relationship.

Competition in the CDMO Field

We compete with a number of companies both directly and indirectly. Key competitors include the following CMOs and CDMOs: Lonza Group Ltd, Progenitor Cell Therapy (PCT) LLC (acquired by Hitachi), WuxiAppTec (WuXi PharmaTech (Cayman) Inc.), Cognate Bioservices Inc., Apceth GmbH & Co. KG, Eufets GmbH, Fraunhofer Gesellschaft, Cellforcure SASU, Cell Therapy Catapult Limited and Molmed S.p.A. Some of these companies are large, well-established manufacturers with financial, technical, research and development and sales and marketing resources that are significantly greater than those that we currently possess.

More generally, we face competition inherent in any third-party manufacturer’s business - namely, that potential customers may instead elect to invest in their own facilities and infrastructure, affording them greater control over their products and the hope of long-term cost savings compared to a third party contract manufacturer. To be successful, we will need to convince potential customers that our current and expanding capabilities are more innovative, of higher-quality and more cost-effective than could be achieved through internal manufacturing and that our experience and quality manufacturing and process development expertise are unique in the industry. Our ability to achieve this and to successfully compete against other manufacturers will depend, in large part, on our success in developing technologies that improve both the quality and profitability associated with cell therapy manufacturing. If we are unable to successfully compete against other manufacturers, we may not be able to develop our CDMO business plans which may harm our business, financial condition and results of operations.

We believe that Masthercell Global’s services differ from our competition in two major aspects:

| · | Quality and expertise of its services: Clients identify the excellence of its facility, quality system, and people as a major differentiating point compared to competitors; and |

| · | Agile and tailored approach: Our philosophy is to build a true partnership with our clients and adapt ourselves to clients’ needs, which entails no “off-the-shelf process” nor in-house technology platform, but a dedicated person for each client, joint steering committees on each project and dedicated project managers. |

* Diagram above signifies “one-stop-shop service offering” from process development through quality manufacturing and logistics to point of care.

We strengthen our position by our “one-stop-shop” service offering, from pre-clinical to commercial, with a clear focus on COGS of manufacturing processes. This differentiation results in a price premium compared to other CMO’s as we operate with a lean organization focused solely on cell therapy. Quality is a critical aspect of our industry, and we believe we have developed unique expertise in this field. We devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates for our customers, as well as our cost of goods and time to market. Our goal is to carefully manage our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible. We believe that operating our own manufacturing facility, which provides us with enhanced control of material supply for both clinical trials and the commercial market, will enable a more rapid implementation of process changes, and will allow for better long-term margins.

Finally, we have sought to establish manufacturing centers in regions which logistically offers an ideal location given the high concentration of companies active in cell therapy, including potential clients and companies with complementary know-how, products and services.

CDMO Government Regulation

We are required to comply with the regulatory requirements of various local, state, national and international regulatory bodies having jurisdiction in the countries or localities where we manufacture products or where our customers’ products are distributed. In particular, we are subject to laws and regulations concerning research and development, testing, manufacturing processes, equipment and facilities, including compliance with cGMPs, labeling and distribution, import and export, facility registration or licensing, and product registration and listing. As a result, our facilities are subject to regulation by the FDA, as well as regulatory bodies of other jurisdictions, such as the EMA, Health Canada, and the Australian Department of Health, depending on the countries in which our customers market and sell the products we manufacture and/or package on their behalf. We are also required to comply with environmental, health and safety laws and regulations, as discussed below. These regulatory requirements impact many aspects of our operations, including manufacturing, developing, labeling, packaging, storage, distribution, import and export and record keeping related to customers' products. Noncompliance with any applicable regulatory requirements can result in government refusal to approve facilities for manufacturing products or products for commercialization.

Manufacturing facilities that produce cellular therapies are subject to extensive regulation by the FDA. In particular, FDA regulations set forth requirements pertaining to establishments that manufacture human cells, tissues, and cellular and tissue-based products (“HCT/Ps”). Title 21, Code of Federal Regulations, Part 1271 provides for a unified registration and listing system, donor-eligibility, current Good Tissue Practice ("cGTP"), and other requirements that are intended to prevent the introduction, transmission, and spread of communicable diseases by HCT/Ps. More specifically, key elements of Part 1271 include:

| · | Registration and listing requirements for establishments that manufacture HCT/Ps; |

| · | Requirements for determining donor eligibility, including donor screening and testing; |

| · | cGTP requirements, which include requirements pertaining to the manufacturer's quality program, personnel, procedures, manufacturing facilities, environmental controls, equipment, supplies and reagents, recovery, processing and process controls, labeling, storage, record-keeping, tracking, complaint files, receipt, pre-distribution shipment, distribution, and donor eligibility determinations, donor screening, and donor testing; |

| · | Adverse reaction reporting; |

| · | Labeling of HCT/Ps; |

| · | Specific rules for importing HCT/Ps; and |

| · | FDA inspection, retention, recall, destruction, and cessation of manufacturing operations. |

Masthercell Global currently collects, processes, stores and manufactures HCT/Ps, including the manufacture of cellular therapy products. Therefore, Masthercell Global must comply with cGTP and with the current Good Manufacturing Practices (“cGMP”) requirements that apply to biological products. Cell and tissue-based products may also be subject to the same approval standards, including demonstration of safety and efficacy, as other biologic and drug products if they fail to meet all HCT/P criteria set forth in Title 21, Code of Federal Regulations, Section 1271.10.

The U.S. Federal Food, Drug, and Cosmetic Act (the “FD&C Act”) and FDA regulations govern the quality control, manufacture, packaging, and labeling procedures of products regulated as a drug or biological products, including cellular therapies comprising HCT/Ps. These laws and regulations include requirements for regulated entities to comply with cGTPs applicable to the specific product(s). The cGTPs are designed to ensure that a facility's processes - and products resulting from those processes - meet defined safety requirements. The FDA's objective in requiring compliance with cGTP standards is to protect the public health and safety by ensuring that regulated products (i) have the identity, strength, quality and purity that they purport or are represented to possess; (ii) meet their specifications; and (iii) are free of objectionable microorganisms and contamination. As a central focus of the cGTP requirements, regulated entities must design and build quality assurance safeguards into the manufacturing processes and the production facilities for regulated products and must ensure the consistency, product integrity, and reproducibility of results and product characteristics. This is done by implementing quality systems and processes including appropriate, controlled procedures, specifications and documentation. In addition, drug manufacturers and certain of their subcontractors are required to register their establishments with FDA and certain state agencies. Registration with the FDA subjects entities to periodic unannounced inspections by the FDA, during which the agency inspects manufacturing facilities to assess compliance with applicable cGTPs. The FDA may also initiate for-cause investigations of manufacturing facilities if it learns of possible serious regulatory violations at such facilities. Accordingly, manufacturers must continue to expend time, money, and effort in the areas of production and quality control to maintain compliance with cGTPs. Failure to comply with applicable FDA requirements can result in regulatory inspections and associated observations, warning letters, other enforcement measures requiring remedial action, and, in the case of failures that are more serious, suspension of manufacturing operations, seizure of product, injunctions, product recalls, fines, and other penalties. We believe that our facilities are in material compliance with applicable, existing FDA requirements. Additionally, FDA, other regulatory agencies, or the U.S. Congress may be considering, and may enact laws or regulations regarding the use and marketing of stem cells, cell therapy products, or products derived from human cells or tissue. These laws and regulations may directly affect us or the business of some of Masthercell’s Global’s clients and, therefore, the amount of business Masthercell Global receives from these clients.

The Clinical Laboratory Improvement Amendments (“CLIA”) extends U.S. federal oversight to clinical laboratories that examine or conduct testing on materials derived from the human body for the purpose of providing information for the diagnosis, prevention, or treatment of disease or for the assessment of the health of human beings. CLIA requirements apply to those laboratories that handle biological matter. CLIA requires that these laboratories be certified by the government, satisfy governmental quality and personnel standards, undergo proficiency testing, be subject to biennial inspections and remit fees. The sanctions for failure to comply with CLIA include suspension, revocation, or limitation of a laboratory's CLIA certificate necessary to conduct business, fines, or criminal penalties. Additionally, CLIA certification may sometimes be needed when an entity, such as Masthercell Global, desires to obtain accreditation, certification, or license from non-government entities for cord blood collection, storage and processing.

Our customers’ products must undergo pre-clinical and clinical evaluations relating to product safety and efficacy before they are approved as commercial therapeutic products. The regulatory authorities having jurisdiction in the countries in which our customers intend to market their products may delay or put on hold clinical trials, delay approval of a product or determine that the product is not approvable. The FDA or other regulatory agencies can delay approval of a drug if our manufacturing facilities are not able to demonstrate compliance with cGTPs, pass other aspects of pre-approval inspections (i.e., compliance with filed submissions) or properly scale up to produce commercial supplies. The FDA and comparable government authorities having jurisdiction in the countries in which our customers intend to market their products have the authority to withdraw product approval or suspend manufacture if there are significant problems with raw materials or supplies, quality control and assurance or the product is deemed adulterated or misbranded. In addition, if new legislation or regulations are enacted or existing legislation or regulations are amended or are interpreted or enforced differently, we may be required to obtain additional approvals or operate according to different manufacturing or operating standards or pay additional fees. This may require a change in our manufacturing techniques or additional capital investments in our facilities.

Certain products manufactured by us involve the use, storage and transportation of toxic and hazardous materials. Our operations are subject to extensive laws and regulations relating to the storage, handling, emission, transportation and discharge of materials into the environment and the maintenance of safe working conditions. We maintain environmental and industrial safety and health compliance programs and training at our facilities.

Prevailing legislation tends to hold companies primarily responsible for the proper disposal of their waste even after transfer to third party waste disposal facilities. Other future developments, such as increasingly strict environmental, health and safety laws and regulations, and enforcement policies, could result in substantial costs and liabilities to us and could subject the handling, manufacture, use, reuse or disposal of substances or pollutants at our facilities to more rigorous scrutiny than at present.

Our CDMO operations involve the controlled use of hazardous materials and chemicals. We are subject to federal, state and local laws and regulations in the U.S. governing the use, manufacture, storage, handling and disposal of hazardous materials and chemicals. Although we believe that our procedures for using, handling, storing and disposing of these materials comply with legally prescribed standards, we may incur significant additional costs to comply with applicable laws in the future. Also, even if we are in compliance with applicable laws, we cannot completely eliminate the risk of contamination or injury resulting from hazardous materials or chemicals. As a result of any such contamination or injury, we may incur liability or local, city, state or federal authorities may curtail the use of these materials and interrupt our business operations. In the event of an accident, we could be held liable for damages or penalized with fines, and the liability could exceed our resources. Compliance with applicable environmental laws and regulations is expensive, and current or future environmental regulations may impair our contract manufacturing operations, which could materially harm our business, financial condition and results of operations.

The costs associated with complying with the various applicable local, state, national and international regulations could be significant and the failure to comply with such legal requirements could have an adverse effect on our results of operations and financial condition. See “Risk Factors—Risks Related to Our CDMO Business — Extensive industry regulation has had, and will continue to have, a significant impact on our CDMO business, and it may require us to substantially invest in our development, manufacturing and distribution capabilities and may negatively impact our ability to generate and meet future demand for our products and improve profitability” for additional discussion of the costs associated with complying with the various regulations.

PT Business

Our therapeutic development efforts in our cell therapy business are focused on advancing breakthrough scientific achievements in the field of autologous therapies which have a curative potential. We base our development on therapeutic collaborations and in-licensing with other pre-clinical and clinical-stage biopharma companies as well as direct collaboration with research and healthcare institutes. We are engaging in therapeutic collaborations and in-licensing with other academic centers and research centers in order to pursue emerging technologies of other ATMPs in cell and gene therapy in such areas as cell-based immunotherapies, metabolic diseases, neurodegenerative diseases and tissue regeneration. Each of these customers and collaborations represents a growth opportunity and future revenue potential as we out-license these ATMPs through regional partners to whom we also provide regulatory, pre-clinical and training services to support their activity in order to reach patients in a point-of-care hospital setting.

PT Subsidiaries and Collaboration Agreements

We intend to devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates, as well as our cost of goods and time to market. Our goal is to carefully manage our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible.

We carry out our PT business through three wholly-owned and separate subsidiaries. This corporate structure allows us to simplify the accounting treatment, minimize taxation and optimize local grant support. The subsidiaries related to this business are as follows:

| · | United States: Orgenesis Maryland Inc. – This is the center of activity for North America currently focused on technology licensing, therapeutic collaborations and preparation for U.S. clinical trials. |

| · | European Union: Orgenesis SPRL – This is the center of activity for Europe, currently focused on process development and preparation of European clinical trials. |

| · | Israel: Orgenesis Ltd. – This is a research and technology center, as well as a provider of regulatory, clinical and pre-clinical services. |

We have embarked on a strategy of collaborative arrangements with strategically situated third parties around the world. We believe that these parties have the expertise, experience and strategic location to advance our PT therapy business. Activities in our PT platform include:

| · | Trans-differentiation Technology - Our trans-differentiation technology demonstrates the capacity to induce a shift in the developmental fate of cells from the liver or other tissues and transdifferentiating them into “pancreatic beta cell-like” Autologous Insulin Producing (“AIP”) cells for patients with Type 1 Diabetes (“T1D”), acute pancreatitis and other insulin deficient diseases. This technology, which has yet to be proven in human clinical trials, has shown in relevant animal models that the human derived AIP cells produce insulin in a glucose-sensitive manner. This trans-differentiation technology is licensed by our Israeli Subsidiary and is based on the work of Prof. Sarah Ferber, our Chief Scientific Officer and a researcher at Tel Hashomer Medical Research Infrastructure and Services Ltd. (“THM”) in Israel. Our development plan calls for conducting additional pre-clinical safety and efficacy studies with respect to diabetes and other potential indications prior to initiating human clinical trials. With respect to our trans-differentiation technology, we own or have exclusive rights to ten (10) United States and nineteen (19) foreign issued patents, nine (9) pending applications in the United States, thirty-two (32) pending applications in foreign jurisdictions, including Europe, Australia, Brazil, Canada, China, Eurasia, Israel, Japan, South Korea, Mexico, and Singapore, and four (4) international PCT patent applications. These patents and applications relate, among others, to (1) the trans-differentiation of cells (including hepatic cells) to cells having pancreatic β-cell-like phenotype and function and to their use in the treatment of degenerative pancreatic disorders, including diabetes, pancreatic cancer and pancreatitis, and (2) to scaffolds, including alginate and sulfated alginate scaffolds, polysaccharides thereof, and scaffolds for use for cell propagation, transdifferentiation, and transplantation in the treatment of autoimmune diseases, including diabetes. |

| · | Collaboration Agreement with Hemogenyx Pharmaceuticals Plc - On October 18, 2018, we entered into a collaboration agreement and other ancillary agreements with Hemogenyx Pharmaceuticals Plc (“Hemogenyx”) to collaborate on the development and commercialization of Hemogenyx’s Human Postnatal Hemogenic Endothelial (Hu-PHEC) technology. Hu-PHEC is a cell replacement product candidate that is being designed to generate cancer-free, patient-matched blood stem cells after transplantation into the patient. Pursuant to the terms of the agreements, we shall exclusively manufacture and supply to Hemogenyx, its affiliates and licensees all Hu-PHEC related products both during and following completion of clinical trials. We shall also receive the worldwide -exclusive rights to market such products and shall serve as a global distributor of Hemogenyx’s Hu-PHEC related products. In consideration for such rights, we agreed to advance to Hemogenyx a convertible loan in an amount of no less than $1.0 million for furthering the development of the Hu-PHEC technology. As of November 30, 2018, we have funded $0.5 million under this convertible loan. We also agreed to pay a royalty of 12% of our net revenues resulting from the sale or licensing of products covered by Hemogenyx’s Hu-PHEC technology. |