0001437107DEF 14AFALSE00014371072023-01-012023-12-31iso4217:USD00014371072022-01-012022-12-3100014371072021-01-012021-12-3100014371072020-01-012020-12-310001437107wbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMemberecd:PeoMember2023-01-012023-12-310001437107ecd:PeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2023-01-012023-12-310001437107ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001437107ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001437107ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001437107ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001437107ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310001437107wbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMemberecd:PeoMember2022-01-012022-12-310001437107ecd:PeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2022-01-012022-12-310001437107ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001437107ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001437107ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001437107ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001437107ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310001437107wbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMemberecd:PeoMember2021-01-012021-12-310001437107ecd:PeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2021-01-012021-12-310001437107ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001437107ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001437107ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001437107ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310001437107ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310001437107wbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMemberecd:PeoMember2020-01-012020-12-310001437107ecd:PeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2020-01-012020-12-310001437107ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001437107ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001437107ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001437107ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-01-012020-12-310001437107ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-3100014371072020-12-30iso4217:USDxbrli:shares00014371072021-12-3100014371072022-12-3000014371072023-12-290001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberwbd:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001437107ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-01-012020-12-310001437107ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-31000143710712023-01-012023-12-31000143710722023-01-012023-12-31000143710732023-01-012023-12-31000143710742023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box: | | | | | | | | |

☐ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material under §240.14a-12 |

| | |

Warner Bros. Discovery, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | | | | | | | | | | | | | | |

☒ | | No fee required |

☐ | | Fee paid previously with preliminary materials |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Letter to our Stockholders

| | | | | |

Samuel A. Di Piazza, Jr. Board Chair Warner Bros. Discovery, Inc.

| April 19, 2024 Dear Fellow Stockholders, We look forward to welcoming you to our Annual Meeting on June 3, 2024, at 10:00 a.m. ET. This year’s virtual meeting may be accessed at www.virtualshareholdermeeting.com/WBD2024. In just its second year, Warner Bros. Discovery has made meaningful strides towards achieving its strategic, operational and financial goals. The Board’s focus has been to support David and our leadership team in pursuing WBD’s strategic priorities and positioning the Company on a solid pathway to growth. Together, we have placed continued emphasis on making sure we maintain the critical balance between appropriately investing in the requisite core capabilities and paying down debt, and we are encouraged by the progress made in what is an especially tough media environment. There, of course, remains much work to be done. Among the challenges David and the team are focused on are managing the secular trends impacting linear television and the advertising headwinds facing the entire industry. While we know there are no simple solutions, the Board shares their confidence in the Company’s ability to navigate these and other hurdles, grow the business, and drive long-term value for you, our fellow stockholders. We are especially proud of the significant steps the team took over the past year to achieve our leverage target and generate substantial free cash flow, recognizing these are critical to growth. As we look ahead to the balance of the year and our key investment areas, namely storytelling and technology, we see great opportunity to expand WBD’s global reach and creative impact, particularly through the Company’s strategic priority for this year and next, the global roll-out of Max. Additionally, the Board and the leadership team are pleased to continue to deliver on stockholders’ desire for greater transparency around our policies and practices. WBD’s inaugural Sustainability Report was published earlier this month, and includes information on WBD’s environmental, social and governance objectives and achievements. We are excited for all that’s in store for Warner Bros. Discovery this year, and, as always, appreciate your continued, strong support. Sincerely, Samuel A. Di Piazza, Jr.

Board Chair

Warner Bros. Discovery, Inc. |

|

| |

Notice of 2024 Annual Meeting

of Stockholders

To Warner Bros. Discovery Stockholders:

| | | | | | | | |

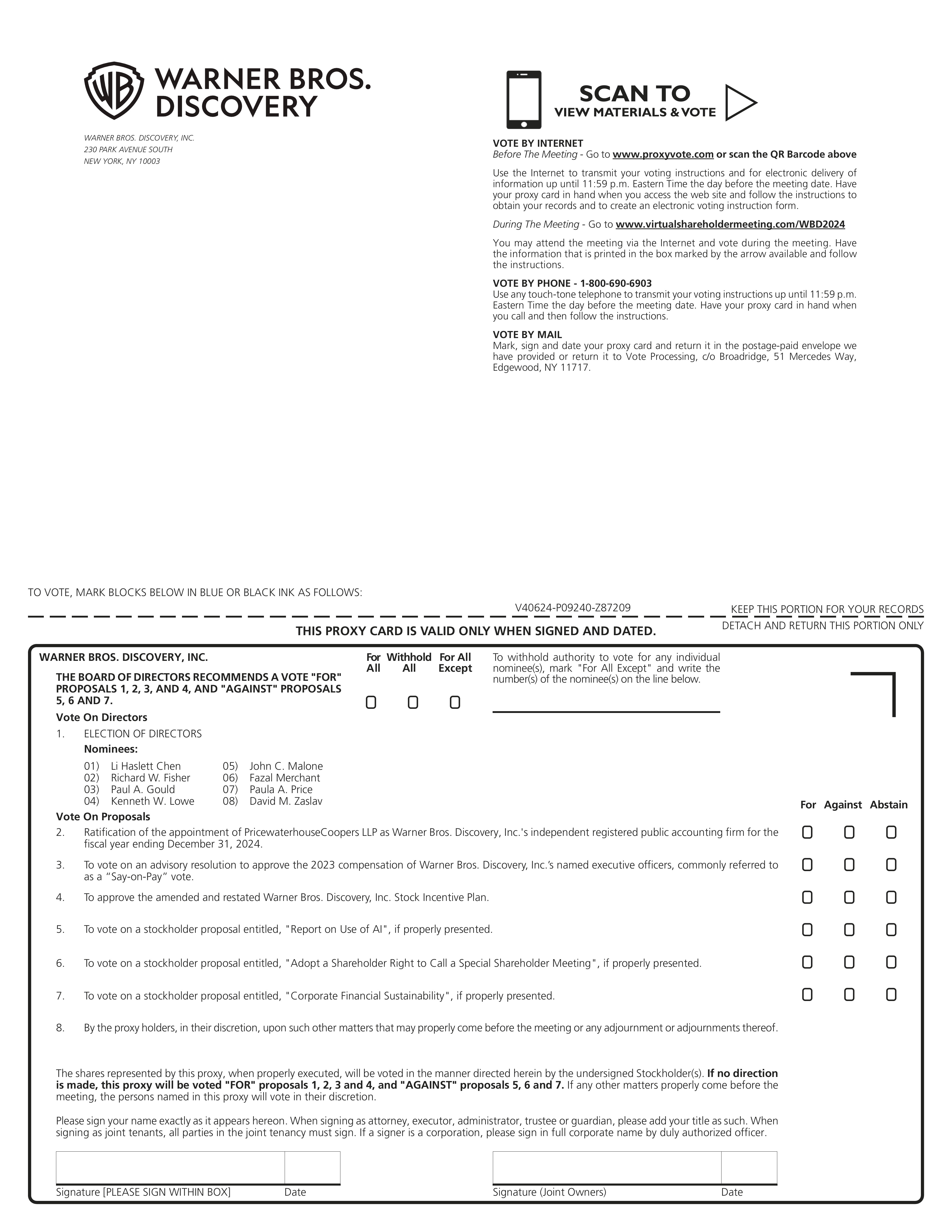

You are cordially invited to attend, and notice is hereby given of, the 2024 Annual Meeting of Stockholders, or 2024 Annual Meeting, of Warner Bros. Discovery, Inc. to be held virtually at www.virtualshareholdermeeting.com/WBD2024 on Monday, June 3, 2024 at 10:00 a.m. ET. To attend the virtual meeting, you will need to log in to www.virtualshareholdermeeting.com/WBD2024 using the 16-digit control number shown on your Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form. Beneficial stockholders who do not have a 16-digit control number should follow the instructions provided by your broker, bank or other nominee prior to the meeting. Electronic entry to the meeting will begin at 9:45 a.m. ET. The 2024 Annual Meeting will be held for the following purposes: | | Date and time: Monday, June 3, 2024 at 10:00 AM, Eastern Time |

| Virtual web conference: www.virtualshareholder

meeting.com/WBD2024 |

| Record date: April 4, 2024 |

Items of Business:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | | 2 | | | | 3 |

| | | | | | | | |

| | | | | | | | |

| To elect each of the eight director nominees named herein for a one-year term. | | | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | | | To vote on an advisory resolution to approve the 2023 compensation of our named executive officers, commonly referred to as a "Say on Pay" vote. |

| | | | | | | | |

| | | | | | | | | |

| FOR each director nominee | | | | FOR | | | | FOR | |

| | | | | | | | | |

| 4 | | | | 5-7 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| To approve the Amended and Restated Warner Bros. Discovery, Inc. Stock Incentive Plan. | | | To vote on the 3 stockholder proposals described in the accompanying proxy statement, if properly presented at the meeting. |

| | | | | | | | | |

| | | | | | | | | |

| FOR | | | | AGAINST | | | | | |

The stockholders will also act on any other business that may properly come before the 2024 Annual Meeting or adjournments thereof.

The close of business on April 4, 2024 was the record date for determining the holders of shares of our Series A common stock ("common stock") entitled to notice of and to vote at the 2024 Annual Meeting and any postponement or adjournment thereof. A complete list of registered stockholders entitled to vote at the 2024 Annual Meeting will be available for inspection by stockholders during the entirety of the 2024 Annual Meeting at www.virtualshareholdermeeting.com/WBD2024. Further information about how to attend the 2024 Annual Meeting online, vote your shares before or during the 2024 Annual Meeting and submit questions online during the 2024 Annual Meeting is included in the accompanying proxy statement.

By Order of the Board of Directors,

Tara L. Smith

Executive Vice President & Corporate Secretary

Global Head of ESG

April 19, 2024

| | |

|

This proxy statement, our proxy card and our Annual Report on Form 10-K for the year ended December 31, 2023 were first made available to stockholders on or about April 19, 2024. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor, INNISFREE M&A INCORPORATED, at 1 (877) 717-3922 (toll-free from the U.S. and Canada), or +1 (212) 750-5833 (from other locations). |

|

Table of Contents

Proxy Statement Summary

The Board of Directors (the "Board") of Warner Bros. Discovery, Inc. (the "Company," "we," "us," "our" "Warner Bros. Discovery" or "WBD") is furnishing this proxy statement and soliciting proxies in connection with the proposals to be voted on at the Warner Bros. Discovery 2024 Annual Meeting of Stockholders, or our 2024 Annual Meeting, and any postponements or adjournments thereof. This summary highlights certain information contained in this proxy statement but does not contain all of the information you should consider when voting your shares. Please read the entire proxy statement carefully before voting.

Proxy Voting Roadmap

The following proposals will be voted on at the 2024 Annual Meeting:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal | For more

information | Recommendation |

| | | |

| | | | | | | |

| | | | | | | | | |

| Proposal One: Election of Directors Eight director nominees will be voted on at the meeting, each to serve a one-year term. The Board and the Nominating and Corporate Governance Committee believe our nominees possess the skills, experience and qualifications to effectively monitor performance, provide oversight and support management’s execution of WBD’s strategy. |

| The Board of Directors recommends a vote "FOR" the election of each of the nominated directors. |

| | | | | |

| | | | | | | | | |

| Director Nominees | | | | |

| | | | | | | | |

| Li Haslett Chen | Richard W. Fisher | Paul A. Gould | Kenneth W. Lowe | John C.

Malone | Fazal

Merchant | Paula A. Price | David M.

Zaslav |

| | | | | | | | | |

| | | | | | | | | |

| Proposal Two: Ratification of Appointment of Independent Registered Public Accounting Firm The Audit Committee has evaluated the performance of PricewaterhouseCoopers LLP ("PwC") and has re-appointed them as our independent registered public accounting firm for the fiscal year ending December 31, 2024. You are requested to ratify the Audit Committee’s appointment of PwC. |

| The Board of Directors recommends a vote "FOR" this proposal. |

| | | | | | | |

| | | | | | | |

| Proposal Three: Advisory Vote on 2023 Executive Compensation ("Say on Pay") Stockholders are being asked to vote to approve, on a non-binding, advisory basis, our 2023 named executive officer compensation. The Board and the Compensation Committee believe our executive compensation program reflects our commitment to paying for performance. |

| The Board of Directors recommends a vote "FOR" this proposal. |

| | | | | | | | | |

| | | | | | | | | | | |

| Proposal | For more

information | Recommendation |

| | | |

| | | |

| Proposal Four: Approve Amended and Restated Warner Bros. Discovery, Inc. Stock Incentive Plan The Board has approved, and is submitting to stockholders for approval, the Amended and Restated Warner Bros. Discovery, Inc. Stock Incentive Plan to provide 125 million additional shares to be used for future equity grants to WBD employees. |

| The Board of Directors recommends a vote "FOR" this proposal. |

| | | |

| | | |

| Proposal Five: Stockholder Proposal — Report on Use of AI Vote on a stockholder proposal submitted by AFL-CIO Equity Index Funds and the NY City Employees' Retirement Systems |

| The Board of Directors recommends a vote "AGAINST" this proposal. |

| | | |

| | | |

| Proposal Six: Stockholder Proposal — Adopt a Shareholder Right to Call a Special Shareholder Meeting Vote on a stockholder proposal submitted by Kenneth Steiner. |

| The Board of Directors recommends a vote "AGAINST" this proposal. |

| | | |

| | | |

| Proposal Seven: Stockholder Proposal — Corporate Financial Sustainability Vote on a stockholder proposal submitted by the National Center for Public Policy Research |

| The Board of Directors recommends a vote "AGAINST" this proposal. |

| | | |

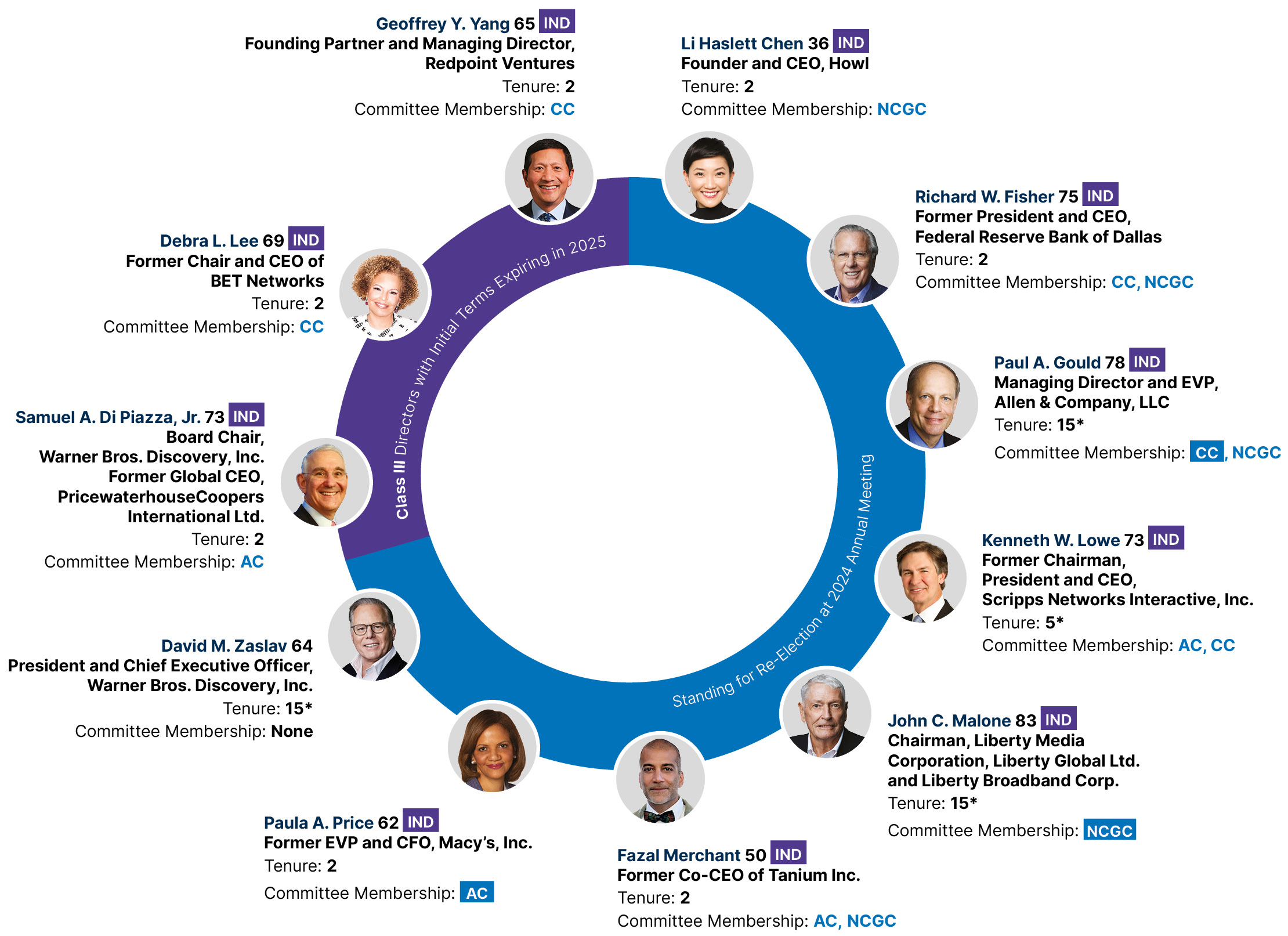

Our Board of Directors

The following provides summary information about each director nominee and each director whose term will extend beyond the 2024 Annual Meeting. Committee memberships, age and tenure information is shown as of April 4, 2024, the record date for our 2024 Annual Meeting. Tenure is shown in years and includes prior service on the Discovery, Inc. Board of Directors, where applicable.

| | | | | | | | | | | | | | | | | |

| AC | Audit Committee | CC | Compensation Committee | NCGC | Nominating and Corporate Governance Committee |

| | | | | | | | | | | | | | |

| Committee Chair | I  | Independent |

|

|

| * | Includes prior service on Discovery, Inc. Board of Directors |

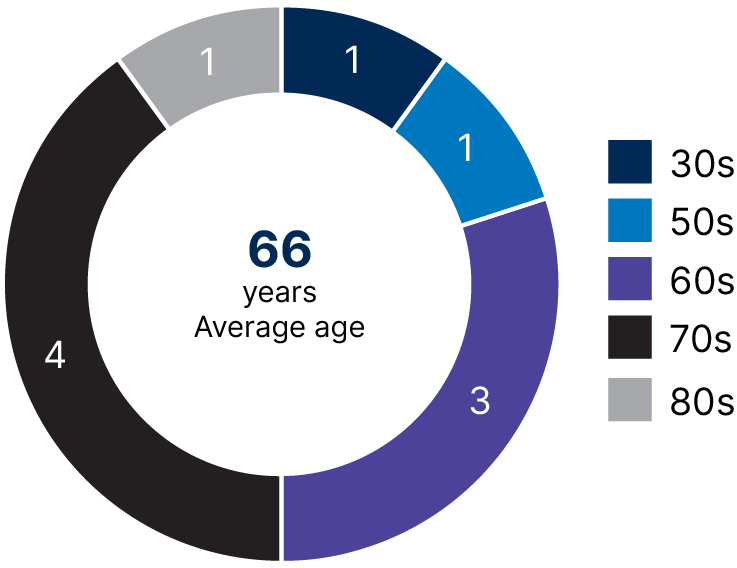

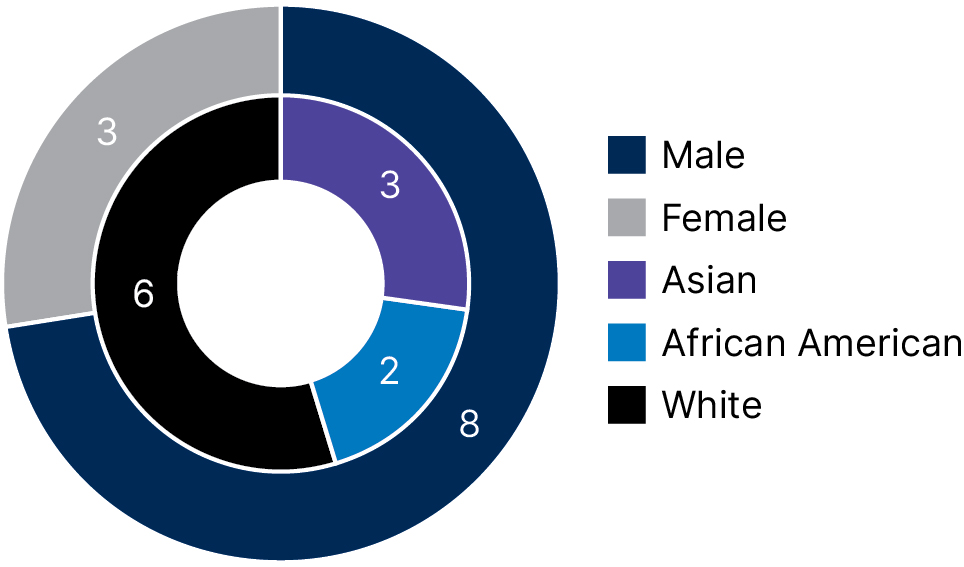

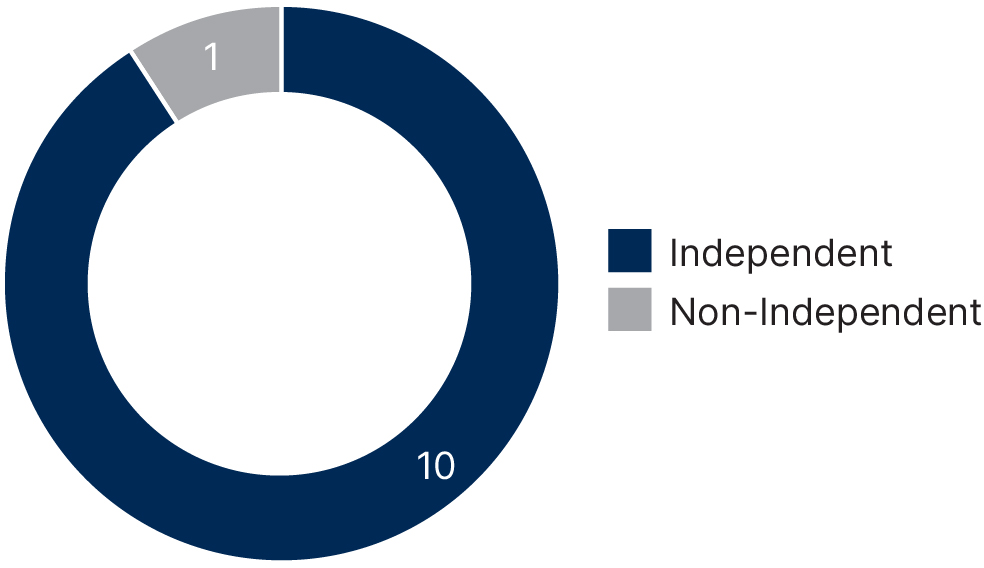

Board Snapshot

The Warner Bros. Discovery Board of Directors ("Board") is currently comprised of 11 directors. Ten of our 11 directors are independent, including the chair of our Board ("Board Chair"), Samuel A. Di Piazza, Jr. All current members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent and all directors who served on these committees at any time since the 2023 Annual Meeting were independent.

Our Board believes that it is essential that Board members represent diverse backgrounds and viewpoints and includes directors who bring a mix of fresh perspectives and deeper experience. Three of our 11 directors, or 27%, are female and five of our 11 directors, or 45%, are racially or ethnically diverse. In April 2022, upon the closing of the WarnerMedia Transaction, we significantly refreshed the Board with the addition of seven new independent directors.

Additional details on our Board composition are as follows (age and tenure information is shown as of April 4, 2024, the record date for the 2024 Annual Meeting):

| | | | | | | | |

| Age of Independent Directors | | Gender Diversity, Racial/Ethnic Diversity |

| | |

| | |

| | |

| Independence | | Tenure of Independent Directors |

| | |

| | |

Corporate Governance Highlights

The WBD Board represents and acts on behalf of WBD stockholders and is committed to sound corporate governance, as reflected through its policies and practices. The Board believes that strong corporate governance is essential to effective fulfillment of its oversight responsibilities and fiduciary duties. The Board has adopted Corporate Governance Guidelines, which provide a framework for effective governance of the Company. You can find a copy of our Corporate Governance Guidelines, along with the charters of the three standing Board committees, and our Amended and Restated Bylaws ("Bylaws") in the Investor Relations section of our corporate website at ir.wbd.com.

Some highlights of WBD’s corporate governance include:

| | | | | |

| |

Director and Committee Independence | ■10 of 11 directors are independent ■3 fully independent Board committees: Audit, Compensation, Nominating and Corporate Governance ■Independent directors meet at least twice a year in executive session |

Board Accountability and Leadership | ■Annual election of directors (beginning at 2025 Annual Meeting of Stockholders) ■Independent Board Chair ■Annual Board and Committee evaluation processes, periodically led by external party ■Board access to outside experts and independent consultants as the Board deems necessary |

Board Refreshment and Diversity | ■Balance of new and experienced directors, with tenure of independent directors averaging 4.9 years ■Added 7 new independent directors since 2022 ■3 of 11 directors are women ■5 of 11 directors are racially or ethnically diverse ■Average age of independent directors is 66 years |

Stockholder Rights | ■Single class of common stock with one vote per share ■No preferred shares outstanding ■No stockholder rights plan or "poison pill" ■Supermajority provisions in Second Restated Certificate of Incorporation expire at 2025 Annual Meeting of Stockholders ■Annual "Say on Pay" advisory vote |

Director Engagement | ■All incumbent directors attended at least 92% of Board and Committee meetings in 2023 and all directors attended the 2023 Annual Meeting of Stockholders ■Annual stockholder outreach efforts led by Board Chair, with other Committee Chairs participating, as appropriate ■Stockholder ability to contact directors |

Director Access and Robust Succession Planning | ■Significant interaction with senior business leaders through regular business reviews and Board presentations ■Directors have access to senior management and other employees ■Annual Board agenda item dedicated to succession planning, with interim discussions as necessary |

| | | | | |

Comprehensive Clawback and Anti-Hedging Policies | ■Clawback policy that requires recoupment of erroneously awarded incentive-based compensation following a financial statement restatement. ■Additional clawback provisions in equity grant documents that permit the Company to recoup equity compensation upon a material financial statement restatement resulting from fraud or intentional misconduct ■Insider Trading Policy prohibits all directors, officers and employees from: ■trading in any public puts, calls, covered calls or other derivative products involving Company securities; ■engaging in short sales of Company securities; and ■hedging without prior consent of our Chief Legal Officer |

Stock Ownership | ■Robust stock ownership guidelines for directors and executive officers ■CEO required to hold shares equivalent to 6x salary ■Other named executive officers are required to hold shares equivalent to 2x salary ■Directors required to hold shares equivalent to 5x the cash portion of their annual retainer within five years of first joining the Board |

| |

Stockholder Engagement on Corporate Governance

During our 2023 engagements with stockholders, we discussed the stockholder proposal presented at the 2023 Annual Meeting of Stockholders relating to the removal of supermajority voting requirements from our governing documents. While the proposal did receive the support of approximately 43% of the votes cast on this proposal at the meeting, it did not receive majority support of the votes cast. In our engagements, stockholders were receptive to the significant governance improvements and enhancements the Board has adopted since April 2022, and took note of the fact that the supermajority provisions contained in our Second Restated Certificate of Incorporation were part of the arm's length negotiations between Discovery, Inc. and AT&T Inc. prior to the closing of the WarnerMedia Transaction and that those provisions would sunset as of our 2025 Annual Meeting of Stockholders. Based on the direct feedback we received from stockholders, the WBD Board determined it was not in the best interests of the Company to adopt the changes called for in the heretofore described stockholder proposal. We look forward to continuing to maintain an open dialogue with our stockholders throughout the year to ensure our corporate governance provisions align with stockholder priorities.

Sustainability Highlights

WBD was proud to publish our inaugural Sustainability Report in April 2024 to provide stockholders and other interested stakeholders with enhanced information about our environmental, social and governance programs. Below are some highlights from our 2024 Sustainability Report.

You can find our 2024 Sustainability Report at esg.wbd.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Our People |

| | | | | | | | |

| | ~6,900 employees participated in

development programs | | | 40 hours of immersive leadership DEI training through our Inclusion Journey for Executives | | | |

| | | | | | | |

| | | | | | | |

| | 12,000+ hours of tech training

completed by employees | | | Launched Inclusive Storytelling Guide, supporting

diverse, equitable, and inclusive

storytelling | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Our Community |

| | | | | | | | | |

| | | Launched Corporate Social Responsibility pillars to guide our social impact efforts | | | 41,488 volunteer hours completed by employees | | | 7,343 causes and organizations supported through employee giving and volunteerism |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Our Planet |

| | | | | | | | | |

| | | Established the greenhouse gas emissions inventory for Scope 1 and 2 and five material Scope 3 categories | | | 44,841 MWh of renewable energy generated and purchased in Finland, New Zealand, Poland, the United States, and the

United Kingdom with 1,035 MWh generated on-site | | | 40 Environmental Media Association Green Seals, 28 with Gold Seal distinction (EMA’s Green Seal recognition program honors progress in sustainable production) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | Governance |

| | | | | | | | | | | |

| | | New employees required to complete training on Code of Ethics within first 45 days; all employees required to acknowledge Code of Ethics annually and complete training bi-annually | | | | Completed an ESG materiality assessment to guide our ESG strategy and reporting | | | | Robust cybersecurity program using NIST's cybersecurity framework and other leading industry practices as guidelines |

Our Performance in 2023

About WBD

2023 marked the first full year of operations for Warner Bros. Discovery, following the transformational merger in April of 2022 between Discovery, Inc. ("Discovery") and the WarnerMedia business (the "WarnerMedia Business" or "WarnerMedia") of AT&T Inc. The combination of Discovery and the WarnerMedia Business is referred to in this proxy statement as the "WarnerMedia Transaction".

Warner Bros. Discovery is a premier global media and entertainment company that provides audiences with a differentiated portfolio of content, brands and franchises across television, film, streaming and gaming. Some of our iconic brands and franchises include Warner Bros. Motion Picture Group, Warner Bros. Television Group, DC, HBO, HBO Max, Max, discovery+, CNN, Discovery Channel, HGTV, Food Network, TNT Sports, TBS, TLC, OWN, Warner Bros. Games, Batman, Superman, Wonder Woman, Harry Potter, Looney Tunes, Hanna-Barbera, Game of Thrones, and The Lord of the Rings.

As of December 31, 2023, we classified our operations in three reportable segments:

■Studios: Our Studios segment primarily consists of the production and release of feature films for initial exhibition in theaters, production and initial licensing of television programs to our networks/direct-to-consumer ("DTC") services as well as third parties, distribution of our films and television programs to various third party and internal television and streaming services, distribution through the home entertainment market (physical and digital), related consumer products and themed experience licensing, and interactive gaming.

■Networks: Our Networks segment primarily consists of our domestic and international television networks.

■DTC: Our DTC segment primarily consists of our premium pay-TV and streaming services.

More information on our business is available in our Annual Report on Form 10-K for the year ended December 31, 2023 ("2023 Form 10-K") which accompanies this proxy statement.

2023 Performance

2023 was a challenging year for WBD and for the media and entertainment industry as a whole. We were impacted by the changing landscape of advertising spending and the continued weakness in the advertising market overall, declines in linear television viewing, increased competition from other traditional media companies and the enhanced presence of large technology companies in the media space, lingering effects of the COVID-19 pandemic on movie-theater attendance, and other general macroeconomic conditions. We also experienced an unprecedented work stoppage in our industry as both the Writers Guild of America ("WGA") and Screen Actors Guild-American Federation of Television and Radio Artists ("SAG-AFTRA") went out on strike for several months during 2023.

Despite these challenges, we delivered strong financial performance in 2023 and progressed against several of our strategic and operational initiatives, including;

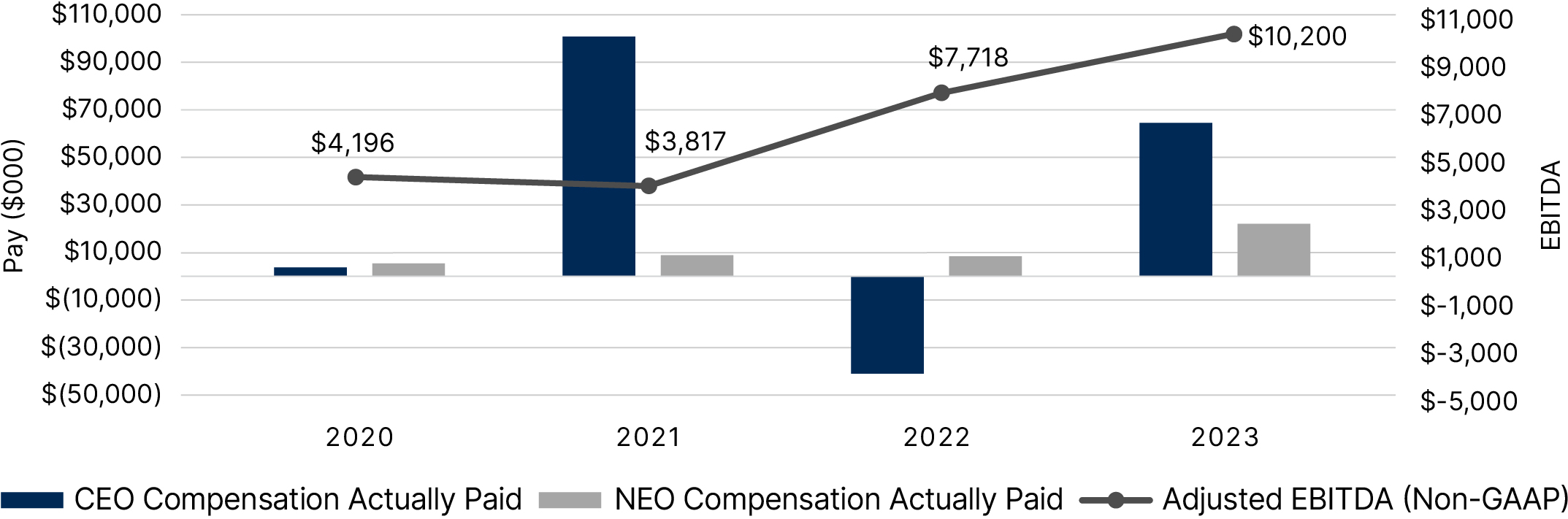

■Net loss available to WBD decreased to $(3.1) billion and Adjusted EBITDA increased 12% ex-FX to $10.2 billion, as compared to 2022 on a pro forma combined basis;*

■Delivered solid revenue performance during a challenging year and significantly exceeded our Free Cash Flow guidance;

■Reduced outstanding debt by approximately $5.4 billion during 2023, bringing us to a total of approximately $12.4 billion of outstanding debt repaid since closing the WarnerMedia Transaction;

■Launched Max in the U.S. in May 2023 and prepared for international expansion in 2024, which includes the launch of Max in Latin America in February 2024 and expected launch in EMEA in spring 2024;

■Recorded full-year positive Adjusted EBITDA in our DTC segment, which was aided by the profitable performance of our U.S. DTC business in 2023, ahead of our original expectations;

■Unprecedented successes in our theatrical and gaming businesses, which were supported by cross-functional marketing and promotional campaigns that leveraged WBD's broad portfolio of networks, brands and assets:

■Barbie, the top grossing movie of 2023 and highest grossing movie in the history of Warner Bros. Pictures, and

■Hogwarts Legacy, the best selling game of 2023; and

■Continued to produce award-winning content at Warner Bros. Television, HBO and Warner Bros. Studios, resulting in 36 primetime Emmy® Awards, as well as six Golden Globe® Awards and one Academy Award®.

*More information on our business and our performance in 2023 is available in our 2023 Form 10-K. A reconciliation of Adjusted EBITDA, which is a non-GAAP measure, to net loss, its most comparable GAAP measure, and additional information regarding "ex-FX," a non-GAAP presentation of results on a constant currency basis, and our pro forma combined financial information for 2022, which present the combined results of the Company and the WarnerMedia Business as if the WarnerMedia Transaction had been completed on January 1, 2021, are available in Appendix C.

2023 Executive Compensation

Compensation Philosophy

WBD's compensation philosophy is to pay for performance, encourage excellence, retain our high-performing executive talent across the blended organization and reward executives who deliver.

| | | | | |

| |

| Our executive compensation programs are designed to implement our pay-for-performance compensation philosophy, as follows: ■ensure a strong alignment of the interests of our stockholders and employees; ■pay for performance, both short-term and long-term; ■pay competitively, across salary grades and geographies; and ■apply compensation policies in an internally consistent manner for similarly situated employees and executives. |

Pay-For-Performance

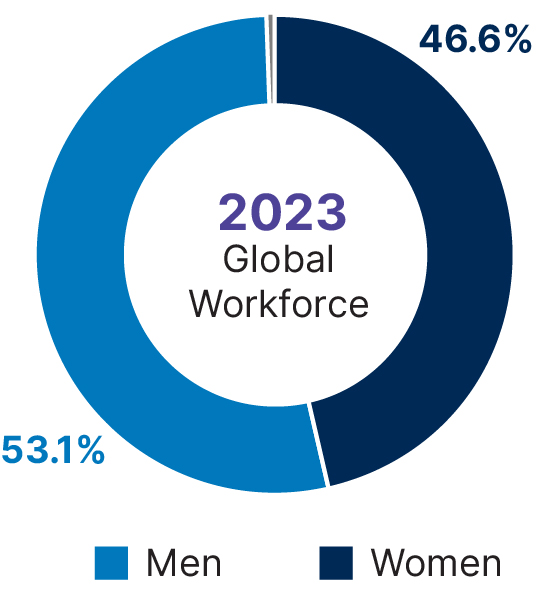

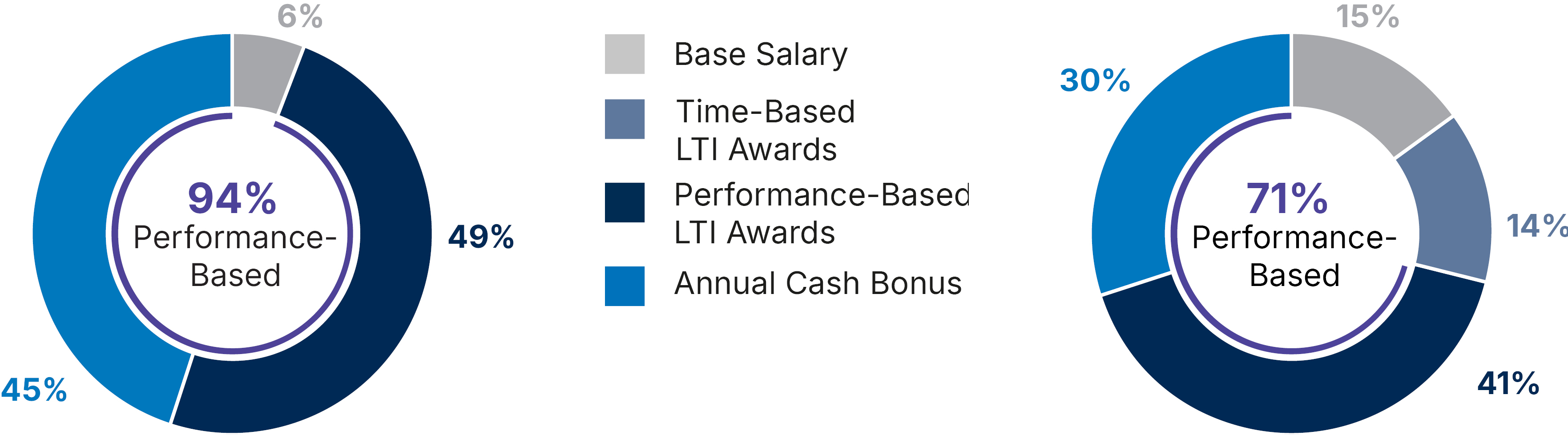

The Compensation Committee (the "Committee") seeks to deliver the majority of target total direct compensation for each named executive officer (or "NEO" as defined in the "Compensation Discussion and Analysis" which begins on page 46) in performance-based pay, with the balance between the annual cash bonus and long-term incentive awards determined by the Committee as appropriate for each role. Approximately 94% of the CEO’s target total compensation under his employment agreement is performance based, and approximately 71% of the average 2023 target total compensation of our other NEOs was performance based. Total Target Compensation Pay Mix

* CEO's 2023 annual cash bonus was required to be paid at target,

per the terms of the CEO's employment agreement.

2023 Stockholder Engagement and Responsiveness

Throughout 2023, we routinely engaged with several of our top stockholders, both during the 2023 proxy season and again during the fall and winter of 2023 following our 2023 "Say on Pay" vote. In response to our 2023 Say on Pay vote outcome, we invited our top 15 stockholders to engage with us. We focused on the top 15 stockholders as our stockholder base is fragmented and our 15 largest stockholders represent approximately 45% of our outstanding shares. We ultimately met with 10 of these stockholders representing approximately 37% of our outstanding shares. Participating in our engagement efforts were our independent Board Chair, Mr. Di Piazza, and our independent Compensation Committee Chair, Mr. Gould, with support from the Company's Investor Relations and Legal Departments.

| | | | | | | | | | | | | | |

Contacted top 15 stockholders representing 45% of outstanding shares | | Engaged with 10 stockholders representing 37% of outstanding shares | | 100% of engagement meetings attended by independent Board members |

Our stockholders conveyed diverse perspectives with regard to our executive compensation program. The majority of our stockholders were aligned with our pay-for-performance philosophy and responded favorably to the compensation-related updates for 2023 disclosed in last year’s proxy, including the reintroduction of performance restricted stock units ("PRSUs") and options in the long-term incentive plan (for NEOs other than our CEO, who already received PRSUs and holds a large number of options), the differentiation of short- and long-term performance metrics, and higher weighting allocated to the free cash flow performance metric.

The following table outlines key feedback we received from our stockholders as it relates to our executive compensation program and the responsive actions the Committee has implemented in light of these discussions. The Committee will continue to evaluate the executive compensation program and commits to maintaining ongoing and open dialogue with our stockholders.

| | | | | | | | |

| What We Heard | | What We Did |

| | |

■Maintain effective compensation governance and transparent compensation disclosures | | ■Implemented an annual "Say on Pay" vote in 2023. See Proposal Three on page 89 ■Continued to enhance our CD&A (as defined below) disclosures to focus on the Committee's decision-making, such as the inclusion of an "Executive Summary" in our 2024 proxy statement, which appears on page 47 |

| | |

| | | | | | | | |

| What We Heard | | What We Did |

■Pay and performance should be aligned | | ■Clear commitment to pay for performance, as demonstrated through the redesign of the 2023 executive compensation program in response to stockholder feedback ■Took several steps to strengthen alignment between executive compensation and the stockholder experience: ■Utilized stock options, which represented 25% of our NEOs (other than the CEO) 2023 target equity grants and each grant was valued between $1.5 million and $2.125 million at the time of grant. As of the date of this proxy statement and based on our current stock price, these awards do not have any value as the strike price is above the current stock price, demonstrating the alignment between executive incentives and stockholder value ■2023 PRSUs for all NEOs were earned at 200% of target based on significant over-delivery against the free cash flow target, but the realizable value on the vesting date was only approximately 109% of the initial target value, reflective of our stock price performance over the last year ■Annual PRSU awards to CEO subject to FCF (as defined below) modifier; annual PRSU awards for other NEOs are subject to a three-year relative total stockholder return ("TSR") modifier ■CEO continues to hold a significant number of premium priced options that require significant stock price appreciation to recognize value |

| | |

■Incorporate longer performance periods for equity compensation | | ■Set three-year performance period for TSR-modifier applied to NEO PRSU awards (other than CEO's awards) |

| | |

■Utilize diversified performance metrics across incentive programs | | ■Differentiated financial metrics used for 2023 cash bonus program (revenue, EBITDA, DTC subscribers) and the 2023 long-term incentive ("LTI") program (free cash flow and total stockholder return) ■Differentiated financial metrics were also adopted for 2024 executive compensation program |

| | |

■WBD leadership should be focused on leverage reduction and generating free cash flow that can be used to invest in future growth | | ■Utilized free cash flow as a financial metric in the 2023 LTI program ■Awarded supplemental PRSUs to the NEOs and certain other executives to further incent achievement of our free cash flow objectives |

■Concerns regarding single-trigger severance provision included in the amended employment agreement with our CEO | | ■The Committee evaluated potential severance provisions in the CEO's employment agreement and determined that these enhanced provisions were essential to retain and incentivize Mr. Zaslav’s continued contributions to our transformation and merger integration efforts and were in the best interest of WBD and our stockholders ■No other NEOs have single-trigger severance provisions |

| | |

| | |

| | | | | | | | |

| |

| Proposal 1 Election of Directors |

| | The Warner Bros. Discovery, Inc. Board of Directors recommends a vote "FOR" the election of the nominated directors. |

Our Board of Directors

Our Board has general oversight responsibility for the Company’s affairs pursuant to the Delaware General Corporation Law and the Company’s Second Restated Certificate of Incorporation and Bylaws. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company’s stockholders and is committed to strong corporate governance, as reflected through its policies and practices. The Board is deeply involved in the Company’s strategic planning process, leadership development, succession planning, and oversight of risk management.

Director Skills, Experience and Diversity Matrix

The WBD Board is comprised of highly skilled directors who bring a diverse range of skills and experiences to the Board's oversight role. The following table summarizes the key skills and experiences of each director nominee and each director whose term extends beyond the 2024 Annual Meeting. Further details about each individual's experiences and qualifications are set forth in their individual biographies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS AND EXPERIENCE |

| | | | | | | | | | | | |

| Executive Management Experience | | | | | | | | | | | |

| Media/Entertainment/

Telecommunications Industry Experience | | | | | | | | | | | |

| Technology/Cybersecurity Experience | | | | | | | | | | | |

| Financial/Accounting Experience | | | | | | | | | | | |

| Risk Management Experience | | | | | | | | | | | |

| International/Global Business Operations Experience | | | | | | | | | | | |

| Regulatory/Government Experience | | | | | | | | | | | |

| Outside Public Company Board Experience | | | | | | | | | | | |

| BACKGROUND |

| Tenure/Age/Gender |

| Years on the Board* | 2 | 2 | 2 | 15 | 2 | 5 | 15 | 2 | 2 | 2 | 15 |

| Age* | 36 | 73 | 75 | 78 | 69 | 73 | 83 | 50 | 62 | 65 | 64 |

| Gender | F | M | M | M | F | M | M | M | F | M | M |

| Race/Ethnicity |

| Black or African American | | | | | | | | | | | |

| Asian | | | | | | | | | | | |

| White | | | | | | | | | | | |

* Age/tenure as of April 4, 2024, the record date of this proxy statement, tenure includes prior service on Discovery, Inc. Board

F=Female, M=Male

Please also see Nasdaq Board Diversity Matrix in Appendix B

Skills and Experience Definitions

| | | | | | | | | | | | | | | | | |

| | | | | |

| Executive Management Experience Experience as an executive member of corporate management | | | | Risk Management Experience Experience assessing risk and reviewing measures to address and mitigate risks |

| | | | | |

| | | | | |

| Media, Entertainment, and Telecommunications Industry Experience Prior experience working as an executive or serving on the board of a sophisticated media, entertainment or telecommunications company | | | | International/Global Business Operations Experience Experience working in global markets and understanding the nuances of international business environments |

| | | | | |

| | | | | |

| Technology/Cybersecurity Experience Experience in a technology-related business and/or an acute understanding of emerging technology trends; experience in the development of technology and processes that protect the storage of information and maintain confidentiality | | | | Regulatory/Government Experience Experience working in a governmental or regulatory agency, or leading an organization in a highly-regulated industry |

| | | | | |

| | | | | |

| Financial/Accounting Experience High-level expertise in finance and accounting, such as those who have experience as an operating executive with responsibility for all or a portion of a company’s financial reporting, in the financial sector or private equity or as an audit committee member for publicly traded companies, or have an educational background or training in accounting or finance | | | | Outside Public Company Board Experience Experience serving on an external public company board |

| | | | | |

Nominees for Election

As shown below, the WBD Board currently consists of 11 directors: eight directors whose terms will expire at the 2024 Annual Meeting and three directors whose initial terms will expire at the 2025 Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | |

| Directors whose Terms Expire at 2024 Annual Meeting | | Class III Directors

Initial Terms Expire at 2025 Annual Meeting |

| | Li Haslett Chen | John C. Malone | | | | Samuel A. Di Piazza, Jr. |

| | Richard W. Fisher | Fazal Merchant | | | | Debra L. Lee |

| | Paul A. Gould | Paula A. Price | | | | Geoffrey Y. Yang |

| | Kenneth W. Lowe | David M. Zaslav | | | | |

| | | | | | | |

In connection with the closing of the WarnerMedia Transaction in 2022, the WBD Board was initially divided into three classes of directors, with Class I consisting of four directors serving a one-year initial term, Class II consisting of four directors serving a two-year initial term and Class III originally consisting of five directors serving a three-year initial term. In accordance with our Second Restated Certificate of Incorporation, upon the expiration of the initial term of each class of directors, such class of directors, if nominated by the Board, will stand for election by our stockholders for a one-year term and, if elected by stockholders, will hold office until the earliest to occur of their respective death, resignation, removal or disqualification or the election and qualification of their respective successors.

On March 29, 2024, Steven A. Miron and Steven O. Newhouse, each an original Class III director, notified WBD that they would be resigning from the Board, effective as of March 29, 2024. The Board subsequently took action to reduce the size of the Board to 11 directors, as permitted by our governing documents.

Consistent with the foregoing, (i) the initial term of the Class I directors expired at the 2023 Annual Meeting and those directors, Li Haslett Chen, Kenneth W. Lowe, Paula A. Price and David M. Zaslav, were nominated by the Board and reelected by the stockholders for a one-year term expiring at the 2024 Annual Meeting, (ii) the initial term of the Class II directors, Richard W. Fisher, Paul A. Gould, John C. Malone and Fazal Merchant, will expire at the 2024 Annual Meeting and (iii) the initial term of the remaining Class III directors will expire at the 2025 Annual Meeting. At our 2025 Annual Meeting, all of our directors will stand for election for one-year terms and the current classified nature of the WBD Board will fully sunset.

The eight directors who are being nominated for re-election at the 2024 Annual Meeting for a one-year term that will expire at the 2025 Annual Meeting are Li Haslett Chen, Richard W. Fisher, Paul A. Gould, Kenneth W. Lowe, John C. Malone, Fazal Merchant, Paula A. Price and David M. Zaslav. Unless otherwise instructed on the proxy card, the persons named as proxies will vote the shares represented by each properly executed proxy "FOR" the election as directors of the persons named in this proxy statement as nominees. Each of the nominees has consented to serve if elected. However, if any of the persons nominated by the Board fails to stand for election, or declines to accept election, proxies will be voted by the proxy holders for the election of such other person or persons as the Board may recommend.

The following tables present information, including age, term of office, committee memberships, independence, business experience, qualifications, education, and other public company directorships held in the past five years, for each person nominated for election as a director at the 2024 Annual Meeting and for those directors whose terms of office will continue after the 2024 Annual Meeting. Each member of our Board and each director nominee possesses skills and experience which makes him or her an important component of the Board as a whole. While consideration of the information presented below regarding each director’s and director nominee’s specific experience, qualifications, attributes and skills led our Board to the conclusion that he or she should serve as a director, we also believe that all of our directors and director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Warner Bros. Discovery and our Board. There is no family relationship among any of WBD's executive officers or directors, by blood, marriage or adoption.

Director Nominees for Election at 2024 Annual Meeting

| | | | | | | | |

Li Haslett Chen Independent Director | |

| | |

| |

Age: 36 Director Since: 2022 Committee Memberships ■Nominating and Corporate Governance Committee | Other Public Company Directorships

(past five years): ■None Education ■Columbia University, BA |

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

| Li Haslett Chen is the founder and chief executive officer of Howl, a technology platform that democratizes access to retail's next frontier - social commerce. For creators on platforms like YouTube, TikTok, and Instagram, Howl provides the foundation to get paid for selling products from global brands. Under her leadership, Howl has been named one of Fast Company’s Most Innovative Companies and one of the Most Promising AI Companies by Forbes. Ms. Chen has been recognized as a Retail Disruptor by The Financial Times, a World Economic Forum Technology Pioneer, and included on Ad Age’s 40-Under-40. | Ms. Chen is skilled in digital interactions in the content and e-commerce spaces, as well as in technology and product development. She also brings significant experience with direct-to-consumer platforms to the WBD Board. |

| |

| | | | | | | | |

Richard W. Fisher Independent Director | |

| | |

| |

Age: 75 Director Since: 2022 Committee Memberships ■Compensation Committee ■Nominating and Corporate Governance Committee | Other Public Company Directorships

(past five years): ■Tenet Healthcare Corporation (2017-present) ■Beneficient Company Group (2023-March 2024) ■AT&T Inc. (2015-2021) ■PepsiCo, Inc. (2015-2021) Education: ■Harvard University, BA ■Stanford University, MBA |

|

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

| Richard W. Fisher served as President and Chief Executive Officer of the Federal Reserve Bank of Dallas from 2005 until March 2015. He served as a Senior Advisor to Barclays PLC from 2015 until March 2024, and began serving as a Senior Advisor to Jefferies in April of 2024. From 2001 to 2005, Mr. Fisher was Vice Chairman and Managing Partner of Kissinger McLarty Associates. From 1997 to 2001, Mr. Fisher served as Deputy U.S. Trade Representative with the rank of Ambassador. Previously, he served as Managing Partner of Fisher Capital Management and Fisher Ewing Partners LP (investment advisory firms) and prior to that was Senior Manager of Brown Brothers Harriman & Co. From 2015 to 2021, Mr. Fisher served as a director at PepsiCo and he currently serves on the Audit committee of Tenet Healthcare, where he has been a director since 2017. | Mr. Fisher has extensive knowledge of financial matters and expertise in international markets, trade and regulatory frameworks. He brings to our Board strategy, leadership and risk oversight experience, including his prior experience chairing a Federal Reserve committee on information technology architecture and cybersecurity risks for five years. |

| |

| | | | | | | | |

Paul A. Gould Independent Director | |

| | |

| |

Age: 78 Director Since: 2008 Committee Memberships ■Compensation Committee (Chair) ■Nominating and Corporate Governance Committee | Other Public Company Directorships

(past five years): ■ Liberty Latin America, Ltd. (2017-present) ■ Liberty Global Ltd. (2005-present) ■ Radius Global Infrastructure, Inc. (2020-2023) Education: ■Farleigh Dickinson University, BA |

|

| | |

| | | | | |

Professional Experience Paul A. Gould served as a director of Discovery Holding Company from 2005 to 2008 when it merged with Discovery, Inc. Mr. Gould has served at Allen & Company Incorporated, an investment banking services company, since 1972, including as a Managing Director and Executive Vice President for more than the last five years. He is also a member of an International Monetary Fund advisory committee, and a long-serving board member of the Wildlife Conservation Society, where he has chaired the investment committee since 2017. Mr. Gould has served as a financial advisor to many Fortune 500 corporations and advised on a number of large media company acquisitions. Since 2020, Mr. Gould has served as a director of Radius Global Infrastructure, Inc., which ceased to be a public company in 2023. | Qualifications and Expertise Provided to Our Board Mr. Gould brings to our Board a wealth of experience in matters relating to public company finance and mergers and acquisitions, particularly in the media and entertainment industries. Mr. Gould’s knowledge of our Company and our industry, combined with his expertise in finance, makes him an important part of our Board. |

| |

| | | | | | | | |

Kenneth W. Lowe Independent Director | |

| | |

| |

Age: 73 Director Since: 2018-2022; 2023 Committee Memberships ■Audit Committee ■Compensation Committee | Other Public Company Directorships

(past five years): ■None Education: ■University of North Carolina at Chapel Hill, BA |

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

Kenneth W. Lowe served as Chairman, President and Chief Executive Officer of Scripps Networks Interactive, Inc. ("Scripps Networks") from 2008 until 2018, when Scripps Networks merged with Discovery, Inc. From 2000-2008, Mr. Lowe served as President and Chief Executive Officer of The E.W. Scripps Company. Prior to 2000, Mr. Lowe was Chairman and CEO of Scripps Networks. | Through his experience as a media executive and his extensive experience with Scripps Networks, Mr. Lowe has developed a deep understanding of our industry. Mr. Lowe has a proven track record of building content and lifestyle brands as well as integrating and growing global media companies. Mr. Lowe’s expertise in the media industry, experience as a public company executive, and prior experience on the Discovery board during a period of transformation following the Scripps Networks acquisition makes him a valued addition to the WBD Board. |

| |

| | | | | | | | |

John C. Malone Independent Director | |

| | |

| |

Age: 83 Director Since: 2008 Committee Memberships ■Nominating and Corporate Governance Committee (Chair) | Other Public Company Directorships

(past five years): ■Liberty Broadband Corporation (2014-present) ■Liberty Media Corporation (including its predecessors) (2010-present) ■Liberty Global Ltd. (including its predecessors) (2005-present) ■Qurate Retail, Inc. (including its predecessors) (1994-present) ■GCI Liberty, Inc. (2018-2020) ■Liberty Expedia Holdings, Inc. (2016-2019) ■Liberty Latin America, Ltd. (2017-2019) Education: ■Yale University, BS ■Johns Hopkins University, MA, Ph.D. |

|

| | |

| | | | | |

Professional Experience John C. Malone served as Chief Executive Officer and Chairman of the Board of Discovery Holding Company from 2005 to 2008, when it merged with Discovery, Inc. Mr. Malone is currently chairman of the boards of Liberty Media Corporation, Liberty Broadband Corporation and Liberty Global Ltd. His extensive experience includes serving as chief executive officer of Telecommunications Inc. for over 25 years until its merger with AT&T Corporation in 1999. | Qualifications and Expertise Provided to Our Board Mr. Malone has played a pivotal role in the cable television industry since its inception and is considered one of the preeminent figures in the media and telecommunications industry. Mr. Malone brings to our Board his well-known sophisticated problem solving and risk assessment skills. His breadth of industry knowledge and unique perspective on our business make him an invaluable member of our Board. He also brings extensive experience serving on other public company boards and boards of non-profit organizations within the cable industry, including Cable Television Laboratories, Inc. and the National Cable Television Association. |

| |

| | | | | | | | |

Fazal Merchant Independent Director | |

| | |

| |

Age: 50 Director Since: 2022 Committee Memberships ■Audit Committee ■Nominating and Corporate Governance Committee | Other Public Company Directorships

(past five years): ■Ryman Hospitality Properties, Inc. (2017-present) ■Meritor, Inc. (2020-2022) Education ■University of Texas at Austin, B.A. ■Indiana University, MBA |

|

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

Fazal Merchant is currently a Senior Advisor to Sixth Street Partners and various media and technology related endeavors, and a member of the board of directors at Ryman Hospitality Properties and Ariel Investments. He retired in 2020 as Co-CEO of Tanium Inc., a subscription-based global cybersecurity and IT management company, which he joined in 2017 as COO & CFO and was appointed Co-CEO in May 2019 and served as a board member from June 2019 until February 2022. Prior to joining Tanium, Mr. Merchant was CFO of DreamWorks Animation SKG (2014-2016) and he served in several executive roles at DirecTV, including SVP Corporate Development, Corporate Treasurer, and CFO of Latin America (2012-2014). Earlier in his career, Mr. Merchant spent over 8 years in investment banking at Barclays Capital and RBS, and he began his career at Ford Motor Company. | Mr. Merchant brings extensive business experience in senior leadership positions with involvement in and oversight of technology, strategy, financial reporting and controls, marketing, sales and capital markets. In addition, Mr. Merchant’s experience as chief financial officer of multiple companies provides our Board with extensive financial acumen and experience. Mr. Merchant also brings valuable experience with respect to media and technology. |

| |

| | | | | | | | |

Paula A. Price Independent Director | |

| | |

| |

Age: 62 Director Since: 2022 Committee Memberships ■ Audit Committee (Chair) | Other Public Company Directorships

(past five years): ■Bristol Myers Squibb (2020 - present) ■Accenture plc (2014 - present) ■DaVita Inc. (2020 to 2022) ■Western Digital Corporation (2014 to 2019, 2020 to 2022) Education ■DePaul University, BS ■University of Chicago, MBA |

|

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

| From July 2018 through May 2020, Paula A. Price was the executive vice president and chief financial officer of Macy’s, Inc., an omni-channel retailer of apparel, accessories and other goods, and she continued to serve as its strategic advisor until November 2020. From 2014 to 2018, she was a full-time senior lecturer at Harvard Business School. Prior to joining the faculty of Harvard Business School, she was executive vice president and chief financial officer of Ahold USA, a U.S. grocery retailer, which she joined in 2009. Prior to joining Ahold USA, Ms. Price was senior vice president, controller and chief accounting officer at CVS Caremark. Earlier in her career, Ms. Price was the chief financial officer of the Institutional Trust Services division of JPMorgan Chase & Co. and also held senior management positions at Prudential Insurance Co. of America, Diageo and Kraft Foods. A certified public accountant, she began her career at Arthur Andersen & Co. | Ms. Price brings to the WBD Board broad experience across finance, general management and strategy gained from her service in senior executive and management positions at major corporations across several industries, including, in particular, the retail, financial services and consumer packaged goods industries. She brings to the Board an important perspective from her experience as a chief financial officer, a member of the faculty of Harvard Business School and from her service as a director of other public company boards. The Board also benefits from her extensive background and expertise in finance and accounting matters. |

| |

| | | | | | | | |

David M. Zaslav President and Chief Executive Officer of Warner Bros. Discovery, Inc. |

| | |

| |

Age: 64 Director Since: 2008 Committee Memberships ■ None | Other Public Company Directorships

(past five years): ■Grupo Televisa S.A.B. (2015-present) ■Sirius XM Radio, Inc. (2013-present) ■Lions Gate Entertainment Corp. (2015-2021) Education: ■Binghamton University, BS ■Boston University School of Law, JD |

|

| | |

| | | | | |

Professional Experience David M. Zaslav has served as our President and Chief Executive Officer since the closing of the WarnerMedia Transaction on April 8, 2022. Prior to the closing, Mr. Zaslav served as Discovery, Inc.’s President and Chief Executive Officer from January 2007 until April 2022. Previously, Mr. Zaslav served as President, Cable & Domestic Television and New Media Distribution of NBC Universal, Inc. ("NBC"), a media and entertainment company, from May 2006 to December 2006. Mr. Zaslav served as Executive Vice President of NBC, and President of NBC Cable, a division of NBC, from 1999 to May 2006. | Qualifications and Expertise Provided to Our Board As Chief Executive Officer, Mr. Zaslav sets our goals and strategies and oversees all global operations for WBD. Under his leadership, Discovery, Inc. grew into a Fortune 500 public company with world-class brands and networks. Mr. Zaslav conceived, initiated and led the negotiation, signing and closing of the transformational WarnerMedia Transaction to create Warner Bros. Discovery. His ability as director to add his views and insights, which are focused on strategic growth and operational efficiency, to our Board’s deliberations is of significant benefit to our Board. |

| |

Class III Directors with Initial Terms Expiring in 2025

| | | | | | | | |

Samuel A. Di Piazza, Jr. Independent Board Chair | |

| | |

| |

Age: 73 Director Since: 2022 Committee Memberships ■ Audit Committee | Other Public Company Directorships

(past five years): ■ProAssurance Corporation (2014-present) ■Regions Financial Corporation (2016-2023) ■Jones Lang LaSalle Incorporated (2015-2023) ■AT&T Inc. (2015-2022) Education: ■University of Alabama, BS ■University of Houston, MS |

|

| | |

| | | | | |

Professional Experience Samuel A. Di Piazza, Jr. served as Global Chief Executive Officer of PricewaterhouseCoopers International Limited from 2002 until his retirement in 2009. Mr. Di Piazza began his 36-year career with PricewaterhouseCoopers (PwC, formerly Coopers & Lybrand) in 1973 and was named Partner in 1979 and Senior Partner in 2000. From 1979 to 2002, Mr. Di Piazza held various regional leadership positions with PwC. After his retirement from PwC, Mr. Di Piazza joined Citigroup where he served as Vice Chairman of the Global Corporate and Investment Bank from 2011 until 2014. | Qualifications and Expertise Provided to Our Board Mr. Di Piazza brings significant executive and business leadership to our Board through his management of a multicultural, complex professional services organization serving clients around the world. He has significant global accounting, cyber and financial experience, and extensive knowledge of the entertainment business, including from his prior service on the boards of DirecTV and AT&T. |

| |

| | | | | | | | |

Debra L. Lee Independent Director | |

| | |

| |

Age: 69 Director Since: 2022 Committee Memberships ■Compensation Committee | Other Public Company Directorships (past five years): ■The Procter & Gamble Company (2020-present) ■Burberry Group plc (2019-present) ■Marriott International, Inc. (2004-present) ■AT&T Inc. (2019 - 2022) ■Twitter, Inc. (2016-2019) Education: ■Brown University, BA ■Harvard University - Kennedy School of Government, MA ■Harvard University School of Law, JD |

|

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

| Debra L. Lee is Chair of Leading Women Defined Foundation (a nonprofit education and advocacy organization in Los Angeles, California), which she founded in 2009. She has served in this capacity since June 2018. Ms. Lee also co-founded The Monarchs Collective (a management consulting firm in Los Angeles, California), where she has served as a partner since 2020. Ms. Lee served as Chairman and Chief Executive Officer of BET Networks (a global media and entertainment subsidiary of Viacom, Inc., headquartered in New York, New York) from 2006 until her retirement in 2018. Ms. Lee joined BET Networks in 1986 and served in several leadership roles, including President and Chief Executive Officer (2005-2006), President and Chief Operating Officer (1995-2005), and Executive Vice President and General Counsel (1986-1995). | Ms. Lee brings a depth of executive management, strategy, and risk management experience to the Board, gained through her long-tenured leadership of BET Networks and her service on numerous other public company boards. As a result of her experience and service, her depth and breadth of knowledge on matters of corporate governance allows her to provide the Board with valuable perspective on oversight and accountability in a dynamic operating environment. Further, Ms. Lee’s more than 30 years of experience as an executive in the media industry, along with her broad board experience in consumer-facing brands are particularly valuable to the WBD Board. |

| |

| | | | | | | | |

Geoffrey Y. Yang Independent Director | |

| | |

| |

Age: 65 Director Since: 2022 Committee Memberships ■Compensation Committee | Other Public Company Directorships

(past five years): ■Franklin Resources Inc. (2011-present) ■AT&T Inc. (2016-2022) ■Liberty Media Acquisition Corporation (2021-2022) Education: ■Princeton University, BSE ■Stanford University, MBA |

|

| | |

| | | | | |

Professional Experience | Qualifications and Expertise Provided to Our Board |

| Geoffrey Y. Yang is a founding partner and Managing Director of Redpoint Ventures (a global private equity and venture capital firm based in Woodside, California) ("Redpoint") and has served in this capacity since 1999. He also founded Performance Health Sciences (d/b/a Apeiron Life), located in Menlo Park, California, where he has served as Chief Executive Officer and a member of its board of directors since April 2018. He is cofounder and CEO of The Odds, LLC, a seed stage company founded in 2022, and cofounder, director and former CEO of Sake Ono, LLC, a seed stage company formed in 2022. Prior to founding Redpoint, Mr. Yang was a General Partner with Institutional Venture Partners (a private equity investment firm in Menlo Park, California), which he joined in 1987. Mr. Yang has over 35 years of experience in the venture capital industry and has helped found or served on the boards of a variety of consumer media, internet, and infrastructure companies. | Mr. Yang has extensive experience in technology and innovative forms of digital media and advertising. He has helped to found, invest in, and provide strategic guidance to communications infrastructure and consumer media and entertainment companies internationally. |

| |

Corporate Governance

Our corporate governance practices are established and monitored by our Board. Our Board regularly assesses our governance policies in light of legal requirements and governance best practices.

Corporate Governance Guidelines

Our corporate governance practices are embodied in a formal document that has been approved by our Board. The Warner Bros. Discovery, Inc. Corporate Governance Guidelines, or the Guidelines, are posted to the Investor Relations section of our corporate website at ir.wbd.com. These Guidelines, which provide a framework for the conduct of our Board’s business, provide that:

| | | | | |

| |

| |

| ■our Board’s responsibility is to oversee the management of Warner Bros. Discovery and to help ensure that the interests of the stockholders are served; ■a majority of the members of our Board shall be independent directors; ■the independent directors meet at least twice a year in executive session; ■directors have access to senior management and, as necessary and appropriate, independent advisors; ■all directors are encouraged to participate in continuing director education on an ongoing basis; and ■our Board and its committees will conduct annual evaluation processes to determine whether they are functioning effectively. |

Our Board periodically reviews the Guidelines and updates them as appropriate. Printed copies of our Guidelines are available to any stockholder upon request to the Corporate Secretary, at the address specified below under "Stockholder Communication with Directors."

Board Leadership Structure

Discovery, Inc. historically separated the roles of Chief Executive Officer ("CEO") and Board Chair in recognition of the differences between the two roles. In April of 2022, concurrent with the closing of the WarnerMedia Transaction and the related changes to our capital structure and Board composition, the WBD Board considered our Board leadership structure and whether the CEO and Board Chair roles should continue to be separated (as it had been prior to the WarnerMedia Transaction) or combined. The WBD Board noted that the CEO is responsible for setting WBD’s strategic direction, providing leadership and driving the performance of the Company, while the Board Chair provides guidance to the CEO, sets the agenda for Board meetings and presides over meetings of the full Board. In light of the leadership experience and management expertise of Mr. Di Piazza and the dynamic leadership of David M. Zaslav, our CEO, our Board feels that this structure continues to be appropriate for Warner Bros. Discovery.

Director Independence

It is our policy that a majority of the members of our Board be independent. For a director to be deemed independent, a director must be independent as determined under Rule 5605(a)(2) of the Nasdaq Global Select Market Rules ("Nasdaq Rules") and, in the Board’s judgment, the director must not have a relationship with Warner Bros. Discovery that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board considered the relationships and affiliations of each director to determine his or her independence. Our Board has affirmatively determined that each director who served on the Board during 2023 and each director nominee, other than Mr. Zaslav, is independent under the Nasdaq Rules and the Guidelines. Our Board specifically considered the relationships and positions of certain directors with our large distributors, including Charter Communications, Inc., Liberty Global Ltd. and Liberty Broadband Corporation, and concluded that these relationships do not interfere with the directors’ independence.

The Nasdaq Rules impose additional requirements for members of key committees, requiring that, subject to specified exceptions,

■each member of a listed company’s audit, compensation and nominating and governance committees must be independent;

■audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"); and

■compensation committee members must also satisfy the additional independence criteria set forth in Rule 5605(d)(2)(A) of the Nasdaq Rules.

In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board, or any other board committee: (1) accept any consulting, advisory, or other compensatory fee from the listed company, other than for board service; or (2) be an affiliated person of the listed company. In order to be considered independent for purposes of Rule 5605(d)(2)(A) of the Nasdaq Rules, a member of a compensation committee of a listed company may not, other than in his or her capacity as a member of the compensation committee, the board or any other board committee: (1) accept any consulting, advisory, or other compensatory fee from the listed company, other than for board service; or (2) be an affiliated person of the listed company.

In light of the Nasdaq Rules regarding committee service, our Board evaluated each current member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee and each member who served on such committees during 2023 and determined that each individual was an independent director pursuant to all applicable Nasdaq Rules and the Guidelines. In addition, each member of the Audit Committee also meets the additional standards for Audit Committee members established by the Securities and Exchange Commission ("SEC") in Rule 10A-3 of the Exchange Act, and each member of the Compensation Committee meets the additional standards in Rule 5605(d)(2)(A) of the Nasdaq Rules and also qualifies as a "Non-Employee Director" as defined in Rule 16b-3 of the Exchange Act.

Director Nomination Process

The Nominating and Corporate Governance Committee is responsible for recommending to the Board the slate of nominees to be proposed for election by stockholders at our annual meeting of stockholders and for reviewing proposals for nominations from stockholders that are submitted in accordance with the procedures summarized below.

The Nominating and Corporate Governance Committee has the authority to employ a variety of methods for identifying and evaluating potential Board nominees. Candidates for vacancies on the Board may come to the attention of the committee through several different means, including recommendations from Board members, senior management, professional search firms, stockholder nominations and other sources.

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of director nominees, the Nominating and Corporate Governance Committee considers the candidate’s ability to meet the independence standards established by the Nasdaq Rules and also applies the criteria set forth in our Guidelines. The Nominating and Corporate Governance Committee does not assign specific weights to any particular criteria and no particular criterion is a prerequisite for each prospective nominee. Under our Guidelines, a nominee:

| | | | | |

| |

| |

| ■should have a reputation for integrity, honesty and adherence to high ethical standards; ■should have demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company; ■should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees; ■should understand the sometimes-conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, regulatory authorities, creditors and the general public, and should act in the interests of all stockholders; and ■shall not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director. |

The Guidelines also provide that directors shall be selected on the basis of talent and experience. The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity; however, the Board and the Nominating and Corporate Governance Committee believe that it is essential that Board members represent diverse viewpoints and that the value of diversity on the Board will be considered when evaluating nominees. Diversity of background, including diversity of gender, race, ethnic or geographic origin and age are factors that will be considered. Experience in business, government and education and in media, entertainment and other areas relevant to our activities are also factors in the selection process.