Table of Contents

As filed with Securities and Exchange Commission on March 16, 2016

Registration Statement No. 333-209025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Global Water Resources, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 4941 | 90-0632193 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

21410 N 19th Avenue #220

Phoenix, AZ 85027

(480) 360-7775

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael J. Liebman

21410 N 19th Avenue #220

Phoenix, AZ 85027

(480) 360-7775

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael M. Donahey Jeffrey E. Beck Jeffrey A. Scudder Kevin Zen Snell & Wilmer L.L.P. One Arizona Center 400 East Van Buren Phoenix, Arizona 85004-2202 (602) 382-6000 |

Christopher J. Barry Dorsey & Whitney LLP 701 Fifth Avenue, Suite 6100 Seattle, Washington 98104-7043 (206) 903-8800 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 16, 2016

PRELIMINARY PROSPECTUS

Shares

Common Stock

We are offering shares of our common stock. This is our initial public offering and no public market currently exists for shares of our common stock. We anticipate that the initial public offering price will be between $ and $ per share.

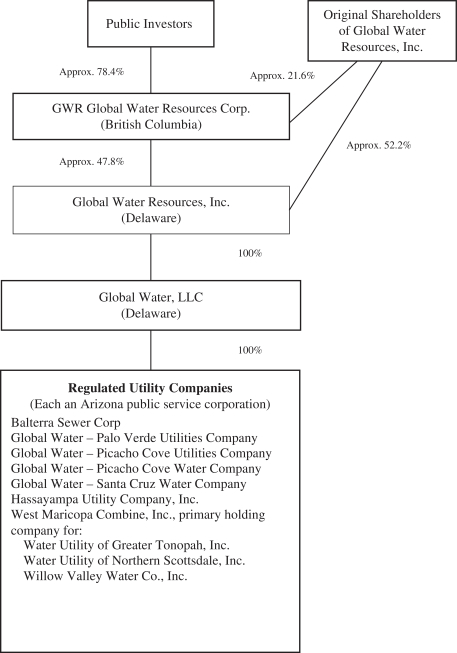

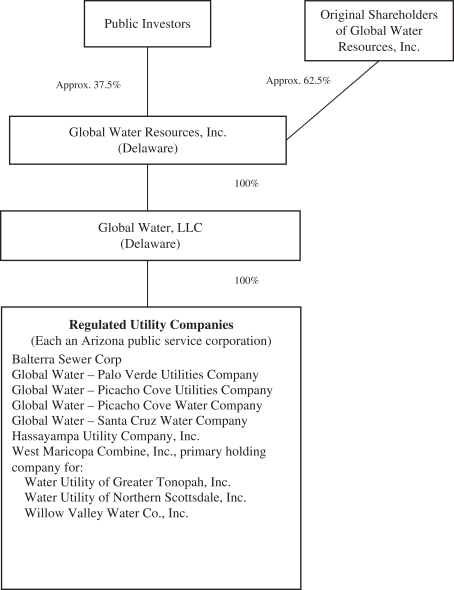

We intend to apply to have the common stock listed on the NASDAQ Global Market under the symbol “GWRS.” The common shares of GWR Global Water Resources Corp., which currently owns approximately 47.8% of our outstanding common stock, are publicly listed on the Toronto Stock Exchange. Concurrently with the consummation of this offering, GWR Global Water Resources Corp. will merge with and into us and on the effectiveness of the merger all of the outstanding common shares of GWR Global Water Resources Corp. will be exchanged for shares of our common stock. See “The Transactions—Reorganization Transaction” for additional information.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, and will be subject to reduced public reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 8.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

We have granted the underwriter an option to purchase up to additional shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common stock to purchasers on or about .

Roth Capital Partners

Prospectus dated , 2016

Table of Contents

| Page | ||||

| 1 | ||||

| 8 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| Selected Historical and Pro Forma Consolidated Financial Data |

40 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | |||

| 63 | ||||

| 80 | ||||

| 85 | ||||

| 97 | ||||

| 100 | ||||

| 103 | ||||

| 105 | ||||

| 107 | ||||

| 111 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

Neither we nor the underwriter have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

Until (25 days after the commencement of our initial public offering), all dealers that buy, sell, or trade shares of our common stock, whether or not participating in our initial public offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriter and with respect to its unsold allotments or subscriptions.

i

Table of Contents

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Unless the context requires otherwise, references in this prospectus to the “Company,” “we,” “us” and “our” refer to Global Water Resources, Inc., a Delaware corporation, and its consolidated subsidiaries. All references to “CAD$” and “Canadian dollars” are to the lawful currency of Canada and references to “$,” “US$” and “U.S. dollars” are to the lawful currency of the United States.

Our Company

We are a leading water resource management company that owns, operates and manages water, wastewater and recycled water utilities in strategically located communities, principally in metropolitan Phoenix, Arizona. We seek to deploy our integrated approach, which we refer to as “Total Water Management,” a term we use to mean managing the entire water cycle by owning and operating the water, wastewater and recycled water utilities within the same geographic areas in order to both conserve water and maximize its total economic and social value. We use Total Water Management to promote sustainable communities in areas where we expect growth to outpace the existing potable water supply. Our model focuses on the broad issues of water supply and scarcity and applies principles of water conservation through water reclamation and reuse. Our basic premise is that the world’s water supply is limited and yet can be stretched significantly through effective planning, the use of recycled water and by providing individuals and communities resources that promote wise water usage practices.

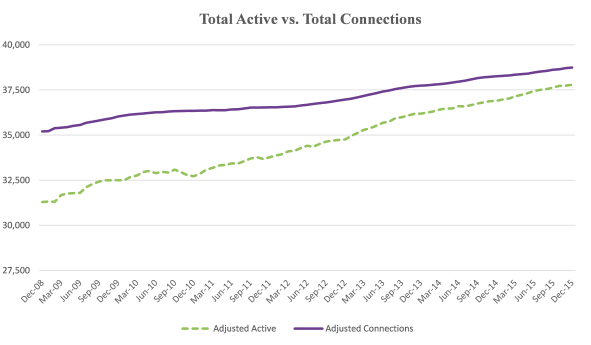

We currently own nine water and wastewater utilities in strategically targeted communities principally in metropolitan Phoenix. We currently serve more than 50,000 people in approximately 20,000 homes within our 332 square miles of certificated service areas, which are serviced by five wholly-owned regulated operating subsidiaries as of December 31, 2015. Approximately 94.9% of our active service connections are customers of our Santa Cruz and Palo Verde utilities, which are located within a single service area. We have grown significantly since our formation in 2003, with total revenues increasing from $4.9 million in 2004 to $32.0 million in 2015, and total service connections increasing from 8,113 as of December 31, 2004 to 38,744 as of December 31, 2015, with regionally planned service areas large enough to serve approximately two million service connections.

Our Growth Strategy

Our long-term goal is to become one of the largest investor-owned operator of integrated water and wastewater utilities in areas of the arid western United States where water scarcity management is necessary for long-term economic sustainability and growth. Our growth strategy involves the elements listed below:

| • | acquiring or forming utilities in the path of prospective population growth; |

| • | expanding our service areas geographically and organically growing our customer base within those areas; and |

| • | deploying our Total Water Management approach into these utilities and service areas. |

We believe this plan can be executed in our current service areas and in other geographic areas where water scarcity management is necessary to support long-term growth and in which regulatory authorities recognize the need for water conservation through water recycling.

1

Table of Contents

Our Competitive Strengths

Our Utilities Are Located in Areas of Strong Population Growth Where We Have Contracted Service Areas

We have three regional planning areas located in the metropolitan Phoenix area with area-wide permits and contractual service rights relating to over 500 square miles of territory. Our Maricopa-Casa Grande regional planning area and Eloy regional planning area are located in Pinal County, Arizona. Pinal County is rapidly changing from primarily rural to an area of suburbanization. According to a U.S. Census estimate, Pinal County grew by 124% from a population of 179,727 in 2000 to 401,918 in 2014, and by 7% between years 2010 and 2014, ranking it as a third fastest growing county in Arizona based on percentage population growth for this period.

Our West Valley regional planning area is located in Maricopa County. Maricopa County gained 797,927 residents between 2000 and 2011, and 270,074 residents between years 2010 and 2014. Maricopa County is one of the fastest growing counties in Arizona and Maricopa County is now the fourth largest county in the U.S. with approximately 4.0 million residents.

Modern Infrastructure Provides Foundation for Future Growth With Low Future Capital Expenditures

We believe that as demand for new homes continues to recover in the regions we serve, there will be opportunities for growth, particularly in the Maricopa-Casa Grande region, where our local utilities have considerable infrastructure already in place. As a result of our investment in modern infrastructure, we expect our regulated utilities business in our current service areas to have relatively low capital expenditures for the foreseeable future because greater than 90% of our infrastructure was built in the last twelve years compared to most U.S. drinking water infrastructure, which were built 50 or more years ago.

Leader in Utilization of Technology and Innovation

We use technology to reduce costs, increase revenues and save water. We focus on technological innovations that allow us to deliver high-quality water and customer service with lower potential for human error, delays and inefficiencies. Our comprehensive technology platform includes FATHOM™, which includes customer information systems, automated meter reading and geographical information system technologies, and supervisory control and data acquisition systems, which we use to map and monitor our physical assets and water resources on an automated, real-time basis with fewer employees than the standard water utility model requires. Our innovative approaches to utility planning, water conservation and technology utilization have led to our development of strong relationships with key regulatory bodies.

Unique and Proven Advanced Technology Platform

We believe that we are one of the only water utilities that has developed its own integrated suite of advanced services, which we branded as FATHOM™. Initially developed to support and optimize our utility operations, implementation of the FATHOM™ system has consistently demonstrated cost savings for third party utilities and provides opportunities for increased utility revenues. We sold the FATHOM™ business in June 2013 (retaining a minority ownership position, which is currently approximately 8%), although we continue to use and benefit from the internally developed FATHOM™ service suite. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Events—Sale of FATHOM™ Business.”

2

Table of Contents

Proven Ability to Acquire and Consolidate

We have acquired or formed 16 regulated water and wastewater utilities (four of which have subsequently been divested and three of which have been merged), five of which are operating with active customer service connections. We have successfully consolidated the operations, management, infrastructure, technology and employees of these utilities. Not all utilities acquired by us can accommodate the Total Water Management model, as it is necessary that we own both the water and the wastewater infrastructure in the area. In those cases, we seek to improve operational and administrative efficiencies of the utility using our technology platform and through economies of scale. We believe that our success to date engenders positive relationships and credibility with regulators, municipalities, developers and customers in both existing and prospective service areas.

The Transactions

Concurrently with the consummation of this offering, GWR Global Water Resources Corp. (“GWRC”), which currently owns approximately 47.8% of our outstanding common stock, will merge with and into the Company with the Company surviving as a Delaware corporation, subject to the satisfaction of certain conditions, including GWRC’s shareholder approval. At the effective time of the merger, following a 100.68-for-1 forward stock split with respect to our common stock, holders of GWRC’s common shares will receive one share of the Company’s common stock for each outstanding common share of GWRC. We refer to this as the “Reorganization Transaction.” The Reorganization Transaction and the consummation of this offering will be contingent upon each other and will occur simultaneously. In addition, following the consummation of this offering and the Reorganization Transaction, we plan to refinance all of our tax-exempt bonds. For additional information, see “The Transactions” elsewhere in this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), under the rules and regulations of the Securities and Exchange Commission (“SEC”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations disclosure; |

| • | reduced disclosure obligations regarding executive compensation in periodic reports; |

| • | no requirement for non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. In future years, we will cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt securities over a three-year period. We may choose to take advantage of some but not all of these reduced requirements.

We have elected to take advantage of some of the reduced disclosure obligations regarding financial statements and executive compensation in this prospectus and may elect to take advantage of other reduced requirements in future filings. As a result, the information we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

3

Table of Contents

The JOBS Act permits an emerging growth company, like us, to elect to delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act until such time as those standards apply to private companies. We are choosing to take advantage of this extended transition provision. See “Risk Factors—Risks Related to This Offering and Ownership of Our Common Stock—Our election to take advantage of the JOBS Act extended accounting transition period may make our financial statements more difficult to compare to other public companies.”

Summary Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy is also subject to certain risks. The risks described under the heading “Risk Factors” included elsewhere in this prospectus may cause us to be unable to successfully execute all or part of our strategy. Some of the most significant challenges and risks include the following:

| • | we may have difficulty accomplishing our growth strategy within and outside of our current service areas; |

| • | our operations of regulated utilities are currently located exclusively in the state of Arizona; |

| • | our active service connections are primarily concentrated in one water utility and one wastewater utility located in the same service area; |

| • | our growth depends significantly on increased residential and commercial development in our service areas; |

| • | the growth of our customer base and revenues could be materially and adversely affected by a deep or prolonged slowdown of development or population growth within our service areas; |

| • | any growth that may occur outside the location and capacity of our existing infrastructure may require significantly more capital expenditures than currently anticipated; |

| • | we may not be permitted to increase our rates; |

| • | we may be required to alter our existing treatment facilities or build additional facilities as a result of changes to environmental and other regulations; |

| • | seasonal fluctuations and other weather-related conditions, such as droughts, could adversely affect the supply of and demand for our services; |

| • | inadequate water and wastewater supplies could have a material adverse effect upon our ability to achieve the customer growth; |

| • | our water and wastewater systems are subject to condemnation by governmental authorities; |

| • | the concentration of our stock ownership with our officers, directors, certain stockholders and their affiliates will limit our stockholders’ ability to influence corporate matters; |

| • | we may take advantage of the reduced disclosure requirements applicable to emerging growth companies; |

| • | our ability to expand into new service areas and to expand current water and wastewater service depends on approval from regulatory agencies; and |

| • | if our financial performance deteriorates, we may need to decrease or eliminate our dividends. |

Our Corporation Information

Global Water Resources, Inc., the issuer of the common stock in this offering, was incorporated as a Delaware corporation on May 2, 2008. Our principal executive offices are located at 21410 N 19th Avenue #220, Phoenix, AZ 85027, and our telephone number is (480) 360-7775. Our website address is www.gwresources.com. Our website and the information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or the registration statement of which it forms a part.

4

Table of Contents

The Offering

| Issuer |

Global Water Resources, Inc. |

| Common stock offered by us |

shares |

| Underwriter’s option to purchase additional shares of common stock from us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Use of proceeds |

We estimate that our net proceeds from the sale of our common stock that we are offering will be approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the price range on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| Our principal reason for this offering is to provide the Company the option to exercise the redemption of its outstanding tax-exempt bonds, which would need to be completed within 90 days after closing of a “public offering” of ownership interests in the Company. See “The Transactions—Planned Refinancing Transaction” for additional information. We intend to use the net proceeds from this offering for working capital and other general corporate purposes. However, we have not made a definitive determination as to how to allocate these proceeds among these and other possible general corporate purposes and we do not anticipate doing so prior to the completion of this offering. We do not intend to use the net proceeds from this offering to refinance the tax-exempt bonds. |

| Dividend policy |

Following the completion of this offering, we intend to pay a regular monthly dividend on our common stock of $0.02 per share ($0.24 per share annually), or an aggregate of approximately $4.7 million on an annual basis. However, our future dividend policy is subject to our compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock we may issue in the future, business prospects and other factors that our board of directors may deem relevant. See “Dividend Policy” and “Risk Factors—We cannot assure you that we will pay dividends on our common stock, and our indebtedness could limit our ability to pay dividends on our common stock.” |

| Risk factors |

See “Risk Factors” beginning on page 8 to read about factors you should consider before buying shares of our common stock. |

| NASDAQ Global Market symbol |

“GWRS” |

5

Table of Contents

Unless otherwise indicated, this prospectus:

| • | assumes no exercise by the underwriter of its option to purchase additional shares of our common stock; |

| • | gives effect to a 100.68-for-1 forward stock split with respect to our common stock that will be effected prior to the completion of this offering in connection with the Reorganization Transaction; and |

| • | does not give effect to the consummation of the Reorganization Transaction and the 8,726,747 shares of our common stock to be issued in the Reorganization Transaction. |

6

Table of Contents

Summary Consolidated Financial Data

The following table summarizes selected historical and pro forma consolidated financial data for Global Water Resources, Inc. and its subsidiaries. We have derived the summary consolidated statement of operations data for the years ended December 31, 2014 and 2015 and the consolidated balance sheet data as of December 31, 2014 and 2015 from our audited consolidated financial statements included elsewhere in this prospectus.

We have derived the pro forma consolidated financial data from our unaudited pro forma condensed consolidated financial information appearing elsewhere in this prospectus. The summary pro forma condensed consolidated balance sheet as of December 31, 2015 is adjusted to give effect to the Reorganization Transaction. The summary pro forma condensed consolidated statement of operations data for the year ended December 31, 2015 is adjusted to give effect to a 100.68-for-1 forward stock split with respect to our common stock that will be effected prior to the completion of this offering in connection with the Reorganization Transaction and to the condemnation of the operations and assets of Valencia Water Company, Inc. (“Valencia Water Company”) as if the transaction had occurred on January 1, 2015.

The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and the related notes and our unaudited pro forma condensed consolidated financial information and related notes, as well as the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Pro Forma | ||||||||||||

| December 31, 2015 |

December 31, 2015 |

December 31, 2014 |

||||||||||

| (dollars in thousands) | ||||||||||||

| ASSETS: |

||||||||||||

| Net property, plant and equipment |

$ | 194,152 | $ | 194,152 | $ | 240,424 | ||||||

| Current assets |

18,715 | 18,715 | 12,293 | |||||||||

| Other assets |

25,108 | 25,108 | 54,884 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Assets |

$ | 237,975 | $ | 237,975 | $ | 307,601 | ||||||

|

|

|

|

|

|

|

|||||||

| LIABILITIES: |

||||||||||||

| Current liabilities |

$ | 10,663 | $ | 10,841 | $ | 13,630 | ||||||

| Noncurrent liabilities |

207,249 | 207,524 | 266,291 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities |

217,912 | 218,365 | 279,921 | |||||||||

|

|

|

|

|

|

|

|||||||

| SHAREHOLDERS’ EQUITY |

20,063 | 19,610 | 27,680 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities and Shareholders’ Equity |

$ | 237,975 | $ | 237,975 | $ | 307,601 | ||||||

|

|

|

|

|

|

|

|||||||

| Pro Forma | ||||||||||||

| Year Ended |

Year Ended |

Year Ended |

||||||||||

| December 31, 2015 |

December 31, 2015 |

December 31, 2014 |

||||||||||

| (dollars in thousands, except per share data) | ||||||||||||

| Revenues |

$ | 31,956 | $ | 28,690 | $ | 32,559 | ||||||

| Operating expenses |

25,429 | 22,802 | (22,232 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

6,527 | 5,888 | 54,791 | |||||||||

| Total other income (expense) |

35,459 | (7,526 | ) | (6,855 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

41,986 | (1,638 | ) | 47,936 | ||||||||

| Income tax benefit (expense) |

(20,623 | ) | 784 | 16,995 | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 21,363 | $ | (854 | ) | $ | 64,931 | |||||

|

|

|

|

|

|

|

|||||||

| Basic earnings (loss) per common share |

$ | 117.55 | $ | (0.05 | )(1)(2) | $ | 356.67 | |||||

| Diluted earnings (loss) per common share |

$ | 117.55 | $ | (0.05 | )(1)(2) | $ | 356.67 | |||||

| (1) | The adjustments to basic earnings (loss) and diluted earnings (loss) per common share reflect the net income eliminated through the pro forma adjustments for the year ended December 31, 2015 and the elimination of the net gain on the condemnation of the operations and assets of Valencia Water Company. |

| (2) | As adjusted to give effect to a 100.68-for-1 forward stock split with respect to our common stock that will be effected prior to the completion of this offering in connection with the Reorganization Transaction. |

7

Table of Contents

This offering and investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We may have difficulty accomplishing our growth strategy within and outside of our current service areas. This would cause us to rely more heavily on regulatory rate increases to increase our revenues, which we may not apply for before May 31, 2017 for our utilities that service approximately 94.9% of our active service connections.

Our ability to expand our business, both within our current service areas and into new areas, involves significant risks, including, but not limited to:

| • | not receiving or maintaining necessary regulatory permits, licenses or approvals; |

| • | downturns in economic or population growth and development in our service areas; |

| • | risks related to planning and commencing new operations, including inaccurate assessment of the demand for water, engineering and construction difficulties and inability to begin operations as scheduled; |

| • | droughts or water shortages that could increase water conservation efforts to a point that materially reduces revenue; |

| • | regulatory restrictions or other factors that could adversely affect our access to sources of water supply; |

| • | our potential inability to identify suitable acquisition opportunities or to form the relationships with developers and municipalities necessary to form strategic partnerships; and |

| • | barriers to entry presented by existing water utilities in prospective service areas. |

If we are unable to execute our growth strategy effectively, we will need to rely more heavily on regulatory rate increases to increase our revenue. However, recent Rate Decision No. 74364 stipulates that none of our utilities can file another rate application before May 31, 2016. Moreover, Global Water-Santa Cruz Water Company (“Santa Cruz”) and Global Water-Palo Verde Utilities Company (“Palo Verde”), which service approximately 94.9% of our active service corrections, may not file for another rate increase before May 31, 2017. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Rate Case Activity” for additional information.

Our operations of regulated utilities are currently located exclusively in the state of Arizona, which increases the impact of local conditions on our results of operations.

The customers of our regulated utilities are currently located exclusively in the state of Arizona. As a result, we cannot diversify or mitigate the risks presented by local regulatory, economic, demographic and weather conditions in this area. An adverse change in any of these conditions would therefore affect our profitability, results of operations, liquidity and cash flows more significantly than if our utilities also operated in other geographic areas.

Our active service connections are primarily concentrated in one water utility and one wastewater utility.

At December 31, 2015, we had 37,784 active service connections, of which approximately 94.9% are serviced by our Santa Cruz water utility and our Palo Verde wastewater utility. Both our Santa Cruz and Palo

8

Table of Contents

Verde utilities are located in the same service area. If, for any reason, including those described below under “—Any disruption or problem at our facilities could increase our expenses,” either of these utilities are unable to service this service area, our ability to conduct our business would be adversely affected.

We face competition for new service areas and acquisition targets.

We face competition from other water and wastewater utilities for new service areas and with respect to acquisition of smaller utilities. These competitors consist primarily of municipalities and investor-owned utilities seeking expansion opportunities. Some of our competitors are larger than we are and have more resources and access to capital than we do. If we are unable to compete effectively for new service areas and acquisitions of existing utilities, our ability to increase our rate base and revenue could be adversely affected.

Operating costs, construction costs and costs of providing services may rise faster than revenue.

The ability to increase rates over time is dependent upon approval of rate increases by utility regulators, which may be inclined, for political or other reasons, to limit rate increases. However, our costs are subject to market conditions and other factors, and may increase significantly. The second largest component of our operating costs after water production is made up of salaries and wages. These costs are affected by the local supply and demand for qualified labor. Other large components of our costs are general insurance, workers compensation insurance, employee benefits and health insurance costs. These costs may increase disproportionately to rate increases authorized by utility regulators and may have a material adverse effect on our financial condition and results of operations.

We may have difficulty recruiting and retaining qualified personnel, and due to the technical and specialized nature of our business, our profitability may suffer if we do not have the necessary workforce.

Our plants require some of our employees to be certified operators of record, a designation requiring specialized training and certification in water and wastewater systems. As workers with these qualifications retire in the industry, we may be unable to replace them readily in view of the relatively low number of younger workers that we believe are entering the workforce to pursue this line of work. Our operations require a variety of other technical skills and specialties in the areas of engineering, systems analysis, laboratory work and equipment repair, and we may have difficulty recruiting and retaining personnel with these skills. If we cannot maintain an employee base with the skills necessary to conduct our operations, our efficiency, margins and ability to expand our business could be adversely affected.

Any disruption or problem at our facilities could increase our expenses.

A natural disaster (such as an earthquake, fire or flood) or an act of terrorism could cause substantial delays in our operations, damage or destroy our equipment or facilities and cause us to incur additional expenses and lose revenue. The insurance we maintain against natural disasters may not be adequate to cover our losses in any particular case, which would require us to expend significant resources to replace any destroyed assets, thereby materially and adversely affecting our financial condition and prospects.

Our growth depends significantly on increased residential and commercial development in our service areas, and if developers or builders are unable to complete additional residential and commercial projects, our revenue may not increase.

The growth of our customer base depends almost entirely on the success of developers in developing residential and commercial properties within our “Certificate of Convenience and Necessity” areas. A Certificate of Convenience and Necessity is a permit issued by the Arizona Corporation Commission allowing a public service corporation to serve a specified area, and preventing other public service corporations from offering the

9

Table of Contents

same services within the specified area, which we refer to as “service areas.” Real estate development is a cyclical industry and the growth rate of development, especially residential development, since 2006, both nationally and in Arizona has been below historical rates. The sale of, for instance, single family residences is affected by a number of national and regional economic factors, including:

| • | interest rates and general levels of economic output; |

| • | levels of activity in the local real estate market; |

| • | the state of domestic credit markets, mortgage standards and availability of credit; |

| • | competition from other builders and other projects in the area and other states; |

| • | federal programs to assist home purchasers; |

| • | costs and availability of labor and materials; |

| • | government regulations affecting land development, homebuilding and mortgage financing; |

| • | availability of financing for development and for home purchasers; |

| • | changes in the income tax treatment of real property ownership; |

| • | unexpected increases in development costs; |

| • | increased commute times and fuel costs that may adversely affect the desirability of outlying suburbs; |

| • | availability of, among other things, other utilities, adequate transportation and school facilities; and |

| • | environmental problems with such land. |

While many developers presently hold necessary zoning approvals, land development within our service areas could also be affected by changes in governmental policies, including, but not limited to, governmental policies to restrict or control development. This may include, for example, actions by the local school districts to restrict admissions to local schools because of inadequate classroom space or, because of other problems, such as failure by local municipalities to approve plats for the development. An increase in current residential foreclosure rates or a deep or prolonged slowdown of the development process and the related absorption rate within the various developments in our service areas because of any or all of the foregoing could materially and adversely affect growth of our customer base and the generation of revenue.

Many national builders and developers in our service areas own or control substantial amounts of the developable land in these areas. There can be no assurance that these builders and developers have the financial capability to continue and complete their developments. Moreover, given that there are limited restrictions on the ability of developers to sell parcels (or portions thereof), developers may continue to transfer ownership of parcels (or portions thereof) within our service areas to other developers and homebuilders and others prior to completion of development, who may then sell to, among others, ultimate homeowners. There can be no assurance that any subsequent owners will have the financial capabilities to complete development of any land so acquired.

A deep or prolonged slowdown of the development process and growth rate within the various developments in our service areas could materially and adversely affect the growth of our customer base.

Development in our service areas is also contingent upon construction or acquisition of major public improvements, such as arterial streets, drainage facilities, telephone and electrical facilities, recreational facilities, street lighting and local in-tract improvements (e.g., site grading). Many of these improvements are built by municipalities with public financing, and municipal resources and access to capital may not be sufficient to support development in areas of rapid population growth. If municipalities, developers, builders or homeowners are unable, financially or otherwise, to make the improvements necessary to complete new residential or commercial developments, our potential revenue growth from new water and wastewater connections within such developments would be reduced.

10

Table of Contents

New or stricter regulatory standards or other governmental actions could increase our regulatory compliance and operating costs, which could cause our profitability to suffer, particularly if we are unable to increase our rates to offset such costs.

In Arizona, water and wastewater utilities are subject to regulation by water, environmental, public utility and health and safety regulators, and we are required to obtain environmental permits from governmental agencies in order to operate our facilities. Regulations relate to, among other things, standards and criteria for drinking water quality and for wastewater discharges, customer service and service delivery standards, waste disposal and raw groundwater abstraction limits and rates and charges for our regulated services. There may be instances in the future when we are not in or cannot achieve compliance with new and evolving laws, regulations and permits without incurring additional operating costs. For example, in 2006, the U.S. Environmental Protection Agency (“EPA”) implemented a new arsenic maximum contaminant level, which effectively required the installation and operation of costly arsenic treatment systems at many of our water production facilities.

Our costs of complying with current and future governmental laws and regulations could adversely affect our business or results of operations. If we fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators and our operations could be curtailed or shut down. We may also be exposed to product liability or breach of contract claims by third parties resulting from our noncompliance. These laws and regulations are complex and change frequently, and these changes may cause us to incur costs in connection with the remediation of actions that were lawful when they were taken.

We may incur higher compliance or remediation costs than expected in any particular period and may not be able to pass those increased costs along to our customers immediately through rate increases or at all. This is because we must obtain regulatory approval to increase our rates, which can be time-consuming and costly and our requests for increases may not be approved in part or in full.

We are required to test our water quality for certain parameters and potential contaminants on a regular basis. If the test results indicate that parameters or contaminants exceed allowable limits, we may be required either to commence treatment to remedy the water quality or to develop an alternate water source. Either of these outcomes may be costly, and there can be no assurance that the regulatory authorities would approve rate increases to recover these additional compliance costs. In addition, by the time that test results are available, contaminated water may have been provided to customers, which may result in liability for us and damage our reputation.

In addition, governments or government agencies that regulate our operations may enact legislation or adopt new requirements that could have an adverse effect on our business, including:

| • | restricting ownership or investment; |

| • | providing for the expropriation of our assets by the government through condemnation or similar proceedings; |

| • | providing for changes to water and wastewater quality standards; |

| • | requiring cancellation or renegotiation of, or unilateral changes to, agreements relating to our provision of water and wastewater services; |

| • | changing regulatory or legislative emphasis on water conservation in comparison to other goals and initiatives; |

| • | promoting an increase of competition among water companies within our designated service areas; |

| • | requiring the provision of water or wastewater services at no charge or at reduced prices; |

| • | restricting the ability to terminate services to customers whose accounts are in arrears; |

| • | restricting the ability to sell assets or issue securities; |

11

Table of Contents

| • | adversely changing tax, legal or regulatory requirements, including environmental requirements and the imposition of additional requirements and costs on our operations, including but not limited to changes adopted in response to regulatory measures to address global climate change; |

| • | changes in the charges applied to raw water abstraction; |

| • | changes in rate making policies; or |

| • | restrictions relating to water use and supply, including restrictions on use, increased offsetting groundwater replenishment obligations, changes to the character of groundwater rights and settlement of Native American claims. |

We may not be permitted to increase our rates, which may necessitate a reduction of our capital investments and operating costs.

Our utility subsidiaries are regulated as public service corporations by the Arizona Corporation Commission. Our utility subsidiaries file general rate cases for rates they charge for services which are established by the Arizona Corporation Commission in accordance with Arizona law, which grants considerable discretion to the Arizona Corporation Commission. If requested rate increases are not allowed, we may have to reduce our costs of capital and operating costs. The members of the Arizona Corporation Commission are selected by the voters in statewide elections and are often responsive to complaints by ratepayers about proposed rate increases. Moreover, even if the Arizona Corporation Commission ultimately agrees that some rate relief is necessary, the relief can only be obtained after a formal and lengthy proceeding before the Arizona Corporation Commission. There can be no assurance that rate increases we request would be approved by the Arizona Corporation Commission.

The operations of our utility subsidiaries are subject to other various federal, state and local laws, regulations and ordinances, including without limitation, the jurisdiction of the Arizona Department of Environmental Quality, Arizona Department of Water Resources, City of Maricopa, Arizona, City of Casa Grande, Arizona, Maricopa, Pinal and Mohave Counties, EPA, the Maricopa Association of Governments and the Central Arizona Association of Governments. Existing laws, regulations and ordinances can be amended, or new laws, regulations or ordinances may be enacted, and the requirements of compliance may change. Continued benefits we receive under existing laws can be withdrawn or become unavailable or more costly. In addition, enforcement practice may become more stringent. As a result, governmental regulatory action and changes in law could adversely affect our financial condition and results of operations if we face delays and difficulties in obtaining approval to raise rates, and if there is a significant gap between the timing of increased expenses and our ability to recover those expenses, or if we are unable to obtain approval to recover expenses, our profitability, results of operations, liquidity and cash flows would be adversely affected.

Changes to environmental and other regulation may require us to alter our existing treatment facilities or build additional facilities.

To comply with federal, state and local environmental laws, our existing facilities may need to be altered or replaced. Altered and new facilities and other capital improvements must be constructed and operated in accordance with multiple requirements, including, in certain cases, an Aquifer Protection Permit issued by the Arizona Department of Environmental Quality, Arizona Pollution Discharge Elimination System permits from the Arizona Department of Environmental Quality and an air quality permit from Maricopa or Pinal Counties. The provision of potable water is subject to, among others, the requirements of the federal Safe Drinking Water Act, and effluent from wastewater treatment facilities must comply with other requirements. Regulated contaminants and associated maximum contaminant levels may change over time, requiring us to alter or build additional treatment facilities. We are also subject to regulation as an employer, property owner and business operator in the State of Arizona. Failure by us to observe the conditions and comply with the requirements of these permits and other applicable laws and regulations could result in delays, additional costs, fines and other adverse consequences up to and including inability to proceed with development in our service areas.

12

Table of Contents

We are subject to environmental risks that may subject us to clean-up costs or litigation that could adversely affect our business, operating results, financial condition and prospects.

Under various federal and state environmental laws, regulations, ordinances and other requirements, a current or previous owner or operator of real property or a facility may be liable for the costs of removal, remediation or containment of hazardous or toxic substances on, under, in or released from such property. These liabilities are not limited to a potential effect on our water supply and include, but are not limited to, liabilities associated with air, soil, or groundwater contamination at any real estate or facilities we own or operate, including liabilities assumed in an acquisition of another utility. Environmental laws often impose liability regardless of whether the owner or operator knew of or was responsible for the presence of the hazardous or toxic substances. Although we currently conduct environmental screening assessments on new properties that we propose to acquire or use to identify significant sources of contaminants on surrounding properties, these assessments are not comprehensive, nor have they been conducted for all of the property owned or used by us. As a result, hazardous or toxic substances may exist at properties owned or used by us. If hazardous or toxic substances are discovered at real property or facilities owned or used by us (including a landfill owned by another party that is used by us for disposal of hazardous substances), we could incur significant remediation costs, liability exposure or litigation expenses that could adversely affect our profitability, results of operations, liquidity and cash flows.

Any failure of our network of water and wastewater pipes and water reservoirs could result in losses and damages that may affect our financial condition and reputation.

Our utilities distribute water and collect wastewater through an extensive network of pipes and store water in reservoirs located across our service areas. A failure of major pipes or reservoirs could result in injuries and property damage for which we may be liable. The failure of major pipes and reservoirs may also result in the need to shut down some facilities or parts of our network in order to conduct repairs. Any failures and shutdowns may limit our ability to supply water in sufficient quantities to customers and to meet the water and wastewater delivery requirements prescribed by applicable utility regulators, which would adversely affect our financial condition, results of operations, cash flow, liquidity and reputation.

We rely on information technology systems to assist with the management of our business and customer relationships. A disruption of these systems could adversely affect our business and operations.

Our information technology systems and the information technology functions that are outsourced to the FATHOMTM business, which we previously owned, are an integral part of our business. For example, FATHOMTM systems allow us to read water meters remotely, identify high water usage and identify water theft from disconnected meters. FATHOMTM systems also provide contracted services and back-office technologies and systems to bill our customers, provide customer service, manage certain financial records and track assets and accounts receivable collections. A disruption of our information technology systems or the FATHOMTM systems could significantly limit our ability to manage and operate our business efficiently, which in turn could cause our business to suffer and cause our results of operations to be reduced.

Further, our information technology systems and the FATHOMTM systems are vulnerable to damage or interruption from:

| • | power loss, computer systems failures and internet, telecommunications or data network failures; |

| • | operator negligence or improper operation by, or supervision of, employees; |

| • | physical and electronic loss of customer data or security breaches, misappropriation and similar events; |

| • | computer viruses; |

| • | intentional acts of vandalism and similar events; and |

| • | fires, floods, earthquakes and other natural disasters. |

13

Table of Contents

Damages or interruptions to our information technology systems or the FATHOMTM systems may result in physical and electronic loss of customer or financial data, security breaches, misappropriation and similar events. These issues could prevent us from issuing billings timely, which could impact revenue, or could negatively impact the efficient operations of the business, resulting in additional costs. The lack of redundancy for some of our IT systems or the FATHOMTM systems, including billing systems, could exacerbate the impact of any of the foregoing events.

Our utilities business is subject to seasonal fluctuations and other weather-related conditions, such as droughts, which could adversely affect the supply of and demand for our services and our results of operations.

We depend on an adequate water supply to meet the present and future needs of our customers. Whether we have an adequate water supply depends upon a variety of factors, including underground water supply from which groundwater is pumped, the rate at which it is recharged by rainfall and snowpack and changes in the amount of water used by our customers. In particular, the arid western U.S. region, which includes our present and potential service areas, has been required to deal with general conditions of water scarcity exacerbated by extended periods of drought.

Drought conditions could interfere with our sources of water supply and could adversely affect our ability to supply water in sufficient quantities to our existing and future customers. For example, our utilities have acted in the past as interim operators for several smaller troubled water systems, at the request of the Arizona Corporation Commission. In one such instance, the onsite well, which was the single source of water, ran dry due to aquifer decline. As a result, we were forced to haul water to the system for several years at a considerable cost. Any future interruption to our water supply or restrictions on water usage during drought conditions or other legal limitations on water use could result in decreased customer billing and lower revenues or higher expenses that we would not be able to recoup without prior regulatory approval for a rate increase, which may not be granted. See “—We may not be permitted to increase our rates, which may necessitate a reduction of our capital investments and operating costs.” These conditions could also lead to increases in capital expenditures needed to build infrastructure to secure alternative water sources. Furthermore, customers may use less water even after a drought has ended because of conservation patterns developed during the drought. Population growth could also decline under drought conditions as individuals and businesses move out of the area or elect not to relocate there. Lower water use for any reason could lead to lower revenue.

Demand for water is seasonal and varies with temperature and rainfall levels. If temperatures during the typically warmer months are cooler than normal, or if there is more rainfall than normal, the demand for our water may decrease, which would adversely affect our profitability, results of operations, liquidity and cash flows. Consequently, the results of operations for one quarter are not necessarily indicative of results for future quarters or the full year.

Funds from our infrastructure coordination and financing agreements are dependent on development activities by developers which we do not control and are also subject to certain regulatory requirements.

In the past, we extended water and wastewater infrastructure financing to developers and builders through infrastructure coordination and financing agreements. These agreements are contracts with developers or builders in which we coordinate and fund the construction of water, wastewater and recycled water facilities that will be owned and operated by our regulated subsidiaries in advance of completion of developments in the area. Our investment can be considerable, as we phase-in the construction of facilities in accordance with a regional master plan, as opposed to a single development. Developers and builders pay us agreed-upon fees upon the occurrence of specified development events for their development projects. The Arizona Corporation Commission requires us to record a portion of the funds we receive under infrastructure coordination and financing agreements as “contributions in aid of construction,” which are funds or property provided to a utility under the terms of a collection main extension agreement and/or service connection tariff, the value of which are not refundable. Amounts received as contributions in aid of construction reduce our rate base once expended on utility plants.

14

Table of Contents

The developer is not required to pay the bulk of the agreed-upon fees until a development receives platting approval. Accordingly, we cannot always accurately predict or control the timing of the collection of our fees. If a developer encounters difficulties, such as during a real estate market downturn, that result in a complete or partial abandonment of the development or a significant delay in its completion, we will have planned, built and invested in infrastructure that will not be supported by development and will not generate either payments under the applicable infrastructure coordination and financing agreement or cash flows from providing services. As a result, our return on our investment and cash flow stream could be adversely affected.

In August 2013, we entered into a settlement agreement with Arizona Corporation Commission staff, the Residential Utility Consumers Office, the City of Maricopa and other the parties to a rate case, which established the policy by which infrastructure coordination and financing agreement fees will be treated going forward. The settlement also prohibits us from entering into new infrastructure coordination and financing agreements. In February 2014, the rate case proceedings were completed and the Arizona Corporation Commission issued Rate Decision No. 74364, approving the settlement agreement. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Rate Case Activity” for additional information.

Risks associated with the collection, treatment and disposal of wastewater and the operation of water utilities may impose significant costs that may not be covered by insurance, which could result in increased insurance premiums.

The wastewater collection, treatment and disposal operations of our utilities are subject to substantial regulation and involve significant environmental risks. If collection or sewage systems fail, overflow or do not operate properly, untreated wastewater or other contaminants could spill onto nearby properties or into nearby streams and rivers, potentially causing damage to persons or property, injury to the environment including aquatic life and economic damages, which may not be recoverable in rates. This risk is most acute during periods of substantial rainfall or flooding, which are the main causes of sewer overflow and system failure. Liabilities resulting from such damage could adversely and materially affect our business, results of operations and financial condition. Moreover, in the event that we are deemed liable for any damage caused by overflow, losses might not be covered by insurance policies, and such losses may make it difficult to secure insurance in the future at acceptable insurance premium rates. Similarly, any related business interruption or other losses might not be covered by insurance policies, which would also make it difficult for us to secure insurance in the future at acceptable insurance premium rates.

We may also incur liabilities under environmental laws and regulations requiring investigations and cleanup of environmental contamination at our properties or at off-site locations where there have been adverse environmental impacts. The discovery of previously unknown conditions, or the imposition of cleanup obligations in the future, could result in significant costs, and could adversely affect our financial condition, results of operations, cash flow and liquidity. Such remediation losses may not be covered by insurance policies and may make it difficult for us to secure insurance in the future at acceptable insurance premium rates.

Inadequate water and wastewater supplies could have a material adverse effect upon our ability to achieve the customer growth necessary to increase our revenues.

In many areas of Arizona (including certain areas that we service), water supplies are limited and, in some cases, current usage rates exceed sustainable levels for certain water resources. As discussed above, we currently rely predominantly (and are likely to continue to rely) on the pumping of groundwater and the generation and delivery of recycled water for non-potable uses to meet future demands in our service areas. At present, groundwater (and recycled water derived from groundwater) is the primary water supply available to us.

We do not currently anticipate any short-term concerns with physical, legal, or continuous availability issues in our service areas. Regardless, the supply of groundwater in Central Arizona, while considerable, is also ultimately finite, closely regulated and geographically limited. In areas where we have not applied for a “Designation of Assured Water Supply,” which is a decision and order issued by the director of the Arizona

15

Table of Contents

Department of Water Resources designating a private water company provider as having an adequate water supply, we have not performed hydrological studies or modeling to evaluate the amount of groundwater likely to be available to meet present and expected future demands. Insofar as we intend to rely on the pumping of groundwater and the generation and delivery of recycled water to meet future demands in our current service areas, our ability and/or the ability of developers inside of our service areas to meet regulatory requirements and to demonstrate assured and adequate water supplies is essential to the continued growth of our service connections and our capacity to supply water to our customers.

Insufficient availability of water or wastewater treatment capacity could materially and adversely affect our ability to provide for expected customer growth necessary to increase revenues. We continuously look for new sources of water to augment our reserves in our service areas, but have not yet obtained surface water rights. Our ability to obtain such rights may depend on factors beyond our control, such as the future availability of Colorado River water supplies. We also plan to construct facilities and obtain the necessary permits to recharge recycled water to stretch and augment our existing and planned future water supplies, but do not yet have this capability in all of our service areas. As a result, it is possible that, in the future, we will not be able to obtain sufficient water or water supplies to increase customer growth necessary to increase or even maintain our revenues.

There is no guaranteed source of water.

Our ability to meet the existing and future water demands of our customers depends on an adequate supply of water. Regulatory restrictions on the use of groundwater and the development of groundwater wells, lack of available water rights, drought, overuse of local or regional sources of water, protection of threatened species or habitats or other factors, including climate change, may limit the availability of ground or surface water.

As stated above, our primary source of water is pumping of groundwater from aquifers within service areas. In the event that our wells cannot meet customer demand, we can purchase water from surrounding municipalities, agencies and other utilities. However, the cost of purchasing water is typically more expensive than producing it. Furthermore, these alternative sources may not always have an adequate supply to sell to us.

To date, we have been able to produce enough water to meet current customer requirements. However, no assurance can be given that we will be able to produce or purchase enough water to fully satisfy future customer demand. We can make no guarantee that we will always have access to an adequate supply of water that will meet all quality standards, or that the cost of water will not adversely affect our operating results.

If we are unable to access adequate water supplies, we may be unable to satisfy all customer demand, which could result in rationing. Rationing may have an adverse effect on cash flow from operations.

Water shortages may affect us in a variety of ways. For example, water shortages could:

| • | adversely affect water supply mix by causing us to rely on more expensive purchased water; |

| • | adversely affect operating costs; |

| • | increase the risk of contamination to water systems due to the inability to maintain sufficient pressure; |

| • | increase capital expenditures for building pipelines to connect to alternative sources of supply, new wells to replace those that are no longer in service or are otherwise inadequate to meet the needs of customers and reservoirs and other facilities to conserve or reclaim water; and |

| • | result in regulatory authorities refusing to approve new service areas if an adequate water supply cannot be demonstrated, and restrictions on new customer connections may be imposed in existing service areas if there is not sufficient water. |

We may or may not be able to recover increased operating and construction costs as a result of water shortages on a timely basis, or at all, for our regulated systems through the rate setting process.

16

Table of Contents

The nature of our business exposes us to various liability claims, which may exceed the level of our insurance coverage and thereby not be reimbursed fully by insurance proceeds, or not be covered by our insurance at all, and may also make it difficult for us to obtain insurance coverage at affordable rates.

In recent years, societal factors have resulted in increased litigation and escalating monetary claims against industries and employers. Although the national insurance market currently provides insurance coverage at affordable premiums, there is no guarantee this will continue or that we will continue to be able to obtain coverage against catastrophic claims and losses. While we may self-insure for some risks in the future, should an uninsured or underinsured loss occur, we may be unable to meet our obligations as they become due.

The operation of our utilities is subject to the normal risks of occupancy as well as the additional risks of receiving, processing, treating and disposing of water and waste materials. As a safeguard, we currently maintain general liability and workers’ compensation insurance coverage, subject to deductibles at levels we believe are sufficient to cover future claims made during the respective policy periods. However, we may be exposed to multiple claims, including workers compensation claims, that do not exceed our deductibles, and, as a result, we could incur significant out-of-pocket costs that could materially adversely affect our business, financial condition and results of operations. In addition, the cost of insurance policies may increase significantly upon renewal of those policies as a result of general rate increases for the type of insurance we carry as well as our historical experience and experience in our industry. Our future claims may exceed the coverage level of our insurance, and insurance may not continue to be available on economically reasonable terms, or at all. If we are required to pay significantly higher premiums for insurance, are not able to maintain insurance coverage at affordable rates or if we must pay amounts in excess of claims covered by our insurance, we could experience higher costs that could materially adversely affect our business, financial condition and results of operations.

Contamination of the water supplied by us may result in disruption in our services, loss of credibility, lower demand for our services and potential liability that could adversely affect our business and financial condition.

Our water supplies are subject to contamination, including contamination from compounds, chemicals in groundwater systems, pollution resulting from man-made sources (such as perchlorate and methyl tertiary butyl ether), and possible biological terrorist attacks. Contamination of water sources can lead to human death and illness, damage to natural resources and other parts of the environment and cause other harms. Among other things, if we are found to be liable for consequences of water contamination arising out of human exposure to hazardous substances in our water supplies or other damage, we would be subject to civil or criminal enforcement actions, litigation and other proceedings or clean up obligations. Further, our insurance policies may not apply or be sufficient to cover the costs of these claims, which could be significant.

Cleaning up water sources can be very expensive and if we are required to do so, it could have a material and adverse effect on our business, operating results and financial condition. In the event that our water supply is contaminated, we may have to interrupt or stop the use of that water supply until we are able to treat the water or to substitute the supply of water from another water source, including, in some cases, through the purchase of water from a supplier. We may incur significant costs in order to warn consumers and to treat the contaminated source through expansion of current treatment facilities or development of new treatment methods. Using a new water source is generally associated with increased costs compared to an existing water source and, as indicated above, purchasing water is typically more expensive than obtaining the water from other means. If we are unable to treat or substitute our water supply in a cost-effective manner, our financial condition, results of operations, cash flow, liquidity and reputation may be adversely affected. We may not be able to recover costs associated with treating contaminated water or developing new sources of supply through the rate setting process or through insurance.

17

Table of Contents

We depend on an adequate supply of electricity and chemicals for the delivery of our water, and an interruption in the supply of these inputs or increases in their prices could adversely affect our results of operations.

We rely on purchased electrical power to operate the wells and pumps that are needed in order to supply potable and recycled water to our customers. An extended interruption in power supply that we cannot remediate through the use of backup generators could adversely affect our ability to continue these operations. Electrical power, which represented approximately 6.3% of our total operating expenses in fiscal year 2015, is a significant and potentially volatile operating expense. Electrical power costs are beyond our control and can increase unpredictably in substantial amounts. Under these circumstances, our cash flows between our general rate case filings and our earnings may be adversely affected until the Arizona Corporation Commission has authorized a rate increase.

In addition, we require bulk supplies of chemicals for water and wastewater treatment, and if we were to suffer an interruption of supply that we cannot replace quickly, we might not be able to perform these functions adequately. Some chemicals are available from a single source or a limited number of sources. Chemical costs represented approximately 2.1% of our total operating expenses in fiscal year 2015 (excluding a one-time gain on regulatory order).

Doing business in jurisdictions other than Arizona may present unforeseen regulatory, legal and operational challenges that could impede or delay our operations or adversely affect our profitability.

We may decide to pursue growth opportunities in states other than Arizona. Other states may present substantially different regulatory frameworks, and we may have difficulty acquiring the necessary approvals and permits or complying with environmental, health and safety or quality standards. In addition, it may become more costly or difficult for us to comply with a multitude of standards and requirements across multiple states.

Other states may also expose us to new legal precedents, condemnation risks and liability concerns based on state legislation or case law.

Our cost structure in other states may be significantly different than our current cost structure due to regional differences. For example, our cost structure may be significantly impacted by differences in labor and energy costs in other markets and the significant portion of overall production costs that they represent.

If future acquisitions do not achieve sufficient profitability relative to expenses and investment, our business and ability to finance our operations could be materially adversely affected.

A typical element of a utility growth strategy is the acquisition or development of other water and wastewater utilities. The potential negotiation of future acquisitions and development of new projects could require us to incur significant costs and expose us to significant risks, including:

| • | risks relating to the condition of assets acquired and exposure to residual liabilities of prior businesses; |

| • | operating risks, including equipment, technology and supply problems, regulatory requirements and approvals necessary for acquisitions; |

| • | risks that potential acquisitions may require the disproportionate attention of our senior management, which could distract them from the management of our existing business; |

| • | risks related to our ability to retain experienced personnel of the acquired company; and |

| • | risks that certain acquisitions may require regulatory approvals, which could be refused or delayed and which could result in unforeseen regulatory expenses or unfavorable regulatory conditions. |

These issues could have a material adverse effect on our business and our ability to finance our operations. The businesses and other assets we acquire in the future may not achieve sufficient revenue or profitability to justify our investment, and any difficulties we may encounter in the integration process could interfere with our

18

Table of Contents

operations and reduce operating margins. Acquisitions could also result in dilutive issuance of our equity securities, incurrence of debt and contingent liabilities and fluctuations in quarterly results and expenses.

We are exposed to various risks relating to legal proceedings or claims that could materially adversely affect our operating results.