ANNUAL INFORMATION FORM

of

B2GOLD CORP.

March 31, 2017

TABLE OF CONTENTS

- 2 -

B2GOLD CORP.

ANNUAL INFORMATION FORM

INTRODUCTORY NOTES

Date of Information

In this Annual Information Form (“Annual Information Form”), B2Gold Corp., together with its subsidiaries, as the context requires, is referred to as “we”, “our”, “us”, the “Company” or “B2Gold”. All information contained in this Annual Information Form is as at December 31, 2016, unless otherwise stated, being the date of our most recently completed financial year, and the use of the present tense and of the words “is”, “are”, “current”, “currently”, “presently”, “now” and similar expressions in this Annual Information Form is to be construed as referring to information given as of that date.

Cautionary Note Regarding Forward-Looking Information

This Annual Information Form includes certain “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of applicable U.S. securities legislation (collectively “forward-looking statements”), including, but not limited to, projections of future financial and operational performance; statements with respect to future events or future performance; production estimates; anticipated operating and production costs and revenue; estimates of capital expenditures; future demand for and prices of commodities and currencies; and statements regarding anticipated exploration, development, construction, production, permitting and other activities on the Company’s properties, including expected grades and sources of ore to be processed in 2017 and expected gold production in 2017; the projections included in existing technical reports, economic assessments and feasibility studies, including the feasibility study for the Fekola Project; anticipated or potential new technical reports and studies, including the potential findings and conclusions thereof; planned exploration and exploration budgets and the results thereof; the estimated reclamation and closure costs; negotiating and finalizing the terms of the mining convention and signing a shareholder’s agreement with the State of Mali; the ownership of Fekola S.A.; the development and production from the Fekola Project by October 2017 and the expected transitioning from construction to steady-state operations in 2017; the Fekola Project being on schedule, on budget and fully funded; the Fekola mill expansion being completed in late 2017, with potential throughput of up to five million tonnes per year in the initial years of production, and the potential to increase estimated production at the Fekola Project; the updated financial analysis for the Fekola Project being completed by the end of Q3 2017; the timing and cost to complete the relocation of Fadougou according to the relocation action plan; the resolution of the audit by the DENR in relation to the Masbate Gold Project and the final outcome thereof; the plant upgrade at Masbate improving gold recoveries and sustaining throughput; expected amount of the new Masbate Gold Project fleet that will be lease financed; expected amount of Otjikoto Mine fleet expansion that will be lease financed; completion of geotechnical, hydrogeological and design studies for the Wolfshag zone; effects of solar power plant at the Otjikoto Mine on fuel consumption; the completion of permitting and resettlement activities in respect of the Jabali Antenna Pit; production from the Jabali Antenna Pit in the third quarter of 2017; Jabali West underground development commencing in 2017 with production in 2018; expected results of an economic viability study for an open pit operation at San Juan in mid-2017; planned drilling at the Limon Mine; the expected timing to release initial mineral resources for Toega; planned drilling at the Kiaka Project in 2017; the potential rescission of Memorandum #1 in respect of a moratorium placed on new mining projects in the Philippines and the continued issuance of permits at existing operations notwithstanding executive order #79; the likelihood of certain terms and conditions being attached to new and renewed mineral licences in Namibia; the coming into force of proposed new mining legislation in Namibia and their potential impact on the Company; the potential to develop and produce from currently non-producing properties; the delivery of ounces under the Prepaid Sales transactions; the adequacy of capital for continued operations, including access to funding under the debt and equity funding facilities described herein; and estimates regarding the outcome of tax audits. Estimates of mineral resources and reserves are also forward looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production, should a production decision be made. All statements in this Annual Information Form that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

- 2 -

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, the risks, uncertainties and other factors referred to in this Annual Information Form under the heading “Risk Factors” and elsewhere herein.

Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking statements contained in this Annual Information Form are qualified by these cautionary statements.

Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those which are anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. You should not place undue reliance on forward-looking statements. Our forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as may be required by applicable securities laws.

Currency and Exchange Rate Information

The financial statements included herein are reported in U.S. dollars. A reference in this Annual Information Form to:

| • | “C$” is to the lawful currency of Canada; | |

| • | “N$” is to the lawful currency of Namibia; | |

| • | “Rand” is the lawful currency of South Africa; | |

| • | “Córdobas” is to the lawful currency of Nicaragua; | |

| • | “PHP” is to the lawful currency of the Philippines; | |

| • | “CFA franc” is the lawful currency of Mali and Burkina Faso; and | |

| • | “$” or “US$” is to the lawful currency of the United States. |

The following table sets forth, for each period indicated, the high and low exchange rates for Canadian dollars expressed in U.S. dollars, the average of such exchange rates during such period, and the exchange rate at the end of such period. These rates are based on the Bank of Canada noon spot rate of exchange.

| Fiscal Year Ended December 31, | ||||||||||

| 2014 | 2015 | 2016 | ||||||||

| Rate at the end of period | US$0.8620 | US$0.7225 | US$0.7448 | |||||||

| Average rate during period | US$0.9054 | US$0.7820 | US$0.7548 | |||||||

| Highest rate during period | US$0.9422 | US$0.8527 | US$0.7972 | |||||||

| Lowest rate during period | US$0.8589 | US$0.7148 | US$0.6854 | |||||||

On March 30, 2017, the noon rate of exchange for one Canadian dollar in United States dollars as reported by the Bank of Canada was C$1.00 = US$0.7531.

- 3 -

Technical Information and Cautionary Note for United States Readers

The disclosure included in this Annual Information Form uses Mineral Reserve and Mineral Resource classification terms that comply with reporting standards in Canada and the Mineral Reserve and Mineral Resource estimates are made in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Council – Definitions adopted by CIM Council on May 10, 2014 (the “CIM Standards”), which were adopted by the Canadian Securities Administrators’ (“CSA”) National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the CSA that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The following definitions are reproduced from the CIM Standards:

A Modifying Factor or Modifying Factors are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A Mineral Reserve is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a pre-feasibility study or feasibility study.

A Probable Mineral Reserve is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve.

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors.

Unless otherwise indicated, all of our Mineral Reserves and Mineral Resources included in this Annual Information Form have been prepared in accordance with NI 43-101. Canadian standards for public disclosure of scientific and technical information concerning mineral projects differ significantly from the requirements of U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with NI 43-101 and CIM Standards. These definitions differ from the definitions in the United States Securities and Exchange Commission’s (the “SEC”) Industry Guide 7 (“Guide 7”) under the U.S. Securities Act of 1933, as amended, and therefore may not qualify as reserves under SEC standards. Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Under Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

- 4 -

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Accordingly, resource information contained herein may not be comparable to similar information disclosed by U.S. companies. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves or that they can be mined economically or legally. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Historical results or feasibility models presented herein are not guarantees or expectations of future performance. It cannot be assumed that all, or any part, of an Inferred Mineral Resource will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or that it can be economically or legally mined. Further, while NI 43-101 permits companies to disclose economic projections contained in pre-feasibility studies and preliminary economic assessments, which are not based on “reserves”, U.S. companies are not normally permitted to disclose economic projections for a mineral property in their SEC filings prior to the establishment of “reserves”. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian reporting standards; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Information Form contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “Qualified Person” as used in this Annual Information Form means a Qualified Person as that term is defined in NI 43-101.

- 5 -

CORPORATE STRUCTURE

Name, Address and Incorporation

We were incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on November 30, 2006. Our head office is located at Suite 3100, Three Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, V7X 1J1 and our registered office is located at 1600-925 West Georgia Street, Vancouver, British Columbia, V6C 3L2.

- 6 -

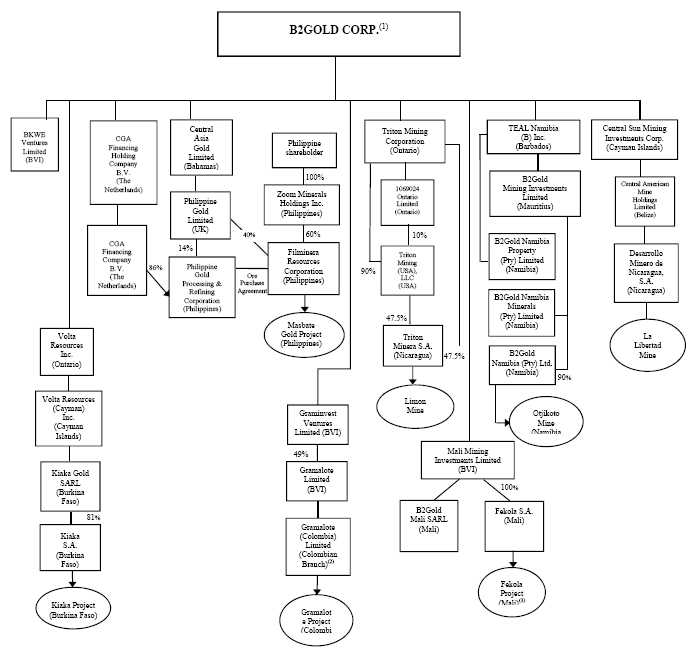

Intercorporate Relationships

A significant portion of our business is carried on through our subsidiaries. A chart showing the names of our material subsidiaries and certain subsidiaries holding an interest in mineral projects described in this Annual Information Form and their respective jurisdiction of incorporation is set out below:

Notes:

| (1) |

All ownership of subsidiaries is 100% unless indicated. Certain subsidiaries are indirectly owned by us through wholly-owned subsidiaries not reflected above. |

| (2) |

Colombian branches are not separate legal entities. |

| (3) |

Please see “Material Properties – Fekola Project – Property Description, Location and Access”, for further information regarding the anticipated ownership of the Fekola Project. |

- 7 -

GENERAL DEVELOPMENT OF THE BUSINESS

We are a Vancouver-based gold producer with four operating mines (two mines in Nicaragua, one mine in the Philippines and one mine in Namibia) and one mine under construction in Mali. In addition, we have a portfolio of other evaluation and exploration projects in several countries including Mali, Colombia, Burkina Faso, Finland and Nicaragua. Our material mineral properties consist of the following three mines and one mine under construction:

| • |

Otjikoto mine (90% ownership), an open pit, and potential underground, gold mine located approximately 300 kilometres (“km”) north of Windhoek, the capital of Namibia (“Otjikoto Mine”); | |

|

| ||

| • |

Masbate mine (ownership as described in “Material Properties – Masbate Gold Project” below), an open pit gold mine, located near the northern tip of the island of Masbate, 360 km south-east of Manila, the capital of the Philippines (“Masbate Gold Project”); | |

|

| ||

| • |

La Libertad mine (100% ownership), an open pit gold mine located 110 km due east of Managua, and 32 km northeast of Juigalpa, Nicaragua (“La Libertad Mine”); and | |

|

| ||

| • |

Fekola gold project (presently 100% ownership ), an open pit gold mine under construction located approximately 40 km south of the city of Kéniéba, Mali (“Fekola Project”). As described in “Material Properties – Fekola Project” below, upon signing of a shareholder’s agreement between the Company and the State of Mali, the Company will contribute a 10% free carried interest in Fekola S.A. to the State of Mali. It is anticipated that the State of Mali will also acquire an additional 10% interest in the Fekola Project. |

Our other significant assets consist of the following mine and two projects:

| • |

Limon mine (95% ownership), an underground gold mine located in northwestern Nicaragua, approximately 100 km northwest of Managua, the capital of Nicaragua (“Limon Mine”); | |

|

| ||

| • |

Kiaka project (81% ownership), a gold project, located 140 km southeast of Ouagadougou, the capital of Burkina Faso (“Kiaka Project”); and | |

|

| ||

| • |

Gramalote project (49% interest as at December 31, 2016, as described in “Other Properties – Gramalote Project” below), a gold project located 230 km northwest of Bogota, the capital of Colombia (“Gramalote Project”). |

Three Year History

Over the three most recently completed financial years, the significant events described below contributed to the development of our business.

2014 Developments

On October 3, 2014, we acquired 100% of the ordinary shares of Papillon Resources Limited, now referred to as Papillon Resources Pty Ltd. (“Papillon”) by way of an Australian scheme of arrangement. The scheme of arrangement was carried out pursuant to the terms and conditions contained in a merger implementation agreement dated June 3, 2014 between us and Papillon. On completion of the transaction, Papillon became our wholly-owned subsidiary and all of the issued and outstanding ordinary shares of Papillon were transferred to us in consideration for the issuance by us to former shareholders of Papillon of 0.661 of a common share of the Company (a “Common Share”) for each Papillon ordinary share held. We also issued Common Shares to Papillon optionholders as consideration for the cancellation of their Papillon stock options based on the in-the-money amount of such Papillon options. In connection with the closing of the transaction, we issued an aggregate of 237,390,819 Common Shares to the former Papillon shareholders and optionholders. The acquisition of Papillon added the Fekola Project in Mali to our property portfolio. See “Material Properties – Fekola Project” below.

- 8 -

On December 11, 2014, we announced that the first gold pour had occurred at the Otjikoto Mine, ahead of schedule.

2015 Developments

In February 2015, we began early earthworks activities at the Fekola Project.

On February 28, 2015, the Otjikoto Mine achieved commercial production, ahead of schedule.

On May 20, 2015, as amended on June 10, 2015, March 11, 2016 and May 10, 2016, we entered into a new $350 million revolving credit facility (the “Credit Facility”) with a syndicate of international banks, which replaced the previous $150 million secured credit facility with a syndicate led by Macquarie Bank Limited dated April 12, 2013 (“Previous Credit Facility”). The Credit Facility allows for an accordion feature whereby upon receipt of additional binding commitments, the Credit Facility may be increased to $450 million any time prior to the maturity date. The syndicate includes HSBC Bank USA, National Association, which acts as administrative agent and lender, HSBC Securities (USA) Inc., which acts as sole lead arranger and sole bookrunner, and The Bank of Nova Scotia, Société Générale and ING Bank N.V, (together, the “Credit Facility Bank Syndicate”). Proceeds from the Credit Facility were used to repay our Previous Credit Facility and for general corporate purposes. The Credit Facility bears interest on a sliding scale of between Libor plus 2.25% to 3.25% based on our consolidated net leverage ratio. The term for the Credit Facility is four years, maturing on May 20, 2019, except that it shall become due on July 1, 2018 in the event that greater than 25% of our convertible notes, initially due on October 1, 2018, remain outstanding or the maturity date of our convertible notes has not been extended to August 1, 2019 or later. On March 14, 2017, the Company received a binding letter of commitment from the Canadian Imperial Bank of Commerce (“CIBC”) to participate in the Company’s Credit Facility. In conjunction with this, the aggregate amount of the Credit Facility was increased from $350 million to $425 million. As of the date of this Annual Information Form and including the CIBC commitment, $225 million remains available for drawdown under the Credit Facility.

The results of an optimized feasibility study for the Fekola Project were announced on June 11, 2015, demonstrating robust economic indicators for the Fekola Project. See “Material Properties – Fekola Project” below for additional information.

On August 10, 2015, we entered into a binding letter agreement with Aurion Resources Ltd. (“Aurion”) setting out the terms of our option to acquire up to a 75% interest in the Kutuvuoma, Ahvenjarvi, Piko-Mustavaara, Palovaara and Soretiavuoma properties located in Finland (the “Finland Properties”), upon certain payments, Common Share issuances and expenditures being made in accordance with the terms of the agreement.

On August 26, 2015, we entered into an earn-in joint venture agreement with Omatjete Mining Company (Proprietary) Limited setting out the terms of our option to earn in stages up to a 100% interest in the Ondundu project located approximately 190 km south west of the Otjikoto Mine.

On November 20, 2015, the official ground-breaking of the Fekola Project took place in connection with the mine construction activities, which were commenced during the fourth quarter of 2015.

2016 Developments

On January 11, 2016, we filed a final short form base shelf prospectus (the “Base Shelf Prospectus”) in each of the provinces of Canada and a corresponding amended shelf registration statement in the United States allowing us to offer up to $300,000,000 of debt securities, warrants, subscription receipts, units or Common Shares, or any combination thereof, from time to time during a 25-month period.

On March 14, 2016, we received approvals for prepaid sales financing arrangements of up to $120 million from our Credit Facility Bank Syndicate (the “Prepaid Sales”). The Prepaid Sales, in the form of metal sales forward contracts, allow us to deliver pre-determined volumes of gold on agreed future delivery dates in exchange for an upfront cash pre-payment (“Prepaid Amount”). The Prepaid Sales arrangements have a term of 33 months commencing March 2016, and settlement will be in the form of physical deliveries of unallocated gold from any of our mines in 24 equal monthly installments during 2017 and 2018. Initial Prepaid Sales contracts have been entered into for the delivery of 49,475 ounces of gold in 2017 and 53,791 in 2018, for total cash Prepaid Amount proceeds of $120 million.

- 9 -

On March 31, 2016, the extension of the Masbate Gold Project’s income tax holiday was approved for a final additional year to June 2017.

On June 8, 2016, the Otjikoto equipment loan facility, entered into on December 4, 2013 (and as amended from time to time) between B2Gold Namibia Minerals (Proprietary) Limited, as borrower, Caterpillar Financial SARL, as arranger, Caterpillar Financial Services Corporation, as original lender, and the Company and B2Gold Namibia (Proprietary) Limited, as guarantors, was amended to extend the term over which loans may be advanced under the facility to December 31, 2016 and an additional $4.5 million was made available for drawdown. As at December 31, 2016, we had drawn down the full amount currently available under the facility.

On August 2, 2016, we decided to proceed with an expansion of the designed mill throughput at the Fekola Project and approved an $18 million expansion budget for additional items including a pebble crusher, one additional leach tank and an additional generator.

On August 11, 2016, we entered into an equity distribution agreement (the “ATM Agreement”) with two placement agents for the sale of Common Shares having up to an aggregate gross offering price of $100 million through “at the market” distributions. The ATM Agreement runs until the earlier of: (i) $100 million worth of Common Shares being issued; (ii) February 11, 2018; or (iii) termination by one of the parties in accordance with the ATM Agreement. The placement agents receive a placement fee of 2% of the gross proceeds from each placement. The offering of Common Shares under the ATM Agreement (the “ATM Offering”) is made pursuant to a prospectus supplement (the “Supplement”) filed in all of the provinces of Canada under our Base Shelf Prospectus. The Supplement is incorporated by reference into the Base Shelf Prospectus for the duration of the ATM Offering. During the year ended December 31, 2016, we issued 14.8 million Common Shares at an average price of $3.17 per Common Share for gross proceeds of $47.1 million (net proceeds of $44.2 million after deducting costs associated with the issuance) under the ATM Agreement. An aggregate commission of $0.9 million was paid to the agents. We are using the proceeds from the ATM Offering to fund ongoing general corporate expenditures, discretionary capital programs, accelerated exploration at the Fekola Project in Mali and exploration and development in Burkina Faso.

In August 2016, Masbate’s mine plan was adjusted to optimize the mine’s development sequence/gold production through to 2017 and beyond. These adjustments included accelerated mining in the Main Vein Stage 1 pit, expanding the Colorado pit and commencing site preparations for later Main Vein stages.

On September 7, 2016, we entered into a Euro 71.4 million term Equipment Facility (the “Equipment Facility”) with Caterpillar Financial SARL, as mandated lead arranger, and Caterpillar Financial Services Corporation, as original lender. The aggregate principal amount of up to Euro 71.4 million is available to our majority-owned subsidiary, Fekola S.A. to finance or refinance the mining fleet and other mining equipment at our Fekola Project in Mali. The Equipment Facility is available for a period that commenced on February 13, 2017 (the “Financial Close Date”) and ends on the earlier of the day when the Equipment Facility is fully drawn and 30 months from the Financial Close Date. The Equipment Facility may be drawn in installments of not less than Euro 5 million, and each such installment shall be treated as a separate equipment loan. The Company is required to maintain a deposit in a debt service reserve account (“DSRA”) equal at all times to the total of the principal, interest and other payments that become payable over the next six month period. Each equipment loan is repayable in 20 equal quarterly installments. The final repayment date shall be five years from the first disbursement under each equipment loan. The interest rate on each loan is a rate per annum equal to EURIBOR plus a margin of 5.10% . A commitment fee of 1.15% per annum on the undrawn balance of each tranche for the first 24 months after December 7, 2016 and 0.5% thereafter is also due, each payable quarterly. In each case, from October 1, 2017, 0.4167% per annum on the undrawn balance of each tranche is also due. We and our subsidiary, Mali Mining Investments Limited, have guaranteed the Equipment Facility and security will be given over equipment which has been financed by the Equipment Facility, related warranty and insurance and over the DSRA.

On September 27, 2016, the Philippine Department of Environment and Natural Resources (“DENR”) announced the preliminary results of mining audits carried out by the DENR in respect of all metallic mines in the Philippines. At that time, DENR spokespersons advised us that the Masbate Gold Project would receive a show-cause letter related to its operations. The DENR subsequently issued the Masbate Gold Project audit report which contains detailed findings from the audit and directed us to provide explanations and comments in response to the audit findings; however, no show-cause order was issued in respect of any findings. The audit findings were related to administrative and regulatory issues, including, without limitation: (a) alleged issues related to certain mining operations occurring in areas not covered by our Environmental Compliance Certificate, which in our view is mistaken and likely arises as a result of incorrect geographical coordinates of the Masbate Gold Project used by the auditors; and (b) alleged issues related to the appropriate approval of mine operating and production plans, the payment of fees for waste and tailing disposal, and a series of alleged infractions of the Philippine Mining Act of 1995 and safety regulations. The audit also includes recommendations related to guidelines to enhance our reclamation planning and practices, and several proposals related to community planning and development which we support. We have provided a comprehensive response to the findings and recommendations in the audit, which we believe addressed the issues raised. As reported by us on February 2, 2017, the DENR announced further results of its mining audit and the Masbate Gold Project was not among the mines announced to be suspended or closed. To date, the Company has not received any updated formal written response from the DENR confirming the results of the audit in respect of the Masbate Gold Project and as such, the final outcome of the audit is not certain. We will continue to work closely with the DENR to maintain compliance with regulations and continue to promote improved quality of life in the communities where we operate. Operations remain uninterrupted at the mine and the projections and guidance for the Masbate Gold Project and the Company on a consolidated basis are provided on this basis.

- 10 -

In December 2016, we completed a merger of Songhoi Resources SARL (“Songhoi”) and Fekola S.A. as result of which Fekola S.A. became the holder of the exploitation permit for the Fekola Project. Upon signing of a Shareholder’s Agreement between the Company and the State of Mali in respect of Fekola S.A. (the “Fekola Shareholder Agreement”), the Company will contribute a 10% free carried interest in Fekola S.A. to the State of Mali, resulting in B2Gold holding a 90% interest in Fekola S.A. The 2012 Mining Code (Mali) (the “2012 Mining Code”) also allows the State of Mali the option to purchase (at market terms) an additional 10% interest, which the State of Mali has confirmed its intent to exercise. Both parties have engaged an independent external valuator to prepare a valuation of the additional 10% interest in Fekola S.A. so that a final purchase price can be determined. We have signed a mining convention in the form prescribed under the 2012 Mining Code with the State of Mali (the “Fekola Convention”). We are in the process of negotiating with the State of Mali to address and clarify certain matters under the 2012 Mining Code and the Fekola Convention as described under the heading “Material Properties – Fekola Project – Property Description and Location”. The Fekola Convention, as it may be amended, is expected to govern the procedural and economic parameters pursuant to which the Company will operate the Fekola Project.

2017 Subsequent Developments

On February 13, 2017, the Financial Close Date was established under the Equipment Facility and the first drawdown in the amount of Euro 24.7 million was advanced on February 20, 2017.

In February 2017, we entered into further Prepaid Sales transactions with the Credit Facility Banking Syndicate totalling $15 million for delivery of 12,780 ounces of gold for delivery between January 31 and May 20, 2019.

DESCRIPTION OF THE BUSINESS

General

We are a Vancouver-based mid-tier gold producer with a strategic focus on acquiring and developing interests in mineral properties with demonstrated potential for hosting economic mineral deposits, with gold deposits as the primary focus. We conduct gold mining operations and exploration and drilling campaigns to define and develop Mineral Resources and Mineral Reserves on our properties with an intention of developing, constructing and operating mines on such properties.

Our corporate objective is to continue growing as a profitable and responsible gold producer through ongoing exploration of our existing projects and accretive acquisitions, irrespective of the gold price.

- 11 -

Principal Product

Our principal product is gold, with gold production forming all of our revenues. There is a global market into which we can sell our gold and, as a result, we are not dependent on a particular purchaser with respect to the sale of the gold that we produce.

Special Skills and Knowledge

Various aspects of our business require specialized skills and knowledge. Such skills and knowledge include the areas of permitting, engineering, geology, metallurgy, logistical planning, implementation of exploration programs, mine construction and development, mine operation, as well as legal compliance, finance and accounting.

Competitive Conditions

The gold exploration and mining business is a competitive business. We compete with numerous other companies and individuals in the search for and the acquisition of quality gold properties, mineral claims, permits, concessions and other mineral interests, as well as recruiting and retaining qualified employees. Our ability to acquire gold properties in the future will depend not only on our ability to develop our present properties, but also on our ability to select and acquire suitable producing properties or prospects for development or mineral exploration.

Employees

Our business is administered principally from our head office in Vancouver, British Columbia, Canada. We also have offices in Managua, Nicaragua; Manila, Philippines; Windhoek, Namibia; Ouagadougou, Burkina Faso; Bamako, Mali; Accra, Ghana; Dakar, Senegal; and Medellin, Colombia. As at the date of this Annual Information Form, we, including our subsidiaries, employ a total of 2,282 full-time employees, 1,847 temporary employees, and 1 supervised worker, for a total of 4,130 employees.

Production at our mining operations is dependent upon the efforts of our employees and our relations with our unionized and non-unionized employees. Some of our employees are represented by labour unions under various collective labour agreements. The collective bargaining agreement covering the workers at Limon Mine is effective until July 1, 2018. The collective bargaining agreement covering the workers at the La Libertad Mine is effective until December 31, 2017. The collective bargaining agreement covering the workers at the Otjikoto Mine is negotiated annually and is in place for 2017 as of March 1, 2017.

Foreign Operations

Our principal operations and assets are located in Nicaragua, the Philippines, Namibia, Mali, Burkina Faso and Colombia. Our operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties vary from country to country and include, but are not limited to government regulations (or changes to such regulations), with respect to restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. The effect of these factors cannot be accurately predicted. See “Risk Factors”.

Environmental Protection

Our activities are subject to extensive laws and regulations governing the protection of the environment, natural resources and human health. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. We are required to obtain governmental permits and, in some instances, provide bonding requirements under federal, state, or provincial air, water quality, and mine reclamation rules and permits. Violations of environmental, health and safety laws are subject to civil sanctions and, in some cases, criminal sanctions, including the suspension or revocation of permits. The failure to comply with environmental laws and regulations or liabilities related to hazardous substance contamination could result in project development delays, material financial impacts or other material impacts to our projects and activities, fines, penalties, lawsuits by the government or private parties, or material capital expenditures. As noted under the heading “General Development of the Business – Three Year History – 2016 Developments”, the Masbate Gold Project was the subject of an audit by the DENR to assess compliance with, among other things, environmental regulations.

- 12 -

Additionally, environmental laws in some of the countries in which we operate require that we periodically perform audits and environmental impact studies at our mines. These studies could reveal environmental impacts that would require us to make significant capital outlays or cause material changes or delays in our intended activities.

Our current closure and reclamation cost estimate at La Libertad Mine, the Limon Mine, the Masbate Gold Project, the Otjikoto Mine and the Fekola Project is approximately $87.0 million on an undiscounted basis. These estimates are generally based on conceptual level engineering and will be updated periodically to reflect changes in site conditions and the life-of-mine (“LOM”) plans.

Environmental, Occupational Health and Safety, and Regulatory

We have adopted environmental and biodiversity policies designed to ensure environmental risks are adequately addressed while committing to environmental protection for all our activities. We have also adopted occupational health and safety policies designed to ensure the protection and promotion of the safety, human health, and welfare of our employees. We have also implemented Health, Safety & Environmental (“HSE”) Management System Standards and Occupational Health and Safety, Environmental and Biodiversity Performance Standards at the corporate level to provide minimum requirements for the development and implementation of both corporate and site HSE management systems. Our HSE Management System and Performance Standards are based on international standards including compliance with in-country regulations, relevant International Organization for Standardization (“ISO”) and Occupational Health, Safety and Security (“OHSAS”) standards, and reliance on the International Finance Corporation (“IFC”) Performance Standards and international best practices in cases where national regulatory systems are not sufficiently stringent. These management systems enable us to mitigate and manage the potential risks and impacts of our operations.

We implement the HSE management systems and manage HSE performance with dedicated HSE personnel at both the corporate and site levels. In addition, we have in place a Health, Safety, Environment and Social Committee of the board of directors to assist the board of directors in overseeing our health, safety, environmental and corporate social responsibility policies and programs, and our health, safety, environmental and corporate social responsibility performance.

The following is a brief summary of HSE management systems in place across our different projects:

| • |

Masbate Gold Project: Masbate Gold Project has developed and implemented an HSE management system based on our HSE Management System and Performance Standards. The HSE management system and performance includes annual internal auditing of the Masbate Gold Project by independent experts. In addition, the Masbate Gold Project maintains ISO 14001 certification and evaluates its management of cyanide in relation to the International Cyanide Management Code. | |

|

| ||

| • |

La Libertad Mine: La Libertad Mine continues to develop its HSE management system based on our HSE Management System and Performance Standards through its internal management system implementation committee. La Libertad Mine undergoes annual audits by independent experts. In addition, La Libertad Mine continues its work towards certification with the International Cyanide Management Code. | |

|

| ||

| • |

Otjikoto Mine: B2Gold Namibia (Proprietary) Limited (“B2Gold Namibia”) continues to develop and implement a full HSE management system that covers all corporate HSE management systems and performance standards requirements on health, safety, environment, and biodiversity. This includes annual internal audits by independent experts that began in 2015. |

- 13 -

| • |

Limon Mine: Limon Mine continues to develop its HSE management system based on our HSE Management System and Performance Standards led by senior management, the HSE departments, and HSE Management System Coordinators. The HSE management system and performance includes annual internal auditing of the Limon Mine by independent experts. | |

|

| ||

| • |

Fekola Project: The Fekola Project is currently in the construction phase. During this phase, dedicated HSE personnel are working to implement the components of our HSE management system and performance standards that are relevant to construction. Implementation of an auditable management system will be in place when the facility commences operations. | |

|

| ||

| • |

Regional Exploration Projects: Regional exploration projects adhere to the same HSE policies as the rest of our projects, and apply specific standards, procedures, and processes as are relevant and applicable to the specific site. | |

|

| ||

| • |

Reclamation and Care and Maintenance Sites: Reclamation and care and maintenance sites adhere to the same HSE policies as the rest of our projects, and apply specific standards, procedures, and processes as are relevant and applicable to the site. |

In addition, we work with occupational health, safety, and environmental regulatory agencies to ensure that the performance of our operations is at a level that is acceptable to the regulatory authorities. We encourage open dialogue and have prepared procedures for responding to concerns of all entities with respect to HSE issues.

SUMMARY OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Mineral Reserves are reported from pit designs and underground stope designs based on Indicated Mineral Resources. Mineral Resources are reported inclusive of those Mineral Resources that have been converted to Mineral Reserves.

Economic parameters such as mining costs, processing costs, metallurgic recoveries and geotechnical considerations have been applied to determine economic viability of the Mineral Reserves based on a gold price of US$1,250 per ounce (“/oz”). Mineral Reserves contained in stockpiles are also included for Masbate and Otjikoto Mines.

Mineral Resources amenable to open pit mining are constrained with conceptual pit shells defined by economic parameters and using a gold price of US$1,400/oz. Mineral Resources amenable to underground mining methods are reported above cutoff grades defined by site operating costs and using a gold price of US$1,400/oz. Gold grades are expressed in grams per tonne of gold (“g/t Au”).

Mineral Reserves and Resource estimates are reported from B2Gold’s Mineral Resource model that has an effective date of December 31, 2016.

Probable Mineral Reserves Statement

| Mine | Tonnes

(t) |

Gold

Grade (g/t Au) |

Contained

Gold Ounces (oz) |

Contained

Gold Kilograms (kg) |

| Fekola | 43,800,000 | 2.37 | 3,340,000 | 103,900 |

| Masbate | 95,290,000 | 0.88 | 2,683,000 | 83,500 |

| Otjikoto | 23,140,000 | 1.33 | 986,000 | 30,700 |

| La Libertad | 1,910,000 | 1.94 | 119,000 | 3,700 |

| Limon | 1,130,000 | 4.20 | 152,000 | 4,700 |

| Total Probable Mineral Reserves (includes Stockpiles) | 7,281,000 | 226,500 |

- 14 -

| Notes: | ||

| 1. |

Mineral Reserves have been classified using the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content. | |

| 2. |

Fekola Project: Mineral Reserves are reported on a 90% attributable basis; the remaining 10% interest will be held by the State of Mali. We expect that the State of Mali will exercise its right to acquire an additional 10% interest in the Fekola Project. For further details of our interest in the Fekola Project, see the heading “Material Properties – Fekola Project – Property Description, Location and Access”. The Mineral Reserves have an effective date of December 31, 2016. The Qualified Person for the estimate is Peter Montano, P.E., who is our Project Director. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, metallurgical recovery of 92.7%, and average operating cost estimates of US$2.90/t mined (mining), US$20.25/t processed (processing) and US$3.72/t processed (general and administrative). Reserve model dilution and ore loss was applied through whole block averaging such that at a 0.8 g/t Au cutoff there is a 2.8% increase in tonnes, a 3.1% reduction in grade and 0.5% reduction in ounces when compared to the Mineral Resource model. An additional 5% dilution and 2% ore loss was applied during pit optimization and scheduling. Mineral Reserves are reported above a cutoff grade of 0.8 g/t Au. | |

| 3. |

Masbate Gold Project: Mineral Reserves are reported on a 100% attributable basis. Pursuant to the ore sales and purchase agreement between Filminera Resources Corporation (“Filminera”) and Philippine Gold Processing & Refining Corporation (“PGPRC”), our wholly-owned subsidiary, PGPRC has the right to purchase all ore from the Masbate Gold Project. The Mineral Reserves have an effective date of December 31, 2016. The Qualified Person for the estimate is Kevin Pemberton, P.E., who is our Chief Mine Planning Engineer. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, modeled metallurgical recovery (resulting in average LOM metallurgical recoveries by pit that range from 65% to 82%), and operating cost estimates of US$1.50/t mined (mining), a variable ore differential cost by pit (average cost is US$0.17), US$9.36– 10.18/t processed (processing) and US$2.30–3.84/t processed (general and administrative). Dilution and ore loss were applied through block averaging such that at a cutoff of 0.45 g/t Au, there is a 5% increase in tonnes, a 6% reduction in grade and 1% reduction in ounces when compared to the Mineral Resource model. Mineral Reserves are reported at cutoffs that range from 0.46– 0.49 g/t Au. | |

| 4. |

Otjikoto Mine: Mineral Reserves are reported on a 90% attributable basis; the remaining 10% interest is held by EVI Mining (Proprietary) Ltd., a Namibian empowerment company (“EVI”). The Mineral Reserves have an effective date of December 31, 2016. The Qualified Person for the estimate is Peter Montano, P.E., who is our Project Director. Mineral Reserves that will be mined by open pit methods assume a gold price of US$1,250/oz, metallurgical recovery of 98%, and operating cost estimates of US$1.75/t mined (mining), US$13.00/t processed (processing) and US$3.00/t processed (general and administrative). Dilution and ore loss was applied through block averaging such that at a cutoff of 0.45 g/t Au, there is a 1% decrease in tonnes, a 4% reduction in grade and 5% reduction in ounces when compared to the Mineral Resource model. Mineral Reserves are reported at a cutoff of 0.45 g/t Au. | |

| 5. |

La Libertad Mine: Mineral Reserves are reported on a 100% attributable basis, and have an effective date of December 31, 2016. The Qualified Person for the estimate is Kevin Pemberton, P.E., who is our Chief Mine Planning Engineer. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, metallurgical recoveries that range from 90% to 94%, and operating cost estimates of US$3.88/t mined (mining), US$13.31/t processed (processing) and US$4.13/t processed (general and administrative). Dilution and ore loss was applied to the Jabali material through block averaging such that at a cutoff of 0.75-0.76 g/t Au, there is a 15% increase in tonnes, a 26% reduction in grade and 14% reduction in ounces when compared to the Mineral Resource model. No dilution is applied to spent-ore. Mineral Reserves are reported at cutoffs that range from 0.70–0.76 g/t Au. | |

| 6. |

Limon Mine: Mineral Reserves are reported on a 95% attributable basis; the remaining 5% interest is held by Inversiones Mineras S.A. (“IMISA”). The Mineral Reserves have an effective date of December 31, 2016. The Qualified Person for the estimate is Kevin Pemberton, P.E., who is our Chief Mine Planning Engineer. Mineral Reserves are based on underground long-hole stoping mining methods, gold price of US$1,250/oz, metallurgical recovery of 93.5%, and operating cost estimates of US$58.05–82.39/t of ore mined (mining), US$26.33/t of ore processed (processing) and US$13.14/t processed (general and administrative). Dilution of 20- 30% is applied to most zones in addition to 90% mine recovery for all zones. Mineral Reserves are reported at cutoffs that range from 3.04–3.22 g/t Au. | |

| 7. |

Stockpiles: Mineral Reserves are reported in the totals for the Masbate and Otjikoto mines, and were prepared by mine site personnel at each operation. Ore stockpile balances are derived from mining truck movements to individual stockpiles or detailed surveys, with grade estimated from routine grade control methods. Stockpile cutoffs vary by deposit, from 0.25–0.7 g/t Au. | |

Measured and Indicated Mineral Resource Statement

| Mine |

Tonnes

(t) |

Gold

Grade (g/t Au) |

Contained

Gold Ounces (oz) |

Contained

Gold Kilograms (kg) |

| Measured | ||||

| Kiaka | 27,310,000 | 1.09 | 953,000 | 29,600 |

| Gramalote | 15,980,000 | 0.79 | 406,000 | 12,600 |

| Total Measured Mineral Resources |

1,359,000 | 42,300 | ||

| Indicated | ||||

| Fekola | 65,820,000 | 2.13 | 4,499,000 | 139,900 |

| Masbate | 126,820,000 | 0.89 | 3,649,000 | 113,500 |

| Otjikoto | 30,410,000 | 1.26 | 1,230,000 | 38,200 |

| La Libertad | 2,800,000 | 2.36 | 212,000 | 6,600 |

| Limon | 2,530,000 | 5.06 | 411,000 | 12,800 |

| Kiaka | 96,830,000 | 0.96 | 2,986,000 | 92,900 |

| Gramalote | 70,230,000 | 0.48 | 1,092,000 | 34,000 |

| Total Indicated Mineral Resources (includes Stockpiles) | 14,079,000 | 437,900 | ||

| Measured and Indicated | ||||

| Fekola | 65,820,000 | 2.13 | 4,499,000 | 139,900 |

| Masbate | 126,820,000 | 0.89 | 3,649,000 | 113,500 |

| Otjikoto | 30,410,000 | 1.26 | 1,230,000 | 38,200 |

| La Libertad | 2,800,000 | 2.36 | 212,000 | 6,600 |

| Limon | 2,530,000 | 5.06 | 411,000 | 12,800 |

| Kiaka | 124,140,000 | 0.99 | 3,938,000 | 122,500 |

| Gramalote | 86,220,000 | 0.54 | 1,498,000 | 46,600 |

| Total Measured and Indicated Mineral Resources (includes Stockpiles) | 15,438,000 | 480,200 | ||

- 15 -

Inferred Mineral Resource Statement

| Mine | Tonnes

(t) |

Gold Grade

(g/t Au) |

Contained Gold

Ounces (oz) |

Contained Gold

Kilograms (kg) |

| Fekola | 4,430,000 | 1.73 | 246,000 | 7,600 |

| Masbate | 10,100,000 | 0.74 | 240,000 | 7,500 |

| Otjikoto | 1,720,000 | 5.42 | 299,000 | 9,300 |

| La Libertad | 2,900,000 | 4.94 | 460,000 | 14,300 |

| Limon | 1,000,000 | 4.43 | 142,000 | 4,400 |

| Kiaka | 27,330,000 | 0.93 | 815,000 | 25,300 |

| Gramalote | 143,060,000 | 0.40 | 1,841,000 | 57,200 |

| Total Inferred Mineral Resources |

4,042,000 | 125,700 |

| Notes: | ||

| 1. |

Mineral Resources have been classified using the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral Resources are reported inclusive of those Mineral Resources that have been modified to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content. | |

| 2. |

Fekola Project: Mineral Resources are reported on a 90% attributable basis; the remaining 10% interest will be held by the State of Mali. We expect that the State of Mali will exercise its right to acquire an additional 10% interest in the Fekola Project. For further details of our interest in the Fekola Project, see the heading “Material Properties – Fekola Project – Property Description, Location and Access”. The Mineral Resources have an effective date of December 31, 2016. The Qualified Person for the estimate is Tom Garagan, P.Geo., who is our Senior Vice President, Exploration. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 92.7%, and average operating cost estimates of US$2.90/t mined (mining), US$20.25/t processed (processing) and US$3.72/t processed (general and administrative). Mineral Resources are reported at a cutoff of 0.6g/t Au. | |

| 3. |

Masbate Gold Project: Mineral Resources are reported on a 100% attributable basis. Pursuant to the ore sales and purchase agreement between Filminera and PGPRC, our wholly-owned subsidiary, PGPRC has the right to purchase all ore from the Masbate Gold Project. The Mineral Resources have an effective date of December 31, 2016. The Qualified Person for the estimate is Tom Garagan, P.Geo., who is our Senior Vice President, Exploration. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, modeled metallurgical recovery (resulting in average LOM metallurgical recoveries by pit that range from 65% to 82%), and operating cost estimates of US$1.50/t mined (mining), a variable ore differential cost by pit (average cost is US$0.17), US$9.36 –10.18/t processed (processing) and US$2.30 –3.84/t processed (general and administrative). Mineral Resources are reported at an average cutoff of 0.42 g/t Au. | |

- 16 -

| 4. |

Otjikoto Mine: Mineral Resources are reported on a 90% attributable basis; the remaining 10% interest is held by EVI. The Mineral Resources have an effective date of December 31, 2016. The Qualified Person for the estimate is Tom Garagan, P.Geo., who is our Senior Vice President, Exploration. Mineral Resource estimates that are amenable to open pit mining methods assume a gold price of US$1,400/oz, metallurgical recovery of 98%, and operating cost estimates of US$1.75/t mined (mining), US$13.00/t processed (processing) and US$3.00/t processed (general and administrative). Mineral Resources that are amenable to open pit mining are reported at a cutoff of 0.40 g/t Au. Mineral Resources that are amenable to underground mining are reported at cutoff of 3.00 g/t Au. |

|

| 5. |

La Libertad Mine: Mineral Resources are reported on a 100% attributable basis, and have an effective date of December 31, 2016. The Qualified Person for the estimate is Brian Scott, P.Geo., who is our Vice President, Geology and Technical Services. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, metallurgical recoveries that range from 90% to 94%, and operating cost estimates of US$3.88/t mined (mining), US$13.31/t processed (processing) and US$4.13/t processed (general and administrative). Mineral Resources are reported at cutoffs that range from 0.61–2.85 g/t Au. |

|

| 6. |

Limon Mine: Mineral Resources are reported on a 95% attributable basis; the remaining 5% interest is held by IMISA. Mineral Resources have an effective date of December 31, 2016. The Qualified Person for the estimate is Brian Scott, P.Geo., who is our Vice President, Geology and Technical Services. Mineral Resource estimates assume underground long-hole stoping mining methods, a gold price of US$1,400/oz, metallurgical recovery of 93.5%, and operating cost estimates of US$58.05–82.39/t of ore mined (mining), US$26.33/t of ore processed (processing) and US$13.14/t processed (general and administrative). Mineral Resources are reported at cutoffs that range from 2.7–2.9 g/t Au. |

|

| 7. |

Kiaka Project: Mineral Resources are reported on an 81% attributable basis; the remaining interest is held by GAMS-Mining F&I Ltd (9%) a Cypriot company, and the Government of Burkina Faso (10%). The Mineral Resource estimate has an effective date of January 8, 2013. The Qualified Person for the estimate is Ben Parsons, MSc, MAusIMM (CP), Principal Consultant for SRK Consulting. Mineral Resources assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 89.8%, and operating cost estimates of US$1.58/t mined (mining), US$11.89/t processed (processing, and general and administrative). Mineral Resources are reported at a cutoff of 0.4 g/t Au. |

|

| 8. |

Gramalote Project: Mineral Resources are reported on a 49% attributable basis; the remaining 51% interest is held by AngloGold Ashanti Limited. Mineral Resources have an effective date of October 6, 2015. The Qualified Person for the estimate is Vaughan Chamberlain, FAusIMM, Senior Vice President, Geology and Metallurgy for AngloGold. Mineral Resources assume an open pit mining method, gold price of US$1,400, metallurgical recovery of 95%, and operating cost estimates of US$5.40/t processed (processing) and US$1.19 /t processed (general and administrative). Mineral Resources are reported at a cutoff of 0.1 g/t Au. |

|

| 9. |

Stockpiles: Mineral Resources are reported in the totals for the Masbate and Otjikoto mines, and were prepared by mine site personnel at each operation. Ore stockpile balances are derived from mining truck movements to individual stockpiles or detailed surveys, with grade estimated from routine grade control methods. Stockpile cutoffs vary by deposit, from 0.25–0.7 g/t Au. |

MATERIAL PROPERTIES

Fekola Project

Certain portions of the following information are derived from and based on the technical report entitled “NI 43-101 Technical Report Feasibility Study on the Fekola Gold Project in Mali” that has an effective date of June 30, 2015, and was prepared by Tom Garagan, P.Geo, William Lytle, P.E, Peter Montano, P.E., Ken Jones, P.E., Sandra Hunter, MAusIMM(CP), and David J. T. Morgan, MIEAust CPEng (the “Fekola Feasibility Study”) and is based on the assumptions, qualifications and procedures set out therein. For a more detailed overview of the Fekola Project, please refer to the Fekola Feasibility Study, which is available on SEDAR at www.sedar.com. Information that post-dates the Fekola Feasibility Study is provided by the Company.

Property Description, Location, and Access

The Fekola Project is situated in southwestern Mali, on the border between Mali and Senegal. The Fekola deposit is located about 210 kilometres (“km”) south of Kayes and approximately 40 km south of the city of Kéniéba, in the Kayes Region. From Bamako, the Malian capital, it is about a 480 km drive along the Millennium Highway to Kéniéba, then 40 km along a newly-completed two-way traffic road from the Millennium Highway to the mine site. The mine can also be accessed by road from Dakar in Senegal. The mine is also serviced by a purpose-built gravel airstrip.

Permit number 0070/PM-RM (the “Médinandi Exploitation License”), which has an area of 75 square kilometers (“km2”) was granted on February 13, 2014, and is valid to February 2044, a 30-year term. The Médinandi Exploitation License was initially held in the name of Songhoi. B2Gold initially acquired a 90% interest in Songhoi through the acquisition of Papillon in October 2014, and purchased the remaining 10% non-controlling interest in Songhoi held by Mani SARL (“Mani”) through a subsequent transaction in January 2015.

- 17 -

Fekola S.A., the new Malian exploitation company, was incorporated on March 17, 2016 and merged with Songhoi in December 2016 to become the holder of the Médinandi Exploitation Licence. Upon signing of a Fekola Shareholder Agreement, the Company will contribute a 10% free carried interest in Fekola S.A. to the State of Mali as required under the 2012 Mining Code, so that the shareholding will be distributed as follows: 90% indirectly to B2Gold, through its subsidiary Mali Mining Investments Limited, which owns Fekola S.A. and 10% to the State of Mali. Under the 2012 Mining Code, the State of Mali also has the option to purchase an additional 10% participating interest in Fekola S.A. on market terms, which it has confirmed its intent to exercise. As a result, it is expected that the State of Mali will hold an 20% interest in Fekola S.A. The 2012 Mining Code introduced an option for Malian private investors to acquire for cash at least 5% of the shares of an exploitation company, under the same conditions as other private shareholders. The conditions for the exercise of such right by Malian private investors and the exact obligations of a mining operator have not been specifically set out in either the 2012 Mining Code or the regulations published in 2012 that follow the 2012 Mining Code. We have signed the Fekola Convention in the form required under the 2012 Mining Code that relates to, among other things, the ownership, permitting, reclamation bond requirements, development, operation and taxation applicable to the Fekola Project with the State of Mali. We are currently in the process of negotiating certain matters with the State of Mali including: (i) the Fekola Shareholder Agreement, (ii) the valuation and terms under which the State of Mali may acquire its additional 10% ownership interest in Fekola S.A., and (iii) certain other matters to address and clarify certain issues under the 2012 Mining Code and the Fekola Convention including, the terms of the reclamation bond for the Fekola Project, the right of Malian private investors under the 2012 Mining Code, the final ownership of Fekola S.A. and the entity to operate the Fekola Project. The Fekola Convention, as it may be amended, is expected to govern the procedural and economic parameters pursuant to which the Company will operate the Fekola Project.

The State of Mali owns all of the surface rights in the Fekola Project area and no surface rights have been registered to a private entity. There are a number of small villages in the Exploitation License area, but there are currently no known inhabitants in a “no-go” zone, which is the area required for mining operations, infrastructure, and a 500 metre (“m”) buffer zone around the active blasting area. Farmers and other inhabitants have previously been relocated and compensation has been paid and there are no expected future payments or liabilities associated with the completed relocation effort. The Company has also approved a plan to relocate the village of Fadougou, located adjacent to the main Fekola pit. While the relocation of the village was not a requirement in the construction permit, after extensive stakeholder engagement with the local population, the Company decided to proceed with it because of the near proximity of the village to the mine site. Relocation will be completed in accordance with a Resettlement Action Plan (“RAP”) that was completed by an independent consultant in consultation with all stakeholders. The RAP has been submitted to the appropriate Malian authorities and the Company is currently in the process of acquiring the land necessary for relocation. It is anticipated that the relocation process will take two years to complete.

A 1.65% royalty is payable to Zoumana Traore SARL.

The financial model in the Fekola Feasibility Study was prepared on a pre-tax basis. The 2012 Mining Code introduced an ad valorem tax applicable to all substances, the taxable basis of which is the square-mine value of extracted substances, exported or not, minus intermediary fees and expenses. The tax rate is based on specified mining groups. Gold and other precious metals are levied at a 3% royalty rate.

Value-added tax (“VAT”) is payable in Mali; however, the 2012 Mining Code has a provision that exploitation license holders have a three year VAT exemption period. Corporate income tax in Mali is 30%. For exploitation license holders, there is a 15-year period from the start of production where the corporate income tax is reduced to 25%.

A new tax has been introduced applying to holders of an exploitation license that produce, in one year, more than 10% of the expected quantity fixed in the annual production program approved by its shareholders’ general assembly. This new tax consists of standard taxes and rights applying to operations and results relating to overproduction.

- 18 -

A special tax on certain products (Impôt Spécial sur Certains Produits or “ISCP”), calculated on the basis of turnover exclusive of VAT, also applies and is based on the specified mining group assignment. For a gold project, the applicable ISCP rate in force upon enactment of the 2012 Mining Code was 3%.

To the extent known, there are no other significant factors or risks that might affect access or title, or the right or ability to perform work on, the property, including permitting and environmental liabilities to which the project is subject that are not discussed in this Annual Information Form.

History

A number of companies have completed exploration activities in the general Fekola area, including Société Nationale de Recherches et d’Exploitation des Ressources Minières de Mali, Bureau de Recherches Géologiques et Minières, the Guefest Company, Western African Gold and Exploration S.A., Randgold Resources Ltd., Central African Gold plc (“Central African”) and Papillon.

The work programs included geological reconnaissance, interpretation of Landsat and aeromagnetic data, regional geological and regolith mapping, ground induced polarization (“IP”) geophysical surveys, airborne magnetic and electromagnetic (“EM”) surveys, soil, rock, and termite geochemical sampling, trenching, auger, rotary air blast (“RAB”), air core, reverse circulation (“RC”) and core drilling, Mineral Resource estimates and updates to those estimates, environmental studies to support environmental permit applications, geotechnical and hydrological surveys and water sampling, topographic surveys, metallurgical sampling, upgrading of access roads and the accommodation camp, and mining and technical studies.

Using assumptions and allowances in the 2004 Australasian JORC Code, Papillon completed a scoping-level study in 2012, and a pre-feasibility study in 2013; both studies indicated positive project economics using the assumptions in the studies. We completed the Fekola Feasibility Study in 2015, and subsequently commenced mine development activities. There are no historical estimates that are relevant to the current Mineral Resources and Mineral Reserves.

There has been no formal production from the mine area by the Company; however, there are known areas of artisanal mining activity.

Geological Setting, Mineralization, and Deposit Types

The Fekola deposit is hosted in Birimian Supergroup rocks within the eastern portion of the Paleo-Proterozoic Kédougou–Kéniéba inlier, which covers eastern Senegal and western Mali. It is considered to be an example of an orogenic-style gold deposit.

The deposit is hosted by a moderate to steeply west dipping, folded sequence of marine meta-sediments of the Kofi group, which locally include: minor pelitic sediments; fine grained turbidites, comprising laminated to thin-bedded siliciclastic siltstone and mudstone; and a heterolithic, mass flow breccia, or conglomerate. Thin discontinuous marble units are present as a volumetrically minor rock type inter-bedded with the pelitic units. Minor mafic volcanic, or volcaniclastic units occur locally in the upper and possibly, lower portions of the hanging wall stratigraphy. Weakly feldspar-phyric felsic dykes are locally observed. The deposit has been subjected to greenschist facies metamorphism.

Mineralization has been traced over a strike extent of approximately 1.5 km, to depths of as much as 400 m below surface, and up to 300 m wide. The greatest continuity is observed within a high grade shoot (>2 g/t Au) which plunges approximately 13° to the north–northwest. Mineralization remains open at depth, down plunge, and to the north.

Gold mineralization is associated with fine-grained disseminated pyrite and local pyrite veinlets. The total sulphide content of the deposit is typically less than 5%. Mineralization is also associated with a pervasive, texturally destructive, hydrothermal dolomite alteration. Hydrothermal alteration and gold mineralization appear to be synchronous with the development of north to north–northwest plunging folds within a corridor of ductile, high-strain deformation.

- 19 -

Exploration

Exploration activities completed by the Company include a light detection and ranging (“LIDAR”) survey; regolith and geological mapping; geochemical soil, termite mound, rock chip and grab sampling; ground geophysical surveys (IP, gradient, resistivity, pole–dipole, gravimetric); airborne geophysical surveys (aeromagnetic); and pitting and trenching.

The LIDAR survey was used to generate a contour map of the project area. Regolith mapping was performed to determine which areas of the regolith profile were insitu, and therefore could provide reliable geochemical sampling results. Geochemical sampling was used as a first-pass tool to define areas of gold anomalism. Geophysical data have been used to develop the broad lithological and structural framework for the project area. Pits and trenches were used to provide additional information on areas of gold anomalism, and were completed as part of the geotechnical appraisal of the planned plant and tailings storage facility areas.

In addition to the Fekola deposit, the exploration activities have identified the following prospects:

| • |

Kiwi Zone: The Kiwi zone is located approximately 640m north of the proposed pit limits of the Fekola deposit. At Kiwi, exploration is targeting a potential new mineralization shoot, similar to the shallowly north-northwest plunging, main high-grade portion of the Fekola deposit. The shoot occurs approximately 300m up-dip from the Fekola Deeps zone in what appears to be a separate and distinct zone of mineralized folds within the Fekola shear zone. | |

| • |

Weaver Zone: The Weaver zone is located approximately 2.5km north of the Fekola pit. Structural and lithological modeling of historical drill data suggests that prospective stratigraphy and the shear zone controlling gold mineralization at the Fekola deposit persist along strike to the north of the Fekola pit. Weaver may represent a previously unrecognized shoot-like structure, similar to the Fekola deposit, within the Fekola shear zone. | |

| • |

Anaconda Zone: A significant, near-surface zone of saprolite-hosted gold mineralization has been intersected within an area 1,300m long by 600m wide, across an average drill thickness intercept of 23m. | |

| • |

Adder Zone. This comprises saprolite-hosted gold mineralization located immediately west of and contiguous with Anaconda. Mineralization at Adder occurs within a northerly-trending linear zone approximately 2,450m long by 250m wide, across an average drill hole thickness intercept of 18m. | |

| • |

Cobra Zone. This saprolite and potential hard rock zone has a strong element of structural control and has been defined over a strike length of 2km and averages approximately 20m in width. |

Additional zones of saprolite-hosted gold mineralization have been discovered at Mamba and Boomslang, which occur approximately 1km east of Adder and Anaconda, respectively.

Our current and planned exploration activities are discussed under Fekola Project - Exploration, Development, and Production.

Drilling

Drilling has been completed in support of exploration evaluations, Mineral Resource and Mineral Reserve estimates, mine planning, geotechnical and hydrogeological evaluations, and infrastructure site sterilization and condemnation drilling.

Drilling completed at Fekola includes auger, RAB, aircore, RC, and core drilling methods. Drilling and sampling completed prior to January 2007 are not considered part of the current active database, and are not used in support of Mineral Resource estimation. Drilling completed as of December 31, 2016 on the licences in Mali includes 365 core holes (88,312 m), 1,756 RC holes (199,748 m), 2,122 aircore holes (82,782 m) and 8,906 auger holes (69,959 m).

Drilling that supports the Mineral Resource estimates was completed from January 2007 to May 26, 2016. A total of 685 drill holes (131,750 m) were available in the immediate area of the Mineral Resource estimates. There are 211 core holes (62,834 m), 433 RC holes (54,404 m) and 41 holes (14,512 m) that commenced with an RC collar and were completed with core.

- 20 -

Both RC chips and core are photographed and logged. Recoveries are recorded. Drill hole collar locations are surveyed using global positioning system (“GPS”) instruments. Down-hole surveys are performed at regular down-hole intervals using Reflex instrumentation. Most of the drill holes at Fekola are drilled at -50º to -55º to the east (N90 E) which intersects the main mineralized zone at a high angle. In general, true thicknesses are 70% to 80% of the sampled length.