UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Fiscal Year Ended October 31, 2019

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission file number 1-33913

_______________________________

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (713 ) 961-4600

_______________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: NONE

_______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company," and "emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

x | Accelerated filer | ☐ | ||

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of April 30, 2019, computed by reference to the closing price for the Common Stock on the New York Stock Exchange, Inc. on that date, was $544,032,919 . Such calculation assumes only the registrant’s officers and directors at such date were affiliates of the registrant.

At December 9, 2019 there were outstanding 33,019,430 shares of the registrant’s Common Stock, $0.01 par value.

_______________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2020 Annual Meeting of Stockholders to be filed with the Commission within 120 days of October 31, 2019 are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | Mine Safety Disclosures | |

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | Other Information | |

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Unless the context indicates otherwise, references to "Quanex", the "Company", "we", "us" and "our" refer to the consolidated business operations of Quanex Building Products Corporation and its subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

Certain of the statements contained in this document and in documents incorporated by reference herein, including those made under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are “forward-looking” statements as defined under the Private Securities Litigation Reform Act of 1995. Generally, the words “expect,” “believe,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward looking statements are (1) all statements which address future operating performance, (2) events or developments that we expect or anticipate will occur in the future, including statements relating to volume, sales, operating income and earnings per share, and (3) statements expressing general outlook about future operating results. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our current projections or expectations. As and when made, we believe that these forward-looking statements are reasonable. However, caution should be taken not to place undue reliance on any such forward-looking statements since such statements speak only as of the date when made and there can be no assurance that such forward-looking statements will occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to the following:

• | changes in market conditions, particularly in the new home construction, and residential remodeling and replacement activity markets in the United States, United Kingdom, Germany and elsewhere; |

• | changes in non-pass-through raw material costs; |

• | changes in domestic and international economic conditions; |

• | changes in purchases by our principal customers; |

• | fluctuations in foreign currency exchange rates; |

• | our ability to maintain an effective system of internal controls; |

• | our ability to successfully implement our internal operating plans and acquisition strategies; |

• | our ability to successfully implement our plans with respect to information technology (IT) systems and processes; |

• | our ability to control costs and increase profitability; |

• | changes in environmental laws and regulations; |

• | changes in warranty obligations; |

• | changes in energy costs; |

• | changes in tax laws, and interpretations thereof; |

• | changes in interest rates; |

• | our ability to service our debt facilities and remain in good standing with our lenders; |

• | changes in the availability or applicability of our insurance coverage; |

• | our ability to maintain good relationships with our suppliers, subcontractors, and key customers; and |

• | the resolution of litigation and other legal proceedings. |

Additional factors that could cause actual results to differ materially are discussed under "Item 1A. Risk Factors” included elsewhere in this Annual Report on Form 10-K.

About Third-Party Information

In this report, we rely on and refer to information regarding industry data obtained from market research, publicly available information, industry publications, United States government sources and other third parties. Although we believe this information is reliable, we cannot guarantee the accuracy or completeness of the information and have not independently verified it.

PART I

Item 1. Business.

Our Company

Quanex was incorporated in Delaware on December 12, 2007, as Quanex Building Products Corporation. We manufacture components for original equipment manufacturers (OEM) in the building products industry. These components can be categorized as window and door (fenestration) components and kitchen and bath cabinet components. Examples of fenestration components include (1) energy-efficient flexible insulating glass spacers, (2) extruded vinyl profiles, (3) window and door screens, and (4) precision-formed metal and wood products. In addition, we provide certain other non-fenestration components and products, which include solar panel sealants, trim moldings, vinyl decking, fencing, water retention barriers, and conservatory roof components. We use low-cost production processes and engineering expertise to provide our customers with specialized products for their specific window, door, and cabinet applications. We believe these capabilities provide us with unique competitive advantages. We serve a primary customer base in North America and the United Kingdom (U.K.), and also serve customers in international markets through our operating plants in the U.K. and Germany, as well as through sales and marketing efforts in other countries.

Our History

Our predecessor company, Quanex Corporation, was organized in Michigan in 1927 as Michigan Seamless Tube Company, and was later reincorporated in Delaware in 1968. In 1977, Michigan Seamless Tube Company changed its name to Quanex Corporation. On December 12, 2007, Quanex Building Products Corporation was incorporated as a wholly-owned subsidiary in the state of Delaware, in order to facilitate the separation of Quanex Corporation's vehicular products and building products businesses. This separation became effective on April 23, 2008, through a spin-off of the building products business to Quanex Corporation's then-existing shareholders. Immediately following the spin-off, our former parent company, consisting principally of the vehicular products business and all non-building products related corporate accounts, merged with a wholly-owned subsidiary of Gerdau S.A.

Since the spin-off in 2008, we have evolved our business by making investments in organic growth initiatives and taking a disciplined approach to new business and strategic acquisition opportunities, while disposing of non-core businesses.

Notable developments and transactions which occurred since the spin-off include the following:

• | in March 2011, we acquired Edgetech, I.G. Inc. and its German subsidiary, which provided us with three manufacturing facilities, one each in the United States (U.S.), U.K. and Germany, that produce and market a full line of flexible insulating glass spacer systems for window and door customers in North America and abroad. This acquisition complemented our then existing insulating glass products business in the U.S.; |

• | in December 2012, we acquired substantially all of the assets of Alumco Inc. and its subsidiaries (Alumco), an aluminum screen manufacturer, which allowed us to expand the scope of our fenestration business to include screens for vinyl window and door manufacturers and to expand our geographic reach throughout the U.S.; |

• | in April 2014, we sold our interest in a limited liability company which held the net assets of our Nichols Aluminum business to a privately held company that provides aluminum rolled products and extrusions, aluminum recycling and specification aluminum alloy production; |

• | in June 2015, we acquired the outstanding ownership shares of Flamstead Holdings Limited, an extruder of vinyl lineal products and manufacturer of other plastic products incorporated and registered in England and Wales. Following a pre-sale reorganization and purchase, Flamstead Holdings Limited owned 100% of the ownership shares of the following subsidiaries: HL Plastics Limited, Vintage Windows Limited, Wegoma Machinery Sales Limited (renamed in 2016 as Avantek Machinery Company), and Liniar Limited (collectively referred to as “HLP”), each registered in England and Wales. This acquisition expanded our vinyl extrusion product offerings and grew our international presence in the global fenestration business; |

• | in November 2015, we completed the merger of QWMS, Inc., a Delaware corporation which was a newly-formed and wholly-owned Quanex subsidiary, and WII Holding, Inc. (WII), a Delaware corporation. Upon satisfaction or waiver of conditions set forth in the merger agreement, QWMS, Inc. merged with and into WII, and WII became our wholly-owned subsidiary, and, as a result, we acquired all the subsidiaries of WII (referred to collectively as Woodcraft). Woodcraft is a manufacturer of cabinet doors and other components for OEMs in the kitchen and bathroom cabinet industry, operating various plants in the U.S. and Mexico; |

4

• | in October 2016, we committed to a restructuring plan that included the closure of two vinyl extrusion plants in the U.S. and our kitchen and bathroom cabinet door plant in Guadalajara, Mexico; and |

• | in September 2017, we closed a kitchen and bathroom cabinet door plant in Lansing, Kansas, and, in October 2017, sold a wood-flooring business in Shawano, Wisconsin. |

As of October 31, 2019, we operated 30 manufacturing facilities located in 17 states in the U.S., two facilities in the U.K., and one in Germany. These facilities feature efficient plant design and flexible manufacturing processes, enabling us to produce a wide variety of custom engineered products and components primarily focused on the window and door segment of the residential building products markets. We are able to maintain minimal levels of finished goods inventories at most locations because we typically manufacture products upon order to customer specifications. We believe the primary drivers of our operating results are residential remodeling and replacement activity and new home construction in the markets we serve.

Our Industry

Our business is largely North American based and dependent upon the spending and growth activity levels of our customers which include national and regional residential window, door and cabinet manufacturers. Our international presence includes vinyl extruded lineals for house systems to smaller customers primarily in the U.K., as well as our insulating glass business in the U.K. and Germany.

We use data related to housing starts and window shipments in the U.S., as published by or derived from third-party sources, to evaluate the fenestration market in these countries. We also use data related to cabinet demand in the U.S. to evaluate the residential cabinet market.

The following table presents calendar-year annual housing starts information as of October 2019 the National Association of Home Builders (NAHB) (units in thousands):

Single-family Units | Multi-family Units | Manufactured Units | ||||||||||||

Period | Units | % Change | Units | % Change | Units | % Change | Total Units | |||||||

Annual Data | ||||||||||||||

2013 | 620 | N/A | 308 | N/A | 60 | N/A | 988 | |||||||

2014 | 647 | 4% | 355 | 15% | 64 | 7% | 1,066 | |||||||

2015 | 713 | 10% | 394 | 11% | 71 | 11% | 1,178 | |||||||

2016 | 786 | 10% | 392 | (1)% | 81 | 14% | 1,259 | |||||||

2017 | 852 | 8% | 357 | (9)% | 93 | 15% | 1,302 | |||||||

2018 | 873 | 2% | 377 | 6% | 97 | 4% | 1,347 | |||||||

Annual Data - Forecast | ||||||||||||||

2019 | 854 | (2)% | 383 | 2% | 97 | —% | 1,334 | |||||||

2020 | 873 | 2% | 385 | 1% | 111 | 14% | 1,369 | |||||||

2021 | 893 | 2% | 399 | 4% | 115 | 4% | 1,407 | |||||||

5

Ducker Worldwide LLC, a consulting and research firm, indicated that window shipments in the residential remodeling and replacement (R&R) market are expected to decline slightly during the calendar year ended 2019, increase 2% during 2020 and increase 3% during 2021. Derived from reports published by Ducker, the overall decline in window shipments for the trailing twelve months ended September 30, 2019 was 1.6%. During this period, R&R activity and new construction decreased 0.9% and 2.5%, respectively.

According to Catalina Research, a consulting and research firm, total U.S. residential cabinet demand is expected to increase through 2020. Projections from Catalina Research as of September 2019 include growth rates for the stock, semi-custom (the cabinet market we primarily operate in) and custom cabinet markets, which are presented in the table below:

Cabinet Market Annual Growth Rates | ||||||||

Period | Stock | Semi-Custom | Custom | Overall | ||||

Annual Data | ||||||||

2012 | (4.9)% | 10.0% | 5.3% | 1.7% | ||||

2013 | 28.9% | 5.7% | 6.3% | 17.0% | ||||

2014 | 16.6% | (15.6)% | (10.0)% | 2.3% | ||||

2015 | 16.7% | 10.1% | 21.6% | 15.4% | ||||

2016 | 5.3% | 1.0% | 8.1% | 4.4% | ||||

2017 | 7.3% | 5.7% | (0.3)% | 6.0% | ||||

Annual Data - Forecast | ||||||||

2018 | 7.9% | (1.6)% | 3.8% | 4.9% | ||||

2019 | 4.4% | (2.6)% | 4.6% | 2.7% | ||||

2020 | 4.2% | 0.5% | 3.8% | 3.3% | ||||

We have noted the following trends which we believe affect our industry:

• | the recent growth in the housing market over the past several years has been predominately in new construction which has outpaced the growth in the residential remodeling and replacement sector; |

• | the recovery of the housing market has slowed due primarily to the declining growth of multi-family units; |

• | programs in the U.S. such as Energy Star have improved customer awareness of the technological advances in window and door energy-efficiency, but the government has been reluctant to enforce stricter energy standards; |

• | foreign currency rates in the U.K. and other European nations have changed significantly relative to the United States Dollar due in part to Brexit in the U.K., as well as other international unrest or uncertainties; |

• | commodity prices have fluctuated in recent years, and to the extent we cannot pass this cost to our customers, this impacts the cost of critical materials used in our manufacturing processes such as resin, which affects margins related to our vinyl extrusion products; oil products such as butyl, which affects our insulating glass products; and aluminum, wood and silicone products used by our other businesses; and |

• | higher energy efficiency standards in Europe should favorably impact sales of our insulating glass spacer products in the short- to mid-term. |

Strategy

Our vision is to be the preferred supplier to our customers in each market we serve. Our strategy to achieve this vision includes the following:

• | focus on organic growth with our current customer base and expand our market share with national and regional customers by providing: (1) a quality product; (2) a high level of customer service; (3) product choices at different price points; and (4) new products or enhancements to existing product offerings. These enhancements may include higher thermal efficiency, enhanced functionality, improved weatherability, better appearance and best-in-class quality for our fenestration and cabinet door products; |

• | realize improved profitability in our manufacturing processes through: (1) ongoing preventive maintenance programs; (2) better utilization of our capacity by focusing on operational efficiencies and reducing scrap; (3) marketing our value added products; and (4) focusing on employee safety; |

• | offer logistic solutions that provide our customers with just-in-time service which can reduce their processing costs; |

6

• | pursue targeted business acquisitions that allow us to expand our existing footprint, enhance our existing product offerings, acquire complementary technology, enhance our leadership position within the markets we serve, and expand into adjacent markets or service lines; and |

• | exit unprofitable service lines or customer relationships. |

Our Strengths

We believe our strengths include design expertise, new technology development capability, high quality manufacturing, just-in-time delivery systems, customer service, the ability to generate unique patented products and participation in industry advocacy.

Raw Materials and Supplies

We purchase a diverse range of raw materials, which include PVC resin, epoxy resin, butyl, titanium dioxide (TiO2) desiccant powder, silicone and EPDM rubber compounds, coated and uncoated aluminum sheet and wood (both hardwood and softwood). These raw materials are generally available from several suppliers at market prices. We may enter into sole sourcing arrangements with our suppliers from time to time if we believe we can realize beneficial savings, but only after we have determined that the vendor can reliably supply our raw material requirements. These sole sourcing arrangements generally have termination clauses to protect us if a sole sourced vendor could not provide raw materials timely and on economically feasible terms. We believe there are other qualified suppliers from which we could purchase raw materials and supplies.

Competition

Our products are sold under highly competitive conditions. We compete with a number of companies, some of which have greater financial resources than us. We believe the primary competitive factors in the markets we serve include price, product quality, delivery and the ability to manufacture to customer specifications. The volume of engineered building products that we manufacture represents a small percentage of annual domestic consumption. Similarly, our subsidiaries in the U.K. compete against some larger vinyl producers and smaller window manufacturers. For our kitchen and bathroom cabinet door business, we believe we are the largest supplier to OEMs in the U.S., but we compete with other national and regional businesses, including OEMs who are vertically integrated.

We compete against a range of small and mid-size metal, vinyl and wood products suppliers, wood molding companies, and the in-house operations of customers who have vertically integrated fenestration operations. We also compete against insulating glass (IG) spacer manufacturing firms. IG systems are used in numerous end markets including residential housing, commercial construction, appliances and transportation vehicles, but we primarily serve the residential housing market. Competition is largely based on regional presence, custom engineering, product development, quality, service and price. Primary competitors include, but are not limited to, Veka, Deceuninck, Energi, Vision Extrusions, GED Integrated Solutions, Technoform, Swiss Spacer, Thermix, RiteScreen, Allmetal, and Endura. Competitors in the vinyl extrusion business in the U.K. include Epwin, Veka, Synseal, Eurocell and others. Primary competitors in the cabinet door business in the U.S. include Conestoga, Decore-ative Specialties, Northern Contours and others.

Sales, Marketing, and Distribution

We sell our products to customers in various countries. Therefore, we have sales representatives whose territories essentially cover the U.S., Canada, Europe, and to a lesser extent, the Middle East, Latin and South America, Australia, New Zealand and Asia. Our sales force is tasked with selling and marketing our complete range of components, products and systems to national and regional OEMs through a direct sales force in North America and Europe, supplemented with the limited use of distributors and independent sales agents.

Customers

Certain of our businesses or product lines are largely dependent on a relatively few large customers. See Note 1, "Nature of Operations, Basis of Presentation and Significant Accounting Policies - Concentration of Credit Risk and Allowance for Doubtful Accounts," of the accompanying financial statements in this Annual Report on Form 10-K for related disclosure.

Sales Backlog

Given the short lead times involved in our business, we have a relatively low backlog, approximately $25 million as of October 31, 2019. The criteria for revenue recognition has not been met with regard to sales backlog, and therefore, we have not recorded revenue or deferred revenue pursuant to these sales orders. If these sales orders result in a sale, we will record revenue during fiscal 2020 in accordance with our revenue recognition accounting policy.

7

Seasonal Nature of Business

Our business is impacted by seasonality. We have historically experienced lower sales for our products during the first half of our fiscal year as winter weather reduces homebuilding and home improvement activity. Our operating income tends to decline during this period of lower sales because a higher percentage of our operating expenses are fixed overhead. We typically experience more favorable results in the third and fourth quarters of the fiscal year. Our exposure to seasonality was somewhat tempered with the entry into the kitchen and bathroom cabinet door industry, which is focused "inside the house" and less susceptible to inclement weather. Expenses for labor and other costs are generally semi-variable throughout the year.

Working Capital

We fund operations through a combination of available cash and cash equivalents, cash flow generated from our operations, and borrowings from our revolving credit facility. We extend credit to our domestic customers in the ordinary course of business generally for a term of 30 days, while the terms for our international customers vary from cash advances to 90 days. Inventories of raw materials are carried in quantities deemed necessary to ensure a smooth production process, some of which are governed by consignment agreements with suppliers. We strive to maintain minimal finished goods inventories, while ensuring an adequate supply on hand to service customer needs.

Service Marks, Trademarks, Trade Names, and Patents

Our federally registered trademarks or service marks include QUANEX, QUANEX and design, "Q" design, TRUSEAL TECHNOLOGIES, DURASEAL, DURALITE, SOLARGAIN EDGE TAPE, ENVIROSEALED WINDOWS, EDGETHERM, EDGETECH, ECOBLEND, SUPER SPACER, TSS, TRUE WARM, E & Design, QUIET EDGE, HEALTH SMART WINDOWS, ENERGY WISE WINDOWS, DESI-ROPE, 360 and design, INTELLICLIP, SUSTAINAVIEW, MIKRON, MIKRONWOOD, MIKRONBLEND, MIKRON BLEND and design, ENERGYCORE, FUSION INSULATED SYSTEM, AIRCELL, SUPERCOAT, SUPERCAP, STYLELOCK, STYLELOCK and design, K2 MIKRON and design, HOMESHIELD, HOMESHIELD and design, STORM SEAL, and TENON. We consider the following marks, design marks and associated trade names to be valuable in the conduct of our business: HOMESHIELD, TRUSEAL TECHNOLOGIES, EDGETECH, MIKRON, WOODCRAFT and QUANEX. Through HLP, we hold a number of registered designs, patents and trademarks registered in the U.K., which include: MODLOK, LINIAR, SUPERCUT, and various other trademarks and patents which are pending approval. Generally, our business does not depend on patent protection, but patents obtained with regard to our vinyl extrusion products and processes, fabricated metal components and IG spacer products business remain a valuable competitive advantage over other building products manufacturers. We obtain patent protection for various dies and other tooling created in connection with the production of customer-specific vinyl profile designs and vinyl extrusions. Our fabricated metal components business obtains patent protection for its thresholds. Our window sealant business unit relies on patents to protect the design of several of its window spacer products. Although we hold numerous patents, the proprietary process technology that has been developed is also considered a source of competitive advantage.

Environmental and Employee Safety Matters

We are subject to extensive laws and regulations concerning worker safety, the discharge of materials into the environment and the remediation of chemical contamination. To satisfy such requirements, we must make capital and other expenditures on an on-going basis. The cost of worker safety and environmental matters has not had a material adverse effect on our operations or financial condition in the past, and we are not currently aware of any existing conditions that we believe are likely to have a material adverse effect on our operations, financial condition, or cash flows.

8

Safety and Environmental Policies

For many years, we have maintained compliance policies that are designed to help protect our workforce, to identify and reduce the potential for job-related accidents, and to minimize liabilities and other financial impacts related to worker safety and environmental issues. These policies include extensive employee training and education, as well as internal policies embodied in our Code of Business Conduct and Ethics. We have a Director of Environmental, Health and Safety and maintain a company-wide committee, comprising leaders from across the organization, which meets regularly to discuss safety issues and drive safety improvements. We plan to continue to focus on safety in particular as a core strategy to improve our operational efficiency and financial performance.

Remediation

Under applicable state and federal laws, we may be responsible for, among other things, all or part of the costs required to remove or remediate wastes or hazardous substances at locations we, or our predecessors, have owned or operated. From time to time, we also have been alleged to be liable for all or part of the costs incurred to clean up third-party sites where there might have been an alleged improper disposal of hazardous substances. At present, we are not involved in any such matters.

Environmental Compliance Costs

From time to time, we incur routine expenses and capital expenditures associated with compliance with existing environmental regulations, including control of air emissions and water discharges, and plant decommissioning costs. We have not incurred any material expenses or capital expenditures related to environmental matters during the past three fiscal years, and do not expect to incur a material amount of such costs in fiscal 2020. While we will continue to have future expenditures related to environmental matters, any such amounts are impossible to reasonably estimate at this time. Based upon our experience to date, we do not believe that our compliance with environmental requirements will have a material adverse effect on our operations, financial condition or cash flows.

Employees

As of October 31, 2019, we had 3,632 employees. Of these employees, 2,988 were domiciled in the U.S., 558 in the U.K., and 86 in Germany.

For Investors

We periodically file or furnish documents to the Securities and Exchange Commission (SEC), including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports as required. These reports are also available free of charge from the Investor Relations Section of our website at http://www.quanex.com, as soon as reasonably practicable after we file such material or furnish it to the SEC. As permitted by the SEC rules, we post relevant information on our website. However, the information contained on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report.

Item 1A. Risk Factors.

The following risk factors, along with other information contained elsewhere in this Annual Report on Form 10-K and our other public filings with the SEC, should be carefully considered before deciding to invest in our securities. Additional risks and uncertainties that are not currently known to us or that we may view as immaterial could impair our business if such risks were to develop into actual events. Therefore, any of these risks could have a material adverse effect on our financial condition, results of operations and cash flows. This listing of risk factors is not all-inclusive and is not necessarily presented in order of importance.

Industry Risks

Any sustained decline in residential remodeling, replacement activities, or housing starts could have a material adverse effect on our business, financial condition and results of operations.

The primary drivers of our business are residential remodeling, replacement activities and housing starts. The home building and residential construction industry is cyclical and seasonal, and product demand is based on numerous factors such as interest rates, general economic conditions, consumer confidence and other factors beyond our control. Declines in the number of housing starts and remodeling expenditures resulting from such factors could have a material adverse effect on our business, results of operations and financial condition.

9

If the availability of critical raw materials were to become scarce or if the price of these items were to increase significantly, we might not be able to timely produce products for our customers or maintain our profit levels.

We purchase from outside sources significant amounts of raw materials, such as butyl, titanium dioxide, vinyl resin, aluminum, steel, silicone and wood products for use in our manufacturing facilities. Because we do not have long-term contracts for the supply of many of our raw materials, their availability and price are subject to market fluctuation and may be subject to curtailment or change. Any of these factors could affect our ability to timely and cost-effectively manufacture products for our customers.

Compliance with, or liabilities under, existing or future environmental laws and regulations could significantly increase our costs of doing business.

We are subject to extensive federal, state and local laws and regulations concerning the discharge of materials into the environment and the prevention and/or remediation of chemical contamination. To satisfy such requirements, we must make capital and other expenditures on an on-going basis. Future expenditures relating to environmental matters will necessarily depend upon whether such regulations and future governmental decisions or interpretations of these regulations apply to us and our facilities. It is likely that we will be subject to increasingly stringent environmental standards, and we will incur additional expenditures to comply with such standards. Furthermore, if we fail to comply with applicable environmental regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

Our goodwill and indefinite-lived intangible assets may become impaired and could result in a charge to income.

We evaluate our goodwill and indefinite-lived intangible assets at least annually to determine whether we must test for impairment. In making this assessment, we must use judgment to make estimates of future operating results and appropriate residual values. Actual future operating results and residual values associated with our operations could differ significantly from these estimates, which may result in an impairment charge in a future period, resulting in a decrease in net income from operations in the year of the impairment, as well as a decline in our recorded net worth. We recorded goodwill impairment charges in 2019 and 2016 and could record future impairment charges. Goodwill totaled $145.6 million at October 31, 2019. The results of goodwill impairment testing are described in the accompanying notes to the audited financial statements, Note 5, "Goodwill and Intangible Assets" included elsewhere in this Annual Report on Form 10-K.

We may not be able to protect our intellectual property.

We rely on a combination of copyright, patent, trade secrets, confidentiality procedures and contractual commitments to protect our proprietary information. However, these measures can only provide limited protection and unauthorized third parties may try to copy or reverse engineer portions of our products or may otherwise obtain and use our intellectual property. If we cannot protect our proprietary information against unauthorized use, we may not be able to retain a perceived competitive advantage and we may lose sales to the infringing sellers, which may have a material adverse effect on our financial condition, results of operations and cash flows.

We are subject to various existing and contemplated laws, regulations and government initiatives that may materially impact the demand for our products, our profitability or our costs of doing business.

Our business may be materially impacted by various governmental laws, regulations and initiatives that may artificially create, deflate, accelerate, or decelerate consumer demand for our products. For example, when the government issues tax credits designed to encourage increased homebuilding or energy-efficient window purchases, the credits may create a spike in demand that would not otherwise have occurred and our production capabilities may not be able to keep pace, which could materially impact our profitability. Likewise, when such laws, regulations or initiatives expire, our business may experience a material loss in sales volume or an increase in production costs as a result of the decline in consumer demand.

Our operations outside the U.S. require us to comply with a number of U.S. and international anti-corruption regulations, violations of which could have a material adverse effect on our consolidated results of operations and consolidated financial condition.

Our international operations require us to comply with a number of U.S. and international regulations, including the Foreign Corrupt Practices Act (FCPA) and the United Kingdom Bribery Act 2010. While we have implemented appropriate training and compliance programs to prevent violations of these anti-bribery regulations, we cannot ensure that our policies, procedures and programs will always protect us from reckless or criminal acts committed by our employees or agents. Allegations of violations of applicable anti-corruption laws, may result in internal, independent, or government investigations, and violations of anti-corruption laws may result in severe criminal or civil sanctions or other liabilities which could have a material adverse effect on our business, consolidated results of operations and financial condition.

10

Due to the fact that we have operations located within the U.K., our business and financial results may be negatively impacted as a result of the U.K.'s planned exit from the European Union (E.U.), resulting primarily from (a) continued depression in the value of the British Pound Sterling as compared to the United States Dollar; and (b) potential price increases or unavailability of supplies purchased by our U.K. businesses from companies located in the E.U. or elsewhere. These risks would be heightened in the event that the U.K. and the E.U. are unable to reach a mutually satisfactory exit agreement before the current deadline of January 31, 2020.

Following the U.K.’s vote to leave the E.U. in 2016 (commonly referred to as Brexit), the value of the British Pound Sterling incurred significant fluctuations. Additionally, further actions related to Brexit may occur in the future. If the value of the British Pound Sterling continues to incur similar fluctuations, unfavorable exchange rate changes may negatively affect the value of our operations and businesses located in the U.K., as translated to our reporting currency, the United States Dollar, in accordance with US GAAP, which may impact the revenue and earnings we report. For more information with respect to Exchange Rate risk applicable to us, please see Part 2 Item 7A. "Market Risk Disclosures" elsewhere in this Annual Report on Form 10-K. Continued fluctuations in the British Pound Sterling may also result in the imposition of price adjustments by E.U.-based suppliers to our U.K. businesses, as those suppliers seek to compensate for the changes in value of the British Pound Sterling as compared to the European Euro. In addition, a so-called “Hard Brexit,” where no formal agreement is made between the E.U. and U.K. prior to the U.K.’s exit, could result in a continued deflation of the British Pound Sterling; additional increases in prices, fees, taxes or tariffs applicable to goods that are bought and sold between the U.K. and Europe, and a negative impact on end markets in the U.K. as a result of declines in consumer sentiment or decreased immigration rates into the U.K. Any of these results could have a material adverse effect on the business, revenues and financial condition of our U.K. and European operations.

Failure to achieve and maintain effective internal controls could have a material adverse effect on our business and on our stock price.

Effective internal controls are necessary for us to effectively monitor our business, prevent fraud or theft, remain in compliance with our credit facility covenants, and provide reliable financial reports, both to the public and to our lenders. If we fail to maintain the adequacy of our internal controls, both in accordance with current standards and as standards are modified over time, we could trigger an event of default under our credit facilities or lose the confidence of the investing community, both of which could result in a material adverse effect on our stock price, limit our ability to borrow funds, or result in the application of unfavorable commercial terms to borrowings then outstanding.

The impact of foreign trade relations and associated tariffs could adversely impact our business.

We currently source a number of raw materials from international suppliers. Import tariffs, taxes, customs duties and/or other trading regulations imposed by the U.S. government on foreign countries, or by foreign countries on the U.S., could significantly increase the prices we pay for certain raw materials, such as aluminum and wood, that are critical to our ability to manufacture our products. In addition, we may be unable to find a domestic supplier to provide the necessary raw materials on an economical basis in the amounts we require. If the cost of our raw materials increases, or if we are unable to procure the necessary raw materials required to manufacture our products, then we could experience a negative impact on our operating results, profitability, customer relationships and future cash flows.

Company Risks

Our business will suffer if we are unable to adequately address potential supplier or customer pricing pressures, both with respect to OEMs that have significant pricing leverage over suppliers, and to large suppliers who have significant pricing leverage over our customers.

Our primary customers are OEMs, who have substantial leverage in setting purchasing and payment terms. In addition, many of our suppliers are large international conglomerates with numerous customers that are much larger than us, which lessens our leverage in pricing and supply negotiations. We attempt to manage this pricing pressure and to preserve our business relationships with suppliers and OEMs by negotiating reasonable price concessions when needed, and by reducing our production costs through various measures, which may include managing our purchase process to control the cost of our raw materials and components, maintaining multiple supply sources where possible, and implementing cost-effective process improvements. However, our efforts in this regard may not be successful and our operating margins could be negatively impacted.

11

Our revenues could decline or we may lose business if our customers vertically integrate their operations, diversify their supplier base, or transfer manufacturing capacity to other regions.

Certain of our businesses or product lines are largely dependent on a relatively few large customers. Although we believe we have an extensive customer base, if we were to lose one of these large customers or if one such customer were to materially reduce its purchases as a result of vertical integration, supplier diversification, or a shift in regional focus, our revenue, general financial condition and results of operations could be adversely affected.

Our credit facility contains certain operational restrictions, reporting requirements, and financial covenants that limit the aggregate availability of funds.

Our revolving credit facility contains certain financial covenants and other operating and reporting requirements that could present risk to our operating results or limit our ability to access capital for use in the business. For a full discussion of the various covenants and operating requirements imposed by our revolving credit facility and information related to the potential limitations on our ability to access capital, see Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations-Liquidity and Capital Resources, in this Annual Report on Form 10-K.

We may not be able to successfully manage or integrate acquisitions, and if we are unable to do so, then our profitability could be adversely affected.

We cannot provide assurance that we will successfully manage or integrate acquisition targets once we have purchased them. If we acquire a business for which we do not fully understand or appreciate the specific business risks, if we overvalue or fail to conduct effective due diligence on an acquisition, or if we fail to effectively and efficiently integrate a business that we acquire, then there could be a material adverse effect on our ability to achieve the projected growth and cash flow goals associated with the new business, which could result in an overall material adverse effect on our long-term profitability or revenue generation.

If our information technology systems fail, or if we experience an interruption in our operations due to an aging information system infrastructure, then our results of operations and financial condition could be materially adversely affected.

The failure of our information technology systems, our inability to successfully maintain, enhance and/or replace our information technology systems when necessary, or a significant compromise of the integrity or security of the data that is generated from our information technology systems, could adversely affect our results of operations and could disrupt business and prevent or severely limit our ability to respond to data requests from our customers, suppliers, auditors, shareholders, employees or government authorities.

We are subject to data security and privacy risks that could negatively affect our results or operations.

In addition to our own sensitive and proprietary business information, we collect transactional and personal information about our customers and employees. Any breach of our or our service providers’ network, or other vendor systems, may result in the loss of confidential business and financial data, misappropriation of our consumers’ or employees’ personal information or a disruption of our business. Any of these outcomes could have a material adverse effect on our business or our vendor and customer relationships, and could also result in unwanted media attention, reputational damage, or the imposition of fines, lawsuits, or significant legal or remediation expenses.

We may not have the right personnel in place to achieve our operating goals, and the rural location of some of our operations may make it difficult to locate or hire highly skilled employees.

We operate in some rural areas and small towns where the competition for labor can be fierce, and where the pool of qualified employees may be very small. If we are unable to obtain skilled workers and adequately trained professionals to conduct our business, we may not be able to manage our business to the necessary high standards. In addition, we may be forced to pay higher wages or offer other benefits that might impact our cost of labor and thereby negatively impact our profitability.

Equipment failures or catastrophic loss at any of our manufacturing facilities could prevent us from manufacturing our products.

An interruption in production capabilities at any of our facilities due to equipment failure, catastrophic loss, or other reasons could result in our inability to manufacture products, which could severely affect delivery times, return or cancellation rates, and future sales, any of which could result in lower sales and earnings or the loss of customers. Although we have a disaster recovery plan in place, we currently have one plant which is the sole source for our insulating glass spacer business in the U.S. If that plant were to experience a catastrophic loss and our disaster recovery plan were to fail, it could have a material adverse effect on our results of operations or financial condition.

12

Product liability claims and product replacements could harm our reputation, revenue generation and financial condition, or could result in costs related to litigation, warranty claims, or customer accommodations.

We have, on occasion, found flaws and deficiencies in the manufacturing, design, testing or installation of our products, which may result from a product defect, a defect in a component part provided by our suppliers, or as a result of the product being installed incorrectly by our customer or an end user. The failure of products before or after installation could result in litigation or claims by our customers or other users of the products, or in the expenditure of costs related to warranty coverage, claim settlement, litigation, or customer accommodation. In addition, we are currently party to certain legal claims related to a commercial sealant product, and there is no assurance that we will prevail on those claims. We may be required to expend legal fees, expert costs, and other costs associated with defending the claims and/or lawsuits. We may elect to enter into legal settlements or be forced to pay any judgments that result from an adverse court decision. Any such settlements, judgments, fees and/or costs could negatively impact our profitability, results of operations, cash flows and financial condition.

Our insurance coverage may be inapplicable or inadequate to cover certain liabilities, and our insurance policies may exclude coverage for certain products.

While we maintain a robust insurance program that is reasonably designed to cover our known and unknown risks, there is no assurance that our insurance carriers will voluntarily agree to cover every potential liability, or that our insurance policies include limits large enough to cover all liabilities associated with our business or products. In addition, coverage under our insurance policies may be unavailable in the future for certain products. For example, during a prior renewal of our insurance program, our insurance carriers excluded future coverage of a product line we no longer manufacture or sell. If our insurers refuse to cover claims, in whole or in part, or if we exhaust our available insurance coverage at some point in the future, then we might be forced to expend legal fees and settlement or judgment costs, which could negatively impact our profitability, results of operations, cash flows and financial condition.

Risks Associated with Investment in Quanex Securities

Our corporate governance documents and the provisions of Delaware law may delay or preclude a business acquisition or divestiture that stockholders may consider to be favorable, which might result in a decrease in the value of our common shares.

Our certificate of incorporation and bylaws and Delaware law contain provisions that could make it more difficult for a third party to acquire us without the consent of our Board of Directors. These provisions include restrictions on the ability of our stockholders to remove directors and supermajority voting requirements for stockholders to amend our organizational documents and limitations on action by our stockholders by written consent. In addition, our Board of Directors has the right to issue preferred stock without stockholder approval, which could be used to dilute the stock ownership of a potential hostile acquirer. Although we believe these provisions protect our stockholders from coercive or otherwise unfair takeover tactics, and thereby provide for an opportunity for us to receive a higher bid by requiring potential acquirers to negotiate with our Board of Directors, these provisions apply even if the offer may be considered beneficial by some stockholders.

We have the ability to issue additional equity securities, which would lead to dilution of our issued and outstanding common stock.

We are authorized to issue, without stockholder approval, 1,000,000 shares of preferred stock, no par value, in one or more series, which may give other stockholders dividend, conversion, voting, and liquidation rights, among other rights, which may be superior to the rights of holders of our common stock. The issuance of additional equity securities or securities convertible into equity securities would result in dilution of existing stockholders' equity interests. Our Board of Directors has no present intention to issue any such preferred shares, but has the right to do so in the future. In addition, we were authorized, by prior stockholder approval, to issue up to 125,000,000 shares of our common stock, $0.01 par value per share, of which 37,370,402 were issued at October 31, 2019. These authorized shares can be issued, without stockholder approval, as securities convertible into either common stock or preferred stock.

Item 1B. Unresolved Staff Comments.

None.

13

Item 2. Properties.

The following table lists our principal properties by location, general character and use as of October 31, 2019.

Location | Character & Use of Property | |

Executive Offices | ||

Houston, Texas* | Executive corporate office | |

North American Fenestration Segment | ||

Akron, Ohio* | Segment executive office and R&D facility | |

Rice Lake, Wisconsin | Fenestration products | |

Cambridge, Ohio* | Flexible spacer and solar adhesives | |

Richmond, Kentucky | Vinyl and composite extrusions | |

Kent, Washington* | Vinyl and composite extrusions | |

European Fenestration Segment | ||

Denby, United Kingdom* | Vinyl and composite extrusions | |

Heinsberg, Germany* | Flexible spacer | |

North American Cabinet Components Segment | ||

St. Cloud, Minnesota | Hardwood doors & components for kitchen and bath | |

* These locations are leased as of October 31, 2019.

In addition to the locations identified above, our North American Fenestration Segment maintains 14 additional facilities for the manufacture and distribution of fenestration, spacer and extrusion products within the continental U.S., our European Fenestration Segment maintains one additional location for the production of spacer in the U.K., and our North American Cabinet Components Segment maintains 12 locations to manufacture hardwood doors and other wood components for kitchen and bath cabinets. We maintain a lease in Yakima, Washington, which will expire in 2021, related to a location which was closed as a result of restructuring activities. See Note 1, "Nature of Operations, Basis of Presentation and Significant Accounting Policies - Restructuring" to the accompanying consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

We believe our operating properties are in good condition and well maintained, and are generally suitable and adequate to carry on our business. In fiscal 2019, on a consolidated basis, our facilities operated at approximately 59% of capacity. This capacity utilization is subject to variability by product line, seasonality, and location.

Item 3. Legal Proceedings.

From time to time, we, along with our subsidiaries, are involved in various litigation matters arising in the ordinary course of our business, including those arising from or related to contractual matters, commercial disputes, intellectual property, personal injury, environmental matters, product performance or warranties, product liability, insurance coverage and personnel and employment disputes.

We regularly review with legal counsel the status of all ongoing proceedings, and we maintain insurance against these risks to the extent deemed prudent by our management and to the extent such insurance is available. However, there is no assurance that we will prevail in these matters or that our insurers will accept full coverage of these matters, and we could, in the future, incur judgments, enter into settlements of claims, or revise our expectations regarding the outcome or insurability of matters we face, which could materially impact our results of operations.

We have been and are currently party to multiple claims, some of which are in litigation, relating to alleged defects in a commercial sealant product that was manufactured and sold during the 2000's. Several claims were resolved during fiscal 2017, 2018 and 2019, and we continue to defend the remaining claims. While we believe that our product was not defective and that we would prevail in these commercial sealant product claims if taken to trial, the timing, ultimate resolution and potential impact of these claims is not currently determinable. Nevertheless, after taking into account all currently available information, including our defenses, the advice of our counsel, and the extent and currently-expected availability of our existing insurance coverage, we believe that the eventual outcome of these commercial sealant claims will not have a material adverse effect on our overall financial condition, results of operations or cash flows, and we have not recorded any accrual with regard to these claims.

We reserve for litigation loss contingencies that are both probable and reasonably estimable. We do not expect that losses resulting from any current legal proceedings will have a material adverse effect on our consolidated financial statements if or when such losses are incurred.

14

For discussion of environmental issues, see Item 1, "Business - Environmental and Employee Safety Matters” discussed elsewhere in this Annual Report on Form 10-K.

Item 4. Mine Safety Disclosures.

Not Applicable.

15

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock has been listed on the New York Stock Exchange under the ticker symbol NX since April 24, 2008. Electronic copies of our public filings are available on the Securities and Exchange Commission's website (www.sec.gov). There were approximately 1,856 holders of our common stock (excluding individual participants in securities positions listings) on record as of December 9, 2019.

Equity Compensation Plan Information

The following table summarizes certain information regarding equity compensation to our employees, officers and directors under equity compensation plans as of October 31, 2019:

(a) | (b) | (c) | |||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) | Weighted-average exercise price of outstanding options, warrants and rights(2) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

Equity compensation plans approved by security holders | 2,252,331 | $ | 18.71 | 1,678,721 | |||||

(1) Column (a) includes securities that may be issued upon future vesting of performance share awards that have been previously granted to key employees and officers. The number of securities reflected in this column includes the maximum number of shares that would be issued pursuant to these performance share awards assuming the performance measures are achieved. The performance measures may not be achieved.

(2) The weighted-average exercise price in column (b) does not include the impacts of the performance share awards or any securities that may be issued thereunder. For additional details, see Note 14, "Stock-Based Compensation" included elsewhere within this Annual Report on Form 10-K.

Issuer Purchases of Equity Securities

Set forth below is a table summarizing the program and the repurchase of shares during the quarter ended October 31, 2019.

Period | (a) Total Number of Shares Purchased (1) | (b) Average Price Paid per Share(1) | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) | (d) Maximum US Dollars Remaining that May Yet Be Used to Purchase Shares Under the Plans or Programs(1) | ||||

August 2019 | — | $— | — | $21,630,466 | ||||

September 2019 | — | — | — | $21,630,466 | ||||

October 2019 | 175,000 | 18.37 | 175,000 | $18,415,158 | ||||

Total | 175,000 | $18.37 | 175,000 | |||||

(1) On August 30, 2018, our Board of Directors approved a stock repurchase program that authorized the repurchase of up to $60.0 million worth of shares of our common stock. Repurchases under the new program will be made in open market transactions or privately negotiated transactions, subject to market conditions, applicable legal requirements and other relevant factors. The program does not have an expiration date or a limit on the number of shares that may be purchased. During the years ended October 31, 2019 and 2018, we purchased 583,398 shares and 1,900,000 shares, respectively, at a cost of $9.6 million and $32.0 million, respectively, under this program.

16

Stock Performance Graph

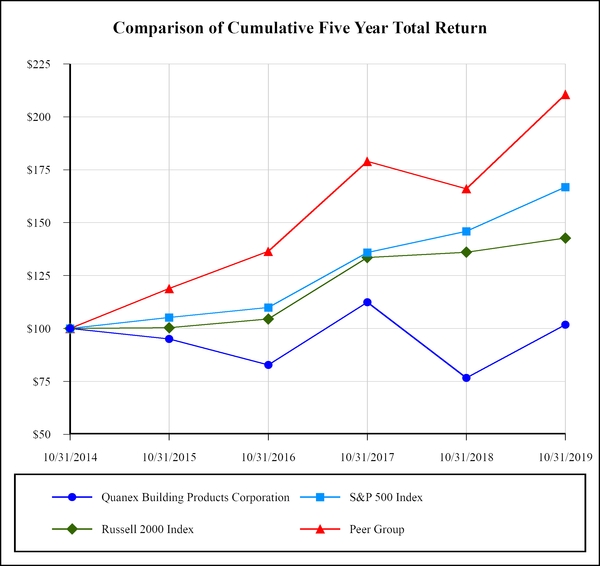

The following chart represents a comparison of the five year total return of our common stock to the Standard & Poor’s 500 Index (S&P 500), the Russell 2000 Index, and a peer group index selected by us, which includes companies offering similar products and services to ours. The companies in our peer group for the year ended October 31, 2019 are AAON Inc., American Woodmark Corp, Apogee Enterprises Inc., Armstrong Flooring Inc., Continental Building Products Inc., Cornerstone Building Brands Inc., CSW Industrials Inc., Gibraltar Industries Inc., Griffon Corporation, Insteel Industries Inc., Masonite International, Patrick Industries Inc., PGT Innovations, Inc., Simpson Manufacturing Company Inc., and Trex Company Inc.

INDEXED RETURNS | For the Years Ended | |||||||||||||||||||||||

Company Name / Index | 10/31/2014 | 10/31/2015 | 10/31/2016 | 10/31/2017 | 10/31/2018 | 10/31/2019 | ||||||||||||||||||

Quanex Building Products Corporation | $ | 100.00 | $ | 95.04 | $ | 82.83 | $ | 112.41 | $ | 76.68 | $ | 101.82 | ||||||||||||

S&P 500 Index | $ | 100.00 | $ | 105.20 | $ | 109.94 | $ | 135.93 | $ | 145.91 | $ | 166.81 | ||||||||||||

Russell 2000 Index | $ | 100.00 | $ | 100.34 | $ | 104.46 | $ | 133.53 | $ | 136.03 | $ | 142.70 | ||||||||||||

New Peer Group | $ | 100.00 | $ | 118.85 | $ | 136.42 | $ | 178.95 | $ | 166.02 | $ | 210.61 | ||||||||||||

17

Item 6. Selected Financial Data.

The following table presents selected historical consolidated financial and operating data for the periods shown. The selected consolidated financial data as of October 31, 2019, 2018, 2017, 2016 and 2015 and for each of the fiscal years then ended was derived from our audited consolidated financial statements for those dates and periods, adjusted for discontinued operations, as indicated. Data reflects the adoption of accounting standards updates and accounting changes made during the year ended October 31, 2019. The following information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Fiscal Years Ended October 31, | |||||||||||||||||||

2019(1)(2) | 2018(2)(3)(4) | 2017(2) | 2016(2)(5)(6)(7) | 2015(8) | |||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||

Consolidated Statements of Income | |||||||||||||||||||

Net sales | $ | 893,841 | $ | 889,785 | $ | 866,555 | $ | 928,184 | $ | 645,528 | |||||||||

Cost and expenses: | |||||||||||||||||||

Cost of sales (excluding depreciation and amortization) | 694,420 | 697,022 | 672,488 | 710,947 | 499,680 | ||||||||||||||

Selling, general and administrative | 101,292 | 103,758 | 98,085 | 115,012 | 86,718 | ||||||||||||||

Restructuring charges | 370 | 1,486 | 4,550 | 529 | — | ||||||||||||||

Depreciation and amortization | 49,586 | 51,822 | 57,495 | 53,146 | 35,220 | ||||||||||||||

Asset impairment charges | 74,600 | — | — | 12,602 | — | ||||||||||||||

Operating (loss) income | (26,427 | ) | 35,697 | 33,937 | 35,948 | 23,910 | |||||||||||||

Non-operating (expense) income: | |||||||||||||||||||

Interest expense | (9,643 | ) | (11,100 | ) | (9,595 | ) | (36,498 | ) | (991 | ) | |||||||||

Other, net | 116 | 1,156 | 1,160 | (5,074 | ) | 234 | |||||||||||||

(Loss) income from continuing operations before income taxes | (35,954 | ) | 25,753 | 25,502 | (5,624 | ) | 23,153 | ||||||||||||

Income tax (expense) benefit | (10,776 | ) | 800 | (6,819 | ) | 3,765 | (7,539 | ) | |||||||||||

(Loss) income from continuing operations | (46,730 | ) | 26,553 | 18,683 | (1,859 | ) | 15,614 | ||||||||||||

Income from discontinued operations, net of taxes | — | — | — | — | 479 | ||||||||||||||

Net (loss) income | $ | (46,730 | ) | $ | 26,553 | $ | 18,683 | $ | (1,859 | ) | $ | 16,093 | |||||||

Basic (loss) earnings per common share: | |||||||||||||||||||

Basic (loss) earnings from continuing operations | $ | (1.42 | ) | $ | 0.77 | $ | 0.55 | $ | (0.05 | ) | $ | 0.46 | |||||||

Basic earnings from discontinued operations | — | — | — | — | 0.01 | ||||||||||||||

Basic (loss) earnings per share | $ | (1.42 | ) | $ | 0.77 | $ | 0.55 | $ | (0.05 | ) | $ | 0.47 | |||||||

Diluted (loss) earnings per common share: | |||||||||||||||||||

Diluted (loss) earnings from continuing operations | $ | (1.42 | ) | $ | 0.76 | $ | 0.54 | $ | (0.05 | ) | $ | 0.46 | |||||||

Diluted earnings from discontinued operations | — | — | — | — | 0.01 | ||||||||||||||

Diluted (loss) earnings per share | $ | (1.42 | ) | $ | 0.76 | $ | 0.54 | $ | (0.05 | ) | $ | 0.47 | |||||||

Cash dividends declared per share | $ | 0.32 | $ | 0.20 | $ | 0.16 | $ | 0.16 | $ | 0.16 | |||||||||

Other Financial & Operating Data | |||||||||||||||||||

Cash provided by operating activities | $ | 96,372 | $ | 104,611 | $ | 79,778 | $ | 87,341 | $ | 67,087 | |||||||||

Cash used for investing activities | (23,559 | ) | (26,052 | ) | (32,627 | ) | (282,103 | ) | (160,144 | ) | |||||||||

Cash (used for) provided by financing activities | (71,264 | ) | (65,817 | ) | (55,133 | ) | 195,448 | (4,581 | ) | ||||||||||

Acquisitions, net of cash acquired | — | — | — | 245,904 | (131,689 | ) | |||||||||||||

Capital expenditures | $ | 24,883 | $ | 26,484 | $ | 34,564 | $ | 37,243 | $ | (29,982 | ) | ||||||||

Selected Consolidated Balance Sheet Data at Year End | |||||||||||||||||||

Cash and cash equivalents | $ | 30,868 | $ | 29,003 | $ | 17,455 | $ | 25,526 | $ | 23,125 | |||||||||

Total assets | 645,110 | 743,214 | 774,944 | 781,418 | 566,581 | ||||||||||||||

Long-term debt, excluding current portion | 156,414 | 209,332 | 218,184 | 259,011 | 53,767 | ||||||||||||||

Total liabilities | $ | 314,923 | $ | 347,992 | $ | 367,252 | $ | 412,742 | $ | 170,441 | |||||||||

18

(1) | In 2019, we recorded goodwill impairment charges of $74.6 million associated with our cabinet components business. |

(2) | In 2019, 2018, 2017 and 2016, we incurred $0.4 million, $1.5 million, $4.6 million, and $0.5 million respectively, of restructuring costs associated with the closure of several plant facilities. See Note 1, "Nature of Operations, Basis of Presentation and Significant Accounting Policies - Restructuring," included elsewhere in this Annual Report on Form 10-K. |

(3) | In October 2018, we refinanced our credit facility resulting in a charge of $1.1 million of unamortized deferred financing fees. See Note 8, "Debt and Capital Lease Obligations" included elsewhere in this Annual Report on Form 10-K. |

(4) | In 2018, we recorded a $6.5 million net benefit related to the tax effect of implementing the Tax Cuts and Jobs Act, which was signed into law on December 22, 2017. See Note 10, "Income Taxes" included elsewhere in this Annual Report on Form 10-K. |

(5) | In November 2015, we acquired Woodcraft, a manufacturer of cabinet doors and other components to OEMs in the kitchen and bathroom cabinet industry. The results of operations of Woodcraft including revenue of $223.4 million and net income of $4.1 million have been included in our consolidated operating results since the date of acquisition, November 2, 2015. |

(6) | In July 2016, we refinanced our credit facility resulting in a $3.1 million prepayment call premium fee, a charge of $8.1 million of unamortized deferred financing fees and a charge of $5.5 million of unamortized original issuer’s discount. See Note 8, "Debt and Capital Lease Obligations" included elsewhere in this Annual Report on Form 10-K. |

(7) | In October 2016, we recorded a goodwill impairment charge of $12.6 million associated with our U.S. vinyl extrusion business. |

(8) | In June 2015, we acquired HLP, a vinyl profile extruder with operations located in the U.K. The results of operations of HLP include revenue of $42.3 million and net income of $1.5 million for the period June 15, 2015 through October 31, 2015. |

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis contains forward-looking statements based on our current assumptions, expectations, estimates and projections about our business and the homebuilding industry, and therefore, it should be read in conjunction with our consolidated financial statements and related notes thereto, as well as "Cautionary Note Regarding Forward-Looking Statements" discussed elsewhere within this Annual Report on Form 10-K. For a listing of potential risks and uncertainties which impact our business and industry, see "Item 1A. Risk Factors.” Actual results could differ from our expectations due to several factors which include, but are not limited to: market price and demand for our products, economic and competitive conditions, capital expenditures, new technology, regulatory changes and other uncertainties. Unless otherwise required by law, we undertake no obligation to publicly update any forward-looking statements, even if new information becomes available or other events occur in the future.

Our Business

We manufacture components for original equipment manufacturers in the building products industry. These components can be categorized as window and door (fenestration) components and kitchen and bath cabinet components. Examples of fenestration components include (1) energy-efficient flexible insulating glass spacers, (2) extruded vinyl profiles, (3) window and door screens, and (4) precision-formed metal and wood products. In addition, we provide certain other non-fenestration components and products, which include solar panel sealants, trim moldings, vinyl decking, fencing, water retention barriers, and conservatory roof components. We use low-cost production processes and engineering expertise to provide our customers with specialized products for their specific window, door, and cabinet applications. We believe these capabilities provide us with unique competitive advantages. We serve a primary customer base in North America and the U.K., and also serve customers in international markets through our operating plants in the U.K. and Germany, as well as through sales and marketing efforts in other countries.

We continue to invest in organic growth initiatives and we intend to continue evaluating business acquisitions that allow us to expand our existing fenestration and cabinet component footprint, enhance our product offerings, provide new complementary technology, enhance our leadership position within the markets we serve, and expand into new markets or service lines. We have disposed of non-core businesses in the past, and continue to evaluate our business portfolio to ensure that we are investing in markets where we believe there is potential future growth.

We currently have three reportable business segments: (1) North American Fenestration segment (“NA Fenestration”), comprising four operating segments primarily focused on the fenestration market in North America manufacturing vinyl profiles, IG spacers, screens & other fenestration components; (2) European Fenestration segment (“EU Fenestration”), comprising our U.K.-based vinyl extrusion business, manufacturing vinyl profiles and conservatories, and the European insulating glass business manufacturing IG spacers; and (3) North American Cabinet Components segment (“NA Cabinet Components”), comprising our North American cabinet door and components business and two wood-manufacturing plants. We maintain a grouping called Unallocated Corporate & Other, which includes transaction expenses, stock-based compensation, long-term incentive awards based on the performance of our common stock and other factors, certain severance and legal costs not deemed to be allocable to all segments, depreciation of corporate assets, interest expense, other, net, income taxes and inter-segment eliminations, and executive incentive compensation and medical expense fluctuations relative to planned costs as determined during the annual planning process. Other corporate general and administrative costs have been allocated to the reportable business segments, based upon a relative measure of profitability in order to more accurately reflect each reportable business segment's administrative costs. We allocate corporate expenses to businesses acquired mid-year from the date of acquisition. The accounting policies of our operating segments are the same as those used to prepare our accompanying consolidated financial statements. Corporate general and administrative expenses allocated during the years ended October 31, 2019, 2018 and 2017 were $18.3 million, $18.7 million and $17.0 million, respectively.

Notable Items

During 2017, we rationalized capacity and closed two U.S. vinyl plants and two cabinet door plants, relocating assets to improve overall operational efficiency. We have incurred $0.4 million, $1.5 million and $4.6 million of expense associated with these restructuring efforts during fiscal 2019, 2018 and 2017, respectively, and recognized $6.2 million of accelerated depreciation and amortization associated with related assets during fiscal 2017.

On December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act (the Act) that included sweeping tax reform which affected U.S. corporations, including a reduction of the statutory federal corporate tax rate from 35% to 21%. We made an initial assessment of the Act and recorded a discrete benefit of $6.5 million, which included a charge of $1.2 million for a one-time mandatory transition tax on deemed repatriation of previously tax-deferred and unremitted foreign earnings during the fiscal year ended October 31, 2018. We completed the accounting for the income tax effects of the Act and recorded a charge of $0.4 million for the re-measurement of the one-time mandatory transition tax during the year ended October 31, 2019. The Act

20

also imposed additional tax law changes that became effective during fiscal 2019, which include new requirements for a global intangible low-taxed income provision (GILTI) and a deduction for foreign-derived intangible income (FDII), which resulted in a net charge of $1.2 million during the year ended October 31, 2019.

Market Overview and Outlook

We believe the primary drivers of our operating results continue to be North American residential remodeling and replacement (R&R) and new home construction activity. We believe that housing starts and window shipments are indicators of activity levels in the homebuilding and window industries, and we use this data, as published by or derived from third-party sources, to evaluate the market. We have historically evaluated the market using data from the National Association of Homebuilders (NAHB) with regard to housing starts, and published reports by Ducker Worldwide, LLC (Ducker), a consulting and research firm, with regard to window shipments. These sources generally provide information about activity levels in the U.S.

The NAHB has forecasted calendar-year housing starts (excluding manufactured units) to increase slightly through 2021. Ducker indicated that window shipments in the R&R market are expected to decline slightly during the calendar year ended 2019, increase 2% during 2020 and increase 3% during 2021. Derived from reports published by Ducker, the overall decline in window shipments for the trailing twelve months ended September 30, 2019 was 1.6%. During this period, R&R activity and new construction decreased 0.9% and 2.5%, respectively.

Our U.K. vinyl business (commonly referred to as "HLP") is largely focused on the sale of vinyl house systems under the trade name “Liniar” to smaller window manufacturers in the U.K. HLP is one of the larger providers of vinyl extruded products in the U.K. in terms of volume shipped. Currently, the U.K. is experiencing a shortage in affordable housing, with rising demand due in part to a growing immigrant population. HLP’s current primary customers are smaller window fabricators, as opposed to the larger OEMs that comprise a large portion of the North American market. These manufacturers seek the quality and technology of the specific products identified by the Liniar trade name. In addition, HLP services non-fenestration markets including the manufacture of roofing for conservatories, vinyl decking and vinyl water retention barriers used for landscaping. We believe there are growth opportunities within these markets in the U.K. and potential synergies which may enable us to sell complementary products.