UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

For the quarterly period ended July 3, 2022

or

For the transition period from to .

Commission File Number: 001-34841

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) | |||||||

(Address of principal executive offices) | (Zip code) | |||||||

(Registrant’s telephone number, including area code) | |||||||||||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of July 22, 2022, there were 262,598,471 shares of our common stock, €0.20 par value per share, issued and outstanding.

NXP Semiconductors N.V.

Form 10-Q

For the Fiscal Quarter Ended July 3, 2022

TABLE OF CONTENTS

Page | ||||||||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

($ in millions, unless otherwise stated)

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| Cost of revenue | ( | ( | ( | ( | |||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Research and development | ( | ( | ( | ( | |||||||||||||||||||

| Selling, general and administrative | ( | ( | ( | ( | |||||||||||||||||||

| Amortization of acquisition-related intangible assets | ( | ( | ( | ( | |||||||||||||||||||

| Total operating expenses | ( | ( | ( | ( | |||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||

| Operating income (loss) | |||||||||||||||||||||||

| Financial income (expense): | |||||||||||||||||||||||

| Extinguishment of debt | ( | ( | |||||||||||||||||||||

| Other financial income (expense) | ( | ( | ( | ( | |||||||||||||||||||

| Income (loss) before income taxes | |||||||||||||||||||||||

| Benefit (provision) for income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Results relating to equity-accounted investees | ( | ( | ( | ||||||||||||||||||||

| Net income (loss) | |||||||||||||||||||||||

| Less: Net income (loss) attributable to non-controlling interests | |||||||||||||||||||||||

| Net income (loss) attributable to stockholders | |||||||||||||||||||||||

| Earnings per share data: | |||||||||||||||||||||||

| Net income (loss) per common share attributable to stockholders in $ | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

| Weighted average number of shares of common stock outstanding during the period (in thousands): | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

See accompanying notes to the Condensed Consolidated Financial Statements

1

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

($ in millions, unless otherwise stated)

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Net income (loss) | |||||||||||||||||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||||||||||||||

| Change in fair value cash flow hedges | ( | ( | ( | ||||||||||||||||||||

| Change in foreign currency translation adjustment | ( | ( | ( | ||||||||||||||||||||

| Change in net actuarial gain (loss) | ( | ( | |||||||||||||||||||||

| Total other comprehensive income (loss) | ( | ( | ( | ||||||||||||||||||||

| Total comprehensive income (loss) | |||||||||||||||||||||||

| Less: Comprehensive income (loss) attributable to non-controlling interests | |||||||||||||||||||||||

| Total comprehensive income (loss) attributable to stockholders | |||||||||||||||||||||||

See accompanying notes to the Condensed Consolidated Financial Statements

2

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

($ in millions, unless otherwise stated)

| July 3, 2022 | December 31, 2021 | |||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | ||||||||||||||

| Accounts receivable, net | ||||||||||||||

| Inventories, net | ||||||||||||||

| Other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Non-current assets: | ||||||||||||||

| Other non-current assets | ||||||||||||||

Property, plant and equipment, net of accumulated depreciation of $ | ||||||||||||||

Identified intangible assets, net of accumulated amortization of $ | ||||||||||||||

| Goodwill | ||||||||||||||

| Total non-current assets | ||||||||||||||

| Total assets | ||||||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | ||||||||||||||

| Restructuring liabilities-current | ||||||||||||||

| Other current liabilities | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Non-current liabilities: | ||||||||||||||

| Long-term debt | ||||||||||||||

| Restructuring liabilities | ||||||||||||||

| Deferred tax liabilities | ||||||||||||||

| Other non-current liabilities | ||||||||||||||

| Total non-current liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Equity: | ||||||||||||||

| Non-controlling interests | ||||||||||||||

| Stockholders’ equity: | ||||||||||||||

Common stock, par value € | ||||||||||||||

| Capital in excess of par value | ||||||||||||||

| Treasury shares, at cost: | ||||||||||||||

| ( | ( | |||||||||||||

| Accumulated other comprehensive income (loss) | ( | |||||||||||||

| Accumulated deficit | ( | ( | ||||||||||||

| Total stockholders’ equity | ||||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | ||||||||||||||

See accompanying notes to the Condensed Consolidated Financial Statements

3

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

($ in millions, unless otherwise stated)

| For the six months ended | |||||||||||

| July 3, 2022 | July 4, 2021 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | |||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Share-based compensation | |||||||||||

| Amortization of discount (premium) on debt, net | |||||||||||

| Amortization of debt issuance costs | |||||||||||

| Net (gain) loss on sale of assets | ( | ||||||||||

| (Gain) loss on equity security, net | |||||||||||

| (Gain) loss on extinguishment of debt | |||||||||||

| Results relating to equity-accounted investees | ( | ||||||||||

| Deferred tax expense (benefit) | ( | ||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| (Increase) decrease in receivables and other current assets | ( | ( | |||||||||

| (Increase) decrease in inventories | ( | ( | |||||||||

| Increase (decrease) in accounts payable and other liabilities | |||||||||||

| Decrease (increase) in other non-current assets | ( | ( | |||||||||

| Exchange differences | ( | ||||||||||

| Other items | ( | ||||||||||

| Net cash provided by (used for) operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Purchase of identified intangible assets | ( | ( | |||||||||

| Capital expenditures on property, plant and equipment | ( | ( | |||||||||

| Purchase of equipment leased to others | ( | ||||||||||

| Proceeds from disposals of property, plant and equipment | |||||||||||

| Purchase of interests in businesses, net of cash acquired | ( | ( | |||||||||

| Purchase of investments | ( | ( | |||||||||

| Proceeds from sale of investments | |||||||||||

| Proceeds from return of equity investment | |||||||||||

| Net cash provided by (used for) investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Repurchase of long-term debt | ( | ||||||||||

| Proceeds from the issuance of long-term debt | |||||||||||

| Cash paid for debt issuance costs | ( | ( | |||||||||

| Dividends paid to common stockholders | ( | ( | |||||||||

| Proceeds from issuance of common stock through stock plans | |||||||||||

| Purchase of treasury shares and restricted stock unit withholdings | ( | ( | |||||||||

| Other, net | ( | ( | |||||||||

| Net cash provided by (used for) financing activities | ( | ( | |||||||||

| Effect of changes in exchange rates on cash positions | ( | ( | |||||||||

| Increase (decrease) in cash and cash equivalents | |||||||||||

| Cash and cash equivalents at beginning of period | |||||||||||

| Cash and cash equivalents at end of period | |||||||||||

| Supplemental disclosures to the condensed consolidated cash flows | |||||||||||

| Net cash paid during the period for: | |||||||||||

| Interest | |||||||||||

| Income taxes, net of refunds | |||||||||||

| Net gain (loss) on sale of assets: | |||||||||||

| Cash proceeds from the sale of assets | |||||||||||

| Book value of these assets | |||||||||||

| Non-cash investing activities: | |||||||||||

| Non-cash capital expenditures | |||||||||||

See accompanying notes to the Condensed Consolidated Financial Statements

4

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (Unaudited)

($ in millions, unless otherwise stated)

| Outstanding number of shares (in thousands) | Common stock | Capital in excess of par value | Treasury shares at cost | Accumulated other comprehensive income (loss) | Accumulated deficit | Total stock- holders’ equity | Non- controlling interests | Total equity | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2021 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation plans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued pursuant to stock awards | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased and retired | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends common stock ($ | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of April 3, 2022 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation plans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued pursuant to stock awards | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased and retired | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends common stock ($ | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of July 3, 2022 | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Outstanding number of shares (in thousands) | Common stock | Capital in excess of par value | Treasury shares at cost | Accumulated other comprehensive income (loss) | Accumulated deficit | Total stock- holders’ equity | Non- controlling interests | Total equity | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2020 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation plans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued pursuant to stock awards | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Treasury shares repurchased and retired | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends common stock ($ | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of April 4, 2021 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation plans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued pursuant to stock awards | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury shares repurchased and retired | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends common stock ($ | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of July 4, 2021 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to the Condensed Consolidated Financial Statements

5

NXP SEMICONDUCTORS N.V.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

All amounts in millions of $ unless otherwise stated

1 Basis of Presentation and Overview

We prepared our interim condensed consolidated financial statements that accompany these notes in conformity with U.S. generally accepted accounting principles, consistent in all material respects with those applied in our Annual Report on Form 10-K for the year ended December 31, 2021.

We have made estimates and judgments affecting the amounts reported in our condensed consolidated financial statements and the accompanying notes. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, but reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This interim information should be read in conjunction with the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2021.

2 Significant Accounting Policies and Recent Accounting Pronouncements

Significant Accounting Policies

For a discussion of our significant accounting policies see, “Part II – Item 8. Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – “Significant Accounting Policies” of our Annual Report on Form 10-K for the year ended December 31, 2021. There have been no changes to our significant accounting policies since our Annual Report on Form 10-K for the year ended December 31, 2021.

Accounting standards recently adopted

No new accounting pronouncements were issued or became effective in the period that had, or are expected to have, a material impact on our Consolidated Financial Statements.

3 Acquisitions and Divestments

2022

There were no

2021

On July 6, 2021, we acquired Retune DSP for a total consideration of $15.7 million, net of closing adjustments.

4 Supplemental Financial Information

Statement of Operations Information:

Disaggregation of revenue

The following table presents revenue disaggregated by sales channel:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Distributors | |||||||||||||||||||||||

| Original Equipment Manufacturers and Electronic Manufacturing Services | |||||||||||||||||||||||

Other | |||||||||||||||||||||||

| Total | |||||||||||||||||||||||

6

Depreciation, amortization and impairment

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Depreciation of property, plant and equipment | |||||||||||||||||||||||

| Amortization of internal use software | |||||||||||||||||||||||

Amortization of other identified intangible assets 1) | |||||||||||||||||||||||

| Total - Depreciation, amortization and impairment | |||||||||||||||||||||||

Financial income and expense

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Total interest expense, net | ( | ( | ( | ( | |||||||||||||||||||

| Extinguishment of debt | ( | ( | |||||||||||||||||||||

| Foreign exchange rate results | ( | ||||||||||||||||||||||

| Miscellaneous financing costs/income and other, net | ( | ( | ( | ( | |||||||||||||||||||

| Total other financial income/ (expense) | ( | ( | ( | ( | |||||||||||||||||||

| Total - Financial income and expenses | ( | ( | ( | ( | |||||||||||||||||||

Earnings per share

The computation of earnings per share (EPS) is presented in the following table:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Net income (loss) | |||||||||||||||||||||||

| Less: net income (loss) attributable to non-controlling interests | |||||||||||||||||||||||

| Net income (loss) attributable to stockholders | |||||||||||||||||||||||

| Weighted average number of shares outstanding (after deduction of treasury shares) during the year (in thousands) | |||||||||||||||||||||||

| Plus incremental shares from assumed conversion of: | |||||||||||||||||||||||

Options 1) | |||||||||||||||||||||||

Restricted Share Units, Performance Share Units and Equity Rights 2) | |||||||||||||||||||||||

| Dilutive potential common shares | |||||||||||||||||||||||

| Adjusted weighted average number of shares outstanding (after deduction of treasury shares) during the year (in thousands) | |||||||||||||||||||||||

| EPS attributable to stockholders in $: | |||||||||||||||||||||||

| Basic net income (loss) | |||||||||||||||||||||||

| Diluted net income (loss) | |||||||||||||||||||||||

1) There were no no

7

Balance Sheet Information

Cash and cash equivalents

At July 3, 2022 and December 31, 2021, our cash balance was $3,545 million and $2,830 million, respectively, of which $193 million and $208 million was held by SSMC, our consolidated joint venture company with TSMC. Under the terms of our joint venture agreement with TSMC, a portion of this cash can be distributed by way of a dividend to us, but 38.8 % of the dividend will be paid to our joint venture partner. During both first six months of 2022 and 2021, no

Inventories

The portion of finished goods stored at customer locations under consignment amounted to $8 million as of July 3, 2022 (December 31, 2021: $12 million).

Inventories are summarized as follows:

| July 3, 2022 | December 31, 2021 | ||||||||||

| Raw materials | |||||||||||

| Work in process | |||||||||||

| Finished goods | |||||||||||

The amounts recorded above are net of allowance for obsolescence of $136 million as of July 3, 2022 (December 31, 2021: $120 million).

Equity Investments

At July 3, 2022 and December 31, 2021, the total carrying value of investments in equity securities is summarized as follows:

| July 3, 2022 | December 31, 2021 | ||||||||||

| Marketable equity securities | |||||||||||

| Non-marketable equity securities | |||||||||||

| Equity-accounted investments | |||||||||||

The total carrying value of investments in equity-accounted investees is summarized as follows:

| July 3, 2022 | December 31, 2021 | ||||||||||||||||||||||

| Shareholding % | Amount | Shareholding % | Amount | ||||||||||||||||||||

SMART Growth Fund, L.P.1) | % | % | |||||||||||||||||||||

| Others | |||||||||||||||||||||||

1) Previously named “Wise Road Industry Investment Fund I, L.P.” | |||||||||||||||||||||||

Results related to equity-accounted investees at the end of each period were as follows:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Company's share in income (loss) | ( | ( | ( | ||||||||||||||||||||

| Other results | |||||||||||||||||||||||

| ( | ( | ( | |||||||||||||||||||||

8

Other current liabilities

Other current liabilities at July 3, 2022 and December 31, 2021 consisted of the following:

| July 3, 2022 | December 31, 2021 | ||||||||||

| Accrued compensation and benefits | |||||||||||

| Income taxes payable | |||||||||||

| Dividend payable | |||||||||||

| Other | |||||||||||

Accumulated other comprehensive income (loss)

Total comprehensive income (loss) represents net income (loss) plus the results of certain equity changes not reflected in the condensed consolidated statements of operations. The after-tax components of accumulated other comprehensive income (loss) and their corresponding changes are shown below:

| Currency translation differences | Change in fair value cash flow hedges | Net actuarial gain/(losses) | Accumulated Other Comprehensive Income (loss) | ||||||||||||||||||||

| As of December 31, 2021 | ( | ||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | ( | |||||||||||||||||||

| Amounts reclassified out of accumulated other comprehensive income (loss) | |||||||||||||||||||||||

| Tax effects | |||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | ( | ( | |||||||||||||||||||

| As of July 3, 2022 | ( | ( | ( | ||||||||||||||||||||

Cash dividends

The following dividends were declared during the first two quarters of 2022 and 2021 under NXP’s quarterly dividend program:

| Fiscal year 2022 | Fiscal year 2021 | ||||||||||||||||||||||

| Dividend per share | Amount | Dividend per share | Amount | ||||||||||||||||||||

| First quarter | |||||||||||||||||||||||

| Second quarter | |||||||||||||||||||||||

The dividend declared in the second quarter (not yet paid) is classified in the condensed consolidated balance sheet in other current liabilities as of July 3, 2022 and was subsequently paid on July 6, 2022.

5 Restructuring

At each reporting date, we evaluate our restructuring liabilities, which consist primarily of termination benefits, to ensure that our accruals are still appropriate.

The following table presents the changes in restructuring liabilities in 2022:

| As of January 1, 2022 | Additions | Utilized | Released | Other changes | As of July 3, 2022 | ||||||||||||||||||||||||||||||

| Restructuring liabilities | ( | ( | ( | ||||||||||||||||||||||||||||||||

There were no significant restructuring costs incurred for both six month periods ended July 3, 2022 and July 4, 2021 and the utilization of the restructuring liabilities mainly reflects the execution of ongoing restructuring programs the Company initiated in earlier years.

9

These restructuring charges recorded in operating income, for the periods indicated, are included in the following line items in the statement of operations:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Cost of revenue | ( | ( | |||||||||||||||||||||

| Research and development | ( | ( | |||||||||||||||||||||

| Selling, general and administrative | |||||||||||||||||||||||

| Net restructuring charges | ( | ( | |||||||||||||||||||||

6 Income Taxes

Benefit/provision for income taxes:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Tax expense (benefit) | |||||||||||||||||||||||

| Effective tax rate | % | % | % | % | |||||||||||||||||||

Our provision for income taxes for the first six months of 2022 was $243 million (15.4 % effective tax rate) compared to a provision from income taxes of $105 million (12.0 % effective tax rate) for the first six months of 2021. The increase in the income tax expense was due to higher income before income taxes as a result of the improved operational performance of the company which was partly offset by an increase in tax incentives also taking into account the effect of specific US tax law that became effective as from 2022. In addition to this, in the first six months of 2021 there were income tax benefits due to changes in estimates of prior positions and a net change in the valuation allowance.

The Company benefits from income tax incentives in certain jurisdictions which provide that we pay reduced income taxes in those jurisdictions for a fixed period of time that varies depending on the jurisdiction. The predominant income tax holiday is expected to expire at the end of 2026. The impact of this tax holiday decreased foreign income taxes for the second quarter of 2022 by $4 million and decreased by $3 million for the second quarter 2021 (YTD 2022: a decrease of $7 million and YTD 2021: a decrease of $7 million). The benefit of this tax holiday on net income per share (diluted) was $0.02 for the second quarter of 2022 (YTD 2022: $0.03 ) and $0.02 for the second quarter of 2021 (YTD 2021: $0.03 ).

7 Identified Intangible Assets

Identified intangible assets as of July 3, 2022 and December 31, 2021, respectively, were composed of the following:

| July 3, 2022 | December 31, 2021 | ||||||||||||||||||||||

| Gross carrying amount | Accumulated amortization | Gross carrying amount | Accumulated amortization | ||||||||||||||||||||

In-process R&D (IPR&D) 1) | — | — | |||||||||||||||||||||

| Marketing-related | ( | ||||||||||||||||||||||

| Customer-related | ( | ( | |||||||||||||||||||||

| Technology-based | ( | ( | |||||||||||||||||||||

| Identified intangible assets | ( | ( | |||||||||||||||||||||

1) IPR&D is not subject to amortization until completion or abandonment of the associated research and development effort. | |||||||||||||||||||||||

The estimated amortization expense for these identified intangible assets for each of the five succeeding years is:

| 2022 (remaining) | |||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| Thereafter | |||||

All intangible assets, excluding IPR&D and goodwill, are subject to amortization and have no assumed residual value.

The expected weighted average remaining life of identified intangibles is 4 years as of July 3, 2022 (December 31, 2021: 4 years).

10

8 Debt

Exchange Offers

On April 14, 2022, we initiated a registered exchange offering of our outstanding Senior Unsecured Notes (the “Notes”) for new issues of substantially identical registered debt securities (the “Exchange Offers”). The Exchange Offers expired on May 16, 2022, at which time substantially all of the Notes were exchanged for registered senior unsecured notes with the U.S. Securities and Exchange Commission.

Debt Issuance and redemption

On May 16, 2022, NXP B.V., together with NXP Funding LLC and NXP USA, Inc., issued $500 million of 4.4 % senior unsecured notes due June 1, 2027 and $1 billion of 5.0 % senior unsecured notes due January 15, 2033.

On May 27, 2022 we redeemed the $900 million aggregate principal amount of outstanding dollar-denominated 4.625 % Senior Unsecured Notes due 2023 in accordance with the terms of the indenture.

The following table summarizes the outstanding debt as of July 3, 2022 and December 31, 2021:

| July 3, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||

| Maturities | Amount | Interest rate | Amount | Interest rate | |||||||||||||||||||||||||

Fixed-rate | Jun, 2023 | ||||||||||||||||||||||||||||

Fixed-rate | Mar, 2024 | ||||||||||||||||||||||||||||

Fixed-rate | May, 2025 | ||||||||||||||||||||||||||||

Fixed-rate | Mar, 2026 | ||||||||||||||||||||||||||||

Fixed-rate | Jun, 2026 | ||||||||||||||||||||||||||||

Fixed-rate | May, 2027 | ||||||||||||||||||||||||||||

Fixed-rate | June, 2027 | ||||||||||||||||||||||||||||

Fixed-rate | Dec, 2028 | ||||||||||||||||||||||||||||

Fixed-rate | Jun, 2029 | ||||||||||||||||||||||||||||

Fixed-rate | May, 2030 | ||||||||||||||||||||||||||||

Fixed-rate | May, 2031 | ||||||||||||||||||||||||||||

Fixed-rate | Feb, 2032 | ||||||||||||||||||||||||||||

Fixed-rate | Jan, 2033 | ||||||||||||||||||||||||||||

Fixed-rate | May, 2041 | ||||||||||||||||||||||||||||

Fixed-rate | Feb, 2042 | ||||||||||||||||||||||||||||

Fixed-rate | Nov, 2051 | ||||||||||||||||||||||||||||

| Floating-rate revolving credit facility (RCF) | Jun, 2024 | ||||||||||||||||||||||||||||

| Total principal | |||||||||||||||||||||||||||||

| Unamortized discounts, premiums and debt issuance costs | ( | ( | |||||||||||||||||||||||||||

| Total debt, including unamortized discounts, premiums, debt issuance costs and fair value adjustments | |||||||||||||||||||||||||||||

| Current portion of long-term debt | |||||||||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||||||||

9 Related-Party Transactions

The Company's related parties are the members of the board of directors of NXP Semiconductors N.V., the executive officers of NXP Semiconductors N.V. and equity-accounted investees.

The following table presents the amounts related to revenue and other income and purchase of goods and services incurred in transactions with these related parties:

| For the three months ended | For the six months ended | ||||||||||||||||||||||

| July 3, 2022 | July 4, 2021 | July 3, 2022 | July 4, 2021 | ||||||||||||||||||||

| Revenue and other income | |||||||||||||||||||||||

| Purchase of goods and services | |||||||||||||||||||||||

11

The following table presents the amounts related to receivable and payable balances with these related parties:

| July 3, 2022 | December 31, 2021 | ||||||||||

| Receivables | |||||||||||

| Payables | |||||||||||

10 Fair Value Measurements

The following table summarizes the estimated fair value of our financial instruments which are measured at fair value on a recurring basis:

Estimated fair value | |||||||||||||||||

| Fair value hierarchy | July 3, 2022 | December 31, 2021 | |||||||||||||||

| Assets: | |||||||||||||||||

| Money market funds | 1 | ||||||||||||||||

| Marketable equity securities | 1 | ||||||||||||||||

| Derivative instruments-assets | 2 | ||||||||||||||||

| Liabilities: | |||||||||||||||||

| Derivative instruments-liabilities | 2 | ( | ( | ||||||||||||||

The following methods and assumptions were used to estimate the fair value of financial instruments:

Assets and liabilities measured at fair value on a recurring basis

Investments in money market funds (as part of our cash and cash equivalents) and marketable equity securities (as part of other non-current assets) have fair value measurements which are all based on quoted prices in active markets for identical assets or liabilities. For derivatives (as part of other current assets or accrued liabilities) the fair value is based upon significant other observable inputs depending on the nature of the derivative.

Assets and liabilities recorded at fair value on a non-recurring basis

We measure and record our non-marketable equity securities, equity method investments and non-financial assets, such as intangible assets and property, plant and equipment, at fair value when an impairment charge is required.

Assets and liabilities not recorded at fair value on a recurring basis

Financial instruments not recorded at fair value on a recurring basis include non-marketable equity securities and equity method investments that have not been remeasured or impaired in the current period and debt.

As of July 3, 2022, the estimated fair value of current and non-current debt was $10.2 billion ($11.3 billion as of December 31, 2021). The fair value is estimated on the basis of broker-dealer quotes, which are Level 2 inputs. Accrued interest is included under accrued liabilities and not within the carrying amount or estimated fair value of debt.

11 Commitments and Contingencies

Purchase Commitments

The Company maintains purchase commitments with certain suppliers, primarily for raw materials, semi-finished goods and manufacturing services and for some non-production items. Purchase commitments for inventory materials are generally restricted to a forecasted time-horizon as mutually agreed upon between the parties. This forecasted time-horizon can vary for different suppliers. As of July 3, 2022, the Company had purchase commitments of $3,885 million, which are due through 2044. Our long-term obligations increased substantially in 2021 as we locked in long-term supply with our key manufacturing partners.

Litigation

We are regularly involved as plaintiffs or defendants in claims and litigation relating to a variety of matters such as contractual disputes, personal injury claims, employee grievances and intellectual property litigation. In addition, our acquisitions, divestments and financial transactions sometimes result in, or are followed by, claims or litigation. Some of these claims may possibly be recovered from insurance reimbursements. Although the ultimate disposition of asserted claims cannot be predicted with certainty, it is our belief that the outcome of any such claims, either individually or on a combined basis, will not have a material adverse effect on our consolidated financial position. However, such outcomes may be material to our condensed consolidated statement of operations for a particular period. The Company records an accrual for any claim that arises whenever it considers that it is probable that it is exposed to a loss contingency and the amount of the loss contingency can be reasonably estimated. The Company does not record a gain contingency until the period in which all contingencies are resolved and the gain is realized or realizable. Legal fees are expensed when incurred.

12

Based on the most current information available to it and based on its best estimate, the Company also reevaluates at least on a quarterly basis the claims that have arisen to determine whether any new accruals need to be made or whether any accruals made need to be adjusted. Based on the procedures described above, the Company has an aggregate amount of $61 million accrued for potential and current legal proceedings pending as of July 3, 2022, compared to $65 million accrued at December 31, 2021 (without reduction for any related insurance reimbursements). The accruals are included in “Other non-current liabilities”. As of July 3, 2022, the Company’s related balance of insurance reimbursements was $43 million (December 31, 2021: $46 million) and is included in “Other non-current assets”.

The Company also estimates the aggregate range of reasonably possible losses in excess of the amount accrued based on currently available information for those cases for which such estimate can be made. The estimated aggregate range requires significant judgment, given the varying stages of the proceedings, the existence of multiple defendants (including the Company) in such claims whose share of liability has yet to be determined, the numerous yet-unresolved issues in many of the claims, and the attendant uncertainty of the various potential outcomes of such claims. Accordingly, the Company’s estimate will change from time to time, and actual losses may be more than the current estimate. As at July 3, 2022, the Company believes that for all litigation pending its potential aggregate exposure to loss in excess of the amount accrued (without reduction for any amounts that may possibly be recovered under insurance programs) could range between $0 and $72 million. Based upon our past experience with these matters, the Company would expect to receive additional insurance reimbursement of up to $89 million on certain of these claims that would partially offset the potential aggregate exposure to loss in excess of the amount accrued.

In addition, the Company is currently assisting Motorola in the defense of personal injury lawsuits due to indemnity obligations included in the agreement that separated Freescale from Motorola in 2004. The multi-plaintiff Motorola lawsuits are pending in the Circuit Court of Cook County, Illinois. These claims allege a link between working in semiconductor manufacturing clean room facilities and birth defects in 22 individuals. The Motorola suits allege exposures between 1980 and 2005. Each claim seeks an unspecified amount of damages for the alleged injuries; however, legal counsel representing the plaintiffs has indicated they will seek substantial compensatory and punitive damages from Motorola for the entire inventory of claims which, if proven and recovered, the Company considers to be material. A portion of any indemnity due to Motorola will be reimbursed to NXP if Motorola receives an indemnification payment from its insurance coverage. Motorola has potential insurance coverage for many of the years indicated above, but with differing types and levels of coverage, self-insurance retention amounts and deductibles. We are in discussions with Motorola and their insurers regarding the availability of applicable insurance coverage for each of the individual cases. Motorola and NXP have denied liability for these alleged injuries based on numerous defenses.

13

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This interim Management’s Discussion and Analysis ("MD&A") should be read in conjunction with our consolidated financial statements and notes and the MD&A in our Annual Report on Form 10-K for the year ended December 31, 2021. This discussion contains forward-looking statements that involve a number of risks and uncertainties, including any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, uncertain events or assumptions, and other characterizations of future events or circumstances, including the expected timeline to remediate the identified material weakness in our internal control over financial reporting, the uncertain nature, magnitude, and duration of hostilities stemming from Russia's recent military invasion of the Ukraine, and our response to the current global pandemic and the potential impact the pandemic will have on our operations, liquidity, customers, facilities and supply chain. Such statements are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this filing, and in “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K. Our actual results may differ materially from those contained in any forward-looking statements. We undertake no obligation to update any forward-looking statement to reflect subsequent events or circumstances.

Our MD&A is provided in addition to the accompanying consolidated financial statements and notes to assist readers in understanding our results of operations, financial condition and cash flows. MD&A is organized as follows:

•Overview - Overall analysis of financial and other highlights to provide context for the MD&A

•Results of Operations - An analysis of our financial results

•Liquidity and Capital Resources - An analysis of changes in our balance sheets and cash flows

•Information Regarding Guarantors of NXP - Financial information of the Obligor Group on a combined basis

Overview

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | YTD 2022 | YTD 2021 | |||||||||||||||||||

| Revenue | 3,312 | 2,596 | 6,448 | 5,163 | |||||||||||||||||||

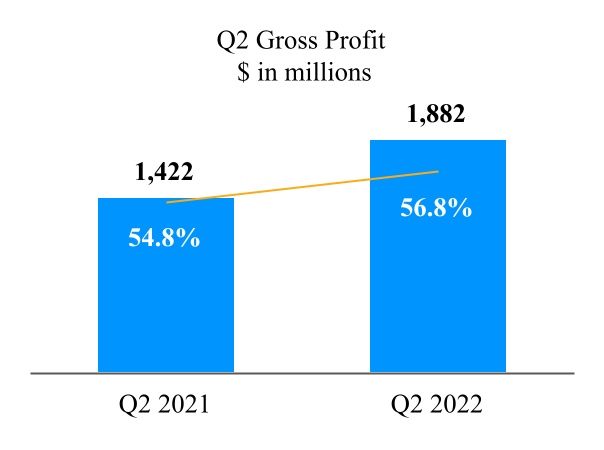

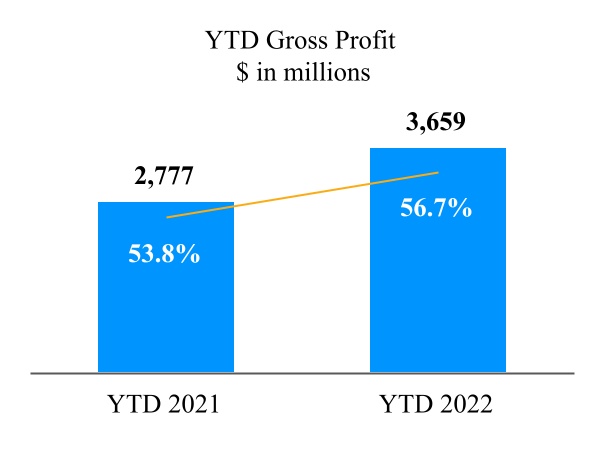

| Gross profit | 1,882 | 1,422 | 3,659 | 2,777 | |||||||||||||||||||

| Operating income (loss) | 943 | 573 | 1,816 | 1,065 | |||||||||||||||||||

| Cash flow from operating activities | 819 | 636 | 1,675 | 1,368 | |||||||||||||||||||

| Total debt | 11,160 | 9,591 | 11,160 | 9,591 | |||||||||||||||||||

| Net debt | 7,615 | 6,681 | 7,615 | 6,681 | |||||||||||||||||||

| Diluted weighted average number of shares outstanding | 264,692 | 278,735 | 264,909 | 281,063 | |||||||||||||||||||

| Diluted net income per share | 2.53 | 1.42 | 5.01 | 2.67 | |||||||||||||||||||

| Dividends per common share | 0.8450 | 0.5625 | 1.6900 | 1.1250 | |||||||||||||||||||

Q2 2022 compared to Q2 2021

Revenue for the three months ended July 3, 2022 was $3,312 million compared to $2,596 million for the three months ended July 4, 2021, an increase of $716 million or an increase of 27.6% year-on-year. Revenue growth during the quarter was due to increased volumes of products shipped driven by the continued industry-wide demand for semiconductors across the company’s focused end markets, and the positive mix effects within the company’s focused end markets. Additionally, the company continued to experience the inflationary effects of increased input costs from its suppliers which were passed along to end customers in the form of higher average selling prices.

Our gross profit percentage for the second quarter of 2022 increased from 54.8% in the second quarter of 2021 to 56.8%, primarily from the continued significant acceleration of revenue in the second quarter of 2022 compared to the same period in 2021, which led to improved factory loading, increased manufacturing volumes, and higher sales prices, which were mostly offset by higher input costs.

We continue to generate strong operating cash flows, with $819 million in cash flows from operations for the second quarter of 2022. We returned $224 million to our shareholders during the second quarter of 2022. Our cash position at the end of the second quarter of 2022 was $3,545 million. This includes the net proceeds of the $1.5 billion of senior unsecured debt issued by NXP on May 16, 2022.

YTD 2022 compared to YTD 2021

Revenue for the six months ended July 3, 2022 was $6,448 million compared to $5,163 million for the six months ended July 4, 2021, an increase of $1,285 million or an increase of 24.9% year-on-year. The increase within the first half 2022 is attributed to strong demand, across all of the end markets.

Our gross profit percentage for the six months ended July 3, 2022 increased from 53.8% for the six months ended July 4, 2021 to 56.7%, primarily from the continued significant acceleration of revenue in the first six months of 2022 compared to the same period in 2021, which led to improved factory loading, increased manufacturing volumes, and higher sales prices, which were mostly offset by higher input costs.

14

Cash flow from operations for the first six months of 2022 was $1,675 million. Total shareholder return for the first six months of 2022 was $925 million. Our cash position remains solid, with the net proceeds of the $1.5 billion in newly issued debt adding to our cash and cash equivalents.

Results of operations

The following table presents operating income for each of the three month periods ended July 3, 2022 and July 4, 2021, respectively:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | YTD 2022 | YTD 2021 | |||||||||||||||||||

| Revenue | 3,312 | 2,596 | 6,448 | 5,163 | |||||||||||||||||||

| % nominal growth | 27.6 | 42.9 | 24.9 | 34.5 | |||||||||||||||||||

| Gross profit | 1,882 | 1,422 | 3,659 | 2,777 | |||||||||||||||||||

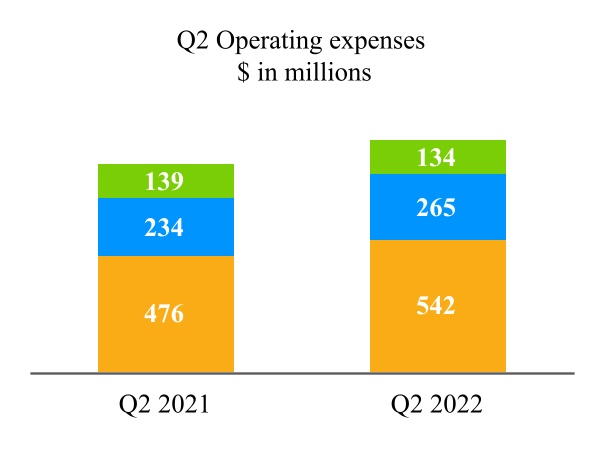

| Research and development | (542) | (476) | (1,060) | (937) | |||||||||||||||||||

| Selling, general and administrative | (265) | (234) | (516) | (456) | |||||||||||||||||||

| Amortization of acquisition-related intangible assets | (134) | (139) | (269) | (319) | |||||||||||||||||||

| Other income (expense) | 2 | — | 2 | — | |||||||||||||||||||

| Operating income (loss) | 943 | 573 | 1,816 | 1,065 | |||||||||||||||||||

Revenue

Q2 2022 compared to Q2 2021

Revenue for the three months ended July 3, 2022 was $3,312 million compared to $2,596 million for the three months ended July 4, 2021, an increase of $716 million or an increase of 27.6% year-on-year, with growth in all of the Company’s four focus end markets.

YTD 2022 compared to YTD 2021

Revenue for the six months ended July 3, 2022 was $6,448 million compared to $5,163 for the six months ended July 4, 2021, an increase of $1,285 million or 24.9%, with growth in all of the Company’s four end markets.

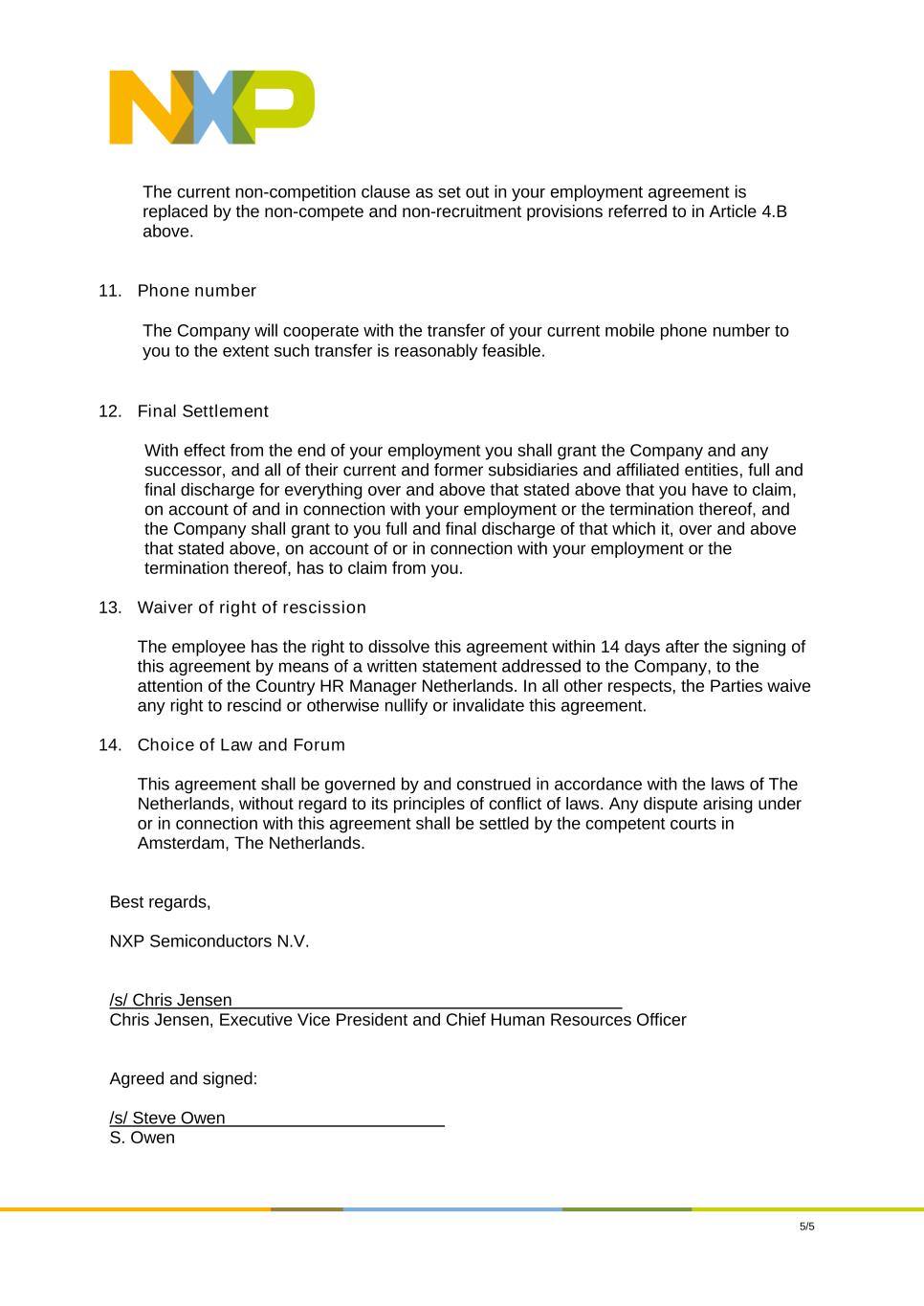

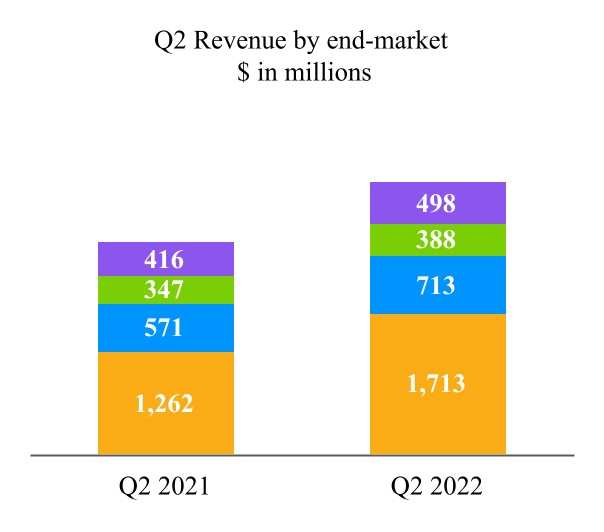

Revenue by end market was as follows:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | Change | YTD 2022 | YTD 2021 | Change | |||||||||||||||||||||||||||||

| Automotive | 1,713 | 1,262 | 35.7 | % | 3,270 | 2,491 | 31.3 | % | |||||||||||||||||||||||||||

| Industrial & IoT | 713 | 571 | 24.9 | % | 1,395 | 1,142 | 22.2 | % | |||||||||||||||||||||||||||

| Mobile | 388 | 347 | 11.8 | % | 789 | 693 | 13.9 | % | |||||||||||||||||||||||||||

| Communication Infrastructure & Other | 498 | 416 | 19.7 | % | 994 | 837 | 18.8 | % | |||||||||||||||||||||||||||

| Revenue | 3,312 | 2,596 | 27.6 | % | 6,448 | 5,163 | 24.9 | % | |||||||||||||||||||||||||||

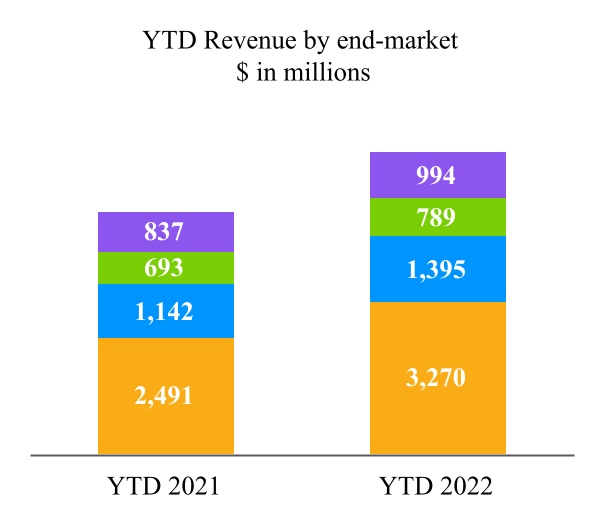

Revenue by sales channel was as follows:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | Change | YTD 2022 | YTD 2021 | Change | |||||||||||||||||||||||||||||

| Distributors | 1,829 | 1,518 | 20.5 | % | 3,509 | 2,986 | 17.5 | % | |||||||||||||||||||||||||||

| OEM/EMS | 1,441 | 1,040 | 38.6 | % | 2,853 | 2,104 | 35.6 | % | |||||||||||||||||||||||||||

| Other | 42 | 38 | 10.5 | % | 86 | 73 | 17.8 | % | |||||||||||||||||||||||||||

| Revenue | 3,312 | 2,596 | 27.6 | % | 6,448 | 5,163 | 24.9 | % | |||||||||||||||||||||||||||

Revenue by geographic region, which is based on the customer’s shipped-to location was as follows:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | Change | YTD 2022 | YTD 2021 | Change | |||||||||||||||||||||||||||||

| Greater China and Asia Pacific | 1,831 | 1,503 | 21.8 | % | 3,531 | 2,985 | 18.3 | % | |||||||||||||||||||||||||||

| EMEA (Europe, the Middle East and Africa) | 668 | 461 | 44.9 | % | 1,306 | 928 | 40.7 | % | |||||||||||||||||||||||||||

| Americas | 435 | 336 | 29.5 | % | 867 | 657 | 32.0 | % | |||||||||||||||||||||||||||

| Japan | 230 | 188 | 22.3 | % | 448 | 377 | 18.8 | % | |||||||||||||||||||||||||||

| South Korea | 148 | 108 | 37.0 | % | 296 | 216 | 37.0 | % | |||||||||||||||||||||||||||

| Revenue | 3,312 | 2,596 | 27.6 | % | 6,448 | 5,163 | 24.9 | % | |||||||||||||||||||||||||||

15

| n | Automotive | n | Mobile | |||||||||||

| n | Industrial IoT | n | Comm Infra & Other | |||||||||||

| n | Distributors | n | Other | |||||||||||

| n | OEM/EMS | |||||||||||||

Q2 2022 compared to Q2 2021

The increase in revenue is attributed to the combination of ongoing demand, across NXP’s Automotive, Industrial IoT, Mobile, and the Communications Infrastructure & Other end markets, as well as the effects of increased input costs from NXP suppliers which were passed along to our end customers in the form of higher average selling prices.

From an end market perspective, the year-on-year growth within the Automotive end market was driven by strong demand across the entire automotive product portfolio in support of the secular shift of electrification, advanced driver safety and assistance, and driver connectivity systems. The growth within the Industrial & IoT market reflects the continued adoption of our complete secure, connected edge processing solutions which leverage our broad processor portfolio, complimented by connectivity, analog attach and security products. The growth within the Mobile end market was due to ongoing adoption of our secure embed transaction solutions along with the company’s growth in our advanced analog high speed interfaces. The growth within the Communication Infrastructure & Other end market was attributable to cellular base stations, the network edge equipment, and the secure access, transit and government sponsored identification market.

When aggregating all end markets together, and reviewing sales channel performance, business transacted through NXP's third party distribution partners was $1,829 million, an increase of 20.5%. Sales to NXP's direct OEM and EMS customers was $1,441 million, an

16

increase of 38.6% versus the second quarter of 2021.

From a geographic perspective, revenue increased across all regions.

Revenue from the Automotive end market was $1,713 million, an increase of $451 million or 35.7% year-on-year. Within Automotive, customers are focused on the key functional pillars of safety, electrification and improved driver comfort to accelerate competitive differentiation. These broad functional areas are fundamentally enabled by the secular adoption of new and increased levels of semiconductor content, which is layered on top of a strong base of existing electronic content in modern automobiles. The increase in Automotive revenue during the second quarter of 2022 can be attributed to strong demand for advanced analog, embedded processing and radar solutions.

Revenue from the Industrial & IoT end market was $713 million, an increase of $142 million or 24.9% year-on-year. The Industrial & IoT market is driven by the secular trend of multi-market OEMs seeking to enable secure, connected, high performance processing solutions at the edge of the network, whether it is in factory automation, smart building/smart home or the exploding plethora of connected IoT devices. The innovation in this market is being driven by thousands of relatively smaller customers, which NXP effectively services through its extended global distribution channel. During the second quarter of 2022, the year-on-year increase was driven by the continued demand for the company’s 32-bit ARM-based microcontrollers and crossover processors, and to a lesser degree industrial application processors. Additionally, the year-on-year increase was supported by demand for industrial analog products, and point-of-sale security solutions.

Revenue from the Mobile end market was $388 million with an increase of $41 million or 11.8% year-on-year. The year-on-year increase was driven by strong adoption of secure mobile wallet solutions and increased demand in our advanced analog high speed interfaces, which was offset by declines in advanced power systems driven by load switch demand decline. Our mobile customers are primarily serviced through our global distribution channels.

Revenue in the Communication Infrastructure & Other end market was $498 million, an increase of $82 million or 19.7% year-on-year. The Communication Infrastructure & Other end market is an amalgamation of three separate product portfolios, which service multiple end markets, including cellular base stations; the network edge equipment, and the secure access, transit and government sponsored identification market. The year-on-year growth in the second quarter of 2022 was driven by a combination of high performance RF Power amplifier products for cellular base-station applications, network edge equipment, and broad based demand for secure access and identification solutions. Offsetting these positive growth trends were declines in demand for the company’s smart antennae products used in the Android mobile handset market, as well as declines in demand for wireless access point solutions.

YTD 2022 compared to YTD 2021

The increase in revenue is primarily attributed to the combination of strong demand, from NXP’s Automotive, Industrial IoT, and the Communications Infrastructure & Other end markets, and to a lesser degree the Mobile end market. The year-to-date growth rates are also influenced by higher average pricing, which were the result of rising inflationary effects on input costs from NXP suppliers, and passed along to our end customers.

From an end market perspective, within the automotive end market the year-on-year growth was driven by strong demand for advanced analog, embedded processing and radar in support of the secular shift of electrification, advanced driver safety and assistance, and driver connectivity systems. The growth within the Industrial & IoT market reflects the successful continuation of adoption of our complete secure, connected edge processing solutions which leverage our broad processor portfolio, complimented by analog attach, connectivity, and security products. Growth within the Mobile end market was due to ongoing adoption of our secure embed transaction solutions along with the company’s growth in our advanced analog high speed interfaces. Growth within the Communication Infrastructure & Other end market was attributable to cellular base stations, the network edge equipment, and the secure access, transit and government sponsored identification market.

When aggregating all end markets together, and reviewing sales channel performance, business transacted through direct OEM and EMS customers was $2,853 million, an increase of 35.6% versus the first half of 2021. NXP's third party distribution partners was $3,509 million, an increase of 17.5%.

From a geographic perspective, revenue increased across all regions.

Revenue in the Automotive end market was $3,270 million, an increase of $779 million or 31.3% versus the year ago period due to the ongoing demand for our automotive products supporting the secular shift of electrification, advanced driver safety and assistance, and driver connectivity systems.

Revenue in the Industrial & IoT end market was $1,395 million, an increase of $253 million or 22.2% versus the year ago period primarily driven by the continued demand for the company’s 32-bit ARM-based microcontrollers and crossover processors, and to a lesser degree industrial application processors. Additionally, the year-on-year increase was supported by demand for industrial analog products, IoT connectivity and point-of-sale security solutions.

Revenue in the Mobile end market was $789 million, an increase of $96 million or 13.9% versus the year ago period due to strong adoption of secure mobile wallet solutions, and demand for our advanced analog high speed interfaces, offset by declines in embedded power solutions.

17

Revenue in the Communication Infrastructure & Other end market was $994 million, an increase of $157 million or 18.8% versus the year ago period due to a combination of strength from RF Power products levered to the secular build-out of 5G base stations, network edge equipment, and broad based demand for secure access and identification solutions. Offsetting these positive growth trends were declines in demand for the company’s smart antennae products used in the Android mobile handset market, as well as declines in demand for wireless access point solutions.

Gross profit

Q2 2022 compared to Q2 2021

Gross profit for the three months ended July 3, 2022 was $1,882 million, or 56.8% of revenue, compared to $1,422 million, or 54.8% of revenue for the three months ended July 4, 2021.The increase of $460 million in gross profit was driven by the significant higher revenue in the second quarter of 2022 compared to the second quarter of 2021, which led to improved factory loading, increased manufacturing volumes, and higher sales prices, which were mostly offset by higher input costs.

YTD 2022 compared to YTD 2021

Gross profit for the six months ended July 3, 2022 was $3,659 million, or 56.7% of revenue, compared to $2,777 million, or 53.8% of revenue for the six months ended July 4, 2021. The increase of $882 million was primarily driven by the significant higher revenue in the first half of 2022 compared to the first half of 2021, which led to improved factory loading, increased manufacturing volumes, and higher sales prices, which were mostly offset by higher input costs.

Operating expenses

Q2 2022 compared to Q2 2021

Operating expenses for the three months ended July 3, 2022 totaled $941 million, or 28.4% of revenue, compared to $849 million, or 32.7% of revenue, for the three months ended July 4, 2021.

YTD 2022 compared to YTD 2021

Operating expenses for the six months ended July 3, 2022 totaled $1,845 million, or 28.6% of revenue, compared to $1,712 million, or 33.2% of revenue, for the six months ended July 4, 2021.

The following table below presents the composition of operating expenses by line item in the statement of operations:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | YTD 2022 | YTD 2021 | |||||||||||||||||||

| Research and development | 542 | 476 | 1,060 | 937 | |||||||||||||||||||

| Selling, general and administrative | 265 | 234 | 516 | 456 | |||||||||||||||||||

| Amortization of acquisition-related intangible assets | 134 | 139 | 269 | 319 | |||||||||||||||||||

| Total operating expenses | 941 | 849 | 1,845 | 1,712 | |||||||||||||||||||

18

| n | R&D | n | SG&A | n | Amortization acquisition-related | ||||||||||||

Q2 2022 compared to Q2 2021

The increase in operating expenses was a result of the following items:

Research and development (R&D) costs primarily consist of engineer salaries and wages (including share based compensation and other variable compensation), engineering related costs (including outside services, fixed-asset, IP and other licenses related costs), shared service center costs and other pre-production related expenses. R&D costs for the three months ended July 3, 2022 increased by $66 million, or 13.9%, when compared to the three months ended July 4, 2021 mainly driven by:

+ higher personnel-related costs, including variable compensation costs;

+ higher pre-production related expenses; and

+ higher professional services.

Selling, general and administrative (SG&A) costs primarily consist of personnel salaries and wages (including share based compensation and other variable compensation), communication and IT related costs, fixed-asset related costs and sales and marketing costs (including travel expenses). SG&A costs for the three months ended July 3, 2022 increased by $31 million, or 13.2%, when compared to the three months ended July 4, 2021 mainly due to:

+ higher legal expense; and

+ higher professional services.

Amortization of acquisition-related intangible assets decreased by $5 million, or 3.6%, when compared to the three months ended July 4, 2021 driven by:

- certain intangibles became fully amortized during 2021.

YTD 2022 compared to YTD 2021

The increase in operating expenses was a result of the following items:

Research and development (R&D) costs primarily consist of engineer salaries and wages (including share based compensation and other variable compensation), engineering related costs (including outside services, fixed-asset, IP and other licenses related costs), shared service center costs and other pre-production related expenses. R&D costs for the six months ended July 3, 2022 increased by $123 million, or 13.1%, when compared to the six months ended July 4, 2021 driven by:

+ higher personnel-related costs, including variable compensation costs;

+ higher pre-production related expenses; and

+ higher professional services .

Selling, general and administrative (SG&A) costs primarily consist of personnel salaries and wages (including share based compensation and other variable compensation), communication and IT related costs, fixed-asset related costs and sales and marketing costs (including travel expenses). SG&A costs for the six months ended July 3, 2022 increased by $60 million, or 13.2%, when compared to the six months ended July 4, 2021 mainly due to:

+ higher legal expense;

+ higher professional services; and

+ higher IT related expenses.

19

Amortization of acquisition-related intangible assets decreased by $50 million, or 15.7%, when compared to the six months ended July 4, 2021 driven by:

- an impairment charge in Q1 2021 as a result of the discontinuation of an IPR&D project.

Financial income (expense)

The following table presents the details of financial income and expenses:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | YTD 2022 | YTD 2021 | |||||||||||||||||||

| Interest income | 6 | 1 | 8 | 2 | |||||||||||||||||||

| Interest expense | (106) | (90) | (210) | (177) | |||||||||||||||||||

| Total interest expense, net | (100) | (89) | (202) | (175) | |||||||||||||||||||

| Extinguishment of debt | (18) | — | (18) | — | |||||||||||||||||||

| Foreign exchange rate results | 3 | (1) | 3 | — | |||||||||||||||||||

| Miscellaneous financing costs/income and other, net | (13) | (10) | (16) | (12) | |||||||||||||||||||

| Total other financial income (expense) | (28) | (11) | (31) | (12) | |||||||||||||||||||

| Total | (128) | (100) | (233) | (187) | |||||||||||||||||||

Q2 2022 compared to Q2 2021

Financial income (expense) was an expense of $128 million in the second quarter of 2022 compared to an expense of $100 million in the second quarter of 2021. The change in financial income (expense) is primarily attributable to an increase in interest expense as a result of the net increase in debt, and debt extinguishment costs incurred in the second quarter of 2022. Higher interest rates resulted in an interest income increase in the second quarter of 2022.

YTD 2022 compared to YTD 2021

Financial income (expense) was an expense of $233 million in the first six months of 2022 compared to an expense of $187 million in the first six months of 2021. The change in financial income (expense) is primarily attributable to an increase in interest expense as a result of the net increase in debt, and debt extinguishment costs incurred in the second quarter of 2022. Higher interest rates resulted in an interest income increase in the second quarter of 2022.

Benefit (provision) for income taxes

Q2 2022 compared to Q2 2021

Our provision for income taxes was $129 million (15.8% effective tax rate) for the second quarter of 2022 compared to a provision for income taxes of $65 million (13.7% effective tax rate) for the second quarter of 2021. The increase in the income tax expense was due to higher income before income taxes as a result of the improved operational performance of the company, which was partly offset by an increase in tax incentives also taking into account the effect of specific US tax law that became effective as from 2022. In addition to this, in the second quarter of 2021 there was an income tax benefit due to a release of the valuation allowance and a lower taxable foreign exchange result.

YTD 2022 compared to YTD 2021

Our provision for income taxes for the first six months of 2022 was $243 million (15.4% effective tax rate) compared to a provision for income taxes of $105 million) (12.0% effective tax rate) for the first six months of 2021. The increase in the income tax expense was due to higher income before income taxes as a result of the improved operational performance of the company which was partly offset by an increase in tax incentives also taking into account the effect of specific US tax law that became effective as from 2022. In addition to this, in the first six months of 2021 there were income tax benefits due to changes in estimates of prior positions and a net change in the valuation allowance.

Net income (loss)

The following table presents the composition of net income for the periods reported:

| ($ in millions, unless otherwise stated) | Q2 2022 | Q2 2021 | YTD 2022 | YTD 2021 | |||||||||||||||||||

| Operating income (loss) | 943 | 573 | 1,816 | 1,065 | |||||||||||||||||||

| Financial income (expense) | (128) | (100) | (233) | (187) | |||||||||||||||||||

| Benefit (provision) for income taxes | (129) | (65) | (243) | (105) | |||||||||||||||||||

| Results relating to equity-accounted investees | (3) | (2) | 9 | (3) | |||||||||||||||||||

| Net income (loss) | 683 | 406 | 1,349 | 770 | |||||||||||||||||||

20

Liquidity and Capital Resources

We derive our liquidity and capital resources primarily from our cash flows from operations. We continue to generate strong positive operating cash flows. At the end of the second quarter of 2022, our cash balance was $3,545 million, an increase of $715 million compared to December 31, 2021. Taking into account the available amount of the Unsecured Revolving Credit Facility of $1,500 million, we had access to $5,045 million of liquidity as of July 3, 2022.

We currently use cash to fund operations, meet working capital requirements, for capital expenditures and for potential common stock repurchases, dividends and strategic investments. Based on past performance and current expectations, we believe that our current available sources of funds (including cash and cash equivalents, RCF Agreement, plus anticipated cash generated from operations) will be adequate to finance our operations, working capital requirements, capital expenditures and potential dividends for at least the next twelve months. Our capital expenditures were $548 million in the first six months of 2022, compared to $300 million in the first six months of 2021. During the six month period ended July 3, 2022, we repurchased $554 million, or 2.7 million shares of our common stock pursuant to our share buyback programs at a weighted average price of $207.77 per share.

Our total debt amounted to $11,160 million as of Q2 2022, an increase of $588 million compared to December 31, 2021 ($10,572 million). On May 16, 2022, NXP issued $500 million aggregate principal amount of 4.400% Senior Notes due in 2027 (the “4.400% 2027 Notes”) and $1 billion aggregate principal amount of 5.000% Senior Notes due in 2033 (the “2033 Notes”). The net proceeds of the 4.400% 2027 Notes, together with cash on hand, has been used to redeem the $900 million aggregate principal amount of outstanding dollar-denominated 4.625% Senior Unsecured Notes due 2023 in accordance with the terms of the indenture. NXP will allocate an amount equal to the net proceeds of the offering of the 2033 Notes to the financing of, in whole or in part, one or more eligible green projects. Pending allocation, NXP will temporarily hold the remaining net proceeds of the 2033 Notes as cash and other short-term securities or use for general corporate purposes, which may include capital expenditures, short-term debt repayment or equity buyback transactions.

Exchange Offers

In connection with the sale of (i) NXP B.V.’s and NXP Funding LLC’s 4.875% Senior Notes due 2024 (the “2024 Notes”), 5.350% Senior Notes due 2026 (the “5.350% 2026 Notes”) and 5.550% Senior Notes due 2028 (the “2028 Notes”) and (ii) NXP B.V.’s, NXP Funding LLC’s and NXP USA Inc.’s 2.700% Senior Notes due 2025 (the “2025 Notes”), 3.875% Senior Notes due 2026 (the “3.875% 2026 Notes”), 3.150% Senior Notes due 2027 (the “3.150% 2027 Notes”), 4.300% Senior Notes due 2029 (the “2029 Notes”), 3.400% Senior Notes due 2030 (the “2030 Notes”), 2.500% Senior Notes due 2031 (the “2031 Notes”), 2.650% Senior Notes due 2032 (the “2032 Notes”), 3.250% Senior Notes due 2041 (the “2041 Notes”), 3.125% Senior Notes due 2042 (the “2042 Notes”) and 3.250% Senior Notes due 2051 (the “2051 Notes”), which we collectively refer to as the “Notes”, the issuers of the Notes (the “Issuers”) entered into registration rights agreements pursuant to which the Issuers agreed, among other things, to use commercially reasonable efforts to file an exchange offer registration statement to exchange the Notes for new issues of substantially identical debt securities registered under the U.S. Securities Act of 1933 (the “Exchange Offers”).

On April 14, 2022, the registration statements on Form S-4 filed by the Issuers were declared effective by the SEC, registering the Exchange Offers. The Exchange Offers expired on May 16, 2022. Any outstanding Notes that were not tendered for exchange in the Exchange Offers remain outstanding and continue to accrue interest and are entitled to the rights and benefits that such holders have under the indentures related to such outstanding Notes, except for any rights under the applicable registration rights agreement which terminated upon consummation of the Exchange Offers. This exchange had no impact on our financial position, result of operations or cash flows.

At July 3, 2022, our cash balance was $3,545 million of which $193 million was held by SSMC, our consolidated joint venture company with TSMC. Under the terms of our joint venture agreement with TSMC, a portion of this cash can be distributed by way of a dividend to us, but 38.8% of the dividend will be paid to our joint venture partner.

Cash flows

Our cash and cash equivalents during the first six months of 2022 increased by $726 million as follows:

| ($ in millions, unless otherwise stated) | YTD 2022 | YTD 2021 | |||||||||

| Net cash provided by (used for) operating activities | 1,675 | 1,368 | |||||||||

| Net cash (used for) provided by investing activities | (617) | (370) | |||||||||

| Net cash provided by (used for) financing activities | (332) | (360) | |||||||||

| Increase (decrease) in cash and cash equivalents | 726 | 638 | |||||||||

Cash Flow from Operating Activities

For the first six months of 2022 our operating activities provided $1,675 million in cash. This was primarily the result of net income of $1,349 million, adjustments to reconcile the net income of $723 million and changes in operating assets and liabilities of $(402) million. Adjustments to net income (loss) includes offsetting non-cash items, such as depreciation and amortization of $627 million, share-based compensation of $178 million and changes in deferred taxes of $(98) million.

The change in operating assets and liabilities was attributable to the following:

21

The $111 million increase in receivables and other current assets for the six months ended July 3, 2022 was mainly driven by the increase in accounts receivable due to the linearity of revenue between the two periods, customer mix, and the related timing of cash collections in the first six months of 2022 compared with the same period in 2021.

The $273 million increase in inventories for the six months ended July 3, 2022 was primarily related to increased production levels as we work to align inventory on hand with the current revenue forecasts.

The $270 million increase in accounts payable and other liabilities for the six months ended July 3, 2022 was primarily related to the increase of trade accounts payable of $210 million as a result of increased demand and timing, $20 million in interest payable due to timing of interest payments, $53 million in income and social tax payables, partially offset by $13 million of other net movements including the non-cash adjustment for capital expenditures and purchased IP.

The $288 million increase in other non-current assets for the six months ended July 3, 2022 was primarily related to prepayments to secure long-term production supply with multiple vendors.

For the first six months of 2021 our operating activities provided $1,368 million in cash. This was primarily the result of net income of $770 million, adjustments to reconcile the net income of $851 million and changes in operating assets and liabilities of $(252) million. Adjustments to net income (loss) includes offsetting non-cash items, such as depreciation and amortization of $646 million, share-based compensation of $184 million and changes in deferred taxes of $12 million.

Cash Flow from Investing Activities

Net cash used for investing activities amounted to $617 million for the first six months of 2022 and principally consisted of the cash outflows for capital expenditures of $548 million, $72 million for the purchase of identified intangible assets and $5 million for the purchase of equipment leased to others.

Net cash used for investing activities amounted to $370 million for the first six months of 2021 and principally consisted of the cash outflows for capital expenditures of $300 million and $72 million for the purchase of identified intangible assets, partly offset by net proceeds of $2 million related to sales and purchases of investments.

Cash Flow from Financing Activities

Net cash used for financing activities was $332 million for the first six months of 2022 compared to net cash provided by financing activities of $360 million for the first six months of 2021, detailed in the table below:

| ($ in millions) | YTD 2022 | YTD 2021 | |||||||||

| Repurchase of long-term debt | (917) | — | |||||||||

| Proceeds from the issuance of long-term debt | 1,496 | 2,000 | |||||||||

| Cash paid for debt issuance costs | (13) | (22) | |||||||||

| Dividends paid to common stockholders | (371) | (260) | |||||||||

| Cash proceeds from exercise of stock options and savings from ESPP | 28 | 31 | |||||||||

| Purchase of treasury shares | (554) | (2,108) | |||||||||

| Other, net | (1) | (1) | |||||||||

Additional Capital Requirements

Expected working and other capital requirements are described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. At July 3, 2022, other than for changes disclosed in the “Notes to Condensed Consolidated Financial Statements” and “Liquidity and Capital Resources” in this Quarterly Report, there have been no other material changes to our expected working and other capital requirements described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Information Regarding Guarantors of NXP (unaudited)

Summarized Combined Financial Information for Guarantee of Securities of Subsidiaries

All debt instruments are guaranteed, fully and unconditionally, jointly and severally, by NXP Semiconductors N.V. and issued or guaranteed by NXP USA, Inc., NXP B.V. and NXP LLC, (together, the “Subsidiary Obligors” and together with NXP Semiconductors N.V., the “Obligor Group”). Other than the Subsidiary Obligors, none of the Company’s subsidiaries (together the “Non-Guarantor Subsidiaries”) guarantee the Notes. The Company consolidates the Subsidiary Obligors in its consolidated financial statements and each of the Subsidiary Obligors are wholly owned subsidiaries of the Company.

22

All of the existing guarantees by the Company rank equally in right of payment with all of the existing and future senior indebtedness of the Obligor Group. There are no significant restrictions on the ability of the Obligor Group to obtain funds from respective subsidiaries by dividend or loan.

The following tables present summarized financial information of the Obligor Group on a combined basis, with intercompany balances and transactions between entities of the Obligor Group eliminated and investments and equity in the earnings of the Non-Guarantor Subsidiaries excluded. The Obligor Group’s amounts due from, amounts due to, and intercompany transactions with Non-Guarantor Subsidiaries have been disclosed below the table, when material.

Summarized Statements of Income

| For the six months ended | |||||

| ($ in millions) | July 3, 2022 | ||||

| Revenue | 3,683 | ||||

| Gross Profit | 1,904 | ||||

| Operating income | 692 | ||||

| Net income | 253 | ||||

Summarized Balance Sheets

| As of | |||||||||||

| ($ in millions) | July 3, 2022 | December 31, 2021 | |||||||||