UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark one)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

For the transition period from __________ to ____________

Commission file number: 1-35016.

SGOCO Group, Ltd.

(Exact name of the Registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

21/F, 8 Fui Yiu Kok Street, Tsuen Wan, New Territories,

Hong Kong

(Address of principal executive offices)

Xiao-Ming HU, Interim Chief Financial Officer

Tel: +852 2153-3957; Fax: +852 3286-3200

21/F, 8 Fui Yiu Kok Street, Tsuen Wan, New Territories,

Hong Kong

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Ordinary shares, par value $0.004 per share | SGOC | The NASDAQ Stock Market, LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Warrants, each to purchase one ordinary share

Title of Class

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

The registrant had 80,026,647 ordinary shares issued and outstanding as of April 30, 2019.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ¨ Large Accelerated filer | ¨ Accelerated filer | x Non-accelerated filer |

| ¨ Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| x U.S. GAAP |

¨ International Financial Reporting Standards as issued by the International Accounting Standards Board |

¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

TABLE OF CONTENTS

2

3

This Annual Report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are subjective. Therefore, they involve known and unknown risks.

They are based largely on our current expectations and projections about future events and financial trends, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, for reasons connected with measuring future developments, including:

| 1. | the correct measurement and identification of factors affecting our business; |

| 2. | the extent of their likely impact; and/or |

| 3. | the accuracy and completeness of the publicly available information regarding the factors upon which our business strategy is based. |

Forward-looking statements should not be read as a guarantee of future performance or results. They will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time regarding future events. Consequently, they are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements.

Important factors that could cause actual performance or results to differ materially from those contained in forward-looking statements include, but are not limited to, those factors discussed under Item 3.D. “Risk Factors” herein, including, among others:

| 1. | The acquisition of Boca International Limited or any future acquisition may not produce the benefits the Company anticipated and the Company is exposed to both operational and acquisition integration risks that could adversely affect the Company |

| 2. | Competition in our industry is intense and, if we are not able to compete effectively, we may lose customers and our financial results will be negatively affected. |

| 3. | If we fail to meet the evolving needs of VR markets, identify new products, services or technologies, or successfully compete in our target markets, our revenue and financial results will be adversely impacted. |

| 4. | Decreases in the price of coal, oil and gas or a decline in popular support for “green” energy technologies could reduce demand for Boca's energy saving projects, which could materially harm our ability to grow our business. |

| 5. | Our strategy of acquiring complementary assets, technologies and businesses may fail and result in impairment losses. |

| 6. | Changes in the growth of demand for or pricing of electricity could reduce demand for Boca's energy saving projects, which could materially harm our ability to grow our business. |

| 7. | We may not be able to adequately respond to changes in technology affecting the energy saving industry. |

| 8. | Giant Credit Limited is subject to greater credit risks than larger lenders, which could adversely affect our results of operations. |

| 9. | Giant Credit may fail to renew its money lenders license. |

4

| 10. | The business of Giant Credit is affected by fluctuations in interest rates and our credit position. | |

| 11. | There is intense competition in the money lending industry. |

| 12. | Provision for loan losses may not be sufficient to absorb future losses or prevent a material adverse effect on our business, financial condition, or results of operations. |

| 13. | An increase to the provision for loan losses will cause our net income to decrease and net loss to increase. |

| 14. | Competition in the lending industry is growing and could cause us to lose market share and revenues in the future. |

| 15. | Giant Credit Limited may face regulatory hurdles in the future in connection with its lending business. | |

| 16. | The business of Giant Credit may be affected by changes in the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). |

| 17. | Our property investment business is sensitive to downturns in the economy, economic uncertainty and particularly the performance of the real estate market in Hong Kong. | |

| 18. | The fair value of our investment properties is likely to fluctuate from time to time and may decrease significantly in the future, which may materially and adversely affect our profitability. | |

| 19. | Our revenue from our investment property portfolio depends on a number of factors, such as changes in market rental levels, competition for tenants and rental collection and renewal. | |

| 20. | We may not be able to generate any growth and our revenues may continue to decrease in the future. | |

| 21. | Giant Credit, 11 Hau Fook Street and Paris Sky have a limited operating history. |

| 22. | Our risk management and internal control systems may not be effective and have deficiencies or material weaknesses |

| 23. | Future changes in laws, regulations or enforcement policies in China could adversely affect our business. |

| 24. | Uncertainties regarding the Chinese legal system could have a material adverse effect on us. |

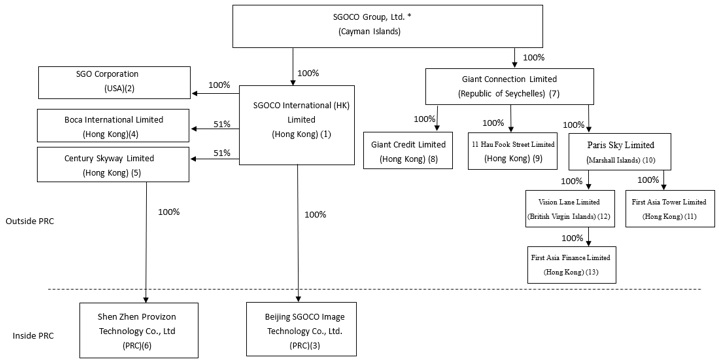

Unless otherwise indicated and except where the context otherwise requires, the following definitions are used in this Annual Report:

1. “Acquisition” means the business combination transaction consummated on March 12, 2010, as provided by the Share Exchange Agreement, dated as of February 12, 2010, by and among our company, Honesty Group and each of the shareholders signatory thereto, as amended by Amendment No. 1 to Share Exchange Agreement, dated March 11, 2010;

2. “Apex” or “Apex Flourish Group Limited” means the British Virgin Islands Company that purchased Honesty Holdings Group Limited and SGOCO (Fujian) Electronic Co., Ltd. from SGOCO in 2011 and 2014, in what is referred to, depending on the context, as the “Sale of Honesty Group” and or the “Sale of SGOCO (Fujian)”, respectively;

3. “Boca” means Boca International Limited, a Hong Kong limited company and a wholly owned subsidiary of SGOCO International.

4. “Beijing SGOCO” means Beijing SGOCO Image Technology Co., Ltd., a company with limited liability incorporated in China and a wholly owned subsidiary of SGOCO International;

5. “Guancheng” means Guancheng (Fujian) Electron Technological Co. Limited, a company with limited liability incorporated in China and a wholly owned subsidiary of Honesty Group;

6. “Guanke” means Guanke (Fujian) Electron Technological Industry Co. Ltd., a company with limited liability incorporated in China and a wholly owned subsidiary of Honesty Group;

7. “Guanwei” means Guanwei (Fujian) Electron Technological Co. Limited, a company with limited liability incorporated in China and a wholly owned subsidiary of Honesty Group;

5

8. “Honesty Group” means Honesty Group Holdings Limited, a Hong Kong limited company and a former wholly owned subsidiary of SGOCO, which was acquired in the Acquisition and was sold to Apex Flourish Group Limited in the Sale of Honesty Group transaction described below;

9. “Jinjiang Guanke” means Jinjiang Guanke Electron Co., Ltd., a company with limited liability incorporated in China and a wholly owned subsidiary of Guanke (Fujian) Electron Technological Industry Co. Ltd.;

10. “PRC” or “China” means the People’s Republic of China;

11. “Sale of Honesty Group” means the transaction consummated as provided by the Sale and Purchase Agreement dated November 15, 2011, by and between our company and Apex Flourish Group Limited pursuant to which we sold our 100% ownership interest in Honesty Group to Apex Flourish Group Limited;

12. “Sale of SGOCO (Fujian)” means the transaction consummated as provided by the Sale and Purchase Agreement dated December 24, 2014, by and between our company and Apex Flourish Group Limited pursuant to which we sold our 100% ownership interest in SGOCO (Fujian) Electronic Co., Ltd. to Apex Flourish Group Limited;

13. “SGO” means SGO Corporation, a Delaware corporation and a wholly owned subsidiary of SGOCO International;

14. “SGOCO”, “we,” “us,” “our,” “the company,” or “our company” means SGOCO Group, Ltd., a company organized under the laws of the Cayman Islands, and its consolidated subsidiaries. SGOCO Group, Ltd. was previously named SGOCO Technology, Ltd., and prior to the Acquisition described below, our predecessor was named Hambrecht Asia Acquisition Corp;

15. “SGOCO (Fujian)” means SGOCO (Fujian) Electronic Co., Ltd., a company with limited liability incorporated in China and a former wholly owned subsidiary of SGOCO International; which was sold to Apex Flourish Group Limited in the Sale of SCOGO (Fujian) transaction described above;

16. “SGOCO International” means SGOCO International (HK) Limited, a Hong Kong limited company and wholly owned subsidiary of SGOCO;

17. “SGOCO Shenzhen” means SGOCO (Shenzhen) Technology Co., Ltd., a company with limited liability incorporated in China and a wholly owned subsidiary of SGOCO International;

18. “U.S. Dollars,” “dollars,” “US$,” or “$” means the legal currency of the United States. “RMB” or “Renminbi” means the legal currency of China;

19. “Shareholders”: means the owner of the equivalent of common stock in a typical corporation organized under state and federal US law. Based on Cayman Islands’ law and our current Amended and Restated Memorandum of Association and Articles of Association we are authorized to issue ordinary shares. Holders of our ordinary shares are referred to as “members” under Cayman Islands’ law, rather than “shareholders.” In this Annual Report, however, references that would otherwise be to “members” are made to “shareholders,” which term is more familiar to investors on the NASDAQ Capital Market.

20. “Convertible notes” refer to a series convertible notes we issued between June and September, 2015.

21. “Giant Connection” means Giant Connection Limited, a limited liability company registered in the Republic of Seychelles and wholly owned by SGOCO Group, Ltd.

22. “Giant Credit” means Giant Credit Limited, a Hong Kong limited company and wholly owned subsidiary of Giant Connection;

23. “Century Skyway” means Century Skyway Limited, a Hong Kong limited company and a wholly owned subsidiary of SGOCO International.

24. “Shen Zhen Provizon” means Shen Zhen Provizon Technology Co., Limited, a company with limited liability incorporated in China and a wholly owned subsidiary of Century Skyway Limited.

25. “11 Hau Fook Street” means 11 Hau Fook Street Limited, a Hong Kong limited company and wholly owned subsidiary of Giant Connection;

26. “Paris Sky” means Paris Sky Limited, a Marshall Islands company and wholly owned subsidiary of Giant Connection;

27. “Vision Lane” means Vision Lane Limited, a British Virgin Islands company and wholly owned subsidiary of Paris Sky;

6

28. “First Asia Tower” means First Asia Tower Limited, a Hong Kong limited company and wholly owned subsidiary of Paris Sky;

29. “First Asia Finance” means First Asia Finance Limited, a Hong Kong limited company and wholly owned subsidiary of Vision Lane;

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

On March 12, 2010, we completed a share-exchange transaction with Honesty Group and its shareholders, and Honesty Group became our wholly-owned subsidiary. The share-exchange transaction was accounted for as a reorganization and recapitalization of Honesty Group. As a result, SGOCO’s (the legal acquirer) consolidated financial statements were previously, in substance, those of Honesty Group (the accounting acquirer), with the assets and liabilities, and revenues and expenses, of SGOCO being included effective from the date of the Share-Exchange Transaction. There was no gain or loss recognized on the transaction. The historical financial statements for periods prior to March 12, 2010 are those of Honesty Group, except that the equity section and earnings per share have been retroactively restated to reflect the reorganization and recapitalization.

On November 15, 2011, we entered into a Sale and Purchase Agreement to sell our 100% ownership interest in Honesty Group to Apex for $76.0 million in total consideration (referred to hereinafter as “Sale of Honesty Group”). Honesty Group and its subsidiaries controlled our core manufacturing facility, including the land, buildings and production equipment. The Sale of Honesty Group allowed SGOCO to transition to a “light-asset” business model with greater flexibility and scalability and focus its operations on developing, branding, marketing and distributing LCD/LED products in China. Honesty Group’s operations are reflected in our Fiscal Year 2011 financial statements through November 30, 2011.

On December 24, 2014, we entered into a Sale and Purchase Agreement to sell our 100% ownership interest in SGOCO (Fujian) to Apex for $11.0 million in total consideration (referred to hereinafter as “Sale of SGOCO (Fujian)”). SGOCO (Fujian)'s operations are reflected in our Fiscal Year 2014 financial statements through December 31, 2014.

On December 28, 2015, SGOCO International entered into a Share Sale and Purchase Agreement for the Sale and Purchase of the Entire Issued Share Capital of Boca International Limited with Richly Conqueror Limited, a company incorporated under the laws of the British Virgin Islands. Pursuant to the Agreement, SGOCO International acquired 100% of the issued share capital of Boca International Limited., a private company incorporated in Hong Kong, from its sole legal and beneficial owner - Richly Conqueror Limited at a consideration of $52 million in cash, plus up to 19.9% newly issued ordinary shares of the Company. In March, 2016, the acquisition of Boca was completed and SGOCO International fully paid $52 million plus 1,162,305 post-split shares of common stock of the Company and received 100% ownership of Boca.

On April 28, 2017, SGOGO International (HK) Limited (“SGOCO International”), a wholly-owned subsidiary of SGOCO, entered into a Share Sale and Purchase Agreement with Full Linkage Limited (the “Seller”) pursuant to which SGOCO International acquired all of the issued and outstanding capital stock of Century Skyway Limited, which was owned by the Seller. In consideration for the acquisition of Century, SGOCO International paid to the Seller $32,600,000 and SGOCO issued to the Seller 1,500,000 of its ordinary shares. The consummation of the transactions contemplated by the Share Sale and Purchase Agreement occurred on May 10, 2017.

On December 22, 2017, Giant Connection Limited, a wholly-owned subsidiary of SGOCO, completed the acquisition of Giant Credit Limited contemplated by the Share Exchange Agreement entered into by and between the parties in consideration for HK$19.6 million ($2.4 million), which was satisfied by the allotment and issuance of 2,220,283 ordinary shares of the Company. The principal activity of Giant Credit Limited is money lending in Hong Kong. Giant Credit Limited is a Hong Kong incorporated company which has a Money Lenders License for carrying on money lending business in Hong Kong. Giant Credit Limited has been providing high-quality mortgage loans to its customers since 2016. Since the commencement of business, Giant Credit Limited has continued to record a growth in its mortgage loans receivable along with satisfactory interest income.

7

On March 8, 2018, the Company’s wholly-owned subsidiary, Giant Connection Limited closed a Share Exchange Agreement with Vagas Lane Limited for the purchase and sale of 11 Hau Fook Street Limited in consideration for HK$26.1 million ($3.4 million), which was satisfied by the allotment and issuance of 2,935,222 ordinary shares.

On June 7, 2018, the Company’s wholly-owned subsidiary, Giant Connection Limited closed a Share Exchange Agreement for the entire issued share capital of Paris Sky Limited. In consideration for (1) the allotment of 3,889,050 ordinary shares of the Company to Leung Iris Chi Yu (“Ms. Leung”), at an initial agreed value of HK$30,334,590 ($3.9 million), the fair value of the 3,889,050 ordinary shares was $4.8 million, which was calculated based on the stock price of $1.23 per share on June 7, 2018, (2) the transfer of a 49% interest in Century Skyway Limited at an agreed value of HK$126,126,000 ($16.2 million), (3) the transfer of a 48.9% interest in Boca International Limited at an agreed value of HK$184,842,000 ($23.7 million), and (4) the issuance of a promissory note to Leung in the principal amount of HK$27,103,410 ($3.5 million), bearing a 8% interest, by Giant Connection Limited, the Company acquired 100% of the issued share capital of Paris Sky Limited, an investment holding company which, through its wholly owned subsidiary, owns a property located at No. 8 Fui Yiu Kok Street, Tsuen Wan, New Territories, Hong Kong. The Company repaid the promissory note in full on August 22, 2018.

In the fourth quarter of 2018, management committed a plan to dispose of its remaining 51% equity interests in Century Skyway and initiated efforts to locate buyers. On April 25, 2019, the Company entered into a Letter of Intent (the “LOI”) to sell to another individual, Ho Pui Lung (the “Purchaser”) 5,100 shares in the share capital of Century Skyway, at a consideration of HK$99.45 million ($12.75 million).

On March 12, 2019, the Company’s wholly-owned subsidiary, Paris Sky Limited closed a Share Exchange Agreement for the entire issued share capital of Vision Lane Limited. The acquisition was initially consummated in consideration for a total of $12,428,205, satisfied by (1) the allotment of 4,519,347 ordinary shares of the Company to Kwok Man Yee Elvis, at $1.10 per share and (2) the payment of $7.5 million in cash. The fair value of the 4,519,347 ordinary shares was $5.2 million, which was calculated based on the stock price of $1.16 per share on March 8, 2019, and the final consideration was $12.7 million. Vision Lane is a private company incorporated in the British Virgin Islands, and engages in property investment and money lending services in Hong Kong.

The selected consolidated statement of operations data presented below for the years ended December 31, 2018, 2017 and 2016 and the selected consolidated balance sheet data as of December 31, 2018 and 2017 are derived from our audited consolidated financial statements included elsewhere in this Annual Report. The selected consolidated statement of operations data for the years ended December 31, 2016, 2015 and 2014 and the selected consolidated balance sheet data as of December 31, 2016, 205 and 2014 are derived from our audited consolidated financial statements that have not been included herein. Our financial statements were prepared according to U.S. GAAP.

Prior period amounts also have been adjusted to exclude discontinued operations of Century Skyway Limited (refer to Note 3 to the Consolidated Financial Statements).

Our historical operation results for any prior period are not necessarily indicative of results to be expected in any future period. See “Key Information — Risk Factors” included elsewhere in this Annual Report. The selected consolidated financial information for the years ended December 31, 2018, 2017 and 2016 should be read together with those consolidated financial statements and the accompanying notes and “Operating and Financial Review and Prospects - Operating Results” included elsewhere in this Annual Report.

8

Consolidated Statement of Income

(In thousands of U.S. Dollars, except share and per share data which are based upon post-split share numbers)

| For the Years Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Net revenues | 1,580 | 51 | 5,069 | 1,921 | 43,230 | |||||||||||||||

| Cost of revenues | (2,635 | ) | (1,343 | ) | (4,867 | ) | (1,826 | ) | (41,213 | ) | ||||||||||

| Gross (loss) profit | (1,055 | ) | (1,292 | ) | 202 | 95 | 2,017 | |||||||||||||

| Selling expenses | - | (257 | ) | (55 | ) | (131 | ) | (297 | ) | |||||||||||

| General and administrative expenses | (2,391 | ) | (1,959 | ) | (4,115 | ) | (1,498 | ) | (3,069 | ) | ||||||||||

| Allowance for guarantee | (157 | ) | - | - | - | - | ||||||||||||||

| Impairment loss of property, plant and equipment | (385 | ) | - | - | - | - | ||||||||||||||

| Impairment loss of goodwill | (10,330 | ) | (5,618 | ) | - | - | - | |||||||||||||

| Total operating expenses | (13,263 | ) | (7,834 | ) | (4,170 | ) | (1,629 | ) | (3,366 | ) | ||||||||||

| Operating loss from continuing operations | (14,318 | ) | (9,126 | ) | (3,968 | ) | (1,534 | ) | (1,349 | ) | ||||||||||

| Interest income | - | 134 | 121 | 220 | 338 | |||||||||||||||

| Interest expense | (198 | ) | (13 | ) | (15 | ) | (57 | ) | (304 | ) | ||||||||||

| Other income (expense), net | (3 | ) | 2 | - | (8 | ) | 319 | |||||||||||||

| Gain from disposal of a subsidiary | 263 | - | - | - | - | |||||||||||||||

| Gain (Loss) on change in fair value of warrant derivative liability | 394 | (150 | ) | - | 2 | 19 | ||||||||||||||

| Loss on change in fair value of convertible notes | - | - | (1,500 | ) | (1,041 | ) | - | |||||||||||||

Loss before provision for income taxes from continuing operations | (13,862 | ) | (9,153 | ) | (5,362 | ) | (2,418 | ) | (977 | ) | ||||||||||

| Income taxes benefit (expense) | 311 | 350 | 315 | - | (1,311 | ) | ||||||||||||||

| Net loss from continuing operations | (13,551 | ) | (8,803 | ) | (5,047 | ) | (2,418 | ) | (2,288 | ) | ||||||||||

| Loss from discontinued operations, net of income taxes | (7,513 | ) | (2,411 | ) | - | - | - | |||||||||||||

| Net loss | (21,064 | ) | (11,214 | ) | (5,047 | ) | (2,418 | ) | (2,288 | ) | ||||||||||

| Net loss attributable to noncontrolling interests – continuing operations | 5,377 | - | - | - | - | |||||||||||||||

| Net loss attributable to noncontrolling interests – discontinued operations | 3,315 | - | - | - | - | |||||||||||||||

| Net loss attributable to ordinary shareholders of SGOCO Group Ltd. | (12,372 | ) | (11,214 | ) | (5,047 | ) | (2,418 | ) | (2,288 | ) | ||||||||||

| Loss from continuing operations per share: | ||||||||||||||||||||

| Basic | (0.23 | ) | (0.78 | ) | (0.68 | ) | (0.55 | ) | (0.53 | ) | ||||||||||

| Diluted | (0.23 | ) | (0.78 | ) | (0.68 | ) | (0.55 | ) | (0.53 | ) | ||||||||||

| Loss from discontinued operations per share: | ||||||||||||||||||||

| Basic | (0.12 | ) | (0.21 | ) | - | - | - | |||||||||||||

| Diluted | (0.12 | ) | (0.21 | ) | - | - | - | |||||||||||||

| Loss per share: | ||||||||||||||||||||

| Basic | (0.35 | ) | (0.99 | ) | (0.68 | ) | (0.55 | ) | (0.53 | ) | ||||||||||

| Diluted | (0.35 | ) | (0.99 | ) | (0.68 | ) | (0.55 | ) | (0.53 | ) | ||||||||||

| Weighted average shares used in calculating loss per share: | ||||||||||||||||||||

| Basic | 35,080,704 | 11,341,629 | 7,422,208 | 4,400,298 | 4,351,517 | |||||||||||||||

| Diluted | 35,080,704 | 11,341,629 | 7,422,208 | 4,400,298 | 4,351,517 | |||||||||||||||

9

Consolidated Balance Sheet Data

(In thousands of U.S. Dollars)

| As of December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Total assets | 190,841 | 98,453 | 100,272 | 86,882 | 92,553 | |||||||||||||||

| Total liabilities | 22,667 | 14,638 | 13,593 | 9,046 | 7,356 | |||||||||||||||

| Total equity | 168,174 | 83,815 | 86,679 | 77,836 | 85,197 | |||||||||||||||

B. Capitalization and Indebtedness.

Not applicable.

C. Reason for the Offer and Use of Proceeds.

Not applicable.

You should carefully consider all the information in this Annual Report, including various changing regulatory, competitive, economic, political and social risks and conditions described below, before making an investment in our ordinary shares. One or more of a combination of these risks could materially impact our business, results of operations and financial condition. In any such case, the market price of our ordinary shares could decline, and you may lose all or part of your investments.

Risks Relating to Our Business and Industry

The acquisition of Boca International Limited or any future acquisition may not produce the benefits the Company anticipated and the Company is exposed to both operational and acquisition integration risks that could adversely affect the Company

In March 2016, we completed the acquisition of 100% ownership of Boca International Limited ("Boca"), a company providing energy saving products and services to reduce the energy costs for new and existing buildings. Our intention is to reduce the reliance on sales of traditional flat panel LED and LCD monitor products and enter into energy saving and new energy market. However, the Company may not be able to fully achieve its strategic objectives and operating efficiencies after the acquisition of Boca. Inherent uncertainties exist in integrating the operations of Boca to the Company. The Company may lose key personnel, either from the acquired entity or from itself, as a result of an acquisition. These factors could contribute to the Company not achieving the expected benefits from its acquisitions within desired time frames, if at all.

Any acquisition or future acquisitions present financial, managerial and operational challenges, including diversion of management attention, difficulty with integrating acquired businesses, integration of different corporate cultures or separating personnel and financial and other systems, increased expenses, assumption of unknown liabilities, indemnities, and potential disputes with the buyers or sellers, and the need to evaluate the financial systems of and establish internal controls for acquired entities. There can be no assurance that the Company will engage in any additional acquisitions or divestitures or that the Company will be able to do so on terms that will result in any expected benefits. If the Company makes any future business acquisitions, it may issue additional shares of common stock to pay for those acquisitions, which would further dilute current shareholders’ ownership interest. Acquisitions also could require the Company to use substantial cash or other liquid assets or to incur debt. In such a case, it could make the Company more vulnerable to business downturns and could negatively affect the Company’s earnings.

Furthermore, our financial results could be adversely affected by our investments or acquisitions. The investments and acquired assets or businesses may not generate the financial results we expect. They could result in occurrence of significant investments and goodwill impairment charges, and amortization expenses for other intangible assets. We periodically review goodwill and investments for impairment. As the financial performance of the green energy products and services reporting unit and the VR technologies products and services reporting unit were below our original expectations, fair value of these reporting units were indicated to be lower than its carrying value. We performed the two-step goodwill impairment test and applied the income approach, resulting an impairment loss of goodwill of $10.3 million and $5.6 million being recorded for the year ended December 31, 2018 and 2017. We may continue to incur impairment charges in connection with our investments or acquisitions, which could depress our profitability and have a material adverse impact on our financial results.

10

Competition in our LCD/LED industry is intense and, if we are not able to compete effectively, we may lose customers and our financial results will be negatively affected.

The LCD/LED products industry in China is highly competitive, and we expect competition to persist and intensify. Due to the increasing popularity of mobile devices, the contraction of personal computer market demand continued and it adversely impacted the market demand of our major products, flat panel LCD and LED monitors. We face competition from distributors and LCD/LED manufacturers that use their extensive brand-name value, manufacturing and marketing size, and in-house sales forces and exclusive sales agents to distribute their products. We compete for customers on the basis of, among other things, our product offerings, customer service and reputation. Some of our competitors have greater financial, research and development, design, marketing, distribution, management or other resources.

Our results of operations could be affected by several competitive factors, including entry by new competitors into our current markets, expansion by existing competitors, better marketing and advertising leading to stronger brand equity for our competitors, and competition with other companies for the production capacity of contract manufacturers. Our results of operations and market position may be adversely impacted by these competitive factors.

There can be no assurance that our strategies will remain competitive or that we will succeed in the future. Increased competition could result in a loss of market share. In particular, if our competitors adopt aggressive pricing policies, we may be forced to adjust the pricing of our products to improve our competitiveness. This could adversely affect our margins, profitability and financial results.

Decreases in the price of coal, oil and gas or a decline in popular support for “green” energy technologies could reduce demand for Boca's energy saving projects, which could materially harm our ability to grow our business.

Higher coal, oil and gas prices provide incentives for customers to invest in “green” energy technologies such as our energy saving projects that reduce their need for electricity. Conversely, lower coal, oil and gas prices would tend to reduce the incentive for customers to invest in equipment to save electric power. Demand for our projects and services depends in part on the current and future commodity prices of coal, oil and gas. We have no control over the current or future prices of these commodities.

In addition, popular support by governments, corporations and individuals for “green” energy technologies may change. Because of the ongoing development of, and the possible change in support for, “green” energy technologies we cannot assure you that negative changes to this industry will not occur. Changes in government or popular support for “green” energy technologies could have a material adverse effect on our business, prospects and results of operations.

Our strategy of acquiring complementary assets, technologies and businesses may fail and result in impairment losses.

As a component of our growth strategy, we have acquired and intend to actively identify and acquire assets, technologies and businesses that are complementary to our existing businesses. Our acquisitions could result in the use of substantial amounts of cash, issuance of potentially dilutive equity securities, significant impairment losses related to goodwill or amortization expenses related to intangible assets and exposure to undisclosed or potential liabilities of acquired companies. Impairment loss for goodwill and acquired intangible assets may exist if our management concluded that expected synergies from acquisitions of assets, technologies and businesses would not materialize.

We may be required to record a significant charge to earnings if we are required to reassess our tangible and intangible assets.

We are required under U.S. GAAP to test for impairment on tangible and intangible assets annually or more frequently if facts and circumstances warrant a review. Currently we are losing money, and our tangible and intangible assets may be impaired if the losses continue. We are also required to review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Factors that may be considered a change in circumstances indicating that the carrying value of our amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization and slower or declining growth rates in our industry. We may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined.

Changes in the growth of demand for or pricing of electricity could reduce demand for Boca's energy saving projects, which could materially harm our ability to grow our business.

Boca's revenues are dependent on the ability to provide savings on energy costs for our clients. According to the National Bureau of Statistics of the PRC, domestic electricity consumption grew at a rate of 6.6% in 2017. Power generation capacity was 13,372 billion kWh, an increase of 10.1% from 2016. Clean energy power generation increased significantly in 2015. However, such growth is unpredictable and depends on general economic conditions and consumer demand, both of which are beyond our control. Furthermore, pricing of electricity in the PRC is set in advance by the state or local electricity administration and may be artificially depressed by governmental regulation or influenced by supply and demand imbalances. If these changes reduce the cost of electricity from traditional sources of supply, the demand for Boca's energy saving projects could be reduced, and therefore, could materially harm our ability to grow our business.

11

We may not be able to adequately respond to changes in technology affecting the energy saving industry.

Our industry could experience rapid technological changes and new product introductions. Current competitors or new market entrants could introduce new or enhanced products with features which render the systems used in our projects obsolete or less marketable. Our future success will depend, in part, on our ability to respond to changing technology and industry standards in a timely and cost-effective manner. We may not be successful in effectively using new technologies, developing new systems or enhancing our existing systems and technology on a timely basis. Our new technologies or enhancements may not achieve market acceptance. Our pursuit of new technologies may require substantial time and expense. We may need to license new technologies to respond to technological change. These licenses may not be available to us on terms that we can accept. Finally, we may not succeed in adapting our projects to new technologies as they emerge.

We are exposed to the credit risks of our customers and borrowers.

Our financial position and profitability is dependent on our customers’ creditworthiness. Thus, we are exposed to our customers’ credit risks. There is no assurance that we will not encounter doubtful or bad debts in the future. Due to economic conditions in China, in particular the risk of monetary and fiscal policies to address inflation, businesses in China are generally conserving cash or under increased financial and credit stress. As a result, we could experience slower payments from our customers and borrowers, an increase in accounts receivable aging and/or an increase in bad debts. If we were to experience any unexpected delay or difficulty in collections from our customers or borrowers, our cash flows and financial results would be adversely affected.

Giant Credit Limited is subject to greater credit risks than larger lenders, which could adversely affect our results of operations.

There are inherent risks associated with our lending activities, including credit risk, which is the risk that borrowers may not repay the outstanding loans balances. As a lending company, we extend credits to individual and commercial households and is premised on the fact that such loans will be timely repaid together with interest. These borrowers generally have fewer financial resources in terms of capital or borrowing capacity than larger entities and may have fewer financial resources to weather a downturn in the economy. Such borrowers may fail to perform their contractual obligations and default on payment of interest and/or the principal, and thus may expose us to greater credit risks than lenders lending to larger, better-capitalized state-owned businesses with longer operating histories. Conditions such as inflation, economic downturn, local policy change, adjustment of industrial structure and other factors beyond our control may increase our credit risk more than such events would affect larger lenders. As at December 31, 2018, loans receivable owed from our customers to Giant Credit amounted to approximately $37.1 million. If Giant Credit’s customers delay or default on their payments, Giant Credit may have to incur additional legal costs and expenses in order to enforce its security and/or make provision for impairment or write-off the relevant loans and interest receivables, which in turn may adversely affect our financial position and profitability.

Giant Credit may fail to renew its money lenders license.

Our money lending business is subject to licensing requirements under the provisions of the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). Money lenders licenses are granted by the licensing court of Hong Kong and are renewable annually subject to satisfaction of all licensing conditions. The licensing court has the discretion to suspend or revoke a license if a licensee is in breach of any licensing conditions. We cannot guarantee that the conditions or requirements which Giant Credit may be required to satisfy or meet will not change from time to time. In the event that Giant Credit is unable to renew its money lenders license in a timely manner or if the licensing court or other relevant authorities do not approve the application for a renewal of its money lenders license, Giant Credit may not be able to operate its money lending business until such time as it receives a new license, which may have a material adverse effect on our financial condition and results of operation.

The business of Giant Credit is affected by fluctuations in interest rates and our credit position.

The interest rate risks faced by Giant Credit arise from both the interest-bearing lending and borrowings of our money lending business. In particular, our profitability is highly correlated with the net interest margin, being the difference between the interest rate charged to our customers and the costs of our funding. The interest rate chargeable by Giant Credit to its customers is determined by, amongst other factors, the market demand for loans and the prevailing competition in the industry, and is ultimately capped by the relevant provisions of the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). The borrowing cost of Giant Credit is determined with reference to the overall local money lending market conditions and our credit positions. An increase in general interest rates or a deterioration of our credit positions will lead to increases in our funding costs.

There is intense competition in the money lending industry.

As of March 15, 2019, as provided by the Hong Kong Licensed Money Lenders Association, there were 2,173 licensed money lenders in Hong Kong. These licensed money lenders operate under various scales and conditions, some of which may or may not be our direct competitors. Some of our competitors may have certain competitive advantages over us, including greater financial resources, more established reputations, stronger brand recognition, broader product and service offerings, lower costs of funding and a branch network with a wider geographic coverage. As a result, we may have to compete by lowering the interest rates charged on loans in order to gain market share. Failure to maintain or enhance our competitiveness within the money lending industry or maintain our customer base with good credit standing may result in a decrease in profit as well as loss of market share. Consequently, our financial performance and profitability may be adversely affected.

12

Provision for loan losses may not be sufficient to absorb future losses or prevent a material adverse effect on our business, financial condition, or results of operations.

Our risk management procedures use historical information to estimate any potential losses based on the experience, judgment, and expectations regarding borrowers and the economic environment in which we operate. Giant Credit Limited has been providing mortgage loans to its customers since it first obtained its money lenders license in 2016. Given its limited operating history, Giant Credit Limited did not have a sufficient operating data to develop a reasonable estimation for its loan loss provision. The provision policy of the Company does not distinguish among loans by type of guarantee. In addition, the Company has a policy in place to calculate the specific provision amount pursuant to U.S. GAAP as funds set aside covering losses due to risks related to a particular borrower. The reserve rate is decided based on management estimate of loan collectability. So far Giant Credit has not experienced any losses on its loans to customers.

However, our loan loss reserves may not be sufficient to absorb future loan losses or prevent a material adverse effect on our business, financial condition, or results of operations.

While we believe we use the best information available to make loan loss provision evaluations, adjustments to the provision may be necessary based on changes in economic and other conditions or changes in accounting guidance, which could negatively affect the our results of operations and financial condition.

An increase to the provision for loan losses will cause the Company’s net income to decrease and net loss to increase.

Our lending business is subject to fluctuations based on economic conditions. These fluctuations are neither predictable nor within our control and may have a material adverse impact on our operations and financial condition. We may voluntarily decide to increase our provision for loan losses. Regulatory authorities may also require an increase in the provision for loan losses or the recognition of further loan charge-offs, based on judgments different from those of its management. Any increase in the provision for loan losses will result in a decrease in net income and an increase in net loss that may have a material adverse effect on our financial condition and results of operations.

Competition in the lending industry is growing and could cause us to lose market share and revenues in the future.

We believe that the lending industry is an emerging market in China. We may face growing competition in the lending industry, and we believe that the lending industry is becoming more competitive as this industry matures and begins to consolidate. We will compete, with traditional financial institutions, other lending companies, other microfinance companies, and some cash-rich state-owned companies or individuals. Some of these competitors have larger and more established borrower bases and substantially greater financial, marketing and other resources than we have. As a result, we could lose market share and its revenues could decline, thereby adversely affecting our earnings and potential for growth.

Giant Credit Limited may face regulatory hurdles in the future in connection with its lending business.

Giant Credit Limited has been providing high-quality mortgage loans to its customers since it first obtained its money lenders license in 2016. The Hong Kong Monetary Authority continues to impose stringent policies and prudential measures on property mortgage loans provided by authorized financial institutions in Hong Kong, which creates additional hurdles for the public who are looking for mortgages to satisfy their financial needs.

The business of Giant Credit may be affected by changes in the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong).

The business operation of Giant Credit is regulated under the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong) and full compliance with such regulation is essential for us to carry on our business. Notwithstanding this, the relevant regulatory authorities may from time to time amend the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong) or adopt new laws and regulations applicable to licensed money lenders in Hong Kong. Our operation, financial performance and business prospects may be materially and adversely affected if we are not able to comply with any changes and/or new requirements in applicable laws and regulations related to the money lending industry in Hong Kong. Notably, for the mortgage loans granted by us to our customers, the interest rate for such loans shall not exceed the maximum effective interest rate of 60% per annum as stipulated under the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). In the event that such maximum limit for interest rate is lowered as a result of any change to the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong) and/or any relevant laws and regulations, thus limiting and lowering the interest rate we can offer to our customers, our financial performance, operational results and profitability may be materially and adversely affected.

13

Our property investment business is sensitive to downturns in the economy, economic uncertainty and particularly the performance of the real estate market in Hong Kong.

Demand for property is sensitive to downturns and uncertainty in the global and regional economy and corresponding changes in the appetite for real estate investments and purchases. Changes in the appetite for real estate investments and purchases are driven by various factors including, amongst others, perceived or actual general economic conditions, employment and job market conditions, actual or perceived levels of disposable consumer income and wealth and consumer confidence in the economy. These and other factors have, in the past, affected consumer demand for real estate and any negative sentiment or downturn in the economy could materially and adversely affect our business, financial condition and results of operations and also our liquidity position. For example, a slowdown in the Hong Kong economy or any changes in the laws, regulations and policies in relation to the real estate market may result in a decline in the number of real estate transactions.

The fair value of our investment properties is likely to fluctuate from time to time and may decrease significantly in the future, which may materially and adversely affect our profitability.

We are required to reassess the fair value of our investment properties at the end of each reporting period. Under US GAAP, impairment losses arising from changes in the fair value of our investment properties are included in our consolidated statements of profit or loss for the period in which they arise. For the year ended December 31, 2018, our impairment on investment properties held by Giant Credit, 11 Hau Fook Street and First Asia Tower was nil, $0.4 million and nil, respectively. The amount of revaluation adjustments has been, and will continue to be, subject to market fluctuations. As a result, we cannot assure you that changes in the market conditions will continue to create fair value gains on our investment properties or that the fair value of our investment properties will not decrease in the future. In addition, the fair value of our investment properties may materially differ from the amounts we would receive in actual sales of the investment properties. Any significant decreases in the fair value of our investment properties or any significant decreases in the amount we could receive in actual sales of the investment properties as compared with the recorded fair value of such properties would materially and adversely impact our results of operations.

Our revenue from our investment property portfolio depends on a number of factors, such as changes in market rental levels, competition for tenants and rental collection and renewal.

Leasing of our investment properties constitutes a very substantial part of the business of 11 Hau Fook Street and Paris Sky. For the year ended December 31, 2018, revenue generated from our investment properties constituted $0.6 million. We are subject to risks incidental to the ownership and operation of commercial properties, such as volatility in market rental rates and occupancy rates, competition for tenants, costs resulting from on-going maintenance and repair and the inability to collect rent from tenants or renew leases with tenants due to bankruptcy, insolvency, financial difficulties or other reasons. In addition, we may not be able to renew leases with our tenants on terms acceptable to us, or at all, upon the expiration of existing terms. If the above occurs, there may be a material adverse effect on our business, financial condition, results of operation and prospectus.

We may not be able to generate any growth and our sales may continue to decrease in the future.

We expanded our business rapidly during the years between 2006 and 2013. Our revenues, however, have dropped significantly since 2014, primarily due to our significant reduction in businesses as a result of the sale of SGOCO (Fujian), weak industry growth and increased competition in China’s flat panel display market, which was our primary market.

In the future, we may expand either through organic growth or through acquisitions and investments in electronic related businesses. Such expansion may place a significant strain on our managerial, operational and financial resources. We will need to effectively manage future growth, which will entail devising and implementing business plans, training and managing a growing workforce, managing costs and implementing adequate controls and reporting systems in a timely manner. There can be no assurance that our personnel, procedures and controls will be managed effectively to adequately support future growth. Failure to effectively manage expansion could prevent us from executing our business plan and adversely affect our business, financial condition and results of operations. In addition, we may not be able to generate any growth in the future. Accordingly, you should not rely on our historic growth rate as an indicator for our future growth rate.

Giant Credit, 11 Hau Fook Street and Paris Sky have a limited operating history.

Our operating subsidiaries, Giant Credit, 11 Hau Fook Street and Paris Sky, were acquired by us in December 22, 2017, March 8, 2018 and June 7, 2018, respectively. Our experience and operations in the Hong Kong money lending and property investment industries are relatively limited. As a result, there is limited historical information available upon which you can base your evaluation of our business prospects and future financial performance in such industries. There is no assurance that we can maintain our profitability and growth in the future. The limited financial results on the three subsidiaries should not be used as an indication of our business prospects and our performance in the future. Furthermore, we may encounter significant risks and difficulties frequently experienced by companies with early stage operations, and such risks and difficulties may be heightened in a rapidly developing market such as the money lending and property investment markets in Hong Kong. Our future operating results depend upon a number of factors, including our ability to manage our growth, retain our customers as well as identify and attract new ones and to provide loan products at competitive rates which suit our customers’ needs. If we are unable to successfully address the above issues, we may be unable to operate our business in the manner which we contemplate and generate revenues from such activities in the amounts and within the timeframes which we anticipate. If any of these events were to occur, it would have a material adverse effect on our business, prospects, financial condition, results of operation and cash flow.

14

As the majority of our operations are in China, we may face risks related to health problems, including epidemics in China, which could adversely affect our operations.

Our business could be materially and adversely affected by the outbreak of avian flu, severe acute respiratory syndrome, other public health problems, or even an epidemic. From time-to-time, there have been reports on the occurrences of avian flu in various parts of China, including a few confirmed human cases and deaths. Any prolonged recurrence of avian flu, severe acute respiratory syndrome or other adverse public health developments in China or elsewhere in Asia would have a material and adverse effect on our business operations.

We may not be able to secure financing needed for future operating needs on favorable terms, or on any terms at all.

From time-to-time, we may seek additional financing to provide the capital required for future acquisitions and to expand our business, if cash flow from operations is not sufficient to do so. We cannot predict with certainty the timing or amount of any such capital requirements. If such financing is not available on satisfactory terms, we may not be able to expand our business or to develop new business at the rate desired. Consequently, our results of operations may be adversely affected.

If we are able to secure financing through debt, lenders may impose certain restrictions. In addition, repaying such debt may limit our cash flow and our ability to grow. If we are not able to secure financing through debt, we may be forced to issue additional equity, which would have a dilutive effect on our shares.

We may be treated as a passive foreign investment company, or “PFIC,” which could result in adverse U.S. federal income tax consequences to U.S. Holders of our ordinary shares and warrants.

In general, we will be treated as a PFIC for any taxable year in which either:

| 1. | at least 75% of our gross income (looking through certain 25% or more-owned corporate subsidiaries) is passive income; or | |

| 2. | at least 50% of the average value of our assets (looking through certain 25% or more-owned corporate subsidiaries) are attributable to assets that produce, or are held for the production of, passive income. |

Passive income generally includes, without limitation, dividends, interest, rents, royalties, and gains from the disposition of passive assets. If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. Holder of our ordinary shares, the U.S. Holder may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements. Our actual PFIC status for any taxable year will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance as to our status as a PFIC for any taxable year. U.S. Holders of our ordinary shares are urged to consult their own tax advisors regarding the possible application of the PFIC rules.

Being a foreign private issuer exempts us from certain SEC requirements that provide shareholders the protection of information that must be made available to shareholders of U.S. public companies.

We are a foreign private issuer within the meaning of the rules promulgated under the Securities Exchange Act of 1934, or Exchange Act. As such, we are exempt from certain provisions applicable to U.S. public companies including:

| 1. | the rules requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| 2. | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations regarding a security registered under the Exchange Act; |

| 3. | provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; and |

| 4. | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short swing” trading transactions (i.e. , a purchase and sale, or a sale and purchase, of the issuer’s equity securities within less than six months). |

15

Because of these exemptions, our shareholders will not be provided with the same protections or information generally available to investors holding shares in public companies organized in the U.S.

Expansion of our business may increase pressure on our management, which may impede our ability to meet any increased demand for our products and adversely affect our results of operations.

Our business plan is to grow our operations profitably and focus on new investments and exploring new products, including but not limited to acquiring equities of potential target companies related to environmental protection, environmental energy saving, electronic and internet-related businesses and enriching our product and service ranges. Growth in our business may place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

| 1. | customers continuing to accept our LCD/LED products; |

| 2. | our ability to successfully and rapidly expand our marketing program to reach potential customers in response to potentially increasing demand; |

| 3. | the costs associated with such growth, which are difficult to quantify, but could be significant; |

| 4. | the competition from larger, better capitalized and well-known competitors and the effect of rapid technological change; |

| 5. | the highly competitive nature of our industry; |

| 6. | the continued availability and favorable pricing of the raw materials and components used in our products; and |

| 7. | the availability and favorability of terms of potential acquisition targets for developing new business. |

If we are successful growing our marketing program, we may be required to provide various support and deliver LCD/LED products to our customers. In addition, we may not be able to meet the needs of our customers, which could adversely affect our relationships with our customers and results of operations.

We intend on continuing to expand our operations in China (including Hong Kong) through investments and acquisitions. Rapid expansion may expose us to new challenges and risks. To manage the further expansion of our business and the growth of our operations and personnel, we need to continuously expand and enhance our infrastructure and technology as well as improve our operational and financial systems, procedures and controls. We also need to expand, train and manage our growing employee base. In addition, our management will be required to obtain, maintain or expand relationships with manufacturer partners and other third-party business partners. We cannot assure you that our current and planned personnel, infrastructure, systems, procedures and controls will be adequate to support our expanding operations. If we fail to manage our expansions effectively, our business, results of operations and prospects may be materially and adversely affected.

Under the Enterprise Income Taxes Law, SGOCO may be classified as a “resident enterprise” of the PRC. Such classification could result in adverse tax consequences to SGOCO and its non-PRC resident shareholders.

Under the Enterprise Income Taxes (EIT) Law and the Implementing Rules, an enterprise established outside of the PRC with “de facto management bodies” within the PRC is considered as a resident enterprise and will be subject to PRC income tax on its global income. According to the Implementing Rules, “de facto management bodies” refer to “establishments that carry out substantial and overall management and control over the business operations, personnel, accounting, properties, etc. of an enterprise.” Accordingly, our holding company, SGOCO Group, Ltd., may be considered a resident enterprise and may therefore be subject to PRC income tax on our global income.

The State Administration of Taxation issued the Notice Regarding the Determination of Chinese-Controlled Offshore Incorporated Enterprises as PRC Tax Resident Enterprises on the Basis of De Facto Management Bodies, or Circular 82, on April 22, 2009. Circular 82 provides certain specific criteria for determining whether the “de facto management body” of a Chinese-controlled offshore incorporated enterprise is located in China.

Circular 82 only applies to offshore enterprises controlled by PRC enterprises and not those invested in by individuals or foreign enterprises like SGOCO. But, the determining criteria set forth in Circular 82 may reflect the State Administration of Taxation’s general position on how the “de facto management body” test should be applied in determining the tax resident status of offshore enterprises, regardless of whether they are controlled by PRC enterprises or controlled by or invested in by individuals or foreign enterprises. If we are considered a resident enterprise and earn income other than dividends from our PRC subsidiaries, such PRC income tax on our global income could significantly increase our tax burden and materially and adversely affect our cash flow and profitability. Since the EIT Law became effective in 2008, SGOCO has not been treated as a “resident enterprise.”

16

If the PRC tax authorities determine that SGOCO is a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, SGOCO may be subject to enterprise income tax at a rate of 25% on SGOCO’s worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if both SGOCO and SGOCO International are treated as PRC “resident enterprises,” all dividends from the PRC operating subsidiaries to SGOCO International and from SGOCO International to SGOCO would be exempt from PRC tax.

If SGOCO were treated as a PRC “non-resident enterprise” under the EIT Law, then dividends that SGOCO receives from its PRC operating subsidiaries (assuming such dividends were considered sourced within the PRC):

| 1. | may be subject to a 5% PRC withholding tax, if the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion regarding Taxes on Income (the “PRC-Hong Kong Tax Treaty”) is applicable; or |

| 2. | may be subject to a 10% PRC withholding tax, if such treaty does not apply ( i.e. , because the PRC tax authorities may deem SGOCO International to be a conduit not entitled to treaty benefits). |

Any such taxes on dividends could materially reduce the amount of dividends, if any, SGOCO could pay to its shareholders.

Finally, the “resident enterprise” classification could result in a 10% PRC tax being imposed on dividends SGOCO pays to its non-PRC shareholders that are not PRC tax “resident enterprises” and gains derived by them from transferring SGOCO’s ordinary shares, if such income is considered PRC-sourced income by the relevant PRC authorities. In such event, SGOCO may be required to withhold the 10% PRC tax on any dividends paid to its non-PRC resident shareholders. SGOCO’s non-PRC resident shareholders also may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of ordinary shares in certain circumstances. SGOCO would not, however, have an obligation to withhold PRC tax regarding such gain.

If any such PRC taxes apply, a non-PRC resident shareholder may be entitled to a reduced rate of PRC taxes under an applicable income tax treaty and/or a foreign tax credit against such shareholder’s domestic income tax liability (subject to applicable conditions and limitations). According to the Notice of the Provisional Regulation of Non-PRC Residents’ Enjoyment of the Preferential Treatment of Tax Treaty, Circular 124, on August 24, 2009, issued by the State Administration of Taxation, the non-PRC shareholders located in countries which have income tax treaties with China may be taxed at a reduced rate lower than 10%. Prospective investors should consult with their own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available foreign tax credits.

Intercompany loans from SGOCO to its operating subsidiaries must comply with PRC law.

Any loans we make to our Chinese subsidiaries, which are treated as foreign-invested enterprises under Chinese law, cannot exceed statutory limits and must be registered with the State Administration of Foreign Exchange, or SAFE, or its local counterparts. Under applicable Chinese law, the Chinese regulators must approve the amount of a foreign-invested enterprise’s registered capital, which represents shareholders’ equity investments over a defined period of time, and the foreign-invested enterprise’s total investment, which represents the total of the Company’s registered capital plus permitted loans. The ratio of registered capital to total investment cannot be lower than the minimum statutory requirement and the excess of the total investment over the registered capital represents the maximum amount of borrowings that a foreign invested enterprise is permitted to have under Chinese law.

If we lend money to our Chinese subsidiaries and such funds exceed the permitted amount of borrowings of the subsidiary, we would have to apply to the relevant government authorities to increase the permitted total investment amounts. The various applications could be time consuming and their outcomes would be uncertain. Concurrently with the loans, we might have to make capital contributions to the subsidiaries in order to maintain the statutory minimum registered capital/total investment ratio, and such capital contributions involve uncertainties of their own, as discussed below. Furthermore, even if we make loans to our Chinese subsidiaries that do not exceed their current permitted amount of borrowings, we will have to register each loan with SAFE or its local counterpart within 15 days after signing the relevant loan agreement.

Subject to SAFE’s stipulated conditions, SAFE or its local counterpart is supposed to issue a registration certificate of foreign debts within 20 days after reviewing and accepting its application. In practice, it may take longer to complete such SAFE registration process.

We cannot be sure that we will be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, regarding future loans by us to our Chinese subsidiaries or affiliated entities or regarding future capital contributions by us to our Chinese subsidiaries. If we fail to complete such registrations or obtain such approvals, our ability to use such future loans or capital contributions to capitalize or otherwise fund our Chinese operations may be negatively affected, which would adversely and materially affect our liquidity and our ability to fund and expand our business.

17

A severe or prolonged downturn in the global economy could materially and adversely affect our business and results of operations.

The global market and economic conditions during the years 2008 through 2012 were unprecedented and challenging, with recessions occurring in most major economies. Continued concerns about the systemic impact of potential long-term and wide-spread recession, energy costs, geopolitical issues, sovereign debt issues, and the availability and cost of credit have contributed to increased market volatility and diminished expectations for economic growth around the world. The difficult economic outlook has negatively affected businesses and consumer confidence and contributed to significant volatility.

There is continuing uncertainty over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by the central banks and financial authorities of some of the world’s leading economies, including China’s. There have also been concerns over unrest in the Middle East and Africa, which may result in significant market volatility. Economic conditions in China are sensitive to global economic conditions. Any prolonged slowdown in the global and/or Chinese economy may have a negative impact on our business, results of operations and financial condition, and continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

Our risk management and internal control systems may not be effective and have deficiencies or material weaknesses

We are subject to the reporting obligations under the U.S. securities laws. The Securities and Exchange Commission, or the SEC, as required under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”), has adopted rules requiring public companies to include a report of management on the effectiveness of such companies’ internal control over financial reporting in their respective annual reports. This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting because we are currently a non-accelerated filer and therefore, not required to obtain such report.

Our management has concluded that under the rules of Section 404, our internal control over financial reporting was ineffective as of December 31, 2018. A material weakness is a deficiency, or a combination of deficiencies, in internal control such that there is a reasonable possibility that a material misstatement of our company’s financial statements will not be prevented, or detected and corrected on a timely basis. A significant deficiency is a deficiency, or combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. The material weakness we identified is our lack of sufficient qualified accounting personnel with appropriate understanding of U.S. GAAP and SEC reporting requirements commensurate with our financial reporting requirements, which resulted in a number of internal control deficiencies that were identified as being significant. Also, as a small company, we do not have sufficient internal control personnel to set up adequate review functions at each reporting level.

We are in the process of implementing measures to resolve the material weakness and improve our internal and disclosure controls. However, we may not be able to successfully implement the remedial measures. For example, we may not be able to identify and hire suitable personnel with the requisite U.S. GAAP and internal control experience. The implementation of our remedial initiatives may not fully address the material weakness and significant deficiencies in our internal control over financial reporting. In addition, the process of designing and implementing an effective financial reporting system is a continuous effort that requires us to anticipate and react to changes in our business and economic and regulatory environments and to expend significant resources to maintain a financial reporting system that is adequate in satisfying our reporting obligations. We also expect to incur additional compensation expenses in connection with hiring additional accounting and internal control personnel.

As a result, our business and financial condition, results of operations and prospects, as well as the trading price of our ordinary shares may be materially and adversely affected. Ineffective internal control over financial reporting could also expose us to increased risk of fraud or misuse of corporate assets, In turn, that could subject us to potential delisting from the stock exchange on which our ordinary shares are listed, regulatory investigations or civil or criminal sanctions.

We have granted shares to our PRC employees, which may require registration with SAFE. We may also face regulatory uncertainties that could restrict our ability to issue equity compensation to our directors and employees and other parties who are PRC citizens or residents under PRC law.