FALSEQ120230001401521December 31239,473237,7352,9173,0720.00010.00011,000,0001,000,000————0.00010.0001100,000,000100,000,00043,486,44243,492,25643,274,35943,280,173212,000212,0832732——150333————7682P4Y0MP1Y0MP4Y4MP1Y4MP10Y0M0DP20YP15YP1Y11MP2Y1MP0Y0MP0Y9MP7Y8MP8Y6MP7Y10MP7Y11MP6Y0M00014015212023-01-012023-03-3100014015212023-05-15xbrli:shares0001401521us-gaap:FixedMaturitiesMember2023-03-31iso4217:USD0001401521us-gaap:FixedMaturitiesMember2022-12-3100014015212023-03-3100014015212022-12-310001401521us-gaap:OtherLongTermInvestmentsMember2023-03-310001401521us-gaap:OtherLongTermInvestmentsMember2022-12-31iso4217:USDxbrli:shares0001401521us-gaap:SegmentContinuingOperationsMember2023-01-012023-03-310001401521us-gaap:SegmentContinuingOperationsMember2022-01-012022-03-310001401521us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-03-310001401521us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-03-3100014015212022-01-012022-03-310001401521us-gaap:CommonStockMember2021-12-310001401521us-gaap:AdditionalPaidInCapitalMember2021-12-310001401521us-gaap:TreasuryStockCommonMember2021-12-310001401521us-gaap:ComprehensiveIncomeMember2021-12-310001401521us-gaap:RetainedEarningsMember2021-12-310001401521us-gaap:ParentMember2021-12-310001401521us-gaap:NoncontrollingInterestMember2021-12-3100014015212021-12-310001401521us-gaap:RetainedEarningsMember2022-01-012022-03-310001401521us-gaap:ParentMember2022-01-012022-03-310001401521us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001401521us-gaap:ComprehensiveIncomeMember2022-01-012022-03-310001401521us-gaap:CommonStockMember2022-01-012022-03-310001401521us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001401521us-gaap:CommonStockMember2022-03-310001401521us-gaap:AdditionalPaidInCapitalMember2022-03-310001401521us-gaap:TreasuryStockCommonMember2022-03-310001401521us-gaap:ComprehensiveIncomeMember2022-03-310001401521us-gaap:RetainedEarningsMember2022-03-310001401521us-gaap:ParentMember2022-03-310001401521us-gaap:NoncontrollingInterestMember2022-03-3100014015212022-03-310001401521us-gaap:CommonStockMember2022-12-310001401521us-gaap:AdditionalPaidInCapitalMember2022-12-310001401521us-gaap:TreasuryStockCommonMember2022-12-310001401521us-gaap:ComprehensiveIncomeMember2022-12-310001401521us-gaap:RetainedEarningsMember2022-12-310001401521us-gaap:ParentMember2022-12-310001401521us-gaap:RetainedEarningsMember2023-01-012023-03-310001401521us-gaap:ParentMember2023-01-012023-03-310001401521us-gaap:ComprehensiveIncomeMember2023-01-012023-03-310001401521us-gaap:CommonStockMember2023-01-012023-03-310001401521us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001401521us-gaap:CommonStockMember2023-03-310001401521us-gaap:AdditionalPaidInCapitalMember2023-03-310001401521us-gaap:TreasuryStockCommonMember2023-03-310001401521us-gaap:ComprehensiveIncomeMember2023-03-310001401521us-gaap:RetainedEarningsMember2023-03-310001401521us-gaap:ParentMember2023-03-310001401521us-gaap:SegmentContinuingOperationsMember2022-12-310001401521us-gaap:SegmentContinuingOperationsMember2021-12-310001401521us-gaap:SegmentContinuingOperationsMember2023-03-310001401521us-gaap:SegmentContinuingOperationsMember2022-03-31uihc:subsidiary0001401521srt:ScenarioPreviouslyReportedMember2023-03-310001401521srt:RestatementAdjustmentMember2023-03-310001401521srt:ScenarioPreviouslyReportedMember2022-12-310001401521srt:RestatementAdjustmentMember2022-12-310001401521srt:ScenarioPreviouslyReportedMember2023-01-012023-03-310001401521srt:RestatementAdjustmentMember2023-01-012023-03-310001401521srt:ScenarioPreviouslyReportedMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-03-310001401521srt:RestatementAdjustmentMemberus-gaap:SegmentContinuingOperationsMember2023-01-012023-03-310001401521srt:ScenarioPreviouslyReportedMemberus-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-03-310001401521srt:RestatementAdjustmentMemberus-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-03-310001401521srt:ScenarioPreviouslyReportedMember2022-01-012022-03-310001401521srt:RestatementAdjustmentMember2022-01-012022-03-310001401521srt:ScenarioPreviouslyReportedMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-03-310001401521srt:RestatementAdjustmentMemberus-gaap:SegmentContinuingOperationsMember2022-01-012022-03-310001401521srt:ScenarioPreviouslyReportedMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-03-310001401521srt:RestatementAdjustmentMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-03-310001401521uihc:UPCInsuranceMemberus-gaap:SegmentDiscontinuedOperationsMember2023-03-310001401521uihc:UPCInsuranceMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310001401521uihc:ServiceEntitiesMemberus-gaap:SegmentDiscontinuedOperationsMember2023-03-310001401521uihc:ServiceEntitiesMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310001401521uihc:CommercialLinesReportingSegmentMember2023-01-012023-03-310001401521uihc:PersonalLinesReportingSegmentMember2023-01-012023-03-310001401521uihc:AdjustmentsAndReconcilingItemsMember2023-01-012023-03-31xbrli:pure0001401521uihc:CommercialLinesReportingSegmentMember2023-03-310001401521uihc:PersonalLinesReportingSegmentMember2023-03-310001401521uihc:AdjustmentsAndReconcilingItemsMember2023-03-310001401521uihc:CommercialLinesReportingSegmentMember2022-01-012022-03-310001401521uihc:PersonalLinesReportingSegmentMember2022-01-012022-03-310001401521uihc:AdjustmentsAndReconcilingItemsMember2022-01-012022-03-310001401521uihc:CommercialLinesReportingSegmentMember2022-03-310001401521uihc:PersonalLinesReportingSegmentMember2022-03-310001401521uihc:AdjustmentsAndReconcilingItemsMember2022-03-310001401521us-gaap:USTreasuryAndGovernmentMember2023-03-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMember2023-03-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMember2023-03-310001401521us-gaap:PublicUtilityBondsMember2023-03-310001401521us-gaap:AllOtherCorporateBondsMember2023-03-310001401521us-gaap:MortgageBackedSecuritiesMember2023-03-310001401521us-gaap:AssetBackedSecuritiesMember2023-03-310001401521us-gaap:USTreasuryAndGovernmentMember2022-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001401521us-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001401521us-gaap:PublicUtilityBondsMember2022-12-310001401521us-gaap:AllOtherCorporateBondsMember2022-12-310001401521us-gaap:MortgageBackedSecuritiesMember2022-12-310001401521us-gaap:AssetBackedSecuritiesMember2022-12-310001401521us-gaap:MutualFundMember2023-03-310001401521us-gaap:MutualFundMember2022-12-310001401521us-gaap:FixedMaturitiesMember2023-01-012023-03-310001401521us-gaap:FixedMaturitiesMember2022-01-012022-03-310001401521us-gaap:EquitySecuritiesMember2023-01-012023-03-310001401521us-gaap:EquitySecuritiesMember2022-01-012022-03-310001401521us-gaap:ShortTermInvestmentsMember2023-01-012023-03-310001401521us-gaap:ShortTermInvestmentsMember2022-01-012022-03-310001401521us-gaap:DebtSecuritiesMember2023-01-012023-03-310001401521us-gaap:DebtSecuritiesMember2022-01-012022-03-310001401521us-gaap:EquitySecuritiesMember2023-01-012023-03-310001401521us-gaap:EquitySecuritiesMember2022-01-012022-03-310001401521uihc:CashCashEquivalentsAndShortTermInvestmentsMember2023-01-012023-03-310001401521uihc:CashCashEquivalentsAndShortTermInvestmentsMember2022-01-012022-03-310001401521srt:PartnershipInterestMember2023-01-012023-03-310001401521srt:PartnershipInterestMember2022-01-012022-03-310001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2023-01-012023-03-310001401521us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2022-01-012022-03-31uihc:security0001401521us-gaap:CorporateDebtSecuritiesMember2023-03-310001401521us-gaap:CorporateDebtSecuritiesMember2022-12-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2023-03-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-03-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-03-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-03-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:PublicUtilityBondsMember2023-03-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:PublicUtilityBondsMember2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityBondsMember2023-03-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-03-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesMember2023-03-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2023-03-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2023-03-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2023-03-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:MutualFundMember2023-03-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MutualFundMember2023-03-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMember2023-03-310001401521us-gaap:FairValueInputsLevel1Member2023-03-310001401521us-gaap:FairValueInputsLevel2Member2023-03-310001401521us-gaap:FairValueInputsLevel3Member2023-03-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2022-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:PublicUtilityBondsMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:PublicUtilityBondsMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:PublicUtilityBondsMember2022-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:MortgageBackedSecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MortgageBackedSecuritiesMember2022-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMember2022-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:FixedMaturitiesMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:MutualFundMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:MutualFundMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:MutualFundMember2022-12-310001401521us-gaap:EquitySecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2022-12-310001401521us-gaap:FairValueInputsLevel1Memberus-gaap:OtherLongTermInvestmentsMember2022-12-310001401521us-gaap:FairValueInputsLevel2Memberus-gaap:OtherLongTermInvestmentsMember2022-12-310001401521us-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMember2022-12-310001401521us-gaap:FairValueInputsLevel1Member2022-12-310001401521us-gaap:FairValueInputsLevel2Member2022-12-310001401521us-gaap:FairValueInputsLevel3Member2022-12-310001401521us-gaap:LimitedPartnerMember2023-03-310001401521us-gaap:ComputerEquipmentMember2023-03-310001401521us-gaap:ComputerEquipmentMember2022-12-310001401521us-gaap:OfficeEquipmentMember2023-03-310001401521us-gaap:OfficeEquipmentMember2022-12-310001401521us-gaap:LeaseholdImprovementsMember2023-03-310001401521us-gaap:LeaseholdImprovementsMember2022-12-310001401521us-gaap:VehiclesMember2023-03-310001401521us-gaap:VehiclesMember2022-12-3100014015212022-01-012022-12-310001401521us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2023-03-310001401521us-gaap:CustomerRelationshipsMember2023-03-310001401521us-gaap:TradeNamesMember2023-03-310001401521us-gaap:IntangibleAssetsArisingFromInsuranceContractsAcquiredInBusinessCombinationMember2022-12-310001401521us-gaap:CustomerRelationshipsMember2022-12-310001401521us-gaap:TradeNamesMember2022-12-310001401521us-gaap:CustomerRelationshipsMember2023-01-012023-03-310001401521us-gaap:TradeNamesMember2023-01-012023-03-310001401521us-gaap:CustomerRelationshipsMember2022-01-012022-03-310001401521us-gaap:TradeNamesMember2022-01-012022-03-310001401521uihc:CatastropheExcessOfLossMember2023-01-012023-03-310001401521uihc:InterboroInsuranceMemberuihc:CatastropheExcessOfLossMember2023-01-012023-03-310001401521uihc:InterboroInsuranceMember2023-03-310001401521uihc:AllOtherPerilsExcessOfLossMember2023-01-012023-03-310001401521uihc:A150MSeniorNotesMember2023-01-012023-03-310001401521uihc:A150MSeniorNotesMember2023-03-31utr:Rate0001401521uihc:A150MSeniorNotesMember2022-12-310001401521us-gaap:NotesPayableOtherPayablesMember2023-01-012023-03-310001401521us-gaap:NotesPayableOtherPayablesMember2023-03-310001401521us-gaap:NotesPayableOtherPayablesMember2022-12-310001401521uihc:BBTTermNotePayableMember2023-01-012023-03-310001401521uihc:BBTTermNotePayableMember2023-03-310001401521uihc:BBTTermNotePayableMember2022-12-310001401521uihc:A150MSeniorNotesMember2017-12-130001401521us-gaap:NotesPayableOtherPayablesMember2006-09-220001401521uihc:BBTTermNotePayableMember2016-05-260001401521uihc:A150MSeniorNotesMember2017-12-132017-12-130001401521us-gaap:NotesPayableOtherPayablesMember2006-09-222006-09-220001401521uihc:BBTTermNotePayableMember2016-05-262016-05-2600014015212023-01-012023-12-310001401521uihc:AmericanCoastalInsuranceCompanyMember2023-01-012023-03-310001401521uihc:AmericanCoastalInsuranceCompanyMember2022-01-012022-03-310001401521uihc:InterboroInsuranceMember2023-01-012023-03-310001401521uihc:InterboroInsuranceMember2022-01-012022-03-310001401521uihc:AmericanCoastalInsuranceCompanyMember2023-03-310001401521uihc:AmericanCoastalInsuranceCompanyMember2022-12-310001401521uihc:InterboroInsuranceMember2022-12-310001401521uihc:ConsolidatedEntityExcludingNoncontrollingInterestsMember2023-01-012023-03-310001401521uihc:EmployeeMember2023-01-012023-03-310001401521uihc:EmployeeMember2022-01-012022-03-310001401521srt:DirectorMember2023-01-012023-03-310001401521srt:DirectorMember2022-01-012022-03-310001401521uihc:EmployeeMember2023-03-31uihc:year0001401521srt:DirectorMember2023-03-310001401521us-gaap:RestrictedStockMember2022-01-012022-03-310001401521us-gaap:RestrictedStockMember2022-12-310001401521us-gaap:RestrictedStockMember2023-01-012023-03-310001401521us-gaap:RestrictedStockMember2023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________

FORM 10-Q/A

_______________________

(Amendment No. 1)

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 001-35761

____________________

American Coastal Insurance Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 75-3241967 | |

| (State or Other Jurisdiction of

Incorporation or Organization) | | (IRS Employer Identification Number) | |

| | | | | | | | | | | | | | | | | |

| 800 2nd Avenue S. | | 33701 | |

| St. Petersburg, | Florida | | |

| (Address of Principle Executive Offices) | | (Zip Code) | |

727-895-7737

(Registrant's telephone number, including area code)

United Insurance Holdings Corp.

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | ACIC | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| Non-accelerated filer | ☑ | Smaller reporting company | ☑ | | |

If an emerging growth company, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No R

As of May 15, 2023, 43,287,573 shares of common stock, par value $0.0001 per share, were outstanding.

EXPLANATORY NOTE

American Coastal Insurance Corporation (formerly known as United Insurance Holdings Corp.) (the “Company”) is filing this amendment to its Quarterly Report on Form 10-Q (the “Amended Report”) for the three months ended March 31, 2023 originally filed with the Securities and Exchange Commission (“SEC”) on May 19, 2023 (the “Original Report”). The purpose of this Amended Report is to restate the Company’s unaudited condensed consolidated financial statements for the three months ended March 31, 2023 (the “First Quarter 2023 10-Q”). Except as described below, no other information included in the Original Report is being amended or updated by this Amendment and this Amendment does not purport to reflect any information or events subsequent to the Original Form 10-Q.

Restatement Background

The Company has identified certain errors related to the reporting of the discontinued operations for the previously issued unaudited condensed consolidated financial statements for the three months ended March 31, 2023, as included in the Original Report, which errors had the effect of understating the net income for the three months ended March 31, 2023 by approximately $6.4 million. These errors were discovered in the course of preparing the Company’s interim financial statements for the fiscal quarter ended June 30, 2023, and included errors in the Company’s accounting for income tax expense primarily relating to the deconsolidation of the Company’s former subsidiary, United Property & Casualty Insurance Company.

As a result, on August 17, 2023, the Company’s management determined that the Company’s previously issued unaudited condensed financial statements as of and for the quarterly periods ended March 31, 2023, should no longer be relied upon solely as a result of the above-described errors.

Restatement

This Amended Report includes restated unaudited interim financial information for the quarterly period ended March 31, 2023.

This Amended Report also amends and restates the following items included in the Original Report as appropriate to reflect the restatement and revision of the relevant periods: Part I — Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation; Part I — Item 4. Controls and Procedures; Part II — Item 1A. Risk Factors and Part II — Item 6. Exhibits.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is also including with this Amended Report currently dated certifications of the Company’s Chief Executive Officer and Chief Financial Officer (attached as Exhibits 31.1, 31.2, 32.1, and 32.2).

Except as discussed above and as further described in the Notes to the unaudited condensed consolidated financial statements, the Company has not modified or updated the disclosures presented in this Amended Report. Accordingly, this Amended Report does not reflect events occurring after the Original Report or modify or update those disclosures affected by subsequent events. Information not affected by the restatement is unchanged and reflects disclosures made at the time of the filing of the Original Report.

Control Considerations

In connection with the restatement, management has reassessed the effectiveness of the Company’s internal control over financial reporting. Based on this assessment, the Company identified a material weakness in its internal control over financial reporting due to a design deficiency in controls related to the review of significant unusual transactions, including the impact to income tax expense from those transactions, resulting in the conclusion by our principal executive officer and principal financial officer, that the internal control over financial reporting and disclosure controls and procedures were not effective as of March 31, 2023. Management has begun to take steps towards remediating the material weakness in the Company’s internal control over financial reporting. For additional information related to the material weakness in internal control over financial reporting and the related remedial measures, see “Part II – Item 4. Controls and Procedures.”

UNITED INSURANCE HOLDINGS CORP.

| | | | | | | | |

PART I. FINANCIAL INFORMATION | |

| Item 1. Restated Financial Statements | |

| Restated Condensed Consolidated Balance Sheets (Unaudited) | |

| Restated Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) | |

| Restated Condensed Consolidated Statements of Stockholders' Equity (Deficit) (Unaudited) | |

| Restated Condensed Consolidated Statements of Cash Flows (Unaudited) | |

| Notes to Restated Unaudited Condensed Consolidated Financial Statements | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4. Controls and Procedures | |

| PART II. OTHER INFORMATION | |

| Item 1. Legal Proceedings | |

| Item 1A. Risk Factors | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3. Defaults Upon Senior Securities | |

| Item 4. Mine Safety Disclosures | |

| Item 5. Other Information | |

| Item 6. Exhibits | |

| Signatures | |

Throughout this Quarterly Report on Form 10-Q (Form 10-Q), we present amounts in all tables in thousands, except for share amounts, per share amounts, policy counts or where more specific language or context indicates a different presentation. In the narrative sections of this Form 10-Q, we show full values rounded to the nearest thousand.

UNITED INSURANCE HOLDINGS CORP.

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about anticipated growth in revenues, gross written premium, earnings per share, estimated unpaid losses on insurance policies, investment returns, and diversification and expectations about our liquidity, our ability to meet our investment objectives, our ability to manage and mitigate market risk with respect to our investments and our ability to continue as a going concern. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “endeavor,” “project,” “believe,” “plan,” “anticipate,” “intend,” “could,” “would,” “estimate,” or “continue” or the negative variations thereof or comparable terminology are intended to identify forward-looking statements. These statements are based on current expectations, estimates and projections about the industry and market in which we operate, and management's beliefs and assumptions. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The risks and uncertainties include, without limitation:

•our exposure to catastrophic events and severe weather conditions;

•the regulatory, economic and weather conditions present in Florida and New York the states in which we are most concentrated;

•our ability to cultivate and maintain agent relationships, particularly our relationship with AmRisc, LLC;

•the possibility that actual claims incurred may exceed our loss reserves for claims;

•assessments charged by various governmental agencies;

•our ability to implement and maintain adequate internal controls over financial reporting;

•our ability to maintain information technology and data security systems, and to outsource relationships;

•our reliance on key vendor relationships, and the ability of our vendors to protect the personally identifiable information of our customers, claimants or employees;

•our ability to attract and retain the services of senior management;

•risks and uncertainties relating to our acquisitions, mergers, dispositions and other strategic transactions;

•risks associated with investments in which we share ownership or management with third parties;

•our ability to generate sufficient cash to service all of our indebtedness and comply with covenants and other requirements related to our indebtedness;

•our ability to maintain our market share;

•changes in the regulatory environment present in the states in which we operate;

•the impact of new federal or state regulations that affect the insurance industry;

•the cost, viability and availability of reinsurance;

•our ability to collect from our reinsurers or others on our reinsurance claims;

•dependence on investment income and the composition of our investment portfolio and related market risks;

•the possibility of the pricing and terms for our products to decline due to the historically cyclical nature of the property and casualty insurance and reinsurance industry;

•the outcome of litigation pending against us, including the terms of any settlements;

•downgrades in our financial strength or stability ratings;

•the impact of future transactions of substantial amounts of our common stock by us or our significant stockholders on our stock price;

•our ability to meet the standards for continued listing on Nasdaq;

•substantial doubt about our ability to continue as a going concern, including the impact on future financing and reinsurance coverage;

•our ability to pay dividends in the future, which may be constrained by our holding company structure;

•the ability of our subsidiaries to pay dividends in the future, which may affect our liquidity and our ability to meet our obligations;

•the ability of R. Daniel Peed and his affiliates to exert significant control over us due to substantial ownership of our common stock, subject to certain restrictive covenants that may restrict our ability to pursue certain opportunities;

•the impact of transactions by R. Daniel Peed and his affiliates on the price of our common stock;

•provisions in our charter documents that may make it harder for others to obtain control of us; and

•other risks and uncertainties described in the section entitled "Risk Factors" in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2022 and in Part II, Item 1A of this Form 10-Q.

We caution you not to rely on these forward-looking statements, which are valid only as of the date they were made. Except as may be required by applicable law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, the occurrence of unanticipated events or otherwise.

UNITED INSURANCE HOLDINGS CORP.

PART I. FINANCIAL INFORMATION

Item 1. Restated Financial Statements

Restated Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| | March 31,

2023 | | December 31, 2022 |

| ASSETS | | | | |

| Investments, at fair value: | | | | |

Fixed maturities, available-for-sale (amortized cost of $239,473 and $237,735, respectively) | | $ | 210,733 | | | $ | 204,682 | |

| Equity securities | | 16,181 | | | 15,657 | |

Other investments (amortized cost of $2,917 and $3,072, respectively) | | 3,550 | | | 3,675 | |

| | | | |

| Total investments | | $ | 230,464 | | | $ | 224,014 | |

| Cash and cash equivalents | | 92,586 | | | 70,903 | |

| Restricted cash | | 49,671 | | | 45,988 | |

| Total cash, cash equivalents and restricted cash | | $ | 142,257 | | | $ | 116,891 | |

| Accrued investment income | | 1,818 | | | 1,605 | |

| Property and equipment, net | | 4,723 | | | 5,293 | |

Premiums receivable, net (credit allowance of $27 and $32, respectively) | | 48,120 | | | 39,301 | |

Reinsurance recoverable on paid and unpaid losses, net (credit allowance of $150 and $333, respectively) | | 792,350 | | | 796,546 | |

| Ceded unearned premiums | | 65,702 | | | 90,496 | |

| Goodwill | | 59,476 | | | 59,476 | |

| Deferred policy acquisition costs, net | | 59,897 | | | 52,369 | |

| Intangible assets, net | | 11,758 | | | 12,770 | |

| Other assets | | 17,476 | | | 3,920 | |

| Assets held for disposal | | 13,395 | | | 1,434,815 | |

| Total Assets | | $ | 1,447,436 | | | $ | 2,837,496 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Liabilities: | | | | |

| Unpaid losses and loss adjustment expenses | | $ | 748,365 | | | $ | 842,958 | |

| Unearned premiums | | 301,625 | | | 258,978 | |

| Reinsurance payable on premiums | | 33,908 | | | 30,503 | |

| Payments outstanding | | 2,326 | | | 2,000 | |

| Accounts payable and accrued expenses | | 89,582 | | | 74,386 | |

| Operating lease liability | | 1,412 | | | 1,689 | |

| Other liabilities | | 30,073 | | | 5,849 | |

| Notes payable, net | | 148,438 | | | 148,355 | |

| Liabilities held for disposal | | 1,817 | | | 1,654,817 | |

| Total Liabilities | | $ | 1,357,546 | | | $ | 3,019,535 | |

| Commitments and contingencies (Note 13) | | | | |

| Stockholders' Equity: | | | | |

| Preferred stock, $0.0001 par value; 1,000,000 shares authorized; none issued or outstanding | | $ | — | | | $ | — | |

Common stock, $0.0001 par value; 100,000,000 shares authorized; 43,486,442 and 43,492,256 issued, respectively; 43,274,359 and 43,280,173 outstanding, respectively | | 4 | | | 4 | |

| Additional paid-in capital | | 395,966 | | | 395,631 | |

| Treasury shares, at cost: 212,083 shares | | (431) | | | (431) | |

| Accumulated other comprehensive loss | | (25,629) | | | (30,947) | |

| Retained earnings (deficit) | | (280,020) | | | (546,296) | |

| | | | |

| | | | |

| Total Stockholders' Equity (Deficit) | | $ | 89,890 | | | $ | (182,039) | |

| Total Liabilities and Stockholders' Equity | | $ | 1,447,436 | | | $ | 2,837,496 | |

See accompanying Notes to Restated Unaudited Condensed Consolidated Financial Statements.

UNITED INSURANCE HOLDINGS CORP.

Restated Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

| | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | | 2023 | | 2022 |

| REVENUE: | | | | | | | | |

| Gross premiums written | | | | | | $ | 187,123 | | | $ | 142,414 | |

| Change in gross unearned premiums | | | | | | (42,647) | | | (19,681) | |

| Gross premiums earned | | | | | | 144,476 | | | 122,733 | |

| Ceded premiums earned | | | | | | (57,152) | | | (64,987) | |

| Net premiums earned | | | | | | 87,324 | | | 57,746 | |

| Net investment income | | | | | | 2,589 | | | 1,404 | |

| Net realized investment gains (losses) | | | | | | (83) | | | 37 | |

| Net unrealized gains (losses) on equity securities | | | | | | 474 | | | (770) | |

| | | | | | | | |

| Other revenue | | | | | | 16 | | | 15 | |

| Total revenue | | | | | | 90,320 | | | 58,432 | |

| EXPENSES: | | | | | | | | |

| Losses and loss adjustment expenses | | | | | | 16,412 | | | 26,315 | |

| Policy acquisition costs | | | | | | 26,972 | | | 20,308 | |

| Operating expenses | | | | | | 2,168 | | | 3,707 | |

| General and administrative expenses | | | | | | 8,793 | | | 8,064 | |

| Interest expense | | | | | | 2,719 | | | 2,359 | |

| Total expenses | | | | | | 57,064 | | | 60,753 | |

| Income before other income | | | | | | 33,256 | | | (2,321) | |

| Other income | | | | | | 588 | | | 1,333 | |

| Income before income taxes | | | | | | 33,844 | | | (988) | |

| Provision for income taxes | | | | | | 3,477 | | | (715) | |

| Income from continuing operations, net of tax | | | | | | $ | 30,367 | | | $ | (273) | |

| Income (loss) from discontinued operations, net of tax | | | | | | 236,913 | | | (32,984) | |

| Net income (loss) | | | | | | $ | 267,280 | | | $ | (33,257) | |

| Less: Net loss attributable to NCI | | | | | | — | | | (85) | |

| Net income (loss) attributable to UIHC | | | | | | $ | 267,280 | | | $ | (33,172) | |

| OTHER COMPREHENSIVE INCOME (LOSS): | | | | | | | | |

| Change in net unrealized gains (losses) on investments | | | | | | 4,231 | | | (27,689) | |

| Reclassification adjustment for net realized investment losses | | | | | | 83 | | | 1,769 | |

| | | | | | | | |

| Income tax benefit related to items of other comprehensive income (loss) | | | | | | — | | | 6,236 | |

| Total comprehensive income (loss) | | | | | | $ | 271,594 | | | $ | (52,941) | |

| Less: Comprehensive loss attributable to NCI | | | | | | — | | | (643) | |

| Comprehensive income (loss) attributable to UIHC | | | | | | $ | 271,594 | | | $ | (52,298) | |

| | | | | | | | |

| Weighted average shares outstanding | | | | | | | | |

| Basic | | | | | | 43,124,825 | | | 42,980,691 | |

| Diluted | | | | | | 43,574,840 | | | 42,980,691 | |

| | | | | | | | |

| Earnings available to UIHC common stockholders per share | | | | | | | | |

| Basic | | | | | | | | |

| Continuing operations | | | | | | $ | 0.70 | | | $ | — | |

| Discontinued operations | | | | | | 5.49 | | | (0.77) | |

| Total | | | | | | $ | 6.19 | | | $ | (0.77) | |

| Diluted | | | | | | | | |

| Continuing operations | | | | | | $ | 0.70 | | | $ | — | |

| Discontinued operations | | | | | | 5.44 | | | (0.77) | |

| Total | | | | | | $ | 6.14 | | | $ | (0.77) | |

See accompanying Notes to Restated Unaudited Condensed Consolidated Financial Statements.

UNITED INSURANCE HOLDINGS CORP.

Restated Condensed Consolidated Statements of Stockholders’ Equity for the Three Months Ended

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Retained Deficit | | Stockholders' Equity Attributable to UIHC | | NCI | | Total Stockholders’ Equity |

| Number of Shares | | Dollars | | | | | | |

| | | | | | |

| December 31, 2021 | 43,370,442 | | | $ | 4 | | | $ | 394,268 | | | $ | (431) | | | $ | (6,531) | | | $ | (74,904) | | | $ | 312,406 | | | $ | 19,551 | | | $ | 331,957 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (33,172) | | | (33,172) | | | (85) | | | (33,257) | |

| Other comprehensive loss, net | — | | | — | | | — | | | — | | | (19,126) | | | — | | | (19,126) | | | (558) | | | (19,684) | |

| Stock Compensation | (112,847) | | | — | | | 452 | | | — | | | — | | | — | | | 452 | | | — | | | 452 | |

| | | | | | | | | | | | | | | | | |

| Cash dividends on common stock ($0.06 per common share) | — | | | — | | | — | | | — | | | — | | | (2,589) | | | (2,589) | | | — | | | (2,589) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| March 31, 2022 | 43,257,595 | | | $ | 4 | | | $ | 394,720 | | | $ | (431) | | | $ | (25,657) | | | $ | (110,665) | | | $ | 257,971 | | | $ | 18,908 | | | $ | 276,879 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Treasury Stock | | Accumulated Other Comprehensive Loss | | Retained Earnings (Deficit) | | Stockholders' Equity (Deficit)

Attributable to UIHC | | NCI | | Total Stockholders’ Equity (Deficit) |

| Number of Shares | | Dollars | | | | | | | |

| | | | | | | |

| December 31, 2022 | 43,280,173 | | | $ | 4 | | | $ | 395,631 | | | $ | (431) | | | $ | (30,947) | | | $ | (546,296) | | | $ | (182,039) | | | $ | — | | | $ | (182,039) | |

| Net Income | — | | | — | | | — | | | — | | | — | | | 267,280 | | | 267,280 | | | — | | | 267,280 | |

| Other comprehensive income, net | — | | | — | | | — | | | — | | | 4,314 | | | — | | | 4,314 | | | — | | | 4,314 | |

| Impact of Deconsolidation of Discontinued Operations | — | | | — | | | — | | | — | | | 1,004 | | | (1,004) | | | — | | | — | | | — | |

| Stock Compensation | (5,814) | | | — | | | 335 | | | — | | | — | | | — | | | 335 | | | — | | | 335 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| March 31, 2023 | 43,274,359 | | | $ | 4 | | | $ | 395,966 | | | $ | (431) | | | $ | (25,629) | | | $ | (280,020) | | | $ | 89,890 | | | $ | — | | | $ | 89,890 | |

See accompanying Notes to Restated Unaudited Condensed Consolidated Financial Statements.

UNITED INSURANCE HOLDINGS CORP.

Restated Condensed Consolidated Statements of Cash Flows (Unaudited) | | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 |

| OPERATING ACTIVITIES | | | | |

| Net income (loss) | | $ | 267,280 | | | $ | (33,257) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | | 2,155 | | | 2,606 | |

| Bond amortization and accretion | | 160 | | | 1,634 | |

| Net realized losses (gains) on investments | | (1,260) | | | 1,769 | |

| Net unrealized losses (gains) on equity securities | | (2,554) | | | 2,268 | |

| Provision for uncollectable premiums | | 5 | | | 12 | |

| Provision for uncollectable reinsurance recoverables | | 183 | | | 168 | |

| | | | |

| Deferred income taxes, net | | 15,767 | | | (11,351) | |

| Stock based compensation | | 335 | | | 452 | |

| | | | |

| Settlement of receivable owed by HCI in connection with purchase agreement | | — | | | 3,800 | |

| Gain on sale of property and equipment | | (422) | | | (1,528) | |

| Fixed asset disposal | | 524 | | | 343 | |

| Disposition of former subsidiary | | (238,440) | | | — | |

| Changes in operating assets and liabilities: | | | | |

| Accrued investment income | | 369 | | | 437 | |

| Premiums receivable | | 15,178 | | | 2,265 | |

| Reinsurance recoverable on paid and unpaid losses | | 289,946 | | | 85,140 | |

| Ceded unearned premiums | | 72,064 | | | 146,667 | |

| Deferred policy acquisition costs, net | | (875) | | | (7,193) | |

| Other assets | | (31,630) | | | (4,618) | |

| Receivable from sale of building | | — | | | 3,236 | |

| Unpaid losses and loss adjustment expenses | | (278,142) | | | (117,236) | |

| Unearned premiums | | (145,540) | | | (39,731) | |

| Reinsurance payable on premiums | | (13,376) | | | (51,714) | |

| Payments outstanding | | (68,493) | | | (10,246) | |

| Accounts payable and accrued expenses | | 16,440 | | | (2,924) | |

| Operating lease liability | | (277) | | | (183) | |

| Other liabilities | | (3,561) | | | 8,291 | |

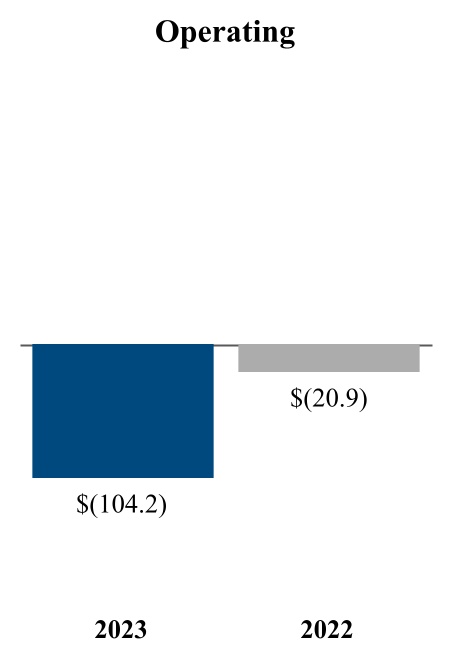

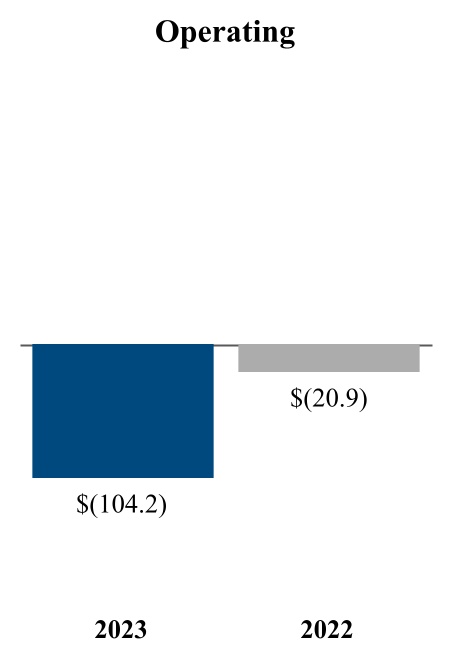

| Net cash provided by (used in) operating activities | | $ | (104,164) | | | $ | (20,893) | |

| INVESTING ACTIVITIES | | | | |

| Proceeds from sales, maturities and repayments of: | | | | |

| Fixed maturities | | 178,211 | | | 85,978 | |

| Equity securities | | 24,163 | | | 88 | |

| Other investments | | 227 | | | 1,063 | |

| | | | |

| Purchases of: | | | | |

| Fixed maturities | | (7,439) | | | (13,415) | |

| Equity securities | | (80) | | | (3,121) | |

| Other investments | | — | | | (459) | |

| Proceeds from sale of property and equipment | | 464 | | | 730 | |

| Cost of property, equipment and capitalized software acquired | | (154) | | | (1,406) | |

| Disposition of cash on divestiture of subsidiary | | (232,582) | | | — | |

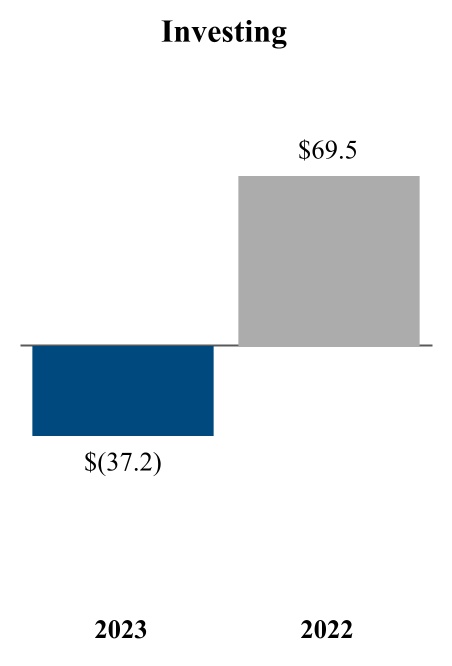

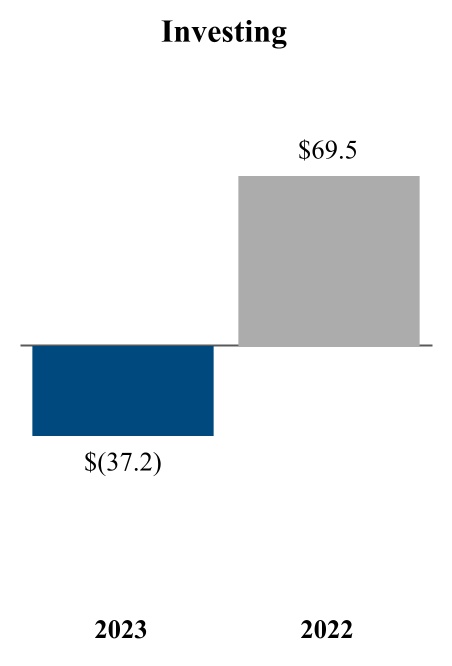

| Net cash provided by (used in) investing activities | | $ | (37,190) | | | $ | 69,458 | |

| FINANCING ACTIVITIES | | | | |

| | | | |

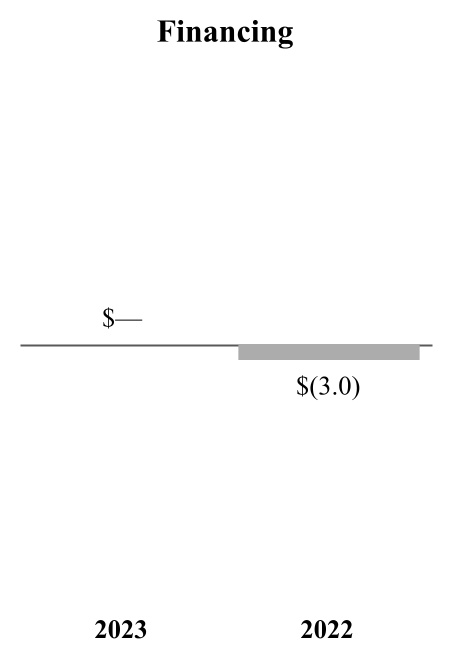

| Repayments of borrowings | | — | | | (381) | |

| Dividends | | — | | | (2,589) | |

| | | | |

| | | | |

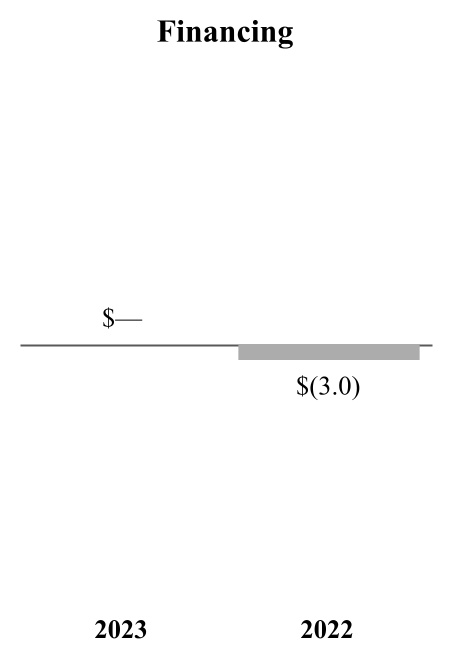

| Net cash used in financing activities | | $ | — | | | $ | (2,970) | |

| Increase in cash, cash equivalents and restricted cash, including cash classified as assets held for disposal | | (141,354) | | | 45,595 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 283,611 | | | 245,278 | |

| | | | |

| | | | |

| Cash, cash equivalents and restricted at end of period | | $ | 142,257 | | | $ | 290,873 | |

| Supplemental Cash Flows Information | | | | |

| Interest paid | | $ | — | | | $ | 35 | |

| Income taxes paid | | $ | 5,325 | | | $ | 77 | |

| | | | |

| | | | |

See accompanying Notes to Restated Unaudited Condensed Consolidated Financial Statements.

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

1) ORGANIZATION, CONSOLIDATION AND PRESENTATION

(a)Business

United Insurance Holdings Corp. (referred to in this document as we, our, us, the Company or UIHC) is a property and casualty insurance holding company that sources, writes and services residential commercial and personal property and casualty insurance policies using a network of agents and two wholly-owned insurance subsidiaries. Our two insurance subsidiaries are Interboro Insurance Company (IIC), acquired via merger on April 29, 2016; and American Coastal Insurance Company (ACIC), acquired via merger on April 3, 2017.

Our other subsidiaries include United Insurance Management, L.C. (UIM), a managing general agent; Skyway Claims Services, LLC, which provides claims adjusting services to ACIC; AmCo Holding Company, LLC (AmCo) which is a holding company subsidiary that consolidates its respective insurance company; BlueLine Cayman Holdings (BlueLine), which reinsures portfolios of excess and surplus policies; UPC Re, which provides a portion of the reinsurance protection purchased by our insurance subsidiaries when needed; Skyway Reinsurance Services, LLC, which provides reinsurance brokerage services for our insurance companies; Skyway Legal Services, LLC, which provides claims litigation services to our insurance companies; and Skyway Technologies, LLC, a managing general agent that provides technological and distribution services to our insurance companies.

Our primary products are commercial and homeowners' residential property insurance. We currently offer commercial residential insurance in Florida. During 2022, we also wrote commercial residential insurance in South Carolina and Texas, however, effective May 1, 2022, we no longer write in these states. In addition, we write personal residential insurance in New York. During 2022, we wrote personal residential business in six other states; however on February 27, 2023, our former insurance subsidiary, United Property & Casualty Insurance Company (UPC) was placed into receivership with the Florida Department of Financial Services (DFS), which divested our ownership of UPC. The events leading to receivership and results of this subsidiary, now included within discontinued operations, are discussed in Note 4 below.

On August 25, 2022, we announced that our former subsidiary UPC had filed plans for withdrawal in the states of Florida, Louisiana, and Texas and intended to file a plan for withdrawal in the state of New York. All filed plans entail non-renewing personal lines policies in these states. Additionally, we announced that Demotech, Inc. (Demotech), an insurance rating agency, notified UPC of its intent to withdraw UPC's Financial Stability Rating. On December 5, 2022, the Florida Office of Insurance Regulation ("FLOIR") issued Consent Order No. 303643-22- CO that provided for the administrative supervision and approval of the plan of run-off for UPC (the "Consent Order"). The Consent Order provided formal approval of UPC's Plan of Run-Off (the "Plan") to facilitate a solvent wind down of its affairs in an orderly fashion. Additionally, in connection with the Plan, IIC agreed to not pay ordinary dividends without the prior approval of the New York Department of Financial Services until January 1, 2025. On February 10, 2023, we announced that a solvent run-off of UPC was unlikely and on February 27, 2023, UPC was placed into receivership with the Florida Department of Financial Services (the "DFS") which divested our ownership of UPC.

Effective June 1, 2022, we merged our majority-owned insurance subsidiary, Journey Insurance Company (JIC) into ACIC, with ACIC being the surviving entity. JIC was formed in strategic partnership with a subsidiary of Tokio Marine Kiln Group Limited (Kiln) on August 30, 2018 and operated independently from ACIC prior to the merging of the entities. The Kiln subsidiary held a noncontrolling interest in JIC, which was terminated prior to the merger.

Effective June 1, 2022, we entered into a quota share reinsurance agreement with TypTap Insurance Company (Typtap). Under the terms of this agreement, we ceded 100% of our former subsidiary UPC's in-force, new, and renewal policies in the states of Georgia, North Carolina and South Carolina. Effective June 1, 2022, we began the transition of South Carolina policies to Homeowners Choice Property and Casualty Insurance Company, Inc. (HCPCI) in connection with our renewal rights agreement. Effective October 1, 2022, we transitioned Georgia policies to HCPCI in connection with our renewal rights agreement. Effective December 1, 2022, we began the transition of North Carolina policies to HCPCI in connection with our renewal rights agreement. As a result, these policies will no longer be covered under this agreement upon their renewal. This agreement replaces the 85% quota share agreement with HCPCI effective December 31, 2021.

Effective May 31, 2022, we merged Family Security Insurance Company, Inc. (FSIC) into our former subsidiary UPC, with UPC being the surviving entity. FSIC was acquired via merger on February 3, 2015, and operated independently from

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

UPC prior to the merging of the entities. In conjunction with the merger, we dissolved Family Security Holdings (FSH), a holding company subsidiary that consolidated its respective insurance company, FSIC.

Effective June 1, 2021, we entered into a quota share reinsurance agreement with HCPCI and TypTap. Under the terms of this agreement, we ceded 100% of our former subsidiary UPC's in-force, new, and renewal policies in the states of Connecticut, New Jersey, Massachusetts, and Rhode Island. The cession of these policies was 50% to HCPCI and 50% to TypTap. HCPCI is responsible for processing all claims as a part of this agreement. As of April 1, 2022, we completed the transition of all policies in these four states to HCPCI in connection with our renewal rights agreement (Northeast Renewal Agreement) to sell UPC's personal lines homeowners business in these states.

We conduct our operations under two reportable segments, personal residential property and casualty insurance policies (personal lines) and commercial residential property and casualty insurance policies (commercial lines). Our chief operating decision maker is our President, who makes decisions to allocate resources and assesses performance at both segment levels, as well as at the corporate level.

(b)Consolidation and Presentation

We prepare our unaudited condensed consolidated interim financial statements in conformity with U.S. generally accepted accounting principles (GAAP). We have condensed or omitted certain information and footnote disclosures normally included in the annual consolidated financial statements presented in accordance with GAAP. In management's opinion, the accompanying unaudited condensed consolidated financial statements reflect all adjustments, including normal recurring items, considered necessary for a fair presentation of interim periods. We include all of our subsidiaries in our consolidated financial statements, eliminating intercompany balances and transactions during consolidation. As described in Note 2, our former subsidiary, UPC, qualifies as a discontinued operation. Our unaudited condensed consolidated interim financial statements and footnotes should be read in conjunction with our consolidated financial statements and footnotes in our Annual Report on Form 10-K for the year ended December 31, 2022.

While preparing our unaudited condensed consolidated financial statements, we make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements, as well as reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from those estimates. Reported amounts that require us to make extensive use of estimates include our reserves for unpaid losses and loss adjustment expenses, investments and goodwill. Except for the captions on our Unaudited Condensed Consolidated Balance Sheets and Unaudited Condensed Consolidated Statements of Comprehensive Loss, we generally use the term loss(es) to collectively refer to both loss and loss adjustment expenses.

Our results of operations and our cash flows as of the end of the interim periods reported herein do not necessarily indicate our results for the remainder of the year or for any other future period.

(c) Going Concern

Our unaudited condensed consolidated interim financial statements have been prepared in accordance with GAAP assuming the Company will continue as a going concern. As disclosed in our Annual Report on Form 10-K for the year ended December 31, 2022, our subsidiary ACIC is a part of a combined reinsurance program with our former subsidiary, UPC.

To properly allocate the reinsurance recoverables under the shared catastrophe treaties, UPC and ACIC entered into a reinsurance allocation agreement that became effective on June 1, 2022 (the "Allocation Agreement"). The Allocation Agreement was filed with and approved by the FLOIR on December 5, 2022. On February 10, 2023, we announced that a solvent run-off of UPC was unlikely, driven by Hurrican Ian losses which exhausted UPC's reinsurance coverage. On February 27, 2023, UPC was placed into receivership with the DFS which divested our ownership of UPC. As of the date of filing our Annual Report, the DFS had not recognized the Allocation Agreement, leaving uncertainty regarding the timing of both recoveries currently held by UPC that are allocated to ACIC and future recoverables. Management also believed that the ability for ACIC to obtain adequate reinsurance to meet its needs for the June 1, 2023 to May 31, 2024 catastrophe cover could only be accomplished assuming that recoveries due to ACIC pursuant to the Allocation Agreement could be resolved in short order.

However, on April 19, 2023, ACIC entered into a Memorandum of Understanding with the DFS. Under the terms of the Memorandum, ACIC and the DFS as receiver of UPC have reached the following agreement:

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

1.The DFS adopts, ratifies and affirms the Allocation Agreement.

2.All future reinsurance recoverable under reinsurance agreements applicable to the Allocation Agreement for Hurricane Ian losses shall be paid, either directly from the reinsurers or directly from the reinsurance intermediary responsible therefor, to ACIC. If a true up adjustment demonstrates that any future reinsurance recoveries were over-collected by ACIC, ACIC will remit any over-payment to UPC.

While the execution of the MOU does alleviate the uncertainty regarding future recoverables, uncertainty does still exist regarding recoveries currently held by UPC. The Company intends to continue to work towards a fair and equitable solution regarding these held recoveries (See Note 19). In addition, the Company has not finalized its catastrophe cover for June 1, 2023 to May 31, 2024. While continued progress is being made, uncertainty does still exist regarding placement of this cover. As a result, the Company has concluded substantial doubt continues to exist regarding its ability to continue as a going concern.

2) SIGNIFICANT ACCOUNTING POLICIES

(a) Changes to Significant Accounting Policies

During the three months ended March 31, 2023, our former subsidiary, UPC, was placed into receivership with the DFS. As described in Note 1, effective February 27, 2023, this receivership divested our ownership of UPC. This disposal was evaluated for qualification as a discontinued operation. The results of operations of business are reported as discontinued operations when the disposal represents a strategic shift that will have a major effect on the entity's operations and financial results. When a business is identified for discontinued operations reporting:

•Results for prior periods are retroactively reclassified as discontinued operations;

•Results of operations are reported in a single line, net of tax, in the Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss); and

•Assets and liabilities are reported as held for disposal in the Unaudited Condensed Consolidated Balance Sheets

•Premiums directly assumed from UPC by another entity of the consolidated group are now captured as assumed.

Additional details by major classification of operating results and financial position are included in Note 4.

There have been no other changes to our significant accounting policies as reported in our Annual Report on Form 10-K for the year ended December 31, 2022.

(b) Pending Accounting Pronouncements

We have evaluated pending accounting pronouncements and do not believe any would have an impact on the operations or financial reporting of our company.

3) RESTATEMENT OF PREVIOUSLY REPORTED FINANCIAL STATEMENTS

Subsequent to the issuance of the Form 10-Q as of and for the three months ended March 31, 2023, the Company concluded it should restate its previously issued financial statements for both 2023 and 2022 to accurately present discontinued operations, including activities that directly support its former subsidiary, UPC, in accordance with ASC 205-20. The Company had previously excluded these supporting activities, assets, and liabilities, presenting only the results, assets and liabilities of UPC as discontinued operations.

In addition, the Company concluded it should restate its previously issued financial statements to accurately present its tax provision (benefit) related to both continuing and discontinued operations. Previously, the calculation of this provision (benefit) incorrectly included the benefit of the use of certain deferred tax assets held by UPC after the disposition of UPC occurred and incorrectly allocated this provision between continuing and discontinued operations.

In accordance with SEC Staff Accounting Bulletin No. 99, the Company evaluated the errors and has determined that the related impact was material to the previously filed financial statements that contained the error, reported in the Company’s Form 10-Q for the quarterly period ended March 31, 2023. Therefore, the Company concluded that the affected quarterly periods should be restated to present continuing and discontinued operations appropriately and recognize the additional

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

provision for income taxes for the period and allocate appropriately to continuing and discontinued operations. As such, the Company is reporting these restated financial statements in this amended quarterly report. The previously filed Form 10-Q should no longer be relied upon.

The impact of the restatement on the financial statements for the affected quarterly periods are presented below.

Restated Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2023 |

| | As Previously Reported | | Adjustment | | As Restated |

| ASSETS | | | | | | |

| Property and equipment, net | | 18,118 | | | (13,395) | | | 4,723 | |

| Other Assets | | 15,426 | | | 2,050 | | | 17,476 | |

| Assets held for disposal | | — | | | 13,395 | | | 13,395 | |

| Total Assets | | $ | 1,445,386 | | | 2,050 | | | $ | 1,447,436 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| Liabilities: | | | | | | |

| Other liabilities | | 36,242 | | | (6,169) | | | 30,073 | |

| Liabilities held for disposal | | — | | | 1,817 | | | 1,817 | |

| Total Liabilities | | $ | 1,361,898 | | | (4,352) | | | $ | 1,357,546 | |

| Stockholders' Equity: | | | | | | |

| Retained earnings (deficit) | | $ | (286,422) | | | 6,402 | | | $ | (280,020) | |

| Total Stockholders' Equity (Deficit) | | $ | 83,488 | | | 6,402 | | | $ | 89,890 | |

| | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2022 |

| | As Previously Reported | | Adjustment | | As Restated |

| ASSETS | | | | | | |

| Property and equipment, net | | 19,591 | | | (14,298) | | | 5,293 | |

| Deferred policy acquisition costs, net | | 60,979 | | | (8,610) | | | 52,369 | |

| Assets held for disposal | | 1,411,907 | | | 22,908 | | | 1,434,815 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| Liabilities: | | | | | | |

| Accounts payable and accrued expenses | | 75,374 | | | (988) | | | 74,386 | |

| Other liabilities | | 17,466 | | | (11,617) | | | 5,849 | |

| Liabilities held for disposal | | 1,642,212 | | | 12,605 | | | 1,654,817 | |

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

Restated Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| REVENUE: | | As Previously Reported | | Adjustment | | As Restated |

| Management fee income | | 9,668 | | | (9,668) | | | — | |

| Other revenue | | 4,075 | | | (4,059) | | | 16 | |

| Total revenue | | 104,047 | | | (13,727) | | | 90,320 | |

| EXPENSES: | | | | | | |

| Losses and loss adjustment expenses | | 19,073 | | | (2,661) | | | 16,412 | |

| Policy acquisition costs | | 26,927 | | | 45 | | | 26,972 | |

| Operating expenses | | 5,651 | | | (3,483) | | | 2,168 | |

| General and administrative expenses | | 9,837 | | | (1,044) | | | 8,793 | |

| Total expenses | | 61,488 | | | (7,143) | | | 54,345 | |

| Income before other income | | 39,840 | | | (6,584) | | | 33,256 | |

| | | | | | |

| Income before income taxes | | 40,428 | | | (6,584) | | | 33,844 | |

| Provision for income taxes | | 9,855 | | | (6,378) | | | 3,477 | |

| Income from continuing operations, net of tax | | $ | 30,573 | | | $ | (206) | | | $ | 30,367 | |

| Income from discontinued operations, net of tax | | 230,305 | | | 6,608 | | | 236,913 | |

| Net income | | $ | 260,878 | | | $ | 6,402 | | | $ | 267,280 | |

| | | | | | |

| Earnings available to UIHC common stockholders per share | | | | | | |

| Basic | | | | | | |

| Continuing operations | | $ | 0.71 | | | $ | (0.01) | | | $ | 0.70 | |

| Discontinued operations | | 5.34 | | | 0.15 | | | 5.49 | |

| Total | | $ | 6.05 | | | $ | 0.14 | | | $ | 6.19 | |

| Diluted | | | | | | |

| Continuing operations | | $ | 0.70 | | | $ | — | | | $ | 0.70 | |

| Discontinued operations | | 5.29 | | | 0.15 | | | 5.44 | |

| Total | | $ | 5.99 | | | $ | 0.15 | | | $ | 6.14 | |

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2022 |

| REVENUE: | | As Previously Reported | | Adjustment | | As Restated |

| Management fee income | | 50,206 | | | (50,206) | | | — | |

| Other revenue | | 8,738 | | | (8,723) | | | 15 | |

| Total revenue | | 117,361 | | | (58,929) | | | 58,432 | |

| EXPENSES: | | | | | | |

| Losses and loss adjustment expenses | | 32,518 | | | (6,203) | | | 26,315 | |

| Policy acquisition costs | | 52,152 | | | (31,844) | | | 20,308 | |

| Operating expenses | | 10,603 | | | (6,896) | | | 3,707 | |

| General and administrative expenses | | 15,435 | | | (7,371) | | | 8,064 | |

| Total expenses | | 113,067 | | | (52,314) | | | 60,753 | |

| Income (loss) before other income | | 4,294 | | | (6,615) | | | (2,321) | |

| | | | | | |

| Income (loss) before income taxes | | 5,627 | | | (6,615) | | | (988) | |

| Provision (benefit) for income taxes | | 980 | | | (1,695) | | | (715) | |

| Income (loss) from continuing operations, net of tax | | $ | 4,647 | | | $ | (4,920) | | | $ | (273) | |

| Loss from discontinued operations, net of tax | | (37,904) | | | 4,920 | | | (32,984) | |

| Net loss | | $ | (33,257) | | | $ | — | | | $ | (33,257) | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Restated Condensed Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| | As Previously Reported | | Adjustment | | As Restated |

| OPERATING ACTIVITIES | | | | | | |

| Net income (loss) | | $ | 260,878 | | | $ | 6,402 | | | $ | 267,280 | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | |

| Disposition of former subsidiary | | (229,183) | | | (9,257) | | | (238,440) | |

| Changes in operating assets and liabilities: | | | | | | |

| Other liabilities | | (6,416) | | | 2,855 | | | (3,561) | |

Restated Condensed Consolidated Statements of Stockholders’ Equity for the Three Months Ended

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| | As Previously Reported | | Adjustment | | As Restated |

| | | | | | |

| Net Income for the three months ended March 31, 2023 | | $ | 260,878 | | | $ | 6,402 | | | $ | 267,280 | |

| Retained Earnings (Deficit) as of March 31, 2023 | | (286,422) | | | 6,402 | | | (280,020) | |

| Stockholders Equity (Deficit) attributable to UIHC at March 31, 2023 | | 83,488 | | | 6,402 | | | 89,890 | |

| Total Stockholders' Equity (Deficit) | | 83,488 | | | 6,402 | | | 89,890 | |

In connection with these changes, our Notes to Unaudited Condensed Consolidated Financial Statements have also been restated where applicable.

4) DISCONTINUED OPERATIONS

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

On August 25, 2022, we announced that our former subsidiary UPC had filed plans for withdrawal in the states of Florida, Louisiana, and Texas and intended to file a plan for withdrawal in the state of New York. All filed plans entailed non-renewing personal lines policies in these states. Additionally, we announced that Demotech, an insurance rating agency, notified UPC of its intent to withdraw UPC's Financial Stability Rating. On December 5, 2022, the FLOIR issued Consent Order No. 303643-22- CO that provided for the administrative supervision and approval of the plan of run-off for UPC (the "Consent Order"). The Consent Order provided formal approval of UPC's Plan of Run-Off (the "Plan") to facilitate a solvent wind down of its affairs in an orderly fashion. On February 10, 2023, we announced that a solvent run-off of UPC was unlikely, driven by Hurricane Ian losses which exhausted UPC's reinsurance coverage. On February 27, 2023, UPC was placed into receivership with the DFS which divested our ownership of UPC.

In the first quarter of 2023, the assets and liabilities of UPC were divested. In addition, activities provided by our entities, SCS, SLS and UIM, related directly to supporting the business conducted by UPC have been included. The assets and liabilities for the balance sheet as of December 31, 2022 are reclassified as held for disposal retrospectively, and the results of UPC and activities related directly to supporting the business conducted by UPC are presented as discontinued operations for all periods presented.

The results from discontinued operations for the three months ended March 31, 2023 and 2022 are presented below.

| | | | | | | | | | | | | | |

| Results From Discontinued Operations | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 |

| REVENUE: | | | | |

| Gross premiums written | | $ | (120,608) | | | $ | 146,828 | |

| Change in gross unearned premiums | | 198,154 | | | 59,726 | |

| Gross premiums earned | | 77,546 | | | 206,554 | |

| Ceded premiums earned | | (48,203) | | | (163,443) | |

| Net premiums earned | | 29,343 | | | 43,111 | |

| Net investment income | | 2,182 | | | 1,075 | |

| Net realized investment gains (losses) | | 1,343 | | | (1,806) | |

| Net unrealized gains (losses) on equity securities | | 2,080 | | | (1,498) | |

| Other revenue | | 2,717 | | | 3,063 | |

| Total revenue | | 37,665 | | | 43,945 | |

| EXPENSES: | | | | |

| Losses and loss adjustment expenses | | 35,226 | | | 65,064 | |

| Policy acquisition costs | | (1,352) | | | 5,708 | |

| Operating expenses | | 3,996 | | | 8,541 | |

| General and administrative expenses | | 1,284 | | | 7,941 | |

| Interest expense | | 22 | | | 20 | |

| Total expenses | | 39,176 | | | 87,274 | |

| Loss before other income | | (1,511) | | | (43,329) | |

| Other income (loss) | | — | | | 9 | |

| Loss before income taxes | | (1,511) | | | (43,320) | |

| Provision (benefit) for income taxes | | 16 | | | (10,336) | |

| Income (loss) from discontinued operations, net of tax | | $ | (1,527) | | | $ | (32,984) | |

As of February 28, 2023, the Company completed the disposal of its former subsidiary, UPC. This divestiture resulted in a gain of $238,440,000 for the period. This gain was driven by the negative equity position of UPC.

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

The major classes of assets and liabilities transferred as a result of the transaction as of the date of transfer and December 31, 2022 are presented below.

| | | | | | | | | | | | | | |

| Major Classes of Assets and Liabilities Disposed | | | | |

| | Closing (1) | | December 31, 2022 |

| ASSETS | | | | |

| Fixed maturities, available-for-sale | | 1,380 | | | 171,781 | |

| Equity securities | | 272 | | | 23,363 | |

| Other investments | | 12,882 | | | 12,952 | |

| Cash and cash equivalents | | 224,824 | | | 158,990 | |

| Restricted cash | | 7,758 | | | 7,730 | |

| Accrued investment income | | 875 | | | 1,457 | |

| Premiums receivable, net | | 22,733 | | | 46,736 | |

| Reinsurance recoverable on paid and unpaid losses, net | | 548,929 | | | 834,863 | |

| Ceded unearned premiums | | 75,262 | | | 122,533 | |

| Deferred policy acquisition costs, net | | (89) | | | (2,046) | |

| Other assets | | 51,625 | | | 33,548 | |

| Total assets | | $ | 946,451 | | | $ | 1,411,907 | |

| | | | |

| LIABILITIES | | | | |

| Unpaid losses and loss adjustment expenses | | 920,431 | | | 1,103,980 | |

| Unearned premiums | | 98,655 | | | 286,842 | |

| Reinsurance payable on premiums | | 12,612 | | | 29,394 | |

| Payments outstanding | | 144,238 | | | 213,058 | |

| Accounts payable and accrued expenses | | 1,361 | | | (872) | |

| Other liabilities | | 3,476 | | | 14,658 | |

| Notes payable, net | | 4,118 | | | 4,118 | |

| Total Liabilities | | $ | 1,184,891 | | | $ | 1,651,178 | |

(1) The Company divested its ownership on February 27, 2023, the date the DFS was appointed as receiver of the entity.

In addition, the major classes of assets and liabilities remaining related to activities directly supporting the business conducted by UPC are outlined in the table below as of March 31, 2023 and December 31, 2022.

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

| | | | | | | | | | | | | | |

| Major Classes of Assets and Liabilities Held for Disposal | | | | |

| | March 31, 2023 | | December 31, 2022 |

| ASSETS | | | | |

| Property and equipment, net | | 13,395 | | | 14,299 | |

| Deferred policy acquisition costs | | — | | | 8,609 | |

| Total assets | | $ | 13,395 | | | $ | 22,908 | |

| | | | |

| LIABILITIES | | | | |

| Commissions Payable | | 1,817 | | | 987 | |

| Unearned Policy Fees | | — | | | 2,652 | |

| Total Liabilities | | $ | 1,817 | | | $ | 3,639 | |

The discontinued operations of the Company incurred $252,000 and $438,000 of amortization expense during the three months ended March 31, 2023 and 2022, respectively. There were no other noncash transactions for either period.

5) SEGMENT REPORTING

Personal Lines Business

Our personal lines business provides structure, content and liability coverage for standard single-family homeowners, renters and condominium unit owners, through our subsidiary IIC. Personal residential products are offered in New York. We include coverage to policyholders for loss or damage to dwellings, detached structures or equipment caused by covered causes of loss such as fire, wind, hail, water, theft and vandalism.

We have developed a unique and proprietary homeowners’ product. This product uses a granular approach to pricing for catastrophe perils. We have focused on using independent agencies as a channel of distribution for our personal lines business. All of our personal lines business is managed internally.

Commercial Lines Business

Our commercial lines business primarily provides commercial multi-peril property insurance for residential condominium associations and apartments in Florida, through our subsidiary ACIC. We include coverage to policyholders for loss or damage to buildings, inventory or equipment caused by covered causes of loss such as fire, wind, hail, water, theft and vandalism. We also wrote commercial residential coverage through our subsidiary JIC, in South Carolina and Texas. Effective June 1, 2022 JIC was merged into ACIC, with ACIC being the surviving entity. As a result, the commercial residential policies originally written by JIC were not renewed effective May 31, 2022.

All of our commercial lines business is administered by an outside managing general underwriter, AmRisc, LLC (AmRisc). This includes handling the underwriting, claims processing and premium collection related to our commercial business. In return, AmRisc is reimbursed through monthly management fees. International Catastrophe Insurance Managers (ICAT) handled the underwriting and premium collection for JIC’s commercial business written in South Carolina and Texas and was also reimbursed through monthly management fees. Effective May 31, 2022, the Company terminated its agreement with ICAT.

Please note the following similarities pertaining to the accounting and transactions of our operating segments for the three months ended March 31, 2023 and 2022:

•Both operating segments follow the accounting policies as reported in our Annual Report on Form 10-K for the year ended December 31, 2022;

•Neither operating segment experienced significant noncash transactions outside of depreciation and amortization for the three months ended March 31, 2023 and 2022.

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

The tables below present the information for each of the reportable segment's profit or loss, as well as segment assets for the three months ended March 31, 2023 and 2022. We have restated our segments to reflect the divestiture of UPC during the first quarter of 2023, excluding the result of the entity for all periods presented.

UNITED INSURANCE HOLDINGS CORP.

Notes to Restated Unaudited Condensed Consolidated Financial Statements

March 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| | Commercial | | Personal (1) | | Adjustments | | Consolidated |

| REVENUE: | | | | | | | | |

| Gross premiums written | | $ | 176,641 | | | $ | 10,482 | | | $ | — | | | $ | 187,123 | |

| Change in gross unearned premiums | | (44,607) | | | 1,960 | | | — | | | (42,647) | |

| Gross premiums earned | | 132,034 | | | 12,442 | | | — | | | 144,476 | |

| Ceded premiums earned | | (53,374) | | | (3,778) | | | — | | | (57,152) | |

| Net premiums earned | | 78,660 | | | 8,664 | | | — | | | 87,324 | |

| Net investment income | | 1,786 | | | 782 | | | 21 | | | 2,589 | |

| Net realized gains (losses) | | (83) | | | — | | | — | | | (83) | |

| Net unrealized losses on equity securities | | 473 | | | — | | | 1 | | | 474 | |

| | | | | | | | |

| Other revenue | | — | | | 16 | | | — | | | 16 | |

| Total revenues | | 80,836 | | | 9,462 | | | 22 | | | 90,320 | |

| EXPENSES: | | | | | | | | |

| Losses and loss adjustment expenses | | 13,901 | | | 2,511 | | | — | | | 16,412 | |

| Policy acquisition costs | | 25,166 | | | 1,806 | | | — | | | 26,972 | |

| Operating expenses | | 96 | | | 1,948 | | | 124 | | | 2,168 | |

General and administrative expenses (2) | | 2,754 | | | 5,907 | | | 132 | | | 8,793 | |

| Interest expense | | — | | | — | | | 2,719 | | | 2,719 | |

| Total expenses | | 41,917 | | | 12,172 | | | 2,975 | | | 57,064 | |

| Income (loss) before other income | | 38,919 | | | (2,710) | | | (2,953) | | | 33,256 | |

| Other income (loss) | | — | | | 803 | | | (215) | | | 588 | |

| Income (loss) before income taxes | | $ | 38,919 | | | $ | (1,907) | | | (3,168) | | | 33,844 | |

| Provision for income taxes | | | | | | 3,477 | | | 3,477 | |

| Net income (loss) | | | | | | $ | (6,645) | | | $ | 30,367 | |