December 31, 2023DEF 14Afalse000140089100014008912023-01-012023-12-31iso4217:USD00014008912022-01-012022-12-3100014008912021-01-012021-12-3100014008912020-01-012020-12-310001400891ecd:PeoMemberihrt:DeductionForStockAndOptionAwardsMember2023-01-012023-12-310001400891ecd:NonPeoNeoMemberihrt:DeductionForStockAndOptionAwardsMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndMemberecd:PeoMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndMemberecd:NonPeoNeoMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYMemberecd:PeoMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYMemberecd:NonPeoNeoMember2023-01-012023-12-310001400891ecd:PeoMemberihrt:FairValueOfAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndMember2023-01-012023-12-310001400891ecd:NonPeoNeoMemberihrt:FairValueOfAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndMember2023-01-012023-12-310001400891ecd:PeoMemberihrt:FairValueOfAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYMember2023-01-012023-12-310001400891ecd:NonPeoNeoMemberihrt:FairValueOfAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringPriorFYThatWereForfeitedDuringApplicableFYMemberecd:PeoMember2023-01-012023-12-310001400891ihrt:FairValueOfAwardsGrantedDuringPriorFYThatWereForfeitedDuringApplicableFYMemberecd:NonPeoNeoMember2023-01-012023-12-310001400891ecd:PeoMemberihrt:DividendsOrOtherEarningsPaidDuringApplicableFYMember2023-01-012023-12-310001400891ecd:NonPeoNeoMemberihrt:DividendsOrOtherEarningsPaidDuringApplicableFYMember2023-01-012023-12-310001400891ihrt:IncrementalFairValueOfOptionsSARsModifiedMemberecd:PeoMember2023-01-012023-12-310001400891ihrt:IncrementalFairValueOfOptionsSARsModifiedMemberecd:NonPeoNeoMember2023-01-012023-12-310001400891ihrt:ChangeInPensionActuarialPresentValuesMemberecd:PeoMember2023-01-012023-12-310001400891ecd:NonPeoNeoMemberihrt:ChangeInPensionActuarialPresentValuesMember2023-01-012023-12-310001400891ihrt:PensionServiceCostPriorServiceCostMemberecd:PeoMember2023-01-012023-12-310001400891ihrt:PensionServiceCostPriorServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | | Definitive Proxy Statement |

| | |

| ☐ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material under §240.14a-12 |

IHEARTMEDIA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

MESSAGE TO OUR STOCKHOLDERS

April 25, 2024

Dear Fellow Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of iHeartMedia, Inc. (the “Company”) to be held on Wednesday, June 5, 2024, at 10:00 a.m. Eastern Time. Our Annual Meeting will be a completely virtual meeting of stockholders that will be conducted via live webcast. You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/IHRT2024. Utilizing the latest technology and a virtual meeting format will allow stockholders to participate from any location and we expect will enable increased attendance, improved communications and cost savings for our stockholders and the Company compared to an in person meeting. If you would like to submit questions in advance of the Annual Meeting, please visit proxyvote.com before 11:59 P.M. Eastern Time on June 4, 2024 and enter your 16-digit control number.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Details regarding how to attend the meeting and the business to be conducted at the Annual Meeting are more fully described in the Notice of Annual Meeting and Proxy Statement.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card.

We appreciate your interest in and support of iHeartMedia and look forward to your participation at the Annual Meeting.

Sincerely,

Robert W. Pittman

Chairman and Chief Executive Officer

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 5, 2024

Dear Fellow Stockholder:

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of iHeartMedia, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, June 5, 2024, at 10:00 a.m. Eastern Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/IHRT2024 and entering your 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card. The Annual Meeting will be held for the following purposes:

| | | | | |

| Proposals | |

| 1 | The election of the eight director nominees named in our proxy statement, each for a one-year term ending at the 2025 Annual Meeting of Stockholders |

| 2 | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 |

| 3 | The approval, on an advisory (non-binding) basis, of the compensation of our named executive officers |

| 4 | The approval of an amendment to our Fifth Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware |

While all of the Company’s stockholders are invited to attend the virtual Annual Meeting, only holders of record of our outstanding shares of Class A common stock and Class B common stock at the close of business on April 12, 2024, are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of these stockholders will be available for examination by any stockholder during the ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to InvestorRelations@iHeartMedia.com, stating the purpose of the request and providing proof of ownership of Company stock. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting. The holders of our Class B common stock are only entitled to vote on Proposal 4 at the Annual Meeting and the holders of our Special Warrants are not entitled to notice of or to vote on any matter before the Annual Meeting.

| | |

Important Information for Holders of Class A Common Stock and Class B Common Stock It is important that your shares be represented regardless of the number of shares you may hold as of the record date. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope, which is addressed for your convenience and needs no postage if mailed in the United States. We encourage stockholders to submit their proxy by mail or via telephone or over the Internet. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option. The Company asks your cooperation in promptly submitting your proxy. YOUR VOTE IS IMPORTANT |

If you would like to attend the virtual Annual Meeting, please refer to the logistical information in the section titled “Questions and Answers About the 2024 Annual Meeting of Stockholders.”

By Order of the Board of Directors,

Jordan R. Fasbender

Executive Vice President, General Counsel

and Secretary

April 25, 2024

TABLE OF CONTENTS

Forward-Looking Statements

Certain statements herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of iHeartMedia, Inc. and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The words or phrases “guidance,” “believe,” “expect,” “anticipate,” “estimates,” “forecast” and similar words or expressions are intended to identify such forward-looking statements. In addition, any statements that refer to expectations or other characterizations of future events or circumstances, such as statements about capital and operating expense reduction initiatives, future financial results, and our business plans, strategies and initiatives, including our environmental, social and governance ("ESG") initiatives, are forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other important factors, some of which are beyond our control and are difficult to predict. Various risks that could cause future results to differ from those expressed by the forward-looking statements included herein include, but are not limited to: risks related to weak or uncertain global economic conditions and our dependence on advertising revenues; competition, including increased competition from alternative media platforms and technologies; dependence upon the performance of on-air talent, program hosts and management; fluctuations in operating costs; technological and industry changes and innovations; shifts in population and other demographics; risks related to our use of artificial intelligence; impact of acquisitions, dispositions and/or other strategic transactions; risks related to our indebtedness; legislative or regulatory requirements; impact of legislation, ongoing litigation or royalty audits on music licensing and royalties; regulations and concerns regarding privacy and data protection and breaches of information security measures; risks related to scrutiny of environmental, social and governance matters; risks related to our Class A common stock; and regulations impacting our business and the ownership of our securities. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results, performance or achievements. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed herein may not occur. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date hereof. Additional risks that could cause future results to differ from those expressed by any forward-looking statement are described in the Company’s reports filed with the U.S. Securities and Exchange Commission, including in the section entitled “Item 1A. Risk Factors” of iHeartMedia, Inc.’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Certain statements contained in this proxy statement, particularly pertaining to our ESG performance, goals, and initiatives, are subject to additional risks and uncertainties, including regarding gathering and verification of information and related methodological considerations; our ability to implement various initiatives under expected timeframes, cost, and complexity; our dependency on third-parties to provide certain information and to comply with applicable laws and policies; and other unforeseen events or conditions. These factors, as well as others, may cause results to differ materially and adversely from those expressed in any of our forward-looking statements. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. Additionally, our discussion of certain environmental, social and governance ("ESG") assessments, goals and related issues in this or other disclosures, including on our corporate website, includes information that is not necessarily material for SEC reporting purposes but that is informed by various ESG standards and frameworks (including standards for the measurement of underlying data), internal controls, and assumptions or third-party information, and stakeholder expectations that are still evolving and subject to change. For example, greenhouse gas monitoring and accounting methodologies continue to evolve, and our reporting on such information may evolve over time as well. Moreover, our disclosures based on any standards may change due to revisions in framework requirements, availability of information, changes in our business or applicable government policies, or other factors, some of which may be beyond our control.

iHeartMedia, Inc.

20880 Stone Oak Parkway

San Antonio, TX 78258

EXECUTIVE SUMMARY

2024 Annual Meeting Information

| | | | | | | | | | | |

| | | |

Date and Time: Wednesday, June 5, 2024 10:00 a.m. Eastern Time | Location: www.virtualshareholdermeeting.

com/IHRT2024 | Record Date: April 12, 2024 | Proxy Mail Date: On or about April 25, 2024 |

How to Vote

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

By Internet: Visit the website listed on your Internet Notice or proxy card | | By Phone: Call the telephone number on your proxy card | | By Mail: If you received paper copies, sign, date and return your proxy card in the provided envelope | | During the Annual Meeting: Participate in the Annual Meeting webcast using your 16-digit control number |

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of iHeartMedia, Inc. (the “Company,” “iHeartMedia,” “iHeart,” “we” or “us”) of proxies to be voted at our Annual Meeting of Stockholders to be held on Wednesday, June 5, 2024 (the “Annual Meeting”), at 10:00 a.m. Eastern Time, and at any continuation, postponement or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/IHRT2024 and entering your 16-digit control number included on your proxy card. If you would like to submit questions in advance of the Annual Meeting, please visit proxyvote.com before 11:59 p.m. Eastern Time on June 4, 2024 and enter your 16-digit control number.

Only holders of record of outstanding shares of our Class A common stock (our “Class A stockholders”) and our Class B common stock (our "Class B stockholders") at the close of business on April 12, 2024 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment of the Annual Meeting. Each share of our Class A common stock entitles its holder to one vote per share on all matters presented to our stockholders. At the close of business on the Record Date, there were 123,416,668 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting. Each share of our Class B common stock entitles its holder to one vote per share on Proposal 4 only. Class B stockholders are not otherwise entitled to vote at the Annual Meeting. The holders of certain warrants to purchase shares of our Class A common stock or Class B common stock (the “Special Warrants”) issued in connection with our emergence from bankruptcy (“Emergence”) are not entitled to vote on any matter before the Annual Meeting. We refer to our Class A common stock and our Class B common stock together as our “common stock”.

This proxy statement and the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2023 (the “2023 Annual Report”) will be sent on or about April 25, 2024 to holders of our common stock (as of the Record Date).

This section summarizes and highlights certain information contained in this proxy statement, but does not contain all the information that you should consider when casting your vote. Please review the entire proxy statement as well as our 2023 Annual Report to Stockholders carefully before voting. Frequently asked questions and logistical information regarding the Annual Meeting is available in the section titled “Questions and Answers About the 2024 Annual Meeting of Stockholders” beginning on page 69. Important Notice Regarding the Availability of Proxy Materials for the Annual

Meeting of Stockholders To Be Held on June 5, 2024:

THIS PROXY STATEMENT AND OUR 2023 ANNUAL REPORT ARE AVAILABLE FOR VIEWING, PRINTING AND DOWNLOADING AT www.proxyvote.com.

Meeting Agenda Items

| | | | | | | | | | | |

| Proposal | Page

Number | Voting Standard | Board Vote

Recommendation |

Proposal No. 1: Election of the eight nominees named in the proxy statement as directors, each for a one-year term ending at the 2025 Annual Meeting of Stockholders | | Plurality of votes cast (only Class A common stock eligible to vote) | FOR each director nominee |

Proposal No. 2: To ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024 | | Majority of votes cast (only Class A common stock eligible to vote) | FOR |

| Proposal No. 3: To approve, on an advisory (non-binding) basis, the compensation of our named executive officers | | Majority of votes cast (only Class A common stock eligible to vote) | FOR |

| Proposal No. 4: To approve an amendment to our Fifth Amended and Restated Certificate of Incorporation to provide for exculpation of officers from breaches of fiduciary duty to the extent permitted by the General Corporation Law of the State of Delaware (the "DGCL") | | 1) Majority of all outstanding shares of Class A common stock

2) Majority of all outstanding shares of Class A common stock and Class B common stock, voting together as a single class

| FOR |

Director Nominees and Continuing Directors

| | | | | | | | | | | | | | | | | |

| | | Committee Memberships |

| Director | Director Since | Independent | A | C | N&CG |

| Director Nominees | | | | | |

Robert W. Pittman (Chairman and CEO) | 2011 | | | | |

James A. Rasulo (Lead Independent Director) | 2019 | ✓ | ✓ | Chair | ✓ |

| Richard J. Bressler | 2008 | | | | |

| Samuel E. Englebardt | 2022 | ✓ | ✓ | ✓ | |

| Brad Gerstner | 2019 | ✓ | Chair | | |

| Cheryl Mills | 2020 | ✓ | | ✓ | Chair |

| Graciela Monteagudo | 2021 | ✓ | ✓ | | |

| Kamakshi Sivaramakrishnan | 2019 | ✓ | | ✓ | ✓ |

A = Audit Committee

C = Compensation Committee

N&CG = Nominating and Corporate Governance Committee

Fiscal 2023 Overview

The Company took many important steps throughout the 2023 fiscal year. We continued to significantly advance the transformation of iHeart into a true multiplatform audio company, driven by innovation and supported by data and technology, while also continuing our critical mission of providing vital support and connection to the communities we serve.

| | | | | | | | |

#1 Audio media company in the United States based on consumer reach | 5x the digital listening hours of the next largest commercial broadcast radio company, as measured by Triton | over 330M social media fans & followers as measured by ListenFirst |

#1 Podcast publisher in the United States as measured by Podtrac | $3,751M in revenues for 2023 | 2X reach of the largest

TV Network and 4X

reach of the largest ad-

enabled streaming

audio player |

Most #1 ranked

station groups

across top 160 markets

and largest 50 markets | 14% Increase in podcast revenues in 2023 | iHeart has the only

total audio media

ecosystem for all

forms of audio |

2023 Business Performance & Highlights

Although the advertising marketplace ended up being more uncertain than we originally anticipated, we continued to innovate and find new ways to engage with our consumers and advertising partners; we remained committed to evolving our business; and we maintained our focus on cost efficiencies and disciplined capital management.

● Consolidated revenue decreased 4% to $3.8 billion, from $3.9 billion in the prior year.

● Digital Audio Group revenue increased 5% as compared to the prior year, including a 14% increase in Podcast Revenue.

● Multiplatform Group revenue decreased 6% as compared to the prior year.

● Consolidated operating loss was $797 million compared to operating income of $57 million in the prior year.

● Consolidated net loss was $1.1 billion compared to a net loss of $263 million in the prior year.

● Consolidated Adjusted EBITDA1 decreased 27% to $697 million, from $950 million in the prior year.

● Cash flows from operating activities decreased 49% to $213 million, from $420 million in the prior year.

● Adjusted Free Cash Flow1 decreased 59% to $118 million, from $291 million in the prior year.

● Cash balance and total available liquidity2 of $346 million and $772 million, respectively, as of December 31, 2023.

● Continued deleveraging, with voluntary debt repurchases of $147 million in cash, reducing the principal balance of our highest-interest debt balance by $204 million.

2023 Operational Highlights

The Company continued to execute on its transformation into a true multiplatform audio company with an industry leading position in content and distribution across broadcast radio, streaming digital radio and podcasts and a best-in-class total audio advertising technology and data solution for all forms of audio — on-demand, broadcast radio, digital streaming radio, and podcasting. The Company made important progress on its strategic goals, including as follows:

•iHeartMedia is the number one audio media company in the United States based on the consumer reach of its broadcast assets alone.

1 See "Supplemental Disclosure Regarding Non-GAAP Financial Information" in Annex A.

2 Total available liquidity is defined as cash and cash equivalents of $346 million plus available borrowings under our ABL Facility of $426 million. We use total available liquidity to evaluate our capacity to access cash to meet obligations and fund operations.

•According to Nielsen, for the 18-49 demographic, iHeart is ranked #1 in 26 of Nielsen’s Top 50 metros, and #1 in 70 of the top 160 metros—that’s more #1 markets than the next two largest radio companies combined.

•Our iHeartRadio digital platform is the number one streaming broadcast radio platform—with five times the digital listening hours of the next largest commercial broadcast radio company, as measured by Triton.

•We are the number one podcast publisher in the United States, according to Podtrac, and have the most shows featured in the Top 10 and across 19 categories.

•We are the only company with a total audio advertising technology and data solution, providing both supply-side and demand-side services for all forms of audio — on-demand, broadcast radio, digital streaming radio, and podcasting.

•Our personalities, stations and brands have a social footprint that includes over 330 million fans and followers, as measured by ListenFirst, which is thirteen times the size of the next largest commercial broadcast audio media company. This social footprint was at the heart of delivering 51 billion social media impressions for our 2023 iHeartRadio Music Festival.

•We held seven nationally recognized tentpole events with some of the biggest names in music, as well as our thousands of local events, all of which provide significant opportunities for consumer promotion, advertising and social amplification.

•iHeartLand, our state of the art, always-on entertainment space for music, live events and gaming in the metaverse, saw over 1 million plays during a recent performance by Ed Sheeran.

•We launched the Outspoken Podcast Network designed to elevate the impactful culture of the LGBTQ+ community.

•We continued to strengthen our social responsibility and human capital commitment by implementing and planning a number of new initiatives. (See Corporate Social Responsibility and Human Capital for additional detail).

•We continued to modernize the Company, utilizing new technologies, including AI, to make our operations more efficient resulting in structural expense savings of over $90 million.

Corporate Governance Highlights

iHeartMedia is committed to good governance practices that protect and promote the long-term value of the Company for its stockholders. The Board regularly reviews our governance practices to ensure they reflect the evolving governance landscape and appropriately support and serve the best interests of the Company and its stockholders. The following chart provides an overview of our corporate governance practices:

| | | | | |

Independent Oversight |  All of our current non-employee directors (6 of 8 directors) are independent All of our current non-employee directors (6 of 8 directors) are independent Strong lead independent director with substantive responsibilities and significant authority including over meeting schedules, agendas and information sent to the Board Strong lead independent director with substantive responsibilities and significant authority including over meeting schedules, agendas and information sent to the Board Regular executive sessions of non-employee directors at Board meetings (chaired by lead independent director) and committee meetings (chaired by independent committee chairs) Regular executive sessions of non-employee directors at Board meetings (chaired by lead independent director) and committee meetings (chaired by independent committee chairs) 100% independent Board committees 100% independent Board committees Active Board and committee oversight of the Company’s strategy and risk management Active Board and committee oversight of the Company’s strategy and risk management Committed to regular Board refreshment, with one new director added and one director departed in 2022 Committed to regular Board refreshment, with one new director added and one director departed in 2022

|

Board Effectiveness |  Directors possess deep and diverse set of skills and expertise relevant to oversight of our business operations and strategy Directors possess deep and diverse set of skills and expertise relevant to oversight of our business operations and strategy  Annual assessment of director skills and commitment to Board diversity to ensure Board meets the Company’s evolving needs Annual assessment of director skills and commitment to Board diversity to ensure Board meets the Company’s evolving needs  Highly engaged Board with all current directors having attended over 75% of all meetings of the Board and committees on which they served in 2023 Highly engaged Board with all current directors having attended over 75% of all meetings of the Board and committees on which they served in 2023  Annual Board and committee self-evaluations overseen by the Nominating and Corporate Governance Committee Annual Board and committee self-evaluations overseen by the Nominating and Corporate Governance Committee  Ongoing director education Ongoing director education |

Stockholder Rights |  Annual director elections Annual director elections No supermajority voting requirement to amend bylaws or charter No supermajority voting requirement to amend bylaws or charter  Directors can be removed without cause Directors can be removed without cause No poison pill No poison pill |

Good Governance Practices |  Development and periodic review of succession plans for members of senior management Development and periodic review of succession plans for members of senior management Code of Business Conduct + Ethics ("Code of Conduct") applicable to directors and all employees, which reinforces our core values and helps drive our workplace culture of compliance with ethical standards, integrity and accountability Code of Business Conduct + Ethics ("Code of Conduct") applicable to directors and all employees, which reinforces our core values and helps drive our workplace culture of compliance with ethical standards, integrity and accountability We prohibit all directors and executive officers from hedging our securities; directors and executive officers are also prohibited from pledging our securities, unless such pledge is specifically pre-approved by the Company’s General Counsel We prohibit all directors and executive officers from hedging our securities; directors and executive officers are also prohibited from pledging our securities, unless such pledge is specifically pre-approved by the Company’s General Counsel  Stock ownership guidelines for directors and executive officers and clawback policy for recovery of erroneously awarded incentive compensation from executive officers Stock ownership guidelines for directors and executive officers and clawback policy for recovery of erroneously awarded incentive compensation from executive officers Responsible corporate citizenship and environmental initiatives Responsible corporate citizenship and environmental initiatives Annual review of Governance Guidelines and committee charters Annual review of Governance Guidelines and committee charters |

PROPOSAL ONE—ELECTION OF DIRECTORS

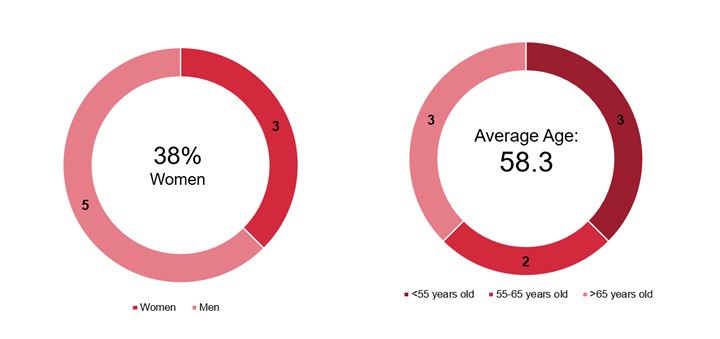

The current term of office of the Company’s eight directors expires at the Annual Meeting. The Board proposes that the following eight directors be elected for a term of one year and until their successors are duly elected and qualified: Robert W. Pittman, James A. Rasulo, Richard J. Bressler, Samuel E. Englebardt, Brad Gerstner, Cheryl Mills, Graciela Monteagudo and Kamakshi Sivaramakrishnan. The Board and the Nominating and Corporate Governance Committee believe that the eight director nominees encompass a range of talents, skills and expertise sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests. The directors reflect the diversity of the Company’s stockholders, employees, listeners and communities.

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of April 25, 2024) |

| Total Number of Directors | 8 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 3 | 5 | 0 | 0 |

| Part II: Demographic Background |

| African American or Black | 1 | 0 | 0 | 0 |

| | | | |

| Asian | 1 | 0 | 0 | 0 |

| Hispanic or Latinx | 1 | 0 | 0 | 0 |

| | | | |

| White | 0 | 5 | 0 | 0 |

| |

| |

Board Recommendation

| | | | | | | | |

| | Our Board unanimously recommends that you vote “FOR” the election of each of the persons nominated by the Board. |

If you return a duly executed proxy card without specifying how your shares are to be voted, the persons named in the proxy card will vote to elect Robert W. Pittman, James A. Rasulo, Richard J. Bressler, Samuel E. Englebardt, Brad Gerstner, Cheryl Mills, Graciela Monteagudo and Kamakshi Sivaramakrishnan as directors. Each nominee currently serves on our Board, has consented to being named in this proxy statement and has indicated their willingness to continue to serve if elected. However, if any such director nominee should be unable to serve, or for good cause will not serve, the shares of Class A common stock represented by proxies may be voted for a substitute nominee designated by our Board, or our Board may reduce its size. Our Board has no reason to believe that any of the nominees will be unable to serve if elected.

Our Board of Directors

Director Biographies

| | | | | | | | |

Director Since: 2011 Age: 70 Committee Memberships: • None | | ROBERT W. PITTMAN Mr. Pittman was appointed our Chairman on May 17, 2013. Prior to adding the Chairmanship, he became the Chief Executive Officer of the Company in October 2011. Mr. Pittman was also the Executive Chairman of Clear Channel Outdoor Holdings, Inc. (“CCOH”) from January 2012 to March 2015 and Chairman and Chief Executive Officer of CCOH from March 2015 to May 2019. Mr. Pittman served as a director of CCOH from October 2011 to May 2019. From November 2010 to October 2011, Mr. Pittman served as Chairman of Media and Entertainment Platforms for the Company and iHeartCommunications. He was the founding member and investor in the Pilot Group LP (“Pilot Group”), a private equity investment firm, from April 2003 until the winding up of that entity in September 2022. Mr. Pittman was formerly Chief Operating Officer of AOL Time Warner, Inc. from May 2002 to July 2002. He also served as Co-Chief Operating Officer of AOL Time Warner, Inc. from January 2001 to May 2002, and earlier, as President and Chief Operating Officer of America Online, Inc. from February 1998 to January 2001 and President and CEO of AOL Networks from October 1996 to February 1998. Earlier in his career, he was the programmer who led the team that created MTV and was later CEO of MTV Networks, Inc. and CEO of Six Flags Theme Parks, Inc., Time Warner Enterprises, Inc. and Century 21 Real Estate Corporation. Mr. Pittman was selected to serve as a member of our Board because of his service as our Chief Executive Officer, and we believe his extensive media experience gained through the course of his career is valuable to the Board.

|

| | |

Director Since: 2019 Age: 68 Committee Memberships: • Audit Committee • Compensation Committee (CHAIR) • Nominating and Corporate Governance Committee | | JAMES A. RASULO Mr. Rasulo was formerly an executive at Walt Disney Company ("Walt Disney") from 1986 through 2015, having spent his last five years at Disney as the Chief Financial Officer and Senior Executive Vice President. During his tenure at Walt Disney, among other roles, he served as the Chairman of Walt Disney Parks & Resorts. Mr. Rasulo served on the board of Saban Capital Acquisition Corporation from September 2016 to April 2019, where he sat on the Audit Committee and the Compensation Committee. Mr. Rasulo also serves on the board of the Los Angeles Philharmonic Association. Mr. Rasulo is a graduate of Columbia University and received his M.A. and M.B.A. from the University of Chicago. Mr. Rasulo’s proven business acumen and extensive experience serving in executive management roles at a large publicly traded company brings tremendous value to the Board. |

| | |

Director Since: 2007 Age: 66 Committee Memberships: • None | | RICHARD J. BRESSLER Mr. Bressler was appointed as our President and Chief Financial Officer in July 2013 and as our Chief Operating Officer in February 2015. Mr. Bressler also served as the Chief Financial Officer of CCOH from July 2013 to May 2019. Prior thereto, Mr. Bressler was a Managing Director at the private equity investment company, Thomas H. Lee Partners, L.P. (“THL”). Prior to joining THL, Mr. Bressler was the Senior Executive Vice President and Chief Financial Officer of Viacom, Inc. ("Viacom") from 2001 through 2005. He also served as Chairman and Chief Executive Officer of Time Warner Digital Media and, from 1995 to 1999, was Executive Vice President and Chief Financial Officer of Time Warner Inc. ("Time Warner"). Prior to joining Time Inc. (which became Time Warner in 1990) in 1988, Mr. Bressler was a partner with the accounting firm of EY since 1979. Mr. Bressler has been one of our directors since July 2008. Mr. Bressler also currently is a director of Gartner, Inc., a research and consulting services company, where he sits on the Audit Committee and the Mount Sinai Medical Center Foundation, a non-profit hospital. Mr. Bressler previously served as a member of the boards of directors of Nielsen Holdings B.V. and Warner Music Group Corp. and as a member of the J.P. Morgan Chase National Advisory Board. Mr. Bressler holds a B.B.A. in Accounting from Adelphi University. Mr. Bressler’s experience in and knowledge of the industry gained through his various positions with Viacom and Time Warner as well as his knowledge of finance and accounting gained from his experience at THL, Gartner and EY are all important contributions to the Board. |

| | |

Director Since: 2022 Age: 46 Committee Memberships: • Audit Committee • Compensation Committee | | SAMUEL E. ENGLEBARDT Samuel Englebardt has served as a Co-founder and Partner at Galaxy Digital, a technology-driven financial services and investment management firm, since 2018 and the Founding General Partner of Galaxy Interactive, a venture capital franchise focused on companies operating at the intersection of content, finance and technology, since 2018. From 2017 to 2018, Mr. Englebardt was Partner and Managing Director at Galaxy Investment Partners. He is a media and technology investor and content producer who has created, acquired and/or financed a broad range of traditional and digital businesses and dozens of video games, films and television shows over the past decade. Prior to Galaxy Digital, Mr. Englebardt was a Partner and Managing Director at Lambert Media Group (“LMG”) from 2007 to 2016, where he managed a portfolio of media-sector private equity investments. Before LMG, Mr. Englebardt was a Vice President and Financial Advisor at Alliance Bernstein from 2006 to 2008. Mr. Englebardt earned his J.D. from Harvard Law School and received his B.A. in philosophy and political science from the University of Colorado at Boulder. Mr. Englebardt’s deep experience with digital assets and content, including the metaverse and web3, is invaluable to the Board as it expands its digital business. |

| | | | | | | | |

| | |

Director Since: 2019 Age: 52 Committee Memberships: • Audit Committee (CHAIR) | | BRAD GERSTNER Mr. Gerstner has served, since 2008, as the CEO of Altimeter Capital Management, LP, a leading technology investment firm that manages public and private portfolios. Mr. Gerstner also served as Chief Executive Officer, President and Chairman of the board of directors of Altimeter Growth Corp. from October 2020 to December 2021 and of Altimeter Growth Corp. 2 from January 2021 to December 2022, both of which were public special purpose acquisition companies. Prior to launching Altimeter Capital Management, LP, Mr. Gerstner was an internet entrepreneur, co-founding and selling three start-ups. Additionally, Mr. Gerstner previously served as a board member and compensation committee member of Orbitz, Inc. and as a board member of private companies SilverRail Technologies, Duetto Research, HotelTonight, Samooha, Inc., Sigma Computing and Cerebras. Mr. Gerstner is also the founder of Invest America, a foundation working to pass legislation to establish a 401k-like investment account at birth. Mr. Gerstner holds a B.S. in economics and political science from Wabash College, a J.D. from Indiana University School of Law and an M.B.A. from Harvard Business School. Mr. Gerstner has advised a broad range of companies on business, financial and value-creation strategies. Mr. Gerstner’s proven financial acumen and background in analyzing financial markets brings a depth of knowledge and practical experience to the Board. |

| | |

Director Since: 2020 Age: 59 Committee Memberships: • Nominating and Corporate Governance Committee (CHAIR) • Compensation Committee | | CHERYL MILLS Ms. Mills is Founder and Chief Executive Officer of the BlackIvy Group LLC, a private company that builds and operates businesses in Sub-Saharan Africa. Previously, she served as Chief of Staff to former Secretary of State Hillary Clinton and Counselor to the U.S. Department of State from 2009 to 2013. Ms. Mills was with New York University from 2002 to 2009, where she served as Senior Vice President for Administration and Operations, General Counsel and as Secretary of the Board of Trustees. She also served as Senior Vice President for Corporate Policy and Public Programming at Oxygen Media from 1999 to 2001. Prior to joining Oxygen Media, Ms. Mills served as Deputy Counsel to President Clinton and as the White House Associate Counsel. Ms. Mills currently serves on the board of directors of BlackRock, Inc., a financial services company that she joined in 2013. She previously served on the board of directors of Cendant Corporation (now Avis Budget Group, Inc.), a consumer real estate and travel conglomerate, from 2003 to 2006. Ms. Mills received her B.A. from the University of Virginia and her J.D. from Stanford Law School. Ms. Mills brings to the Board a range of leadership experiences from private equity, government and academia, and through her prior service on the boards of corporations and non-profits, she provides expertise on issues concerning government relations, public policy, corporate administration and corporate governance. |

| | |

Director Since: 2021 Age: 57 Committee Memberships: • Audit Committee | | GRACIELA MONTEAGUDO

Ms. Monteagudo served as Chief Executive Officer of LALA U.S., a producer and distributor of dairy-based products from March 2017 to December 2018. Ms. Monteagudo previously served as Senior Vice President and President, Americas for Mead Johnson Nutrition Company, a global manufacturer of infant formula, from July 2015 to February 2017 where she was responsible for Mead Johnson’s businesses in North America and Latin America. Between May 2012 and June 2015, Ms. Monteagudo served as Mead Johnson’s Senior Vice President and General Manager, North America and Global Marketing. Prior to that, Ms. Monteagudo served in several capacities for Walmart Mexico, most recently as Senior Vice President and Business Unit Head, Sam’s Club. Ms. Monteagudo has served as a director of WD 40 Company since June 2020, where she serves on its nominating/governance and finance committees, and as a director of ACCO Brands Corp since 2016, where she serves on its compensation and human capital committee and chairs its nominating, governance and sustainability committee. Ms. Monteagudo holds a National Association of Corporate Directors (NACD) Directorship Certification as well as ESG/Climate leadership certifications from Berkeley Law and Diligent. She received her B.S. in Industrial Engineering from Universidad Panamericana and her M.B.A. from Instituto Tecnológico Autónomo de México. Ms. Monteagudo brings to the Board a range of commercial and public company leadership experiences, as well as expertise in digital marketing, e-commerce, consumer goods and international operations, all of which the Board believes are important contributions to the Board. |

| | |

Director Since: 2019 Age: 48 Committee Memberships: • Compensation Committee • Nominating and Corporate Governance Committee | | KAMAKSHI SIVARAMAKRISHNAN Ms. Sivaramakrishnan was the founder and Chief Executive Officer of Samooha Inc., a data collaboration company that was acquired by Snowflake in 2023. Ms. Sivaramakrishnan was previously the founder and CEO of Drawbridge Inc. ("Drawbridge"), an identity management company enabling brands and enterprises to create personalized online and offline experiences for their customers. In 2019, Drawbridge was acquired by LinkedIn, a Microsoft company, where Ms. Sivaramakrishnan led the Drawbridge integration and identity charter for LinkedIn Marketing Solutions until 2021. Prior to founding Drawbridge in November 2010, Ms. Sivaramakrishnan was a Senior Research Scientist at AdMob, which was acquired by Google in 2010. Ms. Sivaramakrishnan has also served on the board of directors of LiveRamp Holdings, Inc., a data connectivity platform company, since November 2020. Ms. Sivaramakrishnan received her Ph.D. in Information Theory and Algorithms from Stanford University. Ms. Sivaramakrishnan’s entrepreneurial experience, expertise of data and technology and business acumen bring extensive knowledge to the Board. |

CORPORATE GOVERNANCE

Governance Overview

We are committed to maintaining robust governance practices and a strong ethical culture that benefits the long-term interests of our stockholders. The Company, with the oversight of the Board, regularly reviews, updates and enhances its corporate governance practices and compliance and training programs, as appropriate, in light of stockholder feedback, changes in applicable laws, regulations and stock exchange requirements and the evolving needs of our business. Our corporate governance and compliance practices include:

•Independent Oversight. A majority of the current directors of the Board (6 of 8) are independent directors, including a strong lead independent director and fully independent Board committees, as defined by the rules of The Nasdaq Stock Market LLC (the “Nasdaq Rules”) and applicable rules of the Securities and Exchange Commission ("SEC"). Executive sessions of Board and Committee meetings are regularly held without management present.

•Annual Director Elections. All of our directors are elected annually.

•Prohibition on Hedging and Pledging. We prohibit all directors and executive officers from engaging in hedging transactions, including options (such as puts or calls) or other financial instruments (such as forward contracts, equity swaps, collars or exchange funds) that are designed to hedge or offset any decrease in the market value of our securities. We also prohibit all directors and executive officers from pledging Company securities, unless specifically pre-approved by the Company’s General Counsel.

•Committee Charters. Each Board committee operates under a written charter that has been approved by the Board and reviewed and, if necessary, amended annually.

•Board and Committee Self-Evaluations. The Nominating and Corporate Governance Committee oversees an annual evaluation of the Board and its committees.

•Frequent and Robust Stockholder Engagement. The Company has a robust stockholder engagement program pursuant to which the Company participates in investor conferences and holds numerous meetings with stockholders to discuss various topics, including its financial performance, strategy, corporate governance, environmental, social & governance (“ESG”) practices and executive compensation program. During 2023, the Company engaged with stockholders representing approximately 68% of the Company’s outstanding common stock.

•Stock Ownership Guidelines. Our directors and senior executives are subject to stock ownership guidelines.

•Annual Say on Pay Vote. We hold an annual say-on-pay vote so that our stockholders are able to provide annual feedback on our executive compensation program.

•Clawback Policy. We have adopted a clawback policy consistent with Nasdaq Rules that requires our executive officers to repay erroneously awarded incentive-based compensation following certain corrections to our financial statements.

•No poison pill. The Company does not have a poison pill in place.

•No supermajority voting requirements. The Company’s Fifth Amended and Restated Certificate of Incorporation (the "Charter") and Fourth Amended and Restated Bylaws (the "Bylaws") do not require any supermajority voting requirements for any matters considered by stockholders.

•Succession Planning. The Board engages in periodic review of succession plans for members of senior management.

•Environmental, Social & Governance. iHeartMedia is dedicated to serving the communities in which we live and work – especially in times of need – and we are equally committed to strengthening our ESG strategy as a path to advancing our management of the greatest opportunities and risks to our business including, as applicable, with its relationship with our communities, planet and other stakeholders and report our progress in our ESG Report and Annual Impact Report. For more details, please see "Corporate Social Responsibility and Human Capital" in the proxy statement and our 2023 ESG Report and Annual Impact Report, which is available on our website at www.investor.iheartmedia.com.

•Ethics & Compliance. Our Code of Conduct, which applies to all iHeartMedia employees and directors, reinforces our core values and helps drive our workplace culture of compliance, ethical standards, integrity and accountability.

•Independent, Anonymous Complaint Process. The Company maintains a third-party managed hotline (“Hotline”) that permits the anonymous reporting of violations of our Code of Conduct and other concerns. All Hotline submissions are reviewed and investigated by appropriate members of management. The results of all such investigations are reported to senior management and the Audit Committee quarterly.

Our Board has adopted the Governance Guidelines, Code of Conduct and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Governance Guidelines and our Code of Conduct in the “Corporate Governance” section of the “Investor Relations” page of our website located at www.iheartmedia.com, or by writing to our Secretary at our offices at 20880 Stone Oak Pkwy, San Antonio, Texas 78258.

Board Composition

Our Board currently consists of eight (8) members: Robert W. Pittman, James A. Rasulo, Richard J. Bressler, Samuel E. Englebardt, Brad Gerstner, Cheryl Mills, Graciela Monteagudo, and Kamakshi Sivaramakrishnan.

Director Independence

Our Board of Directors has affirmatively determined that Messrs. Rasulo, Englebardt, and Gerstner and Mses. Mills, Monteagudo, and Sivaramakrishnan are each an “independent director,” as defined under the Nasdaq Rules and under the standards adopted by the Board in the Company’s Governance Guidelines that are available on our website, www.iheartmedia.com.

Director Candidates

The Nominating and Corporate Governance Committee is responsible for identifying and reviewing the qualifications of potential director candidates and recommending to the Board those candidates to be nominated for election to the Board.

To facilitate the search process for director candidates, the Nominating and Corporate Governance Committee may identify potentially qualified director candidates through a number of channels, including soliciting our current directors and executives for the names of potentially qualified candidates or asking directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates or consider director candidates recommended by our stockholders. Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from us and determines if candidates meet the qualifications desired by the Nominating and Corporate Governance Committee of candidates for election as director. All of our directors were previously elected by stockholders.

In accordance with our Governance Guidelines, in evaluating the suitability of individual candidates, the Nominating and Corporate Governance Committee will consider a candidate’s (i) experience in positions with a high degree of responsibility; (ii) leadership roles in organizations with which they are affiliated; (iii) the time, energy, interest and willingness to serve as a member of the Board; and (iv) contributions they can make to the Board and oversight of the Company’s business. The Board evaluates each candidate in the context of the Board as a whole and recommends candidates who can best contribute to the future success of the Company and represent stockholder interests through the exercise of sound judgment using the group’s diversity of skills and experience. Our Board also seeks to have members from diverse backgrounds, including, among other attributes, gender, ethnicity and professional experience.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to iHeartMedia, Inc., 20880 Stone Oak Parkway, San Antonio, TX 78258, Attn: Nominating and Corporate Governance Committee, c/o Secretary. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Communications From Stockholders

Stockholders and other interested parties may contact the Board as a group, a specified Board committee or individual members by writing to the following address: iHeartMedia, Inc., 20880 Stone Oak Parkway, San Antonio, TX 78258, Attn: Secretary. Each communication should specify the applicable addressee or addressees to be contacted, as well as the general topic of the communication. We will initially receive and process communications before forwarding them to the addressee. We may also refer communications to other departments at the Company. We generally will not forward to the directors a communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requests general information regarding the Company.

Stockholder Engagement

The Board strongly believes in proactive engagement, communication and transparency with the Company’s stockholders. During 2023, the Company, led by our senior management and Board, continued its strong level of engagement with its stockholders, and engaged with stockholders representing approximately 68% of the Company’s outstanding common stock. This engagement included participation in several investor conferences and numerous meetings and correspondence with stockholders to discuss our financial performance, strategy, corporate governance, ESG practices and executive compensation program. Our Annual Impact Report and ESG Report reflect the results of the Company’s outreach on ESG matters. This feedback provides the Company with important insights, which management shares with the Board, and the Company is committed to ongoing engagement with its investors on all appropriate matters, including executive compensation and governance.

Self-Evaluation

Our Board conducts an annual self-evaluation process to determine whether the Board, its committees and the directors are functioning effectively. This includes survey materials and a report to, and discussion of survey results with, the Nominating and Corporate Governance Committee, as well as each committee and the full Board’s respective results. The survey materials solicit feedback on board composition, board process and function, board responsibilities and board committees. The directors use the results to identify trends and themes and discuss potential action items in order to increase the effectiveness of the Board and its committees. Each committee also conducts its own annual self-evaluation to assess the functioning of the committee and the effectiveness of the committee members, including the committee chair. In addition, focus areas identified through the evaluation are incorporated into the Board’s agenda for the following year. All directors are free to make suggestions on improvement of the Board’s or the committees’ practices at any time and are encouraged to do so.

Board Leadership Structure

The Company’s current Board leadership structure comprises a combined Chairman of the Board and Chief Executive Officer, an independent director serving as the Lead Independent Director, and five other highly qualified, active independent directors. Our Board exercises its judgment in combining or separating the roles of Chairman of the Board and Chief Executive Officer as it deems appropriate in light of prevailing circumstances. The Board will continue to exercise its judgment on an ongoing basis to determine the optimal Board leadership structure that the Board believes will provide effective leadership, oversight and direction, while optimizing the functioning of both the Board and management and facilitating effective communication between the two. The Board has concluded that the current structure provides a well-functioning and effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. A combined role of Chairman and Chief Executive Officer confers advantages, including for the following reasons:

•Our Chief Executive Officer is more familiar with our business and strategy than a non-employee chairman and is able to draw on his detailed knowledge of the Company to provide the Board, in coordination with the Lead Independent Director, leadership in focusing its discussions, review and oversight of the Company’s strategy, business, and operating and financial performance;

•A single Chairman and Chief Executive Officer provides strong and consistent leadership for our Company, without risking overlap or conflict of roles;

•A combined role ensures that the Company presents its message and strategy to stakeholders with a unified voice;

•The structure allows for efficient decision-making and focused accountability;

•Oversight of our Company is the responsibility of our Board as a whole, and this responsibility can be properly discharged without an independent Chairman; and

•Our strong Lead Independent Director provides similar benefits to those associated with an independent Chairman.

The Board continues to believe that it is in the best interest of the Company and its stockholders for Mr. Pittman to serve as Chairman and Chief Executive Officer, considering the strong role of our Lead Independent Director and other corporate governance practices that provide independent oversight of management.

Our Governance Guidelines provide that, if our Chairman of the Board is not an independent director, the independent directors will select an independent director to act as Lead Independent Director. Since our Emergence, James A Rasulo has served as our Lead Independent Director. The Lead Independent Director’s responsibilities include:

•presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors and of non-management directors;

•having discretion to call meetings of the independent directors;

•facilitating discussion and open dialogue among the independent directors during Board meetings, executive sessions and outside of Board meetings;

•serving as the principal liaison between the independent directors and the Chairman, without inhibiting direct communication between them;

•communicating, as appropriate in his or her judgment, to the Chairman and management any decisions reached, suggestions, views or concerns expressed by independent directors in executive sessions or outside of Board meetings;

•providing the Chairman with feedback and counsel concerning the Chairman’s interactions with the Board;

•working with the Chairman to develop and approve Board meeting agendas and meeting schedules, including to ensure that there is sufficient time for discussion of all agenda items;

•working with the Chairman on the appropriateness (including quality and quantity) and timeliness of the information provided to the Board;

•authorizing the retention of advisors and consultants who, when appropriate, report directly to the Board;

•in consultation with the Nominating and Corporate Governance Committee, reviewing and reporting on the results of the Board and committee performance evaluations;

•periodically meeting on an individual basis with independent directors to discuss Board and committee performance, effectiveness and composition;

•leading the independent directors’ evaluation of the effectiveness of the Chairman (as Chairman), including his or her interactions with directors and ability to provide leadership and direction to the Board;

•if requested, and in coordination with management, to be available for consultation and direct communication with stockholders; and

•participating in crisis management oversight, as appropriate under the circumstances.

The Board believes that this management and Board leadership structure, combined with the oversight of the Board comprised of a majority of independent directors, a strong Lead Independent Director with significant responsibilities and the Company’s robust corporate governance policies and procedures, effectively maintains independent oversight of the Company.

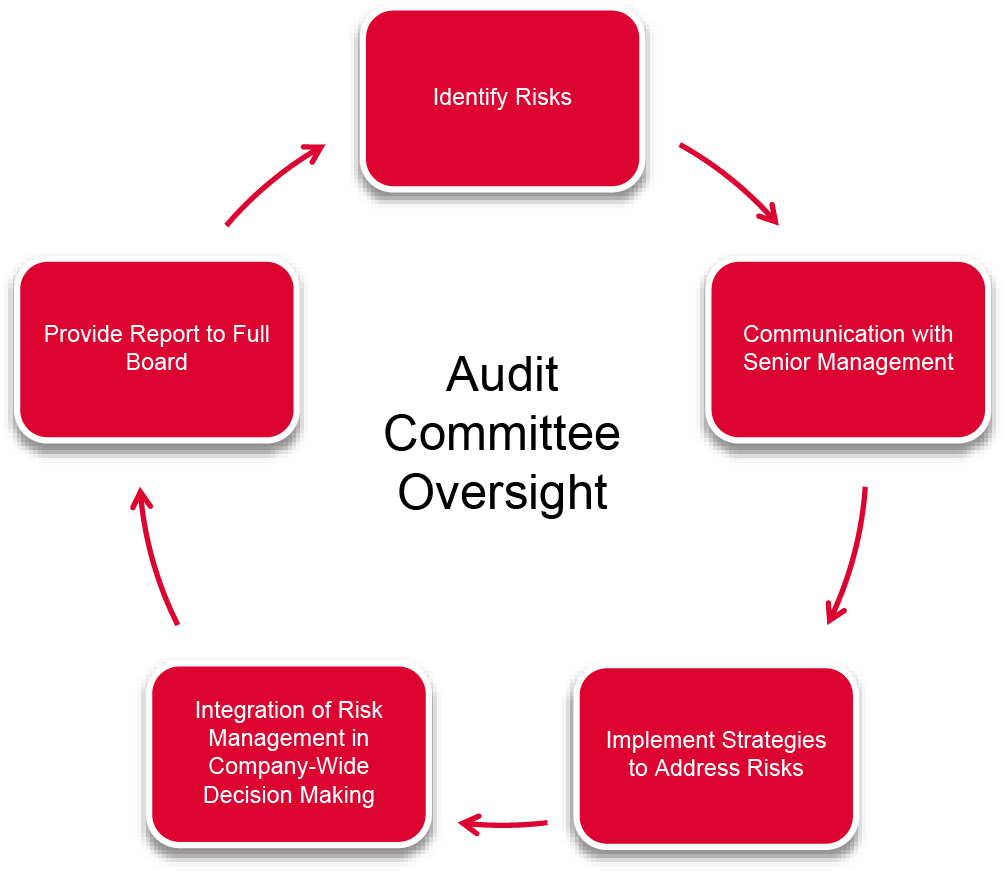

Board’s Role in Risk Oversight

Risk assessment and oversight are an integral part of our governance and management processes. The Board encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations. Our risk management philosophy strives to:

•timely identify the material risks that we face;

•communicate necessary information with respect to material risks to senior management and, as appropriate, to the Board or relevant Board committee;

•implement appropriate and responsive risk management strategies consistent with our risk profile; and

•integrate risk management into our decision-making.

The Board has designated the Audit Committee to broadly oversee risk management in accordance with our Audit Committee charter. Under the oversight of the Audit Committee, and with the support of the compliance function and the internal and external audit functions, we operate an enterprise-wide risk management governance framework that sets standards and provides guidance for the identification, assessment, monitoring and control of the most significant risks facing the Company and that have the potential to affect stockholder value, our customers and colleagues, the communities in which we operate and the safety and soundness of the Company. The Audit Committee then oversees the implementation and effectiveness of strategies to address these risks. The Audit Committee reports to the Board regarding briefings provided by management and advisors, as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of our risk management processes.

Our Audit Committee is also responsible for overseeing quality and integrity of accounting, internal control and financial reporting practices, legal and ethical compliance programs and cybersecurity risks. The Audit Committee receives annual reports from management on information security and privacy matters, including our cybersecurity risks. In addition, management updates the Audit Committee, as necessary, regarding any material cybersecurity incidents, as well as certain incidents with lesser potential impact. Our Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions. Our Compensation Committee oversees risks related to the Company’s compensation practices and policies. Our Nominating and Corporate Governance Committee oversees risks related to environmental, social, sustainability and governance matters. The Board believes that its role in the oversight of our risks supports its determination that the Board’s leadership structure effectively maintains independent oversight of the Company.

The Company’s risk oversight framework and key areas of responsibility are illustrated below:

| | | | | | | | | | | | | | |

| Board of Directors |

Our Board of Directors is apprised of particular risk management matters

in connection with its general oversight and approval of corporate matters and significant transactions. |

| | | | |

| Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| Our Audit Committee is responsible for overseeing risk assessment and management, including quality and integrity of accounting, internal control and financial reporting practices, legal and ethical compliance programs and data privacy and cybersecurity risks. | | Our Compensation Committee oversees the risks related to the Company's compensation practices and policies. | | Our Nominating and Corporate Governance Committee oversees risks related to environmental, social and governance matters. |

| | | | |

| Management |

| Our Management is responsible for our day-to-day risk management activities. |

Code of Conduct

Our Code of Conduct applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer and principal accounting officer. Our Code of Conduct constitutes a “code of ethics” as defined by Item 406(b) of Regulation S-K. The Code of Conduct is publicly available on our internet website at www.iheartmedia.com. We intend to satisfy the disclosure required by law or Nasdaq Stock Market listing standards regarding any amendment to, or waiver from, a provision of the Code of Conduct by posting such information on our website at www.iheartmedia.com.

Governance Guidelines

We operate under Governance Guidelines that set forth our corporate governance principles and practices on a variety of topics, including director qualifications, director responsibilities, board leadership, and the composition and functioning of the Board. Our Governance Guidelines are designed to maximize long-term stockholder value, align the interests of the Board with those of our stockholders and promote high ethical conduct among our directors. The Governance Guidelines include the following key practices to assist the Board in carrying out its responsibility for the business and affairs of iHeartMedia:

| | |

1. Director Responsibilities. The basic responsibility of a director is to exercise his or her business judgment and act in what he or she reasonably believes to be in the best interests of iHeartMedia and its stockholders. Directors are expected to attend Board meetings and meetings of committees on which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. |

2. Executive Sessions of Non-Management Directors. The non-management directors and/or the independent directors conduct executive sessions, without management participation, as part of each regularly scheduled Board meeting, and may do so at special Board meetings. |

3. Board Access to Senior Management. Directors have access to iHeartMedia’s management, employees and advisors and can initiate contact or meetings through the CEO, the Chair or Lead Independent Director, if any, or any other executive officer. |

4. Board Access to Independent Advisers. The Board and each Board committee have the power to retain independent legal, financial or other advisors as they may deem necessary, at our expense. |

5. Board Tenure. The Board believes that term limits on director service and a predetermined retirement age impose arbitrary restrictions on Board membership that may deprive the Board of insights and knowledge of the Company gained over time and multiple business cycles. The Board’s annual performance evaluation described above is a significant determinant for continuing service on the Board. The Board’s goal is to maintain a mix of tenures so that the Board has a balance of fresh perspectives and continuity of experience. |

6. Directors who Change their Current Job Responsibilities. A director who changes the nature of the job he or she held when elected to the Board shall tender his or her resignation from the Board, subject to acceptance by the Board, by sending such resignation to the chair of the Nominating and Corporate Governance Committee. This provides an opportunity for the Board to review the continued appropriateness of Board membership under these circumstances. The Nominating and Corporate Governance Committee will then review the director’s continuation on the Board in light of all the circumstances and recommend to the Board whether the Board should accept such proposed resignation or request that the director continue to serve on the Board. |

7. Service on Multiple Boards. Each director is expected to be available for a significant time commitment. A director who serves as a chief executive officer of a public company may not serve on the board of directors of more than two public companies (not including the Company) without prior approval of the Board. All other directors may not serve on the board of directors of more than four public companies (not including the Company) without prior approval of the Board. |

8. Management Development and Succession Planning. The Compensation Committee periodically considers management development and succession planning, including short-term succession planning for certain of the Company’s most senior management positions in the event that all or a portion of such members of senior management should unexpectedly become unable to perform their duties. |

Anti-Hedging Policy

Our Board has adopted an Insider Trading Policy, which applies to all of our directors, executive officers, employees, consultants and contractors. Among its provisions, the policy prohibits those covered by the policy from engaging in transactions in publicly traded options related to the Company’s equity securities, such as puts or calls, or engaging in transactions involving any other financial instruments, such as forward contracts, equity swaps, collars or exchange funds, that are designed to hedge or offset any decrease in the market value of the Company’s equity securities.

Executive Sessions

The independent members of the Board meet in regularly scheduled executive sessions. Such meetings are presided over by the Lead Independent Director.

Attendance by Members of the Board of Directors at Meetings

There were 6 meetings of the Board during the fiscal year ended December 31, 2023. During the fiscal year ended December 31, 2023, each incumbent director attended at least 75% of the meetings of the Board and committees on which such director served that occurred while such director served on the Board or such committee(s). In addition, all of our directors then in office attended our 2023 annual meeting of stockholders.

Under our Governance Guidelines, which is available on our website at www.iheartmedia.com, a director is expected to spend the time and effort necessary to properly discharge his or her responsibilities. Accordingly, a director is expected to prepare for and attend Board meetings and meetings of committees on which he or she serves. Pursuant to the Company’s Governance Guidelines, we expect Board members to attend the Annual Meeting.

Board Committees

| | | | | | | | | | | |

| Committee Memberships |

| Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Richard J. Bressler | | | |

| Samuel E. Englebardt | | | |

| Brad Gerstner | CHAIR | | |

| Cheryl Mills | | | CHAIR |

| Graciela Monteagudo | | | |

| Robert W. Pittman | | | |

| James A. Rasulo | | CHAIR | |

| Kamakshi Sivaramakrishnan | | | |

CHAIR = Committee Chair

= Member

= Member

| | | | | | | | |

Audit Committee Met 4 times in 2023 Current Committee Members: Brad Gerstner (CHAIR) Samuel E. Englebardt Graciela Monteagudo James A. Rasulo | | Primary Responsibilities Include: ● annually evaluate, determine the selection of and, if necessary, determine the replacement or rotation of the independent registered public accounting firm; ● approve all auditing and non-audit services provided by the independent registered public accounting firm; ● annually review, evaluate and discuss reports regarding the independent registered public accounting firm’s independence; ● review with the internal auditors and the independent registered public accounting firm the scope and plan for audits; ● review with management, the internal auditors and the independent registered public accounting firm, our system of internal control, financial and critical accounting practices and our policies relating to risk assessment and risk management, including legal and ethical compliance programs; ● review information technology procedures and controls, including as they relate to data privacy and cybersecurity; ● review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; and ● review material pending legal proceedings involving the Company and other contingent liabilities. Financial Expertise and Independence All members of the Audit Committee meet the independence standards of Nasdaq and the SEC, as well as the financial literacy requirements of Nasdaq. The Board has determined that each of Brad Gerstner, Samuel E. Englebardt and James A. Rasulo qualifies as an “audit committee financial expert” as defined by SEC rules. Report The Report of the Audit Committee is included beginning on page 27 of this proxy statement. |

| | | | | | | | |

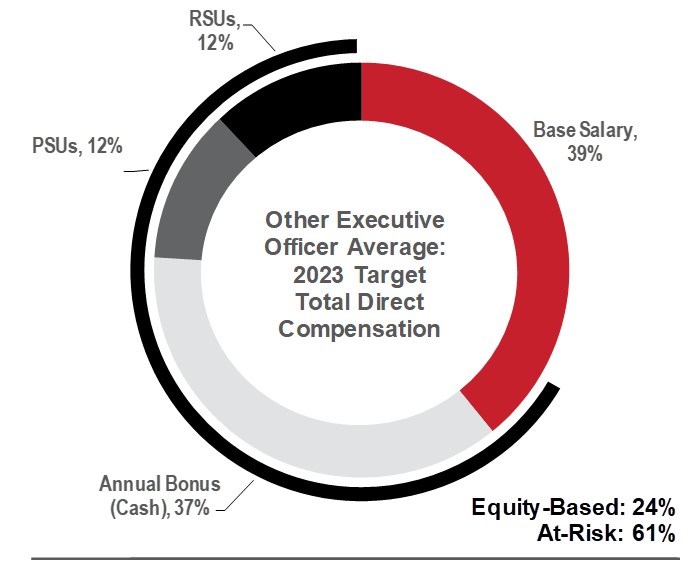

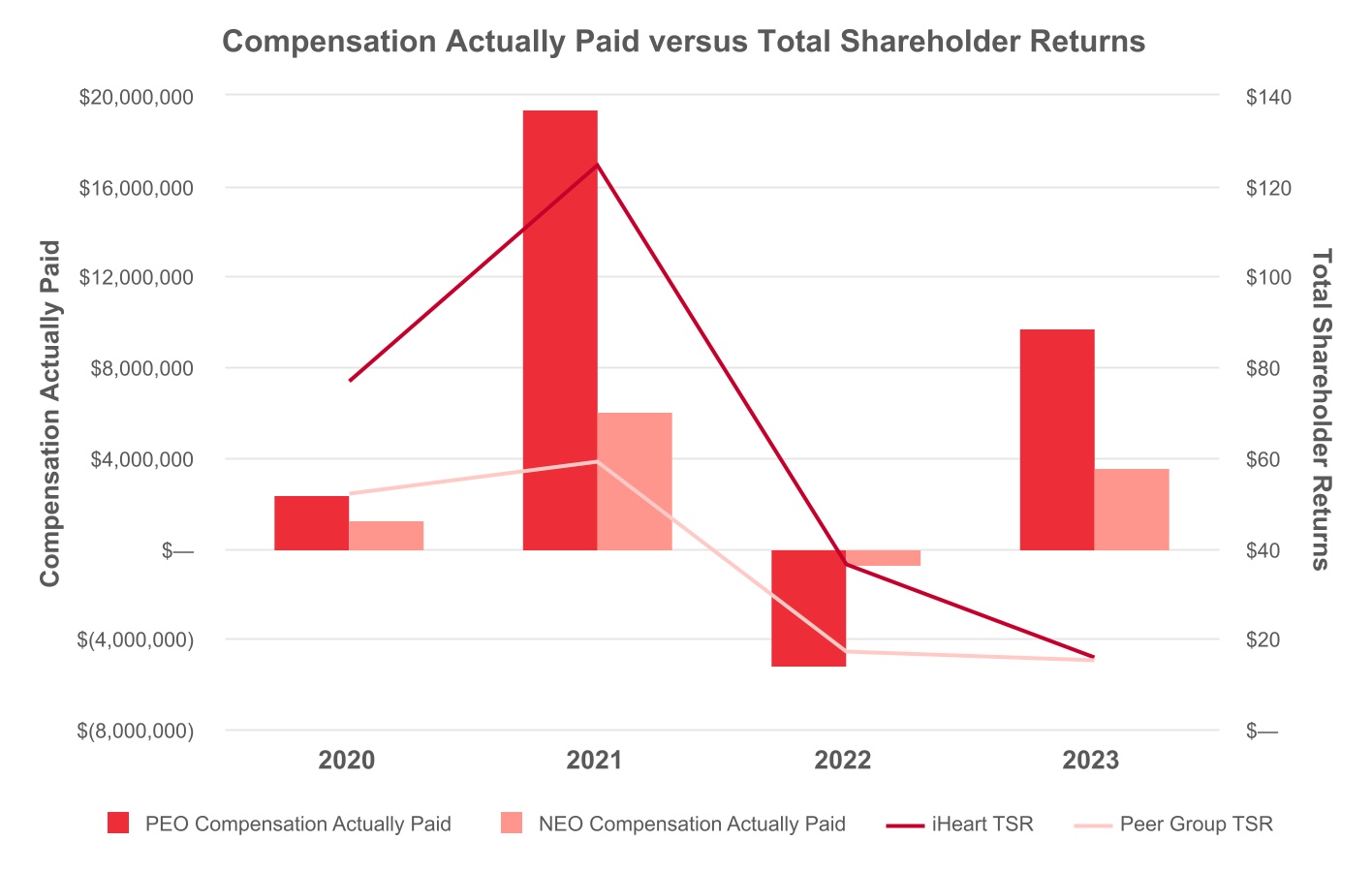

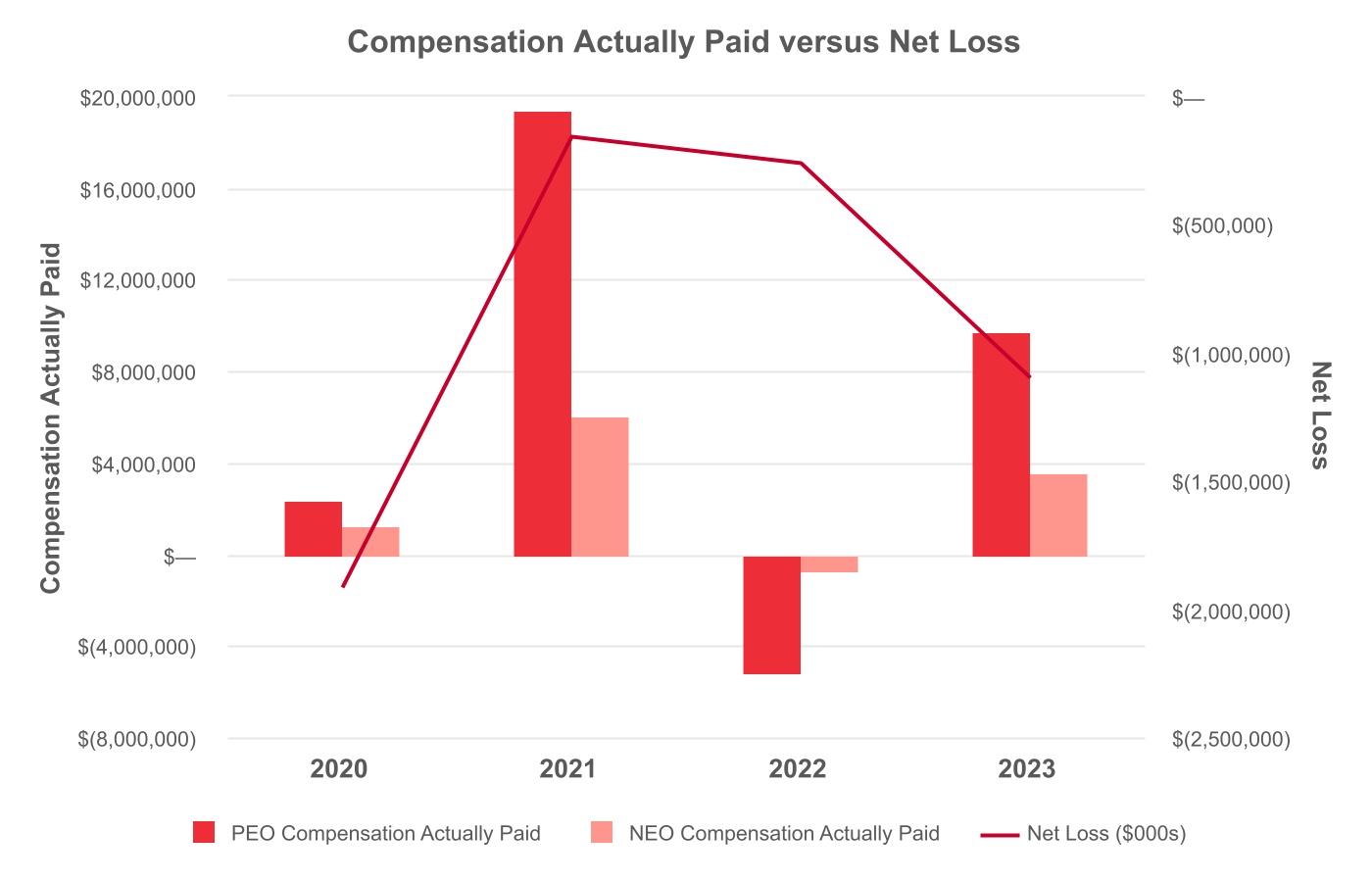

Nominating and Corporate Governance Committee Met 3 times in 2023 Current Committee Members: Cheryl Mills (CHAIR) James A. Rasulo Kamakshi Sivaramakrishnan | | Primary Responsibilities Include: ● identify individuals qualified to become members of our Board; ● periodically review the Board’s Governance Guidelines and consider other governance matters and, as appropriate, make recommendations to the Board; ● establish any qualifications, desired background, expertise and other selection criteria for members of our board of directors and any committee; ● annually review committee assignments and make recommendations to the Board; ● annually review ESG initiatives and strategy; ● periodically consider other governance matters, and as appropriate, make recommendations to the Board; ● oversee the annual self-evaluation process of the Board and its committees; and ● recommend to our Board the director nominees for the next annual meeting of stockholders. Independence The Nominating and Corporate Governance Committee is comprised entirely of directors who are independent under Nasdaq rules. |