Exhibit 99.1

united states

bankruptcy court

district of DELAWARE

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MONTHLY OPERATING REPORT – SUPPORTING DOCUMENTATION1

Reporting Period: May 30, 2021 – July 3, 2021

| SUPPORTING DOCUMENTS | Form No.2 | Document Attached | Explanation Attached | Affidavit/ Supplement Attached |

| Schedule of Cash Receipts and Disbursements | MOR-1 | X | X | |

| Bank Account Balances, Debtor Statement with Respect to Bank Account Reconciliations | MOR-1a | X | X | See Attestation |

| Schedule of Professional Fees and Expenses Paid | MOR-1b | X | ||

| Copies of bank statements | See Attestation | |||

| Cash disbursements journals | See Attestation | |||

| Statement of Operations by Legal Entity | MOR-2 | X | X | |

| Balance Sheet by Legal Entity | MOR-3 | X | X | |

| Status of Postpetition Taxes | See Attestation | |||

| Summary of Unpaid Postpetition Debts | MOR-4 | X | ||

| Accounts Receivable Reconciliation and Aging | MOR-5 | X | ||

| Debtor Questionnaire | MOR-5 | X | ||

| Opening Balance Sheet by Legal Entity | Exhibit A | X | ||

| Disbursements by Legal Entity | Exhibit B | X | ||

| Balance Sheet Bridge | Exhibit C | X |

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

| /s/ Anthony M. Saccullo | 7/20/21 | |

| Signature of Debtor | Date | |

| Anthony M. Saccullo | ||

| Wind-Down Officer |

1 These supporting documents are attached to the filing for the lead Debtor, FHC Holdings Corporation (Case No. 20-13076); however, these supporting documents should be incorporated by reference in each of the other report fillings for the affiliated Debtors, including FHC, LLC (Case No. 20-13077); FHC Collections, Inc. (Case No. 20-13078); and FHC Services Corporation (Case No. 20-13079).

2 Form No. listed for each supporting document reflects Form No. from MOR template submitted in previous periods.

Page 1 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

Notes to the Monthly Operating Report (“MOR”) Supporting Documentation

Reporting Period: May 30, 2021 – July 3, 2021

General:

The Debtors filed for relief under chapter 11 of title 11 of the United States Code, §§ 101-1532, et seq. on December 3, 2020. Per agreement with the Office of the United States Trustee for the District of Delaware (the “U.S. Trustee”), the Debtors have prepared this monthly operating report supporting documentation on a fiscal month basis (this “MOR” supporting documentation) for the period from May 30, 2021 through July 3, 2021.

The financial information contained herein is unaudited, limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the monthly reporting requirements applicable in these chapter 11 cases. This MOR is not prepared in accordance with GAAP and does not include all of the information and footnotes required thereby. Additionally, certain transactions that would be required to be included in GAAP financial statements are not reflected in this MOR. There can be no assurance that the financial information presented herein is complete, and readers are strongly cautioned not to place reliance on this MOR, which was not prepared for the purpose of providing the basis for an investment decision relating to the Debtors. The unaudited financial statements have been derived from the books and records of the Debtors. The information furnished in this MOR includes certain normal recurring adjustments, but may not include all the adjustments that would typically be made for the quarterly and annual consolidated financial statements in accordance with GAAP. Furthermore, the monthly financial information contained herein has not been subjected to the same level of accounting review and testing that the Debtors apply in the preparation of its annual financial information in accordance with GAAP. Upon the application of such procedures, the Debtors believe that this financial information may be subject to change, and these changes could be material. The financial information contained herein is presented on a preliminary and unaudited basis and remains subject to future reconciliation and adjustment (which may be material). However, the Debtors are not required to publicly update this MOR to reflect more current facts or estimates, or upon the occurrence of future events, including if the facts, estimates, or assumptions upon which this MOR is based change.

The Debtors entered into an Asset Purchase Agreement to sell substantially all of the Debtors’ assets to Terramar Capital, LLC (the “Buyer”) effective 11:59 p.m. on January 30, 2021 (the “Sale Transaction”).

Notes to MOR Forms:

Except for Part 5, which reflects case-to-date totals, all cumulative totals listed in the MOR forms reflect total amounts for the second calendar quarter of 2021.

Notes to MOR-1:

Cash is received and disbursed by the Debtors as described in the Debtors' Motion for Entry of Interim and Final Orders (I) Authorizing Continued Use of the Debtors' Existing Cash Management System, Corporate Credit Card Program and Bank Accounts; (II) Waiving Certain United States Trustee Requirements; (III) Extending Time to Comply with Section 345(b) of the Bankruptcy Code; (IV) Authorizing Continued Performance of Intercompany Transactions; and (V) Granting Related Relief [D.I. 29] and is consistent with the Debtors’ historical cash management practices. Cash receipts and disbursements reflected herein include activity from May 30, 2021 to July 3, 2021. Cash receipts and disbursements were derived from the bank statements and accounting system. Cash receipts and disbursements related to intercompany transfers among the Debtors such as cash concentration account sweeps and expense reimbursements, are excluded from total cash receipts and disbursements set forth in MOR-1. Cash receipts and disbursements include certain intercompany expense transactions.

Page 2 of 16

Notes to MOR-1a:

Amounts listed are the bank balances as of the close of business on July 3, 2021. Copies of the bank statements were not included with this MOR due to the voluminous nature of the statements and are available upon reasonable request in writing to counsel for the Debtors.

Notes to MOR-2 and MOR-3:

This MOR has been prepared on a legal entity basis for the Debtors.

As a result of the Debtors’ chapter 11 filings, the payment of prepetition indebtedness is subject to compromise or other treatment under the Debtors’ chapter 11 plan of liquidation [D.I. 737] (the “Plan”). The amounts currently classified as liabilities subject to compromise may be subject to future adjustments depending on Bankruptcy Court actions, payments pursuant to Bankruptcy Court order, further developments with respect to, among other things, the reconciliation and adjudication of claims, determinations of the secured status of certain claims, the value of any collateral securing such claims, rejection of executory contracts, or other events. The determination of how liabilities will ultimately be settled and treated cannot be made until the Debtors’ Plan, which was confirmed by the Bankruptcy Court on July 20, 2021 [D.I. 988], goes effective and all deadlines to file claims and requests for payment of administrative expenses have passed. The Debtors continue to reconcile claims that have been, or may be, in whole or in part, satisfied through the Sale Transaction consummated in these cases and related transactions and/or agreements. Future MORs will reflect these continuing reconciliation efforts. Accordingly, the ultimate amount of such liabilities is not determinable at this time. No assurance can be given as to the value, if any, that may be ascribed to the Debtors' various prepetition liabilities and other securities.

Page 3 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-1

Schedule of Cash Receipts and Disbursements[1]

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| Consolidated | ||||||||||||||||||||||

| # | FCI | FSC | FHC | FLLC | 5/30/21 - 7/3/21 | |||||||||||||||||

| 1 | Receipts | |||||||||||||||||||||

| 2 | Credit Card and Cash Receipts | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||

| 3 | Inventory Liquidation | - | - | - | - | - | ||||||||||||||||

| 4 | Federal Tax Refund | - | - | - | - | - | ||||||||||||||||

| 5 | Total Receipts | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||

| 6 | Operating Disbursements | |||||||||||||||||||||

| 7 | Payroll & Taxes[2] | (112 | ) | - | - | - | (112 | ) | ||||||||||||||

| 8 | Rent[3] | 1,096 | - | - | - | 1,096 | ||||||||||||||||

| 9 | Inventory | - | - | - | - | - | ||||||||||||||||

| 10 | Sales Tax | - | - | - | - | - | ||||||||||||||||

| 11 | Merchant Fees | - | - | - | - | - | ||||||||||||||||

| 12 | Employee Benefits[4] | 50 | - | - | - | 50 | ||||||||||||||||

| 13 | Marketing | - | - | - | - | - | ||||||||||||||||

| 14 | Professional/Computer Services[5] | - | 154,953 | - | - | 154,953 | ||||||||||||||||

| 15 | Other A/P[6] | 24,925 | 84,376 | - | - | 109,300 | ||||||||||||||||

| 16 | Total Operating Disbursements | 25,958 | 239,328 | - | - | 265,287 | ||||||||||||||||

| 17 | Net Cash Flow from Operations | $ | (25,958 | ) | $ | (239,328 | ) | $ | - | $ | - | $ | (265,287 | ) | ||||||||

| 18 | Non-Operating Disbursements / (Receipts) | |||||||||||||||||||||

| 19 | Debt Service | - | - | - | - | - | ||||||||||||||||

| 20 | State Taxes | - | - | - | - | - | ||||||||||||||||

| 21 | Federal Taxes | - | - | - | - | - | ||||||||||||||||

| 22 | CapEx | - | - | - | - | - | ||||||||||||||||

| 23 | Tenant Allowance | - | - | - | - | - | ||||||||||||||||

| 24 | Total Non-Operating Disbursements / (Receipts) | - | - | - | - | - | ||||||||||||||||

| 25 | Net Cash Flow Before Restructuring | $ | (25,958 | ) | $ | (239,328 | ) | $ | - | $ | - | $ | (265,287 | ) | ||||||||

| 26 | Restructuring Related Disbursements | |||||||||||||||||||||

| 27 | Professional Fees[7] | - | - | - | - | - | ||||||||||||||||

| 28 | Credit Card Program Deposits | - | - | - | - | - | ||||||||||||||||

| 29 | Utility Deposit and Other Reserves[8] | - | - | - | - | - | ||||||||||||||||

| 30 | 503(b)(9) and Critical Vendor Payments | - | - | - | - | - | ||||||||||||||||

| 31 | KEIP/KERP | - | - | - | - | - | ||||||||||||||||

| 32 | UST Fees | - | - | - | - | - | ||||||||||||||||

| 33 | DIP Fees & Interest - Term | - | - | - | - | - | ||||||||||||||||

| 34 | DIP Fees & Interest - Revolver | - | - | - | - | - | ||||||||||||||||

| 35 | Prepetition Term Loan Repayment | - | - | - | - | - | ||||||||||||||||

| 36 | Cure Costs | - | - | - | - | - | ||||||||||||||||

| 37 | Funding to Professional Fee Account | - | - | - | - | - | ||||||||||||||||

| 38 | Total Restructuring Related Disbursements | - | - | - | - | - | ||||||||||||||||

| 39 | Net Cash Flow | $ | (25,959 | ) | $ | (239,328 | ) | $ | - | $ | - | $ | (265,287 | ) | ||||||||

| 40 | Beginning Cash Balance | $ | 1,772,988 | $ | (198,565 | ) | $ | 7,265,739 | $ | - | $ | 8,840,163 | ||||||||||

| 41 | Net Cash Flow | (25,959 | ) | (239,328 | ) | - | - | (265,287 | ) | |||||||||||||

| 42 | Borrowings | - | - | - | - | - | ||||||||||||||||

| 43 | Repayments | - | - | - | - | - | ||||||||||||||||

| 44 | Intercompany | - | 265,000 | (265,000 | ) | - | - | |||||||||||||||

| 45 | Change in deposits in transfer | - | - | - | - | - | ||||||||||||||||

| 46 | Ending Cash Balance | $ | 1,747,029 | $ | (172,894 | ) | $ | 7,000,739 | $ | - | $ | 8,574,876 | ||||||||||

Footnotes:

[1] Cash balance represents book balance, which is net of outstanding checks and may differ from bank balance due to the timing of items being posted to the Debtors’ bank accounts.

[2] Payroll & taxes disbursements reflect a return from an overpayment of payroll.

[3] Rent disbursements include payments of stub rent for landlords who were underpaid in prior periods.

[4] Employee benefits disbursements reflect employee benefit administrative expenses paid in arrears.

[5] Professional/computer services reflect payments to non-restructuring professionals.

[6] Other AP disbursements include payments of franchise tax, utilities, and bank service charges.

[7] $255K of disbursements for restructuring professional fees were paid out of the professional fee account from amounts funded in prior periods.

[8] $1.5M of disbursements for D&O insurance were paid out of the D&O insurance account from amounts funded in prior periods.

Page 4 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-1a

Bank Account Balances, Debtor Statement with Respect to Bank Account Reconciliations

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| # | Debtor Entity | Account Number (Last 4 Digits) | Bank | Account Type | Period Ended 7/3/2021[1] | |||||||||

| 1 | FHC Collections, Inc. | 4644 | Chase | Checking[2] | 1,747,030 | |||||||||

| 2 | FHC Collections, Inc. | 4669 | Chase | Checking | - | |||||||||

| 3 | FHC Holdings Corporation | 9350 | Chase | Checking | 7,000,739 | |||||||||

| 4 | FHC Services Corporation | 8238 | Chase | Checking[3] | (172,894 | ) | ||||||||

| 5 | Reported Cash and Cash Equivalents at 7/3/2021 | $ | 8,574,876 | |||||||||||

| 6 | FHC Services Corporation | 5317 | Chase | Professional Fee Account[4] | 1,037,745 | |||||||||

Footnotes:

[1] Cash balance represents book balance, which is net of outstanding checks and may differ from bank balance due to the timing of items being posted to the Debtors’ bank accounts.

[2] Excludes $(975,892) of cash on bank statement that is liability of the Buyer. Includes $66,618 of outstanding checks not included on bank statement.

[3] Excludes $580,733 of cash on bank statement that is property of the Buyer. Includes $86,236 of outstanding checks not included on bank statement. As of July 3, 2021, the Debtor’s balance in account 8238 was negative. The Debtors made an intercompany transfer from account 9350 to account 8238 in July to bring the balance positive.

[4] Professional Fee Account is included in restricted cash on Debtors' Balance Sheet. Other restricted cash accounts are not included on MOR-1a.

Page 5 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-1a

Debtor Attestation to with Respect to Bank Account Reconciliations, Bank Statements and Open/Closed Bank Accounts

Reporting Period: May 30, 2021 – July 3, 2021

Bank Account Reconciliations & Cash Disbursement Journal

The Debtors affirm that bank account reconciliations are prepared for all open and active bank accounts on a monthly basis. The Debtors affirm that within their financial accounting systems, check registers and/or disbursement journals are maintained for each disbursement account.

Bank Statement

The Debtors affirm that bank statements for all open and active bank accounts are retained by the Debtors.

Open/Closed Bank Accounts

The Debtors did not open or close any bank accounts in June.

| /s/ Anthony M. Saccullo | 7/20/21 | |

| Anthony M. Saccullo | Date | |

| Wind-Down Officer |

Page 6 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-1b

Schedule of Professional Fees and Expenses Paid

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| Period Covered | Amount Paid this Period | Amount Paid Case to Date | ||||||||||||||||||||||||

| # | Payee | Role | Beginning Date | End Date | Payment Date | Fees | Expenses | Fees | Expenses | |||||||||||||||||

| 1 | Cole Schotz, P.C. | Counsel to the Committee | February 1, 2021 | February 28, 2021 | 7/1/2021 | $ | 29,476 | $ | 81 | $ | 512,698 | $ | 2,742 | |||||||||||||

| 2 | Cole Schotz, P.C. | Counsel to the Committee | March 1, 2021 | March 31, 2021 | 7/1/2021 | 15,801 | 325 | |||||||||||||||||||

| 3 | FTI Capital Advisors, LLC | Financial Advisor | December 3, 2020 | December 31, 2020 | 7/2/2021 | 135,117 | - | |||||||||||||||||||

| 4 | FTI Capital Advisors, LLC | Financial Advisor | January 1, 2021 | January 31, 2021 | 7/2/2021 | 119,275 | - | |||||||||||||||||||

| 5 | FTI Capital Advisors, LLC | Financial Advisor | February 1, 2021 | February 28, 2021 | 7/2/2021 | 101,859 | - | 1,583,065 | - | |||||||||||||||||

| 6 | FTI Capital Advisors, LLC | Financial Advisor | March 1, 2021 | March 31, 2021 | 7/2/2021 | 25,651 | - | |||||||||||||||||||

| 7 | FTI Capital Advisors, LLC | Financial Advisor | April 1, 2021 | April 30, 2021 | 7/1/2021 | 183,596 | - | |||||||||||||||||||

| 8 | Province, LLC | Financial Advisor to the Committee | February 1, 2021 | February 28, 2021 | 7/1/2021 | 61,882 | - | 558,730 | 829 | |||||||||||||||||

| 9 | Total | $ | 672,657 | $ | 406 | $ | 2,654,494 | $ | 3,572 | |||||||||||||||||

Footnotes:

[1] Payments to FTI Capital Advisors, LLC include $128K cash payment and $438K application of retainer on file.

Payments to Insiders

The Debtors did not make any payments to insiders in June.

Page 7 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-2

Statement of Operations by Legal Entity

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| # | Category | FCI | FSC | FHC | FLLC | Consolidated | ||||||||||||||||

| 1 | Net sales | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||

| 2 | Cost of goods sold and occupancy costs[1] | 669 | - | - | - | 669 | ||||||||||||||||

| 3 | Gross profit | (669 | ) | - | - | - | (669 | ) | ||||||||||||||

| 4 | Selling, general and administrative expenses[2] | 8,145 | 441,832 | - | - | 449,977 | ||||||||||||||||

| 5 | (Loss) income from operations | (8,814 | ) | (441,832 | ) | - | - | (450,646 | ) | |||||||||||||

| 6 | Restructuring (expenses)[3] | - | (872,523 | ) | - | - | (872,523 | ) | ||||||||||||||

| 7 | Gain (loss) on assets | - | - | - | - | - | ||||||||||||||||

| 8 | Interest income (expense) | - | - | - | - | - | ||||||||||||||||

| 9 | Other income (expense)[4] | - | (1,200 | ) | - | - | (1,200 | ) | ||||||||||||||

| 10 | (Loss) income before income tax expense | (8,814 | ) | (1,315,555 | ) | - | - | (1,324,369 | ) | |||||||||||||

| 11 | Income tax expense | - | - | - | - | - | ||||||||||||||||

| 12 | Net (loss) income | $ | (8,814 | ) | $ | (1,315,555 | ) | $ | - | $ | - | $ | (1,324,369 | ) | ||||||||

Footnotes:

[1] FCI cost of goods sold & occupancy costs includes a true-up to actuals for utilities.

| [2] | FSC selling, general and administrative ("SG&A") expenses are primarily related to D&O insurance expense, and also include non-restructuring professional fees and DE franchise taxes. FCI SG&A expenses primarily include include bank charges and pre-Sale Transaction paid leave expense. |

[3] Restructuring expenses includes $872K of restructuring professional fees.

[4] FSC other expense reflects penalty for late payment of franchise taxes.

Page 8 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-3

Balance Sheet by Legal Entity

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

Balance Sheet at 07/03/2021

| # | Category | FCI | FSC | FHC | FLLC | Eliminations | Consolidated | |||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current Assets | ||||||||||||||||||||||||||

| 1 | Cash and cash equivalents | $ | 1,747,030 | $ | (172,894 | ) | $ | 7,000,739 | $ | - | $ | - | $ | 8,574,876 | ||||||||||||

| 2 | Accounts receivable[1] | 34,152,129 | 255,292,687 | 1,250,000 | - | (255,292,687 | ) | 35,402,129 | ||||||||||||||||||

| 3 | Inventories | 3,796,328 | - | - | - | (3,796,328 | ) | - | ||||||||||||||||||

| 4 | Prepaid expenses and other current assets[2] | 459,805 | 7,116,996 | - | - | - | 7,576,800 | |||||||||||||||||||

| 5 | Total Current Assets | 40,155,291 | 262,236,789 | 8,250,739 | - | (259,089,015 | ) | 51,553,805 | ||||||||||||||||||

| 6 | Operating lease right-of-use assets, net | - | - | - | - | - | - | |||||||||||||||||||

| 7 | Property and equipment, net | - | - | - | - | - | - | |||||||||||||||||||

| 8 | Other assets, Net[3] | 72,665 | (1 | ) | - | - | - | 72,664 | ||||||||||||||||||

| 9 | Total Assets | $ | 40,227,956 | $ | 262,236,789 | $ | 8,250,739 | $ | - | $ | (259,089,015 | ) | $ | 51,626,469 | ||||||||||||

| Liabilities And Stockholders' Equity | ||||||||||||||||||||||||||

| Current Liabilities | ||||||||||||||||||||||||||

| 10 | Accounts payable | $ | 259,047,741 | $ | 19,835,419 | $ | 857,028 | $ | - | $ | (255,292,687 | ) | $ | 24,447,501 | ||||||||||||

| 11 | Accrued liabilities[4] | 181,182 | 240,538 | - | - | - | 421,720 | |||||||||||||||||||

| 12 | Current portion of long-term debt | - | - | - | - | - | - | |||||||||||||||||||

| 13 | Current portion of operating lease liabilities[5] | 54,216,810 | - | - | - | - | 54,216,810 | |||||||||||||||||||

| 14 | Total Current Liabilities | 313,445,733 | 20,075,957 | 857,028 | - | (255,292,687 | ) | 79,086,031 | ||||||||||||||||||

| 15 | Operating lease liabilities | - | - | - | - | - | - | |||||||||||||||||||

| 16 | Long-term debt, net | - | - | - | - | - | - | |||||||||||||||||||

| 17 | Intercompany liabilities | (209,178,030 | ) | 52,412,189 | 157,286,163 | - | (520,322 | ) | - | |||||||||||||||||

| 18 | Total Liabilities | 104,267,703 | 72,488,147 | 158,143,190 | - | (255,813,009 | ) | 79,086,031 | ||||||||||||||||||

| 19 | Preferred Stock | - | - | - | - | - | - | |||||||||||||||||||

| Stockholders' Equity | ||||||||||||||||||||||||||

| 20 | Common stock | - | 1 | 39,449 | - | (2 | ) | 39,448 | ||||||||||||||||||

| 21 | APIC | - | 8,609,538 | 113,157,531 | - | (8,609,537 | ) | 113,157,532 | ||||||||||||||||||

| 22 | Retained earnings | (64,039,747 | ) | 181,139,103 | (103,068,049 | ) | - | 5,333,534 | 19,364,841 | |||||||||||||||||

| 23 | Treasury stock | - | - | (160,021,383 | ) | - | - | (160,021,383 | ) | |||||||||||||||||

| 24 | Total Stockholders' Equity | (64,039,747 | ) | 189,748,642 | (149,892,451 | ) | - | (3,276,005 | ) | (27,459,562 | ) | |||||||||||||||

| 25 | Total Liabilities And Stockholders' Equity | $ | 40,227,956 | $ | 262,236,789 | $ | 8,250,739 | $ | - | $ | (259,089,015 | ) | $ | 51,626,469 | ||||||||||||

Footnotes:

| [1] | Accounts receivable includes $34.0M income tax receivable, a $1.25M promissory note (due December 31, 2021) as a result of the Sale Transaction, and $140K of sales tax receivables. |

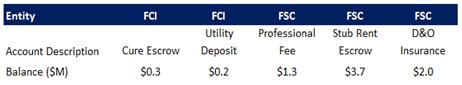

| [2] | Prepaid expenses and other current assets includes $1.8M of prepaid D&O insurance and the restricted cash as detailed in the table below: |

| [3] | Other assets, Net includes $73K of prepetition boutique utility and security deposits held by FCI. |

| [4] | FCI accrued liabilities includes $167K of accrued payroll taxes and $21K of accrued sales tax, offset by $7K of accrued income tax credits. FSC accrued liabilities includes $241K of accrued severance and payroll taxes. |

| [5] | Current portion of operating lease liabilities includes $29.1M of unpaid rent, $24.8M of lease rejection damages, and $243K of percent rent accruals. The leases associated with these liabilities are a part of ongoing negotiations and as such, the liability amount is subject to material change in future periods. |

Page 9 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

Debtor Attestation with Respect to Postpetition Taxes

Reporting Period: May 30, 2021 – July 3, 2021

Anthony M. Saccullo hereby declares under penalty of perjury:

I am the Wind-Down Officer appointed by order of the United States Bankruptcy Court for the District of Delaware [D.I. 475] in the above-captioned case to oversee the bankruptcy of the debtors and debtors in possession (collectively the "Debtors"). I am familiar with the Debtors’ day-to-day operations, business affairs, and books and records. I am authorized to submit this statement on behalf of the Debtors.

All statements in this statement are based on my personal knowledge, my review of the relevant documents, my discussions with other employees of the Debtors, or my opinion based upon my experience and knowledge of the Debtors' operations and financial condition. If I were called upon to testify, I could and would testify to each of the facts set forth herein based on such personal knowledge, review of documents, discussions with other employees of the Debtors or opinion.

To the best of my knowledge, information, and belief, and except as otherwise set forth in the MOR, all of the Debtors have filed all the necessary federal, state and local tax returns, or extensions related there to, and have timely made (or are in the process of remediating any immaterial late filings or prepayments) all related required postpetition tax payments, which are not subject to dispute or reconciliation, and are current.

| /s/ Anthony M. Saccullo | 7/20/21 | |

| Anthony M. Saccullo | Date | |

| Wind-Down Officer |

Page 10 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-4

Summary of Unpaid Postpetition Debts

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| Days Past Due[4] | ||||||||||||||||||||||||||

| # | Accounts Payable | Current | 0 - 30 Days | 31 - 60 Days | 61 - 90 Days | > 91 Days | Total | |||||||||||||||||||

| 1 | Combined Debtors[1][2][3] | $ | 532 | $ | - | $ | 3,955 | $ | 8,252 | $ | 533,285 | $ | 546,024 | |||||||||||||

Footnotes:

[1] The postpetition accounts payable represents open and outstanding trade vendor invoices that have been entered into the Debtors’ accounts payable system.

[2] This summary does not include accruals or intercompany payables.

[3] The postpetition accounts payable do not include any amounts for retained professionals.

[4] The Debtors' accounts payable system has incorrect aging information. The Debtors have paid post-petition invoices as they come due.

Page 11 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-5

Accounts Receivable Reconciliation and Aging

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

Accounts Receivable Reconciliation

| # | Reconciliation | Beginning Accounts Receivable | Change in Accounts Receivable | Ending Accounts Receivable | ||||||||||

| 1 | Total Accounts Receivable[1][2] | $ | 35,402,129 | $ | - | $ | 35,402,129 | |||||||

Accounts Receivable Aging

| Days Past Due | ||||||||||||||||||||||||||||||||||

| # | Aging | Current | 0 - 30 Days | 31 - 60 Days | 61 - 90 Days | 91+ Days | Total | Uncollectible | AR (Net) | |||||||||||||||||||||||||

| 2 | Income Tax Receivables | $ | 34,012,072 | $ | - | $ | - | $ | - | $ | - | $ | 34,012,072 | $ | - | $ | 34,012,072 | |||||||||||||||||

| 3 | Transaction Receivables[3] | 1,250,000 | - | - | - | - | 1,250,000 | - | 1,250,000 | |||||||||||||||||||||||||

| 4 | Sales Tax Receivables | 140,057 | - | - | - | - | 140,057 | - | 140,057 | |||||||||||||||||||||||||

| 5 | Total Accounts Receivable[1][2] | $ | 35,402,129 | $ | - | $ | - | $ | - | $ | - | $ | 35,402,129 | $ | - | $ | 35,402,129 | |||||||||||||||||

Footnotes:

[1] Amounts are aged from the due date and shown on a gross basis before any adjustment for estimated bad debts and other uncollectable amounts.

[2] This summary does not include any accrued fees, discounts or intercompany receivables.

[3] Transaction receivables includes the $1.25M promissory note due December 31, 2021.

Page 12 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

MOR-5

Debtor Questionnaire

Reporting Period: May 30, 2021 – July 3, 2021

| Must be completed each month | Yes | No | |

| 1. | Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. | X | |

| 2. | Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. | X | |

| 3. | Have all postpetition tax returns been timely filed? If no, provide an explanation below. | X | |

| 4. | Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. | X3 | |

| 5. | Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. | X | |

3 There are no employees or locations being operated by the Debtors as of February 1, 2021. As such, the only insurance policy of the Debtors in effect as of February 1, 2021, is the Debtors’ D&O insurance.

Page 13 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

Exhibit A

Balance Sheet by Legal Entity

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

Opening Balance Sheet at 05/30/2021

| # | Category | FCI | FSC | FHC | FLLC | Eliminations | Consolidated | |||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current Assets | ||||||||||||||||||||||||||

| 1 | Cash and cash equivalents | $ | 1,772,988 | $ | (198,565 | ) | $ | 7,265,739 | $ | - | $ | - | $ | 8,840,163 | ||||||||||||

| 2 | Accounts receivable[1] | 34,152,129 | 255,292,687 | 1,250,000 | - | (255,292,687 | ) | 35,402,129 | ||||||||||||||||||

| 3 | Inventories | 3,796,328 | - | - | - | (3,796,328 | ) | - | ||||||||||||||||||

| 4 | Prepaid expenses and other current assets[2] | 459,834 | 7,574,696 | - | - | - | 8,034,531 | |||||||||||||||||||

| 5 | Total Current Assets | 40,181,279 | 262,668,818 | 8,515,739 | - | (259,089,015 | ) | 52,276,822 | ||||||||||||||||||

| 6 | Operating lease right-of-use assets, net | - | - | - | - | - | - | |||||||||||||||||||

| 7 | Property and equipment, net | - | - | - | - | - | - | |||||||||||||||||||

| 8 | Other assets, Net[3] | 72,665 | (1 | ) | - | - | - | 72,664 | ||||||||||||||||||

| 9 | Total Assets | $ | 40,253,944 | $ | 262,668,818 | $ | 8,515,739 | $ | - | $ | (259,089,015 | ) | $ | 52,349,486 | ||||||||||||

| Liabilities And Stockholders' Equity | ||||||||||||||||||||||||||

| Current Liabilities | ||||||||||||||||||||||||||

| 10 | Accounts payable | $ | 259,064,857 | $ | 19,216,894 | $ | 857,028 | $ | - | $ | (255,292,687 | ) | $ | 23,846,091 | ||||||||||||

| 11 | Accrued liabilities[4] | 181,240 | 240,538 | - | - | - | 421,778 | |||||||||||||||||||

| 12 | Current portion of long-term debt | - | - | - | - | - | - | |||||||||||||||||||

| 13 | Current portion of operating lease liabilities[5] | 54,216,810 | - | - | - | - | 54,216,810 | |||||||||||||||||||

| 14 | Total Current Liabilities | 313,462,907 | 19,457,432 | 857,028 | - | (255,292,687 | ) | 78,484,679 | ||||||||||||||||||

| 15 | Operating lease liabilities | - | - | - | - | - | - | |||||||||||||||||||

| 16 | Long-term debt, net | - | - | - | - | - | - | |||||||||||||||||||

| 17 | Intercompany liabilities | (209,178,030 | ) | 52,147,189 | 157,551,163 | - | (520,322 | ) | - | |||||||||||||||||

| 18 | Total Liabilities | 104,284,877 | 71,604,621 | 158,408,190 | - | (255,813,009 | ) | 78,484,679 | ||||||||||||||||||

| 19 | Preferred Stock | - | - | - | - | - | - | |||||||||||||||||||

| Stockholders' Equity | ||||||||||||||||||||||||||

| 20 | Common stock | - | 1 | 39,449 | - | (2 | ) | 39,448 | ||||||||||||||||||

| 21 | APIC | - | 8,609,538 | 113,157,531 | - | (8,609,537 | ) | 113,157,532 | ||||||||||||||||||

| 22 | Retained earnings | (64,030,933 | ) | 182,454,658 | (103,068,049 | ) | - | 5,333,534 | 20,689,210 | |||||||||||||||||

| 23 | Treasury stock | - | - | (160,021,383 | ) | - | - | (160,021,383 | ) | |||||||||||||||||

| 24 | Total Stockholders' Equity | (64,030,933 | ) | 191,064,197 | (149,892,451 | ) | - | (3,276,005 | ) | (26,135,193 | ) | |||||||||||||||

| 25 | Total Liabilities And Stockholders' Equity | $ | 40,253,944 | $ | 262,668,818 | $ | 8,515,739 | $ | - | $ | (259,089,015 | ) | $ | 52,349,486 | ||||||||||||

Footnotes:

| [1] | Accounts receivable includes $34.0M income tax receivable, a $1.25M promissory note (due December 31, 2021) as a result of the Sale Transaction, and $140K of sales tax receivables. |

| [2] | Prepaid expenses and other current assets include $604K of prepaid assets (primarily related to D&O insurance) and restricted cash as detailed in the table below: |

| [3] | Other assets, Net includes $73K of prepetition boutique utility and security deposits held by FCI. |

| [4] | FCI accrued liabilities includes $167K of accrued payroll taxes and $21K of accrued sales tax, offset by $7K of accrued income tax credits. FSC accrued liabilities includes $241K of accrued severance and payroll taxes. |

| [5] | Current portion of operating lease liabilities includes $29.1M of unpaid rent, $24.8M of lease rejection damages, and $243K of percent rent accruals. The leases associated with these liabilities are a part of ongoing negotiations and as such, the liability amount is subject to material change in future periods. |

Page 14 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

Exhibit B

Disbursements by Legal Entity

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| # | Debtor Name | Abbreviation | Case Number | Disbursements[1] | ||||||

| 1 | FHC Holdings Corporation | FHC | 20-13076 | $ | - | |||||

| 2 | FHC, LLC | FLLC | 20-13077 | - | ||||||

| 3 | FHC Collections, Inc. | FCI | 20-13078 | 25,958 | ||||||

| 4 | FHC Services Corporation | FSC | 20-13079 | 239,328 | ||||||

| 5 | Total | $ | 265,287 | |||||||

[1] Includes disbursements made May 30, 2021 - July 3, 2021.

Page 15 of 16

| In re: | Case No. 20-13076 (BLS) |

| FHC Holdings Corporation, et al. | Reporting Period: May 30, 2021 – July 3, 2021 |

| Debtors |

Exhibit C

Balance Sheet Bridge

Reporting Period: May 30, 2021 – July 3, 2021

($’s in USD)

| Category | FCI | FSC | FHC | FLLC | Eliminations | Consolidated[1] | ||||||||||||||||||

| Total liabilities per MOR Form Part 2 | $ | 215,896,665 | $ | 13,649,914 | $ | - | $ | - | $ | - | $ | 229,546,579 | ||||||||||||

| Plus: Other liabilities on balance sheet | ||||||||||||||||||||||||

| Other accrued expenses and payables | 72,564,124 | 6,185,505 | 857,028 | - | (255,292,687 | ) | (175,686,030 | ) | ||||||||||||||||

| Other accrued liabilities | 24,984,944 | 240,538 | - | - | - | 25,225,482 | ||||||||||||||||||

| Intercompany liabilities | (209,178,030 | ) | 52,412,189 | 157,286,163 | - | (520,322 | ) | - | ||||||||||||||||

| Total liabilities per balance sheet | $ | 104,267,703 | $ | 72,488,147 | $ | 158,143,190 | $ | - | $ | (255,813,009 | ) | $ | 79,086,031 | |||||||||||

| Liabilities per MOR Form Part 2 | $ | 215,896,665 | $ | 13,649,914 | $ | - | $ | - | $ | - | $ | 229,546,579 | ||||||||||||

| Liabilities per balance sheet | 104,267,703 | 72,488,147 | 158,143,190 | - | (255,813,009 | ) | 79,086,031 | |||||||||||||||||

| Liabilities Variance | $ | 111,628,962 | $ | (58,838,233 | ) | $ | (158,143,190 | ) | $ | - | $ | 255,813,009 | $ | 150,460,548 | ||||||||||

| [1] | This table shows detail that is not able to be captured directly by each MOR Form Part 2 being filed by each Debtor in their respective cases regarding total liabilities for the Debtors on their consolidated balance sheet. When all four affiliated Debtors are viewed on a consolidated basis, the total liabilities presented on the individual MOR Form Part 2 filed by each Debtor are, in the aggregate, greater than the consolidated liabilities on the Debtors’ balance sheet by approximately $150M, due to intercompany scheduled liabilities. |

Page 16 of 16