falseFY20190001396009P3YP4YP3YP4Y0001396009srt:MinimumMemberus-gaap:PerformanceSharesMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:PerformanceSharesMember2019-01-012019-12-310001396009us-gaap:AccountingStandardsUpdate201609Member2019-01-012019-12-310001396009us-gaap:AccountingStandardsUpdate201609Member2018-01-012018-12-310001396009us-gaap:AccountingStandardsUpdate201609Member2017-01-012017-12-3100013960092012-01-012013-12-310001396009srt:MinimumMembervmc:AggregatesMember2019-01-012019-12-310001396009srt:MaximumMembervmc:AggregatesMember2019-01-012019-12-310001396009vmc:TopFiveBondsMember2019-01-012019-12-310001396009stpr:ALus-gaap:StateAndLocalJurisdictionMemberus-gaap:LatestTaxYearMember2019-01-012019-12-310001396009stpr:ALus-gaap:StateAndLocalJurisdictionMemberus-gaap:EarliestTaxYearMember2019-01-012019-12-310001396009us-gaap:SuretyBondMember2019-01-012019-12-310001396009vmc:AsphaltMembervmc:AsphaltConstructionPavingMember2019-01-012019-12-3100013960092007-05-012007-05-310001396009vmc:InvestmentGradeTypeCovenantsGovernedMember2019-01-012019-12-310001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2018-02-012018-02-280001396009vmc:NorthAmericanFreeTradeAgreementMembersrt:MinimumMember2019-01-012019-12-310001396009vmc:TexasBrineMember2019-01-012019-12-310001396009vmc:NewYorkWaterDistrictCasesMember2019-01-012019-12-310001396009srt:MinimumMembervmc:SalesYardMember2019-01-012019-12-310001396009srt:MinimumMembervmc:RailMember2019-01-012019-12-310001396009srt:MinimumMembervmc:OfficeAndPlantEquipmentMember2019-01-012019-12-310001396009srt:MinimumMembervmc:ConcreteAndAsphaltSiteMember2019-01-012019-12-310001396009srt:MinimumMembervmc:BargeMember2019-01-012019-12-310001396009srt:MaximumMembervmc:SalesYardMember2019-01-012019-12-310001396009srt:MaximumMembervmc:RailMember2019-01-012019-12-310001396009srt:MaximumMembervmc:OfficeAndPlantEquipmentMember2019-01-012019-12-310001396009srt:MaximumMembervmc:ConcreteAndAsphaltSiteMember2019-01-012019-12-310001396009srt:MaximumMembervmc:BargeMember2019-01-012019-12-310001396009vmc:TexasBrineMember2017-12-012017-12-310001396009vmc:OccidentalChemicalCoMember2017-12-012017-12-310001396009srt:ParentCompanyMember2017-12-012017-12-310001396009vmc:Acquisitions2017Memberus-gaap:ContractualRightsMember2019-01-012019-12-310001396009vmc:EnvironmentalProtectionAgencyMembersrt:MaximumMember2019-01-012019-12-310001396009us-gaap:LineOfCreditMembervmc:MaximumUponCertainAcquisitionsMember2019-01-012019-12-310001396009vmc:ThreePointNinetyNotesDueTwentyTwentySevenMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:SevenPointOneFivePercentNotesDueTwentyThirtySevenMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:SevenPointFiveZeroPercentNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:FourPointFiveZeroPercentDueTwentyFortySevenMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:FourPointFiveZeroNotesDueTwentyTwentyFiveMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:FloatingRateNotesDue2021Memberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:FloatingRateNotesDue2020Memberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:EightPointEightFiveNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:UnsecuredDebtMember2019-01-012019-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:LineOfCreditMember2019-01-012019-12-310001396009srt:MinimumMember2019-01-012019-12-310001396009srt:MaximumMember2019-01-012019-12-310001396009vmc:ConstructionPavingMembersrt:MaximumMember2019-01-012019-12-310001396009us-gaap:RetainedEarningsMember2019-12-310001396009us-gaap:AdditionalPaidInCapitalMember2019-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001396009us-gaap:RetainedEarningsMember2018-12-310001396009us-gaap:AdditionalPaidInCapitalMember2018-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001396009us-gaap:RetainedEarningsMember2016-12-310001396009us-gaap:AdditionalPaidInCapitalMember2016-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2016-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:LineOfCreditMember2019-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:LineOfCreditMember2018-12-310001396009us-gaap:CommonStockMember2019-12-310001396009us-gaap:CommonStockMember2018-12-310001396009us-gaap:CommonStockMember2016-12-310001396009vmc:StockOnlyStockAppreciationRightsMember2018-12-310001396009us-gaap:RestrictedStockMember2018-12-310001396009us-gaap:PerformanceSharesMember2018-12-310001396009vmc:StockOnlyStockAppreciationRightsMembervmc:TwoThousandSixteenAwardsMember2019-01-012019-12-310001396009vmc:StockOnlyStockAppreciationRightsMembervmc:TwoThousandSeventeenToTwoThousandNineteenAwardsMember2019-01-012019-12-310001396009us-gaap:RestrictedStockMembervmc:TwoThousandSixteenAwardsMember2019-01-012019-12-310001396009us-gaap:RestrictedStockMembervmc:TwoThousandSeventeenToTwoThousandNineteenAwardsMember2019-01-012019-12-310001396009us-gaap:PerformanceSharesMembervmc:TwoThousandSixteenAwardsMember2019-01-012019-12-310001396009us-gaap:PerformanceSharesMembervmc:TwoThousandSeventeenToTwoThousandNineteenAwardsMember2019-01-012019-12-310001396009vmc:WestMembervmc:ConcreteMember2019-01-012019-12-310001396009vmc:WestMembervmc:CalciumMember2019-01-012019-12-310001396009vmc:WestMembervmc:AsphaltMember2019-01-012019-12-310001396009vmc:WestMembervmc:AggregatesMember2019-01-012019-12-310001396009vmc:GulfCoastMembervmc:ConcreteMember2019-01-012019-12-310001396009vmc:GulfCoastMembervmc:CalciumMember2019-01-012019-12-310001396009vmc:GulfCoastMembervmc:AsphaltMember2019-01-012019-12-310001396009vmc:GulfCoastMembervmc:AggregatesMember2019-01-012019-12-310001396009vmc:EastMembervmc:ConcreteMember2019-01-012019-12-310001396009vmc:EastMembervmc:CalciumMember2019-01-012019-12-310001396009vmc:EastMembervmc:AsphaltMember2019-01-012019-12-310001396009vmc:EastMembervmc:AggregatesMember2019-01-012019-12-310001396009us-gaap:NonUsMembervmc:AsphaltConcreteAndCalciumMember2019-01-012019-12-310001396009us-gaap:NonUsMembervmc:AggregatesMember2019-01-012019-12-310001396009us-gaap:IntersegmentEliminationMembervmc:ConcreteMember2019-01-012019-12-310001396009us-gaap:IntersegmentEliminationMembervmc:CalciumMember2019-01-012019-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AsphaltMember2019-01-012019-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AggregatesMember2019-01-012019-12-310001396009vmc:WestMember2019-01-012019-12-310001396009vmc:RevenueExcludingFreightDeliveryMember2019-01-012019-12-310001396009vmc:GulfCoastMember2019-01-012019-12-310001396009vmc:EastMember2019-01-012019-12-310001396009us-gaap:ServiceMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMember2019-01-012019-12-310001396009us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001396009us-gaap:CargoAndFreightMember2019-01-012019-12-310001396009country:US2019-01-012019-12-310001396009vmc:WestMembervmc:ConcreteMember2018-01-012018-12-310001396009vmc:WestMembervmc:CalciumMember2018-01-012018-12-310001396009vmc:WestMembervmc:AsphaltMember2018-01-012018-12-310001396009vmc:WestMembervmc:AggregatesMember2018-01-012018-12-310001396009vmc:GulfCoastMembervmc:ConcreteMember2018-01-012018-12-310001396009vmc:GulfCoastMembervmc:CalciumMember2018-01-012018-12-310001396009vmc:GulfCoastMembervmc:AsphaltMember2018-01-012018-12-310001396009vmc:GulfCoastMembervmc:AggregatesMember2018-01-012018-12-310001396009vmc:EastMembervmc:ConcreteMember2018-01-012018-12-310001396009vmc:EastMembervmc:CalciumMember2018-01-012018-12-310001396009vmc:EastMembervmc:AsphaltMember2018-01-012018-12-310001396009vmc:EastMembervmc:AggregatesMember2018-01-012018-12-310001396009us-gaap:NonUsMembervmc:AsphaltConcreteAndCalciumMember2018-01-012018-12-310001396009us-gaap:NonUsMembervmc:AggregatesMember2018-01-012018-12-310001396009us-gaap:IntersegmentEliminationMembervmc:ConcreteMember2018-01-012018-12-310001396009us-gaap:IntersegmentEliminationMembervmc:CalciumMember2018-01-012018-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AsphaltMember2018-01-012018-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AggregatesMember2018-01-012018-12-310001396009vmc:WestMember2018-01-012018-12-310001396009vmc:RevenueExcludingFreightDeliveryMember2018-01-012018-12-310001396009vmc:GulfCoastMember2018-01-012018-12-310001396009vmc:EastMember2018-01-012018-12-310001396009us-gaap:ServiceMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMember2018-01-012018-12-310001396009us-gaap:IntersegmentEliminationMember2018-01-012018-12-310001396009us-gaap:CargoAndFreightMember2018-01-012018-12-310001396009country:US2018-01-012018-12-310001396009vmc:WestMembervmc:ConcreteMember2017-01-012017-12-310001396009vmc:WestMembervmc:CalciumMember2017-01-012017-12-310001396009vmc:WestMembervmc:AsphaltMember2017-01-012017-12-310001396009vmc:WestMembervmc:AggregatesMember2017-01-012017-12-310001396009vmc:GulfCoastMembervmc:ConcreteMember2017-01-012017-12-310001396009vmc:GulfCoastMembervmc:CalciumMember2017-01-012017-12-310001396009vmc:GulfCoastMembervmc:AsphaltMember2017-01-012017-12-310001396009vmc:GulfCoastMembervmc:AggregatesMember2017-01-012017-12-310001396009vmc:EastMembervmc:ConcreteMember2017-01-012017-12-310001396009vmc:EastMembervmc:CalciumMember2017-01-012017-12-310001396009vmc:EastMembervmc:AsphaltMember2017-01-012017-12-310001396009vmc:EastMembervmc:AggregatesMember2017-01-012017-12-310001396009us-gaap:NonUsMembervmc:AsphaltConcreteAndCalciumMember2017-01-012017-12-310001396009us-gaap:NonUsMembervmc:AggregatesMember2017-01-012017-12-310001396009us-gaap:IntersegmentEliminationMembervmc:ConcreteMember2017-01-012017-12-310001396009us-gaap:IntersegmentEliminationMembervmc:CalciumMember2017-01-012017-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AsphaltMember2017-01-012017-12-310001396009us-gaap:IntersegmentEliminationMembervmc:AggregatesMember2017-01-012017-12-310001396009vmc:WestMember2017-01-012017-12-310001396009vmc:RevenueExcludingFreightDeliveryMember2017-01-012017-12-310001396009vmc:GulfCoastMember2017-01-012017-12-310001396009vmc:EastMember2017-01-012017-12-310001396009vmc:ConcreteMember2017-01-012017-12-310001396009vmc:CalciumMember2017-01-012017-12-310001396009vmc:AsphaltMember2017-01-012017-12-310001396009vmc:AggregatesMember2017-01-012017-12-310001396009us-gaap:ServiceMember2017-01-012017-12-310001396009us-gaap:OperatingSegmentsMember2017-01-012017-12-310001396009us-gaap:IntersegmentEliminationMember2017-01-012017-12-310001396009us-gaap:CargoAndFreightMember2017-01-012017-12-310001396009country:US2017-01-012017-12-310001396009vmc:NoncapitalMember2019-12-310001396009us-gaap:PropertyPlantAndEquipmentMember2019-12-310001396009srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2019-01-012019-12-310001396009srt:MinimumMemberus-gaap:LandImprovementsMember2019-01-012019-12-310001396009srt:MinimumMemberus-gaap:BuildingMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:LandImprovementsMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:BuildingMember2019-01-012019-12-310001396009vmc:DeferredAssetRetirementCostsMember2019-12-310001396009us-gaap:ProductiveLandMember2019-12-310001396009us-gaap:MachineryAndEquipmentMember2019-12-310001396009us-gaap:LeaseholdsAndLeaseholdImprovementsMember2019-12-310001396009us-gaap:LandAndLandImprovementsMember2019-12-310001396009us-gaap:ConstructionInProgressMember2019-12-310001396009us-gaap:BuildingMember2019-12-310001396009vmc:DeferredAssetRetirementCostsMember2018-12-310001396009us-gaap:ProductiveLandMember2018-12-310001396009us-gaap:MachineryAndEquipmentMember2018-12-310001396009us-gaap:LeaseholdsAndLeaseholdImprovementsMember2018-12-310001396009us-gaap:LandAndLandImprovementsMember2018-12-310001396009us-gaap:ConstructionInProgressMember2018-12-310001396009us-gaap:BuildingMember2018-12-310001396009us-gaap:CorporateMember2019-01-012019-12-310001396009us-gaap:CorporateMember2018-01-012018-12-310001396009us-gaap:CorporateMember2017-01-012017-12-3100013960092018-02-012018-02-280001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2018-03-012018-03-310001396009vmc:SevenPointFiveZeroPercentNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2018-01-012018-01-310001396009vmc:SevenPointOneFivePercentNotesDueTwentyThirtySevenMemberus-gaap:UnsecuredDebtMember2018-03-012018-03-310001396009vmc:OfficersAndKeyEmployeesMember2019-01-012019-12-310001396009vmc:OfficersAndKeyEmployeesMember2018-01-012018-12-310001396009vmc:OfficersAndKeyEmployeesMember2017-01-012017-12-310001396009vmc:NonIncentiveEligibleEmployeesMember2017-01-012017-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-01-012019-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-01-012018-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-01-012017-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-01-012017-12-310001396009stpr:ALus-gaap:StateAndLocalJurisdictionMember2019-12-310001396009us-gaap:AccountingStandardsUpdate201602Member2019-03-310001396009us-gaap:GoodwillMember2019-01-012019-12-310001396009us-gaap:NonUsMember2019-12-310001396009us-gaap:NonUsMember2018-12-310001396009us-gaap:NonUsMember2017-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2017-01-012017-12-310001396009vmc:NorthAmericanFreeTradeAgreementMember2019-01-012019-12-310001396009vmc:TopFiveBondsMember2019-12-310001396009us-gaap:SuretyBondMember2019-12-310001396009vmc:EpaAdministrativeOrderMember2019-06-012019-06-300001396009vmc:HewittLandfillMatterMember2019-10-012019-12-3100013960092018-01-012019-12-310001396009vmc:FloatingRateNotesDue2020Member2019-12-310001396009us-gaap:StandbyLettersOfCreditMember2019-01-012019-12-310001396009srt:MinimumMemberus-gaap:LineOfCreditMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:LineOfCreditMember2019-01-012019-12-310001396009us-gaap:LineOfCreditMember2019-01-012019-12-310001396009us-gaap:LineOfCreditMember2019-12-310001396009us-gaap:StandbyLettersOfCreditMember2019-12-310001396009srt:MinimumMembervmc:SalesYardMember2019-12-310001396009srt:MinimumMembervmc:RailMember2019-12-310001396009srt:MinimumMembervmc:OfficeAndPlantEquipmentShortTermLeaseMember2019-12-310001396009srt:MinimumMembervmc:OfficeAndPlantEquipmentMember2019-12-310001396009srt:MinimumMembervmc:ConcreteAndAsphaltSiteMember2019-12-310001396009srt:MinimumMembervmc:BargeMember2019-12-310001396009srt:MinimumMemberus-gaap:BuildingMember2019-12-310001396009srt:MaximumMembervmc:SalesYardMember2019-12-310001396009srt:MaximumMembervmc:RailMember2019-12-310001396009srt:MaximumMembervmc:OfficeAndPlantEquipmentMember2019-12-310001396009srt:MaximumMembervmc:ConcreteAndAsphaltSiteMember2019-12-310001396009srt:MaximumMembervmc:BargeMember2019-12-310001396009srt:MaximumMemberus-gaap:EquipmentMember2019-12-310001396009srt:MaximumMemberus-gaap:BuildingMember2019-12-310001396009us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-01-012019-12-310001396009us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2018-01-012018-12-310001396009us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2017-01-012017-12-310001396009vmc:DebtInstrumentMember2017-01-012017-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-01-012019-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-01-012018-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-01-012017-12-310001396009us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-01-012017-12-310001396009vmc:Acquisitions2018Member2019-01-012019-12-310001396009vmc:ConcreteMember2019-01-012019-12-310001396009vmc:CalciumMember2019-01-012019-12-310001396009vmc:AsphaltMember2019-01-012019-12-310001396009vmc:AggregatesMember2019-01-012019-12-310001396009vmc:Acquisitions2018Member2018-01-012019-12-310001396009vmc:ConcreteMember2018-01-012018-12-310001396009vmc:CalciumMember2018-01-012018-12-310001396009vmc:AsphaltMember2018-01-012018-12-310001396009vmc:AggregatesMember2018-01-012018-12-310001396009vmc:ConcreteMember2019-12-310001396009vmc:CalciumMember2019-12-310001396009vmc:AsphaltMember2019-12-310001396009vmc:ConcreteMember2018-12-310001396009vmc:CalciumMember2018-12-310001396009vmc:AsphaltMember2018-12-310001396009vmc:ConcreteMember2017-12-310001396009vmc:CalciumMember2017-12-310001396009vmc:AsphaltMember2017-12-310001396009stpr:GA2018-01-012018-03-310001396009vmc:AggregatesUsaMember2017-10-012017-12-310001396009stpr:AZ2017-10-012017-12-310001396009vmc:Acquisitions2018Membervmc:ContractualRightsStraightLineMethodMember2018-01-012018-12-310001396009vmc:Acquisitions2018Membervmc:ContractualRightsInPlaceUnitsOfSalesMember2018-01-012018-12-310001396009vmc:Acquisitions2017Membervmc:ContractualRightsStraightLineMethodMember2017-01-012017-12-310001396009vmc:Acquisitions2017Membervmc:ContractualRightsInPlaceUnitsOfSalesMember2017-01-012017-12-310001396009vmc:Acquisitions2017Member2017-01-012017-12-310001396009us-gaap:UseRightsMember2019-12-310001396009us-gaap:OtherIntangibleAssetsMember2019-12-310001396009us-gaap:NoncompeteAgreementsMember2019-12-310001396009us-gaap:ContractualRightsMember2019-12-310001396009us-gaap:UseRightsMember2018-12-310001396009us-gaap:OtherIntangibleAssetsMember2018-12-310001396009us-gaap:NoncompeteAgreementsMember2018-12-310001396009us-gaap:ContractualRightsMember2018-12-310001396009vmc:AggregatesMember2019-12-310001396009vmc:AggregatesMember2018-12-310001396009vmc:AggregatesMember2017-12-310001396009vmc:StockOnlyStockAppreciationRightsMember2019-12-310001396009us-gaap:RestrictedStockMember2019-12-310001396009us-gaap:PerformanceSharesMember2019-12-310001396009us-gaap:ScenarioPlanMember2018-01-012018-12-3100013960092019-10-012019-12-3100013960092019-07-012019-09-3000013960092019-04-012019-06-3000013960092019-01-012019-03-3100013960092018-10-012018-12-3100013960092018-07-012018-09-3000013960092018-04-012018-06-3000013960092018-01-012018-03-310001396009vmc:Acquisitions2017Membervmc:AggregatesUsaMember2017-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2019-01-012019-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2018-01-012018-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2017-01-012017-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2017-01-012017-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2017-01-012017-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2017-01-012017-12-310001396009us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2017-01-012017-12-310001396009us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001396009us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-01-012017-12-310001396009vmc:ReturnSeekingMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:LiabilityHedgeMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:ReturnSeekingMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:LiabilityHedgeMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:TotalMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:PrivatePartnershipsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:InterestInCommonCollectiveTrustsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:EquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:TotalMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:PrivatePartnershipsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:InvestmentsInFairValueHierarchyMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009vmc:InterestInCommonCollectiveTrustsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:EquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:DebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:CommodityContractMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001396009us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001396009us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001396009us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2017-01-012017-12-310001396009srt:ScenarioForecastMember2020-01-012020-12-310001396009srt:MinimumMember2019-12-310001396009srt:MaximumMember2019-12-310001396009srt:MinimumMember2018-12-310001396009srt:MaximumMember2018-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2017-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2017-01-012017-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-01-012017-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310001396009us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2019-12-310001396009us-gaap:NonqualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2018-12-310001396009stpr:AL2019-12-310001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2018-02-280001396009vmc:FloatingRateNotesDue2021Memberus-gaap:UnsecuredDebtMember2018-02-280001396009vmc:SevenPointFiveZeroPercentNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2018-01-310001396009vmc:ThreePointNinetyNotesDueTwentyTwentySevenMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:SevenPointOneFivePercentNotesDueTwentyThirtySevenMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:InvestmentGradeTypeCovenantsGovernedMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:FourPointFiveZeroPercentDueTwentyFortySevenMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:FourPointFiveZeroNotesDueTwentyTwentyFiveMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:FloatingRateNotesDue2021Memberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:FloatingRateNotesDue2020Memberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:EightPointEightFiveNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2019-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:LineOfCreditMember2019-12-310001396009us-gaap:UnsecuredDebtMember2019-12-310001396009us-gaap:NotesPayableOtherPayablesMember2019-12-310001396009vmc:ThreePointNinetyNotesDueTwentyTwentySevenMemberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:TermLoanDue2021Memberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:SevenPointOneFivePercentNotesDueTwentyThirtySevenMemberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:FourPointSeventyPercentDue2048Memberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:FourPointFiveZeroPercentDueTwentyFortySevenMemberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:FourPointFiveZeroNotesDueTwentyTwentyFiveMemberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:FloatingRateNotesDue2021Memberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:FloatingRateNotesDue2020Memberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:EightPointEightFiveNotesDueTwentyTwentyOneMemberus-gaap:UnsecuredDebtMember2018-12-310001396009vmc:BankLineOfCreditDue2021Memberus-gaap:LineOfCreditMember2018-12-310001396009us-gaap:NotesPayableToBanksMember2018-12-310001396009us-gaap:NotesPayableOtherPayablesMember2018-12-310001396009us-gaap:LineOfCreditMember2018-12-310001396009vmc:SevenPointOneFivePercentNotesDueTwentyThirtySevenMemberus-gaap:UnsecuredDebtMember2018-03-310001396009srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001396009srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001396009srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2019-01-012019-12-310001396009us-gaap:StandbyLettersOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001396009us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001396009us-gaap:LineOfCreditMemberus-gaap:BaseRateMember2019-01-012019-12-310001396009us-gaap:RetainedEarningsMember2017-12-310001396009us-gaap:CommonStockMember2017-12-310001396009us-gaap:AdditionalPaidInCapitalMember2017-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001396009us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001396009us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001396009vmc:Acquisitions2018Member2019-12-310001396009vmc:ImmaterialBusinessAcquisitionsMember2017-12-310001396009vmc:Acquisitions2019Member2019-01-012019-12-310001396009vmc:Acquisitions2018Member2018-01-012018-12-310001396009vmc:ImmaterialBusinessAcquisitionsMember2017-01-012017-12-3100013960092016-01-012016-12-310001396009vmc:Acquisitions2018Member2018-12-310001396009vmc:Acquisitions2017Member2017-12-310001396009vmc:Acquisitions2017Member2019-01-012019-12-310001396009stpr:AZ2017-12-310001396009us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001396009us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001396009us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001396009us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001396009us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001396009us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001396009us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001396009us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2019-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2019-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2019-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2019-12-310001396009us-gaap:OperatingSegmentsMember2019-12-310001396009us-gaap:CorporateMember2019-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2018-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2018-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2018-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2018-12-310001396009us-gaap:OperatingSegmentsMember2018-12-310001396009us-gaap:CorporateMember2018-12-310001396009us-gaap:OperatingSegmentsMembervmc:ConcreteMember2017-12-310001396009us-gaap:OperatingSegmentsMembervmc:CalciumMember2017-12-310001396009us-gaap:OperatingSegmentsMembervmc:AsphaltMember2017-12-310001396009us-gaap:OperatingSegmentsMembervmc:AggregatesMember2017-12-310001396009us-gaap:OperatingSegmentsMember2017-12-310001396009us-gaap:CorporateMember2017-12-310001396009stpr:CA2019-01-012019-12-310001396009stpr:CA2018-01-012018-12-310001396009us-gaap:StandbyLettersOfCreditMember2019-12-310001396009vmc:StockOnlyStockAppreciationRightsMember2019-01-012019-12-310001396009vmc:PerformanceSharesRestrictedStockUnitsAndStockOptionsMember2019-01-012019-12-310001396009vmc:DeferredStockUnitsMember2019-01-012019-12-310001396009us-gaap:RestrictedStockMember2019-01-012019-12-310001396009us-gaap:PerformanceSharesMember2019-01-012019-12-310001396009vmc:StockOnlyStockAppreciationRightsMember2018-01-012018-12-310001396009vmc:PerformanceSharesRestrictedStockUnitsAndStockOptionsMember2018-01-012018-12-310001396009vmc:DeferredStockUnitsMember2018-01-012018-12-310001396009us-gaap:RestrictedStockMember2018-01-012018-12-310001396009us-gaap:PerformanceSharesMember2018-01-012018-12-310001396009vmc:StockOnlyStockAppreciationRightsMember2017-01-012017-12-310001396009vmc:PerformanceSharesRestrictedStockUnitsAndStockOptionsMember2017-01-012017-12-310001396009vmc:DeferredStockUnitsMember2017-01-012017-12-310001396009us-gaap:RestrictedStockMember2017-01-012017-12-310001396009us-gaap:PerformanceSharesMember2017-01-012017-12-310001396009us-gaap:RetainedEarningsMember2019-01-012019-12-310001396009us-gaap:CommonStockMember2019-01-012019-12-310001396009us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001396009us-gaap:RetainedEarningsMember2018-01-012018-12-310001396009us-gaap:CommonStockMember2018-01-012018-12-310001396009us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-3100013960092018-01-012018-12-310001396009us-gaap:RetainedEarningsMember2017-01-012017-12-310001396009us-gaap:CommonStockMember2017-01-012017-12-310001396009us-gaap:AdditionalPaidInCapitalMember2017-01-012017-12-310001396009us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-01-012017-12-3100013960092017-01-012017-12-310001396009vmc:Acquisitions2019Membervmc:ContractualRightsStraightLineMethodMember2019-01-012019-12-310001396009vmc:Acquisitions2018Membervmc:ContractualRightsStraightLineMethodMember2019-01-012019-12-310001396009vmc:Acquisitions2018Membervmc:ContractualRightsInPlaceUnitsOfSalesMember2019-01-012019-12-310001396009vmc:Acquisitions2017Membervmc:ContractualRightsStraightLineMethodMember2019-01-012019-12-310001396009vmc:Acquisitions2017Membervmc:ContractualRightsInPlaceUnitsOfSalesMember2019-01-012019-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310001396009us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2016-12-310001396009us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2016-12-3100013960092016-12-3100013960092017-12-310001396009us-gaap:SegmentDiscontinuedOperationsMember2019-12-310001396009us-gaap:SegmentContinuingOperationsMember2019-12-310001396009us-gaap:SegmentDiscontinuedOperationsMember2018-12-310001396009us-gaap:SegmentContinuingOperationsMember2018-12-3100013960092019-12-3100013960092018-12-3100013960092019-06-2800013960092020-02-1300013960092019-01-012019-12-31utr:acrevmc:entityutr:mivmc:factorvmc:ShareBasedCompensationPlanvmc:propertyvmc:statevmc:itemvmc:segmentxbrli:pureiso4217:USDxbrli:sharesiso4217:USDvmc:employeexbrli:shares

| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2019 OR |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From to |

Commission file number: 001-33841 VULCAN MATERIALS COMPANY (Exact Name of Registrant as Specified in Its Charter) |

New Jersey (State or other jurisdiction of incorporation or organization) | 20-8579133 (I.R.S. Employer Identification No.) |

1200 Urban Center Drive, Birmingham, Alabama (Address of Principal Executive Offices) | 35242 (Zip Code) |

(205) 298-3000 (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class Common Stock, $1 par value | Trading Symbol VMC | Name of each exchange on which registered New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer þ Non-accelerated filer o | Accelerated filer o Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes o No þ

|

| |

Aggregate market value of voting and non-voting common stock held by non-affiliates as of June 28, 2019: |

$18,124,821,274

|

Number of shares of common stock, $1.00 par value, outstanding as of February 13, 2020: | 132,394,732 |

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the registrant’s annual proxy statement for the annual meeting of its shareholders to be held on May 8, 2020, are incorporated by reference into Part III of this Annual Report on Form 10-K. |

Unless otherwise stated or the context otherwise requires, references in this report to “Vulcan,” the “Company,” “we,” “our,” or “us” refer to Vulcan Materials Company and its consolidated subsidiaries.

PART I

“SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

Certain of the matters and statements made herein or incorporated by reference into this report constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. All such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements reflect our intent, belief or current expectation. Often, forward-looking statements can be identified by the use of words, such as “anticipate,” “may,” “believe,” “estimate,” “project,” “expect,” “intend” and words of similar import. In addition to the statements included in this report, we may from time to time make other oral or written forward-looking statements in other filings under the Securities Exchange Act of 1934 or in other public disclosures. Forward-looking statements are not guarantees of future performance, and actual results could differ materially from those indicated by the forward-looking statements. All forward-looking statements involve certain assumptions, risks and uncertainties that could cause actual results to differ materially from those included in or contemplated by the statements. These assumptions, risks and uncertainties include, but are not limited to:

general economic and business conditions

our dependence on the construction industry, which is subject to economic cycles

the timing and amount of federal, state and local funding for infrastructure

changes in the level of spending for private residential and private nonresidential construction

changes in our effective tax rate

the increasing reliance on information technology infrastructure, including the risks that the infrastructure does not work as intended, experiences technical difficulties or is subjected to cyber-attacks

the impact of the state of the global economy on our businesses and financial condition and access to capital markets

the highly competitive nature of the construction industry

the impact of future regulatory or legislative actions, including those relating to climate change, wetlands, greenhouse gas emissions, the definition of minerals, tax policy or international trade

the outcome of pending legal proceedings

pricing of our products

weather and other natural phenomena, including the impact of climate change and availability of water

energy costs

costs of hydrocarbon-based raw materials

healthcare costs

the amount of long-term debt and interest expense we incur

changes in interest rates

the impact of a discontinuation of the London Interbank Offered Rate (LIBOR)

volatility in pension plan asset values and liabilities, which may require cash contributions to the pension plans

the impact of environmental cleanup costs and other liabilities relating to existing and/or divested businesses

our ability to secure and permit aggregates reserves in strategically located areas

our ability to manage and successfully integrate acquisitions

the effect of changes in tax laws, guidance and interpretations

significant downturn in the construction industry may result in the impairment of goodwill or long-lived assets

changes in technologies, which could disrupt the way we do business and how our products are distributed

the risks set forth in Item 1A “Risk Factors,” Item 3 “Legal Proceedings,” Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 12 “Commitments and Contingencies” to the consolidated financial statements in Item 8 “Financial Statements and Supplementary Data,” all as set forth in this report

other assumptions, risks and uncertainties detailed from time to time in our filings made with the Securities and Exchange Commission

All forward-looking statements are made as of the date of filing or publication. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by law. Investors are cautioned not to rely unduly on such forward-looking statements when evaluating the information presented in our filings, and are advised to consult any of our future disclosures in filings made with the Securities and Exchange Commission and our press releases with regard to our business and consolidated financial position, results of operations and cash flows.

ITEM 1

BUSINESS

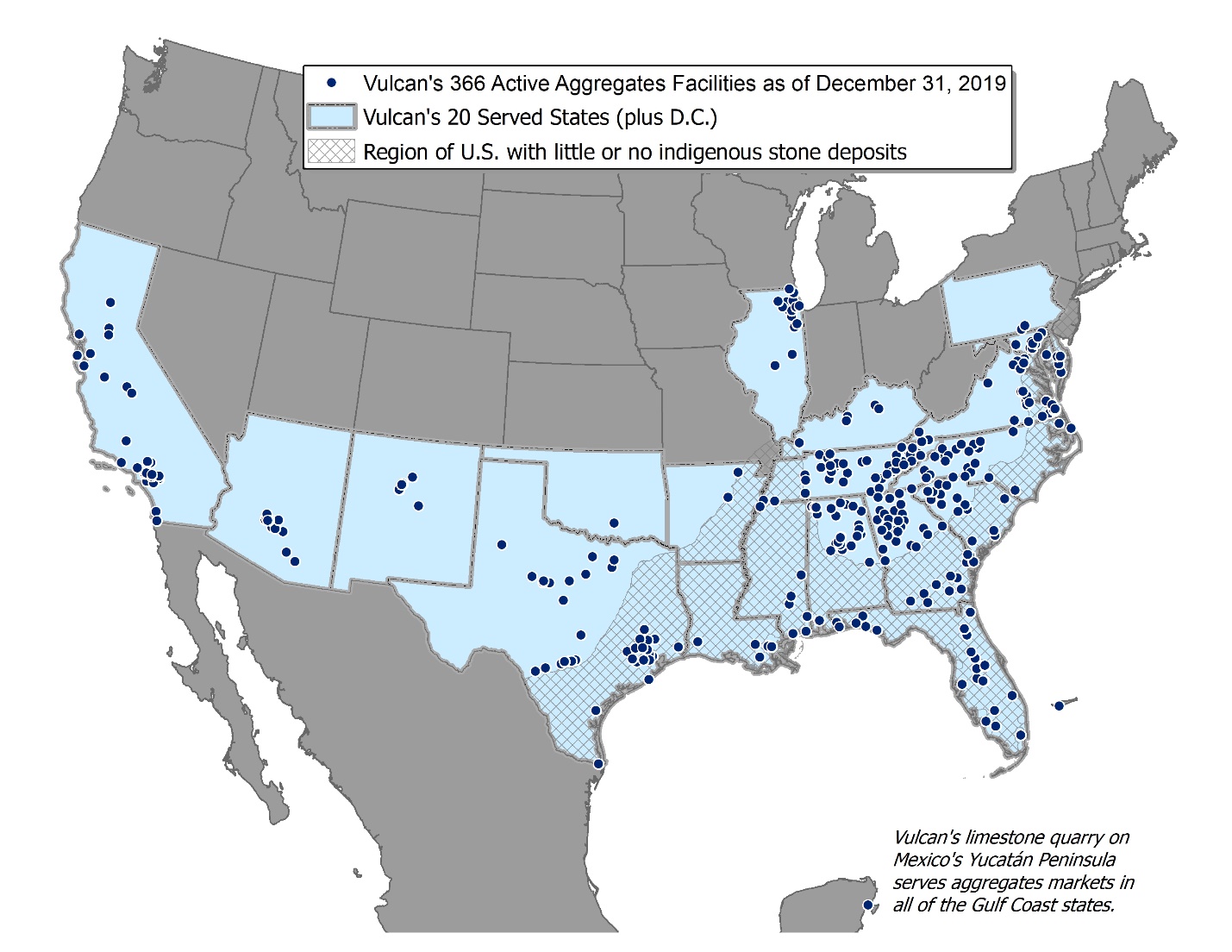

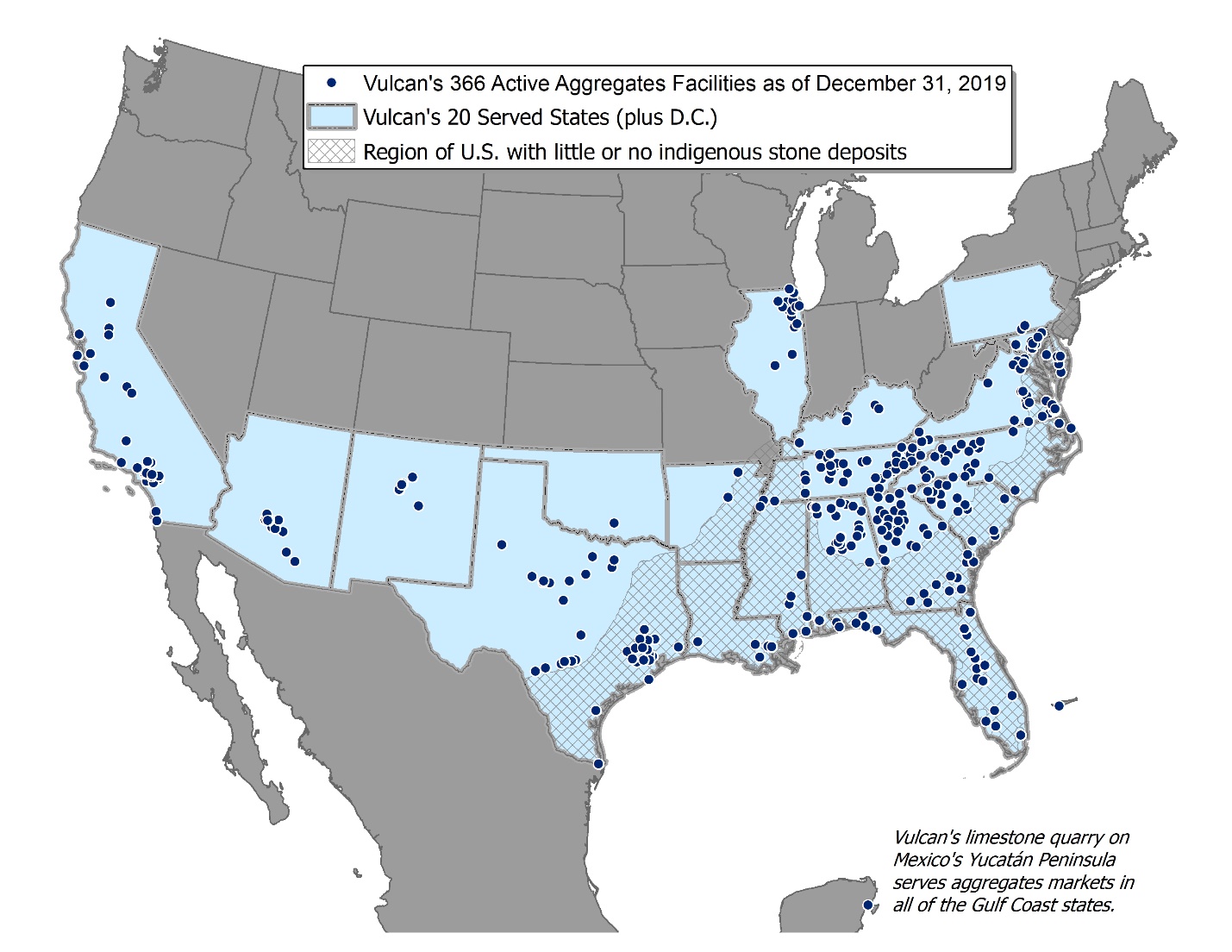

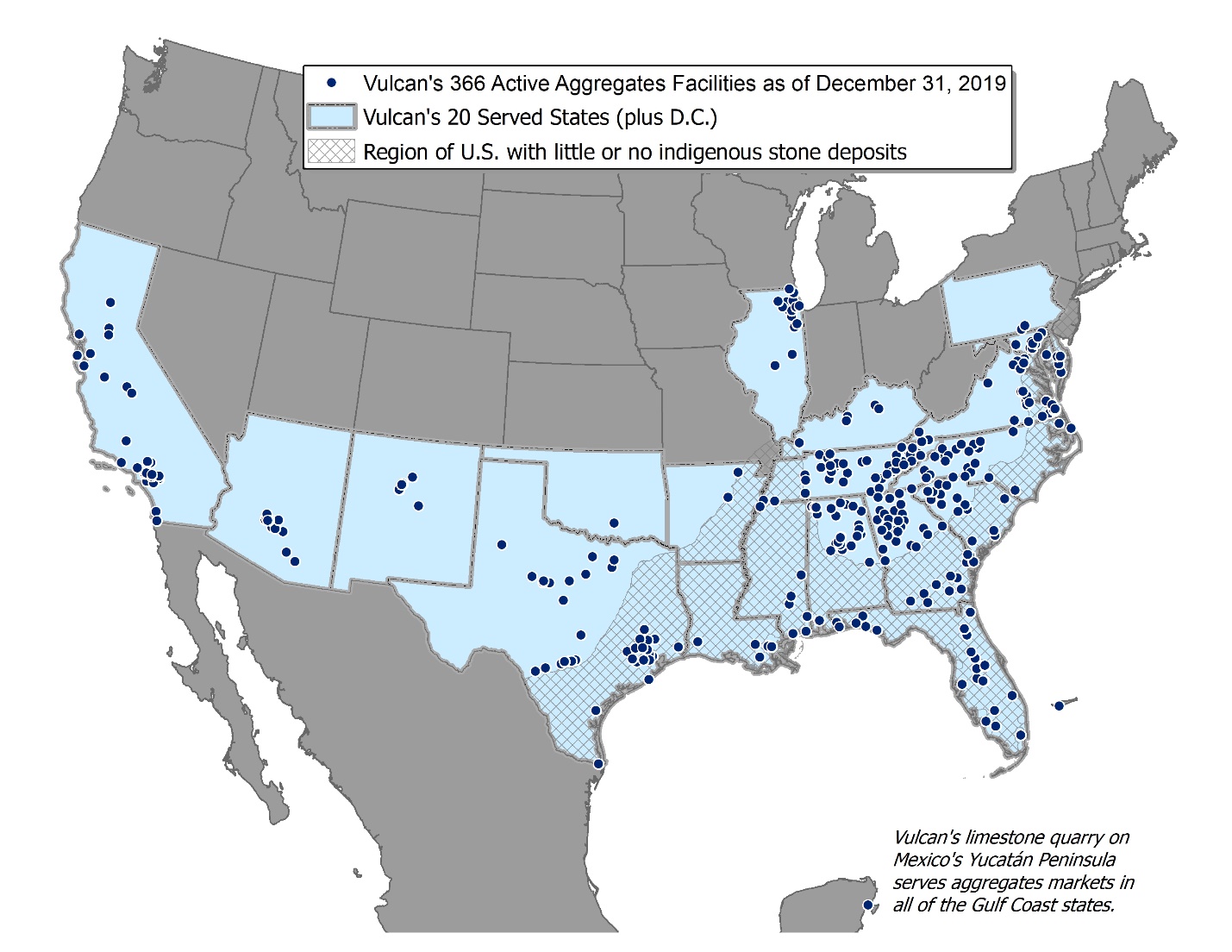

Vulcan Materials Company, a New Jersey corporation, operates primarily in the U.S. and is the nation’s largest supplier of construction aggregates (primarily crushed stone, sand and gravel) and a major producer of asphalt mix and ready-mixed concrete. We provide the basic materials for the infrastructure needed to maintain and expand the U.S. economy. Delivered by trucks, ships, barges and trains, our products are the indispensable materials building homes, offices, places of worship, schools, hospitals and factories, as well as vital infrastructure including highways, bridges, roads, ports and harbors, water systems, campuses, dams, airports and rail networks. As of December 31, 2019, we had 366 active aggregates facilities, 70 asphalt facilities and 53 concrete facilities.

BUSINESS STRATEGY

Our strategy and competitive advantage are based on our strength in aggregates which are used in most types of construction and in the production of asphalt mix and ready-mixed concrete. Our strategy for long-term value creation is built on: (1) an aggregates-focused business, (2) a disciplined approach to portfolio management and capital allocation, (3) a focus on continuous compounding improvement in profitability, (4) a holistic approach to land management, and (5) our commitment to safety, health and the environment.

1. AGGREGATES FOCUS

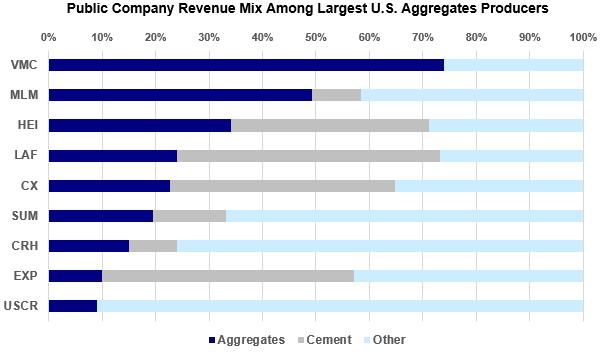

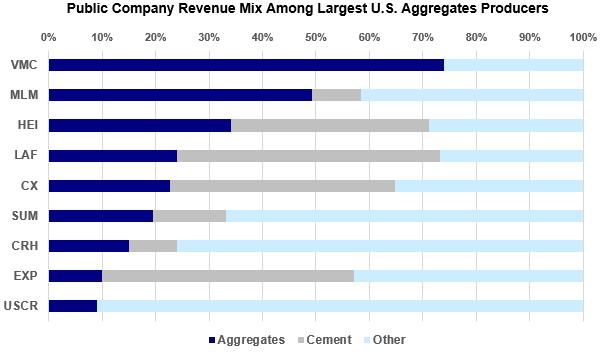

Vulcan is uniquely positioned as the largest aggregates supplier in the U.S. and the most aggregates-focused public company.

Source: 2018 reported financial information and Company estimates

Aggregates are used in virtually all types of public and private construction, and practically no substitutes for quality aggregates exist. Given our focus on aggregates, we:

nTAKE ADVANTAGE OF SIZE AND SCALE: Our 366 active aggregates facilities as of December 31, 2019 provide opportunities to standardize operating practices and procure equipment (fixed and mobile), parts, supplies and services in an efficient and cost-effective manner, both regionally and nationally. Each aggregates operation is also unique because of its location within a local market and its particular geological characteristics. Every operation, however, uses a similar group of assets to produce saleable aggregates and provide customer service. Additionally, we are able to share best practices across the organization and leverage our size for administrative support, customer service, accounting, procurement, technical support and engineering.

BUILD AND HOLD SUBSTANTIAL RESERVES: Our reserves are critical to our long-term success. We currently have 16.2 billion tons of permitted and proven or probable aggregates reserves. They are strategically located throughout the United States in high-growth areas that are expected to require large amounts of aggregates to meet future construction demand. Moreover, there are significant barriers to entry in many metropolitan markets due to stringent zoning and permitting regulations. These restrictions curtail expansion in certain areas, but they also increase the value of our reserves at existing locations.

2. PORTFOLIO MANAGEMENT AND CAPITAL ALLOCATION

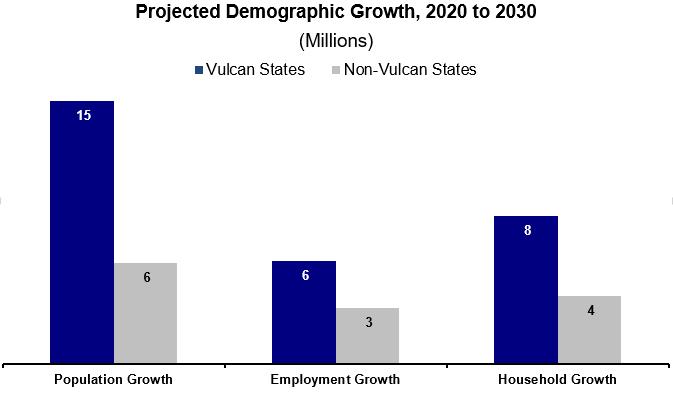

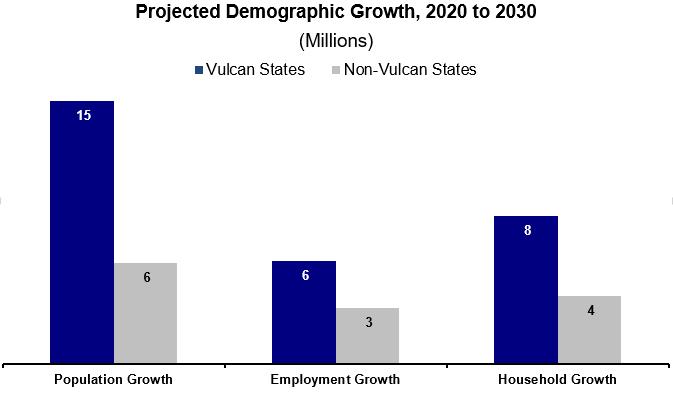

Demand for our products is dependent on construction activity and correlates positively with changes in population growth, household formation and employment. During the period 2020 - 2030, Moody's Analytics projects that 72% of the U.S. population growth, 68% of household formation and 65% of new jobs will occur in Vulcan-served states. The close proximity of our aggregates reserves and our production facilities to this projected population growth creates many opportunities to invest capital in high-return projects.

Source: Moody’s Analytics as of December 12, 2019

We have pursued a strategy to increase our presence in U.S. metropolitan areas that are expected to grow the most rapidly and to divest assets that are no longer considered part of our long-term growth strategy. Our coast-to-coast footprint serves 19 of the top 25 highest-growth U.S. metropolitan areas in 20 states plus the District of Columbia.

Our top ten revenue producing states accounted for 87% of our 2019 revenues while our top five accounted for 61%.

| | | | | | |

| VULCAN’S TOP TEN REVENUE PRODUCING STATES IN 2019 | |

| 1. | Texas | | 6. | Florida | |

| 2. | California | | 7. | Arizona | |

| 3. | Virginia | | 8. | North Carolina | |

| 4. | Tennessee | | 9. | Alabama | |

| 5. | Georgia | | 10. | South Carolina | |

portfolio management: Since becoming a public company in 1956, Vulcan has principally grown by mergers and acquisitions. For example, in 1999 we acquired CalMat Co., thereby expanding our aggregates operations into California and Arizona and making us one of the nation’s leading producers of asphalt mix. In 2007, we acquired Florida Rock Industries, Inc. This acquisition expanded our aggregates business in Florida and our aggregates and ready-mixed concrete businesses in other Mid-Atlantic and Southeastern states. In 2017, we acquired Aggregates USA — this acquisition greatly expanded our ability to serve customers in Florida, Georgia and South Carolina. Additionally, throughout our history we have completed many bolt-on aggregates acquisitions that have contributed significantly to our growth. For example, during 2019 we acquired aggregates operations that strengthened our position in Tennessee.

While an aggregates-focused business, we selectively make investments in downstream products that drive local market profitability. Our downstream businesses (asphalt and concrete) use Vulcan-produced aggregates almost exclusively. In 2017, we entered the asphalt market in Tennessee through the acquisition of several asphalt mix operations and a construction paving business. In 2018, we entered the asphalt mix and construction paving markets in Alabama and expanded our asphalt operations and service offerings in Texas through the acquisition of several asphalt mix operations and construction paving businesses. Additionally, throughout our history we have completed many bolt-on downstream acquisitions that have contributed significantly to our growth. For example, during 2019 we expanded our Virginia ready-mixed concrete operations.

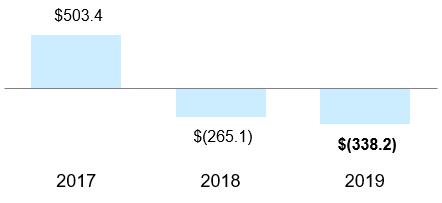

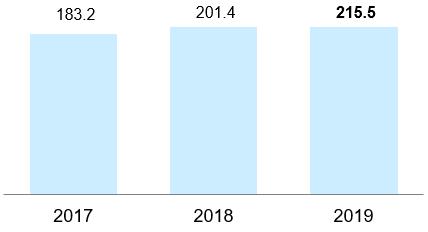

From 2017 to 2019, we invested over $1.1 billion in acquisitions, while further strengthening our portfolio through divestitures and swaps, including swapping our concrete operations in Arizona for asphalt operations in Arizona during 2017.

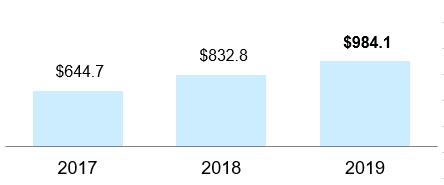

capital allocation: Our long-term strategy around capital allocation has given us the ability to leverage decisions we have made over the past few years. During 2019, we reinvested $384.1 million into core operating & maintenance capital and internal growth capital, in addition to $469.1 million and $459.6 million reinvested in 2018 and 2017, respectively. These investments are fundamental actions that sustain and strengthen the business. They improve the longer-term efficiency, capacity and flexibility of our production, and they support our strong commitment to superior customer service.

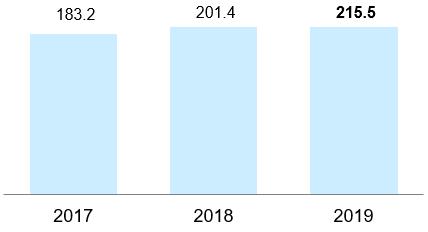

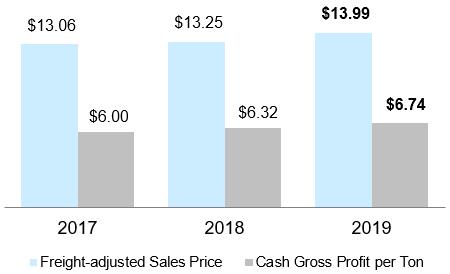

3. compounding improvement in profitability

Our focus on the following four strategic initiatives has made us one of the most profitable public companies in the industry (as measured by aggregates gross profit per ton).

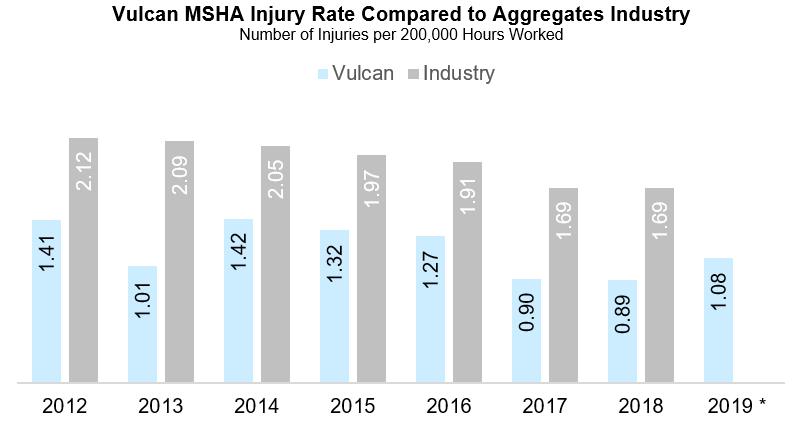

Operational Excellence — Continuous and sustainable improvements in both our operating disciplines and our industry-leading safety performance coupled with better asset utilization through improved availability and throughput leads to effective cost control.

Strategic Sourcing — Leveraging common practices and innovation leads to more time in our plants and with our suppliers to optimize the total cost of ownership (right part at the right time).

Commercial Excellence — Clearly defined roles and responsibilities together with access to real time, forward-looking metrics leads to our sales teams spending less time on non-selling activities and more time responding to our customers’ needs.

Logistics Innovation – Partnering with our customers (truck drivers and contractors) to provide a bundled logistics solution with digital shipping records and on-site, mobile visibility leads to streamlined scheduling, speed and accuracy of delivery, and efficient back-office processes.

We manage these initiatives locally and align our talent and incentives accordingly. Our knowledgeable and experienced workforce and our flexible production capabilities allow us to manage operational and overhead costs aggressively.

4. LAND MANAGEMENT

With approximately 240,000 acres in our land portfolio, a long-term holistic approach to preserving land and water is integral to sustaining our success. From pre-mining to mining to reclamation, we are actively managing the entire life cycle of our land, creating maximum value for the business, our shareholders and our communities.

We are putting land to use before we mine by creating opportunities for agriculture and timber development. After mining, our land and water assets will be converted to other valuable uses including drinking water reservoirs, aquifer recharge basins, public parks, habitat mitigation banks, wetlands, productive farmland and residential and commercial developments.

Because of the evolving needs of our communities, we listen to and collaborate with our neighbors to prepare the land for its highest and best use after mining is complete. Our work with state, regional and local governments to develop solutions today will benefit future generations.

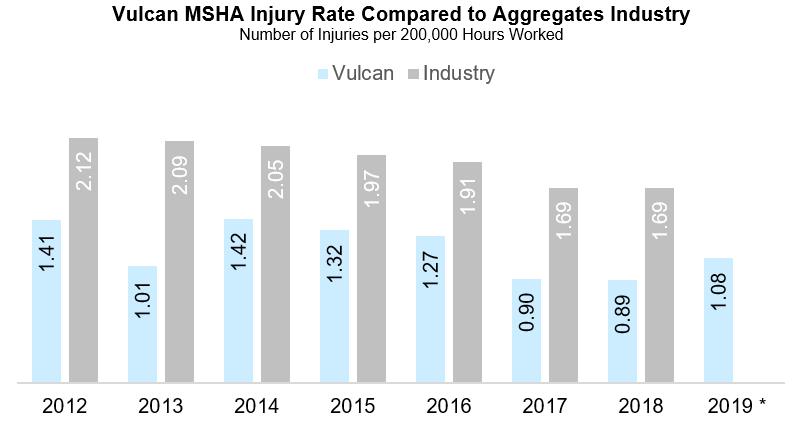

5. SAFETY, HEALTH AND THE ENVIRONMENT

A strategy for sustainable, long-term value creation must include doing right by your employees, your neighbors and the environment in which you operate. We are a leader in our industry in safety performance by applying the shared experiences, expertise and resources at each of our locally led sites with an emphasis on taking care of one another. We focus on our environmental stewardship programs with the same intensity that we bring to our health and safety initiatives. And, our community relations programs serve our neighbors while ensuring that we grow and thrive in the communities where we operate.

PRODUCT LINES

Our products are used to build the roads, tunnels, bridges, railroads and airports that connect us, and to build the hospitals, schools, shopping centers, factories and places of worship that are essential to our lives and the economy. We have four operating (and reportable) segments (Aggregates, Asphalt, Concrete and Calcium) organized around our principal product lines.

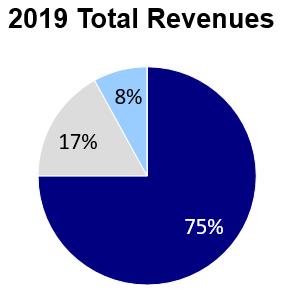

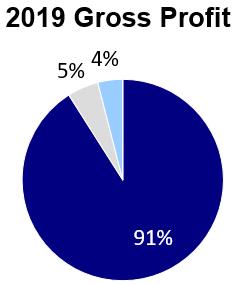

Our 2019 total revenues and gross profit by segment are illustrated as follows (Calcium revenues and gross profit were less than one percent):

For actual amounts, see Note 15 “Segment Reporting” in Item 8 “Financial Statements and Supplementary Data.”

1. AGGREGATES

Our construction aggregates are used in a number of ways:

as a base material underneath highways, walkways, airport runways, parking lots and railroads

to aid in water filtration, purification and erosion control

as a raw material used in combination with other resources to construct many of the items we rely on to sustain our quality of life including:

houses and apartments

roads, bridges and parking lots

schools and hospitals

commercial buildings and retail space

sewer systems

power plants

airports and runways

AGGREGATES INDUSTRY

Factors that affect the U.S. aggregates industry and our business include:

Location and transportation of reserves: Aggregates have a high weight-to-value ratio and, in most cases, must be produced near where they are used; if not, transportation can cost more than the materials, rendering them uncompetitive compared to locally produced materials. Where practical, we have operations located close to our local markets because the cost of trucking materials long distances is prohibitive. Approximately 80% of our total aggregates shipments are delivered exclusively from the producing location to the customer by truck.

Exceptions to this typical market structure include areas along the U.S. Gulf Coast and the Eastern Seaboard where there are limited supplies of locally available, high-quality aggregates. We serve these markets from quarries that have access to cost-effective long-haul transportation — shipping by barge and rail — and from our quarry on Mexico’s Yucatan Peninsula with our fleet of Panamax-class, self-unloading ships. Approximately 17% of our total aggregates shipments are delivered by truck to the customer after reaching a sales yard by rail or water. The remaining 3% of aggregates shipments are delivered directly to the customer by rail or water.

Limited product substitution: There are limited substitutes for quality aggregates. Recycled concrete and asphalt have certain applications as a lower-cost alternative to virgin aggregates. However, many types of construction projects cannot be served by recycled concrete and require the use of virgin aggregates to meet technical specifications and performance-based criteria for durability, strength and other qualities. Likewise, the amount of recycled asphalt included in asphalt mix as a substitute for aggregates is limited due to specifications.

Highly fragmented industry: The U.S. aggregates industry is composed of over 5,800 companies that manage close to 10,000 operations. This fragmented structure provides many opportunities for consolidation. Companies in the industry commonly enter new markets or expand positions in existing markets through the acquisition of existing facilities.

Through strategic acquisitions and investments, we have developed an unmatched coast-to-coast footprint of strategically located permitted reserves concentrated in and serving the nation’s key growth centers. We have over 23,000 customers in 20 states, the District of Columbia, Mexico and the Bahamas.

Flexible production capabilities: The production of aggregates is a mechanical process in which stone is crushed and, through a series of screens, separated into various sizes depending on how it will be used. Production capacity is flexible by adjusting operating hours to meet changing market demand. We are currently operating considerably below full capacity, making us extremely well positioned to further benefit from economies of scale when additional growth materializes.

raw material inputs largely ControlLED: Unlike typical industrial manufacturing industries, the aggregates industry does not require the input of raw material beyond owned or leased aggregates reserves. Stone, sand and gravel are naturally occurring resources. However, production does require the use of explosives, hydrocarbon fuels and electric power.

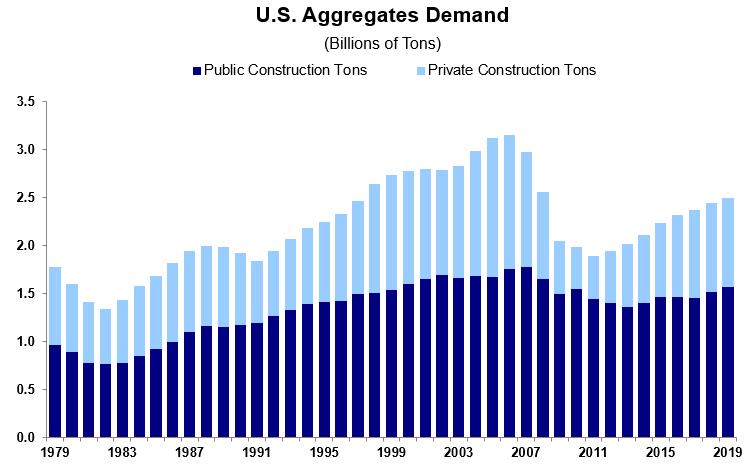

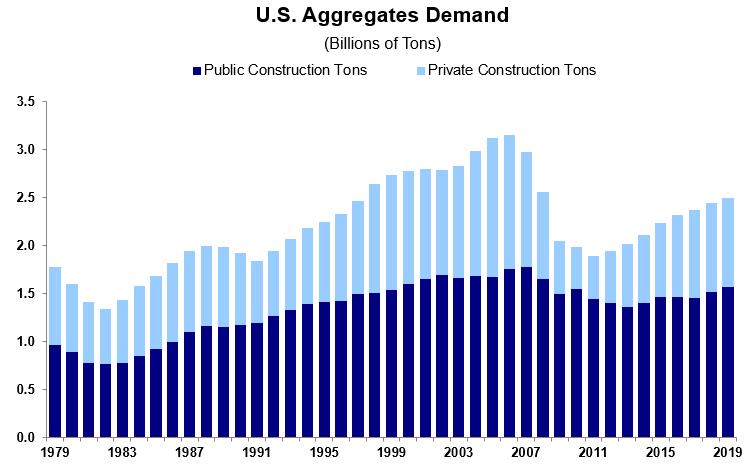

Demand cycles: Long-term growth in demand for aggregates is largely driven by growth in population, jobs and households. While short-term and medium-term demand for aggregates fluctuates with economic cycles, declines have historically been followed by strong recoveries, with each peak establishing a new historical high.

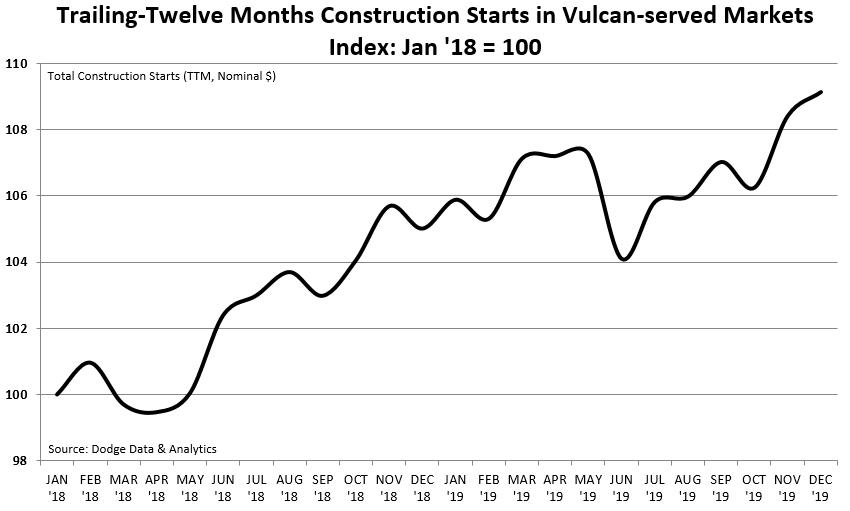

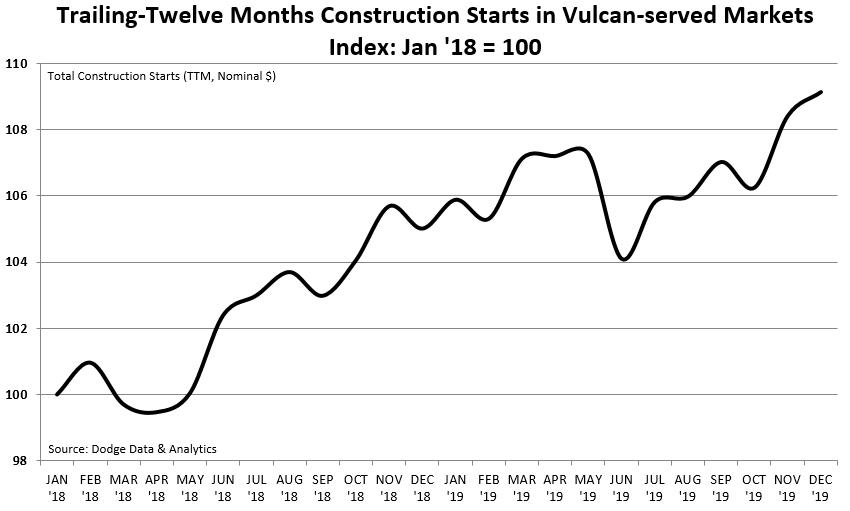

The drivers underpinning demand recovery — and sustained, multi-year volume and pricing growth — remain firmly in place, in both the public and private sectors of the economy. They include: population growth; gains in total employment and in household income and wages; a continuing increase in household formations; the growing need for additional housing stock and housing demand; a multi-year federal transportation law in place and continuing increases in transportation funding at state and local levels; record state tax receipts; public investment in infrastructure that is still well below the long-term trend-line, and increasing political awareness and acceptance of the need to invest in infrastructure.

AGGREGATES MARKETS

We focus on the U.S. markets with above-average long-term expected population growth and where construction is expected to expand. Because transportation is a significant part of the delivered cost of aggregates, our facilities are typically located in the markets they serve or have access to economical transportation via rail, barge or ship to a particular end market. We serve both the public and the private sectors.

Public sector construction activity has historically been more stable and less cyclical than privately-funded construction, and generally requires more aggregates per dollar of construction spending. Private sector construction (primarily residential and nonresidential buildings) typically is more affected by general economic cycles than publicly-funded projects (particularly highways, roads and bridges), which tend to receive more consistent levels of funding throughout economic cycles.

Source: Company estimates

PUBLIC SECTOR CONSTRUCTION MARKET

Public sector construction includes spending by federal, state, and local governments for highways, bridges, buildings, airports, schools, prisons, sewer and waste disposal systems, water supply systems, dams, reservoirs and other public construction projects. Construction for power plants and other utilities is funded from both public and private sources. In 2019, publicly-funded construction accounted for approximately 44% of our total aggregates shipments, and approximately 23% of our aggregates sales by volume were used in highway construction projects.

Public Sector Funding: Generally, public sector construction spending is more stable than private sector construction spending; public sector spending is less sensitive to interest rates and has historically been supported by multi-year laws, which provide certainty in funding amounts, program structures, and rules and regulations. Federal spending is governed by authorization, budget and appropriations laws. The level of state and local spending on infrastructure varies across the United States and depends on individual state needs and economies.

STATE AND LOCAL TRANSPORTATION FUNDING: Since 2012, 32 states have increased or adjusted taxes on motor fuel to increase revenues available for transportation investment. In 2019, Alabama and Illinois became the two most recent states in Vulcan’s footprint to raise significant revenue for highway construction and maintenance through motor fuel tax increases. Other states have increased revenues outside of fuel taxes or made one-time increases. Since 2012, eleven Vulcan-served states representing over 85% of our 2019 total revenues have averaged a 60% increase in revenues for highways.

In addition, we benefit from state and local transportation funding ballot measures. Major transportation funding measures in Vulcan-served areas are estimated to result in $30 billion in revenues and bond proceeds primarily dedicated to roads, streets and bridges. Across the U.S., voters in 19 states approved 89% of 305 measures in 2019, which will generate $9.6 billion in new and recurring transportation investment. This continues a decade-long trend in which voters have approved 81% of nearly 2,000 transportation investment ballot measures.

federal highway funding: In December 2015, President Obama signed a new, long-term federal highway and transit authorization bill, Fixing America’s Surface Transportation Infrastructure Act (FAST Act), into law after the final legislation received strong, bipartisan support in both the House and the Senate. The FAST Act provides multi-year funding to state and local governments in support of road, bridge, intermodal and public transportation projects.

The FAST Act increases Federal-Aid Highway Program funding from $41 billion in the federal fiscal year (FFY) 2015 to $47 billion in FFY 2020. In addition, the Bipartisan Budget Act of 2018 added approximately $2 billion per year to base highway programs in 2018 and 2019.

The long-term nature of the FAST Act is important. The Federal-Aid Highway Program is the largest component of the law and has provided, on average, 52% of all state capital investment in roads and bridges over the last 10 years. This multi-year authorization and the associated dedicated funding provides state departments of transportation with the ability to plan and execute long-range, complex highway projects.

The FAST Act also contains important policy changes. To further accelerate the project delivery process, it augments the environmental review and permitting process reforms contained in the prior law, Moving Ahead for Progress in the 21st Century Act (MAP-21). This law also provides assistance for states making investments in major capital projects — particularly freight projects. In states where we operate, we are well positioned to serve the large general contractors who will compete for new freight and other major capacity projects that will move forward with FAST Act funding and policy implementation.

Project financing remains an important additional component of overall surface transportation spending, with the Transportation Infrastructure Finance & Innovation Act (TIFIA) program authorized at $275 million (in line with the previous program outlays) and growing to $300 million by 2020. The FAST Act also created a new National Surface Transportation and Innovative Finance Bureau to provide technical assistance to states seeking to pursue public-private partnerships and other financing arrangements for transportation projects.

The FAST Act expires on September 30, 2020. Congress is in the process of developing policy and funding legislative proposals for FAST Act reauthorization. It would not be atypical for an extension of current law to be required to provide Congress with adequate time to complete the reauthorization process. Historically, there is minimal disruption to the flow of federal funding to state and local projects due to extensions.

FEDERAL WATER INFRASTRUCTURE: In October 2018, President Trump signed America’s Water Infrastructure Act of 2018 (AWIA 2018) into law. The new law includes the Water Resources Development Act of 2018 (WRDA 2018), which reauthorizes needed investment in America’s ports, channels, locks, dams, and other infrastructure that supports the maritime and waterways transportation system and provides flood protection for communities. It also improves EPA programs for storm water, water recycling, and sewer overflow projects. Included in AWIA 2018 are improvements to the Water Infrastructure Finance and Innovation Act (WIFIA) program, which was modeled after the highly popular TIFIA program in the surface transportation sector. Created in the Water Resources Reform and Development Act of 2014 (WRRDA 2014), WIFIA allows for federal credit assistance to water resources projects in the form of low-cost loans, loan guarantees and lines of credit.

In addition to these regular authorizations, federal emergency supplemental appropriations were provided in 2018 in the Bipartisan Budget Act of 2018 for hurricane-affected areas in Florida, Louisiana, Texas and other states ($89.3 billion) and in the Additional Supplement Appropriations for Disaster Relief Act in 2019 ($19.9 billion). A portion of these funds will be directed to long-term and short-term U.S. Army Corps of Engineers-supported flood control and other water resources construction projects as well as additional infrastructure projects that use aggregates and related materials.

Private sector CONSTRUCTION MARKET

The private sector construction markets include both nonresidential building construction and residential construction and are considerably more cyclical than public construction. In 2019, privately-funded construction accounted for approximately 56% of our total aggregates shipments.

Nonresidential Construction: Private nonresidential building construction includes a wide array of projects. Such projects generally are more aggregates intensive than residential construction. Overall demand in private nonresidential construction generally is driven by job growth, vacancy rates, private infrastructure needs and demographic trends. The growth of the private workforce creates demand for offices, hotels and restaurants. Likewise, population growth generates demand for stores, shopping centers, warehouses and parking decks as well as hospitals, places of worship and entertainment facilities. Large industrial projects, such as a new manufacturing facility, can increase the need for other manufacturing plants to supply parts and assemblies. Construction activity in this end market is influenced by a firm's ability to finance a project and the cost of such financing. This end market also includes capital investments in public nonresidential facilities to meet the needs of a growing population.

Residential Construction: Household formations in Vulcan-served states continue to outpace household formations in the rest of the United States. The majority of residential construction is for single-family housing with the remainder consisting of multi-family construction (i.e., two family houses, apartment buildings and condominiums). Public housing comprises only a small portion of housing demand. Construction activity in this end market is influenced by the cost and availability of mortgage financing and builders’ ability to maintain skilled labor.

U.S. housing starts, as measured by Dodge Data & Analytics data, peaked in early 2006 at over 2 million units annually. By the end of 2009, total housing starts had declined to less than 0.6 million units, well below prior historical lows of approximately 1 million units annually. In 2019, total annual housing starts in the U.S. reached 1.34 million units.

ADDITIONAL AGGREGATES PRODUCTS AND MARKETS

We sell aggregates that are used as ballast for construction and maintenance of railroad tracks. We also sell riprap and jetty stone for erosion control along roads and waterways. In addition, stone can be used as a feedstock for cement and lime plants and for making a variety of adhesives, fillers and extenders. Coal-burning power plants use limestone in scrubbers to reduce harmful emissions. Limestone that is crushed to a fine powder can be sold as agricultural lime.

We sell a relatively small amount of construction aggregates outside of the United States, principally in the areas surrounding our large quarry on the Yucatan Peninsula in Mexico. Nondomestic sales and long-lived assets outside the United States are reported in Note 15 “Segment Reporting” in Item 8 “Financial Statements and Supplementary Data.”

VERTICAL INTEGRATION

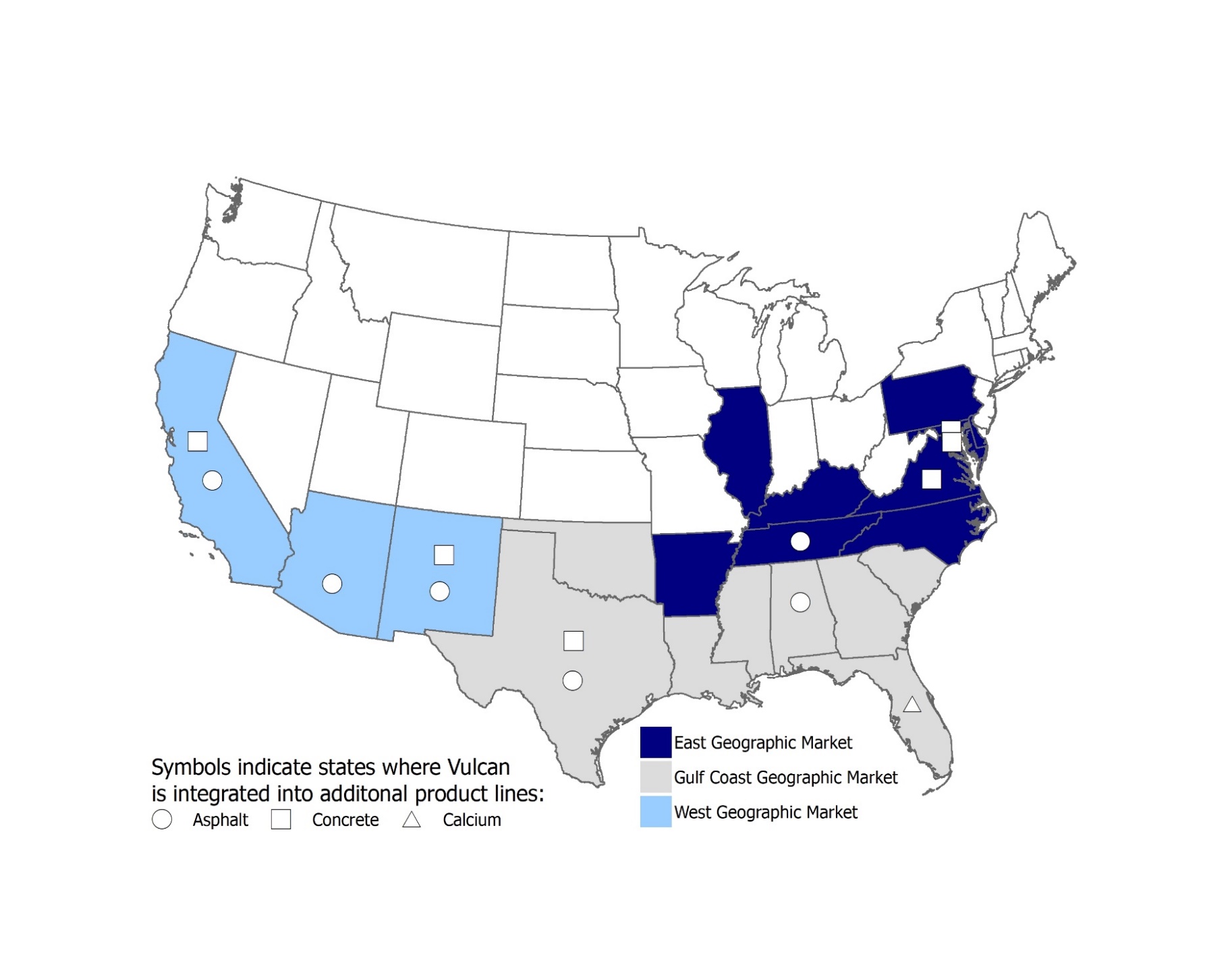

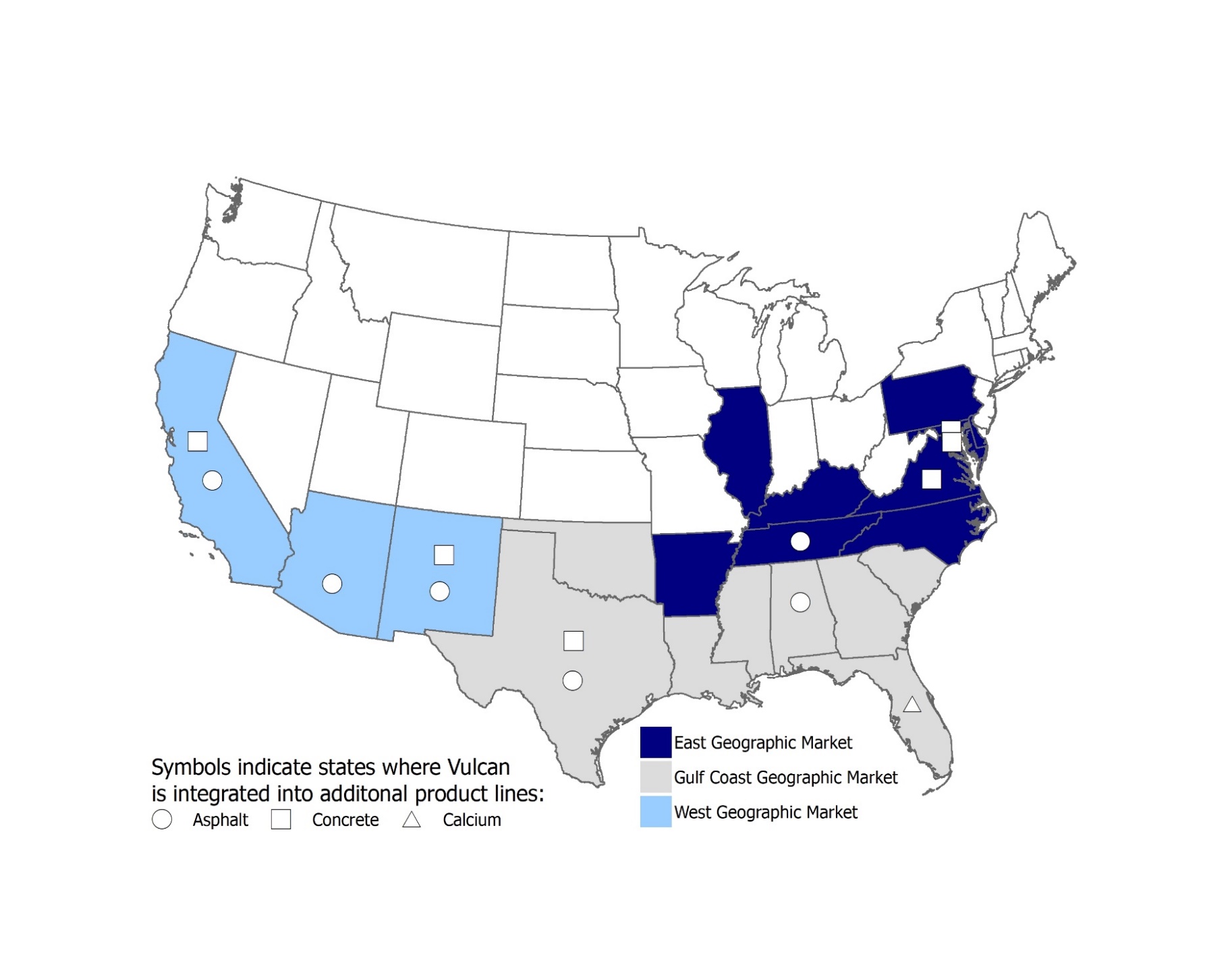

While aggregates is our focus and primary business, we believe vertical integration between aggregates and downstream products, such as asphalt mix and ready-mixed concrete, can be managed effectively in certain markets to generate attractive financial returns and enhance financial returns in our core Aggregates segment. We produce and sell asphalt mix and/or ready-mixed concrete within each of our three geographic markets, as noted below. Aggregates comprise approximately 95% of asphalt mix by weight and 80% of ready-mixed concrete by weight. In both of these downstream businesses, aggregates are primarily supplied from our operations.

2. ASPHALT

We produce and sell asphalt mix in Alabama, Arizona, California, New Mexico, Tennessee and Texas. In June 2018, we strengthened our asphalt position in Texas by acquiring additional asphalt mix operations and a construction paving business. In March 2018, we entered the Alabama asphalt market through the acquisition of an aggregates, asphalt mix and construction paving business. In December 2017, we strengthened our asphalt position in Arizona by swapping ready-mixed concrete operations for an asphalt mix operation. In January 2017, we entered the Tennessee asphalt market through the acquisition of several asphalt mix operations and a construction paving business. For additional details, see Note 19 “Acquisitions and Divestitures” in Item 8 “Financial Statements and Supplementary Data.”

This segment relies on our reserves of aggregates, functioning essentially as a customer to our aggregates operations. Aggregates are a major component in asphalt mix, comprising approximately 95% by weight of this product. We meet the aggregates requirements for our Asphalt segment primarily through our Aggregates segment. These product transfers are made at local market prices for the particular grade and quality of material required.

Because asphalt mix hardens rapidly, delivery typically is within close proximity to the producing facility. The asphalt mix production process requires liquid asphalt cement, which we purchase from third-party producers. We do not anticipate any significant difficulties in obtaining the raw materials necessary for this segment to operate. We serve our Asphalt segment customers directly from our local production facilities.

3. CONCRETE

We produce and sell ready-mixed concrete in California, Maryland, New Mexico, Texas, Virginia, Washington D.C. and the Bahamas. In October 2019, we expanded our ready-mixed concrete operations in Virginia via an acquisition. In March 2018, we exited the Georgia ready-mixed concrete market (we retained all real property which is leased to the buyer and obtained a long-term aggregates supply agreement). As noted above, in December 2017 we exited the Arizona ready-mixed concrete market via a swap for an asphalt mix operation, continuing our strategy to focus on asphalt mix in that market. In March 2017, we reentered the California ready-mixed concrete market through an acquisition. For additional details see Note 19 “Acquisitions and Divestitures” in Item 8 “Financial Statements and Supplementary Data.”

This segment relies on our reserves of aggregates, functioning essentially as a customer to our aggregates operations. Aggregates are a major component in ready-mixed concrete, comprising approximately 80% by weight of this product. We meet the aggregates requirements of our Concrete segment primarily through our Aggregates segment. These product transfers are made at local market prices for the particular grade and quality of material required.

Because ready-mixed concrete hardens rapidly, delivery typically is within close proximity to the producing facility. Ready-mixed concrete production also requires cement which we purchase from third-party producers. We do not anticipate any significant difficulties in obtaining the raw materials necessary for this segment to operate. We serve our Concrete segment customers from our local production facilities or by truck.

4. CALCIUM

Our Calcium segment is composed of a single calcium operation in Brooksville, Florida. This facility produces calcium products for the animal feed, plastics and water treatment industries with high-quality calcium carbonate material mined at the Brooksville quarry.

OTHER BUSINESS-RELATED ITEMS

SEASONALITY AND CYCLICAL NATURE OF OUR BUSINESS

Almost all of our products are produced and consumed outdoors. Seasonal changes and other weather-related conditions can affect the production and sales volumes of our products. Therefore, the financial results for any quarter do not necessarily indicate the results expected for the year. Normally, the highest sales and earnings are in the third quarter and the lowest are in the first quarter. Furthermore, our sales and earnings are sensitive to national, regional and local economic conditions, demographic and population fluctuations, and particularly to cyclical swings in construction spending, primarily in the private sector.

COMPETITORS

We operate in a fragmented industry with a large number of small, privately-held companies. We estimate that the ten largest aggregates producers accounted for roughly one-third of the total U.S. aggregates production in 2019. Despite being the industry leader, Vulcan’s total U.S. market share is less than 10%. Other publicly traded companies among the ten largest U.S. aggregates producers include the following:

Cemex S.A.B. de C.V.

CRH plc

HeidelbergCement AG

LafargeHolcim

Martin Marietta Materials, Inc.

MDU Resources Group, Inc.

Summit Materials, Inc.

Because the U.S. aggregates industry is highly fragmented, with over 5,800 companies managing close to 10,000 operations during 2019, many opportunities for consolidation exist. Therefore, companies in the industry tend to grow by acquiring existing facilities to enter new markets or extend their existing market positions.

CUSTOMERS

No material part of our business depends upon any single customer whose loss would have a significant adverse effect on our business. In 2019, our five largest customers accounted for 7.7% of our total revenues, and no single customer accounted for more than 1.9% of our total revenues. Although approximately 45% to 55% of our aggregates shipments have historically been used in publicly-funded construction, such as highways, airports and government buildings, a relatively small portion of our sales are made directly to federal, state, county or municipal governments/agencies. Therefore, although reductions in state and federal funding can curtail publicly-funded construction, the vast majority of our business is not directly subject to renegotiation of profits or termination of contracts with local, state or federal governments. In addition, our sales to government entities span several hundred entities coast-to-coast, ensuring that negative changes to various government budgets would have a muted impact across such a diversified set of government customers.

ENVIRONMENTAL COSTS AND GOVERNMENTAL REGULATION

Our operations are subject to numerous federal, state and local laws and regulations relating to the protection of the environment and worker health and safety; examples include regulation of facility air emissions and water discharges, waste management, protection of wetlands, listed and threatened species, noise and dust exposure control for workers, and safety regulations under both Mine Safety and Health Administration (MSHA) and Occupational Safety and Health Administration (OSHA). Compliance with these various regulations requires capital investment, and ongoing expenditures for the operation and maintenance of systems and implementation of programs. We estimate that capital expenditures for environmental control facilities in 2020 and 2021 will be $9.3 million and $7.3 million, respectively. These anticipated expenditures are not expected to have a material impact on our earnings or competitive position.