As filed with the Securities and Exchange Commission on April 20, 2023

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

ANNUAL REPORT PURSUANT TO SECTION

13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

Empresa

Distribuidoray Comercializadora Norte S.A. (

(Exact name of

Registrant as specified in its charter)

| Distribution and Marketing Company of the North S.A. | Argentine Republic |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Ciudad de Buenos Aires,

(Address of principal executive offices)

|

Tel.: Chief Financial Officer (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol | Name of each exchange on which registered |

|

EDN |

New York Stock Exchange, Inc. |

* Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission.

___

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: N/A

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Class A Common Shares, Class B Common Shares and Class C Common Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this

report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Sections

13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2)

has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant

was required to submit such fi les).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| ☒ | Emerging Growth Company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of

its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (§ 15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. GAAP

☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange

Act). Yes ☐

PART I

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

In this annual report, except as otherwise specified, references to “we”, “us”, “our” and “the Company” are references to (i) Empresa Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.), or “Edenor”. For more information, see “Item 4—Information on the Company—History and Development of the Company.”

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements, principally under the captions “Item 3. Key Information - Risk Factors”, “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects”. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. Forward-looking statements may also be identified by words such as “believes”, “expects”, “anticipates”, “projects”, “intends”, “should”, “seeks”, “estimates”, “future” or similar expressions. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ materially from those expressed or implied in our forward-looking statements, including, among other things:

| · | the treatment of tariff updates according to the Integral Tariff Revision process (Revisión Tarifaria Integral or “RTI”); |

| · | uncertainties related to future Government interventions or legal actions; |

| · | general political, economic, social, demographic and business conditions in the Republic of Argentina, (“Argentina”) and, particularly, in the geographic market we serve; |

| · | the evolution of energy losses and the impact of fines and penalties and uncollectible debt; |

| · | the impact of regulatory reform and changes in the regulatory environment in which we operate; |

| · | electricity shortages; |

| · | the high temperatures and extreme climate registered during the year which affects the provision of transport and distribution energy services |

| · | potential disruption or interruption of our service; |

| · | the revocation or amendment of our concession by the granting authority; |

| · | our ability to implement our capital expenditure plan, including our ability to arrange financing when required and on reasonable terms; |

| · | high depreciation of the Peso; |

| · | the impact of high rates of inflation on our costs; |

| · | the unsustainability of the tariff freeze in the distribution of energy margin; |

| · | our ability to continue as a going concern; |

| · | Argentina’s renegotiation with the International Monetary Fund (“IMF”); and |

| · | additional matters identified in “Risk factors”. |

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward-looking statements contained in this annual report.

| 1 |

PRESENTATION OF FINANCIAL INFORMATION

We are a stock corporation (sociedad anónima) incorporated under the laws of the Republic of Argentina. Unless otherwise stated, references to the financial results of “Edenor” are to the consolidated financial results of Edenor. We hold a concession to distribute electricity on an exclusive basis to the northwestern part of the greater Buenos Aires metropolitan area and in the northern part of the City of Buenos Aires, comprising an area of 4,637 square kilometers and a population of approximately 9 million people. .

Our financial statements as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020, and the notes thereto (the “Financial Statements”) are set forth on pages F-1 through F-67 of this annual report.

Our Financial Statements, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”), have been approved by resolution of the Board of Directors’ meeting held on March 9, 2023 and have been audited by an independent registered public accounting firm.

Argentina has been considered a high-inflation economy for accounting purposes according to the IAS 29 “Financial reporting in hyperinflationary economies” since July 1, 2018. Therefore, the financial information included in this annual report for all the periods reported are presented on the basis of constant Argentine Pesos as of December 31, 2022 (“current currency”). See “Item 3. Key Information— Risk Factors—As of July 1, 2018, the Argentine Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements in accordance with IFRS, in terms of the measuring unit current at the end of the reporting year, which could adversely affect our results of operation and financial condition”, “Item 5. Operating and Financial Review and Prospects—Factors Affecting Our Results of Operations” and Note 3 to our Financial Statements.

We maintain our accounting records and prepare our financial statements in Argentine Pesos, which is our functional currency.

Certain amounts and ratios contained in this annual report (including percentage amounts) may have been rounded up or down to facilitate the summation of the tables in which they are presented. The effect of this rounding is not material. These rounded amounts and ratios may also be included within the text of this annual report.

EXCHANGE RATES

In 2022, the Argentine Peso continued to depreciate against major foreign currencies, particularly against the U.S. dollar. According to the exchange rate information published by the Banco de la Nación Argentina, the Argentine Peso depreciated by 72.5% against the U.S. dollar during the year ended December 31, 2022 (compared to 22.1%, 40.5% and 58.9% in the years ended December 31, 2021, 2020 and 2019, respectively).

The following table sets forth the high, low, average and period-end exchange rates for the periods indicated, expressed in Pesos per U.S. Dollar and not adjusted for inflation. When preparing our financial statements, we utilize the selling exchange rates for U.S. Dollars quoted by the Banco de la Nación Argentina (“Banco Nación”) to translate our U.S. Dollar denominated assets and liabilities into Pesos. There can be no assurance that the Peso will not further depreciate or appreciate in the future. The Federal Reserve Bank of New York does not report a noon buying rate for Pesos. For more information regarding depreciation, see “Item 3. Key Information—Risk Factors—Factors Relating to Argentina—Fluctuations in the value of the Peso could adversely affect the Argentine economy and, which could, in turn adversely affect our results of operations.”

| 2 |

In this annual report, except as otherwise specified, references to “U.S.$” and “Dollars” are to U.S. Dollars, and references to “Ps.”, “AR$” and “Pesos” are to Argentine Pesos. Solely for the convenience of the reader, we have converted certain amounts included in this annual report from Pesos into Dollars using, for the information provided as of December 31, 2022, the selling exchange rate reported by the Banco Nación, as of December 31, 2022, which was Ps.177.16 to U.S.$1.00 unless otherwise indicated. These conversions should not be considered representations that any such amounts have been, could have been or could be converted into U.S. Dollars at that or at any other exchange rate. On April 11, 2023, the exchange rate was Ps. 213.76, to U.S.$1.00. As a result of fluctuations in the Dollar Peso exchange rate, the exchange rate at such date may not be indicative of current or future exchange rates.

| Low | High | Average | Period End | |||||||||

| (Pesos per U.S. Dollar) | ||||||||||||

| Year ended December 31, | ||||||||||||

| 2018 | 18.41 | 41.25 | 29.26 | (1) | 37.70 | |||||||

| 2019 | 36.90 | 60.40 | 47.82 | (1) | 59.89 | |||||||

| 2020 | 59.82 | 84.15 | 70.87 | (1) | 84.15 | |||||||

| 2021 | 84.15 | 105.20 | 95.13 | (1) | 102.72 | |||||||

| 2022 | 102.72 | 177.16 | 131.08 | (1) | 177.16 | |||||||

| Month | ||||||||||||

| November-22 | 157.28 | 167.28 | 162.07 | (2) | 167.28 | |||||||

| December-22 | 167.72 | 177.16 | 172.38 | (2) | 177.16 | |||||||

| January-23 | 177.16 | 187.00 | 182.12 | (2) | 187.00 | |||||||

| February-23 | 187.29 | 197.15 | 191.97 | (2) | 197.15 | |||||||

| March-23 | 197.57 | 209.01 | 202.92 | (2) | 197.57 | |||||||

| _____________________ | ||||||||||||

| Source: Banco Nación | ||||||||||||

(1) Represents the average of the exchange rates on the last day of each month during the period.

(2) Average of the lowest and highest daily rates in the month.

RISK FACTORS

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Item 3.D. “Risk Factors” of this annual report for a more thorough description of these and other risks:

Risks Related to Argentina

| · | A global or regional financial crisis and unfavorable credit and market conditions may negatively affect our liquidity, users, business, and results of operations. |

| · | The Argentine economy remains vulnerable and any significant decline may adversely affect our business, results of operations, and financial condition. |

| · | Economic and political developments in Argentina, and future policies of the Argentine Government may affect the economy as well as the operations of the energy distribution industry, including Edenor. |

| · | If high levels of inflation continue, the Argentine economy and our results of operations could be adversely affected. |

| 3 |

| · | As of July 1, 2018, the Argentine Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements in accordance with IFRS, in terms of the measuring unit current at the end of the reporting year, which could adversely affect our results of operation and financial condition. |

| · | The credibility of several Argentine economic indexes was called into question, which may lead to a lack of confidence in the Argentine economy and, in turn, limit our ability to access credit and the capital markets. |

| · | Argentina’s ability to obtain financing from international markets could be limited, which may impair its ability to implement reforms and foster economic growth and, consequently, affect our business, results of our operations and growth prospects. |

| · | Fluctuations in the value of the Argentine Peso could adversely affect the Argentine economy and could in turn adversely affect our results of operations. |

| · | Intervention by the Argentine Government may adversely affect the Argentine economy and, as a result, our business and results of operations. |

| · | Argentine corporations may be restricted to make payments in foreign currencies or import certain products. |

| · | Argentine public expenditures may adversely affect the Argentine economy. |

| · | The Argentine economy remains vulnerable to external shocks that could be caused by significant economic difficulties of Argentina’s major regional trading partners, or by more general “contagion” effects. Such external shocks and “contagion” effects could have a material adverse effect on Argentina’s economic growth and, therefore, our results of operations and financial condition. |

| · | The global and local economies and our results of operations could be adversely affected as a result of the outbreak of war between Ukraine and Russia. |

| · | The application of certain laws and regulations could adversely affect our results of operations and financial condition. |

| · | The Argentine economy and finances may be adversely affected as a consequence of a decrease in the international prices of commodities that Argentina exports. |

| · | Failure to adequately address actual and perceived risks of institutional deterioration and corruption may adversely affect Argentina’s economy and financial condition. |

| · | Any downgrade in the credit rating or rating outlook of Argentina could adversely affect both the rating and the market price of our ADS, our Class B common shares and our corporate debt, affecting also our liquidity. |

Risks Relating to the Electricity Distribution Sector

| · | The Argentine Government has intervened in the electricity sector in the past, and may continue intervening. |

| · | There is uncertainty as to what other measures the Argentine Government may adopt in connection with tariffs on public services and their impact on the Argentine economy. |

| · | Electricity distributors were severely affected by the emergency measures adopted during the economic crisis, many of which remain in effect. |

| · | Electricity demand may be affected by tariff increases, which could lead distribution companies, such as us, to record lower revenues. |

| · | Energy shortages may act as a brake on growing demand for electricity and disrupt distribution companies’ ability to deliver electricity to their customers, which could result in customer claims and material penalties imposed on these companies. |

| · | If the demand for energy is increased suddenly, the difficulty in increasing the capacity of distribution companies in a short or medium term, could adversely affect the Company, which in turn could result in customer complaints and substantial fines for any interruptions. |

| 4 |

Risks Relating to Our Business

| · | We operate our business pursuant to our Concession Agreement granted by the Argentine Government, the revocation or termination of which would have a material adverse effect on our business. |

| · | Downgrades in our credit ratings could have negative effects on our funding costs and business operations. |

| · | Our business is subject to risks arising from natural disasters, catastrophic accidents and terrorist attacks. Additionally, our businesses are subject to the risk of mechanical or electrical failures and any resulting unavailability may affect our ability to fulfil our contractual commitments and thus adversely affect our business and financial performance. |

| · | Our operations could cause environmental risks and any change in environmental laws, climate change legislation or regulations restricting emissions of greenhouse gases (“GHGs”) and legal frameworks promoting an increase in the participation of energies from renewable sources could significantly impact our business and result in increased operating costs. |

| · | Failure or delay to negotiate further improvements to our tariff structure, including increases in our distribution margin, and/or to have our tariffs adjusted to reflect increases in our distribution costs in a timely manner or at all, affected and may continue to affect our capacity to perform our commercial obligations and could also have a material adverse effect on our ability to perform our financial obligations. |

| · | We may not be able to adjust our tariffs to reflect increases in our distribution costs in a timely manner, or at all, which may have a material adverse effect on our results of operations. |

| · | Our distribution tariffs may be subject to challenges by Argentine consumer and other groups. |

| · | We have been, and may continue to be, subject to fines and penalties that could have a material adverse effect on our financial condition and results of operations. |

| · | The increase in the illegal settlements within the greater Buenos Aires metropolitan area may affect the Company’s ability to distribute energy to its customers, as well as produce an increase in public safety risks. |

| · | If we are unable to control our energy losses, especially the theft of energy, our results of operations could be adversely affected. |

| · | Under the Concession Agreement, the Argentine Government could foreclose on its pledge over our Class A common shares under certain circumstances, which could have a material adverse effect on our business and financial condition. |

| · | Default by the Argentine Government could lead to termination of our concession, and have a material adverse effect on our business and financial condition. |

| · | The expiration of the management period could result in the sale of the Company’s controlling interest. |

| · | We may be unable to import certain equipment to meet growing demand for electricity, which could lead to a breach of our Concession Agreement and could have a material adverse effect on the operations and financial position. |

| · | We employ a largely unionized labor force and could be subject to an organized labor action, including work stoppages that could have a material effect on our business. |

| · | We could incur material labor liabilities in connection with our outsourcing that could have an adverse effect on our business and on our results of operations. |

| · | Our performance is largely dependent on recruiting and retaining key personnel. |

| · | We are subject to anti-corruption, anti-bribery, anti-money laundering and antitrust laws and regulations in Argentina. Any violation thereunder could have a material adversed effect on our reputation and the results of our operation. |

| · | We are involved in various legal proceedings which could result in unfavorable decisions for us, which could in turn have a material adverse effect on our financial position and results of operations. |

| · | In the event of an accident or other event not covered by our insurance, we could face significant losses that could materially adversely affect our business and results of operations. |

| · | We currently are not able to effectively hedge our currency risk in full and, as a result, a devaluation of the Peso may have a material adverse effect on our results of operations and financial condition. |

| · | A substantial number of our assets are not subject to attachment or foreclosure and the enforcement of judgments obtained against us by our shareholders may be substantially limited. |

| 5 |

| · | The loss of the exclusivity of electricity distribution in our service area may be adversely affected by technological or other changes in the energy distribution industry, which could have a material adverse effect on our business. |

| · | A potential nationalization or expropriation of 51% of our capital stock, represented by Class A shares, may limit the ability of Class B shares to participate in the Board of Directors. |

| · | We may not be able to raise the funds necessary to repay our commercial debt with CAMMESA, our major supplier. |

| · | We may not have the ability to collect the amounts corresponding to the discounts of the Social Rate, the ceilings of the Social Rate and the bonuses for neighbourhood clubs, that must be financed by the Province of Buenos Aires and the Autonomous City of Buenos Aires. |

| · | All of our outstanding financial indebtedness contains bankruptcy, reorganization proceedings and expropriation events of default, and we may be required to repay all of our outstanding debt upon occurrence of any such events. |

| · | We may not have the ability to raise the funds necessary to finance a change of control offering as required by our Senior 2025 Notes and Senior 2024 Notes. |

| · | The New York Stock Exchange and/or ByMA may suspend trading and/or delist our ADSs and Class B common shares, upon the occurrence of certain events relating to our financial situation. |

| · | Changes in weather conditions or the occurrence of severe weather (whether or not caused by climate change or natural disasters), could adversely affect our operations and financial performance. |

| · | Cybersecurity events, such as interruptions or failures in our information technology systems as well as cyber-attacks, could adversely affect our business, financial condition, results of operations and cash flows. |

| · | The Company’s operations and business could be affected by the adoption of restrictions on the import of products or the technical conditions applicable thereto. |

Risks relating to our ADSs and Class B common shares

| · | Restrictions on the movement of capital out of Argentina may impair the ability of holders of ADSs to receive dividends and distributions on, and the proceeds of any sale of, the Class B common shares underlying the ADSs, which could affect the market value of the ADSs. |

| · | Our shareholders’ ability to receive cash dividends may be limited. |

| · | Our shareholders may be subject to liability for certain votes of their securities. |

| · | If we fail to maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud and investor confidence and the market price of our securities may be adversely impacted. |

| · | Provisions of Argentine securities laws could deter takeover attempts and have an adverse impact on the price of our shares and ADSs. |

Risks Related to Argentina

Overview

We are a stock corporation (sociedad anónima) incorporated under the laws of the Republic of Argentina and all of our revenues are earned in Argentina and all of our operations, facilities, and users are located in Argentina. Accordingly, our financial condition and results of operations depend to a significant extent on macroeconomic, regulatory, political and financial conditions prevailing in Argentina, including growth rates, inflation rates, currency exchange rates, taxes, interest rates, and other local, regional and international events and conditions that may affect Argentina in any manner. For example, a slowdown in economic growth or economic recession could lead to a decreased demand for electricity in our concession area or a decline in the purchasing power of our users, which, in turn, could lead to a decrease in collection rates from our users or increased energy losses due to illegal use of our service. For example, Argentina’s economy grew in 2017, 2021 and slightly in 2022, but contracted in 2018, 2019 and 2020. Several factors have impacted the Argentine economy in the recent past, and may continue to impact it in the future, including among others, inflation rates, exchange rates, commodity prices, public debt, availability of IMF SDRs, amendments to the tax regime and policies on trade and fiscal balances.

| 6 |

Our activity is highly regulated and subject to uncertainties due to politic and economic factors, changes in legislation, termination and modification of contractual rights, control of prices and currency fluctuations, among others.

We cannot assure that the Argentine Government will not adopt other policies that could adversely affect the Argentine economy or our business, financial condition or results of operations. In addition, we cannot assure you that future economic, regulatory, social and political developments in Argentina will not impair our business, financial condition or results of operations, nor cause the market value of our ADSs and Class B common shares to decline.

A global or regional financial crisis and unfavorable credit and market conditions may negatively affect our liquidity, users, business, and results of operations

The effects of a global or regional financial crisis and related turmoil in the global financial system may have a negative impact on our business, ability to access credit and the international capital markets, financial condition and results of operations, which is likely to be more severe on an emerging market economy, such as Argentina. See “Item 3. Key Information—Risk Factors—Factors Relating to Argentina—Argentina’s ability to obtain financing from international markets could be limited, which may impair its ability to implement reforms and foster economic growth and, consequently, affect our business, results of our operations and growth prospects”.

Global economic and financial crises, and the general weakness of the global economy due to the COVID-19 pandemic negatively affected emerging economies like Argentina’s economy. Additionally, abrupt changes in monetary and fiscal policies or foreign exchange regime could rapidly affect local economic output, while lack of appropriate levels of investment in certain economy sectors could reduce long-term growth. Access to the international financial markets could be limited. Consequently, an increase in public spending not correlated with an increase in public revenues could affect the Argentina’s fiscal results and generate uncertainties that might affect the economy’s growth level.

In addition to the severe social and market disruption at a global scale during 2020 caused by the COVID 19 outbreak, in recent years, several trading partners of Argentina (such as Brazil, Europe and China) have experienced significant slowdowns or recession periods in their economies. While the vast majority of economies recovered during 2021 and 2022, if such slowdowns or recessions were to recur, this may impact the demand for products coming from Argentina and hence affect its economy. Additionally, there is uncertainty as to how the trade relationship between the Mercosur member States will unfold, in particular between Argentina and Brazil. We cannot predict the effect on the Argentine economy and our operations if trade disputes arise between Argentina and Brazil, or in case either country decided to exit the Mercosur.

In addition, the global macroeconomic environment is facing challenges. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies in 2020 and 2021, including the United States and China. There have been concerns over unrest and terrorist threats in the Middle East, Europe and Africa and over the conflicts involving Iran, Ukraine, Syria and North Korea. Moreover, political and social crises arose in several countries of Latin America during 2019, as the economy in much of the region has slowed down after almost a decade of sustained growth, among other factors. There have also been concerns on the relationship among China and other Asian countries, which may result in or intensify potential conflicts in relation to territorial disputes, and the possibility of a trade war between the United States and China. In addition, United Kingdom exited the European Union (“Brexit”) on January 31, 2020. The medium and long term implications of Brexit could adversely affect European and worldwide economic and market conditions and could contribute to instability in global financial and foreign exchange markets.

| 7 |

Furthermore, in February 2022, Russian troops invaded Ukraine. Although the severity and duration of the ongoing military action are unpredictable, the conflict in Ukraine, Russia’s prior annexation of Crimea, recent recognition of two separatist republics in the Donetsk and Luhansk regions of Ukraine and subsequent military interventions in Ukraine have led to sanctions being levied by the United States, the European Union and other countries against Russia. Russia’s military incursion and the market volatility has adversely affected and may continue to affect the global economy and financial markets and thus could affect our business, financial condition or results of operations. The extent and duration of the military action, sanctions and resulting market disruptions are difficult to predict, but could be substantial. Any such disruptions caused by Russian military action or resulting sanctions may magnify the impact of other risks described in this annual report and may result in compliance and operational challenges for the Company. Trade restrictions imposed on Russia have led to increasing prices of oil, fluctuation in commodities markets and foreign currency exchange volatility. Russia’s military incursion and the market volatility could adversely affect the global economy and financial markets and thus could affect our business, financial condition or results of operations. Further escalation of such armed conflict could lead to supply disruptions and higher energy costs, among others, which could adversely affect our results of operations.

The effects of an economic crisis on our users and on us cannot be predicted. Weak global and local economic conditions, together with increased international tension and oil & gas constraints, could lead to reduced demand or lower prices for energy, hydrocarbons and related oil products and petrochemicals, which could have a negative effect on our revenues. Economic factors such as unemployment, inflation and the unavailability of credit could also have a material adverse effect on the demand for energy and, therefore, on our business, financial condition and results of operations. The financial and economic situation in Argentina or in other countries in Latin America, such as Brazil, may also have a negative impact on us and third parties with whom we do, or may do, business.

The Argentine economy remains vulnerable and any significant decline may adversely affect our business, results of operations, and financial condition

The Argentine economy has experienced significant volatility in recent decades, characterized by periods of low or negative growth, high levels of inflation and currency depreciation. Sustainable economic growth in Argentina depends on a variety of factors including the international demand for Argentine exports, the stability and competitiveness of the Peso against foreign currencies, confidence among consumers and foreign and domestic investors and a stable rate of inflation, national employment levels and the circumstances of Argentina’s regional trade partners. The Argentine macroeconomic environment, in which we operate, remains vulnerable, as reflected by the following economic conditions:

· according to the recent data published by the INDEC in 2023, for the year ended December 31, 2022, Argentina’s real GDP increased by 5.2% compared to the same period in 2021;

· continued increases in public expenditures have resulted and could continue to result in fiscal deficit and affect economic growth;

| · | inflation remains high and may continue at those levels in the future, while regulated tariffs may lag behind; |

| · | investment as a percentage of GDP remains low to sustain the growth rate of the past decades; |

| 8 |

| · | protests or strikes may adversely affect the stability of the political, social and economic environment and may negatively impact the global financial market’s confidence in the Argentine economy; |

| · | energy or natural gas supply by generators may not be sufficient to supply increased industrial activity (thereby limiting industrial development) and consumption, mostly at peak demand such as in the winter season; |

| · | unemployment and informal employment remain high, which could have a bearing on energy theft levels potentially impacting our results and operations; and |

| · | the Argentine Government’s economic expectations may not be met and the process of restoring the confidence in the Argentine economy may take longer than anticipated. |

As in the recent past, Argentina’s economy may be adversely affected if political and social pressures inhibit the implementation by the Argentine Government of policies designed to control inflation, generate growth and enhance consumer and investor confidence, or if policies implemented by the Argentine Government that are designed to achieve these goals are not successful. These events could materially affect our financial condition and results of operations, or cause the market value of our ADSs and our Class B common shares to decline.

The Argentine Peso has been subject to significant depreciation against the U.S. dollar in the past and may be subject to fluctuations in the future. We cannot predict whether and to what extent the value of the Peso could depreciate or appreciate against the U.S. dollar and the way in which any such fluctuations could affect our business. The value of the Peso compared to other currencies is dependent, in addition to other factors listed above, on the level of international reserves maintained by the Central Bank of the Republic of Argentina (Banco Central de la República Argentina, the “Central Bank” or “BCRA”), which have also shown significant fluctuations in recent years. As of December 31, 2022, the international reserves of the BCRA totaled U.S.$44,598 million. According to the exchange rate information published by the Banco de la Nación Argentina, the Argentine Peso depreciated by 72.5% against the U.S. dollar during the year ended December 31, 2022 (compared to 22.1%, 40.5% and 58.9% in the years ended December 31, 2021, 2020 and 2019, respectively).

In 2019, as a result of the economic instability, economic uncertainty, and rising inflation rates, the former Argentine administration and the BCRA adopted a series of measures reinstating foreign exchange controls, which applied with respect to access to the foreign exchange market by residents for savings and investment purposes abroad, the payment of external financial debts, the payment of dividends in foreign currency abroad, payments of goods and services in foreign currencies, payments of imports of goods and services, and the obligation to repatriate and settle for Pesos the proceeds from exports of goods and services, among others. Other financial transactions such as derivatives and securities related operations, were also covered by the new foreign exchange regime. Following the change in government, the new administration extended the validity of such measures, which were originally in effect until December 31, 2019, and established further restrictions by means of the enacted Law No. 27,541 on Social Solidarity and Productive Reactivation in the Framework of the Public Emergency (Ley de Solidaridad Social y Reactivación Productiva en el Marco de la Emergencia Pública, or the “Productive Reactivation Law”), regulated by Decrees No. 58 and 99/19, including a new tax on certain transactions involving the purchase of foreign currency by both Argentine individuals and entities. Although the official exchange rate has stabilized since the adoption of the foreign exchange controls, we cannot assure you that the official exchange rate will not fluctuate significantly in the future. There can be no assurances regarding future modifications to exchange controls. Exchange controls could adversely affect our financial condition or results of operations and our ability to meet our foreign currency obligations and execute our financing plans. See “Item 10. Additional Information— Exchange Controls.”

| 9 |

The success of these measures or other measures that the BCRA may implement in the future, is uncertain and any further depreciation of the Argentine Peso or our inability to acquire foreign currency could have a material adverse effect on our financial condition and results of operations. We cannot predict the effectiveness of these measures. We cannot predict whether, and to what extent, the value of the Argentine Peso may depreciate or appreciate against the U.S. dollar or other foreign currencies, and how these uncertainties will affect electricity consumption. Furthermore, no assurance can be given that, in the future, no additional currency or foreign exchange restrictions or controls will be imposed. Existing and future measures may negatively affect Argentina’s international competitiveness, discouraging foreign investments and lending by foreign investors or increasing foreign capital outflow which could have an adverse effect on economic activity in Argentina, and which in turn could adversely affect our business and results of operations. We cannot predict how these conditions will affect the consumption of services provided by Edenor or our ability to meet our liabilities denominated in currencies other than the Argentine Peso, including our Senior Notes due 2024 and 2025 for U.S.$60 million and U.S.$55 million, respectively. Any restrictions on transferring funds abroad imposed by the Government could undermine our ability to pay dividends on our ADSs or make payments (of principal or interest) under our outstanding indebtedness in U.S. dollars, as well as to comply with any other obligation denominated in foreign currency.

Due to the above mentioned macroeconomic situation, the financial impact on the Company is discussed in Note 1 to our 2022 financial statements, where the Company’s Board and management concluded that a material uncertainty exists that may cast significant doubt (or raise substantial doubt as contemplated by the Public Company Accounting Oversight Board (United States) (“PCAOB”) standards) about Edenor’s ability to continue as a going concern, which was also expressed by our independent registered public accounting firm in their report appearing elsewhere herein. A decline in economic growth, an increase in economic instability or the expansion of economic policies and measures taken or that may be adopted in the future by the Argentine Government to control inflation or address other macroeconomic developments that affect private sector entities such as us, all developments over which we have no control, could have an adverse effect on our business, financial condition or results of operations or would not have a negative impact on the market value of our ADSs and Class B common shares.

Economic and political developments in Argentina, and future policies of the Argentine Government may affect the economy as well as the operations of the energy distribution industry, including Edenor

The Argentine Government has historically exercised significant influence over the economy, and our Company has operated in a highly regulated environment. The Argentine Government may promulgate numerous, far-reaching regulations affecting the economy and electricity companies in particular.

In the event of any economic, social or political crisis, companies operating in Argentina may face the risk of strikes, expropriation, nationalization, mandatory amendment of existing contracts, and changes in taxation policies, including tax increases and retroactive tax claims. In addition, Argentine courts have sanctioned modifications on rules related to labor matters, requiring companies to assume greater responsibility for the assumption of costs and risks associated with subcontracted labor and the calculation of salaries, severance payments and social security contributions. Since we operate in a context in which the governing law and applicable regulations change frequently, also as a result of changes in government administrations, it is difficult to predict if and how our activities will be affected by such changes.

We cannot assure you that future economic, regulatory, social and political developments in Argentina will not adversely affect our business, financial condition or results of operations, or cause the decrease of the market value of our securities.

| 10 |

If the high levels of inflation continue, the Argentine economy and our results of operations could be adversely affected

Historically, inflation has materially undermined the Argentine economy and the Argentine Government’s ability to create conditions that allow growth. In recent years, Argentina has confronted inflationary pressures, evidenced by significantly higher fuel, energy and food prices, among other factors.

According to data published by the INDEC, Consumers Price Index (“CPI”) rates for 2022, 2021 and 2020 were 94.8% in 2022 50.9% in 2021 and 36.1%, , respectively and 6.0% and 6.6% in January and February 2023, respectively. See “Item 3. Key Information— Risk Factors—Risks Related to Argentina—The credibility of several Argentine economic indexes was called into question, which may lead to a lack of confidence in the Argentine economy and, in turn, limit our ability to access credit and the capital markets” below. The Argentine Government’s adjustments to electricity and gas tariffs, as well as the increase in the price of gasoline have affected prices, creating additional inflationary pressure. If the value of the Argentine Peso cannot be stabilized through fiscal and monetary policies, an increase in inflation rates could be expected.

A high inflation rate affects Argentina’s foreign competitiveness by diluting the effects of the Peso depreciation, negatively impacting employment and the level of economic activity and undermining confidence in Argentina’s banking system, which may further limit the availability of domestic and international credit to businesses. In turn, a portion of the Argentine debt continues to be adjusted by the Stabilization Coefficient (Coeficiente de Estabilización de Referencia, or “CER”), a currency index, that is strongly related to inflation. Therefore, any significant increase in inflation would cause an increase in the Argentine external debt and consequently in Argentina’s financial obligations, which could exacerbate the stress on the Argentine economy. The efforts undertaken by the Argentine Government to reduce inflation have not achieved the desired results. A continuing inflationary environment could undermine our results of operations, adversely affect our ability to finance the working capital needs of our businesses on favorable terms, and it could adversely affect our results of operations and cause the market value of our ADSs and our Class B common shares to decline.

There is uncertainty regarding the effectiveness of the policies implemented by the Argentine Government to reduce and control inflation and the potential impact of those policies. An increase in inflation may adversely affect the Argentine economy, which in turn may have a negative impact in our financial condition and the result of our operations.

As of July 1, 2018, the Argentine Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements in accordance with IFRS, in terms of the measuring unit current at the end of the reporting year, which could adversely affect our results of operation and financial condition

As of July 1, 2018, the Peso qualifies as a currency of a hyperinflationary economy and we are required to restate our historical financial statements by applying inflationary adjustments to our financial statements.

Pursuant to IAS 29 “Financial Reporting in Hyperinflationary Economies”, the financial statements of entities whose functional currency is that of a hyperinflationary economy must be restated for the effects of changes in a suitable general price index. IAS 29 does not prescribe when hyperinflation arises, but includes several characteristics of hyperinflation. The IASB does not identify specific hyperinflationary jurisdictions. However, in June 2018, the International Practices Task Force of the Centre for Quality (“IPTF”), which monitors “highly inflationary countries”, categorized Argentina as a country with projected three-year cumulative inflation rate greater than 100%. Additionally, some of the other qualitative factors of IAS 29 were present, providing prima facie evidence that the Argentine economy is hyperinflationary for the purposes of IAS 29. Therefore, Argentine companies using IFRS are required to apply IAS 29 to their financial statements for periods ending on and after July 1, 2018.

| 11 |

We cannot predict the future impact that the eventual inflation adjustments described above will have on our financial statements or their effects on our business, results of operations and financial condition.

The credibility of several Argentine economic indexes was called into question, which may lead to a lack of confidence in the Argentine economy and, in turn, limit our ability to access credit and the capital markets

Prior to 2015, the credibility of the CPI, as well as other indices published by the INDEC were called into question.

On January 8, 2016, based on its determination that the INDEC had failed to produce reliable statistical information, particularly with respect to CPI, GDP, inflation and foreign trade data, as well as with poverty and unemployment rates, the Argentine Government declared a state of administrative emergency for the national statistical system and the INDEC. The INDEC temporarily suspended the publication of certain statistical data until a reorganization of its technical and administrative structure to recover its ability to produce reliable statistical information.

In 2017, the INDEC began publishing a national CPI, which is based on a survey conducted by the INDEC and several provincial statistical offices in 39 urban areas including each of Argentina’s provinces. The official CPI inflation rate for the year ended December 31, 2022 was 94.8%.

Any future required correction or restatement of the INDEC indexes could result in decreased confidence in Argentina’s economy, which, in turn, could have an adverse effect on our ability to access international capital markets to finance our operations and growth, and which could, in turn, adversely affect our results of operations and financial condition and cause the market value of our ADSs and Class B common shares to decline.

Argentina’s ability to obtain financing from international markets could be limited, which may impair its ability to implement reforms and foster economic growth and, consequently, affect our business, results of our operations and growth prospects

Argentina’s history of defaults on its external debt and the protracted litigation with holdout creditors may reoccur in the future and prevent Argentine companies such as us from accessing the international capital markets readily or may result in higher costs and more onerous terms for such financing, and may therefore negatively affect our business, results of operations, financial condition, the value of our securities, and our ability to meet our financial obligations.

Following the default on its external debt in 2001, Argentina sought to restructure its outstanding debt exchange offers in 2005 and again in 2010. Holders of approximately 93% of Argentina’s defaulted debt participated in the exchanges. Nonetheless, a number of bondholders held out from the exchange offers and pursued legal actions against Argentina.

In 2016, the Argentine Government settled several agreements with the defaulted bondholders, ending more than 15 years of litigation.

| 12 |

In 2020, the Argentine Government reached an agreement with private creditors to renegotiate certain debt conditions as maturity dates and interest rates applicable for the following first years. On April 21, 2020, Argentina invited holders of approximately U.S.$66.5 billion aggregate principal amount of its foreign currency external bonds to exchange such bonds for new bonds. The invitation contemplated the use of collective action clauses included in the terms and conditions of such bonds, whereby the decision by certain majorities would bind holders that do not tender into the exchange offer. On August 31, 2020 it announced that it had obtained bondholder consents required to exchange and or modify 99.01% of the aggregate principal amount outstanding of all series of eligible bonds invited to participate in the exchange offer. The restructuring settled on September 4, 2020. As a result of the invitation, the average interest rate paid by Argentina’s foreign currency external bonds was lowered to 3.07%, with a maximum rate of 5.0%, compared to an average interest rate of 7.0% and maximum rate of 8.28% prior to the invitation. In addition, the aggregate amount outstanding of Argentina’s foreign currency external bonds was reduced by 1.9% and the average maturity of such bonds was extended.

On June 22, 2021, the Minister of Economy announced that the Argentine Government had obtained a “time bridge” within the framework of the Paris Club negotiations, consequently avoiding default. The understanding provides that the Argentine Government will have until March 31, 2022 to reach a restructuring agreement with the Paris Club members, which was further extended until July 31, 2022. On October 28, 2022, the Minister of Economy announced a new agreement with the Paris Club, which is an addendum to the Paris Club 2014 Settlement Agreement. This new agreement recognizes a principal amount of US$1.97 billion, extending the repayment period to thirteen semi-annual installments, starting in December 2022 to be repaid in full in September 2028. As part of the agreement, the interest rate applicable to the first three installments was reduced from 9% to 3.9%, with subsequent gradual increases to 4.5%. The payment profile implies semi-annual payments averaging US$170 million (principal and interest included). Over the next two years, Argentina will repay 40% of the principal amount outstanding.

On January 28, 2022, the IMF and the Argentine authorities reached an understanding on key policies as part of their ongoing discussions on an IMF-supported program for the refinancing of the debt of U.S.$44.1 billion set to mature in 2022 and 2023. On March 4, 2022, the Argentine Government reached a staff-level agreement with the IMF and a bill was sent to the Argentine Congress. On March 11, 2022, the lower house of the Argentine Congress passed and sent to the Senate the bill that supports the agreement between Argentina and the IMF. On March 17, 2022, the Senate approved the agreement “Program of Extended Facilities” between the Argentine Government and the IMF, following the Argentine Congress’ endorsement of the understanding with the IMF, and on March 25, the Program of Extended Facilities was approved by the Executive Board of the IMF.

As a result, the Law No. 27,668 was sanctioned on March 18, 2022, and consequently the Program of Extended Fund Facility was approved, allowing the IMF to pay out U.S.$44.500 million. This agreement includes an obligation to develop an energetic plan, that focuses on improving energy efficiency, and researching for a cleaner and cheaper way to produce and distribute electricity among other goals to achieve. Furthermore, the law reinforces Argentina’s commitment to create a new subsidy segmentation scheme, concentrated on improving the energy distribution as well as protecting the low- and middle-income users.

In June 2022, the IMF’s staff published the first review of the Extended Agreement, taking into the account the exceptional risk resulting from the war in Ukraine, a resurgence of the pandemic and a slowdown in key emerging economies. The IMF strongly supported the Decree No. No. 332/2022, which created a new subsidy segmentation scheme, eliminating the subsidies for the top 10 percent of residential consumers with the highest income level.

On September 19, 2022, the second review of the arrangement took place. Although ir acknowledged the registered growth of real GDP and the decisive steps taken by the authorities to restore macroeconomic stability, the Staff reiterated the need to significantly reduce subsidies for residential users with greatest payment capacity and commercial users. In addition, the IMF encouraged the Argentine Government to continue reducing subsidies, while improving its performance in the following aspects: database improvement, allowing consumers to self- declare their income and assets and reduce the number of non-registered consumers; linkage of prices to cost, instead of wages; less generous consumption ceilings, together with the introduction of a ceiling for low–income consumers, focusing on energy efficiency; and enhanced targeting, composed of three groups and the chance of reconsideration.

| 13 |

On December 2, 2022, the IMF Staff published a third review, with positive feedback on macroeconomic aspects, but underlining the challenging global environment. Focusing on the energy aspect, the IMF reinforced the need to reduce subsidies for residential users with the greatest payment capacity and commercial users. In both cases, the remaining subsidies would be removed in February 2023, establishing a cap for electricity and gas prices during peak consumption months to ensure the fiscal targets. On the other side, middle and low-income residential users would cap the cost of energy at 40 percent and 80 percent of growth in the wage index, respectively. Furthermore, the tariff agreements with electricity distributors within the metropolitan region of Buenos Aires would be updated in February 2023 to improve CAMMESA’s income, including an arrangement to eliminate distributors’ arrears to or from CAMMESA and therefore alleviate the pressures on government finances.

On March 13, 2023, the IMF web page published an article emphasising a successful fourth review, as a result of the agreement between its Staff and the Argentine authorities.

We cannot assure whether the agreement with IMF could not affect Argentina’s ability to implement reforms and public policies and boost economic growth, nor the impact of the result that renegotiation will have in Argentina’s ability to access international capital markets (and indirectly in our ability to access those markets) to access international capital markets, in the Argentine economy or in our economic and financial situation or in our capacity to extend the maturity dates of our debt or other conditions that could affect our results and operations or businesses.

Fluctuations in the value of the Argentine Peso could adversely affect the Argentine economy and could in turn adversely affect our results of operations

The Argentine Peso suffered important fluctuations during the last four years. We are unable to predict the future value of the Peso against the U.S. Dollar. If the Peso devaluates further, the negative effects on the Argentine economy could have adverse consequences on our business, our results of operations and the market value of our ADSs, including as measured in U.S. Dollars.

Fluctuations in the value of the Peso may also adversely affect the Argentine economy, our financial condition and results of operations. The Peso has been subject to significant depreciation against the U.S. dollar in the past and may be subject to further fluctuation in the future. A depreciation of the Peso against major foreign currencies may also have an adverse impact on our capital expenditure program and increase the Peso amount of our trade liabilities and financial debt denominated in foreign currencies. The depreciation of the Peso may have a negative impact on the ability of certain Argentine businesses to service their foreign currency-denominated debt, lead to high inflation, significantly reduce real wages, jeopardize the stability of businesses whose success depends on domestic market demand, including public utilities, and the financial industry and adversely affect the Argentine Government’s ability to honor its foreign debt obligations.

Intervention by the Argentine Government may adversely affect the Argentine economy and, as a result, our business and results of operations

In the recent past, the Argentine Government intervened in the economy, including through the implementation of expropriation and nationalization measures, price controls and exchange controls, among others.

| 14 |

In the future, the Argentine Government may introduce new exchange controls and/or strengthen the existing ones, create restrictions on transfers to other countries, restrictions to capital movements or other measures in response to an eventual capital flight or an important depreciation in the Peso, measures that can, in turn, affect our ability to access the international capital markets. Such restrictions and measures may generate political and social tensions and deteriorate the Argentine Government´s public finances, as has occurred in the past, generating an adverse effect in the Argentine economic activity and, in consequence, adversely affecting our business and the result of our operations, and cause the market value of our ADSs and our Class B common shares to decline. See “Item 10. Additional Information— Exchange Controls.” Moreover, we cannot preditct the measures that may be adopted by the current or any future government, such as expropriation, nationalization, forced renegotiation or modification of existing contracts, new taxation policies, changes in laws, regulations and policies affecting foreign trade and investments, restrictions to transfers to other countries or to capitals movement, or an important depreciation of the Peso will not have a material adverse effect on the Argentine economy and, as a consequence, adversely affect our financial condition, our results of operations or cause the market value of our ADSs and our Class B common shares to decline.

Argentine corporations may be restricted to make payments in foreign currencies or import certain products

There are certain restrictions in Argentina that affect corporations’ ability to access to the exchange market (Mercado Libre de Cambios, or the “MLC”) to acquire foreign currency, transfer funds abroad, service debt payments in foreign currency, make payments outside Argentina and other operations, requiring, in some cases, previous approval by the Central Bank.

These restrictions may affect our operations and our expansion projects, as they require the import of services and goods for which payment may be restricted. The Argentine Government may impose or create further restrictions on the access to the MLC. In such case, the ability of Argentine corporations to make payments outside Argentina and to comply with their obligations and duties may be affected.

We cannot predict how the current foreign exchange restrictions may evolve after this annual report, mainly regarding limitations to transfer funds outside the country. The Argentine Government may impose further exchange controls or restrictions to capital transfers and modify and adopt other policies that may limit or restrict our ability to access international capital markets, to make payments of principal and interests and other additional amounts outside the country (including payments relating to our notes), or affect in other ways our business and the results of our operations, or cause the market value of our ADSs and our Class B common shares to decline.

Exchange controls in an economic environment in which the access to local capital markets is restricted may cause an adverse effect in our activities, mainly in our ability to make payments of principal and/or interests of our notes in foreign currency. See “Item 10. Additional Information—Exchange Controls.”

Argentine public expenditure may affect the Argentine economy

Public expenditure increased throughout the last decade in Argentina. The Argentine Government adopted several measures to finance its public expenditure.

As of the date of this annual report, we cannot predict how the measures that the Argentine Government has applied and may continue to apply will impact the Argentine economy, and, in turn, our business, our financial condition and the results of our operations.

| 15 |

The Argentine economy remains vulnerable to external shocks that could be caused by significant economic difficulties of Argentina’s major regional trading partners, or by more general “contagion” effects. Such external shocks and “contagion” effects could have a material adverse effect on Argentina’s economic growth and, therefore, our results of operations and financial condition

Although economic conditions vary from country to country, investors’ perceptions of events occurring in certain countries have in the past substantially affected, and may continue to substantially affect, capital flows into and investments in securities of issuers from other countries, including Argentina. There can be no assurance that the Argentine financial system and securities markets will not be adversely affected by policies that may be adopted by foreign governments or the Argentine Government in the future. Argentina can also be adversely affected by negative economic or financial events that take place in other countries, subsequently affecting our operations and financial condition, including our ability to repay our debt at its maturity date.

Argentina’s economy is vulnerable to external shocks. For example, economic slowdowns, especially in Argentina’s major trading partners such as Brazil, led to declines in Argentine exports in the last few years. Specifically, fluctuations in the price of commodities sold by Argentina and a significant devaluation of the Peso against the U.S. dollar could harm Argentina’s competitiveness and affect its exports. In addition, international investors’ reactions to events occurring in one market may result in a “contagion” effect which could lead to an entire region or class of investment being disfavored by international investors. Additionally, financial and securities markets in Argentina are also influenced by economic and market conditions in other markets worldwide.

The situation of the U.S. economy and the restrictive economic measures taken by the federal administration could adversely affect the economy of developing countries, including Argentina.

The U.S. economy has registered its highiest inflation rates over the last decades. We cannot predict the decisions and policies that the Biden administration will adopt in the future, which could generate uncertainty in the international markets and could have a negative effect on developing economies, including Argentina.

In July 2019, the Southern Common Market (“MERCOSUR”) signed a strategic partnership agreement with the European Union (the “EU”), which is expected to enter into force in the near future, subject to the approval of the corresponding legislatures of each member country. Such approval is pending as of today, as some member countries are demanding amendments to the agreement (for example, the French government has demanded the inclusion of guarantees regarding the protection of the Amazon, compliance with European agri-food and phytosanitary standards and the fight against climate change). The objective of this agreement is to promote investment, regional integration, increase the competitiveness of the economy and achieve an increase in GDP. However, the effect that this agreement could have on the Argentine economy and on the policies implemented by the Argentine Government is uncertain. Regarding other free trade agreement negotiations, the current Argentine government announced on April 24, 2020 that it would stop participating in Mercosur’s trade agreement negotiations with countries such as South Korea, Singapore, Lebanon, Canada and India, excluding those already concluded with the EU.

Moreover, the challenges faced by the EU in stabilizing some of its member economies have had and may continue to have international implications affecting the stability of global financial markets, which has hampered economies around the world.

Finally, international investors’ perceptions of events occurring in one market may generate a “contagion” effect by which an entire region or class of investment is disfavored by international investors. Argentina could be adversely affected by negative economic or financial developments in other emerging and developed countries, which in turn may have material adverse effects on the Argentine economy and, indirectly, on our business, financial condition and results of operations, and the market value of our ADSs and Class B common shares.

| 16 |

The global and local economies and our results of operations could be adversely affected as a result of the outbreak of war between Ukraine and Russia.

In October 2021, Russia began moving troops and military equipment near the border with Ukraine, generating concerns about a possible invasion. By December 2021, more than one hundred thousand troops were located near the border.

In mid-December 2021, the Russian Foreign Ministry issued a series of demands that included a ban on Ukraine joining the North Atlantic Treaty Organization (“NATO”) and the reduction of NATO troops and military equipment in Eastern Europe for its military forces to withdraw. The United States and other NATO allies rejected those demands and warned Russia that they would retaliate if Russia invaded Ukraine, including the imposition of economic sanctions. Tensions remained high as negotiations continued without any apparent progress toward a formal agreement.

Subsequently, on February 23, 2022, Russian President Vladimir Putin declared a “special military operation” in Ukraine. On the same day, several media organizations reported explosions in several cities and evidence of large-scale military operations throughout Ukraine. Following the Russian invasion of Ukraine, many countries have imposed economic sanctions against Russia, which has impacted the global economy as many commercial, industrial and financial businesses are closing operations in Russia. Trade restrictions imposed on Russia have led to increasing prices of oil, fluctuation in commodities markets and foreign currency exchange volatility. Russia’s military incursion and the market volatility could adversely affect the global economy and financial markets and thus could affect our business, financial condition or results of operation. Further escalation of such armed conflict could lead to supply disruptions and higher energy costs, among others, which could adversely affect our results of operations.

We are not sure and cannot predict if and to what extent this war will impact the global economy, nor can we foresee what measures the Argentine Government may take to address any scenario, and if those measures will result in any negative effect on the Argentine economy, which could, in turn, affect our business and results of operations.

The application of certain laws and regulations could adversely affect our results of operations and financial condition

The Company’s operations and business could be affected by the adoption of restrictions on the import of products.

As of the date of this annual report, Edenor cannot guarantee that in the future, measures limiting or restricting import of products or the technical conditions will not be adopted which may have an impact on the goods used by the Company as inputs, causing the Company an adverse effect on its net worth, economic, financial or other situation, its results of operations, business operations and/or its ability to comply with its obligations in general.

On August 7, 2014, Law No. 26,944 on State Responsibility was enacted to regulate the liability of the Argentine Government and public officers, including state liability for unlawful and lawful actions. Such law regulates the Argentine Government’s liability on damages that its activity or inactivity may cause to individuals’ properties or rights, establishing that (i) the Argentine Government’s liability is objective and direct, (ii) the provisions of the Argentine Civil and Commercial Code are not applicable to the actions of the Argentine Government in a direct or subsidiary manner and (iii) no dissuasive financial penalties may be imposed on the Argentine Government, its agents or officers. Additionally, it specifies that the Argentine Government shall not be liable for the damages caused by public services concessionaires.

| 17 |

On September 18, 2014, the Argentine Congress enacted Law No. 26,991 amending Law No. 20,680 (the “Supply Law”), which became effective on September 28, 2014, to increase control over the supply of goods and provision of services. The Supply Law applies to all economic processes linked to goods, facilities and services which, either directly or indirectly, satisfy basic consumer needs (“Basic Needs Goods”) and grants a broad range of powers to its enforcing agency. It also grants the enforcing agency the power to order the sale, production, distribution or delivery of Basic Needs Goods throughout Argentina in case of a shortage of supply. The Supply Law includes the ability of the Argentine Government to regulate consumer rights under Article 42 of the Constitution and permits the creation of an authority to maintain the prices of goods and services (the “Observer of Prices of Goods and Services”). The Supply Law, as amended: (i) requires the continued production of goods to meet basic requirements; (ii) creates an obligation to publish prices of goods and services produced and borrowed; (iii) allows financial information to be requested and seized; and (iv) increases fines for legal entities and individuals. Additionally, on September 18, 2014 the Argentine Congress enacted Law No. 26,993, amending, among other laws, Law No. 25,156, which provides (i) the creation of a preliminary system where consumers may request a settlement of their complaints with companies, (ii) the incorporation of a new branch within the Judicial Power, namely the “National Courts on Consumer Relations” and (iii) the amendment of Law No. 24,240 (the “Consumer Defense Law”). Such reforms and creation of the Observer of Prices of Goods and Services could adversely affect our operations.

By means of Executive Order No. 990/20, the 2021 Budget Law was partially approved. In its Section 87, the law provides for a system for the settlement of debts with CAMMESA and/or the Wholesale Electric Market (Mercado Eléctrico Mayorista or “WEM”) accumulated by the electricity distribution companies as of September 30, 2020, whether on account of the consumption of energy, power, interest and/or penalties, in accordance with the conditions to be set out by the application authority, which may provide for credits equivalent to up to five times the monthly average bill or to 60% percent of the existing debt, whereas the remaining debt is to be paid in up to sixty monthly installments, with a grace period of up to six months, and at the rate in effect in the WEM, reduced by 50%.

Consequently, by means of Resolution No. 40/2021, the SE established the “Special System for the Regularization of Payment Obligations” of electricity distribution companies that are agents of the WEM for the debts held with CAMMESA and/or the WEM whether on account of the consumption of energy, power, interest and/or penalties, accumulated as of September 30, 2020. It also established a “Special System of Credits” for those electricity distribution companies that are agents of the WEM and have no debts with CAMMESA and/or the WEM or whose debts are regarded as being within reasonable values vis-à-vis their levels of transactions as of September 30, 2020.

Subsequently, the SE determined that it was suitable to establish as indicators for purposes of calculating the credits to be recognized, the maintenance of the electricity rate schedules throughout the year 2020, the policies implemented by each distribution company that is an agent of the WEM aimed at benefiting the demand, the effect of the application of the provisions of Executive Order No. 311 dated March 24, 2020, as amended and supplemented, as well as the investment commitments on energy efficiency, technology applied to the provision of the service and/or energy infrastructure works that imply an improvement in the quality of the service provided to users. Therefore, it issued Resolution No. 371/2021, which supplements Resolution No. 40/2021.

On February 22, 2022, by means of Executive Order No. 88/2022, the Argentine Government extended until December 31, 2022 the implementation of the “Special System for the Regularization of Payment Obligations” provided for in Section 87 of Law No. 27,591. In this context, we expressed our interest in participating in the execution of an agreement for the implementation of the above mentioned regime and after some negotiations, on December 29, 2022, we reached an agreement with the Argentine Government to restructure our commercial debt with CAMMESA as of August 2022 (the “2022 Agreement”). (Detailed information on the 2022 Agreement can be found in the section “Agreement on the Regularization of Payment Obligations – Debt for the purchase of energy in the MEM).

| 18 |

The implementation of the aforementioned laws and regulations has modified Argentina’s legal system. Future changes in applicable laws and regulations (including as a result of a change in government administration), administrative or judicial proceedings, including potential future claims by us against the Argentine Government, cannot be predicted and we cannot assure you that such changes will not adversely affect our business, financial condition and results of operations.

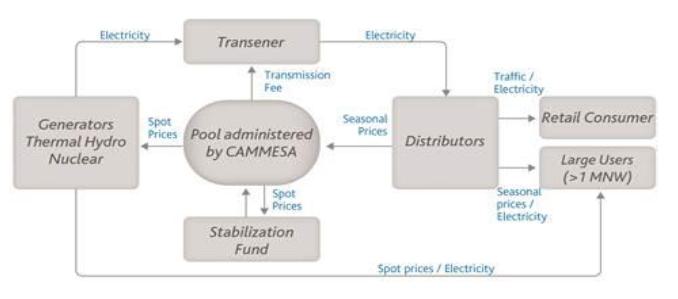

The Argentine economy and finances may be adversely affected as a consequence of a decrease in the international prices of commodities that Argentina exports