falseQ10001393818--12-31http://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#OtherAssetsDuring the period presented, Blackstone also had one share outstanding of each of Series I and Series II preferred stock, with par value of each less than one cent.Level III freestanding derivatives are valued using an option pricing model where the significant inputs include the expected return and expected volatility. Equity Securities, Partnership and LLC Interest includes investments in investment funds.As of March 31, 2023 and December 31, 2022, Other Investments includes Level III Freestanding Derivatives. Unobservable inputs were weighted based on the fair value of the investments included in the range. Fair value is determined by broker quote and these notes would be classified as Level II within the fair value hierarchy. The Secured Borrowing, Due 10/27/2033 has an interest rate of 6.97% and the Secured Borrowing, Due 1/29/2035 has an interest rate of 3.72%. Blackstone Fund Facilities represents borrowing facilities for the various consolidated Blackstone Funds used to meet liquidity and investing needs. Such borrowings have varying maturities and may be rolled over until the disposition or refinancing event. Borrowings bear interest at spreads to market rates or at stated fixed rates that can vary over the borrowing term. Interest may be subject to the performance of the assets within the fund and therefore, the stated interest rate and effective interest rate may differ. CLO Notes Payable are due 10/15/2029 and have an effective interest rate of 6.97% as of March 31, 2023. Dividends declared reflects the calendar date of the declaration for each distribution.The split of clawback between Blackstone Holdings and Current and Former Personnel is based on the performance of individual investments held by a fund rather than on a fund by fund basis.Total is a component of Due to Affiliates. See Note 16. “Related Party Transactions — Affiliate Receivables and Payables — Due to Affiliates.”Total Segment Revenues is comprised of the following:This adjustment removes Unrealized Performance Revenues on a segment basis.This adjustment removes Unrealized Principal Investment Income (Loss) on a segment basis.This adjustment removes Interest and Dividend Revenue on a segment basis.This adjustment removes Other Revenue on a segment basis. For the three months ended March 31, 2023 and 2022, Other Revenue on a GAAP basis was $(14.2) million and $72.9 million, and included $(14.7) million and $72.8 million of foreign exchange gains (losses), respectively.This adjustment reverses the effect of consolidating Blackstone Funds, which are excluded from Blackstone’s segment presentation. This adjustment includes the elimination of Blackstone’s interest in these funds, the removal of revenue from the reimbursement of certain expenses by the Blackstone Funds, which are presented gross under GAAP but netted against Management and Advisory Fees, Net in the Total Segment measures, and the removal of amounts associated with the ownership of Blackstone consolidated operating partnerships held by non-controlling interests.This adjustment removes Transaction-Related Charges, which are excluded from Blackstone’s segment presentation. Transaction-Related Charges arise from corporate actions including acquisitions, divestitures, and Blackstone’s initial public offering. They consist primarily of equity-based compensation charges, gains and losses on contingent consideration arrangements, changes in the balance of the Tax Receivable Agreement resulting from a change in tax law or similar event, transaction costs and any gains or losses associated with these corporate actions.Total Segment Expenses is comprised of the following:This adjustment removes Unrealized Performance Allocations Compensation.This adjustment removes Equity-Based Compensation on a segment basis.This adjustment adds back Interest Expense on a segment basis, excluding interest expense related to the Tax Receivable Agreement.This adjustment removes the amortization of transaction-related intangibles, which are excluded from Blackstone’s segment presentation.Fee related performance compensation may include equity-based compensation based on fee related performance revenuesRepresents the (1) removal of amortization of transaction-related intangibles, (2) removal of certain expenses reimbursed by the Blackstone Funds, which are presented gross under GAAP but netted against Management and Advisory Fees, Net in the Total Segment measures, and (3) a reduction equal to an administrative fee collected on a quarterly basis from certain holders of Blackstone Holdings Partnership Units which is accounted for as a capital contribution under GAAP, but is reflected as a reduction of Other Operating Expenses in Blackstone’s segment presentation.Represents (1) the add back of Principal Investment Income, including general partner income, earned from consolidated Blackstone Funds which have been eliminated in consolidation, and (2) the removal of amounts associated with the ownership of Blackstone consolidated operating partnerships held by non-controlling interests.Represents the removal of Transaction-Related Charges that are not recorded in the Total Segment measures.Represents (1) the add back of net management fees earned from consolidated Blackstone Funds which have been eliminated in consolidation, and (2) the removal of revenue from the reimbursement of certain expenses by the Blackstone Funds, which are presented gross under GAAP but netted against Management and Advisory Fees, Net in the Total Segment measures.Corporate Treasury Commitments are measured using third party pricing. This adjustment adds an amount equal to an administrative fee collected on a quarterly basis from certain holders of Blackstone Holdings Partnership Units. The administrative fee is accounted for as a capital contribution under GAAP, but is reflected as a reduction of Other Operating Expenses in Blackstone’s segment presentation.Level III contingent consideration liabilities are valued using a discounted cash flow model where the significant inputs include the discount rates. 0001393818 2022-01-01 2022-03-31 0001393818 2023-01-01 2023-03-31 0001393818 2023-03-31 0001393818 2022-12-31 0001393818 2022-01-01 0001393818 2022-01-01 2022-12-31 0001393818 2023-04-28 0001393818 2021-12-31 0001393818 2022-03-31 0001393818 srt:ParentCompanyMember bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 us-gaap:LoansReceivableMember 2022-12-31 0001393818 us-gaap:DebtSecuritiesMember 2022-12-31 0001393818 us-gaap:CorporateDebtSecuritiesMember 2022-12-31 0001393818 us-gaap:InvestmentsMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2022-12-31 0001393818 bx:DueFromAffiliatesMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2022-12-31 0001393818 bx:RelatedPartiesMember bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:DueToNonConsolidatedEntityMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2022-12-31 0001393818 bx:PotentialClawbackObligationMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member 2022-12-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember bx:CashHeldByFundsAndOtherMember 2022-12-31 0001393818 us-gaap:InvestmentsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2022-12-31 0001393818 us-gaap:AccountsReceivableMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2022-12-31 0001393818 bx:DueFromAffiliatesMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2022-12-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2022-12-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember us-gaap:OtherAssetsMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember 2022-12-31 0001393818 us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2022-12-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember us-gaap:AccountsPayableAndAccruedLiabilitiesMember 2022-12-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember bx:DueToAffiliatesMember 2022-12-31 0001393818 us-gaap:LoansPayableMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember 2022-12-31 0001393818 bx:DebtInstrumentsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel1Member bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:NetAssetValueMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:NetAssetValueMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:InvestmentAssetOtherMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:NetAssetValueMember bx:InvestmentAssetOtherMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel2Member bx:InvestmentAssetOtherMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member bx:InvestmentAssetOtherMember 2022-12-31 0001393818 bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueInputsLevel2Member 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueInputsLevel1Member 2022-12-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:NetAssetValueMember 2022-12-31 0001393818 us-gaap:CreditDefaultSwapMember bx:BlackstoneMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 bx:BlackstoneMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:TotalReturnSwapMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember us-gaap:InterestRateContractMember bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 us-gaap:InterestRateContractMember bx:BlackstoneMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 us-gaap:ForeignExchangeContractMember bx:BlackstoneMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesMember us-gaap:MaturityOvernightMember 2022-12-31 0001393818 us-gaap:MaturityUpTo30DaysMember us-gaap:AssetBackedSecuritiesMember 2022-12-31 0001393818 us-gaap:Maturity30To90DaysMember us-gaap:AssetBackedSecuritiesMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesMember us-gaap:MaturityOver90DaysMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember us-gaap:MaturityOvernightMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember us-gaap:MaturityUpTo30DaysMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember us-gaap:Maturity30To90DaysMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember us-gaap:MaturityOver90DaysMember 2022-12-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2022-12-31 0001393818 us-gaap:MaturityOvernightMember 2022-12-31 0001393818 us-gaap:MaturityUpTo30DaysMember 2022-12-31 0001393818 us-gaap:MaturityOver90DaysMember 2022-12-31 0001393818 us-gaap:Maturity30To90DaysMember 2022-12-31 0001393818 bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:PartnershipInvestmentsMember 2022-12-31 0001393818 bx:AccruedPerformanceAllocationsMember 2022-12-31 0001393818 bx:CorporateTreasuryInvestmentsMember 2022-12-31 0001393818 bx:InvestmentAssetOtherMember 2022-12-31 0001393818 us-gaap:ForeignExchangeContractMember bx:ConsolidatedBlackstoneFundsMember bx:FreestandingDerivativesMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:StockOptionMember 2022-12-31 0001393818 bx:EquityAndPreferredSecuritiesMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember bx:TransactionPriceValuationTechniqueMember 2022-12-31 0001393818 us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:LoansReceivableMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:CorporateTreasuryInvestmentsMember 2022-12-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember bx:DebtInstrumentsMember us-gaap:ValuationTechniqueDiscountedCashFlowMember 2022-12-31 0001393818 us-gaap:ValuationTechniqueDiscountedCashFlowMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:FourPointSevenFiveZeroPercentNotesMember 2022-12-31 0001393818 bx:TwoPointZeroZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:OnePointZeroZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:ThreePointOneFiveZeroPercentNotesMember 2022-12-31 0001393818 bx:OnePointFiveZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:TwoPointFiveZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:OnePointSixZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:TwoPointZeroZeroZero1PercentNotesMember 2022-12-31 0001393818 bx:SixPointTwoFiveZeroPercentNotesMember 2022-12-31 0001393818 bx:FivePointZeroZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:FourPointFourFiveZeroPercentNotesMember 2022-12-31 0001393818 bx:FourPointZeroZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesOneMember 2022-12-31 0001393818 bx:TwoPointEightZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:TwoPointEightFiveZeroPercentNotesMember 2022-12-31 0001393818 us-gaap:SeniorNotesMember 2022-12-31 0001393818 bx:FivePointNineZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:TwoPointFiveFiveZeroPercentageNoteMember 2022-12-31 0001393818 bx:SixPointTwoZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesMember 2022-12-31 0001393818 bx:ThreePointTwoZeroZeroPercentageNoteMember 2022-12-31 0001393818 bx:SecuredBorrowingsOneMember us-gaap:OtherDebtSecuritiesMember 2022-12-31 0001393818 bx:SecuredBorrowingsTwoMember us-gaap:OtherDebtSecuritiesMember 2022-12-31 0001393818 us-gaap:OtherDebtSecuritiesMember 2022-12-31 0001393818 bx:BlackstoneFundFacilitiesMember bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:OnePointSixTwoFivePercentNotesMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueInputsLevel2Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueInputsLevel1Member us-gaap:FairValueMeasurementsRecurringMember 2022-12-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesMember 2022-12-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember 2022-12-31 0001393818 bx:SeriesOnePreferredStockMember 2022-12-31 0001393818 bx:SeriesTwoPreferredStockMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:CorporateTreasuryCommitmentsMember 2022-12-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryCommitmentsMember 2022-12-31 0001393818 bx:ConsolidatedBlackstoneFundsMember srt:ParentCompanyMember 2023-03-31 0001393818 us-gaap:HedgeFundsEquityMember 2023-03-31 0001393818 us-gaap:RealEstateFundsMember 2023-03-31 0001393818 bx:CreditDrivenMember 2023-03-31 0001393818 us-gaap:CommoditiesInvestmentMember 2023-03-31 0001393818 bx:DiversifiedInstrumentsMember 2023-03-31 0001393818 us-gaap:LoansReceivableMember 2023-03-31 0001393818 us-gaap:DebtSecuritiesMember 2023-03-31 0001393818 us-gaap:CorporateDebtSecuritiesMember 2023-03-31 0001393818 bx:CashPoolingArrangementMember 2023-03-31 0001393818 us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember us-gaap:InvestmentsMember 2023-03-31 0001393818 bx:DueFromAffiliatesMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2023-03-31 0001393818 bx:RelatedPartiesMember bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember bx:DueToNonConsolidatedEntityMember 2023-03-31 0001393818 bx:PotentialClawbackObligationMember us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2023-03-31 0001393818 bx:OperatingBorrowingsMember 2023-03-31 0001393818 bx:BlackstoneFundFacilitiesCloVehiclesMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member 2023-03-31 0001393818 bx:CashHeldByFundsAndOtherMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 us-gaap:InvestmentsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 us-gaap:AccountsReceivableMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 bx:DueFromAffiliatesMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 us-gaap:OtherAssetsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember 2023-03-31 0001393818 us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember 2023-03-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember us-gaap:AccountsPayableAndAccruedLiabilitiesMember 2023-03-31 0001393818 us-gaap:VariableInterestEntityPrimaryBeneficiaryMember bx:ConsolidatedBlackstoneFundsMember bx:DueToAffiliatesMember 2023-03-31 0001393818 us-gaap:LoansPayableMember bx:ConsolidatedBlackstoneFundsMember us-gaap:VariableInterestEntityPrimaryBeneficiaryMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:NetAssetValueMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:InvestmentAssetOtherMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:NetAssetValueMember bx:InvestmentAssetOtherMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel2Member bx:InvestmentAssetOtherMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member bx:InvestmentAssetOtherMember 2023-03-31 0001393818 bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueInputsLevel2Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryInvestmentsMember us-gaap:FairValueInputsLevel1Member 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:NetAssetValueMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel1Member bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember bx:FreestandingDerivativesMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember 2023-03-31 0001393818 bx:DebtInstrumentsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel2Member bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel1Member bx:ConsolidatedBlackstoneFundsMember bx:DebtInstrumentsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:NetAssetValueMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel3Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel2Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueInputsLevel1Member 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:InterestRateContractMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:ForeignExchangeContractMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:CreditDefaultSwapMember 2023-03-31 0001393818 bx:BlackstoneMember bx:FreestandingDerivativesMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:InterestRateContractMember bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:TotalReturnSwapMember bx:BlackstoneMember bx:FreestandingDerivativesMember 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:MaturityOvernightMember us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2023-03-31 0001393818 us-gaap:MaturityUpTo30DaysMember us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2023-03-31 0001393818 us-gaap:Maturity30To90DaysMember us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2023-03-31 0001393818 us-gaap:MaturityOver90DaysMember us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2023-03-31 0001393818 us-gaap:AssetBackedSecuritiesSecuritizedLoansAndReceivablesMember 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:PartnershipInvestmentsMember 2023-03-31 0001393818 bx:AccruedPerformanceAllocationsMember 2023-03-31 0001393818 bx:CorporateTreasuryInvestmentsMember 2023-03-31 0001393818 bx:InvestmentAssetOtherMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:BlackstoneMember us-gaap:StockOptionMember 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember bx:PortfolioCompanyAcquisitionMember 2023-03-31 0001393818 us-gaap:PhantomShareUnitsPSUsMember 2023-03-31 0001393818 bx:EquityAndPreferredSecuritiesMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember bx:TransactionPriceValuationTechniqueMember 2023-03-31 0001393818 us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:LoansReceivableMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 bx:ThirdPartyPricingValuationTechniqueMember us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:CorporateTreasuryInvestmentsMember 2023-03-31 0001393818 bx:TransactionPriceValuationTechniqueMember bx:DebtInstrumentsMember us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:EquitySecuritiesPartnershipsAndLlcInterestsMember us-gaap:ValuationTechniqueDiscountedCashFlowMember 2023-03-31 0001393818 bx:BlackstoneHoldingsMember 2023-03-31 0001393818 bx:FourPointSevenFiveZeroPercentNotesMember 2023-03-31 0001393818 bx:TwoPointZeroZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:OnePointZeroZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:ThreePointOneFiveZeroPercentNotesMember 2023-03-31 0001393818 bx:OnePointFiveZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:TwoPointFiveZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:OnePointSixZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:TwoPointZeroZeroZero1PercentNotesMember 2023-03-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:SixPointTwoFiveZeroPercentNotesMember 2023-03-31 0001393818 bx:FivePointZeroZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:FourPointFourFiveZeroPercentNotesMember 2023-03-31 0001393818 bx:FourPointZeroZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesOneMember 2023-03-31 0001393818 bx:TwoPointEightZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:TwoPointEightFiveZeroPercentNotesMember 2023-03-31 0001393818 bx:ThreePointTwoZeroZeroPercentageNoteMember 2023-03-31 0001393818 us-gaap:SeniorNotesMember 2023-03-31 0001393818 bx:FivePointNineZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:SixPointTwoZeroZeroPercentNotesMember 2023-03-31 0001393818 bx:OnePointSixTwoFivePercentNotesMember 2023-03-31 0001393818 bx:OnePointFiveZeroZeroMember 2023-03-31 0001393818 bx:TwoPointFiveFiveZeroPercentageNoteMember 2023-03-31 0001393818 bx:SecuredBorrowingsOneMember us-gaap:OtherDebtSecuritiesMember 2023-03-31 0001393818 bx:SecuredBorrowingsTwoMember us-gaap:OtherDebtSecuritiesMember 2023-03-31 0001393818 us-gaap:OtherDebtSecuritiesMember 2023-03-31 0001393818 bx:BlackstoneFundFacilitiesMember bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 bx:BorrowingsOfConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel1Member bx:FreestandingDerivativesMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 us-gaap:FairValueInputsLevel2Member bx:FreestandingDerivativesMember us-gaap:FairValueMeasurementsRecurringMember 2023-03-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesMember 2023-03-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember 2023-03-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember 2023-03-31 0001393818 bx:SecuredBorrowingsTwoMember 2023-03-31 0001393818 bx:SecuredBorrowingsOneMember 2023-03-31 0001393818 bx:RealEstateSegmentMember us-gaap:OperatingSegmentsMember 2023-03-31 0001393818 bx:PrivateEquitySegmentMember us-gaap:OperatingSegmentsMember 2023-03-31 0001393818 bx:CreditAndInsuranceMember us-gaap:OperatingSegmentsMember 2023-03-31 0001393818 bx:HedgeFundSolutionsSegmentMember us-gaap:OperatingSegmentsMember 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember 2023-03-31 0001393818 bx:SeriesOnePreferredStockMember 2023-03-31 0001393818 bx:SeriesTwoPreferredStockMember 2023-03-31 0001393818 bx:UnvestedParticipatingCommonStockMember 2023-03-31 0001393818 us-gaap:CommonStockMember 2023-03-31 0001393818 bx:ParticipatingPartnershipUnitsMember 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryCommitmentsMember us-gaap:FairValueInputsLevel3Member 2023-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember bx:CorporateTreasuryCommitmentsMember 2023-03-31 0001393818 srt:ConsolidationEliminationsMember 2023-03-31 0001393818 bx:BlackstoneRealEstateInvestmentTrustOrBreitMember 2023-03-31 0001393818 bx:BlackstoneRealEstateInvestmentTrustOrBreitMember bx:UniversityOfCaliforniaMember 2023-03-31 0001393818 bx:BlackstonePartnershipUnitsMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember 2022-01-01 2022-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember 2022-01-01 2022-03-31 0001393818 bx:CorporateTreasuryInvestmentsMember 2022-01-01 2022-03-31 0001393818 bx:InvestmentAssetOtherMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:RealEstateSegmentMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:PrivateEquitySegmentMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:CreditAndInsuranceMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:HedgeFundSolutionsSegmentMember 2022-01-01 2022-03-31 0001393818 bx:RelatedPartiesMember 2022-01-01 2022-03-31 0001393818 us-gaap:MaterialReconcilingItemsMember 2022-01-01 2022-03-31 0001393818 us-gaap:InvestmentAdviceMember 2022-01-01 2022-03-31 0001393818 us-gaap:InvestmentPerformanceMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member 2022-01-01 2022-03-31 0001393818 us-gaap:ForeignExchangeContractMember bx:FreestandingDerivativesMember 2022-01-01 2022-03-31 0001393818 us-gaap:CreditDefaultSwapMember bx:FreestandingDerivativesMember 2022-01-01 2022-03-31 0001393818 us-gaap:TotalReturnSwapMember bx:FreestandingDerivativesMember 2022-01-01 2022-03-31 0001393818 bx:FreestandingDerivativesMember 2022-01-01 2022-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:InterestRateContractMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:LoansReceivableMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member srt:WeightedAverageMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member srt:MaximumMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member srt:MinimumMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2022-01-01 2022-03-31 0001393818 us-gaap:IntersegmentEliminationMember 2022-01-01 2022-03-31 0001393818 us-gaap:NoncontrollingInterestMember bx:BlackstoneIncMember 2022-01-01 2022-03-31 0001393818 us-gaap:NoncontrollingInterestMember us-gaap:ConsolidatedEntitiesMember 2022-01-01 2022-03-31 0001393818 us-gaap:ParentMember 2022-01-01 2022-03-31 0001393818 us-gaap:RetainedEarningsMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputEbitdaMultipleMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputEbitdaMultipleMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:FairValueMeasurementsRecurringMember bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputEbitdaMultipleMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:MeasurementInputCapRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:MeasurementInputCapRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:FairValueMeasurementsRecurringMember us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:MeasurementInputCapRateMember 2022-01-01 2022-03-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2022-01-01 2022-03-31 0001393818 us-gaap:OperatingSegmentsMember us-gaap:InvestmentAdviceMember 2022-01-01 2022-03-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2022-01-01 2022-03-31 0001393818 srt:ConsolidationEliminationsMember 2022-01-01 2022-03-31 0001393818 us-gaap:CapitalUnitsMember 2022-01-01 2022-03-31 0001393818 us-gaap:CommonStockMember 2022-01-01 2022-03-31 0001393818 bx:SeriesTwoPreferredStockMember 2022-01-01 2022-03-31 0001393818 bx:SeriesOnePreferredStockMember 2022-01-01 2022-03-31 0001393818 bx:RealizedGainsLossesMember us-gaap:DebtSecuritiesMember 2022-01-01 2022-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:DebtSecuritiesMember 2022-01-01 2022-03-31 0001393818 us-gaap:AssetsMember bx:RealizedGainsLossesMember 2022-01-01 2022-03-31 0001393818 us-gaap:AssetsMember bx:NetChangeInUnrealizedGainsLossesMember 2022-01-01 2022-03-31 0001393818 bx:CorporateTreasuryCommitmentsMember bx:NetChangeInUnrealizedGainsLossesMember 2022-01-01 2022-03-31 0001393818 bx:EquityAndPreferredSecuritiesMember bx:RealizedGainsLossesMember 2022-01-01 2022-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember bx:EquityAndPreferredSecuritiesMember 2022-01-01 2022-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:LiabilityMember 2022-01-01 2022-03-31 0001393818 us-gaap:LoansReceivableMember bx:RealizedGainsLossesMember 2022-01-01 2022-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:LoansReceivableMember 2022-01-01 2022-03-31 0001393818 bx:BlackstonePartnershipUnitsMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember 2023-01-01 2023-03-31 0001393818 bx:RealEstateSegmentMember bx:BlackstoneHoldingsMember 2023-01-01 2023-03-31 0001393818 bx:RealEstateSegmentMember bx:CurrentAndFormerBlackstonePersonnelMember 2023-01-01 2023-03-31 0001393818 bx:RealEstateSegmentMember 2023-01-01 2023-03-31 0001393818 bx:PrivateEquitySegmentMember bx:BlackstoneHoldingsMember 2023-01-01 2023-03-31 0001393818 bx:CurrentAndFormerBlackstonePersonnelMember bx:PrivateEquitySegmentMember 2023-01-01 2023-03-31 0001393818 bx:PrivateEquitySegmentMember 2023-01-01 2023-03-31 0001393818 bx:BlackstoneHoldingsMember bx:CreditAndInsuranceMember 2023-01-01 2023-03-31 0001393818 bx:CreditAndInsuranceMember bx:CurrentAndFormerBlackstonePersonnelMember 2023-01-01 2023-03-31 0001393818 bx:CreditAndInsuranceMember 2023-01-01 2023-03-31 0001393818 bx:BlackstoneHoldingsMember 2023-01-01 2023-03-31 0001393818 bx:CurrentAndFormerBlackstonePersonnelMember 2023-01-01 2023-03-31 0001393818 bx:ConsolidatedBlackstoneFundsMember 2023-01-01 2023-03-31 0001393818 bx:CorporateTreasuryInvestmentsMember 2023-01-01 2023-03-31 0001393818 bx:InvestmentAssetOtherMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:RealEstateSegmentMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:PrivateEquitySegmentMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:CreditAndInsuranceMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember bx:HedgeFundSolutionsSegmentMember 2023-01-01 2023-03-31 0001393818 bx:RelatedPartiesMember 2023-01-01 2023-03-31 0001393818 bx:EquitySettledAwardsDeferredRestrictedSharesOfCommonStockMember bx:BlackstoneGroupIncMember 2023-01-01 2023-03-31 0001393818 bx:CashSettledAwardsPhantomSharesMember bx:BlackstoneGroupIncMember 2023-01-01 2023-03-31 0001393818 us-gaap:CommonStockMember 2023-01-01 2023-03-31 0001393818 srt:ParentCompanyMember bx:BlackstonePartnershipUnitsMember 2023-01-01 2023-03-31 0001393818 us-gaap:MaterialReconcilingItemsMember 2023-01-01 2023-03-31 0001393818 us-gaap:InvestmentAdviceMember 2023-01-01 2023-03-31 0001393818 us-gaap:InvestmentPerformanceMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2023-01-01 2023-03-31 0001393818 us-gaap:HedgeFundsEquityMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2023-01-01 2023-03-31 0001393818 bx:PerformanceFeesMember bx:RealEstateSegmentMember 2023-01-01 2023-03-31 0001393818 bx:PerformanceFeesMember bx:PrivateEquitySegmentMember 2023-01-01 2023-03-31 0001393818 bx:CreditAndInsuranceMember bx:PerformanceFeesMember 2023-01-01 2023-03-31 0001393818 bx:HedgeFundSolutionsSegmentMember bx:PerformanceFeesMember 2023-01-01 2023-03-31 0001393818 bx:PerformanceFeesMember 2023-01-01 2023-03-31 0001393818 us-gaap:ForeignExchangeContractMember bx:FreestandingDerivativesMember 2023-01-01 2023-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:CreditDefaultSwapMember 2023-01-01 2023-03-31 0001393818 bx:FreestandingDerivativesMember 2023-01-01 2023-03-31 0001393818 bx:FreestandingDerivativesMember us-gaap:TotalReturnSwapMember 2023-01-01 2023-03-31 0001393818 us-gaap:InterestRateContractMember bx:FreestandingDerivativesMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:LoansReceivableMember 2023-01-01 2023-03-31 0001393818 bx:FreestandingDerivativesMember bx:OtherDerivativesMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member srt:WeightedAverageMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member srt:MaximumMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member srt:MinimumMember us-gaap:LoansReceivableMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:ValuationTechniqueDiscountedCashFlowMember us-gaap:MeasurementInputDiscountRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:IntersegmentEliminationMember 2023-01-01 2023-03-31 0001393818 bx:BlackstoneIncMember us-gaap:NoncontrollingInterestMember 2023-01-01 2023-03-31 0001393818 us-gaap:NoncontrollingInterestMember us-gaap:ConsolidatedEntitiesMember 2023-01-01 2023-03-31 0001393818 us-gaap:ParentMember 2023-01-01 2023-03-31 0001393818 us-gaap:RetainedEarningsMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:MeasurementInputEbitdaMultipleMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:MeasurementInputEbitdaMultipleMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:MeasurementInputEbitdaMultipleMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 bx:FourPointSevenFiveZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointZeroZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:OnePointZeroZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:ThreePointOneFiveZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:FivePointNineZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:OnePointSixTwoFivePercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:OnePointFiveZeroZeroMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointFiveZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:OnePointSixZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointZeroZeroZero1PercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointFiveFiveZeroPercentageNoteMember 2023-01-01 2023-03-31 0001393818 bx:SixPointTwoZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:SixPointTwoFiveZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:FivePointZeroZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:FourPointFourFiveZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:FourPointZeroZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:ThreePointFiveZeroZeroPercentNotesOneMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointEightZeroZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:TwoPointEightFiveZeroPercentNotesMember 2023-01-01 2023-03-31 0001393818 bx:ThreePointTwoZeroZeroPercentageNoteMember 2023-01-01 2023-03-31 0001393818 bx:SecuredBorrowingsOneMember 2023-01-01 2023-03-31 0001393818 bx:SecuredBorrowingsTwoMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:WeightedAverageMember us-gaap:MeasurementInputCapRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MaximumMember us-gaap:MeasurementInputCapRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember bx:EquitySecuritiesPartnershipsAndLlcInterestsMember srt:MinimumMember us-gaap:MeasurementInputCapRateMember us-gaap:FairValueMeasurementsRecurringMember 2023-01-01 2023-03-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2023-01-01 2023-03-31 0001393818 us-gaap:OperatingSegmentsMember us-gaap:InvestmentAdviceMember 2023-01-01 2023-03-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2023-01-01 2023-03-31 0001393818 srt:ConsolidationEliminationsMember 2023-01-01 2023-03-31 0001393818 us-gaap:CapitalUnitsMember 2023-01-01 2023-03-31 0001393818 bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember 2023-01-01 2023-03-31 0001393818 bx:SeriesTwoPreferredStockMember 2023-01-01 2023-03-31 0001393818 bx:SeriesOnePreferredStockMember 2023-01-01 2023-03-31 0001393818 bx:RealizedGainsLossesMember us-gaap:AssetsMember 2023-01-01 2023-03-31 0001393818 us-gaap:AssetsMember bx:NetChangeInUnrealizedGainsLossesMember 2023-01-01 2023-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember bx:CorporateTreasuryCommitmentsMember 2023-01-01 2023-03-31 0001393818 bx:RealizedGainsLossesMember us-gaap:CorporateDebtSecuritiesMember 2023-01-01 2023-03-31 0001393818 bx:RealizedGainsLossesMember us-gaap:DebtSecuritiesMember 2023-01-01 2023-03-31 0001393818 us-gaap:DebtSecuritiesMember bx:NetChangeInUnrealizedGainsLossesMember 2023-01-01 2023-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:CorporateDebtSecuritiesMember 2023-01-01 2023-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember bx:LiabilitiesOfConsolidatedCloVehiclesNotesPayableMember 2023-01-01 2023-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:LiabilityMember 2023-01-01 2023-03-31 0001393818 bx:RealizedGainsLossesMember us-gaap:LoansReceivableMember 2023-01-01 2023-03-31 0001393818 bx:NetChangeInUnrealizedGainsLossesMember us-gaap:LoansReceivableMember 2023-01-01 2023-03-31 0001393818 bx:RealizedGainsLossesMember bx:EquityAndPreferredSecuritiesMember 2023-01-01 2023-03-31 0001393818 bx:EquityAndPreferredSecuritiesMember bx:NetChangeInUnrealizedGainsLossesMember 2023-01-01 2023-03-31 0001393818 us-gaap:DomesticCountryMember us-gaap:TaxYear2019Member 2023-01-01 2023-03-31 0001393818 us-gaap:TaxYear2009Member bx:NewYorkCityMember 2023-01-01 2023-03-31 0001393818 bx:NewYorkStateMember us-gaap:TaxYear2016Member 2023-01-01 2023-03-31 0001393818 country:GB us-gaap:TaxYear2011Member 2023-01-01 2023-03-31 0001393818 bx:BlackstoneHoldingsMember bx:RealEstateSegmentMember 2022-01-01 2022-12-31 0001393818 bx:RealEstateSegmentMember bx:CurrentAndFormerBlackstonePersonnelMember 2022-01-01 2022-12-31 0001393818 bx:RealEstateSegmentMember 2022-01-01 2022-12-31 0001393818 bx:BlackstoneHoldingsMember bx:PrivateEquitySegmentMember 2022-01-01 2022-12-31 0001393818 bx:PrivateEquitySegmentMember bx:CurrentAndFormerBlackstonePersonnelMember 2022-01-01 2022-12-31 0001393818 bx:PrivateEquitySegmentMember 2022-01-01 2022-12-31 0001393818 bx:CreditAndInsuranceMember bx:BlackstoneHoldingsMember 2022-01-01 2022-12-31 0001393818 bx:CreditAndInsuranceMember bx:CurrentAndFormerBlackstonePersonnelMember 2022-01-01 2022-12-31 0001393818 bx:CreditAndInsuranceMember 2022-01-01 2022-12-31 0001393818 bx:BlackstoneHoldingsMember 2022-01-01 2022-12-31 0001393818 bx:CurrentAndFormerBlackstonePersonnelMember 2022-01-01 2022-12-31 0001393818 us-gaap:CommonStockMember 2021-12-07 0001393818 us-gaap:FairValueInputsLevel3Member 2021-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2021-12-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:LoansReceivableMember 2021-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2021-12-31 0001393818 us-gaap:NoncontrollingInterestMember bx:BlackstoneIncMember 2021-12-31 0001393818 us-gaap:NoncontrollingInterestMember us-gaap:ConsolidatedEntitiesMember 2021-12-31 0001393818 us-gaap:ParentMember 2021-12-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2021-12-31 0001393818 us-gaap:RetainedEarningsMember 2021-12-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2021-12-31 0001393818 us-gaap:CommonStockMember 2021-12-31 0001393818 us-gaap:CapitalUnitsMember 2021-12-31 0001393818 us-gaap:FairValueInputsLevel3Member 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:LoansReceivableMember 2022-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2022-03-31 0001393818 us-gaap:CommonStockMember 2022-03-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2022-03-31 0001393818 us-gaap:RetainedEarningsMember 2022-03-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2022-03-31 0001393818 us-gaap:ParentMember 2022-03-31 0001393818 us-gaap:NoncontrollingInterestMember us-gaap:ConsolidatedEntitiesMember 2022-03-31 0001393818 us-gaap:NoncontrollingInterestMember bx:BlackstoneIncMember 2022-03-31 0001393818 us-gaap:CapitalUnitsMember 2022-03-31 0001393818 bx:BlackstoneGroupIncMember bx:EquitySettledAwardsDeferredRestrictedSharesOfCommonStockMember 2022-12-31 0001393818 bx:CashSettledAwardsPhantomSharesMember bx:BlackstoneGroupIncMember 2022-12-31 0001393818 srt:ParentCompanyMember bx:BlackstonePartnershipUnitsMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member us-gaap:LoansReceivableMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2022-12-31 0001393818 bx:BlackstoneIncMember us-gaap:NoncontrollingInterestMember 2022-12-31 0001393818 us-gaap:NoncontrollingInterestMember us-gaap:ConsolidatedEntitiesMember 2022-12-31 0001393818 us-gaap:ParentMember 2022-12-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2022-12-31 0001393818 us-gaap:RetainedEarningsMember 2022-12-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2022-12-31 0001393818 us-gaap:CommonStockMember 2022-12-31 0001393818 us-gaap:CapitalUnitsMember 2022-12-31 0001393818 srt:ParentCompanyMember bx:BlackstonePartnershipUnitsMember 2023-03-31 0001393818 bx:EquitySettledAwardsDeferredRestrictedSharesOfCommonStockMember bx:BlackstoneGroupIncMember 2023-03-31 0001393818 bx:CashSettledAwardsPhantomSharesMember bx:BlackstoneGroupIncMember 2023-03-31 0001393818 bx:PerformanceFeesMember bx:RealEstateSegmentMember 2022-12-31 0001393818 bx:PrivateEquitySegmentMember bx:PerformanceFeesMember 2022-12-31 0001393818 bx:CreditAndInsuranceMember bx:PerformanceFeesMember 2022-12-31 0001393818 bx:HedgeFundSolutionsSegmentMember bx:PerformanceFeesMember 2022-12-31 0001393818 bx:PerformanceFeesMember 2022-12-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:InvestmentAssetOtherMember 2023-03-31 0001393818 us-gaap:LoansReceivableMember us-gaap:FairValueInputsLevel3Member 2023-03-31 0001393818 us-gaap:FairValueInputsLevel3Member bx:ConsolidatedBlackstoneFundsMember 2023-03-31 0001393818 us-gaap:RetainedEarningsMember 2023-03-31 0001393818 us-gaap:AccumulatedOtherComprehensiveIncomeMember 2023-03-31 0001393818 us-gaap:ParentMember 2023-03-31 0001393818 us-gaap:ConsolidatedEntitiesMember us-gaap:NoncontrollingInterestMember 2023-03-31 0001393818 us-gaap:NoncontrollingInterestMember bx:BlackstoneIncMember 2023-03-31 0001393818 us-gaap:AdditionalPaidInCapitalMember 2023-03-31 0001393818 us-gaap:CapitalUnitsMember 2023-03-31 0001393818 bx:PerformanceFeesMember bx:RealEstateSegmentMember 2023-03-31 0001393818 bx:PrivateEquitySegmentMember bx:PerformanceFeesMember 2023-03-31 0001393818 bx:CreditAndInsuranceMember bx:PerformanceFeesMember 2023-03-31 0001393818 bx:HedgeFundSolutionsSegmentMember bx:PerformanceFeesMember 2023-03-31 0001393818 bx:PerformanceFeesMember 2023-03-31 iso4217:USD xbrli:pure xbrli:shares utr:Year bx:Segment bx:Person iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2023 |

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number:

001-33551

(Exact name of Registrant as specified in its charter)

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

|

(Address of principal executive offices)(Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| |

|

|

|

Name of each exchange on which registered |

| Common Stock |

|

BX |

|

New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒

No

☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒

No

☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule

12b-2

of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer ☒ |

|

|

|

Accelerated filer ☐ |

| |

|

|

|

Smaller reporting company ☐ |

|

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule

12b-2

of the Exchange Act). Yes

☐

No

☒

As of April 28, 2023, there were 706,084,809 shares of common stock of the registrant outstanding.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, which reflect our current views with respect to, among other things, our operations, taxes, earnings and financial performance, share repurchases and dividends. You can identify these forward-looking statements by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “scheduled,” “estimates,” “anticipates,” “opportunity,” “leads,” “forecast” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in our Annual Report on

Form 10-K

for the year ended December 31, 2022, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other periodic filings. The forward-looking statements speak only as of the date of this report, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Website and Social Media Disclosure

We use our website (www.blackstone.com), Facebook page (www.facebook.com/blackstone), Twitter (www.twitter.com/blackstone), LinkedIn (www.linkedin.com/company/blackstonegroup), Instagram (www.instagram.com/blackstone), SoundCloud (www.soundcloud.com/blackstone-300250613), PodBean (www.blackstone.podbean.com), Spotify (https://spoti.fi/2LJ1tHG), YouTube (www.youtube.com/user/blackstonegroup) and Apple Podcast (https://apple.co/31Pe1Gg) accounts as channels of distribution of company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about Blackstone when you enroll your email address by visiting the “Contact Us/Email Alerts” section of our website at http://ir.blackstone.com. The contents of our website, any alerts and social media channels are not, however, a part of this report.

In this report, references to “Blackstone,” the “Company,” “we,” “us” or “our” refer to Blackstone Inc. and its consolidated subsidiaries.

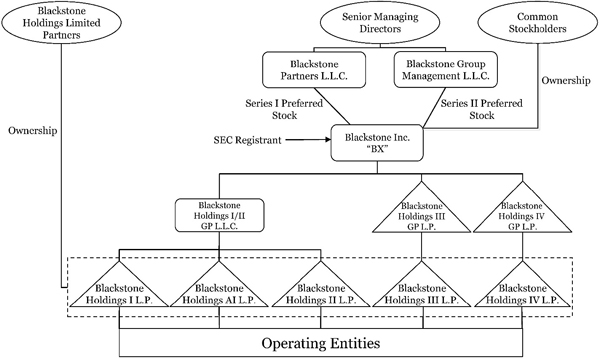

“Series I Preferred Stockholder” refers to Blackstone Partners L.L.C., the holder of the sole outstanding share of our Series I preferred stock.

“Series II Preferred Stockholder” refers to Blackstone Group Management L.L.C., the holder of the sole outstanding share of our Series II preferred stock.

“Blackstone Funds,” “our funds” and “our investment funds” refer to the funds and other vehicles that are managed by Blackstone. “Our carry funds” refers to funds managed by Blackstone that have commitment-based multi-year drawdown structures that pay carry on the realization of an investment.

We refer to our real estate opportunistic funds as Blackstone Real Estate Partners (“BREP”) funds and our real estate debt investment funds as Blackstone Real Estate Debt Strategies (“BREDS”) funds. We refer to our real estate investment trusts as “REITs,” to Blackstone Mortgage Trust, Inc., our NYSE-listed REIT, as “BXMT” and to Blackstone Real Estate Income Trust, Inc., our

non-listed

REIT, as “BREIT.” We refer to our real estate funds that target substantially stabilized assets in prime markets, as Blackstone Property Partners (“BPP”) funds and our income-generating European real estate funds as Blackstone European Property Income (“BEPIF”) funds. We refer to BREIT, BPP and BEPIF collectively as our Core+ real estate strategies.

We refer to our flagship corporate private equity funds as Blackstone Capital Partners (“BCP”) funds, our energy-focused private equity funds as Blackstone Energy Transition Partners (“BETP”) funds, our core private equity funds as Blackstone Core Equity Partners (“BCEP”), our opportunistic investment platform that invests globally across asset classes, industries and geographies as Blackstone Tactical Opportunities (“Tactical Opportunities”), our secondary fund of funds business as Strategic Partners Fund Solutions (“Strategic Partners”), our infrastructure-focused funds as Blackstone Infrastructure Partners (“BIP”), our life sciences investment platform as Blackstone Life Sciences (“BXLS”), our growth equity investment platform as Blackstone Growth (“BXG”), our multi-asset investment program for eligible high net worth investors offering exposure to certain of our key illiquid investment strategies through a single commitment as Blackstone Total Alternatives Solution (“BTAS”) and our capital markets services business as Blackstone Capital Markets (“BXCM”).

“Our hedge funds” refers to our funds of hedge funds, hedge funds, certain of our real estate debt investment funds, including a registered investment company, and certain other credit-focused funds which are managed by Blackstone.

We refer to our business development companies as “BDCs,” to Blackstone Private Credit Fund as “BCRED” and to Blackstone Secured Lending Fund as “BXSL.”

“BIS” refers to Blackstone Insurance Solutions, which partners with insurers to deliver capital-efficient investments tailored to each insurer’s needs and risk profile.

We refer to our separately managed accounts as “SMAs.”

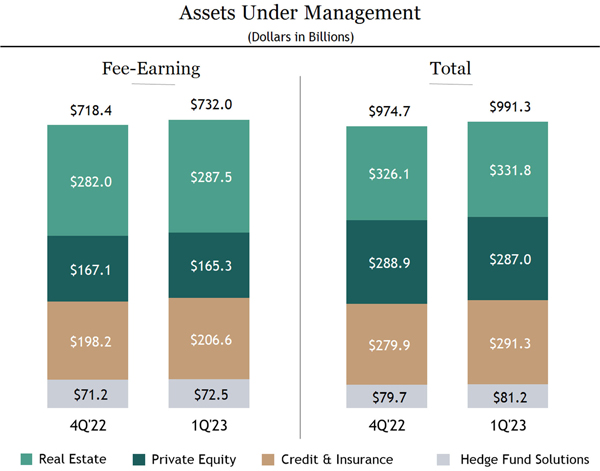

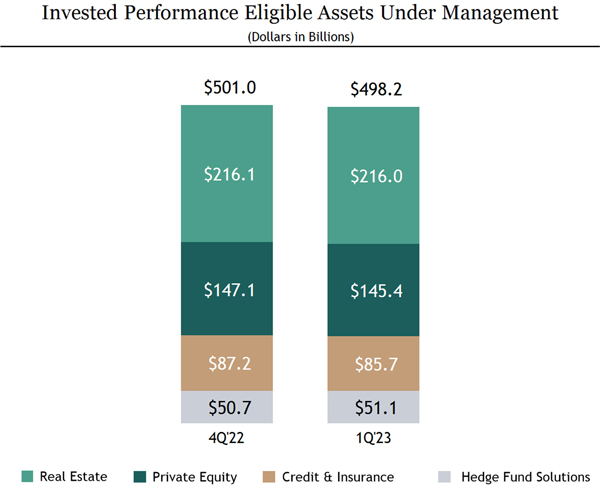

“Total Assets Under Management” refers to the assets we manage. Our Total Assets Under Management equals the sum of:

| |

(a) |

the fair value of the investments held by our carry funds and our and co-investment entities managed by us plus the capital that we are entitled to call from investors in those funds and entities pursuant to the terms of their respective capital commitments, including capital commitments to funds that have yet to commence their investment periods, |

| |

(b) |

the net asset value of (1) our hedge funds, real estate debt carry funds, BPP, certain co-investments managed by us, certain credit-focused funds, and our Hedge Fund Solutions drawdown funds (plus, in each case, the capital that we are entitled to call from investors in those funds, including commitments yet to commence their investment periods), and (2) our funds of hedge funds, our Hedge Fund Solutions registered investment companies, BREIT, and BEPIF, |

| |

(c) |

the invested capital, fair value or net asset value of assets we manage pursuant to separately managed accounts, |

| |

(d) |

the amount of debt and equity outstanding for our collateralized loan obligations (“CLO”) during the reinvestment period, |

| |

(e) |

the aggregate par amount of collateral assets, including principal cash, for our CLOs after the reinvestment period, |

| |

(f) |

the gross or net amount of assets (including leverage where applicable) for our credit-focused registered investment companies and BDCs, |

| |

(g) |

the fair value of common stock, preferred stock, convertible debt, term loans or similar instruments issued by BXMT, and |

| |

(h) |

borrowings under and any amounts available to be borrowed under certain credit facilities of our funds. |

3

Our carry funds are commitment-based drawdown structured funds that do not permit investors to redeem their interests at their election. Our funds of hedge funds, hedge funds, funds structured like hedge funds and other open-ended funds in our Real Estate, Credit & Insurance and Hedge Fund Solutions segments generally have structures that afford an investor the right to withdraw or redeem their interests on a periodic basis (for example, annually, quarterly or monthly), typically with 2 to 95 days’ notice, depending on the fund and the liquidity profile of the underlying assets. In our Perpetual Capital vehicles where redemption rights exist, Blackstone has the ability to fulfill redemption requests only (a) in Blackstone’s or the vehicles’ board’s discretion, as applicable, or (b) to the extent there is sufficient new capital. Investment advisory agreements related to certain separately managed accounts in our Credit & Insurance and Hedge Fund Solutions segments, excluding our BIS separately managed accounts, may generally be terminated by an investor on 30 to 90 days’ notice. Our BIS separately managed accounts can generally only be terminated for long-term underperformance, cause and certain other limited circumstances, in each case subject to Blackstone’s right to cure.

“Fee-Earning

Assets Under Management” refers to the assets we manage on which we derive management fees and/or performance revenues. Our

Fee-Earning

Assets Under Management equals the sum of:

| |

(a) |

for our Private Equity segment funds, Real Estate segment carry funds including certain BREDS funds, and certain Hedge Fund Solutions funds, the amount of capital commitments, remaining invested capital, fair value, net asset value or par value of assets held, depending on the fee terms of the fund, |

| |

(b) |

for our credit-focused carry funds, the amount of remaining invested capital (which may include leverage) or net asset value, depending on the fee terms of the fund, |

| |

(c) |

the remaining invested capital or fair value of assets held in co-investment vehicles managed by us on which we receive fees, |

| |

(d) |

the net asset value of our funds of hedge funds, hedge funds, BPP, certain co-investments managed by us, certain registered investment companies, BREIT, BEPIF, and certain of our Hedge Fund Solutions drawdown funds, |

| |

(e) |

the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| |

(f) |

the net proceeds received from equity offerings and accumulated distributable earnings of BXMT, subject to certain adjustments, |

| |

(g) |

the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| |

(h) |

the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies and BDCs. |

Each of our segments may include certain

Fee-Earning

Assets Under Management on which we earn performance revenues but not management fees.

Our calculations of Total Assets Under Management and

Fee-Earning

Assets Under Management may differ from the calculations of other asset managers, and as a result this measure may not be comparable to similar measures presented by other asset managers. In addition, our calculation of Total Assets Under Management includes commitments to, and the fair value of, invested capital in our funds from Blackstone and our personnel, regardless of whether such commitments or invested capital are subject to fees. Our definitions of Total Assets Under Management and

Fee-Earning

Assets Under Management are not based on any definition of Total Assets Under Management and

Fee-Earning

Assets Under Management that is set forth in the agreements governing the investment funds that we manage.

4

For our carry funds, Total Assets Under Management includes the fair value of the investments held and uncalled capital commitments, whereas

Fee-Earning

Assets Under Management may include the total amount of capital commitments or the remaining amount of invested capital at cost, depending on whether the investment period has expired or as specified by the fee terms of the fund. As such, in certain carry funds

Fee-Earning

Assets Under Management may be greater than Total Assets Under Management when the aggregate fair value of the remaining investments is less than the cost of those investments.

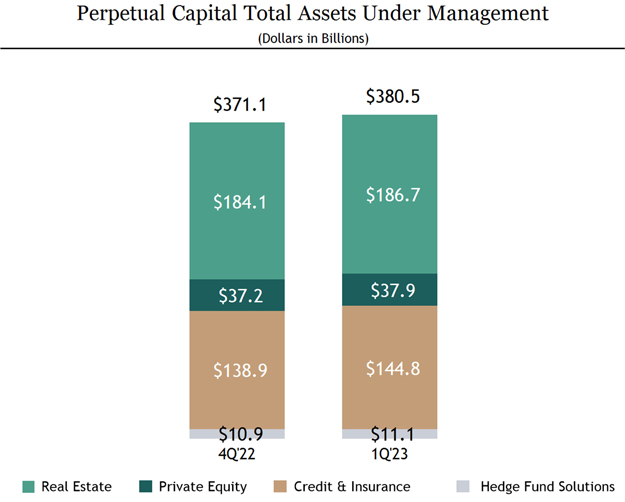

“Perpetual Capital” refers to the component of assets under management with an indefinite term, that is not in liquidation, and for which there is no requirement to return capital to investors through redemption requests in the ordinary course of business, except where funded by new capital inflows. Perpetual Capital includes

co-investment

capital with an investor right to convert into Perpetual Capital.

This report does not constitute an offer of any Blackstone Fund.

5

Part I. Financial Information

Condensed Consolidated Statements of Financial Condition (Unaudited)

(Dollars in Thousands, Except Share Data)

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

2,830,971 |

|

|

$ |

4,252,003 |

|

Cash Held by Blackstone Funds and Other |

|

|

190,322 |

|

|

|

241,712 |

|

Investments |

|

|

26,985,951 |

|

|

|

27,553,251 |

|

Accounts Receivable |

|

|

924,934 |

|

|

|

462,904 |

|

Due from Affiliates |

|

|

4,099,765 |

|

|

|

4,146,707 |

|

Intangible Assets, Net |

|

|

230,295 |

|

|

|

217,287 |

|

Goodwill |

|

|

1,890,202 |

|

|

|

1,890,202 |

|

Other Assets |

|

|

833,232 |

|

|

|

800,458 |

|

|

|

|

894,067 |

|

|

|

896,981 |

|

Deferred Tax Assets |

|

|

2,206,700 |

|

|

|

2,062,722 |

|

| |

|

|

|

|

|

|

|

|

|

|

$ |

41,086,439 |

|

|

$ |

42,524,227 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Loans Payable |

|

$ |

12,311,469 |

|

|

$ |

12,349,584 |

|

Due to Affiliates |

|

|

1,974,182 |

|

|

|

2,118,481 |

|

Accrued Compensation and Benefits |

|

|

5,470,773 |

|

|

|

6,101,801 |

|

Securities Sold, Not Yet Purchased |

|

|

3,881 |

|

|

|

3,825 |

|

Repurchase Agreements |

|

|

19,563 |

|

|

|

89,944 |

|

Operating Lease Liabilities |

|

|

1,016,808 |

|

|

|

1,021,454 |

|

Accounts Payable, Accrued Expenses and Other Liabilities |

|

|

1,575,938 |

|

|

|

1,158,071 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

22,372,614 |

|

|

|

22,843,160 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

Redeemable Non-Controlling Interests in Consolidated Entities |

|

|

1,644,697 |

|

|

|

1,715,006 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity of Blackstone Inc. |

|

|

|

|

|

|

|

|

Common Stock, $0.00001 par value, 90 billion shares authorized, (712,794,968 shares issued and outstanding as of March 31, 2023; 710,276,923 shares issued and outstanding as of December 31, 2022) |

|

|

7 |

|

|

|

7 |

|

Series I Preferred Stock, $0.00001 par value, 999,999,000 shares authorized, (1 share issued and outstanding as of March 31, 2023 and December 31, 2022) |

|

|

— |

|

|

|

— |

|

Series II Preferred Stock, $0.00001 par value, 1,000 shares authorized, (1 share issued and outstanding as of March 31, 2023 and December 31, 2022) |

|

|

— |

|

|

|

— |

|

|

|

|

5,957,054 |

|

|

|

5,935,273 |

|

Retained Earnings |

|

|

1,156,109 |

|

|

|

1,748,106 |

|

Accumulated Other Comprehensive Loss |

|

|

(22,333 |

) |

|

|

(27,475 |

) |

| |

|

|

|

|

|

|

|

|

Total Stockholders’ Equity of Blackstone Inc. |

|

|

7,090,837 |

|

|

|

7,655,911 |

|

Non-Controlling Interests in Consolidated Entities |

|

|

5,058,090 |

|

|

|

5,056,480 |

|

Non-Controlling Interests in Blackstone Holdings |

|

|

4,920,201 |

|

|

|

5,253,670 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

17,069,128 |

|

|

|

17,966,061 |

|

| |

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

|

$ |

41,086,439 |

|

|

$ |

42,524,227 |

|

| |

|

|

|

|

|

|

|

|

continued...

See notes to condensed consolidated financial statements.

6

Condensed Consolidated Statements of Financial Condition (Unaudited)

The following presents the asset and liability portion of the consolidated balances presented in the Condensed Consolidated Statements of Financial Condition attributable to consolidated Blackstone Funds which are variable interest entities. The following assets may only be used to settle obligations of these consolidated Blackstone Funds and these liabilities are only the obligations of these consolidated Blackstone Funds and they do not have recourse to the general credit of Blackstone.

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash Held by Blackstone Funds and Other |

|

$ |

190,322 |

|

|

$ |

241,712 |

|

| Investments |

|

|

5,443,867 |

|

|

|

5,136,542 |

|

| Accounts Receivable |

|

|

39,006 |

|

|

|

55,223 |

|

| Due from Affiliates |

|

|

23,041 |

|

|

|

7,152 |

|

| Other Assets |

|

|

2,523 |

|

|

|

2,159 |

|

| |