ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

| |

| |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Class A |

|

|

| ☒ |

Accelerated filer ☐ | |

| Non-accelerated filer ☐ |

Smaller reporting company | |

| Emerging growth company |

| Page |

||||||

| Item 1. |

5 |

|||||

| Item 1A. |

17 |

|||||

| Item 1B. |

68 |

|||||

| Item 2. |

68 |

|||||

| Item 3. |

68 |

|||||

| Item 4. |

69 |

|||||

| Item 5. |

70 |

|||||

| Item 6. |

72 |

|||||

| Item 7. |

74 |

|||||

| Item 7A. |

131 |

|||||

| Item 8. |

135 |

|||||

| Item 8A. |

211 |

|||||

| Item 9. |

213 |

|||||

| Item 9A. |

213 |

|||||

| Item 9B. |

214 |

|||||

| Item 10. |

215 |

|||||

| Item 11. |

221 |

|||||

| Item 12. |

241 |

|||||

| Item 13. |

244 |

|||||

| Item 14. |

25 2 |

|||||

| Item 15. |

253 |

|||||

| Item 16. |

265 |

|||||

| 266 |

||||||

| (a) | the fair value of the investments held by our carry funds and our side-by-side and co-investment entities managed by us, plus (1) the capital that we are entitled to call from investors in those funds and entities pursuant to the terms of their respective capital commitments, including capital commitments to funds that have yet to commence their investment periods, or (2) for certain credit-focused funds the amounts available to be borrowed under asset based credit facilities, |

| (b) | the net asset value of (1) our hedge funds and real estate debt carry funds, BPP, certain co-investments managed by us, certain credit-focused funds, and our Hedge Fund Solutions drawdown funds (plus, in each case, the capital that we are entitled to call from investors in those funds, including commitments yet to commence their investment periods), and (2) our funds of hedge funds, our Hedge Fund Solutions registered investment companies, and BREIT, |

| (c) | the invested capital, fair value or net asset value of assets we manage pursuant to separately managed accounts, |

| (d) | the amount of debt and equity outstanding for our collateralized loan obligations (“CLO”) during the reinvestment period, |

| (e) | the aggregate par amount of collateral assets, including principal cash, for our CLOs after the reinvestment period, |

| (f) | the gross or net amount of assets (including leverage where applicable) for our credit-focused registered investment companies, and |

| (g) | the fair value of common stock, preferred stock, convertible debt, or similar instruments issued by BXMT. |

| (a) | for our Private Equity segment funds and Real Estate segment carry funds including certain BREDS and Hedge Fund Solutions funds, the amount of capital commitments, remaining invested capital, fair value, net asset value or par value of assets held, depending on the fee terms of the fund, |

| (b) | for our credit-focused carry funds, the amount of remaining invested capital (which may include leverage) or net asset value, depending on the fee terms of the fund, |

| (c) | the remaining invested capital or fair value of assets held in co-investment vehicles managed by us on which we receive fees, |

| (d) | the net asset value of our funds of hedge funds, hedge funds, BPP, certain co-investments managed by us, certain registered investment companies, BREIT, and certain of our Hedge Fund Solutions drawdown funds, |

| (e) | the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| (f) | the net proceeds received from equity offerings and accumulated core earnings of BXMT, subject to certain adjustments, |

| (g) | the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| (h) | the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies. |

Item 1. |

Business |

| • | The investment adviser of each of our non-EEA domiciled carry funds and the AIFM of each of our EEA domiciled carry funds generally receives an annual management fee based on a percentage of the fund’s capital commitments, invested capital and/or undeployed capital during the investment period and the fund’s invested capital or investment fair value after the investment period, except that the investment adviser or AIFM to certain of our credit-focused, BPP and BCEP funds receives a management fee based on a percentage of invested capital or net asset value. These management fees are payable on a regular basis (typically quarterly) in the contractually prescribed amounts over the life of the fund. Depending on the base on which management fees are calculated, negative performance of one or more investments in the fund may reduce the total management fee paid for the relevant period, but not the fee rate. Management fees received are not subject to clawback. |

| • | The investment adviser of each of our funds that are structured like hedge funds, or of our funds of hedge funds, registered mutual funds and separately managed accounts that invest in hedge funds, generally receives a management fee based on a percentage of the fund’s or account’s net asset value. These management fees are payable on a regular basis (typically quarterly). These funds generally permit investors to withdraw or redeem their interests periodically, in some cases following the expiration of a specified period of time when capital may not be withdrawn. Decreases in the net asset value of investor’s capital accounts may reduce the total management fee paid for the relevant period, but not the fee rate. Management fees received are not subject to clawback. In addition, to the extent the mandate of our funds is to invest capital in third party managed funds, as is the case with our funds of hedge funds, our funds will be required to pay management fees to such third party managers, which typically are borne by investors in such investment vehicles. |

| • | The investment adviser of each of our CLOs typically receives annual management fees based on a percentage of each fund’s assets, subject to certain performance measures related to the underlying assets the vehicle owns, and additional management fees, which are incentive-based (that is, subject to meeting certain return criteria). These management fees are payable on a regular basis (typically quarterly). The term of each CLO varies from deal to deal and may be subject to early redemption or extension; typically, however, a CLO will be wound down within eight to eleven years of being launched. The amount of fees will decrease as the fund deleverages toward the end of its term. |

| • | The investment adviser of each of our separately managed accounts generally receives annual management fees based on a percentage of each account’s net asset value or invested capital. The management fees we receive from each of our separately managed accounts are generally paid on a regular basis (typically quarterly) such management fees are generally subject to contractual rights the investor has to terminate our management of an account on generally as short as 30 days’ notice. |

| • | The investment adviser of each of our credit-focused registered and non-registered investment companies typically receives an annual management fee based on a percentage of net asset value or total managed assets. The management fees we receive from the registered investment companies we manage are generally paid on a regular basis (typically quarterly). Such management fees are generally subject to contractual rights the company’s board of directors has to terminate our management of an account on as short as 30 days’ notice. |

| • | The investment adviser of BXMT receives an annual management fee, paid quarterly, based on a percentage of BXMT’s net proceeds received from equity offerings and accumulated “core earnings” (which is generally equal to its net income, calculated under generally accepted accounting principles in the U.S. (“GAAP”), excluding certain non-cash and other items), subject to certain adjustments. |

| • | The investment adviser of BREIT receives a management fee based on a percentage of the REIT’s net asset value, payable monthly. |

| • | In our Hedge Fund Solutions segment, the investment adviser of our funds of hedge funds, certain hedge funds, separately managed accounts that invest in hedge funds and certain non-U.S. registered investment companies, is entitled to an incentive fee of 0% to 20%, as applicable, of the applicable investment vehicle’s net appreciation, subject to “high water mark” provisions and in some cases a preferred return. In addition, to the extent the mandate of our funds is to invest capital in third party managed hedge funds, as is the case with our funds of hedge funds, our funds will be required to pay incentive fees to such third party managers, which typically are borne by investors in such investment vehicles. |

| • | The general partners or similar entities of each of our real estate and credit hedge fund structures receive incentive fees of generally up to 20% of the applicable fund’s net capital appreciation per annum. |

| • | The investment manager of BXMT receives an incentive fee generally equal to 20% of BXMT’s core earnings in excess of a 7% per annum return on stockholder’s equity (excluding stock appreciation or depreciation), provided that BXMT’s core earnings over the prior three years is greater than zero. |

| • | The investment manager of BREIT receives an incentive fee of 12.5% of BREIT’s total return, subject to a 5% hurdle amount with a catch-up and recouping any loss carryforward amounts, payable annually. |

| • | The general partner of certain open-ended BPP funds is entitled to an incentive fee allocation of generally 10% of net profit, subject to a hurdle amount generally of 6% to 7%, a loss recovery amount and a catch-up. Incentive Fees for these funds are generally realized every three years from when a limited partner makes its initial investment. |

Item 1A. |

Risk Factors |

| • | economic slowdown in the U.S. and internationally; |

| • | changes in interest rates and/or a lack of availability of credit in the U.S. and internationally; |

| • | commodity price volatility; and |

| • | changes in law and/or regulation, and uncertainty regarding government and regulatory policy. |

| • | a number of our competitors in some of our businesses have greater financial, technical, marketing and other resources and more personnel than we do, |

| • | some of our funds may not perform as well as competitors’ funds or other available investment products, |

| • | several of our competitors have significant amounts of capital, and many of them have similar investment objectives to ours, which may create additional competition for investment opportunities and may reduce the size and duration of pricing inefficiencies that many alternative investment strategies seek to exploit, |

| • | some of our competitors, particularly strategic competitors, may have a lower cost of capital, which may be exacerbated to the extent potential changes to the Internal Revenue Code limit the deductibility of interest expense, |

| • | some of our competitors may have access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities, |

| • | some of our competitors may be subject to less regulation and accordingly may have more flexibility to undertake and execute certain businesses or investments than we can and/or bear less compliance expense than we do, |

| • | some of our competitors may have more flexibility than us in raising certain types of investment funds under the investment management contracts they have negotiated with their investors, |

| • | some of our competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we want to make, |

| • | some of our competitors may be more successful than us in the development and implementation of new technology to address investor demand for product and strategy innovation, particularly in the hedge fund industry, |

| • | there are relatively few barriers to entry impeding new alternative asset fund management firms, and the successful efforts of new entrants into our various businesses, including former “star” portfolio managers at large diversified financial institutions as well as such institutions themselves, is expected to continue to result in increased competition, |

| • | some of our competitors may have better expertise or be regarded by investors as having better expertise in a specific asset class or geographic region than we do, |

| • | our competitors that are corporate buyers may be able to achieve synergistic cost savings in respect of an investment, which may provide them with a competitive advantage in bidding for an investment, |

| • | some investors may prefer to invest with an investment manager that is not publicly traded or is smaller with only one or two investment products that it manages, and |

| • | other industry participants will from time to time seek to recruit our investment professionals and other employees away from us. |

| • | Immigration reform has been a continued area of focus for the Trump administration. Although the details and timing of potential changes to immigration law are difficult to predict, restrictions on the ability of individuals from certain countries to obtain non-immigrant visas or limitations on the number of individuals eligible for U.S. work visas may make it more difficult for current and future portfolio companies to recruit and retain skilled foreign workers and may increase labor and compliance costs. |

| • | Effective for months beginning after December 31, 2018, the Tax Reform Bill provides for the repeal of the provision of the Patient Protection and Affordable Care Act (“ACA”), which requires certain individuals without minimum health coverage to pay a penalty. This repeal and other measures being pursued by the Trump administration could result in an increase in the size of the uninsured population or a reduction in funds presently available to patients as a result of the repeal of this provision or the potential repeal of other significant portions of the ACA could adversely affect multiple businesses in the healthcare industry, including pharmaceutical companies that benefit from purchases by individuals covered by government-subsidized insurance, hospitals that may be required to increase write-offs for bad debt resulting from the inability of insured patients to pay for care and insurance companies that have developed effective plans for participating in healthcare exchanges. Further, one court has ruled that the ACA is unconstitutional, but stayed that decision pending resolution of an appeal. If that decision is not reversed on appeal, that could exacerbate the types of adverse developments that are described above. |

| • | we may create new funds in the future that reflect a different asset mix and different investment strategies, as well as a varied geographic and industry exposure as compared to our present funds, and any such new funds could have different returns from our existing or previous funds, |

| • | despite periods of volatility, market conditions have been largely favorable in recent years, which has helped to generate positive performance, particularly in our private equity and real estate businesses, but there can be no assurance that such conditions will repeat or that our current or future investment funds will avail themselves of comparable market conditions, |

| • | the rates of returns of our carry funds reflect unrealized gains as of the applicable measurement date that may never be realized, which may adversely affect the ultimate value realized from those funds’ investments, |

| • | competition for investment opportunities resulting from, among other things, the increased amount of capital invested in alternative investment funds continues to increase, |

| • | our investment funds’ returns in some years benefited from investment opportunities and general market conditions that may not repeat themselves, our current or future investment funds might not be able to avail themselves of comparable investment opportunities or market conditions, and the circumstances under which our current or future funds may make future investments may differ significantly from those conditions prevailing in the past, |

| • | newly established funds may generate lower returns during the period in which they initially deploy their capital, and |

| • | the rates of return reflect our historical cost structure, which may vary in the future due to various factors enumerated elsewhere in this report and other factors beyond our control, including changes in laws. |

| • | give rise to an obligation to make mandatory pre-payments of debt using excess cash flow, which might limit the entity’s ability to respond to changing industry conditions to the extent additional cash is needed for the response, to make unplanned but necessary capital expenditures or to take advantage of growth opportunities, |

| • | limit the entity’s ability to adjust to changing market conditions, thereby placing it at a competitive disadvantage compared to its competitors who have relatively less debt, |

| • | allow even moderate reductions in operating cash flow to render it unable to service its indebtedness, leading to a bankruptcy or other reorganization of the entity and a loss of part or all of the equity investment in it, |

| • | limit the entity’s ability to engage in strategic acquisitions that might be necessary to generate attractive returns or further growth, and |

| • | limit the entity’s ability to obtain additional financing or increase the cost of obtaining such financing, including for capital expenditures, working capital or general corporate purposes. |

| • | currency exchange matters, including fluctuations in currency exchange rates and costs associated with conversion of investment principal and income from one currency into another, |

| • | less developed or efficient financial markets than in the United States, which may lead to potential price volatility and relative illiquidity, |

| • | the absence of uniform accounting, auditing and financial reporting standards, practices and disclosure requirements and less government supervision and regulation, |

| • | changes in laws or clarifications to existing laws that could impact our tax treaty positions, which could adversely impact the returns on our investments, |

| • | a less developed legal or regulatory environment, differences in the legal and regulatory environment or enhanced legal and regulatory compliance, |

| • | heightened exposure to corruption risk in non-U.S. markets, |

| • | political hostility to investments by foreign or private equity investors, |

| • | reliance on a more limited number of commodity inputs, service providers and/or distribution mechanisms, |

| • | higher rates of inflation, |

| • | higher transaction costs, |

| • | difficulty in enforcing contractual obligations, |

| • | fewer investor protections and less publicly available information in respect of companies in non-U.S. markets, |

| • | certain economic and political risks, including potential exchange control regulations and restrictions on our non-U.S. investments and repatriation of profits on investments or of capital invested, the risks of political, economic or social instability, the possibility of expropriation or confiscatory taxation and adverse economic and political developments, and |

| • | the possible imposition of non-U.S. taxes or withholding on income and gains recognized with respect to such securities. |

| • | the use of new technologies, including hydraulic fracturing, |

| • | reliance on estimates of oil and gas reserves in the evaluation of available geological, geophysical, engineering and economic data for each reservoir, and |

| • | encountering unexpected formations or pressures, premature declines of reservoirs, blow-outs, equipment failures and other accidents in completing wells and otherwise, cratering, sour gas releases, uncontrollable flows of oil, natural gas or well fluids, adverse weather conditions, pollution, fires, spills and other environmental risks. |

| • | Ownership of infrastructure assets may present risk of liability for personal and property injury or impose significant operating challenges and costs with respect to, for example, compliance with zoning, environmental or other applicable laws. |

| • | Infrastructure asset investments may face construction risks including, without limitation: (a) labor disputes, shortages of material and skilled labor, or work stoppages, (b) slower than projected construction progress and the unavailability or late delivery of necessary equipment, (c) less than optimal coordination with public utilities in the relocation of their facilities, (d) adverse weather conditions and unexpected construction conditions, (e) accidents or the breakdown or failure of construction equipment or processes; and (f) catastrophic events such as explosions, fires, terrorist activities and other similar events. These risks could result in substantial unanticipated delays or expenses (which may exceed expected or forecasted budgets) and, under certain circumstances, could prevent completion of construction activities once undertaken. Certain infrastructure asset investments may remain in construction phases for a prolonged period and, accordingly, may not be cash generative for a prolonged period. Recourse against the contractor may be subject to liability caps or may be subject to default or insolvency on the part of the contractor. |

| • | The operation of infrastructure assets is exposed to potential unplanned interruptions caused by significant catastrophic or force majeure events. These risks could, among other effects, adversely impact the cash flows available from investments in infrastructure assets, cause personal injury or loss of life, damage property, or instigate disruptions of service. In addition, the cost of repairing or replacing damaged assets could be considerable. Repeated or prolonged service interruptions may result in permanent loss of customers, litigation, or penalties for regulatory or contractual non-compliance. Force majeure events that are incapable of, or too costly to, cure may also have a permanent adverse effect on an investment. |

| • | The management of the business or operations of an infrastructure asset may be contracted to a third party management company unaffiliated with us. Although it would be possible to replace any such operator, the failure of such an operator to adequately perform its duties or to act in ways that are in our best interest, or the breach by an operator of applicable agreements or laws, rules and regulations, could have an adverse effect on the investment’s financial condition or results of operations. Infrastructure investments may involve the subcontracting of design and construction activities in respect of projects, and as a result our investments are subject to the risks that contractual provisions passing liabilities to a subcontractor could be ineffective, the subcontractor fails to perform services which it has agreed to perform and the subcontractor becomes insolvent. |

| • | BXLS’s strategies include, among others, investments that are referred to as “pharmaceutical corporate partnership” transactions. Pharmaceutical corporate partnership transactions are risk-sharing collaborations with large pharmaceutical partners on drug development programs and investments in royalty streams of |

pre-commercial pharmaceutical products. BXLS’s ability to source pharmaceutical corporate partnership transactions has been, and will continue to be, in part dependent on the ability of three special purpose development companies to identify, diligence, negotiate and in many cases, take the lead in executing the agreed development plans with respect to, a pharmaceutical corporate partnership transaction. Moreover, as such special purpose development companies are jointly owned by us and two unaffiliated life sciences investors, we (and our funds) are not the sole beneficiaries of such sourcing strategies and capabilities of such special purpose development companies. |

| • | Life sciences and healthcare companies are subject to extensive regulation by the U.S. Food and Drug Administration, similar foreign regulatory authorities and, to a lesser extent, other federal and state agencies, prior to marketing their products to the public. These companies are subject to the expense, delay and uncertainty of the approval process, and there can be no guarantee that a particular product will obtain regulatory approval. In addition, the current regulatory framework may change or additional regulations may arise at any stage during the product development phase of an investment, which may delay or prevent regulatory approval or impact applicable exclusivity periods. If a company in which our funds are invested is unable to obtain regulatory approval for its product, or a product in which our funds are invested does not obtain regulatory approval, in a timely fashion or at all, the value of our investment would be adversely impacted. In addition, in connection with certain pharmaceutical corporate partnership transactions, our special purpose development companies will be contractually obligated to run clinical trials. In the event such clinical trials do not comply with the complicated regulatory requirements applicable thereto, such special purpose development companies may be subject to regulatory actions. Lastly, if legislation is passed in the U.S. that reduces the applicable exclusivity period for biologic products, this reform could result in price reductions at an earlier stage of a product’s life cycle than originally estimated by BXLS, which could reduce the cumulative financial returns on BXLS’s investment in any such product. |

| • | Intellectual property often constitutes an important part of a life sciences company’s assets and competitive strengths, particularly for royalty monetization transactions. To the extent such companies’ intellectual property positions with respect to products in which BXLS invests, whether through a royalty or otherwise, are challenged, invalidated or circumvented, the value of BXLS’s investment may be impaired. The success of a life sciences investment depends in part on the ability of the pharmaceutical or other life sciences companies in whose products BXLS invests to obtain and defend patent rights and other intellectual property rights that are important to the commercialization of such products. The patent positions of such companies can be highly uncertain and often involve complex legal, scientific and factual questions. |

| • | The commercial success of products could be compromised if governmental or third party payers do not provide coverage and reimbursement, breach, rescind or modify their contracts or reimbursement policies or delay payments for such products. In both the U.S. and foreign markets, the successful sale of a life sciences company’s product depends on the ability to obtain and maintain adequate coverage and reimbursement from third party payers, including government healthcare programs and private insurance plans. Governments and third party payers continue to pursue aggressive initiatives to contain costs and manage drug utilization and are increasingly focused on the effectiveness, benefits and costs of similar treatments, which could result in lower reimbursement rates and narrower populations for whom the products in which BXLS invests will be reimbursed by payers. To the extent an investment made by BXLS relies in whole or in part on royalties or other payments based on product sales, adequate third party payer reimbursement may not be available to enable price levels for the product sufficient for BXLS to realize an appropriate return on the investment. |

| • | Certain of the funds in which we invest are newly established funds without any operating history or are managed by management companies or general partners who may not have as significant track records as an independent manager. |

| • | Generally, the execution of these hedge funds’ investment strategies is subject to the sole discretion of the management company or the general partner of such funds. |

| • | Hedge funds may engage in speculative trading strategies, including short selling, which is subject to the theoretically unlimited risk of loss because there is no limit on how much the price of a security may appreciate before the short position is closed out. A fund may be subject to losses if a security lender demands return of the lent securities and an alternative lending source cannot be found or if the fund is otherwise unable to borrow securities that are necessary to hedge or cover its positions. |

| • | Hedge funds are exposed to the risk that a counterparty will not settle a transaction in accordance with its terms and conditions because of a dispute over the terms of the contract (whether or not bona fide) or because of a credit or liquidity problem or otherwise, thus causing the fund to suffer a loss. Counterparty risk is accentuated for contracts with longer maturities where events may intervene to prevent settlement, or where the fund has concentrated its transactions with a single or small group of counterparties. Generally, hedge funds are not restricted from dealing with any particular counterparty or from concentrating any or all of their transactions with one counterparty. Moreover, the funds’ internal consideration of the creditworthiness of their counterparties may prove insufficient. The absence of a regulated market to facilitate settlement may increase the potential for losses. |

| • | Credit risk may arise through a default by one of several large institutions that are dependent on one another to meet their liquidity or operational needs, so that a default by one institution causes a series of defaults by the other institutions. This “systemic risk” may adversely affect the financial intermediaries (such as clearing agencies, clearing houses, banks, securities firms and exchanges) with which the hedge funds interact on a daily basis. |

| • | The efficacy of investment and trading strategies depend largely on the ability to establish and maintain an overall market position in a combination of financial instruments. A hedge fund’s trading orders may not be executed in a timely and efficient manner due to various circumstances, including systems failures or human error. In such event, the funds might only be able to acquire some but not all of the components of the position, or if the overall position were to need adjustment, the funds might not be able to make such adjustment. As a result, the funds would not be able to achieve the market position selected by the management company or general partner of such funds, and might incur a loss in liquidating their position. |

| • | Hedge funds are subject to risks due to potential illiquidity of assets. Hedge funds may make investments or hold trading positions in markets that are volatile and which may become illiquid. Timely divestiture or sale of trading positions can be impaired by decreased trading volume, increased price volatility, concentrated trading positions, limitations on the ability to transfer positions in highly specialized or structured transactions to which they may be a party, and changes in industry and government regulations. It may be impossible or costly for hedge funds to liquidate positions rapidly in order to meet margin calls, withdrawal requests or otherwise, particularly if there are other market participants seeking to dispose of similar assets at the same time or the relevant market is otherwise moving against a position or in the event of trading halts or daily price movement limits on the market or otherwise. Any “gate” or similar limitation on withdrawals with respect to hedge funds may not be effective in mitigating such risk. Moreover, these risks may be exacerbated for our funds of hedge funds. For example, if one of our funds of hedge funds were to invest a significant portion of its assets in two or more hedge funds that each had illiquid positions in the same issuer, the illiquidity risk for our funds of hedge funds would be compounded. For example, in 2008 many hedge funds, including some of our hedge funds, experienced significant declines in value. In many cases, these declines in value were both provoked and exacerbated by margin calls and forced selling of assets. Moreover, certain of our funds of hedge funds were invested in third party hedge funds that halted redemptions in the face of illiquidity and other issues, which precluded those funds of hedge funds from receiving their capital back on request. |

| • | Hedge fund investments are subject to risks relating to investments in commodities, futures, options and other derivatives, the prices of which are highly volatile and may be subject to the theoretically unlimited risk of loss in certain circumstances, including if the fund writes a call option. Price movements of commodities, futures and options contracts and payments pursuant to swap agreements are influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments and national and international political and economic events and policies. The value of futures, options and swap agreements also depends upon the price of the commodities underlying them and prevailing exchange rates. In addition, hedge funds’ assets are subject to the risk of the failure of any of the exchanges on which their positions trade or of their clearinghouses or counterparties. Most U.S. commodities exchanges limit fluctuations in certain commodity interest prices during a single day by imposing “daily price fluctuation limits” or “daily limits,” the existence of which may reduce liquidity or effectively curtail trading in particular markets. |

| • | permitting our board of directors to issue one or more series of preferred stock; |

| • | providing for the loss of voting rights for the Class A common stock; |

| • | requiring advance notice for shareholder proposals and nominations if they are ever permitted by applicable law; |

| • | placing limitations on convening shareholder meetings; |

| • | prohibiting shareholder action by written consent unless such action is consent to by the Class C Shareholder; and |

| • | imposing super-majority voting requirements for certain amendments to our certificate of incorporation. |

Item 1B. |

Unresolved Staff Comments |

Item 2. |

Properties |

Item 3. |

Legal Proceedings |

Item 4. |

Mine Safety Disclosures |

Item 5. |

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

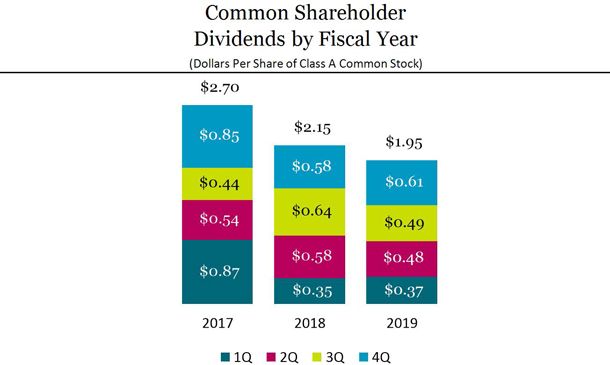

| 2019 |

2018 |

|||||||

| First Quarter |

$ | 0.37 |

$ | 0.35 |

||||

| Second Quarter |

0.48 |

0.58 |

||||||

| Third Quarter |

0.49 |

0.64 |

||||||

| Fourth Quarter |

0.61 |

0.58 |

||||||

| $ | 1.95 |

$ | 2.15 |

|||||

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (a) |

Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program (Dollars in Thousands) (a) |

||||||||||||

| Oct. 1 - Oct. 31, 2019 |

— |

$ | — |

— |

$ | 864,012 |

||||||||||

| Nov. 1 - Nov. 30, 2019 |

— |

$ | — |

— |

$ | 864,012 |

||||||||||

| Dec. 1 - Dec. 31, 2019 |

1,500,000 |

$ | 55.22 |

1,500,000 |

$ | 781,182 |

||||||||||

| 1,500,000 |

1,500,000 |

|||||||||||||||

| (a) | On July 16, 2019, our board of directors authorized the repurchase of up to $1.0 billion of Class A common stock and Blackstone Holdings Partnership Units. Under the repurchase program, repurchases may be made from time to time in open market transactions, in privately negotiated transactions or otherwise. The timing and the actual numbers repurchased will depend on a variety of factors, including legal requirements, price and economic and market conditions. The repurchase program may be changed, suspended or discontinued at any time and does not have a specified expiration date. See “— Item 8. Financial Statements and Supplementary Data — Notes to Consolidated Financial Statements — Note 16. Earnings Per Share and Stockholder’s Equity” and “— Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Sources and Uses of Liquidity” for further information regarding this unit repurchase program. |

Item 6. |

Selected Financial Data |

| Year Ended December 31, |

||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| (Dollars in Thousands, Except Per Share Data) |

||||||||||||||||||||

| Revenues |

||||||||||||||||||||

| Management and Advisory Fees, Net |

$ | 3,472,155 |

$ | 3,027,796 |

$ | 2,751,322 |

$ | 2,464,290 |

$ | 2,566,449 |

||||||||||

| Incentive Fees |

129,911 |

57,540 |

242,514 |

149,928 |

168,554 |

|||||||||||||||

| Total Investment Income |

3,473,813 |

2,903,659 |

4,144,712 |

2,381,604 |

1,844,930 |

|||||||||||||||

| Interest and Dividend Revenue and Other |

262,391 |

844,264 |

6,467 |

150,477 |

102,739 |

|||||||||||||||

| Total Revenues |

7,338,270 |

6,833,259 |

7,145,015 |

5,146,299 |

4,682,672 |

|||||||||||||||

| Expenses |

||||||||||||||||||||

| Total Compensation and Benefits |

3,067,857 |

2,674,691 |

2,933,523 |

2,202,986 |

2,296,515 |

|||||||||||||||

| General, Administrative and Other |

679,408 |

594,873 |

488,582 |

541,624 |

600,047 |

|||||||||||||||

| Interest Expense |

199,648 |

163,990 |

197,486 |

152,654 |

144,522 |

|||||||||||||||

| Fund Expenses |

17,738 |

78,486 |

132,787 |

52,181 |

79,499 |

|||||||||||||||

| Total Expenses |

3,964,651 |

3,512,040 |

3,752,378 |

2,949,445 |

3,120,583 |

|||||||||||||||

| Other Income |

||||||||||||||||||||

| Change in Tax Receivable Agreement Liability |

161,567 |

— |

403,855 |

— |

82,707 |

|||||||||||||||

| Net Gains from Fund Investment Activities |

282,829 |

191,722 |

321,597 |

184,750 |

176,364 |

|||||||||||||||

| Total Other Income |

444,396 |

191,722 |

725,452 |

184,750 |

259,071 |

|||||||||||||||

| Income Before Provision (Benefit) for Taxes |

3,818,015 |

3,512,941 |

4,118,089 |

2,381,604 |

1,821,160 |

|||||||||||||||

| Provision (Benefit) for Taxes |

(47,952 |

) | 249,390 |

743,147 |

132,362 |

190,398 |

||||||||||||||

| Net Income |

3,865,967 |

3,263,551 |

3,374,942 |

2,249,242 |

1,630,762 |

|||||||||||||||

| Net Income (Loss) Attributable to Redeemable Non-Controlling Interests in Consolidated Entities |

(121 |

) | (2,104 |

) | 13,806 |

3,977 |

11,145 |

|||||||||||||

| Net Income Attributable to Non-Controlling Interests in Consolidated Entities |

476,779 |

358,878 |

497,439 |

246,152 |

219,900 |

|||||||||||||||

| Net Income Attributable to Non-Controlling Interests in Blackstone Holdings |

1,339,627 |

1,364,989 |

1,392,323 |

960,099 |

686,529 |

|||||||||||||||

| Net Income Attributable to The Blackstone Group Inc. |

$ | 2,049,682 |

$ | 1,541,788 |

$ | 1,471,374 |

$ | 1,039,014 |

$ | 713,188 |

||||||||||

| Year Ended December 31, |

||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| (Dollars in Thousands, Except Per Share Data) |

||||||||||||||||||||

| Net Income Per Share of Class A Common Stock |

||||||||||||||||||||

| Basic |

$ | 3.03 |

$ | 2.27 |

$ | 2.21 |

$ | 1.60 |

$ | 1.12 |

||||||||||

| Diluted |

$ | 3.03 |

$ | 2.26 |

$ | 2.21 |

$ | 1.56 |

$ | 1.04 |

||||||||||

| Dividends Declared Per Share of Class A Common Stock (a) |

$ | 1.92 |

$ | 2.42 |

$ | 2.32 |

$ | 1.66 |

$ | 2.90 |

||||||||||

| (a) | Dividends declared reflects the calendar date of declaration for each dividend. The fourth quarter dividend, if any, for any fiscal year will be declared and paid in the subsequent fiscal year. |

| December 31, |

||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| (Dollars in Thousands) |

||||||||||||||||||||

| Statement of Financial Condition Data |

||||||||||||||||||||

| Total Assets (a) |

$ | 32,585,506 |

$ | 28,924,650 |

$ | 34,415,919 |

$ | 26,386,650 |

$ | 22,510,246 |

||||||||||

| Senior Notes |

$ | 4,600,856 |

$ | 3,471,151 |

$ | 3,514,815 |

$ | 3,399,922 |

$ | 2,797,060 |

||||||||||

| Total Liabilities (a) |

$ | 17,482,454 |

$ | 15,170,564 |

$ | 20,692,828 |

$ | 13,879,169 |

$ | 10,286,836 |

||||||||||

| Redeemable Non-Controlling Interests in Consolidated Entities |

$ | 87,651 |

$ | 141,779 |

$ | 210,944 |

$ | 185,390 |

$ | 183,459 |

||||||||||

| Total Equity/Partners’ Capital |

$ | 15,015,401 |

$ | 13,612,307 |

$ | 13,512,147 |

$ | 12,322,091 |

$ | 12,039,951 |

||||||||||

| (a) | The decrease in Total Assets and Total Liabilities from December 31, 2017 to December 31, 2018 is primarily due to the deconsolidation of CLOs and other fund entities, partially offset by the launch of new consolidated CLOs. The increase in Total Assets and Total Liabilities from December 31, 2016 to December 31, 2017 is principally due to new consolidated CLO vehicles managed by our Credit segment. |

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| • | Real Estate. |

| • | Private Equity. |

| (b) our opportunistic investment platform that invests globally across asset classes, industries and geographies, Blackstone Tactical Opportunities (“Tactical Opportunities”), (c) our secondary fund of funds business, Strategic Partners Fund Solutions (“Strategic Partners”), (d) our infrastructure-focused funds, Blackstone Infrastructure Partners (“BIP”), (e) our life sciences private investment platform, Blackstone Life Sciences (“BXLS”), (f) a multi-asset investment program for eligible high net worth investors offering exposure to certain of Blackstone’s key illiquid investment strategies through a single commitment, Blackstone Total Alternatives Solution (“BTAS”) and (g) our capital markets services business, Blackstone Capital Markets (“BXCM”). |

| • | Hedge Fund Solutions. |

| • | Credit. sub-advises predominantly consist of loans and securities of non-investment grade companies spread across the capital structure including senior debt, subordinated debt, preferred stock and common equity. |

| (a) | the fair value of the investments held by our carry funds and our side-by-side and co-investment entities managed by us, plus (1) the capital that we are entitled to call from investors in those funds and entities pursuant to the terms of their respective capital commitments, including capital commitments to funds that have yet to commence their investment periods, or (2) for certain credit-focused funds the amounts available to be borrowed under asset based credit facilities, |

| (b) | the net asset value of (1) our hedge funds and real estate debt carry funds, BPP, certain co-investments managed by us, certain credit-focused funds, and our Hedge Fund Solutions drawdown funds (plus, in each case, the capital that we are entitled to call from investors in those funds, including commitments yet to commence their investment periods), and (2) our funds of hedge funds, our Hedge Fund Solutions registered investment companies, and BREIT, |

| (c) | the invested capital, fair value or net asset value of assets we manage pursuant to separately managed accounts, |

| (d) | the amount of debt and equity outstanding for our CLOs during the reinvestment period, |

| (e) | the aggregate par amount of collateral assets, including principal cash, for our CLOs after the reinvestment period, |

| (f) | the gross or net amount of assets (including leverage where applicable) for our credit-focused registered investment companies, and |

| (g) | the fair value of common stock, preferred stock, convertible debt, or similar instruments issued by BXMT. |

| (a) | for our Private Equity segment funds and Real Estate segment carry funds, including certain BREDS and Hedge Fund Solutions funds, the amount of capital commitments, remaining invested capital, fair value, net asset value or par value of assets held, depending on the fee terms of the fund, |

| (b) | for our credit-focused carry funds, the amount of remaining invested capital (which may include leverage) or net asset value, depending on the fee terms of the fund, |

| (c) | the remaining invested capital or fair value of assets held in co-investment vehicles managed by us on which we receive fees, |

| (d) | the net asset value of our funds of hedge funds, hedge funds, BPP, certain co-investments managed by us, certain registered investment companies, BREIT, and certain of our Hedge Fund Solutions drawdown funds, |

| (e) | the invested capital, fair value of assets or the net asset value we manage pursuant to separately managed accounts, |

| (f) | the net proceeds received from equity offerings and accumulated core earnings of BXMT, subject to certain adjustments, |

| (g) | the aggregate par amount of collateral assets, including principal cash, of our CLOs, and |

| (h) | the gross amount of assets (including leverage) or the net assets (plus leverage where applicable) for certain of our credit-focused registered investment companies. |

| Year Ended December 31, |

2019 vs. 2018 |

2018 vs. 2017 | |||||||||||||||||||||||||||

| 2019 |

2018 |

2017 |

$ |

% |

$ |

% |

|||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||||

| Revenues |

|||||||||||||||||||||||||||||

| Management and Advisory Fees, Net |

$ | 3,472,155 |

$ | 3,027,796 |

$ | 2,751,322 |

$ | 444,359 |

15% |

$ | 276,474 |

10% |

|||||||||||||||||

| Incentive Fees |

129,911 |

57,540 |

242,514 |

72,371 |

126% |

(184,974 |

) | -76% |

|||||||||||||||||||||

| Investment Income (Loss) |

|||||||||||||||||||||||||||||

| Performance Allocations |

|||||||||||||||||||||||||||||

| Realized |

1,739,000 |

1,876,507 |

3,571,811 |

(137,507 |

) | -7% |

(1,695,304 |

) | -47% |

||||||||||||||||||||

| Unrealized |

1,126,332 |

561,373 |

(105,473 |

) | 564,959 |

101% |

666,846 |

N/M |

|||||||||||||||||||||

| Principal Investments |

|||||||||||||||||||||||||||||

| Realized |

393,478 |

415,862 |

635,769 |

(22,384 |

) | -5% |

(219,907 |

) | -35% |

||||||||||||||||||||

| Unrealized |

215,003 |

49,917 |

42,605 |

165,086 |

331% |

7,312 |

17% |

||||||||||||||||||||||

| Total Investment Income |

3,473,813 |

2,903,659 |

4,144,712 |

570,154 |

20% |

(1,241,053 |

) | -30% |

|||||||||||||||||||||

| Interest and Dividend Revenue |

182,398 |

171,947 |

139,696 |

10,451 |

6% |

32,251 |

23% |

||||||||||||||||||||||

| Other |

79,993 |

672,317 |

(133,229 |

) | (592,324 |

) | -88% |

805,546 |

N/M |

||||||||||||||||||||

| Total Revenues |

7,338,270 |

6,833,259 |

7,145,015 |

505,011 |

7% |

(311,756 |

) | -4% |

|||||||||||||||||||||

| Expenses |

|||||||||||||||||||||||||||||

| Compensation and Benefits |

|||||||||||||||||||||||||||||

| Compensation |

1,820,330 |

1,609,957 |

1,442,485 |

210,373 |

13% |

167,472 |

12% |

||||||||||||||||||||||

| Incentive Fee Compensation |

44,300 |

33,916 |

105,279 |

10,384 |

31% |

(71,363 |

) | -68% |

|||||||||||||||||||||

| Performance Allocations Compensation |

|||||||||||||||||||||||||||||

| Realized |

662,942 |

711,076 |

1,281,965 |

(48,134 |

) | -7% |

(570,889 |

) | -45% |

||||||||||||||||||||

| Unrealized |

540,285 |

319,742 |

103,794 |

220,543 |

69% |

215,948 |

208% |

||||||||||||||||||||||

| Total Compensation and Benefits |

3,067,857 |

2,674,691 |

2,933,523 |

393,166 |

15% |

(258,832 |

) | -9% |

|||||||||||||||||||||

| General, Administrative and Other |

679,408 |

594,873 |

488,582 |

84,535 |

14% |

106,291 |

22% |

||||||||||||||||||||||

| Interest Expense |

199,648 |

163,990 |

197,486 |

35,658 |

22% |

(33,496 |

) | -17% |

|||||||||||||||||||||

| Fund Expenses |

17,738 |

78,486 |

132,787 |

(60,748 |

) | -77% |

(54,301 |

) | -41% |

||||||||||||||||||||

| Total Expenses |

3,964,651 |

3,512,040 |

3,752,378 |

452,611 |

13% |

(240,338 |

) | -6% |

|||||||||||||||||||||

| Other Income |

|||||||||||||||||||||||||||||

| Change in Tax Receivable Agreement Liability |

161,567 |

— |

403,855 |

161,567 |

N/M |

(403,855 |

) | -100% |

|||||||||||||||||||||

| Net Gains from Fund Investment Activities |

282,829 |

191,722 |

321,597 |

91,107 |

48% |

(129,875 |

) | -40% |

|||||||||||||||||||||

| Total Other Income |

444,396 |

191,722 |

725,452 |

252,674 |

132% |

(533,730 |

) | -74% |

|||||||||||||||||||||

| Income Before Provision (Benefit) for Taxes |

3,818,015 |

3,512,941 |

4,118,089 |

305,074 |

9% |

(605,148 |

) | -15% |

|||||||||||||||||||||

| Provision (Benefit) for Taxes |

(47,952 |

) | 249,390 |

743,147 |

(297,342 |

) | N/M |

(493,757 |

) | -66% |

|||||||||||||||||||

| Net Income |

3,865,967 |

3,263,551 |

3,374,942 |

602,416 |

18% |

(111,391 |

) | -3% |

|||||||||||||||||||||

| Net Income (Loss) Attributable to Redeemable Non-Controlling Interests in Consolidated Entities |

(121 |

) | (2,104 |

) | 13,806 |

1,983 |

-94% |

(15,910 |

) | N/M |

|||||||||||||||||||

| Net Income Attributable to Non- Controlling Interests in Consolidated Entities |

476,779 |

358,878 |

497,439 |

117,901 |

33% |

(138,561 |

) | -28% |

|||||||||||||||||||||

| Net Income Attributable to Non- Controlling Interests in Blackstone Holdings |

1,339,627 |

1,364,989 |

1,392,323 |

(25,362 |

) | -2% |

(27,334 |

) | -2% |

||||||||||||||||||||

| Net Income Attributable to The Blackstone Group Inc. |

$ | 2,049,682 |

$ | 1,541,788 |

$ | 1,471,374 |

$ | 507,894 |

33% |

$ | 70,414 |

5% |

|||||||||||||||||

| N/M | Not meaningful. |

| Year Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (Dollars in Thousands) |

||||||||||||

| Income Before Provision (Benefit) for Taxes |

$ | 3,818,015 |

$ | 3,512,941 |

$ | 4,118,089 |

||||||

| Provision (Benefit) for Taxes |

$ | (47,952 |

) | $ | 249,390 |

$ | 743,147 |

|||||

| Effective Income Tax Rate |

-1.3 |

% | 7.1 |

% | 18.0 |

% | ||||||

| Year Ended December 31, |

2019 vs. 2018 |

2018 vs. 2017 |

|||||||||||||||||||

| 2019 |

2018 |

2017 |

|||||||||||||||||||

| Statutory U.S. Federal Income Tax Rate |

21.0 |

% | 21.0 |

% | 35.0 |

% | — |

-14.0 |

% | ||||||||||||

| Income Passed Through to Common Shareholders and Non-Controlling Interest Holders (a) |

-13.5 |

% | -15.5 |

% | -25.9 |

% | 2.0 |

% | 10.4 |

% | |||||||||||

| State and Local Income Taxes |

1.6 |

% | 1.8 |

% | 1.5 |

% | -0.2 |

% | 0.3 |

% | |||||||||||

| Equity-Based Compensation |

— |

— |

-0.1 |

% | — |

0.1 |

% | ||||||||||||||

| Change to a Taxable Corporation |

-10.3 |

% | — |

— |

-10.3 |

% | — |

||||||||||||||

| Impact of the Tax Reform Bill |

— |

— |

8.3 |

% | — |

-8.3 |

% | ||||||||||||||

| Change in Valuation Allowance (b) |

-0.8 |

% | — |

— |

-0.8 |

% | — |

||||||||||||||

| Other |

0.7 |

% | -0.2 |

% | -0.8 |

% | 0.9 |

% | 0.6 |

% | |||||||||||

| Effective Income Tax Rate |

-1.3 |

% | 7.1 |

% | 18.0 |

% | -8.4 |

% | -10.9 |

% | |||||||||||

| (a) | Includes income that was not taxable to Blackstone and its subsidiaries. Such income was directly taxable to shareholders of Blackstone’s Class A common stock for the period prior to the Conversion and remains taxable to Blackstone’s non-controlling interest holders. |

| (b) | The Change in Valuation Allowance for the year ended December 31, 2019 represents the change from July 1, 2019 to December 31, 2019, following the change to a taxable corporation. |

| Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2019 |

2018 | ||||||||||||||||||||||||||||||||||||||||

| Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

||||||||||||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||||||||||||||||

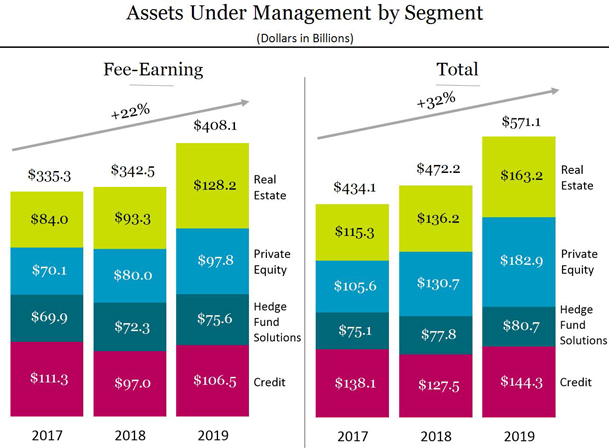

| Fee-Earning Assets Under Management |

|||||||||||||||||||||||||||||||||||||||||

| Balance, Beginning of Period |

$ | 93,252,724 |

$ | 80,008,166 |

$ | 72,280,606 |

$ | 96,986,011 |

$ | 342,527,507 |

$ | 83,984,824 |

$ | 70,140,883 |

$ | 69,914,061 |

$ | 111,304,230 |

$ | 335,343,998 |

|||||||||||||||||||||

| Inflows, including Commitments (a) |

52,424,662 |

27,260,480 |

11,488,234 |

21,069,189 |

112,242,565 |

17,961,223 |

16,096,543 |

12,354,410 |

24,587,957 |

71,000,133 |

|||||||||||||||||||||||||||||||

| Outflows, including Distributions (b) |

(9,690,143 |

) | (2,352,716 |

) | (11,928,940 |

) | (9,067,554 |

) | (33,039,353 |

) | (2,000,367 |

) | (1,888,223 |

) | (10,278,403 |

) | (27,640,908 |

) | (41,807,901 |

) | |||||||||||||||||||||

| Net Inflows (Outflows) |

42,734,519 |

24,907,764 |

(440,706 |

) | 12,001,635 |

79,203,212 |

15,960,856 |

14,208,320 |

2,076,007 |

(3,052,951 |

) | 29,192,232 |

|||||||||||||||||||||||||||||

| Realizations (c) |

(11,353,675 |

) | (7,212,993 |

) | (1,153,785 |

) | (5,629,089 |

) | (25,349,542 |

) | (8,781,140 |

) | (4,729,843 |

) | (429,912 |

) | (6,672,539 |

) | (20,613,434 |

) | |||||||||||||||||||||

| Market Activity (d)(g) |

3,580,569 |

71,027 |

4,949,889 |

3,092,190 |

11,693,675 |

2,088,184 |

388,806 |

720,450 |

(4,592,729 |

) | (1,395,289 |

) | |||||||||||||||||||||||||||||

| Balance, End of Period (e) |

$ | 128,214,137 |

$ | 97,773,964 |

$ | 75,636,004 |

$ | 106,450,747 |

$ | 408,074,852 |

$ | 93,252,724 |

$ | 80,008,166 |

$ | 72,280,606 |

$ | 96,986,011 |

$ | 342,527,507 |

|||||||||||||||||||||

| Increase (Decrease) |

$ | 34,961,413 |

$ | 17,765,798 |

$ | 3,355,398 |

$ | 9,464,736 |

$ | 65,547,345 |

$ | 9,267,900 |

$ | 9,867,283 |

$ | 2,366,545 |

$ | (14,318,219 |

) | $ | 7,183,509 |

||||||||||||||||||||

| Increase (Decrease) |

37 |

% | 22 |

% | 5 |

% | 10 |

% | 19 |

% | 11 |

% | 14 |

% | 3 |

% | -13 |

% | 2 |

% | |||||||||||||||||||||

| Annualized Base Management Fee Rate (f) |

1.04 |

% | 1.02 |

% | 0.75 |

% | 0.56 |

% | 0.86 |

% | 1.09 |

% | 1.00 |

% | 0.73 |

% | 0.56 |

% | 0.84 |

% | |||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||

| 2017 | |||||||||||||||||||||

| Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

|||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||

| Fee-Earning Assets Under Management |

|||||||||||||||||||||

| Balance, Beginning of Period |

$ | 72,030,054 |

$ | 69,110,457 |

$ | 66,987,553 |

$ | 68,964,608 |

$ | 277,092,672 |

|||||||||||

| Inflows, including Commitments (a) |

23,555,866 |

8,257,430 |

10,302,444 |

55,099,845 |

97,215,585 |

||||||||||||||||

| Outflows, including Distributions (b) |

(2,773,181 |

) | (1,196,502 |

) | (9,777,064 |

) | (4,364,916 |

) | (18,111,663 |

) | |||||||||||

| Net Inflows |

20,782,685 |

7,060,928 |

525,380 |

50,734,929 |

79,103,922 |

||||||||||||||||

| Realizations (c) |

(11,851,866 |

) | (6,558,390 |

) | (2,182,220 |

) | (10,396,313 |

) | (30,988,789 |

) | |||||||||||

| Market Activity (d)(g) |

3,023,951 |

527,888 |

4,583,348 |

2,001,006 |

10,136,193 |

||||||||||||||||

| Balance, End of Period (e) |

$ | 83,984,824 |

$ | 70,140,883 |

$ | 69,914,061 |

$ | 111,304,230 |

$ | 335,343,998 |

|||||||||||

| Increase |

$ | 11,954,770 |

$ | 1,030,426 |

$ | 2,926,508 |

$ | 42,339,622 |

$ | 58,251,326 |

|||||||||||

| Increase |

17 |

% | 1 |

% | 4 |

% | 61 |

% | 21 |

% | |||||||||||

| Annualized Base Management Fee Rate (f) |

1.06 |

% | 1.07 |

% | 0.74 |

% | 0.56 |

% | 0.83 |

% | |||||||||||

| Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2019 |

2018 | ||||||||||||||||||||||||||||||||||||||||

| Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

||||||||||||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||||||||||||||||

| Total Assets Under Management |

|||||||||||||||||||||||||||||||||||||||||

| Balance, Beginning of Period |

$ | 136,247,229 |

$ | 130,665,286 |

$ | 77,814,516 |

$ | 127,515,286 |

$ | 472,242,317 |

$ | 115,340,363 |

$ | 105,560,576 |

$ | 75,090,834 |

$ | 138,136,470 |

$ | 434,128,243 |

|||||||||||||||||||||

| Inflows, including Commitments (a) |

34,190,566 |

56,836,570 |

12,242,855 |

31,107,288 |

134,377,279 |

31,478,431 |

26,639,963 |

13,278,327 |

29,578,890 |

100,975,611 |

|||||||||||||||||||||||||||||||

| Outflows, including Distributions (b) |

(2,664,717 |

) | (1,065,445 |

) | (13,433,702 |

) | (11,629,269 |

) | (28,793,133 |

) | (2,162,958 |

) | (1,617,585 |

) | (10,780,055 |

) | (28,057,658 |

) | (42,618,256 |

) | |||||||||||||||||||||

| Net Inflows (Outflows) |

31,525,849 |

55,771,125 |

(1,190,847 |

) | 19,478,019 |

105,584,146 |

29,315,473 |

25,022,378 |

2,498,272 |

1,521,232 |

58,357,355 |

||||||||||||||||||||||||||||||

| Realizations (c) |

(18,097,899 |

) | (13,540,914 |

) | (1,271,968 |

) | (7,291,045 |

) | (40,201,826 |

) | (14,675,095 |

) | (10,396,611 |

) | (471,931 |

) | (8,516,996 |

) | (34,060,633 |

) | |||||||||||||||||||||

| Market Activity (d)(h) |

13,480,885 |

9,990,612 |

5,386,411 |

4,639,918 |

33,497,826 |

6,266,488 |

10,478,943 |

697,341 |

(3,625,420 |

) | 13,817,352 |

||||||||||||||||||||||||||||||

| Balance, End of Period (e) |

$ | 163,156,064 |

$ | 182,886,109 |

$ | 80,738,112 |

$ | 144,342,178 |

$ | 571,122,463 |

$ | 136,247,229 |

$ | 130,665,286 |

$ | 77,814,516 |

$ | 127,515,286 |

$ | 472,242,317 |

|||||||||||||||||||||

| Increase (Decrease) |

$ | 26,908,835 |

$ | 52,220,823 |

$ | 2,923,596 |

$ | 16,826,892 |

$ | 98,880,146 |

$ | 20,906,866 |

$ | 25,104,710 |

$ | 2,723,682 |

$ | (10,621,184 |

) | $ | 38,114,074 |

||||||||||||||||||||

| Increase (Decrease) |

20 |

% | 40 |

% | 4 |

% | 13 |

% | 21 |

% | 18 |

% | 24 |

% | 4 |

% | -8 |

% | 9 |

% | |||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||

| 2017 | |||||||||||||||||||||

| Real Estate |

Private Equity |

Hedge Fund Solutions |

Credit |

Total |

|||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||

| Total Assets Under Management |

|||||||||||||||||||||

| Balance, Beginning of Period |

$ | 101,963,652 |

$ | 100,189,994 |

$ | 71,119,718 |

$ | 93,280,101 |

$ | 366,553,465 |

|||||||||||

| Inflows, including Commitments (a) |

23,844,270 |

12,631,106 |

12,106,471 |

59,373,876 |

107,955,723 |

||||||||||||||||

| Outflows, including Distributions (b) |

(1,399,741 |

) | (1,230,409 |

) | (10,661,542 |

) | (6,165,216 |

) | (19,456,908 |

) | |||||||||||

| Net Inflows |

22,444,529 |

11,400,697 |

1,444,929 |

53,208,660 |

88,498,815 |

||||||||||||||||

| Realizations (c) |

(24,527,951 |

) | (15,760,727 |

) | (2,409,985 |

) | (12,487,834 |

) | (55,186,497 |

) | |||||||||||

| Market Activity (d)(h) |

15,460,133 |

9,730,612 |

4,936,172 |

4,135,543 |

34,262,460 |

||||||||||||||||

| Balance, End of Period (e) |

$ | 115,340,363 |

$ | 105,560,576 |

$ | 75,090,834 |

$ | 138,136,470 |

$ | 434,128,243 |

|||||||||||

| Increase |

$ | 13,376,711 |

$ | 5,370,582 |

$ | 3,971,116 |

$ | 44,856,369 |

$ | 67,574,778 |

|||||||||||

| Increase |

13 |

% | 5 |

% | 6 |

% | 48 |

% | 18 |

% | |||||||||||

| (a) | Inflows represent contributions, capital raised, other increases in available capital (recallable capital, increased side-by-side commitments), purchases, inter-segment allocations and acquisitions. |

| (b) | Outflows represent redemptions, client withdrawals and decreases in available capital (expired capital, expense drawdowns and decreased side-by-side commitments). |

| (c) | Realizations represent realizations from the disposition of assets or capital returned to investors from CLOs. |

| (d) | Market activity includes realized and unrealized gains (losses) on portfolio investments and the impact of foreign exchange rate fluctuations. |

| (e) | Assets Under Management are reported in the segment where the assets are managed. |

| (f) | Represents the annualized current quarter’s Base Management Fee divided by period end Fee-Earning Assets Under Management. |

| (g) | For the year ended December 31, 2019, the impact to Fee-Earning Assets Under Management due to foreign exchange rate fluctuations was $(94.9) million, $(280.6) million and $(375.5) million for the Real Estate, Credit and Total segments, respectively. For the year ended December 31, 2018, the impact to Fee-Earning Assets Under Management due to foreign exchange rate fluctuations was $(904.2) million, $(626.6) million and $(1.5) billion for the Real Estate, Credit and Total segments, respectively. For the year ended December 31, 2017, such impact was $1.4 billion, $1.3 million, $1.4 billion and $2.8 billion for the Real Estate, Private Equity, Credit and Total segments, respectively. |

| (h) | For the year ended December 31, 2019, the impact to Total Assets Under Management due to foreign exchange rate fluctuations was $(908.4) million, $238.8 million, $(233.0) million and $(902.6) million for the Real Estate, Private Equity, Credit and Total segments, respectively. For the year ended December 31, 2018, the impact to Total Assets Under Management due to foreign exchange rate fluctuations was $(2.1) billion, $(354.1) million, $(821.9) million and $(3.3) billion for the Real Estate, Private Equity, Credit and Total segments, respectively. For the year ended December 31, 2017, such impact was $3.1 billion, $1.1 billion, $1.8 billion and $5.9 billion for the Real Estate, Private Equity, Credit and Total segments, respectively. |

| • | Inflows of $112.2 billion related to: |

¡ |

$52.4 billion in our Real Estate segment primarily driven by $20.1 billion from BREP IX, which started its investment period on June 3, 2019 (this amount was reflected in Total Assets Under Management at each capital closing of the fund), $9.8 billion from BREP Europe VI, which started its investment period on October 9, 2019 (this amount was reflected in Total Assets Under Management at each capital closing of the fund), $8.2 billion from BREIT, $5.3 billion from BREDS, $3.1 billion from BPP U.S. and co-investment, $1.3 billion from BPP Europe and co-investment and $970.6 million from BPP Asia, |

¡ |

$27.3 billion in our Private Equity segment driven by $11.7 billion from Strategic Partners, $8.1 billion from BIP, $4.0 billion from Tactical Opportunities, $2.5 billion from core private equity, $492.5 million from corporate private equity and $429.9 million from multi-asset products, |

¡ |

$21.1 billion in our Credit segment driven by $19.0 billion from certain long only and MLP strategies, $5.2 billion from direct lending, $4.8 billion from BIS, $3.7 billion from new CLOs, $2.8 billion from our distressed strategies and $993.8 million from mezzanine funds, partially offset by $16.0 billion of allocations to various strategies, and |

¡ |

$11.5 billion in our Hedge Fund Solutions segment driven by $7.0 billion from individual investor and specialized solutions, $2.8 billion from customized solutions and $1.7 billion from commingled products. |

| • | Market activity of $11.7 billion due to: |

¡ |

$4.9 billion of market activity in our Hedge Fund Solutions segment driven by returns from BAAM’s Principal Solutions Composite of 8.2% gross (7.3% net), |

¡ |

$3.6 billion of market activity in our Real Estate segment driven by $3.1 billion of appreciation from our core+ real estate funds ($3.0 billion from market appreciation and $50.8 million from foreign exchange appreciation) and $710.1 million of market appreciation from BREDS, partially offset by $145.8 million of foreign exchange depreciation from BREP opportunistic funds, and |

¡ |

$3.1 billion of market activity in our Credit segment driven by $3.4 billion of market appreciation (primarily in certain long only and MLP strategies and BIS), partially offset by $280.6 million of foreign exchange depreciation. |

| • | Outflows of $33.0 billion primarily attributable to: |

¡ |

$11.9 billion in our Hedge Fund Solutions segment driven by $6.3 billion from customized solutions, $3.4 billion from individual investor and specialized solutions and $2.2 billion from commingled products, |

¡ |

$9.7 billion in our Real Estate segment driven by $5.4 billion of uninvested reserves at the end of BREP VIII’s investment period and $2.9 billion of uninvested reserves at the end of BREP Europe V’s investment period (these amounts are still classified as available capital and included in Total Assets Under Management), $693.7 million of redemptions from core+ real estate funds and $583.9 million of redemptions from BREDS liquids funds, |

¡ |

$9.1 billion in our Credit segment driven by $6.6 billion from certain long only and MLP strategies, $1.3 billion from BIS and $493.8 million from our distressed strategies, and |

¡ |

$2.4 billion in our Private Equity segment driven by $978.1 million from core private equity, $440.2 million from multi-asset products, $369.2 million from corporate private equity, $286.4 million from Tactical Opportunities and $194.1 million from BXLS. |

| • | Realizations of $25.3 billion primarily driven by: |

¡ |

$11.4 billion in our Real Estate segment driven by $5.8 billion from BREP opportunistic funds and co-investment, $3.1 billion from BREDS and $2.5 billion from core+ real estate funds, |

¡ |

$7.2 billion in our Private Equity segment driven by $3.5 billion from corporate private equity, $2.0 billion from Tactical Opportunities and $1.4 billion from Strategic Partners and $260.0 million from core private equity, |

¡ |

$5.6 billion in our Credit segment driven by $1.9 billion from our distressed strategies, $1.4 billion from our mezzanine funds, $904.9 million from capital returned to investors from CLOs that are post their reinvestment periods, $762.9 million from certain long only and MLP strategies and $610.4 million from direct lending, and |

¡ |

$1.2 billion in our Hedge Fund Solutions segment drive by $1.1 billion from individual investor and specialized solutions. |

| • | Inflows of $134.4 billion related to: |

¡ |

$56.8 billion in our Private Equity segment driven by $27.7 billion from corporate private equity primarily due to the initial close for the eighth flagship private equity fund in the first quarter of 2019 (this amount will be reflected in Fee-Earning Assets Under Management when the investment period commences), $11.2 billion from Strategic Partners, $8.3 billion from BIP, $5.4 billion from Tactical Opportunities, $3.0 billion from BXLS, $608.3 million from core private equity and $606.9 million from multi-asset products, |

¡ |

$34.2 billion in our Real Estate segment driven by $10.0 billion capital raised from BREP Europe VI, $8.2 billion capital raised from BREIT, $5.2 billion capital raised from BREP IX, $6.0 billion total inflows from BREDS and $3.8 billion from BPP funds, |

¡ |

$31.1 billion in our Credit segment driven by $19.9 billion from certain long only and MLP strategies, $10.3 billion from direct lending, $8.1 billion from BIS, $4.0 billion from our distressed strategies, $3.7 billion from new CLOs and $587.3 million from mezzanine funds, partially offset by $16.0 billion of allocations to various strategies, and |

¡ |

$12.2 billion in our Hedge Fund Solutions segment driven by $6.5 billion from individual investor and specialized solutions, $4.1 billion from customized solutions, and $1.6 billion from commingled products. |

| • | Market activity of $33.5 billion due to: |

¡ |

$13.5 billion of market activity in our Real Estate segment driven by carrying value increases in our opportunistic and BPP funds of 17.6% and 9.2% for the year, respectively, which includes $908.4 million of foreign exchange depreciation across the segment, |

¡ |

$10.0 billion of market activity in our Private Equity segment driven by carrying value increase in Strategic Partners, Tactical Opportunities and corporate private equity of 17.0%, 13.1% and 9.3%, respectively, which included $238.8 million of foreign exchange appreciation across the segment, |

¡ |

$5.4 billion of market activity in our Hedge Fund Solutions segment driven by reasons noted above in Fee-Earning Assets Under Management, and |

¡ |

$4.6 billion of market activity in our Credit segment driven by $4.9 billion of market appreciation (primarily in certain long only and MLP strategies, BIS, and mezzanine funds), partially offset by $233.0 million of foreign exchange depreciation. |

| • | Realizations of $40.2 billion primarily driven by: |

¡ |

$18.1 billion in our Real Estate segment driven by $13.1 billion from BREP opportunistic and co-investment, $2.7 billion from core+ real estate funds and $2.3 billion from BREDS, |

¡ |

$13.5 billion in our Private Equity segment driven by disposition activity across the segment, mainly related to $6.9 billion from corporate private equity, $3.2 billion from Tactical Opportunities, $2.7 billion from Strategic Partners, $418.1 million from core private equity, and $353.9 million from BXLS, |

¡ |

$7.3 billion in our Credit segment driven by $2.8 billion from our distressed strategies, $1.6 billion from our mezzanine funds, $1.1 billion from direct lending, $904.9 million from capital returned to investors from CLOs that are post their reinvestment periods and $788.2 million from certain long only and MLP strategies, and |

¡ |

$1.3 billion in our Hedge Fund Solutions segment driven by $1.2 billion from individual investor and specialized solutions. |

| • | Outflows of $28.8 billion primarily attributable to: |

¡ |

$13.4 billion in our Hedge Fund Solutions segment driven by $7.5 billion from customized solutions, $3.4 billion from individual investor and specialized solutions and $2.5 billion from commingled products, |

¡ |

$11.6 billion in our Credit segment driven by $6.9 billion from certain long only and MLP strategies, $1.4 billion from direct lending, $1.3 billion from BIS and $1.2 billion from our distressed strategies, |

¡ |

$2.7 billion in our Real Estate segment driven by the release of uninvested capital in BPP and BREDS, and redemptions from BREDS liquid funds, BPP U.S. and BREIT, and |

¡ |

$1.1 billion in our Private Equity segment driven by $447.1 million from Strategic Partners, $365.2 million from Tactical Opportunities, $268.3 million from corporate private equity and $111.0 million from multi-asset products, partially offset by $145.6 million from BXLS. |

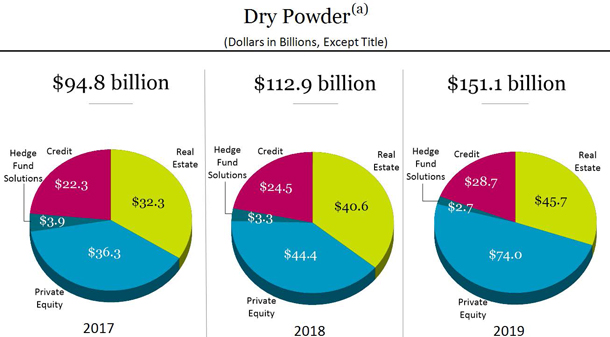

| (a) | Represents illiquid drawdown funds, a component of Perpetual Capital and fee-paying co-investments; includes fee-paying third party capital as well as general partner and employee capital that does not earn fees. Amounts are reduced by outstanding capital commitments, for which capital has not yet been invested. |

| December 31, | |||||||||||||

| 2017 |

2018 |

2019 |

|||||||||||

| (Dollars in Thousands) | |||||||||||||

| Dry Powder Available for Investment |

|||||||||||||

| Real Estate |

$ | 32,251,005 |

$ | 40,627,676 |

$ | 45,698,155 |

|||||||