Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the year ended December 31, 2016 |

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

DISCOVER FINANCIAL SERVICES

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 36-2517428 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

2500 Lake Cook Road, Riverwoods, Illinois 60015 | | (224) 405-0900 |

(Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Depositary Shares, each representing 1/40th interest in a share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series B, par value $0.01 per share | | New York Stock Exchange |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the common equity held by non-affiliates of the registrant on the last business day of the registrant’s most recently completed second fiscal quarter was approximately $21,650,557,104.

As of February 17, 2017, there were 385,534,055 shares of the registrant’s Common Stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its annual stockholders’ meeting to be held on May 11, 2017 are incorporated by reference in Part III of this Form 10-K.

DISCOVER FINANCIAL SERVICES

Annual Report on Form 10-K for the year ended December 31, 2016

TABLE OF CONTENTS

Except as otherwise indicated or unless the context otherwise requires, “Discover Financial Services,” “Discover,” “DFS,” “we,” “us,” “our,” and “the Company” refer to Discover Financial Services and its subsidiaries.

We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business, including, but not limited to: Discover®, PULSE®, Cashback Bonus®, Discover Cashback Checking®, Discover® More® Card, Discover it®, Discover® MotivaSM Card, Discover® Open Road® Card, Discover® Network, and Diners Club International®. All other trademarks, trade names and service marks included in this annual report on Form 10-K are the property of their respective owners.

Part I.

Introduction

Discover Financial Services (the "Company") is a direct banking and payment services company. We were incorporated in Delaware in 1960. We are a bank holding company under the Bank Holding Company Act of 1956 as well as a financial holding company under the Gramm-Leach-Bliley Act and therefore are subject to oversight, regulation and examination by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). We provide direct banking products and services and payment services through our subsidiaries. We offer our customers credit card loans, private student loans, personal loans, home equity loans and deposit products. We had $77.3 billion in loan receivables and $36.0 billion in deposits issued through direct-to-consumer channels and affinity relationships at December 31, 2016. We also operate the Discover Network, the PULSE network (“PULSE”) and Diners Club International (“Diners Club”). The Discover Network processes transactions for Discover-branded credit cards and provides payment transaction processing and settlement services. PULSE operates an electronic funds transfer network, providing financial institutions issuing debit cards on the PULSE network with access to ATMs domestically and internationally, as well as point-of-sale ("POS") terminals at retail locations throughout the U.S. for debit card transactions. Diners Club is a global payments network of licensees, which are generally financial institutions, that issue Diners Club branded charge cards and/or provide card acceptance services.

Available Information

We make available, free of charge through the investor relations page of our internet site www.discover.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, Forms 3, 4 and 5 filed by or on behalf of directors and executive officers, and any amendments to those documents filed with or furnished to the Securities and Exchange Commission (the "SEC") pursuant to the Securities Exchange Act of 1934. These filings are available as soon as reasonably practicable after they are filed with or furnished to the SEC.

In addition, the following information is available on the investor relations page of our internet site: (i) our Corporate Governance Policies; (ii) our Code of Ethics and Business Conduct; and (iii) the charters of the Audit, Compensation and Leadership Development, Nominating and Governance, and Risk Oversight Committees of our Board of Directors. These documents are also available in print without charge to any person who requests them by writing or telephoning our principal executive offices: Discover Financial Services, Office of the Corporate Secretary, 2500 Lake Cook Road, Riverwoods, Illinois 60015, U.S.A., telephone number (224) 405-0900.

Operating Model

We manage our business activities in two segments: Direct Banking and Payment Services. Our Direct Banking segment includes consumer banking and lending products, specifically Discover-branded credit cards issued to individuals on the Discover Network and other consumer banking products and services, including private student loans, personal loans, home equity loans, and other consumer lending and deposit products. We announced the closure of our mortgage origination business in June 2015 as described in Note 3: Business Dispositions to our consolidated financial statements. Our Payment Services segment includes PULSE, Diners Club and our Network Partners business, which provides payment transaction processing and settlement services on the Discover Network.

We are principally engaged in providing products and services to customers in the United States, although the royalty and licensee revenue we receive from Diners Club licensees is mainly derived from sources outside of the United States. For quantitative information concerning our geographic distribution, see Note 5: Loan Receivables to our consolidated financial statements.

Below are descriptions of the principal products and services of each of our reportable segments. For additional financial information relating to our business and our operating segments, see Note 23: Segment Disclosures to our consolidated financial statements.

Direct Banking

Set forth below are descriptions of our credit cards, student loans, personal loans, home equity loans and deposit products. For additional information regarding the terms and conditions of these products, see "— Product Terms and Conditions."

Credit Cards

We currently offer credit cards issued to consumers. Our credit card customers are permitted to "revolve" their balances and repay their obligations over a period of time and at an interest rate set forth in their cardmember agreements, which may be either fixed or variable. The interest that we earn on revolving credit card balances makes up approximately 83% of our total interest income. We also charge customers other fees as specified in the cardmember agreements. These fees may include fees for late payments, balance transfer transactions and cash advance transactions.

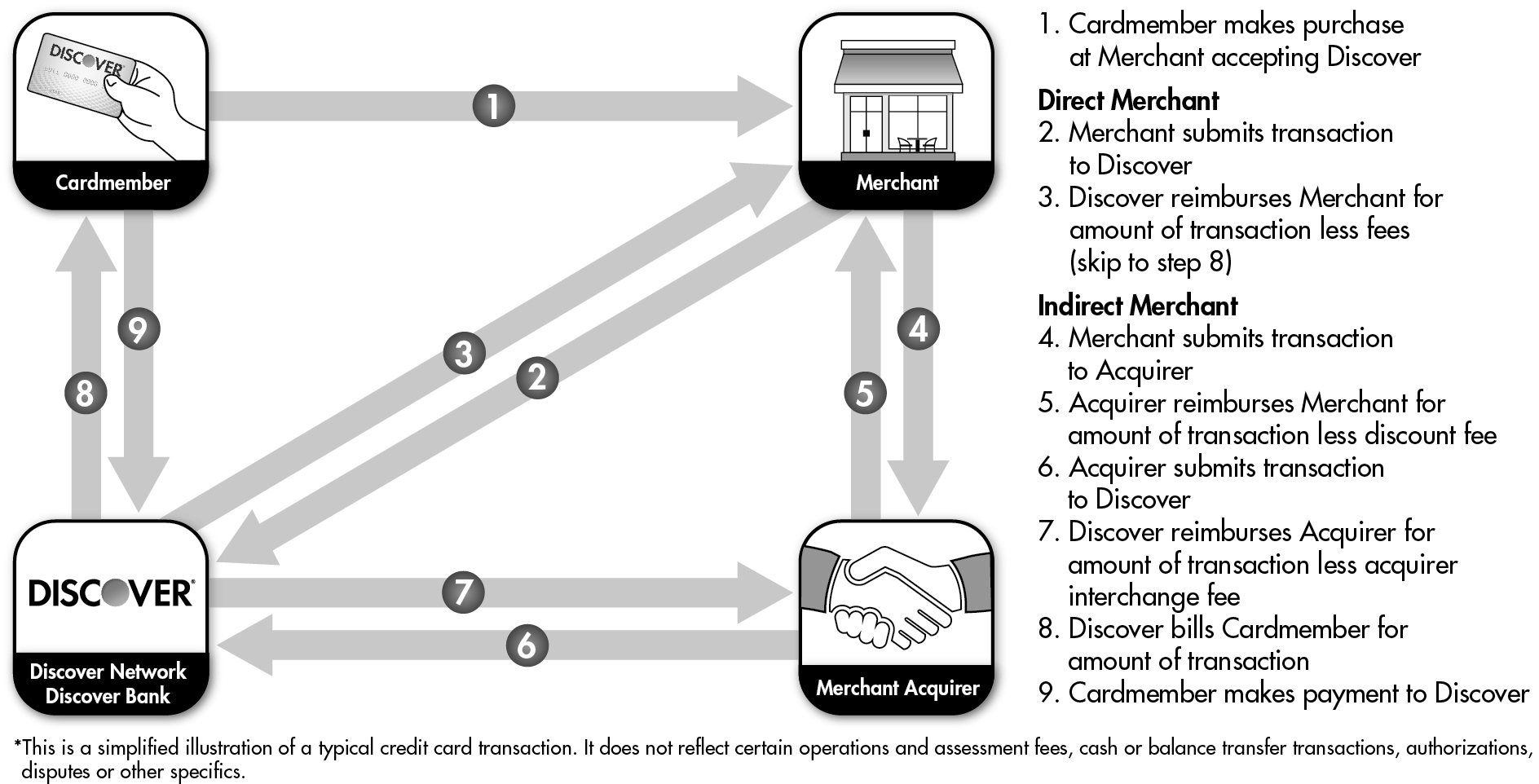

Our credit card customers' transactions in the U.S. are processed over the Discover Network. Where we have a direct relationship with a merchant, which is the case with respect to our large merchants representing a majority of Discover card sales volume, we receive discount and fee revenue from merchants. Discount and fee revenue is based on pricing that is set forth in contractual agreements with each such merchant and is based on a number of factors including industry practices, special marketing arrangements, competitive pricing levels and merchant size. Where we do not have a direct relationship with a merchant, we receive acquirer interchange and assessment fees from the merchant acquirer that settles transactions with the merchant. The amount of this fee is based on a standardized schedule and can vary based on the type of merchant.

Most of our cards offer the Cashback Bonus rewards program, the costs of which we record as a reduction of discount and interchange revenue. See "— Marketing — Rewards/Cashback Bonus" for further discussion of our programs offered.

The following chart* shows the Discover card transaction cycle as processed on the Discover Network:

Student Loans

Our private student loans are available to students attending eligible non-profit undergraduate and graduate schools. We also offer certain post-graduate loans, including consolidation, bar study and residency loans. We encourage students to borrow responsibly and maximize grants, scholarships and other free financial aid before taking student loans.

We currently offer fixed and variable rate private student loans originated by Discover Bank. We market our student loans online and through direct mail and email to existing and potential customers. We also work with school financial aid offices and high school guidance counselors to create awareness of our products with students and their families. Students can apply for our student loans online, by phone, or by mail, and we have dedicated staff within our call centers to service student loans. We invite applicants who qualify to apply with a creditworthy cosigner, which may improve the likelihood for loan approval and a lower interest rate.

As part of the loan approval process, all of our student loans, except for bar study, residency and private consolidation loans, are certified by and disbursed through the school to ensure students do not borrow more than the cost of attendance less other financial aid. Upon graduation, for variable rate loans originated before May 2014, students are generally eligible to receive a graduation reward. Students may redeem their graduation reward as a credit

to the balance of any of their Discover student loans or as a direct deposit to a bank account. For all loans originated in May 2014 and after, students are generally eligible to receive a reward for achieving a specified grade point average during the academic period covered by the loan.

Personal Loans

Our personal loans are unsecured loans with fixed interest rates, terms and payments. These loans are primarily intended to help customers consolidate existing debt, although they can be used for other reasons. We generally market personal loans through direct mail advertising complemented by other marketing channels. Consumers can submit applications via phone, online or through the mail, and can service their accounts online or by phone.

Home Equity Loans

We offer closed-end home equity loans to help consumers improve their homes as well as payoff higher interest debt, although they can be used for other purposes. These loans are fixed term and fixed rate loans that provide consumers the stability of a fixed payment on their obligation while being secured against the equity in their homes. We market this product primarily to existing card customers through a mix of direct mail, internet advertising and email. Non-Discover customers can obtain information regarding Discover home equity products on our website and have the ability to apply over the phone.

Deposits

We obtain deposits from consumers directly or through affinity relationships ("direct-to-consumer deposits"). Additionally, we also obtain deposits through third-party securities brokerage firms that offer our deposits to their customers ("brokered deposits"). Our deposit products include certificates of deposit, money market accounts, online savings and checking accounts and Individual Retirement Arrangement certificates of deposit. We market our direct-to-consumer deposit products to our existing customer base and other prospective customers through the use of our website, mobile platform, print materials, direct mail, affinity arrangements with third parties and internet advertising. Customers can apply for, fund and service their deposit accounts online or via phone, where we have a dedicated U.S.-based staff within our call centers to service deposit accounts. For more information regarding our deposit products, see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Funding Sources — Deposits."

Payment Services

Set forth below are descriptions of PULSE, Diners Club and our Network Partners business, which provides among other services payment transaction processing and settlement services.

PULSE

Our PULSE network is one of the nation’s leading debit/ATM networks. PULSE links cardholders served by approximately 4,600 financial institutions to ATMs and POS terminals located throughout the United States. This includes more than 3,300 financial institutions with which PULSE has direct relationships and approximately 1,300 additional financial institutions through agreements PULSE has with other debit networks. PULSE also provides cash access at 1.9 million ATMs in more than 125 countries.

PULSE's primary source of revenue is transaction fees charged for switching and settling ATM, personal identification number ("PIN") POS debit and signature debit transactions initiated through the use of debit cards issued by participating financial institutions. In addition, PULSE offers a variety of optional products and services that produce income for the network, including signature debit transaction processing, debit card fraud detection and risk mitigation services, and connections to other regional and national electronic funds transfer networks.

When a financial institution joins the PULSE network, debit cards issued by that institution are eligible to be used at all of the ATMs and PIN POS debit terminals that participate in the PULSE network, and the PULSE mark can be used on that institution's debit cards and ATMs. In addition, financial institution participants may sponsor merchants, direct processors and independent sales organizations to participate in the PULSE PIN POS and ATM debit service. A participating financial institution assumes liability for transactions initiated through the use of debit cards issued by that institution, as well as for ensuring compliance with PULSE's operating rules and policies applicable to that institution's debit cards, ATMs and, if applicable, sponsored merchants, direct processors and independent sales organizations.

When PULSE enters into a network-to-network agreement with another debit network, the other network's participating financial institutions' debit cards can be used at terminals in the PULSE network. PULSE does not have a direct relationship with these financial institutions and the other network bears the financial responsibility for transactions of those financial institutions' cardholders and for ensuring compliance with PULSE's operating rules.

Diners Club

Our Diners Club business maintains an acceptance network in 185 countries and territories through its relationships with over 90 licensees, which are generally financial institutions. We do not directly issue Diners Club cards to consumers, but grant our licensees the right to issue Diners Club branded cards and/or provide card acceptance services. Our licensees pay us royalties for the right to use the Diners Club brand, which is our primary source of Diners Club revenues. We also earn revenue from providing various support services to our Diners Club licensees, including processing and settlement of cross-border transactions. We also provide a centralized service center and internet services to our licensees.

When Diners Club cardholders use their cards outside the host country or territory of the issuing licensee, transactions are routed and settled over the Diners Club network through its centralized service center. In order to increase merchant acceptance in certain targeted countries and territories, we work with merchant acquirers to offer Diners Club and Discover acceptance to their merchants. These acquirers are granted licenses to market the Diners Club brands to existing and new merchants. As we continue to work toward achieving full card acceptance across our networks, Discover customers are using their cards at an increasing number of merchant and ATM locations that accept Diners Club cards around the world. Diners Club cardholders with cards issued by licensees outside of North America continue to use their cards on the Discover Network in North America and on the PULSE and Diners Club networks domestically and internationally, respectively.

Network Partners Business

We have agreements with a number of financial institutions, networks and commercial service providers for issuance of products or processing of payments on Discover networks. We refer to these financial institutions, networks and commercial service providers as "Network Partners." We may earn merchant discount and acquirer assessments net of issuer fees paid, in addition to other fees, for processing transactions for Network Partners. We also leverage our payments infrastructure in other ways, such as business-to-business payment processing.

The following chart* shows an example of Network Partners transaction cycle:

* * *

The discussion below provides additional detail concerning the supporting functions of our two segments. The credit card, student loan, personal loan, home equity loan and deposit products issued through our Direct Banking segment require significant investments in consumer portfolio risk management, marketing, customer service and related

technology, whereas the operation of our Payment Services business requires that we invest in the technology to manage risk and service network partners, merchants and merchant acquirer relationships.

Credit Risk Management

Credit risk management is a critical component of our management and growth strategy. Credit risk refers to the risk of loss arising from borrower default when borrowers are unable or unwilling to meet their financial obligations to us. Our credit risk arising from consumer lending products is generally highly diversified across millions of accounts without significant individual exposures. We manage credit risk primarily based on customer segments and product types. See "— Risk Management" for more information regarding how we define and manage our credit and other risks.

Account Acquisition (New Customers)

We acquire new credit card customers through direct mail, internet, media advertising, merchant or partner relationships, or through unsolicited individual applications. We also acquire new student loan and personal loan customers through similar channels. In all cases we have a rigorous process for screening applicants.

To identify credit-worthy prospective customers, our credit risk management and marketing teams use proprietary analytical tools to match our product offerings with customer needs. We consider the prospective customer's financial stability, as well as ability and willingness to pay.

We assess the creditworthiness of each consumer loan applicant through evaluating an applicant’s credit information provided by credit bureaus and information from other sources. The assessment is performed using our credit scoring systems, both externally developed and proprietary. For our unsecured lending products, we also use experienced credit underwriters to supplement our automated decision-making processes. For our home equity products, experienced credit underwriters must review and approve each application.

Upon approval of a customer's application for one of our unsecured lending and home equity products, we assign a specific annual percentage rate using an analytically driven pricing framework that simultaneously provides competitive pricing for customers and seeks to maximize revenue on a risk-adjusted basis. For our credit card loans, we also assign a credit line based on risk level and expected return.

Portfolio Management (Existing Customers)

The revolving nature of our credit card loans requires that we regularly assess the credit risk exposure of such accounts. This assessment uses the individual's Discover account performance information as well as information from credit bureaus. We utilize statistical evaluation models to support the measurement and management of credit risk. At the individual customer level, we use custom risk models together with generic industry models as an integral part of the credit decision-making process. Depending on the duration of the customer's account, risk profile and other performance metrics, the account may be subject to a range of account management treatments, including transaction authorization limits and increases or decreases on credit limits. Our installment loans are billed according to an amortization schedule that is calculated at the time of the disbursement of the loan and at the time the loan enters repayment.

Customer Assistance

We provide our customers with a variety of tools to proactively manage their accounts, including electronic payment reminders and a website dedicated to customer education, as further discussed under the heading "— Customer Service." These tools are designed to limit a customer's risk of becoming delinquent. When a customer's account becomes delinquent or is at risk of becoming delinquent, we employ a variety of strategies to assist customers in becoming current on their accounts.

All monthly billing statements of accounts with past due amounts include a request for payment of such amounts. Customer assistance personnel generally initiate contact with customers within 30 days after any portion of their balance becomes past due. The nature and the timing of the initial contact, typically a personal call or letter, are determined by a review of the customer's prior account activity and payment habits.

We reevaluate our collection efforts, and consider the implementation of other techniques, as a customer becomes increasingly delinquent. We limit our exposure to delinquencies through controls within our process for authorizing transactions and credit limits and criteria-based account suspension and revocation. In situations involving

customers with financial difficulties, we may enter into arrangements to extend or otherwise change payment schedules, lower interest rates and/or waive fees to aid customers in becoming current on their obligations to us. For more information see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Loan Quality — Modified and Restructured Loans."

Marketing

In addition to working with our credit risk management personnel on account acquisition and portfolio management, our marketing group provides other key functions, including product development, management of our Cashback Bonus and other rewards programs, protection product management, and brand and advertising management.

Product Development

In order to attract and retain customers and merchants, we continue to develop new programs, features and benefits and market them through a variety of channels, including mail, phone and online. Targeted marketing efforts may include balance transfer offers and reinforcement of our Cashback Bonus and other rewards programs. Through the development of a large prospect database, use of credit bureau data and use of a customer contact strategy and management system, we have been able to improve our modeling and customer engagement capabilities, which helps optimize product, pricing and channel selection.

Rewards / Cashback Bonus

Our cardmembers use several card products that allow them to earn their rewards based on how they want to use credit, as set forth below.

| |

• | Discover it card offers 5% Cashback Bonus in categories that change each quarter up to a quarterly maximum (signing up is required) and 1% Cashback Bonus on all other purchases, as well as other benefits. |

| |

• | Discover it NHL card offers the same reward features as the Discover it card plus 10% off purchases at shopNHL.com and a team-branded credit card. |

| |

• | Discover it Chrome card offers 2% Cashback Bonus at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% Cashback Bonus on all other purchases, as well as other benefits. |

| |

• | The Discover it Miles card offers 1.5 miles for every dollar spent on purchases, no annual fee and an annual credit of up to $30 for in-flight Wi-Fi charges. |

| |

• | Discover it Secured card offers the same reward features as the Discover it Chrome card, as well as other benefits. This card requires the customer to provide a security deposit as collateral for the credit card account. Starting seven months after account opening, Discover reviews the account monthly to determine whether the security deposit can be returned. These reviews look for responsible credit use across all of the customer’s cards and loans. |

| |

• | Discover More card offers 5% Cashback Bonus in categories that change each quarter up to a quarterly maximum (signing up is required). Customers earn .25% Cashback Bonus on their first $3,000 on all other annual purchases and on all warehouse purchases, and 1% Cashback Bonus on purchases over $3,000. |

| |

• | Discover Open Road card offers 2% Cashback Bonus on the first $250 in combined gas and restaurant purchases each billing period. Customers earn .25% Cashback Bonus on their first $3,000 on all other annual purchases and on all warehouse purchases, and 1% Cashback Bonus on purchases over $3,000. |

| |

• | Discover Motiva card provides customers with Cashback Bonus equal to 5% of their interest charges each month for making on-time payments. Customers earn .25% Cashback Bonus on their first $3,000 on all other annual purchases and on all warehouse purchases, and 1% Cashback Bonus on purchases over $3,000. |

| |

• | Miles by Discover customers receive two miles for every $1 on the first $3,000 in travel and restaurant purchases each year and one mile for every $1 on all other purchases. |

| |

• | Discover Business card offers 5% Cashback Bonus on the first $2,000 spent in office supply purchases, 2% Cashback Bonus on the first $2,000 spent in gas purchases each year, .25% Cashback Bonus on the first $5,000 in annual purchases and up to 1% Cashback Bonus on all other purchases. |

Protection Products

We currently service and maintain existing enrollments of the protection products detailed below for our credit card customers. Although we suspended new sales of these products to consumers at the end of 2012, we may resume offering similar products in the future.

| |

• | Identity Theft Protection. The most comprehensive identity theft monitoring product includes an initial credit report, credit bureau report monitoring at the three major credit bureaus, prompt alerts to key changes to credit bureau files that help customers spot possible identity theft quickly, internet surveillance to monitor up to 20 credit and debit card numbers and social security numbers on suspicious websites, identity theft insurance up to $25,000 to cover certain out-of-pocket expenses due to identity theft, and access to knowledgeable professionals who can provide information about identity theft issues. |

| |

• | Payment Protection. This product allows customers to suspend their payments for up to two years, depending on the qualifying event and product level, when certain qualifying life events occur. While on benefit, customers have no minimum monthly payment, and are not charged interest, late fees or the fees for the product. This product covers a variety of different events, such as unemployment, disability, natural disasters or other life events, such as marriage or birth of a child. Depending on the product and availability under state laws, outstanding balances up to $10,000 or $25,000, depending on product level are cancelled in the event of death. |

| |

• | Wallet Protection. This product offers one-call convenience if a customer's wallet is lost or stolen, including requesting cancellation and replacement of the customer's credit and debit cards, monitoring the customer's credit bureau reports at the three major credit bureaus for 180 days and alerting them to key changes to their credit files, and providing up to $100 to replace the customer's wallet or purse. |

Brand and Advertising Management

We maintain a full-service marketing department charged with delivering integrated mass and direct communications to foster customer engagement with our products and services. Our brand team utilizes consumer insights and market intelligence to define our mass communication strategy, create multi-channel advertising messages and develop marketing partnerships with sponsorship properties. This work is performed in house as well as with a variety of external agencies and vendors.

Customer Service

Our customers can contact our customer service personnel by calling 1-800-Discover. Our customers can also manage their accounts online or through applications for certain mobile devices. Our internet and mobile solutions offer a range of benefits, including:

| |

• | Online account services that allow customers to customize their accounts, choose how and when they pay their bills, view annual account summaries that assist them with budgeting, research transaction details, initiate transaction disputes and chat with or email a customer representative; |

| |

• | Email and mobile text reminders that help customers avoid fees, keep their accounts secure and track big purchases or returns; |

| |

• | Money management tools like the Spend Analyzer, Paydown Planner and Purchase Planner; and |

| |

• | An online portal where customers automatically earn 5-20% Cashback Bonus when they shop at well-known online merchants using their Discover card. |

Our student loan, personal loan, home equity and deposit product customers can utilize our online account services to manage their accounts, and to use interactive tools and calculators.

Processing Services

Our processing services cover four functional areas: card personalization/embossing, print/mail, remittance processing and document processing. Card personalization/embossing is responsible for the embossing and mailing of plastic credit cards for new accounts, replacements and reissues. Print/mail specializes in statement and letter printing and mailing for merchants and customers. Remittance processing, currently a function outsourced to third-party vendors, handles account payments and check processing. Document processing handles hard-copy forms, including new account applications.

Fraud Prevention

We monitor our customers' accounts to help prevent, detect, investigate and resolve fraud. Our fraud prevention processes are designed to protect the security of cards, applications and accounts in a manner consistent with our customers' needs to easily acquire and use our products. Prevention systems monitor the authorization of application information, verification of customer identity, sales, processing of convenience and balance transfer checks, and electronic transactions.

Each credit card transaction is subject to screening, authorization and approval through a proprietary POS decision system and each deposit transaction is subject to screening and approval through a dynamic transaction evaluation and scoring methodology. We use a variety of techniques that help identify and halt fraudulent transactions, including adaptive models, rules-based decision-making logic, report analysis, data integrity checks and manual account reviews. We manage accounts identified by the fraud detection system through technology that integrates fraud prevention and customer service. Strategies are subject to regular review and enhancement to enable us to respond quickly to changing conditions as well as to protect our customers and our business from emerging fraud activity.

Product Terms and Conditions

Credit Cards

The terms and conditions governing our credit card products vary by product and change over time. Each credit card customer enters into a cardmember agreement governing the terms and conditions of the customer's account. Discover card's terms and conditions are generally uniform from state to state. We are allowed, to the extent permitted by law, to change any term of the cardmember agreement, including any finance charge, rate or fee, or add or delete any term of the cardmember agreement, with notice to the customer as required by law. The customer has the right to opt out of certain changes of terms and pay their balance off under the original terms. Each cardmember agreement provides that the account can be used for purchases, cash advances and balance transfers. Each Discover card account is assigned a credit limit when the account is initially opened. Thereafter, individual credit limits may be increased or decreased from time to time, at our discretion, based primarily on our evaluation of the customer's creditworthiness. We offer various features and services with the Discover card accounts, including the Cashback Bonus rewards programs described under “— Marketing — Rewards/Cashback Bonus.”

All Discover card accounts generally have the same billing structure. We generally send a monthly billing statement to each customer who has an outstanding debit or credit balance. Customers also can waive their right to receive a physical copy of their bill, in which case they will receive email notifications of the availability of their billing statement online. Discover card accounts are grouped into multiple billing cycles for operational purposes. Each billing cycle has a separate billing date, on which we process and bill to customers all activity that occurred in the related accounts during a period of approximately 28 to 32 days that ends on the billing date.

Discover card accounts are assessed periodic finance charges using fixed and/or variable interest rates. Certain account balances, such as balance transfers, may accrue periodic finance charges at lower fixed rates for a specified period of time. Variable rates are indexed to the highest prime rate published in The Wall Street Journal on the last business day of the month. Periodic finance charges are calculated using the daily balance (including current transactions) method, which results in daily compounding of periodic finance charges, subject to a grace period on new purchases. The grace period provides that periodic finance charges are not imposed on new purchases, or any portion of a new purchase, that is paid by the due date on the customer's current billing statement if the customer paid the balance on his or her previous billing statement in full by the due date on that statement. Neither cash advances nor balance transfers are subject to a grace period.

Each customer with an outstanding debit balance on his or her Discover card account must generally make a minimum payment each month. If a customer exceeds his or her credit limit as of the last day of the billing period, we may include all or a portion of this excess amount in the customer's minimum monthly payment. A customer may pay the total amount due at any time. We also may enter into arrangements with delinquent customers to extend or otherwise change payment schedules, and to waive finance charges and/or fees, including re-aging accounts in accordance with regulatory guidance.

In addition to periodic finance charges, we may impose other charges and fees on Discover card accounts, including cash advance transaction fees, late fees where a customer has not made a minimum payment by the required due date, balance transfer fees and returned payment fees.

The Credit Card Accountability Responsibility and Disclosure Act of 2009 (the "CARD Act") required us to review, every six months, certain interest rates that were increased on accounts since January 1, 2009 to determine whether to reduce the interest rate based on the factors that prompted the increase or factors we currently consider in determining interest rates applicable to similar new credit card accounts. The amount of any rate decrease must be determined based upon our reasonable policies and procedures. Any reduced interest rate must be applied to the account not later than 45 days after completion of the review.

Student Loans

The terms and conditions governing our student loans vary by product and are specified in the borrower's promissory note and disclosures. Each borrower signs a promissory note and accepts the loan terms during the application process. Student loans feature fixed or variable interest rates with zero origination fees, and borrowers can elect to make extra payments to pay their loans off faster without penalty. Student loans may include a deferment period, during which borrowers are not required to make payments while enrolled in school at least half time as determined by the school. This period begins on the date the loan is first disbursed and ends six to nine months (depending on loan type) after the borrower ceases to be enrolled in school at least half time. Additionally, the loans can feature potential rewards for good grades and we also offer an optional "In-School Payment" product that requires a student to make monthly payments while in school. The standard repayment period is 15 to 20 years, depending on the type of student loan. Borrowers can choose to receive electronic communications, in which case they will receive email notifications of the availability of their monthly billing statements online.

We calculate interest on a daily basis on the outstanding principal loan balance until the loan is paid in full. The interest rate will never be higher than 18%, as stated in the promissory note and disclosures. The variable interest rate we offer, is equal to a variable index (e.g., based on the prime rate or London Interbank Offered Rate ("LIBOR") plus a fixed margin assigned to the loan during origination. Variable interest rates may adjust quarterly if the index changes. In certain circumstances, we may offer borrower assistance programs including forbearance periods of up to 12 months over the life of the loan, short-term payment reductions or maturity extensions. We accrue interest when loans are in forbearance or in other payment assistance programs.

Personal Loans

The terms and conditions governing personal loans are set at the time the loan is accepted and generally do not change for the life of the loan. Personal loan account terms and conditions are generally uniform from state to state. All personal loan accounts generally have the same billing structure. Customers receive monthly statements approximately 20 days prior to payment due dates. The statement provides detail on all transactions processed since the last statement was generated, as well as a summary of the current amount due. Customers also can waive their right to receive physical copies of their bills, in which case they will receive email notifications of the availability of their billing statements online. Personal loan accounts are assessed periodic finance charges using simple interest. We may impose other charges, including late charges when a customer has not made a minimum payment by the required due date and a returned check charge. There is no prepayment penalty for repaying a personal loan balance in full prior to the scheduled maturity date. In certain circumstances, we may offer customers temporary and permanent assistance programs, which may reduce payments, extend loan terms and/or reduce the interest rate on loan balances.

Home Equity Loans

Home equity loans are fixed-rate loans that carry a monthly payment over the term of the loan and are secured by a first or second lien on a customer's home. The terms of the loan are set at closing. Customers are sent monthly statements approximately 20 days in advance of the payment due date. The statements provide the customer the allocation of any payments made since the last billing date as well as the payment due on the next scheduled payment date. The customer has the ability to view their account information as well as make payments online through the account center. Customers are also subject to additional charges, including late fees and returned payment charges. The customer has the ability to make larger than minimum payments on the loans and early payoffs are not currently subject to a prepayment penalty.

Deposits

We offer four main types of deposit products directly to consumers on a national basis: certificates of deposit, savings accounts, money market and checking accounts, though at the current time we are offering checking accounts only to existing credit card, personal loan or deposit customers. All of these deposits are insured by the Federal Deposit Insurance Corporation (the "FDIC") to the maximum permitted by law. Interest is compounded daily and credited to each account on a monthly basis, using the daily balance method. We do not pay interest generally on checking account balances, but instead offer cashback rewards for certain transactions. We offer a range of ownership options, including single, joint, trust and custodial. Deposit accounts are primarily funded through electronic funds transfer, check or wire transfer. Customers may service their accounts through a variety of convenient methods, including online at www.discoverbank.com, mobile and tablet device applications, and by telephone.

Certificates of deposit are offered on a full range of tenors from three months through ten years with interest rates that are fixed for the full period. We provide automatic renewal along with options on reinvestment or disbursement of interest. There are minimum balance requirements to open certificates of deposit and penalties for early withdrawals. Money market accounts are transactional accounts with minimum balance requirements. Money market account funds may be accessed through electronic funds transfer, checks, wire transfer and debit cards. Savings accounts may be accessed through electronic funds transfer, wire transfer and official checks. Money market accounts and savings accounts have limitations on withdrawal frequency, as required by law. Interest rates on money market accounts and savings accounts are subject to change at any time. Fees apply to some transactions and availability of funds varies based on product and method of funding.

We also issue certificates of deposit through select contracted brokerage firms. All of these deposits are also FDIC insured to the maximum allowed by law. All settlements occur through the Depository Trust Company. Tenors issued, interest and commission rates are determined weekly with tenor issuances of five months to ten years. Simple interest is applied to brokered certificates of deposit. At any given time, we may choose to not issue these certificates of deposit or to issue only certain tenors in a given week. Early redemption of these certificates occurs only in the event of death or adjudication of incompetence.

Discover Network Operations

We support our merchants through a merchant acquiring model that includes direct relationships with large merchants in the United States and arrangements with merchant acquirers generally for small- and mid-size merchants. In addition to our U.S.-based merchant acceptance locations, Discover Network cards also are accepted at many locations in Canada, Mexico, the Caribbean, China, Japan and a growing number of countries around the world on the Diners Club network, or through reciprocal acceptance arrangements made with international payment networks (i.e., network-to-network).

We maintain direct relationships with most of our large merchant accounts, which enables us to benefit from joint marketing programs and opportunities and to retain the entire discount revenue from the merchants. The terms of our direct merchant relationships are governed by merchant services agreements. These agreements are also accompanied by additional program documents that further define our network functionality and requirements, including operating regulations, technical specifications and dispute rules. To enable ongoing improvements in our network's functionality and in accordance with industry convention, we publish updates to our program documents on a semi-annual basis. Discover card transaction volume was concentrated among our top 100 merchants in the year ended December 31, 2016 with our largest merchant accounting for approximately 6% of total Discover card transaction volume.

In order to increase merchant acceptance, Discover Network services the majority of its small- and mid-size merchant portfolios through third-party merchant acquirers to allow such acquirers to offer a comprehensive payments processing package to such merchants. Merchants also can apply to our merchant acquirer partners directly to accept Discover Network cards through the acquirers' integrated payments solutions. Merchant acquirers provide merchants with consolidated servicing for Discover, Visa and MasterCard transactions, resulting in streamlined statements and customer service for merchants, and reduced costs for us. These acquirer partners also perform credit evaluations and screen applications against unacceptable business types and the Office of Foreign Asset Control Specifically Designated Nationals list.

Discover Network operates systems and processes that seek to ensure data integrity, prevent fraud and ensure compliance with our operating regulations. Our systems evaluate incoming transaction activity to identify abnormalities that require investigation and fraud mitigation. Designated Discover Network personnel are responsible for validating compliance with our operating regulations and law, including enforcing our data security standards and prohibitions against illegal or otherwise unacceptable activities. Discover Network is a founding and current member of the Payment Card Industry Security Standards Council, LLC, and is working to expand the adoption of the Council's security standards globally for merchants and service providers that store, transmit or process cardholder data.

Technology

We provide technology systems processing through a combination of owned and hosted data centers and the use of third-party vendors. These data centers support our payment networks, provide customers with access to their accounts and manage transaction authorizations, among other functions. Discover Network works with a number of vendors to maintain our connectivity in support of POS authorizations. This connectivity also enables merchants to receive timely payment for their Discover Network card transactions.

Our approach to technology development and management involves both third-party and in-house resources. We use third-party vendors for basic technology services (e.g., telecommunications, hardware and operating systems) as well as for processing and other services for our direct banking and payment services businesses. We subject each vendor to a formal approval process, which includes among other things a security assessment, to ensure that the vendor can assist us in maintaining a cost-effective and reliable technology platform. We use our in-house resources to build, maintain and oversee some of our technology systems. We believe this approach enhances our operations and improves cost efficiencies.

Seasonality

In our credit card business, we experience fluctuations in transaction volumes and the level of loan receivables as a result of higher seasonal consumer spending and payment patterns around the winter holidays, summer vacations and back-to-school periods. In our student loan business, our loan disbursements peak at the beginning of a school's academic semester or quarter. Although there is a seasonal impact to transaction volumes and the levels of credit card and student loan receivables, seasonal trends have not caused significant fluctuations in our results of operations or credit quality metrics between quarterly and annual periods.

Revenues in our Diners Club business are generally higher in the first half of the year as a result of Diners Club's tiered pricing system where licensees qualify for lower royalty rate tiers as cumulative volume grows during the course of the year.

Competition

We compete with other consumer financial services providers, including non-traditional providers such as financial technology firms and payment networks on the basis of a number of factors, including brand, reputation, customer service, product offerings, incentives, pricing and other terms. Our credit card business also competes on the basis of reward programs and merchant acceptance. We compete for accounts and utilization with cards issued by other financial institutions (including American Express, Bank of America, JPMorgan Chase and Citi) and, to a lesser extent, businesses that issue their own private label cards or otherwise extend credit to their customers. In comparison to our largest credit card competitors, our strengths include cash rewards, conservative portfolio management and strong customer service. Competition based on cash rewards programs, however, has increased in recent years. Our student loan product competes for customers with Sallie Mae and Wells Fargo, as well as other lenders that offer student loans. Our personal loan product competes for customers primarily with Wells Fargo, PNC and non-traditional lenders, including financial technology firms and peer to peer lenders. Our home equity product faces competition primarily from traditional branch lending institutions like Wells Fargo, JPMorgan Chase, U.S. Bank and PNC.

Although our student and personal loan receivables have increased, our credit card receivables continue to represent most of our receivables. The credit card business is highly competitive. Some of our competitors offer a wider variety of financial products than we do, including automobile loans, which may currently position them better among customers who prefer to use a single financial institution to meet all of their financial needs. Some of our competitors enjoy greater financial resources, diversification and scale than we do, and are therefore able to invest more in initiatives to attract and retain customers, such as advertising, targeted marketing, account acquisitions and pricing offerings in interest rates, annual fees, reward programs and low-priced balance transfer programs. In addition, some of our competitors have assets such as branch locations and co-brand relationships that may help them compete more effectively. Another competitive factor in the credit card business is the increasing use of debit cards as an alternative to credit cards for purchases.

Because most domestically-issued credit cards, other than those issued on the American Express network, are issued on the Visa and MasterCard networks, most other card issuers benefit from the dominant market share of Visa and MasterCard. The former exclusionary rules of Visa and MasterCard limited our ability to attract merchants and credit and debit card issuers, contributing to Discover not being as widely accepted in the U.S. as Visa and MasterCard. Merchant acceptance of the Discover card has increased in the past several years, both in the number of merchants enabled for acceptance and the number of merchants actively accepting Discover. We continue to make investments in expanding Discover and Diners Club acceptance in key international markets where an acceptance gap exists.

In our payment services business, we compete with other networks for volume and to attract network partners to issue credit, debit and prepaid cards on the Discover, PULSE and Diners Club networks. We generally compete on the basis of customization of services and various pricing strategies, including incentives and rebates. We also compete on the basis of issuer fees, fees paid to networks (including switch fees), merchant acceptance, network functionality,

customer perception of service quality, brand image, reputation and market share. The Diners Club and Discover networks' primary competitors are Visa, MasterCard and American Express, and PULSE's network competitors include Visa's Interlink, MasterCard's Maestro and First Data's STAR. American Express is a particularly strong competitor to Diners Club as both cards target international business travelers. As the payments industry continues to evolve, we are also facing increasing competition from new entrants to the market, such as online networks, telecom providers and other alternative payment providers, which leverage new technologies and a customer's existing deposit and credit card accounts and bank relationships to create payment or other fee-based solutions.

In our direct-to-consumer deposits business, we have acquisition and servicing capabilities similar to other direct competitors, including USAA, Ally Bank, American Express, Capital One (360), Sallie Mae and Barclays. We also compete with traditional banks and credit unions that source deposits through branch locations. We seek to differentiate our deposit product offerings on the basis of brand reputation, convenience, customer service and value.

For more information regarding the nature of and the risks we face in connection with the competitive environment for our products and services, see "Risk Factors — Strategic Business Risk."

Intellectual Property

We use a variety of methods, such as trademarks, patents, copyrights and trade secrets, to protect our intellectual property. We also place appropriate restrictions on our proprietary information to control access and prevent unauthorized disclosures. Our Discover, PULSE and Diners Club brands are important assets, and we take steps to protect the value of these assets and our reputation.

Employees

As of January 31, 2017, we employed approximately 15,549 individuals.

Risk Management

Our business exposes us to strategic (including reputational), credit, market, liquidity, operational, compliance and legal risks. We use an enterprise-wide risk management framework to identify, measure, monitor, manage and report risks that affect or could affect the achievement of our strategic, financial and other objectives.

Enterprise Risk Management Principles

Our enterprise risk management philosophy is expressed through five key principles that guide our approach to risk management: Comprehensiveness, Accountability, Independence, Defined Risk Appetite and Transparency.

Comprehensiveness

We seek to maintain a comprehensive risk management framework for managing risk enterprise-wide, including policies, risk management processes, monitoring and testing, and reporting. Our framework is designed to be comprehensive with respect to our reporting segments and their control and support functions, and across all risk types.

Accountability

We structure accountability across three lines of defense along the principles of risk management execution, oversight and independent validation. As the first line of defense, our business units seek to manage the risks to which they are exposed as a result of their activities, including those risks arising from activities that have been outsourced to third parties. The principles apply across all businesses and risk types and guide the definition of specific roles and responsibilities.

Independence

Our second and third lines of defense, which are comprised of risk and control functions, operate independent of the business units. The second line of defense includes our corporate risk management ("CRM") department, which is led by our Chief Risk Officer (“CRO”), who is appointed by our Board of Directors. The CRM department sets risk management standards and policies that are consistent with the size and complexity of our business, industry practices and applicable legal and regulatory requirements. The CRO is accountable for providing our Board of Directors and executive management with an independent perspective on: the risks to which we are exposed; how well management is identifying, assessing and managing risk; and the capabilities we have in place to manage risks across the

enterprise. Our internal audit department, as the third line of defense, performs periodic, independent reviews and tests compliance with risk management policies, procedures and standards across the Company. It also periodically reviews the design and operating effectiveness of our risk management program and processes, including the independence and effectiveness of our CRM function, and reports the results to our Audit Committee of the Board of the Directors ("Audit Committee") and, where appropriate, the Risk Oversight Committee of the Board of Directors ("Risk Oversight Committee").

Defined Risk Appetite

We operate within a risk appetite framework approved by our Board of Directors, which guides an acceptable level of risk-taking, considering desired financial returns and other objectives. To that end, limits and escalation thresholds are set consistent with the risk appetite approved by our Board of Directors.

Transparency

We seek to provide transparency of exposures and outcomes, which is core to our risk culture and operating style. We provide this risk transparency through our risk committee structure and standardized processes for escalating issues and reporting. This is accomplished at several levels within the organization, including quarterly meetings held by our Risk Committee and quarterly reports to the Risk Oversight Committee, as well as regular reporting to our Risk subcommittees commensurate with the needs of our businesses. Further, our CRO is a member of the Company's Executive Committee.

Enterprise Risk Management Governance Structure

Our governance structure is based on the principle that each line of business is responsible for managing risks inherent in its business with appropriate oversight from our senior management and Board of Directors. Various committees are in place to oversee the management of risks across our Company. We seek to apply operating principles consistently to each committee. These operating principles are detailed in committee charters which are approved by the Risk Committee. Our banking subsidiaries have their own risk governance, compliance, auditing and other requirements. Our risk governance framework is implemented such that bank-level risk governance requirements are satisfied as well.

Board of Directors

Our Board of Directors (i) approves certain risk management policies, (ii) approves our capital targets and goals, (iii) approves our risk appetite framework, (iv) monitors our strategic plan, (v) appoints our CRO, and other risk governance function leaders, as appropriate, (vi) receives reports on any exceptions to the Enterprise Risk Management policy and (vii) receives and reviews regulatory examination reports. The Board of Directors receives reports from the Audit Committee and Risk Oversight Committee on risk management matters.

Risk Oversight Committee of our Board of Directors

Our Risk Oversight Committee is responsible for overseeing our risk management policies and the operations of our enterprise-wide risk management framework and our capital planning, liquidity risk management and resolution planning activities. The Committee is responsible for (i) approving and periodically reviewing our risk management policies, (ii) overseeing the operation of our policies and procedures establishing our risk management governance, risk management procedures, and our risk-control infrastructure, (iii) overseeing the operation of processes and systems for implementing and monitoring compliance with such policies and procedures, (iv) reviewing and making recommendations to the Board of Directors, as appropriate, regarding the Company's risk management framework, key risk management policies and the Company's risk appetite and tolerance, (v) receiving and reviewing regular reports from our CRO on risk management deficiencies and emerging risks, the status of and changes to risk exposures, policies, procedures and practices, and the steps management has taken to monitor and control risk exposures, (vi) receiving reports on compliance with our risk appetite and limit structure and risk management policies, procedures and controls, (vii) overseeing Capital Planning, Liquidity Risk Management and Resolution Planning related activities, and (viii) sharing information, liaising and meeting in joint session with the Audit Committee (which it may do through the Chairs of the Committees) as necessary or desirable to help ensure that the committees have received the information necessary to permit them to fulfill their duties and responsibilities with respect to oversight of risk management matters.

Audit Committee of our Board of Directors

With respect to the enterprise risk management framework, our Audit Committee is responsible for the following: (i) discussing policies with respect to risk assessment and management, (ii) receiving and reviewing reports from our CRO and other members of management as the Committee deems appropriate on the guidelines and policies for assessing and managing our exposure to risks, the corporation’s major financial risk exposures and the steps management has taken to monitor and control such exposures, and (iii) sharing information and liaising with the Risk Oversight Committee as necessary or desirable to help ensure that the committees have received the information necessary to permit them to fulfill their duties and responsibilities with respect to oversight of risk management matters.

Compensation and Leadership Development Committee of our Board of Directors

Our Compensation and Leadership Development Committee is responsible for overseeing risk management associated with the Company's compensation practices. The Committee receives reporting regarding the Company's compensation practices and evaluates whether these practices encourage excessive risk-taking. As a part of its reviews, the Committee obtains the input of our CRO and takes into account risk outcomes as well as other outcomes.

Risk Committee

Our Risk Committee is an executive management-level committee that establishes a comprehensive enterprise risk management program which includes (i) providing a regular forum for representatives of our different functional groups to identify and discuss key risk issues and to recommend to senior management actions that should be taken to manage the level of risk taken by the business lines, (ii) establishing and overseeing an enterprise-wide approach to risk management through the development of our Enterprise Risk Management Policy and the associated oversight framework for the identification, measurement, monitoring, management and reporting of enterprise risk, (iii) communicating our risk appetite and philosophy, including establishing limits and thresholds for managing enterprise-wide risks, and (iv) reviewing, on a periodic basis, our aggregate enterprise-wide risk exposures and the effectiveness of risk identification, measurement, monitoring, management and reporting policies and procedures, and related controls within the lines of business.

Our Risk Committee has formed and designated a number of committees to assist it in carrying out its responsibilities. These committees, made up of representatives from senior levels of management, escalate issues to our Risk Committee as guided by escalation thresholds. These risk management committees include the Discover Bank Credit Committee, Asset/Liability Management Committees (Discover Financial Services and Discover Bank), the Counterparty Credit Committee, the New Initiatives Committee, the Operational Risk Committee, the Capital Planning Committee and the Compliance Committee.

Chief Executive Officer

The Chief Executive Officer ("CEO") is ultimately responsible for risk management within our Company. In that capacity, the CEO establishes a risk management culture throughout the Company and ensures that businesses operate in accordance with this risk culture.

Business Unit Heads

Our business unit heads are responsible for managing risk associated with pursuit of their strategic, financial and other business objectives. Business unit heads are responsible for (i) complying with all risk limits and risk policies, (ii) identifying risks and implementing appropriate controls, (iii) explicitly considering risk when developing strategic plans, budgets and new products, (iv) implementing appropriate controls when pursuing business strategies and objectives, (v) ensuring business units implement business unit processes, controls and monitoring to support corporate model risk management standards such as documentation standards and reporting standards, (vi) coordinating with CRM to produce relevant, sufficient, accurate and timely risk reporting that is consistent with the processes and methodology established by CRM, (vii) ensuring sufficient financial resources and qualified personnel are deployed to control the risks inherent in the business activities, and (viii) designating, in consultation with the CRO, a Business Risk Officer to assist with the above and to perform the specific duties described below.

Business Risk Officers work in conjunction with the business unit head to implement a business risk management program that satisfies business unit needs and adheres to corporate policy, standards and risk architecture.

Chief Risk Officer

As a member of the Company's senior management team, the CRO chairs our Risk Committee. In addition, the CRO has oversight responsibility to establish the CRM function with capabilities to exercise its mandate across all risk categories. Our CRO reports directly to our Risk Oversight Committee and administratively to the CEO. Our CRO provides an independent view on the key risks to which our Company is exposed to our Risk Committee, our Audit Committee, our Risk Oversight Committee and our Board of Directors.

Corporate Risk Management

The CRM department is led by the CRO and supports business units by providing objective oversight of our risk profile to help ensure that risks are managed, aggregated and reported to our Risk Committee, our Risk Oversight Committee and our Audit Committee. The CRM department participates in our Risk Committee and sub-committee meetings to provide an enterprise-wide perspective on risk, governance matters, policies and risk thresholds. The CRM department is comprised of operational, consumer credit, counterparty credit, and market and liquidity risk oversight functions. In addition, the CRM department has enterprise risk management, corporate compliance, third-party risk management, model risk management, regulatory program office and risk and insurance management frameworks to manage potential risk that might arise within these respective areas.

Credit Risk Management

Credit Risk Management is responsible for (i) developing, validating and implementing credit policy criteria and predictive loan origination and servicing models in order to optimize the profitability of Company lending activities, (ii) ensuring adherence to our credit risk policies and approval limits, and that departmental policies, procedures, and internal controls are consistent with the standards defined by the Company, (iii) ensuring that we manage credit risk within approved limits, and (iv) monitoring performance for both new and existing consumer loan products and portfolios.

Law Department

The CRM department collaborates and coordinates closely with other risk and control functions in exercising its oversight responsibilities, in particular with the Law department. This department plays a significant role in managing our legal risk by, among other things, identifying, interpreting and advising on legal and regulatory risks. Our Law department participates in meetings of the Risk Committee and the sub-committees of the Risk Committee in order to advise on legal risks and to inform the committees of any relevant legislative and regulatory developments.

Internal Audit Department

Our Internal Audit Department performs periodic, independent reviews and testing of compliance with risk management policies and standards across the Company, as well as assessments of the design and operating effectiveness of these policies and standards. The Internal Audit Department also validates that risk management controls are functioning as intended by reviewing and evaluating the design and operating effectiveness of the CRM program and processes, including the independence and effectiveness of the CRM function. The results of such reviews are reported to our Audit Committee.

Risk Categories

We are exposed to a broad set of risks in the course of our business activities due to both internal and external factors, which we segment into six major risk categories. The first five are defined to be broadly consistent with guidance published by the Federal Reserve and the Basel Committee on Banking Supervision (“BCBS”): credit, market, liquidity, operational, and compliance/legal risk. We recognize the sixth, strategic risk, as a separate risk category. We evaluate the potential impact of a risk event on the Company by assessing the financial impact, the impact to our reputation, the legal and regulatory impact, and the client/customer impact. In addition, we have established various policies to help govern these risks.

Credit Risk

Our credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. Our credit risk includes consumer credit risk and counterparty credit risk. Consumer credit risk is primarily incurred by Discover Bank through the issuance of (i) unsecured credit including credit cards, student loans and personal loans and (ii) secured credit including secured credit cards, deposit secured loans and home equity loans. Counterparty credit risk

is incurred through a number of activities including settlement, certain marketing programs, treasury and asset/liability management, network incentive programs, vendor relationships and insurers.

Our counterparty credit risk arises in the following forms: (i) direct exposure, in which we have formally extended credit to a counterparty in the form of a cash payment, (ii) settlement activity, in which a credit relationship is created through differences in payment timing, (iii) contingencies, in which a credit relationship may develop due to insurance or guarantees, and (iv) accounting losses, in which a counterparty default would generate a non-cash write-off, as would be the case with prepaid expenses or corporate insurance premiums we pay to third-party insurers.

Our Counterparty Credit Committee is responsible for the enterprise-wide approach to counterparty credit risk management through development of the Counterparty Credit Risk Management Policy and the associated oversight framework for the identification, measurement, monitoring, managing and reporting of counterparty credit risk.

Market Risk

Market risk is the risk to our financial condition resulting from adverse movements in market rates or prices, such as interest rates, foreign exchange rates, credit spreads or equity prices. Given the nature of our business activities, we are exposed to various types of market risk; in particular interest rate risk, foreign exchange risk and other risks that arise through the management of our investment portfolio. Interest rate risk is more significant relative to other market risk exposures and results from potential mismatches in the repricing term of assets and liabilities (yield curve risk) and volatility in reference rates used to reprice floating-rate structures (basis risk). Foreign exchange risk is primarily incurred through exposure to currency movements across a variety of business activities and is derived, specifically, from the timing differences between transaction authorizations and settlement.

Liquidity Risk

Liquidity risk is the risk that we will be unable to meet our obligations as they become due because of an inability to liquidate assets or obtain adequate funding, or an inability to easily unwind or offset specific exposures without significantly lowering market prices because of inadequate market depth or market disruptions.

Operational Risk

Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. Operational risk is inherent in all our businesses. Operational risk categories incorporate all of the operational loss event-type categories set forth by the BCBS, which include the following: (i) fraud (internal and external), (ii) employment practices and workplace safety, (iii) clients, products and business practices, (iv) damage to physical assets, (v) business disruption and system failures, and (vi) execution, delivery and process management.

Compliance and Legal Risk

Compliance risk is the operational risk of legal or regulatory sanctions, financial loss or damage to reputation resulting from failure to comply with laws, regulations, rules, other regulatory requirements, or codes of conduct and other standards of self-regulatory organizations applicable to us.

Legal risk arises from the potential that unenforceable contracts, lawsuits or adverse judgments can disrupt or otherwise negatively affect our operations or condition. These risks are inherent in all of our businesses. Both compliance and legal risk are subsets of operational risk but are recognized together as a separate and complementary risk category by us given their importance and the specific capabilities and resources we deploy to manage these risk types effectively.

Compliance and legal risk exposures are actively and primarily managed by our business units in conjunction with our compliance and law departments. Our compliance program governs the management of compliance risk. Our Risk Committee and Compliance Committee oversee our compliance and legal risk management. Specifically, the Law department is responsible for providing advice, interpreting and identifying developments regarding laws, regulations, regulatory guidance and litigation, and setting standards for communicating relevant changes to Corporate Compliance, the Business and Internal Audit. The Law department also identifies and communicates legal risk associated with new products and business practices.

Strategic Risk

Strategic risk can arise from: adverse business decisions; improper implementation of decisions; or a failure to anticipate and respond to industry changes, create and maintain a competitive business model, and attract and profitably serve clients.

Our Risk Committee actively manages strategic risk through the development, implementation and oversight of our business strategies, including the development of budgets and business plans. Our business units take on and are accountable for managing strategic risk in pursuit of their objectives.

Enterprise Risk Management Framework

Our enterprise risk management principles are executed through a risk management framework that is based upon industry standards for managing risk and controls. While the detailed activities vary by risk type, there are common process elements that apply across risk types. We seek to apply these elements consistently in the interest of effective and efficient risk management. This framework seeks to link risk processes and infrastructure with the appropriate risk oversight to create a risk management structure that raises risk awareness, reduces impact of potential risk events, improves business decision-making and increases operational efficiency.

Risk Identification